IST,

IST,

II. Recent Economic Developments (Part 2 of 3)

Table 2.20: Expenditure Pattern of State Governments

|

(Rupees crore) |

||||||||||

|

Item |

Average |

2002-03 |

2003-04 |

2003-04 |

2004-05 |

Percentage variation |

||||

|

BE |

RE |

BE |

||||||||

|

1990-95 |

1995-00 |

2000-02 |

Col.7/6 |

Col.8/7 |

||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

|

Total Expenditure |

4,19,450 |

4,84,552 |

5,51,956 |

5,42,824 |

13.9 |

-1.7 |

||||

|

1+2 = 3+4+5 |

(16.0) |

(15.3) |

(16.6) |

(17.0) |

(17.7) |

(19.9) |

(17.4) |

|||

|

1. |

Revenue Expenditure |

3,32,563 |

3,79,513 |

3,99,541 |

4,15,687 |

5.3 |

4.0 |

|||

|

of which |

(12.8) |

(12.6) |

(13.9) |

(13.5) |

(13.8) |

(14.4) |

(13.3) |

|||

|

Interest Payments |

69,966 |

82,667 |

83,724 |

91,648 |

1.3 |

9.5 |

||||

|

(1.7) |

(2.0) |

(2.6) |

(2.8) |

(3.0) |

(3.0) |

(2.9) |

||||

|

2. |

Capital Expenditure |

86,887 |

1,05,039 |

1,52,415 |

1,27,137 |

45.1 |

-16.6 |

|||

|

of which |

(3.2) |

(2.7) |

(2.7) |

(3.5) |

(3.8) |

(5.5) |

(4.1) |

|||

|

Capital Outlay |

36,209 |

55,160 |

60,751 |

56,629 |

10.1 |

-6.8 |

||||

|

(1.6) |

(1.4) |

(1.5) |

(1.5) |

(2.0) |

(2.2) |

(1.8) |

||||

|

3. |

Development Expenditure |

2,27,034 |

2,67,030 |

2,99,357 |

2,80,823 |

12.1 |

-6.2 |

|||

|

(10.8) |

(9.6) |

(9.8) |

(9.2) |

(9.7) |

(10.8) |

(9.0) |

||||

|

4. |

Non Development Expenditure |

1,50,264 |

1,76,009 |

1,76,821 |

1,99,065 |

0.5 |

12.6 |

|||

|

(4.3) |

(4.9) |

(5.9) |

(6.1) |

(6.4) |

(6.4) |

(6.4) |

||||

|

5. |

Others |

42,152 |

41,513 |

75,778 |

62,936 |

82.5 |

-16.9 |

|||

|

(0.9) |

(0.7) |

(0.9) |

(1.7) |

(1.5) |

(2.7) |

(2.0) |

||||

|

BE : Budget Estimates. |

||||||||||

Public Debt

2.39 Due to persistent fiscal deficits, the combined outstanding liabilities of the Centre and the State Governments (as a ratio to GDP) have been rising since mid-1990s (Table 2.22). This ratio is expected to increase further by around one percentage point during 2004-05 and is estimated to reach 77.5 per cent as at March 2005. The high level of debt of the Centre as well as the State Governments has resulted in a sizeable increase in interest payments, notwithstanding the softening of interest rate regime in recent years.

|

Table 2.21: Decomposition and Financing Pattern of Gross Fiscal Deficit of States |

||||||||

|

(Per cent) |

||||||||

|

Item |

Average |

2002-03 |

2003-04 BE |

2003-04 RE |

2004-05 BE |

|||

|

1990-95 |

1995-00 |

2000-02 |

||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

|

Decomposition (1+2+3) |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

|

|

1. |

Revenue Deficit |

24.7 |

44.7 |

60.7 |

54.0 |

42.1 |

51.5 |

43.0 |

|

2. |

Capital Outlay |

55.3 |

43.2 |

34.2 |

35.5 |

47.5 |

43.3 |

50.4 |

|

3. |

Net Lending |

20.0 |

12.1 |

5.1 |

10.5 |

10.4 |

5.2 |

6.6 |

|

Financing (1+2+3+4+5) |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

|

|

1. |

Special Securities Issued to the NSSF |

.. |

5.8 |

36.8 |

49.7 |

43.2 |

41.6 |

53.5 |

|

2. |

Market Borrowings |

16.0 |

16.1 |

16.0 |

27.9 |

14.5 |

32.1 |

23.0 |

|

3. |

State Provident Fund |

14.3 |

13.4 |

10.2 |

9.6 |

9.3 |

8.2 |

10.9 |

|

4. |

Loans and Advances from the Centre |

49.0 |

40.6 |

13.5 |

-1.8 |

6.7 |

-15.1 |

-6.5 |

|

5. |

Others |

20.7 |

24.0 |

23.6 |

14.6 |

26.3 |

33.2 |

19.1 |

|

.. |

Not Applicable. |

|||||||

|

BE : Budget Estimates. |

||||||||

III. MONETARY AND CREDIT SITUATION

Monetary Conditions

2.40 The Annual Policy Statement of May 2004 had indicated that, barring the emergence of any adverse and unexpected developments in the various sectors of the economy and assuming that the underlying inflationary situation does not turn adverse, the overall stance of monetary policy for 2004-05 will be:

- Provision of adequate liquidity to meet credit growth and support investment and export demand in the economy while keeping a very close watch on the movements in the price level.

- Consistent with the above, while continuing with the status quo, to pursue an interest rate environment that is conducive to maintaining the momentum of growth and, macroeconomic and price stability.

|

Table 2.22: Combined Liabilities and Debt-GDP Ratio |

||||||

|

Year |

Outstanding Liabilities |

Debt - GDP Ratio |

||||

|

(end-March) |

(Rupees crore) |

(Per cent) |

||||

|

Centre |

States |

Combined |

Centre |

States |

Combined |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

1990-91 |

3,14,558 |

1,10,289 |

3,50,957 |

55.3 |

19.4 |

61.7 |

|

1995-96 |

6,06,232 |

2,12,225 |

6,89,545 |

51.0 |

17.9 |

58.0 |

|

2001-02 |

13,66,408 |

5,86,686 |

16,28,972 |

59.9 |

25.7 |

71.4 |

|

2002-03 |

15,59,201 |

6,86,142 |

18,70,519 |

63.1 |

27.8 |

75.7 |

|

2003-04 RE |

17,24,499 |

8,05,667 |

21,25,151 |

62.2 |

29.1 |

76.7 |

|

2004-05 BE |

19,86,167 |

9,10,902 |

24,20,091 |

63.6 |

29.2 |

77.5 |

|

RE : Revised Estimates. |

||||||

2.41 Consistent with the expected growth and inflation rates, the Annual Policy Statement placed the growth in broad money (M 3) and non-food credit(including non-SLR investments) at 14.0 per cent and 16.0-16.5 per cent, respectively, for 2004-05. The projection for non-food bank credit (including non SLR investments) growth during the year was revised upwards to around 19.0 per cent in the Mid-Term Review of October 2004. It was felt that the higher credit expansion could be accommodated without putting undue pressure on money supply because of the lower borrowing of the Government from the banking sector. In the eventuality of Government borrowings being larger, unwinding of MSS would facilitate such borrowings. Monetary management in the first half of 2004-05 was conducted broadly in conformity with the monetary policy stance announced in the Annual Policy Statement. In monetary management, the Reserve Bank faced challenges on two counts: overhang of liquidity and the surge in headline inflation. Accordingly, the Reserve Bank undertook calibrated measures. On a review of liquidity conditions, the Cash Reserve Ratio (CRR) was raised by 50 basis points to 5.0 per cent in two stages effective September 18, 2004 and October 2, 2004, even as the Reserve Bank indicated that it will continue to pursue its medium-term objective of reducing CRR to its statutory minimum of 3.0 per cent. This measure reduced the liquidity in the banking system by about Rs.9,000 crore. The Reserve Bank chose to increase the CRR, partly for absorbing liquidity in the system, but more importantly for signalling the Reserve Bank's concern at the unacceptable levels of inflation so that inflationary expectations are moderated while reiterating the importance of stability in financial market conditions. On the interest rate front, the Bank Rate was kept unchanged at 6.0 per cent. However, the fixed repo (now called reverse repo in accordance with international practice) rate was increased, effective October 27, 2004, by 25 basis points to 4.75 per cent.

|

Table 2.23: Variations in Major Components and Sources of Reserve Money |

||||||||||

|

(Rupees crore) |

||||||||||

|

Item |

2003-04 |

2004-05 |

2003-04 |

2004-05 |

||||||

|

(upto |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

||||

|

December 10) |

||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

||

|

Reserve Money |

67,451 |

16,293 |

16,342 |

-18,235 |

23,980 |

45,363 |

-6,813 |

-6,408 |

||

|

(18.3) |

(3.7) |

|||||||||

|

Components |

||||||||||

|

1. |

Currency in circulation |

44,555 |

30,235 |

17,882 |

-5,955 |

17,986 |

14,641 |

14,315 |

-4,166 |

|

|

(15.8) |

(9.2) |

|||||||||

|

2. |

Bankers’ Deposits with RBI |

21,019 |

-12,921 |

-1,606 |

-12,633 |

5,961 |

29,297 |

-19,665 |

-2,874 |

|

|

3. |

Other Deposits with the RBI |

1,877 |

-1,022 |

65 |

352 |

33 |

1,426 |

-1,463 |

632 |

|

|

Sources |

||||||||||

|

1. |

RBI’s net credit to Government Sector |

-75,772 |

-39,807 |

-4,451 |

-53,146 |

-12,506 |

-5,669 |

-34,143 |

-6,179 |

|

|

of which: to Central Government |

-76,065 |

-32,294 |

434 |

-53,744 |

-15,844 |

-6,911 |

-30,029 |

-4,499 |

||

|

(-67.3) |

(-87.5) |

|||||||||

|

2. |

RBI’s credit to Banks and commercial sector |

-2,728 |

-2,351 |

-1,564 |

-2,525 |

-796 |

2,156 |

-2,985 |

-740 |

|

|

3. |

NFEA of RBI |

1,26,169 |

87,937 |

22,710 |

25,720 |

51,931 |

25,808 |

57,525 |

-5,260 |

|

|

(35.2) |

(18.2) |

|||||||||

|

4. |

Govts’ Net Currency Liabilities to the Public |

225 |

44 |

84 |

74 |

43 |

24 |

35 |

8 |

|

|

5. |

Net Non-Monetary Liabilities of RBI |

-19,557 |

29,530 |

437 |

-11,642 |

14,692 |

-23,044 |

27,245 |

-5,762 |

|

|

Memo: |

||||||||||

|

1. |

Net Domestic Assets |

-58,719 |

-71,644 |

-6,368 |

-43,955 |

-27,951 |

19,555 |

-64,338 |

-1,148 |

|

|

2. |

FCA, adjusted for revaluation |

1,41,428 |

58,301 |

23,943 |

31,832 |

37,560 |

48,093 |

33,160 |

- 3,413 |

|

|

3. |

NFEA/Reserve Money (per cent) (end-period) |

110.0 |

126.4 |

98.8 |

110.8 |

117.2 |

111.0 |

126.1 |

126.8 |

|

|

NFEA : Net Foreign Exchange Assets. |

||||||||||

2.42 The overall stance of monetary policy for the second half of 2004-05, as the Mid-Term Review indicated, barring the emergence of any adverse and unexpected developments in the various sectors of the economy and keeping in view the inflationary situation, will be:

- Provision of appropriate liquidity to meet credit growth and support investment and export demand in the economy while placing equal emphasis on price stability.

- Consistent with the above, to pursue an interest rate environment that is conducive to macroeconomic and price stability, and maintaining the momentum of growth.

- To consider measures in a calibrated manner, in response to evolving circumstances with a view to stabilising inflationary expectations.

Reserve Money Survey

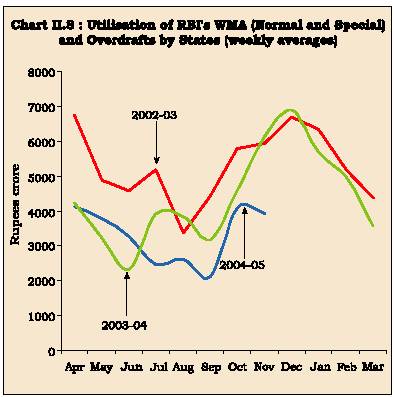

2.43 Reserve money growth during the current fiscal year 2004-05 (up to December 10, 2004), as in the past few years, primarily emanated from the accretion to the Reserve Bank's foreign currency assets (Table 2.23 and Chart II.9).

Box II.1

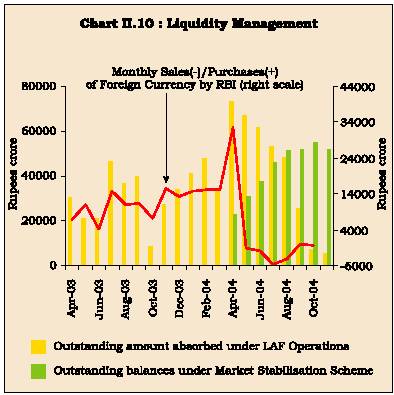

Market Stabilisation Scheme

On March 25, 2004 the Government of India signed a Memorandum of Understanding (MoU) with the Reserve Bank of India detailing the rationale and operational modalities of the Market Stabilisation Scheme (MSS). The scheme came into effect from April 1, 2004. The ceiling on the outstanding amount under MSS was fixed initially at Rs.60,000 crore which was, however, subject to an upward revision based on the liquidity assessment. The ceiling has been since enhanced to Rs.80,000 crore. An indicative schedule for the issuance of Treasury Bills/ dated securities under the MSS for the first quarter of the 2004-05 (April 1, 2004-June 30, 2004) was also announced to provide transparency and stability in the financial markets. It was proposed to issue an aggregate of Rs.35,500 crore (face value) of Treasury Bills/ dated securities under the MSS during the first quarter of 2004-05. As against this, Rs.39,730 crore was issued during the first quarter reflecting an unscheduled auction of dated securities amounting to Rs.5,000 crore on April 8, 2004 and acceptance of bids amounting to Rs.230 crore (as against the notified amount of Rs.1,000 crore in respect of 364-day Treasury Bills on June 23, 2004). The MSS schedule for the second quarter was issued on June 29, 2004 which indicated issuances of Rs. 36,500 crore (inclusive of rolling over of Rs.19,500 crore under 91-day Treasury Bills issued during the first quarter). On September 29, 2004, an indicative calendar for MSS issuances of Rs.25,500 crore was announced (including of rolling over of Rs.16,955 crore under 91-day Treasury Bills maturing during the quarter).

2.44 The expansionary effect of forex purchases was neutralised through sterilisation operations. These operations were greatly facilitated by the introduction of the Market Stabilisation Scheme (MSS) in April 2004 to absorb liquidity of a more enduring nature (Box II.1). With the introduction of the MSS, the amounts tendered under the Liquidity Adjustment Facility (LAF) declined from an average of Rs.70,523 crore in April 2004 to Rs.10,805 crore in October 2004. There was, however, a net injection of Rs. 5,066 crore in November 2004. During the first quarter of 2004-05, sterilisation was done primarily through the MSS. In the second quarter (July-September), capital flows tapered off. In the subsequent period (October 2004 onwards), the revival of capital inflows in November were mainly offset by the seasonal pick up in cash demand (Table 2.24 and Chart II.10). The total stock of Treasury Bills and dated securities issued under the MSS amounted to Rs.51,334 crore as on December 10, 2004 inclusive of Rs.25,000 crore raised through dated securities with a residual maturity of upto two years. In addition to the MSS and LAF operations, surplus balances in the Central Government account with the Reserve Bank also helped in draining out excess liquidity from time to time.

|

Table 2.24: Phases of Reserve Bank’s Liquidity Management Operations |

||||||||

|

(Rupees crore) |

||||||||

|

2003-04 |

2004-05 |

|||||||

|

Item |

April 1 - |

December 27, |

March 27 - |

June 26 - |

September 25 - |

|||

|

December 26, |

2003 - March |

June 25, 2004 |

September 24, |

December 10, |

||||

|

2003 |

26, 2004 |

2004 |

2004 |

|||||

|

1 |

2 |

3 |

4 |

5 |

6 |

|||

|

1. |

RBI’s Foreign Currency Assets |

|||||||

|

(adjusted for revaluation) |

93,334 |

46,171 |

34,971 |

-3,607 |

28,748 |

|||

|

2. |

LAF |

(net repo/reverse repo)* |

27,075 |

31,910 |

-35 |

-42,120 |

-3,425 |

|

|

3. |

OMO sales (net) |

36,517 |

5,332 |

429 |

428 |

593 |

||

|

4. |

MSS |

– |

– |

37,812 |

14,443 |

-921 |

||

|

5. |

Currency |

29,914 |

14,641 |

14,315 |

-7,195 |

23,115 |

||

|

6. |

Others (residual) |

8,106 |

-15,346 |

-17,547 |

25,302 |

8,177 |

||

|

6.1 |

Surplus Cash balances of the |

|||||||

|

Centre with the Reserve Bank |

13,135 |

-6,685 |

-18,577 |

25,139 |

4,106 |

|||

|

Bank Reserves (1-2-3-4-5-6) |

-8,278 |

9,634 |

-3 |

5,535 |

1,209 |

|||

|

*Since October 29, 2004, repo and reverse repo indicates injection (+) and absorption (-), respectively. |

||||||||

Monetary Survey

2.46 As on November 26, 2004, the year-on-year growth in broad money (M3) was 13.5 per cent (net of the impact of the conversion of a non-banking entity into a banking entity) as compared with 12.4 per cent in the preceding year (Table 2.26). The year-on-year growth rate in was consistent with the M3 indicative trajectory of 14.0 per cent. Both currency and aggregate deposits recorded a strong growth (Chart II.11).

|

Table 2.25: Variations in Net Reserve Bank Credit to the Centre |

||||||||||||

|

(Rupees crore) |

||||||||||||

|

Variable |

2003-04 |

2003-04 |

2004-05 |

|||||||||

|

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

||||||

|

upto |

||||||||||||

|

December |

||||||||||||

|

10, 2004) |

||||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

||||

|

Reserve Bank Credit to the |

||||||||||||

|

Centre (1+2+3+4-5) |

-76,067 |

435 |

-53,744 |

-15,845 |

-6,913 |

-30,028 |

-4,500 |

2,234 |

||||

|

1. |

Loans and Advances |

0 |

8,145 |

-8,145 |

0 |

0 |

3,222 |

-3,222 |

0 |

|||

|

2. |

Treasury Bills held by the Reserve Bank |

-3 |

-3 |

0 |

0 |

0 |

0 |

0 |

0 |

|||

|

3. |

Reserve Bank’s Holdings |

of Dated |

||||||||||

|

Securities |

-72,227 |

-11,300 |

-45,530 |

-15,795 |

398 |

-2,901 |

22,176 |

-2,746 |

||||

|

4. |

Reserve Bank’s Holdings of Rupee Coins |

20 |

163 |

-69 |

-51 |

-24 |

175 |

-11 |

-36 |

|||

|

5. |

Central Government Deposits |

3,856 |

-3,430 |

0 |

-1 |

7,287 |

30,525 |

23,443 |

-5,017 |

|||

|

Memo Items* |

||||||||||||

|

1. |

Market Borrowings of Dated Securities |

|||||||||||

|

by the Centre # |

1,21,500 |

44,000 |

36,000 |

15,000 |

26,500 |

43,000 ** |

36,000 |

*** |

14,000 |

|||

|

2. |

Reserve Bank’s Primary Subscription |

|||||||||||

|

to Dated Securities |

-21,500 |

-5,000 |

0 |

0 |

16,500 |

0 |

847 |

0 |

||||

|

3. |

Repos (-) / Reverse Repos (+) (LAF), |

|||||||||||

|

net position £ |

-32,230 |

-25,052 |

1,557 |

-3,580 |

-5,155 |

26,720 |

-35,205 |

-10,340 |

||||

|

4. |

Net Open Market Sales # |

41,849 |

-48,160 |

16,672 |

14,225 |

5,332 |

429 |

429 |

593 |

|||

|

5. |

Primary Operations $ |

-100 |

25,643 |

-32,608 |

2,304 |

4,560 |

10,825 |

-48,150 |

-923 |

|||

|

*At face value. |

||||||||||||

|

Table 2.26: Monetary Indicators |

|||||||||||

|

(Rupees crore) |

|||||||||||

|

Variable |

Outstanding |

Year-on-Year Variation |

|||||||||

|

as on |

2003 |

2004 |

|||||||||

|

November 26, |

(As on November 28) |

(As on November 26) |

|||||||||

|

2004 |

Absolute |

Per cent |

Absolute |

Per cent |

|||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

||||||

|

I. |

Reserve Money* |

4,52,805 |

46,120 |

13.2 |

57,444 |

14.5 |

|||||

|

II. |

21,35,552 |

2,08,254 |

12.4 |

2,53,760 |

13.5 |

||||||

|

Broad Money (M3) |

|||||||||||

|

a) |

Currency with the Public |

3,43,100 |

38,547 |

14.9 |

45,948 |

15.5 |

|||||

|

b) Aggregate Deposits |

17,91,780 |

1,69,277 |

12.0 |

2,10,501 |

13.3 |

||||||

|

i) |

Demand Deposits |

2,58,756 |

29,208 |

15.8 |

44,606 |

20.8 |

|||||

|

ii) |

Time Deposits |

15,29,454 |

1,40,069 |

11.4 |

1,62,326 |

11.9 |

|||||

|

Of which:Non-Resident Foreign Currency |

|||||||||||

|

Deposits |

76,306 |

-4,044 |

-4.3 |

-12,824 |

-14.4 |

||||||

|

III. |

20,52,190 |

2,06,561 |

13.3 |

2,90,599 |

16.5 |

||||||

|

NM3 |

|||||||||||

|

IV. |

a) |

21,31,858 |

2,20,373 |

13.7 |

3,08,003 |

16.9 |

|||||

|

L |

1 |

||||||||||

|

Of which: |

Postal Deposits |

79,668 |

13,811 |

28.5 |

17,404 |

28.0 |

|||||

|

b) |

21,38,106 |

2,19,480 |

13.6 |

3,08,221 |

16.8 |

||||||

|

L |

2 |

||||||||||

|

Of which: |

FI Deposits |

6,248 |

-893 |

-12.9 |

218 |

3.6 |

|||||

|

c) |

21,57,828 |

2,21,186 |

13.6 |

3,07,575 |

16.6 |

||||||

|

L |

3 |

||||||||||

|

Of which: |

NBFC Deposits |

19,722 |

1,706 |

9.1 |

-646 |

-3.2 |

|||||

|

V. |

Major Sources of Broad Money |

||||||||||

|

a) |

Net Bank Credit to the Government (i+ii) |

7,33,849 |

79,636 |

12.3 |

6,324 |

0.9 |

|||||

|

i) |

Net Reserve Bank Credit to Government |

18,204 |

-54,295 |

-46.0 |

-45,634 |

-71.5 |

|||||

|

Of which: to the Centre |

14,052 |

-56,021 |

-49.1 |

-43,944 |

-75.8 |

||||||

|

ii) |

Other Banks’ Credit to Government |

7,27,838 |

1,33,931 |

25.3 |

64,151 |

9.7 |

|||||

|

b) |

Bank Credit to Commercial Sector |

11,58,505 |

97,641 |

11.6 |

2,16,199 |

22.9 |

|||||

|

Of which: |

Scheduled Commercial |

||||||||||

|

Banks’ Non-food Credit |

9,31,247 |

1,03,427 |

16.4 |

1,98,497 |

27.1 |

||||||

|

c) |

Net Foreign Exchange Assets of Banking Sector |

6,07,733 |

1,04,679 |

28.3 |

1,33,772 |

28.2 |

|||||

|

* Variations pertain to December 10, 2004 and corresponding period of

previous year. |

|||||||||||

Bank Credit

2.47 A positive feature of the current year has been the sharp increase in commercial credit off-take reflecting, inter alia, the strong industrial performance (Table 2.27 and Chart II.12). The pickup in scheduled commercial banks’ non-food credit

|

Table 2.27: Scheduled Commercial Banks: Variations in Select Banking Indicators |

||||||||||

|

(Rupees crore) |

||||||||||

|

Item |

Year-on-Year Variation |

|||||||||

|

2002-03 |

2003-04 |

2003-04 |

2004-05 P |

|||||||

|

(up to Nov. 28) |

(up to Nov. 26) |

|||||||||

|

Absolute |

Per cent |

Absolute |

Per cent |

Absolute |

Per cent |

Absolute |

Per cent |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

||

|

Aggregate Deposits |

1,47,822 |

13.4 |

2,23,563 |

17.5 |

1,48,391 |

11.8 |

2,00,894 |

14.3 |

||

|

Demand Deposits |

17,241 |

11.3 |

54,733 |

32.1 |

26,063 |

16.3 |

41,580 |

22.3 |

||

|

Time Deposits |

1,30,581 |

16.9. |

1,68,830 |

15.2 |

1,22,328 |

11.1 |

1,59,314 |

13.1 |

||

|

Bank Credit |

94,949 |

16.1 |

1,11,570 |

15.3 |

85,542 |

12.5 |

2,04,415 |

26.6 |

||

|

Food Credit |

-4,499 |

-8.3 |

-13,518 |

-27.3 |

-17,885 |

- 32.9 |

5,918 |

16.2 |

||

|

Non-food Credit |

99,448 |

18.6 |

1,25,088 |

18.4 |

1,03,427 |

16.4 |

1,98,497 |

27.1 |

||

|

Investments |

1,09,276 |

24.9 |

1,30,042 |

23.8 |

1,20,035 |

22.9 |

44,456 |

6.9 |

||

|

Government Securities |

1,12,241 |

27.3 |

1,31,341 |

25.1 |

1,21,360 |

24.2 |

41,886 |

6.7 |

||

|

Other Approved Securities |

-2,964 |

-10.9 |

-1299 |

-5.4 |

- 1,325 |

- 5.4 |

2,570 |

11.0 |

||

|

P : Provisional. |

||||||||||

growth at 9.5 per cent during the first half of the year was, in fact, the highest in the 1990s aided partially due to base effects. Food credit reversed its declining trend of the previous year, reflecting higher procurement and lower off-take operations. In the face of the pick-up in credit demand, banks reduced their investments in government securities. Year-on-year growth of banks’ investment in

2.48 Data on sectoral deployment show that priority sector continued to be the largest recipient of bank credit largely driven by the demand for housing loans below Rs.10 lakh. A noteworthy aspect is the turnaround in industrial credit. This was dominated by two sectors, viz., infrastructure and petroleum, which accounted for as much as 86 per cent of the incremental off-take during April-September 2004. Credit off-take declined for industries such as coal, mining, sugar, tobacco and tobacco products, petro chemicals and computer software. Growth in credit to the housing sector continued to be strong and accelerated even further (Table 2.28).

2.49 The pick-up in industrial credit was supplemented by an increased recourse to external commercial borrowings (Table 2.29). In addition, improved corporate profitability and other internal sources remained a key source of funds for the industry.

|

Table 2.28: Sectoral and Industry-wise Deployment of Bank Credit of Scheduled Commercial Banks |

||||||

|

(Rupees crore) |

||||||

|

Sector / Industry |

Outstanding as on |

Variation |

||||

|

September 17, 2004 |

||||||

|

2003 (April-September) |

2004 (April-September) |

|||||

|

Absolute |

Per cent |

Absolute |

Per cent |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

|

|

Priority sector # |

2,84,064 |

13,907 |

6.6 |

20,230 |

7.7 |

|

|

Of which: Agriculture |

97,709 |

3,690 |

5.0 |

7,168 |

7.9 |

|

|

Small Scale |

65,571 |

-990 |

-1.6 |

-284 |

-0.4 |

|

|

Others |

1,20,784 |

11,207 |

14.4 |

13,346 |

12.4 |

|

|

Industry (Medium and Large) |

2,65,316 |

-13,308 |

-5.7 |

18,106 |

7.3 |

|

|

Housing |

64,903 |

5,337 |

14.6 |

12,922 |

24.9 |

|

|

Wholesale Trade |

27,108 |

-147 |

-0.7 |

2,241 |

9.0 |

|

|

Rest of the sectors |

1,50,504 |

7,838 |

6.9 |

9,974 |

7.1 |

|

|

Non-food Gross Bank Credit |

7,91,895 |

13,627 |

2.2 |

63,473 |

8.7 |

|

|

Memo Items |

||||||

|

(i) |

Export Credit |

56,798 |

759 |

1.5 |

-889 |

-1.5 |

|

(ii) |

Credit to Industry (Small, Medium and Large) |

3,30,887 |

-14,298 |

-4.8 |

17,822 |

5.7 |

|

Petroleum |

16,981 |

-5,552 |

-37.7 |

4,715 |

38.4 |

|

|

Infrastructure |

47,795 |

2,089 |

7.9 |

10,571 |

28.4 |

|

|

Cement |

5,698 |

-473 |

-7.4 |

9 |

0.2 |

|

|

Cotton Textiles |

17,677 |

-918 |

-5.8 |

511 |

3.0 |

|

|

Iron and Steel |

26,086 |

-2,160 |

-7.7 |

-209 |

-0.8 |

|

|

Electricity |

15,711 |

322 |

2.9 |

1,621 |

11.5 |

|

|

Engineering |

25,254 |

-973 |

-3.7 |

-1,094 |

-4.2 |

|

|

Fertilisers |

6,180 |

-404 |

-5.8 |

-69 |

-1.1 |

|

|

Computer Software |

2,241 |

87 |

3.3 |

-788 |

-26.0 |

|

|

Gems & Jewellery |

10,295 |

1,069 |

14.2 |

1,117 |

12.2 |

|

|

#Excluding investment in eligible securities. |

||||||

2.50 Reflecting the higher credit off-take, the excess liquid funds with the commercial banks have recorded a sustained decline since August 2004.

Moderation in capital flows in the first-half of the year and the increase in the CRR also contributed to the reduction in excess liquid funds.

|

Table 2.29: Key Sources of Funds to Industry |

||||

|

(Rupees crore) |

||||

|

Item |

April-September |

|||

|

2003-04 |

2004-05 |

|||

|

1 |

2 |

3 |

||

|

1. |

Bank Credit to Industry |

-14,298 |

17,822 |

|

|

2. |

Net profits |

12,702 |

18,764 |

|

|

3. |

Depreciation Provision |

7,456 |

8,380 |

|

|

4. |

Capital Issues * (i+ii) |

115 |

4,730 |

|

|

i) Non-Government Public Ltd. Companies (a+b) |

15 |

4,730 |

||

|

a) Bonds/Debentures |

0 |

0 |

||

|

b) Shares |

15 |

4,730 |

||

|

ii) PSUs and Government Companies |

100 |

0 |

||

|

5. |

Euro Issues + |

1,819 |

1,367 |

|

|

6. |

External Commercial Borrowings (April - June) $ |

6,113 |

12,458 |

|

|

7. |

Issue of CPs # |

1,183 |

3,038 |

|

|

8. |

Financial assistance extended by FIs (net) @ |

-2,074 |

-8,171 |

|

|

9. |

Flow from Non-banks to Corporates (4 to 8) |

7,156 |

13,422 |

|

|

Total Industry (1+2+3+9) |

13,016 |

58,388 |

||

|

*Gross issuances excluding issues by banks and financial institutions.

Figures are not adjusted for banks’ investments in capital issues, which

are not expected to be significant. |

||||

Concomitantly, secondary market yields of Government securities increased across the maturity spectrum (Chart II.13). Reflecting these factors, some banks have raised their deposit rates and housing loan rates (Table 2.30).

2.51 Inflation is hardening worldwide, albeit from fairly low levels, on the back of elevated commodity, especially fuel, prices. Commodity prices have been driven by increased demand emanating from the global economic recovery led by the strong expansion of the Chinese economy. Although the base effects are beginning to moderate the metals price inflation, fuel prices have been quite volatile. Fuel prices hit their highest level in October 2004 crossing US $ 55 per barrel, amidst concerns over oil supply bottlenecks, low inventories, and very low spare output capacity as well as nervous market sentiment (Chart II.14). The increase in producer prices is beginning to pull up consumer price inflation in many countries, especially as exhaustion of slack available in capacity utilisation is now forcing producers to pass on higher input costs to consumers (Table 2.31 and Chart II.15).

2.52 Central banks in a number of economies have, therefore, star ted withdrawing their accommodative stance by raising key policy rates in a measured manner to stabilise inflationar y expectations and yet at the same time support economic recovery. The Federal Open Market

|

Table 2.30: Deposit and Lending Interest Rates |

|||||||

|

(Per cent) |

|||||||

|

Item |

March 2002 |

March 2003 |

March 2004 |

September 2004 |

November 2004 |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

||

|

Domestic Deposit Rates |

|||||||

|

Public Sector Banks |

|||||||

|

a) |

Up to 1 year |

4.25 – 7.50 |

4.00 – 6.00 |

3.75 – 5.25 |

3.50 – 5.00 |

3.50 – 5.00 |

|

|

b) |

1 year up to 3 years |

7.25 – 8.50 |

5.25 – 6.75 |

5.00 – 6.75 |

4.75 – 5.75 |

4.75 – 5.50 |

|

|

c) |

Over 3 years |

8.00 – 8.75 |

5.50 – 7.00 |

5.75 – 6.00 |

5.25 – 5.75 |

5.00 – 5.75 |

|

|

Private Sector Banks |

|||||||

|

a) |

Up to 1 year |

5.00 – 9.00 |

3.50 – 7.50 |

3.50 – 7.50 |

3.00 – 6.00 |

3.00 – 6.00 |

|

|

b) |

1 year up to 3 years |

8.00 – 9.50 |

6.00 – 8.00 |

5.75 – 7.75 |

5.00 – 6.50 |

5.00 – 6.75 |

|

|

c) |

Over 3 years |

8.25 – 10.0 |

6.00 – 8.00 |

6.00 – 8.00 |

5.25 – 7.00 |

5.25 – 6.50 |

|

|

Foreign Banks |

|||||||

|

a) |

Up to 1 year |

4.25 – 9.75 |

3.00 – 7.75 |

3.00 – 7.75 |

2.75 – 7.50 |

3.00 – 5.75 |

|

|

b) |

1 year up to 3 years |

6.25 – 10.0 |

4.15 – 8.00 |

3.50 – 8.00 |

3.25 – 8.00 |

3.50 – 7.00 |

|

|

c) |

Over 3 years |

6.25 – 10.0 |

5.00 – 9.00 |

4.75 – 8.00 |

3.25 – 8.00 |

3.50 – 7.00 |

|

|

Prime Lending Rates # |

|||||||

|

a) |

Public Sector Banks |

10.00 – 12.50 |

9.00 – 12.25 |

10.25 – 11.50 |

10.25 – 11.50 |

10.25 – 11.00 |

|

|

b) |

Private Sector Banks |

10.00 – 15.50 |

7.00 – 15.50 |

10.50 – 13.00 |

9.75 – 13.00 |

9.75 – 13.00 |

|

|

c) |

Foreign Banks |

9.00 – 17.50 |

6.75 – 17.50 |

11.00 – 14.85 |

11.00 – 14.85 |

11.00 – 13.00 |

|

|

#Benchmark Prime Lending Rate from March 2004. |

|||||||

2.53 Inflation in India has increased during 2004-05 so far (up to December 4, 2004) (Chart II.16). This essentially reflects supply side pressures emanating

|

Table 2.31: Annual Consumer Price Inflation |

|||||||||

|

(Per cent) |

|||||||||

|

Country/Area |

1996 |

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 P |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

Advanced Economies |

2.4 |

2.0 |

1.5 |

1.4 |

2.1 |

2.1 |

1.5 |

1.8 |

2.1 |

|

US |

2.9 |

2.3 |

1.5 |

2.2 |

3.4 |

2.8 |

1.6 |

2.3 |

3.0 |

|

Japan |

.. |

1.7 |

0.6 |

-0.3 |

-0.9 |

-0.8 |

-0.9 |

-0.2 |

-0.2 |

|

Euro Area |

2.2 |

1.6 |

1.1 |

1.1 |

2.0 |

2.4 |

2.3 |

2.1 |

2.1 |

|

Other Emerging Market and |

|||||||||

|

Developing Countries |

18.1 |

11.6 |

11.3 |

10.4 |

7.3 |

6.8 |

6.0 |

6.1 |

6.0 |

|

Developing Asia |

8.2 |

4.9 |

7.8 |

2.5 |

1.9 |

2.7 |

2.1 |

2.6 |

4.5 |

|

China |

8.3 |

2.8 |

-0.8 |

-1.4 |

0.4 |

0.7 |

-0.8 |

1.2 |

4.0 |

|

India |

9.0 |

7.2 |

13.2 |

4.7 |

4.0 |

3.8 |

4.3 |

3.8 |

4.7 |

|

.. Not Available |

|||||||||

|

P : IMF Projections. |

|||||||||

|

Source : World Economic Outlook, September 2004, IMF. |

|||||||||

2.54 The path of WPI inflation during the year reflected the influence of a number of supply-side pressures (Table 2.33). Domestic inflation rose from 4.6 per cent at end-March 2004 to the peak of 8.7 per cent by end-August. This reflected the lagged pass-through effects of the rise in prices of global steel, crude oil, coal and iron ore. This was

|

Table 2.32: Central Bank Policy Rates |

||||

|

(Per cent) |

||||

|

Country |

January |

January |

October |

December |

|

1, 2003 |

1, 2004 |

1, 2004 |

15, 2004 |

|

|

1 |

2 |

3 |

4 |

5 |

|

Australia |

4.75 |

5.25 |

5.25 |

5.25 |

|

Brazil |

25.00 |

16.50 |

16.25 |

17.75 |

|

Canada |

2.75 |

2.75 |

2.25 |

2.50 |

|

Euro Area |

2.75 |

2.00 |

2.00 |

2.00 |

|

India |

6.25 |

6.00 |

6.00 |

6.00 |

|

Indonesia |

12.93 |

8.31 |

7.39 |

7.43 |

|

Israel |

8.90 |

4.80 |

4.10 |

3.90 |

|

Japan |

0.10 |

0.10 |

0.10 |

0.10 |

|

South Korea |

4.25 |

3.75 |

3.50 |

3.25 |

|

Malaysia |

2.72 |

2.71 |

2.69 |

2.69 |

|

New Zealand |

5.75 |

5.00 |

6.25 |

6.50 |

|

Poland |

6.50 |

5.25 |

6.50 |

6.50 |

|

Sweden |

3.75 |

2.75 |

2.00 |

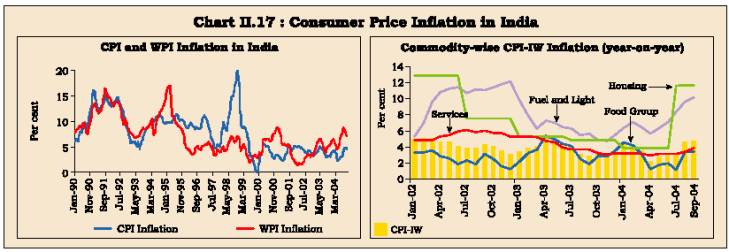

2.00 |

|

Switzerland |

0.25 to |

0 to |

0.25 to |

0.25 to |

|

1.25 |

0.75 |

1.25 |

1.25 |

|

|

Thailand |

1.75 |

1.25 |

1.50 |

2.00 |

|

United Kingdom |

4.00 |

3.75 |

4.75 |

4.75 |

|

United States |

1.25 |

1.00 |

1.75 |

2.25 |

|

Source : Central Bank websites. |

||||

exacerbated by a sharp increase in prices of vegetables in August 2004 in the wake of the uneven progress of the South-West monsoon. Sugar prices also increased during the year. Given the supply-induced nature of inflation, the Government responded with fiscal measures, particularly relating to oil. Inflation declined thereafter to 7.1 per cent by end-October 2004 partly facilitated by the easing of drought fears as well as the base effects. It, however, rose to 7.8 per cent on November 6, 2004 reflecting the hike in petroleum prices effective November 5,

|

Table 2.33: Annual Point-to-Point WPI Inflation by Component |

||||||||||

|

(Base 1993-94=100) |

||||||||||

|

(Per cent) |

||||||||||

|

Group/ Item |

Annual Variation |

Variation |

Weighted |

Contribution |

||||||

|

Weight |

2001-02 |

2002-03 |

2003-04 |

2003-04 |

2004-05 |

2003-04 |

2004-05 |

|||

|

(Dec. 6) |

(Dec. 4) |

(Dec. 6) |

(Dec. 4) |

|||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

||

|

All Commodities |

100.0 |

1.6 |

6.5 |

4.6 |

5.6 |

7.0 |

100.0 |

100.0 |

||

|

I. |

Primary Articles |

22.0 |

3.9 |

6.1 |

1.6 |

3.2 |

3.5 |

13.3 |

11.2 |

|

|

i) |

Cereals |

4.4 |

0.8 |

4.0 |

-0.3 |

-1.2 |

4.1 |

-1.0 |

2.5 |

|

|

ii) |

Pulses |

0.6 |

-3.3 |

0.3 |

-2.6 |

-4.6 |

1.8 |

-0.6 |

0.2 |

|

|

iii) |

Fruits & Vegetables |

2.9 |

14.4 |

-1.2 |

-4.9 |

7.0 |

3.9 |

4.1 |

1.8 |

|

|

iv) |

Raw Cotton |

1.4 |

-21.3 |

34.3 |

12.3 |

22.3 |

-17.7 |

4.8 |

-3.5 |

|

|

v) |

Oilseeds |

2.7 |

6.8 |

30.0 |

-1.2 |

5.3 |

1.4 |

2.5 |

0.5 |

|

|

vi) |

Sugarcane |

1.3 |

6.2 |

11.5 |

6.5 |

6.5 |

-1.3 |

2.0 |

-0.3 |

|

|

II. |

Fuel, Power, Light and Lubricants |

14.2 |

3.9 |

10.8 |

2.5 |

7.2 |

13.0 |

26.2 |

38.2 |

|

|

i) |

Mineral Oils |

7.0 |

1.2 |

18.4 |

0.0 |

9.1 |

21.3 |

17.3 |

33.0 |

|

|

ii) |

Electricity |

5.5 |

9.2 |

3.4 |

4.9 |

4.1 |

0.6 |

5.8 |

0.6 |

|

|

iii) |

Coal Mining |

1.8 |

-1.9 |

0.0 |

9.2 |

9.2 |

16.2 |

3.1 |

4.5 |

|

|

III. |

Manufactured Products |

63.7 |

0.0 |

5.1 |

6.7 |

6.0 |

6.2 |

61.0 |

50.4 |

|

|

i) |

Sugar |

3.6 |

-3.8 |

-15.0 |

16.9 |

7.4 |

15.8 |

3.4 |

5.9 |

|

|

ii) |

Edible Oils |

2.8 |

12.5 |

27.4 |

6.6 |

8.2 |

0.1 |

3.6 |

0.0 |

|

|

iii) |

Oil Cakes |

1.4 |

15.0 |

40.3 |

5.0 |

-0.7 |

8.8 |

-0.2 |

1.9 |

|

|

iv) |

Cotton Textiles |

4.2 |

-6.7 |

8.3 |

15.6 |

16.0 |

-4.0 |

10.8 |

-2.3 |

|

|

v) |

Man Made Fibre |

4.4 |

-5.0 |

17.4 |

-0.4 |

3.0 |

5.8 |

1.3 |

1.9 |

|

|

vi) |

Fertilisers |

3.7 |

3.6 |

2.1 |

-0.1 |

0.1 |

0.4 |

0.1 |

0.2 |

|

|

vii) |

Iron and Steel |

3.6 |

0.0 |

9.2 |

34.6 |

28.6 |

25.8 |

16.4 |

14.3 |

|

|

viii) |

Cement |

1.7 |

-4.7 |

1.1 |

1.3 |

0.9 |

0.9 |

0.2 |

0.2 |

|

|

ix) |

Non-electrical Machinery |

3.4 |

5.4 |

2.5 |

4.7 |

3.0 |

9.8 |

1.7 |

4.3 |

|

|

x) |

Electrical Machinery |

5.0 |

-1.1 |

-1.3 |

1.7 |

0.4 |

4.5 |

0.2 |

2.1 |

|

|

xi) |

Transport Equipment and Parts |

4.3 |

1.3 |

-0.9 |

1.4 |

0.5 |

5.3 |

0.3 |

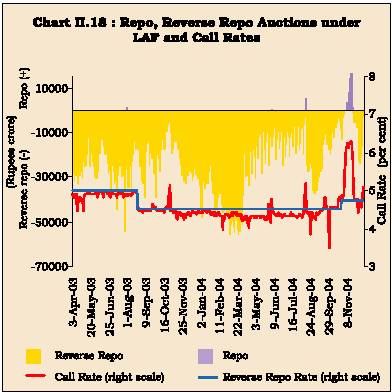

2.7 |

|

2004 before edging down to 7.3 per cent on November 13, 2004 and further to 7.0 per cent by December 4, 2004.

2.55 Although all measures of inflation have shown uptrend during the year, the increase in consumer price inflation has been relatively muted. The year-on-year variation in the consumer price index for industrial workers (CPI-IW) increased to 4.6 per cent in October 2004 from 3.3 per cent in October 2003 reflecting higher food and fuel prices (Chart II.17). On an annual average basis, consumer price inflation stood marginally lower at 3.7 per cent as compared with 3.8 per cent a year ago. The lower order of consumer price inflation vis-a-vis wholesale price inflation is due to two key factors. First, food prices,

2.56 Fuel prices continue to hold the key to the inflation outlook. Domestic prices are yet to catch up with past hikes in the prices of petroleum products and administered items such as coal and fertilisers (Table 2.34). Counterbalancing these upside risks are several mitigating factors. First, the inflationary impact of a lower kharif 2004 output due to the uneven SouthWest monsoon now appears to be restricted to a few commodities such as sugar. Although prices of fruits and vegetables continue to be volatile, primary articles prices are expected to moderate further in view of the expected rabi crop. Second, adequate foreign exchange reserves as well as food stocks should help contain inflationary expectations in the economy, especially as international prices of wheat and edible oil are softening. Third, metal price inflation has moderated in recent months on account of base effects and capacity expansion - although prices are likely to persist at elevated levels in the coming months. Fourth, the fiscal measures taken have been able to contain partly the impact of imported inflation in the economy. Finally, monetary measures to reduce the liquidity overhang are expected to check inflationary expectations. Pressures on inflation emanating from aggregate demand are thus muted at this stage.

2.57 Assuming there were no significant supply shocks and appropriate management of liquidity during the remaining part of the fiscal year, the Reserve Bank in its Annual Policy Statement (May 2004) had placed the WPI inflation rate for 2004-05, on a point-to-point basis, at around 5.0 per cent. While the overhang of excess liquidity was being managed, domestic as well as external supply shocks put pressure on prices by a magnitude and persistence greater than anticipated. In view of these developments, under the assumption of no further supply shocks and that liquidity conditions remain manageable, the Mid-term Review of Annual Policy (October 2004) revised the inflation projections relevant for monetary policy purposes to around 6.5 per cent for end-March 2005.

IV. FINANCIAL MARKETS

2.58 Financial markets during 2004-05 operated in an environment of uncertainty over the pace of reversal of the interest rate cycle and the impact of the spurt in oil prices on inflation and growth prospects. Notwithstanding these uncertainties, the Indian financial markets have remained generally stable during 2004-05 so far (Table 2.35). Interest

|

Table 2.34: Price Movements in Domestic and International Markets - Sensitive Commodities |

|||||||

|

(Per cent) |

|||||||

|

Item |

Global Inflation |

Domestic Inflation (WPI) |

|||||

|

Year-on-Year |

Fiscal Year |

Year-on-Year |

Fiscal Year |

||||

|

(November 2004) |

(November over |

(December 4, |

(December 4, |

||||

|

March 2004) |

2004) |

over end-March |

|||||

|

2004) |

|||||||

|

1 |

2 |

3 |

4 |

5 |

|||

|

Agricultural Commodities |

|||||||

|

1. |

Cotton |

-36.2 |

-31.8 |

-17.7 |

* |

-20.1 |

* |

|

-4.0 |

** |

-7.2 |

** |

||||

|

2. |

Soybean Oil |

-9.4 |

-18.0 |

0.1 |

# |

-0.6 |

# |

|

3. |

Palm Oil |

-14.1 |

-21.4 |

– |

– |

||

|

4. |

Rice |

32.3 |

7.6 |

3.5 |

2.2 |

||

|

5. |

Wheat |

-2.5 |

-5.8 |

1.6 |

-0.6 |

||

|

6. |

Sugar |

34.3 |

26.3 |

15.8 |

10.3 |

||

|

Non-Agricultural Commodities |

|||||||

|

1. |

Coal (Australia) |

72.4 |

7.7 |

16.2 |

16.2 |

||

|

2. |

Crude Oil (Dubai) |

26.8 |

14.5 |

21.3 |

16.1 |

||

|

3. |

Steel Products |

55.3 |

10.5 |

25.8 |

17.6 |

||

|

* Raw cotton in India. |

|||||||

rates have witnessed a correction from the record lows seen in 2003-04 in consonance with the international trends and increase in inflation.

Money Market

2.59 Call money rates remained stable during the first half of 2004-05, reflecting the substantial overhang of liquidity in the system. As a result, call rates ruled below the reverse repo rate (earlier the repo rate)3 during April-September 2004. The Reserve Bank continued to balance the money market through large-scale reverse repo operations, supplemented by the operationalisation of the MSS from April 2004 (Chart II.18). The scenario began to change in October with the pressures emanating from a number of factors: higher non-food credit off-take, upward pressure in inflation and increase in reserve requirements. As a result, call money rate ruled above the reverse repo rate during the second half of the year beginning October 17, 2004. Seasonal festival cash demand drove call rates to a high of 6.30 per cent on November 18, 2004. In order to stabilise the market, the Reserve Bank switched to LAF repo operations in mid-November 2004 to inject liquidity in the system. The call money market stabilised thereafter and the call rate was 4.8 per cent on November 30, 2004. With a view to further enhancing the effectiveness of the LAF and to facilitate liquidity management in a flexible manner, the 7-day and 14-day reverse repo have been discontinued effective November 1, 2004. The fixed repo (now reverse repo) rate was increased by 25 basis points to 4.75 per cent effective October 27, 2004.

2.60 In order to preserve the integrity of the money market and making it more efficient, the following

|

Table 2.35: Domestic Financial Markets - Select Indicators |

||||||||||||||

|

Liquidity |

||||||||||||||

|

Year/Month |

Call Money |

Gilt |

Foreign Exchange |

Management |

Equity |

|||||||||

|

Average |

Average |

10-year |

Turnover |

Average |

Average |

RBI's net |

Forward |

Net |

Net |

Average |

Average |

Average |

Average |

|

|

Daily |

Call |

Yield |

in |

Daily |

Exchange |

Foreign |

Premia 3- |

OMO |

Average |

Daily |

Daily |

BSE |

S & P |

|

|

Turnover |

Rates |

(Per |

Govt. |

Inter- |

Rate |

Currency |

month |

Sales(-)/ |

Daily |

BSE |

NSE |

Sensex |

CNX |

|

|

(Rupees |

(Per |

cent) |

Securities |

bank |

(Rupees |

Sales (-)/ |

(Per |

Purchases |

Absorption |

Turnover |

Turnover |

Nifty |

||

|

crore) |

cent) |

(Rupees |

Turnover |

per US $) |

Purchases |

cent) |

(+) |

under LAF |

(Rupees |

(Rupees |

||||

|

crore) + |

(US $ |

(+) |

(Rupees |

Outstan- |

crore) |

crore) |

||||||||

|

Million) |

(US $ |

crore) |

ding |

|||||||||||

|

Million) |

(Rupees |

|||||||||||||

|

crore) |

||||||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

|

2003-04 |

||||||||||||||

|

April |

17,338 |

4.87 |

5.90 |

2,26,803 |

5,585 |

47.38 |

1,432 |

2.08 |

-7 |

27,372 |

1,041 |

2,449 |

3037 |

965 |

|

May |

18,725 |

4.87 |

5.80 |

2,99,933 |

5,960 |

47.08 |

2,342 |

1.10 |

-5,569 |

25,223 |

1,072 |

2,604 |

3033 |

963 |

|

June |

20,544 |

4.91 |

5.72 |

3,00,504 |

5,837 |

46.71 |

896 |

2.76 |

-44 |

24,805 |

1,187 |

2,933 |

3387 |

1069 |

|

July |

18,698 |

4.90 |

5.62 |

3,04,587 |

5,920 |

46.23 |

3,146 |

2.65 |

-57 |

42,690 |

1,434 |

3,429 |

3665 |

1150 |

|

August |

19,556 |

4.83 |

5.36 |

4,09,539 |

5,983 |

45.93 |

2,352 |

2.25 |

-11,546 |

39,995 |

1,817 |

4,267 |

3978 |

1261 |

|

September |

20,584 |

4.50 |

5.26 |

2,65,848 |

6,862 |

45.85 |

2,345 |

0.91 |

-5,107 |

31,373 |

2,032 |

4,698 |

4315 |

1369 |

|

October |

23,998 |

4.64 |

5.11 |

3,89,968 |

7,672 |

45.39 |

1,593 |

0.02 |

-13,986 |

13,569 |

2,288 |

5,026 |

4742 |

1506 |

|

November |

15,156 |

4.38 |

5.19 |

1,77,063 |

6,795 |

45.52 |

3,449 |

(-) 0.002 |

-69 |

21,182 |

2,252 |

4,644 |

4951 |

1580 |

|

December |

15,276 |

4.40 |

5.14 |

1,81,991 |

6,207 |

45.59 |

2,888 |

(-) 0.30 |

-132 |

32,020 |

2,492 |

5,017 |

5425 |

1740 |

|

January |

14,189 |

4.43 |

5.23 |

1,81,619 |

7,306 |

45.46 |

3,294 |

0.50 |

5,228 |

38,539 |

3,125 |

6,394 |

5494 |

1906 |

|

February |

9,809 |

4.33 |

5.26 |

1,39,130 |

7,171 |

45.27 |

3,357 |

0.51 |

-35 |

46,244 |

2,709 |

5,722 |

5668 |

1800 |

|

March |

12,422 |

4.37 |

5.15 |

2,22,685 |

8,018 |

45.02 |

3,382 |

0.62 |

-69 |

54,915 |

2,308 |

4,767 |

5613 |

1780 |

|

2004-05 |

||||||||||||||

|

April |

12,916 |

4.29 |

5.14 |

3,00,864 |

10,118 |

43.93 |

7,427 |

(-) 0.35 |

-253 |

75,006 |

2,243 |

5,048 |

5809 |

1848 |

|

May |

10,987 |

4.30 |

5.29 |

1,92,264 |

8,521 |

45.25 |

-220 |

(-)1.33 |

-116 |

74,502 |

2,188 |

4,710 |

5205 |

1640 |

|

June |

10,972 |

4.35 |

5.81 |

1,75,802 |

7,741 |

45.51 |

-413 |

0.93 |

-60 |

61,981 |

1,681 |

3,859 |

4824 |

1506 |

|

July |

8,632 |

4.31 |

6.18 |

1,30,400 |

7,684 |

46.04 |

-1,180 |

2.25 |

-218 |

59,594 |

1,793 |

4,265 |

4973 |

1568 |

|

August |

11,562 |

4.41 |

6.16 |

1,29,373 |

5,753 |

46.34 |

-876 |

2.85 |

-78 |

42,692 |

1,736 |

3,948 |

5144 |

1615 |

|

September |

15,691 |

4.45 |

6.23 |

1,75,635 |

7,266 |

46.09 |

19 |

2.20 |

-131 |

31,589 |

1,800 |

4,023 |

5584 |

1746 |

|

October |

16,667 |

4.63 |

6.89 |

1,12,709 |

7,039 |

45.78 |

-99 |

2.87 |

-189 |

10,805 |

1,730 |

3,785 |

5672 |

1787 |

|

November |

13,764 |

5.62 |

7.18 |

78,225 |

9,808 |

45.13 |

.. |

2.20 |

-342 |

-5,066 |

1,787 |

4,102 |

5961 |

1874 |

|

.. Not Available. + Outright turnover in Central Government dated securities. |

||||||||||||||

- With the operationalisation of the Negotiated Dealing System (NDS)/Clearing Corporation of India Ltd. (CCIL), moving towards a pure inter-bank call/notice money market has become easier. Effective fortnight beginning January 8, 2005, non-bank participants would be allowed to lend, on average, in a reporting fortnight, upto 30 per cent of their average daily lending in call/ notice money market during 2000-01.

- In order to provide an option to issuers to raise short-term resources through Commercial Paper (CP) as also an avenue to investors to invest in quality short-term papers, the minimum maturity period of CP was reduced from 15 days to 7 days.

- In order to provide transparency and also facilitate benchmarking of CP issues, issuing and paying agents (IPAs) would report issuance of CP on the NDS platform by the end of the day. The date of commencement of reporting would be finalised in consultation with market participants.

- Automated value-free transfer of securities between market participants and the CCIL was facilitated to further develop the Collateralised Borrowing and Lending Operations (CBLO).

2.61 In view of development of repo market as also to ensure balanced development of various segments of money market, Primary Dealers (PDs ) have been allowed to borrow with effect from February 7, 2004, on average in a reporting fortnight, upto 200 per cent of their Net Owned Funds (NOF) as at end-March of the preceding financial year in the call/notice money market.

2.62 Amongst the key segments of the money market, there was increased recourse to issuances of Certificates of Deposit (CDs) as well as CPs. The spurt in the growth of CDs has been on account of a number of factors such as issuance of guidelines by the Reserve Bank on investments by banks in non-SLR debt securities, reduction in stamp duty on CDs effective March 1, 2004 and greater opportunity for secondary market trading. These developments have led to greater demand for investment in CDs by mutual funds particularly in the wake of their improved funds position. An encouraging development is that some of the top banks have been getting their CDs rated for better access to the market even when such rating is not required under the extant guidelines. Private banks continued to account for the largest share of CDs outstanding. In consonance with money market trends, the typical discount rates on both CDs and CPs have increased in recent months (Table 2.36).

|

Table 2.36: Commercial Paper and Certificates of Deposit |

|||||

|

Year/ |

Commercial Paper |

Certificates of Deposit |

|||

|

Month Outstanding |

Weighted |

Outstanding |

Interest |

||

|

Amount |

Average |

Amount |

Rate |

||

|

(Rupees |

Discount Rate |

(Rupees |

(Per cent) |

||

|

crore) |

(Per cent) |

crore) |

|||

|

1 |

2 |

3 |

4 |

5 |

|

|

2003-04 |

|||||

|

April |

5,994 |

5.98 |

1,485 |

5.25-7.40 |

|

|

May |

6,820 |

5.58 |

1,996 |

3.94-7.00 |

|

|

June |

7,108 |

5.47 |

2,183 |

3.74-6.50 |

|

|

July |

7,557 |

5.45 |

2,466 |

5.25-6.75 |

|

|

August |

7,646 |

5.39 |

2,961 |

4.75-5.68 |

|

|

September |

7,258 |

5.05 |

3,098 |

4.25-6.00 |

|

|

October |

6,845 |

5.18 |

3,321 |

4.25-6.50 |

|

|

November |

7,956 |

5.15 |

3,666 |

3.75-6.10 |

|

|

December |

8,762 |

5.05 |

3,830 |

3.75-6.00 |

|

|

January |

9,562 |

5.04 |

4,419 |

3.57-6.11 |

|

|

February |

9,379 |

5.02 |

4,856 |

3.75-6.00 |

|

|

March |

9,131 |

5.11 |

4,461 |

3.87-5.16 |

|

|

2004-05 |

|||||

|

April |

9,706 |

5.04 |

4,725 |

3.50-4.45 |

|

|

May |

10,328 |

4.85 |

4,860 |

1.09-4.73 |

|

|

June |

10,910 |

4.83 |

5,438 |

3.96-6.75 |

|

|

July |

10,848 |

4.86 |

5,478 |

4.02-6.75 |

|

|

August |

10,956 |

5.17 |

4,480 |

4.50-5.00 |

|

|

September |

11,319 |

5.26 |

5,112 |

4.09-5.09 |

|

|

October |

10,266 |

5.40 |

4,785 |

4.50-6.26 |

|

|

November |

10,150 |

5.98 |

5,425 |

* |

3.90-7.00 * |

|

* as on November 12, 2004. |

|||||

صفحے پر آخری اپ ڈیٹ: