IST,

IST,

Minutes of the Monetary Policy Committee Meeting, February 8 to 10, 2022

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The thirty third meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held from February 8 to 10, 2022. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Mridul K. Saggar, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (February 10, 2022) decided to:

The reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

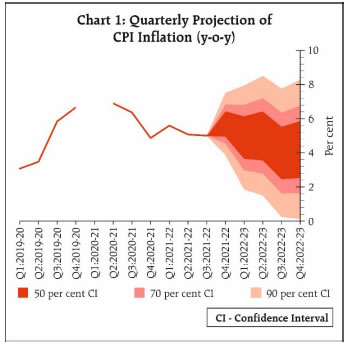

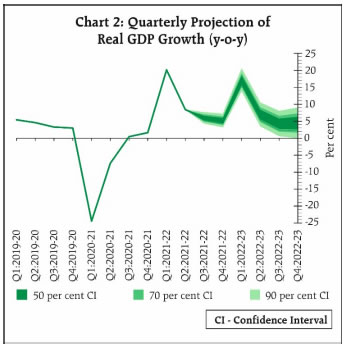

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Since the MPC’s meeting in December 2021, the rapid spread of the highly transmissible Omicron variant and the associated restrictions have dampened global economic activity. The global composite purchasing managers’ index (PMI) slipped to an 18 month low of 51.4 in January 2022, with weakness in both services and manufacturing. World merchandise trade continues to grow. There are, however, headwinds emanating from persistent container and labour shortages, and elevated freight rates. In its January 2022 update of the World Economic Outlook, the International Monetary Fund (IMF) revised global output and trade growth projections for 2022 downward to 4.4 per cent and 6.0 per cent from its earlier forecasts of 4.9 per cent and 6.7 per cent, respectively. 7. After reversing the transient correction that had occurred towards end-November, commodity prices resumed hardening and accentuated inflationary pressures. With several central banks focused on policy normalisation, including ending asset purchases and earlier than expected hikes in policy rates, financial markets have turned volatile. Sovereign bond yields firmed up across maturities and equity markets entered correction territory. Currency markets in emerging market economies (EMEs) have exhibited two-way movements in recent weeks, driven by strong capital outflows from equities with elevated uncertainty on the pace and quantum of US rate hikes. The latter also led to an increasing and volatile movement in US bond yields. Domestic Economy 8. The first advance estimates (FAE) of national income released by the National Statistical Office (NSO) on January 7, 2022 placed India’s real gross domestic product (GDP) growth at 9.2 per cent for 2021-22, surpassing its pre-pandemic (2019-20) level. All major components of GDP exceeded their 2019-20 levels, barring private consumption. In its January 31 release, the NSO revised real GDP growth for 2020-21 to (-) 6.6 per cent from the provisional estimates of (-) 7.3 per cent. 9. Available high frequency indicators suggest some weakening of demand in January 2022 reflecting the drag on contact-intensive services from the fast spread of the Omicron variant in the country. Rural demand indicators – two-wheeler and tractor sales – contracted in December-January. Area sown under Rabi up to February 4, 2022 was higher by 1.5 per cent over the previous year. Amongst the urban demand indicators, consumer durables and passenger vehicle sales contracted in November-December on account of supply constraints while domestic air traffic weakened in January under the impact of Omicron. Investment activity displayed a mixed picture – while import of capital goods increased in December, production of capital goods declined on a year-on-year (y-o-y) basis in November. Merchandise exports remained buoyant for the eleventh successive month in January 2022; non-oil non-gold imports also continued to expand on the back of domestic demand. 10. The manufacturing PMI stayed in expansion zone in January at 54.0, though it moderated from 55.5 in the preceding month. Among services sector indicators, railway freight traffic, e-way bills, and toll collections posted y-o-y growth in December-January; petroleum consumption registered muted growth and port traffic declined. While finished steel consumption contracted y-o-y in January, cement production grew in double digits in December. PMI services continued to exhibit expansion at 51.5 in January 2022, though the pace weakened from 55.5 in December. 11. Headline CPI inflation edged up to 5.6 per cent y-o-y in December from 4.9 per cent in November due to large adverse base effects. The food group registered a significant decline in prices in December, primarily on account of vegetables, meat and fish, edible oils and fruits, but sharp adverse base effects from vegetables prices resulted in a rise in y-o-y inflation. Fuel inflation eased in December but remained in double digits. Core inflation or CPI inflation excluding food and fuel stayed elevated, though there was some moderation from 6.2 per cent in November to 6.0 per cent in December, driven by transportation and communication, health, housing and recreation and amusement. 12. Overall system liquidity continued to be in large surplus, although average absorption (through both the fixed and variable rate reverse repos) under the LAF declined from ₹8.6 lakh crore during October-November 2021 to ₹7.6 lakh crore in January 2022. Reserve money (adjusted for the first-round impact of the change in the cash reserve ratio) expanded by 8.4 per cent (y-o-y) on February 4, 2022. Money supply (M3) and bank credit by commercial banks rose (y-o-y) by 8.4 per cent and 8.2 per cent, respectively, as on January 28, 2022. India’s foreign exchange reserves increased by US$ 55 billion in 2021-22 (up to February 4, 2022) to US$ 632 billion. Outlook 13. Since the December 2021 MPC meeting, CPI inflation has moved along the expected trajectory. Going forward, vegetables prices are expected to ease further on fresh winter crop arrivals. The softening in pulses and edible oil prices is likely to continue in response to strong supply-side interventions by the Government and increase in domestic production. Prospects of a good Rabi harvest add to the optimism on the food price front. Adverse base effect, however, is likely to prevent a substantial easing of food inflation in January. The outlook for crude oil prices is rendered uncertain by geopolitical developments even as supply conditions are expected to turn more favourable during 2022. While cost-push pressures on core inflation may continue in the near term, the Reserve Bank surveys point to some softening in the pace of increase in selling prices by the manufacturing and services firms going forward, reflecting subdued pass-through. On balance, the inflation projection for 2021-22 is retained at 5.3 per cent, with Q4 at 5.7 per cent. On the assumption of a normal monsoon in 2022, CPI inflation for 2022-23 is projected at 4.5 per cent with Q1:2022-23 at 4.9 per cent; Q2 at 5.0 per cent; Q3 at 4.0 per cent; and Q4:2022-23 at 4.2 per cent, with risks broadly balanced (Chart 1). 14. Recovery in domestic economic activity is yet to be broad-based, as private consumption and contact-intensive services remain below pre-pandemic levels. Going forward, the outlook for the Rabi crop bodes well for agriculture and rural demand. The impact of the ongoing third wave of the pandemic on the recovery is likely to be limited relative to the earlier waves, improving the outlook for contact-intensive services and urban demand. The announcements in the Union Budget 2022-23 on boosting public infrastructure through enhanced capital expenditure are expected to augment growth and crowd in private investment through large multiplier effects. The pick-up in non-food bank credit, supportive monetary and liquidity conditions, sustained buoyancy in merchandise exports, improving capacity utilisation and stable business outlook augur well for aggregate demand. Global financial market volatility, elevated international commodity prices, especially crude oil, and continuing global supply-side disruptions pose downside risks to the outlook. Taking all these factors into consideration, the real GDP growth for 2022-23 is projected at 7.8 per cent with Q1:2022-23 at 17.2 per cent; Q2 at 7.0 per cent; Q3 at 4.3 per cent; and Q4:2022-23 at 4.5 per cent (Chart 2).   15. The MPC notes that inflation is likely to moderate in H1:2022-23 and move closer to the target rate thereafter, providing room to remain accommodative. Timely and apposite supply side measures from the Government have substantially helped contain inflationary pressures. The potential pick up of input costs is a contingent risk, especially if international crude oil prices remain elevated. The pace of the domestic recovery is catching up with pre-pandemic trends, but private consumption is still lagging. COVID-19 continues to impart some uncertainty to the future outlook. Measures announced in the Union Budget 2022-23 should boost aggregate demand. The global macroeconomic environment is, however, characterised by deceleration in global demand in 2022, with increasing headwinds from financial market volatility induced by monetary policy normalisation in the systemic advanced economies (AEs) and inflationary pressures from persisting supply chain disruptions. Accordingly, the MPC judges that the ongoing domestic recovery is still incomplete and needs continued policy support. It is in this context that the MPC has decided to keep the policy repo rate unchanged at 4 per cent and to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 16. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 4.0 per cent. 17. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das, except Prof. Jayanth R. Varma, voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 18. The minutes of the MPC’s meeting will be published on February 24, 2022. 19. The next meeting of the MPC is scheduled during April 6-8, 2022.

Statement by Dr. Shashanka Bhide 20. The First Advance Estimates (FAE) released by NSO place the GDP growth in 2021-22 at 9.2 per cent over the previous year, lower than the projected 9.5 per cent in the December MPC statement. However, the First Revised Estimates (FRE) for 2020-21 released subsequent to the FAE point to slightly higher level of GDP than the Provisional Estimates used for calculating the FAE for 2021-22 implying lower projected growth rate for 2021-22. Overall, GDP in 2021-22 is likely to exceed the level achieved in 2019-20 by less than 2 per cent highlighting the need for accelerating the pace of economic recovery. 21. The FAE for 2021-22 show that the private consumption expenditure, the largest component of GDP, is yet to reach the pre-pandemic 2019-20 level. Two other components - government final consumption expenditure and gross fixed capital formation in 2021-22 are projected to exceed the 2019-20 levels. Exports and imports of goods and services are projected to rise in 2021-22 above their 2019-20 levels. 22. Even as the pace of growth appeared to be on track at the end of November, with the Covid situation again turning uncertain, policy measures have become crucial to sustain the growth momentum. The dominant impact of the latest state of the pandemic, directly or indirectly, has emerged from the global scenario. The direct impact is the significant caseload across countries and the restrictions on economic activities to contain the disease spread. The indirect impact follows as the spill overs of the initial impact through the supply chains, inflation and monetary policy tightening to contain inflation are realised. The YOY rate of growth of the world economy in 2022 is now projected by IMF in its January 2022 update of the World Economic Outlook at 4.4 per cent, compared to 4.9 per cent in October 2021. Going forward, growth is projected at 3.8 per cent in 2023. Globally, inflationary pressures from fuel and food are expected to abate during 2022-23. The January 2022 update by IMF also projects the World trade volume - goods and services - to grow in 2022 at a lower rate than the previous October 2021 projections. The projections also recognise the downside risks to growth related to the spread of Covid. 23. The global economic environment is also affected by the continued geopolitical risks that may in turn affect trade, prices and capital flows. 24. The domestic economy has shown strong recovery from the impact of the second wave of the pandemic in Q1: 2021-22. The growth recovery, however, has been incomplete so far, particularly with respect to private consumption expenditure. RBI’s bi-monthly Consumer Confidence Survey conducted in the major urban areas across the country in January, reflects continued weakness in consumer sentiments compared to the survey in November 2021. Majority of the respondents report increased spending now compared to a year back, with ‘essential expenditure’ driving the increase and ‘discretionary expenditure’ remaining weak. The pattern is the same for expectations of one-year-ahead situation. Although slightly higher proportion of respondents now find improvement in the prevailing general economic conditions compared to a year back, majority find that the situation has worsened. The one year ahead assessment by the respondents reflects decline in positive ratings, probably due to the impact of rise in the infections from the Omicron variant during December 2021. Perceptions of the prevailing employment and income conditions also reflect weak sentiments. The mixed picture on consumer spending is also reflected in the pattern of Index of Industrial Production (IIP). The IIP for consumer durables is yet to rise above the 2019-20 levels in a significant way. The IIP for consumer nondurables has just reached 2019-20 level. Overall, boost to the consumption spending would require sustained improvement in employment and income conditions. 25. The Gross Fixed Capital Formation is projected to increase by 17.4 per cent in 2021-22 (FAE) over the previous year. The significant increase is over a decline of 10.4 per cent in the previous year highlighting again the need for sustaining this momentum. The latest estimates of IIP for Capital Goods for October and November in 2021 are lower than the levels in 2020 for the same months. The Business Expectations Survey conducted by NCAER in December 2021 (https://www.ncaer.org/data_details.php?dID=21), reports improvement in Business Confidence in Q3 2021 over the previous quarter, although pace of improvement slowed and the index based on responses in the last week of the survey was lower than the first three weeks of December drawing attention to the impact of rising Omicron cases. RBI’s latest Industrial Outlook Survey shows decline in the Business Expectations Index for Q4: 2021-22 from Q3: 2021-22 after its steady increase since Q2: 2020-21 even as it indicates expansion. Capital goods imports, one of the key indicators of investment conditions, has increased consistently above the 2019-20 levels during September-December 2021. To sustain the positive trends in investment demand, improvement in the overall demand conditions would be crucial. The proposed increase in capital expenditure in the Union Government Budget for 2022-23 will be one of the positive drivers for investment spending, besides continuation of the buoyant export growth seen in 2021-22. 26. While the current wave of Covid infections has affected consumer and business sentiments, there are also indicators that suggest underlying positive growth trends. GST collection has registered double digit growth in December 2021 and January 2022, although at a much slower pace than in October-November 2021. Non-food bank credit expanded by 9.3 per cent in December 2021, year on year basis and by 8.1 per cent as on January 14, 2022. These are the highest rates of growth in the last 12 months. The PMI for manufacturing and services, while declining from the levels of previous month, remain in expansion zone for the month of January 2022. 27. The growth momentum of domestic economy is expected to pick up as the impact of the current wave of the pandemic subsides. The vaccinations and continued adherence to Covid protocols to prevent any further spread of the virus are essential for achieving sustained growth in employment and household income. 28. Based on the assumption of a normal monsoon, and the present trends in the key indicators of economic activity, GDP growth for 2022-23 is placed at 7.8 per cent, YOY basis. The quarterly growth trajectory is projected as Q1:2022-23 at 17.2 per cent; Q2 at 7.0 per cent; Q3 at 4.3 per cent; and Q4:2022-23 at 4.5 per cent, YOY basis. The Survey of Professional Forecasters, conducted by RBI in January 2022 provides a median GDP forecast of 7.7 per cent for 2022-23. Applying the forecast of 7.8 per cent on 2021-22 FAE value for GDP, implies an increase of 9.6 per cent over the Second Revised Estimates for 2019-20 or an average annual growth of 3.2 per cent for the three years ending 2022-23. This highlights the need for supportive policies for achieving a sustained higher growth momentum. 29. The CPI headline inflation rate for the first three quarters of 2021-22 has come at 5.6, 5.1 and 5.0 per cent YOY basis. The non-Food and non-Fuel Core CPI inflation rate for the same periods has been at 6.0, 5.8 and 6.0 per cent. The CPI core measure, which includes the prices of petrol and diesel as well as the prices of transportation services, captures the cost of retail selling prices of petrol and diesel as well as its cost passed on in the prices of the other products in the consumption basket. The double-digit growth of prices in the petroleum products, therefore, is one of the key drivers of the Core inflation as well. Going forward, the trajectories of food and petroleum product prices would impact the prices of the other sectors, besides the other sector-specific factors. The Inflation Expectations Survey of Households conducted by the RBI in the first two weeks of January 22 shows a decline in the median of expected inflation rate on three months ahead and one-year ahead horizons. Perceptions of current inflation rate also declined. Although the perceived inflation rates are high compared to the actuals, changes in these perceived rates point to expectations of moderation in inflation rate. Taking into account the present trends, and the favourable impact of the Rabi crop conditions, the inflation projection for 2021-22 is retained at 5.3 per cent. The projected inflation rate for Q4 is at 5.7 per cent, the same as in the December 2021 projections. The median forecast of CPI inflation rate in the Survey of Professional Forecasters for Q4: 2021-22 is 5.8 per cent. With a normal monsoon and easing of supply conditions with the decline of the Covid infections, the headline CPI inflation for 2022-23 has been projected at 4.5 per cent by the RBI. The quarterly estimates are Q1 at 4.9 per cent; Q2 at 5.0 per cent; Q3 at 4.0 per cent; and Q4 at 4.2 per cent. There are indeed factors that may change this scenario, particularly the impact of geopolitical tensions affecting international commodity prices and trade, and the impact of macroeconomic policies of the advanced economies. 30. To strengthen the positive growth trends in the economy, the need for favourable monetary and financial conditions has remained a critical condition. Pickup in momentum of consumption and investment expenditure would require access to financial resources to both consumers and firms. The inflation rates are projected to moderate and stay below the upper level of the tolerance band of the inflation target at this juncture. With these factors in view, I vote in favour of keeping the policy repo rate unchanged at 4.0 per cent. I also vote in favour of continuing with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Statement by Dr. Ashima Goyal 31. To arrive at a voting decision I take up issues of global risks facing the economy, factors determining its expected inflation path and growth recovery, as well as the type and the impact of guidance. 32. Global risks include high oil prices, rising inflation and interest rates in major countries and possible volatility in foreign capital outflows. 33. Indian headline CPI inflation, however, is expected to soften after Q4. Oil prices are high currently but are volatile and unlikely to stay at current levels, lowering WPI, which will also ease as adverse base effects fade. The dominance of food price inflation in second round inflation in India makes CPI inflation affect WPI inflation more than the reverse, although normally it is producer prices that are expected to affect consumer prices1. Therefore, high WPI need not raise CPI. Household inflation expectations have also moderated. 34. Moreover, the food items dominating headline CPI are more amenable to government action. The government is taking active measures to lower domestic commodity inflation, apart from longer term supply-side measures such as reducing logistics and other costs of doing business. Monetary-fiscal coordination on this is excellent. 35. Spillover to CPI from high inflation in advanced economies (AEs) is unlikely since the structure of consumption is very different—imported consumer goods are 12.1% of the Indian consumption basket but 37% for US. Inflation propagation mechanisms such as high wage growth and labour shortages in AEs are not at work here, firms’ pass through of input costs shows moderation yet their profit margins are constant. A combination of cost restructuring and better scale economies may account for this. Container costs have been declining since October. 36. That M3 and credit growth has remained in single digits since the pandemic struck, despite surplus durable liquidity, indicates that aggregate demand is low. In an IT regime the liquidity adjustment facility makes money supply endogenous2, any excess durable liquidity is absorbed in the remunerated reverse repo. Money growth reflects the current state of demand rather than creating demand. 37. Although the third wave of the pandemic seems to have passed with less economic cost, consumption continues at below pre-pandemic levels pointing to loss of income and demand. A future corona variant remains a possibility although we seem to have learnt to handle it better. 38. The budget has reduced deficits only marginally but improved the composition of government spending, which will lower future inflation. Expenditure commitments have been reasonably met, but the proposed rise in capex will take some time to stimulate demand further, even though some construction activities create jobs with little delay. 39. Export growth is high and is expected to continue despite some softening of world growth, but since imports exceed exports, largely because of commodity imports, net contribution of trade to domestic demand is negative. 40. Another indicator of low demand is high unemployment. Many have lost jobs in the pandemic. Inflation targeting theory tells us that output sacrifice is required to reduce inflation when it is caused by supply shocks and the sacrifice can be very high if supply is elastic as in India. It would not be wise to create even more unemployment in order to reduce inflation, especially when inflation itself is expected to reduce towards the target. Despite continuing uncertainty there are signs of credit growth and investment picking up in some sectors. This needs to be supported in order to sustainably reverse the decade long slowdown in private investment. 41. It follows it is necessary for the MPC to continue to stimulate demand at present. But not as much as earlier, because some recovery has taken place compared to last year. Since one year ahead expected inflation is at 4 per cent and the weighted reverse repo is near 4 per cent, the real policy rate has risen from negative to near zero. 42. Markets, however, have priced in steeply rising policy rates and spreads have risen. This seems to be an over-reaction to the expected rise in Fed rates and of government borrowing requirements. It could also be due to equating Indian inflation incorrectly with US inflation. The Fed has yet to start normalization although inflation has exceeded their target for some time now. But Indian policy started rebalancing excess durable liquidity from early 2021 with the re-introduction of the VRRRs and the reversal of the CRR cut while communicating that ample liquidity will be ensured and conditions remain supportive. Gradual adjustment already undertaken, together with the expected inflation path, implies a sharp rise in Indian policy rates is unlikely to be required. In uncertain times policy is more data driven but the reaction function should be well understood. 43. The interest differential with the US is large. Their real rates remain highly negative. Since interest sensitive foreign flows are still a small percentage of Indian markets, potential outflows are a minuscule portion of India’s large foreign exchange reserves. Sustained equity outflows are unlikely in view of India’s growth potential. Moreover, some outflows will give more space to support government borrowing without raising durable liquidity. In any case room has been created to rebalance any rise or fall in liquidity, as required, with existing instruments in the LAF. 44. The current account deficit remains manageable and the overall balance of payments in surplus with a rising share of foreign direct investment. In 2013 and 2018 following Fed tightening had upset Indian growth and other macros. This time there is space to align policy to the needs of the domestic cycle. 45. In view of expected trends in inflation and growth and in order to moderate market over-reaction, I vote to continue with the current stance and repo rate. Statement by Prof. Jayanth R. Varma 46. As the third Covid-19 wave peters out in India, the time has come to think of the objectives of monetary policy in much broader terms than “mitigate the impact of COVID-19 on the economy”. Of course, a fourth wave cannot be ruled out, but the third wave has shown that the economy is no longer hostage to the pandemic, and in fact, as we meet, geopolitical tensions have become a bigger risk to the global economy than the virus. 47. Monetary policy acts with lags, and it is important to set policy looking at the expected state of the economy 3-4 quarters from now and not in terms of where it is today. The RBI projections presented in the fan charts (Chart 2) show growth running out of steam after an initial burst of decent growth in the first couple of quarters. In other words, the pre-pandemic situation of an economy growing below potential is expected to re-assert itself. According to Chart 1, inflation is expected to drop close to the 4% target towards the end of 2022-23. Going by these projections, it appears to me that while real interest rates need to be remain low, they do need to become mildly positive during 2022-23. The projections also suggest that though a significant part of the normalization of real interest rates would happen through the expected decline in inflation, there would be a need for a modest rise in nominal interest rates. 48. The fan charts also reveal a very large range of uncertainty on both inflation and growth. Robust growth coupled with sticky inflation could necessitate larger rises in nominal rates, while weak growth accompanied by benign inflation could open up the space for a more accommodative monetary policy. With risks appearing to be balanced on both sides, the policy stance needs to be neutral. 49. I find it instructive to compare the situation today (February 2022) with that at the last pre-pandemic MPC meeting (February 2020) in terms of projections three quarters ahead (Q3 of 2022-23 and Q3 of 2020-21 respectively). Compared to then, (i) three-quarter ahead growth expectations are about 2% lower, (ii) three-quarter ahead inflation expectations are about 1% higher, and (iii) the real policy rate (based on three-quarter ahead inflation expectations) is now about 2% lower. This comparison also suggests a neutral policy stance. 50. Taking all this into account, I vote in favour of maintaining the policy rate at 4% while voting against the policy stance on two counts. First, a switch to neutral stance is now long overdue. Second, the continued harping on combating the ill effect of the pandemic has become counter productive and deflects the focus of the MPC away from the core issue of addressing the recessionary trends that go back at least to 2019. 51. I have in the past expressed my reservations about the abnormal width of the policy corridor, but with all money market rates having moved close to the upper end of the corridor, the persistence with a low reverse repo rate has now become a somewhat harmless fetishism, and I will therefore not dwell on it. Statement by Dr. Mridul K. Saggar 52. The contours of shifting macroeconomic conditions, visible since October 2021, have got elevated further since we last met in early December. Let me dwell into these shifts and their implications. 53. First, the global interest rate cycle is decidedly changing. The benchmark 10-year JGB yield is at its highest since 2015, while the 10-year German bunds yields have moved into positive terrain in February crossing early 2019 levels with spreads widening in the euro area periphery. The US treasury yields have surged above pre-pandemic levels. On current indications, the Fed is on path to complete taper and start lift off by March and quantitative tightening a few months later. Markets have moved to expecting five rate hikes by the Fed, two by ECB and three more by BoE this year in addition to the two already effected over last two months. CPI inflation for December 2021 in the US came at 7% (highest since June 1982) and the PCE inflation at 5.8% (highest since July 1982). Headline inflation for the euro area as per flash estimates for January 2022 was ruling at 5.1% (highest since 1997 when index recording began) and in UK at 5.4% in December 2021 (highest since March 1992). With inflation in these geographies witnessing wide gaps over their 2% inflation targets, their central banks have little choice but to raise rates sooner than later. The situation in India is not similar. While CPI inflation at 5.6% in December 2021 is higher than the target, it is still within the tolerance band and is projected to recede in 2022-23 allowing monetary authorities to remain accommodative. However, the changing global monetary policy cycle implies that emerging market economies like ours will do well to brace for tighter financial conditions ahead even if domestic monetary policy stays accommodative. 54. Moreover, as interest differential narrows and current account widens, macroeconomic dynamics will come into play. How should our monetary policy react to this; and will inflation targeting hamper exchange rate management in these conditions? Low for long interest rates will certainly bring in macroeconomic imbalances and it is expedient that policy rate should be raised as soon as growth is judged to recover on a durable basis or inflation is seen to be turning endemic. In the interim, the good part is that we have built buffers against possible capital outflows. There is evidence to suggest that in small open economies that face imperfect substitution between domestic and foreign financial assets, the exchange rate management greatly enhances the efficacy of inflation targeting. These economies are able to avoid macroeconomic fluctuations which can be driven by self-fulfilling expectations. Sterilised interventions can be a key strategy should the need arise. 55. Typically, in case of sudden stops, rise in global interest rates prompts corporate sector to deleverage. Indian corporates have already deleveraged significantly and also reduced stock of external commercial borrowings in US dollar terms, which at end-September 2021 was 7.3% lower than at end of 2019. The ‘original sin’, a situation in which a country cannot borrow abroad in their own currency has been the bug bear for emerging markets during upturn cycles in global interest rates. However, the original sin has somewhat weakened in recent years with the development of local currency bond markets. With high foreign reserves, exchange rates may turn less sensitive to global factors such as the US VIX. India having moved to inflation targeting regime should benefit from lower local currency spreads as well as lower exchange rate risk premia. However, it will be important to maintain credibility by aiming to maintain inflation on a sustained basis at or near the target as soon as real economy conditions normalise. 56. Second, Omicron variant, along with continued port congestions and supply shortages has started to drag down global growth. This, in turn, may act in accordance with Bernoulli’s principle on fluid pressure, making the growth pipe narrower with falling external demand acting to dampen price pressures that have turned elevated from the supply-side. Omicron wave has pushed the broad-based recovery further down the time, even though the disruptions caused by this third wave have been smaller compared to the first and even the second wave. Three points are noteworthy: (i) in India, the 7-day Moving Average of daily new confirmed COVID-19 cases during this wave has dropped 60% from its peak on January 25 but is still 14 times the number when the first Omicron case was detected in India; (ii) though the mortality incidence in India is currently about a fourth of the peak seen during the second wave, the daily new deaths have risen three times since the onset of the Omicron wave and currently matches the peak deaths seen during the elongated first wave and so, hard statistics do not yet afford the comfort that we can overlook the pandemic and focus beyond; (iii) vaccinations have certainly contributed to mitigating the severity of disease outcomes. However, with continuous mutations, there is lack of clarity on enduring vaccine efficacy. 57. Third, uncertainties about energy prices have risen considerably. Indian crude oil basket is up nearly 25% in the previous two months. The current geopolitical stress in Europe is a significant risk and if it translates into oil and gas prices spiking, we will need to adjust macro-economic policies suitably. 58. Fourth, it is a no-brainer that the fiscal impulse needs to be factored in our monetary policy calculations. The pace of fiscal consolidation this year has been balanced by consideration to preserve Keynesian stimulus and to continue spending support for those disproportionately affected by the pandemic. The size of the gross market borrowing at ₹14.3 lakh crore is large. Therefore, monetary-fiscal coordination remains important to avoid inferior outcomes. In this backdrop, smooth rebalancing of liquidity assumes critical importance for inflation management. 59. This, however, does not mean that monetary policy should no longer support growth. While the capex push in the latest budget will support growth, monetary policy still has a complementary role to play. Uncertainty remains on account of whether States and PSUs will keep capex high this year and whether execution will remain on track. 60. Let me now briefly sum up how growth and inflation scenarios might unfold and my view on the decisions at hand. High frequency indicators, after impressive sequential improvements during June-October 2021 lost momentum in November but bounced back in December. Early information on select high frequency indictors now available for January 2022 exhibit renewed loss of momentum in January on account of Omicron spread. Electricity demand met has decelerated to a 2.1% m-o-m increase in January 2022 from 9.9% in December 2021. Vehicle registrations, E-way bills and toll collection volumes contracted m-o-m by 7.9%, 3.9% and 4.6%, respectively in January 2022. Overall, automobile sales, crude oil production, railway and air passenger traffic are yet below the 2019-20 levels. While the unemployment rate fell in January 2022 to 6.6% from 7.9% in December, it was mostly due to a marked sequential fall in Labour Force Participation Rate (LFPR) by 1-percentage point to 39.9%. Employment rate worsened in January 2022 to 37.2% and was the lowest since August 2021 and LFPR was the lowest in last seven months. 61. On inflation, the headline inflation is projected to ease to the vicinity of 5.0% mark in H1:2022-23 and then recede further to the target of 4.0% by Q3:2020-23. However, monsoon outturn and oil price dynamics will need to be closely watched. While for decision at hand, both the baseline and the risks are important, the incremental data since the December meeting affords some comfort as it suggests that the fears that price increases may get generalised are not materialising. At the item-level, while 80% of the items registered a sequential increase in October 2021, the number dropped to 73% in November and further to only 66% in the latest reading for the month of December, which is in line with the pre-pandemic average for the inflation targeting period. Similar trend of a lower diffusion is also seen in the case of WPI, with the index falling in December for the first time in 19-months. 62. Considering the above, I vote for keeping the policy rate unchanged and retaining the accommodative stance, while emphasising the need to maintain appropriate financial conditions with evolving situation. Statement by Dr. Michael Debabrata Patra 63. The global outlook is sombre. Consumption spending is dented by the Omicron-driven wave of the pandemic. Labour and production disruptions continue. Consensus forecasts suggest that a global deceleration has commenced in the first quarter of 2022. Multilateral institutions project global growth losing up to 2 percentage points of speed during 2022 and 2023. In other words, a prolonged slowdown looms and there are risks that it could tip over into a recession. 64. Inflation may take longer to slow – perhaps the greater part of 2022 – but slow it will. Already there are indications that supply chain pressures are peaking and getting set to ease. In corroboration, the UNCTAD nowcasts merchandise trade volume to have picked up pace in the last quarter of 2021 from the quarter before. This cannot happen without port decongestion and supply chain pressures easing. 65. In my view, the pandemic inflation surge is not being driven by excess demand but by supply constraints. It is turning out to be harder to bring supply capacities on stream than for demand to restart, partly due to the fact that supply capacities are in the wrong places. For instance, the pandemic caused a shift in consumer spending away from services and towards goods. The result is supply bottlenecks in goods producing sectors and spare capacities in services. Consequently, inflation is driven ever higher even though economic activity is yet to fully recover to its potential. 66. Monetary policy is an instrument of stabilisation. Its role is to align demand with supply, not the other way round. When inflation is driven by demand, monetary policy can stabilise inflation and growth. Monetary policy cannot play its stabilization role when inflation is the result of supply constraints. So central banks have a choice: either accept higher inflation for some time or be prepared to be accountable for destroying demand. 67. The reality, however, is that in terms of the policy responses, the biggest economies in the world are pulling in opposite directions. Monetary policy authorities in several parts of the world look at inflation in the rear-view mirror in which objects can look bigger than they are and they prepare to normalise and tighten. If they looked forward, they would sight a falling trajectory of inflation. Other countries have to brace up for shock waves from spillovers. Geo-political tensions and climate transition challenges complicate the outlook. Overall, I regard monetary policy chasing inflation instead of anticipating it as the main factor weighing down on global growth prospects. 68. The Indian economy is encountering headwinds as well as cross currents. First the headwinds: (1) even though we allow ourselves cautious optimism about the recent decline in infections, it is important to keep in mind that India has the second highest caseload of Covid-19 in the world and it is important to be cognisant of the scarring; (2) a mutation of Omicron - Ba2 - is showing up around the world and spreading fast - India has already reported cases of this sub-variant; and (3) more than a billion vaccinations have been achieved but only 56 per cent of the total population is fully vaccinated; the next billion will be back breaking. 69. Turning to cross currents, mobility of people has exhibited a sequential moderation in January, but movement of goods remains robust as evident in freight volumes, toll collections and GST revenues. Aggregate demand conditions are facing similar conflicted pulls. Power and fuel consumption is rising, but there is a broad-based decline in vehicle registrations, primarily due to shortage of semiconductors amidst global supply chain disruptions. Consumer confidence has improved, sales of fast moving consumer goods has been inching up and in the top 7 cities, housing sales jumped in 2021. On the hand, labour participation is falling. All in all, very divergent pulls. 70. There are several positives too which have withstood the pandemic’s waves. First, India’s merchandise exports are on course to reach an ambitious target for 2021-22. Second, services exports are also doing well. These developments should work towards keeping the current account deficit within sustainable limits. Third, foreign direct investment into India has held up well, moderating slightly from last year’s level. Fourth, India’s total external debt is more than covered by the stock of international reserves. In fact, India’s international assets cover three-fourth of all international liabilities. Thus, the external sector, which will bear the brunt of shocks from abroad, remains robust and resilient enough to withstand the tidal waves of global spillovers. Fifth, the agriculture outlook is bright, with both foodgrains and horticulture heading towards new records. 71. The projections indicate that headline CPI inflation (year-on-year) may test the upper tolerance band in January 2022. There will be public consternation on February 14 when the CPI for January will be released, but what may escape public notice is that this will essentially be because of an unfavourable base effect which may camouflage a welcome decline in the momentum of key food prices that has set in since October 2021. There has also been some let-up in input cost pressures. 72. To sum up, economic activity in India appears to have resiliently withstood the third wave, but messages from incoming high frequency indicators are mixed. It is prudent to assume that the recovery may have lost some momentum during Q4: 2021-22 and Q1: 2022-23. Inflation appears to be approaching an inflection point after which it is projected on a downward path through all of 2022-23. Accordingly, I vote for maintaining the policy rate and the accommodative stance of policy unchanged. Statement by Shri Shaktikanta Das 73. This MPC meeting takes place in the backdrop of global headwinds turning more adverse. Perceptible slowdown in growth together with elevated inflation in several countries characterise the global economy at present. The trajectories of growth and inflation, however, continue to diverge between countries. This has impelled some central banks to embark on aggressive policy tightening to quell inflation risks, while a few others, mostly emerging market economies (EMEs), continue to maintain accommodative policies. The adverse spillovers from such divergent policy responses could materialise quickly on the global and domestic outlook. Policy making is getting increasingly complex in this environment. 74. In the domestic front, rapid spread of the Omicron variant in conjunction with the fading of festive and pent-up demand has tempered economic activity in the near-term as reflected in several high-frequency indicators. Going forward, the current wave is showing signs of waning and with the return of normalcy, the pace of economic activity is likely to be bolstered by buoyant Rabi prospects, robust export demand, accommodative monetary and liquidity conditions, improving credit offtake, and the continued push in capital expenditure and infrastructure in the Union Budget 2022-23. On the downside, slowing global growth could impact exports while demand for contact intensive services would remain contingent on the trajectory of COVID-19 infections. High commodity prices and supply side shortages could weigh on corporate profitability amid weak pricing power and unfavourable base effects during 2022-23. The global financial market volatility associated with monetary policy normalisation process in the advanced economies could further complicate the situation. 75. As regards inflation, there has been considerable improvement in the outlook for food prices since the last bi-monthly review. Vegetable prices, after the spike of October-November, have seen significant seasonal correction which is likely to continue on fresh winter crop arrivals. In addition, the December CPI print saw price corrections in edible oils and pulses coming from the supply side interventions by the Government. The record Rabi acreage, propelled by a significantly higher acreage of oilseeds and pulses, along with prospects of higher yields for wheat, augur well for a bumper harvest of key food items. Further, considering the advance estimates of a robust kharif harvest, and on the assumption of a normal monsoon, there is room for considerable optimism on the food inflation trajectory over the next financial year. 76. The renewed surge in international crude oil prices, however, requires close monitoring. We need to remain watchful of the risks to domestic inflation arising from rise in international commodity prices due to exogenous factors including geo-political developments. While core inflation remains elevated, demand-pull pressures are still muted, given the slack in the economy. On balance, inflation is likely to peak in Q4: 2021-22 and thereafter soften to around 5.0 per cent in H1:2022-23 and further closer to the target in H2:2022-23 with an average inflation rate of 4.5 per cent for the entire financial year. 77. Amidst growing divergence in policy responses on the global front, our monetary policy should remain attuned to the evolving domestic inflation and growth dynamics. Despite recovery in 2021-22, real GDP is only marginally higher than the pre-pandemic level with private consumption still trailing its 2019-20 level. Inflation pressures in India continue to emanate largely from supply side factors, and the recent print also reflects adverse base effects. The expected moderation in inflation trajectory over the next financial year provides room for monetary policy to remain accommodative. At the same time, economic recovery from the pandemic remains incomplete and uneven and continued support from various policies remains crucial for a sustained recovery. 78. In this period of prolonged uncertainty, it would be wise to remain agile and respond in a gradual, calibrated and well telegraphed manner to the emerging challenges. Taking into consideration the outlook for inflation and growth, in particular the comfort provided by the improving inflation outlook, the uncertainties related to Omicron and global spillovers, I vote for status quo in the repo rate. I also vote to continue with our forward guidance of accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. (Yogesh Dayal) Press Release: 2021-2022/1763 1 Goyal, A. and S. Tripathi. 2011. ‘New Keynesian Aggregate Supply in the Tropics: Food prices, wages and inflation’ International Journal of Monetary Economics and Finance. 4(4): 330-354. 2 Indeed, one reason for shifting to the interest rate as an instrument is that money demand becomes unstable, and money supply endogenous, with near money substitutes that financial institutions can create. See Goyal, A. and S. Dash. 2000. ‘The Money Supply Process in India: Identification, Analysis and Estimation’, Indian Economic Journal, Vol. 48(1), July-September. | ||||||||||||||||

صفحے پر آخری اپ ڈیٹ: