| CONTENTS |

| S.N. |

Particulars |

| 1. |

Select Abbreviations |

| 2. |

Foreword |

| 3. |

Executive Summary |

| 4. |

Chapter 1 - Introduction to ombudsman schemes of RBI |

| |

Banking Ombudsman Scheme, 2006 |

| |

Ombudsman Scheme for NBFCs, 2018 |

| |

Ombudsman Scheme for Digital Transactions, 2019 |

| |

Internal Ombudsman Scheme for Banks, 2018 and Non-bank System Participants, 2019 |

| 5. |

Chapter 2 - The Banking Ombudsman Scheme, 2006, as amended upto July 1, 2017: Activities during 2019-20 |

| |

Receipt of complaints |

| |

Modes of receipt of complaints |

| |

Population-group wise distribution of complaints |

| |

Zone-wise distribution of complaints |

| |

Complainant-group wise classification of complaints |

| |

Bank- wise distribution of complaints |

| |

Nature of complaints handled |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

Turn Around Time for disposal of complaints |

| |

Grounds for rejection of maintainable complaints |

| |

Age-wise classification of pending complaints |

| |

Awards issued |

| |

Appeals against decisions of the BOs |

| 6. |

Chapter 3 - The Ombudsman Scheme for Non Banking Financial Companies, 2018: Activities during 2019-20 |

| |

Receipt of complaints |

| |

Mode of receipt of complaints |

| |

Complainant-group wise classification of complaints |

| |

Category wise complaints received |

| |

Nature of complaints received |

| |

Disposal of complaints |

| |

Mode of disposal of complaints |

| |

ONBFCO wise position of complaints disposed |

| |

Appeals |

| 7. |

Chapter 4 - The Ombudsman Scheme for Digital Transactions, 2019: Activities during 2019-20 |

| |

Receipt of complaints |

| |

Mode of receipt of complaints |

| |

Zone wise distribution of complaints |

| |

Complainant-group wise classification |

| |

Entity wise classification |

| |

Nature of complaints handled |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

Grounds for rejection of maintainable complaints |

| |

Age-wise classification of pending complaints |

| |

Appeals against the decisions of ODTs |

| 8. |

Chapter 5 - Complaints received on CPGRAMS and applications under Right to Information Act, 2005 |

| |

Centralized Public Grievance Redress and Monitoring System (CPGRAMS) |

| |

Applications received under Right to Information Act, 2005 |

| 9. |

Chapter 6 - Other Developments |

| |

Regulations: Important regulatory measures taken by the Reserve Bank |

| |

Root Cause Analysis of major areas of complaints |

| |

Awareness generation activities of ombudsmen and CEPD |

| |

Winding down of the Banking Codes and Standards Board of India |

| |

Status of implementation of the action plan set out in Utkarsh 2022 for the year 2019-20 |

| |

Conduct review of CEPCs for empowering them on the lines of ombudsmen |

| |

Review the Internal Ombudsman Scheme for extension to NBFCs |

| |

Review the ombudsman schemes for updation and effective implementation including through convergence |

| |

Operationalize Interactive Voice Response System for online support to complainant |

| |

Internal Ombudsman for Non-bank System Participants |

| |

Way forward |

| 10. |

Appendices |

SELECT ABBREVIATIONS

| AA |

Appellate Authority |

BSBDA |

Basic Savings Bank Deposit Account |

| ADR |

Alternative Dispute Resolution |

CDD |

Customer Due Diligence |

| AFA |

Additional Factor of Authentication |

CDES |

Currency Distribution and Exchange Scheme |

| AI |

Artificial Intelligence |

CEPC |

Consumer Education and Protection Cell |

| APBS |

Aadhaar Payment Bridge System |

CEPD |

Consumer Education and Protection Department |

| ATM |

Automated Teller Machine |

CIBIL |

Credit Information Bureau of India Limited |

| BBPCU |

Bharat Bill Payment Central Unit |

CMS |

Complaint Management System |

| BBPOU |

Bharat Bill Payment Operating Unit |

CNP |

Card Not Present |

| BBPS |

Bharat Bill Payment System |

CPGRAMS |

Centralized Public Grievance Redress and Monitoring System |

| BC |

Business Correspondent |

CTS |

Complaint Tracking System |

| BCSBI |

Banking Codes and Standards Board of India |

DG |

Deputy Governor |

| BO |

Banking Ombudsman |

DLA |

Digital Lending Applications |

| BOS |

Banking Ombudsman Scheme |

ECS |

Electronic Clearing Service |

| EMI |

Equated Monthly Instalment |

PB |

Payment Bank |

| FPC |

Fair Practices Code |

PD |

Primary Dealer |

| FRC |

First Resort Complaint |

PIN |

Personal Identification Number |

| IMPS |

Immediate Payment System |

PMAY |

Pradhan Mantri Awas Yojana |

| IO |

Internal Ombudsman |

PMJDY |

Pradhan Mantri Jan Dhan Yojana |

| IWG |

Internal Working Group |

PML |

Prevention of Money Laundering |

| IRDAI |

Insurance Regulatory and Development Authority of India |

POS |

Point of Sale |

| NBFCO |

NBFC Ombudsman |

PPI |

Prepaid Payment Instrument |

| NEFT |

National Electronic Funds Transfer |

QR |

Quick Response |

| NETC |

National Electronic Toll Collection |

RBI |

Reserve Bank of India |

| OBOs |

Offices of Banking Ombudsmen |

RCA |

Root Cause Analysis |

| ODT |

Ombudsman for Digital Transactions |

RE |

Regulated Entity |

| OSDT |

Ombudsman Scheme for Digital Transactions |

RRB |

Regional Rural Bank |

| OSNBFC |

Ombudsman Scheme for NBFCs |

RTGS |

Real Time Gross Settlement |

| ONBFCO |

Office of the NBFC Ombudsman |

RTI |

Right to Information |

| PAN |

Permanent Account Number |

SMS |

Short Message Service |

| SARFAESI |

Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act |

TAT |

Turn Around Time |

| SBI |

State Bank of India |

TRAI |

Telecom Regulatory Authority of India |

| SEBI |

Securities and Exchange Board of India |

UCB |

Urban Cooperative Bank |

| SCB |

Scheduled Commercial Bank |

UPI |

Unified Payments Interface |

| SFB |

Small Finance Bank |

V-CIP |

Video based Customer Identification Process |

| S-UCB |

Scheduled Urban Cooperative Bank |

XML |

eXtensible Markup Language |

| SLBC |

State Level Bankers Committee |

Y-o-Y |

Year-on-Year |

FOREWORD

Financial consumer protection is an increasingly important policy priority across jurisdictions. The G20 OECD ‘High Level Principles (HLPs) on Financial Consumer Protection (FCP)’, which underscore the significance of consumer protection for stability and growth, serve as a benchmark for the design and implementation of national frameworks. RBI maintains material compliance with the HLPs and actively contributes to global deliberations and initiatives on consumer protection.

The year 2019-20 was challenging for financial consumers who were vulnerable to the adverse consequences of the pandemic. The uninterrupted functioning of the Ombudsman offices through the exigent situation was commendable. Despite 64.97% increase in the volume of complaints, the Ombudsman offices maintained a higher than 92% disposal rate, which RBI will strive to further improve.

Consumer awareness initiatives were aligned to the emergent needs to extensively disseminate germane messages on safe digital banking and limited liability of customers. The Internal Ombudsman Scheme was extended to Non-bank System Participants that are issuers of Pre-paid Payment Instruments to strengthen their internal grievance redressal mechanism.

Going forward, RBI will endeavor to further enhance the efficacy of the alternate grievance redressal mechanism in line with international best practices. A framework for education, with a focus on consumer protection, will be formalized to augment awareness initiatives.

This Annual Report provides an analysis of the complaints received and resolved, including a Root Cause Analysis of complaints and the corrective actions initiated.

I hope this Report would be informative and useful for all stakeholders.

(M K Jain)

EXECUTIVE SUMMARY

The grievance redressal machinery of Reserve Bank of India (RBI) functioned with round-the-clock availability, leveraging on the capabilities of the state-of-the-art Complaint Management System (CMS). The CMS platform, which was launched in June 2019, brought all stakeholders viz RBI, the Regulated Entities (REs) and complainants on one web-based platform; and digitalized the entire process of complaint handling at RBI. Despite an increase of 64.97% in the receipt of complaints under the three Ombudsman Schemes, from 2,00,362 complaints in 2018-19 to 3,30,543 complaints in 2019-20, disposal rate of more than 92% was achieved.

Banking Ombudsman Scheme

2. The Banking Ombudsman Scheme (BOS) was notified by RBI in 1995 under Section 35A of the Banking Regulation Act, 1949. As on date, Scheduled Commercial Banks (SCBs), Scheduled Primary Urban Co-operative Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs) and Payment Banks (PBs) are covered under the Scheme. It is administered by RBI through 22 Offices of Banking Ombudsman (OBOs) covering all states and union territories.

3. A brief analysis of the complaints handled under BOS is as follows:

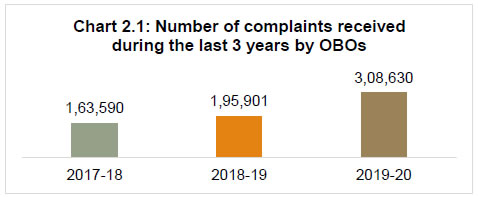

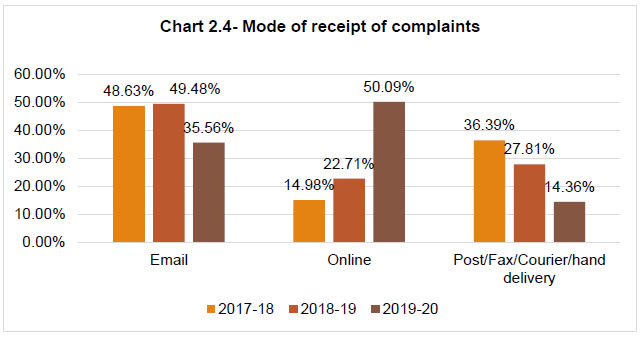

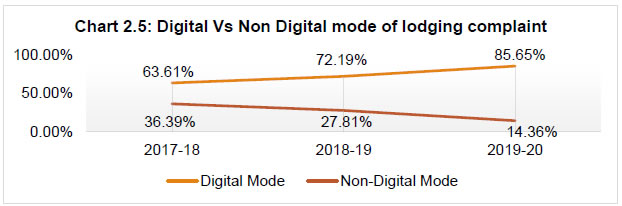

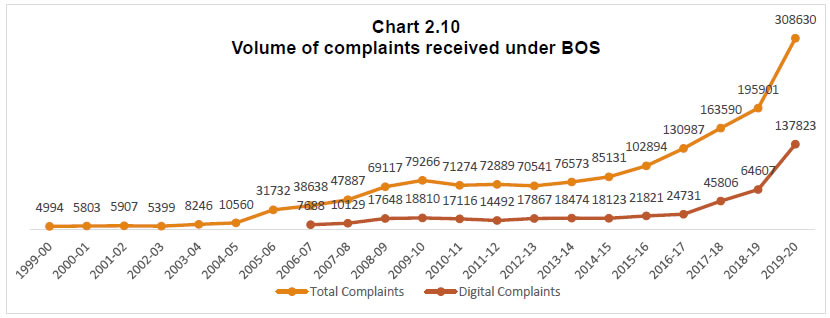

i. The complaints received at OBOs during the year 2019-20 recorded an increase of 57.54% Year-on-Year (Y-o-Y), leading to a total of 3,08,630 complaints as compared to 1,95,901 complaints received during 2018-19. Of these, 85.65% were received electronically i.e. through the online portal CMS and though email, as against 72.19% in the previous year.

ii. The disposal rate for 2019-20 declined marginally to 92.36%, as against 94.03% in 2018-19, amidst the surging inflow of complaints with the available human resources remaining the same during the year.

iii. Complaints related to (a) ATM/ Debit Cards and (b) Mobile/ Electronic banking overtook those pertaining to non-observance of Fair Practices Code (FPC) as the major grounds of complaints during the year. Their share in the total complaints received in 2019-20 was 21.97% and 13.38%, respectively, while the share of complaints relating to non-observance of FPC stood at 11.73%. The figures against these grounds during the previous year were 18.65%, 7.55% and 19.17%, respectively.

iv. Complaints received on grounds relating to Credit Cards, failure to meet commitments, levy of charges without notice, loans and advances and non-adherence to the Banking Codes and Standards Board of India (BCSBI) Codes increased this year vis-à-vis the previous year. The number of complaints pertaining to ‘Direct Sales Agent (DSA) and recovery agents’ increased from 629 complaints in 2018-19 to 1,406 complaints this year.

v. Of the total maintainable complaints, the share of complaints resolved by agreement i.e. through intervention of OBOs, mediation and conciliation increased from 69.88% in 2018-19 to 72.34% in 2019-20.

vi. The number of appeals received decreased from 78 in 2018-19 to 63 in 2019-20.

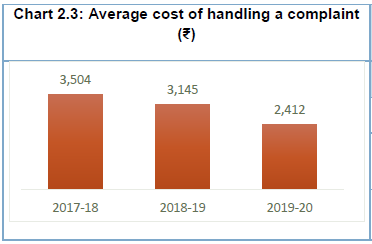

vii. The average cost of handling a complaint decreased by 23.31%, from ₹3,145/- in 2018-19 to ₹2,412/- in 2019-20. The reduction was mainly due to the handling of increased volume of complaints by the OBOs with the same level of resources as available during the previous year.

Ombudsman Scheme for Non-Banking Financial Companies

4. The Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC) was notified by RBI under Section 45L of the RBI Act, 1934 on February 23, 2018. The Scheme is applicable to (a) Non-Banking Financial Companies (NBFCs) which are authorised to accept deposits; and (b) Non-deposit taking NBFCs (NBFC-NDs) having customer interface, with an asset size of ₹100 crore or above, as on the date of the audited balance sheet of the previous financial year. The Scheme is administered from the Offices of the NBFC Ombudsman (ONBFCOs) in four metro centers viz. Chennai, Kolkata, Mumbai, and New Delhi for handling complaints from the respective zones.

5. A brief analysis of the complaints handled by ONBFCOs during the year is as follows:

i. The receipt of complaints at ONBFCOs gained momentum with 19,432 complaints received during 2019-20 as compared to 3,991 in 2018-19, an increase of 386.89%. Of the complaints received during 2019-20, 93.16% were received electronically, i.e. through the online CMS portal and through email.

ii. Non-adherence to FPC constituted 36.29% of the complaints received, followed by non-observance of RBI directions (18.56%), lack of transparency in contract/loan agreement (8.77%) and levy of charges without notice (8.38%).

iii. The disposal rate stood at 95.34% in 2019-20 as compared to 99.10% in 2018-19.

iv. Of the total maintainable complaints, 71.12% were resolved through mutual settlement/ agreement i.e. through intervention of the ONBFCOs, mediation and conciliation.

v. One appeal was received against the decision of the NBFC Ombudsman (NBFCO) during 2019-20.

Ombudsman Scheme for Digital Transactions

6. The Ombudsman Scheme for Digital Transactions (OSDT), was notified by RBI under Section 18 of the Payment and Settlement Systems Act, 2007 on January 31, 2019. The Scheme is applicable to Non-bank System Participants1 (issuers of Pre-paid Payment Instruments (PPIs)) regulated by RBI. The Offices of Ombudsman for Digital Transactions (OODTs) function from all the existing OBOs, and handle complaints of customers in their respective territorial jurisdiction.

7. A brief analysis of complaints handled by OODTs during the year is as follows:

i. The number of complaints received at OODTs rose from 470 in the five months of operation during 2018-19, to 2,481 in 2019-20, of which 99.40% were received through electronic means.

ii. Non-adherence to RBI/ System Provider instructions on payment transactions through Unified Payment Interface (UPI)/ Bharat Bill Payment System (BBPS)/ Bharat Quick Response (QR) Code, with 43.89% of complaints, was the major ground of complaints, followed by Mobile/ Electronic transfers (24.10%), non-reversal of funds due to wrong beneficiary transfer by the System Participant (8.79%) and non-adherence to RBI guidelines for PPIs (7.98%).

iii. The disposal rate stood at 90.92% in 2019-20. Of the maintainable complaints, 56.12% were disposed through mutual settlement/ agreement i.e. through intervention of the OODTs, mediation and conciliation.

iv. No appeal was received against the decisions of the Ombudsmen for Digital Transactions (ODT) during 2019-20.

Developments during the year

8. During the year, Consumer Education and Protection Department (CEPD) took the following initiatives for improving the level of services rendered by Regulated Entities (REs) and further strengthening the grievance redressal:

-

In line with the Internal Ombudsman (IO) Scheme for banks, 2018, the IO Scheme was extended to Non-bank System Participants (issuers of PPIs) with more than one crore outstanding PPIs as at the end of the previous financial year.

-

Root Cause Analysis (RCA) of the complaints received in RBI during 2019-20 was undertaken to identify the major concerns and systemic issues, their root causes, and to formulate remedial measures to address the concerns.

-

A ‘Review of the Ombudsman Schemes for updation and effective implementation, including through convergence’ was conducted by an In-house Committee. The recommendations covering, inter alia, convergence of the three Schemes, bringing all REs with retail customers under the ambit of the converged Scheme, measures for reduction in Turn Around Time (TAT) for disposal of complaints, and improving effectiveness in resolution of consumer complaints; are under consideration.

-

Education and awareness campaigns were undertaken through print and electronic media for the benefit of customers of REs/ members of public.

-

The RBI-Ombudsmen conducted 26 Town Hall (TH) events and 113 awareness programmes during the year focused on avenues of grievance redressal and consumer protection issues.

Way forward

9. During the period July 2020 to March 2021, the recommendations of the Committee to review the Ombudsman Schemes will be examined and taken up for implementation. The capabilities of CMS will be enhanced for more efficient redressal and the Interactive Voice Response System (IVRS) content will be enriched for better user engagement. The education and awareness efforts with a focus on consumer protection issues will be intensified, for which a framework for consumer education will be put in place to meet the needs arising from increased digitization and challenges in banking space. The IO Scheme for NBFCs is being reviewed for select applicability, and a disincentive framework for banks deficient in grievance redressal is being finalized.

Chapter 1

Introduction to the Ombudsman Schemes of RBI

| The BOS was launched in the year 1995. It has undergone five revisions and also forms the basis for launch of OSNBFC in 2018 and OSDT in 2019. In the year 2015, the Internal Ombudsman (IO) mechanism was mandated for select banks. In 2018, the IO Scheme was extended to all Scheduled Commercial Banks (excluding Regional Rural Banks) with more than 10 banking outlets in India; and in 2019 to Non-bank System Participants with more than one crore outstanding Prepaid Payment Instruments (PPIs) as on March 31 of the previous year. |

1.1 The Ombudsman Schemes of RBI constitute the cornerstone of supply side intervention for ensuring consumer protection through effective grievance redressal for customers of REs. Operated directly under the aegis of RBI as a free Alternative Dispute Resolution (ADR) mechanism to customers as well as REs, the Ombudsman Schemes present a structured framework for redressal of complaints not settled by the REs falling within the ambit of the Schemes viz commercial banks - Public, Private and Foreign, RRBs, Scheduled Urban Cooperative Banks (S-UCBs), SFBs and PBs falling under the BOS, all deposit taking Non-Banking Financial Companies (NBFC-Ds) and NBFC-NDs with customer interface and asset size exceeding ₹100 crore falling under the OSNBFC and non-bank issuers of PPIs falling under the OSDT. There was an increase of 64.97% in the receipt of complaints under the three Ombudsman Schemes, from 2,00,362 complaints in 2018-19 to 3,30,543 complaints in 2019-20. Of these, 86.19% were received electronically i.e. through the CMS online portal and email. Despite surge in receipt of complaints, disposal rate of more than 92% was achieved. 72.27% of the maintainable complaints were resolved through mediation and conciliation.

Banking Ombudsman Scheme, 2006

1.2 BOS was introduced in the year 1995 for expeditious and inexpensive redressal of customers’ grievances against deficiencies in services provided by banks. The Scheme is presently administered through 22 OBOs with specific jurisdiction covering the entire country. The BOS has undergone five revisions since its inception to keep it relevant to the changing landscape of the banking sector.

1.3 The first revision of BOS, 1995 came into effect on June 14, 2002. Under BOS 2002, a review option was provided to banks against an Award passed by the Banking Ombudsman (BO), the BO’s role was expanded by allowing him/ her to arbitrate in individual disputes of under ₹ 10 lakh, and RRBs were brought within the ambit of the Scheme.

1.4 BOS, 2002 was revised with effect from January 01, 2006. BOS, 2002 was funded by the participant banks and staffed by the State Level Bankers’ Committee (SLBC) Convener Banks and RBI. Under BOS, 2006, RBI took over the funding and staffing of the OBOs to increase accountability. The arbitration clause of BOS, 2002 was taken away to enable BOs to focus on the resolution of complaints under the Scheme. BOS, 2006 permitted online mode of submission of complaints and included new grounds of complaints - Credit Card complaints, deficiencies in providing the promised services, levying of service charges without prior notice and non-adherence to FPC. Further, the 'Review’ mechanism of BOS, 2002, which was made available to banks was replaced with a provision for ‘Appeal’ against the Awards passed by the BOs.

1.5 BOS, 2006 was amended with effect from May 24, 2007 whereby, complainants were allowed to file an Appeal against the decision of the BOs in the case of rejection of their complaints on certain grounds. Prior to this amendment, bank customers could appeal only against the Awards given by the BOs. This was followed by the addition of new grounds with effect from February 3, 2009: a) Non-adherence to the ‘Code of Bank's Commitments to Customers’ issued by BCSBI; b) Non-observance of RBI guidelines on engagement of recovery agents by banks; c) Complaints on internet banking.

1.6 The major amendments in the BOS 2006 made with effect from 2017 were (i) pecuniary jurisdiction of the BO for issuing an Award was increased from ₹10 lakh to the sum equivalent to value of amount under dispute and a compensation ₹20 lakh or the actual loss suffered, whichever is lower; (ii) compensation of ₹1 lakh for loss of time, expenses, harassment, and mental anguish, which was available only for Credit Card complaints was extended to all complaints; (iii) inclusion of additional grounds on mis-selling and Electronic/ Mobile banking; and (iv) widening the scope of appeals. The procedures for settlement of a complaint by agreement were also simplified by laying down the detailed process to be followed by the BO.

1.7 The significance of the BOS as ADR is reflected in the volume of complaints handled under the Scheme over the years, which has gone up from less than 5,000 complaints in 1999-2000 (4,994) to 3,08,630 in 2019-20. The details of the complaints handled and redressed under BOS, 2006 during the year are covered in Chapter 2.

Ombudsman Scheme for NBFC, 2018

1.8 The OSNBFC, designed on the lines of BOS, 2006 was launched on February 23, 2018. At the time of its launch, the OSNBFC covered NBFC-Ds registered with the RBI. NBFC-NDs with customer interface and having an asset size of ₹ 100 crore and above were brought within the ambit of OSNBFC with effect from April 26, 2019. The ONBFCOs are functioning at the four metro centres viz. Chennai, Kolkata, Mumbai and New Delhi and handle complaints of customers of NBFCs in the respective zones, to cover the entire country.

1.9 The number of complaints received in ONBFCOs increased from 675 complaints received during February 01, 2018 – June 30, 2019 to 3,991 complaints during 2018-19 and to 19,432 complaints in 2019-20. The details of the complaints and their redressal under the OSNBFC are covered in Chapter 3.

Ombudsman Scheme for Digital Transactions, 2019

1.10 The OSDT, launched on January 31, 2019 has also been formulated on the lines of BOS, 2006 and covers Non-bank System Participants (issuers of PPIs) regulated by RBI. Complaints relating to digital transactions conducted through banks continue to be handled under the BOS, 2006. The OODTs function from all the existing OBOs and handle complaints from customers in their respective territorial jurisdictions.

1.11 The number of complaints received in the OODTs has gone up from 470 complaints in February 2019 – June 30, 2019 to 2,481 in 2019-20. The details of the complaints handled and redressed under the Scheme are covered in Chapter 4.

Internal Ombudsman Scheme for Banks, 2018 and Non-bank System Participants, 2019

1.12 While the Ombudsman Schemes offer an opportunity to the customers of REs covered under their ambit to seek redressal of grievances not resolved to their satisfaction, the RBI has also instituted the IO mechanism for strengthening the internal grievance redressal machinery of REs. At present, all SCBs, excluding RRBs, with more than 10 banking outlets in India are covered under the IO Scheme for Banks, 2018. Similarly, all non-bank issuers of PPIs with more than one crore PPIs outstanding as at the close of March 31, 2019 are covered under the ambit of IO Scheme for Non-bank System Participants, 2019.

Chapter 2

The Banking Ombudsman Scheme, 2006, as amended upto July 01, 2017: Activities during 2019-20

| The number of complaints received by the 22 OBOs during 2019-20 rose by 57.54%, and the OBOs handled 58.69% more complaints as compared to the previous year. Complaints relating to digital modes of transactions were the highest, constituting 44.66% of the total complaints received, surpassing violation of non-observance of FPC as the top category of complaints received at OBOs. The majority (72.34%) of the maintainable complaints were resolved through mediation. During the year, 68 Awards were issued by BOs. Sixty-three Appeals were received against the decisions of the BOs. Of these, 29 Appeals were against Awards passed by the BOs and 34 were Appeals made by customers against the rejection of their complaints. |

Receipt of complaints

2.1 During the year 2019-20, there was an increase of 57.54% over the previous year in receipt of complaints under BOS. The year-wise number of complaints received at OBOs in last three years is given in Chart 2.1.

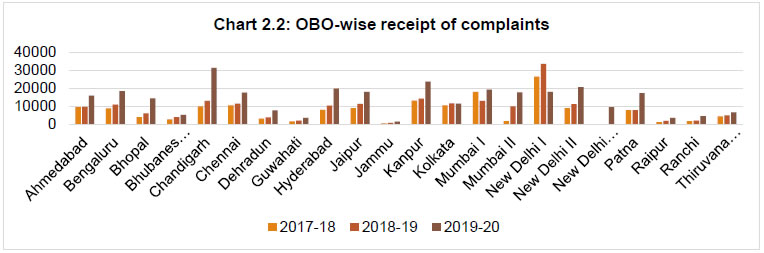

2.2 The OBO wise receipt of complaints, given at Appendix 2.1, shows that OBO, Chandigarh received the maximum number of complaints (31,594) during 2019-20, accounting for 10.24% of the total complaints received by the OBOs, followed by OBO, Kanpur (23,895) and OBO, New Delhi II (20,817) accounting respectively for 7.74% and 6.74% of total complaints received by the OBOs.

2.3 Complaints received in 2019-20 at OBO, New Delhi III, set up on July 01, 2019 stood at 9,589 (5.88% of total complaints received by OBOs). Consequently, complaints received at OBO, New Delhi I witnessed a decline of 46.13% (from 33,690 complaints in 2018-19 to 18,147 complaints in 2019-20) during the year.

2.4 OBOs at Bhopal, Chandigarh, Patna, and Ranchi witnessed more than 100% Y-o-Y growth in the number of complaints received in 2019-20. A comparative position of complaints received by OBOs during the last three years is given in Chart 2.2.

2.5 The number of complaints handled by the OBOs in the year 2019-20 rose by 58.69% to 3,20,6992 in comparison to 2,02,083 complaints of the previous year. The position of customer complaints handled by OBOs in the last three years is given at Appendix 2.2.

2.6 During the year, in line with the trend observed over the last three years, the average cost of handling a complaint declined from ₹3,145/- to ₹2,412/-, as evident from Chart 2.3 and Table 2.1. The decline was largely due to the increase in the volume of complaints with the human resources for handling these complaints remaining at the same level.

| Table 2.1 - Cost of handling a complaint |

| Year-> |

2017-18 |

2018-19 |

2019-20 |

| Total Cost (₹ Crore) |

61.2 |

63.55 |

77.36 |

| No of complaints handled |

1,74,805 |

2,02,083 |

3,20,699 |

| Average Cost (₹) |

3,504 |

3,145 |

2,412 |

2.7 The OBO wise cost for the year 2019-20 is given at Appendix 2.3. Considering the fixed costs involved, the offices having lesser inflow of complaints show higher cost of handling a complaint.

Modes of receipt of complaints

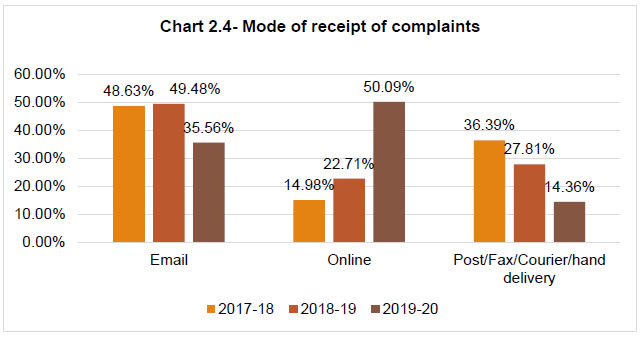

2.8 Complaints were received in the OBOs through various modes, predominantly through the online portal (i.e., the CMS). The other modes were e-mails, hand delivery, post, courier and fax. With the launch of CMS, physical lodgment of complaints has declined from 27.81% to 14.36% of the total complaints received during the year. A comparative position of the various modes through which the complaints were received during the last three years is given at Appendix 2.4 and depicted in Chart 2.4 below:

2.9 The trend of complainants shifting to online mode is indicative of not only of the ease in filing complaints on CMS, as compared to the earlier portal - Complaint Tracking System (CTS), but as also is the result of intensive awareness campaigns undertaken by RBI. During the year, 85.65% of the complaints were filed using the digital mode of which 35.56% were through e-mails and 50.09% were using CMS. The trend of digital versus non-digital modes of lodgment of complaints during the last three years is given in Chart 2.5 below:

Population-group wise distribution of complaints

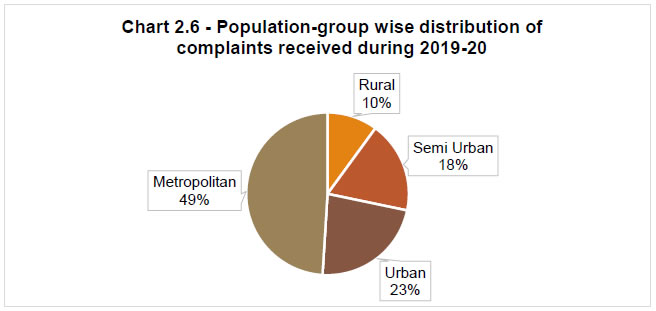

2.10 There was a significant Y-o-Y increase in the number of complaints received from metropolitan areas (176.75%) and the semi urban areas (138.21%). An upward trend was also observed in complaints from rural areas (35.50%), however, the complaints received from urban areas during the year decreased by 26.03% over the previous year. The population-group wise distribution of complaints received during the year is given in Chart 2.6 below and in Appendix 2.5.

2.11 Under each of the grounds of complaints listed under the BOS (with exception of pension and loans and advances), the maximum number of complaints were received from metropolitan centres, followed by urban, semi-urban and rural centres as given in Appendix 2.6. It can be inferred that the complaints rise proportionately with the size of population, bank branches and awareness among the public.

Zone wise distribution of complaints

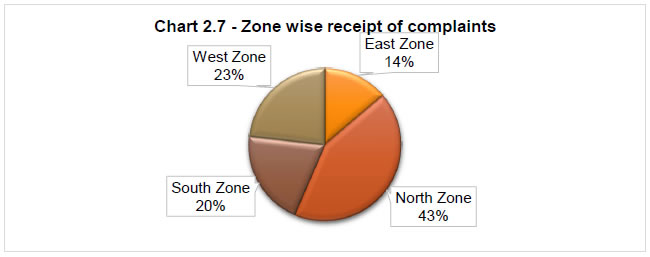

2.12 Continuing the trend and owing to huge volume of complaints received at OBOs of New Delhi, Chandigarh and Dehradun, the North zone accounted for the maximum share of complaints (42.63%) in 2019-20, followed by West zone (23.20%) and South zone (20.36%). East zone (13.81%) continued with least share of complaints despite OBOs like Patna and Ranchi showing a marked increase in the number of complaints received. In terms of growth of complaints, the West zone registered the highest Y-o-Y growth at 74.28%, followed by South zone (65.24%) and East zone (51.34%). The zone wise distribution of complaints received is depicted in Chart 2.7 below and Appendix 2.7.

Complainant-group wise classification of complaints

2.13 Individual customers, despite showing a drop from the previous year in the percentage share in total complaints, constituted the largest segment (84.75%) of complainants during the year 2019-20, followed by individual-business (3.29%) and others (3.16%). Complaints lodged by senior citizens stood at 2.64% of total complaints as compared to 0.68% in the previous year. Appendix 2.8 provides the complainant-group wise classification of complaints for the last three years.

Bank-group wise classification of complaints

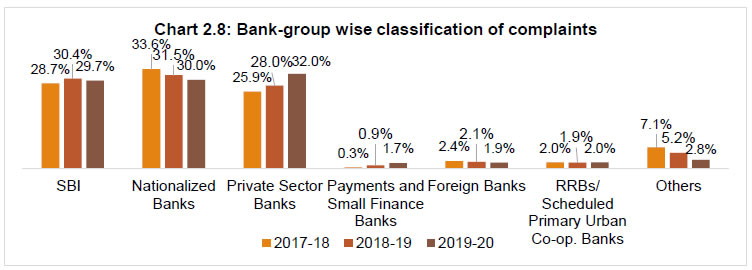

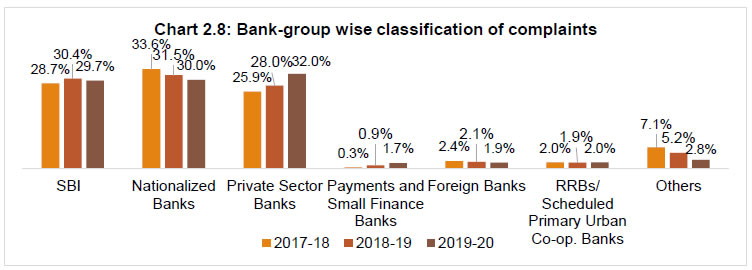

2.14 The bank group-wise classification of complaints received by OBOs during the last three years is indicated in Chart 2.8

2.15 The share of total complaints received against SBI and nationalised banks have decreased from 61.90% in 2018-19 to 59.65% in 2019-20, while the share of Private Sector Banks increased from 28.04% of the total complaints received last year to 31.96% during current year. The RRBs and Scheduled Primary Urban Cooperative Banks together accounted for 1.96% of the total complaints, compared to 1.87% in the previous year. Complaints against the entities like PBs and SFBs stood at 1.69% compared to 0.09% during the previous year. The share of complaints against Foreign banks declined from 2.14% in 2018-19 to 1.92% in 2019-20 and complaints against entities that are not covered under the BOS declined from 5.15% in 2018-19 to 2.82% during the year under review. The bank-group wise classification of complaints received during the last three years is detailed at Appendix 2.9.

Nature of complaints handled

2.16 Clause 8 of the BOS, 2006 specifies the grounds under which a customer can file a complaint before the BO. Table 2.2 categorizes complaints received on the grounds of deficiency in banking services as specified under Clause 8.

| Table 2.2 – Category-wise distribution and share of complaints |

| Category |

Complaints received |

| 2017-18 |

2018-19 |

2019-20 |

| ATM / Debit Cards |

24,672 |

36,539 |

67,800 |

| 15.08% |

18.65% |

21.97% |

| Mobile / electronic banking |

8,487 |

14,794 |

41,310 |

| 5.19% |

7.55% |

13.38% |

| Non-observance of FPC |

36,146 |

37,557 |

36,215 |

| 22.10% |

19.17% |

11.73% |

| Credit Cards |

12,647 |

13,274 |

28,713 |

| 7.73% |

6.78% |

9.30% |

| Failure to meet commitments |

11,044 |

13,332 |

25,036 |

| 6.75% |

6.81% |

8.11% |

| Levy of charges without prior notice |

8,209 |

8,391 |

18,558 |

| 5.02% |

4.28% |

6.01% |

| Loans and advances |

6,226 |

7,610 |

16,437 |

| 3.81% |

3.88% |

5.33% |

| Non-adherence to BCSBI Codes |

3,962 |

5,981 |

14,194 |

| 2.42% |

3.05% |

4.60% |

| Deposit Accounts related |

6,719 |

10,844 |

8,778 |

| 4.11% |

5.54% |

2.84% |

| Pension payments |

7,833 |

7,066 |

6,307 |

| 4.79% |

3.61% |

2.04% |

| Remittances |

3,330 |

3,451 |

4,045 |

| 2.04% |

1.76% |

1.31% |

| DSAs and recovery agents |

554 |

629 |

1,406 |

| 0.34% |

0.32% |

0.46% |

| Para banking |

579 |

1,115 |

1,117 |

| 0.35% |

0.57% |

0.36% |

| Notes and Coins |

1,282 |

480 |

514 |

| 0.78% |

0.25% |

0.17% |

| Others |

26,219 |

28,330 |

29,204 |

| 16.03% |

14.46% |

9.46% |

| Out of purview of BOS |

5,681 |

6,508 |

8,996 |

| 3.47% |

3.32% |

2.91% |

| Total |

1,63,590 |

1,95,901 |

3,08,630 |

| Note: Figures in % indicate the percentage to total complaints of the respective year |

2.17 Complaints on non-observance of FPC constituted the largest number of complaints in 2017-18 and 2018-19. However, in the year 2019-20, complaints related to ATM/ Debit Cards surpassed FPC as the ground with the highest number of complaints. The upsurge in complaints related to Credit Cards and Mobile/ Electronic Banking was also observed.

2.18 Of the ATM / Debit Card complaints, a major sub-category was ‘Account debited but cash not dispensed by ATMs’ with a share of 46.95% in the ATM related complaints (Table 2.3). The share of complaints under sub-category ‘Debit in account without use of the card or details of the card’ increased substantially from 12.27% to 23.23% of the total ATM / Debit Card complaints.

| Table 2.3 Breakup of ATM/ Debit Card complaints |

| Sub-Category |

2017-18 |

2018-19 |

2019-20 |

| Non-payment of cash / account debited but cash not dispensed by ATMs |

14,691 |

19,366 |

31,832 |

| 8.98% |

9.89% |

10.31% |

| Debit in account without use of the card or details of the card |

2,356 |

4,481 |

15,752 |

| 1.44% |

2.29% |

5.10% |

| Use of stolen / cloned cards |

2117 |

4,961 |

7,511 |

| 1.29% |

2.53% |

2.43% |

| Account debited more than once for one withdrawal in ATMs or for POS transaction |

965 |

1,288 |

2,687 |

| 0.59% |

0.66% |

0.87% |

| Short payment of cash / less or excess amount of cash dispensed by ATMs |

1,166 |

1,186 |

1,613 |

| 0.71% |

0.61% |

0.52% |

| Others |

3,377 |

5,257 |

8,405 |

| 2.06% |

2.68% |

2.72% |

| Sub-total |

24,672 |

36,539 |

67,800 |

| 15.08% |

18.65% |

21.97% |

| Total complaints received |

1,63,590 |

1,95,901 |

3,08,630 |

| Note: Figures in % indicate percentage to total number of complaints of respective year |

2.19 Complaints on grounds relating to digital transactions (Mobile / Electronic banking, ATM / Debit Cards and Credit Cards) rose from 64,607 in 2018-19 to 1,37,823 complaints in 2019-20 and accounted for 44.66% of total complaints, as compared to 32.98% in the previous year. The number of these complaints is increasing and is an area of concern for RBI [Box 2.1].

|

Box 2.1: Rising digital complaints along with rising digital transactions

The volume of digital transactions has gone up across all electronic modes over the years. The rising transactions in the digital space have inevitably led to rising complaints relating to deficiency of such services provided by banks.

During the year 2019-20, 44.66% (1,37,823) of the total complaints (3,08,630) against banks received under BOS, 2006 related to digital services like ATM/ Debit/ Credit Card and Mobile/ Electronic transactions. The distribution of receipt of digital complaints across OBOs in the year 2019-20 is represented in Figure 1.

The receipt of digital complaints was the highest in the Ombudsman Offices in New Delhi (25,498 complaints), followed by Mumbai (17,207), Kanpur (11,349), Chandigarh (11,283) and Ahmedabad (7,594). Of the total complaints received during the year 2019-20, 9.3% related to Credit Cards, of which 61.85% were against Private Sector Banks. Granulating further, 67.20% of the Credit Card complaints against Private Sector Banks originated from the metropolitan regions, which can be attributed to the very low penetration of Credit Cards in the rural areas.

In respect of complaints related to ATM/ Debit Cards, which accounted for 21.97% of the total complaints, the share against ‘Debit in account without use of card or details of card’ has grown by 247.51% Y-o-Y.

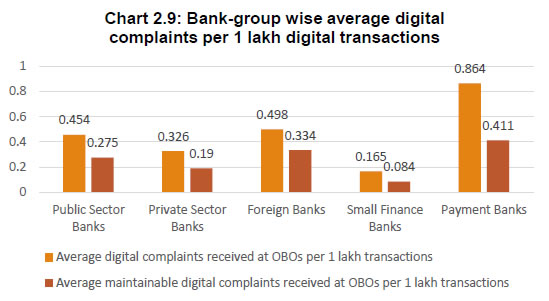

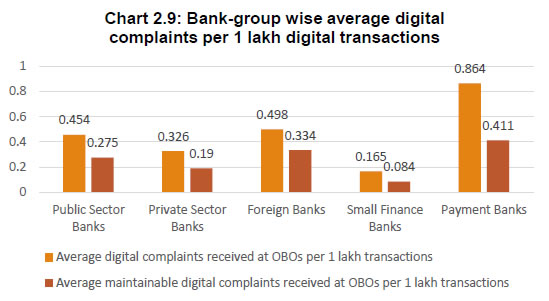

In order to assess the grievance redressal machineries of banks with regard to digital complaints, an analysis of maintainable complaints received against bank-groups relating to digital services like ATM/ Debit/ Credit Card and Mobile/ Electronic transactions was made vis-a-vis the respective transaction volumes during the year. The Chart 2.9 below shows the average number of total complaints and the maintainable complaints received against every one lakh electronic transactions executed through the respective banks.

