Chapter III

Operations

and Performance of Commercial Banks Introduction

3.1 The business and financial performance of scheduled commercial banks

(SCBs)1 during 2007-08 continued to be shaped by the strong macroeconomic performance

during the year. In line with the policy initiatives undertaken by the Reserve

Bank, the growth in credit by SCBs exhibited some moderation during the year.

The moderation in credit was observed across all the sectors, barring services.

On the liability side, deposit growth continued to be strong, albeit

it was marginally lower than that in the previous year mainly on account of deceleration

in term deposits. Banks' investments in government and other securities recorded

a higher growth during 2007-08, partly on account of a large issuance of MSS securities

during the year. However, as percentage of net demand and time liabilities (NDTL),

investment by banks in Government and other approved securities remained more

or less at the previous year's level. Overall, the credit-deposit ratio of banks

declined during the year as a result of continued strong growth in deposits combined

with moderation in credit.

3.2 Net interest margins of banks continued

to decline during the year, reflecting the increase in competitive pressures.

However, sharp increase in non-interest income and subdued growth in operating

costs resulted in sharp increase in net profits of SCBs during the year. Consequently,

return on assets showed a marginal improvement in 2007-08. Despite increase in

gross non-performing assets (NPAs) in absolute terms during the year, asset quality

(gross NPAs as percentage of gross loans and advances) of banks in general and

of public sector banks in particular continued to improve. The capital to risk-weighted

assets ratio of the banking sector also showed marked improvement during the year,

both on account of large capital raised by banks from the capital market during

2007-08 and increase in reserves.

3.3 Against this backdrop, this

chapter profiles the operations and financial performance of SCBs at the aggregate

as well as bank group levels. The chapter is organised into eleven sections. Section

2 analyses the balance sheet operations of SCBs on an aggregate basis, while Section

3 delineates their off-balance sheet operations. Financial performance of SCBs

is analysed in Section

4. Section 5 delineates the trends in soundness indicators.

Operations of SCBs in the capital market are detailed in Section 6, while technological

developments in banking during the year are covered in Section 7. Regional spread

of banking is set out in Section 8. Section 9 presents an update on customer service

and financial inclusion. Apart from the SCBs, 91 regional rural banks (RRBs)2

and four local area banks (LABs) were also operating in the country. While the

performance of SCBs forms the core of this chapter, the performance of RRBs and

LABs is detailed separately in Section 10 and Section 11, respectively. 2.

Liabilities and Assets of Scheduled Commercial Banks

3.4 As the process of consolidation of banks continued during 2007-08, the number

of SCBs declined from 82 at end-March 2007 to 79 at end-March 2008 due to merger

of two old private sector banks and amalgamation of a foreign bank. The Sangli

Bank Ltd. was amalgamated with ICICI Bank Ltd. under Section 44A of the Banking

Regulation Act, 1949 effective April 19, 2007. Under the same Section, the Reserve

Bank, on August 27, 2007 sanctioned the Scheme of Amalgamation of Lord Krishna

Bank Ltd. with Centurion Bank of Punjab Ltd. The Scheme came into force with effect

from the commencement of business on August 29, 2007. Subsequently, the Scheme

of Amalgamation of Centurion Bank of Punjab Ltd. with HDFC Bank Ltd. was sanctioned

by the Reserve Bank on May 20, 2008; the Scheme came into force with effect from

the commencement of business on May 23, 2008.

3.5 Consequent upon

the global acquisition of banking business (excluding credit card and travel related

business) of American Express Bank Ltd. (AEBL) by Standard Chartered Bank as a

stock sale, the Reserve Bank sanctioned amalgamation of the Indian branches of

AEBL with the Indian branches of Standard Chartered Bank on March 5, 2008. Furthermore,

American Express Banking Corporation (AEBC), the parent bank of AEBL, was issued

a banking license under Section 22 of the BR Act, 1949 to open its maiden branch

in New Delhi for conducting the business relating to credit cards, travel related

services and institutional deposits of AEBL, which was transferred to it prior

to the sale of AEBL’s banking business to Standard Chartered Bank.

3.6 The aggregate balance sheet of SCBs expanded by 25.0 per cent during

2007-08 as compared with 24.2 per cent in the previous year (Table

III.1). The continued higher growth in assets of SCBs than the growth rate

of the economy resulted in the increase in the ratio of assets of SCBs to GDP

(at current market prices) to 91.8 per cent at end-March 2008 from 83.5 per cent

at end-March 2007. As banks improved their capital base during 2007-08, the leverage

(measured by the equity multiplier, which is defined as total assets divided by

the total equity) of the banking system during the year declined significantly

to 13.7 at end-March 2008 from 15.8 a year ago.

Table

III.1: Consolidated Balance Sheet of Scheduled Commercial Banks |

(Amount

in Rs. crore) | Item | As

at end-March |

| 2007 | 2008 |

| Amount

Per cent | Amount | Per

cent |

| to

Total |

| to

Total | 1 | 2 | 3 | 4 | 5 |

Liabilities | | | | |

1. | Capital | 29,559 | 0.9 | 39,900 | 0.9 |

2. | Reserve

and Surplus | 1,89,619 | 5.5 | 2,75,657 | 6.4 |

3. | Deposits | 26,96,936 | 77.9 | 33,20,054 | 76.7 |

| 3.1. | Demand

Deposits | 3,54,895 | 10.3 | 4,42,055 | 10.2 |

| 3.2. | Savings

Bank | | | | |

| | Deposits | 6,31,651 | 18.3 | 7,44,051 | 17.2 |

| 3.3. | Term

Deposits | 17,10,388 | 49.4 | 21,33,947 | 49.3 |

4. | Borrowings | 2,43,010 | 7.0 | 2,97,349 | 6.9 |

5. | Other

Liabilities and Provisions | 3,00,836 | 8.7 | 3,93,523 | 9.1 |

Total Liabilities/Assets | 34,59,961 | 100.0 | 43,26,486 | 100.0 |

Assets |

1. | Cash

and Balances | | | | |

| with

RBI | 1,95,265 | 5.6 | 3,22,997 | 7.5 |

2. | Balances

with Banks | | | | |

| and

Money at Call and | | | | |

| Short

Notice | 1,58,302 | 4.6 | 1,10,326 | 2.6 |

3. | Investments | 9,50,981 | 27.5 | 11,76,154 | 27.2 |

| 3.1 | Government | | | | |

| | Securities

(a+b) | 7,54,446 | 21.8 | 9,25,799 | 21.4 |

| | a)

In India | 7,50,722 | 21.7 | 9,20,241 | 21.3 |

| | b)

Outside India | 3,723 | 0.1 | 5,558 | 0.1 |

| 3.2 | Other

Approved | | | | |

| | Securities | 12,764 | 0.4 | 10,587 | 0.2 |

| 3.3 | Non-Approved | | | | |

| | Securities | 1,83,771 | 5.3 | 2,39,767 | 5.5 |

4. | Loans

and Advances | 19,81,236 | 57.3 | 24,77,039 | 57.3 |

| 4.1 | Bills

purchased | | | | |

| | and

Discounted | 1,24,292 | 3.6 | 1,50,983 | 3.5 |

| 4.2 | Cash

Credits, | | | | |

| | Overdrafts,

etc. | 7,09,803 | 20.5 | 8,89,663 | 20.6 |

| 4.3 | Term

Loans | 11,47,140 | 33.2 | 14,36,391 | 33.2 |

5. | Fixed

Assets | 31,362 | 0.9 | 42,395 | 1.0 |

6. | Other

Assets | 1,42,812 | 4.1 | 1,97,573 | 4.6 |

Note: Data

for 2006-07 are as reported in the balance sheets of banks for 2007-08 and hence

may not match with those reported in the Report on Trend and Progress of Banking

in India, 2006-07, as the figures for 2006-07

were revised by some banks.

Source: Balance Sheets of respective banks. | 3.7

The composition of assets of SCBs during 2007-08 remained more or less the same

as in the previous year. On the liability side, the share of reserves and surplus

increased, while that of deposits declined. Aggregate deposits of SCBs continued

to show strong growth during 2007-08, though it was lower than the previous year.

Capital and reserves grew at a significantly higher rate in 2007-08 in comparison

with 2006-07. The growth rate of loans and advances moderated as compared with

that in the previous year, partly reflecting the impact of measures taken by the

Reserve Bank such as increase in cash reserve ratio (CRR), which, in turn, was

reflected in the significant increase in cash and balances with the Reserve Bank.

Banks' investments in Government securities grew at a much higher rate in comparison

with the last year [Table III.1, Table III.2

and Appendix Table III.1 (A) to (C)]. 3.8 Among the banks groups, the balance

sheets of foreign and new private sector banks expanded at a higher rate as compared

with other bank groups (Table III.2). As a result, the combined

share of foreign and new private sector bank groups in total assets of SCBs increased

further to 25.6 per cent at end-March 2008 from 24.8 per cent at end-March 2007.

The growth rates in the assets of public sector banks and old private sector banks

during 2007-08 at 23.9 per cent and 21.2 per cent, respectively, were higher than

those during the previous year. However, their assets grew at a lower rate than

those of SCBs as a whole [Appendix Table III.1 (A) to (C)].

Table

III.2: Growth of Balance Sheet of Scheduled Commercial Banks - Bank Group-wise

| (Per

cent) | Item | As

at end-March |

| 2007 | 2008 |

| Public

Sector Banks | Old

Private Sector Banks | New

Private Sector Banks | Foreign

Banks | All

SCBs | Public

Sector

Banks | Old

Private Sector Banks | New

Private Sector Banks | Foreign

Banks | All

SCBs | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1. | Capital | 0.7 | 4.4 | 5.6 | 45.4 | 17.3 | 5.2 | 1.8 | 14.6 | 71.0 | 35.0 |

2. | Reserve

and Surplus | 20.0 | 11.6 | 17.4 | 30.6 | 20.0 | 31.3 | 47.1 | 97.9 | 35.0 | 45.4 |

3. | Deposits | 22.9 | 6.0 | 38.8 | 32.5 | 24.6 | 23.1 | 19.8 | 23.1 | 26.8 | 23.1 |

| 3.1. | Demand

Deposits | 19.3 | 3.9 | 36.7 | 19.3 | 21.1 | 20.4 | 23.4 | 38.6 | 28.3 | 24.6 |

| 3.2. | Saving

Bank Deposits | 15.0 | 6.7 | 33.3 | 16.3 | 16.4 | 14.9 | 16.2 | 40.5 | 20.2 | 17.8 |

| 3.3. | Term

Deposits | 27.3 | 6.1 | 40.6 | 47.1 | 28.7 | 27.0 | 20.2 | 16.0 | 27.7 | 24.8 |

4. | Borrowings | 5.7 | 22.3 | 42.8 | 33.0 | 19.6 | 24.1 | 8.0 | 26.1 | 14.2 | 22.4 |

5. | Other

Liabilities and Provisions | 16.3 | 16.1 | 51.1 | 72.4 | 28.1 | 28.5 | 21.3 | 17.5 | 65.5 | 30.8 |

Total Liabilities/Assets | 21.1 | 7.1 | 38.7 | 37.6 | 24.2 | 23.9 | 21.2 | 27.5 | 32.7 | 25.0 |

1. | Cash

and Balances with RBI | 26.1 | 25.9 | 93.7 | 49.8 | 35.2 | 61.5 | 74.4 | 74.3 | 81.2 | 65.4 |

2. | Balances

with Banks and Money | | | | | | | | | | |

| at

Call and Short Notice | 26.8 | 5.8 | 91.9 | 41.9 | 35.9 | -31.7 | -20.2 | -33.7 | -25.1 | -30.3 |

3. | Investments | 4.9 | -3.6 | 26.4 | 36.4 | 9.7 | 20.2 | 23.1 | 31.3 | 38.4 | 23.7 |

| 3.1 | Government

Securities (a+b) | 3.6 | -2.2 | 33.0 | 37.5 | 9.3 | 20.5 | 20.0 | 21.8 | 47.5 | 22.7 |

| | a.

In India | 3.6 | -2.0 | 32.9 | 37.5 | 9.4 | 20.3 | 20.0 | 21.9 | 47.5 | 22.6 |

| | b.

Outside India | -8.6 | -100.0 | 125.0 | 0.0 | -5.9 | 58.3 | 0.0 | -53.6 | 0.0 | 49.3 |

| 3.2 | Other

Approved Securities | -7.8 | -30.9 | -10.3 | 0.2 | -8.5 | -16.7 | -20.7 | 12.0 | -60.9 | -17.0 |

| 3.3 | Non-Approved

Securities | 13.8 | -7.6 | 11.4 | 32.8 | 13.3 | 22.6 | 37.7 | 57.0 | 5.2 | 30.5 |

4. | Loans

and Advances | 30.2 | 12.0 | 39.9 | 29.5 | 30.6 | 24.8 | 20.2 | 26.4 | 27.5 | 25.0 |

| 4.1 | Bills

Purchased and Discounted | 22.4 | -15.4 | 20.7 | 21.3 | 19.9 | 16.3 | 36.9 | 36.8 | 36.5 | 21.5 |

| 4.2 | Cash

Credits, Overdrafts, etc. | 25.6 | 11.6 | 42.3 | 20.9 | 25.6 | 24.3 | 20.3 | 31.0 | 33.8 | 25.3 |

| 4.3 | Term

Loans | 34.6 | 16.5 | 40.7 | 38.7 | 35.3 | 26.2 | 18.3 | 24.6 | 21.2 | 25.2 |

5. | Fixed

Assets | 37.7 | -5.6 | 4.2 | 24.4 | 25.0 | 42.6 | 26.2 | 15.9 | 32.3 | 35.2 |

6. | Other

Assets | 7.1 | 0.7 | 33.9 | 72.9 | 22.5 | 31.2 | -1.5 | 28.1 | 67.0 | 38.3 |

Source :

Balance Sheets of respective banks. | 3.9 The impact of

differential growth rate across different banks groups was broadly reflected in

their market shares in terms of major indicators of balance sheets (Table

III.3).

Deposits

3.10

Aggregate deposits of scheduled commercial banks showed a lower growth of 23.1

per cent during 2007-08 as compared with 24.6 per cent in the previous year. The

deceleration in aggregate deposits was on account of moderation in the growth

of term deposits (24.8 per cent) as compared with that in the previous year (28.7

per cent). Demand deposits and saving bank deposits showed a higher growth than

that in the previous year.

3.11 The trend of increasing dependence

of banks on certificates of deposit (CDs) continued during 2007-08. The amount

of CDs outstanding increased by 58.5 per cent to Rs.1,47,792 crore by end-March

2008. CDs outstanding as percentage of aggregate deposits increased to 4.5 per

cent as on March 28, 2008 from 3.5 per cent a year ago (Appendix Table III.2). 3.12

Bank groups-wise analysis reveals that deposits of foreign sector banks grew at

the highest rate (26.8 per cent). While deposits of public sector banks and new

private sector banks showed a growth of 23.1 per cent each, old private sector

banks’ deposits increased by 19.8 per cent during 2007-08. Though the growth

in deposits of old private sector banks was significantly higher than that in

the previous year, their share in aggregate deposits of SCBs declined further,

albeit marginally during 2007-08. The share of foreign banks in aggregate

deposits increased marginally during 2007-08, while that of public and new private

sector banks remained at the previous year’s level (Chart

III.1).

Non-Deposit Resources

3.13

Among the non-deposit resources, borrowings by banks increased by 22.4 per cent

during 2007-08 as compared with a growth of 19.6 per cent in the previous year

(Table III.2). Resources raised from the capital market through

public issues (excluding offer for sale) in the domestic capital market increased

sharply by Rs.30,455 crore during 2007-08 as compared with Rs.1,066 crore during

2006-07. This was mainly on account of good performance of banking scrips in the

secondary market, strong financial results of banks, increased need to raise capital

in the face of sharp expansion of balance sheets, ensuing implementation of Basel

II norms and tightening of capital adequacy norms for sensitive sectors (refer

Section 6 for details).

Table

III.3: Major Components of Balance Sheets of Scheduled Commercial Banks -

Bank

Group-wise | (As

at end-March) | (Per

cent) | Bank

Group | Assets | Deposits | Advances | Investments |

| 2007 | 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

Public Sector Banks | 70.5 | 69.9 | 73.9 | 73.9 | 72.7 | 72.6 | 69.9 | 67.9 |

Nationalised Banks | 44.2 | 43.5 | 48.8 | 48.4 | 45.2 | 45.3 | 44.9 | 42.7 |

State Bank Group | 23.3 | 23.4 | 23.5 | 23.3 | 24.3 | 24.0 | 22.3 | 22.4 |

Other Public Sector Bank | 3.0 | 3.0 | 1.6 | 2.2 | 3.2 | 3.3 | 2.7 | 2.8 |

Private Sector Banks | 21.5 | 21.7 | 20.5 | 20.3 | 20.9 | 20.9 | 22.6 | 23.7 |

Old Private Sector Banks | 4.6 | 4.5 | 5.1 | 5.0 | 4.7 | 4.5 | 4.6 | 4.6 |

New Private Sector Banks | 16.9 | 17.2 | 15.3 | 15.3 | 16.2 | 16.4 | 18.0 | 19.1 |

Foreign Banks | 7.9 | 8.4 | 5.6 | 5.8 | 6.4 | 6.5 | 7.5 | 8.4 |

Scheduled Commercial Banks | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Source : Balance

sheets of respective banks. |

International

Liabilities of Banks

3.14 International liabilities of banks

grew at a slower rate of 8.4 per cent during 2007-08 as compared with 17.6 per

cent in the previous year. The slowdown was mainly due to decline in FCNR(B) deposits,

NRE deposits, own issues of securities and lower growth in ADRs/GDRs and equities

of banks held by non-residents. On the other hand, NRO rupee deposits, foreign

currency borrowings, and capital/remittable profits of foreign banks in India

increased at a higher rate (Table III.4).

Table

III.4: International Liabilities of Banks - By Type |

(Amount

in Rs. crore) | Item |

| As

at end-March |

| 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 |

1. | Deposits

and Loans | 2,46,246 | 2,71,403 | 2,89,362 |

| | | (80.3) | (75.2) | (74.0) |

| of

which: | | | |

| a) | Foreign

Currency Non-Resident Bank [FCNR(B)] | 58,110 | 68,086 | 60,340 |

| | | (19.0) | (18.9) | (15.4) |

| b) | Foreign

currency Borrowings * | 63,722 | 61,470 | 77,257 |

| | | (20.8) | (17.0) | (19.8) |

| c) | Non-resident

External Rupee (NRE) A/C | 100,310 | 112,907 | 111,301 |

| | | (32.7) | (31.3) | (28.5) |

| d) | Non-Resident

Ordinary (NRO) Rupee Deposits | 5,449 | 6,855 | 11,387 |

| | | (1.8) | (1.9) | (2.9) |

2. | Own

Issues of Securities/Bonds (including IMD/RIBs) | 4,856 | 10,036 | 9,166 |

| | | (1.6) | (2.8) | (2.3) |

3. | Other

Liabilities | 55,506 | 79,258 | 92,329 |

| | | (18.1) | (22.0) | (23.6) |

| of

which: | | | |

| a) | ADRs/GDRs | 14,835 | 23,515 | 25,111 |

| | | (4.8) | (6.5) | (6.4) |

| b) | Equity

of banks held by non-residents | 28438 | 40328 | 45603 |

| | | (9.3) | (11.2) | (11.7) |

| c) | Capital/remittable

profits of foreign banks in India and other unclassified international liabilities | 12,233 | 15,415 | 21,615 |

| (4.0) | (4.3) | (5.5) |

Total International

Liabilities | 3,06,609 | 3,60,698 | 3,90,857 |

| (100.0) | (100.0) | (100.0) |

* : Inter-bank borrowings in

India and from abroad and external commercial borrowings of banks.

Note

: Figures in parentheses are percentages to total.

Source

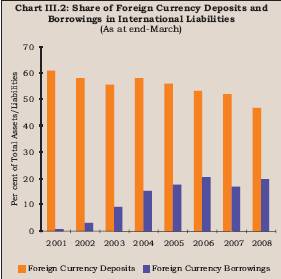

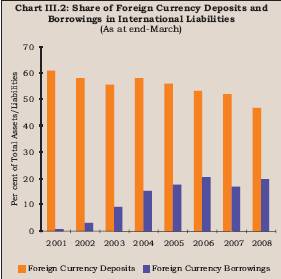

: Locational Banking Statistics. | 3.15 The share

of foreign currency deposits in total international liabilities continued to decline

during 2007-08, whereas that of borrowings increased to 19.8 per cent from 17.0

per cent in the previous year (Chart III.2).

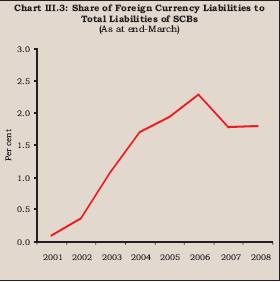

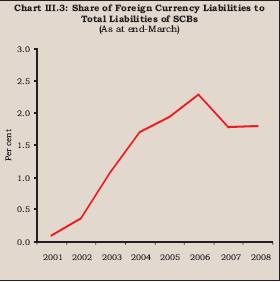

3.16

The share of foreign currency liabilities of scheduled commercial banks in their

total liabilities in 2007-08 remained unchanged at the previous year’s level

(Chart III.3).

Bank Credit

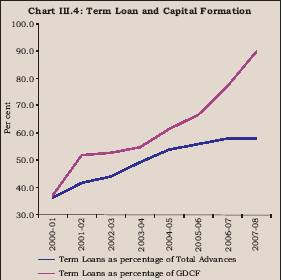

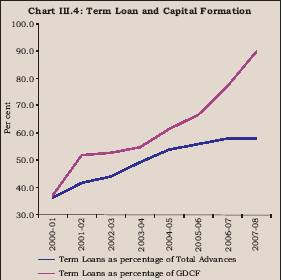

3.17 Growth rate in aggregate loans and advances of

SCBs decelerated to 25.0 per cent during 2007-08 from 30.6 per cent in 2006-07

and an average growth of 31.9 per cent during 2004-05 to 2006-07. This was mainly

on account of sharp deceleration in growth of terms loans (which constituted 58.0

per cent of total loans and advances) to 25.2 per cent in 2007-08 from 35.3 per

cent in the previous year. Notwithstanding the deceleration in terms loans, the

ratio of term loans to gross domestic capital formation (GDCF) in the country

increased to 89.9 per cent in 2007-08 from 77.1 per cent in the previous year

(Chart III.4). Among the other major components, bills purchased

and discounted witnessed a higher growth in the 2007-08, while cash credit and

overdraft grew broadly at the same rate as in the previous year.

Sectoral

Deployment of Bank Credit

3.18 The overall deceleration in bank

credit during 2007-08 was reflected in the flow of credit to all the major sectors,

barring the services sector. The deceleration was more pronounced in respect of

agriculture and allied activities and personal loans, whereas credit to industry

showed a marginal slowdown. Apart from general moderation of overall credit, drought

in certain pockets of the country, lower demand for credit in anticipation of

waiver under Debt Waiver Scheme, exclusion of loans to bodies such as Electricity

Boards from the category of agricultural lending under the revised priority sector

guidelines and lower investment credit may have contributed to the deceleration

in credit to agriculture (Table III.5 and Appendix Table

III.3).

Table

III.5 Sectoral Deployment of Gross Bank | Credit:

Flows | (Variations

over the year) | (Amount

in Rs. crore) | Sector | 2006-07 | 2007-08 |

| Absolute | Per

cent | Absolute | Per

cent | 1 | 2 | 3 | 4 | 5 |

1. | Agriculture

and | | | | | |

| Allied

Activities | | 56,426 | 32.4 | 43,260 | 18.8 |

2. | Industry

(Small, | | | | | |

| Medium

and Large) | | 1,46,890 | 26.7 | 1,74,566 | 25.0 |

| Of

which: Small | | 25,888 | 28.4 | 27,924 | 32.2 |

3. | Personal

Loans | | 96,486 | 26.8 | 48,656 | 10.7 |

| Of

which: Housing | | 45,791 | 24.7 | 24,659 | 10.7 |

4. | Other

Services | | 96,596 | 30.2 | 1,29,743 | 31.1 |

| Of

which: | | | | | |

| (i) | Wholesale

Trade | | 10,422 | 26.3 | 4,472 | 8.9 |

| | (other

than food | | | | | |

| | procurement) | | | | | |

| (ii) | Real

Estate Loans | | 18,483 | 69.2 | 17,070 | 37.8 |

| (iii) | Non-Banking | | | | | |

| | Financial

Companies | 14,722 | 42.9 | 26,274 | 53.6 |

Total | Non-Food

Gross | | | | | |

Bank Credit (1 to 4) | 3,96,399 | 28.2 | 4,01,799 | 22.3 |

Of which, Priority

Sector | 1,23,404 | 24.2 | 1,04,544 | 16.5 |

Notes

: 1. Data are provisional and relate to select scheduled commercial banks

which account for more than 90 per cent of bank credit of all scheduled commercial

banks. Data include the figures of Bharat Overseas Bank,which was merged with

Indian Overseas Bank on March 31, 2007.

2. Gross bank credit data include

bills rediscounted with Reserve Bank, Exim Bank, other financial institutions

and inter-bank participations. | 3.19 Provisional data

on sectoral deployment of credit up to September 28, 2008 indicate that, on a

year-on-year basis, overall credit growth was higher at 26.9 per cent as compared

with 22.2 per cent a year ago. Bank credit growth to agriculture and personal

loans decelerated to 20.6 per cent and 15.3 per cent (23.2 per cent and 18.5 per

cent a year ago), respectively, while credit to industry and services increased

at a higher rate of 33.1 per cent and 32.2 per cent (23.2 per cent and 24.1 per

cent a year ago), respectively. Credit growth to real estate remained high at

45.9 per cent, notwithstanding a sharp deceleration. Priority

Sector Advances

3.20 The Reserve Bank has taken several

initiatives in recent years to enhance the credit flow to the sectors considered

to be constrained by the inadequate credit availability. The priority sector definition

was modified from time to time to take into account the structural changes in

the economy. As per the revised guidelines, the priority sector broadly comprises

agriculture, small enterprises sector, micro credit, education and housing. The

targets and sub-targets for all banks are now linked to the adjusted net bank

credit (ANBC) or credit equivalent amount of off-balance sheet exposures (CEOBSE),

whichever is higher (refer Chapter II).

3.21 The growth in priority

sector lending by banks during 2007-08 decelerated to 16.9 per cent in line with

the deceleration in overall bank credit. Among bank groups, the outstanding priority

sector advances of public sector banks at end-March 2008 increased by 16.8 per

cent as compared with a growth of 27.2 per cent a year ago. Deceleration in priority

sector advances was mainly due to lower growth in lending to agriculture and other

priority sector advances, including micro credit and housing. Advances to micro

and small enterprises sector by PSBs, however, exhibited a significantly higher

growth of 45.0 per cent in 2007-08 as compared with an increase of 24.4 per cent

during 2006-07. Notwithstanding some deceleration, total priority sector advances

by PSBs during 2007-08 as a percentage of their ANBC/CEOBSE improved significantly

to 44.6 per cent as compared with 39.7 per cent in the previous year (Table III.6).

Among the other priority sector advances by PSBs, advances to housing constituted

the largest share (10.8 per cent ANBC/CEOBSE) followed by retail credit (3.0 per

cent of ANBC/CEOBSE), education (1.5 per cent of ANBC/CEOBSE) and micro-credit

(0.2 per cent of ANBC/CEOBSE) (Appendix Table III.4 and III.5). Total priority

sector advances extended by private sector banks during 2007-08 grew by 12.9 per

cent as compared with a rise of 35.6 per cent in the previous year. While advances

to micro and small enterprises sector by private sector banks in 2007-08 increased

by around two and half times, advances to agriculture registered a lower growth

of 10.9 per cent as compared with 41.7 per cent in the previous year. Total priority

sector advances by private sector banks, as on the last reporting Friday of March

2008, constituted 47.5 per cent of ANBC or CEOBSE (Appendix Table

III.6 and III.7).

Table

III.6: Priority Sector Lending by Public | and

Private Sector Banks | (As

on the last reporting Friday of March) | (Amount

in Rs. crore) | Item | Public

Sector | Private

Sector |

| Banks | Banks |

| 2007 | 2008@ | 2007 | 2008@ |

1 | 2 | 3 | 4 | 5 |

Priority Sector Advances | 5,21,376 | 6,08,963 | 1,44,549

1,63,223 | | (39.7) | (44.6) | (42.9) | (47.5) |

of which: | | | | |

Agriculture | 2,02,614 | 2,48,685 | 52,034 | 57,702 |

| (15.4) | (17.4^) | (12.7) | (15.4) |

Micro and Small Enterprises* | 1,02,550 | 1,48,651 | 13,136 | 46,069 |

| (7.8) | (10.9) | (3.9) | (13.4) |

Other Priority Sector# | 2,06,661 | 2,11,627 | 76,919 | 59,452 |

| (15.7) | (15.5) | (22.9) | (17.3) |

@ : Provisional.

*: The revised guidelines on priority sector advances issued on April 30,2007

take into account the revised definition of small and micro enterprises as per

the Micro, Small and Medium Enterprises Development Act, 2006.

# : Includes

retail trade, micro-credit, education and housing.

^ : Indirect agriculture

is reckoned up to 4.5 per cent of ANBC for calculation of percentage.

Note

: Figures in parentheses represent percentages to net bank credit/ANBC/CEOBSE. |

3.22 As on the last reporting Friday of March 2008, lending to the

priority sector by foreign banks constituted 39.5 per cent of their ANBC/CEOBSE

as against the target of 32 per cent. Of this, credit to the micro and small enterprises

(MSE) and export sectors constituted 12.2 per cent and 22.8 per cent, respectively,

of ANBC/CEOBSE (Table III.7 and Appendix Table

III.8).

3.23 At individual bank-level, 12 banks achieved the

overall target of lending to the priority sector and sub-targets of lending to

agriculture and weaker sections. Twenty seven banks (12 public sector banks and

15 private sector banks) achieved the overall target, but did not achieve the

sub-targets. Only two private sector banks did not achieve the overall target

as also the sub-targets (Table III.8; Appendix Table III.5(A),

III.7(A) and III8(A)].

Special Agricultural Credit Plans (SACP)

3.24 With a view to increasing the flow of credit to agriculture, the Reserve

Bank in 1994-95 had advised public sector banks to prepare special agricultural

credit plans (SACP) on an annual basis. Under SACP, banks are required to fix

self-set targets for achievement during the year (April-March). The targets are

generally fixed by the banks showing an increase of about 20-25 per cent over

the disbursements made in the previous year. During 2005-06 and 2006-07, public

sector banks disbursed Rs.94,278 crore and Rs.1,22,443 crore, respectively, surpassing

the targets under the plan. The disbursements under the plan during 2007-08 aggregated

Rs.1,33,226 crore, constituting 87.6 per cent of the target of Rs.1,52,133 crore.

Drought in certain regions, lower investment credit, lower demand for credit in

anticipation of waiver under Debt Waiver Scheme and general moderation of overall

credit growth would have contributed to the shortfall. The SACP mechanism was

also made applicable to private sector banks from 2005-06. The disbursements to

agriculture by private sector banks under SACP during 2006-07 aggregated Rs.44,093

crore, surpassing the target of Rs.40,656 crore by 8.3 per cent. As against the

target of Rs.41,427 crore for 2007-08, disbursements to agriculture by private

sector banks aggregated Rs.47,862 crore, exceeding the target by 15.5 per cent.

Table

III.7: Priority Sector Lending by Foreign Banks |

(As

on the last reporting Friday of March) |

(Amount

in Rs. crore) | Sector | 2006 | 2007 | 2008@ |

| Amount | Percentage | Amount | Percentage | Amount | Percentage |

|

| to

ANBC/ |

| to

ANBC/ |

| to

ANBC/ |

|

| CEOBSE |

| CEOBSE |

| CEOBSE |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Priority

Sector Advances | 30,439 | 34.4 | 37,831 | 33.4 | 50,301 | 39.5 |

of which: | | | | | | |

| Export

credit | 17,326 | 19.6 | 20,711 | 18.3 | 29,007 | 22.8 |

| Micro

and Small Enterprises* | 8,430 | 9.5 | 11,637 | 10.3 | 15,489 | 12.2 |

@:Provisional.

*:The revised guidelines on priority sector advances issued on April 30, 2007

take into account the revised definition of small and micro enterprises as per

the Micro, Small and Medium Enterprises Development Act, 2006. |

3.25 Public sector banks were advised to earmark 5 per cent of their ANBC to women.

At end-March 2008, aggregate credit to women by public sector banks constituted

6.12 per cent of their ANBC with 24 banks reaching the target. Eight PSBs opened

19 specialised women branches.

Table

III.8: Achievement of Targets under the Priority Sector |

(Number

of banks) | Target/Sub-target | Public | Private | Total |

| Sector | Sector |

|

1 | 2 | 3 | 4 |

1.Overall/Agriculture/Weaker

Sections | 12 | - | 12 |

2. Only Overall | 12 | 15 | 27 |

3. Overall and Agriculture | 3 | 6 | 9 |

4. Overall and Weaker Sections | 3 | - | 3 |

5. Agriculture and Weaker Sections | - | - | - |

6. Only Agriculture | - | - | - |

7. Only Weaker Sections | - | - | - |

8. None | - | 2 | 2 |

- : Nil. | | | |

Micro finance

3.26 The SHG-Bank Linkage Programme

has emerged as a major micro finance programme in the country. It is being implemented

by commercial banks, RRBs and co-operative banks. At end-March 2008, 2.9 million

SHGs were having outstanding bank loans of Rs.12,366 crore. During the year 2007-08,

552,992 new SHGs were provided with bank loans and 186,883 existing SHGs with

repeat loans. Total bank loans disbursed during the year were Rs.4,228 crore,

of which repeat bank loans existing SHGs were Rs.1,686 crore (see Chapter VI for

details).

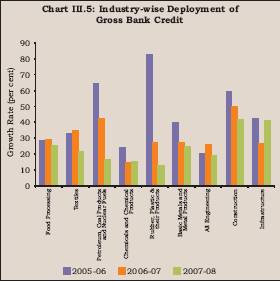

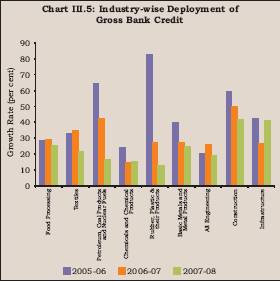

Credit to Industry

3.27 Growth in

credit to industry (small, medium and large) decelerated marginally to 25.0 per

cent in 2007-08 from 26.7 per cent in the previous year. As credit growth to industry

grew faster than the overall credit growth, the share of outstanding credit to

industry in non-food gross bank credit increased to 39.6 per cent at end-March

2008 from 38.7 per cent at end-March 2007.Infrastructure, which has the largest

share in credit outstanding, also accounted for the largest share of incremental

bank credit to industry in absolute terms, followed by basic metals and metal

products, and textiles. In terms of growth rates, credit to cement and cement

products showed the highest growth rate (51.3 per cent), followed by construction

(41.7 per cent) and infrastructure (41.5 per cent) (Chart III.5

and Appendix Table III.9). Compared to the previous year, credit growth to most

of the sectors decelerated during 2007-08, barring a few sectors including infrastructure,

leather and leather products, chemical and chemical products, and cement and cement

products.

Credit to Micro and Small Enterprises (MSE) Sector

3.28 The total credit provided by public sector banks to the micro and

small enterprises (MSE) as on last reporting Friday of March 2008 was Rs.1,48,651

crore, representing 10.9 per cent of ANBC/CEOBSE and 24.4 per cent of their total

priority sector advances. Within the MSE sector, advances to manufacturing enterprises

and service enterprises were at Rs.1,14,146 crore and Rs.32,094 crore constituting

76.8 per cent and 21.6 per cent, respectively, of the total advances to the small

enterprises sector. The total credit extended by private sector banks to the MSE

sector as on last reporting Friday of March 2008 was Rs.46,069 crore, constituting

13.4 per cent of ANBC/CEOBSE and 28.2 per cent of their total priority sector

advances. Out of these advances, advances to manufacturing enterprises and service

enterprises amounted to Rs.16,526 crore (35.9 per cent of MSE advances) and Rs.29,178

crore (63.3 per cent of SME advances). The total credit provided by foreign banks

to the MSE sector as on last reporting Friday of March 2008 was Rs. 15,489 crore,

representing 12.2 per cent of ANBC/CEOBSE and 30.8 per cent of their total priority

sector advances.

3.29 At end-March 2008, credit extended by scheduled commercial banks to 85,187

sick MSE units was at Rs.13,849 crore. Of these, 4,210 units with their outstanding

bank credit at Rs.247 crore were found to be viable, of which, banks placed 1,262

units, involving an outstanding credit of Rs.127 crore under nursing programmes.

75,829 units with outstanding credit of Rs.13,462 crore were found non-viable.

Credit extended by scheduled commercial banks to 14,754 sick medium enterprises

(MEs) during the year was Rs.1,740 crore. Out of these, 495 MEs with outstanding

bank credit at Rs.328 crore were found to be viable, of which, banks placed 50

MEs, involving an outstanding credit of Rs.185 crore under nursing programmes.

14,226 ME units with outstanding credit of Rs.1,302 crore were found non-viable

.

Credit to Khadi and Village Industries Commission

3.30 A consortium of select public sector banks was formed with the State Bank

of India as the leader of the consortium to provide credit to the Khadi

and Village Industries Commission (KVIC). These loans are provided at 1.5 per

cent below the average prime lending rates of five major banks in the consortium.

At end-September 2008, an amount of Rs.306 crore was outstanding out of Rs.738

crore disbursed by the consortium of banks under the scheme.

Retail

Credit

3.31 Growth in retail credit by banks decelerated further

during 2007-08 to 17.1 per cent from 29.9 per cent in 2006-07 and 40.9 per cent

in 2005-06. It also remained lower than the growth in overall credit by the banking

sector (23.2 per cent). As a result, the share of retail credit in total loans

and advances declined to 24.5 per cent at end-March 2008 from 25.8 per cent at

end-March 2007. Deceleration in the retail portfolio of banks was on account of

decline in credit for consumer durables and deceleration in the growth of auto

loans, housing loans and other personal loans (Table III.9).

The outstanding amount under credit card receivables, however, increased by almost

50 per cent during 2007-08 reflecting the increase in the usage of credit cards

for various payments.

Lending to Sensitive Sectors

3.32 SCBs lending to sensitive sectors (capital market, real estate and

commodities) showed a significant deceleration during 2007-08, though it was marginally

higher than the overall credit growth. Lending to real estate, which constituted

87.4 per cent of total lending to sensitive sectors, showed a significantly lower

growth during 2007-08, partly on account of tightening of prudential norms by

the Reserve Bank. The lending to capital market increased significantly during

2007-08. While exposure to commodities showed a significant growth, it remained

relatively low (Table III.10). The Reserve Bank in its Annual

Policy Statement for 2008-09 had advised banks to exercise caution while extending

advances to traders in agricultural commodities to ensure that bank finance was

not used for hoarding (Box III.1) Overall exposure of SCBs

to sensitive sectors as percentage of aggregate bank loans remained at the previous

year’s level (20.6 per cent) (Appendix Table III.11).

Table

III.9: Retail Portfolio of Banks |

(Amount in

Rs. crore) | Item | Outstanding

as at end-March | Percentage

Variation |

| 2007 | 2008 | 2006-07 | 2007-08 |

1 | 2 | 3 | 4 | 5 |

1. | Housing

Loans | 2,24,481 | 2,52,932 | 25.4 | 12.7 |

2. | Consumer

Durables | 7,296 | 4,802 | 63.3 | -34.2 |

3. | Credit

Card Receivables | 18,317 | 27,437 | 47.3 | 49.8 |

4. | Auto

Loans | 82,562 | 87,998 | 34.5 | 6.6 |

5. | Other

Personal Loans | 1,55,204 | 1,97,879 | 31.1 | 27.5 |

Total Retail Loans

(1 to 5) | 4,87,860 | 5,71,048 | 29.9 | 17.1 |

| | (25.8) | (24.5) | | |

Total Loans and Advances

of SCBs | 18,93,775 | 23,32,490 | 28.5 | 23.2 |

Note: Figures

in parentheses represent percentage share in total loans and advances.

Source:

Off-site Returns (domestic, unaudited and provisional). |

Table

III.10: Lending to the Sensitive Sectors by

Scheduled Commercial

Banks | (As

at end-March) | (Amount

in Rs. crore) | Item | 2007 | 2008 |

| Amount | Per

cent to Total | Amount | Per

cent to

Total | 1 | 2 | 3 | 4 | 5 |

1. Capital Market | 35,106 | 8.6 | 62,998 | 12.3 |

| (57.4) | | (79.5) | |

2. Real Estate Market | 3,72,874 | 91.2 | 4,46,758 | 87.4 |

| (42.3) | | (19.8) | |

3. Commodities | 862 | 0.2 | 1,237 | 0.2 |

| (-39.0) | | (43.5) | |

Total (1+2+3) | 4,08,842 | 100.0 | 5,10,994 | 100.0 |

-: negligible. | (43.1) | | (25.0) | |

Note: Figures in parentheses

are percentage variations over the previous year. | 3.33

Bank group-wise pattern of lending to sensitive sectors indicates that new private

sector banks had the largest exposure to sensitive sectors in 2007-08 in terms

of their share in total loans and advances, mainly on account of higher lending

to the real estate sector, followed by foreign banks, old private sector banks

and public sector banks (Table III.11 and Appendix

Table III.11).

Investments

3.34

Investments by banks recorded a high growth of 23.7 per cent in 2007-08 as compared

with 9.7 per cent in 2006-07 and a decline of 0.4 per cent in 2005-06 (Table

III.12). This broadly reflected the pattern of banks’ investment in

SLR securities, which constitute the bulk of their investments. In relation to

total assets of SCBs, the share of Government securities declined marginally to

21.4 per cent (27.8 per cent of NDTL) during 2007-08 from 21.8 per cent (27.9

per cent of NDTL) in the previous year whereas that of non-approved securities

increased from 5.3 per cent as at end-March 2007 to 5.5 per cent as at end-March

2008 (Table III.1).

3.35 Although the banking

sector held excess SLR investment at Rs.98,033 crore (above the then prescribed

minimum requirement of 25.0 per cent) at end-March 2008, several banks were operating

their statutory liquidity ratio portfolio very close to the prescribed minimum

level. The prescribed SLR which was 25.0 per cent of NDTL since October 1997 was

revised to 24.0 per cent of NDTL with effect from November 8, 2008. Excess SLR

investments of SCBs increased to Rs.1,30,736 crore on November 21, 2008 (including

the collateral securities received by banks from the RBI under LAF reverse repo).

SLR investments in relation to NDTL declined to 26.9 per cent (Chart

III.6).

Non-SLR investments

3.36 Banks’

investments in non-SLR securities (i.e., bonds/debentures/shares and

commercial papers) increased by 14.3 per cent (Rs.11,961 crore) during 2007-08

as compared with a decline of 5.1 per cent (Rs.4,081 crore) in the previous year.

While investments in bonds/debentures declined, those in shares (mutual funds

in particular) and commercial paper increased (Table III.13).

The total flow of funds from SCBs to the commercial sector comprising credit and

non-SLR investments increased by 22.6 per cent (Rs.4,44,807 crore) in 2007-08

as compared with 27.3 per cent (Rs.4,22,363 crore) in the previous year. Box

III.1: Exposure of Banks to the Commodity Sector The turnover in

the commodity futures market has shown a significant growth in recent years. Along

with the trading volumes, banking sector exposure to commodity market had also

shown a noticeable growth. In view of the public policy concerns in regard to

trading in food items, the Reserve Bank in the Annual Policy Statement for the

year 2008-09 advised the banks to review their advances to traders in agricultural

commodities including rice, wheat, oilseeds and pulses as also advances against

warehouse receipts. Banks were further advised to exercise caution while extending

such advances to ensure that bank finance was not used for hoarding. The first

such review was required to be completed by May 15, 2008 and forwarded to the

Reserve Bank for carrying out supervisory review.

Accordingly, banks

had carried out review of their exposure to agricultural commodities as on March

31, 2008. The data submitted by banks revealed that the advances to traders in

agricultural commodities including advances against warehouse receipts as on March

31, 2008 constituted less than one per cent of their gross advances. Banks have

confirmed that they are exercising due caution while extending advances to agricultural

commodities so as to ensure that bank finance is not used for hoarding. Another

review carried out with reference to the position as on June 30, 2008 revealed

no significant change in such exposure of banks.

Table

III.11: Lending to the Sensitive Sectors - Bank Group-wise* |

(As

at end-March) | (Per

cent) | Sector/Bank

Group | Public

Sector Banks | New

Private Sector Banks | Old

Private Sector Banks | Foreign

Sector Banks |

| 2007 | 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

Capital Market# | 1.4 | 1.8 | 2.8 | 5.6 | 1.8 | 2.0 | 3.0 | 3.3 |

Real Estate Market@ | 15.3 | 15.3 | 32.3 | 28.5 | 16.8 | 16.5 | 26.5 | 23.1 |

Commodities | 0.0 | 0.0 | 0.0 | 0.0 | 0.5 | 0.4 | 0.0 | 0.1 |

Total Advances to Sensitive Sectors | 16.7 | 17.2 | 35.1 | 34.1 | 19.1 | 18.9 | 29.5 | 26.4 |

*: Advances to the sensitive

sector as percentage to total loans and advances of the concerned bank group.

#: Exposure to the capital market is inclusive of both investments and advances.

@: Exposure to real estate sector is inclusive of both direct and indirect lending. |

3.37 In terms of instruments, bank’s investments in bonds and

debentures declined in recent years, while it increased in shares, commercial

papers and units of mutual funds (Table III.14).

International Assets of Banks

3.38 Prevailing macroeconomic

and financial market conditions globally have influenced international assets

position of banks in India. Overall, there was a deceleration in international

assets due to decline in ‘nostro balances’, holding of debt securities

and other assets. Banks reduced their ‘nostro balances’ in 2007-08

partly on account of increase in domestic deposit rates. Banks' foreign currency

loans to residents recorded a substantially higher growth during 2007-08. As a

result, the share of foreign currency loans to residents in total international

assets of SCBs increased to 48.7 per cent as at end-March 2008 from 37.0 per cent

at end-March 2007. The share of outstanding export bills held by banks (drawn

by residents on non-residents) also increased significantly between end-March

2007 and end-March 2008 (Table III.15).

Table

III.12: Growth in Investments and Deposits of SCBs |

(Per cent) |

Year | SLR | SLR | Total | Deposits | Loans |

| Invest- | Invest- | Invest- |

|

|

| ments | ments | ments |

|

|

| as

per cent |

|

|

|

|

| of

NDTL

(end-March) |

|

|

|

|

1 | 2 | 3 | 4 | 5 | 6 |

2002-03 | 38.8 | 24.9 | 17.9 | 12.7 | 14.5 |

2003-04 | 41.3 | 23.8 | 15.8 | 16.2 | 16.8 |

2004-05 | 38.2 | 9.1 | 8.3 | 16.6 | 33.3 |

2005-06 | 31.3 | -2.9 | -0.4 | 17.8 | 31.8 |

2006-07 | 27.9 | 10.3 | 9.7 | 24.6 | 30.6 |

2007-08 | 27.8 | 22.8 | 23.7 | 23.1 | 25.0 |

Table

III.13: Non-SLR Investments of Scheduled Commercial Banks |

(Amount

in Rs. crore) | Instrument | As

on March | Per

cent | As

on March | Per

cent | As

on | Per

cent | As

on | Per

cent |

| 30,

2007 | to

Total | 28,2008 | to

Total | Oct.

12, 2007 | to

Total | Oct.

10, 2008 | to

Total | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

1. | Commercial

Paper | 8,978 | 9.0 | 13,045 | 11.4 | 6,582 | 4.7 | 10,640 | 10.5 |

2. | Investment

in shares | 18,352 | 19.3 | 26,410 | 23.1 | 20,350 | 14.3 | 27,691 | 27.7 |

| of

which: | | | | | | | | |

| a) | Public

sector | | | | | | | | |

| | undertakings | 2,127 | 2.2 | 3,023 | 2.6 | 1,485 | 1.4 | 3,405 | 3.4 |

| b) | Private

corporate sector | 16,225 | 17.0 | 23,387 | 20.5 | 18,364 | 13.0 | 24,364 | 24.3 |

3. | Investment

in | | | | | | | | |

| bonds/debentures | 56,215 | 59.0 | 56,051 | 49.1 | 49,353 | 35.7 | 52,741 | 52.6 |

| of

which: | | | | | | | | |

| a) | Public

sector | | | | | | | | |

| | undertakings | 28,595 | 30.0 | 27,382 | 24.0 | 24,867 | 17.5 | 23,661 | 21.8 |

| b) | Private

corporate sector | 27,620 | 29.0 | 28,669 | 25.1 | 24,666 | 17.5 | 29,080 | 29.0 |

4. | Units

of MFs | 11,659 | 12.3 | 18,692 | 16.4 | 64,628 | 45.8 | 9,124 | 9.1 |

Total Non-SLR Investment | | | | | | | | |

(1+2+3+4) | 95,204 | 100.0 | 1,14,198 | 100.0 | 1,25,399 | 100.0 | 1,00,244 | 100.0 |

Source: Section

42(2) returns submitted by SCBs. | 3.39 The consolidated

international claims of banks, based on immediate country risk, showed a lower

growth of 13.5 per cent during 2007-08 as compared with 61.0 per cent during 2006-07.

The share of short-term claims (with residual maturity less than one year) in

the consolidated international claims declined during 2007-08, with corresponding

increase in long-term claims.

3.40 Sector-wise disaggregation of

consolidated international claims of banks indicated a decline in the share of

banks (36.8 per cent at end-March 2008 from 46.8 per cent at end-March 2007).

The share of ‘non-bank private’ showed a corresponding increase of

10 percentage points during 2007-08 (Table III.16). 3.41

The country-wise consolidated international claims of banks, based on immediate

country risk, showed some variations during 2007-08. Continuing the recent trend,

the shares of claims on the US and the UK in total consolidated international

claims declined, while those on Singapore and Germany increased. The claims on

the US, the UK, Singapore, Germany and Hong Kong collectively accounted for over

50 per cent of total international claims (Table III.17).

Developments during 2008-09

3.42 During 2008-09

so far (up to October 24, 2008), aggregate deposits of SCBs increased by 21.0

per cent, year-on-year, as compared with 25.9 per cent a year ago. While demand

deposits increased by 15.1 per cent (14.8 per cent a year ago), time deposits

increased by 22.0 per cent (28.0 per cent a year ago). Non-food credit growth

accelerated to 28.9 per cent, year-on-year, from 23.1 per cent a year ago. In

view of the increased demand for credit, banks reduced their incremental investments

in Government and other approved securities. As on October 24, 2008, the investments

in Government and other approved securities showed a lower growth of 11.1 per

cent, year-on-year, as compared with 25.0 per cent a year ago.

Table

III.14: Composition of Non-SLR Investments |

(Per

cent) | Instrument | 2001-02 | 2002-03 | 2003-04 | 2004-05 | 2005-06 | 2006-07 | 2007-08 | up

to | up

to |

|

|

|

|

|

|

|

| Oct

26, | Oct

24, |

|

|

|

|

|

|

|

| 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

Commercial Paper | 7.2 | 3.1 | 2.7 | 2.7 | 5.4 | 9.4 | 11.4 | 4.6 | 14.3 |

Bonds/debentures | 81.7 | 84.2 | 81.5 | 79.2 | 68.9 | 59.0 | 49.1 | 34.2 | 47.5 |

Shares | 6.6 | 7.9 | 7.3 | 9.4 | 14.2 | 19.3 | 23.1 | 13.9 | 25.7 |

Units of Mutual Funds | 4.5 | 4.9 | 8.5 | 8.7 | 11.5 | 12.2 | 16.4 | 47.3 | 12.5 |

Source : Section

42(2) returns submitted by SCBs. |

Table

III.15: International Assets of Banks - By Type |

(Amount

in Rs. crore) | Asset | 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 |

International Assets

(1+2+3) | 1,58,201 | 2,02,973 | 2,22,711 |

1. | Loans

and Deposits | 1,46,014 | 1,90,888 | 2,12,126 |

| | | (92.3) | (94.0) | (95.2) |

| of

which : | | | |

| a) | Loans

to Non-Residents* | 6,270 | 7,122 | 8,565 |

| | | (4.0) | (3.5) | (3.8) |

| b) | Foreign

Currency Loans to Residents ** | 63,231 | 75,000 | 108,440 |

| | | (40.0) | (37.0) | (48.7) |

| c) | Outstanding

Export Bills

drawn on Non-Residents | | | |

| | by

Residents | 31,556 | 40,846 | 49,011 |

| | | (19.9) | (20.1) | (22.0) |

| d) | Nostro

Balances@ | 44,515 | 67,487 | 45,752 |

| | | (28.1) | (33.2) | (20.5) |

2. | Holdings

of Debt Securities | 2,079 | 1,761 | 334 |

| | | (1.3) | (0.9) | (0.1) |

3. | Other

Assets @@ | 10,109 | 10,324 | 10,250 |

| | | (6.4) | (5.1) | (4.6) |

*: Includes

rupee loans and foreign currency (FC) loans out of non-residents (NR) deposits.

**: Includes loans out of FCNR (B) deposits, PCFC's, FC lending to and FC deposits

with banks in India.

@: Includes placements made abroad and balances in

term deposits with non-resident banks.

@@:Capital supplied to and receivable

profits from foreign branches/subsidiaries of Indian banks and other unclassified

international assets.

Note :Figures in parentheses are

percentages to total.

Source : Locational Banking Statistics. |

Table

III.16: Classification of Consolidated International Claims of Banks - By Maturity

and Sector | (As

at end-March) | (Amount

in Rs. crore) | Residual

Maturity/Sector | 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 |

Total Consolidated

International Claims | 92,711 | 1,49,258 | 1,69,481 |

a) | Maturity-wise | | | |

| 1) | Short-term

(residual maturity less than one year) | 73,176 | 1,09,481 | 1,17,279 |

| | | (78.9) | (73.4) | (69.2) |

| 2) | Long-term

(residual maturity of one year and above) | 18,627 | 39,775 | 50,232 |

| | | (20.1) | (26.6) | (29.6) |

| 3) | Unallocated | 907 | 2 | 1,970 |

| | | (1.0) | (0.0) | (1.2) |

b) | Sector-wise | | | |

| 1) | Bank | 43,050 | 69,781 | 62,394 |

| | | (46.4) | (46.8) | (36.8) |

| 2) | Non-Bank

Public | 1,248 | 871 | 748 |

| | | (1.3) | (0.6) | (0.4) |

| 3) | Non-Bank

Private | 48,413 | 78,607 | 106,339 |

| | | (52.2) | (52.7) | (62.7) |

Notes

:1. Figures in parentheses are percentages to total.

2. Unallocated

residual maturity comprises maturity not applicable (e.g.,for equities)

and maturity information not available from reporting bank branches.

3.

Bank sector includes official monetary institutions (e.g., IFC, ECB,

etc.) and central banks.

4. Prior to the quarter ended March 2005,

non-bank public sector comprised of companies/ institutions other than banks in

which shareholding of state/central governments was at least 51 per cent, including

state/central governments and their departments. From March 2005 quarter, 'Non-bank

public' sector comprises only state/central governments and their departments

and, accordingly, all other entities excluding banks are classified under 'Non-bank

private' sector.

Source : Consolidated Banking Statistics

- Immediate Country Risk Basis. |

Table

III.17: Consolidated International Claims

of Banks on Countries

other than India | (As

at end-March) | (Amount

in Rs. crore) | Item | 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 |

Total Consolidated | | | |

International Claims | 92,711 | 1,49,258 | 1,69,481 |

of which: | | | |

a) | United

States of America | 23,176 | 32,875 | 35,374 |

| | (25.0) | (22.0) | (20.9) |

b) | United

Kingdom | 14,212 | 22,598 | 21,899 |

| | (15.3) | (15.1) | (12.9) |

c) | Singapore

| 4,182 | 8,921 | 11,918 |

| | (4.5) | (6.0) | (7.0) |

d) | Germany

| 4,678 | 7,234 | 10,607 |

| | (5.0) | (4.8) | (6.3) |

e) | Hong

Kong | 6,652 | 8,977 | 9,792 |

| | (7.2) | (6.0) | (5.8) |

f) | United

Arab Emirates | 4,059 | 6,686 | 7,990 |

| | (4.4) | (4.5) | (4.7) |

Note:Figures

in the parentheses are percentage shares in

total international claims.

Source :Consolidated Banking Statistics - Immediate Country Risk

Basis. | Quarterly Trends–Commercial Banking

Survey3

3.43 A quarterly analysis of developments in scheduled

commercial banks revealed several features during 2007-08 (Table

III.18). Mobilisation of deposits by banks across all the quarters was higher

than that during 2006-07. On the other hand, credit expansion, which was lower

in the first two quarters, picked up during the third and fourth quarters of 2007-08.

Banks’ investments in other approved securities declined in all the quarters

of the year. 3.44 During Q1 of 2007-08, notwithstanding a decline in demand

deposits, aggregate deposits of SCBs increased. The decline in demand deposits

mainly reflected the unwinding of large accretion during the previous quarter.

Time deposits, however, increased sharply reflecting attractive interest rates

on bank deposits. However, during the quarter, bank credit declined, while credit

to government increased sharply. Banks also liquidated foreign currency assets.

3.45 In Q2 of 2007-08, bank credit picked up, but net accretion to deposits

remained higher than the expansion of credit to the commercial sector, thus, accommodating

an increase in credit to government as well. Higher growth in deposits was largely

led by increase in time deposits. Banks increased their overseas borrowings and

also reduced their investments in foreign currency assets.

3.46 In

Q3 of 2007-08, accretion to aggregate deposits and credit offtake declined sharply.

The outstanding demand deposits declined and time deposits increased at a much

lower rate. Credit to the commercial sector was higher than the fresh accretions

in aggregate deposits. To meet the increased credit offtake, banks slowed down

their investments in government securities. Furthermore, the SCBs increased their

overseas foreign currency borrowings and liquidated their foreign currency assets.

3.47 During Q4 of 2007-08, both aggregate deposits and credit to the commercial

sector increased sharply. Accretion to deposits was higher than the expansion

in credit to the commercial sector. Higher growth in deposits was led by time

deposits, while demand deposits after remaining subdued for most part of 2007-08

recorded robust expansion particularly in January and February 2008, when there

was also increased volatility in the equity market. Commercial banks increased

their overseas foreign currency borrowings, while reducing their investment in

foreign currency assets. The movements in bank reserves during the fourth quarter

as also for the year as a whole, reflected, apart from movements in deposits,

the increase in the cash reserve ratio (CRR).

Table

III.18: Operations of Scheduled Commercial Banks |

(Amount

in Rs. crore) | Item | Outstanding

as on | Variation |

| March

28, 2008 | 2006-07 | 2007-08 | 2008-09 |

|

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

Components | | | | | | | | | | | |

1. | Aggregate

Deposits | | | | | | | | | | | |

| of

Residents (a+b) | 31,40,004 | 30,677 | 1,66,396 | 31,469 | 2,66,158 | 58,993 | 2,08,191 | 67,544 | 2,60,803 | 53,155 | 1,86,384 |

| a. | Demand

Deposits | 5,24,310 | -41,272 | 43,300 | -8,905 | 71,967 | -41,898 | 57,771 | -7,894 | 86,600 | -77,630 | 49,993 |

| b. | Time

Deposits of | | | | | | | | | | | |

| | Residents | 26,15,695 | 71,949 | 1,23,096 | 40,374 | 1,94,190 | 1,00,890 | 1,50,420 | 75,439 | 1,74,204 | 1,30,785 | 1,36,391 |

2. | Call/Term

Funding from | | | | | | | | | | | |

| Financial

Institutions | 1,06,504 | 3,118 | -1,576 | -4,468 | 5,618 | -2,984 | 5,756 | 7,441 | 10,455 | -1,116 | 4,506 |

Sources | | | | | | | | | | | |

1. | Credit

to the Government | 9,58,661 | 23,238 | 10,723 | 602 | 40,753 | 50,067 | 68,965 | 27,436 | 36,136 | 33,245 | -23,374 |

2. | Credit

to the Commercial | | | | | | | | | | | |

| Sector

(a to d) | 25,49,097 | 22,606 | 1,41,465 | 64,777 | 1,97,555 | -13,527 | 1,34,775 | 94,969 | 2,42,980 | 40,471 | 1,27,214 |

| a. | Bank

Credit | 23,61,914 | 14,050 | 1,40,364 | 74,213 | 1,95,485 | -36,348 | 1,42,638 | 87,012 | 2,37,422 | 31,325 | 1,49,229 |

| | i.

Food Credit | 44,399 | 607 | -7,840 | 8,171 | 4,891 | -2,564 | -6,948 | 3,259 | 4,131 | 5,478 | 1,11,865 |

| | ii.

Non-food Credit | 23,17,515 | 13,443 | 1,48,204 | 66,042 | 1,90,593 | -33,784 | 1,49,586 | 83,752 | 2,33,291 | 25,557 | 37,364 |

| b. | Net

Credit to Primary | | | | | | | | | | | |

| | Dealers | 3,521 | -1,963 | 3,988 | -2,783 | -812 | -282 | 780 | 1,370 | -1,146 | -797 | -1,500 |

| c. | Investments

in Other | | | | | | | | | | | |

| | Approved

Securities | 13,053 | 526 | -1,132 | -352 | -297 | -384 | -1,010 | -654 | -357 | -194 | 5,848 |

| d. | Other

Investments | | | | | | | | | | | |

| | (in

non-SLR Securities) | 1,70,609 | 9,993 | -1,756 | -6,301 | 3,178 | 23,487 | -7,634 | 7,241 | 7,061 | 10.136 | -26,363 |

3. | Net

Foreign Currency | | | | | | | | | | | |

| Assets

of Commercial | | | | | | | | | | | |

| Banks

(a-b-c) | -70,196 | -21,137 | 10,844 | 13,322 | 1,974 | 2,817 | -16,584 | 974 | -16,793 | -19,924 | -4,481 |

| a. | Foreign

Currency | | | | | | | | | | | |

| | Assets | 31,189 | -13,919 | 8,830 | 11,781 | 8,567 | -8,312 | -9,934 | -781 | -8,537 | -8,383 | 3,044 |

| b. | Non-resident

Foreign | | | | | | | | | | | |

| | Currency

Repatriable | | | | | | | | | | | |

| | Fixed

Deposits | 56,935 | 3,917 | 1,671 | 1,233 | 1,364 | -4,202 | -1,181 | -3,490 | -1,653 | 2,048 | 3,611 |

| c. | Overseas

Foreign | | | | | | | | | | | |

| | Currency

Borrowings | 44,451 | 3,301 | -3,685 | -2,774 | 5,229 | -6,928 | 7,830 | 1,734 | 9,909 | 9,494 | 3,914 |

4. | Net

Bank Reserves | 2,71,166 | -6,090 | 20,381 | -15,423 | 52,629 | 6,468 | 76,009 | -22,695 | 21,268 | 28,526 | 35,163 |

5. | Capital

Account | 2,72,622 | 12,025 | 6,168 | 2,250 | 4,630 | 26,813 | 24,184 | 6,887 | 11,937 | 47,618 | 1,479 |

Note : Data

relate to last reporting Friday of each quarter. | 3.48

During Q1 of 2008-09, accretion to aggregate deposits was lower than in the previous

year while demand deposits registered a negative growth. Bank credit, however,

remained strong compared with its first quarter performance in last year. Credit

to government also remained strong. In order to finance the increased activity,

banks resorted to drawdown of foreign currency assets and substantial recourse

to overseas borrowings. 3.49 In the Q2 of 2008-09, accretion to aggregate

deposits increased sharply led by both demand and time deposits. Increase in aggregate

deposits, however, remained lower than the Q2 of last year. Bank credit also increased

sharply. Banks reduced their investment in government securities and also in non-SLR

securities. During the quarter, commercial banks reduced their investment in foreign

currency assets and also overseas foreign currency borrowings. Credit-Deposit

Ratio

3.50 The credit-deposit ratio (CDR) and the investment-deposit

ratio (IDR) of SCBs reflected the trend in the credit and deposit growth rates.

On account of the strong credit growth during the previous three years (2004-05

to 2006-07), investment by banks showed a significantly lower average growth of

about 6 per cent. In fact, banks liquidated some investments in 2005-06 leading

to a sharp decline in incremental IDR. During 2007-08, however, with the moderation

in credit growth and strong growth in deposits, the incremental credit-deposit

ratio, as on March 28, 2008, declined to 73.6 per cent as compared with 84.3 per

cent as on March 30, 2007. Incremental IDR, on the other hand, increased sharply

to 30.8 per cent as on March 28, 2008 from 14.7 per cent as on March 30, 2007.

The intra-year movement in the incremental CDR and IDR indicates that the gap

between the two ratios, which narrowed during the last quarter of 2007, widened

again after February 2008 (Chart III.7).

3.51

The CDR and IDR, based on the outstanding amount, which moved more or less in

the same direction between 1999 and the third quarter of 2004-05, tended to move

in the opposite directions thereafter. This pattern continued in 2007-08 as the

CDR increased further to reach an all-time high level of 74.6 per cent at end-March

2008. The IDR, on the other hand, which had declined to a low of 30.3 per cent

as at end-March 2007, increased to 35.4 per cent at end-March 2008 (Chart

III.8).

3.52 Among bank-groups, the CDR (in terms of outstanding

amount) of foreign banks was the highest at end-March 2008, followed by new private

sector banks, public sector banks and old private sector banks (Chart

III.9).

3.53 At individual bank level, the CDR at end-March 2008

showed significant variations, particularly in the case of foreign banks. The

CDR of public sector banks ranged between 59.3 per cent (United Bank of India)

and 71.6 per cent (State Bank of Travancore), barring IDBI Bank Ltd. whose CDR

was 112.6 per cent. In the case of old private sector banks, the CDR ranged between

53.2 per cent (Ratnakar Bank) and 75.1 per cent (Karur Vysya Bank). The CDR of

new private sector banks ranged between 62.9 per cent (HDFC Bank) and 94.7 per

cent (Kotak Mahindra Bank). In the case of foreign banks, the CDR ranged between

a low of 0.8 per cent (Oman International Bank) to a high of 597.8 per cent (Antwerp

Diamond Bank). Of the 28 foreign banks, the CDR of as many as 10 banks was over

100 per cent (Appendix Table III.13).

Maturity

Profile of Assets and Liabilities of Banks

3.54 The maturity

structure of commercial banks’ assets and liabilities at end-March 2008

remained broadly the same as in the previous year, barring minor variations (Table

III.19). The share of deposits of up to one year maturity of all bank groups

(barring new private sector banks) increased moderately, while that of other maturity

buckets (1-3 years and 3-5 years) declined (except foreign banks whose share of

deposits maturing between 3-5 years remained unchanged). The share of borrowings

up to one year maturity increased across all bank groups (barring

Table

III.19: Bank Group-wise Maturity Profile of Select Liabilities /Assets

| (As

at end -March) | (Per

cent to Total) | Assets/Liabilities | Public

Sector | Old

Private | New

Private | Foreign |

|

|

| Banks | Sector

Banks | Sector

Banks | Banks |

|

|

| 2007 | 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | 2008 |

1 |

|

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

I. | Deposits | | | | | | | | |

| a) | Up

to 1 year | 42.4 | 44.1 | 47.0 | 50.9 | 60.4 | 57.1 | 64.0 | 64.7 |

| b) | Over

1 year and up to 3 years | 29.0 | 26.5 | 39.0 | 35.5 | 35.5 | 34.3 | 35.6 | 33.3 |

| c) | Over

3 years and up to 5 years | 11.2 | 10.3 | 7.8 | 7.7 | 2.6 | 2.5 | 0.4 | 0.4 |

| d) | Over

5 years | 17.5 | 19.1 | 6.1 | 6.0 | 1.5 | 6.0 | 0.0 | 1.6 |

II. | Borrowings | | | | | | | | |

| a) | Up

to 1 year | 52.7 | 69.6 | 76.3 | 79.1 | 50.4 | 48.9 | 88.7 | 90.9 |

| b) | Over

1 year and up to 3 years | 19.3 | 16.5 | 8.3 | 5.4 | 26.7 | 25.6 | 11.2 | 8.4 |

| c) | Over

3 years and up to 5 years | 13.5 | 6.0 | 1.7 | 3.0 | 19.9 | 22.0 | 0.1 | 0.3 |

| d) | Over

5 years | 14.5 | 7.9 | 13.7 | 12.5 | 3.0 | 3.5 | 0.0 | 0.3 |

III. | Loans

and Advances | | | | | | | | |

| a) | Up

to 1 year | 36.8 | 38.0 | 40.0 | 40.4 | 30.4 | 33.6 | 52.2 | 49.6 |

| b) | Over

1 year and up to 3 years | 33.1 | 33.3 | 37.2 | 36.1 | 39.9 | 34.3 | 31.2 | 34.4 |

| c) | Over

3 years and up to 5 years | 12.6 | 11.2 | 11.0 | 11.5 | 12.0 | 12.2 | 6.1 | 6.6 |

| d) | Over

5 years | 17.5 | 17.6 | 11.9 | 12.0 | 17.6 | 20.0 | 10.5 | 9.4 |

IV. | Investment | | | | | | | | |

| a) | Up

to 1 year | 13.6 | 19.0 | 20.4 | 21.3 | 51.1 | 55.8 | 52.2 | 62.2 |

| b) | Over

1 year and up to 3 years | 14.6 | 19.0 | 11.5 | 16.5 | 25.0 | 21.1 | 29.7 | 25.9 |

| c) | Over

3 years and up to 5 years | 15.1 | 13.8 | 9.9 | 12.2 | 7.6 | 5.4 | 11.2 | 4.1 |

| d) | Over

5 years | 56.6 | 48.2 | 58.2 | 50.0 | 16.3 | 17.6 | 6.9 | 7.8 |

|

IST,

IST,