IST,

IST,

Government Finances 2022-23: A Half-Yearly Review

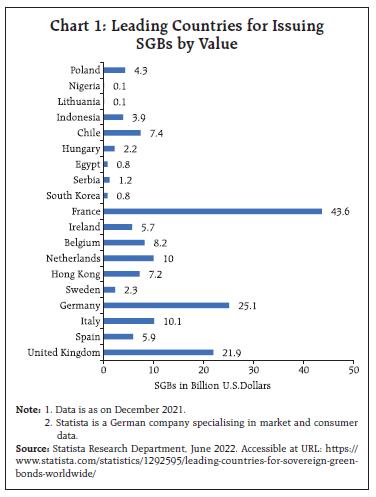

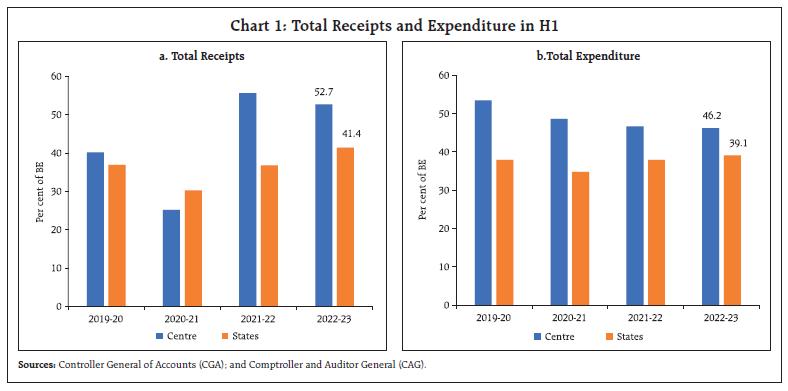

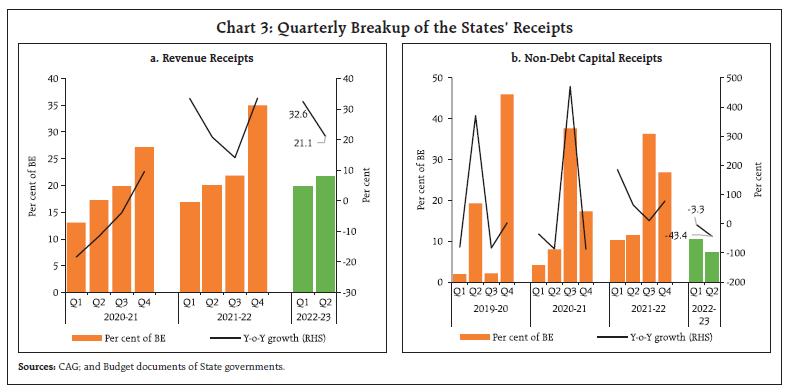

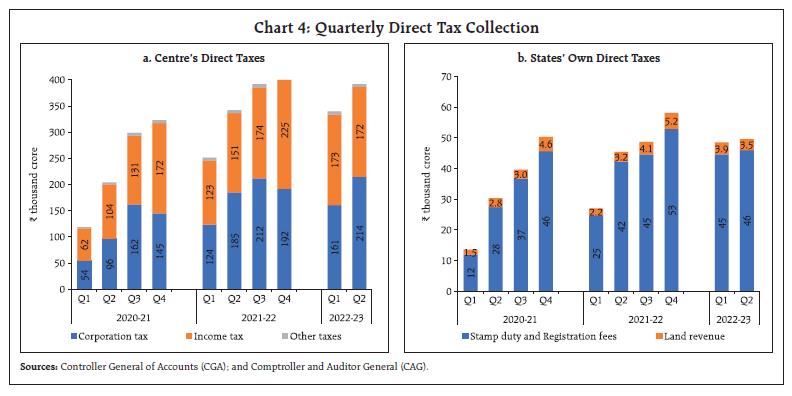

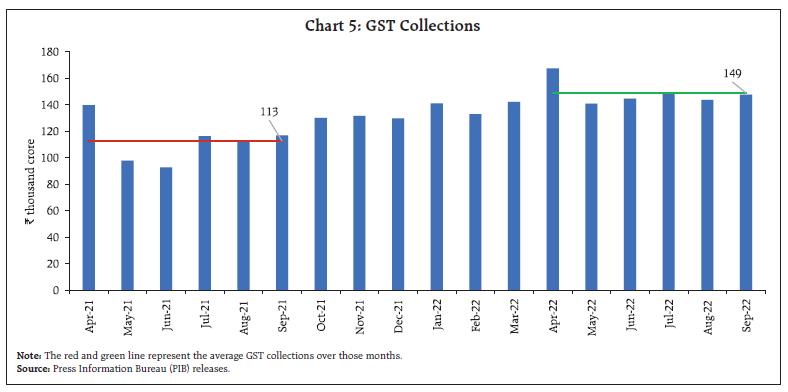

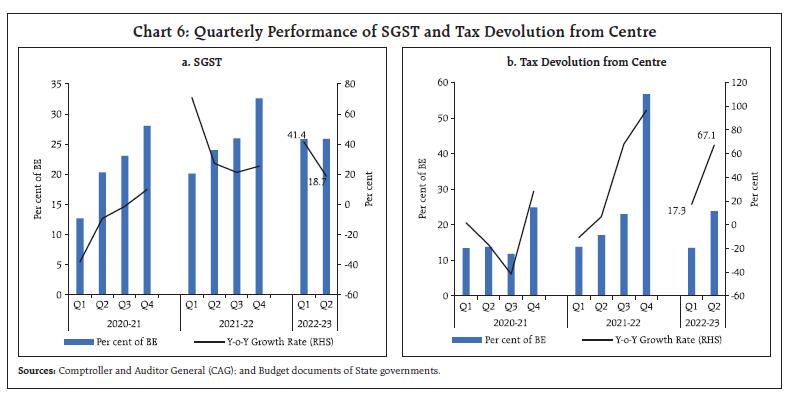

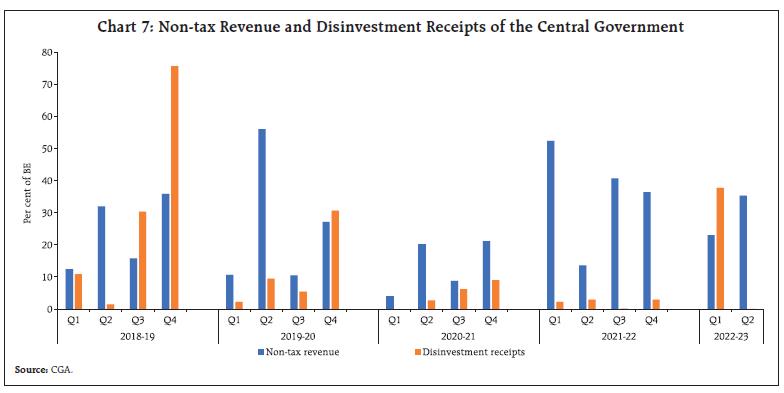

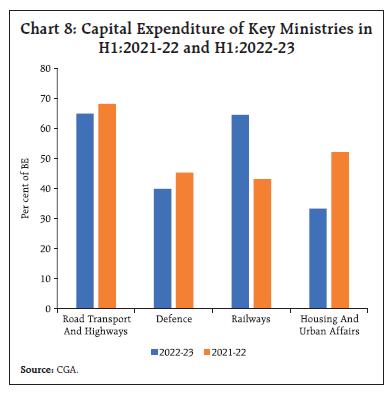

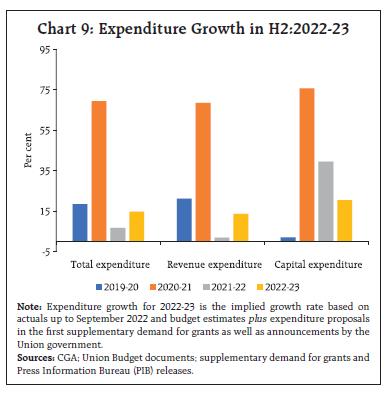

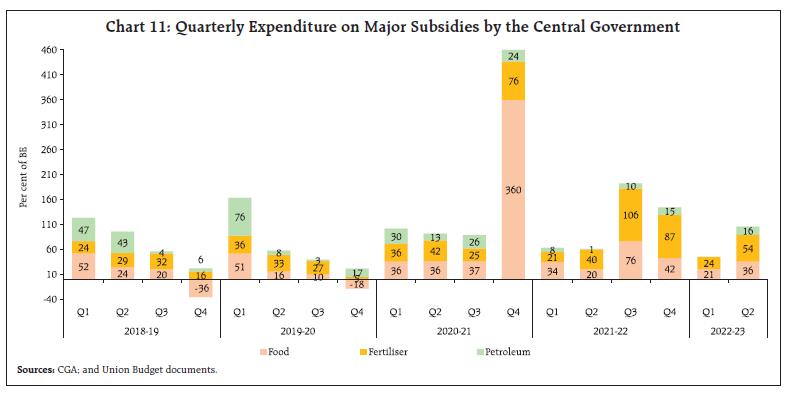

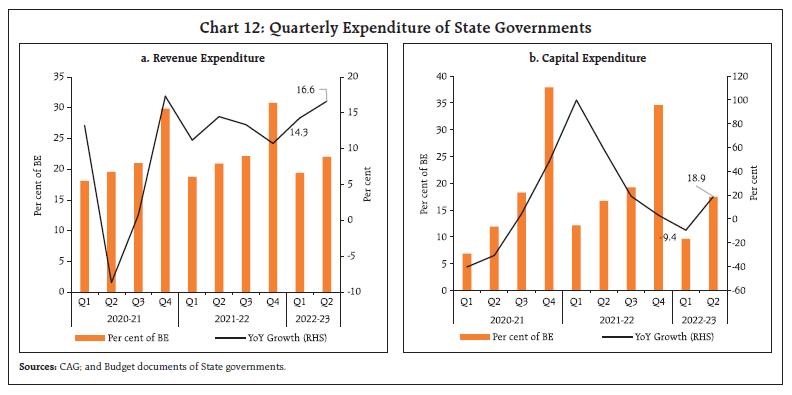

by Aayushi Khandelwal^, Rachit Solanki^, The finances of the Central government as well as the States remained resilient in H1:2022-23, with the receding impact of the pandemic on economic activity, even as the war in Europe warranted higher expenditure on subsidies and targeted fiscal measures to tame inflation. The gross fiscal deficit of the general government remained contained in both the quarters of H1:2022-23, while higher capex by the Centre provided sustained impetus to recovery of growth. Going forward, the States need to speed up their capex within their higher budgetary space in H2:2022-23. I. Introduction The Union Budget 2022-23 was presented at a time when the Indian economy was still recovering from the contractionary impact of the COVID-19 pandemic with high vaccine coverage infusing confidence for faster normalisation of economic activity. Against this backdrop, while catalysing the recovery process through a record level of capital expenditure and greater focus on infrastructure, the Union Budget for 2022-23 aimed at feasible order of fiscal consolidation with the intent to lower the fiscal deficit to below 4.5 per cent of GDP by 2025-26. The States too have endeavoured for fiscal consolidation in 2022-23, budgeting a consolidated GFD of 3.3 per cent1 of the GDP, down from 3.6 per cent in 2021-22 (RE). The performance of government finances, as evident from this half yearly review has been robust, notwithstanding the macroeconomic effect of the war in Europe. The Centre’s tax collections surpassed expectations on the receipts side, with all major heads such as income tax, corporation tax, and goods and services tax (GST) recording high growth. The Central government also ensured front-loaded capital expenditure. In States’ case, the revenue receipts, driven by strong growth of tax revenues, have performed well resulting in a marked improvement in their GFD for H1:2022-23. States have also sustained the pace of their total expenditure. The rest of the article is structured as follows: Section II analyses the receipt and expenditure of the Centre and States (at a quarterly frequency) for H1:2022-23.2 Section III deals with the outcomes in terms of key deficit indicators and their financing. Section IV presents estimates on general government (Centre plus States) finances for Q1 and Q2 of 2022-23 along with projections for the second half of 2022-23. Section V sets out the concluding observations and the near-term fiscal outlook. II. Fiscal Outcomes in Q1 and Q2 of 2022-23 In line with the previous year, more than 50 per cent of the budgeted total receipts of the Central government were realised during H1:2022-23. On the other hand, the total expenditure of the Central government remained contained at 46.2 per cent of budget estimates (BE), as against an average of 53.5 per cent of BE during 2017-18 to 2019-20, despite the challenges posed by the war in Europe on macroeconomic outcomes. The fiscal performance of the States has been robust, with an improvement in their budgetary deficits in H1:2022-23. The States’ total receipts have been strong, as reflected in a higher proportion of budgeted total receipts collected in H1:2022-23, compared to those collected in the previous years. On the expenditure side, the States have expended 39.1 per cent of their budgeted total expenditure during H1:2022-23, broadly in line with their past spending patterns (Chart 1 a and b).  a. Receipts Revenue receipts of the Central government registered a growth of 5.2 per cent in Q1:2022-23, as robust growth in tax revenues was partly offset by a contraction in non-tax revenues on the back of lower dividend transfer from the Reserve Bank. With a pick-up in non-tax revenues in Q2:2022-23, the growth in revenue receipts improved to 11.2 per cent. Non-debt capital receipts3 increased by 278.0 per cent in Q1:2022-23, led by the successful initial public offer (IPO) of Life Insurance Corporation (LIC), but remained lackluster in Q2:2022-23 (Chart 2 a and b). States’ revenue receipts have witnessed a robust y-o-y growth of 26.3 per cent in H1:2022-23 - 32.6 per cent and 21.1 per cent in Q1:2022-23 and Q2:2022-23, respectively. Tax revenue, which accounted for 76 per cent of the revenue receipts during H1:2022-23, grew at 36.8 per cent and 28.5 per cent in Q1:2022-23 and Q2:2022-23, respectively. The non-debt capital receipts of the State government4 remained modest in Q1:2022-23 and Q2:2022-23 (Chart 3 a and b). The Centre’s direct tax collections registered a y-o-y growth of 23.2 per cent in H1:2022-23, led by the growth in income tax and corporation tax by 25.7 per cent and 21.6 per cent, respectively. In Q1:2022-23, the Centre’s direct tax collections grew by 35 per cent whereas in Q2:2022-23 it recorded a growth of 14.5 per cent on a y-o-y basis (Chart 4a). On the other hand, while the Centre’s indirect tax collections increased by 11.9 per cent during H1, there was a contraction in customs and union excise duty collections on account of (i) cuts in excise duty on petrol and diesel in May 2022, and (ii) reduction in customs duty on key raw materials and inputs for the steel and plastic industry as well as commodities such as cotton and vegetable oil, which were aimed at taming inflation.  