IST,

IST,

RBI WPS (DEPR): 01/2022: Stock Price Reaction on the Announcement of Basel Implementation: Evidence from Indian Banks

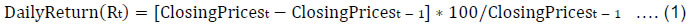

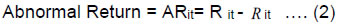

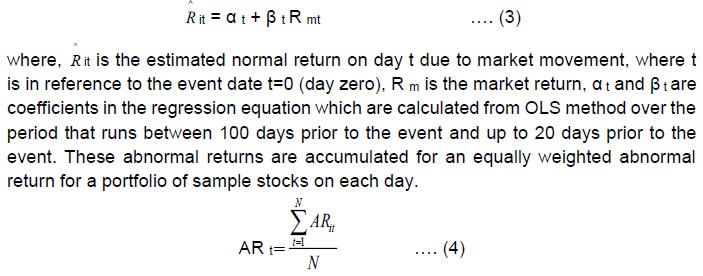

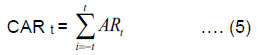

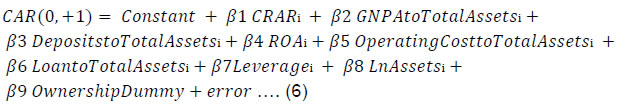

| RBI Working Paper Series No. 01 Stock Price Reaction on the Announcement of Basel Implementation: Evidence from Indian Banks Gaurav Seth, Supriya Katti and B.V. Phani@ Abstract * The study evaluates the market reaction to the Reserve Bank of India’s policy decisions related to aligning its domestic banking regulations with global Basel capital adequacy norms. Using event study methodology, the study finds that in the initial phase, the Indian banks were not prepared to raise the capital to 9 per cent; therefore, the market overreacted to Basel I announcement, and pessimistic sentiments were observed in terms of abnormal returns and cumulative returns. The subsequent announcements received a positive reaction since Indian banks were benefitted from the experience gained by the imposition of previous regulatory decisions and were prepared to cope with the expected changes. The rise in banks' stock prices during announcements of Basel II and Basel III periods provides evidence that implementation of the Basel regulations has a favourable impact on the Indian banking sector in the long run. JEL Classification: E58, G14, G21 Keywords: Capital adequacy, Basel norms, event study Introduction The theory of financial intermediation defines the role of commercial banks with a focus on risk management. This new approach of financial institutions had shifted banks' focus from the traditional economic activity of borrowing and lending to that of a financial intermediary carrying out various other financial transactions (Allen & Santomero, 1997). Due to this, the nature of banking operations characterised by high leverage often leads to moral hazard problems. To address this concern, the banking industry is highly regulated worldwide. The regulations shape the structure for banking operations, determine lending decisions and control risk-seeking behaviour. Therefore, any change in regulation acts as a policy measure for the banking industry. Such decisions have a greater impact on the bank operations resulting in influencing the market performance of the bank. Most countries have adopted the banking norms of the Basel Committee on Banking Supervision (BCBS), known as Basel norms, in integration with domestic policy decisions. One of the important measures of the Basel committee recommendation is the implementation of capital adequacy norms to mitigate the excessive risk-seeking behaviour of any bank. Being one of the largest emerging economies, India adopted Basel norms in a phased manner over a long period. The standard BCBS norms have been customised by the banking regulator, i.e. Reserve Bank of India (RBI), which has brought in significant changes in the operations of Indian banks. This study aims to capture the stock market reaction to the implementation of the Basel norms using the event study technique based on Ghosh et al. (2008). In the field of economics, event studies are used to examine the short-term effect of regulations. While tighter guidelines and higher capital requirements restrict banks' ability to give out more loans, it also keeps a check on lending practices of banks by ensuring skin-in-the-game for promoter entities. Therefore, from this perspective, it becomes important to see how the financial market perceives the implementation of Basel guidelines. There are very few India-specific studies that focus on Basel implementation and the stock markets’ reaction to it; this paper attempts to fill this gap. Any change in policy decisions influences the market performance of commercial banks. We examine the short term market reactions of six important policy decisions taken by RBI for the imposition of Basel I, Basel II and Basel III norms for Indian commercial banks. The first one is the decision taken during the implementation phase of Basel I norms for commercial banks that aimed at increasing the minimum requirement of maintaining capital to a risk-weighted-asset ratio (CRAR) to 9 per cent as compared to 8 per cent recommended by BCBS. The second event we evaluated is when RBI issued final guidelines to implement Basel II norms. The third event is the announcement of draft guidelines for implementation of Basel III capital regulations, while the fourth event that we evaluated is the measures adopted by Indian banks to comply with Basel III norms. The fifth event is the announcement of an extension of the implementation deadline for Basel III by one year. Finally, we evaluated the announcement effect of RBI’s decision to allow banks to expand the capital base of their Tier I capital by including the property and foreign exchange value. This study corroborates that changes in policy decisions result in a significant reaction by the investors in the market. The paper indicates that the market reacted negatively to the first event while positively to the last five events. Here, it becomes important to point out that while the first four events were aimed at ensuring a stricter regulatory framework, the last two events, which relate to the extension of timeline for Basel III implementation and expansion of capital base to meet Basel III requirements were directed at providing relaxation/ relief to the banking sector. The observed results support that the investors show a significant reaction to the market performance of Indian banks with respect to the announcement of these policy decisions. We contribute to the literature on banks’ performance with an analysis of the market reaction to the policy-related announcements made by the regulator, which impacted the operations of all commercial banks. The paper is organised as follows. Section II describes the related literature influencing the market performance with a focus on policy decisions. Section III briefly describes the Indian banking industry, followed by section IV narrating the events’ details. Section V describes data and methodology. Section VI discusses the results and Section VII concludes. The extant literature links and analyses the spillover effect of implementing minimum regulatory capital requirements on different parameters of banking operations. Various