|

Today, the Reserve Bank released the results of 102nd round of its industrial outlook survey (IOS). The survey encapsulates qualitative assessment of the business climate by Indian manufacturing companies for Q1:2023-24 and their expectations for Q2:2023-241 as well as outlook on selected parameters for the two subsequent quarters. In all, 1,247 companies responded in this round of the survey, which was conducted during Q1:2023-24.

Highlights:

A. Assessment for Q1:2023-24

-

Manufacturing companies reported somewhat slower improvement in demand conditions during Q1:2023-24, as revealed in their assessment on production, order books and capacity utilisation (Table A).

-

Raw material cost pressures eased during the quarter but the pressures from rising salary outgo and elevated cost of finance are assessed to have sustained.

-

Manufactures reported an uptick in selling price sentiments, with concomitant change in assessment for profit margin.

-

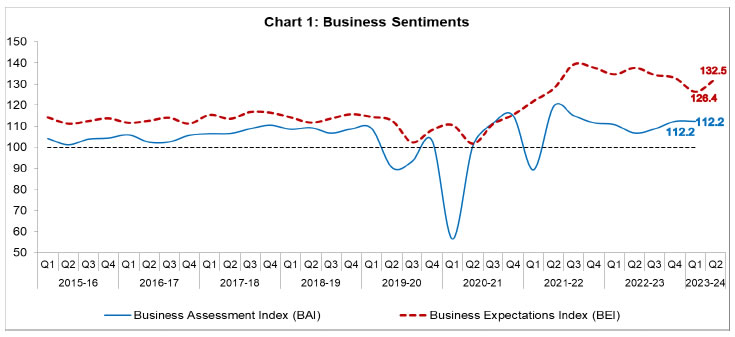

Overall business sentiments in the manufacturing sector remained positive; business assessment index (BAI)2 remained steady at 112.2 in Q1:2023-24 (Chart 1).

B. Expectations for Q2:2023-24

-

Respondents were more optimistic on demand conditions for Q2:2023-24, as reflected in their improved expectations on production, order book, capacity utilisation, employment and foreign trade (Table A).

-

Cost pressures from financing and wages are likely to continue during Q2:2023-24, whereas it is expected to soften a bit in the case of raw materials.

-

Manufacturers expect higher selling prices and profit margins in Q2:2023-24.

-

The business expectations index (BEI) improved to 132.5 for Q2:2023-24 from 126.4 in the previous quarter (Chart 1).

C. Expectations for Q3:2023-24 and Q4:2023-24

-

Manufacturers continue to remain optimistic on production, order books, employment, capacity utilisation and overall business situation for the second half of the financial year (Table B).

-

Input cost pressure is expected to continue with some easing and manufacturers expect that improved pricing power may enable them to raise selling price.

| Table A: Summary of Net responses3 on Survey Parameters |

| (per cent) |

| Parameters |

Assessment period |

Expectation period |

| Q4:2022-23 |

Q1:2023-24 |

Q1:2023-24 |

Q2:2023-24 |

| Production |

33.0 |

25.3 |

54.8 |

58.0 |

| Order Books |

25.4 |

21.9 |

47.8 |

58.1 |

| Pending Orders |

8.9 |

4.9 |

3.4 |

-1.7 |

| Capacity Utilisation |

22.8 |

15.5 |

41.2 |

46.6 |

| Inventory of Raw Materials |

-8.3 |

-6.3 |

-18.0 |

-29.0 |

| Inventory of Finished Goods |

-8.2 |

-7.2 |

-17.2 |

-28.8 |

| Exports |

12.2 |

17.6 |

36.2 |

53.5 |

| Imports |

15.3 |

20.4 |

33.2 |

52.6 |

| Employment |

12.4 |

16.1 |

26.7 |

40.5 |

| Financial Situation (Overall) |

30.6 |

24.0 |

52.9 |

56.3 |

| Availability of Finance (from internal accruals) |

28.8 |

25.8 |

46.6 |

52.3 |

| Availability of Finance (from banks & other sources) |

23.3 |

20.4 |

40.1 |

49.0 |

| Availability of Finance (from overseas, if applicable) |

7.6 |

18.0 |

32.5 |

50.4 |

| Cost of Finance |

-32.4 |

-32.4 |

-45.8 |

-54.2 |

| Cost of Raw Material |

-59.1 |

-41.1 |

-60.9 |

-58.3 |

| Salary/ Other Remuneration |

-21.2 |

-38.1 |

-44.3 |

-49.3 |

| Selling Price |

9.7 |

12.8 |

28.4 |

41.4 |

| Profit Margin |

-5.4 |

-1.2 |

19.1 |

35.7 |

| Overall Business Situation |

34.4 |

24.9 |

58.3 |

60.7 |

| Table B: Business Expectations of Select Parameters for extended period – Net response |

| (per cent) |

| Parameters |

Round 101 |

Round 102 |

| Q1:2023-24 |

Q2:2023-24 |

Q3:2023-24 |

Q4:2023-24 |

| Overall Business Situation |

58.3 |

60.7 |

60.7 |

63.1 |

| Production |

54.8 |

58.0 |

58.0 |

60.2 |

| Order Books |

47.8 |

58.1 |

54.6 |

55.2 |

| Capacity Utilisation |

41.2 |

46.6 |

54.4 |

56.5 |

| Employment |

26.7 |

40.5 |

43.7 |

43.3 |

| Cost of Raw Materials |

-60.9 |

-58.3 |

-49.3 |

-49.6 |

| Selling Prices |

28.4 |

41.4 |

45.1 |

46.5 |

Note: Please see the excel file for time series data.

| Table 1: Assessment and Expectations for Production |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

36.6 |

14.4 |

48.9 |

22.2 |

70.4 |

4.9 |

24.7 |

65.6 |

| Q2:2022-23 |

1,234 |

34.3 |

16.3 |

49.4 |

18.1 |

72.4 |

5.0 |

22.6 |

67.4 |

| Q3:2022-23 |

1,356 |

40.5 |

15.4 |

44.1 |

25.1 |

60.8 |

4.6 |

34.5 |

56.2 |

| Q4:2022-23 |

1,066 |

46.3 |

13.3 |

40.4 |

33.0 |

61.2 |

3.8 |

34.9 |

57.4 |

| Q1:2023-24 |

1,247 |

39.6 |

14.3 |

46.0 |

25.3 |

60.6 |

5.8 |

33.6 |

54.8 |

| Q2:2023-24 |

|

|

|

|

|

63.0 |

5.0 |

31.9 |

58.0 |

‘Increase’ in production is optimistic.

Note: The sum of components may not add up to total due to rounding off (This is applicable for all tables). |

| Table 2: Assessment and Expectations for Order Books |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

34.1 |

12.5 |

53.4 |

21.7 |

70.4 |

4.2 |

25.4 |

66.1 |

| Q2:2022-23 |

1,234 |

30.7 |

12.1 |

57.2 |

18.6 |

72.7 |

4.6 |

22.6 |

68.1 |

| Q3:2022-23 |

1,356 |

33.1 |

12.1 |

54.8 |

21.0 |

67.1 |

4.7 |

28.3 |

62.4 |

| Q4:2022-23 |

1,066 |

37.2 |

11.8 |

51.0 |

25.4 |

63.3 |

3.9 |

32.8 |

59.4 |

| Q1:2023-24 |

1,247 |

33.0 |

11.1 |

55.9 |

21.9 |

54.6 |

6.8 |

38.6 |

47.8 |

| Q2:2023-24 |

|

|

|

|

|

63.0 |

4.8 |

32.2 |

58.1 |

| ‘Increase’ in order books is optimistic. |

| Table 3: Assessment and Expectations for Pending Orders |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above Normal |

Below Normal |

Normal |

Net response |

Above Normal |

Below Normal |

Normal |

Net response |

| Q1:2022-23 |

1,239 |

6.7 |

14.2 |

79.1 |

7.5 |

8.8 |

10.6 |

80.6 |

1.8 |

| Q2:2022-23 |

1,234 |

10.3 |

17.6 |

72.0 |

7.3 |

7.7 |

10.3 |

82.1 |

2.6 |

| Q3:2022-23 |

1,356 |

8.4 |

14.6 |

76.9 |

6.2 |

10.8 |

10.1 |

79.2 |

-0.7 |

| Q4:2022-23 |

1,066 |

4.2 |

13.1 |

82.7 |

8.9 |

8.9 |

10.1 |

81.0 |

1.2 |

| Q1:2023-24 |

1,247 |

9.2 |

14.1 |

76.6 |

4.9 |

4.5 |

8.0 |

87.5 |

3.4 |

| Q2:2023-24 |

|

|

|

|

|

10.9 |

9.2 |

79.9 |

-1.7 |

| Pending orders ‘Below Normal’ is optimistic. |

| Table 4: Assessment and Expectations for Capacity Utilisation (Main Product) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

29.5 |

12.8 |

57.7 |

16.8 |

63.5 |

4.5 |

32.0 |

59.0 |

| Q2:2022-23 |

1,234 |

23.4 |

14.8 |

61.8 |

8.6 |

65.6 |

5.0 |

29.4 |

60.6 |

| Q3:2022-23 |

1,356 |

29.8 |

15.0 |

55.2 |

14.9 |

51.5 |

4.9 |

43.6 |

46.6 |

| Q4:2022-23 |

1,066 |

34.3 |

11.5 |

54.1 |

22.8 |

51.3 |

4.1 |

44.6 |

47.2 |

| Q1:2023-24 |

1,247 |

28.5 |

13.0 |

58.5 |

15.5 |

46.7 |

5.5 |

47.8 |

41.2 |

| Q2:2023-24 |

|

|

|

|

|

51.8 |

5.2 |

42.9 |

46.6 |

| ‘Increase’ in capacity utilisation is optimistic. |

| Table 5: Assessment and Expectations for Level of CU (compared to the average in last 4 quarters) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above Normal |

Below Normal |

Normal |

Net response |

Above Normal |

Below Normal |

Normal |

Net response |

| Q1:2022-23 |

1,239 |

19.6 |

10.4 |

70.0 |

9.2 |

39.3 |

5.4 |

55.4 |

33.9 |

| Q2:2022-23 |

1,234 |

20.5 |

12.8 |

66.7 |

7.8 |

50.2 |

6.3 |

43.5 |

43.9 |

| Q3:2022-23 |

1,356 |

28.7 |

13.2 |

58.1 |

15.5 |

37.0 |

6.1 |

56.9 |

30.9 |

| Q4:2022-23 |

1,066 |

19.8 |

10.5 |

69.7 |

9.3 |

34.7 |

8.1 |

57.2 |

26.7 |

| Q1:2023-24 |

1,247 |

31.4 |

10.4 |

58.2 |

21.0 |

23.7 |

6.2 |

70.2 |

17.5 |

| Q2:2023-24 |

|

|

|

|

|

39.0 |

6.0 |

55.1 |

33.0 |

| ‘Above Normal’ in Level of capacity utilisation is optimistic. |

| Table 6: Assessment and Expectations for Assessment of Production Capacity (with regard to expected demand in next 6 months) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| More than adequate |

Less than adequate |

Adequate |

Net response |

More than adequate |

Less than adequate |

Adequate |

Net response |

| Q1:2022-23 |

1,239 |

25.2 |

7.2 |

67.6 |

18.0 |

42.7 |

3.9 |

53.5 |

38.8 |

| Q2:2022-23 |

1,234 |

21.1 |

6.8 |

72.1 |

14.3 |

51.5 |

5.4 |

43.0 |

46.1 |

| Q3:2022-23 |

1,356 |

28.9 |

4.4 |

66.7 |

24.6 |

42.9 |

4.5 |

52.7 |

38.4 |

| Q4:2022-23 |

1,066 |

17.3 |

5.7 |

77.0 |

11.6 |

42.7 |

3.3 |

53.9 |

39.4 |

| Q1:2023-24 |

1,247 |

25.8 |

5.7 |

68.4 |

20.1 |

25.3 |

3.8 |

70.9 |

21.5 |

| Q2:2023-24 |

|

|

|

|

|

43.4 |

3.9 |

52.7 |

39.5 |

| ‘More than adequate’ in Assessment of Production Capacity is optimistic. |

| Table 7: Assessment and Expectations for Exports |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

25.5 |

11.2 |

63.4 |

14.3 |

62.4 |

4.4 |

33.2 |

58.0 |

| Q2:2022-23 |

1,234 |

25.2 |

14.0 |

60.8 |

11.1 |

65.2 |

4.4 |

30.4 |

60.8 |

| Q3:2022-23 |

1,356 |

25.6 |

17.1 |

57.3 |

8.5 |

61.2 |

5.2 |

33.6 |

56.0 |

| Q4:2022-23 |

1,066 |

25.4 |

13.3 |

61.3 |

12.2 |

55.5 |

3.9 |

40.6 |

51.5 |

| Q1:2023-24 |

1,247 |

30.1 |

12.5 |

57.4 |

17.6 |

43.0 |

6.8 |

50.2 |

36.2 |

| Q2:2023-24 |

|

|

|

|

|

57.9 |

4.4 |

37.7 |

53.5 |

| ‘Increase’ in exports is optimistic. |

| Table 8: Assessment and Expectations for Imports |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

23.9 |

9.0 |

67.0 |

14.9 |

59.7 |

3.4 |

36.9 |

56.4 |

| Q2:2022-23 |

1,234 |

23.5 |

10.1 |

66.4 |

13.4 |

64.5 |

3.2 |

32.3 |

61.3 |

| Q3:2022-23 |

1,356 |

23.8 |

12.2 |

64.0 |

11.6 |

60.8 |

3.2 |

36.0 |

57.6 |

| Q4:2022-23 |

1,066 |

22.6 |

7.3 |

70.1 |

15.3 |

54.3 |

2.8 |

42.9 |

51.5 |

| Q1:2023-24 |

1,247 |

28.9 |

8.6 |

62.5 |

20.4 |

37.4 |

4.2 |

58.4 |

33.2 |

| Q2:2023-24 |

|

|

|

|

|

55.8 |

3.2 |

41.0 |

52.6 |

| ‘Increase’ in imports is optimistic. |

| Table 9: Assessment and Expectations for level of Raw Materials Inventory |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above average |

Below average |

Average |

Net response |

Above average |

Below average |

Average |

Net response |

| Q1:2022-23 |

1,239 |

16.8 |

7.0 |

76.1 |

-9.8 |

42.4 |

3.6 |

54.0 |

-38.8 |

| Q2:2022-23 |

1,234 |

15.0 |

10.5 |

74.5 |

-4.6 |

46.1 |

4.6 |

49.3 |

-41.5 |

| Q3:2022-23 |

1,356 |

18.1 |

7.3 |

74.6 |

-10.8 |

32.8 |

7.1 |

60.1 |

-25.7 |

| Q4:2022-23 |

1,066 |

13.1 |

4.7 |

82.2 |

-8.3 |

32.4 |

5.6 |

62.0 |

-26.8 |

| Q1:2023-24 |

1,247 |

13.4 |

7.1 |

79.5 |

-6.3 |

20.5 |

2.5 |

76.9 |

-18.0 |

| Q2:2023-24 |

|

|

|

|

|

33.0 |

4.0 |

63.1 |

-29.0 |

| ‘Below average’ Inventory of raw materials is optimistic. |

| Table 10: Assessment and Expectations for level of Finished Goods Inventory |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above average |

Below average |

Average |

Net response |

Above average |

Below average |

Average |

Net response |

| Q1:2022-23 |

1,239 |

16.4 |

7.4 |

76.2 |

-9.0 |

42.4 |

3.0 |

54.6 |

-39.5 |

| Q2:2022-23 |

1,234 |

14.2 |

10.2 |

75.6 |

-4.0 |

45.6 |

4.3 |

50.1 |

-41.3 |

| Q3:2022-23 |

1,356 |

17.1 |

7.7 |

75.2 |

-9.5 |

33.4 |

6.9 |

59.7 |

-26.5 |

| Q4:2022-23 |

1,066 |

13.3 |

5.1 |

81.5 |

-8.2 |

31.9 |

5.8 |

62.3 |

-26.1 |

| Q1:2023-24 |

1,247 |

14.0 |

6.8 |

79.2 |

-7.2 |

19.9 |

2.8 |

77.3 |

-17.2 |

| Q2:2023-24 |

|

|

|

|

|

33.2 |

4.4 |

62.4 |

-28.8 |

| ‘Below average’ Inventory of finished goods is optimistic. |

| Table 11: Assessment and Expectations for Employment |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

23.4 |

8.1 |

68.4 |

15.3 |

52.7 |

2.5 |

44.7 |

50.2 |

| Q2:2022-23 |

1,234 |

21.5 |

9.0 |

69.5 |

12.5 |

57.1 |

2.1 |

40.8 |

54.9 |

| Q3:2022-23 |

1,356 |

23.0 |

9.4 |

67.7 |

13.6 |

45.0 |

1.2 |

53.9 |

43.8 |

| Q4:2022-23 |

1,066 |

19.3 |

7.0 |

73.7 |

12.4 |

39.0 |

2.5 |

58.5 |

36.4 |

| Q1:2023-24 |

1,247 |

25.9 |

9.9 |

64.2 |

16.1 |

29.8 |

3.1 |

67.1 |

26.7 |

| Q2:2023-24 |

|

|

|

|

|

43.5 |

3.0 |

53.5 |

40.5 |

| ‘Increase’ in employment is optimistic. |

| Table 12: Assessment and Expectations for Overall Financial Situation |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Better |

Worsen |

No change |

Net response |

Better |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

33.0 |

12.3 |

54.7 |

20.6 |

69.3 |

3.9 |

26.7 |

65.4 |

| Q2:2022-23 |

1,234 |

28.7 |

14.8 |

56.4 |

13.9 |

70.4 |

3.4 |

26.2 |

67.1 |

| Q3:2022-23 |

1,356 |

35.6 |

15.5 |

49.0 |

20.1 |

61.4 |

3.8 |

34.8 |

57.7 |

| Q4:2022-23 |

1,066 |

40.2 |

9.6 |

50.2 |

30.6 |

63.9 |

3.3 |

32.8 |

60.6 |

| Q1:2023-24 |

1,247 |

36.6 |

12.6 |

50.7 |

24.0 |

56.3 |

3.4 |

40.3 |

52.9 |

| Q2:2023-24 |

|

|

|

|

|

60.2 |

3.9 |

35.9 |

56.3 |

| ‘Better’ overall financial situation is optimistic. |

| Table 13: Assessment and Expectations for Working Capital Finance Requirement |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

33.4 |

7.9 |

58.7 |

25.5 |

62.8 |

1.4 |

35.7 |

61.4 |

| Q2:2022-23 |

1,234 |

29.6 |

6.8 |

63.5 |

22.8 |

65.0 |

2.6 |

32.5 |

62.4 |

| Q3:2022-23 |

1,356 |

35.2 |

7.3 |

57.5 |

27.9 |

51.2 |

1.6 |

47.3 |

49.6 |

| Q4:2022-23 |

1,066 |

36.4 |

4.3 |

59.3 |

32.1 |

52.3 |

1.1 |

46.5 |

51.2 |

| Q1:2023-24 |

1,247 |

34.8 |

5.8 |

59.4 |

29.1 |

48.0 |

1.9 |

50.0 |

46.1 |

| Q2:2023-24 |

|

|

|

|

|

53.3 |

2.2 |

44.4 |

51.1 |

| ‘Increase’ in working capital finance is optimistic. |

| Table 14: Assessment and Expectations for Availability of Finance (from Internal Accruals) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

27.8 |

9.7 |

62.4 |

18.1 |

62.4 |

2.5 |

35.2 |

59.9 |

| Q2:2022-23 |

1,234 |

24.0 |

8.0 |

68.0 |

15.9 |

64.2 |

2.4 |

33.4 |

61.9 |

| Q3:2022-23 |

1,356 |

31.1 |

9.1 |

59.8 |

21.9 |

51.3 |

2.0 |

46.7 |

49.3 |

| Q4:2022-23 |

1,066 |

33.3 |

4.5 |

62.2 |

28.8 |

55.2 |

1.7 |

43.1 |

53.5 |

| Q1:2023-24 |

1,247 |

33.2 |

7.4 |

59.4 |

25.8 |

48.7 |

2.0 |

49.3 |

46.6 |

| Q2:2023-24 |

|

|

|

|

|

54.4 |

2.1 |

43.5 |

52.3 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 15: Assessment and Expectations for Availability of Finance (from banks and other sources) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

24.8 |

7.6 |

67.5 |

17.2 |

59.3 |

1.5 |

39.2 |

57.8 |

| Q2:2022-23 |

1,234 |

21.9 |

6.5 |

71.6 |

15.4 |

62.2 |

1.8 |

36.1 |

60.4 |

| Q3:2022-23 |

1,356 |

26.0 |

9.1 |

64.9 |

17.0 |

56.7 |

1.7 |

41.6 |

55.1 |

| Q4:2022-23 |

1,066 |

27.8 |

4.5 |

67.7 |

23.3 |

50.5 |

1.3 |

48.2 |

49.2 |

| Q1:2023-24 |

1,247 |

26.5 |

6.1 |

67.4 |

20.4 |

42.2 |

2.1 |

55.7 |

40.1 |

| Q2:2023-24 |

|

|

|

|

|

50.5 |

1.5 |

47.9 |

49.0 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 16: Assessment and Expectations for Availability of Finance (from overseas, if applicable) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

21.9 |

7.5 |

70.6 |

14.4 |

60.2 |

0.9 |

38.9 |

59.2 |

| Q2:2022-23 |

1,234 |

17.4 |

6.8 |

75.8 |

10.6 |

65.8 |

1.2 |

33.0 |

64.6 |

| Q3:2022-23 |

1,356 |

20.4 |

9.7 |

69.9 |

10.7 |

59.6 |

0.8 |

39.6 |

58.9 |

| Q4:2022-23 |

1,066 |

11.1 |

3.6 |

85.3 |

7.6 |

51.3 |

1.3 |

47.4 |

50.1 |

| Q1:2023-24 |

1,247 |

23.8 |

5.8 |

70.4 |

18.0 |

34.3 |

1.8 |

64.0 |

32.5 |

| Q2:2023-24 |

|

|

|

|

|

52.4 |

2.0 |

45.7 |

50.4 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 17: Assessment and Expectations for Cost of Finance |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

30.5 |

6.9 |

62.6 |

-23.6 |

57.0 |

2.1 |

40.9 |

-54.9 |

| Q2:2022-23 |

1,234 |

36.1 |

6.1 |

57.8 |

-30.1 |

65.6 |

1.6 |

32.8 |

-64.0 |

| Q3:2022-23 |

1,356 |

37.0 |

5.9 |

57.1 |

-31.1 |

53.5 |

1.6 |

44.9 |

-51.9 |

| Q4:2022-23 |

1,066 |

36.2 |

3.8 |

60.0 |

-32.4 |

51.6 |

1.1 |

47.3 |

-50.5 |

| Q1:2023-24 |

1,247 |

36.9 |

4.5 |

58.6 |

-32.4 |

47.5 |

1.7 |

50.8 |

-45.8 |

| Q2:2023-24 |

|

|

|

|

|

56.4 |

2.2 |

41.5 |

-54.2 |

| ‘Decrease’ in cost of finance is optimistic. |

| Table 18: Assessment and Expectations for Cost of Raw Materials |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

85.5 |

1.1 |

13.3 |

-84.4 |

78.2 |

1.2 |

20.6 |

-77.0 |

| Q2:2022-23 |

1,234 |

77.0 |

4.6 |

18.4 |

-72.5 |

80.6 |

1.6 |

17.9 |

-79.0 |

| Q3:2022-23 |

1,356 |

73.0 |

8.1 |

18.9 |

-64.9 |

66.8 |

2.6 |

30.7 |

-64.2 |

| Q4:2022-23 |

1,066 |

64.5 |

5.4 |

30.2 |

-59.1 |

63.4 |

2.4 |

34.2 |

-60.9 |

| Q1:2023-24 |

1,247 |

49.1 |

8.0 |

42.8 |

-41.1 |

62.6 |

1.7 |

35.8 |

-60.9 |

| Q2:2023-24 |

|

|

|

|

|

60.6 |

2.4 |

37.0 |

-58.3 |

| ‘Decrease’ in cost of raw materials is optimistic. |

| Table 19: Assessment and Expectations for Salary/Other Remuneration |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

39.6 |

4.8 |

55.5 |

-34.8 |

66.3 |

0.7 |

33.0 |

-65.6 |

| Q2:2022-23 |

1,234 |

30.8 |

4.4 |

64.7 |

-26.4 |

61.3 |

0.4 |

38.3 |

-60.8 |

| Q3:2022-23 |

1,356 |

30.1 |

3.1 |

66.8 |

-27.0 |

46.3 |

0.3 |

53.4 |

-46.0 |

| Q4:2022-23 |

1,066 |

23.1 |

1.9 |

75.0 |

-21.2 |

39.3 |

0.6 |

60.0 |

-38.7 |

| Q1:2023-24 |

1,247 |

41.1 |

3.0 |

56.0 |

-38.1 |

45.2 |

0.9 |

53.9 |

-44.3 |

| Q2:2023-24 |

|

|

|

|

|

49.8 |

0.5 |

49.7 |

-49.3 |

| ‘Decrease’ in Salary / other remuneration is optimistic. |

| Table 20: Assessment and Expectations for Selling Price |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

33.3 |

8.3 |

58.4 |

25.0 |

59.5 |

3.8 |

36.7 |

55.7 |

| Q2:2022-23 |

1,234 |

25.1 |

10.7 |

64.2 |

14.4 |

63.4 |

3.2 |

33.4 |

60.3 |

| Q3:2022-23 |

1,356 |

23.3 |

12.9 |

63.8 |

10.4 |

48.8 |

3.7 |

47.5 |

45.1 |

| Q4:2022-23 |

1,066 |

21.6 |

11.8 |

66.6 |

9.7 |

43.2 |

3.6 |

53.1 |

39.6 |

| Q1:2023-24 |

1,247 |

26.1 |

13.3 |

60.6 |

12.8 |

34.0 |

5.6 |

60.4 |

28.4 |

| Q2:2023-24 |

|

|

|

|

|

46.9 |

5.4 |

47.7 |

41.4 |

| ‘Increase’ in selling price is optimistic. |

| Table 21: Assessment and Expectations for Profit Margin |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

22.5 |

20.7 |

56.7 |

1.8 |

53.6 |

10.4 |

35.9 |

43.2 |

| Q2:2022-23 |

1,234 |

16.2 |

25.5 |

58.2 |

-9.3 |

57.6 |

10.1 |

32.3 |

47.4 |

| Q3:2022-23 |

1,356 |

17.6 |

26.1 |

56.3 |

-8.4 |

44.2 |

9.0 |

46.8 |

35.2 |

| Q4:2022-23 |

1,066 |

16.2 |

21.6 |

62.1 |

-5.4 |

41.0 |

8.1 |

50.9 |

32.9 |

| Q1:2023-24 |

1,247 |

20.6 |

21.8 |

57.5 |

-1.2 |

30.5 |

11.4 |

58.1 |

19.1 |

| Q2:2023-24 |

|

|

|

|

|

43.8 |

8.1 |

48.1 |

35.7 |

| ‘Increase’ in profit margin is optimistic. |

| Table 22: Assessment and Expectations for Overall Business Situation |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Better |

Worsen |

No change |

Net response |

Better |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

36.0 |

13.8 |

50.2 |

22.3 |

71.8 |

3.8 |

24.4 |

68.0 |

| Q2:2022-23 |

1,234 |

31.6 |

15.7 |

52.7 |

15.8 |

73.9 |

3.2 |

22.9 |

70.7 |

| Q3:2022-23 |

1,356 |

37.7 |

17.4 |

44.9 |

20.3 |

63.8 |

4.4 |

31.7 |

59.4 |

| Q4:2022-23 |

1,066 |

45.9 |

11.4 |

42.7 |

34.4 |

66.9 |

3.7 |

29.4 |

63.1 |

| Q1:2023-24 |

1,247 |

39.9 |

15.0 |

45.1 |

24.9 |

62.4 |

4.0 |

33.6 |

58.3 |

| Q2:2023-24 |

|

|

|

|

|

65.0 |

4.3 |

30.7 |

60.7 |

| ‘Better’ Overall Business Situation is optimistic. |

| Table 23: Business Sentiments |

| Quarter |

Business Assessment Index (BAI) |

Business Expectations Index (BEI) |

| Q1:2022-23 |

110.1 |

134.7 |

| Q2:2022-23 |

106.7 |

137.5 |

| Q3:2022-23 |

108.6 |

134.4 |

| Q4:2022-23 |

112.2 |

132.9 |

| Q1:2023-24 |

112.2 |

126.4 |

| Q2:2023-24 |

|

132.5 |

|

IST,

IST,