With the objective of reducing complaints relating to digital services and improving the efficacy of the grievance redressal machineries of the Regulated Entities, the Reserve Bank has taken various initiatives including issue of guidelines relating to ‘Charter of Customer Rights’ dated December 03, 2014, ‘Harmonisation of Turn Around Time (TAT) and customer compensation for failed transactions using authorised Payment Systems’ dated September 20, 20193 and ‘Online Dispute Resolution (ODR) System for Digital Payments’ dated August 6, 20204. Further, to address the issue of non-maintainability of digital complaints received at the OBOs, which is high at around 45%, several initiatives for creating awareness regarding the Ombudsman Schemes and safe banking practices are being taken up.

|

2.20 Complaints relating to ‘Loans and Advances’ constituted 5.33% of the total complaints received and generally pertained to delay in sanction, disbursement, non-observance of prescribed time schedule for disposal of loan applications, non-acceptance of application without valid reason, etc.

2.21 Complaints on ‘deposit accounts’ constituted 2.84% of the total complaints received, witnessing a considerable decline of 19.05% on Y-o-Y basis. The complaints were mainly on grounds of delay in credit, non-credit of proceeds to party’s account, non-payment of deposit or non-observance of the RBI directives and wrong application of rate of interest on deposits in savings or other accounts, etc.

2.22 During the year, 2.04% of the total complaints received related to ‘Pension Payments’ as compared to 3.61% in the previous year. This decline is seen in absolute number as well. The BOs emphasize upon the banks to deal with grievances of the pensioners in a sensitive manner. Continuous efforts will be ensured to bring the number of complaints further down in future as well through improved services to the pensioners.

2.23 In 2019-20, 1.31% of the complaints received related to ‘Remittances’ such as non-payment/ inordinate delay in the payment or in the collections of cheques, drafts, bills etc.

2.24 OBOs also received 2.91% of the complaints which were ‘Out of purview’ of the Scheme and were closed as non-maintainable. The share of such complaints stood at 3.32% in the previous year.

2.25 Complaints under ‘Others’ category declined to 9.46% in 2019-20 from 14.46% in 2018-19 as detailed in Table 2.4.

| Table 2.4 – Break-up of complaints in ‘Others’ category |

| Break-up of complaints in ‘Others’ category |

| Sub-Category |

2017-18 |

2018-19 |

2019-20 |

| Non-adherence to RBI directives on: |

|

|

|

| I. Banking or other services |

5,669 |

6,571 |

3,944 |

| 3.47% |

3.35% |

1.28% |

| II. Interest rates (Loans and Advances) |

1,226 |

1,193 |

1,946 |

| 0.75% |

0.61% |

0.63% |

| III. Any other direction or instruction as may be specified by the RBI on Loans and Advances and other matters |

17,061 |

16,246 |

15,002 |

| 10.43% |

8.29% |

4.86% |

| ii. Non-adherence to prescribed working hours |

258 |

465 |

945 |

| 0.16% |

0.24% |

0.31% |

| iii. Refusal to accept or delay in accepting payment towards taxes as required by RBI/ Government |

213 |

419 |

429 |

| 0.13% |

0.21% |

0.14% |

| iv. Refusal to issue or delay in issuing or Failure to Service or Delay in Servicing or Redemption of Government Securities |

169 |

233 |

355 |

| 0.10% |

0.12% |

0.12% |

| v. Other Matters Specified by RBI |

1,623 |

3,203 |

6,583 |

| 0.99% |

1.64% |

2.13% |

| Sub-Total |

26,219 |

28,330 |

29,204 |

| 16.03% |

14.46% |

9.46% |

| Total complaints received |

1,63,590 |

1,95,901 |

3,08,630 |

| Note: Figures in % indicate percentage to total complaints of the respective year |

2.26 The growth in the volume of complaints received under BOS, 2006 over the years is shown in Chart 2.10. As may be observed, the rate of growth of complaints in OBO has risen sharply over the last four years.

Disposal of complaints

2.27 Table 2.5 below indicates a comparative position of disposal of complaints by OBOs.

| Table 2.5 - Comparative position of disposal of complaints by OBOs |

| Number of Complaints |

2017-18 |

2018-19 |

2019-20 |

| Received during the year |

1,63,590 |

1,95,901 |

3,08,630 |

| Brought forward from previous year |

11,215 |

6,182 |

12,069 |

| Handled during the year |

1,74,805 |

2,02,083 |

3,20,699 |

| Disposed during the year |

1,68,623 |

1,90,014 |

2,96,201 |

| Rate of Disposal (%) |

96.46% |

94.03% |

92.36% |

| Carried forward to the next year |

6,182 |

12,069 |

24,498 |

2.28 Table 2.5 indicates that the disposed complaints by OBOs increased by 1,06,187 complaints during the year 2019-20. This was achieved without additional human resources due to efficiency gains arising from CMS and by the extra efforts put in by the respective OBOs. The OBO wise position of complaints disposed during the year 2019-20 is given at Appendix 2.10.

2.29 While 12,069 complaints comprising 5.97% of the total handled complaints were pending at the end of the year 2018-19, the pendency for the year 2019-20 has gone up to 24,498 complaints, at 7.64% of the complaints handled by the OBOs. This is largely due to the 57.54% increase in the inflow of complaints attended to by the same available resources at the disposal of OBOs. It is worth noting that the number of complaints handled, and the number of complaints disposed also increased in the same proportions, indicating the efforts put up by the OBOs even under these extraordinary times of the ongoing pandemic.

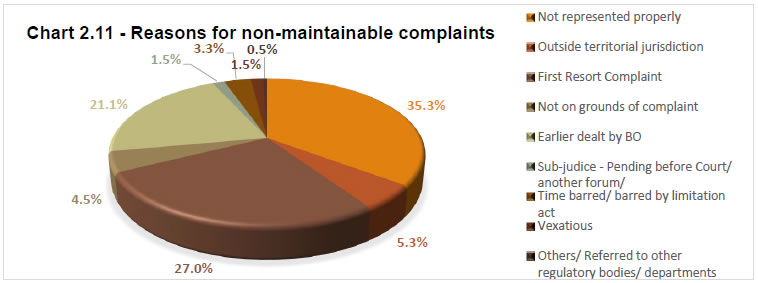

2.30 The non-maintainable5 complaints fell to 45.76% of the total complaints during the year 2019-20 as compared to 54.34% in the previous year. The reasons for complaints found non-maintainable are given in Chart 2.11.

2.31 It is observed that complaints were disposed of as non-maintainable largely due to i) complaints not being represented properly, ii) First Resort Complaints (FRCs), and iii) complaints having already been dealt with earlier by the BO.

2.32 FRCs are those complaints which are received by the OBOs without the complainant having approached the concerned bank first. These complaints are sent to the respective banks for disposal at their end. Complainants are, however, advised through closure letters that they could approach the OBO again in case they are not satisfied with the decision of the bank.

2.33 The OBO wise and bank wise distribution of non-maintainable complaints is given at Appendix 2.11 and Appendix 2.12, respectively.

Mode of disposal of maintainable complaints

2.34 ‘Maintainable’ complaints are those that are made to the BO, relating to the grounds of complaint specified in Clause 8 of the BOS, 2006 and are in line with the requirements laid down in the Scheme. The Scheme envisages settlement of complaints by agreement through conciliation and/ or mediation. If the parties fail to arrive at an acceptable agreement, the BO gives a decision, which includes passing an Award against the bank. There has been a marked increase in the number of complaints resolved by agreement in the last two years.

2.35 Table 2.6 depicts the mode of disposal of maintainable complaints under BOS. The share of maintainable complaints disposed by way of mutual settlement/ agreement has gone up to 72.34% during 2019-20 as compared to 69.88% during 2018-19 and 65.83% during 2017-18, indicating the increasing share of complaints being resolved through mediation.

| Table 2.6 - Mode of disposal of maintainable complaints |

| Disposal of maintainable complaints |

2017-18 |

2018-19 |

2019-20 |

| By Mutual Settlement/ Agreement |

54,987 |

64,470 |

1,25,836 |

| |

65.83% |

69.88% |

72.34% |

| Disposal by Award |

133 |

98 |

68 |

| |

0.16% |

0.11% |

0.04% |

| Maintainable Complaints Rejected |

28,259 |

26,905 |

47,873 |

| |

33.83% |

29.16% |

27.52% |

| Maintainable Complaints Withdrawn |

153 |

791 |

181 |

| |

0.18% |

0.86% |

0.10% |

| Total |

83,532 |

92,264 |

1,73,958 |

| Note: Figures in % indicate the percentage to maintainable complaints disposed |

Turn Around Time (TAT) for disposal of complaints

2.36 The time taken by BOs to dispose a complaint increased significantly to 95 days during the year 2019-20 as compared to 47 days a year ago. The TAT pertaining to all the complaint categories showed a substantial increase, which is attributable to the transition to CMS and its stabilisation post its launch. While complaints could be received seamlessly on the CMS portal, the processing of complaints was initially hindered due to technical reasons even as OBOs and REs grew familiar with CMS. The issues were addressed during first half of the year, which helped in disposing the increased number of complaints over the remaining period of the year. The TAT of complaints during the second half of the year (January-June 2020) improved considerably to 45 days; a significant drop from the yearly average, showing perceptible increase in disposal efficiency over time. The ground wise TAT is given at Appendix 2.13.

Grounds for rejection of maintainable complaints

2.37 The grounds for rejection of maintainable complaints and their proportion to total complaints received over the last three years are indicated in Table 2.7.

| Table 2.7- Grounds for rejection of maintainable complaints |

| Ground for rejection |

No. of complaints rejected |

| 2017-18 |

2018-19 |

2019-20 |

| Not on grounds of complaint (Clause 8) |

25,114

89% |

26,447

98.30% |

46,237 |

| 96.58% |

| Not in accordance with provisions of Clause 9 (3) |

983 |

| 2.05% |

| Beyond pecuniary jurisdiction of BO - Clause 12 (5) & (6) |

115 |

137 |

147 |

| 0.41% |

0.51% |

0.31% |

| Requiring elaborate documentary and oral evidence - Clause 13 (d) |

2,337 |

193 |

28 |

| 8.27% |

0.72% |

0.06% |

| Complaints without sufficient cause - Clause 13(e) |

298 |

42 |

195 |

| 1.05% |

0.16% |

0.41% |

| Not pursued by the complainants - Clause 13(f) |

272 |

71 |

27 |

| 0.96% |

0.26% |

0.06% |

| No loss/ damage/ inconvenience to the complainant - Clause 13 (g) |

123 |

15 |

44 |

| 0.44% |

0.06% |

0.09% |

| The complaint pertains to the same cause of action, for which any proceedings before any court, tribunal or arbitrator or any other forum is pending 13(2) |

-- |

-- |

212 |

| -- |

-- |

0.44% |

| Total maintainable complaints rejected |

28,259 |

26,905 |

47,873 |

| Note: Figures in % indicate percentage to total rejected maintainable complaints |

2.38 As may be seen from Table 2.7 above, the number of maintainable complaints rejected has increased in absolute number from 26,905 in 2018-19 to 47,873 in 2019-20. The maximum number of rejections was on the ground that the complaint was ‘not on the grounds of complaint (Clause 8)’ or ‘not filed in accordance with required provisions of Clause 9 (3)’, accounting for 98.30% of the rejected maintainable complaints in 2018-19 and 98.64% in 2019-20.

|

Box 2.2: An analysis of rejected Maintainable complaints

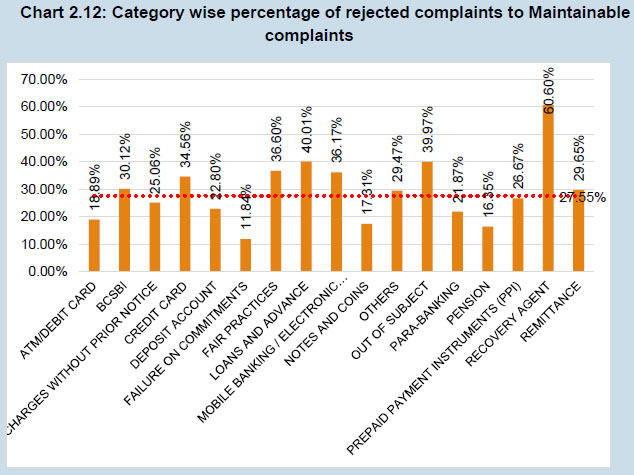

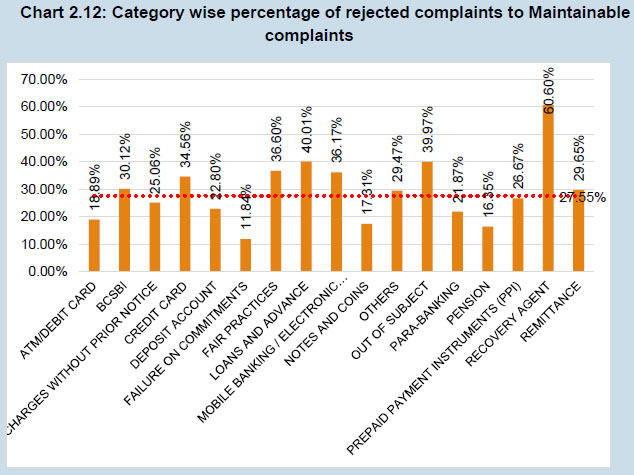

An analysis of the maintainable complaints rejected by Ombudsmen shows that out of the total 1,73,928 maintainable complaints closed during the year 2019-20, the total number of complaints rejected under Clause 13 of BOS stood at 47,873 (27.5%). The rejection rate (rejected complaints as a percentage of maintainable complaints) across different complaint categories is presented in Chart 2.12. Though the rejection rate related to recovery agents was the highest at 60.60%, the number of complaints received against the said category was nominal at 703 maintainable complaints during the year, of which 426 were rejected. High rejection rates were observed in complaints related to Loans and Advances (40.01%), Fair Practices Code (36.6%) and Mobile/ Electronic banking (36.1%). The lowest rejection rate was observed in complaints related to Failure on Commitments (11.84%), followed by pension related complaints (16.35%). The rejection rate in Credit Card related complaints stood at 34.56%.

On further analysis of the reasons for rejection of maintainable complaints category-wise, it is observed that around 96% of the total maintainable complaints rejected under each category were rejected under Clause 13(a) of the Scheme i.e. ‘not on the grounds of complaints referred to in Clause 8 of the Scheme’. Maintainable complaints rejected under Clause 13(b) of the Scheme i.e. ‘otherwise not in accordance with Sub Clause (3) of clause 9’ out of total maintainable complaints rejected was slightly higher for complaints related to Notes and Coins (4.4%), ATM and Debit Cards (3.74%) and Remittance (3.4%). It is likely that complainants approach the BO platform on grounds of complaints that are not covered under the Scheme. To address the concern of possible ambiguity for complainants on which grounds are covered/ not covered under BOS, the expansion of grounds of complaints is under consideration.

|

2.39 BOS envisages summary disposal of complaints. As such, complaints requiring elaborate documentary and oral evidence are rejected by the BOs. Such rejections were made appealable with effect from July 1, 2017 with an objective to review these decisions at Appellate Authority (AA) level. Consequently, the number of such rejections declined from 193 in 2018-19 to 28 in 2019-20.

Age-wise classification of pending complaints

2.40 Although BOS does not specify any time limit for resolution of complaints by OBOs, efforts are made to resolve the same within two months. However, due to reasons such as non-submission and/ or delay in submission of complete information by complainants/ banks, the time taken for resolution may get extended in some cases. The BOs and the Principal Nodal Officers (PNOs) of banks are advised/ sensitized to ensure that complaints are resolved within two months. During the first half of 2019-20, however, the BOs and the PNOs were new to CMS which led to build-up in the pendency of complaints in some OBOs. During the later period however, the disposal of complaints picked up. The age-wise classification of the number of pending complaints is detailed at Appendix 2.14.

Awards issued

2.41 During the year, 68 Awards were issued by BOs of which 38 were implemented. The OBO-wise position of Awards issued and implemented is indicated in Table 2.8.

| Table 2.8: OBO wise position of Awards issued during 2019-20 |

| OBO |

Awards Issued |

Implemented |

| Ahmedabad |

0 |

0 |

| Bengaluru |

1 |

0 |

| Bhopal |

1 |

1 |

| Bhubaneswar |

5 |

5 |

| Chandigarh |

9 |

1 |

| Chennai |

3 |

1 |

| Dehradun |

1 |

0 |

| Guwahati |

1 |

1 |

| Hyderabad |

0 |

0 |

| Jaipur |

0 |

0 |

| Jammu |

0 |

0 |

| Kanpur |

7 |

4 |

| Kolkata |

3 |

1 |

| Mumbai |

0 |

0 |

| Mumbai II |

0 |

0 |

| New Delhi I |

24 |

16 |

| New Delhi II |

1 |

1 |

| New Delhi III |

0 |

0 |

| Patna |

0 |

0 |

| Raipur |

1 |

0 |

| Ranchi |

1 |

1 |

| Thiruvananthapuram |

10 |

6 |

| Total |

68 |

38 |

Appeals against the decisions of the BOs

2.42 The Deputy Governor-in-Charge of CEPD, RBI is designated as the AA6 as per the provisions of BOS, 2006. CEPD provides the secretariat to the AA. During the year, 63 appeals were received as compared to 78 appeals during the previous year. Of these, 34 appeals were received from complainants who were aggrieved by the decision of the respective BOs whereas 29 were filed by the banks against Awards. With 72 appeals pending from the previous year, the AA handled 135 appeals during the year. Eighty-eight appeals were disposed during the year.

2.43 The position of appeals handled by the AA during the last three years and the OBO-wise position of appeals received during the year 2019-20 is given in Tables 2.9 and 2.10, respectively.

| Table 2.9 - Position of Appeals |

| Particulars |

2017-18 |

2018-19 |

2019-20 |

| Appeals pending at the beginning of the year |

7 |

95 |

72 |

| Appeals received during the year from complainants |

115 |

57 |

34 |

| Appeals received during the year from banks |

10 |

21 |

29 |

| Total appeals handled during the year |

132 |

173 |

135 |

| Appeal disposed during the year |

37 |

101 |

88 |

| Pending at the end of the year |

95 |

72 |

47 |

| Mode of Disposal |

| Appeals remanded to the BO |

19 |

11 |

4 |

| Appeals withdrawn/ settled/ infructuous |

7 |

21 |

14 |

| Appeals rejected |

6 |

38 |

43 |

| Appeals allowed |

5 |

31 |

27 |

| Appeals Disposed |

| i. In favour of complainant |

7 |

26 |

29 |

| ii. In favour of banks |

17 |

41 |

21 |

| iii. Neither in favour of complainant nor in favour of banks (Remanded back to BO/ infructuous) |

13 |

34 |

38 |

| Table 2.10 – OBO wise position of Appeals received during the year 2019-20 |

| OBO |

No of Appeals |

| Ahmedabad |

3 |

| Bengaluru |

1 |

| Bhopal |

- |

| Bhubaneswar |

- |

| Chandigarh |

5 |

| Chennai |

2 |

| Dehradun |

2 |

| Guwahati |

- |

| Hyderabad |

2 |

| Jaipur |

- |

| Jammu |

1 |

| Kanpur |

2 |

| Kolkata |

1 |

| Mumbai-I |

1 |

| Mumbai-II |

19 |

| New Delhi-I |

15 |

| New Delhi-II |

1 |

| New Delhi-III |

- |

| Patna |

- |

| Raipur |

2 |

| Ranchi |

2 |

| Thiruvananthapuram |

4 |

| Total |

63 |

Chapter 3

The Ombudsman Scheme for Non-Banking Financial Companies, 2018: Activities during 2019-20

| The number of complaints received by the four ONBFCOs increased from 3,991 in 2018-19 to 19,432 received during 2019-20. Complaints relating to non-adherence of FPC were the highest and constituted 36.29% of the total complaints received. The majority (71.12%) of maintainable complaints were resolved through mediation. No Award was passed by the NBFCOs. During the year, one appeal was received against the decision of the NBFCO. |

Receipt of complaints

3.1 The OSNBFC is being administered through four ONBFCOs located at Chennai, Kolkata, Mumbai, and New Delhi. These four ONBFCOs handle complaints of South, East, West and North zones to cover the entire country.

3.2 During the year, the number of complaints received at ONBFCOs increased by 387% to 19,432, up from 3,991 complaints received in 2018-19. The increase was mainly on account the extension of the OSNBFC to additional NBFCs and the enhanced awareness regarding the Scheme arising from the initiatives of the Reserve Bank. A comparison of the number of complaints received by the ONBFCOs during the last three years and the Y-o-Y growth is given in Appendix-3.1.

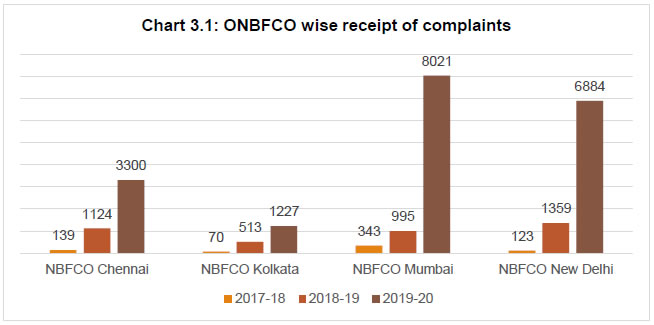

3.3 The ONBFCO, Mumbai accounted for the maximum (41.28%) number of complaints received, followed by New Delhi (35.43%), Chennai (16.98%) and Kolkata (6.31%). Mumbai also witnessed the highest increase in the inflow of complaints (706.13%) as compared to the previous year. A comparison of the number of complaints received by the respective ONBFCOs during the last three years is given in Chart 3.1.

3.4 During the year, the average cost of handling a complaint was ₹2,375/- as given in Table- 3.1 below.

| Table 3.1 - Cost of handling a complaint 2019-20 |

| ONBFCO |

Cost of handling (₹ / Complaint) |

Total cost (₹) |

| Chennai |

3,787 |

1,17,81,538 |

| Kolkata |

5,460 |

7,921,845 |

| Mumbai |

2,195 |

1,71,00,000 |

| New Delhi |

1,354 |

94,31,800 |

| Total |

2,375 |

4,62,35,183 |

Mode of receipt of complaints

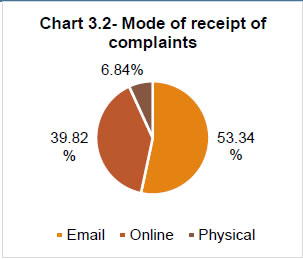

3.5 ONBFCOs receive complaints through various modes, viz. through the CMS portal, e-mail, ordinary registered post, hand delivery, courier, etc. The number of complaints received through different modes during the year 2019-20 is indicated in Table 3.2 and Chart 3.2.

| Table 3.2 Mode of receipt of complaints |

| Mode of receipt |

No. of complaints received during 2019-20 |

| Email |

10,365 |

| 53.34% |

| Online |

7,737* |

| 39.82% |

| Post / Fax / Courier / hand delivery |

1,330 |

| 6.84% |

| Total |

19,432 |

Note: Figures in % show percentage to total complaints received

*1,286 Complaints were received on CPGRAMS |

3.6 It may be observed that 10,365 (53.34%) complaints were received through e-mail while 7,737 (39.82%) complaints were received through the online portal - 6,451 on CMS, and 1,286 on Centralized Public Grievance Redress and Monitoring System (CPGRAMS), the Government of India portal for receipt and monitoring of complaints from members of public. Physical sources like post/ courier/ fax/ hand delivery accounted for 1,330 complaints (6.84%). Digital media accounted for the 93.16% of the total complaints received. CPGRAMS being a generic grievance filing system, the complainants lodge their grievance on the portal and the same is forwarded to RBI, Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), Pension Fund Regulatory and Development Authority of India (PFRDA), etc. according to the nature of the non-bank entity complained against.

Complainant-group wise classification of complaints

3.7 Individual customers constituted the largest segment (51.17%) of complainants during the year 2019-20. 0.32% of the total complaints were lodged by senior citizens. The complainant group-wise classification of complaints is given at Appendix 3.2.

Category wise complaints received

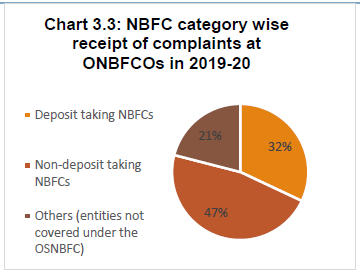

3.8 Of the total complaints received, 6,210 (31.96%) complaints were against NBFC-Ds, while 9,075 (46.70%) complaints were against NBFC-NDs. Complaints against entities not covered under the OSNBFC, at 4,147, accounted for 21.34% of the complaints lodged in the ONBFCOs. Such complaints were forwarded to the regulators concerned (National Housing Bank (NHB), SEBI, IRDAI, etc.). The category wise classification of complaints received by ONBFCOs during the last three years is indicated at Table 3.3 and Chart 3.3 below:

| Table 3.3: NBFC category wise receipt of complaints at ONBFCOs in 2019-20 |

| NBFC Category |

Complaints |

% Share |

| Deposit taking NBFCs |

6,210 |

31.96 |

| Non-deposit taking NBFCs |

9,075 |

46.70 |

| Others (entities not covered under the OSNBFC) |

4,147 |

21.34 |

| Total |

19,432 |

100.00 |

Nature of complaints received

3.9 Clause 8 of the OSNBFC, 2018, specifies 13 grounds regarding deficiency in NBFC services under which a customer can file a complaint before the Ombudsman. The complaints received under various grounds of deficiency in NBFCs’ services are furnished in Table 3.4 below:

| Table 3.4: Category-wise distribution of complaints |

| Complaint category |

2017-18 |

2018-19 |

2019-20 |

| Non-adherence to FPC |

338 |

1,614 |

7,052 |

| 1.74% |

8.31% |

36.29% |

| Non-observance of RBI directions |

58 |

687 |

3,607 |

| 0.30% |

3.54% |

18.56% |

| Non transparency in contract/ loan |

16 |

366 |

1,704 |

| 0.08% |

1.88% |

8.77% |

| Levy of charges without prior notice |

26 |

504 |

1,628 |

| 0.13% |

2.59% |

8.38% |

| No communication about loan sanctioned |

5 |

107 |

399 |

| 0.03% |

0.55% |

2.05% |

| Delay in repayment of deposits |

18 |

131 |

395 |

| 0.09% |

0.67% |

2.03% |

| Delay in release of securities/ documents |

7 |

72 |

268 |

| 0.04% |

0.37% |

1.38% |

| Delay in payment of interest |

2 |

20 |

232 |

| 0.01% |

0.10% |

1.19% |

| Non-understandable or no adequate notice on terms and conditions |

4 |

57 |

82 |

| 0.02% |

0.29% |

0.42% |

| Non-understandable or non-issuance of sanction letter/ terms |

3 |

45 |

49 |

| 0.02% |

0.23% |

0.25% |

| Not covered under Clause 8 of the Scheme |

73 |

380 |

474 |

| 0.38% |

1.96% |

2.44% |

| Other categories |

125 |

8 |

3,542 |

| 0.64% |

0.04% |

18.23% |

| Total |

675 |

3,991 |

19,432 |

| Note: Figures in % indicate percentage share to total complaints received |

3.10 During the year 2019-20, complaints pertaining to non-adherence to FPC constituted the largest share of complaints at 36.29% of the complaints received, followed by non-observance of RBI directions to NBFCs at 18.56%.

3.12 Complaints under the ‘others’ category, at 18.23%, also took a significant share of the total complaints received. The break-up for the ‘others’ category is as detailed in Table 3.5.

| Table 3.5: Break-up of complaints in ‘Others’ category |

| Sub-Category |

2019-20 |

% to total ‘Others’ |

| Failure on commitments |

855 |

4.40% |

| Loans & Advances |

286 |

1.47% |

| Delay in presentation of Post-dated Cheques |

76 |

0.39% |

| Recovery agent related |

65 |

0.33% |

| Non-adherence to BCSBI Code |

58 |

0.30% |

| Other matters specified by RBI |

2,202 |

11.33% |

| Sub-Total |

3,542 |

18.23% |

| Total number of complaints received |

19,432 |

100.00% |

Disposal of Complaints

3.11 During the period under review, ONBFCOs handled 19,4687 complaints, as against 4,022 complaints handled in the previous year. Despite the significant increase in the number of complaints received, 18,560 complaints were disposed of by the end of the year, achieving a disposal rate of 95.34%. The position of complaints handled by ONBFCOs is tabulated in Table 3.6 below:

| Table 3.6: Position of customer complaints handled by ONBFCOs |

| Particulars |

2017-18 |

2018-19 |

2019-20 |

| Complaints brought forward from the previous year |

0 |

31 |

36 |

| Complaints received |

675 |

3,991 |

19,432 |

| Total number of complaints handled |

675 |

4,022 |

19,468 |

| Complaints disposed |

644 |

3,986 |

18,560 |

| Complaints pending at the end of the year |

31 |

36 |

908 |

| Complaints pending for less than one month |

26 |

25 |

380 |

| Complaints pending for one to two months |

3 |

10 |

187 |

| Complaints pending for two to three months |

2 |

1 |

60 |

| Complaints pending for more than three months |

0 |

0 |

281 |

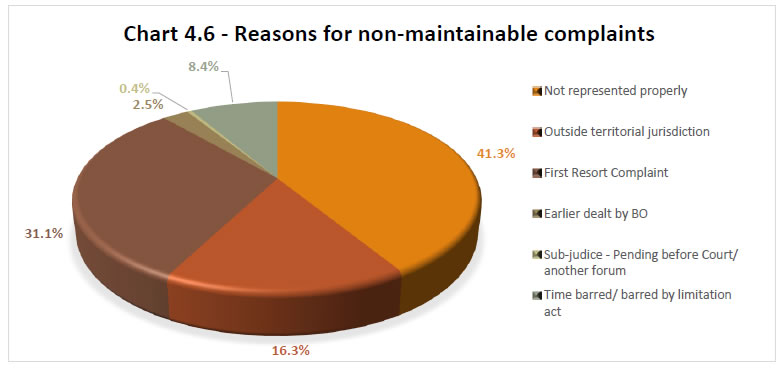

3.12 Complaints that are not on the grounds specified in Clause 8 of the OSNBFC, complaints where the procedure for filing the complaint as laid down in Clause 9 and 9A of the OSNBFC is not followed or complaints received against entities not registered with the Reserve Bank, etc. are classified as ‘non-maintainable’.

3.13 The NBFCO wise position of maintainable and non-maintainable complaints is given in Table 3.7 below.

| Table 3.7: ONBFCO wise position of complaints |

| ONBFCO |

Maintainable |

Non-maintainable |

Total Disposed |

| Chennai |

1,731 |

1,350 |

3,081 |

| Delhi |

1,673 |

4,806 |

6,479 |

| Kolkata |

502 |

717 |

1,219 |

| Mumbai |

1,781 |

6,000 |

7,781 |

| Total |

5,687 |

12,873 |

18,560 |

Mode of disposal of complaints

3.14 The mode of disposal of maintainable complaints is indicated in Table 3.8 below:

| Table 3.8- Mode of disposal of maintainable complaints by ONBFCO |

| |

2017-18 |

2018-19 |

2019-20 |

| Mode of disposal |

|

| Mutual settlement/ agreement |

93

78.81% |

742

79.02% |

4,045

71.12% |

| Complaints withdrawn |

0 |

0 |

1

0.02% |

| Awards issued |

0 |

0 |

0 |

| Rejected |

25

21.19% |

197

20.97% |

1641

28.85% |

| Total maintainable complaints |

118 |

939 |

5,687 |

| Note: Figures in % indicate percentage to maintainable complaints |

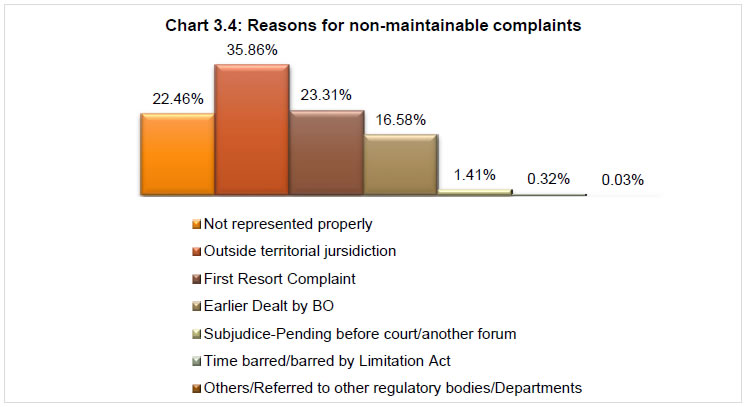

3.15 The majority of the complaints handled during the year were disposed of under Clause 11(4)(a) of the OSNBFC, which states that the grievances raised by the complainant have been resolved by the NBFC with the intervention of the Ombudsman. Further, 28.85% of the complaints were rejected; and no Awards were issued during the year.

3.16 The non-maintainable complaints formed a sizeable portion of the complaints received during 2019-20. The grounds under which the complaints were disposed of as non-maintainable are given in Chart 3.4. It may be observed that complaints were disposed of as non-maintainable largely due to i) being outside the territorial jurisdiction, ii) being FRCs, or iii) not represented properly.

ONBFCO wise position of complaints disposed

3.17 The status of complaints received in the ONBFCO is given in Table 3.9:

| Table 3.9 - ONBFCO wise position of complaints |

| ONBFC-O |

Complaints brought forward from previous year |

Complaints received |

Complaints handled |

Complaints disposed |

Pending at the end of the year |

Rate of disposal |

| Chennai |

3 |

3,300 |

3,303 |

3,081 |

222 |

93.28% |

| Kolkata |

0 |

1,227 |

1,227 |

1,219 |

8 |

99.35% |

| Mumbai |

12 |

8,021 |

8,033 |

7,781 |

252 |

96.86% |

| New Delhi |

21 |

6,884 |

6,905 |

6,479 |

426 |

93.83% |

| Total |

36 |

19,432 |

19,468 |

18,560 |

908 |

95.34% |

3.18 The NBFC wise list of total complaints received by the ONBFCOs, and the maintainable complaints disposed is given in Appendix 3.3.

Appeals

3.19 The OSNBFC provides an appellate mechanism under which, the complainant as well as the NBFC, can appeal against the decision or Award of the Ombudsman, to the AA designated under the Scheme. Appeals can be made against the closure of a complaint provided it has been closed under the appealable clauses of the Scheme, for the reasons referred to in Sub Clauses (c) to (f) of Clause 13; and against an Award under Clause 12 of the Scheme. The Deputy Governor-in-Charge of the CEPD is the designated AA. The secretarial assistance to the AA is provided by the CEPD. During the year, only one appeal against the decision of the Ombudsman was received, which was under process.

| Table 3.10: Position of Appeals – ONBFCO |

| Particulars |

2019-20 |

| Appeals pending at the beginning of the year |

1 |

| Appeals received during the year from complainants |

1 |

| Appeals received during the year from NBFCs |

0 |

| Total appeals handled during the year |

2 |

| Appeal disposed during the year |

1 |

| Pending at the end of the year |

1 |

| Mode of Disposal: |

| Appeals remanded |

0 |

| Appeals withdrawn/ settled/ infructuous |

0 |

| Appeals rejected |

1 |

| Appeals allowed |

0 |

| Appeals Disposed: |

| In favour of complainants |

0 |

| In favour of NBFCs |

0 |

| Neither in favour of complainants nor in favour of NBFCs (remanded back /infructuous) |

1 |

Chapter 4

Ombudsman Scheme for Digital Transactions (OSDT), 2019: Activities during 2019-20

| The number of complaints received by the 22 OODTs during 2019-20 rose by 119.95% (annualized) compared to the previous year. Most of the complaints (2,239 – 99.4%) were lodged through electronic mode. Fund Transfers/ Unified Payments Interface (UPI)/ Bharat Bill Payment System (BBPS)/ Bharat Quick Response (QR) Code constituted the main areas of complaint at 43.89%. The majority (56.12%) of maintainable complaints were resolved through mediation. No Award was passed by ODTs. |

4.1 The OSDT, 2019 is administered by the 22 offices where the OBOs are situated.

Receipt of complaints

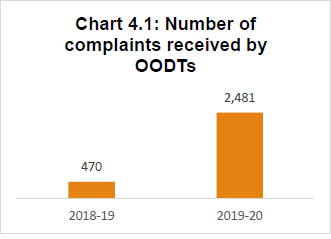

4.2 The number of complaints received under the OSDT increased from 470 complaints in 2018-19 to 2,481 during 2019-20. Annualizing the receipt of complaints (the OSDT was launched on January 31, 2019), the complaints grew by 119.95% over last year. The main reasons for the increase included increased awareness regarding the Scheme due to various media campaigns conducted by Reserve Bank and the ease of lodging complaints through the CMS portal. The year wise number of complaints received at OODTs in the last two years is given in Chart 4.1 and Table 4.1.

| Table 4.1 - Number of complaints received by OODTs |

| |

2018-19 |

2019-20 |

| No. of OODTs |

21 |

22 |

| Complaints received during the year |

470 |

2,481 |

4.3 During the period under review, 2,534 complaints were handled by OODTs, of which 53 complaints were those brought forward from the previous year. The position of customer complaints handled by OODTs is tabulated in Table 4.2 below:

| Table 4.2 - Position of customer complaints handled by OODTs |

| Particulars |

2019-20 |

| Complaints brought forward from previous year |

53 |

| Complaints received |

2,481 |

| Total number of complaints handled |

2,534 |

| Complaints disposed |

2,304 |

| Complaints pending at the end of the year |

230 |

| Complaints pending for less than one month |

31 |

| Complaints pending for one to two months |

20 |

| Complaints pending for two to three months |

23 |

| Complaints pending for more than three months |

156 |

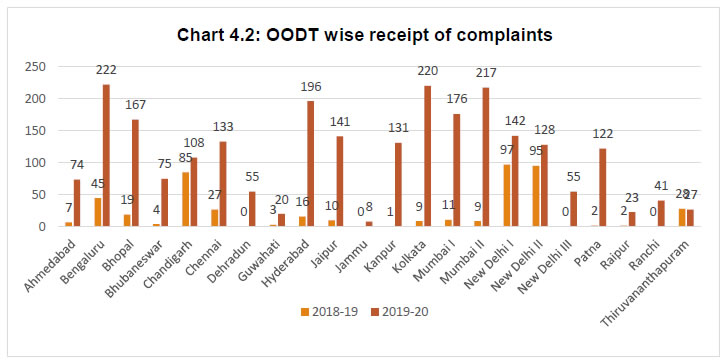

4.4 Of the 2,481 complaints received by the OODTs, (Appendix 4.1), OODT, Bengaluru received the maximum number of complaints (222), which accounted for 8.95% of the total complaints received by the OODTs, followed by OODT, Kolkata (220) and OODT, Mumbai II (217). OODT, Jammu (8) received the least share of complaints with 0.32%.

4.5 A comparative position of complaints received by OODTs during the last two years is given in Chart 4.2.

Mode of receipt of complaints

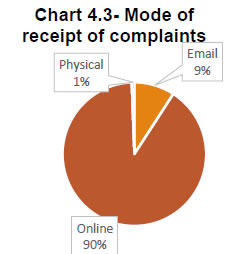

4.6 During the year 2019-20, 90.25% (2,239) of the complaints were lodged through the online mode using the CMS portal (one complaint was received through CPGRAMS). This reflects the tech-friendly nature of the users of digital financial products who are more comfortable in filing their complaints online as compared to other modes. Only 15 complaints were received through the physical mode. A comparative position of the various modes through which the complaints during 2019-20 were received during the year is given in Table 4.3 and depicted in Chart 4.3 below:

| Table 4.3 – Mode of receipt of complaints |

| Mode of receipt |

No. of complaints |

| Email |

227 |

| 9.15% |

| Online |

2,239 |

| 90.25% |

| Post/ Fax/ Courier/ Hand delivery |

15 |

| 0.60% |

| Total |

2,481 |

| Note: Figures in % indicate percentage to total complaints received |

Zone wise distribution of complaints

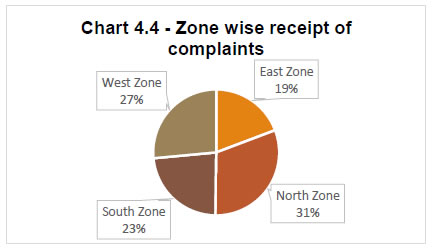

4.7 North zone accounted for the maximum share of complaints (30.96%) in 2019-20, followed by West zone (26.48%) and South zone (23.30%). The East zone accounted for the least share i.e. 19.27% of the total complaints received. The zone wise distribution of complaints received is given at Appendix 4.2 and depicted in Chart 4.4 below.

Complainant-group wise classification

4.8 Individual customers constituted the largest segment (77.23%) of complainants during the year 2019-20. Senior citizens accounted for 1.01% of the total complaints. The complainant group-wise classification of complaints is given at Appendix 4.3.

Entity wise classification

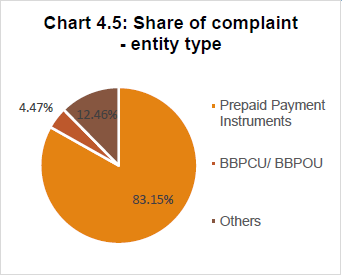

4.9 The entity-wise classification of complaints received by OODTs during 2019-20 is indicated in Chart 4.5 and Table 4.4 below.

| Table 4.4: Entity type wise break-up of complaints at OODTs |

| Entity |

2019-20 |

| Prepaid Payment Instruments |

2,061 |

| 83.07% |

| BBPCU/ BBPOU |

111 |

| 4.47% |

| Others |

309 |

| 12.46% |

| Note: Figures in % indicate percentage to total complaints |

4.10 In tune with the size of their network and businesses, PPIs had the highest share of complaints accounting for 83.07% of the total complaints, followed by Bharat Bill Payment Central Unit (BBPCU)/ Bharat Bill Payment Operating Unit (BBPOU) with 4.47% share in total complaints. Other entities accounted for 12.46% of total complaints.

Nature of complaints handled