studies evaluated the impact of capital regulations on banks’ performance, credit availability, risk of bank portfolio, net interest margin, asset quality etc. The effect is evaluated at an individual bank level with respect to the other banks. Some other studies measured the relative performance of a group of banks with other groups in other countries or regions. Therefore, the measurements of the impact of capital regulations on the performance of banks have been viewed in several dimensions. The study by Chiuri, Feeri, and Majnoni (2002) examined a panel dataset for 572 banks after adopting capital adequacy regulations as stipulated by Basel norms during the period 1992-1998. The study considered banks in 15 developing countries (Argentina, Brazil, Chile, Costa Rica, Hungary, India, Korea, Malaysia, Mexico, Paraguay, Poland, Slovenia, Thailand, Turkey, and Venezuela) and revealed that the imposition of capital regulation resulted in the reduction of loan supply, consequently reducing its profitability and interest margin for these banks. In addition to the bank performance, capital adequacy is also linked with the insolvency risk of a bank (Lin, Penm, Garg & Chang, 2005). Furfine (2000) in his study on U.S. banks during the period 1989 to 1997, found evidence that the reduction in loan growth is consistent with the changes in risk-based capital adequacy regulations. Demirguc-Kunt, Laeven, and Levine (2003) studied data on over 1400 banks, across 72 countries (includes Canada, France, Germany, the US, the UK, Japan, India, Mexico, New Zealand) during the period 1995-1999 to analyse the impact of capital regulations/other internal variables like concentration and institutions on profit margins of the banks. They found that the restrictions on bank activities through enhanced capital requirements could be negatively associated with bank development, adversely affecting credit expansion and credit growth. Moreover, regulatory restrictions on bank activities may increase net interest margins or overhead costs. The ability of banks to stabilise income flows by diversifying activities may only work in countries with sufficient securities market development. Goddard, Molyneux, and Wilson (2004) studied the determinants of profitability of European banks using a dynamic estimation technique. They found a significant positive relationship between the capital adequacy ratio and profitability. Other researchers like Kwan and Eisenbeis (1997), Fare, Grosskopf and Weber (2004) and Berger and Di Patti (2006) used frontier techniques to examine the effect of capital ratios on bank profit efficiency. They found that higher leverage or a low equity/asset ratio reduces the agency costs of outside equity and increases its value by constraining or encouraging managers to act more in the interest of shareholders. Hence, higher leverage can mitigate conflicts between shareholders and managers concerning the choice of investment. The theoretical model developed by Kahane (1977), Koehn and Santomero (1980), and Kim and Santomero (1988) supported that a bank determines its optimal portfolio intending to maximise the expected utility derived from end-of-period capital. This capital depends on the degree of the bank’s risk profile. An increase in the required leverage ratio constrains the bank’s efficient asset investment frontier, forcing banks to adjust their choice of asset portfolios. The bank that is willing to take more risks will respond by choosing a riskier asset mix. However, it has to be supported by the required capital to mitigate the opted risk level. The effect of capital requirements on the overall banking system depends on the distribution of risk aversion across banks. The implementation of capital adequacy norms also received investors’ responses reflecting it on the bank share prices. If the market perceives favourable/adverse effects of the implementation of the binding capital regulations on the bank's profitability, then it should be reflected in banks’ stock prices. But this instantaneous market reaction cannot be treated as the long-run effect of banks’ competitiveness as event studies capture the market's reaction around event dates in the short-term only. The academic literature on announcement effects of the implementation of capital adequacy norms on profitability produced inconclusive results regarding the market expectations in the short run. Bruno et al., (2018) examined market reaction to bank liquidity regulations related to seven announcements under the new Basel III framework in European banks from 2008 to 2013; they found that the market reacted adversely to these seven announcements with large negative cumulative abnormal returns1. Shares of more liquid banks displayed larger cumulative abnormal returns than shares of less liquid banks. Eyssell and Arshadi (1990) used an event study methodology to test the impact of three major announcements of capital regulations, during the period 1986 to 1988, on the stock prices of 27 large banks in the UK. The study revealed significantly negative abnormal returns for the events preceding the imposition of risk-based capital requirements. However, evaluation of long-term effect showed an inverse relation between long-term profitability and imposition of capital requirements. Madura and Zarruk (1993) analysed the stock market reaction to information to capital adequacy regulations that were disseminated on four different event dates between 1987 to 1988 and corroborated that the share prices of US banks were adversely affected by a change in the regulations. The study on 27 large banks in Canada, Japan, the UK and the US by Cooper, Kolari, and Wagster (1991) estimated the impact of series of twelve announcements of the change in capital regulations on the banks’ stock prices during the period January 1987 to July 1988. They observed that the trend of abnormal returns of banking stock in the countries of Canadian, the UK, and the US banks are being adversely affected by the announcements, observing the greatest decline in the stock prices of US banks. Wagster (1996) used the estimation method to examine the market reaction of eighteen announcements on 57 banks from Canada, Japan, the the UK, the US, Germany, the Netherlands, and Switzerland. The author observed that in each of the seven countries, at least one of the eighteen events had a statistically significant effect on the banks' share prices. However, in the case of Japanese banks, the overall significant effect was a gain of 32 per cent in cumulative wealth. It indicates that the cost of raising new capital was outweighed by the benefits of the capital regulations in Japan. Besides, Japan being a bank-centric economy shows deviation from other economies and thus the market expectation from banking institutions differs. The above-mentioned event studies are based on abnormal returns in banks’ share prices and showed that in most of the countries the market expected that the imposition of capital regulations would reduce profitability (a statistically significant effect). However, Sensarma and Jaydev (2009) examined risk management behaviour on the stock market returns of Indian banks between the years 1999 till 2006 and observed that stock returns appeared to respond positively to sound risk management practices of the banks. The summary for literature discussed in this section is given in the table below: It is evident from the literature that the impact of capital adequacy regulation is different on banks’ performance in developed and developing economies. III. Indian Banking Environment The Indian banking industry is regulated by its banking regulator, i.e., the Reserve Bank of India (RBI). RBI voluntarily adopted capital adequacy regulations in April 1992 for the Indian banking sector, thus complying with the best practices of Basel I norms recommended by BCBS in 1988. These capital adequacy norms were revised to Basel II and subsequently upgraded to Basel III. The objective was to make the capital adequacy ratio one of the primary measures for regulatory purposes of the banking sector. In addition to global capital adequacy regulation, Indian banks need to comply with various domestic regulatory requirements laid by the RBI. The requirement of maintaining a cash reserve ratio (CRR-4 per cent) and statutory liquidity ratio (SLR-18 per cent) are mandatory to all the Indian commercial banks2. Further, banks are expected to lend 40 per cent of their assets to the priority sector defined as priority sector lending norms. However, banks also take investment decision that involves greater risk in anticipation of higher return. RBI classifies the Indian banking industry into five different groups based on its ownership structure. The bank groups are SBI and its Associates3, Nationalised banks, New Private banks, Old Private banks and Foreign banks. The study examined market reaction to the announcement of the imposition of Basel capital norms based on the event study approach. Event 1, occurring under Basel I phase on October 30, 1998, is an announcement to raise capital to risk-weighted-asset ratio (CRAR) from 8 per cent to 9 per cent by RBI in its Mid-term Review of Monetary and Credit Policy. Event 2 is considered on April 27, 2007, when RBI announced the final guidelines for implementation of Basel II. The third event is the announcement of draft guidelines for implementation of Basel III capital regulations issued on December 30, 2011, the fourth event occurred on May 2, 2012, when RBI announced to adopt stricter measures of Basel III framework governing improved risk management systems in banks. The fifth event date is considered on March 27, 2014, when RBI revised Basel III capital regulation norms and announced the extension of the timeline from March 31, 2018, to March 31, 2019, for Indian banks. The sixth event took place on March 1, 2016, when RBI allowed banks to expand the capital base to meet Basel III norms. The details of the events are presented in the following table: As we evaluate the major reforms in the Indian banking industry after financial liberalisation, the above-mentioned events are some of the major and important decisions that have brought significant changes in the operations of Indian banks. To analyse the performance, this study considers abnormal return and cumulative return for three portfolios of bank stocks: the combined portfolio for all banks, public sector banks and private sector banks. We include nationalised banks and SBI and its associates in public sector banks, old private and new private in private sector banks in these event studies. Foreign banks are excluded from the study as their stocks are not listed. Public sector banks are those in which more than fifty per cent stake is held by the government and plays a dominant role in the financial intermediation in the economy. These banks are relatively large and have lower asset quality, leading to higher provisioning requirements, falling profitability, and a weak capital position4. The majority stake in private sector banks is held by private shareholders and are better placed than public sector banks in terms of financial parameters of asset quality and net interest margin. The purpose of Basel regulations was to reduce risks and promote the safety of banks. Since both categories of banks have distinct characteristics, we have segregated all banks further into public and private sector banks to have valuable insights. We expect that the market reaction for the regulatory announcements would differ since public sector banks are perceived to have a higher risk (lower asset quality) which these regulations would mitigate as compared to those of private sector banks. For the 30th October 1998 event, the sample includes 15 banks: 6 public sector banks and 9 private sector banks5. For the 27th April 2007 event, the sample includes 31 banks: 16 public and 15 private sector banks. For the 30th December 2011 event, the sample includes 40 banks: 25 public and 16 private sector banks. For the event of 2nd May 2012, the final sample includes 34 banks: 20 public and 14 private sector banks. For the fifth event of March 27, 2014, the sample consists of 40 banks: 24 public and 16 private banks. The last event related to the announcement of March 01, 2016, includes 24 public and 15 private banks totalling 39 banks in the study (Appendix 1). In line with Ghosh et al. (2008), this study considers abnormal return and cumulative return to analyse the bank performance. The published date of any announcement by RBI is considered as an event date, thus, taking it as a reference day of zero in the event study. The prices of security at the timing of closing are considered to avoid the intra-day anomalies of trading. The data of the bank is obtained from the Prowess database of CMIE. The price of the security for the performance analysis is obtained from prowess, where prices are considered from the trading price of the Bombay Stock Exchange (BSE) – the largest and oldest stock exchange of India. Daily returns are calculated as the change in closing prices of the stock using the equation:  The stock performance is analysed by estimating abnormal and cumulative abnormal returns from 141 days for every time period. 