IST,

IST,

Consultative Document on Regulation of Microfinance

Microfinance is a form of financial service which provides small loans and other financial services to poor and low-income households. It is an economic tool designed to promote financial inclusion which enables the poor and low-income households to come out of poverty, increase their income levels and improve overall living standards. It can facilitate achievement of national policies that target poverty reduction, women empowerment, assistance to vulnerable groups, and improvement in the standards of living. Indian microfinance sector has witnessed phenomenal growth over past two decades in terms of increase in both the number of institutions providing microfinance as also the quantum of credit made available to the microfinance customers. Microcredit is delivered through a variety of institutional channels viz., (i) scheduled commercial banks (SCBs) (including small finance banks (SFBs) and regional rural banks (RRBs)) lending both directly as well as through business correspondents (BCs) and self-help groups (SHGs), (ii) cooperative banks, (iii) non-banking financial companies (NBFCs), and (iv) microfinance institutions (MFIs) registered as NBFCs as well as in other forms. A snapshot of the microfinance sector is given below:

1.2 Developments in the Microfinance Sector Microfinance activities gained prominence in the early 1990s and RBI recognized it as a new paradigm, with immense potential and was very supportive for its growth. When the demands for regulating the MFIs were made, Shri Jagdish Capoor, the then Deputy Governor, in 2001 stated that “As MFIs are significantly different from commercial banks both in terms of institutional structure and product portfolio, application of the same set of regulatory and prudential guidelines to MFIs, in our view, not only runs the risk of distorting the emerging market but it may also reduce the efficiency of these institutions.” When the demands gained momentum by 2005, the then Governor, Dr YV Reddy in 2005 stated that “Microfinance movement across the country involving common people has benefited immensely by its informality and flexibility. Hence, their organisation, structure and methods of working should be simple, and any regulation will be inconsistent with the core-spirit of the movement”. Thus, RBI had extended every possible support for a financial innovation that was seen as important for furthering financial inclusion in the country. However, as the sector grew, certain inadequacies and failures became apparent culminating in the Andhra Pradesh (AP) microfinance crisis in 2010. This crisis was attributed to the irrational exuberance of some MFIs who, in their eagerness to grow business, had given a go by to the conventional wisdom and good practices such as due diligence in lending and ethical recovery practices. Over-indebtedness of the borrowers led to difficulties in repayments and forced recoveries by some of the MFIs finally led to public uproar and subsequent intervention by the state government. In the wake of this crisis, RBI constituted a Committee (Chairman: Shri Y H Malegam) to study issues and concerns in the MFI sector. The recommendations of the committee are discussed later in paragraph 1.5. Over the last decade, the landscape of the microfinance sector has changed significantly. One out of two entities granted approval for starting a universal bank in 20141 was an NBFC-MFI viz., Bandhan Financial Services Limited, while eight out of ten entities granted approval for starting SFBs in 20162 were NBFC-MFIs. Some of the NBFC-MFIs have got merged with banks including Bharat Financial Inclusion Limited, the then largest NBFC-MFI, which was merged with IndusInd bank in July 2019. As a result, the share of NBFC-MFIs in microfinance sector stands at a little over 30 per cent as on September 2020 in terms of gross loan portfolio of ₹2.27 lakh crore. 1.3 Concerns in Microfinance Sector related to Customer Protection 1.3.1 Over-indebtedness and Multiple Lending The comprehensive regulatory framework is applicable only to NBFC-MFIs, whereas other lenders, which comprise of around 70 per cent share in the microfinance portfolio, are not subjected to similar regulatory conditions. As a result, small borrowers are increasingly able to get multiple loans from several lenders, contributing to their over-indebtedness which, then, can potentially get manifested into coercive recovery practices. This compromises the essential objective of protection of small borrowers enshrined in the NBFC-MFI regulations which do not permit more than two NBFC-MFIs to lend to the same borrower. Besides, there is a regulatory ceiling on the maximum amount that can be lent by an NBFC-MFI to a microfinance borrower. With decline in the share of NBFC-MFIs in the overall volume of microfinance, it is the customer who ends up being the victim of over-indebtedness. 1.3.2 Pricing of Microfinance Loans The regulatory ceiling on interest rate is applicable only to NBFC-MFIs. Regulatory instructions and clarifications over the years have led to a complex set of rules governing the cost of funds. The prescribed ceiling on lending rate for NBFC-MFIs has had an unintended consequence of not allowing competition to play out and most lenders have similar levels of pricing. There is a concern that the current guidelines, prescribing an interest rate ceiling for only NBFC-MFIs, are effectively acting as a regulatory benchmark for other lenders as well. Lending rates of banks also hover around this ceiling despite comparatively lower cost of funds. Even among NBFC-MFIs, increasing size of the operations leading to greater economy of scale has not resulted in any perceptible decline in their lending rates. As a result, it is the borrowers who are getting deprived of the benefits from enhanced competition as well as economy of scale. Thus, there is a non-level playing field which results in customer protection getting compromised. 1.4 Need for Review of the Current Regulatory Framework The current regulatory framework for NBFC-MFIs has been put in place with the objective of making credit available to low-income households in a transparent manner while ensuring borrowers’ protection from any sharp practices adopted by the lenders. However, this framework again is applicable only to 30 per cent of the microfinance loan portfolio. The emerging dynamics in the microfinance sector as well as the concerns of customer protection call for a review of the regulations so that all the regulated entities (REs) engaged in microfinance pursue the goal of customer protection within a well-calibrated and harmonized set-up. This discussion paper intends to facilitate a review of the applicable regulatory framework for microfinance activities undertaken by all REs of the Reserve Bank. The primary objective is to address the concerns related to the over-indebtedness of microfinance borrowers and to enable the market mechanism to bring the interest rates downwards in the microfinance sector while empowering the borrowers to make an informed decision by enhancing prevalent mechanisms on transparency of loan pricing. While introducing lender agnostic and activity-based regulations in the microfinance sector, the Reserve Bank is also conscious of the fact that certain prudential norms specific to NBFC-MFIs should not be harmonized with other REs to address the idiosyncratic risks on account of concentrated exposure of NBFC-MFIs to unsecured microfinance loans. Further, the proposed regulations shall be introduced in a non-disruptive manner and all REs shall be provided with sufficient time to comply with the guidelines post their introduction. Before we proceed with the proposed changes in the regulatory framework, it would be appropriate to have a look at the important extant guidelines covering activities of the NBFC-MFIs. 1.5 Regulatory Approach towards Microfinance With the objective of integrating the client centric principles with the operations of NBFC-MFIs, the regulations have tried to ensure that the product design and delivery are to the advantage of the customers. A ‘fair practices code’ including a suitable grievance redressal mechanism, has also been prescribed for NBFC-MFIs with the objective of customer protection and transparency, as majority of the clients of NBFC-MFIs are socially as well as financially vulnerable. As stated earlier, in the wake of AP microfinance crisis in 2010, RBI had constituted a committee under the chairmanship of Shri Y H Malegam to study issues and concerns in the MFI sector. Regulatory approach towards microfinance has been largely based on the recommendations of the Malegam Committee. The key recommendations of the Malegam Committee were as follows:

1.5.1 Introduction of Regulations for NBFC-MFIs Based on the recommendations of the Malegam Committee, RBI introduced a comprehensive regulatory framework for NBFC-MFIs on December 02, 2011. The regulations prescribed eligibility criteria for microfinance loans linked to core features of microfinance i.e., lending of small amounts to borrowers belonging to low-income groups, without collateral, and with flexible repayment schedules. Besides, the regulations laid special emphasis on protection of borrowers and fair practices in lending such as transparency in charges, ceilings on margins and interest rates, non-coercive methods of recovery, measures to contain multiple lending and over-indebtedness. Some of the limits and operational guidelines have been revised subsequently but the core regulatory framework has remained the same. Key features of the regulatory framework for NBFC-MFIs are given in box-1 below. Chapter 2: Proposed Framework to address the Concerns of Over-indebtedness and Multiple Lending 2.1 Introduction to the Proposed Framework It is proposed to revise the definition of microfinance loans as also the limits applicable to such loans. Further, to avoid over-indebtedness and multiple lending, it is proposed to apply these regulations to all REs of RBI operating in the microfinance sector. The proposed framework is discussed in detail in the following paragraphs. 2.2 Broad Approach of the Proposed Framework It is felt that in order to avoid over-indebtedness of microfinance borrowers, the regulations should focus on total indebtedness of these borrowers vis-à-vis their repayment capacity rather than considering only indebtedness by itself or indebtedness from only NBFC-MFIs. Accordingly, it is proposed to address the issue of over-indebtedness by way of following measures:

2.3 Details of the Proposed Framework 2.3.1 Common Definition of Microfinance Borrower linked to Household Income Under extant instructions for NBFC-MFIs, a microfinance borrower is identified by annual household income not exceeding ₹1,25,000 for rural and ₹2,00,000 for urban and semi-urban areas. Same criteria shall be extended to all REs for the purpose of the common definition. 2.3.2 Assessment of Household Income The proposed definition of ‘microfinance’ primarily hinges on the income of the borrower. Therefore, it becomes imperative to clarify the following aspects related to the criterion of income assessment:

2.3.3 Limits on Household Indebtedness 2.3.3.1 To address the concerns of over-indebtedness, it is proposed to link the loan amount to household income in terms of debt-income ratio. The intention of the proposed regulation is to ensure that the household is not strained. Accordingly, the payment of interest and repayment of principal for all outstanding loans of the household at any point of time shall be capped at 50 per cent of the household income. However, individual RE may adopt a conservative threshold as per their own assessments and Board approved policy. The threshold of 50 per cent has been arrived at on the basis of following aspects:

2.3.3.2. This threshold shall become effective from the date of introduction of the proposed regulations. Existing loans to the households which are not complying with the limit of 50 per cent of the household income, shall be allowed to mature. However, in such cases, no new loans shall be provided to these households till the limit is complied with. 2.3.3.3 In view of the above, it becomes more critical for each RE to provide timely and accurate data to the credit information companies and use the data available with them to ensure compliance with the level of indebtedness. Besides, REs should also ascertain the same from other sources such as declaration from borrower, bank account statement and local enquiries. The REs shall cover this issue in their Board approved policy, in detail. 2.3.4 Need for Collateral Low-income borrowers often lack the type of collateral often preferred by the lenders and what they have for pledging, instead is of little value for the lenders but is highly valued by the borrower (e.g. household items, furniture, etc.). Even if lenders take such collateral, it is for leverage to induce repayments rather than to recover losses. Malegam Committee had also stated that low-income borrowers often do not have assets which can be offered as collateral, and, therefore, it becomes important to ensure that in the event of default, the borrowers do not lose possession of assets which are essential for their continued existence. These concerns have also been flagged in the document on ‘Microfinance Activities and the Core Principles for Effective Banking Supervision’ by Basel Committee on Banking Supervision (BCBS)5. Therefore, the collateral free nature of microfinance loans, as applicable to NBFC-MFIs, should logically be extended to all REs. 2.3.5 Pre-payment Penalty and Repayment Periodicity As a measure of customer protection, microfinance borrowers of all REs shall be provided with the right of prepayment without attracting penalty, as is the case for NBFC-MFIs. Further, microfinance borrowers of NBFC-MFIs are permitted to repay weekly, fortnightly or monthly instalments as per their choice. Since the repayment pattern should be designed to suit the borrower’s repayment capacity/preferences, all REs shall have a Board approved policy to provide the flexibility of repayment periodicity to microfinance borrowers as per their requirement. 2.4 Definition of ‘microfinance’ for ‘not for profit’ Companies 2.4.1. In January 20006, RBI had granted exemption from Sections 45-IA (Requirement of registration and net owned fund), 45-IB (Maintenance of percentage of assets) and 45-IC (Reserve Fund) of the RBI Act, 1934 to those ‘not for profit’ companies (registered under Section 25 of the Companies Act, 1956 (Section 8 of the Companies Act, 2013)) which are engaged in micro-financing activities and not accepting public deposits. For this purpose, micro-financing activities have been defined as providing credit not exceeding ₹50,000 for a business enterprise and ₹1,25,000 for meeting the cost of a dwelling unit to any poor person. It has been two decades since the aforementioned criteria was introduced and it becomes imperative to harmonize the definition of ‘microfinance activities’ for ‘not for profit’ companies with the proposed definition of ‘microfinance’. 2.4.2 Another issue that requires consideration is whether a blanket exemption should be provided to all Section 8 companies undertaking microfinance activities, irrespective of their size. Section 8 companies are dependent for their funding needs on public funds including borrowings from banks and other financial institutions. Due to their interconnectedness with other financial intermediaries, any risk arising out of their business can get transmitted to the financial sector. Therefore, it may be prudent to bring Section 8 companies above a certain threshold in terms of balance sheet size (say, asset size of ₹100 crore and above) under the regulatory ambit of the Reserve Bank. As per information available in Bharat Microfinance Report, 20207, around 90 per cent of Section 8 companies engaged in microfinance activities shall continue to enjoy the exemption from registration requirement. Those Section 8 Companies which meet the asset size threshold for registration, shall be provided six months’ time to comply with registration requirements including minimum net owned fund (NOF) criterion. 2.4.3 Accordingly, the revised criteria for exemption from certain sections of the RBI Act, 1934 shall be as under: ‘Exemption from Sections 45-IA, 45-IB and 45-IC of the RBI Act, 1934 shall be available to a micro finance company which is-

2.5 Net Owned Fund (NOF) Requirement for NBFC-MFIs Reserve Bank had issued a Discussion Paper8 on ‘Revised Regulatory Framework for NBFCs - A Scale-Based Approach’ on January 22, 2021 wherein it has been proposed to revise the minimum NOF for all NBFCs including NBFC-MFIs, from ₹2 crore to ₹20 crore. However, unlike other NBFCs, NBFC-MFIs are presently required to have a minimum NOF of ₹5 crore (₹2 crore for NBFC-MFIs registered in the North Eastern Region). It needs to be considered whether similar differential approach for NBFC-MFIs should continue under proposed scale-based regulations for NBFCs.

Chapter 3: Review of Regulations Applicable to NBFC-MFIs only In Chapter 2, a framework was proposed to deal with over-indebtedness of the microfinance borrowers with the suggestion that the framework shall be made applicable to all the entities regulated by RBI. In this chapter, certain issues, which are relevant for NBFC-MFIs only, have been examined and measures have been proposed to address these issues. 3.2 Qualifying Assets Criteria for NBFC-MFIs As per extant guidelines, each NBFC-MFI is required to maintain not less than 85 per cent of its net assets as ‘qualifying assets’. Eligibility criteria for ‘qualifying assets’ i.e. microfinance loans for NBFC-MFIs include a number of parameters. With introduction of a common definition of ‘microfinance’ for all REs, a need is felt to review those parameters which have not been captured under this proposed definition. 3.3 Parameters under Definition of ‘Qualifying Assets’ Current parameters under the definition of ‘Qualifying Assets’ and their treatment under the proposed framework are given below. 3.3.1 Household annual income limits of ₹1,25,000 (Rural) and ₹2,00,000 (Urban); collateral free loans; no pre-payment penalty and flexibility of repayment periodicity These parameters have been included under the revised definition of microfinance loans and, therefore, shall continue. 3.3.2 Loan amount limit of ₹1,25,000 (₹75,000 in first cycle and exclusion of loans for meeting education and medical expenses from loan limit); and minimum tenure of 24 months for loans above ₹30,000 With the proposed regulation of linking the loan amount to household income, an absolute cap on loan amount would no longer be necessary. Further, it would not be feasible for any lender to extend large loans for short tenures given the proposed cap of 50 per cent on outflows w.r.t. income. Therefore, limits on loan amount and minimum tenure, which are presently applicable to only NBFC-MFIs, shall be withdrawn. 3.3.3 Aggregate amount of loans, given for income generation, is not less than 50 per cent of the total loans given by the MFIs Ideally, microfinance loans should be used for income-generating activities as their main objective is to enable borrowers to work their way out of poverty by undertaking income generating activities. Borrowing for non-income generating purposes may also tempt the borrowers to borrow in excess of their repayment capacity. However, providing access of credit for other purposes such as repayment of high-cost loans to moneylenders, education, medical expenses, consumption smoothing, acquisition of household assets, housing, emergencies, etc., is also equally important in the Indian context. As Microfinance is useful in smoothing consumption and relieving seasonal liquidity crises, it obviates the need for high-cost borrowing from informal sources. However, these limits are only applicable to NBFC-MFIs representing only around 30 per cent of the microfinance loan portfolio. It will be relevant to mention here that, the ‘Committee on Comprehensive Financial Services for Small Businesses and Low-Income Households’ had recommended that over-emphasis on income-generating loans may drive the borrowers towards more expensive informal loans for fulfilling their entire financial needs. Therefore, limits regarding minimum 50 per cent of loans for income generation purpose, which are presently applicable only to NBFC-MFIs, shall be withdrawn. 3.4 Harmonization of Microfinance Regulations With aforementioned changes, the definition of ‘qualifying assets’ for NBFC-MFIs would be in alignment with the definition of ‘microfinance loans’ as applicable to all REs and limit of lending by only two NBFC-MFIs to a borrower shall also be withdrawn. 3.5.1 Current Framework on Interest Rate Regulations for NBFC-MFIs a) Extant guidelines9 on pricing of credit by NBFC-MFIs, inter alia, prescribe that the interest rate charged by an NBFC-MFI will be lower of-

b) Besides interest charge, NBFC-MFIs are not permitted to levy any other charge except for a processing fee (capped at 1 per cent of the loan amount) and actual cost of insurance. c) Additionally, clarifications on components of cost of funds and computation methodology for arriving at cost of funds have also been provided under FAQs10. d) NBFC-MFIs are not permitted to charge any penalty for delayed payment. 3.5.2 Evolution of Extant Framework Malegam Committee had recommended a margin cap of 10 per cent for NBFC-MFIs with loan portfolio of ₹100 crore and above, and 12 per cent for other NBFC-MFIs, along with a cap of 24 per cent on individual loans. In the final guidelines issued on December 2, 2011, a uniform margin cap of 12 per cent was prescribed for all NBFC-MFIs along with a cap of 26 per cent on individual loans. In view of the dynamic costs of borrowings and to allow for operational flexibility, fixed interest rate ceiling of 26 per cent was removed in 2012 with the safeguard that the maximum variance permitted between the minimum and maximum interest rate for individual loans cannot exceed 4 per cent. The margin cap was also changed to 10 per cent and 12 per cent depending on the size of loan portfolio (₹100 crore threshold). These guidelines were subsequently reviewed and an additional criterion of 2.75 times of the average base rate of five largest commercial banks was introduced w.e.f. April 1, 2014. 3.5.3 Rationale behind Extant Framework Instead of prescribing a single ceiling on interest rates, multiple ceilings have been prescribed to achieve varied objectives. With prescription of a fixed spread over the cost of funds, the borrower gets benefitted in a low-cost environment whereas in a rising rate environment, the NBFC-MFIs can operate on viable lines. The other criterion of ceiling at 2.75 times of the average base rate of five largest commercial banks provides a linkage with the prevailing interest rate in the economy and ensures that higher borrowing costs for NBFC-MFIs with riskier business models are not transmitted to the end borrowers. Besides interest charge, NBFC-MFIs are not permitted to levy any other charge except for a processing fee (capped at 1 per cent of loan amount) and actual cost of insurance to ensure that interest rate ceilings are not bypassed by NBFC-MFIs through higher associated fees or other hidden charges. 3.5.4 Concerns with Extant Framework Some of the main arguments against the current framework for pricing of loans by NBFC-MFIs are as under: a) Non-applicability of the extant interest rate regulations on 70 per cent of microfinance b) The interest rate ceiling for NBFC-MFIs also has had an unintended consequence of creating a regulatory prescribed benchmark for rest of the entities operating in the microfinance segment. The lending rates of banks also hover around this regulatory ceiling despite comparatively lower cost of funds. Even among large NBFC-MFIs, greater economy of scale has not resulted in any perceptible decline in their lending rates. The legitimacy provided to margins over cost of funds (10 per cent and 12 per cent for large and small NBFC-MFIs respectively) through prevailing regulations has been keeping the interest rates at a higher level for this segment as a whole. As a result, all lenders tend to charge high interest rates in line with rates charged by NBFC-MFIs. Ultimately, the borrowers are deprived of the benefits from enhanced competition as well as economy of scale even under falling interest rate regime. c) A multiplication-based methodology (2.75 times of base rate) results in proportionally higher changes in the lending rate for NBFC-MFIs in comparison to changes in their borrowing costs. During current financial year, average base rate has declined by 80 basis points (bps) translating in to a reduction of 220 bps (2.75*80) in the lending rate. However, a decline of 80 bps would have impacted borrowing costs of NBFC-MFIs by say 80 bps whereas their non-financing costs would have remained the same. d) The margin of 10/ 12 per cent was based on the following cost structure suggested by the Malegam Committee:

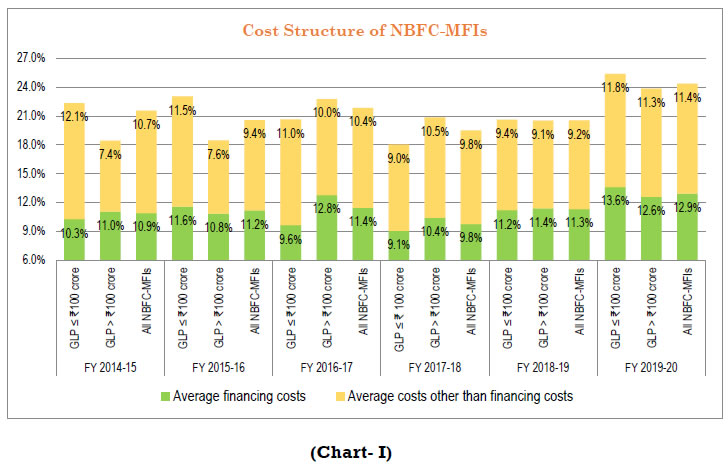

The Malegam Committee recommended a margin cap of 10 per cent over the cost of funds for MFIs having loan portfolio exceeding ₹100 crore and 12 per cent for the smaller MFIs along with a cap of 24 per cent on the individual loans. To empirically assess the cost structure of NBFC-MFIs vis-à-vis assumptions of the Malegam Committee, an assessment of their cost structure over last six years was undertaken (Chart I):  Source: Analysis based on information compiled from annual financial statements of NBFC-MFIs Note: Financing costs include all expenses related to raising funds viz., interest paid, processing fees, DD charges, foreign exchange hedging cost, credit rating & investment banker fee, legal charges, documentation charges, other expenses and taxes on expenses directly and solely attributable to raising debt. Non-financing costs include staff costs, other operational expenses and provisions for loan losses. In its cost structure, Malegam Committee has computed all costs including cost of funds as a percentage of loan portfolio assuming 100 per cent of assets being microfinance loans financed by 15 per cent equity and 85 per cent borrowings. In practice, this may not be the case. Therefore, a slightly different approach has been adopted in the analysis, i.e., while the average non-financing costs have been computed as a percentage of loan portfolio, average financing costs have been calculated as a percentage of borrowings. A significant share of loan portfolio of smaller NBFC-MFIs is financed by equity and calculating cost of funds as a percentage of loan portfolio may indicate lower cost of funds which will be misleading. It was observed that in four out of six years, financing costs for small NBFC-MFIs (loan portfolio of less than ₹100 crore) have been lower than the large NBFC-MFIs and in last four years, the difference between non-financing costs of small NBFC-MFIs and large NBFC-MFIs has been less than 2 per cent (margin difference considered by the Malegam Committee). Further, the break-up of various components of non-financing costs has not turned out to be as per assumptions of the Malegam Committee (Table II). 3.5.5 Suggested Framework 3.5.5.1 Prevalent interest rate regulations for NBFC-MFIs had a role when lending in microfinance sector was primarily from these entities. However, in the current scenario, these entities account for only 30 per cent of the microfinance loans. While banks (including SFBs) have been advised to benchmark all new floating rate personal or retail loans to an external benchmark w.e.f. October 1, 2019, benchmark-based pricing has not been introduced for NBFCs yet. In view of the substantial divergence between the financing costs (unlike banks, NBFC-MFIs are not permitted to accept deposits) as well as operational costs (due to differences in the use of technology, quality of human capital and the geographical spread etc.) among the REs operating in the microfinance sector, mandating any specific benchmark or any specific spread over a benchmark would have the same issues as are there with current guidelines. The ideal solution seems to lie in aligning pricing guidelines for NBFC-MFIs with that prescribed for NBFCs, in general. In other words, NBFC-MFIs, like any other NBFC, shall be guided by a board-approved policy and the fair practices code, whereby disclosure and transparency would be ensured. There would be no ceiling prescribed for the interest rate. However, while doing so they should ensure that usurious interest rates are not charged. The intention is to enable the market mechanism to bring the lending rates downwards for the entire microfinance sector. 3.5.5.2 A multi-country study11 undertaken by World Bank has concluded that a simplified fact sheet on pricing of financial products leads to improvement in decision making by low-income borrowers by three times in comparison to other financial literacy related materials and it also enhances their price-sensitivity which can then bring about more price competition. Therefore, in order to empower the microfinance borrowers to make an informed decision, a standardized and simplified one-page disclosure format containing information only on pricing of microfinance loans shall be prescribed for all REs. This format shall enable the borrowers to compare interest rates as well as other fees associated with a microfinance loan in an easy to understand manner e.g. it will require disclosure of repayments (total as well as periodic) in absolute amount (with further break-up of principal and interest component) rather than only in percentage terms (which are generally misrepresented/difficult to comprehend). This pricing related fact sheet shall not have any other information to keep it uncluttered and shall be provided to every prospective borrower before on-boarding. A simplified fact sheet (Table-III) related to pricing of microfinance loans shall be made mandatory for all REs. 3.5.5.3 Boards of all REs shall lay down appropriate internal principles and procedures for determining interest rates and other charges for microfinance loans so that all-inclusive interest rates charged to the microfinance borrowers are not usurious in nature. All REs shall be required to display the minimum, maximum and average interest rates charged by them on microfinance loans. This information shall also be made part of the returns submitted by the REs to the Reserve Bank and shall be subjected to the supervisory scrutiny.

Extant Regulations vis-à-vis Proposed Changes

1 RBI had granted “in-principle” approval to two applicants viz., IDFC Limited and Bandhan Financial Services Private Limited, to set up universal banks on April 2, 2014. 2 RBI had granted “in-principle” approval to ten applicants viz., Au Financiers (India) Ltd., Jaipur; Capital Local Area Bank Ltd., Jalandhar; Disha Microfin Private Ltd., Ahmedabad; Equitas Holdings P Limited, Chennai; ESAF Microfinance and Investments Private Ltd., Chennai; Janalakshmi Financial Services Private Limited, Bengaluru; RGVN (North East) Microfinance Limited, Guwahati; Suryoday Micro Finance Private Ltd., Navi Mumbai; Ujjivan Financial Services Private Ltd., Bengaluru; Utkarsh Micro Finance Private Ltd., Varanasi, to set up small finance banks on September 16, 2015. 3 A study carried out for the European Commission to develop a common definition for indebtedness across the EU inter alia suggested that the unit of measurement should be the household because the incomes of individuals are usually pooled within the same household (https://ec.europa.eu/social/BlobServlet?docId=9817&langId=en) 4 Technical document on ‘Introduction, Concepts, Design and Definitions for India’ – Survey of household expenditure on services and durable goods, 72 round (http://microdata.gov.in/nada43/index.php/catalog/137) 5 https://www.bis.org/publ/bcbs175.pdf 6 Circular dated January 13, 2000 on ‘Amendments to NBFC regulations’ (/en/web/rbi/-/notifications/amendments-to-nbfc-regulations-225) and Notification dated January 13, 2000 (/en/web/rbi/-/notifications/amendments-to-nbfc-regulations-225) 7 http://www.sa-dhan.net/bharat-microfinance-report/ 8 /en/web/rbi/-/publications/discussion-paper-on-revised-regulatory-framework-for-nbfcs-a-scale-based-approach-20316 9 Additional Guidelines on Pricing of Credit a) NBFC-MFIs shall ensure that the average interest rate on loans sanctioned during a quarter does not exceed the average borrowing cost during the preceding quarter plus the margin, within the prescribed cap. b) The maximum variance permitted for individual loans between the minimum and maximum interest rate cannot exceed 4 per cent. c) The average interest paid on borrowings and charged by the MFI are to be calculated on average monthly balances of outstanding borrowings and loan portfolio respectively. The figures shall be certified annually by statutory auditors and disclosed in the balance sheet. 10 Clarifications provided under FAQs Q: What are the components which will be considered for the purpose of arriving at the cost of funds as stated under guidelines on ‘Pricing of Credit’? Ans. The cost of funds will include the following components: Expenses incurred towards interest payments; Processing fee including service tax (amortized monthly); Stamp duty charges (amortized monthly); DD charges (amortized monthly) less interest accrued on security deposit. Q: Whether the net amount of loan received from lending bank (i.e. loan amount reduced by cash collateral kept as a certain proportion of borrowed amount as deposit) may be used in denominator for computing the cost of funds? Ans. NBFC-MFIs are not permitted to exclude the amount of cash collateral from total borrowings to arrive at the denominator for computing cost of funds. 11 Giné, Xavier, Cristina Martínez Cuellar, and Rafael Keenan Mazer. 2017. “Information Disclosure and Demand Elasticity of Financial Products: Evidence from a Multi-Country Study.” 8210. Policy Research Working Paper Series. Washington, DC: The World Bank. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: