IST,

IST,

Financial Inclusion Index for India

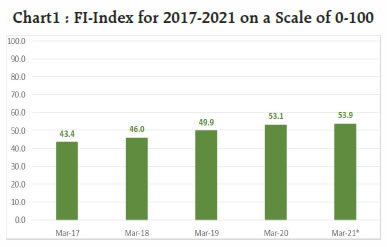

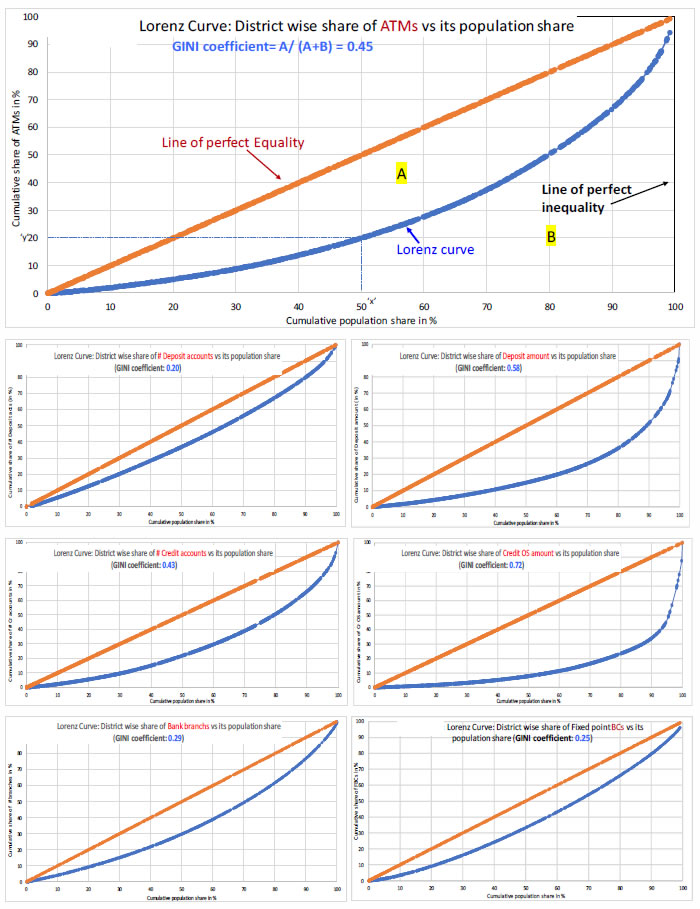

Greater financial inclusion (FI) is crucial for a wider, inclusive and sustainable growth. Therefore, a measure of FI is necessary to effectively monitor the progress of the policy initiatives undertaken to promote FI. A multidimensional composite Financial Inclusion Index (FI-Index) has been constructed based on 97 indicators which quantifies the extent of financial inclusion and is responsive to availability, ease of access, usage, unequal distribution and deficiency in services, financial literacy, and consumer protection. In a scale of 0 to 100, the annual FI-Index, with three sub-indices viz., ‘Access’, ‘Usage’, and ‘Quality’ computed for 2021 stood at 53.9, driven largely by Access sub-index which stood at 73.3 reflecting substantial progress so far in creating financial infrastructure in the country through combined efforts of all stakeholders. “We must continue our efforts for greater financial inclusion in pursuance of the goal of sustainable future for all” Shaktikanta Das, July 20211 I. Introduction Access to finance has always been considered as one of the vital parameters of economic growth, and therefore, the promotion of an inclusive financial system is an area of policy thrust and priority. In the post-independence period, mainstream financial inclusion journey of the country can be traced back to the promotion of cooperatives in 1950s, nationalisation of major commercial banks in 1960s and channelising the credit to the neglected sectors of the economy and weaker sections of the population. This was accompanied by various initiatives over the years such as expansion of branch network, introduction of Priority Sector Lending (PSL), launch of Lead Bank Scheme, promotion of Self-Help Groups (SHGs) and Joint Liability Groups (JLGs), implementation of Business Correspondents (BC) model, among others. The brick and mortar branches, complemented by the BC model have spread the reach of the banking system to every nook and corner of the country. However, the inflection point in the journey to greater FI was reached with the launch of Pradhan Mantri Jan Dhan Yojana (PMJDY), under which a large number of accounts of hitherto excluded population were opened in a time-bound manner, and with the evolution, promotion and adoption of digital channels in recent years. The Jan Dhan, Aadhaar and Mobile (JAM) eco-system has brought about a major shift in the field of financial inclusion and several initiatives have been taken to universalise digital payments in a convenient, safe, secure, transparent and affordable manner. Given the latent potential of harnessing value at the bottom of the pyramid, a large number of players are active in the field, ranging from commercial banks, cooperative banks, Non-Banking Financial Companies (NBFCs), niche financial entities such as payments banks, small finance banks, micro finance institutions (MFIs) and fintech companies. Greater focus is also being given to addressing the needs of the vulnerable segments of the economy and population, while paying attention to consumer protection and enhancing capacity of customers to undertake responsible and sustainable use of financial services. Taking this forward, the National Strategy for Financial Inclusion 2019-2024 (NSFI) and National Strategy for Financial Education 2020-2025 (NSFE) provide a road map for a coordinated approach towards financial inclusion, financial literacy, and consumer protection. With concerted efforts for furthering financial inclusion, a consolidated measure of financial inclusion is necessary to effectively monitor the progress of the policy initiatives undertaken to promote financial inclusion. It is, therefore, pertinent to construct a Financial Inclusion Index (FI-Index) which quantifies the extent of financial inclusion and is responsive to availability, ease of access, extent of usage, inequality and deficiency in services, extent of financial literacy and consumer protection in the formal financial system; and captures the expansion of banking, investments, insurance, postal as well as the pension sector. A Task Force (TF) was constituted by Government of India in October 2017, wherein all the stakeholders were represented, to suggest various dimensions and aspects for creation of an Index of Financial Inclusion. The TF submitted its report in August 2020. While the methodology suggested by the TF was retained, inter alia, a number of indicators under various sub-indices were added and a dimension of ‘Quality’ was introduced, in addition to determining weighting distribution, target values, etc. Accordingly, this article dwells on the creation of the FI-Index in terms of indicators for ‘Access’, ‘Usage’ and ‘Quality’ dimensions, weighting distributions, desired goals for the selected indicators, and methodology to combine these indicators into a composite index. The FI-Index, thus constructed, captures information on various dimensions of financial inclusion in a single number ranging between 0 and 100 - where 0 represents complete financial exclusion and 100 indicates full financial inclusion. The article is divided into five sections. Section II reviews some of the existing studies on financial inclusion. Section III discusses the methodology adopted for the FI-Index. Section IV captures the data and outcomes; and Section V dwells on the way forward. Most of the studies followed a multidimensional approach, with different set of indicators such as per capita bank accounts, bank branches, ATMs, credit/debit cards, number of household depositors/ borrowers (Sarma 2012; Dabla-Norris et al., 2015; Mialou et al., 2017). Single indicator approach may not capture the true extent of financial inclusion, for example, just having a bank account may not necessarily imply that the account is well utilised on account of physical or psychological barriers. Also, despite having bank accounts, “marginally banked” people may not be making sufficient use of formal financial infrastructure and may be using informal non-bank services (Diniz et al., 2011; Kempson, 2004; Seidman et al., 2005). At the institutional level, Financial Access Survey (FAS) of the International Monetary Fund (IMF) collects annual time series data on access and use of basic financial services around the world. The FAS was launched in 2009 to collate supply side data on key access and usage indicators under financial inclusion. The FAS, inter alia, provides information about ATMs per 100,000 population, bank branches per 100,000 population, number of depositors and borrowers per 1000 adults, deposit and credit as per cent of GDP, etc. It also captures data on insurance and digital transactions. The FAS serves as a comprehensive source of financial inclusion data for most of the countries of the globe and can be used for cross references. CRISIL’s Inclusix, first published in 2013 with next three iterations in 2014, 2015 and 2018, is a composite index that measures financial inclusion as an aggregate of six parameters across four dimensions of Branch Penetration (BP), Credit Penetration (CP), Deposit Penetration (DP) and Insurance Penetration (IP). The ‘Inclusix’ considers district wise data and provides extent of financial inclusion at the national, regional, and district levels. Findex database (Demirguc-Kunt and Klapper, 2012) published by the World Bank every three years beginning 2011, is based on surveys of more than 150,000 adults of age 15 and above in over 140 economies on how adults save, borrow, make payments, and manage risk. Construction of FI-Index has three broad challenges, i.e., selection of appropriate indicators or variables, setting the target (desired level), and determining the weighting distribution. Most of the existing studies on FI-index concentrate on indicators representing access and usage dimension of financial inclusion and then construct a composite index based on the weighted average (or equal weight) of normalised indicators. These studies, however, omit the ‘Quality’ dimension of the financial inclusion, which plays a very important role towards the objective of deepening financial inclusion. As the selected indicators are required to be normalised to bring these on the same scale before combining, each indicator is compared with respect to its desired goal; when an indicator achieve its desired goal or ‘optimum value; it is presumed that financial inclusion as proxied by the indicator is complete. Since theoretically it is difficult to arrive at an optimum level of achievement for an indicator of financial inclusion, fixing the target value is a challenging task. Further, all selected indicators may not have equal significance towards financial inclusion goal. Therefore, weighting distribution among the selected indicators may be unequal and determined exogenously. The FI-Index constructed by the Reserve Bank is based on the three dimensions of financial inclusion, viz., ‘Access’, ‘Usage’ and ‘Quality’ with weights as 35, 45 and 20 per cent respectively. The weights were determined to make the index forward-looking with higher weights to the deepening aspect of financial inclusion (‘Usage’ and ‘Quality’). The indicators for the three dimensions of the Index, their optimum values and their respective weights were decided in further consultation with the respective sectoral regulators and the Government, keeping in mind their role in furthering FI. Broadly, one-third of total weight has been assigned to ‘Access’ where most of the initiatives in the past have been undertaken and which reflects the extent of supply side financial infrastructure made available. Two-thirds of the weight has been assigned to deepening aspect of financial inclusion, i.e., ‘Usage’ and ‘Quality’. Each of these three sub-indices are further composed of distinct set of dimensions computed based on non-overlapping set of indicators. ‘Access’ sub-index which is further divided into four dimensions, viz., ‘Banking’, ‘Digital’, ‘Pension’, and ‘Insurance’, reflects the efforts made on the supply side of financial inclusion, such as availability of physical and digital infrastructure and measures for making basic products and services available for the excluded segments. The 26 indicators across four dimensions have been selected to capture number of banking outlets including BCs, NBFCs, and post offices etc., total number of savings accounts including small savings, all type of cards and electronic payment infrastructure, JAM ecosystem, subscription base of various pension schemes and offices and agents of life and non-life insurance etc. ‘Usage’ sub-index is divided into five dimensions, viz., ‘Savings & Investment’, ‘Credit’, ‘Digital’, ‘Insurance’ and ‘Pension’. Comprised of 52 indicators, it is more of a demand side measure and reflects the extent of active usage of financial infrastructure by way of savings, investment, insurance, availing of credit and remittance facilities, etc. The indicators are designed to reflect savings and investment habits, availment of credit from banks and non-banks, use of retail digital payments, penetration of insurance both life and non-life, and contribution to various pension schemes. ‘Quality’ sub-index has three dimensions, viz., ‘Financial Literacy’, ‘Consumer Protection’, and ‘Inequality’ in the distribution of financial infrastructure with 19 indicators. These indicators capture the efforts undertaken by the stakeholders to make citizens aware of the appropriate financial services available, safe ways of using them, and making them aware of their rights such as to overcome the psychological barriers. They also reflect effectiveness of the grievance redress mechanism and account for uneven distribution of certain indicators of financial access and usage. Gini coefficient based on Lorenz curve with district level data granularity has been used to measure inequality. Of the 97 indicators in the Index, 90 are primary indicators and remaining seven indicators are inequality measures of respective seven primary indicators viz., distribution of bank branches, distribution of fixed-point business correspondents (FBCs) outlets, distribution of ATMs, distribution of number of savings account and savings amounts, distribution of number of credit accounts and outstanding credit. Lorenz curve and inequality measure in terms of Gini coefficients of these seven indicators are presented in Annex. All indicators wherever necessary are adjusted for inflation based on the Consumer Price Index (CPI). For creating a composite financial inclusion index, many research studies have used similar methodology as used by United Nations Development Programme (UNDP) in constructing Human Development Index (HDI) and Human Poverty Index (HPI). The approach of combining multiple indicators into a single number is similar to the method used by Sarma (2008) which had also followed the UNDP adopted methodology. Selected indicators were normalised with respect to the case when no financial services were available, therefore, the FI-Index has no ‘base year’. Lowest value of a normalised parameter is ‘0’ and highest value is ‘100’. All indicators (Yi) are normalised (Ni), to make them unit free and to bring them on the same scale, by dividing them by the respective desired goal. Desired goals (ti) of all indicators and weighting distributions (wi) of indicators, the dimensions, and sub-indices were arrived at after consultations with the stakeholders. Some of the indicators are separately added (e.g., BSBDA, PMJDY accounts) in addition to their implicit presence in the total or overall macro indicators (Total savings accounts) as a group, which are also taken as one of the selected indicators, to emphasis their importance towards financial inclusion. Financial inclusion for all dimensions is measured by averaging the normalised ‘Euclidean distance’ of weighted normalised indicators (w1N1, w2N2,..wkNk) from their worst points (0,0,..0) and inverse of distance from their best points (w1,w2,..wn) in n-dimensional space. FI sub-indices are calculated based on respective dimensions and FI-Index is calculated based on three sub-indices following the same methodology as used to calculate the dimensions. Let Yi, where i=1,2,..k, is ith indicator, and wi is associated weight to the ith indicator and ti is the desired goal or target set for the ith indicator. Let Ni is the normalised value of ith indicators corresponding to Yi  Required data, at annual frequency, for all indicators for the period 2017-2021 have been obtained from the respective sectoral regulators. The annual FI-Index computed for 2021 stood at 53.9 as against 43.4 for 2017 registering compound annual growth rate (CAGR) of 5.5 per cent. Of the three sub-indices, FI-Access with the index value at 73.3, expectedly, is higher as compared to both FI-Usage (43.0) and FI-Quality (50.7) which indicates that building blocks for greater financial inclusion in the form of financial infrastructure put in place over the years needs to be built upon by deepening the FI through focusing on promoting ‘Usage’ and improving ‘Quality’. Access sub-index: Large number of measures since 1950s and recently, as outlined above, have been undertaken in providing greater access to financial services. Accordingly, 16 out of 26 indicators under ‘Access’ have index values which are more than the overall index value of 53.9, resulting in Access sub-index value of 73.3, which for a country of India’s size and diversity, indicates commendable progress. This value is largely driven by the growth over the years, and recently, in the number of bank outlets manned by own staff, FBCs, total number of savings accounts, post offices, number of subscribers in Mutual Funds (MFs), JAM ecosystem, number of offices for insurance, Prepaid Payment Instrument (PPI) issuers, and Point of Sale (PoS) terminals etc.

Usage sub-index: Usage has shown highest growth as compared to other sub-indices, driven largely by ‘Insurance’, ‘Credit’ and ‘Saving & Investment’. Some of the indicators under these dimensions which have shown substantial growth include total number of credit accounts, amount outstanding in the credit accounts, volume and value of Unified Payments Interface (UPI) transactions. Increased use of direct benefit transfer (DBT) for various government programmes also had a positive impact on the index value through higher outstanding amounts in Savings Bank (SB) accounts. While digital infrastructure has expanded in last few years showing good index value under ‘Access’, its ‘Usage’ has declined in 2021 possibly due to COVID-19 related restrictions. The BC model, which uses the Aadhaar enabled Payment System (AePS) channel, came to the fore during these restrictions ensuring last mile delivery of cash benefits as announced under Pradhan Mantri Garib Kalyan Yojana (PMGKY) by undertaking more than 94 crore transactions accounting for ₹2.25 lakh crore during 2020-21. Quality sub-index: Regional disparity in credit outstanding is most prominent with Gini coefficient at 0.72, followed by disparity in deposit amount with Gini coefficient of 0.58. Gini coefficient for number of deposit accounts, FBCs, bank branches, credit accounts, ATMs are computed at 0.20, 0.25, 0.29, 0.43, 0.45 respectively (Annex). The progress, as measured by the FI-Index, highlights the need for greater and focussed interventions on the demand side of the inclusion effort. The NSFE has set an ambitious vision of creating a financially aware and empowered India. It includes a ‘5 C’ approach for dissemination of financial education through emphasis on development of relevant Content (including in the curriculum in schools, colleges, and training establishments); improving Capacity of the intermediaries who provide financial services and education; adopting the Community led model for financial literacy through appropriate Communication Strategy; and enhancing Collaboration among various stakeholders. To build on the success of PMJDY program in providing access, it is essential to address the issue of dormant/inoperative accounts through an understanding of the underlying factors like lack of sufficient/regular income, creating appropriate financial products and addressing lack of awareness about them, procedural/operational challenges and lack of available acceptance infrastructure, etc. Recognising that sustainable financial inclusion can be achieved only when access to financial service providers is complemented with provision of a bouquet of financial products including insurance, pension, investment, and credit besides deposit, the NSFI, inter alia, recommends that every willing and eligible customer be provided with the same. This facet of financial inclusion needs further impetus. Moreover, in pursuance to the NSFI milestone to expand the reach of Centers for Financial Literacy (CFLs) to every block in the country by March 2024, the pilot project of CFL is being scaled up by setting up 1,199 CFLs in phase I. With the proliferation of large number of BCs in the financial ecosystem with varying business models, given the crucial role they play in furthering financial inclusion by addressing the last mile disconnect, the issues pertaining to continued availability of BC agents, their capacity building, certification requirements and remuneration related issues need to be addressed proactively. Ease of credit access, particularly to Micro Small and Medium enterprises (MSMEs), Small and Marginal Farmers (SMFs), women and micro credit segments remain a policy priority for policy makers. Recent revision in Priority Sector Lending (PSL) guidelines with a framework to encourage flow of credit to identified credit deficient districts across the country, inclusion of startups, emphasis on health infrastructure & renewable energy etc., are expected to mitigate regional disparities in deployment of credit and ensure greater credit flow to the targeted sectors. To facilitate expansion and deepening of digital transactions that promotes greater FI, 42 districts were identified as part of a pilot project to ensure these districts become 100 per cent digitally enabled in one year, through creation of necessary digital infrastructure and digital literacy. The scale up of the pilot in the other identified districts needs to be closely monitored. With greater financial inclusion and increasing digital transactions, it is important to ensure effective and expeditious redressal of grievances which may arise on account of deficiency in services and failed transactions etc., create awareness about, and address issues related to, frauds, cyber security and data protection. While several steps have been taken in these respects by all the regulators, efforts need to be scaled up and coordinated. It is expected that the FI-Index to be published by the Reserve Bank every year in July, will not only reflect the success of measures already taken and being taken by various stakeholders, but will also serve as a guide with regard to further measures that need to be taken. References Dabla-Norris, E., Y. Deng, A. Ivanova, I. Karpowicz, F. Unsal, E. VanLeemput, and J. Wong (2015). “Financial Inclusion: Zooming in on Latin America,” IMF Working Paper 15/206, International Monetary Fund, Washington, D.C. Demirguc-Kunt, A., and Klapper L. (2012). “Measuring Financial Inclusion: The Global Findex Database”. Policy Research Working Paper 6025, The World Bank. Diniz, E., Birochi, R. and Pozzebon, M. (2011). “Triggers and barriers to financial inclusion: The use of ICT-based branchless banking in an Amazon county”. Electronic Commerce Research and Applications online at: http://dx.doi.org/10.1016/j.elerap.2011.07.006 Kempson E, Atkinson, A., and Pilley, O. (2004). “Policy level response to financial exclusion in developed economies: lessons for developing countries”. Report of Personal Finance Research Centre, University of Bristol. Mialou, A.,Amidzić, G., Massara, A. (2017),” Assessing Countries’ Financial Inclusion Standing — A New Composite Index”, Journal of Banking and Financial Economics, Central and Eastern European Online Library GmbH, Frankfurt, Germany. Sarma, M. (2012). “Index of Financial Inclusion—A measure of financial sector inclusiveness”, Competence Centre on Money, Trade, Finance and Development Working Paper No. 07/2012, Berlin. Seidman, E., Hababou, M. and Kramer, J. (2005) “Getting to Know Underbanked Consumers: A Financial Services Analysis”. Report of the Center for Financial Services Innovation, Chicago. Inequality measured for select indicators  * This article is prepared by Anil Kumar Sharma, Executive Director; Sonali Sengupta, CGM-in-charge; Indrajit Roy, Director; and Sushmita Phukan, GM Financial Inclusion and Development Department. 1 Inaugural address by Shri Shaktikanta Das, Governor, Reserve Bank of India, delivered at the Economic Times Financial Inclusion Summit on July 15, 2021. | ||||||||||||||||||||||||||||||||||||||||

صفحے پر آخری اپ ڈیٹ: