IST,

IST,

RBI WPS (DEPR): 06/2022: Saving Banks from a Black Swan: Options and Trade-offs

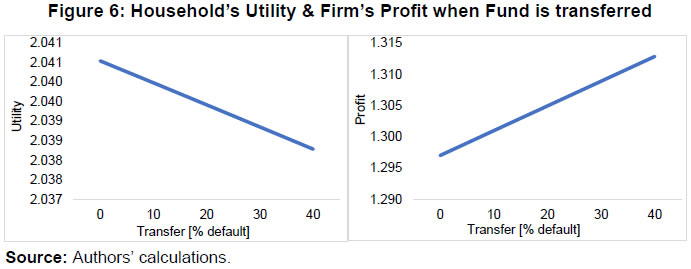

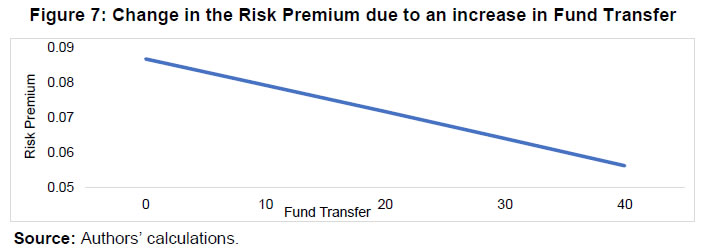

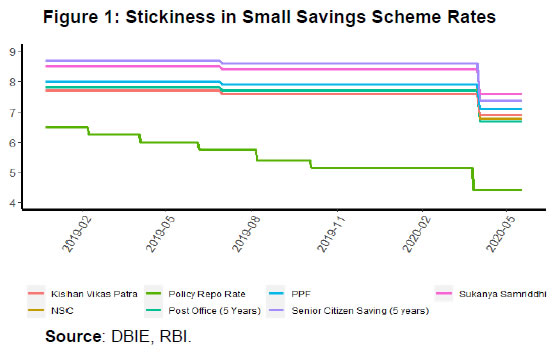

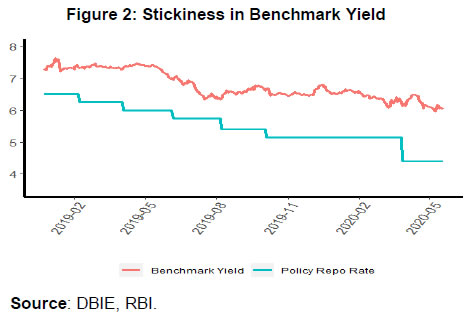

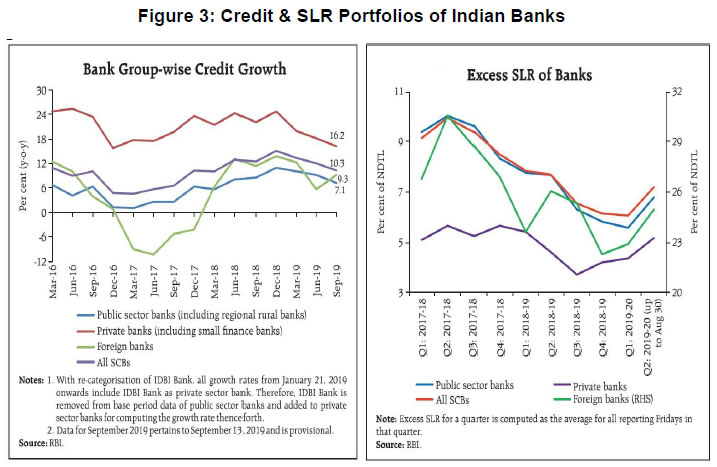

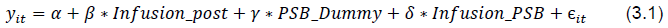

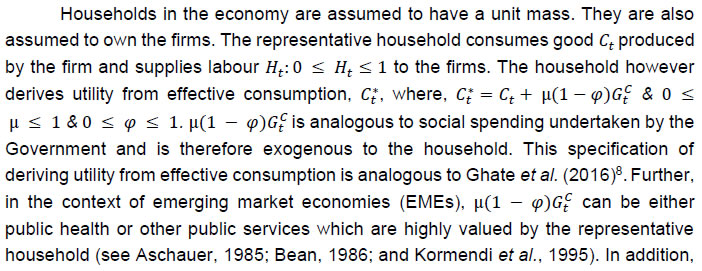

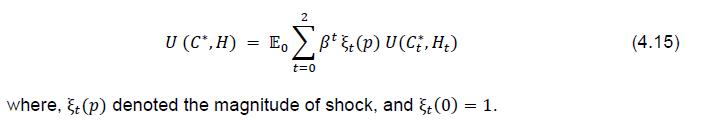

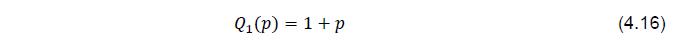

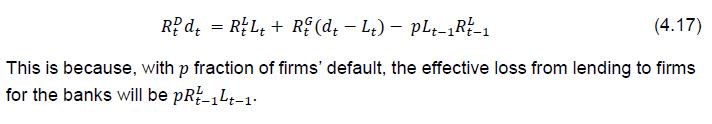

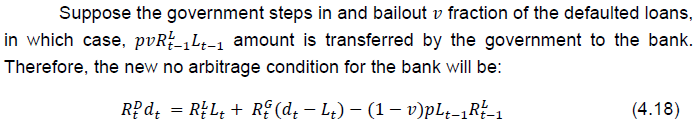

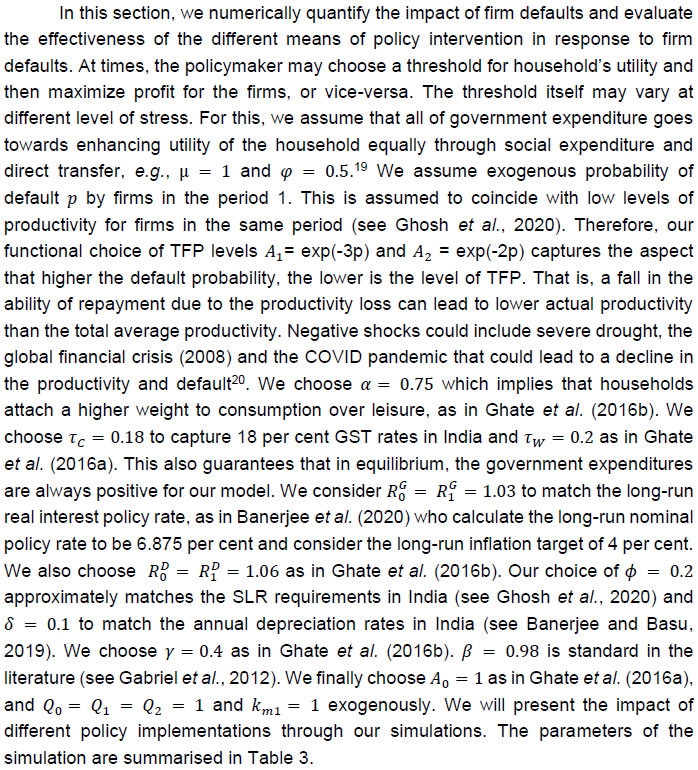

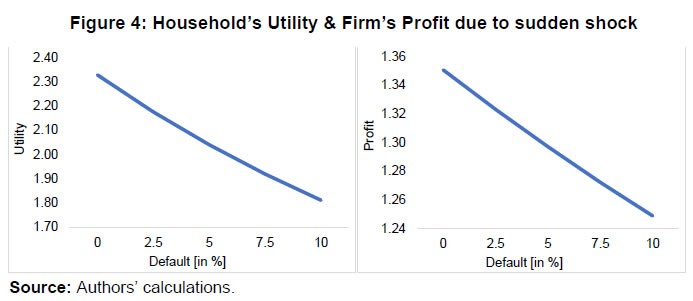

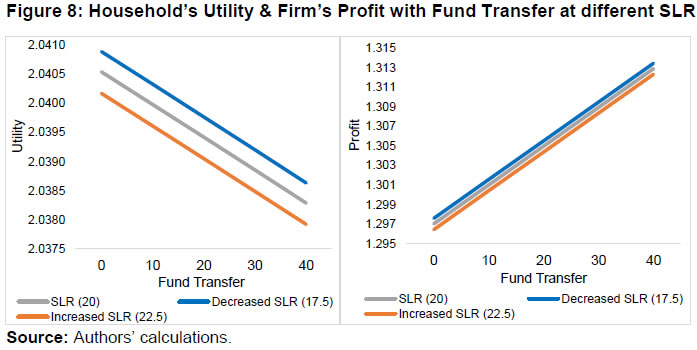

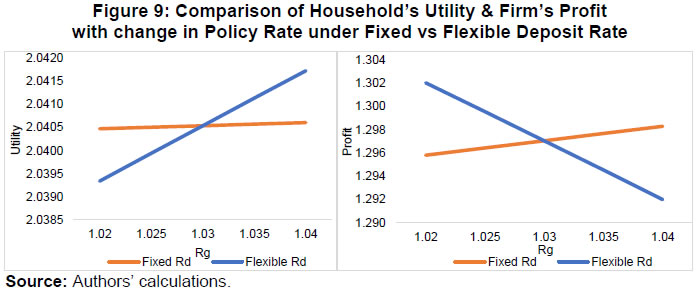

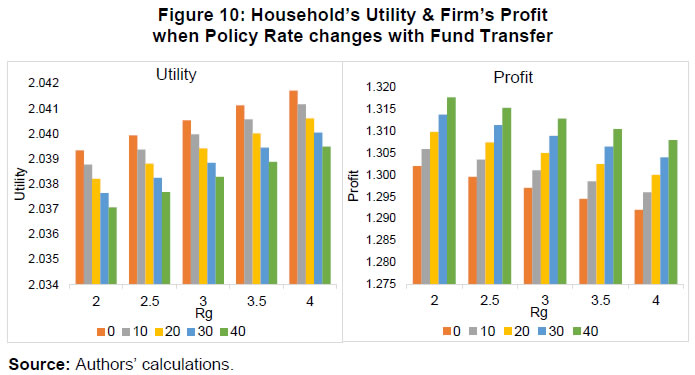

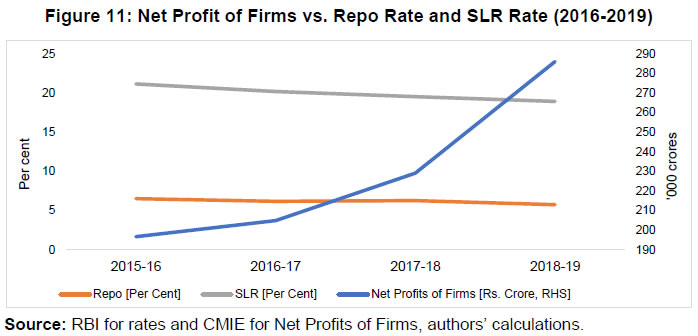

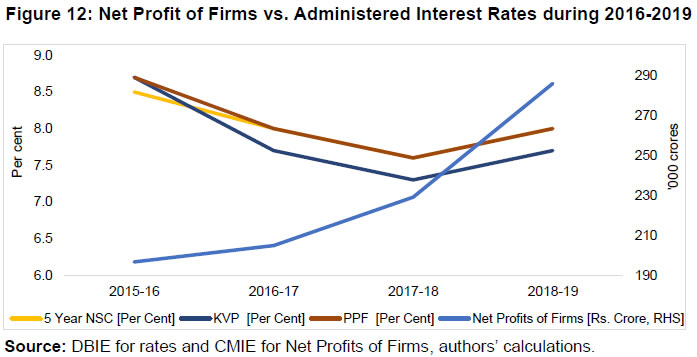

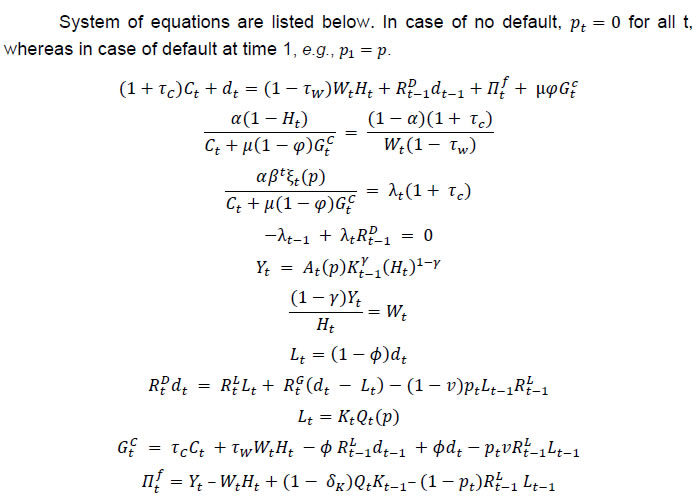

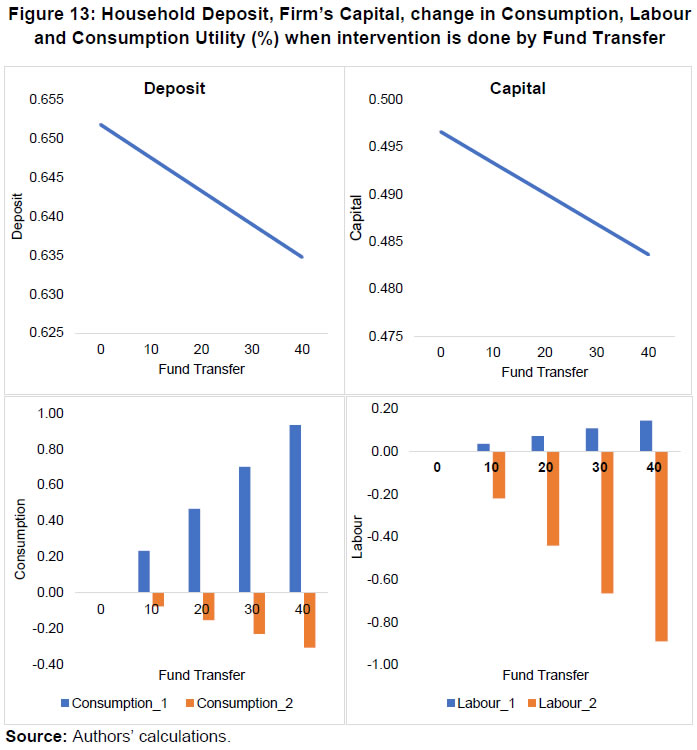

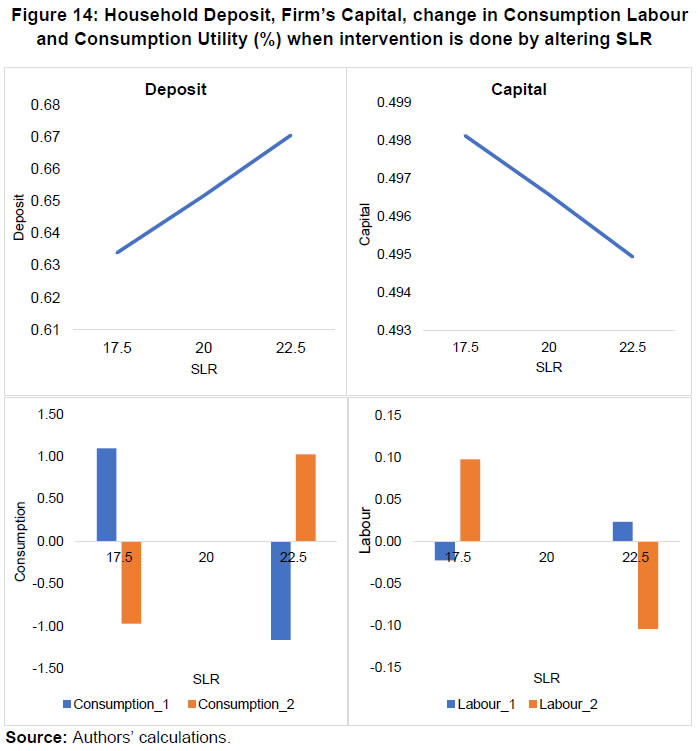

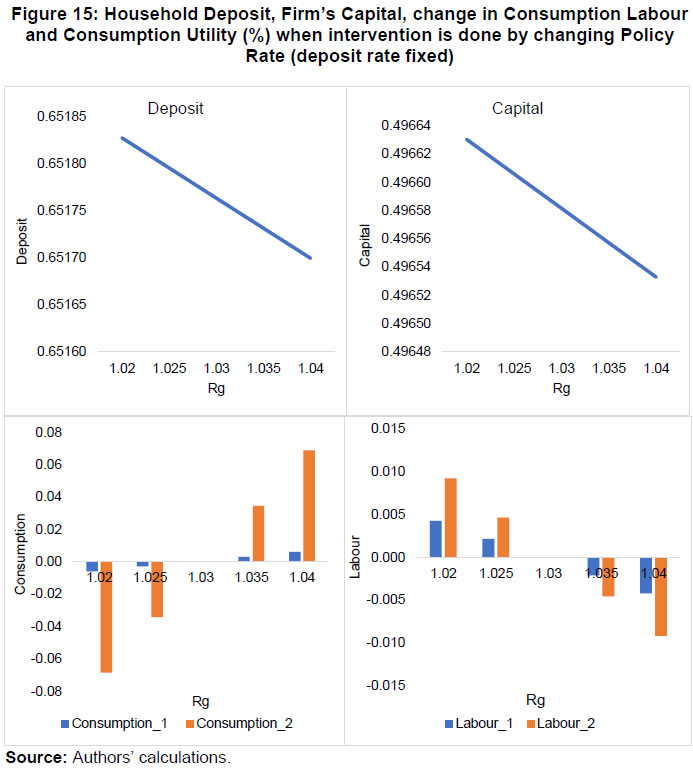

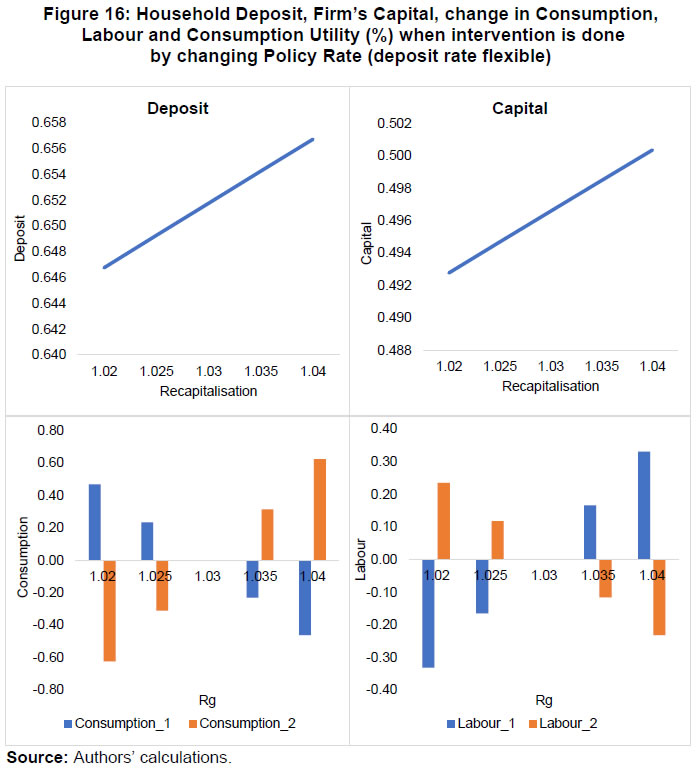

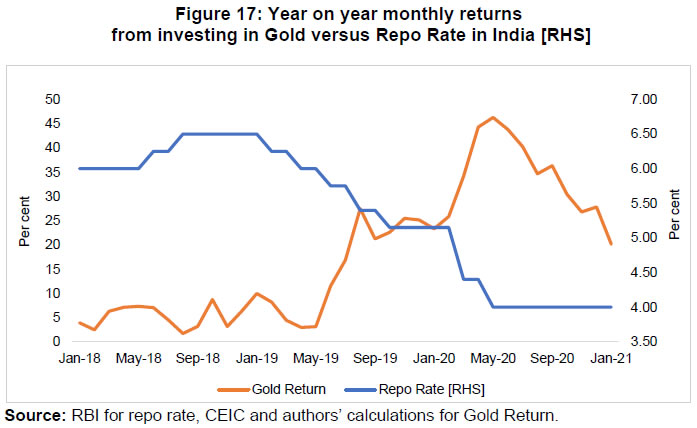

| RBI Working Paper Series No. 06 Saving Banks from a Black Swan: Options and Trade-offs Saurabh Ghosh, Pawan Gopalakrishnan and Abhishek Ranjan@ Abstract 1In this paper, we analyse the best possible policy responses for banks facing a loan default because of an extreme and rare negative productivity shock. We use a finite-period framework with complete information to analyse the impact of such a shock on an economy with sticky deposit rates and bond yields. Our findings indicate that any recapitalisation measure works best in a flexible deposit/ lending rate environment for all alternative saving vehicles, as it leads to better transmission. However, policy interventions to revive economic activity may result in a trade-off between firms’ profit and consumers’ welfare. We, therefore, underline the importance of household welfare, which is augmented by government social expenditure, and households’ interest income. Since these may decline due to supply side measures, we note the importance of demand management policies that may help overcome any such welfare effects. JEL Classification: E32, E43, E52, E58, E6 Keywords: Capital infusion, bank bailouts, administered interest rates, statutory liquidity ratio, monetary policy transmission Introduction Nassim Nicholas Taleb coined the metaphor of “black swan” in his 2007 book as an extremely rare event with severe consequences that are beyond normal expectations. Considering the current pandemic as an example of a black swan event, we use a finite-period model with complete information to address questions relating to best policy rescue plan for banks faced with such a black swan event. While a rare event such as the ongoing pandemic may induce long-term structural breaks, the objective of the paper is to help understand short-run response to policy and therefore evaluate the best policy intervention. The presence of rigidities could influence policy outcomes. We, therefore, first identify some of the economic rigidities that may influence the Indian banking sector. Second, we analyse the impact of previous capital infusions to the banking sector on credit and investment, but in the absence of a black swan event. Finally, we write a finite-period dynamic general equilibrium model with complete information to understand the channels that drive our empirical observations. Our choice of model is influenced by the following considerations. Finite date models are easy to understand and interpret, without affecting any transmission channels, and are often used in general equilibrium models to explain the dynamics (Dubey et al., 2007; Mateos-Planas and Secccia, 2014). The impact of an adverse rare shock supersedes in relevance of evaluating the impact of asymmetric information and moral hazards on borrowing, lending and repayments, as these are relevant frictions during normal times, motivating us to assume a simplified environment with full information. We, therefore, use a 3−date model where firms borrow from banks for purchasing capital, and banks face two frictions: 1) statutory liquidity requirements, and 2) sticky deposit rates. There is an exogenous one-time probability with which firms default on their loans. The government collects taxes, issues debt, and undertakes 3 types of expenses - providing lump sum transfers to households, undertaking utility enhancing social expenditure and bailing out banks if firms default (Ghosh et al. (2020) for bank bailouts; Ghate et al. (2016) and Dave et al. (2020) for other government spending). We show that if there is an unconditional bailout transfer to banks, there would be an increase in profits of firms. However, given the government budget, an increase in public bank recapitalisation in general and bailout packages in extreme cases may lead to higher corporate profits, but the consequent reduction in transfer or social expenditure may introduce a trade-off as there could be a decline in the welfare of the representative household. This is because there is some reduction in utility enhancing social spending which reduces both effective consumption and leisure (Ghosh et al., 2020). This trade-off between firm profits and household welfare is further aggravated in the presence of the two frictions. Our main result is that an environment with flexible alternative deposit rates (e.g., small savings, post office deposits) and bond yields, results in better monetary policy transmission. Our numerical simulations also underline the role of demand in reviving the economy, which is driven by consumers’ income. While we use certain developments from the recent COVID-19 pandemic for model simulation and validation, our study is motivated by a rare shock in general and not only by the COVID-19 crisis. The rest of the paper focuses on understanding the impact of a one-time negative productivity shock and is organised as follows: Section II provides a brief review of the literature and provides data evidence of the deposit rate / yield stickiness in India. Section III provides bank level empirical evidence on how they responded to previous bailout packages. Section IV describes the objective of the household, firm, bank and the government, and the structure of the model. Section V elaborates the different scenarios using simulation results. Section VI provides model validation with the Indian data. Finally, Section VII concludes by offering some policy insights. II. Literature and Frictions: India Bank bailouts, mainly via recapitalisation, have historically been undertaken to protect failing banks that are large and systemically important. There have been instances where such measures were undertaken both in advanced and emerging economies, especially after the 2008 Global Financial Crisis. Examples of such measures in advanced economies include recapitalisation by issuing debt, preference shares, and/or common equity by the promoters of banks that are seeking recapitalisation (see Panetta et al., 2009). Such bailout packages for banks in emerging economies, however, face challenges that are different from advanced economies. To begin with, in EMEs, capital markets are underdeveloped, and availability of funds is costly. Second, most economic activity in EMEs (e.g., China, Philippines, Pakistan, Brazil, and India) are highly bank dependent2. Third, the government is a major stakeholder in public sector banks (PSBs), which contributes significantly to the overall credit. Given that GDP growth has largely been dependent on credit creation by banks in most EMEs, and since large banks are state-owned, bailout measures for these banks are typically undertaken by the governments. The question, however, remains whether these bailout packages are effective. Ghosh et al. (2020) analyse the mechanics and the offsetting effects of a government induced recapitalisation plan in a DSGE framework, which indicates that such policy interventions come with other trade-offs in the form of reduction in the government’s capital investment and social expenditure. This study, however, does not quantify whether the presence of other frictions (e.g., liquidity requirement or rate rigidity) could further aggravate these trade-offs.3 In the presence of liquidity requirements, Lahiri and Patel (2016) show that a binding SLR requirement removes the substitutability between bank assets because the loans are now to be distributed between the private sector and to the government in fixed proportions. Now, if the government were to undertake large expenses such as bank bailouts, it may have two countering effects - on the one hand, banks’ balance sheets are cleaned up which facilitates credit activity, but on the other hand, it will increase the fiscal deficit. Therefore, according to them, in the presence of a high and binding SLR requirement bank bailout may not have the desired policy impacts. Second major friction is the presence of sticky interest rates extended on schemes that provide alternative saving channels, such as National Saving Certificates, Public Provident Funds, and Post Office Deposits. An important implication of these administered interest rates is that deposit rates offered by banks in India also remain sticky. Therefore, these competing saving schemes result in not just sticky long-term bank deposit rate, but also short-term deposit rates. This is shown in Figure 1, which indicates rates in alternative deposits as compared to the Repo rate during the easing rate cycle in India (2019-20). Moreover, as these rates are not directly linked to the Central Bank’s policy rate, it makes monetary policy transmission challenging. Furthermore, in the absence of large-scale social security measures, senior citizens are largely dependent on deposit interest income, and therefore the deposit rates for senior citizens are generally 50 to 100 bps higher than the normal rates. Another factor which contributes to making rates sticky is the large central government borrowing requirements. This makes yields on the government securities sticky, and therefore changes in the policy rate are at best only partially transmitted to the yields. Moreover, the rates in some of the above-mentioned small-saving schemes become sticky because they are linked to benchmark government security (G-Sec) yields. The stickiness in benchmark G-Sec yield vis-a-vis policy rate is shown in Figure 2.4   In this vein, Banerjee et al. (2020) include administered interest rates and the SLR requirements as frictions in the model. In addition, the authors also include informality. They find that while base money shocks are very important, the presence of an informal sector hampers monetary policy transmission the most. Finally, several RBI Committee Reports and research (see RBI, 2014) suggest that along with SLR requirements, these small saving schemes with sticky interest rates and a large informal sector in India also weaken the monetary policy transmission. III. Past Capital Infusions and Banks’ Responses The Government of India - the major stakeholder in the public-sector banks (PSBs) - has been infusing capital in PSBs intermittently, over the past years to meet regulatory capital requirements, ensure financial stability, and to sustain credit growth. In this section, we empirically evaluate the impact of such intermittent fund infusions in the banking sector. To answer whether the capital infusion in the form of recapitalisation can boost credit creation into the private sector, we need to test whether there was a significant change in loans and advances extended to the private sector by PSBs. For this, we use bank-wise data and historical episodes of bank recapitalisation using a difference-in-difference strategy (or double difference).  We use the Database on Indian Economy (DBIE) for bank wise data on 97 Indian banks during 2015Q1-2018Q4 and work with a balanced panel of 1405 observations. We construct a dummy variable ‘Infusion post’ that takes value one for all the years in which the bank has been infused with capital and zero otherwise.5 This empirical specification, therefore, also helps to capture the effect of multiple capital infusions if a bank receives capital infusions for all different years. We also distinguish between private and public-sector banks. This is because, in India, the capital to risk weighted asset ratios are generally higher for private banks as compared to their public-sector counterpart (see RBI, 2020-21). PSB dummy, that takes the value one for public sector banks, otherwise zero, is designed to capture the treatment to control difference. The difference-in-difference (DID) strategy for our empirical exercise is as follows:  The dependent variable, yit, represents bank i's investment in period t either in SLR securities or in risky loans, e.g., loans with positive risk weights. Table 1 summarizes the regression result in level terms. That is, we assume yit as the level of investment and design the DID-coefficients as representing the incremental investment of the treatment groups (i.e., PSBs). As the coefficient of the interaction term of the public-sector dummy and capital infusion dummy (Infusion_PSB) is negative and significant it indicates that there is a decline in the bank’s holding in the zero risk-weight government bond. This implies that public sector banks reduce their incremental investment in government securities as compared to their private counterpart, post capital infusion. The negative and statistically significant coefficient δ (Infusion_PSB), which captures a decline in SLR holdings as shown in column (2) shows this contraction. However, there is also a decline in private loans and advances, as shown in column (4). This may imply that despite a capital infusion, there is an overall reduction in the loans made to the private sector6. But is it the case that private lending was declining more than overall credit, e.g., a crowding-out effect such that more credit was extended to the government in response to a capital infusion from the government in general? Broad banking aggregates indicate that banks respond to negative productivity shocks or even negative rainfall shocks, by increasing their holding of government securities (Figure 3). This is because negative shocks lead to defaults in loan repayment due to loss of incomes, and this makes banks decline their lending activity, in turn increasing their investment in government securities. The left panel in Figure 3 shows that in the recent periods, with increases in financial risks, there has been a deceleration in credit, but an increase in Indian banks' investment in SLR. The holding of SLR more than the mandated SLR requirements saw a sharp increase in recent time, as compared to private and foreign banks. This is shown in the right panel in Figure 3. To answer this empirically, we re-estimate equation 3.1 now in terms of shares of loans in a particular category. The dependent variable (yi) is now the SLR advances as a ratio of total bank-advances or loans (RISKY_ADV) as ratio of total bank-advances. We continue to apply the same DID strategy to evaluate the changes in Indian public-sector banks' portfolios in a post capital infusion period. Broadly, we find from our empirical exercise that the shares of loans made to each of the lending activity (yi) remained sticky. This is true for both private and public-sector banks. These results are summarized in columns (1)-(2) and (5)-(6) in Table 27. To evaluate the robustness of these results, we have also included a ratio, capital infusion as a percentage of banks’ asset, rather than (Infusion_PSB) dummy. This is a continuous regression version of our DID-framework. However, the corresponding coefficient was not found to be statistically significant. The finding could be because of the low variability in the recapitalisation to asset ratio. These apparent insignificances of fund infusion could be because of several reasons. One possibility could be that the intermittent recapitalisation of the PSBs, though help them to meet the regulatory stipulation, fell short of the threshold for kick-starting the loan growth cycle. A recent empirical study on India (Herwadkar and Verma, 2019), indicates that the relationship between banks’ capital and credit growth is non-linear, and there is evidence of optimal threshold level of capital-to-risk weighted assets ratio (CRAR). Second, it could be that the slowdown in economic growth in India and the concomitant slowdown in investment or capital expenditure demand has dampened the risky investment and favoured lazy banking in India (Mohan, 2002). Finally, households’ savings might have found other investment avenues, and therefore the overall deposits of the banking sector have witnessed a contraction during the sample period, given that the deposit rates and rates on bond yields are sticky in India. In the rest of this paper, we attempt to quantify - by understanding the mechanics - and explain the channels through which the effect of two major rigidities faced by banks (namely the statutory liquidity requirement and sticky interest rates) interacted with an adverse supply shock. As we will discuss in our model simulations (see Section V), the main reason why bank-bailouts may not have the intended impact could be because of an overall contraction in the bank’s balance sheet. Therefore, despite receiving a capital infusion in the form of a bailout package, there will be a contraction in the overall lending activity. Such a framework also helps us analyse the interplay of several countervailing forces and frictions in the face of a negative productivity shock. In this model, there are four agents - households, firms, banks and the Government. Households derive utility from effective consumption and leisure. Effective consumption in this model is a non-separable function of private consumption and utility enhancing government expenditure (see Ghosh et al., 2020 and Ghate et al., 2016). Government spending included this way captures social sector spending, and it guarantees that fiscal policy affects labour supply, therefore having larger welfare effects (see Dave et al., 2020). Households supply labour to firms and receive wage-income and firms’ profit in the form of dividends. They also save their deposits in the bank, which yields interest earnings in the next period. The firm produces the final good using labour hired from households, and new capital purchased from a notional market for physical capital, at a stochastic price Qt. Banks receive deposits from households, of which a fixed portion is to be held in the form of government bonds, e.g., SLR requirement. This is somewhat analogous to the Basel-III mandate of Liquidity Coverage Ratio Requirement or LCR (see BCB, 2010). The remainder share of the deposits is lent to the goods producing firms to purchase new capital for producing the final good in the economy. Finally, the government taxes household consumption and wage incomes, borrows by issuing bonds to banks, and undertakes a welfare enhancing expenditure. IV.1.1. Date Model: Description All agents in the economy survive only for three time periods. Households deposit their savings in the bank at date t = {0, 1} only, and the bank repays the household at time t + 1. Banks lend part of the deposit to the firms after accounting for the mandatory SLR requirement. We start with a model where there is no default. We then introduce defaults as an unanticipated random shock to the economy. We then assume the government intervenes with certain policy measure to reduce the impact of the default shock. The household, good producing firms, and the bank will adjust their consumption and investment decision based on the observed default and the government’s policy response. IV.1.2. Households   IV.1.3. Firms  Equation 4.11 implies that if labour is fixed, then decline in today’s capital will impact tomorrow’s wage. Furthermore, equation 4.12 implies that an increase in lending rate will impact today’s capital inversely, whereas the labour required in the next time period will be directly proportional. IV.1.4. Banks   IV.1.5. Government The government in our model imposes taxes on consumption and wage income. It also issues bonds at the rate RtG that are held by the banks. A mandatory Statutory Liquidity Ratio (SLR) requirement on banks, imposed by the Banking Regulation Act, 1949 which requires17 banks to hold a mandatory portion of total deposits received, in the form of government securities. On the expenditure side, the government spends GtC, part of which enhances household’s utility, and the remainder is extended to households as a lump sum transfer. The government budget constraint in period t is therefore given by equation 4.14 as follows:  By Walras law18, the goods market will clear. IV.2. Exogenous Shock Now suppose there is a large negative exogenous shock to the economy. This shock affects both supply and demand. Since the preference shock ξt is assumed to be correlated with the exogenous productivity shock, there would also be an effect on the demand side. As discussed, the utility function of the households is given by  The firms face decline in the productivity due to this shock and the productivity of the firm At = At (p), a function of p. Further, in the presence of the shock, the asset quality deteriorates, and we model the deterioration of the asset quality by increasing the cost of capital. This shock affects the firm’s repayment capability to the bank, and firms’ default p portion of their liability to the bank. Further, Qt, the cost of capital is also correlated with defaults and is given by:  The default by firms in the economy alters the banks’ No-Arbitrage condition to equation 4.17:  IV.3. Policy Intervention The question is if the government decides to intervene in response to these defaults, what could be the most efficient set of policies? We consider three plausible policy interventions in response to firms’ defaults. IV.3.1. Intervention I: Government Bailouts and No Deregulation  In response to this policy intervention, the government budget constraint in equation 4.15 will change to equation 4.19, as follows:  IV.3.2. Intervention II: Government Bailouts with Altered SLR Requirements The SLR requirement Φ is a source of friction which uses depositor funds available for risky lending that yield higher returns to the banks. On the other hand, this also guarantees a certain return for the banks by holding risk-free G-Sec bonds. The net impact of increasing or decreasing the SLR requirements, is therefore, theoretically unclear. IV.3.3. Intervention III: Government Bailouts with Flexible Deposit Rates As discussed in Figure 1, and in Banerjee et al. (2020) and the RBI Committee Report (2014), a long-standing debate is that the transmission of monetary policy is weak due to sticky deposit rates. The deposit rates are sticky because of sticky deposit rates on NSSF and PPF, and these are mandated by the Government of India. Therefore, one alternative measure could be to make the RD flexible and pegged to the benchmark policy rate RG. This would improve policy transmission through the general equilibrium of the model. In Section V, we will discuss the implications of all these three policy implications, numerically.  In our simulations, we track the effect of shocks on the real economy via the discounted lifetime utility of households and profit of firms. The key channel, as we will show, is the impact that defaults have on deposits, and the lending rates. Since firms in our model are assumed to default only in cases of a black-swan event, they are otherwise assumed to be safe. Compared to government bonds, firms also pay higher interest on loans. So, the no-arbitrage condition in our model ensures that banks invest all funds in excess of the SLR requirement in these firms. Therefore, the investment composition of the banks remains unchanged since it is exogenously determined by the SLR requirement. V.1. Baseline In this framework, an adverse one-time productivity shock amounts to a decline in the firm’s productivity. This causes the firm to default on its outstanding loans with the bank. The default on the bank credit leads to the higher lending rate by the bank in the next period, leading to further loss in the firm’s profit. A decline in the firm’s profit, on the other hand, leads to lower income for the household, lower tax collection for the government, and therefore lower government expenditure. This eventually leads to lower household utility. Therefore, a negative productivity shock leads to a decline in the household’s utility and the firm’s profit (Figure 4). The risk premium, i.e., the difference between the lending rate and the deposit rate, increases on account of an increase in the probability of default.21 This is shown in Figure 5.   V.1.1. Intervention I: Government Bailouts and No Deregulation Figure 6 shows that government bailout without any deregulation leads to a loss in the household’s utility, whereas profit for the firms increases. Appendix A.2 discusses the mode of transmission. As the government bailout banks, the government expenditure on household decreases22. Lower government expenditure leads to a decline in the household’s utility. A decrease in the government expenditure leads to lower social consumption for the household. To compensate for the lesser social consumption, households front-load their consumption and decrease their saving in that time-period. Given that µ = 1, effective consumption declines and therefore leisure declines from the MRS condition between consumption and leisure (see equation 4.5-4.6). This causes a decline in current period welfare. A fall in savings causes a decline in future welfare levels too, as a result of which, overall welfare falls. The decline in current period saving leads to a decline in the lending capacity of the bank, and therefore a contraction in the balance sheet of the bank. This decline in the lending will lower firm’s capital. A decline in firm’s capital will decrease wage in the next period, and this reinforces increases in labour supply by front-loading the labour.23 On the contrary, firms’ profits increase because government bailouts to the banks lead to lower lending rate for the firms, and this impacts firms’ profits positively24. This finding is consistent with our empirical finding, i.e., with government bailouts to banks coexisting with a decline in incremental investment (see Table 1 in Section III). The risk premium decreases on account of an increase in the fund transfer. This is shown in Figure 7. V.1.2. Intervention II: Government Bailouts with Altered SLR Requirements As shown in the intervention I, the government transfer to the bank leads to lower social spending. The government may choose to increase borrowing (by issuing bonds) to fund for the bailout rather than decreasing social expenditure. In our simplified framework, we incorporate this possibility through an increase in SLR requirement by the central bank. Appendix A.3 shows the mode of transmission when the SLR is altered. As the government income increases due to increase in SLR, the government expenditure on households increases. An increase in the government expenditure leads to higher social consumption for the household. As the social consumption increases in that time-period, household saves and postpone their consumption. As household saves more, banks will have more funds to lend, however, quantum of available fund net of SLR will fall short of the initial amount. Consequently, there could be a net decline in the lending amount to the firms. This lower lending amount leads to lower capital for the firms. Today’s decline in the capital leads to a decline in the wage at the next time-period, since the output depends on lagged capital, this decline will decrease the output in the next time-period. Therefore, households front-load their labour (by reducing leisure time) because of this anticipated decline in the wage at next time-period. Further, higher borrowing requirement leads to higher lending rate, leading to a decline in the firm’s profit. Therefore, an increase in the SLR leads to decline in the household’s utility as well as the firm’s profit. This implies that when a bank bailout is partially funded by increasing the SLR requirement on the bank, it may result in a decline in welfare and firms’ profits (Figure 8). Lowering SLR requirement, on the other hand, will increase both the household’s utility and firm’s profit (see blue lines associated with decreased SLR requirement).  V.1.3. Intervention III: Government Bailouts with Flexible Deposit Rates Central Bank25 reduces its policy rate, a movement from right side to left in Figure 10. For households, it indicates that the utility declines more when the deposit rate is pegged to the policy rate by a mark-up condition, because a decrease in the policy rate will lead to a lower deposit rate. As this lower deposit rates are passed on to the households, their interest income falls. In other words, the income effect dominates the inter-temporal substitution effect, which induces households to front-load current consumption. However, from the point of view of the firms, profit increases sharply with a decrease in the policy rate and with flexible rates. This channel was muted during the sticky deposit rate environment as the benefits of lower rates were not passed on to the firms. An increase in the lending rate, on the other hand, leads to higher cost of capital and therefore, lower profits for the firms. Appendix A.4 and A.5 shows the mode of transmission when the deposit rate is fixed and flexible, respectively. The 3-dimensional figure (flexible RD) helps us to build on the household-firm trade-off (Figure 10). As public-policy intervenes to bailout banks (in the X-axis as a percentage of defaults), household’s utility suffers, as social expenditure by the government declines. However, these bailout packages improve firm’s profitability. Forced with a rare event, the central bank may choose to reduce its policy rates. This may, however, have a muted impact in reviving firms’ profit if deposit rates are sticky, as this reduction is not passed on to the firms. A flexible deposit rate, on the other hand, helps in sharp recovery of the firms’ profit. However, it comes with an added cost as it erodes households’ interest income and results in a further decline in deposit rates. This assumes significance in EMEs where social security network is still evolving, and a large proportion of retired population depends on deposit interest for their living.   The key results from our model simulations are that a decrease in the SLR or the Central Bank policy rate increases firms’ profits. Further, making the deposit rates flexible and lowering the policy rate can increase the profit of the firms due to a fall in lending rates. In order to validate our simulation results, we plot the historical annual net profit of listed firms against the annual average Repo rate, SLR, and returns from a variety of small saving schemes.  Figure 11 shows that during 2015-16 and 2018-19, the annual average repo rate and the SLR rate have fallen. During the same time, there has been a steady increase in the firms’ net profits. This, ceteris paribus, is in line with our model simulation results and suggests that a fall in costs of funds or more availability of funds for private lending may result in an increased firms’ net profits.  Figure 12 shows that with a fall in the administered interest rates during 2016-2018, there was a steady increase in the firms’ net profits. Between 2018 and 2019, even though the administered interest rates marginally increased, the increase in the administered rates was lower than the decline in the repo rate and the SLR suggesting an overall decline in banks’ cost of funds thereby enabling them to lower lending rates. This observation broadly supports our simulation findings. A Black Swan event could lead to loan defaults, which may have severe second round implications for financial and macro stability. In an economy with state owned banks, if government decides to recapitalise banks, our simulation results indicate that banks' recapitalisation could be most effective, when deposit / lending rates are flexible, as it leads to better rate transmission. While our model simulations are broadly consistent with our bank level empirical findings, we take a look at the policy making during such a rare adverse shock in a state-owned bank dominated emerging market economy, India. The most recent COVID-19 outbreak could be considered as an example of such a rare event. Well-designed economic policies generally attempt to address frictions (like shrinking liquidity, sticky alternative deposit rates and sticky government yields) and thereby help in economic revival. In India, during the pandemic, the Reserve Bank has pre-emptively taken several policy measures in a calibrated manner, amongst which, long term repo operations (LTRO) are perhaps the most effective one. It has helped in addressing frictions highlighted in our model, namely the rigidities in small savings rate and the possibility of shrinking deposits or liquidity. RBI Bulletin (August 2020) presented empirical evidences that both operation twist (OT) and LTRO had a significant static as well as dynamic impact on G-sec, yields of some maturities, thereby facilitating policy transmission, and addressing the third friction of large scale government borrowing requirement resulting in sticky yields. These pre-emptive policy measures and their success in the present juncture indeed validate our model findings from the policy space. Finally, as we gradually move towards normalisation, some of the current economic variables (e.g., current account deficit, excess SLR holding) may converge to our long-term path. Our model indicates that pressure points could be used for policy simulations and generating counterfactuals and facilitate optimal policy designs. A rare adverse shock to the economy could adversely impact production, and thereby may lead to loan defaults by cash constrained firms. Bank credit being the lifeline in many of the emerging economies, a large loan default could have severe second round implications for financial stability and aggregate demand. This is especially true in the presence of frictions such as sticky deposit rates in the loan markets as these frictions result in weaker policy transmission. Given the severity, the disruptions due to a black swan event supersede other problems such as moral hazards and asymmetric information which cause loan defaults in regular times. Therefore, in the absence of moral hazard problems, in this paper, we attempt to assess the role and effectiveness of different public policy options and their trade-offs using a tractable 3-period model. While this model is applicable to rare and extreme negative events, some of our model assumptions are influenced by the recent pandemic shock. We find that government-provided recapitalisation/bailout packages face trade-offs. Firms may benefit from improved discounted lifetime profits from these packages, but households may be worse off because of lower government expenditure in social sectors. In terms of monetary policy, our simulation results indicate that it is most effective, when deposit / lending rates are flexible, as it leads to better transmission. But an easing cycle coupled with flexible rate regime may lead to a sharp decline in the interest income and adversely impact consumers’ income and welfare. This also needs policy attention in a society with a large dependency on deposit interest income, emerging financial markets and lack of social security. Therefore, if a recapitalisation package is extended to save the banks from a black swan, the policymaker may need to consider these trade-offs. Our simulation results also highlight that government social spending and consumers’ interest income might take a hit because of the supply-side measures. In view of these trade-offs, it may be useful to underline the role of demand in reviving the economy, which is driven by consumers’ income. However, such demand management policies are not completely free from trade-offs, as fiscal expansion via tax cuts or monetary expansion through an interest easing cycle has inter-temporal welfare costs, as current tax cut may tighten future government spending, and lower interest rates may trigger inflation. Therefore, it may be important to fine tune these demand revival policies with appropriate and calibrated supply-side reform measures to achieve an optimal policy mix. For instance, in the face of a cyclical decline in interest income, consumers may be encouraged to invest in liquid assets that exhibit counter-cyclical returns (gold bonds). Further, demand-side measures may also include re-prioritisation of government expenditure towards capex spending and in social sector spending for stimulating demand and welfare. Finally, on the banking reform side, policies such as further improvements in the banks’ governance and adequate capital buffers may be actively pursued to provide a cushion against black swan shocks and for bringing down the need for future bank recapitalisation. @ Saurabh Ghosh (saurabhghosh@rbi.org.in) is Director, Pawan Gopalakrishnan (pawangopalakrishnan@rbi.org.in) and Abhishek Ranjan (abhishekranjan@rbi.org.in) are Managers, Department of Economic and Policy Research, Reserve Bank of India (RBI). 1 The authors thank Sitikantha Pattanaik, Mridul Kumar Saggar, Dongmin Kong, and seminar participants at the DEPR Study Circle and the 15th BMEB Bank of Indonesia Conference. The views and opinions expressed in this paper are those of the authors and do not necessarily represent those of the institution to which they belong. 2 For total credit as a percentage of GDP across countries, see https://www.bis.org/statistics/totcredit.htm. See also Raj et al. (RBI WPS 24/2020) who argue that bank credit channel has a large bearing on monetary transmission in emerging economies. 3 The impact of a one-time negative productivity shock could have a prolonged effect on lending activity. In the case of the recent pandemic, uncertainties in the future time period can persist due to firms becoming vulnerable and weaker. Hence, this paper is also related to the literature which looks at the impact of news shocks in models with bank lending channels. Some of the papers that look at the impact of news shocks on future productivities include Gunn and Johri (2011), Beaudry and Portier (2004 and 2006), and Gertler and Karadi (2012). Specifically, Gertler and Karadi (2012) study unrealized news shocks to capital quality in a closed economy monetary model with leverage constrained banks. 4 As a result of observations in Figures 1 and 2, we assume deposit rates and the yields on government securities to be sticky. 5 While we make an attempt to capture multiple rounds of recapitalisation in the public sector banks through this dummy, we are aware of the fact that the coefficient of recapitalisation may capture the immediate effect but may not capture the overall effect. 6 We had included RoA (Return on Assets), and GNPA (Gross Non-Performing Assets) ratio of banks to control for bank specific impacts and GDP growth for GDP Growth cycles. However, there seem to be multicollinearity problems when Bank-fixed coefficients and GDP were introduced in regression. Since there could be many other unobserved bank specific variables influencing our results, we have followed the golden rule of including Bank and Time fixed-effects in our regression specifications. 7 Adjusted R square is negative, which means explanatory variables are insignificant. The objective of this analysis is to only see whether banks in an aggregate sense, across bank categories, alter their lending relative to the placebo banks in the aftermath of capital infusion, which is found to be statistically insignificant in this setup. 8 There exists a vast literature on such utility functions. See Barro (1981), Christiano and Eichenbaum (1992), and Ambler and Paquet (1996). The degree of substitutability between private and effective consumption may however be mixed. See Kuehlwein (1998). 9 Using log-separable utility function is nothing but a Cobb-Douglas specification which in turn is a special case of Constant Relative Risk Aversion (CRRA) utility. Given that it provides analytical ease without affecting equilibrium properties of the model, we choose to retain this specification. See, Ghate et al. (2020). 10 A shortage, however, will be due to a black swan event such as the ongoing COVID pandemic, which would result in firms defaulting on their borrowing. We will view such a large negative shock as a decline in future TFP levels, due to overall inability to repay by firms. 11 Gertler and Karadi (2012) introduce a valuation shock which provides a source of variation in the return to capital. This disturbance in the valuation could create a “contraction in real activity”. In our model, we assume Qt is stochastic which on increasing reduces the real economic activity. 12 This specification is identical to the goods producing firms in Ghosh et al. (2020), Gerali et al. (2010), and Banerjee et al. (2020). There is no capital generating firm in our model, we assume capital is in abundance, and goods producing firms can buy and sell capital at any time. 13 See /en/web/rbi/-/notifications/declaration-of-dividends-by-banks-12003 (Circular No. RBI/2020-21/75 dated December 04, 2020). 14 In our simplified model bank’s investment in Government securities is classified as SLR. So, any increase in government bond holding will get reflected under this head. 15 While we do recognize that banks can be modelled as optimizing agents, that are risk averse, the objective of this paper is to consider the impact of a 1-time default due to a severe negative productivity shock. Banks are considered as facilitator between household and firms, as in Lahiri and Patel (2016) who write the Bank’s equations as just balance sheet identity. Given this, the only equation that governs policy transmission in our model is the no-arbitrage condition. This also enables us to work with a framework without separately analysing the NPA problem, since banks recover their loss (NPA) in the next time period by adjusting the lending rate, via the No-Arbitrage Condition. 16 Given that the Government of India announces interest rates on National Small Saving Funds (NSSF) such as post-office deposits, National Saving Certificates, and Public Provident Fund (PPF), and the interest rates on these deposits are sticky, commercial banks are in reality unable to change the deposit rate RtD very often. Second, RtG is linked with the Policy Repo rate announced by the Central Bank, which again, does not change very often. We consider a scenario, where we change RtG as a policy measure. Given these frictions, in case of firms defaulting, banks can therefore only increase lending rates which will have an adverse effect on firm-level borrowing.17 For simplicity, our model follows the broad line of literature, see Hnatskovska et al. (2013), we assume Government and the Central Bank in the same block. 18 Walras law states: In equilibrium it is sufficient to show (n-1) markets clear. 19 Ghate et al. (2016b) consider µ = 1 as one of their cases. This also implies that utility enhancing government expenditure is equally important for the representative household as is private consumption. 20 In order to decrease the probability of default, banks may ask for a collateral from the firms which can be liquidated in the event of default. Further, the banks may liquidate, and the share of default will be the only under-evaluation/depreciation of the collateral. We however do not consider this case in our simulations. 21 For the risk premium, we take the difference between the lending rate and the deposit rate. The deposit rate is analogous to the “marginal cost of fund” as per the definition of the Marginal Cost of Fund Based Lending Rate (MCLR) in which costs comprise of marginal cost of funds, negative carry-on account of CRR, operating costs, and tenor premium. See /en/web/rbi/-/notifications/master-direction-reserve-bank-of-india-interest-rate-on-advances-directions-2016-updated-as-on-june-10-2021-10295 22 This assumes that Government recapitalises either from its budget or by issuing recapitalisation bonds. The former reduces funds available for social spending directly, while the latter reduces it indirectly through interest spending. 23 While the current COVID pandemic has manifold effects, a large negative shock to TFP captures the event because, it is a Hicks Neutral Solow residual. Therefore, a negative shock to TFP would cause the labour demand curve to shift inward resulting in lower demand for jobs and therefore, lower equilibrium wage payments. 24 In our model, in the absence of moral hazard, the representative firms and banks operate in an arbitrage free market condition and therefore the benefits of a capital infusion pass on to banks in the form of increased capacity to lend. However, in reality, anecdotal evidence indicate that the increased capital doesn’t always lead to reduction in interest rates as in some instances cost of capital is much higher. 25 We assume in this paper that the government and the central bank is a unified entity. References Ambler, S. & Paquet, A. (1996) Fiscal Spending Shocks, Endogenous Government Spending, and Real Business Cycles. Journal of Economic Dynamics and Control, 14 (1-3), 237–256. Aschauer, D. (1985) Fiscal Policy and Aggregate Demand. American Economic Review, 75, 117–127. Banerjee, S. & Basu, P. (2019) Technology Shocks and Business Cycles in India. Macroeconomic Dynamics, 23(5), 1721–1756. Banerjee, S., Basu, P. & Ghate, C. (2020) A Monetary Business Cycle for India. Economic Inquiry, 1–25. Barro, R. J. (1986) Output Effects of Government Purchases. Journal of Political Economy, 89 (6), 1086–1121. Bean, C. R. (1986) The Estimation of Surprise Models and the Surprise Consumption Function. The Review of Economic Studies, 53(4), 497–516. Beaudry, P. & Portier, F. (2004) An exploration into Pigou’s theory of cycles. Journal of Monetary Economics, 51 (6), 1183–1216. Beaudry, P. & Portier, F. (2006) Stock Prices, News, and Economic Fluctuations. American Economic Review, 96 (4), 1293–1307. Christiano, L. J. & Eichenbaum, M. (1992) Current Real Business Cycle Theories and Aggregate Labour Market Fluctuations. American Economic Review, 82(3), 430–450. Christiano, L. J., Eichenbaum, M., Evans C. L. (2005) Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy. Journal of Political Economy, 113(1), 1–45. Dave, C., Ghate, C., Gopalakrishnan, P. & Tarafdar, S. (Forthcoming 2020) Fiscal Austerity in Emerging Market Economies. Studies in Non-Linear Dynamics and Econometrics. Dubey, P., Geanakoplos, J. & Shubik, M. (2007) Default and punishment in general equilibrium. Econometrica, 73(1), 1-37. Gabriel, V., Levine, P., Pearlman, J. & Yang, B. (2012) An Estimated DSGE Model for the Indian Economy. The Oxford Handbook of the Indian Economy, ed. Chetan Ghate, 835–890. Gerali, A., Neri, S., Sessa, L. & Signoretti, F. M. (2010) Credit and Banking in a DSGE Model of the Euro Area. Journal of Money, Credit and Banking, 42(s1), 107–141. Gertler, M. & Karadi, P. (2012) A model of unconventional monetary policy. Journal of Monetary Economics, 58 (1), 17–34. Ghate, C., Glomm, G. & Streeter. J. L. (2016) Sectoral Infrastructure Investments in an Unbalanced Growing Economy: The Case of Potential Growth in India. Asian Development Review, 33(2), 144–166. Ghate, C., Gopalakrishnan, P. & Tarafdar, S. (2016) Fiscal Policy in an Emerging Market Business Cycle Model. Journal of Economic Asymmetries, 14, 52–77. Ghosh, S., Gopalakrishnan, P. & Satija, S. (2020) Recapitalisation in an Economy with State owned Banks — A DSGE Framework. Theoretical Economics Letters, 10(1), 232–249. Gunn, C. & Johri A. (2011) News and knowledge capital, Review of Economic Dynamics, 14 (1), 92–101. Gunn, C. & Johri A. (2015) Financial News, Banks and Business Cycle, Macroeconomic Dynamics, 22 (2), 173–198. Herwadkar, S. & Verma, R. (2019) Bank Recapitalisation and Credit Growth: The Indian Case. MPRA Working Paper, 97394. Hnatkovska, V., Lahiri, A., & Vegh, C.A. (2013): Interest Rates and the Exchange Rate: A Non-Monotonic Tale, European Economic Review, 63, 68-93. Kormendi, R. (1995) Government Debt, Government Spending, and Private-Sector Behavior: Reply. American Economic Review, 85(5), 1357–1361. Kuehlwein, M. (1998) Evidence on the Substitutability between Government Purhcases and Consumer Spending within Specific Spending Categories. Economics Letters, 58(3), 325–329. Lahiri, A. & Patel, U. (2016) The Challenges of Monetary Policy in Emerging Economies.Monetary Policy in India: A Modern Perspective. Macroeconomic-Advisers. (2009) The shape of things to come. MA Macro Focus, 4(6), 1–11. Mateos-Planas, X. & Seccia, G. (2014) Consumer default with complete markets: default-based pricing and finite punishment. Economic Theory, 56(3), 549-583. Mohan, R. (2002) Transforming indian banking: In search of a better tomorrow. RBI Bulletin. Panetta, F., Faeh, T., Grande, G., Ho, C., King, M., Levy, A., Signoretti, F. M., Taboga, M. & Zahini, A. (2009) An Assessment of Financial Sector Rescue Programmes. BIS Working Paper, 48. Raj, J., Rath D.P., Mitra, P., & John, J. (2020) Asset Quality and Credit Channel of Monetary Policy in India: Some evidence from Bank-Level Data. RBI WPS (DEPR) 14/2020. Taleb, N. N. (2007) The Black Swan. Random House (U.S.). RBI (2014) Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr. Urjit R. Patel). RBI (2021) Report on Trend and Progress of Banking in India, 2020-21. Basel Committee on Banking Supervision (2010) Basel III: International Framework for Liquidity Risk Measurement, Standards and Monitoring. BIS Working Paper. Appendix  A.2. Intervention by Fund Transfer  A.3. Intervention by Altering SLR  A.4. Intervention by Altering Policy Rate: Fixed Deposit Rate  A.5. Intervention by Altering Policy Rate: Flexible Deposit Rate  A.6. Policy Rate versus Gold Returns  |

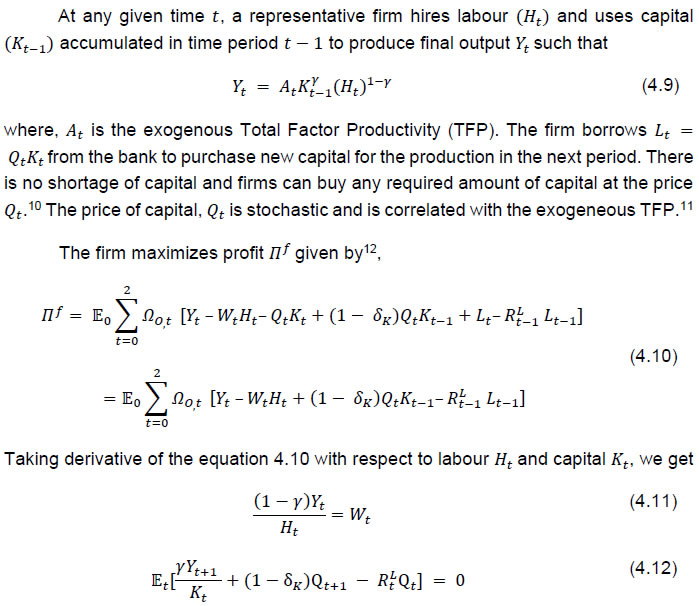

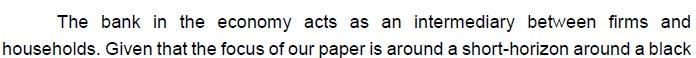

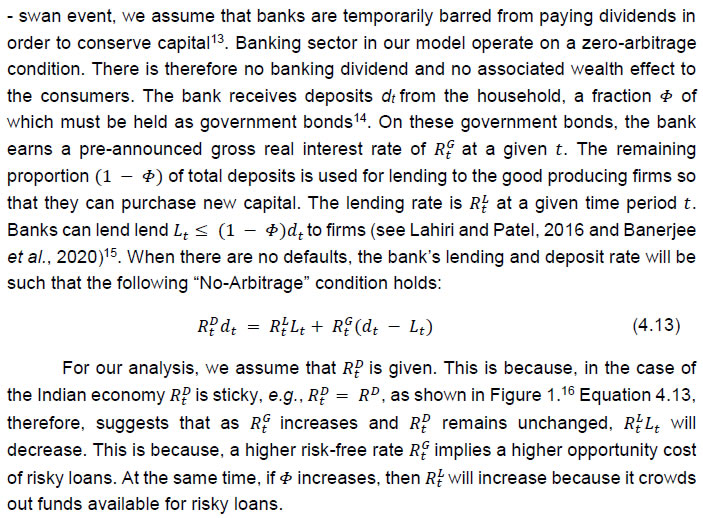

صفحے پر آخری اپ ڈیٹ: