2.1 The Indian economy continued to exhibit strong performance in 2007-08, although the pace of growth moderated from 2006-07. Despite moderation, the performance of the Indian economy was in line with the average growth of the previous four years. The growth of the industrial sector was also lower in 2007-08 relative to that in 2006-07. The subdued growth of the manufacturing sector, which accounts for more than four-fifths of Index of Industrial Production (IIP), primarily contributed to the slowdown in the industrial growth. On the other hand, the services sector maintained its record of double digit growth, primarily aided by high growth in telecommunications, software exports and IT-enabled services. In 2007, the SouthWest monsoon was above normal. This, combined with an improvement in water storage levels, resulted in the record foodgrains production in 2007-08.

2.2 Headline inflation, based on year-on-year variations in the wholesale price index (WPI), showed a sustained decline in the first two quarters of 2007-08. However, beginning from December 2007, headline inflation began to pick up on account of hardening of prices of primary non-food articles and manufactured products items such as edible oils/ oilcakes and metals. Year-on-year consumer price inflation, which had eased by January 2008, hardened in the subsequent months.

2.3 Global commodity prices firmed up during 2007-08 led by sharp increases in food and crude oil prices. International crude oil prices rose sharply during the year, reflecting tight supply-demand balance, geopolitical tensions, weakening of the US dollar against major currencies and increased market activities of investors and financial market players. Food prices also firmed up during 2007-08,

especially in the second half, led by wheat, rice, and oilseeds/edible oils on account of surge in demand (both consumption demand and demand for non-food uses such as bio-fuels production), low stocks of major crops and weather related disturbances in some major food-producing regions. In recognition of global demand and supply side pressures on food items, the Government reduced the import duty on wheat and edible oil, followed by export ban on a number commodities, viz., non-basmati rice and pulses, and administrative measures related to stock limit on select products. The Reserve Bank also undertook monetary measures in the form of increase in the CRR. The CRR was raised by 150 basis points in four stages during 2007-08. However, inflation hardened further in the first quarter of 2008-09. In response, the Reserve Bank increased the CRR by 150 basis points in six stages and repo rate by 125 basis points in three stages during April-August 2008.

2.4 The Indian financial markets remained largely orderly in 2007-08, barring the equity market which witnessed some bouts of volatility in line with the trends in international markets. Swings in cash balances of the Government and capital flows were the main drivers of liquidity conditions in the financial markets. Interest rates in the collateralised segment of the money market, which at present comprises about 80 per cent of the total volume of the money market, moved in line with but remained below the call rate during the year. In the foreign exchange market, the Indian rupee generally exhibited two-way movements. Yield in the Government securities market softened during the major part of the year.

2.5 The profitability of scheduled commercial banks improved during 2006-07, primarily on account of robust macroeconomic performance of the economy. Bank credit continued to expand at a robust pace, albeit with some moderation. The asset quality of banks improved further during the year.

2.6 Central and State Government finances showed further consolidation; the revised estimates of key deficit indicators of the Central Government for 2007-08 were placed lower than their budgeted levels. In the provisional accounts, the key deficit indicators declined further. The State Governments continued to show commitment to pursue fiscal correction and consolidation under the Fiscal Responsibility Legislation (FRL).

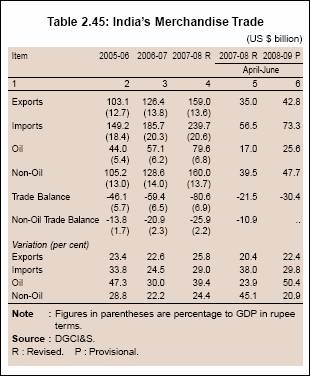

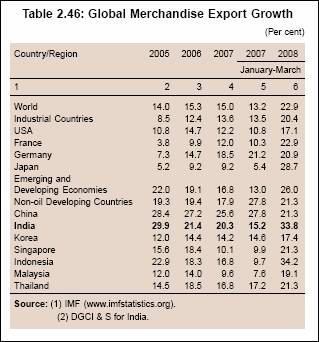

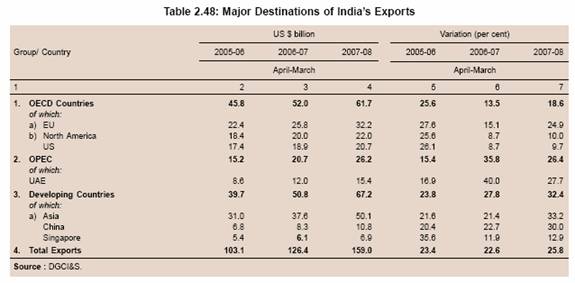

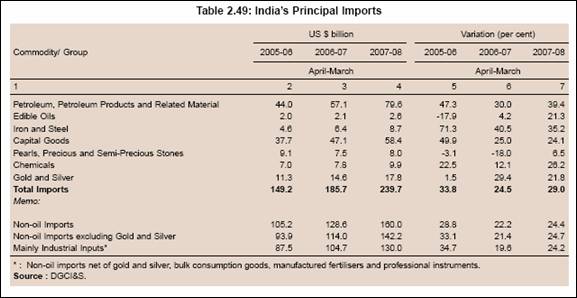

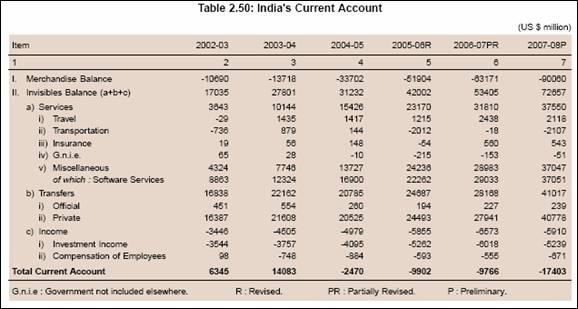

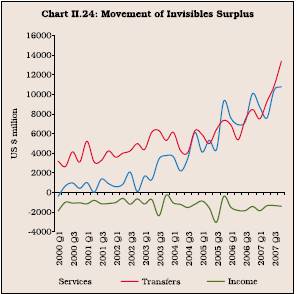

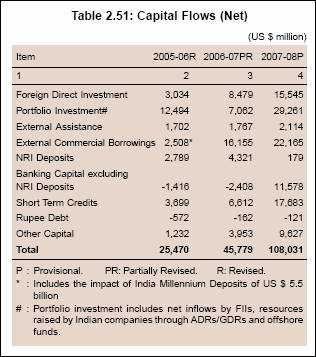

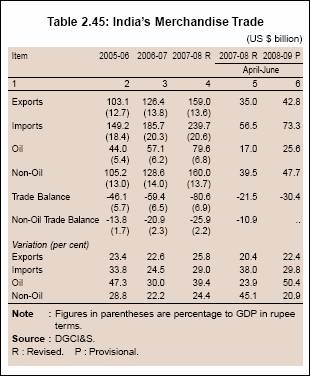

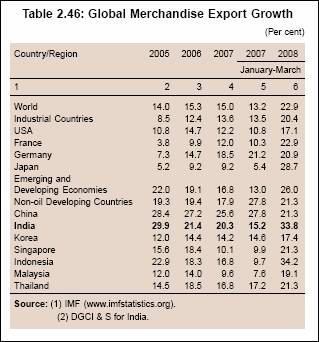

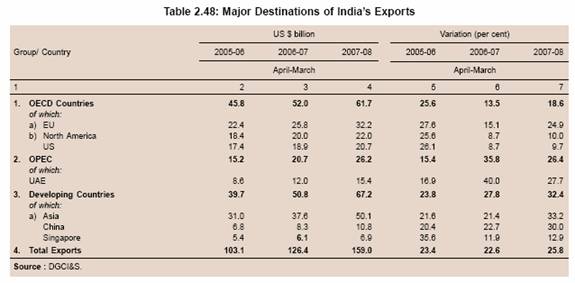

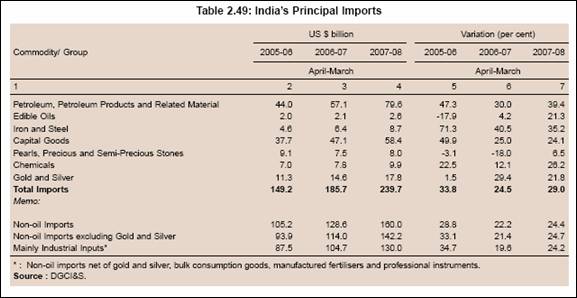

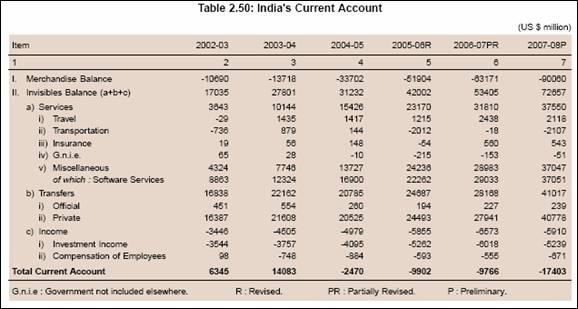

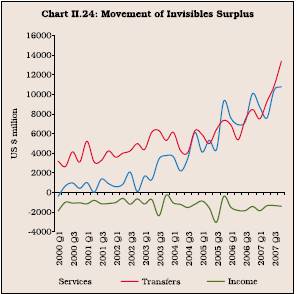

2.7 The external sector continued to witness impressive performance during 2007-08. The exports of goods and services registered strong growth in 2007-08. However, significantly higher growth of imports, especially non-oil imports led to the widening of the trade deficit. The impact of widening of trade deficit on the current account was contained due to surplus in the invisibles account led by higher private remittances and software services exports. Net capital flows to the country were significantly larger than the current account deficit, resulting in overall balance of payments surplus.

2.8 This chapter presents a detailed account of the macroeconomic developments during 2007-08 and 2008-09 (up to the period for which latest data are available). While Section II presents developments in the real sector, Section III sets out a detailed account of Central and State Government finances. Section IV dwells on monetary and credit developments along with the trends in inflation. Section V outlines the major developments in financial markets. Business operations of financial institutions during 2006-07 are covered in Section VI. Section VII sets out developments in the external sector. Overall assessment is presented in Section VIII.

II. REAL SECTOR

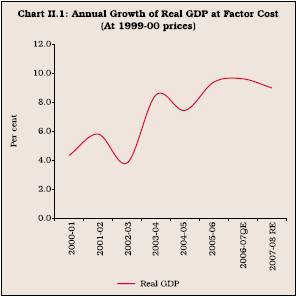

National Income

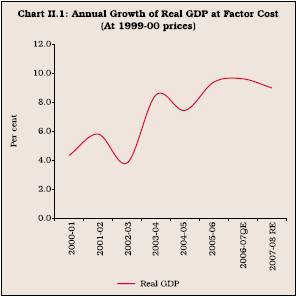

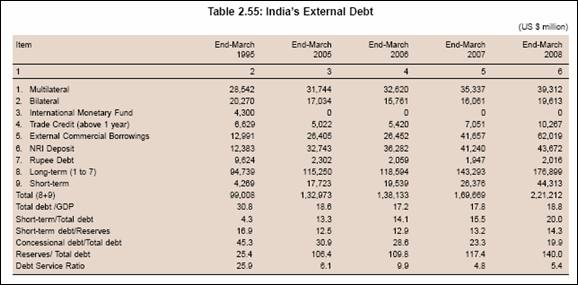

2.9 According to the revised estimates released by the Central Statistical Organisation (CSO) on May 30, 2008, the Indian economy is estimated to have grown by 9.0 per cent in 2007-08 as against 9.6 per cent in 2006-07. Notwithstanding the moderation, the real GDP growth in 2007-08 was above the average growth of 8.7 per cent during the previous four years (2003-04 to 2006-07) (Chart II.1).

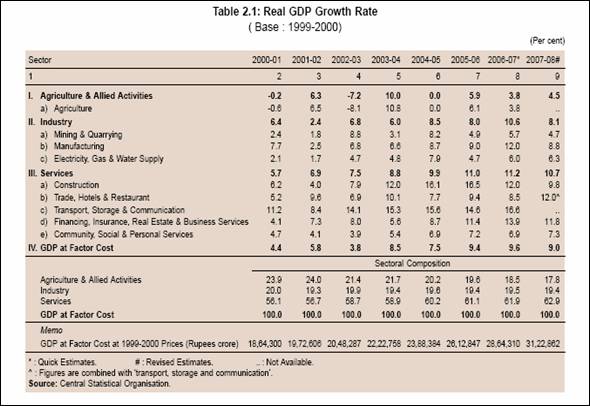

2.10 The moderation in real GDP growth during 2007-08 was due to slowdown in the two major sectors, viz., industry and services sector (Table 2.1 and Table 2.2). The share of agriculture & allied activities GDP declined to 17.8 per cent in 2007-08 from 18.5 per cent in the last year. The share of services sector increased, while that of the industrial sector declined somewhat.

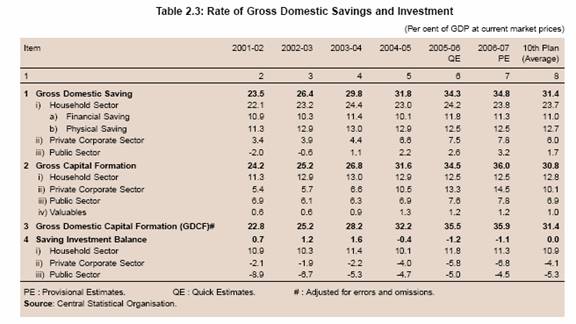

Savings and Investment

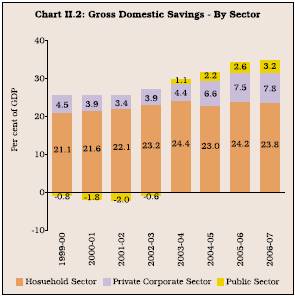

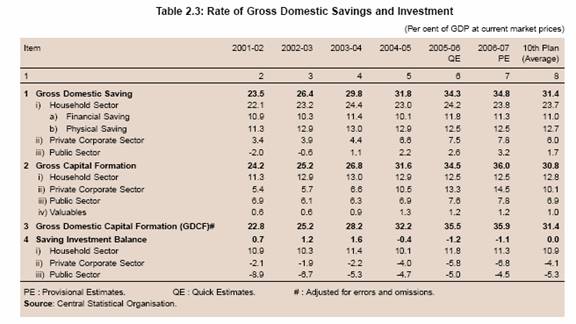

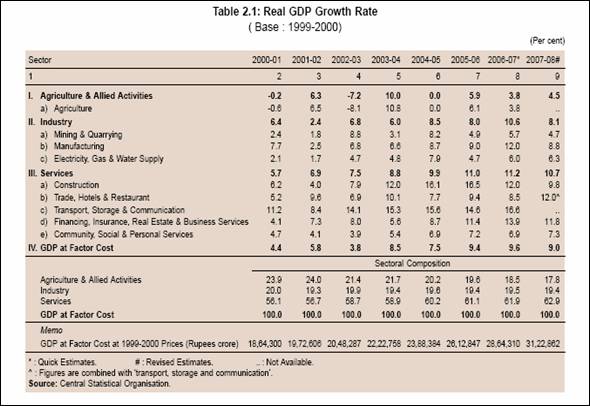

2.11 The rate of gross domestic saving (GDS), as percentage of GDP at current market prices, increased to 34.8 per cent in 2006-07 from 34.3 per cent in 2005-06. The private corporate saving rate improved for the fifth consecutive year from 3.4 per cent in 2001-02 to 7.8 per cent of GDP in 2006-07, reflecting improvement in the performance of the corporate sector leading to higher retained earnings. Savings of the household sector, as percentage of GDP, increased to 23.8 per cent in 2006-07 from 22.1 per cent in 2001-02. Public sector savings, which witnessed a turnaround in 2003-04, continued to improve, largely reflecting the higher savings of non-departmental as well as departmental enterprises (Chart II.2 and Table 2.3).

2.12 As in the past, bulk of investment was financed by domestic saving. The rate of gross domestic capital formation (GDCF) was estimated to be higher at 35.9 per cent in 2006-07 as compared with 35.5 per cent in 2005-06 (Table 2.3 and Chart II.3). Investment activity continued to be driven by the private corporate sector, the rate of which increased to 14.5 per cent of GDP in 2006-07 from 5.4 per cent of GDP in 2001-02. The saving and investment rates for the Tenth Five Year Plan, on an average, were at 31.4 per cent each per annum. The positive saving-investment balance in the first two years of the Plan period was offset by the negative saving-investment balance in the next three years of the Plan period.

Agriculture

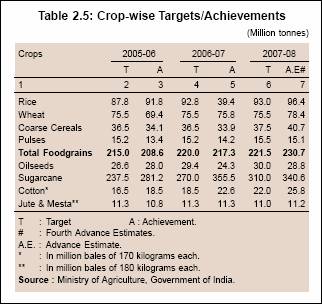

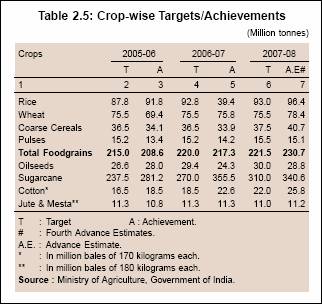

2.13 Agriculture continues to be important to the Indian economy as a large segment of population is dependent on it. According to the Fourth Advance Estimates released by the Ministry of Agriculture, Government of India, the total foodgrains production during 2007-08 was estimated at 230.7 million tonnes (an all-time record), indicating an increase of 6.2 per cent over the previous year (217.3 million tonnes). Accordingly, the growth in agriculture and allied activities was estimated higher at 4.5 per cent for 2007-08 as compared with 3.8 per cent during 2006-07, in the revised estimates of the CSO.

South-West Monsoon 2007

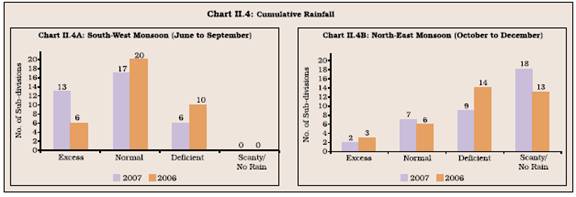

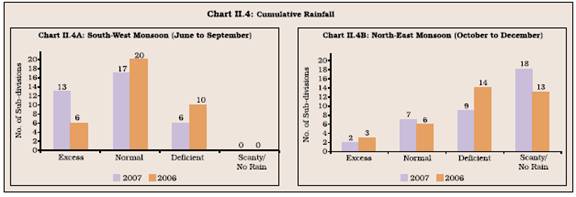

2.14 During the year 2007, the South-West monsoon arrived over Kerala on May 28, four days ahead of the normal date. After a brief spell of hiatus during early June in the advancement of monsoon due to the formation of a Super Cyclone “Gonu” over the East-Central Arabian Sea, the South-West monsoon covered the entire country by July 4, nearly 11 days ahead of the normal schedule. The Long Range Forecast issued by the India Meteorological Department (IMD) on June 29, 2007, placed the South-West monsoon season rainfall at 93 per cent of the long period average (LPA) with a model error of +/- 4 per cent. Actual precipitation during the SouthWest monsoon at 105 per cent of the LPA turned out to be better than the IMD’s forecast. Of the 36 meteorological sub-divisions, cumulative rainfall was excess/normal in 30 sub-divisions (26 sub-divisions during last year) and deficient/scanty/no rain in 6 subdivisions (10 sub-divisions during last year) (Table 2.4 and Chart II.4A).

2.15 Among the four broad homogeneous regions1 , while the South-West monsoon season rainfall was below normal in the North-West India (85 per cent of LPA), it was above normal in the South Peninsula (126 per cent of LPA), Central India (108 per cent of LPA) and North-East India (104 per cent of LPA). In view of the normal performance of the South-West monsoon and improvement in the water storage levels, the Ministry of Agriculture set the target for the total foodgrains production during 2007-08 at around 221.5 million tonnes, marginally higher than the target of 220 million tonnes during the previous year (Table 2.5).

2.16 Five sub-divisions (West Uttar Pradesh, Haryana, Chandigarh and Delhi, Punjab, Himachal Pradesh and East Madhya Pradesh) experienced moderate drought conditions (rainfall deficiency of 26 to 50 per cent) at the end of the season. Monsoon activity was subdued at the beginning of the season. Large rainfall deficiency was observed during the first week of June, third and fourth weeks of July and third week of August. During the rest of the season, rainfall was well-distributed in time. Cumulative rainfall over the country, on the whole, remained always above normal beginning the last week of June. The month-wise distribution showed that rainfall was above normal in June (19 per cent) and September (18 per cent), while it was only marginally below normal during July (3 per cent) and August (1 per cent).

Reservoir Status

2.17 Water stock in the 81 major reservoirs, accounting for around 72 per cent of the total reservoir capacity of the country, was 79 per cent of the full reservoir level (FRL) at the end of the South-West monsoon season (September 27, 2007), lower than 87 per cent during the corresponding period of the previous year, but higher than the average of 67 per cent during the last 10 years.

North-East Monsoon 2007

2.18 The rainfall during North-East monsoon commenced over Tamil Nadu and adjoining States of Southern Peninsula on October 22, 2007. The progress of North-East monsoon (October 1 to December 31, 2007) was deficient with cumulative rainfall 32 per cent below normal as compared with 21 per cent below normal during the corresponding period of the previous year. Of the 36 meteorological sub-divisions, cumulative rainfall was excess/normal in 9 sub-divisions (same as previous year) and deficient/scanty/no rains in 27 sub-divisions (same as previous year) (Chart II.4B). At the end of the season, the total reservoir storage as on January 3, 2008 was 61 per cent of the FRL (65 per cent during the previous year and an average of 51 per cent during the last 10 years).

Kharif 2007

2.19 The Four th Advance Estimates placed foodgrains production during 2007-08 at an all-time high of 230.7 million tonnes, indicating an increase of 6.2 per cent over the previous year (217.3 million tonnes). Total kharif foodgrains production was placed at 121.0 million tonnes, an increase of 9.4 per cent over the previous year (110.6 million tonnes). Among foodgrains, while the production of kharif rice (3.3 per cent) witnessed a modest increase, that of coarse cereals (23.8 per cent) and pulses (34.4 per cent) increased significantly. Further, the production of kharif oilseeds recovered strongly with an increase of 41.6 per cent over the previous year.

Rabi 2007-08

2.20 Rabi foodgrains production for 2007-08 was placed at 109.7 million tonnes, a increase of about 2.8 per cent over the previous year. While a decline was observed for pulses (7.9 per cent), crops such as wheat (3.4 per cent), coarse cereals (8.7 per cent) and rice (3.3 per cent) registered an increase. The production of rabi oilseeds declined by 12.6 per cent.

2.21 On the whole, the record foodgrains production during 2007-08 was mainly led by the strong performance of the kharif season production. Among foodgrains, the overall production of pulses for 2007-08 was estimated at 15.1 million tonnes (14.2 million tonnes in 2006-07), rice at 96.4 million tonnes (93.4 million tonnes) and coarse cereals at 40.7 million tonnes (33.9 million tonnes)

(Table 2.6).

Progress of Sowing in 2007-08

2.22 During 2007-08, kharif sowing showed improvement over the previous year. For all crops, the area sown increased by 2.8 per cent over the previous year, which was also 4 per cent above the normal sown area during the kharif season. The area sown in the case of rice, maize, pulses, oilseeds, cotton and sugarcane was higher, while that under jowar and bajra was lower than that in the previous year.

2.23 The area sown under rabi crops was lower by 2.8 per cent compared with the previous year. The sowing under rabi was lower in the case of coarse cereals, pulses and oilseeds, while it was marginally higher in the case of rice and wheat.

Procurement, Offtake and Stocks of Foodgrains

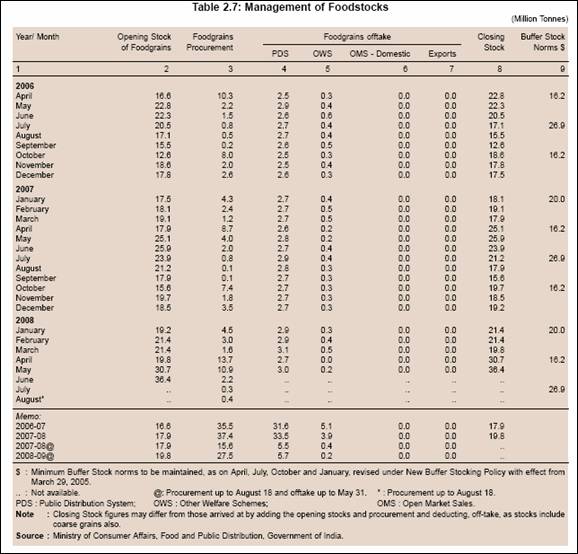

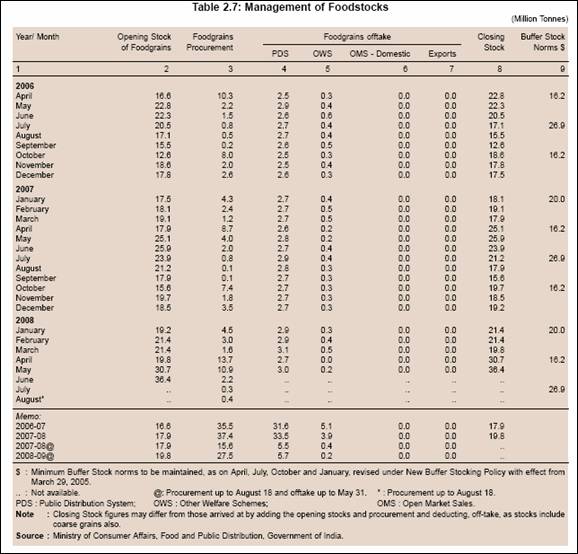

2.24 The procurement of foodgrains (rice and wheat) during 2008-09 (up to August 18, 2008) at 27.5 million tonnes was higher by around 76.0 per cent over the corresponding period of the preceding year (Table 2.7). This was mainly on account of higher procurement of wheat at 22.6 million tonnes during 2008-09 so far (up to August 18, 2008) as against 11.1 million tonnes during the corresponding period of the previous year. Total offtake of rice and wheat during 2008-09 (April 1 to May 31, 2008) at 5.9 million tonnes was marginally higher by 0.1 per cent over the corresponding period of the previous year. While the offtake under the welfare schemes declined significantly by around 55.0 per cent, this was offset by increase in the offtake under Targeted Public Distribution System (TPDS) by around 4.6 per cent. The total stocks of foodgrains with Food Corporation of India and other Government agencies as on June 1, 2008 at 36.4 million tonnes were 40.3 per cent higher as compared with 25.9 million tonnes in the corresponding period of last year. This was mainly due to the increase in the stocks of wheat from 13.3 million tonnes, as on June 1, 2007 to 24.1 million tonnes, as on June 1, 2008.

Industry

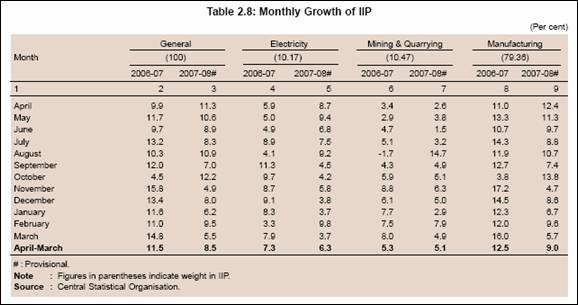

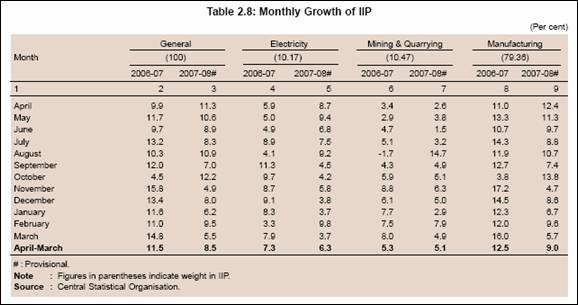

2.25 The growth in terms of Index of Industrial Production (IIP) moderated to 8.5 per cent during 2007-08 from 11.5 per cent recorded during 2006-07. The moderation in the growth of the industrial sector was largely on account of subdued performance of the manufacturing sector, which contributes approximately 90 per cent to the IIP growth (weight in IIP 79.36 per cent) (Table 2.8). The growth of the mining and the electricity sectors witnessed some moderation. Slower growth in thermal and hydro-power generation resulted in lower growth in the electricity sector.

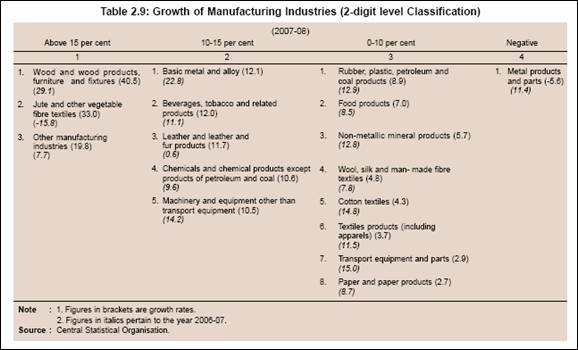

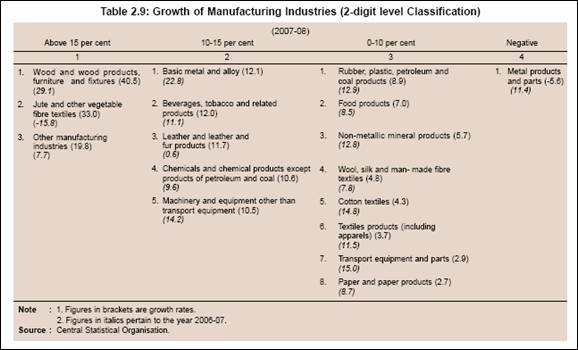

2.26 During 2007-08, six manufacturing industry groups (as per 2-digit level classification) recorded accelerated growth, while eleven recorded decelerated or negative growth (Table 2.9).

2.27 Three industries constituting around 5.9 per cent weight in IIP, viz., ‘wood and wood products’, ‘other manufacturing industries’ and ‘jute and other vegetable fibre textiles’ recorded growth above 15 per cent and contributed 14.3 per cent to manufacturing sector growth during 2007-08. ‘Jute and other vegetable fibre textiles’ made a turnaround, while ‘metal products and parts’ recorded negative growth during the period. The industry groups with relatively higher weight in the IIP, viz., ‘chemicals and chemical products (except products of petroleum and coal)’, ‘machinery and equipment’ and ‘basic metal and alloy industries’ recorded growth in the range of 10-15 per cent during 2007-08.

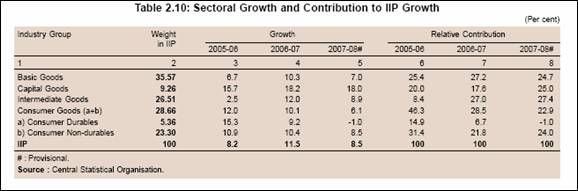

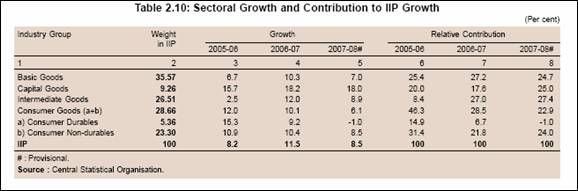

2.28 In terms of the use-based classification, all the key groups decelerated during 2007-08 (Table 2.10). Decline in production in both nitrogenous and phosphatic fertiliser segments, and some steel products such as carbon steel, steel wires, coil and H.R. sheets led to lower growth of the basic goods sector. The decline in production of some chemical dyes, tin metal containers, ball and roller bearings, naptha, polished granite, etc., resulted in deceleration in the intermediate goods sector.

2.29 The capital goods sector, however, continued to exhibit robust growth performance. During 2007-08, the capital goods sector recorded growth of 18.0 per cent as compared with 18.2 per cent during 2006-07. The consumer goods sector recorded lower growth of 6.1 per cent. As a result, its contribution to IIP growth declined to 22.9 per cent during 2007-08 from 28.5 per cent during 2006-07. This was on account of lower growth in consumer non-durables and decline in production of consumer durables. Consumer durables recorded negative growth of 1.0 per cent (9.2 per cent in 2006-07) due to decline in the production of metal utensils, type writers, telephone instruments, tape recorders, motor cycles, alarm time pieces and wrist watches, among others. Further, slowdown in the consumer durables sector appears to be overstated since the product obsolescence in the segment due to changing consumer preferences and availability of technologically superior products in recent years is not adequately captured by the present IIP basket based on 1993-94 series (see RBI Annual Report 2007-08, Box II.6, p.60).

Infrastructure

2.30 The growth of the infrastructure sector decelerated to 5.6 per cent during 2007-08 from 9.3 per cent during 2006-07 (Table 2.11). The lower growth was contributed by all the core infrastructure sectors, barring coal. The electricity sector recorded lower growth of 6.3 per cent and contributed 39.3 per cent to the core sector growth during 2007-08. The cement sector recorded the highest growth of 8.1 per cent during 2007-08.

2.31 The slowdown in steel exports from the country contributed to decelerated growth of steel output, even as the domestic demand continued to be strong. The crude oil sector decelerated sharply to 0.4 per cent on account of decline in production in the Mumbai High unit of ONGC. The growth in the cement sector fluctuated during 2007-08 mainly due to base effect. Moderation in growth of the petroleum refinery sector was attributable to base effect, lower capacity utilisation and decline in production in some public sector refineries.

Services Sector

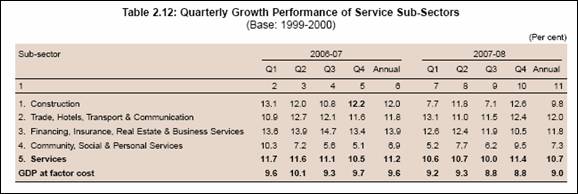

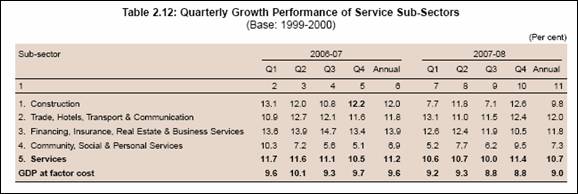

2.32 The services sector grew by 10.7 per cent during 2007-08 over and above 11.2 per cent growth in 2006-07 (Table 2.12). The year 2007-08 was the third year in succession when the services sector posted double digit growth. The sector accounts for 62.9 per cent of domestic output. The ‘trade, hotels, transport and communication’ sector has recorded double digit growth for the last five years and presently accounts for almost half of the services sector growth. The rise in international trade has been remarkable in the last six years with exports and imports averaging annual growth of 24.0 per cent and 29.5 per cent, respectively, during the period 2002-03 to 2007-08. In addition to strong growth in international trade, the domestic retail boom, rapid growth in mobile network connections and aviation uptrend has driven the growth of this sub-sector.

2.33 The ‘community, social and personal services’ recorded improvement in growth during 2007-08 mainly on account higher expenditure on these services by the Central Government. Rise in exports of business process outsourcing and information technology enabled services in conjunction with spread of banking and insurance services sustained the double digit growth of ‘financing, insurance, real estate and business services’ albeit with some moderation due to base effect.

Information Technology Enabled Services and Business Process Outsourcing

2.34 The Indian software and services industry continued its strong performance during 2007-08, with outsourcing remaining the prime growth driver of ITES-BPO industry in India. However, some shift in outsourcing markets was observed with a growing traction in Europe and Asia Pacific offsetting a marginal decline in the share of America. The Indian IT industry has increased its exposure to other geographical regions in the recent times. According to the annual NASSCOM survey, the Indian IT-ITES industry (including domestic market) grew by 33.3 per cent during 2007-08. The software and services exports segment grew by 28.8 per cent to register revenues of US$ 40.3 billion in 2007-08, up from US$ 31.3 billion in 2006-07. While India continues to be the most preferred destination for global IT sourcing due to its talent pool. Nevertheless, in respect of quality management and security, there are certain short to medium term challenges that need to be addressed. These include skill upgradation of the available talent, infrastructure development and sustenance of a positive policy/regulatory environment. These require timely, consistent and continued efforts from all stakeholders including industry and the Government to maintain the competitive edge in this field.

Industrial Outlook

2.35 Despite some moderation in IIP growth, industry, continued to record firm performance during 2007-08, with strong investment demand, reflecting capacity expansions. However, the growth of the consumer goods sector decelerated significantly, primarily on account of decline in the production of consumer durables. The mining sector, which did not perform well in 2005-06, registered improvement in 2006-07 and put up a modest growth in 2007-08. The incentives in terms of excise duty concessions and adjustments in personal income tax slabs in the Union Budget 2008-09 along with the implementation of the award of the Sixth Pay revision of salaries of the Central Government employees are likely to give a fillip to the consumer goods sector in 2008-09. However, there are certain downside risks such as steep rise in industrial input prices, elevated prices of crude oil, turbulence in global financial markets, weakening of growth momentum in advanced economies and domestic inflationary conditions.

2.36 Forecasts of economic growth for 2008-09 by various agencies are set out in Table 2.13.

III. FISCAL SITUATION

Central Government Finances

2.37 The revised estimates (RE) of the finances of the Central Government during 2007-08 placed the key deficit indicators, viz. revenue deficit (RD) and fiscal deficit (GFD) in relation to GDP lower than the budget estimates (BE). In the provisional accounts, these ratios, i.e., RD and GFD as percentage of GDP declined further. Primary surplus in relation to GDP in provisional accounts was also higher than that of RE which, in turn, was higher than the BE. The improvement in revenue receipts mainly accounted for the reduction in the key deficit indicators. The RD and GFD in relation to GDP in the 2008-09 budget estimates were expected to decline further from the revised estimates and provisional accounts for 2007-08. While the FRBM target relating to GFD is set to be achieved as per the mandate, the stipulated target of zero RD by 2008-09 has been rescheduled by one more year to 2009-10 primarily on account of a shift in plan priorities in favour of revenue expenditure-intensive programmes and schemes. The Budget proposed that the ongoing reforms and fiscal correction initiatives would continue to be supportive of raising domestic demand and investment, both of which are main drivers of growth of GDP. Towards this end, the Budget sought to rationalise personal income tax and central excise, broaden the tax base by extending service tax to more ser vices and improve expenditure management with focus on outcome and provision of adequate investment for the social sector. The major thrust of the Budget was to accord priority for sustained, rapid and more inclusive growth with a sharp focus on development of physical and social infrastructure.

2.38 A major proposal in the Budget was the introduction of a scheme of Debt Waiver and Debt Relief for extending help to the distressed farmers, estimated cost of which to the Central Government has been placed at Rs.71,680 crore. This expenditure would be disbursed in phases over four fiscal years albeit with some front loading.

2.39 The focus of the Union Budget 2008-09, the second year of the Eleventh Five Year Plan, was on consolidation, securing the ongoing programmes on a firm financial foundation, close monitoring of implementation and enforcing accountability, and measuring the outcomes in terms of the targets achieved as well as their quality. The Government, therefore, proposed to strengthen evaluation by authorising independent evaluations of the major schemes. A Central Plan Scheme Monitoring System (CPSMS) was also proposed to be put in place to monitor scheme-wise and State-wise releases for the Central Plan and Centrally Sponsored Schemes. The Budget laid special emphasis on schemes for upliftment of women and children.

2.40 The tax policy in recent years has been governed by the overarching objective of increasing the tax-GDP ratio for achieving fiscal consolidation. This is sought to be achieved both through appropriate policy interventions and a steadfast improvement in the quality and effectiveness of tax administration. On the direct taxes front, the main strategy is to further consolidate the achievements made in recent years in terms of (i) minimisation of distortions within the tax structure by expanding the tax base and maintaining the moderate tax rates; (ii) to promote voluntary compliance through tax payer services coupled with enhanced deterrence levels; and (iii) extensive use of information technology to enhance the functional efficiency of Income Tax Department. On the indirect taxes front, the strategy is to integrate the taxes on goods (central excise) and services and finally move on to a goods and services tax. Towards this end, the general CENVAT rate was reduced from 16 per cent to 14 per cent, which is very close to the tax rate on services at 12 per cent. In the case of service tax, the strategy is to expand the tax base, simplification of law and procedure, improved tax administration and increase in tax compliance. In order to broaden the tax base, the scope and coverage of services leviable are further widened by adding more services and expanding the scope of some of the existing services.

Revised Estimates 2007-082

2.41 The revised estimates for 2007-08 carried forward the process of fiscal correction and consolidation under the FRBM framework. Reflecting this, the revenue deficit and fiscal deficit relating to GDP were placed lower than their budgeted levels. Notwithstanding an increase in revenue expenditure on account of higher provision for interest payments and subsidies, the significant increase in tax and non-tax revenue (mainly on account of communication services) resulted in lower revenue deficit. The improvement in revenue deficit coupled with the decline in capital expenditure resulted in lower level of GFD. The primary surplus in the revised estimates improved significantly. Plan expenditure did not diverge much from the budget estimates, though Central assistance for the State and UT plans increased markedly in the revised estimates.

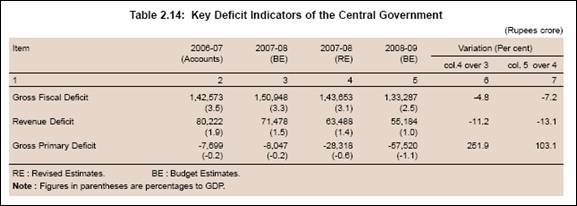

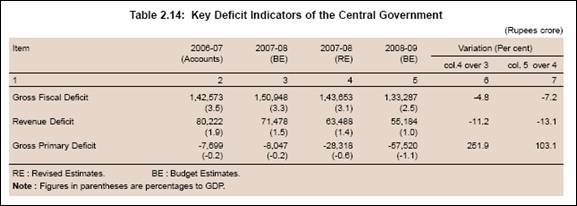

2.42 The revenue deficit in the revised estimates was lower by 11.2 per cent and constituted 1.4 per cent of the GDP in 2007-08 as against the budgeted level of 1.5 per cent. The decline in revenue deficit was on account of a marked improvement in revenue receipts by Rs.38,676 crore (8.0 per cent), which offset the increase in revenue expenditure by Rs.30,686 crore (5.5 per cent). The GFD was lower by Rs.7,295 crore (4.8 per cent). In terms of GDP, it was lower at 3.1 per cent than the budget estimates (3.3 per cent)

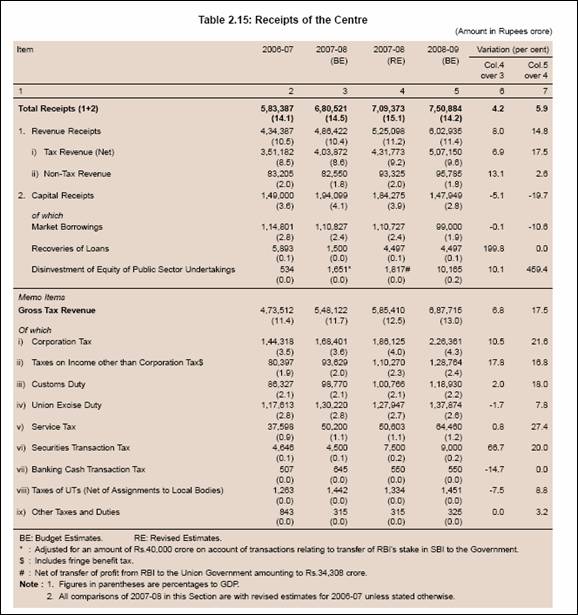

(Table 2.14). Primary surplus at 0.6 per cent of GDP in the revised estimates for 2007-08 was about 3.5 times higher than the budget estimates.

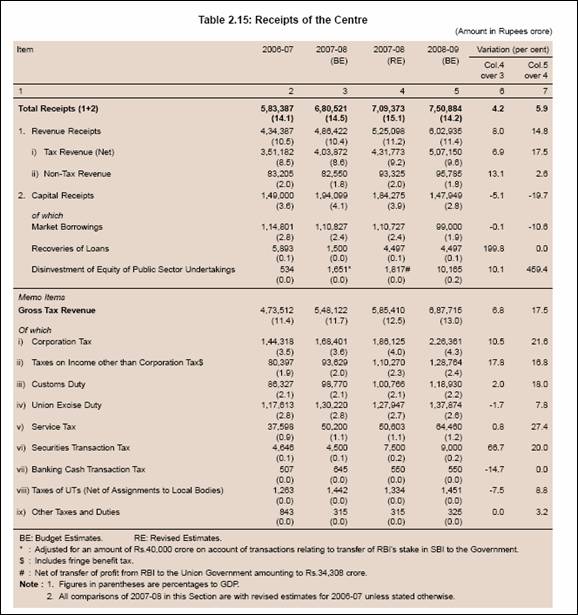

2.43 The gross tax revenue in the revised estimates for 2007-08 was higher by Rs.37,288 crore than the budget estimates. The increase in gross tax revenue in the revised estimates was mainly on account of higher collection in corporation and personal income tax than the budgeted level. The increase in corporation tax by Rs.17,724 crore or 10.5 per cent was on account of higher profits backed by sound balance sheet of the corporates. The personal income tax collection increased by Rs.16,641 crore or 17.8 per cent mainly due to improved tax compliance. Among the recently introduced taxes, fringe benefit tax was estimated to yield Rs.6,800 crore in 2007-08, securities transactions tax Rs.7,500 crore and banking cash transaction tax Rs.550 crore. Non-tax revenue was also 13.1 per cent higher than the budget estimates on account of higher receipts from communication services by way of one-time entry fee from dual technology users and new Unified Access Service Licence (UASL) operators (Table 2.15).

2.44 Under non-debt capital receipts, recoveries of loans and advances are budgeted to increase significantly in the revised estimates for 2007-08 over budget estimates. The proceeds from disinvestment of central public sector undertakings are estimated to increase considerably.

2.45 Revenue expenditure in the revised estimates for 2007-08 was higher by 5.5 per cent than the budget estimates, while capital expenditure showed an increase of 3.2 per cent over the budget estimates (Table 2.16). Revenue expenditure was higher mainly on account of interest payments, fertiliser and interest subsidies, grants to States and pensions. Within capital expenditure, loans and advances and non-defence capital outlay were higher than the budget estimates.

Budget Estimates 2008-093

2.46 After achieving the targets in the preceding year, the Union Budget for 2008-09 proposed to further strengthen the fiscal correction process as stipulated in the Fiscal Responsibility and Budget Management (FRBM) Rules, 2004. The key deficit indicators, viz., revenue deficit (RD) and gross fiscal deficit (GFD), as percentage to GDP, in the budget estimates (BE) for 2008-09 were placed lower than those under the revised estimates (RE) for 2007-08. The FRBM roadmap envisages an annual reduction of at least 0.3 percentage point in the fiscal deficit and 0.5 percentage point in the revenue deficit. While the FRBM targets relating to GFD are set to be achieved as per the mandate, the stipulated target of zero revenue deficit by 2008-09 under the FRBM Rules, 2004 was proposed to be rescheduled primarily on account of a shift in plan priorities in favour of revenue expenditure-intensive programmes and schemes. Furthermore, there are systemic rigidities in containing non-plan expenditures in the short-term, particularly arising from committed and obligatory expenditures such as interest payments, pensions and defence. The GFD/GDP ratio, however, would be lower than the FRBM target. Accordingly, the key deficit indicators, viz., revenue deficit, gross fiscal deficit and primary deficit, as per cent of GDP, were budgeted lower at 1.0 per cent, 2.5 per cent and -1.1 per cent, respectively, in 2008-09 as compared with 1.4 per cent, 3.1 per cent and -0.6 per cent, respectively, in the preceding year (Table 2.14). The revenue deficit and GFD are understated to the extent the Government incurs liabilities on account of oil, food and fertiliser bonds which are recorded below the line. Therefore, as a step towards bringing about greater transparency in fiscal accounting, the Budget reported in its revised estimates for 2007-08 the issuance of special securities aggregating Rs.18,757 crore.

2.47 The Government continued the process of fiscal consolidation through better expenditure management. The revenue expenditure in 2008-09 was budgeted to show a lower growth of 11.8 per cent than 14.4 per cent in 2007-08 (Table 2.16). Notably, the growth of total subsidies was budgeted to decelerate to 2.4 per cent as against an increase of 22.1 per cent in 2007-08. Adjusting for Rs.35,531 crore incurred on account of transactions relating to the transfer of the Reserve Bank’s stake in State Bank of India to the Government, the capital expenditure was budgeted to increase by 8.8 per cent as against 24.0 per cent in 2007-08.

2.48 The revenue receipts in 2008-09 were budgeted to increase by 14.8 per cent as compared with 20.9 per cent increase in 2007-08, primarily because of lower budgeted increase of 17.5 per cent in gross tax collections as against an increase of 23.6 per cent in 2007-08. Among the direct taxes, the growth in corporation tax collections was budgeted to decelerate to 21.6 per cent in 2008-09 from a high of 29.0 per cent in 2007-08. The growth of personal income tax was estimated to decelerate to 16.8 per cent from 37.2 per cent in 2007-08. In the case of indirect taxes, the collections under customs duty were budgeted to increase by 18.0 per cent, higher than 16.7 per cent a year ago. Excise duty collections were, however, budgeted to show a lower growth of 7.8 per cent as compared with 8.8 per cent. Non-tax revenues (NTR) were budgeted to increase to Rs.95,785 crore in 2008-09 from Rs.93,325 crore in 2007-08, reflecting higher revenues from dividends and profits. The interest receipts, on the other hand, continued to decline primarily because lending by the Centre to the States is limited only for loans under externally aided projects as recommended by the Twelfth Finance Commission (refer Table 2.15).

2.49 The financing pattern of the gross fiscal deficit indicates that the net market borrowings (excluding allocations budgeted under the MSS) were budgeted to finance 74.3 per cent of the GFD in 2008-09 as against 77.1 per cent in 2007-08. On the other hand, the share of external assistance was budgeted to increase to 8.2 per cent from 6.9 per cent in 2007-08. Investments by the National Small Savings Fund (NSSF) in special Central Government securities were budgeted to finance 7.4 per cent of GFD. During 2008-09, the Budget proposed to drawdown cash balances to finance 5.4 per cent of GFD, as against the built up of cash balances amounting to 12.7 per cent of GFD in the previous year (Table 2.17).

Outlook

2.50 The Budget 2008-09 continued to pursue the path of fiscal correction with emphasis on quality in expenditure in accordance with the FRBM goals. Although the Budget has met the FRBM target of annual reduction of 0.5 per cent of GDP in the revenue deficit, it was still placed at 1.0 per cent of GDP due to increased expenditure on health and education. Finances of the Central Government may come under pressure during 2008-09 on account of implementation of the Sixth Pay Commission (SPC) award, including payment of arrears,higher oil subsidies, increase in fertiliser subsidy due to sharp rise in the price of raw materials and fertiliser in the international market and the expenditure on account of debt waiver of the farmers.

State Finances

2.51 The State Governments have reiterated commitment to carry forward the process of fiscal correction and consolidation in their budgets for 2008-09. As at end-March 2008, all States, barring West Bengal and Sikkim, have enacted Fiscal Responsibility Legislation (FRL). All States have implemented value added tax (VAT) in lieu of sales tax, with the last State Uttar Pradesh implementing VAT with effect from January 1, 2008.

2.52 The State Governments in their budgets for 2008-09 proposed various policy initiatives aimed at augmenting their revenues and directing expenditure towards the priority areas. The budgetary allocations for the productive sectors such as agriculture and water conservation, infrastructure, power, urban development and housing sector are proposed to be raised in 2008-09 in a number of States. The State Governments are also undertaking construction of houses for low and middle income group families as also slum dwellers and below poverty line families under various schemes, including Indira Awas Yojana and Jawaharlal Nehru National Urban Renewal Mission (JNNURM). The State Governments are undertaking computerisation of the treasuries and tax depar tments. Maharashtra State has implemented a computerised budget distribution system aimed at improving the cash flow system. A few more States, including Arunachal Pradesh, introduced gender budgeting for the empowerment of women. Kerala has announced the setting up of a Gender Board. Manipur has proposed to set up Guarantee Redemption Fund and Consolidated Sinking Fund. In terms of Article 280 of the Indian Constitution, the Thirteenth Finance Commission was constituted on November 13, 2007, which will have an award period spanning 2010-15. The Sixth Pay Commission constituted by the Government of India for Central Government Employees submitted its Report on March 24, 2008. While a number of States follow the recommendations of Union Pay Commission, some States constitute separate Pay Commissions for reviewing the salaries and other benefits for their employees.

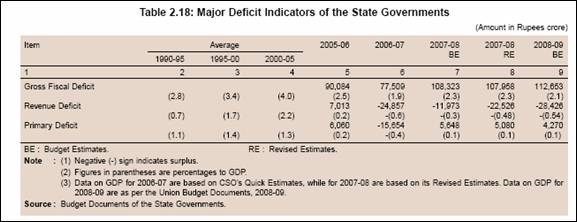

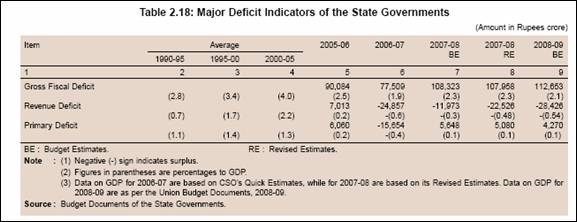

Budget Estimates – 2008-094

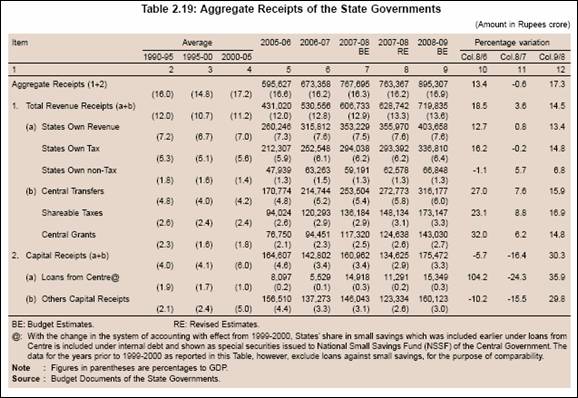

2.53 The consolidated revenue surplus of the States is estimated at Rs.28,426 crore (0.54 per cent of GDP) in 2008-09 (BE) as compared with Rs.22,526 crore (0.48 per cent of GDP) in 2007-08 (RE). Although the GFD is budgeted higher at Rs.1,12,653 crore in 2008-09 (BE) than Rs.1,07,958 crore in 2007-08 (RE), as percentage of GDP, it would come down to 2.1 per cent in 2008-09 (BE) from 2.3 per cent in 2007-08 (RE). The consolidated primary deficit is budgeted at 0.1 per cent of GDP in 2008-09 (BE), the same as in the previous year (Table 2.18).

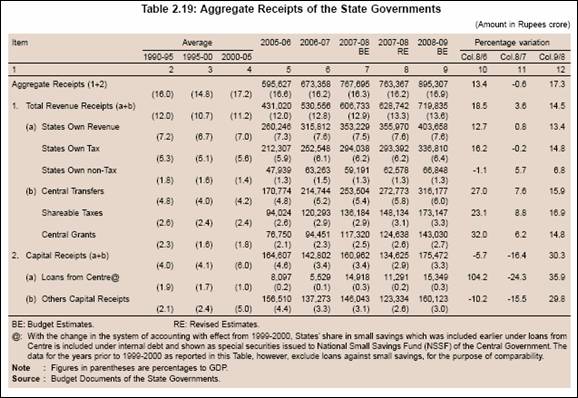

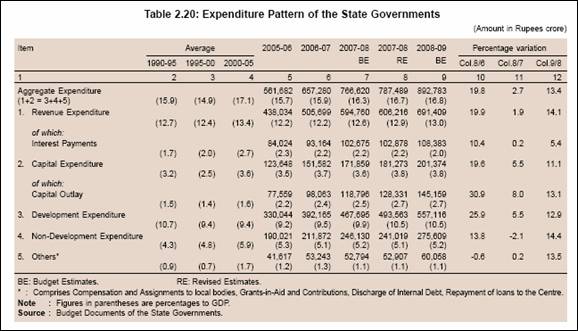

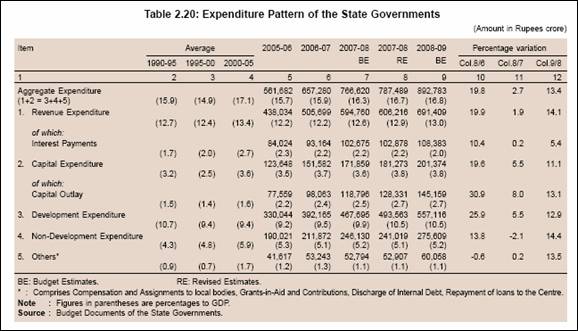

2.54 The improvement in the revenue account during 2008-09 is budgeted to be mainly achieved by increase in revenue receipts, which would emanate from increase in shareable taxes, States’ own tax revenue and grants from the Centre (Table 2.19). The improvement in the revenue account would also be facilitated by deceleration in revenue expenditure, particularly in interest payments and pension. Capital outlay, as percentage to GDP, would be maintained at 2.7 per cent in 2008-09 (BE) as in the previous year. It is important to note that developmental expenditure is budgeted to decelerate in 2008-09 (BE), while non-developmental expenditure is budgeted to accelerate (Table 2.20).

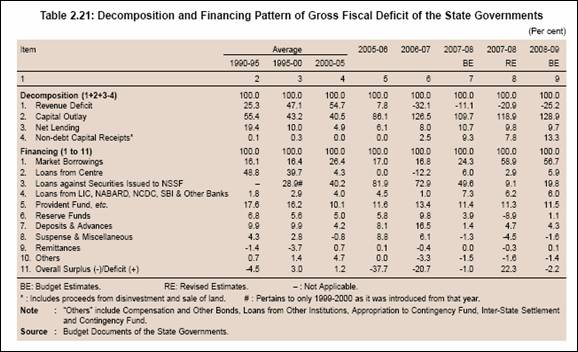

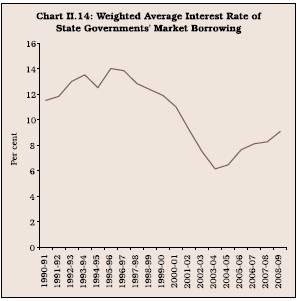

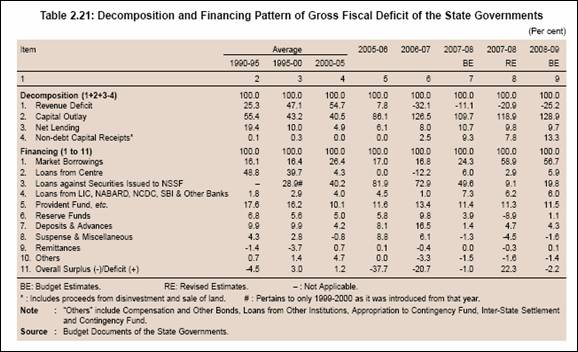

2.55 With the budgeted revenue surplus of 0.5 per cent of GDP in 2008-09 (BE), the revenue surplus would finance capital outlay. Market borrowings would finance the major portion of GFD (56.7 per cent) in 2008-09 (BE), followed by special securities issued to NSSF (19.8 per cent) and provident funds (11.5 per cent) (Table 2.21).

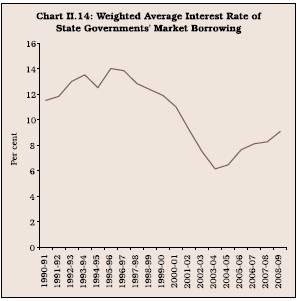

2.56 The provisional net allocation under market borrowing programme of the State Governments for 2008-09 is placed at Rs.47,044 crore. Taking into account repayments of Rs.14,371 crore and additional allocation of Rs.45 crore, the gross market borrowings of State Governments are estimated at Rs.61,460 crore. During the current year so far (up to July 31, 2008), eight State Governments raised Rs.10,812 crore through auctions with a cut-off yield in the range 8.39-9.90 per cent as compared with Rs.8,542 crore by 14 State Governments (cut-off yield ranging from 8.00-8.57 per cent) during the corresponding period of the previous year.

Outlook

2.57 In all, twenty-five State Governments have budgeted revenue surplus during 2008-09, the final year of the TFC target of eliminating revenue deficit. Further, as many as seventeen State Governments have budgeted GFD-GSDP ratio at 3 per cent or less, a year ahead of the TFC target. As the State Governments come closer to meeting the objective of reduction in deficit indicators, the States need to place strong emphasis on sustaining this progress in the post-FRL period. It would be important to generate adequate fiscal space through revenue augmentation that could be utilised for financing developmental expenditure. The generation of revenues through improving efficiency of tax collection and appropriate charges on public services assumes particular significance under the rule-based fiscal framework on account of implicit cap on financing of expenditure by borrowings. States can, however, price the range of services that they provide only by improving the quality of delivery of services.

2.58 The efforts of the States towards reducing fiscal imbalances was aided by larger devolution and transfers from the Centre based on the recommendations. The implementation of VAT by all the States also aided in improving the buoyancy of States’ taxes. On the expenditure side, while States have been able to scale

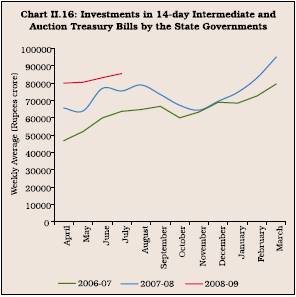

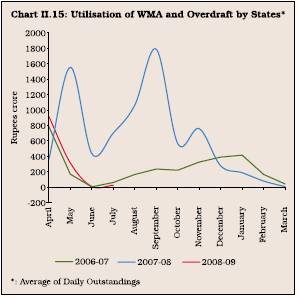

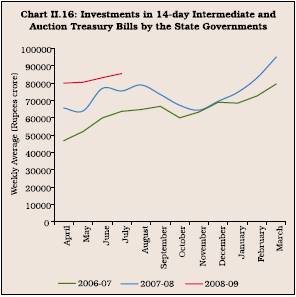

up capital outlay, there has been some rationalisation of revenue expenditure during the FRL period. The financing pattern of GFD has undergone a compositional shift with a decline in accruals under the NSSF. As a result, the market borrowings have emerged as the major source of financing of GFD. The State Governments have maintained a high level of cash surplus during 2008-09 so far, as reflected in their investments in intermediate and auction Treasury Bills.

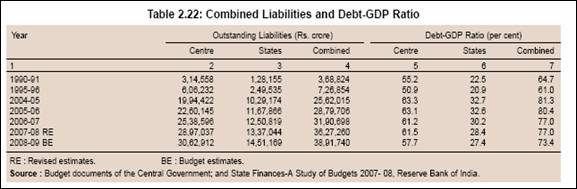

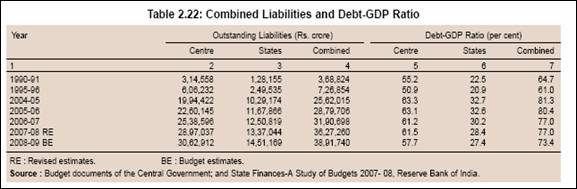

2.59 While the fiscal consolidation efforts have enabled a reduction in key deficit indicators, the level of States’ outstanding liabilities continue to remain high as compared with many emerging and developing countries. Although there has been some reduction in the debt-GDP ratio due to debt consolidation and relief measures, the States continue to hold a large chunk of high cost debt. A few States have prepaid high cost debt on account of comfortable cash balance position.

2.60 The States also need to factor in the impact of higher staff remuneration based on the recommendations of the Sixth Pay Commission of the Central Government. The State Governments may incur revenue losses due to lower tax devolution on account of reduction of excise and customs duties on petroleum products by the Centre and reduction of sales tax on these products by some States. In the near future, State finances would be shaped by the recommendations of the Thirteenth Finance Commission that was set up in November 2007 (award period: 2010-15) and the implementation of the Goods and Services Tax (GST) scheduled from April 1, 2010.

Public Debt

2.61 The combined outstanding liabilities of the Central and State Governments, as percentage to GDP, were budgeted to decline from 77.0 per cent at end-March 2008 to 73.4 per cent by end-March 2009 as a result of the fiscal consolidation process that is underway at the Centre and States as well as strong macroeconomic performance (Table 2.22).

IV. MONETARY AND CREDIT SITUATION

Monetary Condition

2.62 Against the backdrop of emerging inflationary, pressures, the Reserve Bank in its Annual Policy Statement for 2007-08 (April 2007) reaffirmed its resolve to respond swiftly with all possible measures to developments impinging on inflation expectations and the growth momentum. As the overarching policy challenge was to manage the transition to a higher growth path, while containing inflationary pressures, the policy preference for the period ahead was indicated as strongly in favour of price stability and well-anchored inflation expectations with the endeavour to contain inflation close to 5.0 per cent in 2007-08, while reinforcing the medium term objective to condition the policy and perceptions in the range of 4.0-4.5 per cent. Towards this end, it was indicated that the Reserve Bank will continue with its policy of active demand management of liquidity through appropriate use of all the policy instruments at its disposal flexibly as and when the situation warranted.

2.63 Headline inflation turned benign by the First Quarter of the Annual Statement on Monetary Policy for 2007-08, reflecting the combined impact of lagged and cumulative monetary policy actions and fiscal and administrative measures for supply management. These measures also had a salutary effect on inflation expectations. Nevertheless, the First Quarter Review of July 2007 added that monetary management needed to be watchful of movements in commodity prices, particularly oil prices, the elevated levels of asset prices and the re-emergence of pricing power among producers as potential threats to inflation expectations. The outlook for inflation in 2007-08 was, however, left unchanged in the Review.

2.64 The Mid-Term Review continued with the stance set out in the Annual Policy Statement for 2007-08 and the First Quarter Review reinforcing the emphasis on price stability and well-anchored inflation expectations while ensuring a monetary and interest rate environment that supported export and investment demand in the economy so as to enable continuation of the growth momentum. Credit quality and orderly conditions in financial markets for securing macroeconomic and, in particular, financial stability were re-emphasised while simultaneously pursuing greater credit penetration and financial inclusion. While reiterating a readiness to respond swiftly with all possible measures as appropriate to the evolving global and domestic situation impinging on inflation expectations, financial stability and the growth momentum, the Mid-Term Review resolved to take recourse to all possible options for maintainingstability and the growth momentum in the economy in view of the unusually heightened global uncertainties, and the unconventional policy responses to the developments in financial markets.

2.65 The Third Quarter Review (January 2008) of the Annual Statement on Monetary Policy, while continuing to re-emphasise the policy stance of the Mid-Term Review, took note of the developments in global financial markets in the context of the subprime crisis and highlighted the need of more intensified monitoring and swift responses with all available instruments to preserve and maintain macroeconomic and financial stability. While it maintained that there was no visible or immediate threat to financial stability in India from global developments, it underscored the need for continued but heightened vigilance with an emphasis on readiness to take timely, prompt and appropriate measures to mitigate the risks to the extent possible. Accordingly, it emphasised the need to monitor the evolving heightened global uncertainties and domestic situation impinging on inflation expectations, financial stability and growth momentum in order to respond swiftly with both conventional and unconventional measures, as appropriate.

2.66 The Reserve Bank in the Annual Policy Statement for 2008-09 released in April 2008 placed the real GDP growth for 2008-09 at around 8.0 to 8.5 per cent. In view of the prevailing assessment of the economy including the outlook for growth and inflation, the overall stance of monetary policy in the Annual Policy Statement was broadly stated as (i) to ensure a monetary and interest rate environment that accords high priority to price stability, well-anchored inflation expectations and orderly conditions in financial markets while being conductive to continuation of the growth momentum; (ii) to respond swiftly on a continuing basis to the evolving constellation of adverse international developments and to the domestic situation impinging on inflation expectations, financial stability and growth momentum, with both conventional and unconventional measures, as appropriate; and (iii) to emphasise credit quality as well as credit delivery, in particular, for employment-intensive sectors, while pursuing financial inclusion.

2.67 The First Quarter Review of the Annual Statement on Monetary Policy noted that after the announcement of the Annual Policy Statement in April 2008, global as well as domestic developments, on both supply and demand sides pointed to accentuation of inflationary pressures, especially in terms of inflation expectations and perceptions. In an environment of surging global inflation and with domestic inflation also rising to a 13-year high, the Review noted with concern that inflation had emerged as the biggest risk to the global outlook, having risen to very high levels across the world, which had not been generally seen for a couple of decades in the past. As such, bringing down inflation from the high levels and stabilising inflation expectations assumed the highest priority in the stance of monetary policy. It noted that looking forward, the global and, more impor tantly, the domestic factors pose severe challenges to monetary management and warranted reinforced policy actions on several fronts. Accordingly, a realistic policy endeavour would be to bring down inflation from the then prevailing level of about 11.0-12.0 per cent to a level close to 7.0 per cent by March 31, 2009. Taking into account aggregate demand management and supply prospects described above, the projection of real GDP growth of the Indian economy in 2008-09 was placed at around 8.0 per cent, barring domestic or external shocks. Against this backdrop, the stance of monetary policy was retained as stated in the Annual Policy Statement released in April 2008.

2.68 With a view to containing inflation expectations as also the likely impact of prevailing monetary/ liquidity conditions due to large capital inflows, the Reserve Bank announced monetary measures from time to time. Accordingly, beginning March 05, 2007, it was decided to limit the daily reverse repo absorptions to a maximum of Rs.3,000 crore to facilitate the maintenance of appropriate liquidity in the system and active liquidity management through the market stabilisation scheme (MSS). However, in view of the prevailing macroeconomic and overall monetary and liquidity conditions, the ceiling of Rs.3,000 crore on daily reverse repo under the LAF was withdrawn with effect from August 6, 2007. During 2006-07, the cash reserve ratio (CRR) of SCBs was increased by 100 basis points in four stages to 6.00 per cent from 5.00 per cent of NDTL of the scheduled commercial banks. The first round liquidity impact on the banking system due to CRR changes was Rs.27,500 crore in 2006-07. During 2007-08, the CRR was further increased by 150 basis points in four stages to 7.50 per cent and the first round impact on the banking system was Rs.47,000 crore. During 2008-09 so far, the CRR has been increased by another 150 basis points and repo rate by 125 basis points to 9.00 per cent for both. The Government of India, in consultation with the Reserve Bank, revised the ceiling under the MSS for the year 2007-08 from Rs.1,10,000 crore to Rs.1,50,000 crore on August 8, 2007, and further to Rs.2,00,000 crore on October 4, 2007 and Rs.2,50,000 crore from November 7, 2007 to give more manoeuvrability to the Reserve Bank in the conduct of monetary policy.

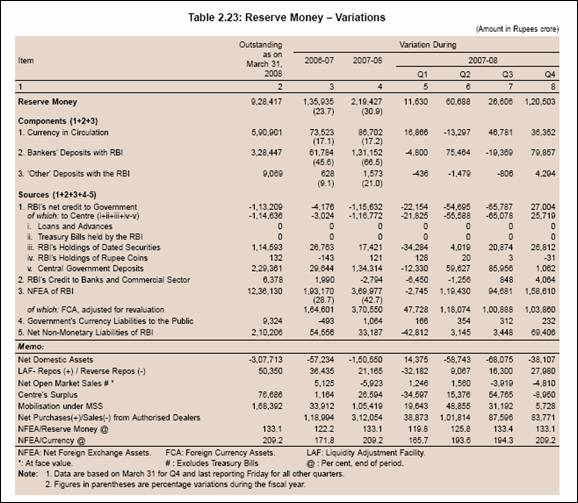

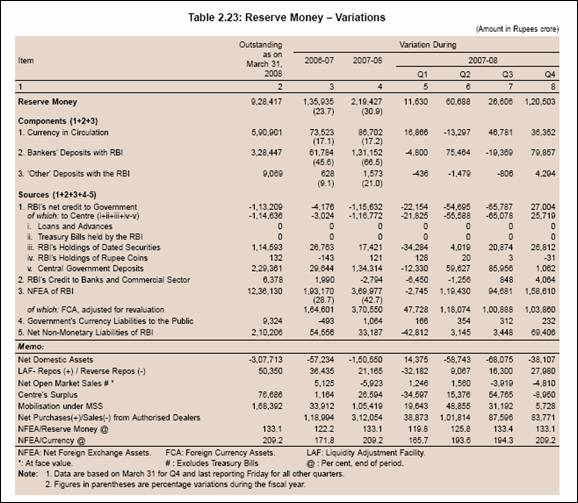

Reserve Money Survey

2.69 Expansion in reserve money year-on-year (y-o-y) at 30.9 per cent at end-March 2008 was higher than that of 23.7 per cent a year ago. Adjusted for the impact of the hike in the CRR, reserve money expansion was 25.3 per cent as compared with 18.9 per cent a year ago. Movements in reserve money during 2007-08 exhibited large variations mainly reflecting the fluctuations in bankers' deposits with the Reserve Bank in the wake of hikes in the CRR, sizeable expansion in demand and time liabilities and the Reserve Bank's market operations. Bankers' deposits with the Reserve Bank expanded by 66.5 per cent during 2007-08 as compared with 45.6 per cent during 2006-07. On the sources side, expansion in reserve money was mainly driven by foreign currency assets of the Reserve Bank which (adjusted for revaluation) increased by Rs.3,70,550 crore during 2007-08 as compared with an increase of Rs.1,64,601 crore in the previous year. Movements in the Reserve Bank's net credit to the Central Government during 2007-08 largely reflected the liquidity management operations by the Reserve Bank and movements in Government deposits with the Reserve Bank. The sterilisation operations of the Reserve Bank under the MSS led to an increase in Central Government deposits with the Reserve Bank. Surplus cash balances of the Central Government with the Reserve Bank also increased. The Reserve Bank's holdings of Central Government dated securities increased on account of injection of liquidity under the LAF. Reflecting these developments, the Reserve Bank's net credit to the Centre declined by Rs.1,16,772 crore during 2007-08 as compared with the decline of Rs. 3,024 crore during 2006-07 (Table 2.23).

Developments during 2008-09

2.70 The year-on-year (y-o-y) reserve money growth was 31.1 per cent as on August 15, 2008 as compared with 24.1 per cent, a year ago. Adjusted for the first round effect of the hike in CRR, reserve money growth was 24.3 per cent as compared with 14.2 per cent a year ago. The Reserve Bank's foreign currency assets (adjusted for revaluation), on a y-o-y basis, increased by Rs.2,51,201 crore as compared with an increase of Rs.2,40,618 crore a year ago. The Reserve Bank's net credit to the Centre increased, y-o-y, by Rs.6,125 crore as against a decline of Rs.78,935 crore, a year ago.

Monetary Survey

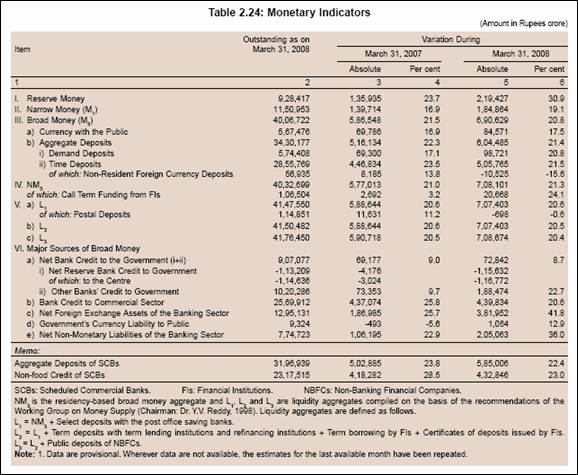

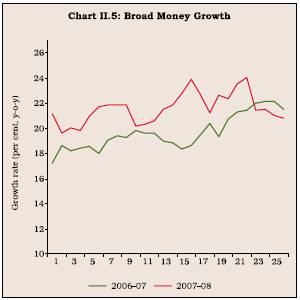

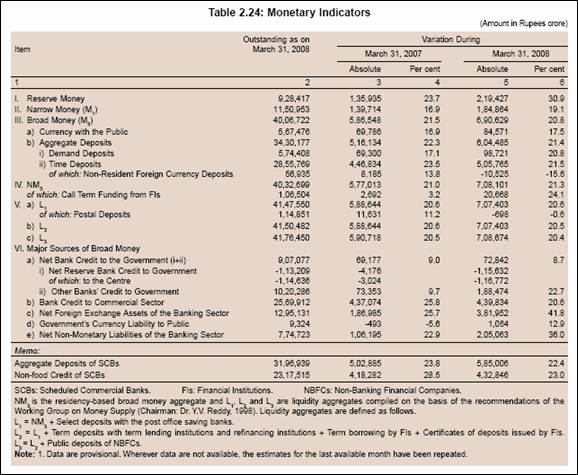

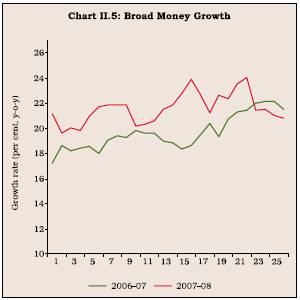

2.71 Broad money (M3) growth was 20.8 per cent, y-o-y, as at end-March 2008 as compared with 21.5 per cent in the previous year (Table 2.24 and Chart II.5). The growth in aggregate deposits of banks

witnessed some moderation. Demand deposits recorded a growth of 20.8 per cent (y-o-y) during 2007-08 as compared with growth of 17.1 per cent a year ago. Time deposits increased by 21.5 per cent (as compared with 23.5 per cent a year ago). Nonetheless growth in time deposits remained strong, benefiting, inter alia, from higher interest rates on bank deposits and tax benefits for deposits with maturity of 5 years and above. During 2007-08, accretion to postal deposits decelerated significantly up to November 2007. Furthermore, in December 2007 there were net outflows from small saving schemes. In order to revive interest in postal deposits, the Government announced in December 2007 some incentives, including tax benefits for certain postal deposits. However, net outflows continued up to June 2008, the latest period for which data are available.

Developments during 2008-09

2.72 On a year-on-year basis, growth in broad money (M3) was 19.6 per cent as on August 1, 2008 as compared with 21.8 per cent a year ago. Amongst the major components, aggregate deposits expanded by 20.0 per cent as compared with 23.1 per cent a year ago. On the sources side, scheduled commercial banks' non-food credit registered a growth of 26.2 per cent as on August 1, 2008 marginally higher than 23.5 per cent in the previous year, while their investment in Government securities expanded by 15.4 per cent as compared with 12.9 per cent a year ago.

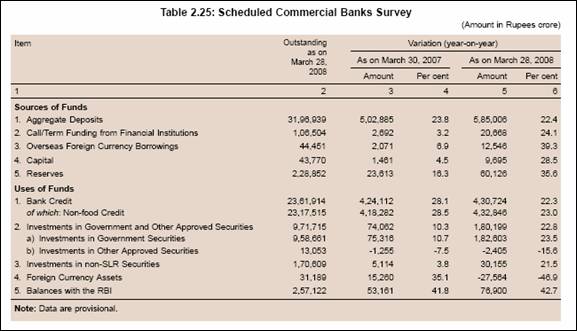

Bank Credit

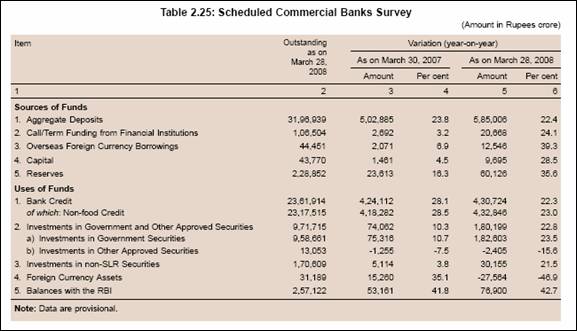

2.73 Demand for bank credit moderated in 2007-08. Non-food credit extended by scheduled commercial banks grew by 23.0 per cent (y-o-y) at end-March 2008, lower than 28.5 per cent a year ago (Table 2.25 and Chart II.6). During 2007-08, commercial banks’ investment in SLR securities increased sharply by 22.8 per cent (y-o-y) as compared with an increase of 10.3 per cent a year ago.

Developments during 2008-09

2.74 Non-food credit as at August 1, 2008 (y-o-y) registered higher growth of 26.2 per cent compared with 23.5 per cent a year ago. Investments in SLR securities by commercial banks’ witnessed a growth of 15.6 per cent as compared with 12.5 per cent in the previous year.

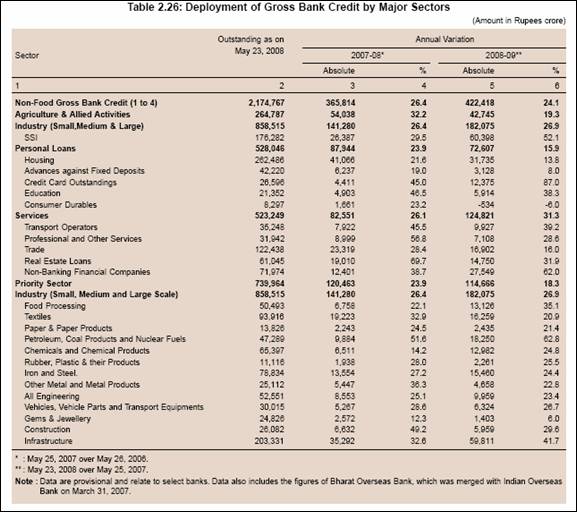

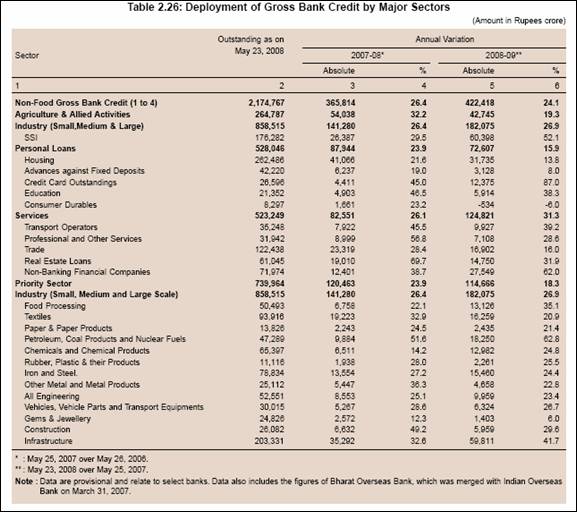

2.75 Information on the sectoral deployment of gross bank credit indicates that, on a year-on-year basis, bank credit to the services sector recorded the highest growth (31.1 per cent) up to March 2008, followed by the industry (25.0 per cent), agricultural sector (18.8 per cent) and personal loans (10.7 per cent). During 2008-09, the year-on-year growth in non-food gross bank credit (up to May 2008) accelerated to 24.1 per cent. Credit to the services sector recorded the highest growth (31.3 per cent), followed by industry (26.9 per cent), agriculture (19.3) and personal loans (15.9 per cent) at end-May 2008. The increase in industrial credit was mainly on account of infrastructure (power, roads, ports, and telecommunication), petroleum, textiles, iron & steel, food processing, chemicals, engineering, vehicles and construction industries.

Credit to the commercial real estate sector moderated significantly, although it was still higher than the credit growth to many other sectors (Table 2.26).

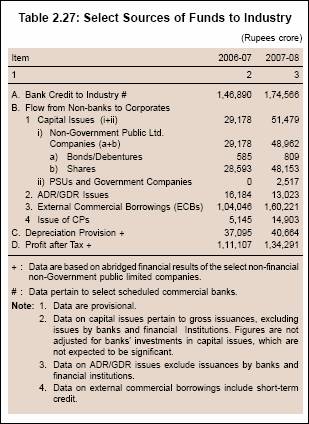

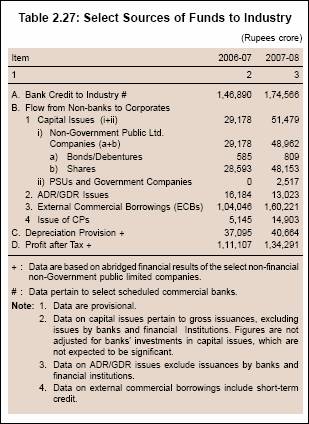

2.76 Apart from credit from banks, the corporate sector continued to meet its funding requirements from a variety of non-bank sources such as capital markets, external commercial borrowings and internal generation of funds. Resources raised through domestic equity issuances during 2007-08 (Rs.48,153 crore) were 68 per cent higher than a year ago. Net mobilisation through external commercial borrowings (ECBs) during 2007-08 increased by 54 per cent over the previous year. Mobilisation through issuances of commercial paper (CPs) during 2007-08 was nearly three times the issuances during the previous year. Internal generation of funds continued to provide support to the funding requirements of the corporate sector, despite the growth in profits after tax of select non-financial non-gover nment companies during 2007-08 witnessing some deceleration as compared with the previous year. Resources raised in the form of equity issuances through American depository receipts (ADRs) and global depository receipts (GDRs) during 2007-08 (Rs.13,023 crore) were 20 per cent lower than a year ago (Table 2.27).

Price Situation

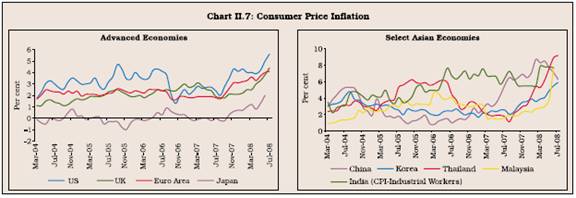

2.77 Headline inflation generally remained firm in major economies during 2007-08, reflecting the combined impact of higher food and fuel prices as well as strong demand conditions, especially in emerging markets. Amongst the major economies, headline inflation in March 2008 was 4.0 per cent in the US, 2.5 per cent in the UK and 3.6 per cent in the euro area as compared with 2.8 per cent, 3.1 per cent and 1.9 per cent, respectively, a year ago. Core inflation also remained firm in major economies. In the US, consumer price inflation (excluding food and energy) was 2.4 per cent in March 2008 as compared with 2.5 per cent a year ago. In the OECD countries, consumer price inflation (excluding food and energy) was 2.1 per cent in March 2008, same as a year ago. Amongst developing economies, headline inflation during March 2008 firmed up to 8.3 per cent in China (3.3 per cent a year ago), 3.9 per cent in Korea (2.2 per cent) and 5.3 per cent in Thailand (2.0 per cent) (Chart II.7). Inflation firmed up further in many developed and developing economies during 2008-09 so far. Among major economies, headline inflation increased to 5.6 per cent in the US, 4.4 per cent in the UK and 4.0 per cent in the euro area in July 2008. Among developing countries, headline inflation was 6.3 per cent in China, 5.9 per cent in Korea and 9.2 per cent in Thailand in July 2008.

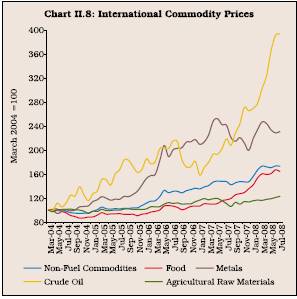

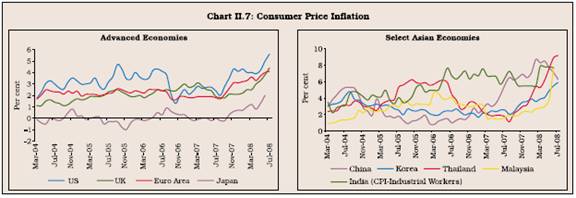

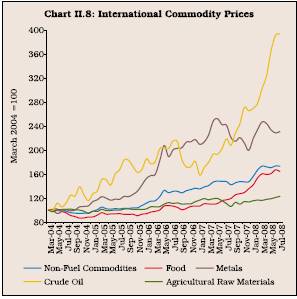

2.78 Global commodity prices firmed up during 2007-08 led by sharp increases in food and crude oil prices (Chart II.8). International crude oil prices rose sharply during the year, reflecting tight supply-demand balance, geo-political tensions, weakening of the US dollar against major currencies and increased interest from investors and financial market players. During 2007-08, the US West Texas Intermediate (WTI) crude oil prices touched a peak of US $ 110.2 a barrel level on March 13, 2008 on the back of a sharp fall in US crude inventories. After easing somewhat thereafter on deepening concerns about slowdown in the US, the biggest consumer of oil, prices rose again to reach a historical peak of US $ 145.3 a barrel level on July 3, 2008 but has moderated to US $ 114.4 by August 19, 2008. Food prices firmed up during 2007-08, especially in the second half, led by wheat, rice, and oilseeds/edible oils on account of surge in demand (both consumption demand and demand for non-food uses such as bio-fuels production) and low stocks of major crops, and partly on account of weather related disturbances on production in some major producing regions. Reflecting these factors, international prices of wheat, rice, soybeans, soybean oil and palm oil increased by 121 per cent, 86 per cent, 79 per cent, 106 per cent and 101 per cent, respectively, year-on-year, in March 2008. International sugar prices remained largely range bound during the year, reflecting higher production in traditional importing countries. Metal prices, which had witnessed some moderation during June-December 2007 reflecting lower import demand and some improvement in supply, rose again during January-March 2008.

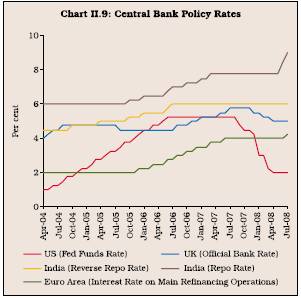

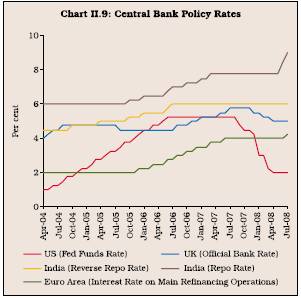

2.79 Notwithstanding hardening of inflation, many central banks in advanced economies resorted to monetary easing in order to forestall the adverse impact of the tightening of credit conditions on the broader economy arising out of the US sub-prime crisis (Chart II.9). The US kept the policy rate unchanged during the first half of 2007-08. However, after viewing that the tightening of credit conditions and the deepening of housing contraction were likely to weigh on economic growth over the next few quarters, the Federal Open Market Committee (FOMC) cut its target for the federal funds rate by 25 basis points to 2.00 per cent on April 30, 2008, taking cumulative reduction to 325 basis points beginning September 2007 when it began cutting rates. The discount rate was also cut by 400 basis points beginning August 2007 to a level of 2.25 per cent to improve market liquidity. In its latest meeting held on August 5, 2008, the FOMC noted that inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities, and some indicators of inflation expectations have been elevated. According to the committee, although inflation is expected to moderate later this year and next year, the outlook remains highly uncertain. Against this backdrop, the federal funds rate was left unchanged at 2.0 per cent. In the UK, the Bank of England, which had raised the policy rate by 50 basis points during May-July 2007 in view of upside risks to inflation outlook, cut its policy rate by 75 basis points from December 2007 to 5.0 per cent on April 10, 2008 to balance the upside risks of above-target inflation this year raising inflation expectations with the downside risks of the disruption in financial markets leading to a slowdown in the economy that was sufficiently sharp to pull inflation below the target. Noting that the CPI inflation would peak around the end of the year and then begin to fall back towards the target of 2 per cent within a period of two years, the MPC left the policy rate unchanged thereafter. In the euro area, after raising the policy rates by 25 basis points on June 6, 2007, the European Central Bank (ECB) left the policy rate unchanged thereafter during 2007-08 as it viewed that risks to price stability over the medium term were on the upside, in the context of very vigorous money and credit growth. However, with inflation rates continued to rise and expected to remain well above the level consistent with price stability for a more protracted period than previously thought, the ECB raised its key policy rates by 25 basis points effective July 9, 2008 to prevent broadly based second-round effects and to counteract the increasing upside risks to price stability over the medium term.

2.80 The Bank of Japan (BoJ) has kept its policy rate unchanged since February 2007, when it raised the uncollateralised overnight call rate (the operating target of monetary policy since March 2006) by 25 basis points to 0.50 per cent. According to the BoJ, inflation is expected to be somewhat higher over the coming months but to moderate gradually thereafter. Economic growth, after remaining sluggish for the time being, is expected to return gradually onto a moderate growth path as commodity prices level out and overseas economies move out of their deceleration phase. Amongst other major advanced economies, the Bank of Canada, which had initially raised its policy rate by 25 basis points in July 2007, eventually cut it by 150 basis points beginning from December 2007 to 3.0 per cent on April 22, 2008, while the Reserve Bank of Australia continued to raise its policy rate – 175 basis points from May 2006 to 7.25 per cent on March 5, 2008.

2.81 Inflation pressures remained firm in major emerging market economies (EMEs) on the back of strong growth and higher oil, food and other commodity prices. Consumer price inflation in China increased to 8.3 per cent in March 2008 from 3.3 per cent a year earlier, mainly due to higher food prices. Subsequently it eased somewhat to 6.3 per cent in July 2008. In order to address the excess liquidity in the banking system and ease pressures on money and credit expansion, the People’s Bank of China (PBC) increased the benchmark 1-year lending rate by 189 basis points beginning April 2006 to 7.47 per cent on December 21, 2007. Apart from continued issuances of its own bills to mop up liquidity, the PBC also raised the cash reserve ratio by 1000 basis points to 17.5 per cent between July 2006 and June 2008 to strengthen liquidity management in the banking system and guide the appropriate growth of money and credit. Amongst other emerging Asian economies, the Bank of Korea, after keeping its policy rate unchanged at 5.0 per cent since August 9, 2007 in view of the uncertainty surrounding future economic developments largely due to the run up in international oil prices, international financial market unrest and the US economic slowdown, raised rate by 25 basis points to 5.25 per cent, on August 7, 2008. According to the latest assessment by the monetary policy committee, consumer price inflation has picked up its pace (it increased to 5.9 per cent in July 2008 from 2.5 per cent a year ago), due to the direct and knock-on effects of high oil prices, and inflation seems likely to remain significantly high for quite some time. In Thailand, the MPC which had kept its policy rate unchanged at 3.25 per cent since July 18, 2007 (when it was last cut by 25 basis points), raised rate by 25 basis points to 3.50 per cent on July 16, 2008. According to the MPC, risks to inflation have risen markedly, which would affect private sector confidence, making it increasingly difficult to ensure economic stability going forward, and impact potential growth as well as the competitiveness of the Thai economy in the long-run.

2.82 In India, headline inflation based on the wholesale price index (WPI) softened from 6.4 per cent at the beginning of the fiscal year to a low of 3.1 per cent by October 13, 2007, partly reflecting moderation in the prices of primary food articles and some manufactured products items as well as base effects. After hovering around 3 per cent in November 2007, inflation began to edge up from early December 2007 and touched 7.7 per cent by March 29, 2008, mainly reflecting the hardening of prices of primary articles such as cereals, vegetables, oilseeds, raw cotton and iron ore, fuel group, and manufactured products items such as edible oils/oil cakes and metals. The annual average WPI inflation rate (average of 52 weeks), after rising up to May 2007, eased from the beginning of June 2007 to reach 4.7 per cent during the week ended March 29, 2008 (5.4 per cent a year ago). Headline inflation moved in a range of 3.1-8.0 per cent during 2007-08 (Chart II.10).

2.83 Amongst major groups, primary articles inflation, y-o-y, eased from 12.2 per cent at the beginning of April 2007 to an intra-year low of 3.7 per cent by end-December 2007, reflecting easing of food articles prices, especially of pulses, fruits and vegetables, and eggs, fish and meat as well as base effects. Subsequently, primary articles inflation increased to 9.7 per cent on March 29, 2008 mainly led by fruits, vegetables, oil seeds, raw cotton and iron ore. Wheat prices increased by 5.1 per cent, year-on-year, as on March 29, 2008 as compared with an increase of 7.3 per cent a year ago, reflecting improved production following the normal monsoon and supply side measures under taken by the Government. Prices of pulses declined by 1.9 per cent as compared with an increase of 12.5 per cent a year ago, reflecting improved production. Rice prices increased by 9.1 per cent, y-o-y, on top of 5.7 per cent a year ago. Prices of oilseeds, y-o-y, increased by 20.3 per cent on top of an increase of 31.6 per cent a year ago, due to higher demand, lower domestic rabi production as well as rising global prices. Raw cotton prices were 14.0 per cent higher, y-o-y, as on March 29, 2008 as compared with an increase of 21.9 per cent a year ago in line with the international price movements (Table 2.28).

2.84 Fuel group inflation, which was negative during June-November 2007, partly reflecting the base effects as well as fuel (petrol and diesel) price cuts last year, turned positive from mid-November 2007 to reach 6.8 per cent on March 29, 2008. The increase beginning November 2007 could be attributed to further increases in the prices of some petroleum products such as naphtha, furnace oil, aviation turbine fuel (ATF) and bitumen as well the upward revision in the domestic prices of petrol and diesel by Rs.2 per litre and by Rs.1 per litre, respectively, effective February 15, 2008 (which came after a gap of almost one year when the prices were cut). International crude oil prices (Indian basket) increased by almost 76 per cent from US $ 56.6 a barrel in February 2007 to US $ 99.3 per barrel level

in March 2008. While domestic petrol and diesel prices have been adjusted par tially, prices of kerosene have not been raised by the Government since April 2002 on grounds of societal concerns while prices of liquefied petroleum gas (LPG), which remained unchanged during 2007-08, have been raised partially in June 2008. In order to contain fuller pass-through of higher international crude prices to domestic prices, the Government, however, has extended the subsidy schemes for these products, available through the public distribution system (PDS) upto March 2010.

2.85 Manufactured products inflation, y-o-y, eased from 6.4 per cent at the beginning of the year to 3.5 per cent by November 24, 2007 (5.3 per cent a year ago) led by decline in the prices of sugar, textiles and non-ferrous metals as well as base effects. Subsequently, manufactured products inflation increased to 7.3 per cent by March 29, 2008, mainly reflecting the continued rise in the prices of edible oils/oil cakes, basic heavy inorganic chemicals, and basic metals and alloys. These commodities together contributed almost 41 per cent to the overall WPI inflation on March 29, 2008. Within the manufactured products group, prices of edible oils (20.0 per cent), oil cakes (27.2 per cent), chemicals and chemical products (6.0 per cent), cement (5.1 per cent), iron and steel (34.2 per cent) and electrical machinery (4.8 per cent) increased, on a year-on-year basis, on March 29, 2008. Domestic non-ferrous metals prices declined during 2007-08, although international prices, which had eased up to December 2007, firmed up during January-March 2008. Iron and steel prices increased in line with the recent hardening of international prices. Domestic cement prices, however, increased largely due to the strong demand from the construction sector and high capacity utilisation rates in the cement industry. The firming up of domestic edible oil and oil cakes prices reflected stagnant domestic production, increased demand and rise in international prices.

2.86 In order to contain inflationary pressures, the Government initiated a number of fiscal and supply augmenting measures during 2007-08. On April 3, 2007, the Government decided to exempt import of portland cement from countervailing duty and special additional customs duty; it was earlier exempted from basic customs duty in Januar y 2007. The Government also took several measures with the aim of containing food price inflation. The Government reduced customs duty on palm oils by 10 percentage points across the board in April 2007 and import duty on various edible oils in a range of 5-10 percentage points in July 2007. It also withdrew the 4 per cent additional countervailing duty on all edible oils. Import of wheat at zero duty, which was available up to end-December 2006, was extended further to end-December 2007. Customs duty on import of pulses was reduced to zero on June 8, 2006 and the period of validity of import of pulses at zero duty, which was initially available up to March 2007, was first extended to August 2007 and further to March 2009. A ban was imposed on export of pulses with effect from June 22, 2006 and the period of validity of prohibition on exports of pulses, which was initially applied up to end-March 2007, was further extended up to end-March 2008. In March 2008, the customs duty on rice was reduced from 70 per cent to zero per cent up to March 2009; customs duties on crude and refined edible oil were reduced from a range of 40-75 per cent to 20.0-27.5 per cent; and export of all edible oils were prohibited with immediate effect from April 1, 2008. These measures were expected to help in containing inflation and inflationary expectations.

2.87 Headline WPI inflation was 12.6 per cent, y-o-y, as on August 9, 2008 as compared with 7.7 per cent at end-March 2008 and 4.2 per cent a year ago. Primary articles group, fuel group, and manufactured products group inflation hardened to 11.8 per cent (9.5 per cent), 18.0 per cent (-2.0 per cent), and 10.9 per cent (4.7 per cent), respectively, on August 9, 2008. The average WPI inflation rate increased to 6.6 per cent as on August 9, 2008 from 5.5 per cent a year ago.

2.88 Inflation, based on year-on-year variation in consumer price indices, eased up to January 2008, mainly reflecting the deceleration in food price inflation. Subsequently, consumer price inflation hardened due to rise in food and fuel prices. However, various measures of consumer price inflation were still placed lower in the range of 6.0-7.9 per cent during March 2008 as compared with 6.7-9.5 per cent in March 2007. Disaggregated data show that food group inflation in various consumer price index measures eased to a range of 7.8-9.3 per cent in March 2008 from 10.9-12.2 per cent in March 2007. The increase in fuel group inflation from a range 3.2-6.9 per cent in March 2007 to a range of 4.6-8.0 per cent in March 2008 also contributed to the rise in consumer price inflation. Services prices, proxied by the “miscellaneous group” generally remained firm during 2007-08 (Table 2.29). CPI inflation ranged between 7.3-8.8 per cent in June 2008.

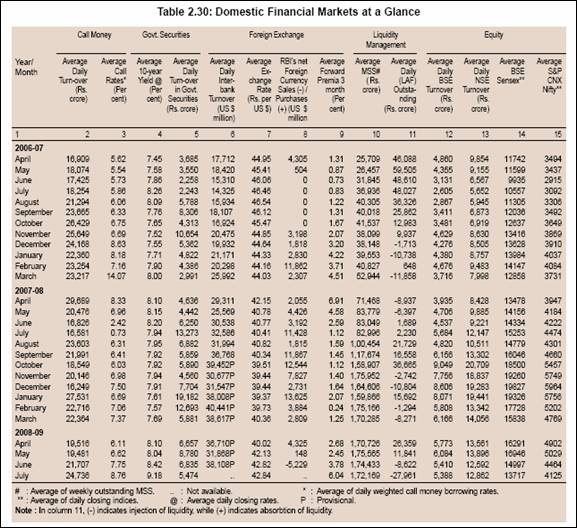

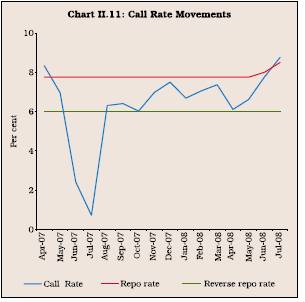

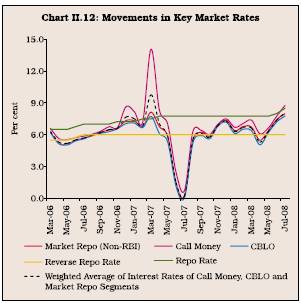

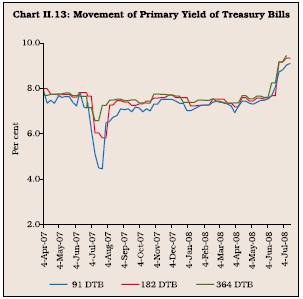

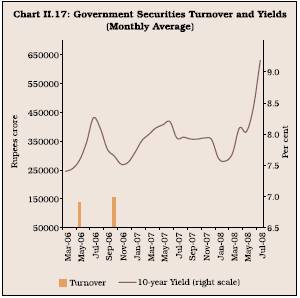

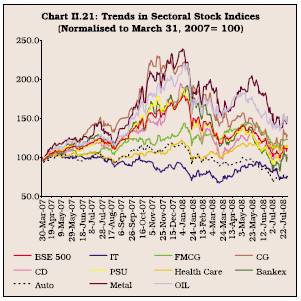

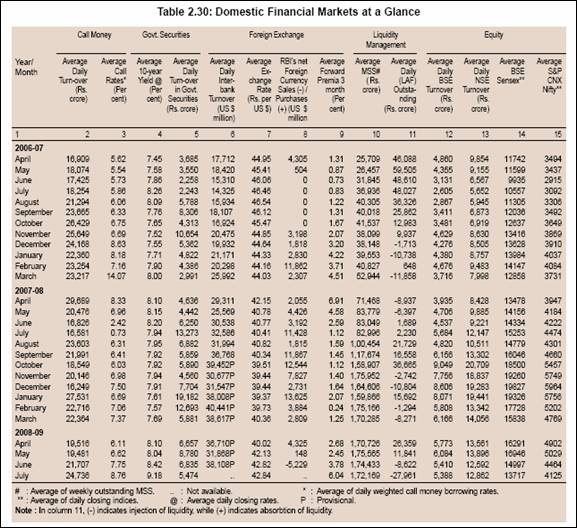

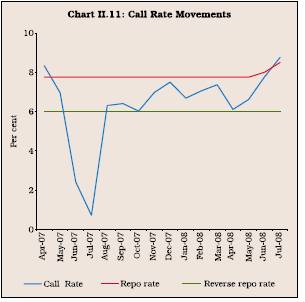

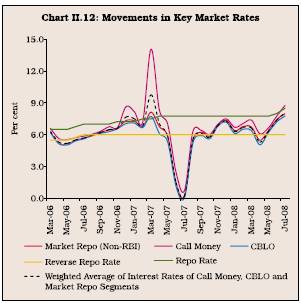

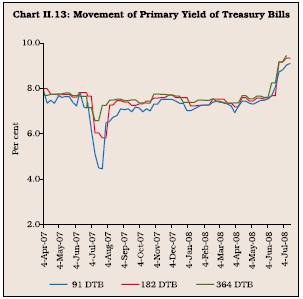

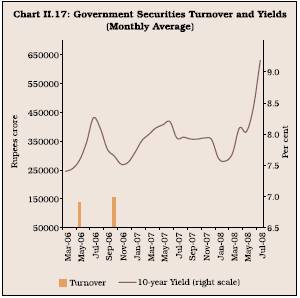

V. FINANCIAL MARKETS

2.89 Indian financial markets remained largely orderly during the year 2007-08, barring some bouts of volatility in the call money market and the equity market. Swings in the cash balances of the Government and capital flows were the main drivers of liquidity conditions in the financial markets. Interest rates in the collateralised segment of the money market moved in line with but remained below the call rate during the year (Table 2.30).

Liquidity Management - 2007-08

2.90 The Reserve Bank continued with its policy of active management of liquidity during 2007-08 through appropriate use of the CRR and open market operations (OMO), including LAF, MSS, and other policy instruments at its disposal flexibly to maintain appropriate liquidity in the system so that all the legitimate requirements of credit, particularly for productive purposes were met consistent with the objective of price and financial stability. In operational terms, this translated into modulating liquidity conditions such that the overnight rates in the money market remained more or less within the informal LAF corridor set by the policy rates.

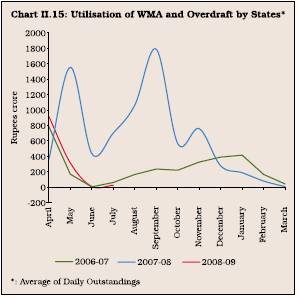

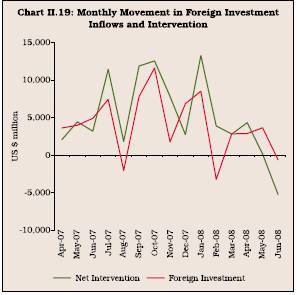

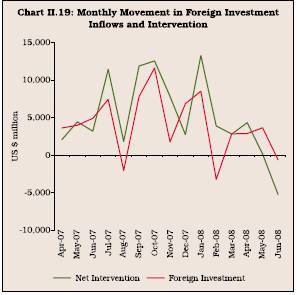

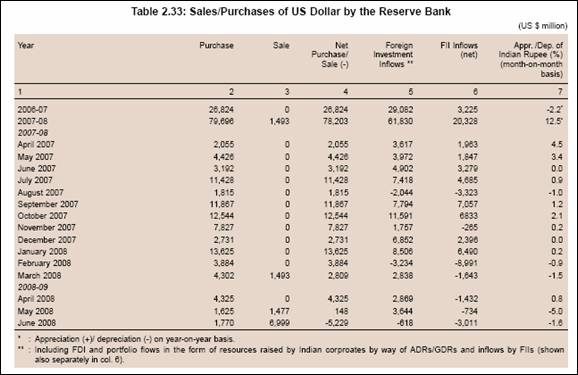

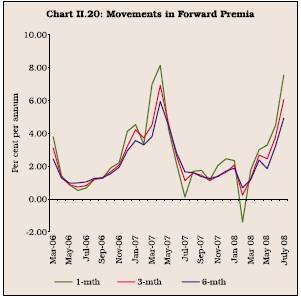

2.91 Liquidity management operations during 2007-08 had to contend with greater variations in market liquidity not only due to variations in the cash

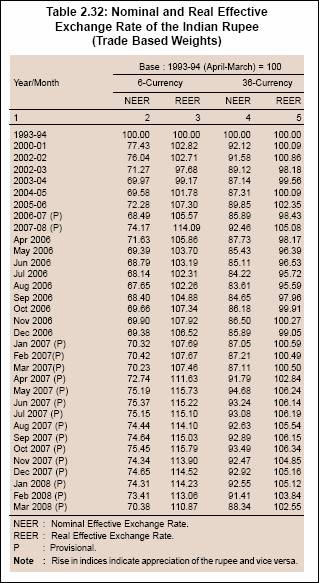

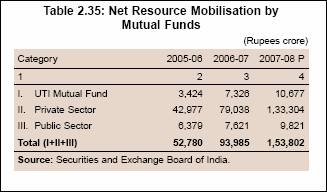

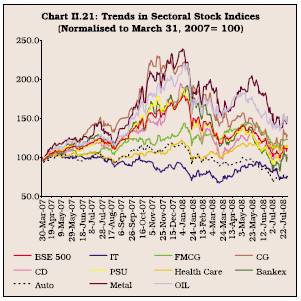

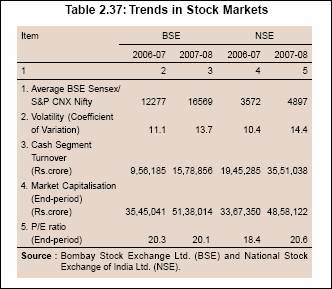

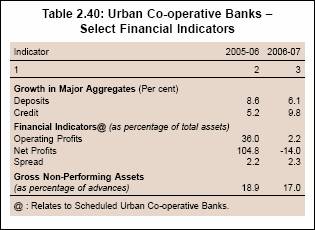

balances of the Central Government but also on account of large and volatile capital inflows during the greater part of the year. The upsurge in capital flows reflected, inter-alia, the strong fundamentals of the Indian economy, the accommodative monetary policy followed by central banks in recent years as well as the large injection of liquidity by central banks in advanced countries in response to the sub-prime turmoil. In general, challenges to liquidity management emanating from changes in the cash balances of the Central Government and large and volatile capital flows have accentuated in recent years on account of a number of factors. First, direct tax collections have increased substantially on account of sustained improvement in corporate profitability and income growth, thereby increasing the share of direct taxes in total tax revenue. As a result, larger amounts of liquidity move out from the banking system every quarter as advance tax. The liquidity impact of these advance tax inflows is large, but temporary. While the timing of such liquidity outflows is generally predictable, the sheer magnitude could cause unexpected volatility on a day to day basis. Second, on the expenditure side, the pattern of the Government spending is much less predictable all through the year. The position is exacerbated around the financial year-end; it is not unusual to see huge unwinding of cash balances towards end-March/first half of April every year, after a build-up in the last quarter of the year. Third, the timing of capital flows is unpredictable as they are driven by a combination of domestic and external factors. Fourth, the magnitude of liquidity shocks and concomitantly, the scale of requisite policy/ operational responses get magnified whenever changes in Government cash balances and capital flows occur concurrently and in the same direction, as was observed in the recent past.