IST,

IST,

Monetary Policy Report - October 2020

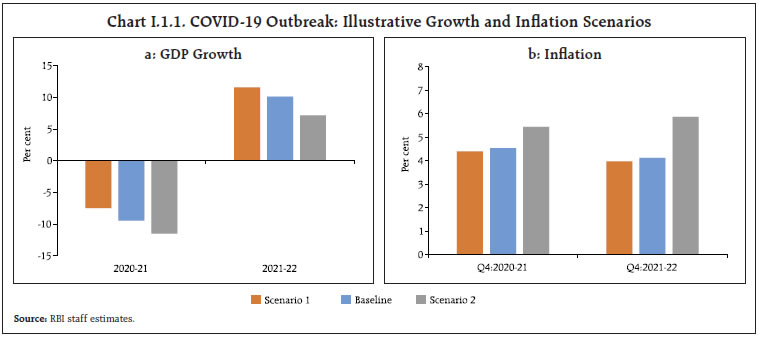

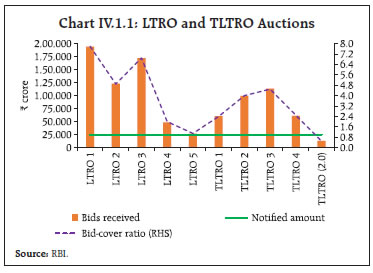

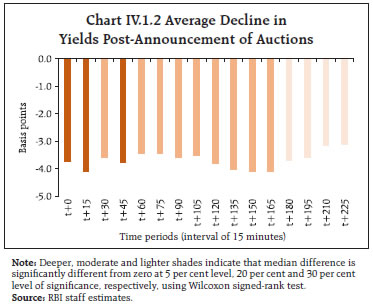

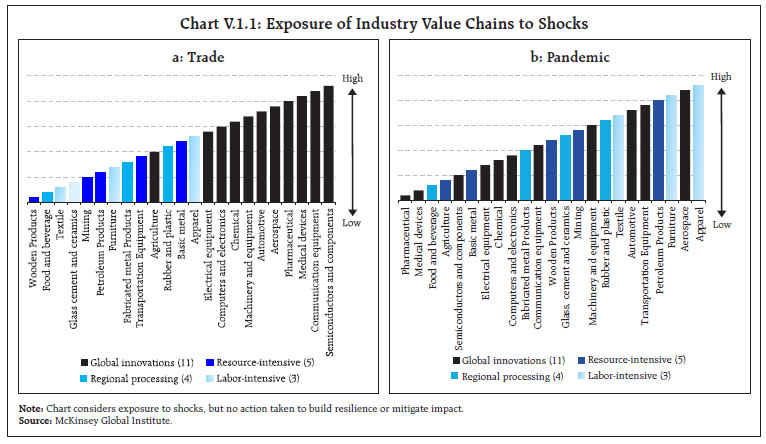

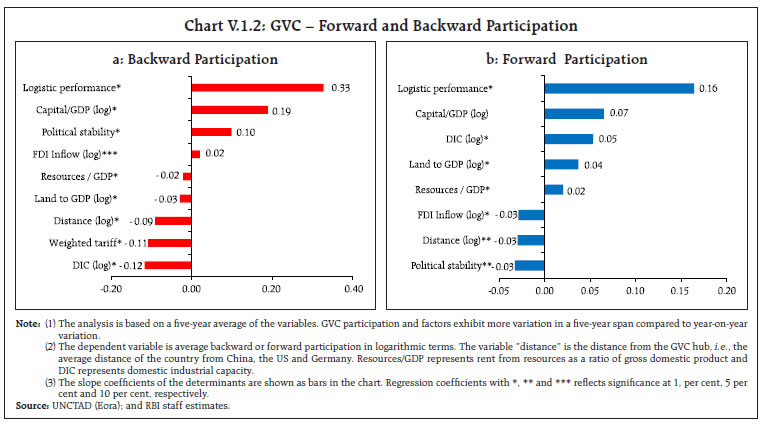

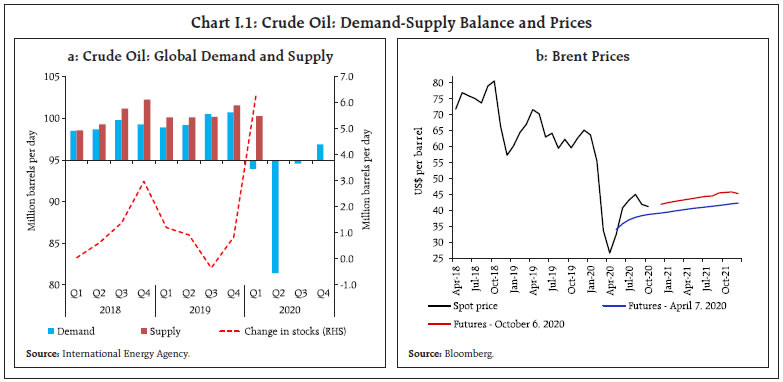

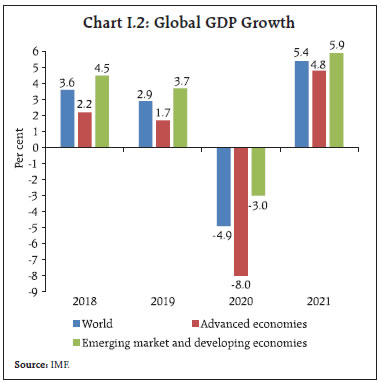

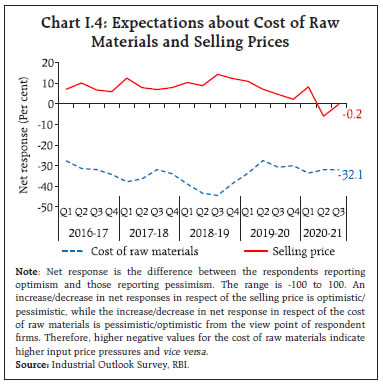

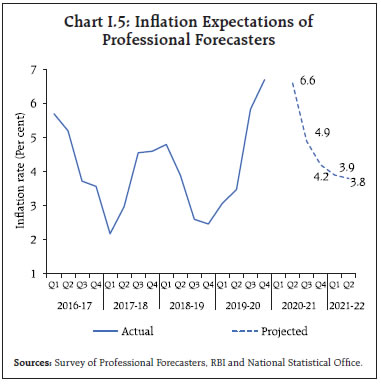

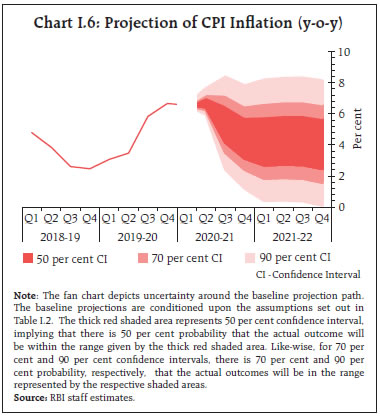

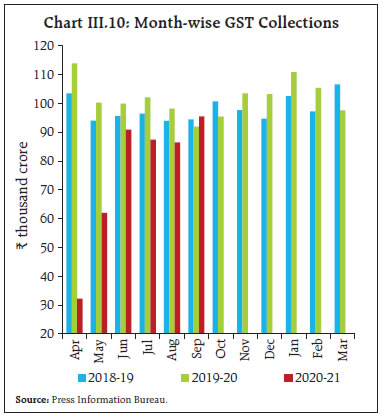

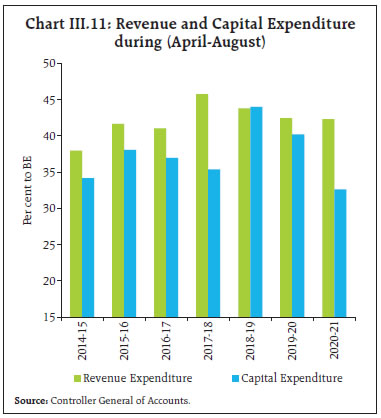

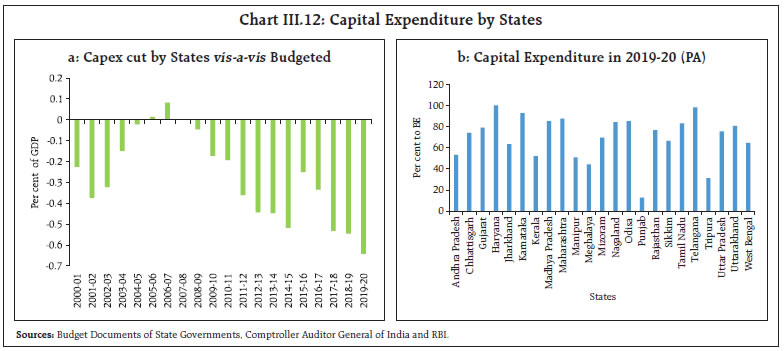

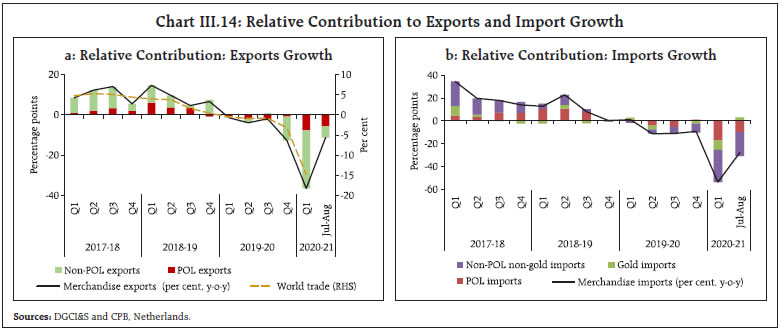

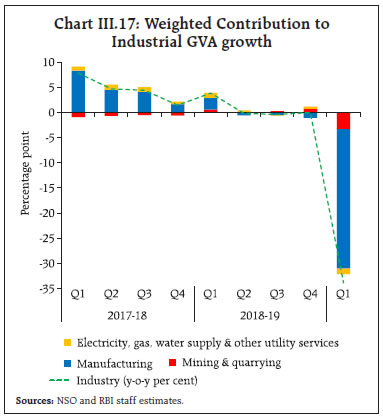

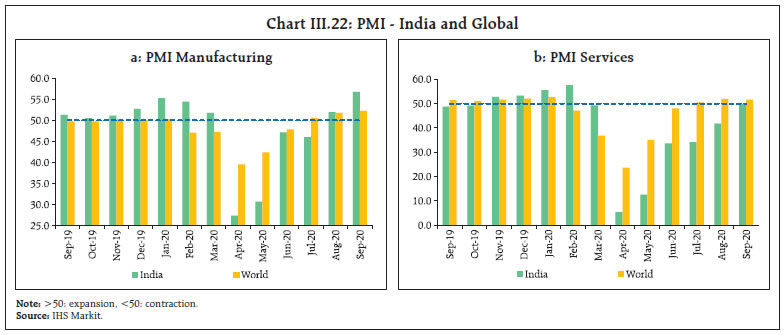

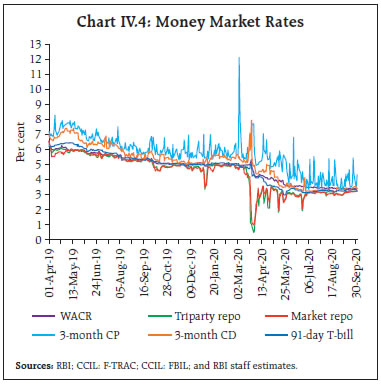

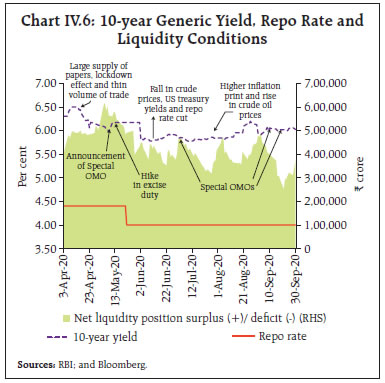

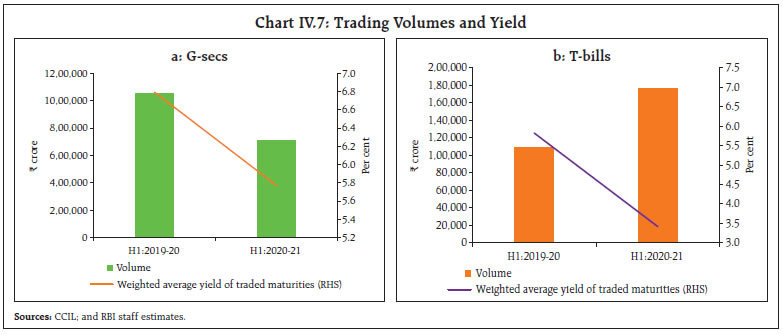

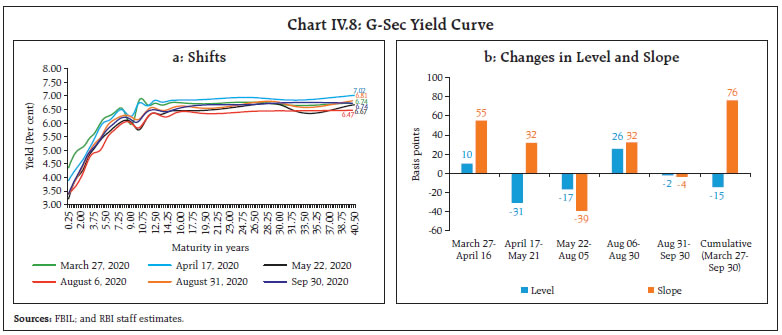

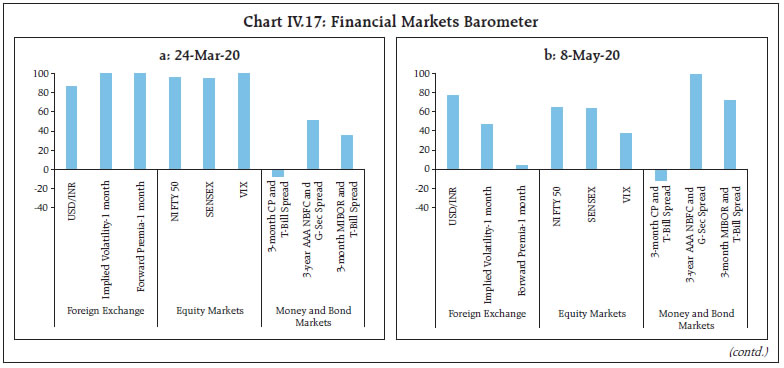

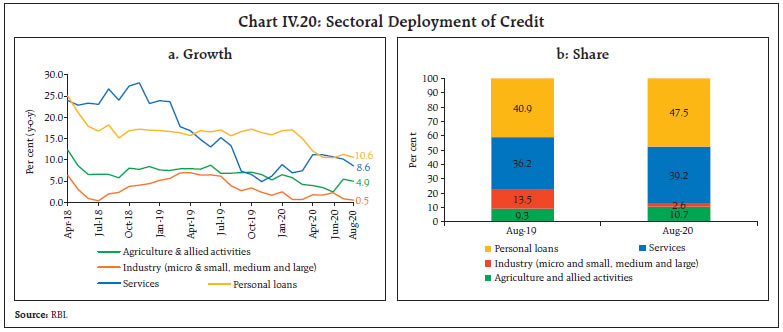

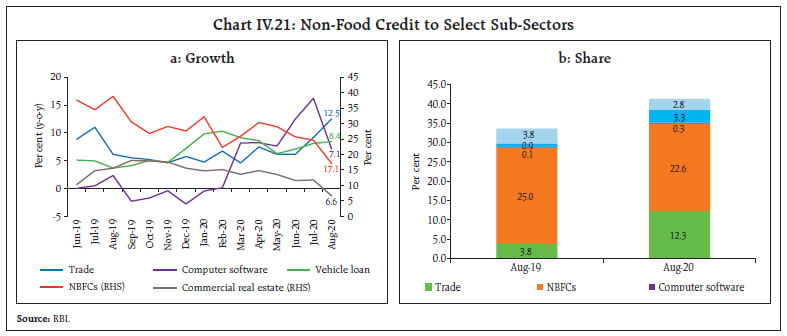

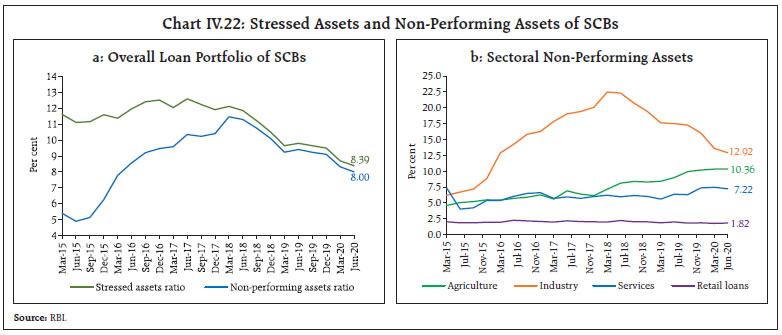

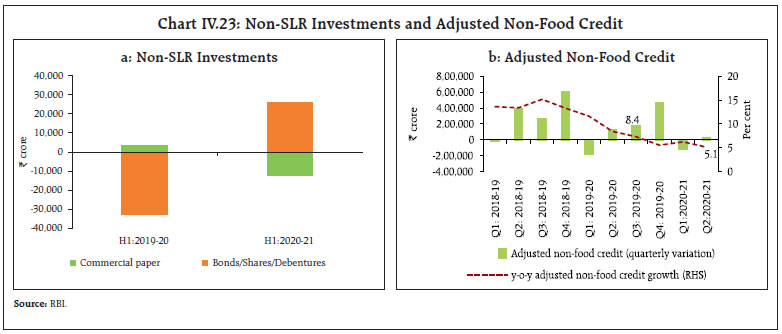

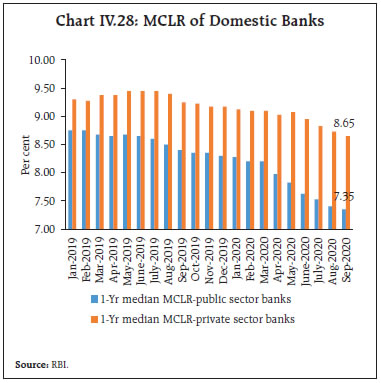

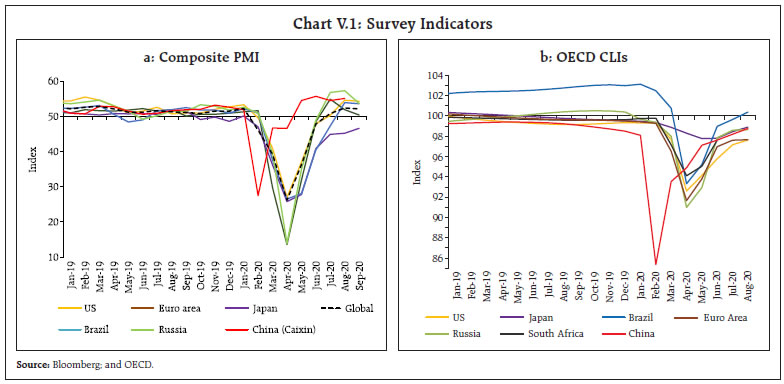

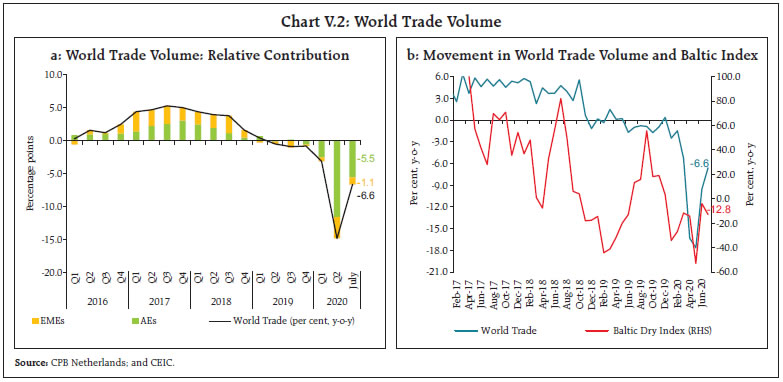

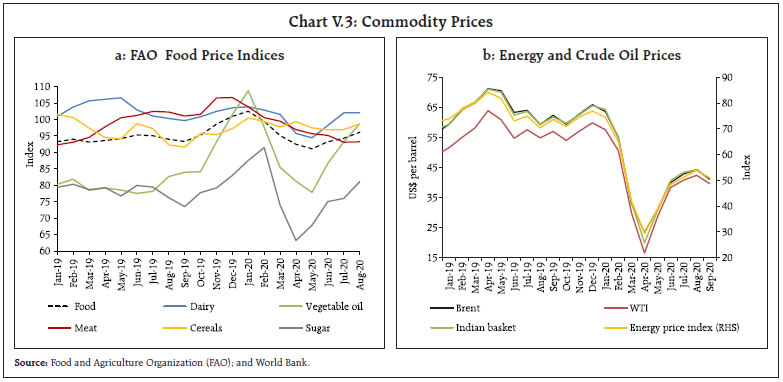

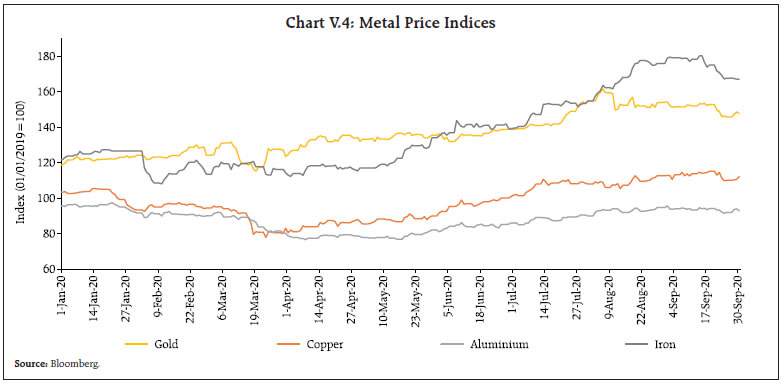

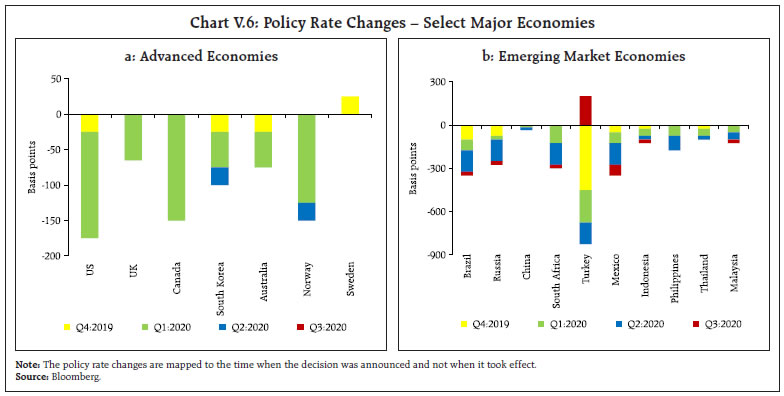

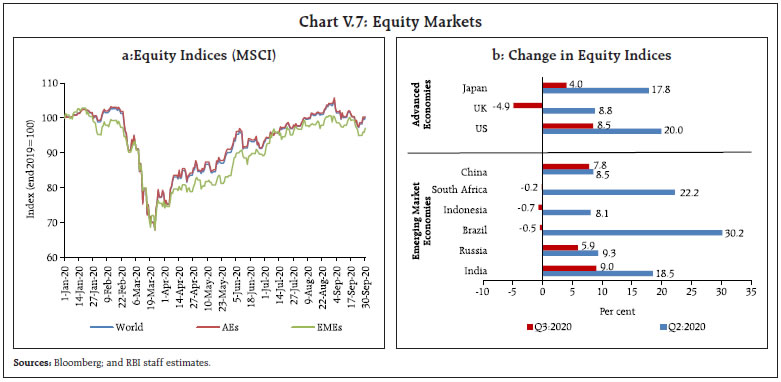

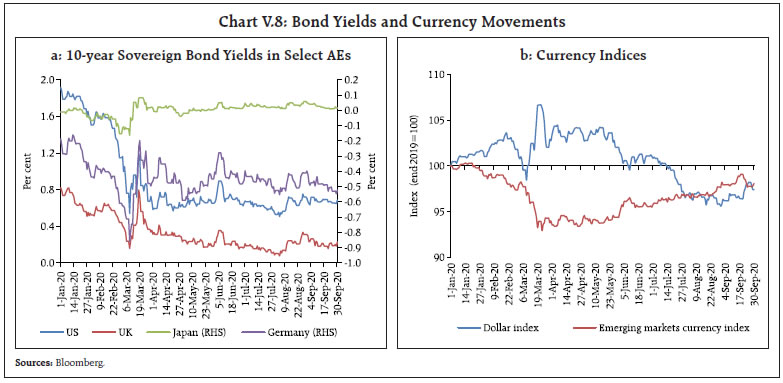

The global economy plunged into its deepest contraction in living memory in April-June 2020 as COVID-19 took its toll. In India, real GDP fell by a record low. Supply bottlenecks and higher taxes pushed inflation above the upper tolerance band of the target. Downside risks from a delayed vaccine, persistence of supply bottlenecks, volatile international financial markets and high food inflation acquiring a structural character are clear and present dangers to the macroeconomic outlook. 1.1 Key Developments Since the April 2020 MPR The COVID-19 pandemic has fundamentally altered the setting and conduct of monetary policy across the world. With the global economy having plunged into its deepest contraction in living memory in Q2:2020, with over 3.5 crore infections, including 10.4 lakh confirmed deaths as on October 7, 2020, with massive supply disruptions and demand destruction from employment and income losses on a scale not seen before, the unconventional has become conventional in the ethos of monetary policy making. Central banks have gone where they have feared to tread before: below the so-called zero lower bound on interest rates; to the outer limits of quantitative and credit easing and beyond. They have undertaken what even until recently they considered as the commission of original sins – the monetisation of fiscal deficits and the management of yield curves. Central bank communication has also turned a radical corner. Ultra-accommodative stances and more policy actions to fight the pandemic have been assured into the foreseeable future, even at the cost of volatility in financial markets shaken by this resolve, and untoward currency movements. This unprecedented monetary policy activism appears to have put equally unprecedented fiscal stimuli in the shade. In the event, their combined impulses have eased financial conditions substantially, helped buoy up global financial markets, and have driven up asset and commodity prices to a point widely regarded as a disconnect with the real economy. Crude oil prices have recovered since May on a gradual rise in demand and production cuts, before softening in September on concerns arising out of the surge in new infections. Gold prices remained elevated as heightened uncertainty continues to boost its safe haven appeal. Inflation, too, has rebounded, although it remains well below targets in advanced economies (AEs), but has risen more strongly on food prices in some emerging market economies (EMEs). The efficacy of these actions in reconstructing economic activity from the ravages of COVID-19 is yet to gain traction on a broad scale. In several economies, rebounds from troughs have begun in Q3, but the resurgence of infections and the lingering risk of a second wave in the absence of the elusive vaccine overshadows these early signs of revival, and contractions persist in several sectors. The balance of risks remains slanted to the downside. The next few quarters can be challenging. Global public debt is projected by the International Monetary Fund (IMF) at over 100 per cent of gross domestic product (GDP) in 2020. The G20 has supported time-bound suspension of the debt service obligations of the poorest countries. Model-based projections suggest that it could take several years for output and activity to recover to pre-pandemic levels in view of the lasting impact on potential output from the loss of human and physical capital. In India, with the second highest caseload in the world – over 67 lakh infections including 1 lakh deaths as of October 7, 2020, the highest daily infections, the severest lockdown in the world during April-May, and re-clamping of containment measures and localised lockdowns thereafter as infections surged into the interior, real GDP fell by a record 23.9 per cent year-on-year (y-o-y) in Q1:2020-21 (April-June 2020). Private consumption and investment slumped precipitously, only partly cushioned by government spending. On the supply side, industry as well as services sectors recorded deep contractions, and only agriculture exhibited resilience. Meanwhile, supply bottlenecks exacerbated by social distancing and higher taxes pushed up inflation sharply, with pressures evident in prices of both food and non-food items. At 6.7 per cent in August, consumer price index (CPI) inflation was ruling above the upper tolerance band of the inflation target, posing testing challenges for the conduct of monetary policy, going forward. Monetary Policy Committee: April-September 2020 The Monetary Policy Committee (MPC) met off-cycle on May 20-22, 2020 advancing its scheduled meeting in view of the exigencies imposed by COVID-19. The MPC noted that various sectors of the economy were experiencing more acute stress than initially anticipated and financial conditions needed further easing to prevent the deep distress in the economy, especially among the vulnerable and disadvantaged. While the inflation outlook remained uncertain, the forecast of a normal monsoon, subdued international commodity prices, deficient demand and favourable base effects offered some policy space. Against this backdrop, the MPC decided to cut the policy repo rate by 40 basis points (bps) to 4.0 per cent (5 members voted for a reduction of 40 bps while one member voted for a reduction of 25 bps) on top of the sizeable cut of 75 bps in its March 27 off-cycle meeting. Inflation surprised on the upside in the run up to the August 2020 meeting of the MPC. The persistence of supply chain disruptions and broad-based cost-push pressures were seen as keeping inflation elevated in Q2:2020-21 with some moderation only in H2:2020-21, aided by large favourable base effects. Real GDP growth for 2020-21 was expected to be negative. In these conditions, the recovery of the economy assumed primacy, but the MPC noted that the headline CPI prints of April-May 2020 required more clarity as the National Statistical Office (NSO) had to resort to imputations for many items as data collection was affected by the lockdowns. Given the uncertainty surrounding the inflation outlook and taking into consideration the extremely weak state of the economy in the midst of the unprecedented shock from the pandemic, the MPC decided unanimously that it was prudent to pause and remain watchful for a durable reduction in inflation to use the available space to support the revival of the economy. All members also voted to continue with the accommodative stance as long as necessary to revive growth and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. The MPC’s voting pattern reflects the diversity in individual members’ assessments, expectations and policy preferences, a feature that is also reflected in voting patterns of other central banks (Table I.1). Macroeconomic Outlook Chapters II and III analyse macroeconomic developments during H1:2020-21 (April-September). For the projections set out in this Chapter, the evolution of key macroeconomic and financial variables over the past six months warrants revisions in the baseline assumptions made in the April 2020 MPR (Table I.2). First, global crude prices have remained volatile on COVID-19-related uncertainty. An unprecedented spike occurred on April 20 when, for the first time ever, West Texas Intermediate (WTI) front month prices turned negative (US$ (-) 37.6 per barrel). Supported by the agreement between the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC partners (OPEC plus) in April 2020 to cut oil production by a record 9.7 million barrels a day, Brent prices recovered from US$ 19 per barrel in April to around US$ 45 in August, before softening in September (Chart I.1). Considering these developments, crude prices (Indian basket) are assumed at US$ 40.9 in the baseline, 17 per cent above the April MPR baseline. Second, the nominal exchange rate (the Indian rupee or INR vis-à-vis the US dollar) has moved in both directions since April 2020. The INR remained under depreciating pressures in April due to the generalised flight out of EMEs to the safety of the US dollar amidst COVID-related concerns. After being largely range-bound during May-July, the INR exhibited an appreciating bias in August. This was driven by the surge in portfolio inflows to India on expectations of highly accommodative monetary policies in advanced economies continuing for longer, and improving prospects of potential vaccines for COVID-19. In the light of these developments, the exchange rate is assumed at INR 73.6 per US dollar in the baseline.  Third, global economic activity has underperformed significantly relative to the April outlook. Global merchandise trade volumes fell by 14.3 per cent in Q2:2020 and the World Trade Organization’s Goods Trade Barometer points to only partial upticks in Q3. The global composite Purchasing Managers’ Index (PMI) moved into expansion zone in July-September after remaining in contraction for five months, but the outlook remains uncertain in view of the resurgence in infections in some AEs and EMEs. The IMF expects the global economy to contract by 4.9 per cent in 2020 (Chart I.2), while the World Bank and the OECD have projected a decline of 5.2 per cent and 4.5 per cent, respectively.  Headline CPI inflation breached the upper tolerance band of the target during June-August 2020, propelled by a broad-based propagation of strong upside pressures (Chapter II). Supply chain disruptions and higher taxes on petroleum products and other items imparted these upward pressures on inflation in spite of muted demand conditions. Data-related uncertainties, as complete coverage of markets and quotes was disrupted by lockdowns, complicate the assessment of the outlook. Looking ahead, three months ahead median inflation expectations of urban households fell by 10 bps in the September 2020 round of the Reserve Bank’s survey while one year ahead median inflation expectations remained unchanged.1 The proportion of respondents expecting the general price level to increase by more than the current rate rose for both horizons vis-à-vis the previous round (Chart I.3). According to the Reserve Bank’s consumer confidence survey for September 2020, one year ahead inflation expectations remained at elevated level. Manufacturing firms polled in the July-September 2020 round of the Reserve Bank’s industrial outlook survey expected selling prices to remain unchanged in Q3:2020-21 on the back of benign input cost pressures (Chart I.4).2 The PMI for the manufacturing sector reported higher input prices in September though the rate of cost inflation softened from August 2020; output prices broadly stabilised in September after falling for five months in a row. Services sector firms also reported higher input costs due to fuel, meat and vegetables and some increase in output prices.  Professional forecasters surveyed by the Reserve Bank in September 2020 expected CPI inflation to moderate from 6.7 per cent in August 2020 to 4.2 per cent in Q4:2020-21 and 3.8 per cent in Q2:2021-22 (Chart I.5).3   A bumper rabi crop, moderate increases in minimum support prices (MSPs) for kharif crops, a normal monsoon, sizeable buffer stocks and good water storage levels in major reservoirs augur well for the inflation outlook. At the same time, the persistence of COVID-related supply bottlenecks, higher taxes and their cost-push implications could impart upward pressures on inflation. The inflation outlook will also depend on trade policies and effective supply management measures with respect to key inflation-sensitive items. As noted in the Monetary Policy Report of April 2020, the uncertainty about the depth, spread and duration of COVID-19 can produce drastic changes in the outlook. Hence, macroeconomic forecasts are subject to large revisions with every incoming data on the pandemic. The RBI Act, however, enjoins the Reserve Bank to, inter alia, publish and explain in the MPR the forecasts of inflation for 6-18 months from the date of its publication. Taking into consideration the statutory requirements, the initial conditions, the signals from forward-looking surveys and estimates from time-series and structural models, CPI inflation is projected at 6.8 per cent in Q2:2020-21; subsequently, large favourable base effects are expected to pull it down to 5.4 per cent in Q3, and 4.5 per cent in Q4 (Chart I.6). The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2020-21 are 3.2-5.9 per cent and 2.4-6.6 per cent, respectively.  For 2021-22, assuming a normalisation of supply chains with the availability of effective vaccines against COVID-19, a normal monsoon, and no major exogenous or policy shocks, structural model estimates indicate that inflation will move in a range of 4.1-4.4 per cent. The 50 per cent and the 70 per cent confidence intervals for Q4:2021-22 are 2.5-5.8 per cent and 1.6-6.6 per cent, respectively. As explained earlier, an unusually high amount of uncertainty surrounds the inflation outlook. In particular, the persistence of the pandemic and delay in vaccine development could render projections of key macroeconomic variables even more uncertain (Box I.1).

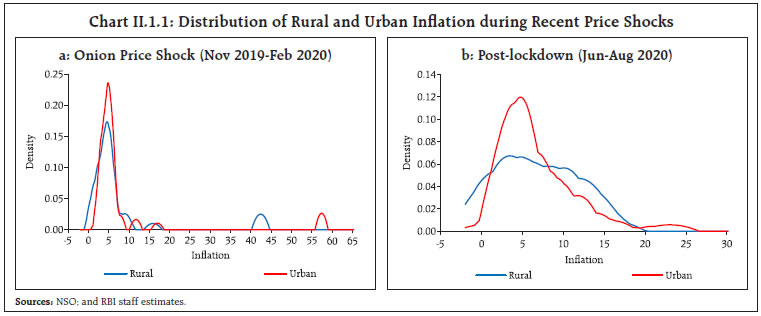

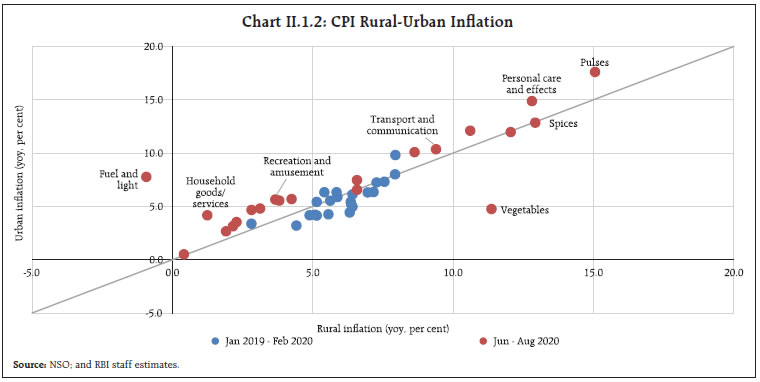

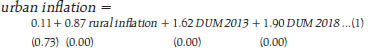

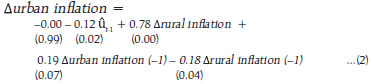

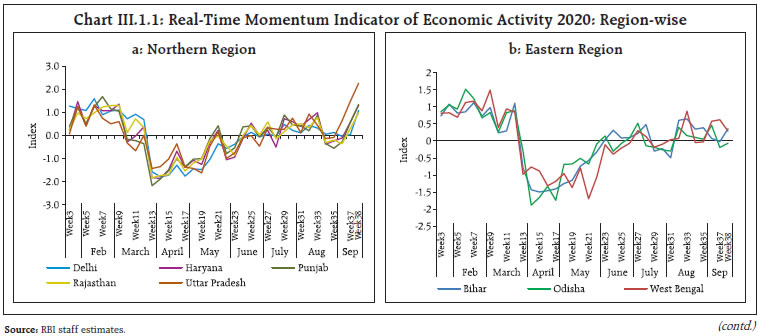

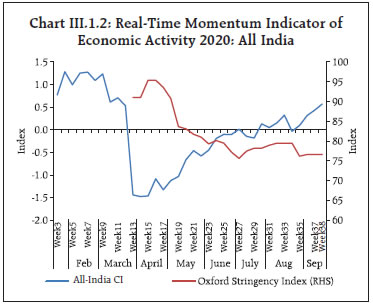

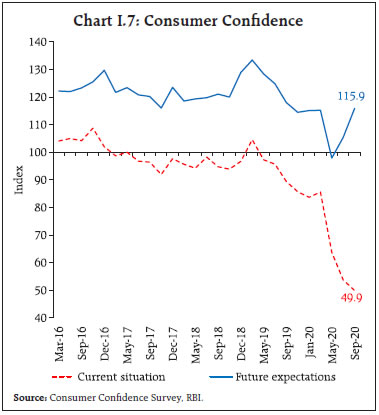

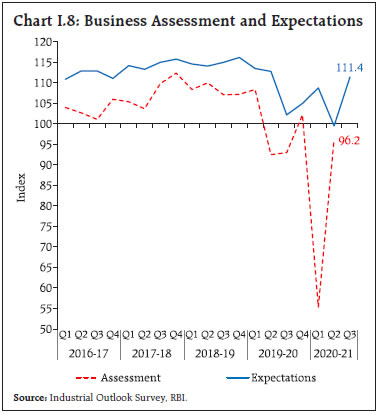

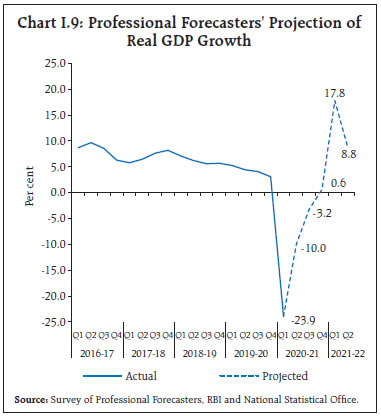

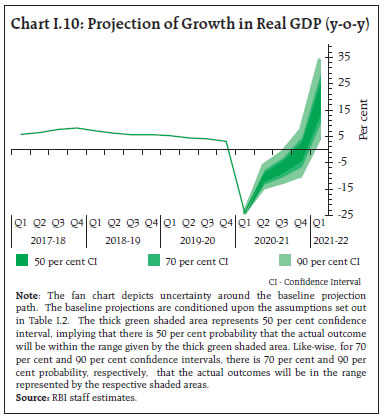

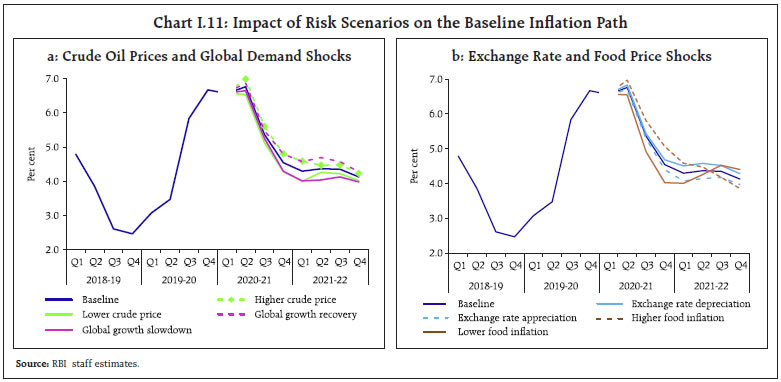

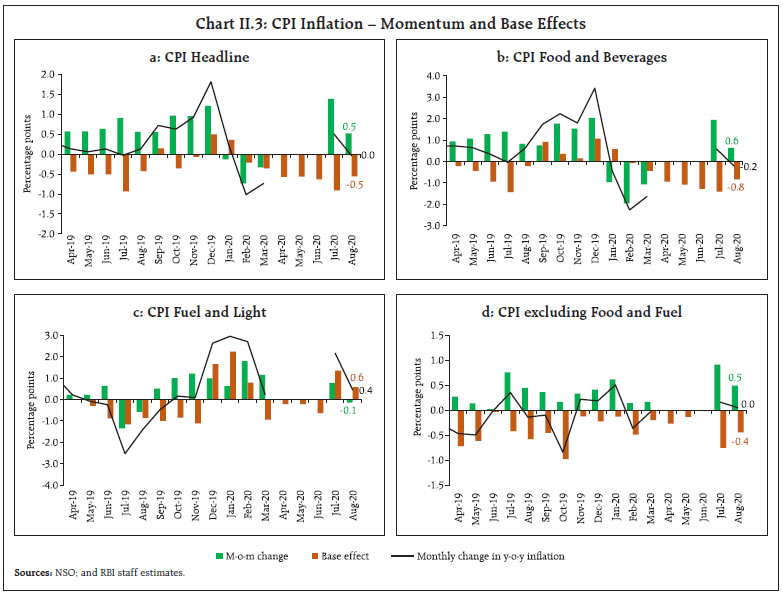

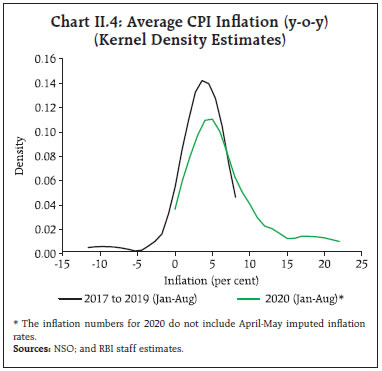

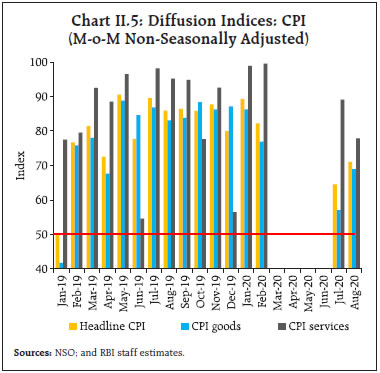

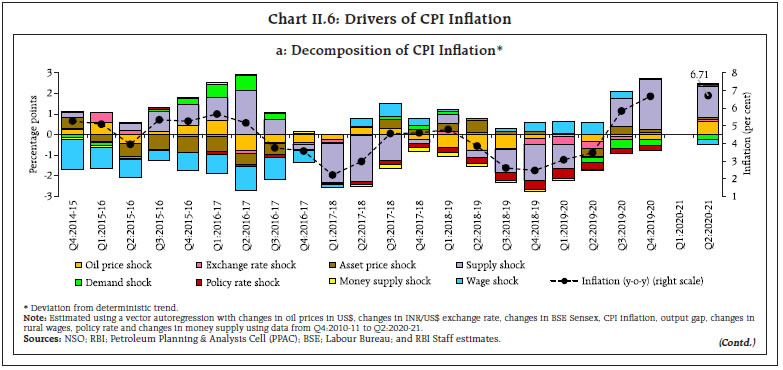

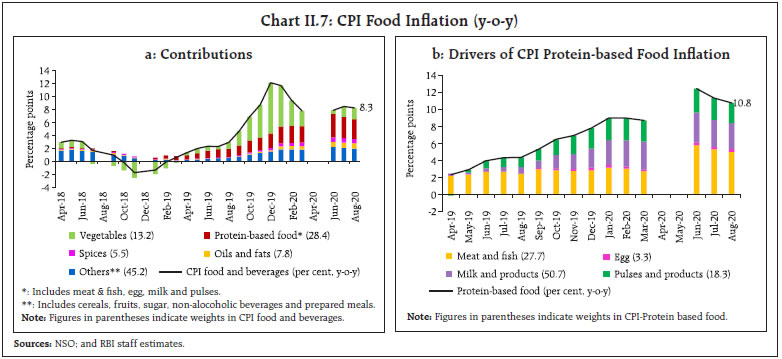

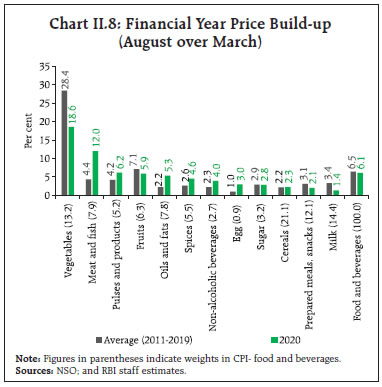

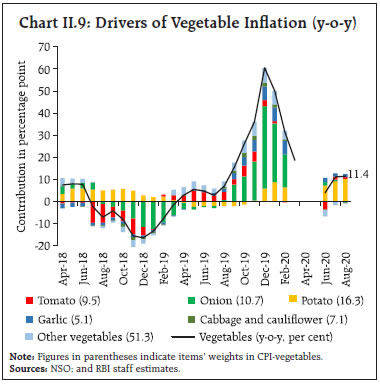

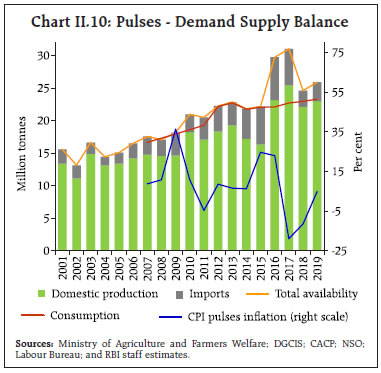

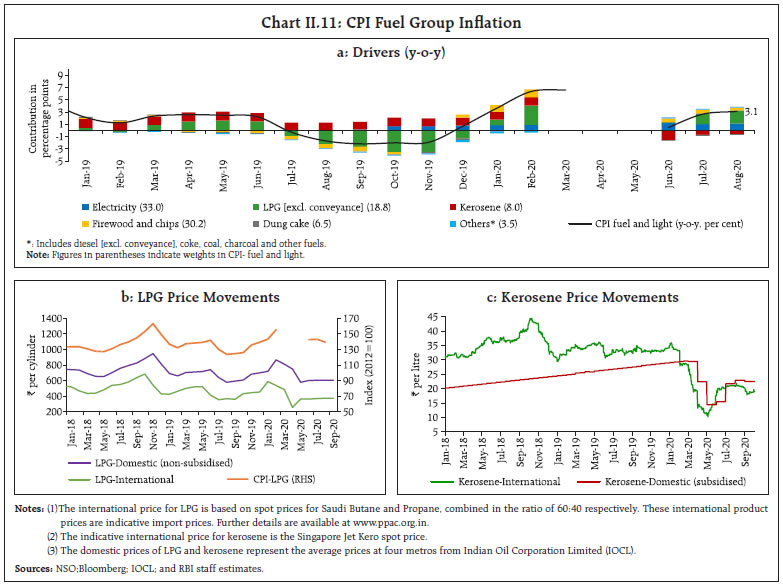

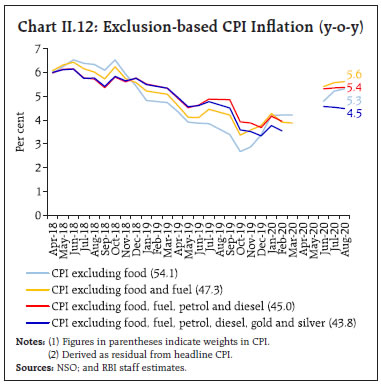

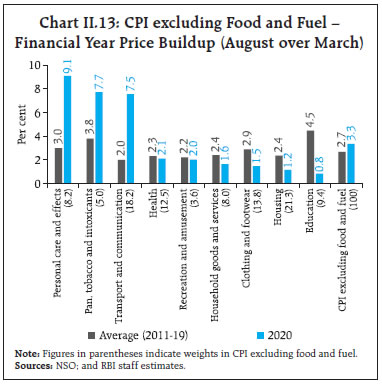

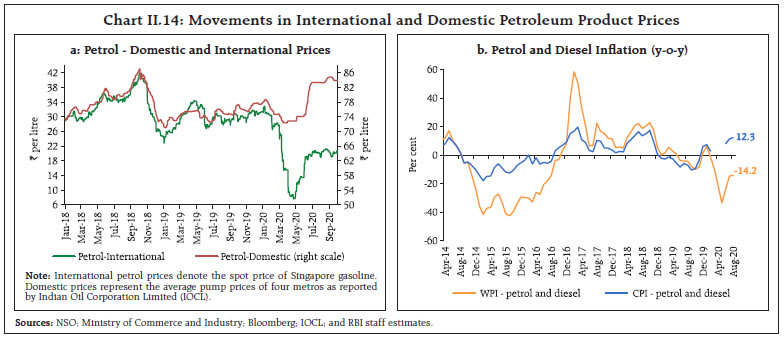

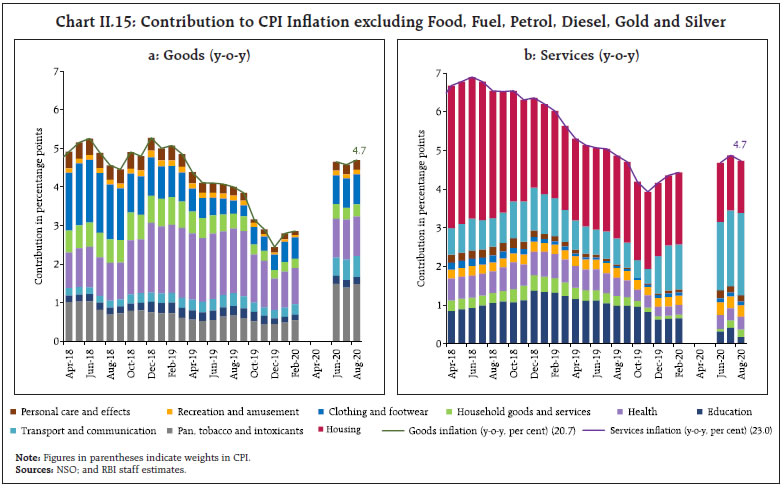

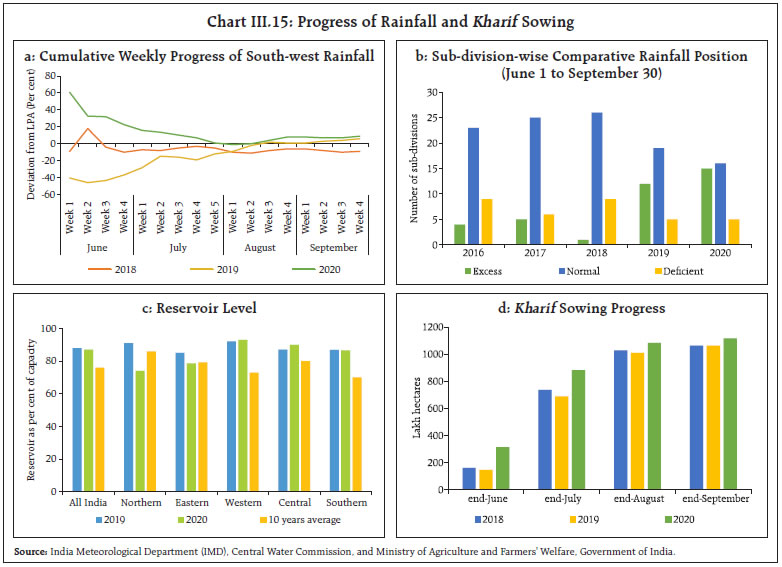

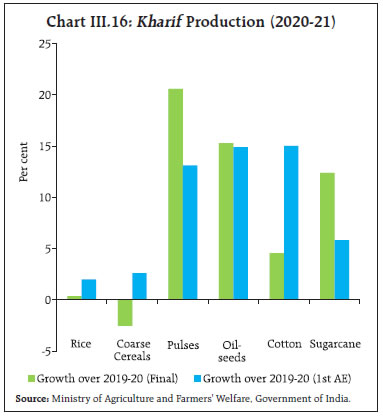

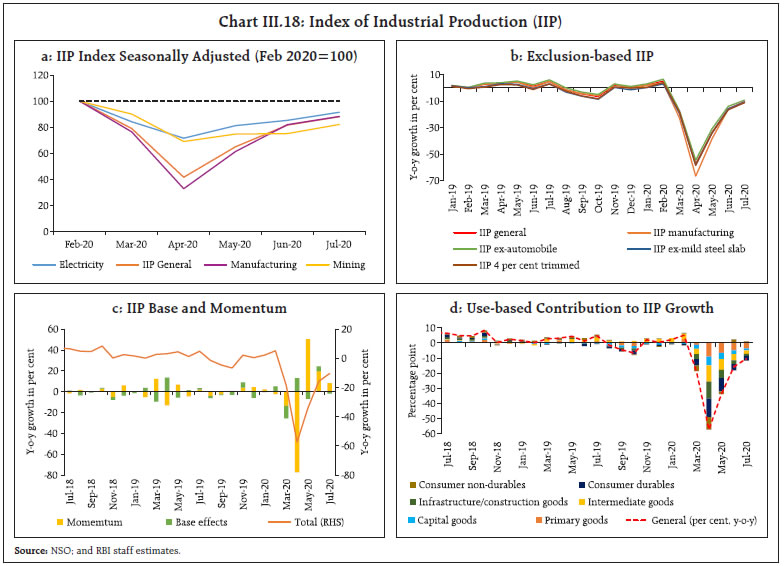

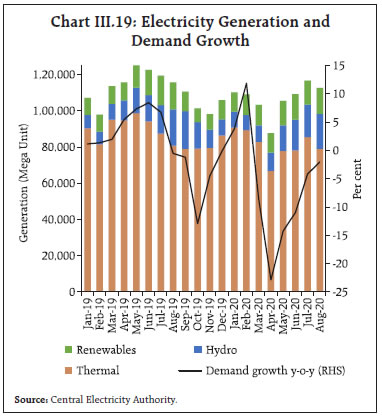

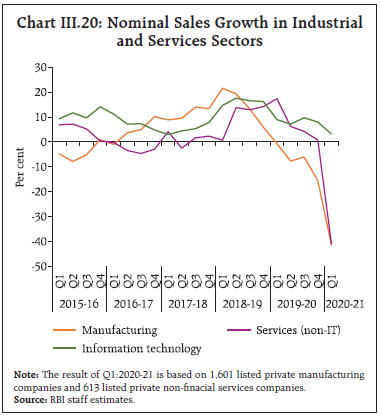

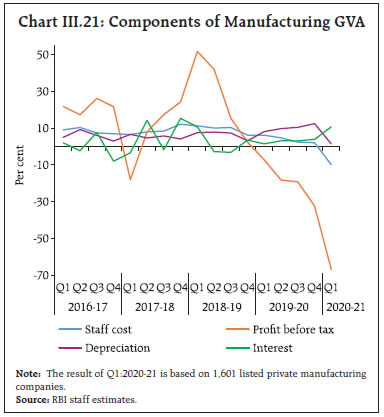

Real GDP declined by an unprecedented 23.9 per cent in Q1:2020-21 and domestic economic activity remains badly hit by the unrelenting pandemic. High frequency indicators, which were looking up in June with the phased unlocking of the economy, levelled off in July amidst re-imposition of local lockdowns due to a surge in fresh cases. In August, some indicators started improving again and strengthened in September. The agricultural sector remains a bright spot, supported by a normal monsoon, robust kharif sowing and adequate reservoir levels. The Pradhan Mantri Garib Kalyan Rojgar Yojana and increased wages under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) are also supporting rural demand. On the other hand, urban demand remains weak. Indicators relating to industry and services present a mixed picture. Turning to the forward-looking surveys, consumer confidence for the year ahead improved in the September 2020 round, driven by improved sentiments on the general economic situation, the employment scenario and income (Chart I.7).5 The current situation index, however, fell to an all-time low in September 2020. Sentiments in the manufacturing sector for the quarter ahead bounced back into the expansion zone in the July-September 2020 round of the Reserve Bank’s industrial outlook survey, reflecting optimism on the overall business situation, production, order books, employment, exports and capacity utilisation (Chart I.8).   Surveys by other agencies indicate a mixed picture on future business expectations (Table I.3). According to the PMI for September 2020, the one year ahead business expectations of firms in the manufacturing sector strengthened on hopes of improvement in demand, while the expectations of firms in the services sector also turned somewhat optimistic after four months of negative or neutral sentiment. Professional forecasters polled in the September 2020 round of the Reserve Bank’s survey expected real GDP growth to remain in negative territory through Q3:2020-21, with a sharp pick up in Q1:2021-22 driven by base effects (Chart I.9 and Table I.4). Overall, the uncertainty about COVID-19’s spread and trajectory continues to fog the outlook and makes forecasts of real GDP growth extremely challenging. The baseline assumes that economic activity will gradually normalise in H2:2020-21, but a wide range of outcomes is possible. Taking into account the baseline assumptions, the survey indicators, and model forecasts, real GDP is projected to contract by 9.5 per cent in 2020-21, with risks tilted to the downside: (-)9.8 per cent in Q2, (-)5.6 per cent in Q3 and 0.5 per cent in Q4 (Chart I.10 and Table I.4). For 2021-22, assuming supply chains are fully restored with the availability of effective vaccines, a normal monsoon, no major exogenous or policy shocks and a large favourable base effect, structural model estimates indicate real GDP growth at 10.1 per cent. In such an environment, the significant monetary accommodation already provided through cuts in the policy repo rate, and ample liquidity infusion through conventional and unconventional measures and fiscal stimulus and other structural reform measures announced by the government would be expected to add to the upside. On the other hand, a more protracted spread of the pandemic, delayed development and availability of vaccines, deviations from the forecast of a normal monsoon in 2021-22 and global financial market volatility are the key downside risks. The recent inflation elevation acquiring a persistent character also poses downside risks to the baseline.   The baseline projections of inflation and growth are conditional on the assumptions relating to the key variables set out in the preceding sections. Uncertainties surrounding these assumptions, especially relating to COVID-19, could lead to large deviations in either direction. This section assesses the balance of risks to the baseline projections in plausible alternative scenarios. (i) Global Growth Uncertainties The global output losses from COVID-19 have turned out to be more severe than anticipated, despite sizeable monetary and fiscal stimuli by many countries. Given the spread of the pandemic and recurrent bouts of resurgence, the recovery is expected to be protracted and there are large downside risks to the baseline assumptions. In such a scenario, the quarterly projection model’s simulations suggest that if global growth slips by 100 bps vis-à-vis the baseline, domestic growth and inflation could be lower by around 40 bps and 20 bps, respectively, from the baseline trajectories. Conversely, an early breakthrough in the development of an effective COVID-19 vaccine and its widespread distribution could boost global trade and demand. In this scenario, assuming global growth surprises by 100 bps on the upside, domestic growth and inflation could edge higher by around 40 bps and 20 bps, respectively (Charts I.11a and I.12a). (ii) International Crude Oil Prices Crude prices rebounded from May 2020 on the back of supply cuts by oil producing countries (OPEC plus) and improved demand prospects due to the gradual easing of lockdown restrictions. Looking ahead, international crude prices may increase more than expected in the event of a quicker containment of COVID-19, a sharper global recovery or an agreement among suppliers on further production cuts. For a net energy importer like India, the dynamics of international crude price movements have significant macroeconomic implications. Assuming crude prices are 10 per cent higher, inflation could increase by 30 bps and growth could be weaker by around 20 bps over the baseline. Conversely, crude prices could soften from the current levels if the agreed production cuts are not adhered to or a second wave of the pandemic further weakens the demand for oil. In this event, if crude prices fall by 10 per cent, inflation could ease by around 30 bps with a boost of 20 bps to growth (Charts I.11a and I.12a).   (iii) Exchange Rate The INR has exhibited two-way movements over the past six months, reflecting global risk-on risk-off sentiments driven by vacillating views on the spread and containment of COVID-19. A renewed surge in COVID-19 infections and safe haven demand could induce capital outflows across EMEs, putting depreciation pressure on the INR. If the INR depreciates by 5 per cent from the baseline, inflation could edge up by around 20 bps and GDP growth could be higher by 15 bps (Charts I.11b and I.12b). On the other hand, if COVID-19 normalises quicker than assumed under the baseline, strong capital inflows could put appreciating pressure on the INR. In such a scenario, if the INR appreciates by 5 per cent, inflation and GDP growth could moderate by around 20 bps and 15 bps, respectively, vis-à-vis the baseline. (iv) Food Inflation Food inflation has remained elevated in recent months driven by price pressures in vegetables, cereals and protein items such as pulses, eggs and meat. The normal south-west monsoon, increased sowing of kharif crops, moderate MSP hikes, and high reservoir storage are expected to soften food inflation going forward. However, a delayed normalisation of supply chains, heavy rains and floods in some states and demand-supply imbalances in key items such as pulses could exert further upward pressure on the headline inflation and keep it higher by around 50 bps (Charts I.11b and I.12b). On the other hand, an accelerated softening of food inflation due to an early restoration of supply chains, ample buffer stocks and efficient food stock management by the Government could bring headline inflation below the baseline by up to 50 bps. At this juncture, global outlook is heavily contingent upon the uncertain trajectory of COVID-19, with significant implications for key variables such as crude oil and commodity prices, global growth, and financial markets. Consequently, the forecasts for domestic inflation and output could change significantly relative to baseline expectations. The behaviour of inflation holds the key to the conduct of monetary policy going forward. The gradual restoration of supply lines, good progress of kharif sowing, sizeable buffer stocks, effective food supply management and a faster progress on the vaccine could pull inflation down from current elevated levels and open up space for addressing the urgent need to repair and revive the economy from the blows it has suffered from the pandemic. Yet, the downside risks from a delayed vaccine, more than expected persistence of supply bottlenecks, volatile international financial markets and high food inflation acquiring a structural character and spilling to non-food items are clear and present dangers that could potentially push inflation above the baseline. By current assessment, real GDP growth can post a modest recovery during H2:2020-21, aided by early containment of COVID-19 and the monetary and fiscal stimuli. Nonetheless, it is prudent to recognise and brace up for the downside risks described earlier. 1 The Reserve Bank’s inflation expectations survey of households is conducted in 18 cities and the results of the September 2020 survey are based on responses from 5,652 households. 2 The results of the July-September 2020 round of the industrial outlook survey are based on responses from 959 companies. 3 33 panellists participated in the September 2020 round of the Reserve Bank’s survey of professional forecasters. 4 Benes, Jaromir, et al. (2016), “Quarterly Projection Model for India: Key Elements and Properties”, RBI Working Paper Series, No. 08/2016. 5 The survey is conducted by the Reserve Bank in 13 major cities and the September 2020 round is based on responses from 5,364 respondents. A broad-based elevation in consumer price index (CPI) inflation between March and July 2020 emanated from tight demand supply balances in protein-based food items, floods damaging the output of vegetables, increase in retail margins due to the pandemic, tax increases in petrol and diesel, safe haven demand for gold and cost-push pressures. At the time of the Monetary Policy Report (MPR) of April 2020, headline inflation1, which was ruling above the upper tolerance level of the inflation target, was projected to decline, with rabi crop arrivals inducing a softening of food inflation. COVID-19 has drastically altered that prognosis. The pandemic and the response in the form of social distancing and the severest lockdown in the world caused a virtual seizure of transactions in non-essential items and threw into complete disarray the price collection system. The National Statistical Office (NSO) suspended the publication of the headline consumer price index (CPI) for April and May. It was not until July 13, 2020 with the lifting of some pandemic-related restrictions and the partial restoration of non-essential activities that the provisional index for June 2020 could be compiled. Even so, prices could be collected from 1030 urban markets and 998 villages that accounted for only 88 per cent of the total sample. As such, the data collected did not meet the adequacy criteria for generating robust estimates of CPI at the state level. Headline indices for April and May were imputed for business continuity purposes. In its resolution of August 6, 2020, the monetary policy committee (MPC) expressed the view that for the purpose of monetary policy formulation and conduct, the imputed prints for April and May can be regarded as a break in the CPI series. In terms of acceptable standards of data collection, it is appropriate to compare the headline inflation reading for July 2020 with that of March 2020. The surge in inflation by 90 basis points between these reference dates was diffused across the board, partly offset by a significant moderation in fuel inflation (Chart II.1).  The Reserve Bank of India (RBI) Act, 1934 (amended in 2016) enjoins the RBI to set out deviations of actual inflation outcomes from projections, if any, and explain the underlying reasons thereof. The April 2020 MPR had projected a moderation in CPI inflation during H1:2020-21 from 6.6 per cent in Q4:2019-20 to 4.8 per cent in Q1:2020-21 and to 4.4 per cent in Q2:2020-21, with the caveat that the uncertainty about the depth, spread and duration of COVID-19 could produce drastic changes in these forecasts. With data for Q1 being regarded as a break in the CPI series as cited above, actual inflation outcomes overshot projections by 2.3 percentage points in Q2 (Chart II.2), largely reflecting the destructive impact of COVID-19. Price spikes became evident in April during the nation-wide lockdown as usurious margins chased panic buying and stocking. Although there was some ebbing in May, these price pressures resurfaced in June and persisted in July-August due to a variety of shocks: an increase in the prices of vegetables due to floods in eastern India; elevated edible oils prices on the back of higher international prices; pressures on meat and fish prices once the initial apprehension of their link with COVID-19 infections was allayed; and supply bottlenecks in the availability of cereals and pulses. From February 2020, international gold prices increased to historic highs on safe haven demand, pushing up prices of personal care and effects by around 10 per cent. International crude oil prices jumped from US $35 per barrel assumed in the April MPR to US $44 per barrel by end-August. Domestic petrol and diesel pump prices rose more than proportionately in view of the sharp increase in excise duties on petrol and diesel by ₹10 per litre and ₹13 per litre, respectively, and state VAT by up to ₹7 per litre in the post-lockdown period. Inflation excluding food, fuel, petrol, diesel and gold from the CPI edged up as costs associated with disruption of supply chains, labour shortages and transportation fed into a host of goods and services. Overall, the supply shocks caused by COVID-19 overwhelmed the collapse in demand.  A decomposition of changes in year-on-year (y-o-y) inflation2 indicates that the sharp increase in headline inflation between March and July was the result of a substantial and broad-based jump in price momentum. By August, the price momentum moderated across food and core groups, and declined in respect of the fuel group; however, favourable base effects across food and core also diminished in August, resulting in headline inflation remaining broadly unchanged at 6.7 per cent during July and August (Chart II.3).  The distribution of CPI inflation over January-August 20203 reveals that the median inflation rate shifted up to 4.6 per cent from around 4 per cent in recent years, indicating a broad-based increase in price pressures (Chart II.4). The diffusion indices of price changes in CPI items4 on a non-seasonally adjusted basis5 also attest to this cross-sectional spread of price increases in the post-lockdown period (Chart II.5). A historical decomposition in a vector autoregression (VAR) framework can help to disentangle the relative role of various factors driving the inflation process. This empirical analysis indicates the predominant role of unfavourable supply side shocks in keeping inflation at elevated levels in recent quarters. Food supply and crude oil price shocks together contributed around 80 per cent of the deviation in inflation from target in Q2:2020-21 (Chart II.6a). Muted demand conditions contributed negatively to the inflation deviation by around 10 per cent in Q2 but were dwarfed by the supply-side shocks. The sizeable repo rate cuts, expansion in money supply and the firming up of equity prices – representing asset prices – together contributed around 10 per cent to the inflation deviation in Q2.6     The contribution of perishable goods (non-durable goods with a 7-day recall7) in overall inflation, during June-August 2020, remained elevated at 46.8 per cent due to supply disruptions. Semi-perishable goods (non-durable goods with a 30-day recall) and durable goods contributed to headline inflation to the extent of 35.7 per cent. During June-August 2020, the contribution of services to headline inflation also edged up to 17.5 per cent compared to February 2020 (15.1 per cent), indicating generalised cost-push pressures (Chart II.6b). Contributions to headline inflation from imported components8 turned positive and amounted to 0.2 percentage points in August 2020 (Chart II.6c). Food Group Food inflation, which was at 7.8 per cent in March, increased to 8.4 per cent by July-August, reflecting primarily the impact of adverse supply shocks. Protein-based food items, especially meat products and pulses, emerged as the key driver and their contribution to overall food inflation also remained elevated (Chart II.7a). Elevated inflation pressures in milk prices also contributed to the surge (Chart II.7b). Inflation in prices of oils and fats and spices was in double digits in H1:2020-21 creating another pressure point. Taken together, the price build-up was close to historical average (Chart II.8). In the case of cereals (weight of 9.7 per cent in the CPI and 21.1 per cent in the food and beverages group), the conundrum of co-existing supply gluts and price pressures complicated inflation dynamics. Cereals inflation remained elevated despite massive buffer stockpiling after the nation-wide lockdown on account of higher procurement. With the easing of lockdown conditions, cereals prices moderated in July-August 2020. Inflation in prices of vegetables (weight of 6.0 per cent in the CPI and 13.2 per cent in the food and beverages group) exhibited high volatility (Chart II.9). Potato price inflation remained elevated at 79.5 per cent in August 2020, contributing 10.6 per cent to headline inflation. Unseasonal rain in Uttar Pradesh in March 2020 and cyclone-related damage to the crop in West Bengal in May 2020, the two major potato producing states, resulted in considerable supply disruptions. Price pressure in potatoes were further exacerbated by labour shortages at mandis, lower stock availability in cold storage and higher exports during 2019-20.  Inflation in onion prices surged from September 2019 onwards and reached a peak of 327.4 per cent in December 2019, contributing 4.8 percentage points to food inflation and 2.1 percentage points to headline inflation. These spikes generally occur in the lean months of July-September during which the entire domestic supply is met through onions procured in the rabi season. With the arrival of the late kharif crop and a large rabi crop, onion prices went into deflation of (-) 4.0 per cent in August 2020. Prices of tomatoes picked up during June-July 2020 due to lower supplies coming from damage to crops in some regions from pre-monsoon rains. Anecdotal evidence suggests that farmers in some states/areas planted less area with tomatoes than a year ago due to the collapse of prices in major centres in May 2020, which might have also contributed to the spike in prices in July. Tomato prices eased slightly in August 2020, with fresh supplies coming into the market.   Inflation in prices of fruits (weight of 2.9 per cent in the CPI and 6.3 per cent within the food and beverages group) declined from a peak of 5.8 per cent in January 2020 to 0.1 per cent in July 2020 but picked up to 1.0 per cent in August 2020 due to higher demand for dry fruits during the pandemic. Within protein-based food items (weight of 13.0 per cent in the CPI and 28.4 per cent in the food and beverages group), inflation in prices of pulses (weight of 2.4 per cent in the CPI and 5.2 per cent in the food and beverages group) exhibits a cobweb phenomenon – lower production and higher prices in a deficit season spur increased acreage in the following season, leading to excess supply and consequent fall in prices. In the short-run, demand-supply mismatches are met mainly through imports, the transit time varying and imposing volatility (Chart II.10). The decline in kharif pulses production (by 4.6 per cent in the 4th advance estimates for 2019-20 over 2018-19 final estimates) and especially, urad production (by 44.9 per cent) led to persistent price pressures, which were accentuated by lockdown-related supply uncertainties and stockpiling by consumers during April-May 2020. With the easing of the lockdown and improved kharif sowing, pulses inflation eased to 14.4 per cent in August.  Inflation in prices of meat and fish (weight of 3.6 per cent in the CPI and 7.9 per cent within the food and beverages group) increased from 9.2 per cent in March to 18.9 per cent in June 2020 before moderating to 16.5 per cent in August 2020. Prices of chicken and eggs eased during February-March 2020 due to a fall in consumption demand on pandemic fears, with poultry farmers culling to avoid feeding costs. With demand recovering from May, inflation in prices of chicken rose to 25.4 per cent in June 2020 while inflation in prices of eggs increased to 10.1 per cent in August 2020. With the onset of the rainy season, prices of mutton, fish and chicken eased as per the usual seasonal pattern in July-August 2020. Milk and products price inflation (weight of 6.6 per cent in the CPI and 14.4 per cent in the food and beverages group), which were impacted by price hikes by major co-operatives last year (in May 2019 and December 2019), remained elevated at 6.2 per cent in August due to supply disruptions. Higher global prices of skimmed milk products also impacted domestic prices. Inflation in prices of sugar and confectionery (weight of 1.4 per cent in the CPI and 3.0 per cent in the food and beverages group) moderated from 3.9 per cent in March to 2.9 per cent in June due to the decline in demand from bulk segments (hotels and restaurants). In July 2020, Andhra Pradesh increased the PDS sugar prices from ₹20 per kg to ₹34 per kg imparting pressures to both PDS and non-PDS sugar prices. Inflation in prices of oils and fats (weight of 3.6 per cent in the CPI and 7.8 per cent in the food and beverages group) increased in January 2020 and remained elevated, reaching 12.4 per cent in August 2020. The rise in global prices of this highly import dependent item was the major reason for the firming up of domestic prices. Domestically, lower production of rapeseed, mustard and soybeans (as per the 4th advance estimates for 2019-20) added to the price pressures. Fuel Group Inflation in fuel prices moderated from 6.4 per cent in February 2020 to 0.5 per cent in June due to a steep fall in domestic LPG and kerosene prices in tandem with the collapse in international benchmark product prices (Chart II.11a). Subsidised domestic kerosene prices firmed up till March and the domestic kerosene price was higher than international prices for the first time. Accordingly, oil marketing companies (OMCs) stopped the calibrated increase in administered kerosene prices from April and linked them to international prices movements with price revisions at the start of every month. As a result, domestic kerosene prices fell sharply during April-May, tracking international prices. By July 2020, international prices reversed, and domestic LPG and kerosene prices edged up (Chart II.11b and Chart II.11c). Prices of items of rural fuel consumption registered some moderation in the post-lockdown period, but the contribution of electricity prices to overall fuel inflation increased (Chart II.11a). CPI excluding Food and Fuel CPI inflation excluding food and fuel (core inflation) rose from 3.9 per cent in February-March 2020 to 5.6 per cent in July-August (Chart II.12). This price build-up was much higher than the historical average (Chart II.13).   International crude oil prices plummeted after the imposition of lockdowns globally, pulling down the price of Indian basket of crude oil to around US$ 16 per barrel on April 21, 2020. Thereafter, the Indian basket crude oil price increased to US$ 44 per barrel by end-August 2020. With the incidence of higher taxes, domestic petrol pump prices9 increased from ₹72.4 per litre at end-March to ₹84.8 per litre by end-August (Chart II.14a). On May 6, 2020, the central government raised the excise duty on petrol and diesel again10 by ₹10 per litre and ₹13 per litre, respectively. There was, however, no commensurate increase in the pump prices, as it was absorbed into the large mark-up over international prices.11 Faced with large revenue shortfalls, various states also increased value added taxes (VATs) since early April12. Coupled with the increase in international prices, this pushed up domestic pump prices sharply during June. CPI petrol inflation jumped from 3.2 per cent in February to 12.1 per cent in August 2020. On the other hand, inflation in respect of wholesale prices of petrol and diesel, which captures prices net of any tax impact, moved from (-) 1.5 per cent in February to (-) 33.4 per cent in May and to (-) 14.2 per cent in August, broadly mirroring international price movements (Chart II.14b).   Even abstracting from the effects of prices of petroleum products, CPI inflation excluding food, fuel, petrol and diesel increased from 4.0 per cent in February to 5.4 per cent in July-August 2020. A major contributor was the increase in gold prices to historic highs by August 2020. CPI inflation excluding food, fuel, petrol, diesel, gold and silver also increased from 3.6 per cent in February 2020 to 4.5 per cent in July-August 2020, indicating broad-based cost-push pressures in the post-lockdown period that were more acute in urban areas than in rural areas (Box II.1). Inflation in the prices of goods component of CPI excluding food, fuel, petrol, diesel, gold and silver (with a weight of 20.7 per cent in CPI) rose from 2.9 per cent in February 2020 to 4.7 per cent in August 2020 due to pan, tobacco and intoxicants, transport and communications goods, clothing and footwear and household goods (Chart II.15a).

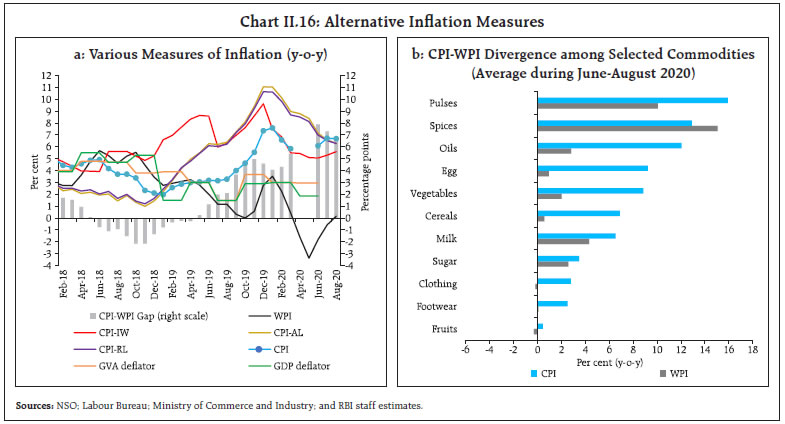

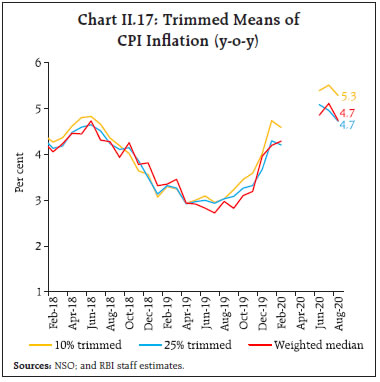

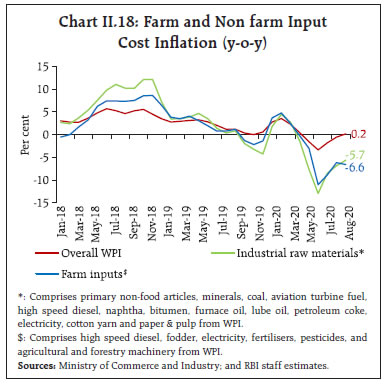

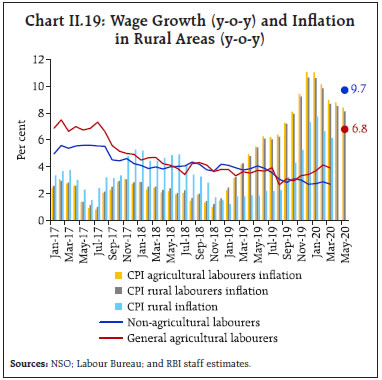

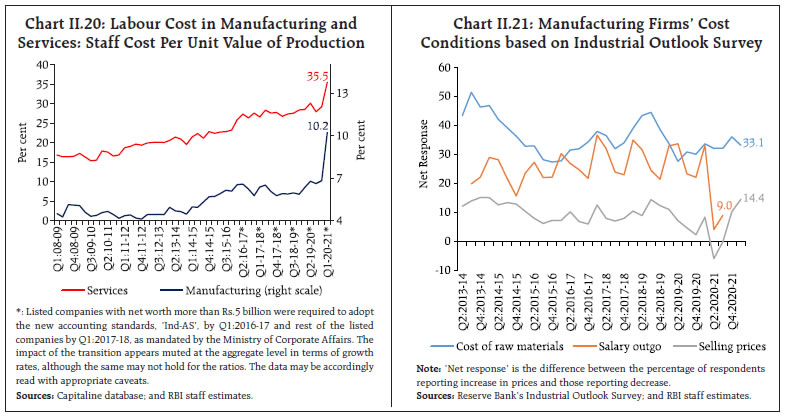

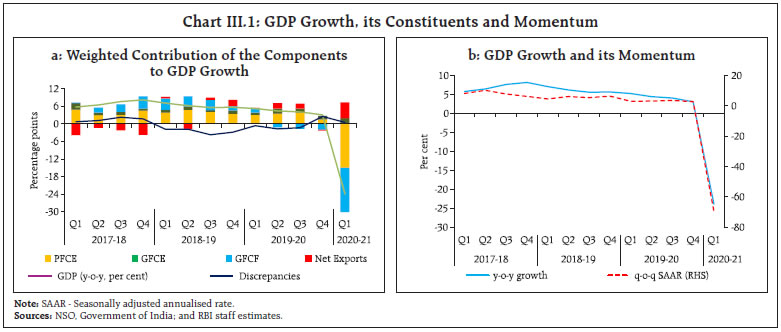

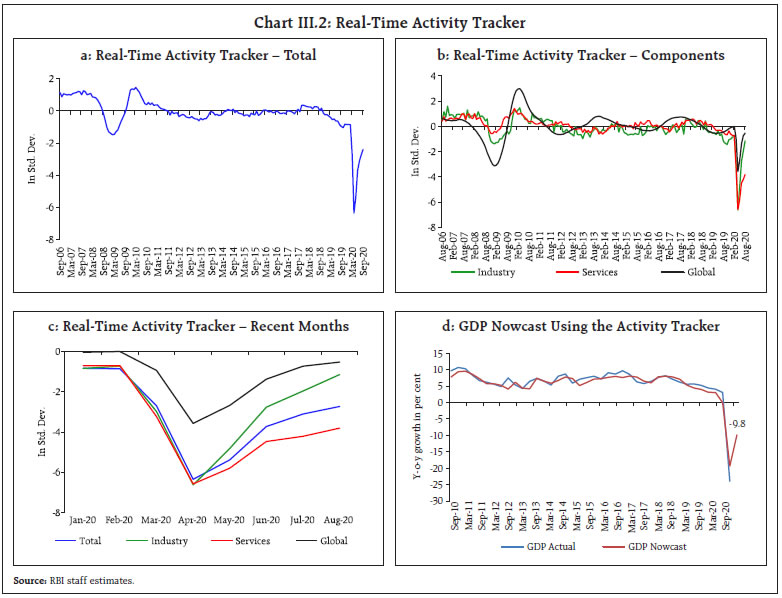

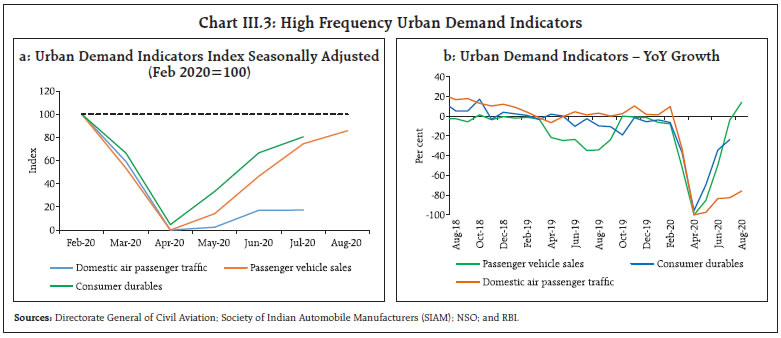

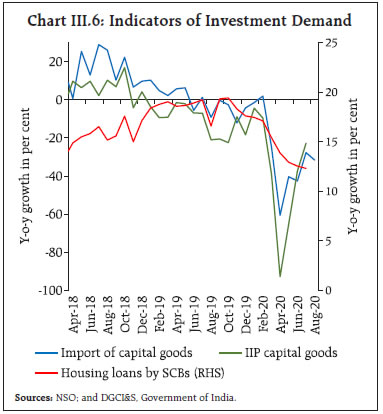

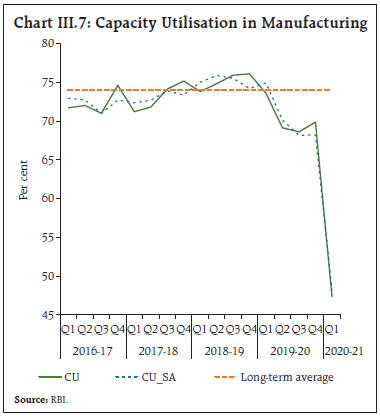

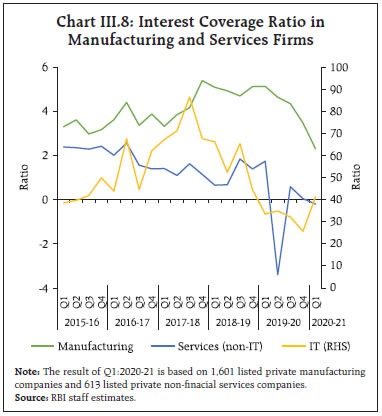

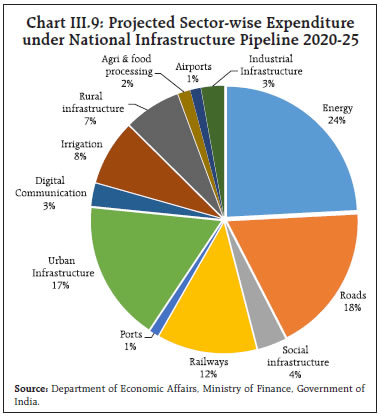

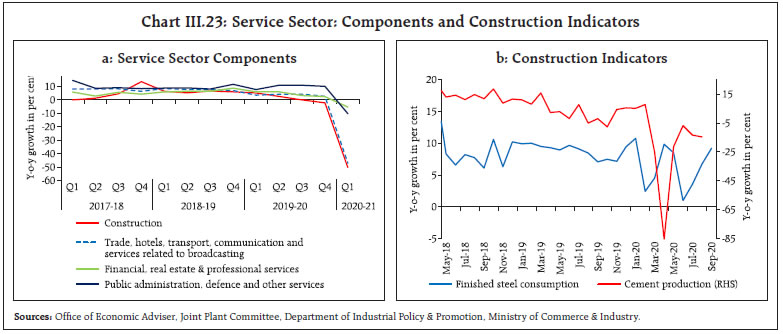

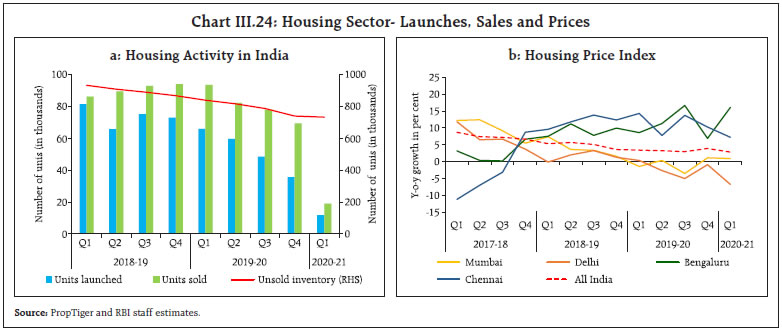

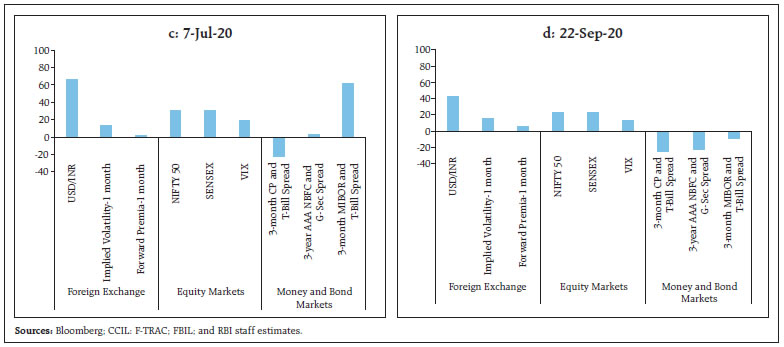

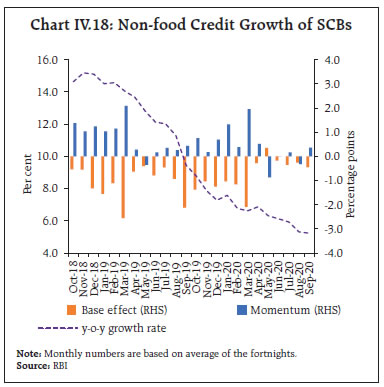

Core services inflation (with a weight of 23.0 per cent in CPI) rose from 4.4 per cent in February 2020 to 4.7 per cent in August 2020, led by prices of transportation and communications services as well as those of household services, the latter due to an increase in price of services provided by domestic servants, cooks and sweepers (Chart II.15b). Other Measures of Inflation Inflation measured by sectoral CPIs for agricultural labourers (CPI-AL) and rural labourers (CPI-RL) after hovering above the headline CPI inflation during 2019-20, with a sharp fall in food and fuel components, fell below CPI-Combined inflation during July and August 2020. Inflation in terms of CPI for industrial workers (CPI-IW) also fell below headline CPI inflation in March 2020 with a steep decline in food inflation. Thereafter, a further moderation in inflation in the food group, coupled with disinflation in the clothing group, kept CPI-IW inflation below headline CPI (Chart II.16a).   Inflation in terms of the wholesale price index (WPI) was on a different trail altogether. It sank into deflation in April, which persisted through till July, with non-food manufactured products in deflation for over a year. Fuel inflation moved into negative territory in March 2020 as a result of the large contraction in mineral oil inflation during March that persisted till August 2020. In August, WPI inflation turned marginally positive (0.2 per cent) due to a sharp uptick in inflation in non-food manufactured products. WPI food inflation remained above 4 per cent but exhibited lower inflationary pressures than in CPI across major sub-groups (Charts II.16b). The WPI measures basic prices less trade discounts, thereby leaving out indirect taxes by definition while retail prices are inclusive of taxes. Gross domestic product (GDP) and gross value added (GVA) deflators sank in Q1:2020-21 in line with the WPI. Trimmed means of inflation provide a measure of underlying inflation dynamics and are computed by statistically eliminating large positive and negative changes. Exclusion based measures of CPI also capture persistent trends in inflation by removing volatile components. Both trimmed means and exclusion-based measures have moved up – barring a slight reversal in August – suggesting generalised inflationary pressures (Charts II.12 and II.17).  The wholesale cost of farm inputs and industrial raw materials entered into deflationary territory in March and dipped to a 55-month low in May 2020, mirroring soft global oil and other commodity prices, and subdued demand (Chart II.18). There was a moderation in coal inflation, given low demand from end-user industries for steel and power, and contraction in international coal prices. Among other non-food items, deflation in prices of fibres intensified during April-August 2020 on account of subdued exports and domestic demand. Amongst farm sector inputs, inflation in the case of fodder prices moderated during June-August 2020, owing to the early onset and good distribution of monsoon. In the case of fertilisers and pesticides, inflation remained muted, reflecting deflation in international prices of phosphate, di-ammonium phosphate (DAP), triple superphosphate (TSP) and urea. Electricity prices have eased since April in view of weak demand conditions. Inflation in agricultural machinery and implements eased to 1.2 per cent during April-August 2020 due to subdued momentum in prices of tractors and agriculture implements.   Growth in nominal rural wages, both for agricultural and non-agricultural labourers, showed a sharp uptick in May 202013 (Chart II.19). Growth in staff costs in the organised sector decreased for listed firms in the manufacturing and services sectors during Q1:2020-21 over layoffs and salary cuts. However, unit labour costs (measured as a ratio of staff cost to value of production) increased during Q1:2020-21 due to contraction in the value of production14. Unit labour cost rose from 6.8 per cent in Q4:2019-20 to 10.2 per cent in Q1:2020-21 for firms in the manufacturing sector15 and from 29.2 per cent to 35.5 per cent for firms in the services sector16 (Chart II.20). Manufacturing firms polled in the Reserve Bank’s industrial outlook survey reported higher input cost pressures during Q2:2020-21 owing to supply shortages and transport delays (Chart II.21). Salary outgoes, which fell in Q1 as firms reported contraction in the level of employment, rose in Q2 and are expected to increase further in Q3. The cost of finance remained subdued. Reflecting cost pressures, selling prices edged up in Q2 and are expected to firm up further in Q4 and Q1:2021-22. Households’ inflation expectations, as polled in the September 2020 round of the Reserve Bank’s survey, remained elevated but eased modestly over the three-months ahead horizon.  Manufacturing as well as services firms polled for the purchasing managers’ index (PMI) reported sharp declines in both input cost and selling prices during Q1:2020-21. In August-September 2020, input prices for the manufacturing firms registered an uptick as raw material costs, particularly for iron and steel, rose. Output prices, however, remained tepid and broadly stabilised in September after declining for five months in a row. For services firms, higher fuel and food prices pushed up input costs during Q2:2020-21, leading to a soft uptick in selling prices in August-September. Inflationary pressures have firmed up in H1 on supply shocks and cost push pressures brought about by COVID-19. In this situation, proactive supply side management holds the key to containment of price pressures within broader supply side reforms. Timely and adequate release of cereal stocks including sales, meeting shortfalls in the availability of pulses through imports, rationalisation of the import duty structure for pulses and for edible oils for which around two-thirds of domestic demand is met by imports, steps to fully restore supply chains for poultry, goat and sheep, and adequate procurement and buffer stocks for stabilisation of vegetables prices, particularly key vegetables like onions and potatoes are the main elements of this approach. Furthermore, the high level of taxes on petroleum products needs to be revisited to ameliorate cost push pressures as the economy recovers. Effective supply side interventions and the presence of large favourable base effects are expected to bring about a moderation in inflation in H2:2020-21 but the uncertainties surrounding the COVID-19 trajectory pose substantial risks to the outlook. In absence of sufficient supply-side responses, the risk of cost push pressures translating to a generalised increase in inflation and its persistence is a serious threat to the evolving macroeconomic outlook. 1 Headline inflation is measured by year-on-year changes in all India CPI Combined (Rural and Urban). 2 A change in CPI year-on-year (y-o-y) inflation between any two months is the difference between the current month-on-month (m-o-m) change in the price index (momentum) and the m-o-m change in the price index 12 months earlier (base effect). For more details see Box I.1 of the MPR, September 2014. 3 Excluding April-May 2020 imputed inflation data. 4 The CPI diffusion index, a measure of dispersion of price changes, categorises items in the CPI basket according to whether their prices have risen, remained stagnant or fallen over the previous month. A reading above 50 for the diffusion index signals a broad expansion or generalisation of price increases and a reading below 50 signals broad-based price decline. 5 The non-availability of CPI item level data for the period March-May 2020 hindered seasonal adjustments in the item level series for the recent period. 6 Historical decomposition is used to estimate the individual impact of shocks on movements in inflation over a sample period, based on a vector auto regression (VAR). The VAR can be written in reduced form as: Yt =c + A Yt-1 + et; where et represents a vector of shocks [oil price shock; exchange rate shock; asset price shock; supply shock (inflation shock); demand shock; wage shock; policy rate shock; and money supply shock]. Using Wold decomposition, Yt can be represented as a function of its deterministic trend and sum of all the shocks et. This formulation facilitates decomposition of the deviation of inflation from its deterministic trend into the sum of contributions from various shocks. The supply shocks represent the unexplained component of the CPI inflation. 7 The CPI weighting diagrams use the modified mixed reference period (MMRP) data based on the 2011-12 Consumer Expenditure Survey conducted by the National Sample Survey Office (NSSO). Under MMRP, data are collected on expenditure incurred for frequently purchased items – edible oil, eggs, fish, meat, vegetables, fruits, spices, beverages, processed foods, pan, tobacco and intoxicants – during the last seven days; for clothing, bedding, footwear, education, medical (institutional), durable goods, during the last 365 days; and for all other food, fuel and light, miscellaneous goods and services including non-institutional medical services, rents and taxes, data relate to the last 30 days. 8 Petrol; diesel; liquefied petroleum gas (LPG); kerosene; electronic goods; gold; silver; chemical and chemical products; metal and metal products; and vegetables oils. 9 Proxied by the average pump prices for petrol in the 4 major metros. 10 Excise duty on petrol and diesel was earlier increased by ₹ 3 per litre each on March 14, 2020. 11 Petrol and diesel pump prices were largely unchanged during the lockdown period by the OMCs. 12 During April-May 2020, VAT on petrol was increased in a range of ₹1 per litre to ₹3.25 per litre while that on diesel was increased in a range of ₹1 per litre to ₹7.10 per litre in the four metropolitan cities (Chennai, Delhi, Mumbai and Kolkata). On July 31, 2020, Delhi reduced the VAT on diesel, effectively reducing its prices by ₹8.4 per litre. 13 Data for April 2020 could not be collected by the Labour Bureau due to the lockdown. Data collection remained constrained for May 2020 as well. 14 The results hold for the common set of companies also: unit labour cost for common 1521 manufacturing firms increased from 6.9 per cent in Q4:2019-20 to 10.2 per cent in Q1:2020-21 and for common 543 services firms increased from 31.0 per cent to 38.0 per cent. 15 Provisional estimate based on 1601 manufacturing firms 16 Provisional estimate based on 613 services firms. After an unprecedented decline in fixed investment, private consumption and exports in Q1:2020-21, aggregate demand recorded sequential improvement in Q2 on the back of robust rural demand and some uptick in urban consumption. On the supply side, the steep decline in manufacturing and plummeting construction activity in Q1 was followed by a gradual easing of contraction in Q2. In the period following the release of the April 2020 MPR, economic activity plunged into a contraction in Q1:2020-21 that is unparalleled in India’s history. The combined impact of demand compression and supply disruptions has produced an unprecedented decline in fixed investment, private consumption and exports. Government expenditure, including in the form of counter-pandemic measures, has cushioned the deterioration. Without it, the downturn would have been even deeper. On the supply side, the stringent nation-wide lockdown, social distancing norms and the mass exodus of migrant workers led to a steep decline in manufacturing and plummeting construction activity. Trade and transportation went down to a fraction of their pre-COVID-19 levels. Credit conditions also remained muted. The only silver lining was the resilience of agriculture and allied activities on the back of record production of rabi and horticulture crops in 2019-20. The bountiful and widespread southwest monsoon in the 2020 season and higher kharif sowing have brightened the outlook for rural consumption. With the gradual unlocking of the economy from May/June 2020, signs of stabilisation appeared but the resurgence of infections especially in the interior part of the country levelled them off in July. High frequency indicators exhibited signs of some recovery again in August, which strengthened in September 2020. The August 2020 data release of the National Statistical Office (NSO) revealed that aggregate demand measured in terms of year-on-year changes in real gross domestic product (GDP) underwent a contraction of 23.9 per cent in Q1:2020-21, taking GDP to its lowest in the history of the quarterly series (Table III.1 and Chart III.1a). As reflected in quarter-on-quarter (q-o-q) seasonally adjusted annualised rates (SAAR) of GDP, this was essentially a cliff effect embodied in a sudden and steep drop in momentum in that quarter (Chart III.1b). Moreover, excluding the support from government expenditure, real GDP would have slumped by 29.3 per cent.  In Q2, aggregate demand recorded sequential improvement on the back of robust rural demand and some uptick in urban consumption. Indicators of rural demand, viz., tractor sales, fertilisers production and non-durable consumer goods, have exhibited resilience. Amongst indicators of urban demand, passenger vehicles sales emerged out of contraction in August. The contraction in production of consumer durables is still high. We can not say that a revival has taken place, while domestic air passenger traffic trailed below pre-COVID levels. In Q2, investment remained subdued, as reflected in coincident indicators – steel consumption; cement production; and production and imports of capital goods. The record issuance of corporate bonds in H1:2020, however, suggests financing conditions remain congenial for enabling traction in investment appetite. Although government expenditure tapered off in August after robust growth in July, it strengthened in later part of September with additional support from supplementary demands of ₹1.67 lakh crore by the central government. Nowcasting – the prediction of the present or the very near future of the state of the economy – has become popular among central banks in the face of long lags and frequent revisions in official measures of economic activity. Historically, nowcasting techniques have been based on simplified heuristic approaches, but more recently, they rely on statistical approaches to produce predictions that eliminate the need for informal judgement. Nowcast models can exploit information from a large quantity of data series at different frequencies and with different publication lags to extract signals from noise on economic activity1. Methods based on social media content have also been developed to estimate hidden sentiment analysis on the 'mood' of a population. Regression-based approaches, mixed data sampling, Bayesian approaches and dynamic factor models are now being employed to improve the forecasting power of nowcasting models. In this context, a dynamic factor model using 27 monthly indicators grouped2 under industry, services, global and miscellaneous activities reveals that an index of economic activity (IEA) plunged to -6.3 in April and moderated to -2.4 in September 2020 after a sharp rebound in May and June with the reopening of the economy (Chart III.2a). Sub-indices for industry, services, global and miscellaneous activities show that the decline in industrial and services activity was synchronous and of equal magnitude in the wake of the lockdown. The recovery has been more rapid for industry, however, and slower for services, pointing to a two-speed recovery (Chart III.2b and c). Contact-intensive service sectors (retail trade; transport; hotels; restaurants; recreation) remain sluggish in the face of continuing health risks. In contrast, the global activity sub-index seems to have posted a stronger recovery, albeit with some tapering in July and August. GDP growth nowcast for Q2:2020-21 is obtained at -9.8 per cent on a year-on-year basis (Chart III.2d).3  Nowcasting exercises offer rich scope of refinement to enhance predictive efficiency by augmenting existing models with spatial and real-time indicators on a daily basis that are becoming available, including through the application of machine learning tools, web scraping and artificial intelligence (Box III.1).