IST,

IST,

Chapter IV : Financial Sector Policies and Infrastructure

Indian banks will migrate to Basel III from a position of strength relative to their counterparts globally. Nonetheless, the new standards may require banks to raise additional capital which may result in their adjusting the lending spreads that will in turn impact GDP. Banks in India may struggle to meet the new liquidity standards, if their SIR investments are not counted for calculating liquidity ratios. Some calibration may hence be required. The progress in respect of migration to the advanced approaches under Basel II has not been very encouraging so far. No Indian bank is likely to emerge as a global SIFI, but a keen eye will need to be kept on international policy developments as the SIFI monitoring mechanism is adapted for domestic SIFIs. The FSDC and its Sub Committee are working towards narrowing the regulatory gaps that have been in existence in the financial system. The resolution regime in the country will need to be fortified to deal with bank failures in an orderly manner. The payment and settlement systems remained robust but trends in intraday liquidity may need to be monitored. Global developments in the OTC derivatives markets call for data aggregation and the establishment of legal entity identifier to monitor the markets. Different access configurations for access to CCPs are emerging. In India, access is largely direct, though concentration risks are posed by designated settlement banks. 'Wrong-way risks' in OTC derivatives will need to be carefully managed and CCIUs stress testing updated to take cognisance of systemic risks and interdependencies in payment systems. Regulatory Infrastructure 4.1 Weak regulatory arrangements and ineffective oversight have been blamed to be one of the factors leading to excessive build up of risks in the financial system that ultimately caused the global financial crisis. The Reserve Bank's first Systemic Risk Survey also features 'regulatory risks' as one of the important risks facing the financial system (Chapter V). Post crisis, international policy makers unveiled an array of reform measures to address the lessons of the crisis. These have been discussed in some detail in the previous issues of this Report. The transition of banks in India to Basel III will be from a position of relative strength... 4.2 With the reforms to the global bank capital and liquidity standards being finalised, the focus has shifted to the smooth implementation of these reform measures. As discussed in previous FSRs, scheduled commercial banks in India will be able to move into Basel III from a position of relative strength. Commercial banks in India migrated to Basel II with effect from March 31, 2009 and the preparations for migration to the advanced approaches are underway. The liquidity position of Indian banks is comfortable and their leverage ratio is well above the minimum stipulated under Basel III. The exposures of Indian banks to complex off balance sheet positions are not very significant and there are in-built regulatory safeguards for securitisation exposures. Also, the banks start with strong capital bases (Tier 1 capital of Indian banks currently stands at over 9 per cent). There may not, thus, be a need for substantial structural adjustments in the Indian banking system though additional capital may be required. ...but banks will need additional capital 4.3 Preliminary estimates show that significant amounts of additional capital will be required by banks as Basel III is implemented, though a precise calculation of the additional requirements is yet to be attempted. Further, banks will also be required to adjust the unamortised portion of their pension and gratuity liabilities in the opening balance sheet on April 01, 2013 on migration to International Financial Reporting Standards (IFRS). Also, capital requirements are likely to be stretched given the inter linkages between bank credit and GDP growth, the demands of financial inclusion and increase in loan requirements from the more credit intensive sectors such as infrastructure. 4.4 The actual quantum of the additional capital requirements of domestic banks on account of implementation of Basel III will depend upon the level of minimum capital requirements and the time period for full implementation of Basel III prescribed by the Reserve Bank - options on which are still under consideration (as discussed in paragraph 4.12 and 4.13 of this Chapter). However, factors like the current levels of equity capital available with banks; growth projections of GDP; earning capacity of banks in the medium-term; impact of various regulatory adjustments/deductions prescribed under Basel III; and impact of additional capital charges in the trading book for market risk and counterparty credit risk will definitely have a bearing. Higher capital requirements could increase the cost of capital for banks and their lending spreads... 4.5 In any case, the higher capital requirements may increase the cost of funds for banks, increasing their lending spreads with downstream impact on the economy. The cost of funds of Indian banks, to the extent that domestic banks rely on foreign funding, may also get impacted due to rising spreads in international markets as a result of implementation of the Basel III guidelines in the advanced countries. ... with some impact on growth 4.6 The primary concern expressed at the international level with Basel III has been with relation to the potential impact of the reforms on the cost and availability of financial services. The extended implementation time frame provided by the Basel Committee on Banking Supervision (BCBS) serves to mitigate the risk of resultant constraints on supply of credit. 4.7 Quantitative studies1 assessing the impact of higher capital requirements on the lending spreads of banks in India suggest that an increase of 100 basis points in the capital adequacy ratio2 would increase lending spreads of the banking industry, on an average by about 10 basis points. Plugging in these estimates into different internally developed macro models suggests only a marginal reduction in the growth rate of GDP. However, if banks were to raise additional capital (either due to the implementation of Basel III or for supporting higher credit growth), the impact on lending spreads would be commensurately higher as would be the downstream impact on the growth rate. The impact on GDP due to the implementation of Basel III can, however, be expected to be balanced by the long term output gain arising from the reduced probability of crisis occurrence. Emerging market economies like India will also gain from the indirect effects of the reduced probability of default of financial institutions in the advanced economies. The impact on lending spreads will depend on the starting level of capital 4.8 The increase in lending spreads differs across different banks with the impact assessed to be the highest for the public sector banks (Chart 4.1). Again, the actual increase in lending spreads and impact on GDP consequent to the implementation of Basel III will depend on the starting levels of capital adequacy of banks, which are also significantly different across banks. Meeting liquidity requirements under Basel III may place Indian banks at a competitive disadvantage... 4.9 Meeting the Basel III liquidity requirements will, however, be considerably more challenging even though Indian banks follow a retail business model and do not rely much on short term/overnight wholesale funding. If the securities held in lieu of the extant Statutory Liquidity Requirements (SLR) are not permitted to be reckoned for the purpose of calculation of the liquidity ratios, a number of Indian banks may not meet the requirement of 100 per cent Liquidity Coverage Ratio (LCR). Asking them to maintain higher level of liquid assets may place Indian banks at a competitive disadvantage and a final view will need to be taken as to what extent of SLR securities can be reckoned towards the Basel III requirements for holding liquid assets.

...even as savings bank rate deregulation and increased interest on small savings schemes may constrain raising higher retail deposits 4.10 Regardless of the treatment of SLR securities, the Basel III requirements apply run-off rates on wholesale funding that are significantly higher than that for retail deposits reflecting the assumption of higher sensitivity of wholesale funding to changes in interest rates and perceived credit risk. This may incentivise banks to source more stable retail deposit funding. However, recent developments viz., deregulation of the savings bank interest rate (which may well increase the sensitivity of retail deposits to interest rates) and increase in interest rate on postal and other public deposits may constrain the ability of the Indian banking sector as a whole to mobilise greater amounts of retail deposits. Liquidity positions can also be shored up through other funding sources, such as issuance of long-term senior debt for banking institutions, but this is likely to be more costly than retail deposits. Data requirements for liquidity stress scenarios also pose their own challenges... 4.11 The other major challenge for Indian banks in implementing the liquidity standards is to develop the capability to collect the relevant data accurately and granularly, and to formulate and predict liquidity stress scenarios with reasonable accuracy and consistent with their own situation, as discussed in the previous FSR. Since Indian financial markets have not experienced the levels of stress akin to advanced economies, predicting the appropriate stress scenario is going to be a complex judgment call, though the stress levels assumed in the liquidity coverage ratio may act as the base level scenario. The Basel III guidelines will be issued shortly... 4.12 Work relating to implementation of Basel III prescriptions in the country, including the liquidity prescriptions, is underway and the Reserve Bank will shortly issue the relevant guidelines, along with the proposed sequencing and timelines of implementation, for public consultation. The Basel Committee has outlined an extended time frame until 2018 for the implementation of the new requirements to provide continued support for the global economic recovery process. ... necessitating decisions on the timing and manner of implementation 4.13 A key question in this regard relates to the speed of implementation of the Basel III prescriptions, i.e. whether or not an accelerated implementation will be favoured in India and whether some of the current more stringent capital requirements will be retained (at present, Indian banks have to maintain a capital to risk weighted asset ratio of 9 per cent against the Basel Committee prescription of 8 per cent). A number of countries (e.g. UK and Switzerland) have announced accelerated/more stringent implementation of Basel III guidelines. Regulators in some other countries (viz.,Sweden) have also announced similar intentions. In the Indian context, a final decision on these issues will be based on the need to ensure that the standards are implemented at a speed and manner that does not disproportionately disrupt the financial system or the broader economy. Advanced approaches under Basel II: Migration of large banks is desirable... 4.14 The timetable for migration of banks to advanced approaches under Basel II has been announced3. From a stability perspective, migration of banks, especially larger banks having sizeable assets and international presence, is important. Migration to the advanced approaches entails adoption of advanced risk measurement and management systems which are integrated into the banks' business processes and can be expected to help achieve closer alignment of regulatory capital requirement with the risk profile of individual banks, thereby adding to the resilience of the financial institutions. Further, non-adoption of advanced approaches could also have reputational connotations for the larger banks. ...notwithstanding some issues and difficulties 4.15 As the schedule for the implementation draws closer, the response from banks has not been very enthusiastic. The reasons for this are not very difficult to ascertain. First, the advanced approaches are far more complex than the standardised approaches (Chart 4.2). This poses relatively more binding hurdles for Indian banks ra-5-ratheir counterparts in advanced economies as Indian banks are new to the concepts of quantitative techniques which form the basis of the Basel II advanced approaches. Therefore, they will need to put greater effort to develop comfort in applying the new quantitative techniques for capital adequacy under Basel II. This will require adequately trained staff and banks may have to take major steps to ensure skill building within their organisations. Forward looking provision may need to be adopted in India 4.16 After the financial crisis, pro-cyclicality of capital and provisioning requirements have attracted considerable attention. Consequently, efforts at international level are being made to introduce counter cyclical capital and provisioning buffers. In India, an Investment Fluctuation Reserve (IFR) was introduced to enable banks to manage the impact of volatility in interest rates well before the financial crisis. A few countries such as Spain introduced dynamic provisioning rules (Box 4.1). Essentially, these approaches ensure build-up of provisions in good times which can be drawn down in bad times to enable banks to continue to lend despite low profitability. Looking ahead, forward looking provisioning for credit risk may have to be adopted in India also. A set of proposed policy reforms for SIFIs has been put in place... 4.17 International policy initiatives in recent period have focused on developing a policy framework for Systemically Important Financial Institutions (SIFIs), especially globally Systemically Important Bank (G-SIBs) (Box 4.2).

Under historic cost accounting, provisions are made for losses recognised at the balance sheet date. However, experience shows that some advances which are in fact impaired at the balance sheet date, are recognised as non performing only sometime in the future for certain technical reasons, To cover the impaired advances which will only be identified as such in the future, a general provision should be made, One alternative approach to the current method of measuring bank loan losses and income is 'dynamic provisioning', The rationale for dynamic provisioning is related to the statistical probability of losses attached to any credit portfolio, and is therefore incurred at the time the loan is granted although it may (or may not) materialise later, The fundamental principle underpinning dynamic provisioning is that provisions are set against loans outstanding in each accounting time period in line with an estimate of long-run, expected loss, Generally, the level of provisioning on this basis would be less subject to sharp swings stemming from the strength of economic activity than the current approach, Loan losses would impinge on banks' profit and loss accounts and balance sheets more smoothly than at present, because of the primacy of expected, rather than actual, losses in a dynamic provisioning approach. The Spanish dynamic provisioning method, also referred to as the statistical provisioning, involves two types of provisions - general and specific, The general provision has two parameters, a and b. The dynamic provisioning model takes the form of : Change in General Provisiont = a* D Ct + b*Ct- D Specific Provision. Where Ct is stock of loans, a covers the latent or inherent loss in each unit over the cycle and b is the average specific provisioning rate over a long estimated period, Both the parameters are based on historical data on credit impairment, During periods of strong credit growth and low levels of specific provisions, the beta component is positive because it recognises the increase in incurred losses, and during recessions those losses quickly translate into specific losses and so the beta component becomes negative, Though backward looking in nature, dynamic provisioning is a transparent rule based approach that can work as a countercyclical tool. References:

...including international standards for orderly resolution 4.18 Key amongst the policy measures aimed at addressing the risks posed by SIFIs is that of the consistent reform of national resolution regimes to ensure that any financial institution can be resolved without significant disturbance to the financial system and without burdening the fiscal. To this end, the FSB has designed a set of international standards in the form of Key Attributes of Effective Resolution Regimes whichare aimed at addressing gaps in legal frameworks and tools for effective intervention in failing systemic firms, including those that operate in multiple jurisdictions, and to remove impediments under existing national laws to cross-border resolution. Implementation requires legislative changes and cross border co-operation 4.19 The achievement of the stated objectives of smooth resolution of a SIFI will, however, require legislative changes in many jurisdictions. Different jurisdictions will also need to co-operate on a much larger scale than at present to prepare feasible and credible G-SIFI resolution plans. They will also need to strengthen their supervisors' resources and mandates so that the supervisors have sufficient independence to act and a full suite of powers to proactively identify and address risks. A framework for monitoring FCs is in place 4.20 In the Indian context, there is a well established framework in place for the monitoring of Financial Conglomerates (FCs), Previous FSRs (December 2010 and June 2011 issues) discussed the framework as well as recent attempts to strengthen it. The Sub Committee of the Financial Stability and Development Council (FSDC), whose mandate includes monitoring of FCs, is also debating steps to further fine tune the supervisory processes in place for these large financial institutions. Extant provisions for bank resolution may not comply with the 'Key Attributes' 4.21 The legal basis for resolution of domestic banks rests in Part III and Part IIIA of the Banking Regulation (BR) Act, 1949 which provide for the suspension of business and winding up of a banking company as also special provisions for speedy disposal of winding up proceedings. The provisions may not, however, meet all the requirements of the aforesaid Key Attributes. Box 4.2: The Set of Proposed Policy Reforms for G-SIBs The Financial Stability Board (FSB) and the Basel Committee have finalised a set of proposals for managing crises at SIFIs and reducing their impact4. The policy measures include:

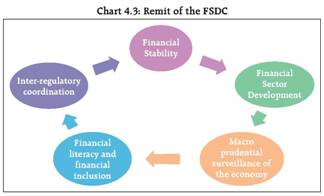

The Basel Committee has proposed a methodology for identifying G-SIBs and prudential safeguards designed to decrease the probability of distress and failure by increasing their loss-absorbing capacity, The indicators selected reflect the size of banks, their interconnectedness, their degree of substitutability (i.e. the presence or lack of readily available substitutes for the services they provide), their global (cross- jurisdictional) activity and their complexity, The methodology was applied initially to a set of 73 banks and an initial group of 29 has been identified as global systemically important (the list has since been published by the FSB), Going forward, the list of G-SIFIs will be updated each year in November. The G-SIBs identified by these parameters will then be divided into four categories (buckets') in increasing order of systemic importance and subjected to capital surcharges ranging from 1 per cent for the first category to 2.5 per cent for the fourth, A fifth 'bucket', currently empty, is also envisaged with a surcharge of 3.5 per cent, to provide an incentive for banks to avoid becoming more systemically important, The judgement of the supervisory authorities plays a role in the banks' classification, but only in exceptional cases can such judgement override the indicator-based measurement approach. The additional loss absorbency requirement must be met out of common equity tier 1 capital only, However, contingent capital instruments can be used to meet any national loss absorbency requirements set above the global level at the national supervisors' discretion. The new rules on the surcharge will come into effect in January 2019 following a transition period beginning in 2016, These will be applicable to those banks identified in November 2014 as G-SIFIs, The resolution-related requirements will, however, be applicable to the initial set of 29 banks and will need to be met by end-2012. 4.22 Also relevant in this connection is the role of the Deposit Insurance and Credit Guarantee Corporation (DICGC), which functions only as a 'pay box' system with a limited mandate to pay the claims of depositors and does not have a mandate for bank resolution.4.23 The Financial Sector Legislative Reforms Commission (FSLRC) may need to address these issues as it reviews the entire set of financial sector legislations. No Indian bank is a G-SIB... but international policy initiatives need to be watched 4.24 An Indian bank is unlikely to be classified as a G- SIB in the near term. But the domestic policy makers will need to be alive to international policy changes as attention is focused on developing a policy framework for domestic SIBs as well as for non-bank financial entities, e.g. systemically important insurance companies. Convergence with IFRS, not adoption, the preferred route in India 4.25 As the date for the migration of scheduled commercial banks to the International Financial Reporting Standards (IFRS) (i.e. April 01, 2013) approaches, the banks face several issues and challenges in implementation. In particular, certain conceptual differences as well as a different prevailing business environment have resulted in India choosing the convergence route rather than the adoption route. IFRS 9 a moving target even as conceptual differences between IASB and FASB continue 4.26 The proposal by International Accounting Standards Board (IASB) to replace IAS 39, the accounting standards pertaining to financial instruments, with a new standard IFRS 9, is of critical importance to the financial sector. The replacement project of IAS 39 is still underway, with the impairment provisions and hedge accounting requirements of IFRS 9 yet to be finalised. This has made the convergence process akin to chasing a fast moving target. Besides, at the international level, the two main standard setting bodies, the IASB which frames the IFRS and the Financial Accounting Standards Board (FASB) of the USA have not been able to make significant progress on a common approach to the standard on financial instruments. In India, there are differences between the IFRS and current regulatory guidelines on classification and measurement of financial assets. IFRS focusses on the business model followed by banks as compared to the relatively rule-based approach being currently adopted. This poses significant challenges to banks as it requires judgement to be exercised by management, based on the principles enunciated in the standard. Further, application of fair values for transactions, where not much guidance is available in India in terms of market practices or benchmarks, has its own difficulties. Banks are also required to be prepared for changes in certain areas, such as measurement and recognition of financial liabilities, consolidation and derecognition as also more and detailed disclosures. The IT systems as also the MIS of banks would need to be changed to cater to the requirements of IFRS. 4.27 The Reserve Bank, on its part has already taken several measures to assess the situation, promote skill development, engage stakeholders and monitor developments. A Working Group to Address Implementation Issues in IFRS is attempting to facilitate a smooth transition to an IFRS converged environment. The FSDC Sub-Committee has emerged as the primary operating arm of the FSDC 4.28 After about a year of its constitution, the modalities of functioning of the FSDC and its Sub Committee have gradually taken shape. The Sub Committee of the FSDC has emerged as the primary operating arm of the Council while the Council provide broad oversight. 4.29 The FSDC met thrice since its inception and discussed the state of the economy in each of its meetings. It underscored the importance of developing the corporate bond market and the need to immediately establish Infrastructure Debt Funds (IDFs) to provide a fillip to infrastructure funding. The Sub Committee, which is required to meet quarterly, met five times since its first meeting in March 2011. The Sub Committee's deliberations spanned across the entire remit of the Council (Chart 4.3). 4.30 The Sub Committee discussed the blueprint for putting in place the necessary modalities for setting up IDFs - the modalities of setting up IDFs as mutual funds or as NBFCs have since been issued by SEBI and the Reserve Bank, respectively while the Reserve Bank has also issued the necessary guidelines for banks or NBFCs sponsoring IDFs. The Sub Committee has been deliberating on the risks to the system arising out of the operations of the government sponsored NBFCs and on the need to strengthen the regulatory framework for wealth management services. It is working to strengthen the mechanism of oversight of the FCs and to put in place a robust crisis management system. 4.31 In order to strengthen the mechanism for inter regulatory coordination in various areas of functioning of the Sub Committee, two Technical Groups have been established (Chart 4.4).

Macroprudential tools a sine qua non in the post crisis policy construct 4.32 The FSR of December 2010 highlighted the importance of macroprudential policy for the calibration of financial policies/regulatory and supervisory arrangements from a systemic perspective rather than from the perspective of individual institutions. 4.33 A cross country analysis presented in an IMF Working Paper5 evaluates the effectiveness of macroprudential instruments in reducing systemic risk over time and across institutions and markets. The analysis suggests that among the most frequently used instruments, many are effective in reducing pro-cyclicality and that the effectiveness is sensitive to the type of shock facing the financial sector. However, as the paper also acknowledges, there are costs, including that of lower growth, involved in using macroprudential instruments and the benefits of macroprudential policy should be weighed against these costs. Use of macroprudential instruments in India has achieved a reasonable degree of success 4.34 In the Indian context, macroprudential tools have been extensively employed especially since the last decade. A range of specific macroprudential policy tools including provisioning and risk weights were preemptively and proactively used both before and since the crisis, with a reasonable degree of success (Charts 4.5 to 4.7). Lacunae in extant regulation of wealth management services will need to be plugged... 4.35 The previous FSR flagged the need to revisit the extant regulatory prescriptions for wealth management services (WMS). In this context, the Reserve Bank conducted a survey in respect of WMS being provided by banks. The objective was to ascertain the market practices in this regard and identify risks and regulatory lacunae, if any. 4.36 A study of global best practices and the results of the Survey threw up several areas which need to be addressed if a robust regulatory framework for WMS is to be put in place, viz., mandatory professional qualifications and periodic training and skill upgradation for officials offering these services, code of conduct for both the institution and officials offering the service, well documented policies/processes for product approval, client risk profiling and product appropriateness and suitability, strengthening of internal systems and controls, establishment of a robust grievance redressal system, etc. The Sub Committee of the FSDC and its Inter Regulatory Technical Group are examining these issues.

...and conflict of interests in distribution of financial products need to be resolved 4.37 A framework for WMS will need to address issues regarding conflict of interest in the distribution of financial products. Such conflicts arise among the originators of financial products (e.g. banks, mutual funds, insurance companies, etc) and the distributors who sell these products (e.g. agents, financial advisors, financial planners, etc.). Conflicts arise on account of dual role played by distributors as an agent of investors as well as of the originators. They may also arise where distributors are marketing similar products of different originators and are likely to be partial to, and sell more products of the originator who is the best paymaster. While such conflicts can exist in any market, they are particularly critical in the case of financial products given the fact that products are intangible and conceptually more difficult to understand and that the pay-offs are often in the distant future. The issue assumes further seriousness in the light of the low levels of financial literacy and awareness in India. Shadow banking, per se, does not exist in India... 4.38 As has been discussed in the previous FSR, shadow banking (Box 4.3) as is understood in the west, does not exist in India as NBFCs which are loosely identified with shadow banking, are under Reserve Bank's regulatory perimeter. Apart from NBFCs, other residual finance companies like chit funds, nidhi companies, mutual funds and micro finance companies could be broadly considered as part of the shadow banking system in India (Chart 4.8). ...nonetheless, there exist certain regulatory gaps which cannot be left unattended 4.39 NBFCs are regulated by the Reserve Bank. There are, however, some regulatory gaps which leave scope for regulatory arbitrage. Some of these have been highlighted in previous FSRs and attempts are underway to address these regulatory gaps in a manner which harmonises the specialised character of NBFCs while at the same time introduces appropriate prudential regulations to address risks and bridge arbitrage opportunities. 4.40. The Working Group on Issues and Concerns in the NBFCs Sector has, inter alia, addressed the gamut of these issues. The recommendations are being examined.

The FSB defines shadow banking as credit intermediation involving activities and entities outside the regular banking system. Shadow banks raise funds from suppliers (e.g. households, corporate, financial institutions) through deposit like liabilities which are short-term in nature. These funds are then used to create assets such as mortgages, auto loans and other longer term assets which are essentially less liquid. Banks also perform the same functions, the only difference being that shadow banks use non-deposit liabilities while banks basically use deposit liabilities. However, like deposit liabilities used by banks, non-deposit liabilities resorted to by shadow banks are also short term and highly liquid in nature. Many of the shadow banks have also been found to be highly leveraged. This maturity / liquidity transformation along with high leverage makes them susceptible to bank-like runs. A withdrawal of such short term deposit-like instruments from the system may have systemic repercussions. In addition to these considerations, the interconnections of shadow banks with regular banks also raise systemic considerations. The leverage built up in the shadow banks may also raise issues of procyclicality. It is also often the case that shadow banks although perform bank-like functions, are outside the ambit of regulatory constraints imposed on banks. The resulting regulatory arbitrage may also undermine banks and may lead to build up of high amount of leverage and risk in the system. During the pre-crisis period, many banks had parked their riskier activities in vehicles or structures that were not consolidated with them but when the crunch came, banks had to take on these risks to their balance sheets. Further, unlike the banks which enjoy the regulatory / public support guarantee in form of lending of last resort / discount window from the Central Banks, deposit insurance facilities, etc, shadow banks lack any such kind of liquidity support. As such they are outside the ambit of regulatory support system which adds to their vulnerability and may enhance their contribution to systemic risk in times of crisis or when some or one of them begins to face solvency issues. Some of the examples on the types of entities / activities which were considered to be conforming to the definition of a shadow bank are finance companies, asset-backed commercial paper (ABCP) conduits, limited-purpose finance companies, securitisation vehicles - structured investment vehicles, securities firms (broker-dealers), investment firms, mortgage insurance companies, other credit insurance companies, credit hedge funds, money market mutual funds, securities lenders, certain government-sponsored enterprises etc. Payment and Settlement System Performance of the payment and settlement infrastructure remained robust 4.41 The payment and settlement system infrastructure in the country continued to perform without any major disruptions in the period since the publication of the previous FSR in June 2011 (Charts 4.9 and 4.10). A series of DR drills revealed some vulnerabilities, which are being addressed 4.42 A series of disaster recovery (DR) drills were conducted during the period since the previous FSR. Various drills were conducted from the DR site of the central systems and /or the DR sites of the members. The DR drills largely testified the resilience of the system to operational failures though some vulnerabilities e.g. DR sites of some members not being operational, constraint regarding bandwidth, connectivity issues in connecting to the central site, etc., were noticed, which are being addressed. Access criteria for payment systems have implications for risks in the systems 4.43 Access criteria are critical for the management of risks arising out of payment and settlement systems. They are particularly important in case of high value payment systems where 'weak' participants can be an important source of systemic risks. These criteria are also an important factor in determining the degree of 'tiering' in the payment system. Internationally, access patterns to high value payment systems vary widely across systems, with very few direct members and correspondingly high level of tiering at one end of the spectrum (e.g. CHAPS in the UK) and systems with almost zero tiering at the other end (e.g. Hong Kong RTGS System). A highly tiered payment system ensures that only the least risk participants become direct members of the system. In such cases, direct participants internalise many payments of indirect participants in their own books (where such systems do exist, these are termed as 'quasi systems'). This could result in increased risks as any credit or operational failure of a customer or second tier bank could disrupt the operations of the first tier or correspondent bank. Systemic consequences could arise as a result, especially if customers are large relative to the correspondent bank or the aggregate system.

Access criteria has recently been revised enabling wider direct access 4.44 In the Indian context, well defined access criteria have been in place for all payment and settlement systems in the country, with the criteria being relatively more stringent for access to the electronic payment systems, especially the large value systems. The access criteria for all payment systems have recently been revised to enable wider access to the system while ensuring that risks emanating from the participants are not aggravated. The revised access criteria for both centralised and decentralised payment systems are (a) Minimum CRAR of 9 per cent; (b) Net NPA ratio below 5 per cent as per the latest audited balance sheet; and (c) Recommendation of the regulatory department concerned. Centralised payment systems have additional criteria of minimum net-worth of ` 25 crore. The revised access criteria will, in particular, enable more banks, especially Regional Rural Banks and Urban Cooperative Banks, to participate in pan-India centralised payment systems like the Real Time Gross Settlement (RTGS), the National Electronic Funds Transfer (NEFT) and National Electronic Clearing Service (NECS) systems. The network of the RTGS system is relatively stable... 4.45 An analysis of the network of the RTGS system on different dates spanning a year (Chart 4.11 presents representations on two separate dates) indicates a relatively low level of network tiering in the RTGS System particularly as compared to the network of inter bank exposures6. The network structure effectively demonstrates only two tiers. The banks that are in the core are the larger participants in the system and these core participants have remained mostly the same over the period. As discussed in Chapter V of this Report, the structure of the network has important implications for financial stability with a less tiered network structure being relatively more stable.

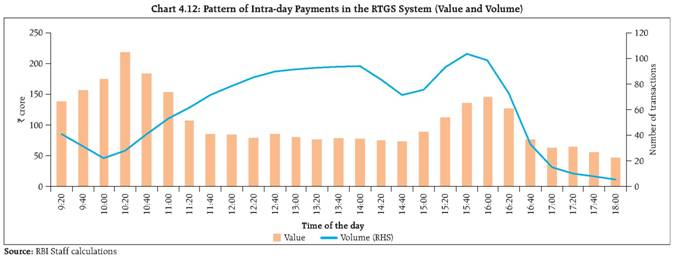

Postponement of settlement of transactions in RTGS systems engender credit, operational and systemic risks... 4.46 RTGS systems typically introduce an intraday funding need to bridge the gap between gross receipts and payments. Intraday liquidity management, thus, becomes an important part of banks' settlement operations. As intraday credit is costly7, participants have incentives to postpone processing payments to the latter part of the day or even to await the settlement of others' payments (i.e. their receipts) before processing their payments. 'In the extreme, banks may adopt a 'receipt-reactive' strategy, only making outgoing payments using liquidity received from incoming payments'8. Such strategic behavior by participants of an RTGS System can lead to delays by one or more participants leading to delayed settlement in the payment system as a whole. This can increase the liquidity risk in the system and can also magnify the impact of an operational event (e.g. if a large number of payments are unsettled when an operational event affects the system/participants), leading to credit and systemic risks. ....indications of some such trends in the domestic RTGS system warrant monitoring 4.47 In this context, a study9 of the pattern of intraday payments in the RTGS system in the country (Chart 4.12) revealed that nearly 30 per cent of average daily payments (both by value and volume) were settled after 3:00 p.m. and nearly 50 per cent of the payments were settled in the second half of the day. The study indicates a certain amount of delayed settlement by the members of the RTGS system though the pattern is, to some extent, affected by timing of customer payments, over which banks typically have little control. There are also significant differences in payment behaviour across banks (Charts 4.13 and 4.14). The trends need to be monitored with a view to avoiding system-wide postponement of settlement of transactions to the end of the day.

Exposure of equity clearing corporations to banks needs to be monitored 4.48 Clearing corporations offering guaranteed settlement typically maintain a Settlement Guarantee Fund (SGF) in addition to collecting transaction based margins from the members. Clearing Corporation of India Limited (CCIL), which functions as the central counterparty (CCP) for the government securities market and foreign exchange market in India, primarily accepts government securities as contribution to the SGF. In the case of equity clearing corporations, however, contribution to SGFs and margins are also accepted in the form of bank guarantees and securities (which may in turn be issued by banks). This exposes the clearing corporations to the banks issuing such guarantees / securities, both directly and indirectly. The associated risks could assume systemic proportions in case of bank failures. Exposure norms in this context have been prescribed by SEBI and also internally by the National Stock Clearing Corporation. Nonetheless, the trends in this respect warrant monitoring. OTC Derivatives Market Initiatives afoot for aggregation of data will assist in monitoring OTC derivative transactions... 4.49 Previous FSRs have reported the set of international initiatives underway to reform the OTC derivatives markets. A key shared priority amongst international policy makers is to ensure, inter alia, reporting of all OTC derivative products to a trade repository so that the information in respect of trades can be used to assess emerging systemic risks. In this context, data aggregation is a key for effective monitoring of the derivatives market.

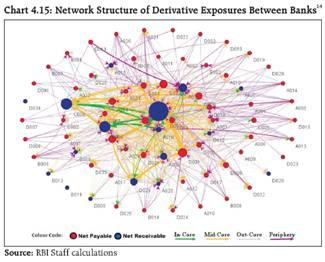

... but will necessitate addressing issues related to methodology and mechanism 4.50 There are difficulties in aggregating data across different trade repositories both within the same asset class and across different asset classes. There will be a need for a global consensus in this regard and legislative changes about data sharing are likely to be required. Issues related to the protocol of sharing the data and confidentiality arrangements will also need to be addressed. LEI may facilitate data aggregation... 4.51 A major challenge for data aggregation is the lack of a unique identifier for a financial entity which acts as a major hindrance in the aggregation of data reported to trade repositories. In this context, the concept of a Legal Entity Identifier (LEI) has been proposed as a useful tool for aggregation of OTC derivatives data. An LEI is a unique global identifier for each legal entity operating in financial markets which can help in identifying participants in different trading, clearing and settlement systems and thus facilitate aggregation of exposures and identification of linkages across markets as well as institutions, both domestic as well as global. The feasibility of migrating to the LEI system in the country is being examined and the Reserve Bank has given its concurrence to the concept of LEI to the Bureau of Indian Standards. Counterparty credit risks in OTC derivatives: lessons from the crisis, regulatory reforms and remaining concerns... 4.52 Financial derivatives play an important role in transferring risks from one counterparty to another. Even while it performs as intended, an OTC derivatives contract exposes its holders to the risk of loss in two ways: through the performance of the underlying asset and through the potential default of the counterparty. Counterparty credit risk is thus a major consideration for participants in the OTC derivatives market. Counterparty credit risks in derivative contracts may have systemic implications... 4.53 The crisis demonstrated that the increased use of derivative contracts increases the interconnectedness between banks, which could result in the build-up of systemic risks. The problem of inter connectedness is further exacerbated by the lack of transparency in inter-bank transactions and due to weaknesses in the banks' risk management framework for counterparty credit exposures, particularly in the areas of back-testing, stress testing and monitoring of 'wrong-way risks'10. Consequently, during episodes of systemic stress, a contract which is perceived as one providing insurance has a significant conditional probability that the insurance provider is not able to pay out11. ... which the post crisis regulatory reforms are attempting to address 4.54 Prior to the crisis, the extant regulatory structure did not take sufficient cognisance of the aforesaid systemic risks. In particular, while the Basel II standard covered the risk of a counterparty default, it did not address 'CVA risk'12. Post crisis, the Basel Committee has introduced measures to strengthen the capital requirements for counterparty credit exposures arising from banks' derivatives, repo and securities financing activities. Also, initiatives to migrate the settlement of an increasing number of OTC derivative transactions to CCP arrangements will aid in addressing associated counterparty risks. The Basel Committee has also extended benefits of lower capital requirements to exposures settled through CCPs. ... but the need for holistic stress tests with stringent assumptions will remain critical 4.55 Going forward, for risks from counterparty exposures in off-balance sheet transactions to be managed, it would be important to take adequate cognisance of how the financial system as a whole operates when building up stress tests. In particular, the need for extensive use of holistic stress tests incorporating more extreme assumptions to assess individual counterparties as well as systemic risks is critical. Derivative contracts add to the interconnectedness of Indian banks 4.56 In the Indian context, derivative contracts add to the interconnectedness among banks (as indicated by the thickness of the lines between the banks in the inner and mid core of the tiered network of off-balance sheet exposures in Chart 4.15)13. The interconnectedness is particularly marked in case of the top 20 banks (in the inner and mid core) raising the potential for systemic disruptions in case of stress scenarios (Chart 4.16). This warrants monitoring in the light of the recent trend of increasing off-balance sheet exposures of banks (as discussed in Chapter III of this Report). The proposed changes relating to the counterparty credit risk framework are likely to have capital adequacy implications for some Indian banks having large OTC bilateral derivatives positions.

Introduction of CCP arrangements for OTC derivatives could mitigate these risks 4.57 This underscores the importance of enlarging the derivatives transactions coming within the scope of a multilateral settlement mechanism through CCPs. At present, forward foreign exchange contracts are settled on a guaranteed basis while interest rate derivatives are settled centrally on a non-guaranteed basis15. Central clearing requirements for foreign exchange options are expected to be phased in a gradual manner while guaranteed settlement for Credit Default Swaps can be envisaged only once a critical amount of market activity and liquidity have been achieved. Alternative access configurations to CCPs present their own macrofinancial implications 4.58 Efforts to migrate standardised OTC derivatives to centralised clearing have led to a debate on the manner of market participants' access to CCPs. There are various alternatives for such access configurations ranging from increasing access to global CCPs through direct or indirect membership, to setting up local CCPs in individual jurisdictions to cater to the requirement of domestic financial institutions. Each alternative has associated macrofinancial implications and trade offs between stability and efficiency. 4.59 Expanding direct access to CCPs may increase competition and reduce the concentration risks arising out of the dominance of a few global dealers in derivatives settlement but will require substantial upgradation to the risk management systems of CCPs for dealing with a larger set of direct members. Domestic CCPs could strengthen the ability of local authorities to exercise oversight on derivatives trading activity in their own jurisdictions, but a large network of domestic CCPs could lead to greater system-wide demand for collateral assets and to fragmentation of trading and financial positions. Again, as links between CCPs are established to reap the benefits of increased multilateral netting, distinct risks, particularly operational and legal challenges as well as associated credit and liquidity risks, can get created.

Domestic CCPs- the appropriate alternative in the Indian context 4.60 CCIL has well defined access criteria which promotes direct access to the CCP, and where not feasible, through a system of designated settlement banks (DSBs), There are risks associated with both direct membership as also concentration risks arising from the DSB mode of settlement, which will need to be continuously monitored. 4.61 CCIL caters to domestic markets with domestic players and the collateral accepted is also largely domestic sovereign paper. The domestic currency is also not fully convertible. At the current juncture, therefore, it is felt that the domestic CCP option may best serve the needs of the economy. Concentration risk in DSB model evidenced... 4.62 The previous FSR recognised the risks arising out of, inter alia, institution based inter-dependencies in payment and settlement systems. Of particular importance in this connection are the concentration risks arising out of the multiple roles played by a few select entities as liquidity backstop providers, settlement banks and large participants in different market segments. 4.63 Important in this context is the system of settlement of transactions of associate members of CCIL through DSBs (the transactions of direct members of CCIL are settled in the Reserve Bank), The distribution of associate members with different DSBs (Table 4.1) points to evident concentration risks as any failure of settlement in a DSB (for example, due to liquidity or operational problems of the associate members) could have market wide repercussions. The risks are exacerbated as the DSBs themselves are large participants (with proprietary positions) in both the CBLO and securities segments.

Portfolio Compression offered by CCIL has evoked positive response... 4.64 The previous FSR reported that CCIL was in the process of developing trade compression services for the rupee interest rate swap (IRS) derivatives market. CCIL has since commenced portfolio compression services. The first live run of the service comprising 14 participants achieved a compression ratio of over 94 per cent. Some finer issues relating to the threshold for identifying trades eligible for compression and ensuring that uniform valuation conventions are followed by participants (so that different MTM values are not reported for the same transaction by the counterparties) are being addressed. CCIL resilient to stress and back testing exercises... 4.65 CCIL has put in place a system of both back testing and stress testing on a periodic basis for various market segments. Back testing results indicate the adequacy of CCILs margining process. Stress test results indicate that the potential losses in all cases were adequately covered by the resources available to CCIL. ... assessment of resilience in more extensive stress scenarios may be warranted 4.66 Going forward, the adequacy and efficacy of the stress tests would need to factor in the limitations of using historical data to design stress scenarios along with difficulties posed by the limited availability of historic data. Further, the stress tests will need to assess the impact of a more generalised failure (two or more large players or a systemic failure) and of stress on availability of liquidity. The risk management framework in CCIL would also need to assess the ability of CCIL to withstand stress in view of the interdependencies in the payment and settlement systems (e.g. risks from settlement failure of DSBs or of banks which are liquidity providers to CCIL) and the prevalence of interconnectedness in the inter-bank and the broader financial sector. Concluding Remarks 4.67 Banks in India are well capitalised and the regulatory requirement of 6 per cent of Tier I capital will hold them in good stead as the system prepares for a transition into Basel III. Nonetheless, the new standards may require raising of additional capital that may in the process lead to increase in banks' lending spreads. Empirical analysis shows that the impact of the increased lending spreads on GDP will be moderate and outweighed by the longer run benefits of reduced probability of failure. The treatment of SLR investments under the new international standards may be a tricky issue. In the event of them being not allowed for the purpose of calculating the liquidity ratio, banks will find it difficult to comply with the new standards. 4.68 No Indian bank is likely to qualify as a global SIFI. However, there is a need to reflect on international developments as the SIFI framework is adapted to domestic systemically important banks. Guidelines for adopting advanced approaches under Basel II have already been issued, yet the response of banks in this regard has not been very enthusiastic. Going forward, the Reserve Bank may need to explore the prescription of forward looking provisions for the banking sector. The date for convergence with IFRS for banks is nearing, but IFRS 9 remains a moving target. 4.69 The Sub Committee of the FSDC has emerged as the Council's main operating arm. In its one year of existence, a range of issues concerning financial stability, financial sector development, inter regulatory coordination, financial inclusion and financial literacy have been reviewed. 4.70 Regulatory gaps between the NBFC and banking sectors are being addressed. The recommendations of the Working Group on Issues and Concerns in the NBFC Sector are being examined in this context. The provisions of the BR Act may not meet all the requirements for effective and orderly bank resolution and may need to be revisited as part of the FSLRC's review of all financial sector legislations. 4.71 The payment and settlement system functioned in a robust manner in the period since the previous FSR. An analysis of intra day settlement patterns in the RTGS system evidences some tendencies on the part of participants to delay settlements to the second half of the day, which needs to be carefully monitored. Data aggregation and the establishment of legal entity identifier that will assist in the monitoring of OTC derivatives are being mulled over. Counterparty credit risks are being addressed in the OTC derivative reforms measures but wrong-way risks will need to be carefully monitored through robust stress testing. As measures to increase centralised clearing of OTC derivatives are implemented, the pros and cons of global CCPs versus domestic CCPs are under discussion. In India, portfolio compression has been initiated to address risks in OTC derivative markets. Concentration risks remain in CCIL, including in DSBs while stress testing and back testing by CCIL may need to be further enhanced. 1 The analysis is based on the methodology used in "Macroeconomic Impact of Basel III", OECD Economics Department Working Papers No. 844, Patrick Slovik and Boris Cournede, The basic premise of the analysis is that a bank's total earnings in the form of interest and non interest income equals its total interest and non interest expenses and cost of capital. The cost of capital is generally more than the cost of deposits and other outside liabilities, Assuming other things remaining constant, an increase in capital will subsequently increase the cost for a bank, and this can be offset only by adjusting the lending rates, since the price of all other assets are essentially market determined. For the purpose of the analysis, 54 banks have been taken representing more than 95 per cent of total banking sector assets. 2 The above analysis has been carried out on the assumption of additional 100 basis points of effective increase in capital adequacy due to Basel III given the current Tier 1 capital ratio of banks in India and the fact that the bulk of this capital comprises core equity. The actual requirement of capital is yet to be estimated and will depend on the time frame for implementation adopted and will differ from bank to bank. 3 The timetable has been set out in Box 6.1 of the Financial Stability Report, March 2010 4 The proposals are contained in a series of consultation papers released on November 4, 2011 5 Macroprudential Policy: "What Instruments and How to Use Them? Lessons from Country Experiences", C. Lim, E Columba, A. Costa, P. Kongsamut, A. Otani, M. Saiyid, T. Wezel, and X. Wu. October 2011. 6 Please see Chapter V of this Report for a full discussion on network tiering structures and their implications for the stability of the network. 7 Typically central banks around the world provide participants in the RTGS System with intraday credit against collateral though some central banks provide it for a price. Intra day credit is therefore costly - either explicitly as fees or implicitly as the opportunity cost of collateral. 8 "Intraday liquidity: risk and regulation, Alan Ball, Edward Denbee, Mark Manning and Anne Wetherilt, Financial Stability Paper No. 11, Bank of England, June 2011. 9 The analysis is based on daily transactions data from the RTGS System for a period of one quarter (July - September 2011) excluding Saturdays. The analysis includes the transactions of all members of the system except institutional entities such as the Reserve Bank, DICGC and CCIL. 10 Wrong-way risk occurs when exposure to a counterparty is adversely correlated with the credit quality of that counterparty. The wrong-way risk arises in a generalised form when the credit quality of the counterparty may for non-specific reasons, be held to be correlated with other macroeconomic factors that may also impact the exposure of open derivatives transactions. 11 "Tail risks and contract design from a financial stability perspective", Paul Fisher, Executive Director, Bank of England, September 2011. 12 The Credit Value Adjustment (CVA) is a measure of diminution in the fair value of derivative position due to deterioration in the creditworthiness of the counterparty. 13 See Chapter V of this FSR for a detailed discussion on tiered network structures and their implications for financial stability. 14 Based on bilateral interbank derivative exposures data as on June 30, 2011. Forward contracts settled through CCIL are excluded from the analysis. 15 Interest Rate Swaps (IRS) will shortly be migrated to a guaranteed settlement platform. Together, forex forwards and IRS comprise the bulk of the derivatives market in India. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

صفحے پر آخری اپ ڈیٹ: