IST,

IST,

Minutes of the Monetary Policy Committee Meeting, September 29, 30 and October 1, 2025

|

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The fifty-seventh meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during September 29, 30 and October 1, 2025. 2. The meeting was chaired by Shri Sanjay Malhotra, Governor and was attended by all the members – Dr. Nagesh Kumar, Director and Chief Executive, Institute for Studies in Industrial Development, New Delhi; Shri Saugata Bhattacharya, Economist, Mumbai; Professor Ram Singh, Director, Delhi School of Economics, Delhi; Dr. Poonam Gupta, Deputy Governor in charge of monetary policy and Shri Indranil Bhattacharyya, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934). 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. The MPC also reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. The Monetary Policy Committee (MPC) held its 57th meeting from September 29 to October 1, 2025, under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Shri Indranil Bhattacharyya attended the meeting. 6. After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the MPC voted unanimously to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 5.50 per cent; consequently, the standing deposit facility (SDF) rate remains at 5.25 per cent while the marginal standing facility (MSF) rate and the Bank Rate remains at 5.75 per cent. The MPC also decided to continue with the neutral stance. Growth and Inflation Outlook 7. The global economy has been more resilient than anticipated in 2025, with robust growth in the US and China. The outlook, however, remains clouded amidst elevated policy uncertainty. Inflation has remained above their respective targets in some advanced economies, posing fresh challenges for central banks as they navigate the shifting growth-inflation dynamics. Financial markets have been volatile. The US dollar strengthened after the upward revision of US growth numbers for the second quarter, and treasury yields hardened recently tracking changes in policy rate expectations. Equities have remained buoyant across several advanced and emerging market economies. 8. In India, real gross domestic product (GDP), driven by strong private consumption and fixed investment, recorded a robust growth of 7.8 per cent in Q1:2025-26. On the supply side, growth in gross value added (GVA) at 7.6 per cent was led by a revival in manufacturing and steady expansion in services. Available high frequency indicators suggest that economic activity continues to remain resilient. Rural demand remains strong, riding on a good monsoon and robust agriculture activity, while urban demand is showing a gradual revival. Revenue expenditure of the Union and State Governments registered robust growth during the fiscal year so far (April-July). Investment activity, as suggested by healthy growth in construction indicators i.e., cement production and steel consumption in July-August, is holding up well even though production and import of capital goods witnessed some moderation. Recovery in manufacturing sector continues while services activity is sustaining its momentum. 9. Looking ahead, an above normal monsoon, good progress of kharif sowing and adequate reservoir levels have further brightened prospects of agriculture and rural demand. Buoyancy in services sector coupled with steady employment conditions are supportive of demand, which is expected to get a further boost from the rationalisation of goods and services tax (GST) rates. Rising capacity utilisation, conducive financial conditions, and improving domestic demand should continue to facilitate fixed investment. However, ongoing tariff and trade policy uncertainties will impact external demand for goods and services. Prolonged geopolitical tensions and volatility in international financial markets caused by risk-off sentiments of investors also pose downside risks to the growth outlook. The implementation of several growth-inducing structural reforms, including streamlining of GST are expected to offset some of the adverse effects of the external headwinds. Taking all these factors into account, real GDP growth for 2025-26 is now projected at 6.8 per cent, with Q2 at 7.0 per cent, Q3 at 6.4 per cent, and Q4 at 6.2 per cent. Real GDP growth for Q1:2026-27 is projected at 6.4 per cent (Chart 1). The risks are evenly balanced. 10. Headline CPI inflation declined to its eight-year low of 1.6 per cent (y-o-y) in July 2025 before rising to 2.1 per cent in August – its first increase after nine months. Benign inflation conditions during 2025-26 so far have been primarily driven by a sharp decline in food inflation from its peak of October 2024. Inflation within the fuel group moved in a narrow range of 2.4-2.7 per cent during June-August. Core inflation remained largely contained at 4.2 per cent in August. Excluding precious metals, core inflation was at 3.0 per cent in August. 11. In terms of the inflation outlook for H2: 2025-26, healthy progress of the south-west monsoon, higher kharif sowing, adequate reservoir levels and comfortable buffer stock of foodgrains should keep food prices benign. The recently implemented GST rate rationalisation would lead to a reduction in prices of several items in the CPI basket. Overall, the inflation outcome is likely to be softer than what was projected in the August MPC resolution, primarily on account of the GST rate cuts and benign food prices. Despite the anticipation of moderate momentum during H2, large unfavourable base effects are likely to exert upward pressure on headline CPI inflation, especially in Q4. Considering all these factors, CPI inflation for 2025-26 is now projected at 2.6 per cent with Q2 at 1.8 per cent; Q3 at 1.8 per cent; and Q4 at 4.0 per cent. CPI inflation for Q1:2026-27 is projected at 4.5 per cent (Chart 2). The risks are evenly balanced.  Rationale for Monetary Policy Decisions 12. The MPC observed that the overall inflation outlook has turned even more benign in the last few months, due to the reasons discussed above. The average headline inflation for 2025-26 is now revised lower from 3.7 per cent and 3.1 per cent projected in June and August policy, respectively, to 2.6 per cent. Headline inflation for Q4:2025-26 and Q1:2026-27 too have been revised downwards and are broadly aligned with the target, despite unfavourable base effects. Core inflation for this year and Q1:2026-27 is also expected to remain contained. 13. Growth outlook remains resilient supported by domestic drivers, despite weak external demand. It is likely to get further support from a favourable monsoon, lower inflation, monetary easing and the salubrious impact of recent GST reforms. However, growth continues to be below our aspirations. Even though the growth projection for the financial year 2025-26 is being revised upwards, the forward-looking projections for Q3 and beyond are expected to be slightly lower than projected earlier, primarily due to tariff-related developments, despite being partially offset by the impetus provided by the rationalisation of GST rates. 14. To summarize, there has been a significant moderation in inflation. Moreover, the prevailing global uncertainties and tariff related developments are likely to decelerate growth in H2:2025-26 and beyond. The current macroeconomic conditions and the outlook has opened up policy space for further supporting growth. However, the MPC noted that the impact of the front-loaded monetary policy actions and the recent fiscal measures is still playing out. The trade related uncertainties are also unfolding. The MPC, therefore, considered it prudent to wait for the impact of policy actions to play out and greater clarity to emerge before charting the next course of action. Accordingly, the MPC unanimously voted to keep the policy repo rate unchanged at 5.5 per cent. The MPC also decided to retain the stance at neutral. However, two members - Dr. Nagesh Kumar and Prof. Ram Singh, were of the view that the stance be changed from neutral to accommodative. 15. The minutes of the MPC’s meeting will be published on October 15, 2025. 16. The next meeting of the MPC is scheduled during December 3 to 5, 2025. Voting on the Resolution to keep the policy repo rate unchanged at 5.5 per cent

Statement by Dr. Nagesh Kumar 17. The external context for economic development has changed dramatically since the August MPC. While the growth rate of 7.8% in the first quarter of the current fiscal year was impressive, exceeding expectations, leading to an upward revision of projections for the year, to 6.8% from 6.5%, it does not factor in the shock that India has faced after the first quarter. Hence, the economic growth trajectory and projection suffer from possible discontinuities. The acceleration in first-quarter growth has been underpinned by consumption, especially rural consumption, and front-loading of government capex. Private investment has continued to remain sluggish, despite healthy growth of profits and profit margins, and capacity utilisation rates staying above the 75% level, perhaps due to the trade policy uncertainties. Hence, there is no room for complacency as the future looks uncertain because of external shocks. 18. In particular, the Trump Administration has delivered a comprehensive assault on India with successive announcements over the past few weeks. Before we could absorb the 25+25% reciprocal and penal tariffs on goods that became effective from the end of August, a hefty $100,000 fee was imposed on H1B visas. There are also other measures, including the proposed HIRE Act on outsourcing, the 100% tax on patented pharmaceuticals, among others which may affect India’s economic prospects. 19. The trade policy measures adopted by the US, India’s biggest trade partner and biggest market for exports of goods and services, pose challenges for the economy. While the effect on the economic growth rate may be limited to between 40-60 bps, a larger effect is expected on MSMEs and jobs. This is because the US is a much more important market for our labour-intensive goods than for all imports. The US accounts for nearly 20% of India’s merchandise exports, but our exposure to the US market is far greater at 33% for labour-intensive goods such as textiles and garments, leather goods, gems & jewellery, processed food products like shrimp. These are also the sectors that are dominated by MSMEs and account for a disproportionately larger share (around 40%) of jobs in the manufacturing sector. Therefore, high penal tariffs imposed by the US on India have the prospect of affecting MSMEs and the jobs in a significant manner. 20. In that context, diversification of export markets is the need of the hour, besides exploiting the domestic demand better. The Government has undertaken GST reforms that should help in charging the domestic consumption engine. Diversification of export markets beyond the US is also critical. In that context, the recent signing of the UK-India FTA and the India-EFTA Economic and Trade Agreement that became effective on October 1, 2025, are important developments. The negotiations of the India-EU FTA have been expedited, and new ones have been planned with the Eurasian Economic Community. We should also tap the potential of existing FTAs with Japan, the Republic of Korea, Australia and the UAE more effectively, for the export of labour-intensive goods, helping to reduce our dependence on the US market. We should also move up the value chain in these sectors by building and acquiring globally known brands, retail chains, and technological upgradation. 21. On the monetary policy front, a pre-emptive action would be important to contain the damage and to support private investments through liquidity provision, credit guarantees/ moratorium for MSMEs, including through a cut in the repo rate. Fortunately, the inflationary expectations remain well-anchored, and the average headline inflation has trended down, with projections for 2025-26 have now been revised downwards to 2.6% from 3.7% in the June MPC meeting. The GST reforms are also likely to push it down further. Therefore, the benign inflation outlook opens up policy space for monetary action. However, we may wish to wait and watch as the transmission of the existing actions is still unfolding and to see how the trade policy uncertainties play out before considering a rate cut at the December Meeting of the MPC. Nevertheless, we may like to signal the readiness of monetary policy to support the industry, investments and growth by changing the stance from ‘neutral’ to ‘accommodative.’ 22. Hence, I vote for keeping the repo rate unchanged at this juncture but feel that the stance could be changed to accommodative. Statement by Shri Saugata Bhattacharya 23. Despite the continuing moderation in inflation opening up space for further monetary policy easing, the arguments for a pause in my August 2025 statement remain materially the same. 24. Although domestic economic activity remains resilient, trade and tariff uncertainties remain a risk to growth and investment. The following line from the MPC resolution aptly summarises my position: “The impact of the frontloaded monetary policy actions and the recent fiscal measures is still playing out. Trade related uncertainties are still unfolding. The MPC therefore considered it prudent to wait for the impact of policy actions to play out and greater clarity to emerge before charting the next course of action.” 25. A moderation in the inflation rate is not a compelling reason, at this point, to cut the policy rate. The Monetary Policy Report forecasts an average FY27 inflation of 4.5 per cent, with Q1 and Q2 FY27 also at 4.5% and Q3 at 5.1%. This is assuming a normal monsoon and no exogenous shocks. In addition, real GDP growth in FY27 is projected at a robust 6.6 per cent, following a forecast 6.8 per cent in FY26. The Report notes that “domestic economic activity remains resilient and is expected to maintain momentum”. 26. Domestic financial conditions remain easy, largely balanced. On bank credit, I should also point to the recent study on banks’ sanctions and disbursement pipeline in FY26. While loan sanctions in FY25 have moderated, total projected disbursements in FY26 remain robust, with the remaining tranches in H2 expected to boost credit growth1. 27. The cumulative effects of the multiple, mutually reinforcing, policy stimulus measures – fiscal, monetary, financial and banking, trade, investment, regulations, etc. – which have been progressively rolled out, need to be monitored. 28. It is also worth re-emphasising that monetary policy has to address multiple, often conflicting, objectives and optimise the consequent trade-offs. Given the economic conditions described above, at this juncture, I do not see the need for a policy easing. 29. Hence, taking into account the fluidity of the macro-financial environment, I vote for a pause in monetary policy decision on the repo rate and for the same reason I believe that stance quo on the stance is appropriate at this point. Statement by Prof. Ram Singh 30. Since the last MPC meeting, the case for another rate cut in this cycle has become stronger. However, in view of the fiscal measures and the earlier monetary easing still working and the uncertainty on the external front looming large, I vote for a pause in the policy repo rate. At the same time, I am in favour of a change in stance from “neutral” to “accommodative”. Below, I elaborate on my decisions. 31. CPI headline inflation has continued to surprise on the downside, as it declined to 2.1 per cent (y-o-y) in August 2025 after registering its eight-year low of 1.6 per cent in July. The sharp decline in food inflation from its October 2024 peak has been consistent and broad-based. The available indicators and projections signal a continuation of the lower price momentum in food prices in the coming months. Accordingly, the CPI inflation for FY 2025-26 has been revised downward to 2.6 per cent, with Q3 at 1.8 per cent and Q4 at 4.0 per cent. 32. Core inflation (excluding food and fuel) has also mainly remained contained in the range of 4.1-4.4 per cent in the financial year so far. The print for Core inflation in August was 4.2 per cent - excluding precious metals, it was 3.0 per cent. 33. The inflation trajectory looks benign at least for the next two quarters. Improved domestic food supply chain logistics, a good kharif harvest, and above-normal water reservoirs bode well for low food inflation in the coming quarters. Crude prices are also expected to remain stable, with a downward bias. The CPI inflation may exceed the 4.0 per cent target in the next fiscal year, as the unfavourable base effect and the expected boost in demand take hold. Core inflation is also expected to be elevated but contained, as the base effect turns favourable following unusual increases in gold and silver prices over the last few months. 34. The GDP surprised on the upside, registering 7.8 per cent growth in Q1:2025-26 – GVA also grew by 7.6 per cent. For Q2, GDP growth also seems to be holding up amid mixed signals from some high-frequency indicators. 35. The GDP growth projection for FY26 is now revised upwards to 6.8 per cent, factoring in the unexpectedly high Q1 number along with the demand boost from monetary easing and GST rationalisation. Still, compared to the MPC’s February 2025 growth forecast, the latest H2: 2025-26 growth projections have been revised downwards indicating some slack in momentum. In February, the forecast for Q3 and Q4 of FY 26 was 6.5 per cent each, whereas the latest growth forecasts are lower at 6.4 per cent for Q3 and 6.2 per cent for Q4. Real GDP growth for Q1:2026-27 is projected at 6.4 per cent. 36. The prevailing inflation rate is too low - it is neither conducive for businesses nor for public finances. Besides, the downward revisions to the growth forecast of H2:2025-26, coming on the heels of a more benign inflationary outlook, make a case for an additional growth-supportive interest rate cut. The case is further supported by the adverse effects of US tariffs and the headwinds from a fluid geopolitical landscape and heightened global uncertainties. 37. The next question to ponder over is what could be the downsides of a further rate cut. It may make more challenging for the banks to mobilise deposits to support credit growth.2 But what matters more is the total savings and the flow of funds to the real sector, and not just credit through the banking channel. An increasing share of savings is being channeled to the private sector through bond and equity markets.3 38. The moderation in aggregate savings rates is a concern from a macroeconomic perspective.4 But interest rates do not seem to be the main driving force of the aggregate saving rate.5 Research suggests that aggregate saving rates are driven by several factors, including demographic and other structural changes in the economy, differences in the rates of return on different forms of capital, and labour market dynamics, including the distribution of wages and income across economic strata. At the household level, interest rates do matter. But their effects are more pronounced on portfolio choices than on total savings.6 Thus, the likely adverse impact on bank deposits and moderation in household savings should not be the reason for not going for a further rate cut. 39. On the external front, the tariffs and financial market-related uncertainties have persisted over the last two quarters. It seems the forex market has already priced in the worst in this regard. Though the exchange rate remains a concern, any pressure on the INR is likely to be confined to the short term, given the robust fundamentals of the Indian economy, including adequate forex reserves, a comfortable current account position7, and the centre’s commitment to maintaining the fiscal glide path. The inclusion of Indian bonds in global indices and improved prospects for gross and net FDI are also a source of comfort. 40. Another concern is our interest rate differential with the U.S. and other major economies. The rate cuts by the US Fed, the BoE and the ECB in recent months have added some comfort on this count. Markets expects few more rates cuts by the US Fed in 2025, which would be further comforting for interest rate differential.8 41. In sum, there is ample scope for an additional rate cut. The question is: Is there a need for one during this policy cycle? 42. When the impact of the demand boost from the 100 bps cuts in repo rates this year is yet to play out fully, a further rate cut today runs the risk of an overdose. The intended effects of the monetary easing and the fiscal measures are still working through the system.9 43. The risk aversion among investors seems to have eased, driven by a demand boost from the fiscal side (income tax reliefs and GST rationalisation), conducive financial conditions, broad-based transmission of rate cuts10, robust system-level financial parameters, and easing of micro and macroprudential regulations on banks. Recent signals on Private capex growth are encouraging. Several indicators corroborate this inference, such as an increased capacity utilisation11, significant pickups in the flow of funds to the corporate sector through non-bank channels, among others. 44. Going forward, buoyancy in a broad range of service sectors and a resilient agriculture sector are supportive of growth momentum. The demand is expected to get a further boost from the GST rationalisation and the festival season. Domestic demand should continue to support fixed investment, amid continued monetary transmission driven by adequate liquidity in the system and the remaining three tranches of CRR cuts. 45. Under such conditions, the available scope for rates can be leveraged to sustain the growth momentum for a longer period by extending the easing cycle. A change in stance to accommodative increases the odds of a rate cut in this easing cycle. Backed by conducive liquidity conditions and further improvement in transmission, it will add to the income and demand effects induced by the 100 bps rate cuts so far. Furthermore, an expectation of a rate cut will likely put downward pressure on bond yields, thereby enhancing the appeal of the bond market for borrowers seeking to raise funds through market instruments. Yet, the accommodative stance gives the RBI flexibility to delay or hold back on further cuts in the event of unexpected developments in food prices or on the external front. 46. In view of the above, I vote to take a pause in the policy repo rate under the liquidity adjustment facility (LAF) at 5.50 per cent. 47. But I am in favour of changing the monetary policy stance from ‘neutral’ to “accommodative”. Statement by Shri Indranil Bhattacharyya 48. In a world characterised by geo-political strife, geo-economic fragmentation and strategic realignment brought about by all-pervasive uncertainty on trade and tariffs, the Indian economy has demonstrated strength and resilience. Based on buoyant services sector activity and rebounding of the manufacturing sector, GDP growth registered an impressive 7.8 per cent in Q1:2025-26, significantly higher than the consensus estimate.12 High-frequency indicators available so far suggest resilience in economic activity in Q2:2025-26; therefore, growth is likely to remain buoyant in Q2. 49. Looking ahead, growth in H2:2025-26 and beyond is likely to be determined by the interplay of domestic tailwinds and external headwinds. Domestic demand is expected to get a boost from growth supportive measures and policies such as GST rationalisation, income tax relief, past monetary policy actions and several regulatory measures announced by the Reserve Bank today. Benign inflation outlook and lower GST rates are also supportive of a revival in urban consumption demand. The spatial and temporal distribution of monsoon has generally been positive for agricultural activity and rural demand. Along with congenial financial conditions, several growth-supportive policies undertaken by the Government and the Reserve Bank should also be a catalyst for a turnaround in private investment sentiments. However, tariff and trade-related uncertainties would inhibit external demand, although it may get partially offset through higher consumption spending. Considering all these factors and the higher realised numbers for Q1, GDP growth for 2025-26 has now been revised upwards from the August policy by 30 basis points. 50. In a span of 10 months, headline inflation moderated from 6.2 per cent in October 2024 to 1.6 per cent in July 2025 before increasing to 2.1 per cent in August. This sharp disinflation was solely brought about by the precipitous decline in food inflation. This unexpectedly swift moderation and its continuation over an extended period suggests that the food inflation trajectory is likely to be more benign than what was anticipated earlier. Moreover, rationalisation of GST is likely to ease prices albeit in varying degree depending on the extent of pass-through to the final consumer. Cumulatively, these factors led to a downward revision in headline inflation forecast for 2025-26 to 2.6 per cent, a cumulative revision of 110 basis points from the projection of 3.7 per cent in June 2025. In terms of the quarterly forecast trajectory, inflation is expected to remain well below the target till Q3:2025-26 but progressively edge up thereafter. Therefore, the current ultra-low levels should be seen as a transitory phenomenon, and monetary policy has to be cognisant of potential demand pressures over the medium term generated by the cumulative impact of past monetary and fiscal measures. At the same time, one needs to be wary of potential supply shocks from weather related uncertainties as well as volatility in international commodity prices. 51. Drawing from the above discussion, it can be inferred that the sharp moderation in inflation has undoubtedly opened up policy space for further rate easing. However, I vote to pause at the present juncture based on several considerations. These are (i) given the heightened uncertainty, a rate cut at this point may not have the intended impact; (ii) allow for all past monetary and fiscal measures as well as the ensuing ones (CRR reductions) to work its way through the financial system; and (iii) given no market expectation of a rate cut13, any rate reduction would surprise the market, which is detrimental in terms of policy credibility over the medium term. 52. Given the prevailing uncertainties, I also agree to continue with the neutral stance as it allows central banks to avoid committing to specific policy settings.14 A neutral stance provides the necessary flexibility to be nimble and agile in conducting two-way market operations consistent with evolving requirements. Any shift to an accommodative stance at this stage could be viewed as explicit forward guidance on the future interest rate path, suggesting that it can only go down. Such precise guidance needs to be avoided since a neutral stance is not inconsistent with a rate cut. In this milieu, messaging has to be done with effective communication as errors can be costly. In this context, it is worthwhile to remember the sagacious advice of a former Fed Chairman “Monetary policy may be 98% talk and only 2% action but cost of sending the wrong message can be high”.15 Statement by Dr. Poonam Gupta 53. The Indian economy is proving to be resilient overall, well on its way to attain a healthy growth rate in the ballpark of 6.5 to 7.0 per cent, both this year and the next. Lower and steadier inflation has been another welcome enabler. Besides its inherent resilience on the back of robust domestic demand, a proactive policy response is adding strength to the economy to withstand the challenges posed by a complex and fast evolving global policy environment. If it were not for the adverse global conditions, perhaps it would have already triggered a turnaround in the private investment cycle and further accelerated economic growth. 54. In this context, the following developments that have occurred since the last meeting of the MPC in August, weigh on this round of policy. 55. With the implementation of the rationalized GST rates since September 22, 2025, the inflation outlook appears to be more benign. This along with the lesser food price build up has led the RBI to lower its current year inflation projection since the last policy by 50 bps to 2.6 per cent. 56. Simultaneously, the growth outlook has evolved too. Due to stronger than anticipated growth rate of 7.8 per cent for Q1:2025-26, and various indicators pointing to a robust expansion in Q2:2025-26, growth forecast for 2025-26 has been revised upwards to 6.8 per cent. This subsumes the expected adverse effects of the US tariffs, partly compensated by the likely growth inducing effects of GST rationalization. 57. As far as the economic outturns at quarterly and half yearly basis are concerned, growth is projected to be much higher in the first half relative to the second half of the fiscal year. Inflation, on the other hand, is projected to be more benign at 1.8 per cent during Q2 and Q3 of this year and is expected to inch up to 4.0 per cent in Q4 and 4.5 per cent in Q1 next year, as the unfavorable base effect kicks in. 58. The described growth-inflation mix, particularly slower growth in H2 and a benign inflation rate, has potentially opened some space for lowering the policy rates further; yet it is difficult for me to vote for a rate cut at this juncture. 59. This is for the following reasons. 60. First, while the recent measures announced by the government have significantly bolstered consumer sentiment, these measures are still working their way through. It would be prudent for the impact of these measures to be sufficiently realized before taking another supportive measure right away. Second, even the policy rate cuts announced by the RBI during this calendar year are currently being transmitted through the system. Announcing a rate cut at this time may only be marginally effective. Third, the global uncertainties are evolving at a very fast pace. Depleting policy ammunition at this point does not seem warranted until there is more clarity on how the global policy environment will unfold henceforth. 61. Hence, I vote for the status quo, i.e., to keep the policy repo rate unchanged at 5.5 per cent. 62. While voting for a pause in the policy rate, I propose to retain the stance at neutral based on the following considerations. 63. Despite some space that has possibly opened up given the forward-looking growth-inflation dynamics, I feel changing the stance to accommodative is not required as the neutral stance does not prevent us from reducing the repo rate when warranted. 64. Moreover, given the heightened global uncertainty, it may not be possible to confidently commit to a new stance. Hence, I consider it prudent to retain the stance at neutral. Statement by Shri Sanjay Malhotra 65. The global economy has been resilient in the first half of 2025. Frontloading of consumption, inventory restocking, and delayed tariff implementation have supported growth. The outlook, however, remains subdued, with downside risks due to current policy uncertainties and simmering geo-political tensions. Inflation is overshooting target in some countries while fiscal concerns remain elevated in advanced economies. There is also downside risk from repricing of financial markets as equity markets remain buoyant amidst bearish sentiments on bonds (hardening yields). 66. Domestic economic growth too was resilient in Q1:2025-26. High frequency indicators suggest that it is likely to remain strong in Q2. Thereafter, however, it is expected to soften due to the impact of tariffs although the GST rationalisation would partially cushion the impact. Several indicators suggest that agricultural prospects are bright in the current year; consequently, rural demand is likely to be buoyant. Strong services sector growth and steady employment conditions would support growth. External demand, however, is likely to remain lukewarm in the wake of prevailing tariff and trade-related uncertainties. On the whole, growth outcome for 2025-26 is now expected to be higher at 6.8 per cent than 6.5 per cent envisaged in the August policy, even as the outlook from H2 onwards is softer. 67. Headline CPI inflation moderated to an eight-year low of 1.6 per cent in July before inching up to 2.1 per cent in August. The decline in inflation was primarily driven by the food component due to improved supply conditions and measures undertaken by the government to manage the supply chain. Core (CPI excluding food and fuel) inflation remained contained at 4.2 per cent in August despite pressures from higher prices of gold and silver. In view of GST rationalisation and benign food prices, the projection of headline inflation for 2025-26 has now been lowered to 2.6 per cent from 3.1 per cent projected in the August policy and 3.7 per cent in June. The outlook for inflation in Q1:2026-27 is also benign and has been revised downwards. 68. To summarise, even though growth is strong by current reckoning, its outlook is softer and is expected to be below our aspirations. The benign outlook for headline and core inflation as a result of the downward revision of projections opens up policy space to further support growth. However, several growth-inducing policies unveiled by the Government and the Reserve Bank should help growth, going ahead. The cumulative impact of fiscal and monetary measures is yet to be realised fully. Tariff-related uncertainties are still evolving. There is elevated uncertainty on the external front. In view of these factors, even though there is policy space to further cut the policy rate, I feel this is not the opportune time for the same as it will not have the desirable impact. Therefore, I vote to keep the policy repo rate unchanged at 5.50 per cent. The intent of policy, nevertheless, is to continue to facilitate growth-enabling conditions. Some of the regulatory measures announced today will also be supportive of this objective. 69. Moreover, I prefer to retain the neutral stance as any change to an accommodative stance at this stage, as suggested by some members, would tantamount to giving a definitive forward guidance about the future trajectory of the policy rate. The policy uncertainty, rapidly evolving developments and the foggy outlook suggest that we exercise caution and take a view for each policy as per the then prevailing macroeconomic conditions and outlook.

(Brij Raj) Press Release: 2025-2026/1317 1 “Private Corporate Investment: Growth in 2024-25 and Outlook for 2025-26”, RBI Monthly Bulletin, August 2025. 2 The rate cut can adversely affect banks’ NIMs and RoAs, ceteris paribus. However, the adverse effects will at least partly be mitigated by the 100 bps CRR cut and other regulatory easing measures for the banking sector. 3 According to the RBI data, the total flow of resources from non-bank sources to the commercial sector increased by ₹2.66 lakh crore in 2025-26 so far, more than offsetting the decline in non-food bank credit. 4 India’s gross domestic savings rate fell from 34.6% of GDP in 2011-12 to 30.7% in FY 24, with a slight uptick in FY25. 5 During 2014-24, (excluding the two Covid years) while the policy rates have varied significantly in the range of 7.75%-5.50%, the aggregate saving rates have fluctuated in the range of 29.6% to 32.2% 6 The RBI’s analysis of household savings a shift away from bank term deposits. The share of term deposits declined from 50.54% in FY20 to 45.77% in FY25, due to households moving to alternative, higher-yielding investments like mutual funds and equities. 7 India’s CAD moderated to 0.2 per cent of GDP in Q1:2025-26 as compared with 0.9 per cent of GDP in Q1:2024-25. For FY 26, robust services exports and remittance receipts is expected to keep the CAD in the comfort zone. 8 The S&P Global expects two 25-basis-point rate cuts by the Fed in calendar year 2025, in addition to the 25 pbs cut in September. 9 According to RBI, in response to the cumulative policy repo rate cut of 100 bps in the current easing cycle (as of September 29), the WACR, the 3-month T-bill rate, the 3-month CP issued by NBFCs, and the 3-month CD rate declined by 92 bps, 105 bps, 118 bps, and 147 bps, respectively. 10 During February-August 2025, in response to the 100-basis points (bps) cut in the policy repo rate, the WALR of SCBs moderated by 58 bps for fresh rupee loans; 71 bps is on account of interest rate effect. The moderation for outstanding rupee loans is to the extent of 55 bps. On the deposit side, the WADTDR on fresh deposits declined by 106 bps, while that on outstanding deposits softened by 22 bps over the same period. Transmission has been broad-based across sectors. The system-level financial parameters related to capital adequacy, liquidity, asset quality and profitability of the SCBs continue to remain healthy. The system-level parameters of NBFCs too are sound, with improved GNPA ratios. 11 Manufacturing PMI surged to a 17.5-year high of 59.3 in August 2025, along with strong business optimism. Services PMI reached a 15-year high of 62.9 in August. 12 Bloomberg poll of economists suggested a median growth forecast of 6.6 per cent in Q1 2025-26. 13 As evident from the flat OIS rates. 14 Agustín Carstens (2025). “Lessons learned and challenges ahead for central banks in the Americas” speech delivered by General Manager, Bank for International Settlements, at the BIS Chapultepec Conference, Mexico City, February 6. 15 Benjamin.S. Bernanke (2015), Inaugurating a new blog, The Brookings Institution, Economic Studies. |

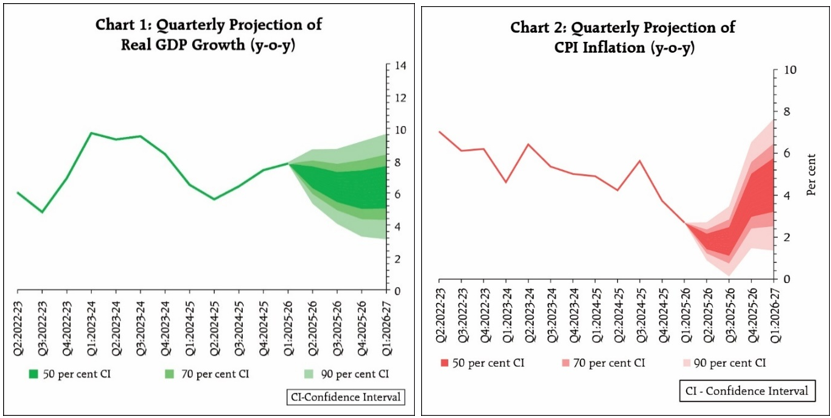

صفحے پر آخری اپ ڈیٹ: