IST,

IST,

Monetary and Credit Information Review

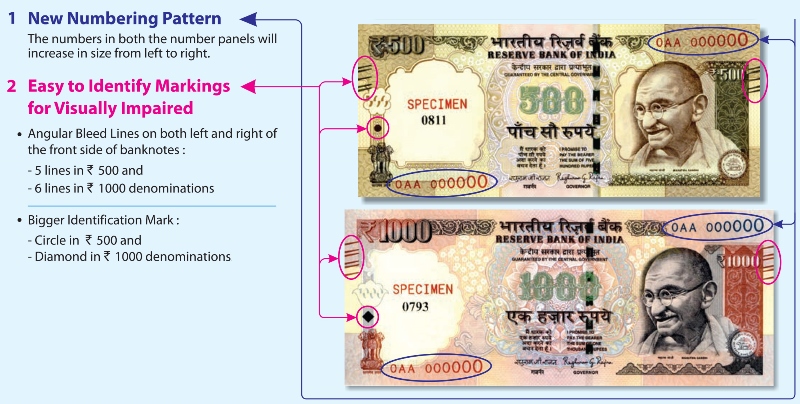

Volume XII MONETARY AND CREDIT INFORMATION REVIEW Banking Regulation Framework for Revitalising Distressed Assets revised The Reserve Bank introduced the following changes/additions in the framework to make it more effective: Joint Lenders’ Forum Empowered Group (JLF – EG) • Banks are expected to depute sufficiently empowered senior level officials for deliberations and decisions in the meetings of Joint Lenders’ Forum (JLF). JLF will finalise the Corrective Action Plan (CAP) and the same will be placed before an Empowered Group (EG) of lenders to approve the rectification/restructuring packages under CAPs. The JLF-EG shall have the following composition: (i) A representative each of State Bank of India (SBI) and ICICI Bank as standing members; (ii) A representative each of the top three lenders to the borrower. If SBI or ICICI Bank is among the top three lenders to the borrower, then a representative of the fourth largest or a representative each of the fourth and the fifth largest lenders as the case may be; (iii) A representative each of the two largest banks in terms of advances who do not have any exposure to the borrower; and (iv) The participation in the JLF-EG shall not be less than the rank of an Executive Director in a PSB or equivalent. • The JLF convening bank will convene the JLF-EG and provide the secretarial support. Restructuring of Doubtful Accounts under JLF • While generally no account classified as doubtful should be considered by the JLF for restructuring, in cases where a small portion of debt is doubtful, that is, the account is standard/sub-standard in the books of at least 90 per cent of creditors (by value), the account may then be considered under JLF for restructuring. • A JLF may decide on restructuring of an account classified as ‘doubtful’ in the books of one or more lenders subject to certain conditions. Disagreement on Restructuring as CAP and Exit Option • Banks, irrespective of whether they are within or outside the minimum 75 per cent and 60 per cent, can exercise the exit option for providing additional finance only by way of arranging their share of additional finance to be provided by a new or existing creditor. • Although co-operation among lenders for deciding a CAP by consensus is desirable for timely turn-around of a viable account, it is also important to enable all lenders to have an independent view on the viability of account and consequent participation in rectification or restructuring of accounts, without allowing them to free ride on efforts made by others. In view of this, it has been decided that dissenting lenders who do not want to participate in the rectification or restructuring of the account as CAP, which may or may not involve additional financing, will have an option to exit their exposure completely by selling their exposure to a new or existing lender(s) within the prescribed timeline for implementation of the agreed CAP. The Reserve Bank also advised the banks about certain changes in the revised Framework with regard to “Duration of Application of Extant Penal Provisions” and “Strategic Debt Restructuring Scheme”.(/en/web/rbi/-/notifications/framework-for-revitalising-distressed-assets-in-the-economy-review-of-the-guidelines-on-joint-lenders-forum-jlf-and-corrective-action-plan-cap-10034) Partial Credit Enhancement to Corporate Bonds The Reserve Bank on September 24, 2015, allowed banks to provide partial credit enhancement (PCE) to bonds issued by corporates /special purpose vehicles (SPVs) for funding all types of projects, subject to certain guidelines, with a view to encouraging corporates to avail of bond financing. To begin with, banks will be allowed to offer PCE only in the form of a non-funded irrevocable contingent line of credit. A view on allowing the PCE as a funded loan facility will be taken in due course after reviewing the implementation and performance of the contingent PCE offered by banks.(/en/web/rbi/-/notifications/partial-credit-enhancement-to-corporate-bonds-10035) Fourth Bi-monthly Monetary Policy Statement, 2015-16 Monetary Policy Measures On the basis of an assessment of the current and evolving macroeconomic situation, the Reserve Bank in its Fourth Bi-monthly Monetary Policy Statement, 2015-16, announced on September 29, 2015, decided to: • reduce the policy repo rate under the liquidity adjustment facility (LAF) by 50 basis points from 7.25 per cent to 6.75 per cent with immediate effect; • keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent of net demand and time liability (NDTL); • continue to provide liquidity under overnight repos at 0.25 per cent of bank-wise NDTL at the LAF repo rate and liquidity under 14-day term repos as well as longer term repos of up to 0.75 per cent of NDTL of the banking system through auctions; and • continue with daily variable rate repos and reverse repos to smooth liquidity. Consequently, the reverse repo rate under the LAF stands adjusted to 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 7.75 per cent. Developmental and Regulatory Policies Banking Structure • The Reserve Bank has put out for comment draft guidelines for banks on the computation of base rate, based on their marginal cost of funds. • In order to bring in greater transparency, better discipline with respect to compliance with income recognition, asset classification and provisioning (IRACP) norms as well as to involve other stakeholders, the Reserve Bank will mandate disclosures in the notes to accounts to the financial statements of banks where such divergences exceed a specified threshold. • With a view to improving “affordability of low cost housing” for economically weaker sections and low income groups and giving a fillip to “Housing for All”, while being cognisant of prudential concerns, it is proposed to reduce the risk weights applicable to lower value but well collateralised individual housing loans. • The ceiling on SLR securities under HTM to be brought down from 22 per cent to 21.50 per cent with effect from the fortnight beginning January 9, 2016. Thereafter, both the SLR and the HTM ceiling will be brought down by 0.25 per cent every quarter till March 31, 2017. • The Reserve Bank is setting up an information technology (IT) subsidiary to assist in monitoring the preparedness of banks and identifying systemic vulnerabilities along with aiding the Reserve Bank in its own cyber initiatives. • The Reserve Bank will update all its master regulations, and streamline the required procedure for compliance with the regulations by January 1, 2016. All master regulations will be fully updated and placed online. The Reserve Bank will also work to improve clarity in regulatory communications. Financial Markets • With the objective of having a more predictable regime for investment by the foreign portfolio investors (FPI), the medium term framework (MTF) for FPI limits in debt securities, has been worked out in consultation with the government, which primarily sets out, among other things, -(i) The limits for FPI investment in debt securities will henceforth be announced/ fixed in rupee terms; (ii) The limits for FPI investment in the central government securities will be increased in phases to 5 per cent of the outstanding stock by March 2018. • Indian corporates would be permitted to issue rupee denominated bonds with a minimum maturity of five years at overseas locations within the ceiling of foreign investment permitted in corporate debt (US$ 51 billion at present). There shall be no restriction on the end use of funds except a small negative list. Detailed instructions are being issued separately. • In order to further develop the repo market, a broad framework for introduction of electronic dealing platform/s for repo in corporate bonds will be designed in consultation with the Securities and Exchange Board of India (SEBI). Currency Management • In order to promote electronic payments and use of cards for transactions, the Reserve Bank will put in the public domain a concept paper for proliferation of card acceptance infrastructure in the country, especially in the tier III to tier VI centres, by end-November 2015.(/en/web/rbi/-/press-releases/fourth-bi-monthly-monetary-policy-statement-2015-16-35087) The Reserve Bank, on September 16, 2015 advised that banks which have capital to risk weighted assets ratio (CRAR) of 10 per cent or more and have also made net profit as of March 31 of the previous year need not approach the Reserve Bank for prior approval for equity investments in cases where after such investment, the holding of the bank remains less than 10 per cent of the investee company’s paid up capital, and the holding of the bank, along with its subsidiaries or joint ventures or entities continues to remain less than 20 per cent of the investee company’s paid up capital. The rationale behind the decision was to give more operational freedom and flexibility in decision making. The investment will continue to be subject to extant prudential limits as well as extant prudential norms. (https://rbi.org.in/ Scripts/NotificationUser.aspx?Id=10026&Mode=0) Guidelines on granting Loans to CEO/ Whole Time Directors In order to streamline the existing processes and to obviate the need to approach the Reserve Bank on case-to-case basis, the Reserve Bank has permitted commercial banks to grant loans and advances to the Chief Executive Officer/ Whole Time Directors, without seeking prior approval of the Reserve bank, subject to the following conditions: (a) Only loans, such as, loan for purchasing of car, loan for purchasing of personal computer, loan for purchasing of furniture, loan for constructing/acquiring a house for personal use, festival advance and credit limit under credit card facility, may be granted. (b) The loans and advances should form part of the compensation /remuneration policy approved by the Board of Directors or any committee of the Board to which powers have been delegated or the Appointments Committee, as the case may be. (c) Guidelines on Base Rate will not be applicable on the interest charged on such loans. However, the interest rate charged on such loans cannot be lower than the rate charged on loans to the bank’s own employees. (d) No other loan can be sanctioned to Directors.(https://rbi.org. in/Scripts/NotificationUser.aspx?Id=10025&Mode=0) Currency Management RBI to issue Banknotes with Three Additional Features The Reserve Bank is issuing Banknotes in Mahatma Gandhi Series 2005 with a new numbering pattern and special features for the visually impaired in ₹ 100, 500 and 1000 denominations. • In the new numbering pattern, the numerals in both the number panels of these denominations ascend in size from left to right, while the first three alphanumeric characters (prefix) remain constant in size. Printing the numerals in ascending size is a visible security feature in the banknotes so that the general public can easily distinguish a counterfeit note from a genuine one.  • Special features for the visually impaired have been introduced in order to make it easier for them to identify banknotes, the size of the identification mark in ₹ 100, 500 & 1000 denominations has been increased by 50 per cent. • Angular bleed lines - 4 lines in 2 blocks in ₹ 100, 5 lines in 3 blocks in ₹ 500 and 6 lines in 4 blocks in ₹ 1000 denominations, have also been introduced. The design of banknotes of ₹ 100, 500 and 1000 denomination is similar in all other respects to the current design of banknotes in Mahatma Gandhi Series 2005. All the banknotes in these denominations issued by the Reserve Bank in the past will continue to be legal tender. The Reserve Bank advised banks to issue suitable instructions to all their branches informing them about the above changes so that no inconvenience is caused to the public, whatsoever. Further, they are advised to ensure that the note sorting / detection machines used by their bank are suitably calibrated for processing these banknotes. (https://www.rbi.org.in/Scripts/NotificationUser. aspx?Id=10040&Mode=0) Detection of Counterfeit Notes The Reserve Bank, on August 27, 2015, reviewed the procedure for detection of counterfeit notes in consultation with the Government and advised as under: • Banknotes tendered over the counter or received directly at the back office / currency chest through bulk tenders should be examined for authenticity through machines and such of these determined as a counterfeit one, shall be stamped as “COUNTERFEIT NOTE” and impounded. • When a banknote tendered at the counter of a bank branch or treasury is found to be counterfeit, an acknowledgement receipt in the prescribed format must be issued to the tenderer, after stamping the note. No credit to customer’s account is to be given for counterfeit notes, if any, in the tender received over the counter or at the back-office / currency chest. • The instructions on compensation to banks of the notional value of counterfeit notes detected and reported and the system of lodging claims for compensation by Forged Note Vigilance Cell of banks stand withdrawn. Penalty at 100 per cent of the notional value of counterfeit notes, in addition to the recovery of loss to the extent of the notional value of such notes, will be imposed. (/en/web/rbi/-/notifications/detection-of-counterfeit-notes-10002) Payment and Settlement Systems Limits for Cash Withdrawal raised for Tier III to VI Centres The Reserve Bank, on August 27, 2015 reviewed and enhanced the limit for cash withdrawal at Point of Sale (POS - for debit cards and open system prepaid cards issued by banks in India) from ₹ 1000 to ₹ 2000 per day in Tier III to VI centres. Customer charges, if any, levied on cash withdrawals shall not exceed 1 per cent of the transaction amount at all centres irrespective of the limit of ₹ 1000 / ₹ 2000. The facility is available irrespective of whether the card holder makes a purchase or not. Banks are advised to submit data on cash withdrawals to the Chief General Manager, Department of Payment and Settlement Systems, Mumbai, 400001 on quarterly basis within 15 days of the end of quarter as per the prescribed format. Such cash withdrawal facility may be provided by banks subject to prescribed conditions. (/en/web/rbi/-/notifications/cash-withdrawal-at-point-of-sale-pos-enhanced-limit-at-tier-iii-to-vi-centres-10004) In-principle Approval to 10 Applicants for Small Finance Banks The Reserve Bank, on September 16, 2015 granted “in-principle” approval to the ten applicants to set up small finance banks under the “Guidelines for Licensing of Small Finance Banks in the private sector” issued on November 27, 2014. These are: 1. Au Financiers (India) Ltd., Jaipur During the validity of 18 months of the “in-principle” approval, the applicants have to comply with the requirements under the Guidelines and fulfil other conditions as may be stipulated by the Reserve Bank. On being satisfied that the applicants have complied with the requisite conditions laid down by it as part of “in-principle” approval, the RBI would consider granting a licence for commencement of banking business to them. Until a regular licence is issued, the applicants cannot undertake any banking business. Going forward, the Reserve Bank intends to use the learning from this licensing round to appropriately revise the Guidelines and move to giving licences more regularly, virtually “on tap”. Issuance of EMV Chip and PIN Cards The Reserve Bank, on August 27, 2015, granted extension of time for issuance of all new EMV Chip and Pin cards – debit and credit, domestic and international – by banks. For cards issued under the Pradhan Mantri Jan-Dhan Yojana (PMJDY) / Basic Savings Bank Deposit Account (BSBDA) / other Government schemes, the time is extended upto September 30, 2016 and for all cards other than these, the extended period is upto January 31, 2016. During the extended period, if any customer specifically requests for EMV Chip and Pin cards, banks should promptly comply with the request. Besides, all cards issued for international usage will necessarily be EMV Chip and Pin cards. Further, the magnetic stripe cards issued would have to be replaced by December 31, 2018 irrespective of the validity period of the card. (/en/web/rbi/-/notifications/security-and-risk-mitigation-measures-for-card-present-and-electronic-payment-transactions-issuance-of-emv-chip-and-pin-cards-10003) The Reserve Bank advised all participants of Real Time Gross Settlement System (RTGS) of the revised RTGS time window with effect from September 1, 2015 as under: The timings were revised consequent upon the Government of India declaring a bank holiday on second and fourth Saturday of the month from September 1, 2015. Processing of future value dated transactions with value date falling on second and fourth Saturdays would, therefore, not be undertaken under RTGS. (https://rbi.org.in/ Scripts/NotificationUser.aspx?Id=10012&Mode=0) Financial Inclusion and Development Timely and Adequate Credit Flow to MSEs The Reserve Bank, on August 27, 2015 advised scheduled commercial banks (excluding regional rural banks) to put in place Board approved policy on lending to micro and small entrepreneurs (MSEs), adopting an appropriate system of timely and adequate credit delivery to borrowers in the MSE segment within the broad prudential regulations of the Reserve Bank. The guidelines include: (i) Standby Credit Facility – Banks may, as part of their lending policy to MSEs, consider providing a ‘standby credit facility’, while funding capital expenditure, to fund unforeseen increases in capital expenditure. Further, at the discretion of banks, such ‘standby credit facility’ may also be sanctioned to fund periodic capital expenditure. The objective of such ‘standby credit facility’ would be, among others, to extend credit speedily so that the capital asset creation is not delayed and commercial production can commence at the earliest. (ii) Working Capital Limits – Banks may also incorporate, in their lending policy to MSEs, a policy for fixing a separate additional limit, at the time of sanction / renewal of working capital limits, specifically for meeting the temporary rise in working capital requirements arising mainly due to unforeseen / seasonal increase in demand for products produced by them. (iii) Review of Regular Working Capital Limits – Where banks are convinced that changes in the demand pattern of MSE borrowers require a mid-term review, they may do so. Such mid-term reviews may be based on an assessment of sales performance of the MSEs since last review without waiting for audited financial statements. (iv) Timelines for Credit Decisions – Banks were advised to put in place a structured monitoring mechanism for holistic monitoring of all credit related matters, pertaining to MSE Sector; to have a Credit Proposal Tracking System (CPTS) with a view to closely tracking the applications and ensuring speedy disposal; the time frame within which loan applications up to ₹ 2 lakh will be disposed of should be indicated at the time of acceptance of loan applications; to make suitable disclosures on the timelines for conveying credit decisions through their websites, notice-boards, product literature. Banks are advised that above systems should be put in place with immediate effect, with regard to credit facilities (regular, additional / ad-hoc credit facilities and restructuring of accounts, if considered viable) for MSE borrowers.(https://rbi.org.in/Scripts/NotificationUser. aspx?Id=10000&Mode=0) Foreign Exchange Management RBI seeks Feedback on Draft Framework on ECBs The Reserve Bank on September 23, 2015, placed on its website for comments/feedback, the draft framework on External Commercial Borrowings (ECBs). Comments/ feedback on the draft framework may be e-mailed or sent by post to the Principal Chief General Manager, Foreign Exchange Department, Reserve Bank of India, Central Office, 11th Floor, Shahid Bhagat Singh Marg, Mumbai - 400 001 on or before October 11, 2015. This is an attempt made to replace the ECB policy with a more rational and liberal framework, keeping in view the evolving domestic as well as global macro-economic and financial conditions, challenges faced in external sector management and the experience gained so far in administering the ECB policy, within the overarching stance of calibrated approach to the capital account liberalisation. (https://rbi. org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=35057) Inter-Bank Hindi Essay Competition - 2015-16 The Reserve Bank on September 24, 2015, announced subjects, for its Inter Bank Hindi Essay Competition 2015-2016 to encourage original writing in Hindi on banking subjects, as under: (i) वित्तीय समावेशन की मुहिम और प्रधानमंत्री जन-धन योजना Employees, except Rajbhasha officers and translators, of all public sector banks (including Regional Rural Banks sponsored by them), financial institutions and Reserve Bank of India are eligible to participate in the Inter-Bank Hindi Essay Competition, conducted every year. The competition is conducted separately for the participants whose mother tongue is: (i) Hindi; (ii) Marathi, Punjabi and Gujarati and (iii) other than those mentioned in (i) and (ii). Three prizes - in the form of cash awards of ₹11000, ₹ 7000 and ₹ 5000, respectively, for first second and third prize – are awarded in each category. Participants may send the essay - of about 3000 to 4000 words and indicating their mother tongue on it - on any one of the three subjects on or before November 16, 2015 (Monday) to: General Manager, Rajbhasha Department, Reserve Bank of India, Central Office, C-9, Second Floor ,Bandra - Kurla Complex, Mumbai - 400 051 (https://www. rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=35070) Edited and published by Alpana Killawala for the Reserve Bank of India, Department of Communication, Central Office, Shahid Bhagat Singh Marg, Mumbai - 400 001. MCIR can be accessed at www.mcir.rbi.org.in |

صفحے پر آخری اپ ڈیٹ: