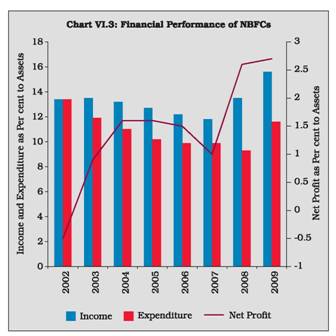

Non-Banking Financial Institutions (NBFIs) play an important role in the Indian financial system given their unique postion of providing complimentarity and competitiveness to banks. On account of intensification of the global financial crisis in September 2008, some impact was experienced in the sector, thereby creating liquidity constraints for NBFIs. In response, the Reserve Bank introduced special fixed term rate Repo under liquidity adjustment facility (LAF) to banks exclusively for the purpose of meeting the funding requirements of Non-Banking Financial Companies (NBFCs). Besides, certain precautionary measures were taken by the Reserve Bank since October 2008 to enhance the availability of liquidity to NBFCs. These steps indirectly helped in dealing with the market pressure which had been building up. All India Financial Institutions (AIFIs) were extended refinance facilities of Rs.16,000 crore. Ceiling on aggregate resource mobilisation and umbrella limit were raised for EXIM Bank and NHB; select AIFIs were allowed to offer market related yield to maturity (YTM). Financial Institutions (FIs) exhibited robust performance in terms of assistance sanctioned and disbursements, balance sheet size and net profit. The weighted average cost of long term resources raised by AIFIs witnessed a mixed trend. Asset quality of FIs improved during the year vis-à-vis the previous year. Regulation of NBFIs in India was being progressively strengthened well before the onset of the global financial crisis. The Reserve Bank undertook regulatory and supervisory policy initiatives in terms of capital to risk weighted asset ratio (CRAR), exposure norms and classification of assets. While the balance sheet size of Primary Dealers (PDs) moderated during the period mainly on account of decline in secured loans and decline in Government securities, their financial indicators like net profit and return on average assets improved during 2008-09 vis-à-vis 2007-08.

1. Introduction

6.1 While the Indian financial system is dominated by banks, NBFIs play an important role by complementing banks in providing a wide range of financial services. Banks have an edge in providing payment and liquidity related services, while NBFIs tend to offer enhanced equity and risk based products. NBFIs are heterogeneous as a group, functionally as well as in terms of size and nature of activities. The major intermediaries that are included in the NBFI group are Development Finance Institutions (DFIs), insurance companies, non-banking financial companies (NBFCs), primary dealers (PDs) and capital market intermediaries such as mutual funds. The NBFIs are providing medium to long-term finance to different sectors of the economy.

6.2 In the wake of the recent global financial crisis and its fall out on the financial institutions (FIs), the Reserve Bank took a number of measures to preserve financial stability and arrest the moderation in the growth momentum. To ensure adequate availability of liquidity in the system and maintain conditions conducive for flow of credit to all productive purposes, particularly to the housing, export and industrial sectors, the Reserve Bank provided special refinance facilities to the Small Industries Development Bank of India (SIDBI),the National Housing Bank (NHB) and the Export-Import (EXIM) Bank of India in December 2008. The ceiling on aggregate resources mobilised by SIDBI, NHB and EXIM Bank, and the ‘umbrella limit’ for NHB and EXIM Bank were also raised. The Reserve Bank took policy initiatives for NBFCs also. As a measure aimed at expanding rupee liquidity, the Reserve Bank provided a special repo window under the LAF for NBFCs. In addition, an existing special purpose vehicle (SPV) was used as platform to provide liquidity support to NBFCs. In December 2008, systemically important non-deposit taking NBFCs (NBFCs-ND-SI) were permitted, as a temporary measure, to raise foreign currency short term borrowings under the approval route subject to certain conditions.

6.3 During 2008-09, the combined balance sheets of FIs, viz., National Bank for Agriculture and Rural Development (NABARD), SIDBI, NHB and EXIM Bank, continued to expand. The financial performance of FIs also improved. Net interest income as well as non-interest income of these FIs increased during 2008-09. The asset quality of the FIs improved as net non-performing assets (NPAs) to net loans ratio declined significantly during 2008-09. The NBFIs in the Indian financial system continued to be resilient as the Reserve Bank had taken various measures to minimise the adverse effects of the ongoing financial crisis on the system.

6.4 NBFCs have been competing with and complementing the services of commercial banks for a long time. The NBFCs as a whole account for 9.1 per cent of assets of the total financial system. The Committee on Financial Sector Assessment (CFSA), 2009 observed that NBFCs are largely compliant in areas relating to licensing, permissible activities, capital adequacy, risk management process, credit risk, problem assets, large exposures, supervisory approach, supervisory techniques and supervisory reporting. However, the assessment has revealed that there are certain gaps in areasrelating to home-host co-operation, transfer of significant ownership, major acquisitions, exposure to related parties, market, liquidity and operational risks, internal control and interest rate risk in the banking book. The CFSA’s recommendations in this regard will be looked into by the Reserve Bank.

6.5 In order to strengthen the market infrastructure of Government securities market and make it vibrant, liquid and broad-based, the PDs system was introduced by the Reserve Bank in 1995. The PDs system is designed to facilitate Government’s market borrowing programme and improve the secondary market trading system by contributing to price discovery, enhancing liquidity and turnover, encouraging voluntary holding of Government securities amongst a wider investor base. The PDs system developed significantly over the years and currently it serves as an effective conduit for conducting open market operations. As of end-September 2009, there were 19 PDs, of which 11 were Bank-PDs and eight stand-alone PDs.

6.6 In this perspective, spread over five sections, this chapter analyses the performance of FIs in section 2. Section 3 explains the trends and developments relating to NBFCs and RNBCs. Activities and performance of PDs have been elaborated in section 4, followed by the conclusion in section 5.

2. Financial Institutions

6.7 Based on the major activity undertaken by FIs, they are classified into three broad categories. First, there exists the term-lending institution - EXIM Bank, whose main activity is direct lending by way of term loans and investments. Second, there are refinance institutions such as NABARD, SIDBI and NHB, which mainly extend refinance to banks as well as NBFIs. In the third category, there are investment institutions such as LIC, which deploy their assets largely in marketable securities. State/regional level institutions are a distinct group and comprise State Financial Corporations (SFCs), State Industrial and Development Corporations (SIDCs) and North Eastern Development Finance Corporation Ltd. (NEDFi). Some of these FIs have been notified as Public Financial Institutions by the Government of India under Section 4A of the Companies Act, 1956.

6.8 As on March 31, 2009, there were four FIs viz., EXIM Bank, NABARD, NHB and SIDBI which were under full-fledged regulation and supervision of the Reserve Bank. Industrial Investment Bank of India (IIBI), a financial institution with headquarter at Kolkata is in the process of voluntary winding up in view of its very poor financial position.

Regulatory Initiatives for Financial Institutions

6.9 In the wake of the emerging global

developments and their fall out on financial

institutions, the Reserve Bank received requests

from select FIs for liquidity support for on-lending

to HFCs/NBFCs/MFIs and exporters, and

accordingly, took a number of measures as follows:

Refinance Facility to SIDBI, EXIM Bank and NHB

6.10 As a measure to encourage flow of credit

to sectors, which were coming under pressure

due to the ongoing global financial crisis, in

December 2008, the Reserve Bank provided

refinance facilities of Rs.7,000 crore, Rs.5,000

crore and Rs.4,000 crore for SIDBI, EXIM Bank

and NHB, respectively, under the relevant

provisions of the Reserve Bank of India Act,

1934. The availment of refinance by the above

FIs under this facility is restricted to a period

of 90 days and the amount could be flexibly drawn and repaid during the period. The facility

could be rolled over and would be available up

to March 31, 2010. Advances under this facility

are charged at the repo rate under the LAF of

the Reserve Bank. The funds provided under

the refinance facility should be utilised as per

the policy approved by the Board of therespective financial institutions, and in adherence to the extant exposure norms for these entities. To facilitate monitoring, the financial institutions are required to submit a weekly report on the utilisation of the refinance facility to the Reserve Bank. The amount outstanding under the special refinance facility remained small up to February 2009 for each institution, but picked up in the subsequent months. The utilisation of refinance facility as at end-June 2009 is indicated in Table VI.1.

Ceiling on Aggregate Resources Mobilised by SIDBI, NHB and EXIM Bank

6.11 The ceiling on aggregate resources mobilised was raised to 12 times of the net owned funds (NOF) for SIDBI and NHB and 13 times of NOF for EXIM Bank with effect from December 8, 2008 for a period of one year from the existing norm of 10 times of NOF as per the last balance

sheet, subject to meeting CRAR requirements.

Umbrella Limit for EXIM Bank and NHB

6.12 The ‘umbrella limit’ for FIs which consists of aggregate borrowings through five specified instruments, viz., term deposits, term money borrowings, certificates of deposits (CDs), commercial papers (CPs) and inter-corporate deposits (ICDs) should not at any time exceed 100 per cent of their NOF as per its latest audited balance sheet. The umbrella limit was raised to 200 per cent of NOF for one year with effect from December 8, 2008 for EXIM Bank and January 15, 2009 for NHB, subject to review and subject to Asset Liability Management (ALM) guidelines of the Reserve Bank.

Table VI.1: Utilisation of Refinance Facilities | (Amount in Rs. crore) | AIFIs | Refinance Sanc

tioned | Cumulative Amount drawn up to June 26, 2009 | Cumulative Amount Disbursed up to June 26, 2009 | No. of Benefi

ciaries | 1 | 2 | 3 | 4 | 5 | SIDBI | 7,000 | 5,684 | 4,971 | 33* | | | | 988 | 1,043 | 22** | | | | 7,747 | 1,841 | 5,179 | EXIM Bank | 5,000 | 3,000 | 3,478 | 35 | NHB | 4,000 | 3,979 | 3,979 | 14# | Total | 16,000 | 21,398 | 15,312 | 5,283 | * : State Finance Corporations (SFCs) and banks.

** : Non-banking Finance Companies (NBFCs).

# : Housing Finance Companies (HFCs). |

Select AIFIs Allowed to Offer Market-related Yield to Maturity

6.13 While issuing bonds/debentures, the select

FIs viz., SIDBI, NHB, EXIM Bank and NABARD

can offer market related YTM. Accordingly, the

current stipulation that the yield to maturity

offered at the time of issue of bonds should not

exceed 200 basis points above the YTM on the

Government of India securities of equal residual

maturities would not apply with effect from

December 8, 2008 for a period of one year.

Prudential Guidelines on Treatment of Restructuring of Advances of Select AIFIs

6.14 The guidelines regarding treatment of

restructuring of advances issued to banks have

been mutatis mutandis applied to the select FIs.

Provisions relating to certain activities generally

not undertaken by FIs, such as extending

working capital, overdrafts and personal loans

would, however, not be applicable to them.

Operations of Financial Institutions

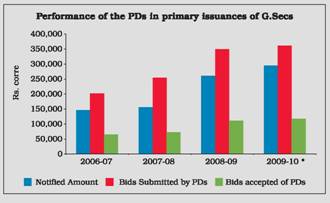

6.15 Financial assistance sanctioned and disbursed by FIs sharply increased during 2008-09 as compared to that in the previous year. A major part of the increase in financial sanctions and disbursements was accounted for mainly by investment institutions (especially LIC) followed by the term lending institutions (Table VI.2 and Appendix Table VI.1).

6.16 During 2008-09, though there was increase in both financial assistance sanctioned and disbursed by FIs, the increase in disbursements (93.3 per cent) was more pronounced than the sanctions (70.2 per cent) (Table VI.2) (Chart VI.1).

Assets and Liabilities of FIs

6.17 The combined balance sheets of select FIs (NABARD, NHB, SIDBI and EXIM Bank) during 2008-09 expanded sharply by 20.8 per cent over the previous year. On the liabilities side, the resources raised by way of bonds and debentures declined by 9.3 per cent during 2008-09. However, deposits and borrowings registered sharp increases of 80.7 per cent and 20.0 per cent, respectively. On the asset side, loans and advances continued to expand by 21.5 per cent and investment portfolio also recorded an increase of 21.8 per cent. Cash and bank balances and other assets registered an increase of 22.7 per cent and 8.8 per cent, respectively. Within liability, the share of deposits increased from 20.2 per cent to 30.2 per cent while other items showed a marginal to moderate decline. Composition of assets remain roughly unchanged during 2008-09 as that of 2007-08 (Table VI.3).

Table VI.2: Financial Assistance Sanctioned and Disbursed by Financial Institutions | (Amount in Rs. crore) | Category | Amount | Percentage Variation | 2007-08 | 2008-09 | 2008-09 | S | D | S | D | S | D | 1 | 2 | 3 | 4 | 5 | 6 | 7 | (i) | All-India Term-Institutions* | 18,696 | 17,379 | 33,660 | 31,604 | 80.0 | 81.9 | (ii) | Specialised Financial Institutions# | 366 | 189 | 597 | 283 | 63.1 | 49.7 | (iii) | Investment Institutions@ | 39,670 | 28,460 | 65,731 | 57,086 | 65.7 | 100.6 | Total Assistance by FIs (i+ii+iii) | 58,732 | 46,028 | 99,988 | 88,973 | 70.2 | 93.3 | S : Sanctions. D : Disbursements.

* : Relating to IFCI, SIDBI and IIBI.

# : Relating to IVCF, ICICI Venture and TFCI.

@ : Relating to LIC and GIC & erstwhile subsidiaries (NIA,UIIC & OIC).

Note : All data are provisional.

Source : Respective Financial Institutions. |

Resources Mobilised by FIs

6.18 Resources raised by the FIs during 2008-09 were considerably higher than those during the previous year. While the short-term resources raised witnessed a sharp rise during 2008-09 as compared with that a year ago, the long-term and foreign currency resources raised declined. NHB mobilised the largest amount of resources, followed by EXIM Bank and SIDBI. Foreign currency resources raised by EXIM Bank moderated while that by SIDBI expanded sharply during 2008-09 (Table VI.4 and Appendix Table VI.2).

6.19 Resources raised by FIs from the money market rose sharply during 2008-09 with the utilisation of umbrella limit reaching 58.0 per cent as compared to 22.9 per cent in the previous year (Table VI.5).

Table VI.3: Liabilities and Assets of Financial Institutions

(As at end-March) | (Amount in Rs. crore) | Item | Amount | Percentage

Variation | 2008 | 2009 | 2008-09 | 1 | 2 | 3 | 4 | Liabilities | | | | 1. | Capital | 4,000 | 4,300 | 7.5 | | | | (2.2) | (2.0) | | 2. | Reserves | 17,137 | 19,069 | 11.3 | | | | (9.5) | (8.8) | | 3. | Bonds and Debentures | 57,741 | 52,390 | -9.3 | | | | (32.1) | (24.1) | | 4. | Deposits | 36,298 | 65,591 | 80.7 | | | | (20.2) | (30.2) | | 5. | Borrowings | 33,716 | 40,443 | 20.0 | | | | (18.7) | (18.6) | | 6. | Other Liabilities | 31,020 | 35,579 | 14.7 | | | | (17.2) | (16.4) | | Total Liabilities/Assets | 1,79,912 | 2,17,372 | 20.8 | | | | (100.0) | (100.0) | | Assets | 1. | Cash and Bank Balances | 15,835 | 19,430 | 22.7 | | | | (8.8) | (8.9) | | 2. | Investments | 6,694 | 8,155 | 21.8 | | | | (3.7) | (3.8) | | 3. | Loans and Advances | 1,47,008 | 1,78,595 | 21.5 | | | | (81.7) | (82.2) | | 4. | Bills Discounted / Rediscounted | 2,044 | 2,145 | 5.0 | (1.1) | (1.0) | | 5. | Fixed Assets | 539 | 570 | 5.6 | | | | (0.3) | (0.3) | | 6. | Other Assets | 7,792 | 8,477 | 8.8 | | | | (4.3) | (3.9) | | Note: 1. Data pertain to four FIs, viz., NABARD, NHB, SIDBI and EXIM Bank. IIBI Ltd. was under voluntary winding up as on March 31, 2009.

2. Figures in parentheses are percentages to total liabilities/ assets.

Source : 1. Balance sheets of respective FIs.

2. Unaudited OSMOS Returns of NHB. |

Sources and Uses of Funds

6.20 Total sources/deployment of funds of FIs increased sharply by 39 per cent during 2008-09. 65.0 per cent of the funds of FIs were raised internally, which recorded a growth of 91.5 per cent. External sources, which contributed 30.7 per cent of sources of funds during 2008-09 as compared to 51.7 per cent during previous year, recorded a decline of 17.4 per cent due to turmoil in global financial markets. A large part of the funds raised were used for fresh deployments (65.5 per cent), followed by repayment of past borrowings (19.0 per cent) during 2008-09. The fresh deployment registered a growth of 55.1 per cent and other deployment 137.9 per cent during 2008-09 over 2007-08. (Table VI.6 and Appendix Table VI.3)

Table VI.4: Resources Mobilised by Financial Institutions | (Amount in Rs. crore) | Institution | Total Resources Raised | Total

Outstanding

(As at end-March) | Long-term | Short-term | Foreign Currency | Total | 2007-08 | 2008-09 | 2007-08 | 2008-09 | 2007-08 | 2008-09 | 2007-08 | 2008-09 | 2008 | 2009 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | EXIM Bank | 6,825 | 3,197 | 2,180 | 8,905 | 5,553 | 3,800 | 14,558 | 15,902 | 31,716 | 37,202 | NABARD | 12,198 | 4,252 | 1,422 | 3,494 | - | - | 13,620 | 7,746 | 32,630 | 26,867 | NHB | 3,100 | 3,124 | 8,016 | 16,881 | - | - | 11,116 | 20,005 | 17,313 | 16,503 | SIDBI | 4,531 | 5,625 | 461 | 8,811 | 92 | 1,361 | 5,084 | 15,797 | 14,665 | 24,487 | Total | 26,654 | 16,198 | 12,079 | 38,091 | 5,645 | 5,161 | 44,378 | 59,450 | 96,324 | 1,05,059 | – : Nil/Negligible

Note : Long-term rupee resources comprise borrowings by way of bonds/debentures; and short-term resources comprise CPs, term deposits, ICDs, CDs and borrowing from the term money. Foreign currency resources comprise largely bonds and borrowings in the international market.

Source: Respective FIs |

Cost and Maturity of Borrowings

6.21 The weighted average cost of long-term resources raised by AIFIs recorded a mixed trend during 2008-09 (Table VI.7 and Appendix Table VI.4). The weighted average maturity of long-term resources raised by FIs increased, except for EXIM Bank and NHB during 2008-09.

Table VI.5: Resources Raised by Financial Institutions from the Money Market | (Amount in Rs. crore) | Instrument | 2006-07 | 2007-08 | 2008-09 | 1 | 2 | 3 | 4 | A. | Total | 3,293 | 4,458 | 15,247 | | | i) | Term Deposits | 89 | 508 | 2,222 | | | ii) | Term Money | - | 250 | 1,184 | | | iii) | Inter-corporate Deposits | - | - | - | | | iv) | Certificate of Deposits | 663 | 2,286 | 5,633 | | | v) | Commercial Paper | 2,540 | 1,414 | 6,207 | Memo: | | | | B. | Umbrella Limit | 19,001 | 19,500 | 26,292 | C. | Utilisation of Umbrella limit

(A as percentage of B) | 17.3 | 22.9 | 58.0 | - : Nil/Negligible.

Source : Fortnightly Return of Resource mobilised by Financial Institutions. |

Table VI.6 : Pattern of Sources and Deployment of Funds of Financial Institutions* | (Amount in Rs. crore) | Item | 2007-08 | 2008-09 | Percentage Variation 2008-09 | 1 | 2 | | 3 | A) | Sources of Funds (i+ii+iii) | 2,13,954 | 2,97,296 | 39.0 | | | | (100.0) | (100.0) | | | | (i) | Internal | 1,00,944 | 1,93,294 | 91.5 | | | | | (47.2) | (65.0) | | | | (ii) | External | 1,10,604 | 91,314 | -17.4 | | | | | (51.7) | (30.7) | | | | (iii) | Others@ | 2,406 | 12,688 | 427.3 | | | | | (1.1) | (4.3) | | B) | Deployment of Funds (i+ii+iii) | 2,13,954 | 2,97,296 | 39.0 | | | | (100.0) | (100.0) | | | | (i) | Fresh Deployment | 1,25,522 | 1,94,711 | 55.1 | | | | | (58.7) | (65.5) | | | | (ii) | Repayment of | 69,096 | 56,592 | -18.1 | | | | past borrowings | (32.3) | (19.0) | | | | (iii) | Other Deployment | 19,333 | 45,993 | 137.9 | | | | | (9.0) | (15.5) | | | | | of which: | | | | | | | Interest Payments | 6,916 | 8,809 | 27.4 | | | | | (3.2) | (3.0) | | * : EXIM Bank, NABARD, NHB and SIDBI.

@: Includes cash and balances with banks, balances with the Reserve Bank and other banks.

Note : Figures in parentheses are percentages to the totals.

Source : Respective FIs. |

Table VI.7: Weighted Average Cost and Maturity of Long-term Resources Raised by Financial Institutions | Institution | Weighted Average cost (per cent) | Weighted Average Maturity in years | 2007-08 | 2008-09 | 2007-08 | 2008-09 | 1 | 2 | 3 | 4 | 5 | EXIM Bank | 8.2 | 9.0 | 3.0 | 2.5 | SIDBI | 8.2 | 6.5 | 1.0 | 3.4 | NABARD | 9.5 | 9.5 | 4.0 | 4.3 | NHB | 7.7 | 7.4 | 2.8 | 2.8 | Note : Data are provisional.

Source : Respective FIs. |

Lending Rates

6.22 NHB, SIDBI and EXIM Bank raised their Prime Lending Rates (PLRs) marginally during 2008-09 as compared to the previous year (Table VI.8).

Table VI.8: Long-term PLR Structure of Select inancial Institutions | (Per cent) | Effective | NHB | EXIM Bank | TFCI | 1 | 2 | 3 | 4 | March 2008 | 10.50 | 13.50 | 12.00 | March 2009 | 10.75 | 14.00 | 12.50 | Source : Respective FIs. |

Financial Performance of Financial Institutions

6.23 Net interest income and non-interest income of FIs increased by 22.5 per cent and 31.1 per cent, respectively. However, in contrast with the decline in the previous year, the wage bill increased by 26.1 per cent during 2008-09. The operating profit increased by 33.5 per cent during the year. The net profit of FIs also increased despite higher provisions for taxation (Table VI.9).

Table VI.9: Financial Performance of Select All-India Financial Institutions | (Amount in Rs. crore) | Item | 2007-08 | 2008-09 | Variation | 2007-08 | 2008-09 | Amount | Percentage | Amount | Percentage | 1 | 2 | 3 | 4 | 5 | 6 | 7 | A) | Income (a+b) | 11,541 | 14,274 | 2,467 | 27.2 | 2,733 | 23.7 | | | a) | Interest Income | 9,934 | 12,169 | 1,796 | 22.1 | 2,234 | 22.5 | | | | | (86.1) | (85.3) | | | | | | | b) | Non-Interest Income | 1,607 | 2,106 | 671 | 71.8 | 499 | 31.1 | | | | | (13.9) | (14.8) | | | | | B) | Expenditure (a+b) | 8707 | 10,492 | 1,812 | 26.3 | 1,785 | 20.5 | | | a) | Interest Expenditure | 7,277 | 8,977 | 1,362 | 22.9 | 1,699 | 23.4 | | | | | (83.6) | (85.6) | | | | | | | b) | Operating Expenses | 1,430 | 1,516 | 450 | 46.6 | 86 | 6.0 | | | | | (16.4) | (14.4) | | | | | | | | of which : Wage Bill | 287 | 362 | -139 | -32.7 | 76 | 26.4 | C) | Provisions for Taxation | 936 | 1,190 | 304 | 48.1 | 254 | 27.2 | D) | Profit | | | | | | | | | Operating Profit (PBT) | 2,834 | 3,782 | 656 | 30.1 | 948 | 33.5 | | | Net Profit (PAT) | 1,898 | 2,592 | 352 | 22.7 | 694 | 36.6 | E) | Financial Ratios@ | | | | | | | | | Operating Profit | 1.6 | 1.7 | | | | | | | Net Profit | 1.1 | 1.2 | | | | | | | Income | 6.4 | 6.6 | | | | | | | Interest Income | 5.5 | 5.6 | | | | | | | Other Income | 0.9 | 1.0 | | | | | | | Expenditure | 4.8 | 4.8 | | | | | | | Interest Expenditure | 4.0 | 4.1 | | | | | | | Other Operating Expenses | 0.8 | 0.7 | | | | | | | Wage Bill | 0.2 | 0.2 | | | | | | | Provisions | 0.5 | 0.6 | | | | | | | Spread (Net Interest Income) | 1.4 | 1.4 | | | | | @ : As percentage of total assets.

Note : Figures in parentheses are percentage shares to the respective total.

Source : Annual Accounts of respective FIs.2) Unaudited OSMOS returns of NHB (As at June-end). |

Table VI.10: Select Financial Parameters of Financial Institutions (As at end-March) | (Per cent) | Institution | Interest Income/

Average Working Funds | Non-interest Income/Average Working Funds | Operating Profits/Average Working Funds | Return on Average Assets | Net Profit

per Employee

(Rs. crore) | 2008 | 2009 | 2008 | 2009 | 2008 | 2009 | 2008 | 2009 | 2008 | 2009 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | EXIM Bank | 7.6 | 7.8 | 1.2 | 0.8 | 2.3 | 2.4 | 1.0 | 1.2 | 1.5 | 2.1 | NABARD | 6.1 | 6.5 | 0.1 | 0.1 | 2.0 | 1.9 | 1.4 | 1.3 | 0.3 | 0.3 | NHB* | 7.5 | 8.0 | 0.3 | 0.3 | 1.1 | 1.7 | 0.6 | 1.2 | .. | .. | SIDBI | 8.5 | 8.8 | 0.7 | 1.1 | 3.1 | 5.3 | 1.6 | 3.1 | 0.2 | 0.3 | .. : Not Available.

* : Position as at end-June as per OSMOS returns. In case of NHB, total assets have been taken in lieu of average working funds.

Source : 1. Respective FIs,

2. Unaudited off-site Returns for NHB. |

6.24 The interest income and the non-interest income as percentage of working funds (except EXIM Bank) increased for all FIs. Operating profit as percentage of working funds and return on average assets (ROA) improved for all FIs except NABARD. The ROA was the highest for SIDBI followed by NABARD, EXIM Bank and NHB

(Table VI.10).

Soundness Indicators: Asset Quality

6.25 It is significant to note that the FIs recorded improvement in their asset quality during 2008-09 notwithstanding the fall out of the ongoing global financial crisis. In terms of net NPA to net loans ratio, the asset quality of SIDBI and EXIM Bank improved during the year. Net NPA ratio of NABARD, however, increased marginally (Table VI.11).

6.26 Improvement in asset quality was also observed in terms of a substantial increase in standard assets of the FIs except NHB in which there is a slight decrease in the standard assets. Furthermore, none of the FIs had any assets in the ‘loss’ assets category as at end-March 2009

(Table VI.12).

Capital Adequacy

6.27 The capital adequacy ratio of all the FIs continued to be significantly higher than the minimum stipulated norm of 9 per cent. Notwithstanding this, CRARs of NABARD, NHB and SIDBI at end-March 2009 were lower than those in the previous year, while CRAR of EXIM Bank increased at end-March 2009 compared to the previous year (Table VI.13).

3. Non-Banking Financial Companies

6.28 The Reserve Bank of India Act, 1934 was amended in January 1997 to provide a comprehensive legislative framework for regulation of NBFCs. The amended Act, inter alia, provided for compulsory registration and minimum NOF for all NBFCs. It also gave the Reserve Bank powers to determine policies and issue directions to NBFCs regarding income recognition, accounting standards, NPAs, capital adequacy, deployment of funds as well as purposes for which advances would be made, etc.

Table VI.11: Net Non-Performing Assets (As at end-March) | (Amount in Rs. crore) | Institution | Net NPAs | Net NPAs/ Net Loans (per cent) | 2008 | 2009 | 2008 | 2009 | 1 | 2 | 3 | 4 | 5 | EXIM Bank | 83 | 79 | 0.29 | 0.23 | NABARD | 19 | 30 | 0.02 | 0.03 | NHB* | - | - | - | - | SIDBI | 49 | 26 | 0.25 | 0.08 | All FIs | 151 | 135 | 0.10 | 0.07 | - : Nil/Negligible.

* : Position as at end-June as per OSMOS returns

Source : Respective FIs. |

Table VI.12: Asset Classification of Financial Institutions (At end-March) | (Amount in Rs. crore) | Institution | Standard | Sub-Standard | Doubtful | Loss | 2008 | 2009 | 2008 | 2009 | 2008 | 2009 | 2008 | 2009 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | EXIM Bank | 28,694 | 34,077 | 41 | 21 | 42 | 58 | - | - | NABARD | 82,853 | 98,822 | 2 | 7 | 17 | 23 | - | - | NHB* | 17,427 | 16,851 | - | - | - | - | - | - | SIDBI | 19,927 | 30,854 | 24 | 23 | 25 | 3 | - | - | All FIs | 1,48,901 | 1,80,605 | 67 | 51 | 84 | 85 | - | - | - : Nil/Negligible.

* : Position as at end-June.

Source : 1. Respective FIs.

2. Unaudited Off-site returns for NHB. |

Regulatory and Supervisory Initiatives

6.29 Regulation of non-banking entities is being progressively strengthened and the process had started before the onset of the global financial crisis. Issues relating to the level playing field between bank sponsored NBFCs and non bank associated NBFCs and other issues of regulatory convergence and regulatory arbitrage were examined with respect to systemic implications. Non Deposit taking NBFCs with asset size of Rs.100 crore and above were defined as systemically important and an elaborate prudential framework was put in place.

6.30 Initially, with a view to protect the interests of depositors, regulatory attention was mostly focused on NBFCs accepting public deposits (NBFCs-D). Over the years, however, this regulatory framework has been widened to include issues of systemic significance. The sector is being consolidated and while deposit taking NBFCs have decreased both in size as well as in terms of the quantum of deposits held by them, NBFCs-ND have increased in terms of number and asset size. NBFCs-ND-SI (NBFCs-ND with asset size of Rs.100 crore and above) are subject to CRAR and exposure norms prescribed by the Reserve Bank.

Table VI.13: Capital Adequacy Ratio of Select Financial Institutions As at end-March | (Per cent) | Institution | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | EXIM Bank | 33.1 | 26.9 | 23.5 | 21.6 | 18.4 | 16.4 | 15.1 | 16.8 | NABARD | 36.9 | 39.1 | 39.4 | 38.8 | 34.4 | 27.0 | 26.6 | 25.9 | NHB* | 22.1 | 27.9 | 30.5 | 22.5 | 22.3 | 21.7 | 24.7 | 17.7 | SIDBI | 45.0 | 44.0 | 51.6 | 50.7 | 43.2 | 37.5 | 41.8 | 34.2 | * : Position as at end-June.

Source : 1. Respective FIs.

2. Unaudited Off-site returns for NHB. |

6.31 The changing regulatory policy also recognised that those activities of NBFCs which are creating productive asset must be given special consideration. Accordingly, reclassification of NBFCs was effected in December 2006, in terms of which companies financing real/physical assets for productive/ economic activities would be classified as Asset Finance Companies (AFCs). The other two categories of NBFCs would be Loan Companies

(LCs) and Investment Companies (ICs).

Monitoring of Frauds in NBFCs

6.32 In July 2008, the Reserve Bank revised the approach towards monitoring of frauds in NBFCs issued in March 2008. Accordingly, NBFCs were advised to report frauds in their subsidiaries and affiliates/joint ventures.

Guidelines for Securitisation Companies (SCs) and Reconstruction Companies (RCs)

6.33 The Reserve Bank revised the formats of quarterly statements to be submitted by Securitisation Companies/Reconstruction Companies (SCs/RCs) in September 2008. The revised statements would capture, inter alia, data on position of owned fund of the SCs/RCs (including FDI component); position of acquisition/realisation of financial assets from banks/FIs by the SCs/RCs in terms of the SARFAESI Act, 2002; and information as regards security receipts (SRs) issued, redeemed and outstanding at the end of particular quarter.

6.34 It was clarified that a SC/RC was neither a ‘bank’ nor a ‘financial institution’ under the provisions of the SARFAESI Act. Therefore, the acquisition of financial assets by a SC/RC from another SC/RC would not be in conformity with the provisions of the said Act. There was, however, no bar on SCs/RCs deploying their funds for undertaking restructuring of acquired loan accounts with the sole purpose of realising

their dues.

Treatment of Deferred Tax Assets (DTA) and Deferred Tax Liabilities (DTL) for Computation of Capital

6.35 As creation of DTA or DTL gives rise to certain issues impacting on the balance sheet of the company, NBFCs were advised on July 31, 2008 that the balance in DTL account will not be eligible for inclusion in Tier I or Tier II capital for capital adequacy purpose. Further, DTA will be treated as an intangible asset and should be deducted from Tier I capital. In this connection, it was further clarified that DTL created by debit to opening balance of Revenue Reserves or to Profit and Loss Account for the current year should be included under ‘others’ of “Other Liabilities and Provisions” and DTA created by credit to opening balance of Revenue Reserves or to Profit and Loss account for the

current year should be included under item‘others’ of “Other Assets.”

Prevention of Money Laundering Act, 2002 – Obligation of NBFCs

6.36 In August 2008, NBFCs, as a part of transaction monitoring mechanism, were required to put in place an appropriate software application to throw alerts when the transactions are inconsistent with risk categorisation and updated profile of customers. In the case of NBFCs, where all the branches are not yet fully computerised, the Principal Officer of the NBFC was required to cull out the transaction details from branches which are not computerised and suitably arrange to feed the data into an electronic file with the help of the editable electronic utilities of Cash Transaction Report (CTR) and Suspicious Transaction Reports (STR) as have been made available by Financial Intelligence Unit-India (FIU-IND) on their website. It was further clarified that cash transaction reporting by branches/offices of NBFCs to their Principal Officer should invariably be submitted on a monthly basis and the Principal Officer, in turn, should ensure to submit CTR for every month to

FIU-IND within the prescribed time schedule.

Regulation of Excessive Interest charged by NBFCs

6.37 The Reserve Bank issued directions regarding excessive rates of interest in January 2009. Accordingly, now the Board of each NBFC should adopt an interest rate model taking into account the relevant factors such as cost of

funds, margin and risk premium, and

determine the rate of interest to be charged for

loans and advances. The rate of interest should

be an annualised rate so that the borrower is

aware of the exact rate that would be charged

to the account.

Ratings of NBFCs

6.38 In February 2009, all NBFCs (both

deposit taking and non-deposit taking) with

asset size of Rs.100 crore and above were

required to furnish the information about

downgrading/upgrading of assigned rating of any

financial product issued by them, within fifteen

days of such a change in rating, to the Regional

Office of the Reserve Bank under whose

jurisdiction their registered office is functioning.

Policy Initiatives for NBFCs-ND-SI

Guideline on Capital Adequacy, Liquidity and Disclosure Norms for NBFC-ND-SI

6.39 The Reserve Bank reviewed the extant

guidelines regarding NBFCs-ND-SI and the final

guidelines were issued on August 1, 2008. In

terms of these guidelines, the minimum CRAR

for each NBFC-ND-SI was raised from the

existing 10 per cent to 12 per cent to be reached

by March 31, 2009 and further to 15 per cent

by March 31, 2010. In view of the economic

downturn and based on several requests

received, this requirement was postponed for

one year. The NBFCs-ND-SI are required to

make additional disclosures relating to CRAR,

exposure to real estate sector and maturity

pattern of assets and liabilities in their balance

sheet from the year ending March 31, 2009.

Enhancement of NBFCs’ Capital Raising Option for Capital Adequacy Purposes

6.40 In October 2008, taking into

consideration, the need for enhanced funds for

increasing business and meeting regulatory

requirements, the Reserve Bank decided that

NBFCs-ND-SI may augment their capital funds

by issue of Perpetual Debt Instruments (PDIs).

Such PDIs shall be eligible for inclusion as Tier

I Capital to the extent of 15 per cent of total Tier

I capital as on March 31 of the previous year.

Raising of Short Term Foreign Currency Borrowings

6.41 In December 2008, systemically

important NBFCs-ND-SI were permitted, as a

temporary measure, to raise foreign currency

short term borrowings under the approval route

subject to certain conditions. In this connection,

all the NBFCs-ND-SI that have availed short

term foreign currency loans were advised to

furnish a monthly return as per the prescribed

format within ten days from the end of the

month to which it pertains.

Acceptance of Deposits by Chit Fund Companies

6.42 In order to regulate the credit system of

the country to its advantage, MNBCs were

prohibited with effect from August 18, 2009

from accepting deposits from public except from

the shareholders, which was subject to the

conditions specified in the MNBC (RBI)

Directions 1977. Any deposit accepted and held

by the MNBCs other than from its shareholders

as on date shall be repaid on maturity and shall

not be eligible for renewal.

Requirement for obtaining prior approval of RBI in cases of acquisition/transfer of control of NBFCs accepting deposits

6.43 To enable RBI to verify the ‘fit and proper’

character of the management of NBFCs is

continuously maintained, it has been decided that any takeover/acquisition of shares or merger/ amalgamation of a deposit taking NBFC with another entity or any merger/amalgamation of an entity with a deposit taking NBFC that would give the acquirer/another entity control of the deposit taking NBFC, would require prior permission of RBI with effect from September 17, 2009. Applications in this regard are to be submitted to the Regional Office of the Department of Non-Banking Supervision in whose jurisdiction the Registered Office of the Company is located.

Introduction of Interest Rate Futures-NBFCs

6.44 To hedge the underlying exposures,

directions were issued covering the framework

for trading of Interest Rate Futures by NBFCs

in exchanges in India recognized by SEBI

subject to RBI/SEBI guidelines in the matter.

Profile of NBFCs (including RNBCs)

6.45 Total number of NBFCs registered with

the Reserve Bank, consisting of NBFCs-D

(deposit-taking NBFCs), RNBCs, mutual benefit

companies (MBCs), miscellaneous non-banking

companies (MNBCs) and Nidhi companies,

declined from 12,809 at end-June 2008 to

12,740 at end-June 2009 (Table VI.14). The number of NBFCs-D also declined from 364 at end-June 2008 to 336 at end-June 2009, mainly due to the exit of many NBFCs from deposit taking activity. Of the 336 deposit taking NBFCs, 275 NBFCs filed annual returns for the year ended March 2009 by the cut off date of September 30, 2009. The number of RNBCs declined to two at end-March 2009.

Table VI.14: Number of NBFCs Registered with the Reserve Bank |

End-June |

Number of Registered NBFCs |

Number of NBFCs-D |

1 |

2 |

3 |

1999 |

7,855 |

624 |

2000 |

8,451 |

679 |

2001 |

13,815 |

776 |

2002 |

14,077 |

784 |

2003 |

13,849 |

710 |

2004 |

13,764 |

604 |

2005 |

13,261 |

507 |

2006 |

13,014 |

428 |

2007 |

12,968 |

401 |

2008 |

12,809 |

364 |

2009 |

12,740 |

336 |

6.46 Total assets of NBFCs declined to Rs.95,727 crore during 2008-09 from Rs.99,014 crore in previous year. Public deposits also recorded a decline to Rs.21,548 crore at end-March 2009 from Rs.24,400 crore at end-March 2008. Net owned funds (NOF) witnessed a growth of 8.8 percent and stood at Rs.13,458 crore as on end-March 2009. The share of RNBCs in NBFCs in terms of total assets, public deposits and NOF recorded marginal decline during 2008-09 over previous year (Table VI.15).

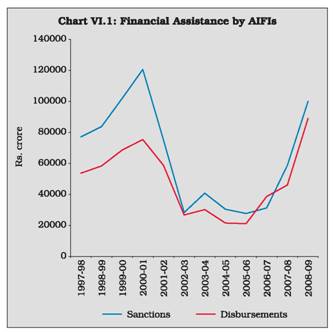

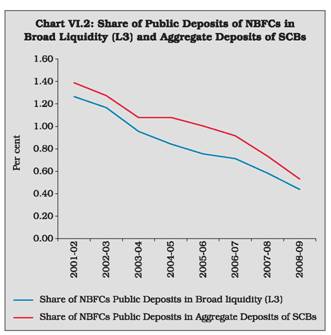

6.47 The ratio of deposits of reporting NBFCs to the aggregate deposits of scheduled commercial banks dropped to 0.53 per cent at end-March 2009 from 0.73 per cent at end-March 2008 mainly due to the decline in deposits of reporting NBFCs. The share of NBFC deposits in broad liquidity aggregate (L3) also declined over the year (Chart VI.2).

Table VI.15: Profile of NBFCs |

(Amount in Rs. crore) |

Item |

As at end-March |

|

2008 |

2009 P |

|

NBFCs |

of which: RNBCs |

NBFCs |

of which: RNBCs |

1 |

2 |

3 |

4 |

5 |

Total Assets |

99,014 |

24,452 |

95,727 |

20,211 |

| |

|

(24.7) |

|

(21.1) |

Public Deposits |

24,400 |

22,358 |

21,548 |

19,607 |

| |

|

(91.6) |

|

(91.0) |

Net Owned Funds |

11,921 |

1,718 |

13,458 |

1,870 |

| |

|

(14.4) |

|

(13.9) |

P: Provisional.

Note : 1. NBFCs comprise NBFCs-D and RNBCs.

2. Figures in parentheses are percentages to respective total of NBFCs.

Source: Annual Returns. |

Operations of NBFCs (excluding RNBCs)

6.48 Total assets/liabilities of NBFCs (excluding RNBCs) expanded at the rate of 1.3 per cent during 2008-09 as compared with 53.6 per cent during 2007-08 (Table VI.16). Borrowings, which is the major source of funds for NBFCs, increased by 9.3 per cent during the year, while public deposits declined by 4.9 per cent indicating the continuing shift in the pattern of resources raised. On the assets side, hire purchase assets and loans and advances, which are major items of assets witnessed growth of 6.3 per cent and 12.0 per cent, respectively as compared with 27.9 per cent and 70.2 per cent, respectively, during previous year. Growth of total investments of NBFCs decelerated mainly due to deceleration in investment in approved securities. Other investments increased by 37.4 per cent during 2008-09 as compared with 30.0 per cent during 2007-08.

Table VI.16: Consolidated Balance Sheet of NBFCs-D |

(Amount in Rs. crore) |

Item |

A s at End-March |

Variation |

2007-08 |

2008-09 |

2007-08 |

2008-09 P |

Absolute |

Per cent |

Absolute |

Per cent |

1 |

2 |

3 |

4 |

5 |

|

6 |

Liabilities |

|

|

|

|

|

|

1. |

Paid up Capital |

3,266 |

3,508 |

998 |

44.0 |

242 |

7.4 |

| |

|

(4.4) |

(4.6) |

|

|

|

|

2. |

Reserves & Surplus |

8,695 |

9,337 |

2,834 |

48.4 |

642 |

7.4 |

| |

|

(11.7) |

(12.4) |

|

|

|

|

3. |

Public Deposit |

2,042 |

1,941 |

-35 |

-1.7 |

-101 |

-4.9 |

| |

|

(2.7) |

(2.6) |

|

|

|

|

4. |

Borrowings |

50,577 |

55,289 |

18,125 |

55.9 |

4,712 |

9.3 |

| |

|

(67.8) |

(73.2) |

|

|

|

|

5. |

Other Liabilities |

9,982 |

5,441 |

4,087 |

69.3 |

-4,541 |

-45.5 |

| |

|

(13.4) |

(7.2) |

|

|

|

|

LIABILITIES/ASSETS |

74,562 |

75,516 |

26,008 |

53.6 |

954 |

1.3 |

Assets |

1. |

Investments |

11,210 |

14,813 |

3,798 |

51.2 |

3,603 |

32.1 |

| |

|

(15.0) |

(19.6) |

|

|

|

|

| |

i) Approved Securities @ |

7,146 |

9,230 |

2,859 |

66.7 |

2,084 |

29.2 |

| |

ii) Other Investments |

4,064 |

5,583 |

939 |

30.0 |

1,519 |

37.4 |

| |

|

(5.5) |

(7.4) |

|

|

|

|

2. |

Loan & Advances |

18,823 |

21,073 |

7,764 |

70.2 |

2,250 |

12.0 |

| |

|

(25.2) |

(27.9) |

|

|

|

|

3. |

Hire Purchase Assets |

33,525 |

35,647 |

7,303 |

27.9 |

2,122 |

6.3 |

| |

|

(45.0) |

(47.2) |

|

|

|

|

4. |

Equipment Leasing Assets |

1,048 |

585 |

-317 |

-23.2 |

-463 |

-44.2 |

| |

|

(1.4) |

(0.8) |

|

|

|

|

5. |

Bill Business |

12 |

23 |

5 |

71.4 |

11 |

91.7 |

| |

|

(0.0) |

(0.0) |

|

|

|

|

6. |

Other Assets |

9,944 |

3,375 |

7,456 |

299.7 |

-6,569 |

-66.1 |

| |

|

(13.3) |

(4.5) |

|

|

|

|

P : Provisional

@ : SLR Asset comprises ‘Approved Securities’ and ‘unencumbered term deposits’ in Scheduled Commercial Banks

Note : Figures in parentheses are percentage shares in respective total

Source : Annual Returns. |

6.49 Among NBFC groups, asset finance companies (AFCs) held the largest share in total assets/liabilities (70.3 per cent), followed by loan companies (28.9 per cent), hire purchase companies (0.6 per cent) and equipment leasing (0.3 per cent) (Table VI.17). The increase in assets/liabilities of AFCs was mainly on account of reclassification of NBFCs, which was initiated in December 2006 and the process of which is still continuing. The share of equipment leasing companies declined to below 1 per cent subsequent upon the re-classification of NBFCs in 2006-07. The relative significance of various NBFC groups reflected largely the pattern of their borrowings as deposits constituted a small share (2.6 per cent) of their total liabilities. Of the total deposits held by all NBFCs, asset finance companies held the largest share in total deposits of NBFCs (70.3 per cent), followed distantly by loan companies with a 19.9 per cent share and by hire purchase companies with a share of 9.6 per cent (Table VI.17).

Deposits: Profile of Public Deposits of Different Categories of NBFCs

6.50 Continuing the trend of the previous year,

public deposits held by all groups of NBFCs

taken together, declined moderately during

2008-09. This trend is indicative of the shift in

preference of NBFCs from public deposits to

bank loans/ debentures. The decline in public

deposits was mainly evident in the case of loan

companies and equipment leasing companies due to reclassification of some of these

companies as asset finance companies. Deposits

of asset finance companies increased by 17.5

per cent during 2008-09 (Table VI.18).

Size-wise Classification of NBFCs Deposits

6.51 Deposits held by NBFCs ranged from

less than Rs.0.5 crore to above Rs.50 crore

(Table VI.19). The deposits held by NBFCs in all

deposit-groups declined during 2008-09, except

in the deposit-class ‘more than Rs.10 crore and

up to Rs.20 crore’ and ‘more than Rs.20 crore

and up to Rs.50 crore’. The share of the deposit

class ‘Rs.50 crore and above’ in total deposits was 80 per cent, while that of other deposit classes combined together was only about 20 per cent of total public deposits of the NBFC sector.

Table VI.17: Major Components of Liabilities of NBFCs-D by Classification of NBFCs |

(Amount in Rs. crore) |

Classification of NBFCs |

Liabilities |

Deposits |

Borrowings |

2007-08 |

2008-09 P |

2007-08 |

2008-09 P |

2007-08 |

2008-09 P |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Asset Finance |

50,998 |

53,068 |

1,161 |

1,364 |

34,093 |

40,232 |

| |

(68.4) |

(70.3) |

(56.9) |

(70.3) |

(67.4) |

(72.8) |

Equipment Leasing |

162 |

192 |

10 |

3 |

76 |

54 |

| |

(0.2) |

(0.3) |

(0.5) |

(0.2) |

(0.2) |

(0.1) |

Hire Purchase |

178 |

425 |

169 |

186 |

38 |

43 |

| |

(0.2) |

(0.6) |

(8.3) |

(9.6) |

(0.1) |

(0.1) |

Investment |

402 |

- |

19 |

- |

358 |

- |

| |

(0.5) |

|

(0.9) |

|

(0.7) |

|

Loan |

22,819 |

21,831 |

682 |

388 |

16,012 |

14,960 |

| |

(30.6) |

(28.9) |

(33.4) |

(19.9) |

(31.7) |

(27.1) |

MNBC |

3 |

- |

1 |

- |

0 |

|

| |

(0.0) |

|

(0.1) |

|

|

|

Total |

74,562 |

75,516 |

2,042 |

1,941 |

50,577 |

55,289 |

– : Nil/Negligible.

P : Provisional.

Note : Figures in parentheses are percentage shares in respective total.

Source : Annual Returns. |

Table VI.18: Public Deposits held by NBFCs-D by Classification of NBFCs |

(Amount in Rs. crore) |

NBFC Group |

As at end-March |

Percentage Variation |

Number of NBFCs |

Public Deposits |

2007-08 |

2008-09 P |

2007-08 |

2008-09 P |

2008-09 |

1 |

2 |

3 |

4 |

5 |

6 |

Asset Finance |

185 |

147 |

1,161 |

1,364 |

17.5 |

| |

|

|

(56.9) |

(70.3) |

|

Equipment Leasing |

15 |

11 |

10 |

3 |

-70.6 |

| |

|

|

(0.5) |

(0.2) |

|

Hire Purchase |

76 |

74 |

169 |

186 |

10.1 |

| |

|

|

(8.3) |

(9.6) |

|

Investment |

1 |

1 |

19 |

– |

– |

| |

|

|

(0.9) |

|

|

Loan |

70 |

42 |

683 |

388 |

-43.3 |

| |

|

|

(33.4) |

(19.9) |

|

MNBCs |

3 |

|

1 |

- |

- |

Total |

350 |

275 |

2,042 |

1,941 |

-4.9 |

– : Nil/Negligible.

P : Provisional

Note : Figures in parentheses are percentage shares in respective total.

Source : Annual Returns. |

Table VI.19: Public Deposits held by NBFCs-D by Deposit Ranges |

(Amount in Rs. crore) |

Deposit Range |

As at end-March |

No. of NBFCs |

Amount of Deposit |

2007-08 |

2008-09P |

2007-08 |

2008-09P |

1 |

2 |

3 |

4 |

5 |

Less than Rs. 0.5 crore |

213 |

177 |

28 |

22 |

| |

|

|

(1.4) |

(1.1) |

More than Rs.0.5 crore |

85 |

53 |

82 |

51 |

and up to Rs.2 crore |

|

|

(4.0) |

(2.6) |

More than Rs.2 crore |

38 |

30 |

186 |

133 |

and up to Rs.10 crore |

|

|

(9.1) |

(6.9) |

More than Rs.10 crore |

4 |

6 |

61 |

76 |

and up to Rs.20 crore |

|

|

(3.0) |

(3.9) |

More than Rs.20 crore |

2 |

3 |

56 |

115 |

and up to Rs.50 crore |

|

|

(2.7) |

(5.9) |

Rs.50 crore and above |

8 |

6 |

1,629 |

1,544 |

| |

|

|

(79.8) |

(79.5) |

Total |

350 |

275 |

2,042 |

1,941 |

P : Provisional.

Note : Figures in parentheses are percentage shares in respective

total.

Source: Annual Returns. |

Region-wise Composition of Deposits held by NBFCs

6.52 Following the trend of the previous year,

deposits held by NBFCs across all the regions

declined during 2008-09 except western region

(Table VI.20). Western region recorded the growth

of 85.7 per cent in the public deposits. As in the

previous year, the southern region accounted for

the largest share of deposits (around 76 per cent),

followed by the northern region (around 15 per

cent) and the western region (around 8 per cent).

The presence of NBFCs in the north-eastern region

continued to be nil during the year. Among the

metropolitan cities, Chennai continued to hold the

largest share of deposits, while New Delhi

continued to account for the largest number of

NBFCs.

Interest Rate on Public Deposits with NBFCs

6.53 The share of public deposits held by

NBFCs contracted in the interest rates up to

10 per cent declined from 73.0 per cent in

2007-08 to 30.1 per cent in 2008-09, while

those contracted in the bracket ‘more than 10

per cent and up to 12 per cent’ witnessed a sharp rise from 25.4 per cent to 65.0 per cent (Table VI.21).

Table VI.20: Public Deposits held by NBFCs-D -Region-wise |

(Amount in Rs. crore) |

Region |

As at end-March |

2007-08 |

2008-09 P |

Number of NBFCs-D |

Public Deposits |

Number of NBFCs-D |

Public Deposits |

1 |

2 |

3 |

4 |

5 |

Central |

54 |

25 |

42 |

20 |

| |

|

(1.2) |

|

(1.0) |

East |

9 |

18 |

5 |

8 |

| |

|

(0.9) |

|

(0.4) |

North |

180 |

284 |

139 |

283 |

| |

|

(13.9) |

|

(14.6) |

South |

84 |

1,631 |

66 |

1,474 |

| |

|

(79.9) |

|

(75.9) |

West |

23 |

84 |

23 |

156 |

| |

|

(4.1) |

|

(8.0) |

Total |

350 |

2,042 |

275 |

1,941 |

Metropolitan cities : |

|

|

|

Kolkata |

6 |

15 |

3 |

8 |

Chennai |

46 |

1,565 |

33 |

1,407 |

Mumbai |

10 |

76 |

11 |

148 |

New Delhi |

63 |

204 |

47 |

207 |

Total |

125 |

1,860 |

94 |

1,770 |

P : Provisional.

Note : Figures in parentheses are percentages to respective total.

Source : Annual Returns. |

Maturity Pattern of Public Deposits

6.54 Deposits with the maturity period of ‘less than 1 year’, ‘more than 1 year and up to 2 years’ and ‘5 years and above’ increased during the year. Deposits in the maturity bucket of ‘more than 2 years and up to 3 years’ and ‘more than 3 years and less than 5 years’ declined significantly at end-March 2009. As a result, their share in total deposits recorded a decline in total deposits (Table VI.22).

Table VI.21: Public Deposits held by NBFCs-D - Deposit Interest Rate Range-wise |

(Amount in Rs. crore) |

Deposit Interest Rate Range |

As at end-March |

2007-08 |

2008-09 P |

1 |

2 |

3 |

Upto 10 per cent |

1,491 |

584 |

| |

(73.0) |

(30.1) |

More than 10 per cent and up to 12 per cent |

518 |

1,261 |

| |

(25.4) |

(65.0) |

12 per cent and above |

33 |

96 |

| |

(1.6) |

(4.9) |

Total |

2,042 |

1,941 |

P : Provisional.

Note : Figures in parentheses are percentages to respective total.

Source : Annual Returns. |

Table VI:22 Maturity Pattern of Public Deposits held by NBFCs-D |

(Amount in Rs. crore) |

Maturity Period |

As at end-March |

2007-08 |

2008-09 P |

1 |

2 |

3 |

1. |

Less than 1 year |

611 |

698 |

| |

|

(29.9) |

(36.0) |

2. |

More than 1 and up to 2 years |

491 |

506 |

| |

|

(24.0) |

(26.1) |

3. |

More than 2 and up to 3 years |

663 |

593 |

| |

|

(32.5) |

(30.6) |

4. |

More than 3 and up to 5 years |

211 |

84 |

| |

|

(10.3) |

(4.3) |

5. |

5 years and above |

66 |

60 |

| |

|

(3.2) |

(3.0) |

Total |

2,042 |

1,941 |

P : Provisional

Note : Figures in parentheses are percentages to respective total.

Source : Annual Returns. |

Borrowings by NBFCs

6.55

The outstanding borrowings by NBFCs increased by 9.3 per cent during 2008-09 (Table VI.23). Borrowings by equipment leasing companies and loan companies declined, while those by asset finance companies and hire purchase companies increased during the year. AFCs continued to hold the largest share (72.8 per cent) of borrowings of all NBFCs, followed by loan companies (27.1 per cent).

6.56

Borrowings by NBFCs from banks and financial institutions increased sharply by 29.3 per cent while borrowings by way of bonds and debentures remained at the same level during 2008-09. The borrowings from Government declined by 21.4 per cent during 2008-09. Other deposits (which include, inter alia, money borrowed from other companies, unsecured loans from directors/promoters, commercial paper, borrowings from mutual funds and any other type of funds which are not treated as public deposits) also registered a decline of 2.6 per cent during 2008-09 (Table VI.24).

Table VI.23: Borrowings by NBFCs-D by Classification of NBFCs |

(Amount in Rs. crore) |

Classification |

As at end-March |

Percentage Variation |

No. of NBFCs |

Total Borrowings |

2007-08 |

2008-09 P |

2007-08 |

2008-09 P |

2008-09 |

1 |

2 |

3 |

4 |

5 |

6 |

Asset Finance |

185 |

147 |

34,093 |

40,232 |

18.0 |

| |

|

|

(67.4) |

(72.8) |

|

Equipment Leasing |

15 |

11 |

76 |

54 |

-28.8 |

| |

|

|

(0.2) |

(0.1) |

|

Hire Purchase |

76 |

74 |

38 |

43 |

13.2 |

| |

|

|

(0.1) |

(0.1) |

|

Investment |

1 |

1 |

358 |

- |

- |

| |

|

|

(0.7) |

|

|

Loan |

70 |

42 |

16,012 |

14,960 |

-6.6 |

| |

|

|

(31.7) |

(27.1) |

|

MNBCs |

3 |

|

- |

- |

- |

Total |

350 |

275 |

50,577 |

55,289 |

9.3 |

P : Provisional

Note : Figures in parentheses are percentages to respective total.

Source : Annual Returns. |

Assets of NBFCs

6.57 The total assets of deposit-taking NBFCs registered a marginal growth of 1.3 per cent during 2008-09 mainly on account of decline in assets of loan companies (Table VI.25). Loans and advances (7.3 per cent) as well as investments (32.1 per cent) of NBFCs also increased during the year. At end-March 2009, 73.0 per cent of total assets, 75.4 per cent of total loans and advances and 23.9 per cent of total investments by all NBFCs were held by AFCs.

Table VI.24: Sources of Borrowings by NBFCs-D by Classification of NBFCs |

(Amount in Rs. crore) |

Classification |

As at end-March |

Government |

External Sources @ |

Banks and Financial Institutions |

Debentures |

Others |

| |

2008 |

2009 P |

2008 |

2009 P |

2008 |

2009 P |

2008 |

2009 P |

2008 |

2009 P |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

Asset Finance |

0 |

0 |

828 |

832 |

16,330 |

21,775 |

10,216 |

11,620 |

6,719 |

6,005 |

| |

|

|

|

(0.5) |

|

(33.3) |

|

(13.7) |

|

(-10.6) |

Equipment Leasing |

0 |

0 |

0 |

0 |

4 |

7 |

0 |

0 |

72 |

47 |

| |

|

|

|

|

|

(83.2) |

|

|

|

-34.8 |

Hire Purchase |

0 |

0 |

0 |

0 |

0 |

13 |

3 |

2 |

35 |

28 |

| |

|

|

|

|

|

|

|

(-33.3) |

|

(-19.7) |

Investment |

72 |

0 |

0 |

0 |

82 |

0 |

0 |

0 |

204 |

0 |

Loan |

2,247 |

1,824 |

627 |

631 |

2,579 |

2770 |

2,835 |

1,444 |

7,723 |

8,291 |

| |

|

(-18.8) |

|

(0.7) |

|

7.4 |

|

-49.1 |

434.8 |

7.4 |

MNBC |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

Total |

2,319 |

1,824 |

1,455 |

1,463 |

18,995 |

24,565 |

13,054 |

13,066 |

14,753 |

14,371 |

| |

|

(-21.4) |

|

(0.6) |

|

(29.3) |

|

(0.1) |

|

(-2.6) |

P : Provisional.

@ : Comprises (i) Foreign Government, (ii) Foreign Authority, and (iii) Foreign Citizen or Person

Note: Figures in parentheses are percentage variations over the previous year.

Source : Annual Returns. |

Table VI.25: Major Components of Assets of NBFCs-D by Classification of NBFCs |

(Amount in Rs. crore) |

Classification |

As at end-March |

Assets |

Advances |

Investment |

2008 |

2009 P |

2008 |

2009 P |

2008 |

2009 P |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Asset Finance |

50998 |

55115 |

42368 |

43607 |

4060 |

3545 |

| |

(68.4) |

(73.0) |

(79.3) |

(75.4) |

(36.2) |

(23.9) |

Equipment Leasing |

162 |

156 |

92 |

65 |

48 |

41 |

| |

(0.2) |

(0.2) |

(0.2) |

(0.1) |

(0.4) |

(0.3) |

Hire Purchase |

178 |

194 |

136 |

153 |

40 |

6390 |

| |

(0.2) |

(0.3) |

(0.3) |

(0.3) |

(0.4) |

(43.1) |

Investment |

402 |

- |

146 |

– |

256 |

– |

| |

(0.5) |

(0.0) |

(0.3) |

|

(2.3) |

|

Loan |

22819 |

20051 |

10653 |

13480 |

6807 |

4837 |

| |

(30.6) |

(26.6) |

(20.0) |

(23.5) |

(60.7) |

(32.7) |

MNBCs |

3 |

– |

2 |

– |

0 |

– |

| |

(0.0) |

|

(0.0) |

|

(0.0) |

|

Total |

74562 |

75516 |

53397 |

57305 |

11211 |

14813 |

P : Provisional.

Note : Figures in parentheses are percentages to respective totals.

Source : Annual Returns. |

Distribution of NBFCs-D According to Asset Size

6.58 The asset size of NBFCs varies

significantly between less than Rs.25 lakh to

above Rs.500 crore. The asset holding pattern

remained skewed in 2008-09, with 12 NBFCs

with asset size of ‘above Rs.500 crore’ holding

95.8 per cent of total assets of all NBFCs, while

the remaining 263 NBFCs held about 4.2 per cent

of total assets at end-March 2009 (Table VI.26)

Distribution of Assets of NBFCs – Type of Activity

6.59 During the year 2008-09, assets held in

the form of investments and loans and inter

corporate deposits witnessed a robust growth.

While growth in assets in the form of hire

purchase moderated considerably, equipment

leasing assests and other assets witnessed sharp

decline during 2008-09. The hire purchase activity

continued to constitute the largest share (47.2 per

cent) in total assets, followed by loans and inter

corporate deposits (27.9 per cent) and

investments (19.6 per cent) (Table VI.27).

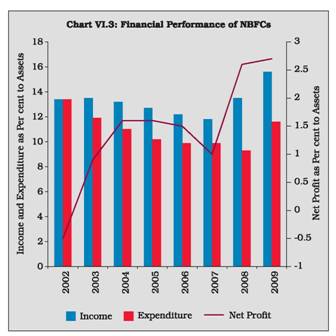

Financial Performance of NBFCs

6.60 Financial performance of NBFCs in

terms of income and net profit improved during 2008-09. Both fund based income (16.9 per cent) and fee based income (46.0 per cent) registered robust growth. While growth in expenditure decelerated over the previous year, it, however, witnessed higher growth than income resulting in decline in operating profit by 2.2 per cent. Net profit registered a moderate growth mainly due to lower provisioning for tax. The cost to income ratio deteriorated from 68.9 per cent 2007-08 to 74.1 per cent in 2008-09 (Table VI.28).

Table VI.26: Assets of NBFCs-D by Asset-Size Ranges |

(Amount in Rs. crore) |

Asset-Size |

As at end-March |

No. of reporting companies |

Assets |

2007-08 |

2008-09P |

2007-08 |

2008-09 |

1 |

2 |

3 |

4 |

5 |

Less than 0.25 crore |

40 |

2 |

4 |

0 |

| |

|

|

(0.0) |

(0.0) |

More than 0.25 crore |

28 |

19 |

11 |

7 |

and upto 0.50 crore |

|

|

(0.0) |

(0.0) |

More than 0.50 crore |

119 |

107 |

133 |

118 |

and upto 2 crore |

|

|

(0.2) |

(0.2) |

More than 2 crore |

91 |

85 |

385 |

383 |

and upto 10 crore |

|

|

(0.5) |

(0.5) |

More than 10 crore |

38 |

36 |

779 |

783 |

and upto 50 crore |

|

|

(1.0) |

(1.0) |

More than 50 crore |

10 |

10 |

620 |

649 |

and upto 100 crore |

|

|

(0.8) |

(0.9) |

More than 100 crore |

9 |

4 |

2,055 |

1,263 |

and upto 500 crore |

|

|

(2.8) |

(1.7) |

Above 500 crore |

15 |

12 |

70,575 |

72,313 |

| |

|

|

(94.7) |

(95.8) |

Total |

350 |

275 |

74,562 |

75,516 |

P : Provisional.

Note : Figures in parentheses are percentages to respective total.

Source : Annual Returns. |

Table VI.27: Assets of NBFCs-D by Activity |

(Amount in Rs. crore) |

Activity |

As at end-March |

Percentage Variation |

2007-08 |

2008-09 P |

2007-08 |

2008-09 |

1 |

2 |

3 |

4 |

5 |

Loans and Intercorporate deposits |

18,823 |

21,073 |

70.2 |

12.0 |

| |

(25.2) |

(27.9) |

|

|

Investments |

11,210 |

14,813 |

51.2 |

32.1 |

| |

(15.0) |

(19.6) |

|

|

Hire Purchase |

33,525 |

35,647 |

27.9 |

6.3 |

| |

(45.0) |

(47.2) |

|

|

Equipment and Leasing |

1,048 |

585 |

-45.6 |

-44.2 |

| |

(1.4) |

(0.8) |

|

|

Bills |

13 |

23 |

85.7 |

76.9 |

| |

(0.0) |

(0.0) |

|

|

Other assets |

9,944 |

3,375 |

219.4 |

-66.1 |

| |

(13.3) |

(4.5) |

|

|

Total |

74,563 |

75,516 |

53.6 |

1.3 |

P : Provisional

Note : Figures in parentheses are percentages to respective total.

Source : Annual Returns. |

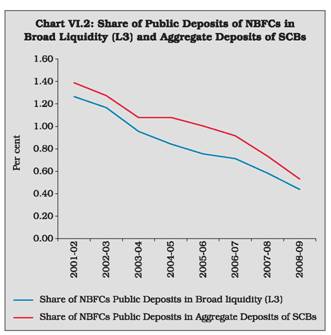

6.61

Non-interest cost at 97.6 percent continued to constitute the dominant share in total cost of the NBFCs during 2008-09. Concomitantly, the interest cost constituted a smaller share of the total cost (Table VI. 29).

6.62

Expenditure (including provisions) as a percentage of assets witnessed a rise during 2008-09. However, income as a percentage of assets increased at a higher pace resulting in a rise in the net profits to asset ratio (Chart VI.3).

Soundness Indicators: Asset Quality of NBFCs-D

6.63 In contrast to the trend during the last

few years, Gross NPA ratio increased to 2.7 per cent during 2008-09 from 2.1 per cent in 2007-08. Net NPA remained negative with provisions exceeding NPA at end-March 2009 (Table VI.30).

Table VI.28: Financial Performance of NBFCs-D |

(Amount in Rs. crore) |

Indicator |

As at end-March |

Percentage Variation |

2008 |

2009 P |

2007-08 |

2008-09 |

1 |

2 |

3 |

4 |

5 |

A. |

Income (i+ii) |

10,038 |

11,799 |

75.5 |

17.5 |

| |

(i) |

Fund Based |

9,832 |

11,498 |

75.9 |

16.9 |

| |

|

|

(98.0) |

(97.0) |

|

|

| |

(ii) |

Fee-Based |

206 |

301 |

57.4 |

46.0 |

| |

|

|

(2.0) |

(3.0) |

|

|

B. |

Expenditure (i+ii+iii) |

6,913 |

8,742 |

43.1 |

26.5 |

| |

(i) |

Financial |

4,525 |

5,641 |

63.7 |

24.7 |

| |

|

|

(60.0) |

(66.0) |

|

|

| |

|

of which |

|

|

|

|

| |

|

Interest Payment |

226 |

211 |

-55.5 |

-6.6 |

| |

|

|

(6.0) |

(2.3) |

|

|

| |

(ii) |

Operating |

2,178 |

2,369 |

72.7 |

8.8 |

| |

|

|

(30.5) |

(27.6) |

|

|

| |

(iii) |

Others |

210 |

732 |

-73.9 |

248.6 |

| |

|

|

(3.4) |

(4.1) |

|

|

C. |

TAX Provisions |

1,213 |

1,002 |

215.1 |

-17.4 |

D. |

Operating Profit (PBT) |

3,125 |

3,057 |

251.1 |

-2.2 |

E. |

Net Profit (PAT) |

1,912 |

2,055 |

279.4 |

7.5 |

F. |

Total Assets |

74,562 |

75,516 |

53.6 |

1.3 |

G. |

Financial Ratios

(as percentage to Total Assets) |

|

|

|

|

| |

i) |

Income |

13.5 |

15.6 |

|

|

| |

ii) |

Fund Based Income |

97.9 |

15.2 |

|

|

| |

iii) |

Fee Based Income |

0.3 |

0.4 |

|

|

| |

iv) |

Expenditure |

9.3 |

11.6 |

|

|

| |

v) |

Financial Expenditure |

6.1 |

7.5 |

|

|

| |

vi) |

Operating Expenditure |

2.9 |

3.1 |

|

|

| |

vii) |

Tax Provision |

1.6 |

1.3 |

|

|

| |

viii) |

Net Profit |

2.6 |

2.7 |

|

|

H. |

Cost to Income Ratio |

68.9 |

74.1 |

|

|

P : Provisional.

Note: Figures in parentheses are percentages to respective total.

Source: Annual Returns. |

Table VI.29: Interest Cost of NBFCs-D |

(Amount in Rs. crore) |

End-March |

Total Income |

Total Cost |

Interest Cost |

Non-Interest Cost |

1 |

2 |

3 |

4 |

5 |

2007-08 |

10,038 |

6,913 |

226 |

6,687 |

2008-09 P |

11,799 |

8,742 |

211 |

8,531 |

P : Provisional.

Note: Figures in parentheses are percentages to respective total.

Source: Annual Returns. |

6.64 Gross NPAs (as percentage of gross advances) of asset finance companies, equipment leasing companies and investment companies and hire purchase companies declined during 2008-09. Net NPAs (as percentage of net advances) increased marginally in case of asset finance companies and hire purchase companies, while those of equipment leasing companies and investment companies decreased. NPAs of loan companies remained negative during 2008-09 also (Table VI.31).

6.65 Asset quality of various types of NBFCs

as reflected in various categories of NPAs

(substandard, doubtful and loss) shows that

there was sharp improvement in the asset

quality of equipment leasing companies and

deterioration in the asset quality of hire

purchase companies during 2008-09 over

previous year (Table VI.32).

Table VI.30 NPA Ratios of NBFCs-D |

(Per cent) |

End-March |

Gross NPAs to Gross Advances |

Net NPAs to Net Advances |

1 |

2 |

3 |

2001 |

11.5 |

5.6 |

2002 |

10.6 |

3.9 |

2003 |

8.8 |

2.7 |

2004 |

8.2 |

2.4 |

2005 |

5.7 |

2.5 |

2006 |

3.6 |

0.5 |

2007 |

2.2 |

0.2 |

2008 |

2.1 |

0* |

2009 P |

2.7 |

0* |

P : Provisional.

* : Provision exceeds NPA

Source: Half-Yearly Returns. |

Capital Adequacy Ratio

6.66 CRAR norms were made applicable to

NBFCs in 1998, in terms of which every deposit-

taking NBFC is required to maintain a minimum

capital, consisting of Tier-I and Tier-II capital,

of not less than 12 per cent (15 per cent in the

case of unrated deposit-taking loan/investment

companies) of its aggregate risk-weighted assets

and of risk-adjusted value of off-balance sheet

items. Total of Tier-II capital, at any point of

time, cannot exceed 100 per cent of Tier-I

capital. The number of NBFCs with less than

the minimum regulatory CRAR of 12 per cent

declined to 9 at end-March 2009 from 47 at end-

March 2008 (Table VI.33). At end-March 2009,

198 out of 207 NBFCs had CRAR of 12 per cent

or more as against 280 out of 327 NBFCs at

end-March 2008. The number of NBFCs with

CRAR more than 30 also declined to 168 at end-

March 2009 from 239 at end-March 2008.

Notwithstanding this, it is noteworthy that the

NBFC sector is witnessing a consolidation

process in the last few years, wherein the weaker

NBFCs are gradually exiting, paving the way for

a stronger NBFC sector.

6.67 NOF of NBFCs is the aggregate of paid-

up capital and free reserves, netted by (i) the

amount of accumulated losses; and (ii)

deferred revenue expenditure and other

intangible assets, if any, and adjusted by

investments in shares, and loans and advances

to (a) subsidiaries, (b) companies in the same

group, and (c) other NBFCs (in excess of 10 per cent of owned fund). Information on NOF can complement the information on CRAR. The ratio of public deposits to NOF in the case of loan companies and hire purchase declined during the year ended March 2009, while that of other category companies witnessed a marginal increase. The ratio of hire purchase companies continued to be negative because of negative NOF. The ratio of public deposits to NOF for all categories of NBFCs taken together was unchanged at 0.2 per cent at end-March 2009 (Table VI.34).

Table VI.31: NPAs of NBFCs-D by Classification of NBFCs |

(Amount in Rs. crore) |

Classification End-March |

Gross Advances |

Amount |

Gross NPAs

Per cent to

Gross

Advances |

Per cent to Assets |

Net Advances |

Amount |

Net NPAs

Per cent to

Net

Advances |

Per cent to Assets |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

8 |

Asset Finance |

|

|

|

|

|

|

|

|

2007 |

11,824 |

262 |

2.2 |

2.2 |

11,548 |

-14 |

-0.1 |

-0.1 |

2008 |

37,233 |

652 |

1.8 |

1.7 |

36,609 |

28 |

0.1 |

0.1 |

2009 P |

34,240 |

573 |

1.7 |

1.6 |

34,023 |

356 |

1.0 |

1.0 |

Equipment Leasing |

|

|

|

|

|

|

|

|

2004 |

3,306 |

582 |

17.6 |

13.3 |

3,067 |

344 |

11.2 |

7.8 |

2005 |

4,187 |

514 |

12.3 |

11.0 |

4,018 |

345 |

8.6 |

7.4 |

2006 |

2,878 |

69 |

2.4 |

2.2 |

2,786 |

-23 |

-0.8 |

-0.7 |

2007 |

1,057 |

45 |

4.2 |

4.0 |

992 |

-20 |

-1.9 |

-1.8 |

2008 |

26 |

6 |

24.3 |

7.2 |

-10 |

-29 |

293.6 |

-34.2 |

2009 P |

26 |

2 |

7.7 |

2.5 |

4 |

-20 |

-491.2 |

-24.6 |

Hire Purchase |

|

|

|

|

|

|

|

|

2004 |

10,437 |

942 |

9.0 |

7.3 |

9,748 |

253 |

2.6 |

2.0 |

2005 |

15,900 |

610 |

3.8 |

3.6 |

15,544 |

253 |

1.6 |

1.5 |

2006 |

17,607 |

444 |

2.5 |

2.4 |

17,238 |

74 |

0.4 |

0.4 |

2007 |

18,280 |

464 |

2.5 |

2.3 |

17,884 |

67 |

0.4 |

0.3 |

2008 |

324 |

158 |

48.8 |

43.8 |

244 |

78 |