Introduction

4.1 The co-operative banking sector, with its more than a century old existence,

plays an important role in enlarging the reach of institutional credit both from

geographic and socio-economic perspective. Though it supplements the efforts of

the commercial banks in credit delivery and deposit mobilisation, its extensive

branch networks with reach even in remote areas, makes it an important instrument

for achieving greater financial inclusion. However, the financial health of most

of the co-operative banks has been a cause for concern and has so far proved to

be a serious handicap in reaching out to the larger population. Thus, the focus

of recent policy measures is on revitalising and strengthening the co-operative

banking sector in India. The ongoing task of revitalising the rural co-operative

sector is progressing on the lines of the recommendations of the Task Force to

review the problems of rural cooperative sector and for the UCBs, based on Vision

Document, 2005.

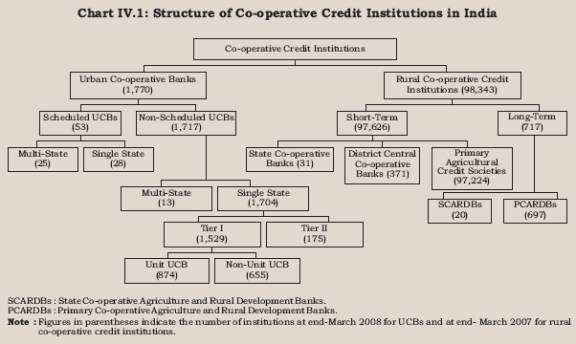

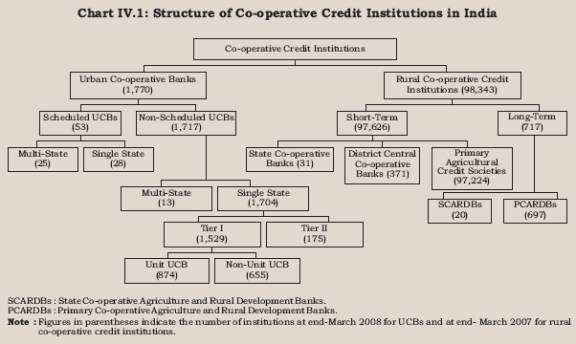

4.2 The structure of the co-operative banking sector

in India is complex. Credit needs of diverse sections of the population, both

in terms of location and tenor, are addressed by different segments of the cooperative

banking sector. While the urban areas are served by the urban co-operative banks

with a single tier structure, the rural areas are largely served by two distinct

sets of institutions extending short-term and long-term credit. The short-term

co-operative credit institutions have a three-tier structure comprising State

co-operative banks (StCBs) at the apex level, district central co-operative banks

(DCCBs) at the intermediate level and primary agricultural credit societies (PACS)

at the base level. The long-term co-operative credit institutions have, generally,

a two-tier structure comprising the State co-operative agriculture and rural development

banks (SCARDBs) at the State level and the primary co-operative agriculture and

rural development banks (PCARDBs) at the district or block level. Long-term co-operative

credit institutions have a unitary structure in some States with State level banks

operating through their own branches, while in other States they have a mixed

structure with the existence of both unitary and two-tier systems. The States

which do not have long-term co-operative credit entities are served by State co-operative

banks (Chart IV.1).

4.3 Recognising

the importance of urban co-operative banks in providing banking services to the

middle and lower income group of people, the Reserve Bank in March 2005 drafted

a Vision Document for UCBs pointing out the problem of dual control as a restrictive

mechanism inhibiting its ability to handle the weaknesses of the entities within

the sector. As per the terms of the document, so far 23 State Governments

and Central Government (in case of multi-State UCBs) have signed the Memoranda

of Understanding (MoUs) with the Reserve Bank covering 98.6 per cent of the total

number of the UCBs representing 99.2 per cent of deposits of the sector. As a

part of the MoU, the State level Task Force for Cooperative Urban Banks (TAFCUBs)

have been set up to identify the potentially viable and non-viable UCBs in the

State and to chart out the revival path and non-disruptive exit route for the

two sets of banks, respectively. These measures instilled public confidence in

the sector which is evident from the increase in deposits for three successive

years, i.e., from 2005-06 to 2007-08.

4.4 During 2007-08, the Reserve Bank continued with its policy of encouraging

States to sign MoUs to establish a co-ordinated supervisory/regulatory structure,

by further incentivising the scheme in the form of additional business opportunities,

opening of new ATMs and conversion of exchange counters into branches, among others.

The process of consolidation through mergers of UCBs progressed further during

the year with a total of 61 mergers being effected upon the issue of statutory

orders by the Central Registrar of Co-operative Societies/Registrar of Co-operative

Societies (CRCS/RCS) concerned. Further, as on March 31, 2008, 268 UCBs were under

various stages of liquidation. All these measures appeared to have positive impact

on the performance of the UCBs as a whole. Their businesses expanded at

an impressive rate and operating profit increased during the year.

4.5

The process of implementation of the recommendations of the Task Force on revival

of short-term rural co-operative credit structure (Chairman: Prof. A. Vaidyanathan)

started with the announcement of a package by the Government of India. Twenty

five States have signed MoUs with the Government of India and NABARD. At end-March

2008, 59,294 PACS completed the required special audit. Until end-August 2008,

eight States had amended their respective Co-operative Societies Acts. Common

Accounting System (CAS) and management information system (MIS) were introduced

along with several human resources development (HRD) initiatives. Recapitalisation

of eligible PACS has been initiated. The Central Government also reached an agreement

with the State Governments regarding the contents of the package to implement

the Vaidyanathan Committee report on revival of long-term cooperative credit structure. 4.6

Balance sheets of all segments of the rural co-operative banking sector, except

for SCARDBs, expanded during 2006-07. Continuing with the trend witnessed in the

last year, the upper tier of both short-term and long-term rural co-operative

credit institutions made profits during 2006-07 also, while the lower tier (viz.,

PACS and PCARDBs) incurred losses. However, the profits made by the upper tier

were lower during 2006-07, while the losses incurred by the lower tier were higher

as compared with 2005-06. As a result, at the aggregate level, the financial performance

of the rural co-operative banking sector on the whole deteriorated further during

2006-07. Asset quality in terms of NPAs to loan ratio improved at the aggregate

level as well as at disaggregated level for all segments of rural credit structure,

barring PCARDBs (in case of PCARDBs the ratio remained unchanged during 2006-07).

The recovery performance improved this year for DCCBs, PACS and PCARDBs, while

it worsened for StCBs and SCARDBs.

4.7 The chapter is organised into

five sections. Section 2 details the policy developments, business operations

and performance of urban co-operative banks, while Section 3 focuses on the policy

developments and performance of rural cooperative banks. Section 4 delineates

the role of NABARD in the rural co-operative sector and the initiatives taken

during the year to improve the performance of the rural cooperative banking sector.

Section 5 reviews the progress made in the implementation of the Vaidyanathan

Committee’s recommendations on revival of the rural cooperative banking

sector.

2. Urban Co-operative Banks Policy Developments

4.8 The consultative mechanism adopted by the Reserve Bank for regulation

and supervision of UCBs in line with the framework suggested in the Vision Document

(2005) through signing of MoUs helped strengthen the sector. Furthermore,

the Reserve Bank guidelines on merger/ amalgamation of UCBs, just prior to commencement

of the MoU process, helped phase out non-viable banks through a non-disruptive

exit route. Both of these mechanisms progressed well during 2007-08 and helped

the UCB sector to strengthen further. Besides, the Reserve Bank continued with

its policy of relaxed regulatory norms for Tier I UCBs, i.e., smaller

UCBs with deposit base of less than Rs.100 crore and having branches limited to

a single district. Moreover, the Reserve Bank also made available a number of

facilities to UCBs in those States that have signed MoU with the Reserve Bank.