100 days of daily returns preceding the event window were used to estimate the market model (the estimation period), and a period of 20 days preceding and following the event day represents the event period. The bank is excluded if it has less than 60 days of data during the estimation period or less than 35 days of data during the event period. In the market model, the abnormal return is calculated as follows:  Rit is the observed stock return on day t for any bank stock i, where  where, N = Number of abnormal returns in a given day. Cumulative Abnormal Return (CAR t) is the aggregate of all the portfolio abnormal returns across time.  Six separate event studies centered on October 30, 1998, April 27, 2007, December 30, 2011, May 2, 2012, March 27, 2014 and March 01, 2016 are conducted by comparing cumulative abnormal returns for the portfolios of banks for the event windows of (-5, +5), (-1, 0), (0, +1), (-1, +1). For a deeper understanding of pre and post-announcement effects on cumulative abnormal returns, we further compared event windows of different intervals (-15, -11), (-10,-6), (+5,+9) and (+10,+14). We evaluate the impact at two levels. The first one is across all the Indian banks and then at the bank group level of public sector banks and private sector banks, respectively. Non-parametric tests like Wilcoxon rank-sum test and Sign test are conducted for pair-wise comparison of event windows to test the hypothesis that within a window of pre-event and post-event, CAR is equal. Wilcoxon rank-sum test is considered to evaluate the difference between the two matched paired observations by taking into account the magnitude of the differences. In contrast, the sign test compares the paired observation based on the sign of the difference only by considering the magnitude of the difference. The methodology adopted is similar to the event study presented by Ghosh et al. (2008). In addition to the non-parametric tests mentioned above, we also employ a multivariate regression model to evaluate the impact of other bank-specific variables on the market return. We follow Ghosh et al. (2016) in consideration of various bank-level control variables such as capital adequacy ratio (CRAR), gross non-performing assets (GNPA) to total assets, deposits to total assets, return on assets (ROA), operating cost to total assets, loan to total assets, leverage and size (natural log of total assets) of the bank. The study employs the following multivariate regression model to analyse the impact of other bank-specific variables that are likely to influence the CAR in addition to the announcement effect. The other independent variables are drawn from the extant literature, and the expected sign of beta coefficient (direction of the impact) is presented in appendix 2. This model enables identification of the determinants of first-day cumulative abnormal return i.e., CAR (0, +1), after the announcement of the relevant changes brought into the banking regulation:  The next section presents the discussion of empirical results obtained through event study model. Table A1 in the Appendix exhibits the results of all the events by examining the impact of announcements surrounding capital adequacy norms on banks' stock prices returns. Event 1 occurred on October 30, 1998, which is an announcement made by RBI to raise CRAR from 8 per cent to 9 per cent. The market felt that if banks were forced to raise minimum CRAR by 1 per cent, then banks would have to reduce their financial leverage, which was expected to harm profitability as happened in advanced economies of the UK and US during the adoption of Basel I norms (Eyssell & Arshadi, 1990; Madura & Zarruk, 1993). The empirical results provide support for this argument because shareholders of 15 banks experienced 4.31 per cent loss in their cumulative abnormal returns immediately after one day of the announcement that is significantly negative at 1 per cent level (Panel A, Table A1), hence the null hypothesis is rejected that within a given event window, the cumulative abnormal return is equal to zero. A dip of 2.96 per cent in return is observed one day prior to the event date. This sudden decrease in return is expected as a news impact of the announcement of raising the norms by RBI. Similar results are observed for the event window of (-1, +1) and (0,+4) surrounding the announcement, where banks had a dip in their cumulative abnormal returns of around 4.36 per cent and 5.90 per cent, respectively. The negative mean CAR of the event window (-1, 0) is significant at 5 per cent level and (0, +1), (-1, +1) & (0, +4) are statistically significant at 1 per cent level, respectively. The only exception is a window of (-5, -1) where it is found to be positive and significant but that is prior to the announcement. The post-event results clearly indicate the investor expectations that the relative competitive position of banks would be hampered if the capital ratios are increased by 1 per cent. The negative market reaction indicates that the expectations regarding the bank profitability were viewed as unfavourable. RBI’s decision to be cautious about reacting to the added risk accepted by the banks was not visualised positively by the investors. The valuation gains surrounding the Event 2 date of April 27, 2007 are strongly positive for all the banks when RBI announced final guidelines for implementation of Basel II. The results observed in Panel A of Table A1, for event 2, indicates that the average cumulative abnormal return over the two-day window (0, +1) is 2.96 per cent for banks and 3.84 per cent over the three-day period of (-1, +1) surrounding the announcement date. In this case, the important point to notice is that the post-event return over various time windows is positive. Shareholders of all 31 banks in the sample ushered positive abnormal returns over this interval. All the t-statistics are positively significant for this event. These consistent findings are aligned with the proposition that RBI’s announcement on April 27, 2007 was helpful in signalling future gains resulting from the revision in Basel norms. Since Indian banks already maintained higher capital holdings than stipulated, the positive returns may reflect shareholder expectations that the revised Basel II standards would provide a more level playing field, thus, making the banks more competitive. Further, higher capital ratios may facilitate the sound growth of these banks, ultimately improving their earnings. In addition, Basel II norms made the computation of risk more sensitive than that of Basel I. Therefore, investors were more optimistic about the decision on the implementation of Basel II, reflecting positively on the stock prices. The third event in the study is considered on December 30, 2011, with the issuance of draft guidelines by RBI for the proposed implementation of Basel III norms for Indian commercial banks after the global financial crisis of 2007-09. The framework sought to increase the capital and improve the quality thereof to enhance the loss absorption capacity and resilience of the banks. Since Indian banks were largely unaffected by the crisis, markets were initially susceptible to adopting these norms for Indian banks. The results exhibited in Table A1 resonate with the same sentiments as the market started to react negatively prior to the announcement since the mean CAR for the event windows of (-10, -6) and (-5, -1) was found negative and highly significant. As we moved closer to the announcement date, the market understood the importance of increased regulations and started to react positively as reflected in the valuation gain of 2.03 per cent, which was statistically significant at 5 per cent level of the event windows of (-5, +5) and (-1,0). As we moved on to days 4th, 9th, and 14th, the positive CAR increases to the statistically significant level of 1 per cent. The fourth event is considered on May 2, 2012, when the RBI announced to adopt stricter measures of Basel III framework governing improved risk management systems in banks. For this purpose, the former RBI Governor, Subbarao (2012)6 reported that Indian banks would have to raise additional capital to meet the new Basel III standards. The empirical results observed in Panel B of Table A1, provide support for this argument because shareholders of 34 banks in the sample experienced a loss of 5.82 per cent in the cumulative abnormal returns over the eleventh-day window (-5, +5) surrounding the announcement which is found statistically significant at the 1 per cent level. This corroborates that investors also interpreted that Indian banks will be adversely affected in terms of their profitability due to the increase in the capital ratios. The immediate short-term reaction after one day of the announcement in a window of (0 to +1) and (0 to +4) is found negative. However, the negative effect is not statistically significant. The negative effect continues till nine days and becomes statistically significant between the 5th and 9th day after the announcement though does not last beyond 9th day. The market reaction shows faith in the RBI decision and reacts positively from day 10. This event has received mixed reactions from the investors in the short run observing the negative influence immediately for a week and improving and turning to positive after around a week. The fifth event under consideration is on March 27, 2014. On this date, the RBI announced an extension of the Basel III compliance-related requirement by one year. It gave additional time for Indian banks to comply and adjust to the revised tier 1 capital-related requirement as revised under Basel III norms. Since the market was aware of the previous two Basel implementations and the upcoming Basel III, banks were given additional time and investors did not react negatively to this announcement. On the other hand, the average return obtained over all the time windows under our consideration is positively significant in the post-announcement period except between (+10, +14). On March 1, 2016, RBI included additional categories to allow the banks to expand their Tier I capital base. This announcement made it easier for the Indian banks to meet the target of minimum capital requirements under Basel III norms. The results presented in Panel B of Table A1 exhibit that during the post-announcement period, the event experienced significant and positive returns except for over (+10, +14) days window. These sequential events presented and tested based on the market reaction in the form of CAR indicate that within an event window of (0, +1), the cumulative abnormal return is not equal to zero for all the events, except for announcements of events 3 and 4, thus, the null hypothesis is rejected. It is observed that except for the first event associated with Basel I, investors have shown confidence in the decision of the central bank’s announcements, which are domestic policy-related regulations and synchronised in response to global regulatory norms for the banking industry in India. In Table A2, we segregate the results of the first event based on bank groups such as public banks and private banks. The market reaction after the announcement is uniformly observed as negative and significant for both categories of bank groups. The difference in the results is found for the pair of windows of (0, +1) and (+10, +14) where the negative reaction for private sector banks is statistically significant. When the effect is observed over 4 days in the window of (0 to +4 days), public sector banks, as well as private banks received a significant negative reaction. The negative reaction diminished after 5 days for public sector banks. In Table A3, we conduct a similar analysis for the second event on April 27, 2007. In this table, we observe a positive reaction for public sector banks as well as private banks for all the post-announcement event windows, the difference in the reaction for public sector banks is observed in the post-event windows of (+5 to +9) and (+10 to +14) which show significantly positive reaction whereas for private sector banks it is not found significant. Similarly, only private banks received a positive statistically significant reaction to the post-event widow of (0 to +1). The overall positive effect observed over different windows ensures the investors’ support in the central bank’s decision. Table A4 indicates the comparative analysis of public and private banks for December 30, 2011. In this table, the announcement effect differs around 4th day onwards. Public sector banks experience higher positive and significant returns as compared to private sector banks for the windows of (0 to +4) and (+5 to +9), The positive reaction to the post-event window of (+10 to +14) is found significant only for public sector banks. In Table A5, we analyse the event of May 2, 2012 by separating all banks into public sector banks and private sector banks. This event received a negative reaction for both the bank groups after the announcement, however, does not have any statistical significance till 4 days for public sector banks. After the 4th day, public sector banks showed a significant negative reaction in the window of (+5 to +9), and then on, it turned positive. On the other hand, though, private sector banks received a similar positive market reaction for post-event windows but were not found statistically significant. The fundamental difference in the public versus private sector banks is based on the objective of the earnings revenues through its operations. Public banks serve with the objective of economies of scale with larger interest and wider social reach in contrast to the private banks, which thrust more on retail and fee-based business segments for their revenues. Table A6 presents the results of the fifth event on March 27, 2014, i.e. an announcement by RBI to defer implementation of revised Basel III capital regulation from March 31, 2018, to March 31, 2019. Investors welcomed the policy decision as they felt that this extension in the timeline would help in addressing the industry-wide concerns about the potential stresses (of the implementation of the regulations) on the asset quality and consequential impact on the performance/profitability of banks7. The empirical results provide support for this argument because shareholders of public sector banks experienced valuation gain in the cumulative abnormal returns (CAR) after the announcement for all the event windows except for (+10, +14). However, for private banks, the positive reaction is not found significant. These results are more pronounced for public sector banks. Table A7 presents the announcement effect of the final event of March 1, 2016. This announcement widened the base for Tier I capital. Investors expected that this move could help in unlocking Rs.30,000-35,000 crore of capital for public sector banks and up to Rs.5,000 crore for private banks8. The results support this argument as the post-announcement effect for public sector banks is positively significant for all the event windows until 9 days. After that, it turns negative, but not statistically significant. In the case of private sector banks, the positive effect is observed to be significant only for the event window of (-1, +1). Around this time when the Indian government also wanted to strengthen the banks by strategically increasing the capital position for public sector banks, widening the base of Tier I capital allowed banks to have more flexibility and reduced the distress of additional capital requirements. We observe critical differences in the investors’ reactions to public banks and private banks. It can be seen that in the case of the fifth and sixth events corresponding to relaxation of guidelines on March 27, 2014, and April 01, 2016, the cumulative abnormal returns for public sector banks are much higher than that of private sector banks, which is plausible because of the greater capital constraints being faced by public sector banks in recent years due to mounting NPA problems and, therefore, any relaxation is likely to trigger a stronger reaction for public sector banks than private sector banks. Investors also showed a larger degree of confidence in public sector banks and their performance. Table A8 presents the comparison results between the pair of event windows. The results for Event 1 indicate that the cumulative abnormal return (CAR) significantly differs for all banks between pair of event windows of (-15, -11) & (+10, +14), (-5,-1) & (0, +4) at the 1 per cent level and between event windows of (-1,0) & (-1, +1) and (0, +1) & (-1, +1) at 5 per cent and 10 per cent, respectively. However, other pair of event windows does not show a significant difference between CAR. Separate bank groups analysis shows that pairwise comparison for public sector banks mirror similar results for event windows of (-15, -11) & (+10, +14) and event windows of (-5, -1) & (0, +4). Private banks show a significant difference between cumulative abnormal return only for a pair of windows of event windows of (-1,0) & (-1, +1), (0, +1) & (-1, +1) and (-5, -1) & (0, +4). Pair-wise comparison with Event 2 in Table A9 indicates that the cumulative abnormal return for all banks differs significantly between event windows of (-1,0) & (-1, +1) at 10 per cent and (-15, -11) & (+10, +14), (-10, -6) & (+5, +9) at 5 per cent, respectively. However, other pair of event windows does not show a significant difference between CAR. Pairwise comparison of separate bank groups indicates that public sector banks show a significant difference between cumulative abnormal return only for a pair of windows of (-5, +5) & (-1, +1), (-1, 0) & (0, +1), (0, +1) & (-1, +1) at 10 per cent and (-5, +5) & (0, +1) at 5 per cent. However private banks show significant difference between cumulative abnormal return only for pair of windows of (-1,0) & (-1, +1), (-15, -11) & (+10, +14), (-10, -6) & (+5, +9) and (-5, -1) & (0, +4) at 5 per cent. Other pair of event windows does not show significant difference between CAR. Table A10 results for Event 3 indicate that the cumulative abnormal return for all banks significantly differs between event window of (-15, -11) & (+10, +14), (-10, -6) & (+5, +9) and (-5, -1) & (0, +4), Separate bank groups analysis show that public sector bank mirror same results for the given event windows but private banks had the significant difference between cumulative abnormal return for a pair of windows of (-5, +5) & (0, +1), (-10, -6) & (+5, +9) and (-5, -1) & (0, +4). Event 4 results for the comparison results between the pair of event windows in Table A11 indicate that the cumulative abnormal return for all banks significantly differ between event windows of (-5, +5) & (-1, +1), (-1,0) & (0, +1), (-5, +5) & (-1,0), (-5, +5) & (0, +1) and (-1,0) & (-1, +1). Pairwise comparison of public sector banks shows results similar to all banks, however, private banks show results is also found significant only for pair of window (-5, +5) & (-1, +1) at 10 per cent. In Table A12 for, event 5, the CAR significantly differs till day 5 for pre- and post-announcement for all banks except for (-5, +5) & (-1, +1). However, the significant disappears after the 5th day. Similar results are observed for public sector banks. For private banks, CAR is found significantly different for pair of windows of (-1, 0) & (-1, +1), (0, +1) & (-1, +1) and (-5, -1) & (0, +4) at 1 per cent. The results observed for event 6 in Table A13 exhibits that, the CAR for all banks significantly differ for all pair of windows except for (-5, +5) & (-1, +1) and (-5, -1) & (0, +4). Pair wise comparison for public sector banks show that CAR significantly differs for pair of all the windows except for (-5, -1) and (0, +4). The CAR for private sector banks significantly differs for pair of windows of (-5, +5) & (-1, +1) at 5 per cent and (-1, 0) & (-1, +1), (0, +1) & (-1, +1) at 1 per cent. The pair-wise comparison of the bank group indicates that the cumulative abnormal returns significantly differ between pre and post-event windows for all the banks. Separate bank groups analysis also confirm that the investors’ reaction differs for public sectors banks and private sector banks in terms of implementation of policy decisions. This is found true for mostly all the events that we analysed in this study. The results of these event studies present evidence that the investors’ reaction differs for various time periods of Basel I, Basel II and Basel III. Initially, it was unfavourable during the imposition of Basel I norms, but by the passage of time, as the investors gained experience and developed a better understanding, the benefits of these norms were perceived by the market. Thus, Basel II and Basel III-related announcements made a positive impact on investors’ valuation gains in terms of cumulative abnormal returns for most of the immediate event widows. The response of the market also varied depending upon ownership structure and policy decisions for public sectors banks and private sector banks. We check the robustness of these results by re-running the analysis with different event periods. The results are essentially unchanged. We then investigate whether there is any influence of other bank-specific characteristics on the market performance through multivariate analysis. The analysis is based on cross-sectional data for which the sample size is relatively small in our study. The listing of the insufficient number of Indian banks on the stock exchange is a limitation of the study. In Table A14, we present the OLS regression results in evaluating the impact on market return by considering cumulative abnormal return (CAR) for (0, +1) time window as a dependent variable. Table A15 presents the CAR for each bank in our sample in the event window of (0, +1) post all the events that are considered in the study. In Table A16 we indicate the expected sign of beta coefficient linking particular variable in the Indian banking environment and theoretical construct and its role on the banking performance in capital market. The regression results exhibit that none of the bank-level parameters significantly influence the CAR for the first, fourth and sixth events of October 30, 1998, March 27, 2014, and March 1, 2016, respectively. These results indicate that the impact on the return is not due to any other bank characteristic and confirms the strong evidence of the announcement effect. For the second event when the RBI issued final guidelines to implement Basel II on April 27, 2007, we observe significant positive impact of CRAR (significant at 5 per cent) and operating cost to a total asset (significant at 10 per cent). These results do not come as a surprise since investors perceived revisions in Basel II positively with the inclusion of (i) operational risk with credit & market risk in the computation of minimum capital requirement of CRAR; and (ii) enhanced supervisory mechanisms and disclosure requirements would ultimately benefit banks. Loan to a total asset (significant at 1 per cent) and size of the bank is found negative and significant at 10 per cent as larger banks tried to reduce their NPAs through an increase in loan portfolios. The results in Table A14 are presented for the event of December 30, 2011, when RBI issued initial draft guidelines for the adoption of Basel III capital regulations. We observed that none of the bank-level parameters significantly influence cumulative abnormal return except for the positive sign for the variables of NPA and deposits to total assets at 5 per cent. The reason is that the proposed Basel III aimed at improvement in the quality of assets to mitigate the risk of bank failure. Further investors also sensed deposit growth to be the stable source of low-cost funding for banks which could help in fostering growth. The analysis of the RBI announcement to adopt stricter measures of Basel III framework governing improved risk management systems in banks on May 02, 2012 reflects the negative and significant impact of leverage at 10 per cent. This is consistent with the investor’s notion that a higher degree of leverage is a sign of weakness which indicates issues related to asset quality in the bank. Except for this, no other bank-specific variables is found to have any significant impact of bank parameters on the market performance of banks. These results corroborate the effect of announcements surrounding the event dates. The Indian banking industry has undergone remarkable changes after the financial sector reforms. The global regulatory policy decisions adopted by the Indian banks in integration with domestic regulations have made the Indian banking industry robust and safe in terms of its susceptibility to any kind of external shocks. In this study, we adopted event study methodology to analyse market reaction based on different events that came along the Indian banks in terms of policy decisions in integration with global capital adequacy norms. These policy decisions were mainly related to the implementation of Basel norms in the Indian banking sector. The study reveals mixed reaction by the investors to different policy announcements, however, investors’ reaction differs further for public sectors banks and private sector banks in terms of implementation of these decisions. This differentiated impact provides another area to examine profoundly and could be a future course of research in terms of perceived implications for the policy changes for different categories/ownership of banks. Initially, the change of Basel 1 regulatory norms was viewed by capital market participants as generally unfavourable in the short run, but subsequent rise in stock prices of banks, in the long run, reflects a favourable impact of the implementation of these Basel guidelines. The policy decisions with respect to Basel II and III, in general, received a positive reaction with small deviations in some of the event windows in the short run. The multivariate analysis does not show any significant impact of bank-specific characteristics on the market performance of various events confirming the strong announcement effect. The updated Basel norms allowed Indian banks to adopt the new capital regulations with required changes. The investors showed confidence in the central bank’s policy decision of aligning the Indian bank regulations with global best practices of Basel capital adequacy norms. @ Gaurav Seth (gauravseth@rbi.org.in) is Assistant General Manager in the Reserve Bank of India (RBI), while Supriya Katti is Project Scientist and B.V. Phani is Professor at Indian Institute of Technology, Kanpur. * The authors are thankful to discussants of the paper in DEPR Study Circle and other participants for their helpful comments and suggestions. The authors also thank an anonymous external reviewer for insightful feedback. The views expressed in the paper are those of the authors and do not necessarily reflect the views of the institutions they belong to. 1 Abnormal return is calculated by subtracting the expected stock return from the observed (actual) stock return. It can be positive or negative. 2 The policy rates of reserves are as of February 9, 2021. 3 SBI merged its five associates with itself from April 2017 and has become the largest bank in India. 4 Indian Banking Sector: Current Status and the Way Forward - Address by Shri Shaktikanta Das, Governor, Reserve Bank of India delivered at the NIBM, at the 15th Annual Convocation of Post Graduate Diploma in Management, Pune on June 8, 2019. 5 Kotak Mahindra Bank Ltd. (KMBL) was given license by RBI to operate as private sector bank in February 2003. Earlier KMBL was working as NBFC and was listed on BSE from 1992. Since its prices were available on BSE/CMIE therefore it was included as a private bank in the sample of 15 banks for announcement of the 30th October, 1998 event study. 6 Basel III in International and Indian Contexts Ten Questions We Should Know the Answers For – Inaugural Address by Dr. Duvvuri Subbarao, Governor, Reserve Bank of India at the Annual FICCI - IBA Banking Conference at Mumbai on September 04, 2012. 7 /en/web/rbi/-/notifications/implementation-of-basel-iii-capital-regulations-in-india-capital-planning-8806 8 http://www.business-standard.com/article/finance/rbi-allows-banks-to-expand-capital-base-to-meet-basel-iii-norms-116030101090_1.html References Allen, F., & Santomero, A. M. (1997). The theory of financial intermediation. Journal of Banking & Finance, 21(11-12), 1461-1485. Berger, A.N., & Di Patti, E., (2006). Capital structure and firm performance: A new approach to testing agency theory and an application to the banking industry. Journal of Banking & Finance, 30(4), 1065-1102. Bruno, B., Onali, E., & Schaeck, K. (2018). Market Reaction to Bank Liquidity Regulation. Journal of Financial and Quantitative Analysis, 53(2), 899-935. Chiuri, M.C., Feeri, G., & Majnoni, G. (2002). The macroeconomic impact of bank capital requirements in emerging economies: Past evidence to assess the future. Journal of Banking & Finance, 26(5), 881-904. Cooper, K., Kolari, J., & Wagster, J. (1991). A note on the stock market effects of the adoption of risk-based capital requirements on international banks in different countries. Journal of Banking & Finance, 15(2), 367-381. Demirguc¸-Kunt, A., Laeven, L., & Levine, R. (2003). The impact of bank regulations, concentration, and Institutions on bank margins. World Bank Development Research Group. Eyssell, T., & Nasser A. (1990). The wealth effects of the risk-based capital requirement in banking: The evidence from the capital markets. Journal of Banking & Finance, 14(1), 179-197. Fare, R., Grosskopf, S., & Weber, W.L. (2004). The effect of risk-based capital requirements on profit efficiency in banking. Applied Economics, 36(15), 1731-1743. Furfine, C. (2000). Evidence on the response of U.S. banks to changes in capital requirements. BIS Working Papers, 88. Ghosh, C., Harding J., & Phani, B.V. (2008). Does liberalisation reduce agency costs? Evidence from the Indian banking sector. Journal of Banking & Finance, 32(3), 405-419. Ghosh, C., Hilliard, J., Petrova, M., & Phani, B. V. (2016). Economic consequences of deregulation: Evidence from the removal of voting cap in Indian banks. Journal of Banking & Finance, 72, S19-S38. Goddard, J., Molyneux, P., & Wilson, J.O. (2004). The profitability of European banks: A cross-sectional and dynamic panel analysis. The Manchester School, 72(3), 363-381. Kahane, Y. (1977). Capital adequacy and the regulation of financial intermediaries. Journal of Banking & Finance, 1(2), 207-218. Kim, D., & Santomero, A. (1988). Risk in banking and capital regulation. Journal of Finance, 43(5), 1219-1233. Koehn, M., & Santomero, A. (1980). Regulation of bank capital and portfolio risk. Journal of Finance, 35(5), 1235-1244. Kwan, S., & Eisenbeis, R.A. (1997). Bank risk, capitalisation, and operating efficiency. Journal of Financial Services Research, 12(2-3), 117-131. Lin, S.L., Penm, J.H., Garg, S.C., & Chang, C.S. (2005). Risk-based capital adequacy in assessing on insolvency-risk and financial performances in Taiwan’s banking industry. Research in International Business & Finance, 19(1), 111-153. Madura, J., & Zarruk, E.R. (1993). Market reaction to uniform capital adequacy guidelines in the banking industry. Journal of Economics & Finance, 17(1), 59-72. Sensarma, R., & Jayadev, M. (2009). Are bank stocks sensitive to risk management? Journal of Risk Finance, 10(1), 7-22. Wagster, J. D. (1996). Impact of the 1988 Basel accord on international banks. Journal of Finance, 51(4), 1321-1346. The proposed null hypothesis for the event is defined as within a given event window, cumulative abnormal return is equal to zero.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

صفحے پر آخری اپ ڈیٹ: