VII. Macroeconomic Outlook - ربی - Reserve Bank of India

VII. Macroeconomic Outlook

Various surveys indicate that business confidence has started to rebuild, though it still stays weak. Growth in 2013-14 is likely to be somewhat weaker than the earlier projection as signs of pick up are yet to emerge. Improved confidence and actions to support infrastructure projects could translate into a slow-paced recovery in 2014-15 provided these actions are sustained. Inflation has exhibited marked moderation in December and may soften further in Q4 but upside risks remain for 2014-15. The persistence in high inflation continues to pose a challenge to growth over the medium-term, even as its fallout in terms of a wide CAD, on the back of lower savings, has been contained through policy responses over Q3 of 2013-14. Surveys show business confidence has improved VII.1 Business confidence has turned around as indicated by a sharp q-o-q growth in various business indices (Table VII.1). These surveys indicate that better investment prospects, improving sales, new orders and improved export performance have contributed to rising optimism. However, weak demand, political uncertainty and high inflation appear to be among the factors restraining growing optimism. The seasonally adjusted HSBC Markit Purchasing Managers’ Index (PMI) for services continued to be in contraction mode in December 2013, while that for manufacturing showed marginal expansion in activity.

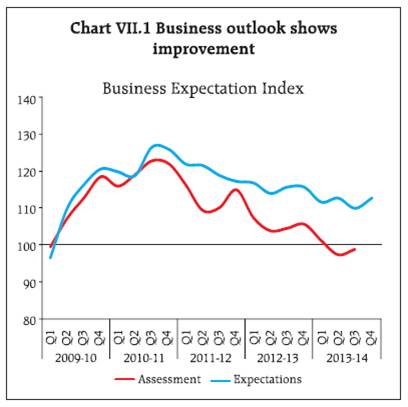

Industrial Outlook Survey reflects marginal recovery in business outlook VII.2 The Reserve Bank’s 64th round of the Industrial Outlook Survey (/en/web/rbi/-/publications/industrial-outlook-survey-q3-2013-14-round-64-15705) conducted during November- December 2013, showed that in terms of assessment, the Business Expectation Index (BEI) improved marginally for Q3 of 2013-14, but still remained below the threshold level of 100 separating contraction from expansion. Based on expectations, the index showed an improvement in Q4 of 2013-14 over the previous quarter (Chart VII.1). VII.3 An analysis of the net responses for various components of demand conditions shows marginal improvement in sentiments regarding production, order books, capacity utilisation, exports and imports for Q3 of 2013-14. The demand outlook for Q4 of 2013-14 shows improved optimism as well. Perceptions on overall financial situation were also better for Q4 of 2013-14 (Table VII.2).

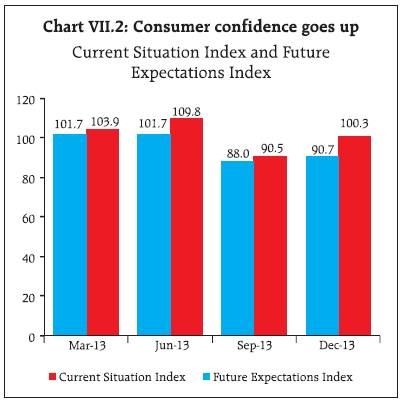

Consumer confidence shows signs of improvement VII.4 The Reserve Bank’s 15th round of the Consumer Confidence Survey (/en/web/rbi/-/publications/consumer-confidence-survey-december-2013-round-15-15706) conducted in December 2013 shows improvement in consumer confidence as indicated by the Current Situation Index (CSI) and Future Expectations Index (FEI) (Chart VII.2). Downward revision in India’s growth projections by external agencies VII.5 Various external agencies have reduced India’s growth projections further. However, the World Bank and the IMF revised it moderately upwards (Table VII.3). The IMF projects India’s 2014-15 growth at 5.4 per cent, while the World Bank places its forecast at 6.2 per cent.

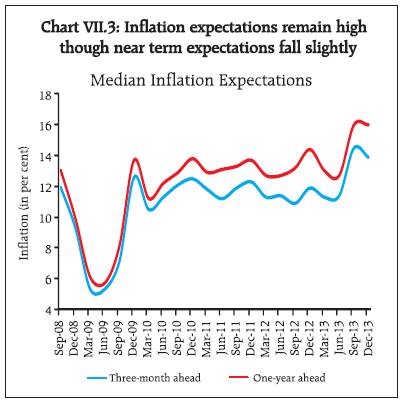

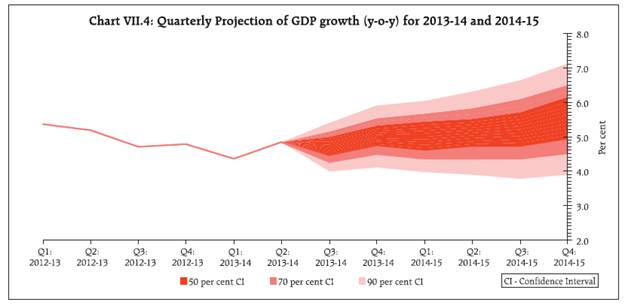

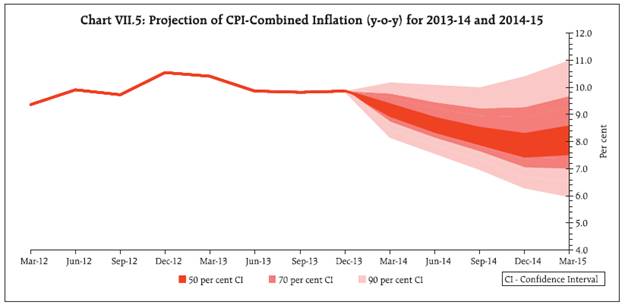

Survey shows professional forecasters expect modest recovery in 2014-151 VII.6 The Reserve Bank’s 26th round of the Survey of Professional Forecasters outside the Reserve Bank (/en/web/rbi/-/publications/results-of-the-survey-of-professional-forecasters-on-macroeconomic-indicators-26th-round-q3-2013-14-15703) indicated growth bottoming out in 2013- 14, and a modest recovery in 2014-15 with growth pegged at 5.6 per cent. CPI inflation is expected to exhibit persistence and decline slowly averaging 8.9 in Q2 of 2014-15 and average 8.5 per cent for the full year. Growth expectations for 2013-14 have remained unchanged, while expected WPI inflation is higher. There has been a significant downward revision in the forecast for CAD for 2013-14 to 2.7 per cent from 3.5 per cent forecasted earlier (Table VII.4). Households’ near term inflation expectations go down marginally VII.7 The latest round (October-December 2013) of Inflation Expectations Survey of Households (IESH Round 34) (/en/web/rbi/-/publications/inflation-expectations-survey-of-households-december-2013-round-34-15707) indicates that the perception of three-month ahead median inflation expectations of households moved down whereas that for the one-year ahead period, remained at the same level as compared to the previous quarter (Chart VII.3). Growth Outlook: Economy poised for gradual recovery in 2014-15 VII.8 Prospects of a pick-up in real GDP growth in the second half of 2013-14, have been dampened by negative growth in industrial production over two consecutive months, sluggishness in services sector activity and the weakening in private consumption and investment demand. Notwithstanding the improved export performance and buoyant outlook for agricultural production, GDP growth for 2013-14 could be somewhat lower than the central estimate of 5 per cent projected at the time of the Second Quarter Review. VII.9 For 2014-15, the Reserve Bank’s assessment is that a gradual recovery could set in, though further actions will be needed to secure it. The GDP growth is likely to be in the range of 5 to 6 per cent, with risks balanced around the central estimate of 5.5 per cent (Chart VII.4). As projects cleared by the CCI so far translate into investment, global growth outlook improves, and inflation softens, real GDP growth in 2014-15 could turn up into the higher reaches of this forecast range. Inflation Outlook: Inflation anticipated to moderate further but remain above comfort zone VII.10 Retail inflation measured by the CPI is expected to moderate from current levels, driven down by further seasonal softening in vegetables and fruits prices in Q4 of 2013-14. However, CPI excluding food and fuel inflation is expected to remain elevated, imparting persistence to the headline. Accordingly, headline CPI inflation could still remain above 9 per cent in the rest of 2013-14. VII.11 In 2014-15, a slow paced inflation moderation amidst sticky prices could continue. Based on the assumptions of the normal rainfall, some cost pressures from administered fuel price increases, elevated rural wages, supply chain bottlenecks and still heightened inflation expectations, CPI inflation is expected to range between 7.5 and 8.5 per cent in Q4 of 2014-15, albeit, with the balance of risk tilted to the upside (Chart VII.5). 1 The forecasts reflect the views of professional forecasters and not of the Reserve Bank. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||