Structural Initiatives

Vision Document

4.9 A significant proposal of the Vision Document was to address the problem

of dual control of UCBs by signing of MoU between the Reserve Bank and the respective

State Governments, and establishing a consultative forum for supervision of the

banks. Accordingly, the Reserve Bank approached the States having a large network

of UCBs for signing MoUs. Since June 2005, MoUs have been signed with 23

State Governments (upto October 20, 2008) and with the Central Government in respect

of multi-State UCBs and TAFCUBs have been constituted in all such States.

The mechanism of TAFCUBs has been able to restore the confidence in the UCB sector

(Box.IV.1).

Two Tier Regulatory Structures - Definition

Amended

4.10 The definition of Tier I bank was amended with effect

from March 7, 2008. Banks falling under the following categories are classified

as Tier I banks: (i) unit banks, i.e., banks having a single branch/head

office

Box IV.1: MoU and TAFCUBs - Impact and

Progress In order to ensure greater convergence of regulatory and

supervisory policies between the two regulators in the urban cooperative banking

sector, viz., State Governments (Central Government in case of Multi-State

UCBs) and the Reserve Bank, the latter pursued a policy of encouraging the State

Governments to sign a Memorandum of Understanding (MoU) in this regard. Pursuant

to this policy, as on October 20, 2008, 23 States, viz., Gujarat, Andhra

Pradesh, Karnataka, Madhya Pradesh, Uttarakhand, Rajasthan, Chhattisgarh, Goa,

Maharastra, Haryana, National Capital Territory of Delhi, West Bengal, Assam,

Tripura, Punjab, U.P., Manipur, Meghalaya, Himachal Pradesh, Kerala, Mizoram,

Tamil Nadu and Sikkim have signed MoUs with the Reserve Bank. MoU has also been

signed with central Government in respect of multi state UCBs. As on October 20,

2008, the MoU has covered 1,746 UCBs out of 1,770 which accounts for 98.6 per

cent of total number of UCBs and 99.2 per cent of total deposits as well as advances

of the sector. As per the arrangements under MoU, the Reserve Bank constitutes

State level Task Force for Co-operative Urban Banks (TAFCUB) comprising representatives

of the Reserve Bank, the State Government and the UCB sector. Accordingly, TAFCUBs

have been constituted in all States that have signed MoUs. A Central TAFCUB has

also been constituted for the multi-state UCBs. TAFCUBs identify potentially viable

and non-viable UCBs in the States and suggest revival path for the viable and

non-disruptive exit route for the non-viable ones. The exit of non-viable banks

could be through merger/amalgamation with stronger banks, conversion of them into

societies or liquidation, as the last option. TAFCUBs, since its inception, have

examined the position of 949 UCBs (Including cases of banks reviewed more than

once) and taken decision on finalising merger with respect to 14 banks. Orders

of directions by the Reserve Bank were imposed on 37 banks and licenses were cancelled

for 40 banks. The impact of the consultative process is assessed in respect

of UCBs in states that signed MoUs before December 2006. As at end-March 2008,

number of UCBs in Grade IV declined from what it was at end-March 2006 in all

of these states, except in Rajasthan and Maharashtra/Goa. In case of UCBs in Grade

III, their number declined in all these states as at end-March 2008 over the same

three year period. However, in Uttarakhand the number remained same as it was

at end-March 2007 (Table I). Total number of Grade I and II

banks increased over the 3 year period from 2006 to 2008 in all these states except

Maharashtra/ Goa which witnessed a decline in number. In Uttarakhand the number

of Grade I and II remained unchanged in 2007 and 2008. Grade III and IV banks

declined in all the States over the mentioned three year reference period (Table

2).

Table

1: Comparison of Grades in the Last Three Years in

First Nine States that

signed MoU before December 2006 |

(As at end-March

2008) | States | End

March | Grade

I | Grade

II | Grade

III | Grade

IV | Total |

1. | Andhra

Pradesh | 2008 | 72 | 26 | 7 | 10 | 115 |

|

| 2007 | 65 | 33 | 7 | 11 | 116 |

|

| 2006 | 48 | 43 | 18 | 15 | 124 |

2. | Gujarat | 2008 | 110 | 99 | 27 | 35 | 271 |

|

| 2007 | 114 | 88 | 42 | 40 | 284 |

|

| 2006 | 136 | 50 | 67 | 43 | 296 |

3. | Karnataka | 2008 | 118 | 75 | 54 | 33 | 280 |

|

| 2007 | 99 | 92 | 55 | 42 | 288 |

|

| 2006 | 90 | 76 | 85 | 46 | 297 |

4. | Madhya

Pradesh/ | |

| |

| |

| | Chhattishgarh | 2008 | 18 | 27 | 16 | 9 | 70 |

|

| 2007 | 17 | 29 | 15 | 13 | 74 |

|

| 2006 | 16 | 28 | 17 | 14 | 75 |

5. | Maharashtra/Goa | 2008 | 201 | 191 | 101 | 116 | 609 |

|

| 2007 | 134 | 254 | 115 | 119 | 622 |

|

| 2006 | 226 | 173 | 127 | 104 | 630 |

6. | Rajasthan | 2008 | 23 | 13 | 1 | 2 | 39 |

|

| 2007 | 24 | 13 | 1 | 1 | 39 |

|

| 2006 | 25 | 10 | 3 | 1 | 39 |

7. | Uttarakhand | 2008 | 4 |

| 1 | 1 | 6 |

|

| 2007 | 4 |

| 1 | 2 | 7 |

| Total | 2008 | 546 | 431 | 207 | 206 | 1,390 |

|

| 2007 | 457 | 509 | 236 | 228 | 1,430 |

|

| 2006 | 541 | 380 | 317 | 223 | 1,461 |

Table

2: Number of UCBs in Grades ‘I & II’ and in Grades ‘III

& IV’ and their Percentage to | Total

Number of UCBs in First Nine TAFCUB States that Signed MoU before December 2006.

| (As

at end-March 2008) | States | No.

of Banks | Percentage

to Total |

| | Grades

I & II | Grades

III & IV | Grades

I & II | Grades

III & IV | 1. | Andhra

Pradesh 2008 | 98 | 17 | 85 | 15 |

| 2007 | 98 | 18 | 84 | 16 |

| 2006 | 91 | 33 | 73 | 27 |

2. | Gujarat

2008 | 209 | 62 | 77 | 23 |

| 2007 | 202 | 82 | 71 | 29 |

| 2006 | 186 | 110 | 63 | 37 |

3. | Karnataka

2008 | 193 | 87 | 69 | 31 |

| 2007 | 191 | 97 | 66 | 34 |

| 2006 | 166 | 131 | 56 | 44 |

4. | Madhya

Pradesh/ |

| |

| |

| Chhattishgarh

2008 | 45 | 25 | 64 | 36 |

| 2007 | 46 | 28 | 62 | 38 |

| 2006 | 44 | 31 | 59 | 41 |

5. | Maharashtra/Goa

2008 | 392 | 217 | 64 | 36 |

| 2007 | 388 | 234 | 62 | 38 |

| 2006 | 399 | 231 | 63 | 37 |

7. | Rajasthan

2008 | 36 | 3 | 92 | 8 |

| 2007 | 37 | 2 | 95 | 5 |

| 2006 | 35 | 4 | 90 | 10 |

8. | Uttarakhand

2008 | 4 | 2 | 67 | 33 |

| 2007 | 4 | 3 | 57 | 43 |

| Total

2008 | 977 | 413 | 70 | 30 |

| 2007 | 966 | 464 | 68 | 32 |

| 2006 | 921 | 540 | 63 | 37 |

Note :

1. Sound UCBs with no supervisory concern are classified as Grade

I. The remaining three grades would indicate existence of supervisory concerns

in increasing degree as per their positions on capital adequacy, net loss, NPA

level, default in maintenance of CRR/SLR etc.

2. Data related to

Uttarakhand for the year 2006 are not available. | and

banks with deposits below Rs.100 crore, whose branches are located in a single

district; (ii) banks with deposits below Rs.100 crore having branches in more

than one district, provided the branches are in contiguous districts, and deposits

and advances of branches in one district separately constitute at least 95 per

cent of the total deposits and advances, respectively, of the bank; (iii) banks

with deposits below Rs.100 crore, whose branches were originally in a single district

but subsequently, became multi-district due to reorganisation of the district.

The deposit base of Rs.100 crore would be determined on the basis of average of

fortnightly net demand and time liabilities (NDTL) in the financial year concerned

and that of advances on the basis of fortnightly average in the financial year

concerned. Rest of the UCBs are categorised as Tier II banks.

Merger/Amalgamation

and Exit of Unviable Entities

4.11 The consolidation

of the UCB sector through the process of merger of weak entities with stronger

ones was set in motion by providing transparent and objective guidelines for granting

'no-objection' to merger proposals (Box IV.2).

Financial

Restructuring of UCBs having Negative Net Worth

4.12 Apart from

the non-disruptive exit route through mergers/amalgamations, the Reserve Bank

also considered financial restructuring proposals for problem banks with large

negative net-worth and with large number of deposit erosion. The financial

restructuring proposals had to fulfill the following conditions: (i) interest

of small depositors should be protected in full; (ii) a portion of deposit of

individual depositors above Rs.1 lakh would be converted into equity. A portion

of deposit of institutional depositors would be converted into innovative perpetual

debt instrument (IPDI), which would be eligible for inclusion as Tier I capital,

subject to certain terms and conditions; (iii) the proportion of deposits converted

into equity/IPDI should be such that the net worth of the bank after reconstruction

becomes positive; (iv) the bank would have to maintain CRR/SLR on the restructured

regular deposits; (v) after restructuring, the management of the bank should be

in the hands of a board of administrators consisting of representatives of individual

depositors, institutional depositors as well as professional bankers to ensure

proper implementation of the reconstruction scheme, including recovery of NPAs.

Working Group on Umbrella Organisations and Constitution of Revival

Fund for the UCB Sector

4.13 A Working Group on Umbrella Organisations

and creation of Revival Fund for the UCB Sector was constituted by the Reserve

Bank (Chairman: Shri V.S Das) on July 23, 2008: (i) to study the regulatory and

supervisory structure of umbrella organisations of financial co-operative institutions/banks

as prevalent in other parts of the world, especially in relation to raising of

capital and intra co-operative group support system; (ii) to study the existing

structure and legal framework for UCBs in India and to examine the need and scope

for a federated structure/umbrella organisation for UCBs at the State level; (iii)

to suggest appropriate supervisory and regulatory framework to facilitate emergence

of such umbrella organisation(s) for UCBs, taking into consideration the international

systems and experiences; and (iv) to study and suggest modalities for setting

up an appropriate mutual assistance/revival fund for urban cooperative banks and

the nature of support that could be provided by such fund. The Working Group,

which comprises members from the Central Government, the State Governments, the

UCB sector and the Reserve Bank have held three meetings so far. Box

IV.2: Merger and Amalgamation of UCBs Merger and amalgamation provides

an inorganic route for expansion, facilitating in the process consolidation, and

emergence of strong entities and also paving the way for non-disruptive exit of

weak/unviable entities. In view of these merits, the Reserve Bank provided transparent

and objective guidelines for granting no-objection to merger proposals. The Reserve

Bank looks into the financial aspects of the merger only with a view to protecting

the interests of depositors and financial stability. Almost invariably, banks

voluntarily approach the Reserve Bank to obtain no objection for their merger

proposal. The guidelines on mergers are intended to facilitate the process by

delineating the pre-requisites and steps to be taken for merger between banks.

The process of merger and amalgamation is elaborate. The application for

merger giving the proposed scheme has to be submitted by the acquirer bank to

the Registrar of Cooperative Societies (RCS)/Central Registrar of Co-operative

Societies (CRCS) and a copy of the proposal is simultaneously forwarded to the

Reserve Bank along with certain specified information. The Reserve Bank examines

the proposals and places the same before an expert group for screening and recommendations.

On evaluation, if the proposal is found to be suitable, the Reserve Bank issues

no objection certificate (NOC) to the RCS/CRCS and the banks concerned. RCS/CRCS,

being the authorities vested with the responsibility of administering the Co-operative

Societies Act, then issues the order of amalgamation of the target UCB in compliance

with the provisions of the Act under which the bank is registered.

Pursuant

to the issue of guidelines on merger of UCBs, since February 2005, Reserve Bank

received 107 proposals for merger in respect of 92 banks. The Reserve Bank has

issued NOC in 68 cases (Table 1 and 2). Of

these, 61 mergers became effective upon the issue of statutory orders by the RCS/CRCS

concerned. Twenty

Table

1: State-wise Break-up of Acquirer Banks | (As

on November 7, 2008) | Sr.

No. | Act

Under Which Registered | No.

of Acquirer Banks | No.

of Proposals Submitted | No.

of NOC Issued | No.

of Proposals Rejected | No.

of Proposals Withdrawn | Proposals

Under Process |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

1. | Multi-State | 13 | 56 | 40 | 9 | 3 | 4 |

2. | Maharashtra | 14 | 22 | 11 | 8 | Nil | 3 |

3. | Gujarat | 6 | 9 | 7 | 1 | 1 | Nil |

4. | Andhra

Pradesh | 6 | 7 | 5 | Nil | Nil | 2 |

5. | Karnataka | 3 | 4 | 2 | 1 | Nil | 1 |

6. | Rajasthan | 2 | 2 | Nil | 1 | Nil | 1 |

7. | Punjab | 1 | 1 | 1 | Nil | Nil | Nil |

8. | Uttarakhand | 2 | 3 | 2 | Nil | 1 | Nil |

9. | Madhya

Pradesh | 2 | 2 | Nil | Nil | Nil | 2 |

10. | Chattisgarh | 1 | 1 | Nil | Nil | Nil | 1 |

Total (1 to 10) | 50 | 107 | 68 | 20 | 5 | 14 |

Table

2: State-wise Break-up of Target Banks | (As

on November 7, 2008) | Sr.

No. | Act

Under Which Registered | No.

of Target Banks | No.

of Proposals Submitted | No.

of NOC Issued | No.

of banks Merged | No.

of

Proposals Withdrawn | Proposals

Rejected | Proposals

Under process | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

1. | Multi-State | 1 | 1 | 1 | 1 | NIL | NIL | NIL |

2. | Maharashtra | 36 | 45 | 24 | 22 | 2 | 12 | 5 |

3. | Gujarat | 25 | 27 | 22 | 19 | 2 | 2 | 1 |

4. | Andhra

Pradesh | 11 | 11 | 9 | 8 | NIL | NIL | 2 |

5. | Karnataka | 6 | 8 | 5 | 4 | NIL | 2 | 1 |

6. | Goa | 1 | 1 | 1 | 1 | NIL | NIL | NIL |

7. | Rajasthan | 1 | 1 | NIL | NIL | NIL | 1 | NIL |

8. | Delhi | 1 | 1 | NIL | NIL | NIL | 1 | NIL |

9. | Punjab | 1 | 1 | 1 | 1 | NIL | NIL | NIL |

10. | Madhya

Pradesh | 6 | 7 | 3 | 4 | NIL | 2 | 2 |

11. | Uttarakhand | 2 | 3 | 2 | 1 | 1 | NIL | NIL |

12. | Chattisgarh | 1 | 1 | NIL | NIL | NIL | NIL | 1 |

Total (1 to 12) | 92 | 107 | 68 | 61 | 5 | 20 | 12 |

Table 3: Grade-wise

Distribution of Merged Banks | proposals

for merger were rejected by the Reserve Bank,

five proposals were withdrawn

by the banks and the remaining 14 are under consideration. Out of the 68 target

banks for which NOC for merger was issued, 61 banks were merged and 35 of them

were having negative net worth (Table 3). The profit-making banks were also permitted

to merge with the aim of consolidation and strengthening the sector. |

Grade | Number

of Banks | I | 8 |

II | 4 |

III | 8 |

IV | 41 |

Total | 61 |

Memo item: Out of

41 Grade IV banks, 35 banks had negative net worth. | Statutory

Pre-emptions

Policy on CRR

4.14 The cash reserve

ratio (CRR) for scheduled primary urban co-operative banks was reduced to 5.50

per cent with effect from the fortnight beginning November 8, 2008 (Table

IV.1).

Policy on SLR

4.15 As per the provisions

of Section 24 of the Banking Regulation Act, 1949 (AACS), deposits placed by UCBs

with the higher financing agencies in the co-operative sector, viz.,

DCCBs/StCBs would be reckoned as SLR assets to the extent they are not encumbered.

However, instances have come to light where some UCBs availed loans from the DCCB/

StCB concerned without specifically earmarking their liability against their deposits.

Though technically the entire deposits were being treated as eligible SLR asset,

the deposits as such may not be available to the UCBs to meet their liquidity

needs. Moreover, the lender bank (DCCB/ StCB) in such cases can exercise

its lien over the deposits of UCBs which have availed of loans in case of defaults.

It was, therefore, decided that when a UCB avails of a loan from a DCCB/StCB with

which it is maintaining deposits, for the purpose of computation of SLR, the amount

of loan availed from the DCCB/StCB, would be deducted from the deposits, irrespective

of whether lien has been marked on such deposits or not. UCBs have

Table

IV.1: Changes in CRR | Sr.No. | Effective

date* | CRR

(As

percentage of NDTL) | 1 | 2 | 3 |

1. | April

14, 2007 | 6.25 |

2. | April

28, 2007 | 6.50 |

3. | August

4, 2007 | 7.00 |

4. | November

10, 2007 | 7.50 |

5. | April

26, 2008 | 7.75 |

6. | May

10, 2008 | 8.00 |

7. | May

24, 2008 | 8.25 |

8. | July

5, 2008 | 8.50 |

9. | July

19, 2008 | 8.75 |

10. | August

30, 2008 | 9.00 |

11. | October

11, 2008 | 6.50 |

12. | October

25, 2008 | 6.00 |

13. | November

8, 2008 | 5.50 |

*: From the fortnight

beginning. | been given a certain

period to comply with the SLR requirements in the case of shortfall, if any, arising

from the above instructions.

4.16 The issue of valuation of special securities,

viz., those that do not qualify for the purpose of complying with the

SLR requirements of banks, was examined. It was decided that for the limited purpose

of valuation, all special securities issued by the Government of India directly

to the beneficiary entities and which do not carry SLR status, may be valued at

a spread of 25 basis points above the corresponding yield on Government of India

securities. This amendment would come into force from the financial year 2008-09.

Presently, such special securities comprise oil bonds, fertiliser bonds, bonds

issued to the State Bank of India (during the recent rights issue), the erstwhile

Unit Trust of India, Industrial Finance Corporation of India Ltd., Food Corporation

of India, Industrial Investment Bank of India Ltd., the erstwhile Industrial

Development Bank of India and the erstwhile Shipping Development Finance

Corporation.

4.17 It was further clarified on July 11, 2008 that the

balance maintained by UCBs in current account with IDBI Bank Ltd. would not be

eligible for being reckoned as ‘net balance’ in current account for

the purpose of CRR/SLR under sections 18 and 24 of Banking Regulation Act, 1949

(AACS) since IDBI Bank Ltd. is not reckoned for maintaining current accounts that

will be treated as cash for the purpose of CRR/SLR by co-operative banks. UCBs,

maintaining current account balances with IDBI Bank and presently reporting the

same as CRR/SLR, were advised to intimate the position as on June 2008 to respective

regional offices of the Reserve Bank.

Regulatory Initiatives

Asset Classification and Provisioning Norms

4.18 The asset

classification and provisioning norms for Tier I UCBs would continue to be different

from Tier II UCBs as follows: (i) the 180 day loan delinquency norm for NPAs was

extended by one year, i.e., up to March 31, 2009; (ii) the 12-month period

for classification of a 'sub-standard' asset in 'doubtful' category by Tier

I UCBs would be made effective from April 1, 2009 instead of April 1, 2008; (iii)

these banks would be required to provide 100 per cent on the secured portion of

D-III advances ('doubtful' for more than 3 years) as on or after April 1, 2010;

and (iv) for the outstanding stock of D-III advances as on March 31, 2010, banks

would be required to provide: (a) 50 per cent as on March 31, 2010; (b) 60 per

cent as on March 31, 2011; (c) 75 per cent as on March 31, 2012; and (d) 100 per

cent as on March 31, 2013.

4.19 For Tier II banks, 100 per cent provisioning

norms for advances classified as D-III would be applicable on or after April 1,

2007 instead of those so classified on or after April 1, 2006. Consequently, for

the outstanding stock of D-III assets as on March 31, 2007, banks are required

to provide: (a) 50 per cent up to March 31, 2007; (b) 60 per cent as on

March 31, 2008; (c) 75 per cent as on March 31, 2009; (d) 100 per cent as on March

31, 2010.

4.20 Keeping in view the nature of membership and loan profile

of the salary earners' banks (SEBs), it was decided that the SEBs in Tier II may

provide for standard assets in respect of personal loans at the rate of 0.4 per

cent instead of the existing level of 2 per cent. Provisioning requirement in

respect of loans and advances qualifying as capital market exposure, commercial

real estate loans and loans and advances to systemically important NBFCs (non-deposit

taking companies) would, however, continue to be 2 per cent for such banks. Tier

I banks are already subject to a provisioning requirement of 0.25 per cent on

their standard advances.

4.21 UCBs were required to provide at the rate

of 10 per cent and 20 per cent per annum, respectively, on their exposure to DCCBs,

StCBs facing financial problems. In view of the absence of adequate avenues for

raising of capital by these banks and the adverse impact of the revised provisioning

norms on the profitability of UCBs, it was decided to defer the implementation

of the revised provisioning norms by one year, i.e., to March 31, 2009. Risk

Weights for Capital Adequacy

4.22 According to the announcement

made in the Annual Policy Statement for the year 2007-08, risk weight on loans

up to Rs.1 lakh against gold and silver ornaments was reduced to 50 per cent from

the prevailing level of 125 per cent. Further, risk weight for capital adequacy

purpose on housing loans to individuals was reduced from the prevailing level

of 75 per cent to 50 per cent as a temporary measure. This dispensation is applicable

for loans up to Rs.20 lakh and would be reviewed after one year, keeping in view

the default experience and other relevant factors. Moreover, as announced in the

Annual Policy Statement 2008-09, the limit in respect of bank loans for housing

in terms of applicability of risk weights for capital adequacy purposes was enhanced

from Rs.20 lakh to Rs.30 lakh and such loans would carry a risk weight of 50 per

cent. Education loans were earlier classified as a part of ‘consumer credit’

for the purpose of capital adequacy and attracted risk weight of 125 per cent.

After a review, UCBs were advised not to classify education loans as 'consumer

credit' for the purpose of capital adequacy norms. Accordingly the risk weight

applicable to education loans would be 100 per cent as against 125 per cent.

Asset-Liability Management

4.23 Scheduled UCBs were advised

to submit the structural liquidity statement and interest rate sensitivity statement

through the asset-liability managment (ALM) module provided in the off-site surveillance

software (OSS). The statement of structural liquidity was to be prepared at fortnightly

intervals starting with the last reporting friday of June 2007, i.e., June

22, 2007 and that of interest rate sensitivity on a monthly basis starting with

the last reporting friday of the month of June, 2007. ALM guidelines have been

prescribed for non-scheduled UCBs also and would be effective from the quarter

ending December 2008. Basic liquidity risk management guidelines have been prescribed

for Tier I banks as well which would also come into effect from the quarter ending

December 2008.

4.24 UCBs were earlier advised not to consider any proposal

for granting advances against shares/debentures for trading or for granting advances

to share or stock brokers. It was further clarified to UCBs that they were

prohibited from extending any fund based or non-fund based credit facilities,

whether secured or unsecured, to stockbrokers. The prohibition would thus cover

in addition to shares and debentures, loans and advances against other securities

such as fixed deposits and LIC policies, among others. They were also advised

not to extend any facility to commodity brokers. This includes issue of guarantees

on behalf of the commodity brokers. Advances against units of mutual funds could

be extended only to individuals as in the case of advances against the security

of shares, debentures and bonds. UCBs were advised that any credit facility presently

in force, but not in consonance with the above instructions should be withdrawn/closed

without any delay.

4.25 Despite various safeguards being in place pertaining

to the post sanction monitoring of advances, instances of diversion of funds and

non-credit of sale proceeds to borrowal accounts continue to come to light and

are observed to be important factor contributing to the perpetration of frauds/the

account turning NPAs. UCBs were, therefore, advised on September 13, 2007 to adopt

more stringent safeguards, especially where accounts showed signs of turning into

NPAs, e.g., resorting to more frequent inspections of borrower’s

godowns, ensuring that the sale proceeds were routed through the borrower’s

accounts maintained with the bank and insisting on pledge of the stock instead

of hypothecation. Whenever stock under hypothecation to cash credit and other

loan accounts are found to have been sold but proceeds thereof have not been credited

to the loan account, such action should normally be treated as a fraud and banks

should take immediate steps to secure the remaining stock so as to prevent further

erosion in the value of the available security.

Frauds and Suspicious

Transactions

4.26 It was communicated to UCBs that as a part of

transaction monitoring mechanism, they are required to put in place an appropriate

software application that alerts them when the transactions are inconsistent with

risk categorisation and updated profile of customers. They were also advised to

initiate urgent steps to ensure electronic filing of cash transaction report (CTR)

and suspicious transaction report (STR) to Financial Intelligence Unit - India

(FIU-IND). Further, in view of reports by FIU-IND that many banks are yet to file

electronic reports, UCBs were advised to arrange for filing the data of non-computerised

branches into an electronic file with the help of the editable electronic utilities

of CTR/STR as made available by FIU–IND on their website (http://fiuindia.gov.in).

It was further clarified that cash transaction reporting by branches to their

principal officer should be submitted on a monthly basis and not on a fortnightly

basis and the principal officer, in turn, should ensure to submit CTR for every

month to FIU-IND within the prescribed time schedule, i.e., by 15 th

of the succeeding month. It was reiterated that the cut-off limit of Rs.10 lakh

for reporting in CTR should be applicable to integrally connected cash transactions

also. 4.27 UCBs were advised on December 15, 2004 that they

should pay special attention to all complex, unusual/large transactions and all

unusual patterns of transactions which had no apparent economic or visible lawful

purpose. It was further advised that the background papers/documents of such transactions

should be examined and properly recorded to make it available to auditors and

also to the Reserve Bank/other relevant authorities.

4.28 UCBs were also

advised that the customers should not be tipped off on the STRs filed by them

with FIU-IND. Banks should report all such attempted transactions in STRs, even

if not completed by customers, irrespective of the amounts of transaction. ‘Suspicious

Transactions’ are defined in Rule 2(g) of Rules notified under the Prevention

of Money Laundering Act, 2002. Banks should submit STRs, if they have reasonable

grounds to believe that the transaction involves proceeds of crime, generally,

irrespective of the amount of transaction and/or threshold limit envisaged for

predicate offences in part B of schedule of the PMLA, 2002. UCBs were advised

to create awareness about KYC/AML among their staff and for generating alerts

for suspicious transactions, they may consider the indicative list of suspicious

activities contained in Annex E of the Indian Bank Association (IBA’s)

Guidance Note for Banks, 2005. UCBs were advised that these guidelines were issued

under section 35A of the Banking Regulation Act, 1949(AACS) and any contravention

of the said guidelines might attract penalties under the relevant provisions of

the Act.

4.29 As wire transfer is an instantaneous and the most preferred

route for transfer of funds across the globe, there is a need for preventing terrorists

and other criminals from having unfettered access to it for moving their funds

and for detecting any misuse when it occurs. UCBs were, therefore, advised to

invariably ensure certain specified information about all wire transfers. An ordering

bank, where the wire transfer originates, must ensure that qualifying wire transfer

contains complete originator information and intermediary bank should ensure that

the same is retained with the transfer. The record of such information should

be preserved for a period of 10 years. A beneficiary bank should have effective

risk-based procedures in place to identify wire transfers lacking complete originator

information. The lack of complete originator information may be considered as

a factor in assessing whether a wire transfer or related transactions are suspicious

and whether they should be reported to the FIU-IND.

Credit Delivery

and Financial Inclusion

Priority Sector Lending

4.30 In view of significant changes in the regulatory framework for UCBs,

which has become more or less comparable with that of commercial banks and the

exemptions hitherto enjoyed by UCBs from the payment of income tax having been

withdrawn, the priority sector lending target for UCBs was brought down to 40

per cent of the adjusted bank credit (ABC) (total loans and advances plus investments

made by UCBs in non-SLR bonds) or credit equivalent amount of off-balance sheet

exposure (OBE), whichever is higher, as on March 31 of the previous year and thus

brought at par with the target applicable to commercial banks. The revised target

came into effect from April 1, 2008.

4.31 UCBs were required to submit

data annually on priority sector lending within a month from the end of the reference

period, i.e., March 31 every year and credit flow to minority communities

every half year as on March 31 and September 30 in the prescribed format. The

existing reporting formats and periodicity were reviewed and revised on June 30,

2008. Sectors that qualify for inclusion as priority sector were revised in August

2007 and areas that qualify for inclusion as priority sector now include: (i)

total agricultural credit (direct and indirect); (ii) total credit to small enterprises

(direct and indirect); (iii) retail trade; (iv) micro credit; (v) State sponsored

organisations for SC/ST; (vi) education; and (vii) housing. UCBs were advised

to submit the first set of revised returns by April 15, 2009 to the concerned

Regional Offices of the Reserve Bank.

4.32 The definitions of micro,

small and medium enterprises were modified on August 30, 2007. The modified definitions

of micro, small and medium enterprises engaged in manufacturing or production

and in providing or rendering services are as under–(i) enterprises engaged

in the manufacture or production, processing or preservation of goods: (a) where

investment in plant and machinery does not exceed Rs.25 lakh is a micro enterprise;

(b) where the investment in plant and machinery is more than Rs.25 lakh, but does

not exceed Rs.5 crore is a small enterprise; (c) where the investment in plant

and machinery is more than Rs.5 crore, but does not exceed Rs.10 crore is a medium

enterprise; and (ii) enterprises engaged in providing or rendering services: (a)

where the investment in equipments does not exceed Rs.10 lakh is a micro enterprise;

(b) where the investment in equipment is more than Rs.10 lakh, but does not exceed

Rs.2 core is a small enterprise; (c) where the investment in equipment is more

than Rs.2 crore, but does not exceed Rs.5 crore is a medium enterprise. Bank’s

lending to medium enterprises would not be included for the purpose of reckoning

under the priority sector.

Agricultural Debt Waiver and Debt Relief

Scheme, 2008

4.33 In the budget speech for 2008-09, the Hon'ble

Union Finance Minister announced a Debt Waiver and Debt Relief Scheme for farmers,

which was subsequently notified by the Government. The detailed scheme along with

necessary explanations was forwarded to UCBs and they were advised to take necessary

action for implementing the scheme.

Guidelines for Relief Measures

by Banks to Poultry Industry, 2008

4.34 In view of the instances

of outbreak of Avian Influenza (bird flu) in some parts of the country and consequent

loss of income on account of culling of birds for poultry units financed by the

banks, UCBs were advised on February 19, 2008 to consider extending certain facilities

to them as under: (i) principal and interest due on working capital loans as also

instalments and interest on term loans which had fallen due for payment on or

after the onset of bird flu, i.e., December 31, 2007 and remaining unpaid

amount may be converted into term loans-the converted loans may be recovered in

instalments based on projected future inflows over a period up to three years

with an initial moratorium of up to one year (the first year of repayment may

be fixed after the expiry of moratorium period); (ii) the remaining portion of

term loans may be rescheduled similarly with a moratorium period up to one year

depending upon the cash flow generating capacity of the unit; (iii) the rescheduling/conversion

may be completed on or before April 30, 2008; (iv) the rescheduled/converted loans

may be treated as current dues; (v) after conversion as above, the borrower will

be eligible for fresh need-based finance; (vi) the relief measures as above may

be extended to all accounts of poultry industry, which were classified as standard

accounts as on December 31, 2007.

KYC norms

4.35 In

order to ensure that the customer acceptance policy and its implementation

does not result in denial of banking services to general public, especially to

those who are financially or socially disadvantaged, UCBs were advised to review

their extant internal instructions in this regard so that a section of public

may not be denied access to banking services. It was clarified to UCBs that ‘permanent

correct address’ referred to in the existing instructions, means the address

at which person normally resides and can be taken as the address as mentioned

in a utility bill or any other document accepted by the bank for verification

of the address of the customer. Banks should keep in mind the spirit of instructions

issued by the Reserve Bank and avoid undue hardships to individuals who are otherwise

classified as low risk customers. Banks were further advised that the review of

risk categorisation of customers should be carried out not less than once in six

months. Banks should also introduce a system of periodical updating of customer

identification data after the account was opened. The periodicity of such updation

should not be less than once in five years in case of low risk category customers

and not less than once in two years in case of high and medium risk categories

of customers.

Customer Services

4.36 UCBs were

advised on May 18, 2007 to lay down appropriate internal principles and procedures

so that usurious interest, including processing and other charges are not levied

by them on loans and advances. In laying down such principles and procedures in

respect of small value loans, particularly, personal loans and such other loans

of similar nature, banks were advised to take into account certain broad guidelines.

Banks were further advised to put in place such principles and procedures within

a period of three months from the date of notification.

4.37 UCBs were

advised that all transactions, including payment of interest on deposits/charging

of interest on advances, should be rounded off to the nearest rupee (fraction

of 50 paise and above to be rounded off to the next higher rupee and that of less

than 50 paise to be ignored). Banks were, however, advised that cheques issued

by their clients for amounts containing fraction of rupee should not be rejected

or dishonoured. Banks were also advised to ensure that the concerned staffs are

well versed with these instructions so that general public does not suffer. They

should also ensure that appropriate action is taken against members of their staff

who are found to have refused to accept cheques/drafts containing fraction of

a rupee. Banks were also advised to note that violation of aforesaid instructions

would be liable to be penalised under the provisions of the Banking Regulation

Act, 1949 (AACS).

4.38 UCBs were advised to generally insist that a person

opening a deposit account makes a nomination. The bank should explain the advantages

of nomination facility to the depositor and if the person still does not want

to nominate, the bank should ask him to give a specific letter to the effect that

he does not want to make nomination. In case the person declines to give such

a letter, the bank should record the fact on the account opening form and proceed

with opening of the account, if otherwise found eligible. Under no circumstances,

though, should a bank refuse to open an account solely on the ground that the

person opening the account has refused to nominate. UCBs were also advised to

follow the procedure outlined above in respect of deposit accounts in the name

of sole proprietary concerns.

4.39 Some schemes with lock-in periods

and other restrictive features floated by some banks were not in conformity with

the Reserve Bank’s instructions. Banks, which have floated such deposit

schemes, were advised to discontinue the schemes with immediate effect and report

compliance to concerned regional offices of the Reserve Bank.

4.40 Scheduled

UCBs were advised to formulate a comprehensive and transparent policy covering

the following three aspects, taking into account their technological capabilities,

systems and processes adopted for clearing arrangements and other internal arrangements

for collection through correspondents: (a) immediate credit of local/ outstation

cheques; (b) timeframe for collection of local/outstation instruments; and (c)

interest payment for delayed collection. They were also advised to review their

existing arrangements and capabilities and work out a scheme for reduction in

collection period. Adequate care should be taken to ensure that the interests

of the small depositors were fully protected. The policy should clearly lay down

the liability of the banks by way of interest payments due to delay for non-compliance

with the standards set by the banks themselves and should be integrated with the

deposit policy formulation by the bank in line with the IBA’s noted policy.

Scheduled UCBs were advised to place the policy before the board and obtain their

specific approval thereon. They were advised to send a copy of cheque collection

policy, after the board’s approval, to the Reserve Bank for its confirmation

before implementation.

4.41 To increase the usage of ATMs as a delivery

channel, banks entered into bilateral or multi-lateral arrangements with other

banks to have inter-bank ATM networks. The charges levied on the customers vary

from bank to bank, according to the ATM network that is used for the transaction.

The ideal situation is that a customer should be able to access any ATM installed

in the country free of charge through an equitable co-operative initiative by

banks. Based on the feedback report on an approach paper placed on the website

of the Reserve Bank, a framework of service charges for implementation by all

banks was decided (Table IV.2).

4.42 For the services

at (i) and (ii) in Table IV.2, the customer would not be levied any charge under

any other head and for services at (iii), the charge of Rs.20 would be all inclusive

and no other charges would be levied under any other head, irrespective of the

amount of withdrawal. The service charges for the following types of cash withdrawal

transactions may be determined by the banks themselves: (a) cash withdrawal with

the use of credit cards; and (b) cash withdrawal in an ATM located abroad.

Other Measures

4.43 The Committee on Procedures and Performance

Audit on Public Services (CPPAPS) had made some recommendations for easy operation

of lockers. on June 21, 2007, UCBs were also advised accordingly. UCBs were also

permitted to lay down policies with the approval of their boards for sanction

of gold loans with bullet repayment option, subject to the guidelines issued by

the Reserve Bank.

4.44 Since visually challenged persons are legally

competent to contract, banking facilities including cheque book facility/

Table

IV.2: ATM Charges | Sr.

No. | Service | Charges |

1 | 2 | 3

| (i) | For

use of own ATMs for any purpose | Free

(with effect from March 12, 2008) | (ii) | For

use of other bank ATMs for balance enquiries | Free

(with effect from March 12, 2008) | (iii) | For

use of other bank ATMs for cash withdrawals | l | No

bank shall increase the charges prevailing as on December 23, 2007 |

|

| | (i.e.,

the date of release of Approach Paper on RBI website) |

| | l | Banks

which are charging more than Rs.20 per transaction shall reduce |

|

| | the

charges to a maximum of Rs.20 per transaction by March 31, 2008 |

|

| l | Free

with effect from April 1, 2009 | operation

of ATM/locker, etc., cannot be denied to them. It was brought to the

notice of the Reserve Bank that visually challenged persons were facing problems

in availing of banking facilities. UCBs were, therefore, advised on June 4, 2008

to ensure that all banking facilities such as cheque book facility, including

third party cheques, ATM facility, net banking facility, locker facility, retail

loans and credit cards, among others, should invariably be offered to

the visually challenged without any discrimination.

Other Policy

Initiatives

Investments in Non-SLR Securities by UCBs

4.45 To allow UCBs greater flexibility in making non-SLR investments, the

instructions on the subject were reviewed and significant changes in the guidelines

were made. First, UCBs can now invest in ‘A’ or equivalent rated commercial

papers (CPs), debentures and bonds that are redeemable in nature which were not

permitted earlier. Second, they can also invest in units of debt mutual funds

and money market mutual funds. Earlier, only investment in units of UTI

were permitted and not in other mutual funds. This distinction was done away with,

though no investment in equity linked mutual funds is permitted. Third, fresh

investments in shares of all-India financial institutions (AIFIs) would also not

be permitted unlike hitherto. Fourth, balances held in deposit accounts with commercial

banks and in permitted scheduled UCBs and investments in certificate of deposits

issued by commercial banks would be outside the limit of 10 per cent of total

deposit prescribed for non-SLR investments. Fifth, a cap of 10 per cent of NDTL

has been placed on the total amount of funds that can be placed as inter-bank

deposits (for all purposes including clearing, remittance, etc). The

prudential inter-bank exposure limit of 10 per cent of the NDTL would be all-inclusive

and not limited to inter-bank call and notice money. The only exception is made

for Tier I UCBs, which may place deposits up to 15 per cent of their NDTL with

public sector banks over and above the said prudential limit of 10 per cent of

NDTL. Sixth, exposure to any single bank should not exceed 2 per cent of the depositing

bank’s DTL as on March 31 of the previous year, inclusive of its total non-SLR

investments and deposits placed with that bank. Deposits, if any, placed for availing

CSGL facility, currency chest facility and non-fund based facilities like bank

guarantee (BG), letter of credit (LC) would be excluded to determine the single

bank’s exposure limit for this purpose.

Instruments for Augmenting

Capital Funds

4.46 In order to facilitate raising of capital funds,

UCBs were permitted on July 15, 2008 to issue preference shares, viz.,

(i) perpetual non-cumulative preference shares (PNCPS); (ii) perpetual cumulative

preference shares (PCPS); (iii) redeemable non-cumulative preference shares (RNCPS);

and (iv) redeemable cumulative preference shares (RCPS). Further, UCBs were also

permitted to raise term deposits for a minimum period of not less than 5 years,

which would be eligible to be treated as Tier II capital. The important features

of the instruments for augmenting capital funds are: first, the extant share linking

norm would not be applicable to a member who was already holding 5 per cent of

the total paid-up share capital of an UCB; Second, Tier II capital has been further

divided into upper and lower tiers. PCPS, RNCPS and RCPS would be treated as upper

Tier II capital. Long-term deposits would be treated as lower Tier II capital.

PNCPS should not exceed 20 per cent of Tier I capital. Long-term deposit should

not exceed 50 per cent of Tier II capital and that total Tier II should not exceed

Tier I capital; Third, as per extant instructions, elements of Tier II capital

were reckoned as capital funds up to a maximum of 100 per cent of Tier I capital.

In the case of banks that are having CRAR less than 9 per cent, it was decided

that the above restriction should be kept in abeyance for five years, i.e.,

up to March 31, 2013 in order to give time to the banks to raise Tier I capital.

In other words, Tier II capital would be reckoned as capital funds for capital

adequacy purpose even if a bank does not have Tier I capital. However, during

this period, for the purpose of capital adequacy requirement, lower Tier II capital

alone would be restricted to 50 per cent of the prescribed CRAR and the progressive

discount in respect of Tier II capital would be applicable.

Implementation

of Recommendations of the Working Group on Access Criteria to Payment Systems

4.47 According to the announcement made in the Annual Policy Statement 2007-08,

a Working Group was constituted for prescribing guidelines for access to various

payment systems. The Working Group recommended that membership to clearing houses

at MICR centres be confined to licenced banks meeting the following financial

criteria: (i) CRAR of 9 per cent; (ii) net NPA of less than 10 per cent; (iii)

no default in maintenance of CRR and SLR during the past one year; and (iv) net

profit in at least one of the two preceding years. Further, the Working Group

recommended that the entities which are presently members of clearing houses at

MICR centres but ineligible to be members as per the proposed access criteria,

would have to conform to the prescribed norms within one year, failing which membership

would be downgraded to that of a sub-member. The Working Group has also recommended

that such banks may be barred with immediate effect, from sponsoring any sub-member.

INFINET Membership for UCBs

4.48 On the basis of the recommendations

of the Working Group for ‘Access to Payment Systems’ constituted for

preparation of comprehensive guidelines setting out the minimum eligibility criteria

for membership of clearing houses/payment systems, regional offices of the Reserve

Bank were advised to extend INFINET membership to all UCBs, provided they had

the requisite infrastructure in place for the same. The applicant bank should

be advised to submit details of infrastructure available with it for participation

in the INFINET, together with a board resolution for seeking the membership. Subject

to the above parameters, unlicensed UCBs could also be permitted to avail of INFINET

membership so long as their application for license has not been rejected by the

Reserve Bank. Regional offices of the Reserve Bank were further advised to make

it clear to these banks that the membership would not in any way entitle them

to claim a banking license at a later date and their application for license would

be examined independently on its merits.

4.49 The efforts to increase

the spread of technology in the UCB sector attracted greater attention with the

setting up of a Working Group to examine the areas relating to IT support to UCBs

(Box IV.3).

Rationalisation of Returns Submitted

by UCBs

4.50 In view of a large number of returns that the UCBs

were required to submit, as directed by the Board for Financial Supervision (BFS),

an exercise for rationalisation of returns to be submitted by UCBs was undertaken.

The returns submitted by UCBs were examined from the point of view of reducing

the volume of data to be submitted by banks without compromising on the breadth

and depth of information being obtained from them. The rationalisation of the

returns was done and the maximum number of returns was reduced to 29 as against

a maximum of 36 returns required to be submitted by the scheduled UCBs earlier.

Insurance Business

4.51 According to the Annual Policy

Statement for the year 2007-08, UCBs registered in States that had entered into

MoU with the Reserve Bank or those registered under Multi-State Co-operative Societies

Act, 2002 were allowed to undertake insurance agency business as corporate agents

without risk participation, subject to compliance with the following eligibility

norms: first, UCB should have a minimum net worth of Rs.10 crore; second, it should

not have been classified as Grade III or IV. The minimum net worth criteria earlier

applicable was dispensed with for such banks on May 15, 2008. Box

IV.3: Working Group on IT support to UCBs The Mid-term

Review of the Annual Policy Statement for the year 2007-08 announced the constitution

of a Working Group comprising representatives of the Reserve Bank, State Governments

and the UCBs sector to examine the various areas where IT support could be provided

to the UCBs by the Reserve Bank. Accordingly a Working Group on IT support to

UCBs (Chairman: Shri R. Gandhi) was constituted.

The Group, while acknowledging

the increasing importance of IT in UCBs, observed that there was a wide variance

among them with regard to the usage of IT. In fact, the lack of uniformity in

the levels of computerisation and inadequate awareness about the efficacy of computers

in enhancing competitiveness prompted the Group to articulate the following minimum

IT infrastructure which should exist in each UCB regardless of its size, location

or profitability: (i) computerised front-end, i.e., customer interface;

(ii) automatic back-end accounting (through software); (iii) computerised MIS

reporting; and (iv) automated regulatory reporting.

The Group felt that

in order to implement the minimum level of IT infrastructure by the UCBs, core

banking solution (CBS) would be required to be adopted by them. The model of CBS

may vary according to the size and spread of the UCBs. The

Group suggested two methods for acquiring the IT infrastructure, viz.,

(i) application service provider; and (ii) outright purchase. The former

is suitable for small banks, particularly the unit banks because the problems

of software development and maintenance, training and retention of IT professionals,

installation and maintenance of complex and costly hardware and other logistics

like data centres, would be addressed by the service provider without need for

much initiative or involvement of the UCBs. An agency like Institute for Development

and Research in Banking Technology (IDRBT) could short-list/select one/a few vendors

and be the conduit and service quality assurer to the UCBs. On the other hand,

the method of outright purchase of the CBS, including data centre may be preferable

to a few large banks.

The Group also deliberated on delivery mechanism

and felt that support could be routed through IDRBT and if required, IDRBT might

develop an area of expertise within itself to cater to the IT needs of small banks,

including UCBs. National and State Federation of co-operatives might also think

of creating such IT facilities for UCBs in the long run for the benefit of the

sector. The recommendations of the Group are being examined by the Reserve Bank. Norms

for Maintaining NRE/NRO Accounts

4.52 UCBs registered in States

that had entered into a MoU with the Reserve Bank for supervisory and regulatory

co-ordination and those registered under the Multi State Cooperative Societies

Act, 2002 were permitted to open NRE account subject to compliance with the following

eligibility norms: (i) minimum net worth of Rs.25 crore; (ii) CRAR of not less

than 9 per cent; (iii) net NPAs to be less than 10 per cent; (iv) compliance with

CRR/SLR requirements; (v) net profit during the preceding three years without

any accumulated losses; (vi) sound internal control systems; (vii) satisfactory

compliance with KYC/AML guidelines; and (viii) presence of at least two professional

directors on the board.

4.53 UCBs are not permitted to accept NRO deposits

and are required to close these accounts within a given time frame. It was decided

on June 4, 2007 that banks may maintain NRO accounts, arising from their re- designation

as such, upon the account holders becoming non-resident. Opening of fresh NRO

accounts was not permitted. Furthermore, no fresh credit, barring periodical credit

of interest, was allowed in these accounts. However, these restrictions were not

applicable to UCBs holding AD Category-I licence.

Relaxation in Branch

Authorisation Policy for UCBs

4.54 In terms of the Annual Policy

Statement 2007-08, UCBs were allowed to open new branches/extension counters.

The eligibility criteria prescribed for new branches/extension counters were as

under: (i) the bank should be registered under the Cooperative Societies Act of

the States that had signed MoU with the Reserve Bank or under the Multi-State

Cooperative Societies Act, 2002; (ii) the bank should be licensed and have an

elected board of directors with at least two professionals; (iii) the bank should

comply with the following mutually exclusive, performance/financial parameters

– (a) CRAR should not be less than 9 per cent; (b) net NPA should be below

10 per cent; (c) there should have been no default in maintenance of CRR/ SLR

in the preceding financial year; (d) the bank should have net profit in the preceding

financial year; (e) the net worth should not be less than Rs.10 crore; and (f)

the average net worth per branch/extension counter, including the additional centres

for which licenses are sought, should not be less than Rs.2 crore per branch in

A and B centres with population more than 5 lakh and Rs.1 crore in C and D centres

with population less than 5 lakh. UCBs satisfying the above mentioned conditions

are eligible for additional branches/extension counters not exceeding 10 per cent

of their existing branch network, over a period of two years. All UCBs are required

to obtain prior authorisation for opening of extension counters.

4.55

Further, in terms of the Annual Policy Statement 2008-09, approvals for branch

expansion including off-site ATMs in respect of well managed and financially sound

UCBs in the States that have signed MoUs and those registered under the Multi-State

Co-operative Societies Act, 2002, are now considered, based on their annual business

plans, subject to: (i) maintenance of a minimum CRAR of 10 per cent on a continuous

basis with minimum owned funds commensurate with entry point capital norms for

the centre where the branch is proposed; (ii) net NPAs should be less than 10

per cent; (iii) no default in maintenance of CRR/SLR during the preceding financial

year; (iv) net profit in the immediate preceding financial year; and (v) regulatory

comfort based on its track record of compliance.

4.56 The Annual Policy

Statement for the Year 2008-09 liberalised the eligibility norms for opening of

on-site ATMs. Accordingly, w.e.f. May 26, 2008, UCBs that are registered in States

that have signed MoUs with the Reserve Bank or under Multi-State Co-operative

Societies Act, 2002 and classified in Grades other than Grade III and IV, are

allowed to set up on-site ATMs without prior approval of the Reserve Bank.

4.57 The powers for grant of branch authorisation for Tier I banks registered

under the State Co-operative Societies Acts in States that had signed MoUs with

the Reserve Bank were delegated to its regional offices. On receipt of annual

business plans, regional offices of the Reserve Bank were advised to scrutinise

whether UCBs satisfied the norms prescribed and any other requirements identified

in consultation with TAFCUB.

Shifting of Offices

4.58

In relaxation of the existing guidelines, UCBs were permitted on August 28, 2007

to shift their branches from one city to another in their area of operation within

the same State, subject to the following conditions: (a) the new centre should

be located in an area with same or lower population compared to the existing centre;

(b) a branch located in under-banked district can be shifted to another centre

in under-banked district only; and (c) the shifting should be beneficial to the

bank in terms of cost and business. UCBs were further advised to submit their

applications in this regard to the regional office of Urban Co-operative Bank

Department of the Reserve Bank in whose jurisdiction the head office of the bank

was situated.

Mahila Urban Co-operative Banks –Membership

4.59 Membership of Mahila UCBs was exclusively confined to women

except as nominal members for the purpose of standing as sureties for the borrowers

from the bank. Taking into account the representations made by the banks and their

federations and the findings of case studies carried out by the Reserve Bank in

this regard, existing Mahila UCBs which conform to the extant entry point

norms for general category banks, were permitted to enroll male members up to

a limit of 25 per cent of their total regular membership, subject to compliance

by the banks with their respective bye-laws. Registrar of Co-operative Societies

of Central and all State Governments were requested to convey their approval to

UCBs wherever applicable, for induction of male borrowers up to a limit of 25

per cent of their total regular membership. |

IST,

IST,