IST,

IST,

Minutes of the Monetary Policy Committee Meeting, April 6 to 8, 2022

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The thirty fourth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held from April 6 to 8, 2022. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Mridul K. Saggar, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (April 8, 2022) decided to:

The marginal standing facility (MSF) rate and the Bank Rate remain unchanged at 4.25 per cent. The standing deposit facility (SDF) rate, which will now be the floor of the LAF corridor, will be at 3.75 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below Assessment Global Economy 6. Since the MPC’s meeting in February 2022, the global economic and financial environment has worsened with the escalation of geopolitical conflict and accompanying sanctions. Commodity prices have shot up substantially across the board amidst heightened volatility, with adverse fallouts on net commodity importers. Financial markets have exhibited increased volatility. Crude oil prices jumped to 14-year high in early March; despite some correction, they remain volatile at elevated levels. Supply chain pressures, which were set to ease, are rising again. The broad-based jump in global commodity prices has exacerbated inflationary pressures across advanced economies (AEs) and emerging market economies (EMEs) alike causing a sharp revision in their inflation projections. The global composite purchasing managers’ index (PMI) eased to 52.7 in March from 53.5 in February with output growth slowing in both manufacturing and services sectors. World merchandise trade momentum has weakened. 7. Several central banks, especially systemic ones, continue to be on the path of normalisation and tightening of monetary policy stances. Resultantly, sovereign bond yields in major AEs have been hardening. Bullion prices had buoyed to near 2020 highs on safe haven flows, with some recent correction as bond yields rose. Global equity markets fell, although more recently they have recovered some ground. In recent weeks, strong capital outflows from the EMEs have moderated thus curbing the downward pressures on their currencies, even as the US dollar has strengthened. Overall, the global economy faces major headwinds from several fronts, including continuing uncertainty about the pandemic’s trajectory. Domestic Economy 8. The second advance estimates (SAE) for 2021-22 released by the National Statistical Office (NSO) on February 28, 2022 placed India’s real gross domestic product (GDP) growth at 8.9 per cent, 1.8 per cent above the pre-pandemic (2019-20) level. On the supply side, real gross value added (GVA) rose by 8.3 per cent in 2021-22, with its major components, including services, exceeding pre-pandemic levels. GDP growth in Q3:2021-22 decelerated to 5.4 per cent. 9. In Q4:2021-22, available high frequency indicators exhibit signs of recovery with the fast ebbing of the third wave but the picture is mixed. Urban demand reflected in domestic air traffic rebounded in March and the pace of contraction in passenger vehicle sales moderated in February. On the other hand, rural demand mirrored in two-wheeler and tractor sales contracted in February. Import of capital goods increased robustly in February, although domestic production continued to contract. Merchandise exports remained buoyant and clocked double-digit growth for the thirteenth successive month in March 2022 and reached US$ 417.8 billion in 2021-22 surpassing the target of US$ 400 billion. All categories of imports, however, have risen even faster, leading to merchandise trade deficit at a record annual level of US $ 192 billion in 2021-22 or 6.1 per cent of GDP. 10. On the supply side, foodgrains production touched a new record in 2021-22, with both kharif and rabi output crossing the final estimates for 2020-21 as well as the targets set for 2021-22. The manufacturing PMI remained in expansion zone in March, although it moderated somewhat to 54.0 from 54.9 in February. Services sector indicators – railway freight; e-way bills; GST collections; toll collections; fuel consumption; and electricity demand – were in expansion in February-March. The services PMI continued in expansion mode, inching up to 53.6 in March from 51.8 in the preceding month. 11. Headline CPI inflation edged up to 6.0 per cent in January 2022 and 6.1 per cent in February, breaching the upper tolerance threshold. Pick-up in food inflation contributed the most in headline inflation, with inflation of cereals, vegetables, spices and protein-based food items like eggs, meat and fish being the key drivers. Fuel inflation moderated on continuing deflation in electricity and steady LPG prices. Core inflation, i.e., CPI inflation excluding food and fuel remained elevated, though there was some moderation from 6.0 per cent in January to 5.8 per cent in February primarily due to the easing of inflation in transport and communication; pan, tobacco and intoxicants; recreation and amusement; and health. 12. Overall system liquidity remained in large surplus, with average daily absorption (through both the fixed and variable rate reverse repos) under the LAF at ₹7.5 lakh crore in March, marginally lower than ₹7.8 lakh crore in January-February 2022. Reserve money (adjusted for the first-round impact of the change in the cash reserve ratio) expanded by 10.9 per cent (y-o-y) on April 1, 2022. Money supply (M3) and bank credit by commercial banks rose (y-o-y) by 8.7 per cent and 9.6 per cent, respectively, as on March 25, 2022. India’s foreign exchange reserves increased by US$ 30.3 billion to US$ 607.3 billion in 2021-22. Outlook 13. Looking ahead, the inflation trajectory will depend critically upon the evolving geopolitical situation and its impact on global commodity prices and logistics. On food prices, domestic prices of cereals have registered increases in sympathy with international prices, though record foodgrains production and buffer stock levels should prevent a major flare up in domestic prices. Elevated global price pressures in key food items such as edible oils, and in animal and poultry feed due to global supply shortages impart high uncertainty to the food price outlook, warranting continuous monitoring. 14. In this scenario, pro-active supply management is critical to contain inflation. International crude oil prices remain volatile and elevated, with considerable uncertainties surrounding global supplies. With the broad-based surge in prices of key industrial inputs and global supply chain disruptions, input cost push pressures appear likely to persist for longer than expected earlier. Their pass-through to retail prices, though limited till now given the continuing slack in the economy, needs to be monitored carefully. Manufacturing sector firms polled in the Reserve Bank’s industrial outlook survey expect higher input and output price pressures going forward. Taking into account these factors and on the assumption of a normal monsoon in 2022 and average crude oil price (Indian basket) of US$ 100 per barrel, inflation is now projected at 5.7 per cent in 2022-23, with Q1 at 6.3 per cent; Q2 at 5.8 per cent; Q3 at 5.4 per cent; and Q4 at 5.1 per cent (Chart 1). 15. Going forward, good prospects of rabi output augur well for rural demand. With the ebbing of the third wave and expanding vaccination coverage, the pick-up in contact-intensive services and urban demand is expected to be sustained. The government’s thrust on capital expenditure coupled with initiatives such as the production linked incentive (PLI) scheme should bolster private investment activity, amidst improving capacity utilisation, deleveraged corporate balance sheets, higher offtake of bank credit and congenial financial conditions. At the same time, the escalation of the geopolitical situation and the accompanying surge in international crude oil and other commodity prices, tightening of global financial conditions, persistence of supply-side disruptions and significantly weaker external demand pose downside risks to the outlook. The future course of the pandemic and the uncertainties about the pace of monetary policy normalisation in major advanced economies also weigh on the outlook. Taking all these factors into consideration, the real GDP growth for 2022-23 is now projected at 7.2 per cent, with Q1 at 16.2 per cent; Q2 at 6.2 per cent; Q3 at 4.1 per cent; and Q4 at 4.0 per cent, with risks broadly balanced (Chart 2).   16. The MPC is of the view that since the February meeting, the ratcheting up of geopolitical tensions, generalised hardening of global commodity prices, the likelihood of prolonged supply chain disruptions, dislocations in trade and capital flows, divergent monetary policy responses and volatility in global financial markets are imparting sizeable upside risks to the inflation trajectory and downside risks to domestic growth. 17. Given the evolving risks and uncertainties, the MPC has decided to keep the policy repo rate unchanged at 4 per cent. The MPC also decided to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 18. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate at 4.0 per cent. 19. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das unanimously voted to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 20. The minutes of the MPC’s meeting will be published on April 22, 2022. 21. The next meeting of the MPC is scheduled during June 6-8, 2022. Voting on the Resolution to keep the policy repo rate unchanged at 4.0 per cent

Statement by Dr. Shashanka Bhide 22. At the beginning of February 2022, a number of indicators reflected an environment of sustained overall growth for the economy. The economic impact of the rise in Omicron variant of the coronavirus appeared limited. However, there were also concerns relating to the global economic outlook with the rise in Covid cases, supply chain disruptions and rising inflation pressures. For India, with a strong growth in agricultural output in FY 2021-22, going forward, adequate policy support for investment and consumer spending was expected to strengthen the growth momentum. The scenario, however, has been reshaped by the Russia-Ukraine war, the economic fallout of which has affected the overall global growth and price conditions sharply. 23. The prolonged duration and scale of destruction in the conflict and the wide ranging economic sanctions by the Western countries on Russia that followed the beginning of the conflict have had global implications. The supply chain disruptions aggravated an already stressed global supply system on account of the Covid pandemic and led prices of a number of commodities in the international markets to rise sharply and turn volatile. Energy prices and prices of some of the food commodities in particular have increased sharply compared to February. Crude oil prices rose by about 30 per cent in the international markets in February-March 2022. Prices of edible oils and wheat also increased sharply during the period. 24. Even before the Russia-Ukraine war, the monetary policy response to the rising inflationary pressures in the advanced countries had begun with the increase in policy rates and measures to tighten the easy liquidity conditions created to manage the adverse impact of the Covid pandemic. The monetary policy tightening in the advanced countries is expected to continue in order to bring down the inflation rates, but it would also have a significant impact on trade and investment flows for the developing world. 25. Given the three successive large negative shocks to growth and employment during the Covid pandemic conditions, the MPC has chosen to maintain conditions favourable to revival of growth on a sustained basis while maintaining inflation rate within the tolerance limits of the target. The sustained recovery seen in the growth conditions in Q3:2021-22 was nevertheless incomplete. On the positive side, there were indications of moderating pattern of inflation rate in 2022-23 on the basis of the ongoing recovery, assumption of a normal monsoon and moderation on international commodity price pressures. The sharp changes in the broader global economic environment that have now unfolded require a reconsideration of the economic outlook and the policy responses. 26. As the shocks to the price conditions are essentially on the supply side, emanating from external sector, unless the potential of the reviving domestic demand conditions to sustain higher prices is reduced, inflation pressures would rise further. While finding alternative international supply sources for imports and markets for exports is necessary, domestic inflationary pressures will not be relieved effectively unless the external supply constraints in the form of restrictions on movement of goods and finances are removed. Global coordination in easing these constraints would have major benefits in minimising the adverse effects of supply disruptions. Limiting the spill over from the rising energy and food prices in the international markets to the domestic markets would also reduce pressures on the external and fiscal imbalances. 27. The Second Advance Estimates of GDP released by the National Statistics Organisation at the end of February 2022 reflect the substantial gap in output growth needed to restore the high growth momentum after the setbacks in the last two years. While the YOY basis real GDP growth of 8.9 per cent in FY 2022 represents a rebound from its contraction by 6.6 per cent in FY 2021, the incomplete nature of the growth recovery is reflected in the growth rates of its components, especially when compared to the pre-pandemic scenario. In comparison to FY 2020, real GDP increased marginally by 1.8 per cent, the private final consumption expenditure increased by 1.2 per cent, gross fixed capital formation by 2.6 per cent. Exports and imports increased by 9.9 and 11.9 per cent in FY 2022 over FY 2020. In terms of value added, the divergence in performance is reflected in the growth rates of 0.4 per cent in the case of Services and 9.8 per cent in manufacturing. Real GDP in Q3:FY 2022 increased by 5.4 per cent over the same period in the previous year. 28. The available data on a wide range of indicators of output and demand conditions for January and February point to an on-going recovery. Year on year growth in GST collection has maintained its strong growth and Non-food Bank Credit has maintained its higher pace of YOY growth since December 2021. Exports for the year have exceeded the record target for $400 billion set by the government. RBI’s survey of Order Books, Inventories and Capacity utilisation in companies conducted in January-March 2022, reveals increase in capacity utilisation rate in the manufacturing sector in Q3:2021-22, moving closer to its long-term average. PMI for manufacturing in March 2022 shows a drop by 0.9 point from February, while PMI for services increased by 1.8 points, both remaining in expansion zone. RBI’s enterprise surveys [Industry Outlook (IOS) and Services and Infrastructure Outlook (SIOS)] conducted during January-March 2022 indicate that the firms are less optimistic about overall business conditions. This may reflect the conditions relating to the abating impact of the Omicron variant on the positive and the apprehensions about the fallout of the Russia-Ukraine war on the negative side of the business environment. The consumption expenditure indicators show a mixed picture. RBI’s Consumer Confidence Survey conducted in the early part of March 2022 indicates that as compared to the findings of the same survey in January 2022, a significantly larger proportion of respondents report higher spending than a year back but this increase is mostly driven by ‘essential spending’. The proportion of respondents reporting reduction in ‘non-essential spending’ has, however, declined. The IIP for consumer durables and non-durables in January 2022 is below the level seen in 2019-20 in the same period. 29. What has changed clearly for the consumers and producers in March 2022 is the price rise for fuels and some food items in what appears to be a first round impact with the full pass through of the rise in the international prices yet to be complete. The input cost pressures are reported in the RBI’s enterprise surveys, particularly in the services and infrastructure. 30. The uncertainty on the evolution of both growth and inflation in next 3-4 quarters has increased considerably. The prolonged war and its fall out may have accentuated the adverse impact of monetary policy tightening that has begun in several countries, especially on the growth front. The Covid related growth disruptions in China also have adverse impact on global demand. 31. The upturn of CPI inflation rate in February 2022 at 6.1 per cent is the second successive monthly reading at or above 6 per cent. Among the major sub-categories of the headline inflation, ‘fuel & light’ and ‘miscellaneous’ registered rates of increase above 6 per cent in both these months, with the fuel & light at 9.0 per cent and Miscellaneous at 6.5 per cent, YOY average for January-February 2022. Although ‘Food & beverages category’ registered an increase of 5.8 per cent, Oils & Fats registered an increase of 17.6 per cent and within Miscellaneous, CPI inflation for Household Goods & Services, Health, Transport & Communications, Recreation & Amusement sub-categories exceeded 6 per cent for the two-month period. The global supply chain disruptions since late-February as a result of Russia-Ukraine war and their impact on energy and food commodity prices on domestic prices have now added to more generalised cost push pressures. 32. Consequent to the above changes in growth and inflation scenarios, the projected GDP and CPI inflation rates for FY 2023 are as follows: GDP growth rates (YOY%) - Q1: 16.2, Q2: 6.2, Q3: 4.1 and Q4: 4.0 with the financial year projection at 7.2 per cent. CPI inflation rates (YOY%): Q1: 6.3, Q2: 5.8, Q3: 5.4 and Q4: 5.1 with the financial year average of 5.7 per cent. The revised projections reflect the impact of both supply disruptions and moderating demand conditions leading to lower GDP growth and higher inflation rate. RBI’s Survey of Professional Forecasters (SPF) carried out during March 2022 provide a median GDP growth forecast of 7.5 per cent and inflation forecast of 5.5 per cent for FY 2023. The SPF assessment has also shown downward revision in GDP growth and upward revision in inflation forecasts for FY 2023. 33. The present situation reflects improving conditions with respect to managing the Covid threat, with the scaled-up vaccinations and an understanding of measures to control any further outbreak of infections. However, improved demand conditions in the face of fresh global supply constraints may lead to increased inflation affecting the growth recovery itself. Response to the evolving price conditions and broad-based policy measures to effectively bring down inflationary pressures without disrupting the favourable environment for sustaining growth are now needed. 34. Accordingly, I vote to keep the policy repo rate at 4.0 per cent. 35. I also vote to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Statement by Dr. Ashima Goyal 36. The Ukraine war has lasted more than a month, uncertainties continue, oil prices are volatile, supply disruptions will raise inflation but also reduce demand; the continued high impact of Covid-19 in major countries will have similar effects. 37. The typical household response to inflationary supply shocks is to decrease consumption. Moreover, falling wage share will also decrease their demand. 38. Although household inflation expectations remain high, they have risen only marginally in the last two months, despite the rise in international oil prices—this points to the salience of domestic oil prices, of government action that affects these prices and of RBI guidance for households. Expectations fell when the government cut fuel excise in November 2021. The absence of any rise in dispersion points to some anchoring. One-year-ahead business inflation expectations, however, recently crossed 6%. 39. Capacity utilisation, especially in some sectors and for large firms has reached pre-Covid-19 levels; unemployment shows signs of falling. The non-oil non-gold current account is also in deficit, although the rising share of financial savings should reduce the need for foreign savings. Credit growth is higher and the PMI continues to be in the expansionary zone. But Q3 shows some softening—the recovery is still not strong. Firms facing low demand have limited their pass through yet profit margins have remained largely constant due to falling wage share and interest costs—firms still have scope to absorb rise in costs. Second round effects have yet to set in. Cost-push is still coming from primary but multiple supply shocks. 40. Covid-19 is waning in India. Current trends suggest there is more physical as well as economic immunity. Signals are mixed, yet clearly crisis level of stimulus is no longer required. 41. As pressures on oil prices persist, pump prices began rising steeply in end March. RBI consumer headline inflation estimate for the year is raised to 5.7 per cent, which implies the real rate has fallen further and is now too negative. 42. With some recovery and high commodity prices it will not be necessary to cut repo rates further. Future policy will either pause or raise rates. Rebalancing of liquidity started in 2021, and has now reached a level, with new facilities to absorb liquidity, that is compatible with raising policy rates. Short rates are set to rise to make the repo rate the operational policy rate again. 43. Research as well as Indian experience in the 2000s shows an early and gradual rise works better. Rebalancing of liquidity began early. It is time now to withdraw crisis time accommodation in terms of moving towards the equilibrium or neutral real rates consistent with non-inflationary growth. As long as rates remain below this, it is still not a tightening regime. When rates are below neutral because of excess crisis related accommodation, the initial rise only takes them towards neutral. 44. Exit should be balanced avoiding the over-stimulus after the global financial crisis and the consequent over-tightening in the 2010s. A rate rise that responds to excess demand, as well as to persistent inflation, so that the real rate adjusts smoothly and does not deviate too far from equilibrium will best be able to anchor inflation expectations yet sustain the growth recovery while minimising market volatility and output sacrifice. 45. Supply-side action has a major role in anchoring inflation expectations in order to sustain consumer confidence and the recovery. In April 2019 domestic petrol prices exceeded international prices by ₹40 per litre. The gap widened in the Covid-19 years as international prices fell but domestic taxes were not reduced. These were an essential revenue-source then as other sources had collapsed with activity. In February 2022 the gap was back to ₹40 as international prices had risen. The difference now is that direct and indirect taxes are buoyant, 30 to 40% higher than their levels in 2019. There is room to cut fuel taxes to mitigate the pass through of international prices to consumers. Excise duty could go back to 2019 levels that were high enough to limit oil consumption, even as other efforts to substitute towards renewable sources continue. 46. The extent of nominal rate and borrowing cost rise required will depend on supply-side action. Even under rising rates, fiscal stress will reduce over time as long as real rates are kept smoothly below growth rates helping lower deficit and debt ratios over time. Outflows under US Fed tightening give more room for supporting government borrowing consistent with the required growth in reserve money. Such support is the most effective in moderating rise in long-term nominal rates in Indian conditions1. There is room for spreads to fall since the historical spread between the repo and the 10-year G-sec was only 60 basis points. 47. Excess inflows are accumulated as reserves. Therefore, excess outflows or a temporary balance of payments deficit requires some of these reserves to be used to moderate excess rupee volatility. Limiting rupee depreciation will also reduce inflation and the oil bill. When inflation expectations are well-anchored terms of trade shocks can be looked through but it is better to avoid adding such shocks at a time of other multiple supply shocks. The real exchange rate is at competitive levels since exports are doing well. Moreover, Indian structural reform has reduced the cost of doing business and this time Indian inflation is less than international. 48. Both fiscal and monetary policy must use the space available to smooth international shocks, while taking unavoidable hits. In the last decade emerging markets as a group grew more slowly because such shocks had persistent effects. Costs of adjusting to the global financial crisis were passed on to them. Countries that have reformed suitably and built buffers may be able to protect themselves better this time. 49. In view of these considerations I vote to keep the repo rate unchanged and to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Exit of accommodation is proceeding but its pace awaits future developments. Statement by Prof. Jayanth R. Varma 50. The geopolitical situation has worsened considerably since the February meeting, and consequently inflation projections have risen sharply. However, I would like to point out that the hostilities in Europe have imparted an adverse shock not only to inflation, but also to growth. While the inflation shock is more clearly and immediately visible, the growth shock cannot be ignored. There is at least anecdotal evidence that businesses are becoming reluctant to pass on input cost increases to the customers because of concerns about demand compression. 51. I refrain from discussing whether, on balance, the changed situation warrants immediate action on the policy rate for the simple reason that the forward guidance given in the last meeting effectively precludes such action. It is important to maintain the credibility of monetary policy communications, and deviation from prior forward guidance should be made only under truly exceptional circumstances. In this backdrop, maintaining the policy rate at the current level is the only sensible choice, and I therefore vote to keep the policy repo rate at 4.0 per cent. 52. I have been arguing for the normalization of the policy corridor for several months now, and I welcome this action which forms part of the MPC statement. 53. Coming to the “stance”, I think it is wholly appropriate that this word has been dropped from the resolution. In the extremely uncertain situation that prevails today, it is very important for the MPC not to issue any forward guidance that would tie its hands. It is necessary to communicate clearly that in future meetings, the MPC would consider itself completely free to take any action on the policy rates that may be warranted by the data that becomes available in the coming weeks. With inflation projected to breach the upper tolerance limit for several months, it is imperative for the MPC to communicate its resolve to ensure that inflation remains within the target going forward. It is also necessary to prepare the markets for the withdrawal of the post pandemic monetary accommodation. I therefore vote to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Statement by Dr. Mridul K. Saggar 54. The world is changing in many important ways. The anticipated global and domestic macroeconomic trajectories that were shaping will get reset in slope and intercept. In my statement in February, I had stated that “the current geopolitical stress in Europe is a significant risk and if it translates into oil and gas prices spiking, we will need to adjust macro-economic policies suitably”. The contingent risk has materialised calling for policy shifts. We are witnessing an entrenched conflict. While it remains unclear how long it may last, it looks that even on its de-escalation, the supply chain disruption and elevated prices of energy, agro-products and minerals and metals may last for at least a year. With some ratchet, it will leave permanent effects on price levels, making it necessary for the monetary policy to deal with its second-round effects so that inflation is not elevated as a multi-year phenomenon. The War will also have significant detrimental effects on growth. In my statement in December last, I had cautioned on the building global stagflationary impulses. The Ukraine shock will further slow the global recovery, risks of a global recession are still small and predicated on war spreading over to the rest of the continent or beyond, thus remaining a tail risk event. 55. To add to the shock, the Fed kept tryst with the lift off in mid-March and indicated a quantitative tightening (balance sheet reduction) starting May. The baseline looks like the Fed will consciously entail a significant growth sacrifice and go ahead with aggressive rate hikes in the rest of the year in a bid to tame high inflation. However, global inflation is here to stay for the rest of the year at least. Against their 2% inflation targets, CPI inflation in the U.S., euro area and UK inflation are set to cross 8% in near term, which is four times their targets. Notwithstanding the difficulties in measuring potential output amid extreme shocks, wide array of measures suggests that the output gaps in the U.S. and the U.K. economies have not just closed but turned positive, though due to shallow cyclical recovery and the war retrenchment the same cannot be said of the euro area. So, the advanced economies face a big inflation gap and a closed output gap, thus justifying aggressive tightening based on the central bank reaction functions. Even in many emerging markets, inflation is ruling at multi-year highs. In contrast, inflation in India is not yet in inertial motion. Nevertheless, considering that we face elevated inflation that is projected, on an average, to be 1.7 percentage point above target and a likely closed output gap in my assessment later this year, it is important to take measured policy actions. 56. Let me now cover the growth and inflation assessment and the trade offs involved. The level of GDP in 2021-22 crossed the pre-pandemic 2019-20 level not just in aggregate but in all components of aggregate demand. In terms of quarterly GDP, it has stayed above corresponding pre-pandemic quarter of 2019 since Q2 of 2021-22 and in Q3 it had exceeded pre-pandemic levels for all components. On the supply-side, the GVA data shows that in 2021-22 the output of all sectors, except the ‘trade, transport, communication and broadcasting services’ had surpassed the 2019-20 level. In terms of quarterly data, output had exceeded pre-pandemic level in aggregate since Q2 of 2021-22 and in Q4 is likely to do so for all sectors, including ‘trade, transport, communication and broadcasting services’. High frequency indicators have shown distinct month-on-month improvements since December 2021. By February 2022, almost all indicators have moved above pre-pandemic levels, except a few, mainly automobile related, where activity has relapsed due to semi-conductor shortages. So, it is safe to assume that output has recovered now, though the improvements from hereon may remain moderate given the expected growth deceleration on account of war. 57. On inflation, it has breached the upper tolerance level and is expected to remain so in Q1 of 2022-23. There are upside risks that cannot be ignored. Global crude oil prices have been highly volatile of late and can move in either direction from here. The uncertainty on this account has large ramifications for projection of any macroeconomic variable. If the war ends and global recovery sustains, oil prices can move up again later this year once the effects of release of strategic reserves wane in 6 months. Gas prices can rise further if Russia cuts supplies to Europe or Europe implements plans to reduce dependence on Russian gas. However, energy prices can fall from here if war ends soon and no sanctions are levied by EU in this sector. The current upsurge in energy prices is masking the potential impact of the likes of EV hummers that portend a trend shift downwards in oil prices over the medium-term. Also, if oil prices persist at current high levels, it can trigger ramping up of tight oil. The expected easing of food prices even if monsoon is normal, runs the risk from elevated input costs, especially of fertilisers and diesel that can result in jacking up of floor that is set by minimum support prices (MSPs). Global food prices have already gone up substantially and supply shortages may persist for more than a year as sowing in war torn Ukraine will be impacted. More importantly, in my assessment, core inflation is expected to stay above 6% through 2022-23 as the price shock from the war in Ukraine will be transmitted through mineral and metals as soaring coal prices and Palladium group and other metal shortages seep through to retail levels. They will also bring down growth and the resultant demand destruction may put some lid on surging commodity prices. 58. The global shock can have large spillovers to India through multiple channels. First, accentuated supply chain disruptions will result in longer episode of cost-push inflation. Second, this will erode purchasing power and slow down the economy. Third, the CAD will rise, especially if negative real rates persist and impact domestic savings. The median rate on fresh rupee term deposits has a negative carry of about 2% in real terms. Fourth, while fiscal policies have scope to limit the pass-through of imported inflation, it will need to be balanced off in a manner that twin deficits remain sustainable. Fifth, the interest rates and exchange rates can have profound effects on growth and inflation through contesting channels, in which the capital flow channel could be the most important. Even as these risks amplify, India has strong buffers to withstand these shocks. There aren’t too many fissures and once markets quickly price the shifts, the dynamics could turn favourable again. 59. So, what are the policy options in this backdrop? As the slowdown and inflationary impulses have hit us with monetary policy already being very accommodative, there is not enough room to pump prime growth. If output levels fall again, the negative output gap may help soften high inflation as the pass-through to retail levels may remain contained. However, lack of contestability and collusive behaviours have been seen in the past and the price rises can follow to protect margins. It is important to keep a sense of scarring and fall in potential output as large scarring will also mean an early closing of output gap causing inflationary pressures to accentuate. Recovering to pre-pandemic trend should not guide monetary policy at this stage and policy should focus on non-inflationary sustainable growth in the economy. A close watch on inflation expectations is necessary. If expectations are rising, especially if they turn unhinged and start rising faster than even actual inflation, monetary policy would have to reign in expectations to prevent a self-sustained inflationary spiral. Headline inflation has stayed elevated for long and has tested our tolerance. Even though the current high inflation is not primarily a monetary phenomenon it is critical to ensure that economic agents place the use of flexibility in the context of extra-ordinary circumstances that were prevailing and do not perceive an implicit upward drift in inflation target. Such a slip can affect inflation expectations. The best way to support growth on a durable basis is to have a strong commitment to low and stable inflation. I wish to sign off with this note. 60. Considering the emergence of a different growth-inflation trade-off, it is best to start withdrawing monetary accommodation through liquidity and rate actions that can begin with raising the floor and normalising the corridor. The policy will still stay accommodative as rates, even after lifting nominal rates, will stay below real neutral rate for foreseeable future. Monetary policy is not a rocket science, but the timing of the launch of the rocket is nevertheless important as monetary policy transmits to its final goals with long and variable lags. With a flatter Phillips curve, tackling inflation becomes that much harder as it may call for larger output sacrifice. So, a deft policy-mix is needed. We have varied tools and with right cross fertilisation of these tools it should be possible to bring back inflation closer to the target later without much growth sacrifice and without a very high terminal rate. It is important to note that the labour markets in India are yet to heat up and this is reflected in muted wage and house price pressures, below trend labour force participation rate and flattish unemployment levels. 61. Considering the above, I vote for leaving policy rate unchanged and for staying accommodative, while focusing on withdrawal of accommodation as indicated in the resolution. Statement by Dr. Michael Debabrata Patra 62. In a world in which deglobalisation seems imminent, one thing has become globalised and that is the alarm about inflation. With 60 per cent of developed countries facing inflation above 5 per cent – unheard of since the 1980s – and more than half of developing countries experiencing inflation above 7 per cent, the climb in prices is testing societal tolerance levels. 63. The view that increasingly occupies centre-stage is that irrespective of whether supply bottlenecks are the driver or pent-up demand, it will become more difficult to tame inflation the longer the fight is delayed. To quote an influential view, it will make central banks unpopular, but they have been there before. The rationale underlying this point of view is that whether the jump in oil and other commodity prices will be short-lived or not is not known; but if these prices ignite and levitate the prices of other goods and services sympathetically, the fear will gain ground amongst the public that inflation is going to stay high for a while, and this can end up becoming a self-fulfilling prophecy. Hence financial markets race ahead of central banks in foretelling what they should do, by how much and by when. 64. Supply disruptions, soaring commodity prices and ensuing financial market turbulence no more tell about fears of the shape of future inflation – the worst fears are already materialising. Instead they darken the outlook for growth. Macroeconomic conditions are the toughest for developing countries, with acute shortages of even essentials showing up alongside spiralling prices. On the one hand, the cost of foreign currency debt for EMEs is rising and on the other, they are forced to drain currency reserves in order to shore up exchange rates. Higher commodity prices could also complicate the situation for governments that have been striving to mitigate the impact of the pandemic by offering food and energy subsidies to households. 65. The key question is: will it be a goldilocks moment? Will central banks deliver the perfect disinflation, the so-called soft landing? Or will they overshoot the runway and precipitate an unwanted recession on a world weary with pandemic woes, war and worn and torn supply chains? In fact, the view gaining ground is that inflation is at heights that have shattered glass ceilings and the only way to excoriate it is to force a recession - the so called hard landing. The dilemma is even sharper for central banks with dual mandates – will their remits allow them to kill the economy for price stability? 66. Geopolitical risks appear overwhelming at this juncture and over the foreseeable near-term. The RBI has been preparing for tail risks in either direction. First, out of the pandemic-related liquidity overhang, an amount of ₹2.94 lakh crore has been withdrawn from the system with the lapse of measures/repayments on due dates. Second, open market sales and forex operations during the year have withdrawn liquidity of the order of ₹2.3 lakh crore. Third, market-based auctions with a menu of maturities have been conducted with a view to get market participants attuned to the alignment of money market rates with normal liquidity management procedures. 67. The RBI is in the process of completing the migration to a fully fledged liquidity management framework that is perfectly symmetrical – standing facilities at the upper and lower bounds with the policy rate at the centre; access on all days of the week, throughout the year; and restoration of the corridor to its pre-pandemic width and operation. During the course of 2022-23 and up to April 2023, all pandemic-related extraordinary measures will cease. 68. These actions empower the RBI at a moment of reckoning. If, as the projections show, inflation persists in high reaches, the drainage of liquidity already achieved and planned for the year ahead will reduce risks of excess liquidity fanning inflationary pressures and posing threats to financial stability. It will also facilitate the transmission of policy impulses across market segments and the interest rate structure. If, on the other hand, risk sentiment improves globally and India receives large volumes of capital flows, the standing deposit facility expands the capability of the RBI to undertake full and seamless sterilisation without running out of instruments. This will help to keep monetary expansion consistent with the outlook on inflation and growth. 69. Accordingly, I vote for status quo on the policy rate. I also vote for the stance as formulated in the MPC’s resolution. Statement by Shri Shaktikanta Das 70. The Monetary Policy Committee (MPC) meets at a time when tectonic shifts in geopolitical environment are materially affecting the global and domestic outlook on both inflation and growth. Just as the global economy seemed to be on the cusp of returning to normalcy from the pandemic, the war in Europe and subsequent sanctions have further clouded the outlook. The war-induced price spikes in food, oil, gas, fertiliser and several key industrial inputs, together with continued supply chain bottlenecks, are posing major upside risks to inflation which has already scaled multi-decadal highs in several countries. At the same time, the war poses major downside risks to global growth in the wake of trade restrictions, sanctions, elevated uncertainties and the flare up in the prices of food and energy. Global financial markets are on tenterhooks reacting to the toxic mix of supply and demand shocks and the varying pace of monetary policy normalisation in advanced countries. Most emerging market economies are caught in the vortex of risk-off sentiments marked by capital outflows and rising bond yields. To say that the world is going through extremely volatile times would be an understatement. 71. These developments are likely to have significant long-term implications for the global economy caused by supply chain reconfigurations, trade and technology fragmentation, and defence and energy security considerations. Emerging market economies find themselves in a much more difficult situation as their economic recovery from the pandemic remains incomplete even as inflation continues its ascent. Central banks in these economies face the difficult trade-off between containing inflation and nurturing growth. The situation is particularly challenging for net oil importing countries like India. 72. The domestic inflation outlook presented in the February 2022 MPC meeting has undergone a significant upward shift since the start of the war on February 24, 2022, with the escalation of conflict and subsequent turmoil in global commodity markets. The increase in crude oil price and its direct and indirect effects on CPI contributed to around 60 per cent of the upward revision in projections with the other major contributor being the spillovers coming from the global food price shocks on wheat, edible oil and feed cost pressures impacting on poultry, milk and dairy product prices. In the current scenario, continuation and further deepening of supply side measures would alleviate food price pressures and also mitigate cost-push pressures across manufacturing and services. 73. Emerging from the Omicron wave, India’s economic recovery remains on track, although there are weak spots – private consumption and investment are still subdued and contact-based services, although catching up, are yet to recover fully. There is also a risk that the ongoing recovery, which is already strained by the current crisis, may get undermined if there is rapid tightening of financial conditions. In these circumstances, policy making has to be nuanced and nimble. 74. Consistent with the strategy of focusing on withdrawal of accommodation, the Reserve Bank intends to gradually withdraw surplus liquidity over a multi-year period, keeping in mind the evolving macroeconomic and financial developments and the stance of monetary policy, while maintaining adequate liquidity to meet the productive requirements of the economy. Signalling this intent, the Liquidity Adjustment Facility (LAF) corridor is being normalised to a width of 50 bps that was prevailing before the pandemic. The liquidity rebalancing operations of the RBI have prepared the market for this normalisation of the LAF corridor. 75. The current geopolitical situation has led to an upward revision of our inflation projections for 2022-23. The estimates now point to inflation remaining above the upper tolerance band in the near-term even as growth projections have undergone downward revisions. These are indicative of the sheer magnitude of the adverse exogenous supply and price shocks. While the risks to domestic growth call for continued accommodative monetary policy, inflationary pressures necessitate monetary policy action. The circumstances warrant prioritising inflation and anchoring of inflation expectations in the sequence of objectives to safeguard macroeconomic and financial stability, while being mindful of the ongoing growth recovery. There is also a need to avoid undue disruptions in the financial markets. Given this delicate balance between inflation and growth, I vote for retaining the repo rate at 4.0 per cent and maintaining the accommodative stance while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. The situation is dynamic and fast changing, and we should constantly re-assess the situation and tailor our actions accordingly. (Yogesh Dayal) Press Release: 2022-2023/103 1 See Goyal, A. 2019. ‘Government Securities Market: Price Discovery, Monetary Management and Government Borrowing’, Economic and Political Weekly, 54(13): 44-58. 30 March. Available at https://www.epw.in/journal/2019/13/money-banking-and-finance/government-securities-market.html |

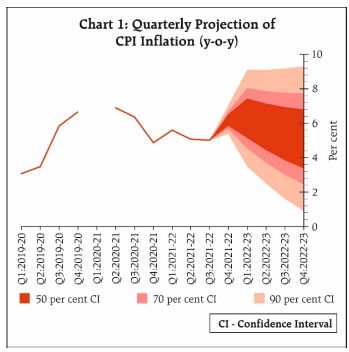

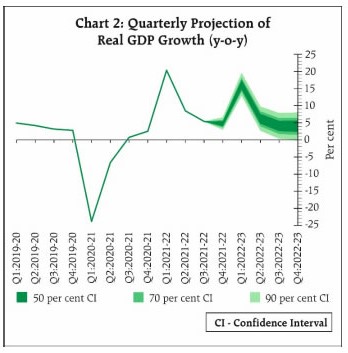

صفحے پر آخری اپ ڈیٹ: