IST,

IST,

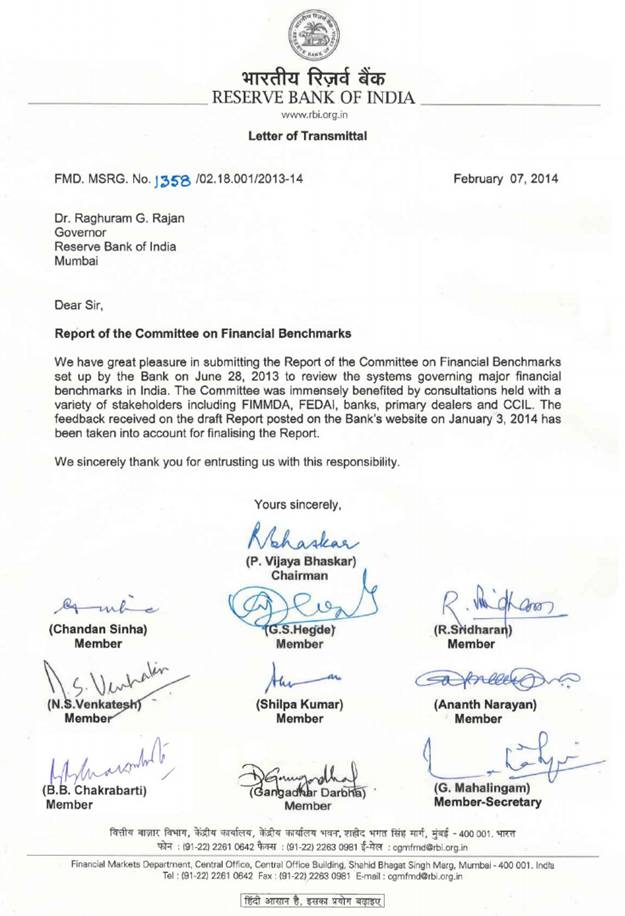

Report of the Committee on Financial Benchmarks

The Committee acknowledges with gratitude the guidance provided by Deputy Governors of RBI Shri H.R. Khan and Dr. Urjit Patel. The Committee places on record its deep sense of appreciation for the exemplary dedication and enormous efforts put in by the core team from the Financial Markets Department comprising Shri Sudarsana Sahoo, DGM, Shri Shariq Hoda, AGM and Shri Sirin Kumar, AGM, in providing comprehensive research and secretarial assistance to the Committee. The Committee acknowledges the assistance provided by Shri Sandeep Mahajan, AGM, Shri Ajay Sisodia, Manager, Shri Madhujit Sinha, Manager and Shri Vikas Kumar, Assistant, for providing various logistical supports for conducting the meetings. The Committee was immensely benefitted by its interactions with Shri D G Patwardhan, Chief Executive, FEDAI; Shri B Prasanna, Chairman, PDAI; Shri Ashok Gautam, Senior Vice President & Head, Global Markets, Axis Bank; Shri Pradeep Khanna, Managing Director and Head- FX Trading, HSBC; and Shri Kuldeepsinh Jagtap, PDAI. The Committee also benefitted from valuable inputs on legal issues received from Shri Amit Shah, Head of Legal, India and South Asia, Standard Chartered Bank; Mr. Keith Noyes, Regional Director, Asia Pacific, ISDA; Ms. Jacqueline Low, Senior Counsel, ISDA; and Shri Erryan Abdul Samad, Counsel, ISDA. The Committee acknowledges the data inputs provided by CCIL team comprising Smt. Indirani Rao, Dr. Golaka C. Nath, Shri Anupam Mitra, Ms. Jigna Thakkar and Ms. Payal Ghose. The Committee acknowledges the background material on benchmarks provided by FIMMDA, FEDAI and Thomson Reuters with special thanks to Shri C.E.S Azariah and Shri DVSSV Prasad of FIMMDA; Shri D G Patwardhan and Shri K V Ramesh of FEDAI; and Shri Dayal Thakkar and Ms. Alice Joseph of Thomson Reuters. The Committee is thankful for the valuable suggestions provided by officials of RBI, viz. Shri K.K. Vohra, PCGM, IDMD, Shri R N Kar, CGM-in-Charge, FED, Dr. N.B. Raje, Director, FMD, Shri Susobhan Sinha, GM, IDMD, Shri Ishan Shukla, GM, FMD, Shri G Seshsayee, DGM, Hyderabad RO, Shri Indranil Chakraborty, DGM, DBS, Shri Rakesh Tripathy, DGM, FMD, Shri Puneet Pancholy, DGM, DBOD, Smt. Mini Kuttykrishnan, ALA, Legal Dept and officials of the Analytics Division of DBS. The Committee gratefully acknowledges the support extended by the personnel attached to IT Cell and Lounge of Mumbai Regional Office of RBI in facilitating the smooth conduct of meetings of the Committee even on holidays. Background and Recent Global Developments 1. Financial benchmarks are primarily used for pricing, valuation and settlement purposes in financial contracts. The aggregate volume of underlying financial contracts referenced to or valued through financial benchmarks being quite huge, the robustness and reliability of financial benchmarks play a critical role for the stability of the financial system. Recent global developments with regard to manipulation of several key global benchmark rates, viz. LIBOR, EURIBOR, TIBOR, London 4 PM FX fixing, etc., have raised concerns about the reliability of the financial benchmarks, particularly about their governance frameworks and setting methodologies. Several international standard setting bodies, national regulators, central banks, and self regulatory market bodies have reviewed the existing benchmark setting process and came out with comprehensive measures and governing principles for reforming financial benchmarks. Important ones among them are IOSCO’s Principles on Financial Benchmarks, Wheatley Review of LIBOR, BIS’s Report titled ‘Towards better reference rate practices: a central bank perspective’, ESMA-EBA’s Principles for benchmark setting processes in EU, European Commission’s proposed regulation on indices used as benchmarks in financial instruments and financial contracts as also the Monetary Authority of Singapore’s proposed regulatory framework for financial benchmarks. The FSB, working under the mandate of G-20, has endorsed the IOSCO’s Principles. 2. The key principles for reform of financial benchmarks that have been accepted across many jurisdictions include (i) Benchmark Administrators are to be primarily responsible for all aspects of benchmark determination, (ii) calculation of financial benchmarks should be, as far as possible, based on observable transactions, (iii) the illiquid benchmarks/benchmark tenors should be phased out, (iv) benchmark setting methodology should be transparently disclosed, (v) individual submissions should be publicly disclosed after a suitable lag (vi) appropriate policies should be framed to address transition issues, (vii) effective policies should be put in place to address the conflicts of interests in benchmark submission and administration, (viii) benchmark submission should be subjected to appropriate Code of Conduct and oversight, (ix) benchmark submission should be supported by well-defined hierarchy of inputs and (x) greater regulatory oversight of benchmark setting process with stringent penal provisions. Review of Major Indian Rupee Interest Rate and Foreign Exchange Benchmarks 3. The Committee identified the major Rupee interest rate benchmarks and foreign exchange benchmarks based on their extent of usage and relevance to the Indian financial system. The base rate and other proprietary rates of individual banks are not considered as these rates are institution specific and are not used in the financial market transactions involving banks/other financial intermediaries. The major Rupee interest rate benchmarks identified are MIBID-MIBOR, MIFOR, INBMK, MIOIS, MIOCS, G-sec yield curve, prices for SDL, spreads for GOI FRBs, Prices for corporate bonds, T-Bill Curve, CP Curve and CD Curve. The major foreign exchange benchmarks identified are RBI Reference Rate, FEDAI’s spot fixings, Month-end revaluation rates for forex spot and forward contracts, FCY/INR option implied volatility and FCNR (B) rates. The Committee reviewed the above major benchmarks with regard to their quality, setting methodology and governance systems. Benchmark Quality and Setting Methodology 4. On the benchmark quality and setting methodology, the Committee observed that although the methodologies followed for the above mentioned benchmarks are generally satisfactory, several measures need to be taken to further strengthen the benchmark quality and setting methodology. The benchmark administrators and calculation agents may need to suitably augment their resources for being up to the rather onerous tasks allotted or expected of them. The major recommendations of the Committee in this regard include:

Governance Framework 5. The existing Governance Framework for the Benchmark Administrators and Calculation Agents was found lacking in several aspects. The Committee recommends several measures to be implemented by the Benchmark Administrators, Calculation Agents and Submitters for strengthening the governance framework for the benchmarks. 6. The Administrators may put in place a comprehensive Code of Conduct for the Submitters specifying hierarchy of data inputs for submission, pre-submission validation and post-submission reviews of inputs by competent officials, role and responsibility of key personnel, procedures to identify suspicious inputs, policies and procedures to manage conflicts of interest, etc. and may oversee the compliance by the Submitters to the Code. The Administrators may constitute a governing body to ensure quality and integrity of the benchmark determination process; retain adequate access to and control over the data and calculation process where the calculation is outsourced, put in place policies and procedures for the identification, disclosure, avoidance or management of existing and potential conflicts of interest; put in place appropriate confidentiality protocols with respect to the data and other information received by or produced by it; establish an effective whistleblowing mechanism; develop appropriate oversight function; establish an effective complaint redressal system; subject the benchmark related activities to periodic independent external audit; maintain all records for a minimum period of eight years. Where the Administrator has outsourced certain functions of benchmark determination, the Administrator may be responsible for all acts of omissions and commissions of the outsourced agent/s. In order to overcome the possible conflicts of interest with the benchmark setting process arising out of the current governance structure, FIMMDA and FEDAI may consider creating a separate independent structure, either jointly or separately, for administration of the benchmarks on the lines of Singapore. 7. The Calculation Agents may strengthen the governance of calculation function by appointing personnel with appropriate level of seniority and clear accountability to be responsible for Benchmark calculation, establishing robust pre- and post-calculation control, setting up an effective whistleblowing mechanism, putting in place appropriate confidentiality protocols with respect to the data and other information received by or produced by it, subjecting the calculation function to periodic internal and external audit, maintaining all records for a minimum period of eight years and submitting a report to the Administrator periodically confirming compliance with all applicable guidelines. 8. The Benchmark Submitters may put in place an internal Board approved policy for governance of the submission process in line with the Code of Conduct prescribed by Administrator; clearly accountable personnel at appropriate senior positions are to be responsible for submissions; maker-checker system to ensure integrity of submissions; periodical review of submissions by appropriate senior level officials; establish effective conflicts of interest policy and whistleblowing policy; subject the submission process to periodic internal audit and where appropriate, to external audit; preserve all records for a minimum period of eight years; and submit a confirmation to the Administrator periodically for having complied with all applicable guidelines including the Code of Conduct prescribed by the Administrator. Regulatory Oversight 9. The Committee favours increased role of RBI for oversight of the benchmark determination in line with international experiences. Although there is no specific provision in the RBI Act with regard to regulation of financial benchmarks, the Committee’s considered opinion is that a broader interpretation of Section 45W of RBI Act empowers RBI to issue directions to the Benchmark Administrators. However, as a long term measure, Section 45W may be amended to explicitly empower RBI to determine the policy with regard to benchmarks used in Money, G-sec, Credit and Foreign Exchange markets in India and to issue binding directions to all the agencies involved in benchmark setting including Administrators, Calculation Agents and Submitters. 10. Pending legal amendments, RBI may entrust the administration function of Rupee interest rate benchmarks and foreign exchange benchmarks to FIMMDA and FEDAI respectively. FIMMDA and FEDAI may review their Memorandum and Articles of Association to bring out necessary amendments and may also enter into agreements with Calculation Agents to enforce the standards. RBI, in exercise of its existing powers, may advise the Banks and PDs to strengthen the Governance Framework for benchmark submission and to extend necessary support to the Administrator for strengthening the benchmark setting process. 11. RBI may bring the benchmark submission system of banks and PDs under its on-site supervision and off-site monitoring. RBI may constitute an internal expert group to conduct periodic on-site inspection of Benchmark Administrators and Calculations Agents and also monitor their activities through an off-site monitoring system. 1.1. Financial benchmarks are mainly used for pricing, settlement, and valuation of financial contracts. The IOSCO’s Report on Principles for Financial Benchmarks describes financial benchmarks as: “Prices, estimates, rates, indices or values that are: a) Made available to users, whether free of charge or for payment; b) Calculated periodically, entirely or partially by the application of a formula or another method of calculation to, or an assessment of the value of one or more underlying Interests; c) Used for reference for purposes that includes one or more of the following: • determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments; 1.2. Keeping in view the huge volume of financial contracts referenced to or valued through the financial benchmarks, robust and credible benchmarks contribute immensely to the stability of the financial system. Properly designed benchmarks help the end-users to effectively manage their financial risks. Loss of confidence in major benchmark/s may disrupt the functioning of the financial markets and may impair the efficiency of the financial system with significant negative externalities as has been observed during the recent period. 1.3. The revelations regarding manipulation of LIBOR in June 2012 had shocked the entire global financial markets. The probes conducted by regulators in various jurisdictions found several governance related issues surrounding conflicts of interests as the major causes of manipulation of LIBOR and some other key benchmark rates. These cases of manipulation of major financial benchmarks have raised serious concerns about the appropriateness of the methodologies and processes followed in determination of such benchmarks and the overall credibility and reliability of the financial benchmarks. 1.4. Market regulators in many jurisdictions and various international standard setting bodies as well as self-regulatory institutions undertook comprehensive reviews of the then existing benchmark setting system and came up with several recommendations to strengthen the system. Notable among them were the Wheatley Review of LIBOR published in September 2012, BIS’s Report titled ‘Towards better reference rate practices: a central bank perspective’ published in March 2013, International Organization of Securities Commissions (IOSCO)’s consultation report on draft Principles for financial benchmarks published in January 2013 and subsequently in April 2013, European Securities Market Authority (ESMA)-European Banking Authority (EBA)’s Principles for benchmark setting processes published in June 2013 and IOSCO’s final report on Principles for financial benchmarks published in July 2013. Several reform measures were undertaken in many jurisdictions with respect to benchmark setting methodology and Governance Framework including introduction of regulatory oversight on the benchmark setting process and stipulation of stringent penal provisions for curbing manipulative practices. 1.5. The Financial Stability Board (FSB), working on the mandate of G-20, has since endorsed the IOSCO’s Principles for financial benchmarks. The IOSCO’s report requires the Benchmark Administrators to disclose their compliance with the Principles within 12 months of its publication, i.e. by July 2014, and subsequently, on an annual basis. The IOSCO expects the member countries to encourage implementation of the Principles including through regulatory actions wherever appropriate. RBI, being the regulator of Money, G-sec and Foreign Exchange markets in India, is required to take appropriate steps to ensure compliance by the Administrators of the Rupee interest rate and foreign exchange benchmarks in India with the IOSCO Principles by July 2014. Constitution of the Committee 1.6. Against the backdrop of these international developments, a need was felt to review the process of computation and dissemination of major financial benchmarks in India, the governance mechanisms in the institutions involved in computing the benchmarks and other related issues. The Reserve Bank of India initiated discussions with the institutions involved in computation and dissemination of benchmarks such as FIMMDA, NSE, Thomson Reuters and CCIL; and select banks and primary dealers who participate in the polling for different benchmarks. It emerged from the consultation process that, in view of the varieties of benchmarks, methodologies and Governance Frameworks in place, it would be appropriate to consider a committee approach to examine the issues surrounding the financial benchmarks in India. However, the Committee’s scope of study was restricted to the major Indian foreign exchange and Rupee interest rate benchmarks primarily used by the banking sector. 1.7. Accordingly, a Committee on Financial Benchmarks was constituted by RBI to study the various issues relating to financial benchmarks on June 28, 2013 with the following members:

Shri D.G. Patwardhan, Chief Executive, FEDAI participated in the deliberations of the Committee as a permanent invitee. The Secretariat of the Committee was provided by the Financial Markets Department of RBI and comprised Shri Sudarsana Sahoo, DGM, Shri Shariq Hoda, AGM and Shri Sirin Kumar, AGM. Terms of Reference 1.8. The terms of reference of the Committee are as follows:

Approach 1.9. The Committee adopted a four-pronged approach as under:

1.10. The Committee held discussions over five meetings in Mumbai and also through teleconferencing and exchange of information over e-mail. The Committee had consulted few outside experts on the subject, viz. Shri B Prasanna, Chairman, Primary Dealers’ Association of India; Shri Ashok Gautam, Senior Vice President and Head of Global Markets, Axis Bank; and Shri Pradeep Khanna, Managing Director and Head of FX trading, HSBC. The Committee had discussed various legal issues involved in transition to new benchmarks and international developments on financial benchmarks with Ms. Jacqueline Low, Senior Counsel Asia, ISDA; Mr. Keith Noyes, Regional Director- Asia Pacific, ISDA; and Mr. Erryan Abdul Samad, Counsel Asia, ISDA. The Committee had also consulted concerned officials of FIMMDA, FEDAI, and Thomson Reuters to know details about the existing benchmark setting process and their Governance Framework. Structure of the Report 1.11. The report is organized as follows:

Chapter 2 2.1. The cases of manipulation and false submissions in some major global financial benchmarks have seriously undermined the credibility and reliability of the financial benchmarks. The official sector across the globe has started playing a crucial role in ensuring that widely-referenced financial benchmarks are subject to appropriate standards of governance, transparency and reliability. The chapter provides a brief coverage of the principles and reform measures recommended by various international standard setting bodies, national regulators, central banks and self-regulatory market bodies for enhancing the robustness and reliability of financial benchmarks. The chapter also provides a snapshot of the reform measures already undertaken/ underway in some countries in respect of some major financial benchmarks with the objective of drawing lessons for suggesting reform measures in the Indian context. 2.2. The major global financial benchmarks came under intense public scrutiny after the information relating to manipulation of London Interbank Offered Rate (LIBOR) came to the fore in June 2012. The LIBOR has been the primary benchmark for short term interest rates globally and has been used for pricing and settlement of large varieties of interest rate and derivative contracts. As per the available estimates, hundreds of trillions of dollars worth of outstanding loans and financial contracts world-wide are linked to LIBOR. The LIBOR had been under the scrutiny of analysts and researchers even before the scandal broke out. The questions surrounding it intensified after the Wall Street Journal published an article on April 16, 2008 alleging that several global banks might have understated their borrowing costs while submitting quotes for LIBOR setting. The public authorities in different jurisdictions including the United Kingdom, United States, Canada, Japan, Switzerland and the European Union have been investigating a number of institutions since 2009 for alleged misconduct relating to LIBOR and other major benchmarks, including EURIBOR (Euro Interbank Offered Rate) and TIBOR (Tokyo Interbank Offered Rate). 2.3. On June 27, 2012, the Financial Services Authority (FSA) of UK notified1 that Barclays Bank had admitted to have made inappropriate submissions towards US dollar LIBOR and EURIBOR on numerous occasions driven by motives such as, requests by derivatives traders who sought to benefit to the detriment of other market participants, avoiding negative media comment about its liquidity position which were facilitated, in part, by lack of effective controls within the bank, etc. The authorities in US and UK have fined several banks and brokerage firms for manipulation of benchmark interest rates. More than a dozen banks and brokerage firms are being investigated, at the moment, by regulators and anti-trust watchdogs worldwide for manipulation of different benchmark rates. 2.4. Following the LIBOR scandal, another sensational scandal of similar proportion broke out in the form of Forex Market scandal. It essentially involved the rigging of WM/Reuters 4PM London fixing rates which is a widely used forex benchmark. It has been alleged that some banks had been front-running client orders in order to manipulate the WM/Reuters fixings by pushing through the trades before and during the 60-second windows in collusion with counterparts. As per the available reports, several foreign exchange traders at various global banks in London, New York and Tokyo have been suspended as a consequence of regulatory and internal inquiries into possible attempted manipulation of various foreign exchange benchmarks. Regulators in UK, Switzerland, the US and some other countries are investigating several banks on the subject. 2.5. Following the FSA’s June 2012 announcement of findings against Barclays, the British Government appointed Martin Wheatley, the then Managing Director of the FSA and Chief Executive-designate of the Financial Conduct Authority (FCA), to conduct an independent review of the various aspects of setting and usage of LIBOR. The final report was published in September 2012. The Review arrived at three fundamental conclusions, viz. (i) LIBOR should be reformed rather than be replaced as moving to a new benchmark may cause financial instability, apart from litigation between parties who are holding contracts referenced to LIBOR, (ii) LIBOR submissions should be explicitly supported by transaction data, (iii) Market participants should continue to play major role in production and oversight of LIBOR with the role of the authorities being primarily to ensure integrity of the setting process. 2.6. The Wheatley Review proposed a ten-point comprehensive reform plan for LIBOR covering the regulation, institutional reform, governing rules and international co-ordination. The Review recommended that the process of submission and administration of LIBOR be classified as regulated activities under the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 and an ‘Approved Persons Regime’ be introduced in terms of which only individuals who can satisfy FSA with regard to complying with the “fit and proper” criteria can perform the activities that are designated as ‘controlled functions’. The proposed framework provides for accountability of the individuals who perform the controlled functions. The FSA needs to be empowered to impose public censure or financial penalty and prohibit the individuals from getting involved in the regulated activities. On the institutional reform front, the Review has recommended that the British Bankers Association (BBA) should transfer responsibility for LIBOR to a new administrator, framing operational issues such as procedure and criteria for banks to become member of LIBOR panel, oversight etc. On the governing rules, the Review has recommended that the new administrator should introduce a Code of Conduct for submitters providing clear guidelines for explicit use of transaction data for determination of submissions, systems and controls, responsibility for maintenance of transaction records by submitting banks, and regular external audit of submitters. The recommendations for immediate improvements to LIBOR include reduction in existing number of currencies and tenors for which there are insufficient transaction data to support submission, delayed dissemination of individual submissions after three months mainly to avoid inferences on credit quality of the Submitter, expanding the contributor panel size, regulatory mandate to expand the panel size, if necessary; and developing robust contingency procedures. The Review envisages international coordination with the European and international community on the long-term future of LIBOR and other global benchmarks, as also for establishing and promoting clear principles for effective global benchmarks.The Review also analyses various features of the main alternatives of LIBOR and feels that though exploring an alternative for LIBOR is favoured, the choice of alternative should be market-led. The Review discusses moving to a transaction-based model and committed-quote model for determination of LIBOR and concludes that it may not be a viable option in the short-term but can be considered in the longer-term when the unsecured interbank lending market revives. 2.7. Several international standard setting bodies, national regulators, and central banks have also come up with guiding principles and suggestions to improve the setting methodology, Governance Framework and oversight of financial benchmarks. The BIS formed a working group chaired by Hiroshi Nakaso, Chairman of its Markets Committee, comprising experts and senior officials from select central banks to review the role of reference interest rates from a central bank perspective, implications of reference rate choice, design and use for financial stability and the conduct of monetary policy. The report of the group was published in March 2013. The Report discusses concerns regarding the potential inaccuracy or manipulation of Benchmarks and identifies Benchmark-related policy issues. While mentioning that the choice of reference rate should be left to private sector participants, the Group opined that the official sector has to play a critical role in developing effective principles and governance framework for the reference rates. If the central banks’ assessment is that various market or regulatory impediments prevent the private sector participants from adopting reference rates which are economically appropriate for their jurisdictions, the authorities should take necessary steps to remove the impediments and encourage smooth transition. On the benchmark setting process, the Group recommended for promotion of sound benchmark setting processes based on increased use of transaction data in combination with appropriate use of expert judgment in a transparent way, where appropriate, and introduction of robust fallback procedures. The Group also recommended that the central banks should work cooperatively with concerned domestic regulators and authorities for strengthening governance framework of the reference rate setting and provide necessary guidance to the market participants for using the reference rates that are reliable and robust. The report has also emphasized the need for improving transparency by disclosing the transaction volume and price in public domain. 2.8. The ESMA-EBA (European Securities and Markets Authority-European Banking Authority) have jointly come out with Principles for benchmark setting processes in the European Union (EU) which was published in June 2013. The Principles seek to address the problems in the area of benchmarks in the period until a potential formal regulatory and supervisory framework for benchmarks has been put in place for the EU. Although the provisions are without binding legal effect, they provide benchmark users, benchmark administrators, benchmark calculation agents and publishers and firms involved in benchmark data submissions, a common framework to work together and provide a transition path towards potential future legal obligations. On the benchmark setting methodology, the Principles suggest that the calculation of a benchmark should be documented and subjected to regular scrutiny and controls to verify their reliability. The data used to construct a benchmark should be anchored in observable transactions, where appropriate. The administrators may rely on non-transactional data such as offers and bids and adjustments based on expert judgment for constructing a Benchmark subject to such data being used only as an adjunct or supplement to transactional data. The Principles provide for well-defined criteria and procedures for selection of members of the governance and compliance functions. The Principles suggest that benchmark should be transparently disclosed to the public with fair and open access to the rules governing its establishment and operation, calculation, and publication. The details of the methodology along with historical records should be placed in the public domain wherever possible, and if this is not possible due to contractual provisions, the relevant information such as weights and prices of components should be disclosed to the public before any change is undertaken in the composition of the Benchmark with sufficient notice period. 2.9. The International Organization of Securities Commissions (IOSCO) published its final report on Principles for Financial Benchmarks in July 2013. The Report prescribes 19 principles covering benchmark governance, quality of benchmark, quality of methodology, and accountability. The Report prescribes that the Benchmark Administrators should publicly disclose their compliance with the Principles within twelve months of the publication of this report, i.e. by July 2014. The Principles do not provide for a one-size-fits-all method of implementation, rather it provides flexibility for application of the Principles in proportion to the size and risks posed by each benchmark and/or administrator and the overall benchmark setting process. On the benchmark governance, the Principles call for the benchmark administrators to hold primary responsibility for all aspects of benchmark setting process and put in place credible and transparent governance, oversight and accountability procedures. On the quality of benchmark determination, the Principles recommend that a variety of data may be used appropriately to determine the benchmark subject to same satisfies the principles of data sufficiency. The benchmark construction should be based on prices, rates, indices or values supported by actual transactions in a well functioning market executed at arm’s length between buyers and sellers. However, the Principles do not preclude the use of executable bids or offers as long as these are available in a well functioning market consisting of genuine transactions carried out at arm’s length. The Principles also do not preclude the use of non-transactional data for indices where the nature of the index supports use of non-transactional data, e.g. certain volatility indices. The Principles call for formulation of guidelines on hierarchy of data inputs and use of expert judgment. Further, while ensuring data sufficiency and transparency of benchmark determinations, the administrator also has to periodically review the conditions in the underlying market interest in all its dimensions that the benchmark measures so as to determine any structural changes in the underlying market interest that might require changes to the design of the methodology. On the quality of methodology, the Principles support publication of the benchmark construction methodology and stipulate that the administrators should have clear policies in place to transit to a new benchmark in case a benchmark ceases to exist. Recognizing the vulnerabilities in the submission process, the Principles prescribe formulation of Submitter’s Code of Conduct outlining the systems and procedures to be followed in submissions. On accountability, the Principles recommends complaints procedures, independent external audit and maintenance of audit trails for verifying compliance with the quality standards prescribed in the IOSCO’s Principles and own policies. 2.10. The G-20 has assigned the Financial Stability Board (FSB) the responsibility to promote consistency in assessments of the financial benchmarks and to ensure that a coordinated approach is followed by the national/regional authorities in this mission. The G-20’s February 2013 Declaration reads as: “We also expect more progress on measures to improve the oversight and governance frameworks for financial benchmarks coordinated under the current FSB agenda this year, including the promotion of widespread adoption of principles and good practices and ask for reporting to our Leaders at the St Petersburg Summit.” 2.11. The FSB has established a high-level Official Sector Steering Group (OSSG)2 of regulators and central banks which is responsible for coordinating and maintaining the consistency of reviews of existing interest rate benchmarks and guiding the work of the Market Participants Group (MPG) which is tasked with studying the feasibility and viability of adopting additional reference rates and the potential transition issues involved therein. The FSB asked the OSSG to review the standards and principles used in sound benchmarks developed by various standard setting bodies and to recommend whether adoption or endorsement of a single consolidated set of principles for financial benchmarks would be desirable. Based on the recommendation of the OSSG, the FSB has endorsed the IOSCO Principles for Financial Benchmarks published in July 2013. The OSSG’s future work plan includes undertaking an assessment of the governance and processes relating to the most widely used interest rate benchmarks against IOSCO Principles and reporting the outcome of these assessments to the FSB by June 2014. The OSSG will also assess the feasibility and viability of the proposals to be made by the MPG with regard to alternative benchmark rates and the strategies for transition to the new benchmark rates. The MPG has been asked to submit its final report to the OSSG by mid-March 2014 and the OSSG in turn will provide its analysis and recommendations to the FSB by June 2014. 2.12. Several countries have adopted measures to reform the benchmark setting process in many major financial benchmarks. The UK Government accepted all the recommendations of Wheatley Review in October 2012 and started implementing them since then. The Hogg Tendering Advisory Committee was constituted by the Government to oversee the reform process and to recommend new set of institutions for the regulation and administration of activities related to LIBOR. For an interim period, the BBA was asked to continue to support the ongoing collection, calculation and dissemination of LIBOR rates. Since April 2, 2013, BBA LIBOR Limited is being authorised and regulated by the FCA as a specified benchmark administrator. The LIBOR became a regulated activity under FSMA (Financial Services and Markets Act 2000) from April 2, 20133. Under the new regulatory regime, the Administrators and Submitters are subject to the regulatory requirements to strengthen their Governance Framework and internal controls. The persons found guilty of LIBOR manipulation will be subject to criminal sanctions. 2.13. Pursuant to the Wheatley Committee’s recommendation for reducing the number of currencies and tenors for which LIBOR is published, the LIBOR on Danish Krone, Swedish Krona, Canadian Dollar, Australian Dollar and New Zealand Dollar have been phased out and the benchmark tenors have been reduced from 15 to seven. As a result, the LIBOR is currently available for five currencies and seven maturities in place of earlier system of 10 currencies and 15 maturities. In line with the recommendations set out in the Wheatley Review, the publication of BBA LIBOR individual panel banks’ daily submissions for USD, EUR, GBP, CHF and JPY, across all tenors, was embargoed for three months with effect from July 1 2013.4 The BBA LIBOR Ltd. has since published an interim Code of Conduct and Whistleblowing Policy. The Whistleblowing Policy5 for LIBOR is designed to provide guidance to all those who work with BBA Libor Ltd and/or are interested persons who intend to disclose concerns about perceived irregularities in conduct relating to the administration of LIBOR and/or LIBOR submissions in good faith and in reasonable belief that the information indicates malpractice and to raise those concerns in confidence and on an anonymous basis, without fear of victimisation or harassment. On July 9, 20136, the Hogg Committee announced that the BBA has accepted its recommendation that NYSE Euronext should be the new LIBOR administrator. The NYSE Euronext was subsequently acquired by the Intercontinental Exchange (ICE). The BBA LIBOR Ltd handed over the administration of LIBOR to ICE Benchmark Administration Ltd on February 01, 20147 after due approval of the FCA. 2.14. Based on the joint-review, the EBA and ESMA had observed several deficiencies in the determination of Euribor and recommended various reform measures8 in January 2013 to strengthen the Euribor setting process. The major recommendations included broadening Euribor Steering Committee, representation of panel banks in the Steering Committee to be kept to a minority, declaration of conflicts of interest to be made public, fixations to be limited to tenors with highest use and the illiquid tenors to be phased out, definition of the benchmark to be adjusted to provide more clarity, improvement in code of conduct especially to address conflicts of interest, benchmark to be subjected to internal and external audit and preservation of records of all submissions. In response, Euribor-EBF (European Banking Federation) has changed the composition of the Euribor Steering Committee by reducing the number of members from panel banks to minority and including members from other classes of stakeholders. It has notified the new Code of Conduct setting out the rights and obligations of Steering Committee, Conflicts of interest policy, accountability procedures, record keeping requirements, obligations of calculation agents and providing clarifications on the definition of Euribor. Effective from November 1, 2013, the number of Euribor maturities has been reduced from 15 tenors to eight tenors. 2.15. The European Commission (EC) proposed draft legislation in September 2013 to help restore confidence in the integrity of benchmarks9. The proposed regulation has four main objectives that aim to improve the framework under which benchmarks are provided, contributed to and used, viz. (i) improvement of the governance and control over the benchmark construction process and to ensure that conflicts of interest with the Administrator are avoided, or at least adequately managed, (ii) improvement of the quality of the input data and methodologies used for benchmark construction and to ensure that sufficient and accurate data is used in construction of benchmark rates, (iii) to ensure that benchmark submitters are subject to adequate controls so as to avoid conflicts of interest and that their contributions to benchmarks are subject to adequate controls. Wherever necessary, the concerned authority should have adequate power to mandate contributors to continue their contributions to the benchmark construction; and (iv) to provide adequate protection for consumers and investors who use the benchmarks by improving transparency of the benchmark, ensuring adequate rights of redress and ensuring that suitability is assessed where necessary. Central banks that are members of the European System of Central Banks are excluded from the scope as they already have systems in place that ensure compliance with the objectives of this draft regulation. 2.16. The Japanese Bankers Association (JBA) had appointed a Working Committee in April 2013 to suggest specific measures to enhance the credibility of the Tokyo Interbank Offered Rate (TIBOR)10. The interim report of the Committee was published in July 2013 and the final report was released in December 2013. Based on the recommendations of the Committee, the JBA had announced that it will form a new legal entity for TIBOR calculation and publication and establish a Code of Conduct to be followed by the reference banks which would be annually assessed for compliance. The Committee has also clarified the definition of TIBOR. The JBA has announced reduction in the number of tenors for the JPY TIBOR and Euroyen TIBOR from the existing 13 tenors to six tenors which will be effective from April 1, 2015.11. The JBA has also announced12 the "JBA TIBOR Code of Conduct” which will replace the current "JBA TIBOR Publication Rules". The Code of Conduct sets forth rules to be adhered to by the Submitters for ensuring compliance with the IOSCO’s Principles for Financial Benchmarks. 2.17. The Hong Kong Association of Banks (HKAB) commissioned the Treasury Markets Association (TMA) to conduct a review of Hong Kong Interbank Offered Rate (HIBOR) in July 201213. Based on the report submitted by the TMA in November 2012, the Hong Kong Monetary Authority (HKMA) had decided to review the composition of the panel once every year instead of every two years, phase out HIBOR fixings with less market demand and to transfer the administrator function of the HIBOR fixing process from HKAB to TMA. The HKMA had also announced several supervisory measures to be implemented forthwith for enhancing the robustness of the revised HIBOR fixing mechanism, viz. (i) HKMA will issue guidelines under Section 7 of the Banking Ordinance with regard to compliance to the Rate Submission Guidance and Code of Conduct to be developed by the TMA, (ii) The guidelines will make the in-charges of the treasury, risk management and compliance functions accountable for the concerned bank’s rate submission activities, (iii) HKMA will exercise powers under the Banking Ordinance to ensure that there is a sufficient number of reference banks participating in the HIBOR fixing process to enhance the representativeness of the benchmark rate, if voluntary basis of participation is not yielding the desired results. The HKMA has also advised the HKAB and TMA to form a joint working group for implementation of various HIBOR enhancement measures. Subsequently, the HKMA announced a statutory guideline on Code of Conduct for Benchmark Submitters.14 The Code lays down the systems of control that the reference banks of HIBOR have to put in place. It also provides comprehensive guidance on the rate corroboration process. The HKMA expects the reference banks to take steps to comply with the provisions of the Code so that full compliance to the Code can be achieved within six months from the notification date. The Code is intended to be of generic application to the Benchmark Submitters, although the application will be confined to reference banks of HIBOR currently. On June 7, 2013, the HKAB announced that it will cease to calculate and publish HIBOR for 7 different tenors with effect from April 01, 201415. 2.18. The Monetary Authority of Singapore (MAS), based on its review of the processes relating to banks’ benchmark submissions, has taken a range of supervisory actions against banks for deficiencies in the governance, risk management, internal controls, and surveillance systems relating to benchmark submissions. The MAS announced the proposed regulatory framework for financial benchmarks on June 14, 2013. The proposed regulatory framework has two key thrusts. First, the MAS will introduce specific criminal and civil sanctions under the Securities and Futures Act (SFA) for manipulation of any financial benchmark. This will cover all financial benchmarks including SGD SIBOR, SGD SOR, and FX Benchmarks. Second, the setting of key financial benchmarks will be subjected to regulatory oversight. The MAS will have the powers under the SFA to designate key benchmarks based on considerations such as the systemic importance of a benchmark and an assessment of its susceptibility to manipulation. The MAS has proposed to designate the SGD SIBOR, SGD SOR and FX Benchmarks as key benchmarks currently administered by the Association of Banks in Singapore (ABS). The MAS has also proposed to introduce a system of licensing for the submitters and administrator of key benchmarks and bring them under its regulation. Several ongoing requirements have been proposed for the Benchmark Administrators which include robust governance arrangements, identification and mitigation of actual/potential conflict of interest, development of Code of Conduct, surveillance of benchmark submissions, formation of oversight committee that would be responsible for overseeing the benchmark administration process, annual review of the Administrator’s adherence to its state policies and procedures by independent external auditors, storage of records for at least five years, putting in place policies and procedures for addressing transition issues, etc. Several ongoing requirements have also been proposed for the Benchmark Submitters which include compliance to the criteria set by the administrator, abiding by the code of conduct prescribed by the administrator, bringing the process of submissions under the scope of external audit, etc. It is also proposed that in case the number of Benchmark Submitters is lower than required quorum then MAS may compel entities to become Submitters to designated benchmarks. 2.19. The Association of Banks in Singapore (ABS) together with the Singapore Foreign Exchange Market Committee (SFEMC) has reviewed all the 11 benchmarks under its administration and has proposed several changes in their media release on June 14, 201316. They have proposed discontinuation of certain less liquid benchmarks, viz. THB SOR, IDR SOR, VND Spot FX, USD SIBOR, SGD IRS and certain maturities of SGD SOR and SGD SIBOR. It has proposed transition of certain surveyed benchmarks, importantly the SGD SOR and SGD Spot FX, to rates based on the volume weighted average price of the actual interbank transactions that are routed electronically and captured through approved brokers. They have proposed to retain the survey based method for SGD SIBOR with improved governance for submitters and the submission process. Since then, six benchmarks have been discontinued due to low usage and market demand. Further, four benchmarks, viz. USD/VND spot rate, SGD IRS rate, THB SOR rate and IDR SOR rate were discontinued after July 12, 2013 and in two other benchmarks, viz. SGD SIBOR and SGD SOR, certain tenors were discontinued. The MYR Spot FX was replaced by the onshore MYR spot FX rate after August 5, 2013 and USD SIBOR was replaced with USD LIBOR after December 31, 2013. ABS and SFEMC have also announced setting up of a new entity, ABS Benchmarks Administration Co. Pte Ltd, to carry out benchmark administration. 2.20. The Australian Financial Markets Association (AFMA) conducted a comprehensive review of the Australia’s Bank Bill Swap (BBSW) benchmark rate. Based on the review, the AFMA has announced its decision to transit the BBSW benchmark rate from the existing submission-based mechanism to a system that collects tradable bids and offers directly from multiple market venues. The AFMA now collects three samples of the prevailing bids and offers for all specified tenors from all approved venues (including brokers with electronic screens and electronic OTC venues) at 9:59 AM, 10:00 AM and 10:01 AM. The best bid/ offer from the range of bids/ offers collected from the approved venues are determined as the National Best Bid/ Offer for that sample. The midpoint of the average National Best Bid and the average National Best Offer for each tenor are published.17 2.21. he reform measures proposed by various national regulators, central banks and international standard setting bodies are being implemented across various jurisdictions with great sense of urgency. The key principles for reform of financial benchmarks that have been accepted across jurisdictions and discussed in the previous paragraphs may be summarised as under.

Chapter 3 3.1. As mentioned in Chapter 1, the Committee’s scope of study is restricted to the major18 Indian foreign exchange and Rupee interest rate benchmarks primarily used by the banking sector. The base rate and other proprietary rates of individual banks are not covered under Committee’s scope of study as these rates are institution specific and are not used in the financial market transactions involving banks/other financial intermediaries. The Indian foreign exchange and Rupee interest rate benchmarks are used by the banking sector mainly for two purposes, i.e. (i) pricing and settlement of foreign exchange and Rupee interest rate contracts, (ii) periodic valuation of various foreign exchange and Rupee interest rate related assets and liabilities. The major foreign exchange and interest rate benchmarks currently in use by the banking sector are listed below. A. Rupee Interest Rate Benchmarks

B. Foreign Exchange Benchmarks

Brief overview of the Benchmarks A. Rupee Interest Rate Benchmarks 3.2. FIMMDA-NSE MIBID-MIBOR

3.3. FIMMDA-Thomson Reuters MIFOR

3.4. Thomson Reuters Indian Benchmark Yield Curve (INBMK) The INBMK comprises fixings for the yields of the central government securities for 20 fixed tenors ranging from 3 month T-Bill to 30 year dated security. The benchmark rates are published by Thomson Reuters at 12:30 PM and 5:10 PM based on quotes collected through polling. The daily INBMK fixings are used for pricing and settlement of INBMK swaps. Banks and financial institutions are the participants in the INBMK swaps. As per the data reported to CCIL, there has been no trading in the INBMK swaps since September 26, 2012. The aggregate amount of outstanding interbank/PD notional principal remained at INR 233.9 billion as on October 31, 201321. 3.5. FIMMDA- Thomson Reuters MIOIS The MIOIS comprises fixings for OIS rates for 11 tenors ranging from 1-month to 10- year. Thomson Reuters publishes the benchmark rates at 5:10 PM based on polled quotes. The daily MIOIS fixings are used for pricing and settlement of MIOIS swaps. It is understood that some market participants use MIOIS fixings for valuation of outstanding OIS contracts. As per the data reported to CCIL, there has been no trading in the MIOIS since March 23, 2011. There is one interbank/PD contract referenced to MIOIS for INR 154 million outstanding as on October 31, 201322. 3.6. FIMMDA- Thomson Reuters MIOCS The MIOCS comprises fixings for MIFOR rates for five tenors ranging from 2 years to 10 years. Thomson Reuters publishes the benchmark rates at 5:10 PM based on polled quotes. It is understood that some banks use the fixings for valuation of their outstanding MIFOR contracts. As mentioned at para 3.3, the aggregate amount of outstanding interbank MIFOR swaps (notional principal) remained at INR 2,819.9 billion as on October 31, 2013. 3.7. FIMMDA-PDAI Government Securities (G-Sec) Yield Curve FIMMDA, PDAI G-Sec Yield Curve is published by FIMMDA after market hours on every working day. The benchmark curve is derived using the Cubic Spline methodology based on the secondary market transactions in the central government securities wherever they have met the pre-defined threshold volume and number of trade criteria. FIMMDA uses the Yield Curve to arrive at the day-end as well as month-end valuation prices for the outstanding central government securities. The month-end valuation prices are used by the banks for valuation of central government securities held in the ‘Held for Trading’ (HFT) and ‘Available for Sale’ (AFS) portfolios. The banks and PDs which undertake short sale transactions use the day-end valuation prices to mark-to-market their entire HFT portfolio, including the short positions. The Yield Curve is also used along with applicable spreads for valuation of SDLs and Corporate Bonds. The secondary market in the central government securities is moderately liquid with average daily trading volume of about INR 414.4 billion during the period from May to October 2013 as against the total outstanding dated securities of INR 33,316.3 billion as on October 31, 201323. The banks, insurance companies and primary dealers are the major players in the market. 3.8. FIMMDA-PDAI Spread for GOI Floating Rate Bonds (FRBs) The FIMMDA Spread for FRBs is used as mark-up over the benchmark T-Bill rate for arriving at the valuation prices of the FRBs which are published by FIMMDA every day after market closure as well as at the end of the month. FIMMDA computes the spread based on actual transaction data or the executable bids/offers subject to the same having met the threshold criteria. Otherwise, FIMMDA uses the spread arrived through polling to determine the applicable spread. The total outstanding amount of GOI FRBs stood at INR 393.5 billion as on October 31, 201324. 3.9. FIMMDA-PDAI Prices for State Development Loans (SDLs) FIMMDA publishes the day-end as well as month-end prices for valuation of SDLs. The last traded price in an SDL is taken as valuation price only if the total volume of trades in the SDL during the day is for INR 50 million and above. In the absence of required volume of trades, FIMMDA adds a spread of 25 basis points (bps) to the corresponding par yields to derive the valuation price for SDLs as per the guidelines issued by RBI in April 200025 based on the then prevailing spread of SDLs over the central government securities of corresponding maturities. The SDLs are very thinly traded in the secondary market with average daily trading volume of INR 6.18 billion during the period from May to October 2013 as against total outstanding amount of SDLs of INR 9,545.03 billion as on October 31, 201326. The banks, insurance companies and primary dealers are the major participants in the market. 3.10. FIMMDA-PDAI Prices for Corporate Bonds FIMMDA publishes the valuation prices for bonds issued by coporates, banks, PSUs and NBFCs based on actual trades subject to threshold. In the absence of required volume of trades, the spread matrix published by FIMMDA is used to arrive at the valuation prices of the bonds of different residual maturities by adding the spread corresponding to the rating and residual tenor of the bond to the yield of the Central Government securities of corresponding maturities. FIMMDA publishes the spread matrix at every month end for four different types of issuers, viz. Banks, PSUs and FIs, NBFCs and Corporates, covering both coupon bearing as well as zero coupon bonds for different tenors and different rating categories. The matrix covers ten rating categories from AAA to BBB-. The spread for 15 year tenor is used for all the bonds with residual maturity of 15 years and above. The corporate bond market in India had registered an average daily trading volume of INR 45.8 billion during the period from April to September 2013 with total outstanding issuances of INR 13,575 billion as on September 30, 201327. Banks, mutual funds, pension funds, and insurance companies are the major participants in the market. 3.11. FIMMDA-Thomson Reuters Treasury Bill (T-Bill) Curve FIMMDA T-Bill Curve is computed and published on every working day by Thomson Reuters based on the data sourced through polling of a panel of market participants. The Curve is used to arrive at valuation prices for outstanding T-Bills. However, the Banks generally do not use the T-Bill Curve as they are required to value the T-Bills at carrying cost. The total outstanding amount of T-Bills stood at INR 4,333.2 billion as on October 31, 201328. 3.12. FIMMDA-Thomson Reuters Commercial Paper (CP) Curve The CP Curve is computed and published on every working day by the Thomson Reuters based on the quotes collected through polling. The curve is used to arrive at the valuation prices of outstanding CPs. The banks generally do not use the benchmark Curve as they are required to value the CPs at carrying cost. The total outstanding amount of CP was at INR 1,574.5 billion as on October 31, 201329. The mutual funds and banks are the major investors in CPs. 3.13. Thomson Reuters Certificates of Deposit (CD) Curve The CD Curve is computed and published on every working day by the Thomson Reuters based on the quotes collected through polling. The curve is used to arrive at the valuation prices of outstanding CDs. The banks generally do not use the Curve as they are required to value the CDs at carrying cost. The total outstanding amount of CDs remained at INR 3,361.8 billion as on November 1, 201330. B. Foreign Exchange Benchmarks 3.14. RBI Reference rates RBI publishes Reference rates for USD/INR and EUR/INR at about 12:30 PM daily. The rates are arrived at based on the quotes polled during a randomly selected five minutes window between 11:45 AM and 12:15 PM from a set of banks selected randomly from a large panel of banks. RBI also publishes the rates for GBP/INR and JPY/INR by crossing the Reference rate for USD/INR with the middle rates of the ruling GBP/USD and USD/JPY exchange rates respectively. The RBI Reference Rates are used for settlement of exchange traded currency futures and options. The average daily trading volume of the USD-INR futures and options during the period from May to October 2013 remained at USD 4.08 billion and USD 1.43 billion respectively. The aggregate open interest in the above instruments stood at USD 1.01 billion and USD 0.32 billion, respectively, as on October 31, 201331. The Reference Rate is reportedly used by many corporates for determining transfer pricing. The foreign exchange transactions of GOI undertaken through RBI take place at the Reference Rate. The RBI’s foreign currency assets and liabilities are revalued at weekly and monthly intervals using the Reference Rate. The IMF also uses the rate for revaluation of SDRs. 3.15. FEDAI Spot Fixing Rates FEDAI publishes spot fixing rates for USD, GBP, EUR and JPY against INR at 11:40 AM - 12 noon on every working day based on quotes collected through polling. It is understood that the FEDAI spot fixings are used for cash settlement of exercise of OTC FCY-INR options primarily by some corporates. As per the data available with the OTC derivative trade repository at CCIL, the average daily interbank trading volume of OTC FCY-INR options remained at USD 97.85 million during the period from May to October 201332. 3.16. FEDAI FCNR (B) Benchmark Rates The interest rate ceilings in FCNR (B) deposits are prescribed in terms of certain spread over the LIBOR/Swap rates for the respective currencies and corresponding maturities as per RBI guidelines. The FEDAI publishes the LIBOR/SWAP rates for 13 currencies and for five tenors, i.e. 1-year, 2-year, 3-year, 4-year and 5-year at every month-end. The benchmark rates are used by banks for determination of periodic interest payable on FCNR (B) deposits. The total outstanding FCNR (B) deposits remained at USD 24.7 billion as on October 31, 2013.33 3.17. FEDAI Month end Revaluation Rate – Foreign Exchange Contracts FEDAI publishes revaluation rates for spot contracts (against INR) in 25 currencies and for forward contracts (against INR) upto 6 months in nine currencies and upto 12 months in four currencies. The banks use the FEDAI revaluation rates for marking to market the outstanding spot and forward contracts in their books. As per the data available with the OTC derivative trade repository at CCIL, USD 377.6 billion of FCY-INR interbank forward contracts are outstanding as on October 31, 201334. 3.18. FEDAI USD-INR option Volatility FEDAI publishes implied volatilities for USD/INR At-the-Money, 25 delta risk reversal and 25 delta butterfly options for 1-week, 1-month, 3- month, 6-month and 1-year tenors at 5 PM on every working day. The rates are arrived at based on the poll conducted by FEDAI among a panel of banks. The benchmark volatility rates are used as reference rates by banks and corporate. Banks use the benchmark volatility rates to compute delta of the option portfolio for calculating open position of the portfolio. Chapter 4 4.1. The Benchmark setting process involves four major activities, i.e. Administration, Submission (for the benchmarks determined through polling process), Calculation and Publication. The Benchmark Administration involves all the processes starting from design of benchmark to determination and dissemination of benchmark and periodic review of benchmark for bringing about necessary changes to ensure that the benchmarks appropriately reflect the underlying interest. While Submission refers to contribution of rate/price by the entities empanelled by the Benchmark Administrator, the Calculation refers to determination of the benchmark based on the inputs defined by the Benchmark Administrator and using the methodology provided/approved by the Benchmark Administrator. The Publication refers to appropriate dissemination of the benchmark rate/price. 4.2. The quality of a benchmark refers to the extent to which it reflects a credible market for an interest measured by that particular benchmark. The quality of a benchmark depends on design factors, sufficiency of data used to construct the benchmark, hierarchy of data inputs, transparency of benchmark determination, and periodic review to determine whether there is any significant change in the interest necessitating changes to the design of methodology. The setting methodology is the methodology used to determine the benchmark rate. The quality of methodology depends on the content of methodology, existence of transparent system to undertake changes in the methodology and internal controls over the data collection process. The Committee’s review of benchmark quality and setting methodology in respect of the Rupee interest rate benchmarks and foreign exchange benchmarks are detailed in the following paragraphs. A. Rupee Interest Rate Benchmarks 4.3. FIMMDA-NSE MIBOR 4.3.1. The benchmark is determined by NSE. FIMMDA has co-branded the benchmark. NSE polls quotes from a select panel of 30 banks/primary dealers. The poll is conducted between 9:40 AM – 9:45 AM for the overnight MIBOR (3 days on Fridays) and between 11:30 AM – 11:40 AM for the term MIBORs (14-day, 1-month and 3-month) on all the working days. The data collected is subjected to bootstrapping, a non-parametric technique which involves trimming of the outliers followed by generation of multiple data sets with a dynamically determined number of iterations and computation of mean and standard deviation for each of the multiple data sets. The mean corresponding to the lowest standard deviation is taken as the fixing rate for the day subject to availability of at least 14 quotes after trimming (not applied for the tenors where polled rates are less than 14). The trimming is carried out at four levels, i.e. 2, 4, 6 and 8 quotes are removed with half from the top and half from the bottom in terms of levels. The NSE has disclosed the methodology on its website. However, the methodology does not contain any contingency provision to determine the benchmark in absence of adequate number of polled submissions. 4.3.2. Issues and Recommendations i) FIMMDA has merely co-branded the benchmark and has not assumed the administrative roles. FIMMDA is the market representative body for the fixed income, money and derivatives markets and has been discharging several market development and self regulatory roles. FIMMDA is therefore better placed to assume the administrative roles for the interest rate benchmarks. The Committee recommends that FIMMDA may be designated as the administrator of MIBID-MIBOR. ii) The NDS-CALL platform operated by CCIL caters to the trading of Call, Notice and Term Money transactions. Although the Notice and Term Money trades are a few, the Call Money market has remained quite deep. The data published by CCIL shows more than 80 percent of the Call Money trades are executed on the NDS-CALL platform. The transparent execution and dissemination of the price and volume information of Call money transactions on NDS-CALL platform acts as an important safeguard against manipulation of polled submissions used for determination of overnight MIBID-MIBOR. iii) CCIL independently publishes overnight MIBID and MIBOR (named as CCIL MIBID-MIBOR) twice daily at 10 AM and 1 PM based on actual transactions and executable bids/offers available on the NDS-CALL platform. The highlights of the CCIL’s methodology are as follows:

iv) The Committee favours shifting the determination of the overnight MIBID and MIBOR (3-day on Fridays) from the current polling based method to the actual transaction based method. There are three options to move over to transaction based method. First option is to replace the NSE MIBID and MIBOR with the existing CCIL MIBID and MIBOR. The second option is to replace the NSE MIBID and MIBOR with modified CCIL MIBID and MIBOR wherein the traded bids and offers are only considered and the outstanding executable bids and offers are excluded. The third option is to move over to a single volume weighted average traded rate based on all the Call transactions (3-day transactions on Fridays) executed between 9 AM to 10 AM without segregating them into bids and offers. The first option may not be preferred as it considers outstanding bids and offers apart from the actual transactions and is fraught with the risk of the benchmark rate being influenced by off-market outstanding bids and offers despite CCIL’s pruning of outlier bids and offers. Between the second and third option, the latter is preferred as a trade reflects matching of bid and offer rates and hence, the single weighted average traded rate is the correct indicator of the prevailing market dynamics. As discussed in Chapter 2, some major benchmarks in different jurisdictions have shifted to actual traded rates or to the mid of bid and offer rates. The Wheatley Review of LIBOR at the Annex A has discussed the option of using the executed price of transactions or in absence of transactions, the mid-price of committed bids and offers. Although the option was found non-viable due to lack of sufficient transactions/quotes in the market, the Review has indicated that the option be explored in longer term as interbank term lending market revives. The Committee recommends that the existing NSE MIBID and MIBOR may be replaced by CCIL’s volume weighted average traded rate computed under the third option. The FIMMDA may decide appropriate timeline for implementing the recommendation in consultation with RBI and disclose the same in public domain. The study of transaction data sourced from CCIL for the period from May 1, 2013 to October 30, 2013 revealed that the first hour of trade in the Call money, i.e. 9am to 10am, contributed 55% and 61% of the day’s trades in terms of number of trades and trading volume respectively on a daily average basis. Since the first hour of trade is the most active hour of the day, the benchmark based on the trades during this hour would embed the best representative character of the market. The study also revealed that the average daily variation between the NSE MIBOR and the CCIL’s weighted average traded rate was at about 0.75 bps and that between NSE MIBID and the CCIL’s weighted average traded rate was about 5 bps. There have been no interbank/PD and client IRS transaction referenced to NSE MIBID reported to CCIL and RBI respectively so far and hence, no transition issue is involved in the NSE MIBID. In case of NSE MIBOR, the variation being quite minimal as mentioned above, may not pose any problem for transition. v) The CCIL may stop publishing the 1 PM fixing to avoid confusions for the end users. As such, the 1 PM fixing does not carry much relevance keeping in view the fact that major chunk of the call market transactions gets cleared during the morning hours. vi) FIMMDA may change the nomenclature of the benchmark keeping in view the change in the calculation agent as well as the nature of inputs to be used for calculation. However, such a change will require amendment to the ISDA agreements for the outstanding IRS contracts referenced to NSE MIBID/MIBOR. Keeping in view the international experience in this regard, it is suggested that all banks and PDs may be mandated to enter into a multilateral agreement which includes an amendment clause specifying transition to the new benchmark. The banks holding IRS contracts referenced to NSE MIBID/MIBOR entered into with their clients may execute bilateral amendment agreements with their clients. The loans and other credit products referenced to NSE MIBID/MIBOR may require bilateral agreement between the counterparties to change the reference benchmark rate to CCIL’s weighted average traded rate. FIMMDA may take necessary steps to facilitate smooth transition. FIMMDA may also educate corporates to agree to bilateral arrangements with banks by pointing out the consequences of not agreeing and the benefits of agreeing. vii) The FIMMDA and CCIL may disclose the details of the methodology used for determination of the benchmark and put in place appropriate contingency mechanism to construct the benchmark rates when the number and/or volume of trades fall below the specified threshold and the same may be disclosed in the public domain. viii) NSE publishes term MIBID and MIBOR for three tenors, viz. 14-day, 1-month and 3- month. It is observed from the IRS trade data reported to CCIL that there has been no trade referenced to the above benchmarks reported to CCIL since introduction of trade reporting in August 2007. The Rupee IRS market in India predominantly uses the overnight MIBOR. The term MIBORs, unlike term LIBORs used internationally, are generally not used as benchmark rates for pricing of loans, debt instruments and derivative products in India primarily on account of lack of credibility in the benchmark rates in absence of active underlying term money market. In the absence of any meaningful utility, the term MIBORs may have to be phased out. However, in the absence of a liquid term money market, the term MIBORs currently provide some idea about the market participants’ view on the term money rates. In view of their informational value, the Committee feels that daily fixation of the term MIBID and MIBOR may be continued. The 3-month MIBOR may be a potential candidate for being referenced in the Rupee IRS contracts in future when term money market develops. The term MIBID and MIBOR may continue to be determined through polling process. ix) In terms of synergy in the work process, it would be advisable to entrust the daily fixation of term MIBID-MIBOR to CCIL as it will handle fixation of overnight benchmark rate. FIMMDA, in consultation with CCIL, may formulate the polling method and timing so as to enhance the representative character of the term MIBID-MIBOR. Appropriate contingency provisions may also be put in place to construct the benchmarks in the absence of adequate submissions. The details of benchmark setting methodology and contingency provisions may be disclosed in the public domain. 4.4. FIMMDA-Thomson Reuters MIFOR 4.4.1. Thomson Reuters determines the benchmark based on polling. FIMMDA has co-branded the benchmark. Thomson Reuters polls the rolling USD/INR forward premium levels for 1-month, 2-month, 3-month, 6-month and 1-year from six banks between 12 noon to 12:10 PM on all the working days for the rates as of 12 noon. The rates submitted for each tenor are subjected to trimming by removing the highest and the lowest submissions. The remaining rates are averaged and the average rate for each tenor is converted into annualised forward premium levels. In the event when the contributions are less than five, no trimming is carried out. The benchmark is not to be calculated when less than three contributions are available. Thomson Reuters publishes the annualised forward premium levels around 1 PM after publication of RBI Reference Rate. The annualised forward premium levels and the LIBOR for respective tenors are used for arriving at the MIFOR rates by using the formulae: MIFOR = ((1+LIBOR * No of days/36000) * (1+USD/INR annualised forward premium in percentage* No of days/36500)-1) *36500/No of days. The Thomson Reuters has disclosed the methodology used to calculate the benchmark. 4.4.2. Issues and Recommendations:

4.5. THOMSON REUTERS INBMK 4.5.1. Thomson Reuters calculates and publishes the benchmark. FIMMDA has not co-branded the benchmark. Thomson Reuters calls a panel of 13 banks on random sequence at 11:55 AM and 4:40 PM on all the working days for government security levels for various tenors with specific security name assigned to each tenor. The highest and lowest submissions are removed and the remaining data are averaged. The government securities used for various tenors are revised based on market polls conducted at every month end. In the event of non-availability of quotes for a certain tenor, the interpolated rates are used. In case of fresh issuance of a security in a particular tenor, the new issue is considered as a replacement. In the event of a security assigned to a particular tenor turns out to be illiquid, another liquid security in that tenor is taken as replacement. The followings are the eligible criteria used for selection of a new benchmark security or rolling over the existing benchmark security:

The reference yields for 3-month and 6-month are computed on annualized basis, while that for tenors of 1-year and above are computed on semi-annualized basis. Thomson Reuters has disclosed the methodology used to calculate the benchmark. 4.5.2. Issues and Recommendations:

4.6. FIMMDA-THOMSON REUTERS MIOIS 4.6.1. Thomson Reuters determines the benchmark through polling and FIMMDA has co-branded the benchmark. The benchmark is published at 5:10 PM for 11 tenors ranging from 1-month to 10-year. Thomson Reuters polls a panel of eight contributors randomly from 4:40 PM onwards on all the working days.The highest and lowest submission are removed when the total number of contributions is more than five. In other cases, no trimming is carried out. The benchmark is not to be calculated when the number of contribution falls below three. The rates up to 1-year are computed on annualized basis, while that for tenors of 1-year and above are done on semi-annualized basis.The submissions are published after the benchmark rates are released. Thomson Reuters has disclosed the methodology used to calculate benchmark. 4.6.2. Issues and Recommendations

4.7. FIMMDA-THOMSON REUTERS MIOCS 4.7.1. The benchmark is published daily by FIMMDA for five tenors, viz. 2-year, 3-year, 5-year, 7-year and 10-year. Thomson Reuters determines the benchmark rates based on polling of the MIFOR swap rates from a panel of seven banks called on a random sequence from 4:40 PM onwards. In the event when the number of contributions is more than five, the highest and lowest contributions are removed. Otherwise, no trimming is carried out. The benchmark is not to be calculated when less than three contributions are received. 4.7.2. Issues and Recommendation

4.8. FIMMDA-PDAI G-Sec Yield Curve 4.8.1. FIMMDA calculates and administers the benchmark. FIMMDA uses the G-Sec yield curve to calculate prices of outstanding central government securities at the end of the day as well as at month-end. FIMMDA applies Cubic Spline methodology for smoothening of the yield curve. The steps followed for construction of the curve are mentioned below. (i) Nodal points for a month are identified at the beginning of the month based on the following criteria:

(ii) The curve is constructed daily using the following inputs and methods:

4.8.2. The methodology used to calculate the benchmark is documented and is publicly available on the website of FIMMDA. The Benchmark construction process follows a well laid-out hierarchy of data inputs covering the actual transactions and executable bids and offers in a particular security and traded yields of other securities of proximate maturities. 4.8.3. Issues and Recommendation