States’ own direct tax collections performed well during H1:2022-23 (Chart 4b). The GST collections (Centre plus States) have remained buoyant, recording a y-o-y growth of 32.2 per cent and averaging ₹1.5 lakh crore during H1:2022-23, as against an average of ₹1.1 lakh crore during H1:2021-22. In Q1:2022-23, the GST collections recorded a growth of 37.1 per cent whereas in Q2:2022-23 it registered a growth of 27.5 per cent on a y-o-y basis (Chart 5).   In the case of States, two major factors which have contributed to the growth in tax revenues are the higher and stable collection of States GST (SGST) and tax devolution from the Centre (on account of higher buoyancy in direct taxes, GST, and higher inflation). In order to support the States in accelerating their capital outlay, the central government front-loaded the tax devolution in August 2022 by releasing two instalments of tax devolution amounting to ₹1.16 lakh crores (Chart 6 a and b).   Centre’s non-tax revenues contracted in Q1:2022-23 due to lower surplus transfer from the Reserve Bank but witnessed a sharp up-tick in Q2, primarily owing to an increase in non-tax collections from economic services.5 However, on the disinvestment front, 37.8 per cent of the budgeted disinvestment target of ₹65,000 crore has been raised in H1, primarily owing to the LIC IPO (Chart 7). In the case of States, the non-tax revenue grew at 55.6 per cent in Q1:2022-23 and 13.3 per cent in Q2:2022-23.  b. Expenditure In 2022-23 (BE), the total expenditure of the central government was budgeted to grow by a modest 4.6 per cent6, on top of 7.4 per cent growth in 2021-22 (RE), with revenue expenditure growth budgeted at 0.9 per cent and capital expenditure growth at 24.5 per cent.7 However, in March 2022 the Union government announced Phase VI of the Pradhan Mantri Garib Kalyan Anna Yojana for the period April to September 2022, with an estimated additional cost of ₹80,000 crore.8 Subsequently, Phase VII of the scheme was also announced for the period October-December 2022, with an estimated additional cost of ₹44,762 crore.9 Further, the Union government has approved additional fertiliser subsidy of ₹1.13 lakh crore over and above the budget estimates, to insulate the farmers from rising international fertilizer prices.10,11 The Union government also placed before the Parliament the first batch of supplementary demand for grants for 2022-23 during the winter session of the parliament12 which involved additional cash outgo.13 Owing to these developments, the growth in total expenditure and revenue expenditure is expected to exceed the budget estimates. During H1:2022-23, total expenditure recorded a y-o-y growth of 12.2 per cent, with revenue expenditure and capital expenditure increasing by 6.0 per cent and 49.5 per cent, respectively.14 Even though in H1:2022-23 around half of the budgeted capital expenditure has been spent, it has recorded a high y-o-y growth of 49.5 per cent attributable to the frontloading of capital expenditure vis-à-vis previous years. In this period, key ministries such as the Ministry of Road Transport and Highways, the Ministry of Defence and the Ministry of Railways have accounted for more than 80 per cent of the total capital expenditure (Chart 8).  Going forward, in H2:2022-23, after accounting for the impact of major post-budget announcements, total expenditure growth is likely to spike to 14.9 per cent, with revenue expenditure growth picking up to 13.8 per cent and capital expenditure slowing down to 20.6 per cent (Chart 9). The trend in quarterly expenditure indicates a decline in expenditure growth from Q1:2022-23 to Q2:2022-23. In the case of revenue expenditure as well as capital expenditure, the expenditure growth (y-o-y basis) in Q2:2022-23 turned out to be lower vis-à-vis the corresponding period of the previous year viz., Q2:2021-22. This is primarily due to the base effect, as Q2:2021-22 recorded high expenditure growth when expenditure had to be frontloaded and expanded to deal with the second wave of the pandemic (Chart 10 a and b).  The major subsidies outgo of the Central government, comprising food, fuel and fertilisers stood at 62.6 per cent of BE in H1:2022-23 compared to 53.8 per cent of BE in H1:2021-22, recording a y-o-y growth of 9.9 per cent. Food subsidy accounted for 58.4 per cent of total outgo on major subsidies in H1:2022-23 vis-à-vis 72.5 per cent in the corresponding period of last year (Chart 11). States’ revenue expenditure remained healthy in the first two quarters of 2022-23 with its growth turning out to be slightly higher than that in the corresponding period of the previous year. Keeping in line with their past spending pattern, States have exhausted 41.4 per cent of their budgeted revenue expenditure in H1:2022-23. On the other hand, the capital expenditure by the States has remained anaemic so far. In Q1:2022-2315, the capital outlay by the States contracted by 9.9 per cent. Though the growth recovered during the next quarter, it remained feeble. The growth rate of capital expenditure and more importantly the capital outlay in H1:2022-23 has been muted at 7 per cent and 2.1 per cent, respectively (Chart 12 a and b).16 Normally, the States tend to back-load their expenditure in the latter half of the year. Going forward, it is expected that the States may boost their capital expenditure.   The effort of the States would be supplemented by augmented availability of resources following the relaxation of norms pertaining to off-budget borrowings17, front-loading of tax devolution by the Centre, payment of GST compensation cess and pick up in the loans by the States under the Scheme for Special Assistance to States for Capital investment.18  III. Fiscal Deficit and its Financing a. Fiscal Deficit Central Government After attaining a GFD of 6.7 per cent of GDP in 2021-22 (PA), the Union government has budgeted for a GFD of 6.4 per cent of GDP in 2022-23 with the medium-term target of bringing down the GFD below 4.5 per cent of GDP by 2025-26. During H1:2022-23, the GFD of the Union government stood at 37.3 per cent of the BE, marginally higher than the GFD of 35.0 per cent during the corresponding period of the previous year (viz., H1:2021-22). In comparison with the corresponding period of the previous year, the fiscal deficit rose during H1:2022-23, attributable to higher subsidy bills and front loading of capital expenditure. On the brighter side, higher tax collections helped offset higher subsidy bills and helped contain the fiscal deficit (Chart 13 a and b).  State Governments The States had budgeted a consolidated GFD of 3.3 per cent of GDP for 2022-23 (BE), lower than 3.6 per cent in 2021-22 (BE). In Q1:2022-23 and Q2:2022-23, the States have exhausted a lower proportion of their budgeted GFD as against the same in the corresponding period of the previous year. Consequently, the fiscal space available to States in the latter half of the year has expanded to 71 per cent of their budgeted GFD in 2022-23, a sharp rise from 57.2 per cent for the corresponding period of the previous year (Chart 14). While the GFD of the States has improved in the post-pandemic period, the debt level of the States continues to remain high.19 Moreover, the implicit debt of the States in the form of State guarantees (viz., contingent liabilities) has also seen a considerable rise in the recent past, which may expose some of the States to additional fiscal risks (Box I).  The quality of expenditure [measured by revenue expenditure to capital outlay (RECO)] for the Centre recorded significant improvement in Q1:2022-23 and Q2:2022-2320, attributed to the higher thrust placed by the Central government on capital expenditure. In contrast, the expenditure quality of the States suffered a setback on account of subdued capital outlay by the States. In Q1:2022-23 and Q2:2022-23 their RECO ratio inched up to 11.6 and 7.2, respectively, higher than the levels in the corresponding period of the last year. Though the revival of capital outlay in Q2:2022-23 helped in improving the expenditure quality, it still leaves room for further improvement.

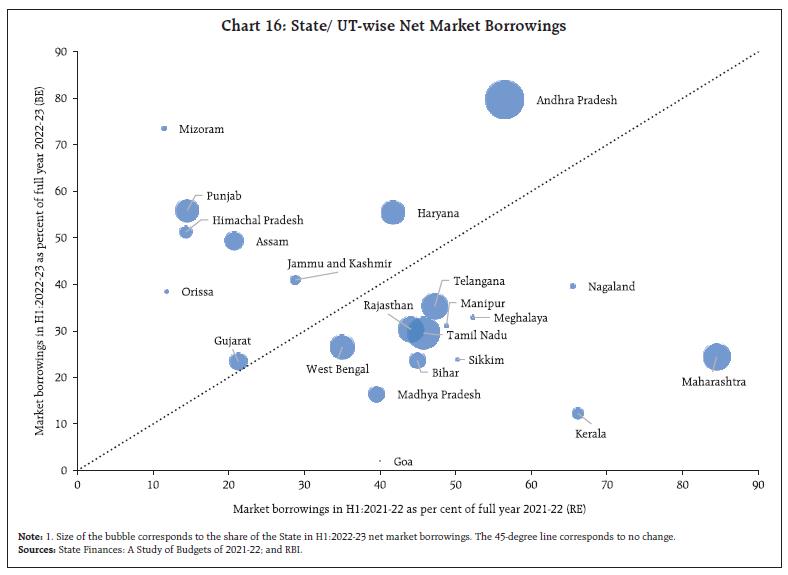

The expenditure quality of the States has a profound impact on medium to long-term growth of the economy necessitating a revamped push on capex in the remaining half of the year by the States (Chart 15 a and b). b. Financing of GFD In H1:2022-23, the Union government completed 55.4 per cent of the budgeted net market borrowings for 2022-23, which financed the major chunk of its GFD during the first half of the year. The market borrowings were followed by the utilisation of National Small Savings Fund (NSSF) for financing the GFD of the Union government. With the private sector demand for credit rising and spill over from the aggressive tightening of monetary policy by the US Fed continuing to exert hardening pressures, the 10-year g-sec yield has remained above 7 per cent during H1:2022-23. Nonetheless, the borrowing programme of the Union government during H1:2022-23 was carried out smoothly. In fact, the decision of the Union government to cut its borrowing target by ₹10,000 crore from its budgeted target for 2022-23 signals its confidence of attaining the fiscal deficit target of 6.4 per cent of GDP despite its unanticipated rise in expenditure for 2022-23 mainly accounted by higher food and fertilizer subsidies.22 This is attributable to the Centre’s tax revenue that has been growing at a robust pace. Going forward, this may aid in containing the spike in 10-year g-sec yields witnessed during H1:2022-23. On the other hand, the Centre’s market borrowing programme for H2:2022-23 would remain unchanged as per the issuance calendar for October 2022 - March 2023. In addition to ₹5.76 lakh crore of gross market borrowing as per the issuance calendar, the Government of India would also be issuing its novel sovereign green bonds for an aggregate amount of ₹16,000 crore (Box II). The net market borrowings undertaken by the States during H1:2022-23 witnessed a decline in comparison to the same period in the previous year, supported by their lower GFD (Chart 16).24 The net market borrowings by the States in H1:2022-23 accounted for only 26 per cent of their budgeted target while States had completed 40 per cent of their budgeted market borrowings in the corresponding period of the previous year. Amongst the larger States/UTs, Andhra Pradesh, Haryana, Punjab, and Jammu and Kashmir have seen a significant rise in their net market borrowings in H1:2022-23.

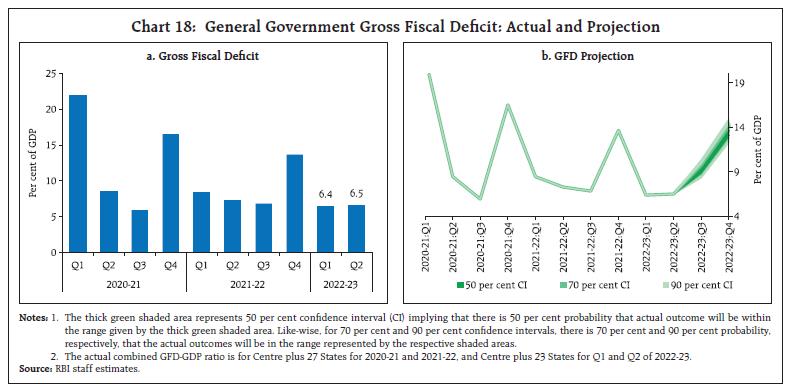

The financial accommodation availed by the States under various facilities provided by the Reserve Bank increased in H1:2022-23 by 20 per cent25 over the corresponding period of the previous year26. The average amount availed by the States under Ways and Means Advances (WMA), and Overdraft (OD) facilities declined by 21.9 per cent and 23.4 per cent, respectively, and that under the Special Drawing Facility (SDF) increased by 160 per cent. Except Himachal Pradesh, Haryana, Manipur, Meghalaya and Telangana rest of the states have seen a decline in their daily utilisation of WMA in H1:2022-23 over the same period in the previous year (Chart 17 a and b).  IV. General Government Finances The general government GFD for 2022-23 is budgeted to consolidate to 9.4 per cent of GDP. In continuation of the effort to provide timely fiscal data on the general government, the quarterly fiscal position of the general government has been compiled till Q2:2022-23. Improved revenue mobilisation by the Centre and States has kept the general government GFD subdued in Q1 and Q2 of 2022-23. Going forward, while tax collections are expected to remain buoyant in H2, higher subsidy pay-outs by the Centre and a pick-up in States capex could result in a general government deficit of 9.3 per cent and 13.6 per cent of GDP in Q3 and Q4 (projected), respectively.  Accordingly, the general government GFD is expected to increase from 6.4 per cent of GDP in H1:2022-23 to 11.5 per cent in H2: 2022-23 (Chart 18 a and b). To sum up, the finances of the Central government as well as the States remained resilient in H1:2022-23 with receding negative spillover effects induced by the pandemic, even as the war in Europe has led to targeted fiscal measures to contain inflation and higher allocation for food and fertiliser subsidies. The Centre recorded robust tax collections, both direct taxes and GST reflecting sustained recovery of the economy, improved tax governance and administration as well as healthier balance sheet of the corporate sector. By reiterating its target of attaining GFD below 4.5 per cent of GDP by 2025-26, the Centre has exhibited its firm commitment to fiscal consolidation while at the same time prioritising capital expenditure to drive the recovery in growth and create a virtuous cycle to crowd in private investment. The States too have strengthened their fiscal parameters as is evident from the decline in their consolidated GFD and net market borrowings. However, the capital expenditure of the States has remained weak which is reflected in the deterioration of its expenditure quality. Going forward, the major challenge for both the Centre as well as States lie on the capex front. For the Centre, the current thrust provided for capex needs to be continued while also focussing on fiscal consolidation. For the States, it is imperative that they necessarily increase their capex due to its centrality in stimulating higher economic growth.

^ The authors are from the Department of Economic and Policy Research (DEPR). * The authors are thankful to Dr. Sitikantha Pattanaik, Dr. Deba Prasad Rath and G. V. Nadhanael for their comments and valuable suggestions. The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. 1 The data pertains to 23 States for which the data for April-September 2022 is available. The GFD-GDP ratio is estimated using GSDP data for the same 23 States. 2 The Appendix Tables 1 to 4 provide item-wise data regarding the budgetary position of the Central government as well as State government finances on a half-yearly as well as quarterly basis. 3 Non-debt capital receipts include recoveries of loans and advances and miscellaneous capital receipts (viz., disinvestment and other receipts). 4 Non-debt capital receipts of States comprises of recoveries of loans and advances disbursed by them to subordinate/ parastatal entities and other miscellaneous capital receipts. 5 Non-tax revenue from economic services includes agriculture and allied activities (receipts from agricultural farms, commercial crops, fees from agricultural education, fees for quality control and grading of agricultural products, etc.), irrigation and flood control (receipts of Central Water Commission and Central Water Power Research Station, Pune, etc.), communication (includes license fees from telecom operators and receipts on account of spectrum usage charges) etc. Non-tax revenue from economic services accounts for 40.8 per cent of budgeted non-tax revenues in 2022-23. 6 Over 2021-22 (PA), the total expenditure of the central government in 2022-23 (BE) is budgeted to grow by 4.0 per cent. 7 Capital outlay (capital expenditure excluding loans and advances) was budgeted to increase by 11.5 per cent in 2022-23, on top of an increase of 73.3 per cent in 2021-22 (RE). 8 https://pib.gov.in/PressReleasePage.aspx?PRID=1810048 9 https://pib.gov.in/PressReleasePage.aspx?PRID=1862944 10 https://www.pib.gov.in/PressReleasePage.aspx?PRID=1820522 11 https://www.pib.gov.in/PressReleasePage.aspx?PRID=1873018 13 https://dea.gov.in/sites/default/files/%21st%20Supplementary%20Demand%202022-23.pdf 14 During H1:2022-23, capital outlay grew by 52.2 per cent vis-a-vis a growth of 41.3 per cent during H1:2021-22 on a y-o-y basis. 15 States’ capital expenditure posted a y-o-y growth of -9.5 per cent (i.e., contraction) and 19.0 per cent in Q1:2022-23 and Q2:2022-23, respectively. 16 States’ Capital Expenditure is composed of their direct Capital Outlay and the loans and advances extended by them to subordinate/parastatal entities. 17 In March 2022, the Centre had stipulated the States to adjust their off-budget borrowings of 2020-21 and 2021-22 against the borrowing limits for 2022-23. However, in July 2022, the Centre relaxed these norms allowing the States to adjust their off-budget borrowings of 2021-22 against the borrowing limits of the next four years till March 2026. 18 The Centre has again renewed the Scheme for Special Assistance to States for Capital investment for FY2022-23 with an enhanced allocation of ₹1 lakh crore. As these 50-year interest-free loans are over and above the 4 per cent of GSDP ceiling for the States, they will enable the States to undertake capital spending on a more consistent basis. 19 States’ cumulative debt stands at 31.2 per cent of GDP [2021-22 (BE)], highest since 2006-07 (RBI, 2021). 20 In Q1:2022-23 and Q2:2022-23, the RECO ratio for the Centre was 4.8 and 4.5, respectively. 21 The 18 States include Andhra Pradesh, Arunachal Pradesh, Assam, Goa, Gujarat, Haryana, Madhya Pradesh, Maharashtra, Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Punjab, Telangana, Tripura, Uttarakhand and West Bengal. Apart from these States, Karnataka has also recently joined the GRF Scheme. 22 After taking into account the switch operations (for ₹63,648 crore) conducted on January 28, 2022, gross market borrowing for 2022-23 (BE) is ₹14.31 lakh crore and net market borrowing is ₹11.19 lakh crore. However, as per the latest issuance calendar for marketable securities (dated September 29, 2022), gross market borrowing budgeted target of the central government for the fiscal year 2022-23 was cut by ₹10,000 crore to ₹14.21 lakh crore. 23 The framework of green bond is similar to a plain vanilla bond. In general, green bond is a fixed income financial instrument sold in the market with a clause which states that the proceeds from issuing of the bond needs to be utilised for green investment. However, noticeably, there is no single global framework which needs to be followed to label a bond as ‘green’. Among many of existing national and international standard frameworks used for labelling green bonds, the most popular are the Green Bonds Principles issued by the International Capital Market Association (ICMA), which was developed by a range of multilateral and investment banks, including the World Bank and the International Finance Corporation (IFC). 24 The data pertains to 30 States/ UTs. 25 The data pertains to 30 States/ UTs 26 Financial accommodation to the states is provided by the Reserve Bank through the Special Drawing Facility (SDF), Ways and Means Advances (WMA) and Overdraft (OD). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: