IST,

IST,

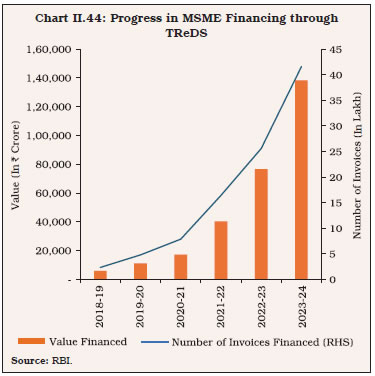

Chapter II: Digitilisation and Financial Innovation

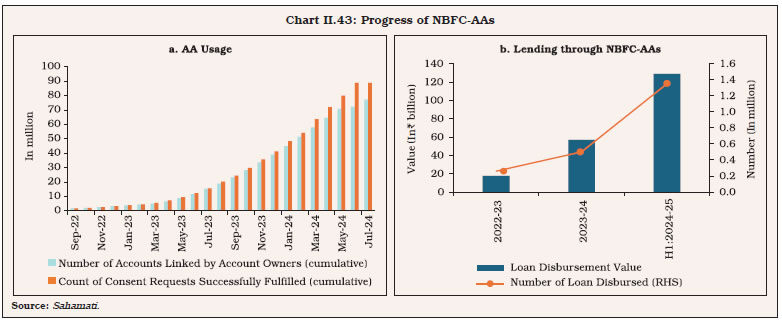

|

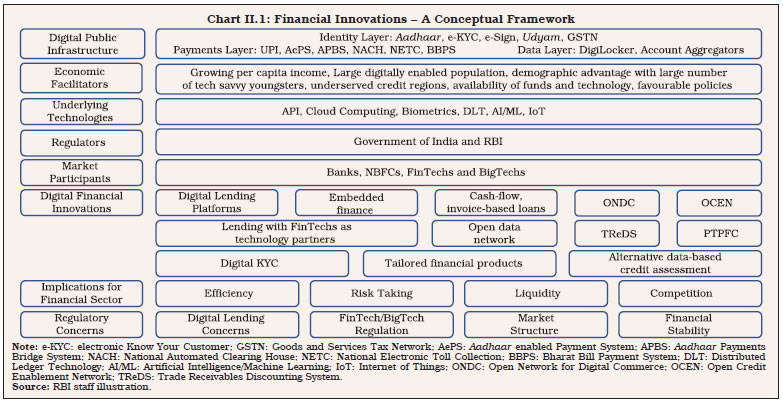

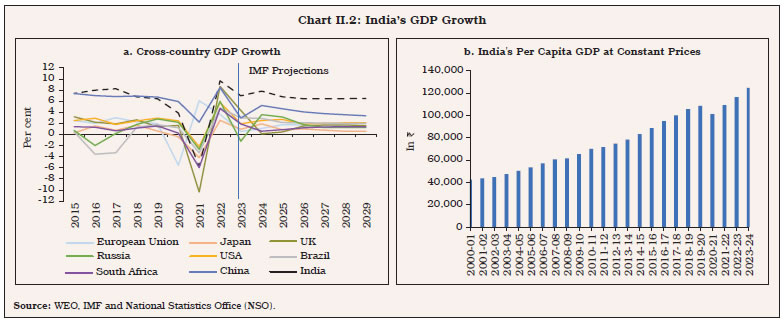

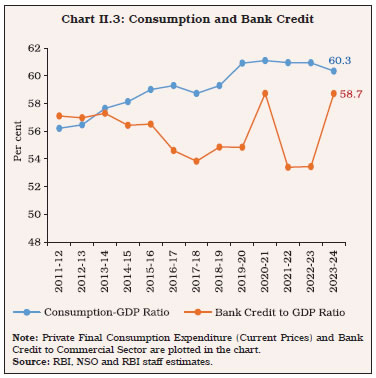

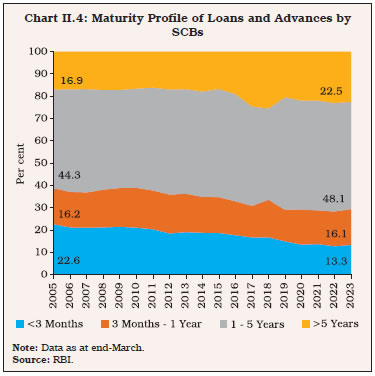

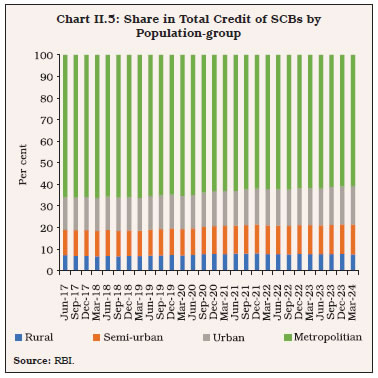

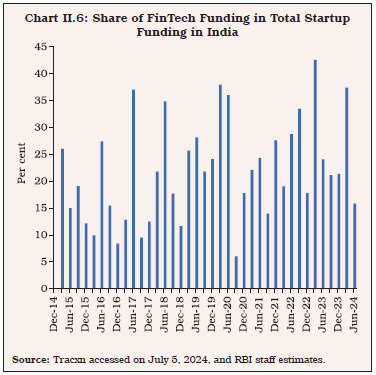

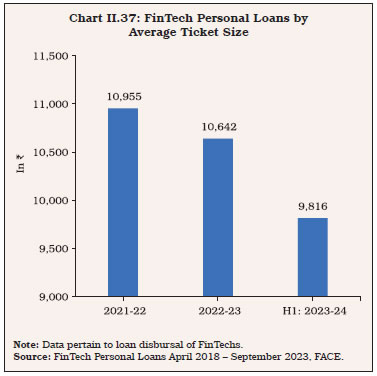

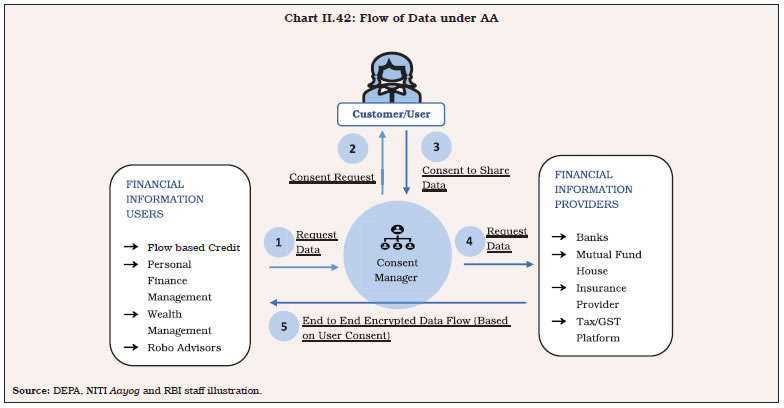

Digitalisation is spurring product and process innovations in India’s banking and financial sector, while catering to diverse needs of customers. The hallmarks of financial innovations are the collaborations of banks and non-banking financial companies (NBFCs) with FinTechs and BigTechs in provision of financial services. Adoption of emerging technologies is enabling financial institutions to improve customer service, operating efficiency, and risk management, while also enhancing liquidity of financial markets. Leveraging India’s digital public infrastructure, platform-based lending and embedded finance are rapidly digitalising the credit space through initiatives like Account Aggregators, Peer-to-peer Lending, Open Credit Enablement Network, Trade Receivables Discounting System, Pilot on Public Tech Platform for Frictionless Credit, and Open Network for Digital Commerce. Several regulatory complexities arise in the wake of emerging financial activities, given the absence of definitive regulatory frameworks governing the technologies involved. Ongoing adjustments to the existing regulatory and supervisory frameworks in line with the transformations in the financial landscape would foster a conducive environment for innovations, while ensuring financial stability. 1. Introduction II.1 Financial sector has been at the forefront of the ongoing digital revolution, marked by the cascading effect of various innovations. India is a pioneer in financial innovations, benefiting from the Government-led India Stack and enabling policies of the Reserve Bank. The state-of-the-art Unified Payments Interface (UPI), with its potential to integrate across various platforms, has opened new vistas for financial innovations like digital lending. The ‘building block approach’ to digitalisation has facilitated unbundling of various components, including identity, payments, and data management, and using them as foundational tools for designing tailored financial solutions (Alonso et al., 2023). New market players like financial technology companies (hereafter FinTechs) and other digital players are emerging as the fourth segment of the Indian financial system, alongside large banks, mid-sized banks including niche banks, Small Finance Banks (SFBs), Regional Rural Banks (RRBs), and cooperative banks (Das, 2020a). Globally, BigTech firms (hereafter BigTechs) offer personalised financial services at scale, tapping into their vast customer data that mitigate information asymmetries and reduce the need for collateral (Feyen et al., 2021). The launch of the pilot end-to-end digitally enabled Public Tech Platform for Frictionless Credit (PTPFC) by the Reserve Bank Innovation Hub has reduced the turnaround time of certain categories of loans from a few weeks to less than an hour. II.2 Financial innovations support economic growth and development through various channels, including reduction in the volatility of consumption (Cavoli and Gopalan, 2023), better risk sharing (Allen and Gale, 1994), enhanced allocative efficiency of capital (Beck et al., 2016), and financial inclusion (Feyen et al., 2023). Innovations have been contributing to banks’ business growth and have enabled financial intermediation in areas where it was previously unfeasible (Johnson and Kwak, 2012). Digitalisation in finance helps better integrate various segments and boosts liquidity and efficiency of financial markets. While the rapid and widespread integration with technology brings forth benefits, it also poses risks to the financial system. The role of central banks becomes more relevant and multi-faceted with the technological advancements leading to financial innovations (Patra, 2024). An appropriate regulatory approach, considering the inherent limitations and risks of digital technologies, would entail striking a fine balance between enabling innovations and preventing systemic risks (Das, 2022). II.3 Against this backdrop, the conceptual framework on financial innovations and their economic facilitators are discussed in Section 2. Section 3 provides an overview of the technology adoption by financial institutions and customers. The collaborations of financial institutions (the Reserve Bank’s regulated entities) with FinTechs and BigTechs in India are examined in Section 4 while developments in digital lending, characteristics of FinTech and BigTech loans, and regulatory innovations are presented in Section 5. Section 6 explores the implications of financial innovations, followed by regulatory concerns and policy initiatives in Section 7. Section 8 provides concluding observations. 2. Financial Innovations: Conceptual Framework and Economic Facilitators II.4 Financial innovations seek to alleviate financial frictions emerging from regulation and taxes, technology shocks (Silber, 1983), and incomplete markets (Duffie and Rahi, 1995), asymmetric information, and moral hazard (Ross, 1989), high transaction, search, and marketing costs (Merton, 1989), and cross-border integration (Tufano, 2003). Such innovations provide customer-centric financial products and services, spanning payments and credit, in a speedy and efficient manner, and also impact the operational efficiency and risk-taking of traditional financial institutions like banks. Thus, digitalisation in finance has profound implications for all stakeholders within the financial system – consumers, firms, and financial intermediaries (Chart II.1).   Financial Innovations: Economic Facilitators II.5 India is the fastest growing large economy in the world (Chart II.2a). The sustained increase in per capita income (Chart II.2b), ongoing financial deepening, economic dynamism and evolving diverse social needs create strong demand impulses for digital financial services and financial innovations. II.6 In India, consumption-led-growth is further providing opportunities in areas of embedded finance1 and the peer-to-merchant (P2M) payment models (Chart II.3). The bank credit to GDP ratio at around 58.7 per cent in 2023-24 leaves room for further financial deepening, which can be facilitated by financial innovations (Chart II.3). II.7 The share of short-term maturity loans (less than three months) by Scheduled Commercial Banks (SCBs) has reduced over time (Chart II.4). This provides opportunities for digital lending in small ticket loans. Financial innovations that reduce loan processing costs can help regulated entities (REs) penetrate this segment in collaboration with FinTechs. II.8 The underserved credit regions in the country offer opportunities for digital banking products and services. The share of rural areas (mainly tier 5 and 6 centres) and semi-urban areas (including tier 2, 3 and 4 centres) taken together in total credit of SCBs has increased from 15.0 per cent in June 2017 to 17.7 per cent in December 2023 and therefore, credit flow to these areas could benefit immensely from the evolving financial innovations (Chart II.5).    II.9 The availability of funds from domestic and external sources supports the financial innovation ecosystem. India - the third largest FinTech ecosystem (after the United States and United Kingdom) - accounts for close to one-fourth of all the unicorns globally. This is partly reinforced by the extent of funding received by FinTechs in India which is around 30 per cent of the startup funding during 2023 (Chart II.6).  3. Financial Innovations : Adoption by India’s Financial Institutions and Customers II.10 The benefits of financial innovations reach customers through their interactions with financial institutions. Banks are making extensive use of financial innovations to service their customers and also for enhancing operational efficiency. An analysis of the annual reports of 20 commercial banks shows that the use of words related to digitalisation and cyber security has increased steadily between 2013 and 2023, with a significant acceleration since the COVID-19 pandemic (Chart II.7a). Further, discussions on new topics like ‘FinTech’, ‘Blockchain/Tokenisation’, ‘Online Account Opening/e-KYC’, ‘Chatbot/Robot’, ‘AI/ ML’ and ‘Digital Lending’ have gained momentum in the recent period (2018-2023), in addition to the technology buzzwords of the previous period (2013-2017) such as ‘UPI’ and ‘Cyber Security Awareness’. Topics like ‘Internet of Things’ (IoT), ‘digital lending’ and ‘Account Aggregators’ have experienced significant traction in discussions post 2018 (Chart II.7b).  II.11 Digitalised financial sector can enhance credit assessment, reduce default rates and broaden the access to finance (Berg et al., 2020). Incorporating alternative digital data, such as cash flow, telecom, utility, and social media sources and leveraging surrogate data allow creditors to comprehensively assess customers’ ability and willingness to repay loans and enable real-time credit monitoring (Koulouridi et al., 2020; Agarwal et al., 2019; Calli and Coskun, 2021). Digital transformation can help banks automate and standardise their business processes, reduce human resources and operational costs (Parviainen et al., 2017). Digitalisation, facilitated by RegTechs2, automates and streamlines compliance with regulatory guidelines. In India, digitalisation has improved the efficiency of banks (Box II.1).

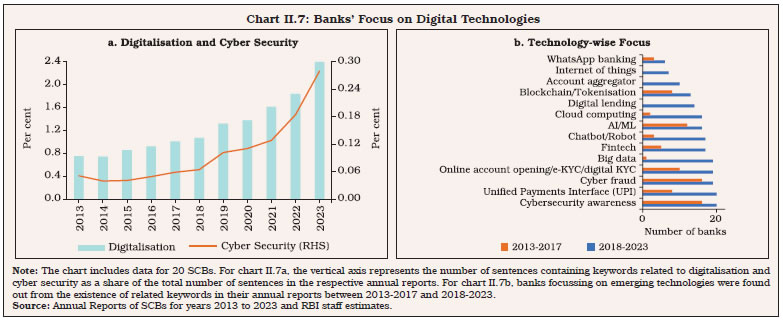

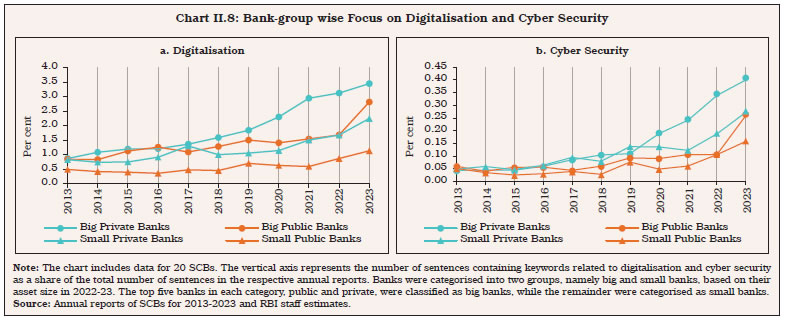

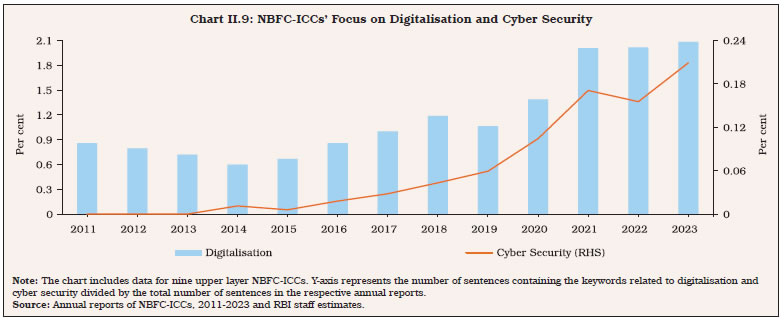

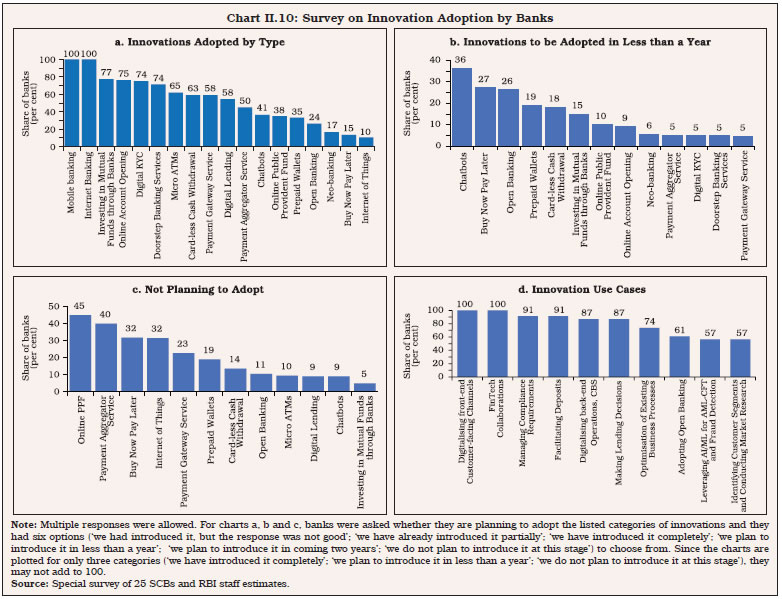

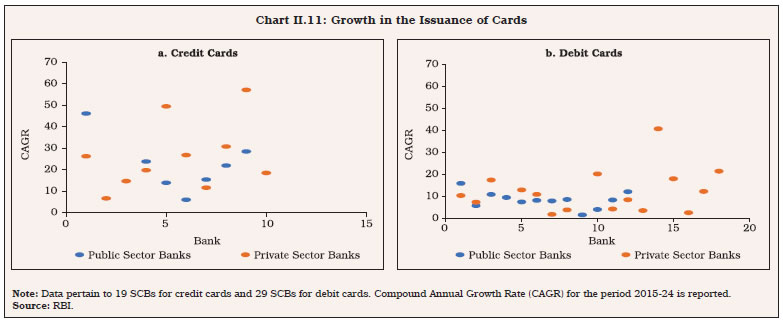

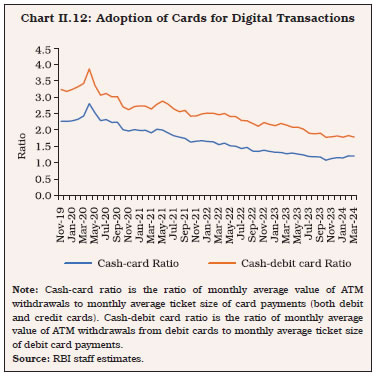

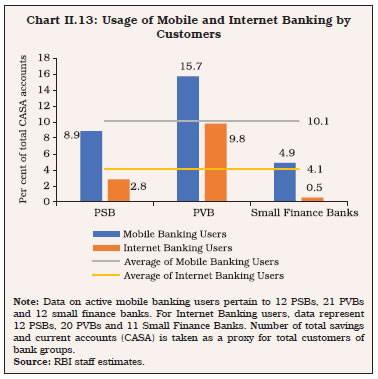

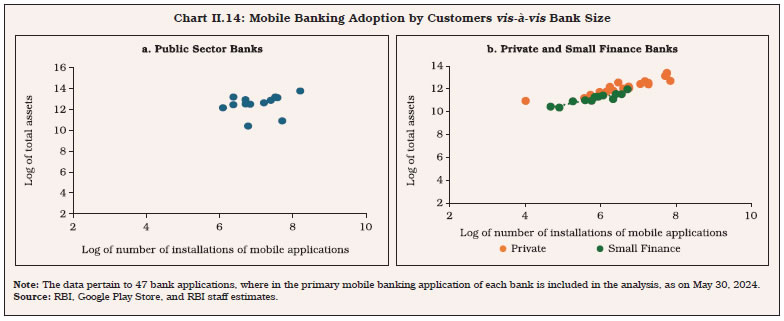

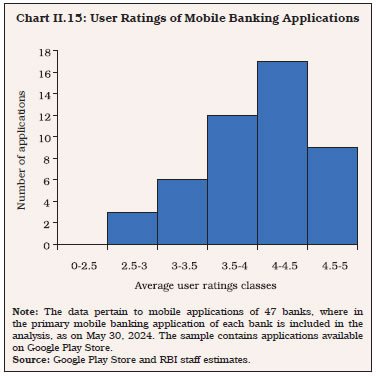

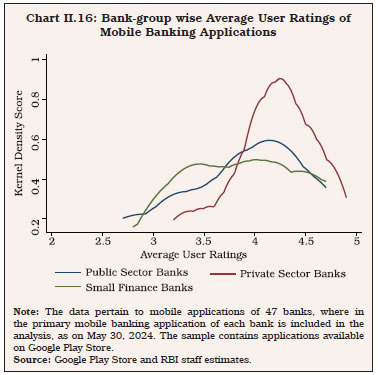

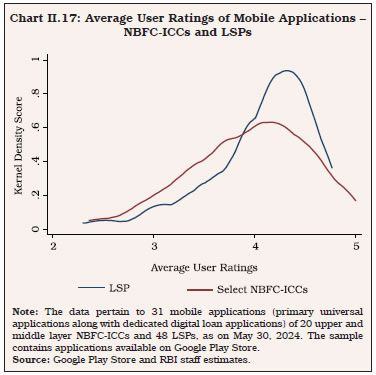

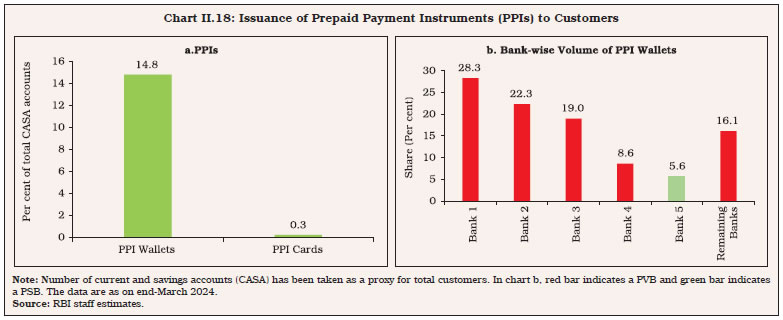

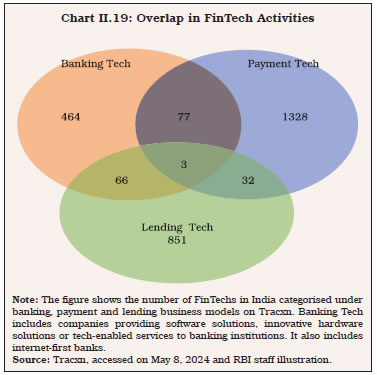

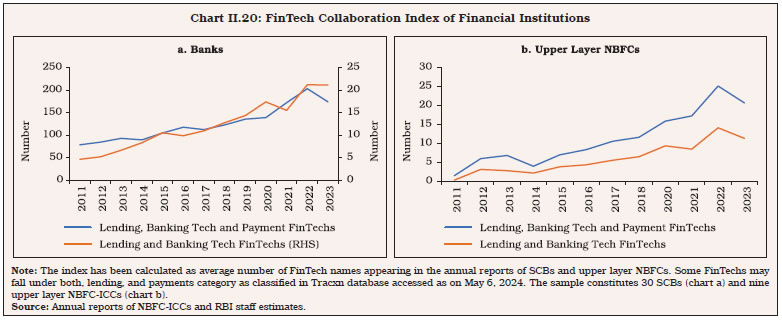

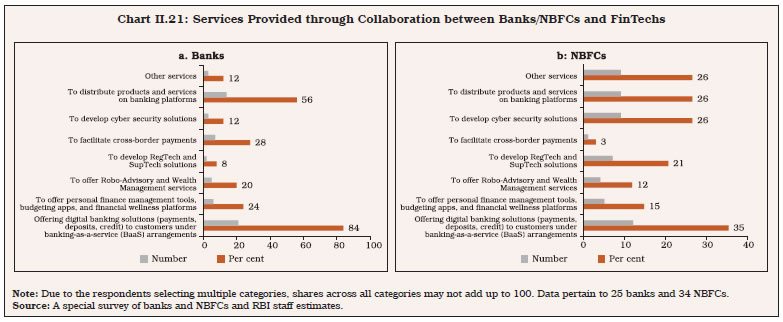

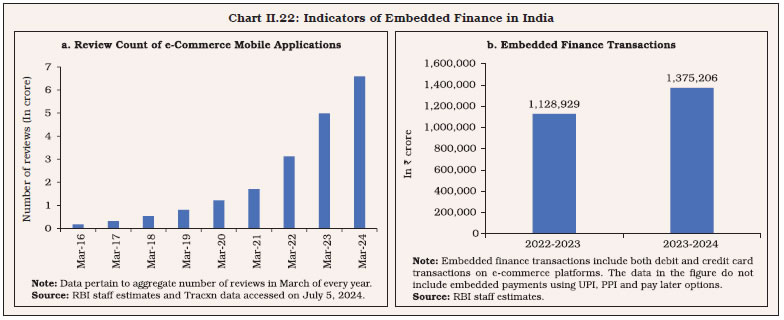

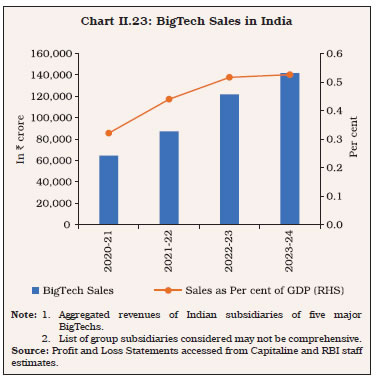

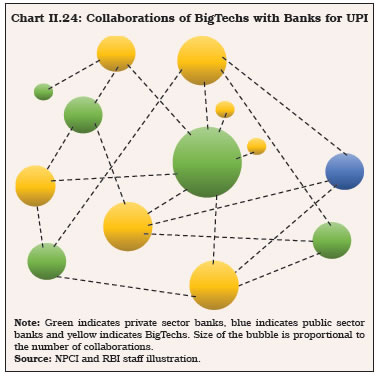

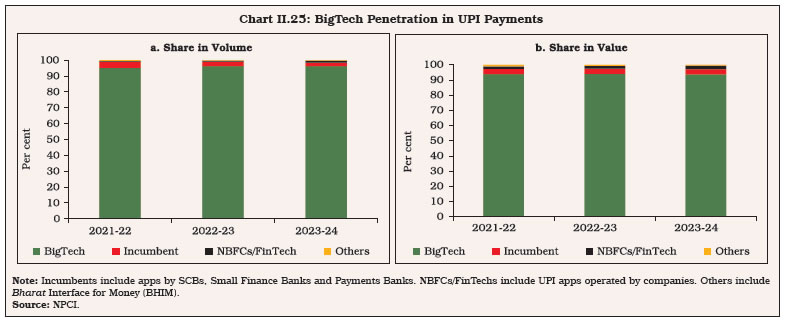

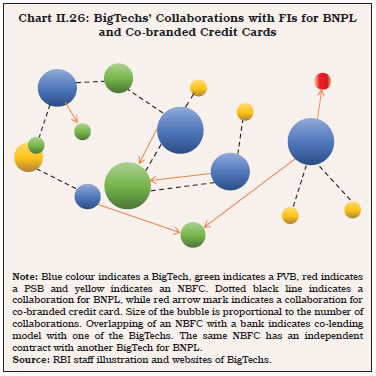

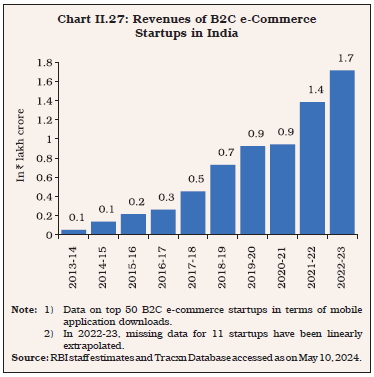

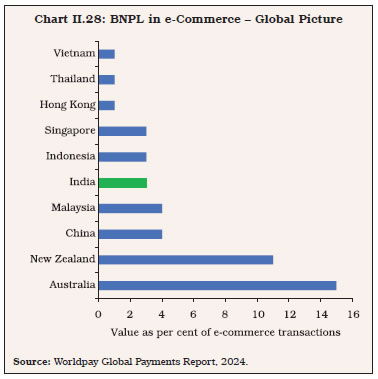

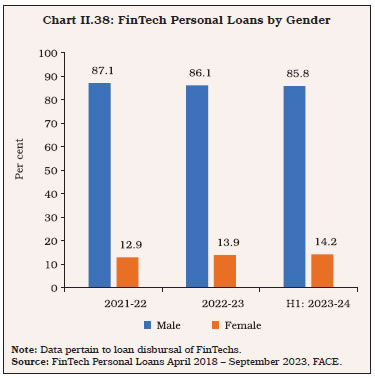

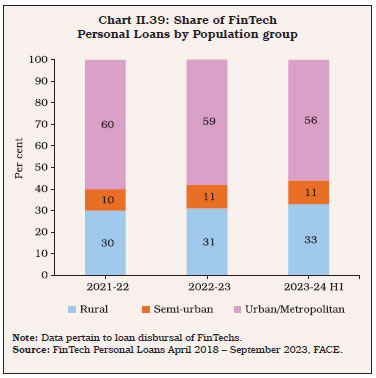

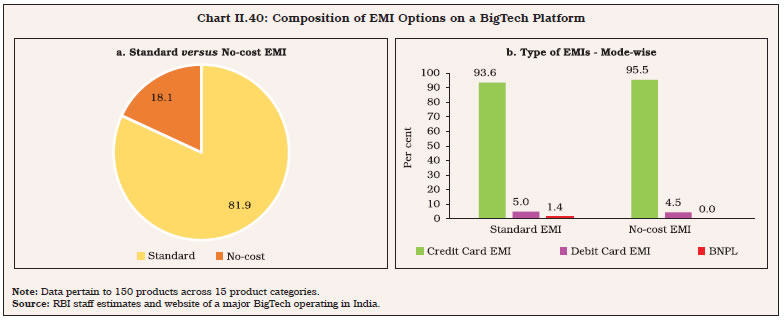

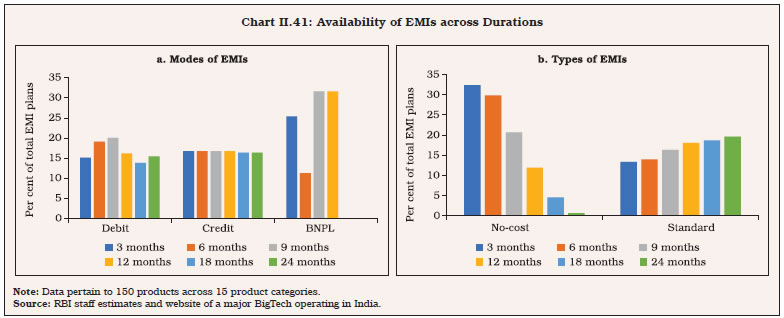

II.12 The adoption of digital technology varies among bank groups. The share of the key words related to digitalisation in the annual reports, an indicator of digitalisation, is higher in private sector banks (PVBs) relative to public sector banks (PSBs) [Chart II.8a]. PVBs are also ahead of PSBs in the realm of cybersecurity (Chart II.8b). Further, in both public and private sectors, small banks lag behind big banks in terms of digitalisation and cyber security.   II.13 The use of digitalisation and emphasis on cyber security is also increasing in the upper-layer NBFC-Investment and Credit Companies (NBFC-ICCs), as suggested by the frequency of these keywords in their annual reports. The extent of usage is, however, less than that of many SCBs (Chart II.9). II.14 A special survey of SCBs4 conducted in March 2024 on the adoption of various types of financial innovations indicates that internet banking, mobile banking, online account opening, digital Know Your Customer (KYC), mutual fund investments, and doorstep banking through digital means are being extensively used across banks (Chart II.10a). The adoption of more recent innovations like payment aggregator services, chatbots, prepaid wallets, open banking, online Public Provident Fund (PPF) and IoT based applications has been relatively lower, with less than half of the surveyed SCBs adopting them. Many SCBs plan on adopting chatbots in less than a year (Chart II.10b). The surveyed banks exhibited muted interest in offering Online PPF, payment aggregator and gateway services, and Buy Now Pay Later (BNPL) [Chart II.10c]. All respondent banks have embraced technology partnerships with FinTechs and have adopted digital technologies to enhance their front-end/ customer interface. Digital technologies are also used for facilitation of deposits, managing compliance requirements, and making lending decisions (Chart II.10d). PSB Alliance – Innovation Adoption at the Community Level II.15 Public sector banks are collaborating amongst themselves on financial innovations to enhance the quality of customer service and operational efficiency. PSB Alliance (PSBA), an umbrella entity in collaboration with 12 PSBs, has implemented several community-level financial innovations. Enhanced Access and Service Excellence (EASE) reforms, governed by the EASE Steering committee of the Indian Bank’s Association, aim to enhance the capabilities of PSBs to meet the changing demands of diverse set of customers. With close to 40 per cent of banks’ total deposits held by senior citizens (above 60 years of age), PSBA offers doorstep banking facilities for both financial and non-financial transactions across 2,760 centres across India as on July 26, 2024. Further, PSBA is expanding doorstep banking technology to more centres. It has introduced Unified Property Listing and Auction Portal (eBKray) with enhanced features and functionalities, including mobile application, AI-based search engines, loan sourcing capabilities, automated earnest money deposit (EMD) management, and an omni-channel interface. Built on a modular architecture with open APIs, the eBKray platform ensures ease of integration with market ecosystem players. Single portal for pre-auction, auction, EMD management, reporting and post-auction is anticipated to enhance user experience.  II.16 As part of risk management and data exchange, the PSBA has also set up the Operational Risk Loss Data Exchange (LDE). The LDE collects and consolidates the individual bank-level data on operational risk losses and shares the sector-level data with member banks. Industry benchmarks of key risk indicators are prepared based on the Basel Committee on Banking Supervision (BCBS) guidelines and are also shared among member banks. The data collected by LDE can be used for various purposes by member banks such as stress testing, scenario analysis and calculation of economic capital for Internal Capital Adequacy Assessment Process (ICAAP). The development of a community cloud, agricultural lending and collateral monitoring platform, and digital supply chain finance platform are also under consideration by the PSBA (PSBA, 2024).  Uptake of Financial Innovations by Banks’ Customers II.17 During 2015-24, the compound annual growth rate (CAGR) of credit cards issued across banks was in the range of 10 to 30 per cent, with a few banks reporting growth of more than 40 per cent, indicating faster adoption of credit cards by customers. The growth in the debit card segment hovered in the range 0-20 per cent across banks, partly reflecting the base effect (Chart II.11). II.18 In India, the cash-to-card ratio – the ratio of average ATM withdrawal to average card payment – has moderated, with an increase in the usage of digital payments by customers (Chart II.12). II.19 On an average, ten and four per cent of banks’ customers made active5 use of mobile and internet banking, respectively, during February and March 2024 (Chart II.13). Usage of mobile and internet banking by PVBs’ customers was higher than that of PSBs’ customers during these months.   II.20 A correlation analysis reveals a positive association between bank size and their respective mobile banking application installations by customers, especially for PVBs (Chart II.14).  II.21 The frequency distribution of average user rating for primary mobile banking applications of 47 banks in India suggests that 55.3 per cent (26 out of 47) of applications have average user rating of 4 or above, reflecting customer satisfaction with mobile banking. Mobile applications of three banks received a rating of below three from customers (Chart II.15).  II.22 Bank group-wise analysis of ratings of mobile banking applications of 47 banks in India shows that ratings are generally higher for PVBs as compared to PSBs and small finance banks (SFBs) [Chart II.16].  II.23 The mobile applications of 20 NBFC-ICCs belonging to the upper layer and middle layer received an average rating of four from the users. The mobile applications of the major FinTech lending service providers (LSPs) of these NBFCs received a higher rating than the applications of the NBFCs themselves (Chart II.17).  II.24 Among the prepaid payment instruments (PPIs), issuance of wallets is higher than cards (Chart II.18a). Private banks lead in the issuance of PPIs to customers (Chart II.18b). Recent initiatives including developments regarding PPIs for Mass Transit Systems (PPI-MTS) may boost issuance going ahead.  4. Collaboration of FinTechs and BigTechs with Financial Institutions (Banks and NBFCs) II.25 FinTechs may be defined as entities that provide technological solutions for delivery of financial products and services to businesses and consumers or encompass regulatory and supervisory compliance in partnership with traditional financial institutions or otherwise (RBI, 2024a). India leads the world with FinTech adoption rate of 87 per cent, higher than the global average of 64 per cent (EY, 2019).6 According to the Department for Promotion of Industry and Internal Trade (DPIIT), there are 8,011 FinTechs in India as on July 22, 2024. Revenues of FinTechs in India are expected to grow exponentially from US$ 17 billion in 2022 to more than US$ 190 billion by 2030 (BCG, 2023). Between January 2018 and December 2023, the FinTech sector in India has received approximately US$ 27 billion in funding7, including both domestic and external sources (Tracxn, 2024). The payments segment leads in terms of fundraising within the Fintech sector. FinTechs have not confined to a single market, and some of them have also ventured into several associated activities in India (Chart II.19). II.26 The partnerships between banks/NBFCs and FinTechs have unique strengths and are mutually beneficial. The comparative advantages of FinTechs include better user experience, agility, use of unconventional data, and the ability to scale rapidly. FinTechs, however, lack a large client base and the necessary expertise to navigate the regulatory landscape of the financial sector. Banks, on the other hand, enjoy customer trust and confidence, a large pre-existing customer base, widespread geographical presence, legal backing to accept deposits, and experience in risk management and regulatory compliance (Mundra, 2017). The annual reports of banks and upper layer NBFC-ICCs have increasingly showcased their growing collaboration with FinTechs (Chart II.20)8. The names of payment FinTechs tend to occur more than the lending and banking FinTechs, highlighting maturity of these partnerships in the payment space.   II.27 An analysis of the empanelled FinTechs of a few SCBs reveals that FinTech collaborations are made for a range of services including lending, remittances and payment services, digitalisation of processes and products, insurance, wealth products, investments, marketing, and API development. II.28 A special survey of select NBFCs and banks9 shows that 84 per cent of the surveyed banks and 35 per cent of the surveyed NBFCs are partnering with FinTechs for offering digital banking solutions (Chart II.21). These collaborations with FinTechs are used to distribute products/services on banking platform, including digital banking solutions. According to the survey, 92 per cent of the responding banks reported that collaboration is effective in driving digital innovation as against 60 per cent of NBFCs.   Collaboration with BigTechs II.29 BigTechs, mainly through e-commerce and payment applications, are reshaping the financial landscape, with implications for public policy, competitiveness, and financial stability. BigTechs mainly operate as online multi-sided platforms, facilitating direct interactions among different user groups like buyers and sellers (Doerr et al., 2023). Rising adoption of e-commerce, as suggested by increasing e-commerce mobile application review counts, may be associated with demand for embedded finance in India (Chart II.22a). Concurrently, the embedded financial transactions and the presence of BigTechs are also rising in India (Chart II.22b and II.23). II.30 The business models of BigTechs are usually characterised by the data-network-activity reinforcing feedback loop (Shin, 2019). As user engagement on the platform increases, network externalities arise, enhancing the platform’s adoption and allowing BigTechs to accumulate more data which enables them to diversify into financial services, such as money management, insurance, and lending, attracting additional users and perpetuating the cycle. Data can also be either sold to third parties or utilised internally to refine services, innovate new offerings, and generate additional revenue streams (Bains et al., 2022). By integrating cutting-edge technology, BigTechs can deliver innovative financial services for households (De la Mano and Padilla, 2018). II.31 There exists scope for seamless integration between financial services and non-financial BigTech platforms to enhance user experiences. Within the financial services industry, BigTechs first entered the payment segment (BIS, 2019). In India, six banks have collaborated with seven BigTechs in the UPI payment space (NPCI, 2024). Most of these collaborations involve PVBs (Chart II.24). BigTech-backed applications have made their mark in the Indian payment industry, with more than 90 per cent share in UPI payment volume and value (Chart II.25).   II.32 BigTech platforms offer multiple contactless payment options such as payment through gateways, platform-specific digital wallets, co-branded credit cards, converting purchase bills into equated monthly instalments (EMIs or No-cost EMI) and BNPL. In India, five BigTechs have entered into collaborations with four PVBs and five NBFCs for offering BNPL through their platforms. Co-branded credit cards are also offered in collaboration with four SCBs (Chart II.26). II.33 For lending activities, BigTechs rely on machine learning for credit risk assessment to address information asymmetries in lieu of the traditional collateral-based lending (Doerr et al., 2023; Gambacorta et al., 2019). They are positioned to capture a significant share of financial services market, including lending, due to economies of scale and scope (Adrian, 2021). In an environment of lower competition, there is greater opportunity for BigTechs’ credit to thrive, attracted by higher profit margins. However, with stringent banking regulations, credit activities of BigTechs might face setbacks (Cornelli et al., 2023). II.34 Standard EMIs and no cost EMIs are the most available lending options on BigTech platforms. These EMIs are offered mainly through three channels, viz., co-branded credit cards, through credit and debit cards of banks and through the BNPL.   II.35 Smaller e-commerce startups in India are also offering embedded financial services on their platforms and their business is gaining ground (Chart II.27). These embedded financial services include BNPL, credit cards, and payments. India is among the top five nations in terms of the percentage of BNPL loans in e-commerce transactions (Chart II.28). There are dedicated BNPL applications that provide BNPL services to smaller e-commerce startups in India. These applications had a high average user rating at 4.2, as of June 2024.10   II.36 Digital lending is remote and automated lending process, largely by use of seamless digital technologies for customer acquisition, credit assessment, loan approval, disbursement, recovery, and associated customer service (RBI, 2022a). Three attributes that differentiate digital credit from traditional credit are speed, automation, and remote operation (Chen and Mazer, 2016). As digital lending operates through an online platform, it is also known as platform-based lending. Banks, NBFCs, as well as individuals and entities other than banks and NBFCs, participate in India’s digital lending ecosystem as lenders (Chart II.29). Lenders provide both secured and unsecured loans through these platforms, which are either publicly or privately owned. Loan origination and management services are also integrated in this ecosystem.  Size of the Digital Lending Market in India II.37 At end-December, 2020, the share of digital lending was two per cent of the total amount disbursed by surveyed banks, which have an asset size of 75 per cent of the total banking sector (RBI, 2021). II.38 SCBs are digitalising their retail portfolio, especially personal and MSME loans. Information provided by five SCBs, having 53 per cent share in the personal loan market, indicates that around 40 per cent of the personal loans by them were processed end-to-end digitally in 2022-23 (Chart II.30). II.39 As of December 2020, surveyed NBFCs (holding 10 per cent share in total NBFCs’ asset size) reported that digital lending constituted 11.4 per cent of their overall lending activities (RBI, 2021). Data for 51 NBFC-ICCs, that are also shown as FinTech on Startup India portal by DPIIT, show that their lending is gaining traction at an increasing rate. The lending share of these NBFC-ICCs, however, constitutes only less than one per cent of the total lending market of NBFC-ICCs (Chart II.31).   II.40 The increasing revenue of FinTech LSPs of upper layer NBFC-ICCs, mainly from operations, in recent years indicates that their scale of activity is experiencing significant growth (Chart II.32).11 II.41 Lending through e-commerce platforms including BigTechs is offered via credit cards, debit card EMIs and BNPL. Credit extended through credit cards on the e-commerce platforms including BigTechs, encompassing both EMI plans and lumpsum credit, grew by 32.4 per cent (y-o-y) in 2023-24 to ₹11 lakh crore (Chart II.33).12  II.42 Crowdfunding through P2P platform, which connects individual lenders with borrowers, to facilitate unsecured loans is another form of digital lending in India (RBI, 2016). There are 26 P2P NBFCs registered with the Reserve Bank of India as on March 31, 2024 (RBI, 2024b).  Characteristics of Loans through FinTechs II.43 Lending through FinTechs mainly catered to semi-urban and rural areas in 2022-23 (Chart II.34a). Younger age groups (less than 25 years and 26-30 years) are the major borrower group (59 per cent of FinTechs loans) [Chart II.34b]. Delinquency rates are higher among younger age groups and are broadly similar across regions (Chart II.34c and d). FinTech Personal Loans II.44 FinTech loan originations mainly include personal loans followed by business and consumer loans (Chart II.35). In India, the personal loan market has seen an accelerated growth phase (Das, 2023b). FinTechs mainly cater to small-value personal loans with 68 per cent of personal loans falling in the category of less than ₹5,000 in 2022-23 (Chart II.36). The average ticket size of personal loans by FinTechs was around ₹11,000 in 2023 (Chart II.37) and these loans typically supplement or smoothen consumption (Agarwal and Chua, 2020).    II.45 There exists vast gender-based divide in digital lending. The percentage of female borrowers of FinTech personal loans is around 14 per cent in 2022-23 (Chart II.38). II.46 By population group, almost 31 per cent of FinTech personal loans in 2022-23 were disbursed in rural areas (Chart II.39).  Characteristics of Consumer Durable Loans through BigTechs II.47 The credit options for purchasing consumer durables on BigTech platforms include purchases through credit card (without EMI), UPI (credit line and Rupay credit card linkage), pay later options, no cost EMI and standard EMI. Out of the total EMI options available on the sample 150 products13, around 82 per cent were standard EMIs, the remaining being no-cost EMIs (Chart II.40a). In both no-cost and standard EMIs, the most offered lending channel was credit card (Chart II.40b).   II.48 Under no-cost EMIs, the interest charged by the bank is offered as an upfront discount to the customer by the BigTech platforms. For 32 per cent of the total products sampled, the number of credit card no-cost EMI plans available per product was in the range of 17-108. Notably, debit card no-cost EMIs were not available on 79 per cent of the sample products. II.49 Standard EMIs charge interest rates on loans offered through the BigTech platform. For 58 per cent of the products analysed, standard EMIs were available for more than 100 credit cards, making this as the most frequently available channel in offering credit through the BigTech platform. For only four per cent of the products analysed, credit card standard EMI was not available. For 20 per cent and 26 per cent of the products, debit card standard EMI and BNPL standard EMI, respectively, were not available.  II.50 Lending through the BigTech platform is available for durations starting from three months to 24 months. The most offered lending channel, viz., credit card EMI, is available uniformly across all durations. Availabililty of debit card EMI is higher in relatively smaller durations, viz., six and nine months. BNPL allows the customer to avail loans without possessing a debit or credit card. In the sample, BNPL is mostly available in medium durations such as nine and 12 months (Chart II.41a). II.51 Availability of no-cost EMIs decreases as the duration of loan increases. In the sample, out of the total no-cost EMIs available, 32 per cent are for three months, 30 per cent are for six months, and 21 per cent are for nine months. Since shorter duration makes the size of EMIs bigger, the benefits of these interest-free loans are restricted to a few who can afford higher EMIs. In contrast, the standard EMIs increase with the duration of the loan, with the highest percentage of standard EMIs available for 24-month plan (Chart II.41b). II.52 The rate of interest charged on loans offered on the BigTech platform under study vary across lending channels. The most frequently available channel, viz., credit card EMIs, charges the lowest interest rates, and interest rates increase with the duration of loans. The highest interest rate is charged on BNPL loans at 24 per cent across various durations of loans. Notably, around 50 per cent of the total consumer durable loans disbursed by the SCBs are at interest rates below 13 per cent. Banks that offer loans through BigTech platforms also charge processing fees for these loans. Processing fee is applicable even if the loan is a no-cost EMI loan. An 18 per cent Goods and Services Tax (GST) is also applicable on the interest charged on these loans, which is revealed on the EMI details page of the BigTech platform. Depending on the chosen EMI plan, this varies from 0.4 per cent to 3.2 per cent of the product price in the sample and GST amount chargeable goes up with the duration of the loans. Regulatory Innovations in Digital Lending II.53 The initiatives of the Government of India and the Reserve Bank have been playing an important role in inculcating trust in platform-based lending by putting in place appropriate safeguards. The major initiatives are discussed below.  Account Aggregators II.54 Account Aggregators (AAs) provide a technology-enabled interface based on standardised application programming interfaces (APIs) for managing customer consent and authentication, and sharing select financial information. AAs address the issue of non-standardised bank specific APIs, that are difficult for third-party applications to integrate and thus, help break down data silos in the financial sector. Financial information of consumers, with their consent, from one or more accounts held with banks, NBFCs, mutual funds, insurance companies, etc., known as Financial Information Providers (FIPs) is digitally shared with other REs in the financial sector, called Financial Information Users (FIUs), who provide services such as loans or insurance to consumers (Chart II.42). II.55 The Reserve Bank has introduced enabling regulations for NBFC-AAs in 2016. The NBFC-AA ecosystem is gaining momentum in terms of the number of accounts linked and requests fulfilled (Chart II.43a). At present, the AA system has 256 live FIUs and 71 live FIPs under the Reserve Bank. The number of successful data shares14 stand close to 40 million. The lending through AAs is on the rise (Chart II.43b). Many RRBs are also coming live on AAs which augurs well for the flow of bank credit to the rural economy. Open Credit Enablement Network (OCEN) II.56 The Government of India has launched the OCEN with the goal of democratising credit and extending financial inclusion to the last mile. The OCEN is a framework of APIs which facilitates easy interaction and codified flow of credit among lenders, borrowers (especially 14 Successful small borrowers), loan agents (LAs)15 and technology service providers (TSPs)16 under a common set of standards. The OCEN helps LAs to effectively provide embedded finance to their customers. Borrowers get access to competing customised credit products on their preferred applications. Lenders gain from nearly zero customer acquisition costs, opportunities to serve additional customers and ease of monitoring the activities of borrowers through LAs. The OCEN helps lenders (banks and NBFCs), LAs and TSPs to create innovative financial products tailored to the needs of a range of customers and small businesses. It aims to reduce the cost of acquisition, underwriting, processing, disbursement and regulatory compliance related to loans.   II.57 Owing to the policy focus on MSME credit, several cashflow based lending platforms have been developed on the OCEN such as the GeM Sahay and GST Sahay apps. The GeM Sahay app provides unsecured short-term financing to sellers on the Government e-Marketplace (GeM).17 There are 1.52 lakh GeM Sahay app installs on the Google Play Store18. As at end-May 2024, four banks and seven NBFCs were banking partners on this platform. GeM Sahay 1.0 has so far disbursed loans around ₹23 crore (FICCI, 2024). GST Sahay is an application developed under the Reserve Bank’s Regulatory Sandbox (RS) that leverages the OCEN and AA framework for providing on-tap, real-time, contactless, cash-flow based financing to micro enterprises. Trade Receivables Discounting System (TReDS) II.58 TReDS, facilitated by the Reserve Bank, addresses the working capital and cash flow challenges faced by MSMEs arising from delayed payments. TReDS is a financing framework, harnessing technology to discount bills and invoices. Currently, four entities are operational as TReDS platforms, with steady growth in transaction volume and value (Chart II.44). Public Tech Platform for Frictionless Credit II.59 In a major step towards digital financial inclusion in India, the Reserve Bank conceptualised the PTPFC. The Platform has been developed by the Reserve Bank Innovation Hub (RBIH). It leverages open APIs and standards to streamline availability of data19 in a ‘plug and play’ model to enable disbursal of credit in a frictionless manner. The reduced cost of operations for lenders due to the ease of availability of data may help them offer credit at affordable rates. The PTPFC pilot, launched in 2023, focused on products such as fully digital Kisan Credit Card (KCC) loans up to ₹1.6 lakh per borrower, dairy loans, MSME loans, personal loans, vehicle loans, tractor loans, digital gold loans, and home loans through participating banks. Given the end-to-end digital processing, PTPFC has demonstrably reduced the turnaround time of KCC loans from a few weeks to less than an hour (RBIH, 2024).  Open Network for Digital Commerce (ONDC) II.60 The ONDC has been launched by DPIIT under the Ministry of Commerce and Industry in 2021. It aims to democratise e-commerce by building an open, interoperable network, enabling buyers and sellers to transact, without the need to be present on the same platform. The traditional model of e-commerce is constrained by dependence on specific platforms and technologies, leading to concentration risk for both buyers and sellers. Decentralisation of operations, open standards, interoperability and unbundling of e-commerce value chains on the ONDC may lead to greater competition among platforms/applications, potentially lowering costs of engaging in digital commerce. II.61 The ONDC has onboarded over six lakh sellers/service providers from more than 607 cities20 (ONDC, 2024a). The daily peak order volume on the ONDC platform has increased from 53,000 in October 2023 to 2,89,000 in June 2024 (ONDC, 2024b). In 2023, e-commerce constituted eight per cent of the total retail market value, indicating huge potential for the ONDC to grow (BCG and RAI, 2024). The ONDC has forayed into sectors, such as food, grocery, fashion, travel, electronics, and financial services. Within financial services, the ONDC is concentrating on credit, insurance, investments, and gift cards. Within the credit domain, the ONDC is focusing on personal loans and GST-based loans for individuals and sole proprietors, respectively (ONDC, 2024c). 6. Financial Innovations: Implications for the Banking Sector II.62 Financial innovations have implications for the banking sector spanning various operational aspects. According to a special survey of banks conducted in March 2024, more than 90 per cent of the respondent banks reported that their customer acquisition and transaction costs have decreased after adopting digital technologies. For 88 per cent of banks, employee costs have come down and around 76 per cent of banks reported lower premises-related costs due to the adoption of digital technologies (Chapter V). II.63 Digitalisation enhances customer acquisition by offering convenient onboarding processes and personalised digital marketing strategies, expanding reach and engagement with different sections of consumers. Technological innovation can improve customer experience, lower costs, increase product diversity, and increase access to financial services (Elekdag et al., 2024). All the banks surveyed indicated improvement in their customer acquisition and retention due to the adoption of digital technologies (Chapter V). II.64 Digitalisation has implications for a competitive banking environment owing to new entrants like FinTechs and BigTechs (Basel Committee on Banking Supervision 2018; Dell’Arricia, 1998). Further, a competitive environment has implications for banks’ market power and price discovery process (Cuadros-Solas et al., 2024; Jia and Liu, 2024). In the Indian context, an empirical exercise indicates that digitalisation (proxied by the volume of digital payments) is associated with a compression of banks’ net interest margin (NIM)21. Financial Innovation and Banks’ Risk Taking II.65 Digitalisation can impact risk taking by banks in both directions. On the one hand, it can improve the risk diversification capabilities of banks through improvement in operational efficiency, risk management capabilities and better monitoring and screening of debtors (Chen et al., 2023; Yang and Masron, 2024; Li et al., 2022). By providing more data for analysis, digital transformation helps financial institutions better identify, measure, and manage risks in real-time and take timely measures to deal with them (Yang and Masron, 2024). Reduced reliance on physical interactions with customers decreases the associated operational risks and the likelihood of human errors (Bhatia, 2022). On the other hand, while better and real-time monitoring of risks may foster an environment of relatively low macroeconomic risk, this may result in an increased risk appetite of banks (Kero, 2013). Digital transformation may also increase operational risks due to excessive reliance on information and communication technology, financial crime risks (including data breaches), and privacy concerns. II.66 Digitalisation may ameliorate certain types of risks, while exacerbating others. FinTech can increase credit and liquidity risks but may reduce insolvency risk (Wu et al., 2023). The effect of FinTechs on the stability of financial institutions is market specific (Fung et al., 2020). Although a stronger FinTech presence is linked to increased risk-taking by financial institutions, the presence of robust domestic institutional framework may encourage financial institutions to reduce their risk levels (Elekdag et al., 2024). In the Indian context, adoption of digital technologies by banks appears to drive down risk taken by banks (Box II.2). Financial Innovations and Impact on Liquidity II.67 Liquidity-enhancing innovations are expected to augment stability in financial markets (O’Hara, 2004). High transaction costs, shallow markets, slow order execution, and operational risks impede liquidity in financial markets. Enhanced liquidity facilitates more effective transmission of monetary policy, enables efficient crisis management and makes financial assets more attractive (Sarr and Lybek, 2002). Historically, advancements in technology and financial innovation22 have catalysed structural transformations within financial markets, in the process, affecting liquidity in the market (Bervas, 2008). Digital technologies expand the reach of financial markets, remove market segmentation, broaden participation, widen the set of financial instruments, and ensure fair conduct by market participants (Das, 2024). Advancements in payment and settlement systems and significant improvements in the market infrastructure have taken place, encompassing state-of-the-art primary issuance process for government securities, an efficient and completely dematerialised depository system within the central bank, electronic trading platforms, trade reporting and central counterparty settlement (Das, 2020b). Digital payment and settlement systems enhance market liquidity (Box II.3). 7. Regulatory Concerns and Policy Initiatives II.68 Digitalisation in finance can contribute significantly to the spread and pace of financial deepening in emerging and developing economies. Such innovations cannot, however, be allowed to disrupt the financial system (Sankar, 2022). The financial stability can be safeguarded if the relationship between banks and FinTechs is appropriately balanced. Not aligning the regulation of non-bank FinTechs to that of banks offering similar services may, however, create inefficiencies, amplify risks of regulatory arbitrage, and create an uneven playing field. Notwithstanding these challenges, the imperative to regulate FinTechs remains. Taking into account these diverse perspectives, the Reserve Bank’s regulation is premised on three principles – encouragement of innovation, assimilation of innovation in the financial system in a non-disruptive manner and customer protection (Sankar, 2022). The approach to regulation needs to be balanced, nuanced and reasonably anticipatory with an oversight framework that should be activity-based, risk-based, scale-based, and phased-in (RBI, 2024a). The recent interventions in this regard include regulation of digital lending applications, measures to address business conduct practices, such as dark patterns and the framework for self-regulation. Other initiatives to promote responsible financial innovations include RS, hackathons, and proof of concept (PoC) for Distributed Ledger Technology (DLT) applications, and adoption of SupTech.

Regulation of Digital Lending II.69 The boom in digital lending has raised several business conduct issues primarily related to unbridled engagement of third parties, mis-selling, breach of data privacy, charging of exorbitant interest rates, and unethical recovery practices. While there is evidence regarding the positive impact of digital credit on the financial well-being of individuals during distress (Suri et al., 2023), it can also result in opposite effects owing to high interest rates and poor information regarding loan conditions (Brailovskaya et al., 2021). Over-reliance on technology for loan arbitration may be harmful, as AI-driven decision-making models can raise concerns associated with algorithmic bias and financial exclusion. II.70 To address digital lending-related concerns, the Reserve Bank put in place the Guidelines on Digital Lending in September 2022 that provide detailed procedures pertaining to customer protection and conduct requirements, technology and data requirements and regulatory framework. According to these guidelines, REs’ outsourcing agreements with LSPs or Digital Lending Applications (DLAs), do not lessen the REs’ obligations and they must continue to adhere to the current outsourcing guidelines. Further, the REs must ensure that the LSPs they work with as well as the DLAs (whether of the RE or the LSP the RE works with) follow the guidelines. Under the guidelines dated June 08, 2023, the RE must adhere to the cap on Default Loss Guarantee (DLG)23 cover not exceeding five per cent of the total loan portfolio, disclosure and capital requirements, specified forms of DLG, due diligence and other requirements with respect to the DLG provider. The Insidious Nature of Dark Patterns II.71 Dark patterns refer to deceptive practices or design patterns in user interface or user experience/interactions that are designed to mislead users to do something they originally did not intend to do, by subverting or impairing consumer autonomy, decision making or choice (CCPA, 2023). Examples include compelling users to perform unrelated actions to proceed with intended purchases, adding items to the cart without user consent, and creating a false sense of urgency to mislead users into making quick purchases, among others (Chapter I). II.72 In India, the Central Consumer Protection Authority (CCPA) has introduced the ‘Guidelines for Prevention and Regulation of Dark Patterns, 2023’, applicable to advertisers, sellers and platforms. Additionally, the Digital Personal Data Protection (DPDP) Act, 2023, addresses dark patterns by requiring companies to imbibe privacy by design while collecting user data and to ensure informed consent for data processing activities. The Insurance Regulatory and Development Authority of India (IRDAI) has prohibited travel portals in India from using pre-checked boxes for selling travel insurance. The Reserve Bank has mandated card issuers to obtain explicit consent from cardholders when offering insurance through tie-ups with insurance companies (RBI, 2022b). Card issuers are mandated to provide customers the option to request closure of credit card through multiple and prominently visible channels. Unsolicited loans and enhanced credit limits shall not be offered to the credit cardholders without explicit consent. To increase transparency in digital lending, the Reserve Bank’s Digital Lending Guidelines mandate that REs shall provide a Key Fact Statement (KFS) to the borrower before the execution of the contract in a standardised format for all digital lending products. All-inclusive cost in the form of Annual Percentage Rate (APR) shall be clearly communicated to the customer in the KFS. This measure can help provide the customer a clear picture of the loan product and mitigate concerns around the presence of dark patterns in any loan application. Framework for Self-Regulation II.73 Self-regulatory organisations (SROs) could play a pivotal role in the FinTech industry by promoting responsible practices and maintaining ethical standards (Sankar, 2023). SRO is an industry-led entity responsible for establishing and enforcing regulatory standards, promoting ethical conduct, ensuring market integrity, resolving disputes, and fostering transparency and accountability among its members. The Reserve Bank has come up with the Framework for Recognising SROs for FinTech Sector (SRO-FT framework). The Framework contains the characteristics of an SRO for the FinTech sector, and includes, inter alia, broad functions, governance standards, eligibility criteria and expectations for grant of recognition as an SRO-FT (RBI, 2024a). Regulatory Sandbox II.74 The ‘Enabling Framework for Regulatory Sandbox’ was announced in 2019 for facilitating responsible innovation in financial services, promoting efficiency, and benefiting consumers. Under RS, eligible domestic entities can live test their innovative products or services in a controlled environment with or without specified regulatory relaxations for the limited purpose of testing. Through this learning-by-doing approach, regulators gather empirical evidence on the benefits and risks of emerging technologies and their implications, enabling them to take a holistic view on the regulatory changes or new regulations that may be needed to support useful innovation, while containing the attendant risks. So far, four theme-based cohorts on ‘Retail payments’, ‘Cross-border payments’, ‘MSME lending’ and ‘Prevention and mitigation of financial frauds’ have been completed. Some of the products that exited successfully from these cohorts have been deployed in the market (Table II.1). A theme-neutral fifth cohort was open for application in 2023 and the shortlisted entities will commence testing in due course. II.75 To facilitate testing of hybrid products falling within the regulatory ambit of more than one financial regulator, viz., the Reserve Bank, Securities and Exchange Board of India (SEBI), IRDAI, International Financial Services Centres Authority and Pension Fund Regulatory and Development Authority, a Standard Operating Procedure for Interoperable Regulatory Sandbox has been prepared by the Inter-Regulatory Technical Group on FinTech (IRTG on FinTech) constituted under the Financial Stability and Development Council Sub-Committee (FSDC-SC). This framework has been operational since October 2022. HaRBInger Hackathon II.76 The Reserve Bank launched a global hackathon called ‘HaRBInger – Innovation for Transformation’, open to both domestic and global FinTech companies, programmers, and students. The hackathon runs in four phases, viz., Screening of entries (Phase I), Shortlisting of entries for Solution Development (Phase II), Solution Development (Phase III) and Evaluation and Selection of winners (Phase IV). The first edition was launched in 2021 with the theme ‘Smarter Digital Payments’, and the second edition was launched in 2023 with the theme ‘Inclusive Digital Services’. In June 2024, the third global hackathon was launched with two themes of ‘Zero Financial Frauds’ and ‘Being Divyang Friendly’. PoC Exercise in DLT Networks by RBIH II.77 RBIH has successfully conducted a PoC exercise in DLT networks by taking ‘inland letter of credit’ as a use case. Eleven banks, three industry partners and two FinTech startups participated in the PoC. The tested DLT-based letter of credit has the potential to fix issues in the current paper-based process, such as slow speed, labour intensiveness, susceptibility to frauds, and dependence on outdated IT systems (RBIH, 2024). G20 Tech Sprints II.78 Given growing global economic integration, cross-border payments are a priority area for digital innovation. Under India’s G20 Presidency, the Reserve Bank and the BIS Innovation Hub jointly conducted the G20 Tech Sprint, seeking innovative solutions to problem statements around cross-border payments from innovators, entrepreneurs, startups, developers, and other experts (BIS, 2023; Apix, 2023).24 Adoption of SupTech II.79 Supervisory technology (Suptech) refers to the utilisation of innovative technology by regulatory bodies to enhance supervision (Broeders and Prenio, 2018). This technology increases access to more granular, diverse, timely and trustworthy data to improve operational efficiency and generate previously unattainable insights using data analytics, artificial intelligence, and machine learning (Cambridge Centre for Alternative Finance, 2022). II.80 The Reserve Bank has been taking various measures to strengthen supervision, including adopting the latest data and analytical tools and leveraging technology for implementing more efficient and automated work processes. The Advanced Supervisory Analytics Group (ASAG) has been set up in the Department of Supervision to leverage ML models for social media analytics, KYC compliances and for gauging governance effectiveness. The establishment of an advanced off-site supervisory monitoring system—DAKSH – is helping to digitalise supervisory processes. An Integrated Compliance Management and Tracking System (ICMTS) and a Centralised Information Management System (CIMS) are also being implemented for seamless reporting by supervised entities for enhancing data management and data analytics capabilities, respectively (Patra, 2024). The RBI has also utilised techniques like phishing simulation and cyber reconnaissance exercises to push for enhanced IT and cyber security governance processes in banks and other supervised entities (Das, 2023a). The Platform for Regulatory Application, Validation, and Authorisation (PRAVAAH) was launched to enhance the efficiency of various processes related to the granting of regulatory approvals and clearances by the Reserve Bank. II.81 Technology adoption and innovations by banks and NBFCs have increased over the last decade, especially post-pandemic. These developments have enabled financial institutions to provide a diverse bouquet of services to customers. FinTech has shown the way for providing contact-less, paper-less, and cash-less banking services in an efficient and scalable manner. FinTech firms have emerged as significant partners to banks and NBFCs, enabling them to leverage the latest technologies. Payment FinTechs feature prominently in partnerships with financial institutions, followed by lending and banking technology FinTechs. Concurrently, collaborations with BigTechs and B2C e-commerce startups have transformed the lending landscape. The digital lending models have contributed noticeably to the small ticket personal loan segment, while increasingly addressing the credit requirements of underserved segments of the society. II.82 Policy innovations including AAs, TReDS, OCEN, PTPFC and ONDC are set to revolutionise the financial sector by enabling tailored and multifaceted financial products, including cash flow-based lending and invoice financing. Digitalisation has improved operating efficiency of Indian banks. Improved real-time monitoring, and diversification into new markets and products, facilitated by digitalisation, is mitigating risks in the banking sector. Digitalisation also has the potential to make financial markets more integrated and liquid. II.83 Several regulatory complexities arise in the wake of emerging financial activities, given the absence of definitive regulatory frameworks governing the technologies involved. Issues pertaining to business conduct, including dark patterns and breach of data privacy, have warranted regulatory attention. Self-regulatory organisations can effectively promote responsible practices and ethical standards within the industry. Looking ahead, fostering a regulatory environment that encourages responsible innovation while prioritising financial stability and customer protection remains paramount. References: Adrian, T. (2021). BigTech in Financial Services. International Monetary Review, 8(3), 90-94. Apix. (2023). G20 TechSprint 2023. Retrieved from: https://apixplatform.com/announcements/20 Agarwal, S., Alok, S., Ghosh, P., and Gupta, S. (2019). Fintech and Credit Scoring for the Millennials: Evidence using Mobile and Social Footprints. Available at SSRN: 3507827 Agarwal, S., and Chua, Y. H. (2020). FinTech and Household Finance: A Review of the Empirical Literature. China Finance Review International, 10(4). Allen, F., and Gale, D. (1994). Financial Innovation and Risk Sharing. The MIT Press. Alonso, C., Bhojwani, T., Hanedar, E., Prihardini, D., Una, G., and Zhabska, K. (2023). Stacking up the Benefits: Lessons from India’s Digital Journey. IMF Working Papers, WP/23/78. Bains, P., Sugimoto, N., and Wilson, C. (2022). BigTech in Financial Services: Regulatory Approaches and Architecture. IMF Fintech Notes No 2022/002. Bank for International Settlements (BIS). (2019). BigTech in Finance: Opportunities and Risks. BIS Annual Economic Report. Bank for International Settlements (BIS). (2023). G20 TechSprint 2023 - Transforming Cross Border Payments. Basel Committee on Banking Supervision. (2018). Sound Practices: Implications of Fintech Developments for Banks and Bank Supervisors. BCG. (2023). State of the Fintech Union. Retrieved from: https://www.bcg.com/publications/2023/india-state-of-the-fintech-union BCG and RAI. (2024). Unlocking the $2Tn Retail Opportunity in the Next Decade. https://www.bcg.com/publications/2024/india-unlocking-the-2tn-retail-opportunity-in-the-next-decade Beck, T., Chen, T., Lin, C., and Song, F. M. (2016). Financial Innovation: The Bright and the Dark Sides. Journal of Banking and Finance, 72, 28-51. Berg, T., Burg, V., Gombovic, A., and Puri, M. (2020). On the Rise of FinTechs: Credit Scoring using Digital Footprints. The Review of Financial Studies, 33(7), 2845-2897. Bervas, A. (2008), Financial Innovation and the Liquidity Frontier. Financial Stability Review: Special Liquidity Issue 11. Bhatia, M. (2022). Banking 4.0: The Industrialised Bank of Tomorrow. Springer Press. Brailovskaya, V., Dupas, P., and Robinson, J. (2021). Is Digital Credit Filling a Hole or Digging a Hole? Evidence from Malawi. NBER Working Paper No. 29573. Broeders, D., and Prenio, J. (2018). Innovation Technology in Financial Supervision (SupTech) - The Experience for Early Users. FSI Insights on Policy Implementation No. 9. Calli, B. A., and Coskun, E. (2021). A Longitudinal Systematic Review of Credit Risk Assessment and Credit Default Predictors. Sage Open, 11(4), 21582440211061333. Cambridge Center for Alternative Finance. (2022). State of SupTech Report. Cambridge SupTech Lab. Cavoli, T., and Gopalan, S. (2023). Does Financial Inclusion Promote Consumption Smoothing? Evidence from Emerging and Developing Economies. International Review of Economics and Finance, 88, 1529-1546. Central Consumer Protection Authority (CCPA). (2023). Guidelines for Prevention and Regulation of Dark Patterns. The Gazette of India, CGDL-E-30112023-250339. Chen, G., and Mazer, R. (2016). Instant, Automated, Remote: The Key Attributes of Digital Credit. CGAP Blog. Retrieved from: https://www.cgap.org/blog/instant-automated-remote-key-attributes-digital-credit Chen, Z., Li, H., Wang, T., and Wu, J. (2023). How Digital Transformation Affects Bank Risk: Evidence from Listed Chinese Banks. Finance Research Letters, 58, 104319. Cornelli, G., Frost, J., Gambacorta, L., Rau, P. R., Wardrop, R., and Ziegler, T. (2023). Fintech and BigTech Credit: Drivers of the Growth of Digital Lending. Journal of Banking and Finance, 148, 106742. Cuadros-Solas, P., Cubillas, E., Salvador, C., and Suarez, N. (2024). Digital Disruptors at the Gate: Does FinTech Lending Affect Bank Market Power and Stability? Journal of International Financial Markets, Institutions and Money, 92, 101964. Das, S. (2020a). Banking Landscape in the 21st Century. Mint’s Annual Banking Conclave 2020, Mumbai. RBI Speeches. February 24. Das, S. (2020b). Accelerating financial market reforms in India. 4th Annual Day of Foreign Exchange Dealers’ Association of India (FEDAI). RBI Speeches. November 26. Das, S. (2022). Disruptions and Opportunities in the Financial Sector. Financial Express Modern BFSI Summit, Mumbai. RBI Speeches. June 17. Das, S. (2023a). Future-proofing the Indian Financial System. Speech Delivered at the Global Conference on Financial Resilience, Mumbai. RBI Speeches. April 27. Das, S. (2023b). Governor’s Statement. RBI Press Releases. October 6. Das, S. (2024). Evolution of Financial Markets in India: Charting the Future. Speech Delivered at the FIMMDA-PDAI Annual Conference, Barcelona. April 8. De la Mano, M., and Padilla, G. (2018). BigTech Banking. Journal of Competition Law and Economics, 14(4), 494-526. Dell’Ariccia, G. (1998). Asymmetric Information and the Market Structure of the Banking Industry. IMF Working Paper No. 98/92. Doerr, S., Frost, J., and Gambacorta, V. S. (2023). Big Techs in Finance. BIS Working Papers No. WP1129. Duffie, D., and Rahi, R. (1995). Financial Market Innovation and Security Design: An Introduction. Journal of Economic Theory, 65(1), 1-42. Elekdag, S., Emrullahu, D., and Naceur, S. B. (2024). Does FinTech Increase Bank Risk Taking? IMF Working Papers No. 24/17. EY. (2019). Global FinTech Adoption Index 2019. Retrieved from: https://www.ey.com/en_gl/financial-services/global-fintech-adoption-index FACE. (2024). FinTech Personal Loans. April 18 - September 23. Retrieved from: https://faceofindia.org/wp-content/uploads/2024/02/1.-Fintech-personal-loans_21st-Feb-2024_website.pdf Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., and Saal, M. (2021). Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. BIS Papers No. 117. Feyen, E., Natarajan, H., and Saal, M. (2023). Fintech and the Future of Finance: Market and Policy Implications. World Bank Publications. FICCI. (2024). GeM: Coverage and Expansion. Retrieved from: https://ficci.in/public/storage/sector/Report/22499/UU1iBkSzYJ5BS81yUF1HIjzt-6v62w64tPhRLBkyB.pdf Fung, D. W., Lee, W. Y., Yeh, J. J., and Yuen, F. L. (2020). Friend or Foe: The Divergent Effects of FinTech on Financial Stability. Emerging Markets Review, 45, 100727. Gambacorta, L., Huang, Y., Qiu, H., and Wang, J. (2019). How do Machine Learning and Nontraditional Data Affect Credit Scoring? New Evidence from a Chinese Fintech Firm. Journal of Financial Stability, 45, 101284. Jia, K., and Liu, X. (2024), ‘Bank Digital Transformation, Bank Competitiveness and Systemic Risk’, Frontiers in Physics, 11, 1297912. Johnson, S., and Kwak, J. (2012). Is Financial Innovation Good for the Economy? Innovation Policy and the Economy, 12(1), 1-16. Kero, A. (2013). Banks’ Risk Taking, Financial Innovation and Macroeconomic Risk. The Quarterly Review of Economics and Finance, 53(2), 112- 124. Koulouridi, E., Kumar, S., Nario, L., and Pepanides, T. (2020). Managing and Monitoring Credit Risk after the COVID-19 Pandemic. McKinsey and Company. Retrieved from: https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/managing-and-monitoring-credit-risk-after-the-covid-19-pandemic Li, G., Elahi, E., and Zhao, L. (2022). FinTech, Bank Risk-taking, and Risk-warning for Commercial Banks in the Era of Digital Technology. Frontiers in Psychology, 13, 934053. Merton, R. (1989). On the Application of the Continuous-time Theory of Finance to Financial Intermediation and Insurance. The Geneva Papers on Risk and Insurance-Issues and Practice, 14, 225-261. Mundra, S. S. (2017). Financing MSMEs: Banks and FinTechs - Competition, Collaboration or Competitive Collaboration? NAMCABS Seminar (Vol. 20). College of Agricultural Banking. February 20. National Payments Corporation of India (NPCI). (2024). UPI 3rd Party Apps. Retrieved from: https://www.npci.org.in/what-we-do/upi/3rd-party-apps O’Hara, M. (2004). Liquidity and Financial Market Stability. National Bank of Belgium Working Paper, 55. Open Network for Digital Commerce (ONDC). (2024a). Homepage. Retrieved from: https://www.ondc.org. Accessed in July 2024. Open Network for Digital Commerce (ONDC). (2024b). ONDC Elevate. Retrieved from: https://www.ondc.org/elevate. Accessed in July 2024. Open Network for Digital Commerce (ONDC). (2024c). ONDC Financial Services. Retrieved from: https://resources.ondc.org/financial-services. Accessed in July 2024. Parviainen, P., Kääriäinen, J., Tihinen, M., and Teppola, S. (2017). Tackling the Digitalization Challenge: How to Benefit from Digitalization in Practice. International Journal of Information Systems and Project Management, 5(1), 63-77. Patra, M. (2024). Harnessing Digital Technologies in Central Banks: Opportunities and Challenges. Speech Delivered at the SAARCFINANCE Seminar on Emerging Digital Technologies in Central Banking and Finance, Goa. RBI Speeches. January 17. PSB Alliance. (2024). Homepage. Retrieved from: https://www.psballiance.org. Accessed in June 2024. Reserve Bank of India (RBI). (2016). Consultation Paper on Peer-to-Peer Lending. April 28. Reserve Bank of India (RBI). (2021). Report of the Working Group on Digital Lending Including Lending through Online Platforms and Mobile Apps. November 18. Reserve Bank of India (RBI). (2022a). Guidelines on Digital Lending. September 02. Reserve Bank of India (RBI). (2022b). Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022 (Updated as on March 07, 2024). March 07. Reserve Bank of India (RBI). (2024a). Framework for Self-Regulatory Organisation(s) in the FinTech Sector. May 30. Reserve Bank of India (RBI). (2024b). List of NBFCs and ARCs Registered with the RBI. March 31. Reserve Bank Innovation Hub (RBIH). (2022). Fin(Wrap). Various Issues. Retrieved from: https://rbihub.in/resources/ Reserve Bank Innovation Hub (RBIH). (2024). Homepage. Retrieved from: https://rbihub.in. Accessed in July 2024. Ross, S. A. (1989). Institutional Markets, Financial Marketing, and Financial Innovation. Journal of Finance, 44(3), 541-556. Sankar, T. R. (2022). FinTech and Regulation. Speech Delivered at the Business Standard Summit, Mumbai. December 21. Sankar, T. R. (2023). FinTech Innovation and Approach to Regulation. Speech Delivered at the Global FinTech Festival, Mumbai. September 5. Sarr, A., and Lybek, T. (2002). Measuring Liquidity in Financial Markets. IMF Working Paper No. WP/02/232. Shin, H. S. (2019). BigTech in Finance: Opportunities and Risk. Speech Delivered on the Occasion of the BIS Annual General Meeting in Basel, Vol. 30. Silber, W. (1983). The Process of Financial Innovation. The American Economic Review, Vol. 73, No. 2. Suresh, A. (2018). RegTech: A New Disruption in the Financial Services Space. PwC India’s Fintech RSS Feeds. Retrieved from: https://www.pwc.in/industries/financial-services/fintech/fintech-insights/regtech-a-new-disruption-in-the-financial-services-space.html. October 10. Suri, T., Bharadwaj, P., and Jack, W. (2021). FinTech and Household Resilience to Shocks: Evidence from Digital Loans in Kenya. Journal of Development Economics, 153, 102697. Tracxn (2024). Retrieved from: https://tracxn.com. Accessed in July 2024. TransUnion CIBIL (2023). The Rise and Evolution of India’s Digital Finance. Retrieved from: https://www.transunioncibil.com/content/dam/transunion-cibil/business/collateral/report/Gff-report-2023.pdf Tufano, P. (2003). Financial Innovation. In Handbook of the Economics of Finance (Vol. 1, pp. 307-335). Wang, Y., Xiuping, S., and Zhang, Q. (2021). Can FinTech Improve the Efficiency of Commercial Banks? - An Analysis Based on Big Data. Research in International Business and Finance, 55, 101338. Wu, X., Jin, T., Yang, K., and Qi, H. (2023). The Impact of Bank FinTech on Commercial Banks’ Risk-taking in China. International Review of Financial Analysis, 90, 101338. Yang, F. and Masron, T. A. (2024). The Effect of Digital Transformation on the Cost of China. SN Business and Economics 4(5), 48. * This chapter has been prepared by a team comprising Rakhe Balachandran, Ashish Khobragade, Rajas Saroy, Sakshi Awasthy, Shashi Kant, Akshara Awasthi, Himani Shekhar, Rajni Dahiya, Radheshyam Verma, Anshu Kumari, Priyanka Upreti from the Department of Economic and Policy Research; Prasad Gajinkar, Jyothisree G, Ashis Mittal, Pramanshu Rajput from the Department of Regulation; Parimal Kumar Shivendu from the FinTech Department; and Sanjeev Kumar Gupta and Amarnath Yadav from the Department of Supervision. Valuable insights provided by Shri Manoranjan Mishra are gratefully acknowledged. Assistance received from Mantisha, Rajkumar Bhandare and Uthara is thankfully acknowledged. 1 Embedded finance refers to the integration of banking and various financial services into non-financial applications and services. 2 Regulatory Technology (RegTech) refers to the application of technology to improve regulatory compliance and risk management within financial institutions (FIs). RegTech, a subset of FinTech, offers tailored solutions for compliance, reduces costs, and manages new regulations, litigation, and remediation. This technology streamlines regulatory processes, helping FIs navigate the evolving regulatory landscape efficiently, enhancing compliance, and reducing complexity (Suresh, 2018). 3 Includes National Electronic Funds Transfer (NEFT), debit and credit card transactions. 4 Twenty-five banks participated in the survey. 5 Active customers are defined as those who have used these facilities at least once in two months. 6 The FinTech adoption rate is the share of consumers who have used at least two categories of FinTech services, including money transfer and payments, budgeting and financial planning, savings and investments, borrowing, and insurance, among the total digitally active adults surveyed (EY, 2019). 7 Data accessed on May 14, 2024. 8 Based on text mining of the Annual Reports of the SCBs and the Upper Layer NBFCs from 2011 to 2023. The number of times the names of the FinTechs and the word “fintech” appears in the annual reports is used as a proxy for collaboration between the Banks/NBFCs and the FinTechs. 9 The survey was conducted in March 2024. Responses were received from 25 banks and 68 NBFCs. 10 User ratings of six major dedicated BNPL applications on Google Play store are considered. 11 Names of the FinTech LSPs of upper layer NBFC-ICCs are collected from their respective websites. 12 Data on credit extended through debit card EMI plans and BNPL are not available. 13 This sub-section is based on a case study, undertaken in July 2024, of 150 individual products randomly selected from varying price ranges across 15 product categories of consumer durables that are sold on a major BigTech platform in India. Consumer durables considered for this analysis are refrigerator, television, smart phone, almirah, sofa, stove, mixer grinder, cot, laptop, and headphone, among others. 14 Successful data shares refer to movement of the requested data from FIPs to FIUs that has actually taken place. 15 Any e-commerce company with a pre-existing user base can be a LA and act as a bridge between lenders and borrowers (users of that e-commerce company). 16 TSPs are FinTech companies that onboard lenders, borrowers, and platforms onto the OCEN. 17 It provides end-to-end digital loans up to a maximum of 80 per cent of loan-to-value (LTV) against GeM orders. 18 The number of installs given is as on April 22, 2024. 19 The information available includes Aadhaar, e-KYC, land records from the state governments (viz., Tamil Nadu, Madhya Pradesh, Andhra Pradesh, Odisha, Uttar Pradesh, and Maharashtra), account aggregation by account aggregators, Permanent Account Number (PAN) validation, GST-related information, Aadhaar e-signing, milk-pouring data from select dairy co-operatives, and house/property search data, among others. 20 Data accessed as on July 23, 2024. 21 The fixed effect panel data model using data for 31 banks for the period Q4:2014-15 – Q4:2022-23 yielded the following estimated regression: 22 Such as securitisation, introduction of new products including options, and exchange traded funds. 23 A DLG is a contractual arrangement in digital lending where an entity, such as an LSP, guarantees to compensate an RE for losses resulting from defaults on a specified percentage of the loan portfolio. LSP is an entity that offers lending services to borrowers, typically in the form of providing loans or credit facilities. 24 This is the fourth edition of the G20 tech sprint. The three problem statements under this tech sprint are “AML/CFT/Sanctions technology solutions to reduce illicit finance risk”, “FX and liquidity technology solutions to enable settlement in EMDE currencies” and “Technology solutions for multilateral cross-border CBDC platforms”. |

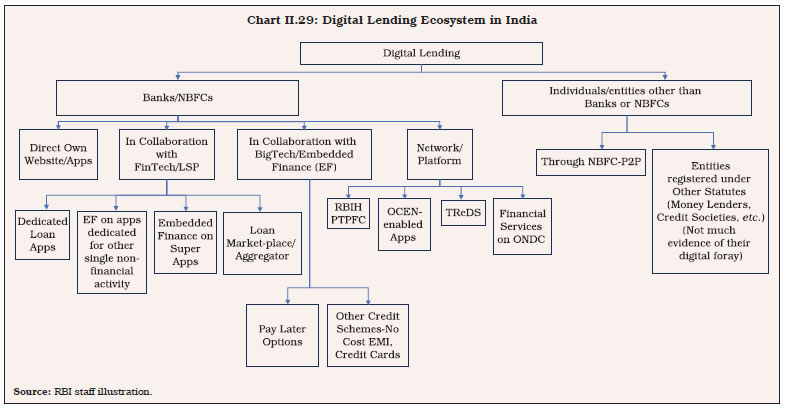

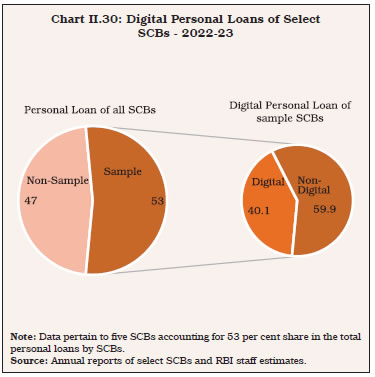

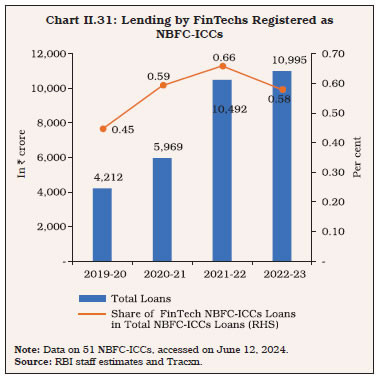

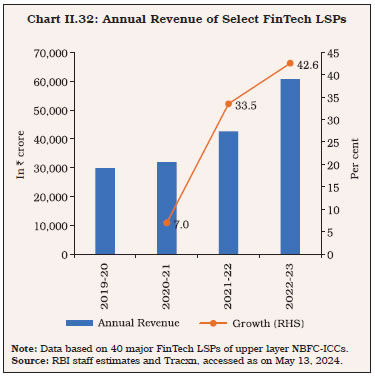

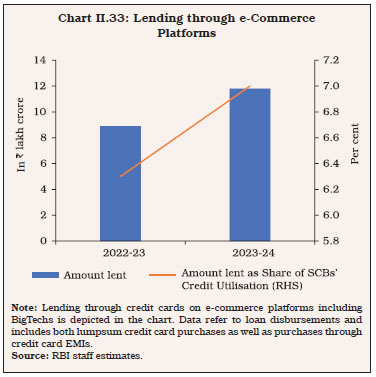

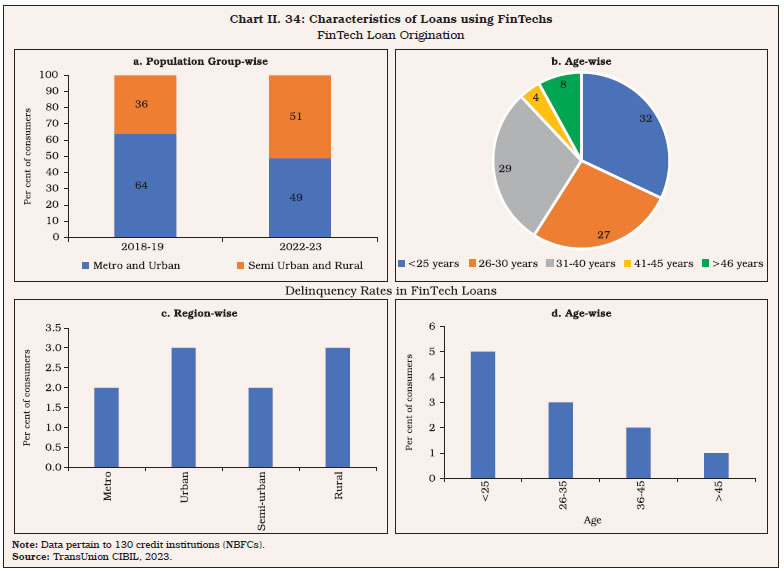

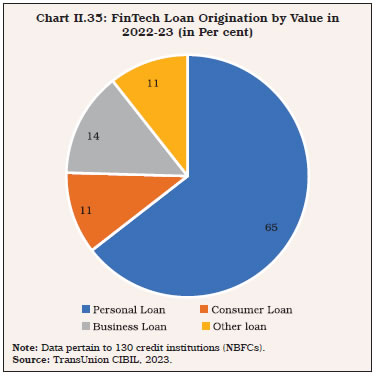

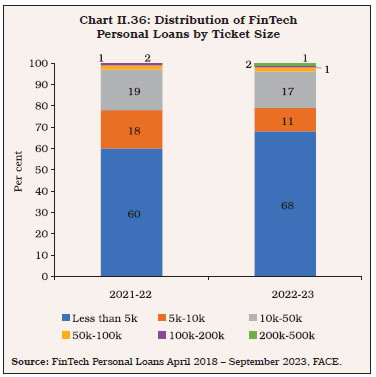

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: