IST,

IST,

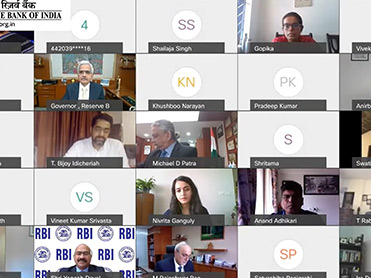

Edited Transcript of Reserve Bank of India’s Monetary Policy Press Conference: April 07, 2021

Shri Shaktikanta Das, Governor, Reserve Bank of India

delivered-on اپریل 08, 2021

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Yogesh Dayal (Moderator): Hello, and welcome to this post policy press conference for the first Bi-monthly monetary policy for the year 2021-22. We have with us around about 35 Media persons representing various organisations; wire agencies, newspapers, televisions, portals, I welcome them all. And, to conduct the press conference in a cordial manner, I will call out the names of people, and then we can go. So with your permission, shall we start? Shaktikanta Das: Yes. Go ahead, please. Yogesh Dayal: Thank you, Sir. I'll invite Ira Dugal from Bloomberg Quint to ask a question please. Ira Dugal (Bloomberg Quint): Good morning, I'll get straight to what seems to be the headline announcement, which is the government bond purchases from the securities market. Sir, can you help us understand what is the rationale behind this? Why this has been an important announcement alongside the OMOs, would it replace OMOs, would it be run alongside OMOs? And, if it is going to replace OMOs, you could have simply announced an OMO calendar. So, I'm trying to understand what the RBI is trying to do through this, what it was not already doing with the existing liquidity management tools? Shaktikanta Das: Thank you Ira for that question. First thing is that it is different from the usual OMO calendar. We have given it a distinct character. In fact, if you see my statement, I have said that this programme will run in addition to our normal LAF operations, special OMOs and other instruments available in our toolkit. So, this is in addition to our normal instruments, various instruments in our toolkit, this is in addition to that; and it has a distinct character, in the sense that for the first time, we are giving out a particular quantum of bond purchase in the secondary market. Earlier, the calendar was never given out for an entire quarter. With this measure, we have announced a particular quantum for the entire quarter, and, within this particular quarter, we will be suitably depending on the evolving situation and other factors, we will be announcing auctions from time to time. And, this is, as I said in my statement that the signals from the Reserve Bank, the communication from the Reserve Bank and the action of the Reserve Bank, all have to be read together. Here, you have a particular action, which is taken outside the normal toolkit of RBI, we are announcing a quantum upfront for the whole quarter. This is the kind of communication we have given. It is a kind of signal, together with the liquidity signal which we have given where I have gone ahead and very explicitly defined what is ample liquidity, that is, after meeting the requirements of all segments of financial markets and the real economy, the system will be surplus. So, we are giving out a signal. We are communicating it very clearly and it is followed up by action, by announcing the ₹ one lakh purchase programme for the first quarter, with the first auction coming up on 15th of April. So, that way it has a distinct character. And, that's how it should be looked at and I will try to make it as participative as possible. So, may I request Deputy Governor, Dr. Patra to supplements. Dr. Michael D. Patra: Thank you, Governor. I just wanted to make three points on this. It is for the first time that the RBI is committing its balance sheet to the conduct of monetary policy. This has not been done by India ever before. The second thing is that it is different from OMO because it gives away discretion. Typically in a OMO auction, we announce the amount, we announce the timing, etc. We are giving up this discretion to give an explicit assurance to markets that we will assist them in the conduct of the borrowing programme. Giving up an amount upfront also helps smart secondary market participants to plan their engagement with the borrowing programme. So, upfront you know how much support is coming from the RBI. So, you can plan your actions accordingly. It is a judgement call, it is a challenging instrument, because it has risks too. It can go awry and that can bring on tensions, but this is a risk of the RBI has taken, keeping its commitment to give an explicit guidance on liquidity. Ira Dugal: If I may just add a follow up question just on this only. So, Governor, is it fair to say that the RBI is standing between the demand and supply mismatch for Government bonds? At the end of the day, that seems to be what is happening here, because we know that there is a certain quantum of demand that will come from banks that may reduce when credit growth picks up. You know, foreign demand is relatively limited, we know the supply is going to be strong. If one strips out all the technicalities, isn't the central bank standing between or bridging the gap between demand and supply of Government bonds? Shaktikanta Das: Well, that is for you to draw your own conclusions, but we are addressing the overall liquidity situation in the market and to ensure that there is an orderly evolution of the yield curve and an orderly evolution of the financial markets also. And, we are not standing in between the demand and supply position. The supply is something which has to be seen, how it plays out in the current year. Last year, I have given out the number- the total OMO was ₹3.13 lakh crore. With that OMO, we supported a borrowing programme of ₹22 lakh crore. So, therefore, in current year also, with a similar size of borrowing, ₹ two or three lakh crore worth of intervention in the market cannot be seen as something like completely taking over the Government borrowing programme or supporting it in terms of quantum. We do expect enough inflows to come in. And, we'll have to see how the situation plays out in the current year. It will be too early to rush into that kind of a conclusion. Yogesh Dayal: Thank you, Sir. In order to manage your time effectively, I request all the participants to ask one question only. And to keep it interesting, I'll be requesting media persons at random to ask questions. So, I would now request Madam Mythili Bhusnurmath from ET Now to ask her question. Mythili Bhusnurmath, ET Now: Thank you, Governor, for giving me this opportunity. I just wanted to ask a simple thing. It's very heartening to hear that RBI says that it will endeavour to ensure orderly evolution of the yield curve governed by fundamentals, as distinct from any specific level thereof. So, can I take it that henceforth, RBI will not be rejecting bids in-toto, in future auctions, if yields demanded by the market are higher than what the RBI is happy with, Governor? Shaktikanta Das: Well, it will depend on whether the bids are orderly or disorderly. So, I cannot say that we will completely give up that option of rejecting the bids. I mean, ultimately, somebody has to take a call and as the central bank, especially when we are managing so many conflicting objectives and conflicting targets which are in front of us and we have to find the right balance. So, it all depends on whether the bids are orderly, in our view and in our judgement; of course, our views and judgement will be based on reasonable assumptions. They will be on rational assumptions. So, we will take a call whether it is an orderly bid or it's completely an outlier kind of bid and based on that we will take a decision. Mythili Bhusnurmath: Okay, so you will have the last call. Yogesh Dayal: Thank you, Sir. May I request Lata Venkatesh of CNBC TV18 to ask you a question? Latha Venkatesh, CNBC TV18: Well, don't count this as my question. I am just completing what Ira asked. Should we assume therefore that the intervention through G-SAP is different and separately, also the OMO of ₹3 Trillion remains, Governor, and the Operation Twist, etc. continue as before? Shaktikanta Das: I would like to make this press interaction as participative as possible from our side and I will ask Deputy Governor, Dr. Patra to reply. Thereafter, if required, I will supplement. Dr. Michael D. Patra: Yes, thank you Governor. Governor's statement makes it explicit that the G-SAP will run alongside the regular operations, which include a whole array from LAF to outright OMOs to Operation Twists, everything. And, for the question that came in earlier, this is built into our liquidity planning framework for the year as a whole. So, it is not that it's a helicopter use of facilities, it is planned into the liquidity framework for 2021-22. Latha Venkatesh: Sir, just going forward with my question, should a hike in the Reverse Repo also be taken as an accommodative policy? Even when you are in accommodative policy, can you hike the Reverse Repo? And, as well, I'm a little confused about your saying that you will keep being accommodative till growth becomes sustainable. Look at your growth guidance- I mean, it's 26, 8, 5.4, 6.2. And, for next year 6.8, according to the Monetary Policy Report (MPR). Look at your inflation guidance- it is above 5 for a better part of this year, and 4.5 to 4.8 for next year, then what exactly can make you exit at all? I'm asking you this, because it looks like household savings are already protesting. Are you not worried about the rise in gold imports steadily over the last six months and ending at almost $9 billion in March? Shaktikanta Das: You have given us a lot of food for thought. But let me say, at this point of time, we have said what we had to say in our Resolution and in my Statement. At what point we will exit, whether reverse repo should be seen in a particular way- you will have to wait for a situation when it arises. But, at that moment, I feel that our Statement and our Resolution are sufficiently clear and also do provide some kind of forward guidance for the markets and for all stakeholders. Thank you. Yogesh Dayal: Thank you, Sir. I would request Mr. Govardhan Rangan from The Economic Times to ask his question. Govardhan Rangan, The Economic Times: The CPI forecast is well above 4 percent for the second year, running this fiscal. Does that mean that the MPC is missing the inflation target of 4%? And, in that context, that's the accommodative stance is extended to the reverse repo as well, or is it not? Shaktikanta Das: I think your question overlaps with the question which Latha also just now asked. At this point of time, as I said very clearly that I will not give you a headline beyond what is there in my Statement and what is there in the Resolution. On a more serious note, target of 4% plus minus two has been reiterated by the Government in its notification. In my statement also, I have said that inflation targeting framework is now well entrenched, it is well anchored, expectations are also well anchored. I have also said that the current framework of plus minus 2% gives enough room and policy space to the central bank to act in extraordinary situations such as the pandemic. So, therefore, throughout the last year, and also in the current MPC, the MPC has looked through certain aspects of inflation. Going forward, we have given out certain projections, the outlook is uncertain, we will see how it plays out. And, ultimately, at the current juncture, we have said that growth is of paramount importance. While of course, keeping in mind very much that inflation targeting is important, because after all, the primary goal of monetary policy is maintaining a certain level of inflation. So therefore, about reverse repo, at the moment we have not said anything. So, you will have to wait for when we make any announcement in that regard. I can see Dr. Patra probably wants to add something, do you have any point? Dr. Michael D. Patra: I just wanted to supplement that whenever the system is in reverse repo, policy is accommodative. Full stop. Yogesh Dayal: Mr. Anup Roy from Business Standard may ask his question. Anup Roy, Business Standard: Thank you, sir. This fiscal, you are expanding your investor base quite a lot. You have retail participation. We are not talking about global bond index inclusion in global bond index. You have also promised at least ₹3 trillion of OMO support this fiscal and now you're coming up with G-SAP and saying that this will run alongside OMO and other tools. Are you anticipating some kind of shock to bond supply this year or you're really trying to drive down yields at a very low level? Shaktikanta Das: Drive down of bond yields will not be the right way of describing it, because, again and again we are emphasising on the orderly evolution of the yield curve. And, in my statement also I have said that both upward and downward movement in the yield curve are quite natural in a bond market, depending on changing macro-economic fundamentals and other macroeconomic factors. So, therefore, we are also mindful of the kind of liquidity which is there in the market. And, given the reserve money numbers, I have given the M3 growth numbers. So, we are mindful of the overall liquidity position in the market. As a part of our liquidity management, we have also announced this variable rate reverse repo auctions that is a part of our liquidity management operations, not a kind of liquidity tightening; I think I have said it very explicitly. So, therefore, we are mindful of all the aspects of the liquidity situation, maintaining financial stability and I will say, you know, there are many conflicting objectives, which the central bank is required to manage. There are trade-offs, and we are quite confident that we will be able to take a balanced call and ultimately it's a judgement call. And at this point of time, I'm reasonably confident or rather very confident that we will be able to deal with such challenges. Yogesh Dayal: I would now request Swati Khandelwal from Zee Business to ask her question. Swati Khandelwal, Zee Business: Thank you Sir. I have a simple question. At this time, what is your immediate priority for the middle class, when the environment is low interest regime or slightly rising inflation rate but at the same time requiring growth also to be supported? So, what can be the investment avenues for the middle class? You had told in the beginning that recovery is a bit uneven, still, we aren’t doing bad as a country. So, in such a paradoxical situation, how do we see the policy, especially for the middle class? Shaktikanta Das: Well, your question is not that simple, as you had cited. As a central bank, we would not want to comment on where the middle class would invest. Middle class has to decide on its own as to where it should invest- the market in which returns are good. The markets in which prospects of returns are good, the risks increase commensurately. Our middle class is quite sharp and intelligent, we should not underestimate them. They would take a judgement call on their investment. Which specific instruments they would want to invest in is not for us to say, and we should not be saying anything on this aspect. On your statement mentioning that our country is not doing that bad, I would like to rephrase it a bit. We should keep in mind that in the year 2020, beginning in April 2020 and ending on March 31, 2021, as an economy, our financial system has faced the challenge well. Whether we look at the macroeconomic numbers or financial stability parameters, we entered the pandemic in a much better position last year. Now also, our macroeconomic numbers and financial sector parameters are quite robust. And, in my Statement, I had mentioned that the underlying theme behind any policy decision is how to preserve financial stability. Going forward, we will take various decisions as the situation emerges. I would like to say that as a country, we have done reasonably well, despite so many challenges. When the pandemic started, world over, it was a surprise for both the monetary authorities and fiscal authorities. But after a year, the world over, central banks and fiscal authorities, and particularly in the context of India, both RBI and Government are better prepared to deal with the recent surge and the new wave of the pandemic. We will perform our role to the best of our ability and I think, we should be able to deal with it well. So, I concluded my Statement with a quote from Mahatma Gandhi, which gives a lot of meaning to the Statement and entire policy approach of the Reserve Bank. Yogesh Dayal: I will request Gopika Gopakumar from Mint to ask her question please. Gopika Gopakumar, Mint: Thank you, Sir. Dr. Patra said about this G-SAP and how RBI is committing its balance sheet for monetary policy. And this is happening for the first time. Can you elaborate what it means? And also, secondly, what would be the impact of having around ₹1 trillion of liquidity surplus in the system? Wouldn't this be inflationary? And is that a concern? Shaktikanta Das: In your question, you have referred to Dr. Patra’s comment and the technical glitch that occurred in between gave me a chance to move to the non-striker’s end. Dr. Patra is now facing the ball, so, Dr. Michael Patra could reply to this question. I will come back when I take the next question. Dr. Michael D. Patra: It is like this. When we are unchanged on the policy rate, we need an instrument to run monetary policy. In the past, all our actions were to move the interest rates up and down and to ensure that proper transmission happens across the market spectrum. This time we are being more explicit. We are not waiting for the indirect channel of interest rates and prices to operate, we are directly committing an expansion in our balance sheet of a certain specified amount which is known to the public, with the hope of ensuring orderly conditions in the market. What this will do is that irrespective of what the RBI wants, we will give you ₹1 lakh crore is what we are telling the market. It is not going to be timed to market situations, market movements, etc. So, there is an upfront assurance. It is very much like what central banks are doing across the world into buying assets of various types. We are sticking to the highest quality assets, and why we are doing so, because, the G-sec is the benchmark for the entire market spectrum. So, by influencing the G-sec interest rates, we can ensure congenial financial conditions across the economy and that is essential for recovery to stabilise and take root and become stronger. That is the whole essence. In an OMO type of situation, the market is guessing. How much will RBI put up there? When will it do the auction? Will it reject? All those questions come up. Here is an explicit commitment that so much I will ensure that liquidity is available. As far as excess liquidity, the second part of your question, no, we have programmed it into our liquidity framework, so that it is not beyond what the economy requires in terms of its growth rate and its inflation rate. It is programmed into that. So, obviously, we are cutting elsewhere. What I forgot to mention in my first set of remarks was that actually Governor has delivered on the promise he made in an earlier statement. If you recall, when the CRR was withdrawn, the Governor said that he will replenish the liquidity taken away with durable liquidity. And he is exactly doing that. So, you have a lot more certainty, going forward, into the market buying programme. A lot of less tension for the markets about the RBI’s presence and support. And, we hope the markets will respond with orderly conditions in the marketplace. Yogesh Dayal: Thank you Dr. Patra. I'll request Mr. Mayur Shetty from the Times of India to ask his question. Mayur Shetty, The Times of India: Thank you. My question is on the Developmental Policies, particularly the one relating to prepaid instruments. It looks like now these PPIs have been made almost at par with payment banks, they're being allowed to withdraw cash, made part of the payment system. So is this the kind of roadmap that you see for wallets? Just like large NBFCs are expected to become banks? And, also, in light of recent major incident, is there any data breach reporting norms for prepaid issuers? Shaktikanta Das: I would request Executive Director, T. Rabi Sankar to take that question. I'll supplement thereafter if required. T. Rabi Sankar: Thank you Sir. Yes, you're right, the basic idea of allowing cash withdrawal, etc. in non-bank PPI issuers is essentially to level the playing field between banks and non-banks and also achieve the comfort that one can access easily, which reduces the need to actually hold cash. The fact that a PPI holder has this comfort that ‘I can whenever I want’ access cash, reduces the actual need to hold cash and that we believe will give a big fillip to digitization in the system. So, that is essentially the reason why this was done. Thank you. Yogesh Dayal: Thank you Sir. I would now request Mr. Bijoy Idicheriah from Informist Media to ask his question. Bijoy Idicheriah, Informist Media: Sir, I'm going back to the guidance. From the time the pandemic started, you've been very clear that at some point, you will have to get out of this chakravyuh, because this is something that you're very clear, is a temporary phenomenon and we need to tide over this phase. It's something that you have reiterated throughout your communication in the early part of 2020. So, when you gave the time based guidance in October 2020, you obviously had some kind of time horizon in mind. Now, when you're moving back to a state based guidance for policy, what is the thinking that is going into this? Is it because you see many more risks on the downside for growth, many more risks on the on the upside for inflation? Is that why the shift to a state based guidance rather than time based guidance? Shaktikanta Das: First thing is that we are at the beginning of a new financial year. And it's too early in the day to give again a time based guidance, especially when the environment at the moment has become more uncertain due to the recent surge in infections, and the daily number of cases are pretty high. But, this time around, at the same time, I would like to say that so far, the current surge is not likely to impact the growth so much as it did at this point of time last year, because, the lockdown this time is selective, it is on physical movements, etc. Many establishments, manufacturing units, service sector facilities and many businesses are very much on with their operations. Manufacturing units, factories- large, small or medium- they are all functional. People are better prepared to take precautions. So, therefore, the growth outlook based on the situation as it prevails today, we have reiterated our 10.5% projection for the current year, that is, for 2021. And, I don't think at the moment that growth has been undermined in any manner. The vaccine is also an additional factor which is on the table. It was not there last year, throughout last year, it started only in January or so. So, therefore, there is uncertainty, but, overall, we are better prepared to continue the various economic activities which are at play in full. There is no impediment, except perhaps, certain businesses like the restaurants and hotels, etc. Indian entrepreneurs have this innate capacity to deal with new situations, many restaurants have taken resort to home delivery of food items in their neighbourhoods. I think their activities will continue to play out. And, at this point of time, whatever guidance we have given looks very much appropriate as the situation prevails today. And, as we expect, and it is also based on our expectation of how the situation is going to play out; we have made certain reasonable assumptions with regard to how the situation is likely to play out and based on that we have provided the guidance. Going forward, we will obviously be watchful, but I can only add that we have taken into consideration the likely scenario that is perhaps going to unfold. Yogesh Dayal: Thank you Governor. I will once again try to connect with Pradeep Pandya from CNBC Awaaz for his question. Pradeep Pandya, CNBC Awaaz: My question was on the guidance, which you have just responded to. There is another connected question that there is an almost total lockdown situation in Maharashtra. Although you said that there have been certain SOPs prepared to keep the factories and manufacturing units running. Still, the trading community and services sector has been seriously impacted. Like the last time, when you had given relief to banks by announcing measures like moratorium, if the lockdown continues like this for couple of months and also extends to other cities and states, then, will you consider such measures again? Especially, how do you see this from the point of view of financial services sector and NBFCs? Shaktikanta Das: What measures we take, going forward, would depend on the situation. I do not want to speculate on the future position based on the present situation. But, I would like to say that not just the monetary authority and fiscal authority, but businesses, particularly private sector businesses are better prepared today to deal with the situation and carry on with their activities. You will have to wait and watch out for what steps we will take, going forward. I may not be able to mention about any future policy today. New situations require new and innovative thinking about dealing with them. The moratorium that you mentioned is a conventional and standard operating tool. You would have seen that in the past year we have also used non-standard and innovative tools. The G-SAP that we announced today is also a non-standard instrument. So, going forward, we will use conventional, unconventional and innovative measures, depending on the situation. We will take a call as the situation unfolds and I would not like to talk about it in advance. As on date, moratorium or similar measure is not needed. Pradeep Pandya: There have been reports that after the Maharashtra lockdown, there may be an impact of up to 0.5% of GDP, so, won’t there be an impact on asset quality? Shaktikanta Das: We regularly monitor the data pertaining to asset quality. Central banks generally don’t exhibit knee jerk reactions under any situation, and, we will also not show such reaction. We will watch the situation to see what is its depth, what is its impact and what would be the likely remedy and we will take a decision after analysing those aspects. If we announce something today based on the present situation, it will be very immature knee-jerk reaction, and may backfire. So, we will take our decision based on the situation, going forward. Not just on this matter, but on other matters too. Thank you. Yogesh Dayal: Thank you, Sir. I would now request Anirban Nag from Bloomberg to ask his question. Anirban Nag, Bloomberg: Thank you for the opportunity. Good afternoon Governor. Good to see you. I had a quick question, Governor. On the G-SAP, you have put out ₹1 trillion for this quarter. So, at the start of every quarter, will you be giving out a certain number to the market, just to assure them? On the forex market, you have been sterilising some of the inflows through the forwards market, will you be continuing to do that to offset some of the domestic liquidity? Shaktikanta Das: With regard to forex, all options are on the table. So, we will use the various options depending on how the situation unfolds. It's a mix of buying it on spot, part of it is pushing forward. So, it will all depend on the situation. I cannot say that we will only continue with this instrument, all instruments and all approaches are on the table. We monitor the situation on a day to day basis and we will use all these instruments and all these approaches. And, with regard to the G-SAP, the intention is to give a guidance on a continuous basis. We have announced the quantum for this quarter and there should be a surprise element too, for the second quarter. We will reserve the positive surprise element for the next quarter, we will continue with G-SAP, it is not a one-off kind of announcement. And if you see, we are calling it G-SAP 1.0. There is obviously a second one, which will follow, so, I'll leave it at that. Yogesh Dayal: Thank you Sir. Ms. Shritama Bose from Financial Express to ask her question please. Shritama Bose, Financial Express: Thank you Sir. I'm going back to the PPI guidelines. Not just non-bank PPI issuers, but also we've seen instances of data breaches and other payment intermediaries who are non-banks, payment gateway operators, etc. So, what is being done in terms of the supervisory architecture at RBI, so that non-bank players in the payment system are subjected to at least the same degree of oversight that banks have to face? Shaktikanta Das: To your question, I will ask T. Rabi Sankar, Executive Director to reply to that and thereafter, Deputy Governor, M. K. Jain, if you want to add any points, you could add that. T. Rabi Sankar: Thank you for the question. Our objective will continue to be to take care of the protection of the customer and make these transactions as safe as possible. To that extent, like it was issued to banks recently, we are also looking at, you know, we're looking at issuing guidelines that could lay down the basic minimum norms for cybersecurity and other security issues. As far as instances of such breaches are concerned, we have seized off those matters and we are taking whatever steps are required to reduce the possibility of such things happening. M. K. Jain: Thank you, Governor. I will just supplement with two of my observations. One is that we are taking policy decisions whenever it is required. Very recently, we issued Digital Payment Security Controls guidelines that will strengthen the entire ecosystem of all the regulated entities. And, second, in terms of supervision, we are monitoring all kinds of IT systems of regulated entities very closely. Yogesh Dayal: Thank you Sir. We are almost out of time but with your permission, we will take three last questions. Shaktikanta Das: Quickly, please. Yogesh Dayal: I will request Swati Bhat from Reuters to ask her question please. Swati Bhat Shetye, Reuters: Good afternoon Governor. Thank you so much for this. I wanted to understand, when the budget was announced in February 2021, we didn’t see these kind of cases. And, all the projections of the government would be based on the data before the infections surged. Is it likely to have any impact on the government’s revenues, going forward? And, is that a concern, especially because most of the surge has been seen in all the industrialised states. Is that likely to have an impact? How do you see that playing out? Shaktikanta Das: It is too early to say that it will have an impact on government revenues, particularly the GST or direct taxes, etc. I am sure, government would be continuously evaluating the situation. At the moment, I think it is too early to rush into any conclusion that the revenues will be adversely affected in the current year. Today is 7th of April and it is just about a week into the new financial year. So, let us see, we will have to wait and see how it plays out and how the economic activities are sustained. That is our effort at the central bank, and as I have mentioned, the fiscal authorities are also equally aware about the impact that it will have on their revenues. And, we are definitely better prepared to deal with the situation. Let me conclude by saying that it is too early to draw any conclusion that revenues are going to be affected because it is too early into the financial year. Yogesh Dayal: I will move on to Nivrita Ganguly from AFP to ask her question. Nivrita Ganguly, AFP: Good afternoon Governor. How is the MPC assessing the risks in the external environment at the moment? Particularly, I wanted to get your thoughts and if there there was any discussion about the stimulus that was announced in the US? What would the risk of a very uneven recovery be for India? Shaktikanta Das: Dr. Patra, you can take that question. Dr. Michael D. Patra: In the MPC’s assessment, perhaps two things are: the rise in inflation and global spill-overs, which are being source of risk for India, both positively and negatively. And, both ways we suffer. There is a saying that ‘if elephants fight, the grass suffers, if elephants get friendly, the grass suffers’. So, if there is a stimulus, there is a likelihood that it leaks out of US and comes to India. Then we will have a problem of high capital inflows. If it is the other way round, then capital leaves countries like India and there is a reverse problem. So, I think that global spill-overs are a big issue, specially since they impact asset prices and financial markets are exposed to these flows. So, we need to take that into account while setting the balance of risks and making our judgement. Yogesh Dayal: Thank you Sir. I will request Mr. K Ramkumar from Hindu Business Line to ask his question. K. Ramkumar, Hindu Business Line: Good afternoon Sir. I wanted to know that you have doubled the day-end amount that depositors can hold in payments bank. Is it because you want payments banks to become small finance banks? You want to discourage them? Shaktikanta Das: No, no. It is not to discourage payment banks. It is to give an additional boost to the payment banks sector. It is to support them and also enable them to play their role for the purpose for which they were created. We have a differential regulation for payment banks. When it was launched in 2016, when the ₹1 lakh limit was fixed, that time itself it was aid that the limit will be revised and after about five years we have reviewed it and we feel that for payment banks to continue to operate successfully and to continue to have a wider reach and serve a wider cross-section of people, this increase in limit from ₹1 lakh to ₹2 lakh was necessary. If at all, it is intended to make payment banks perform their role better and to make them more vibrant. Yogesh Dayal: Thank you Sir. Mr. Anand Adhikari from Business Today. Anand Adhikari, Business Today: Good afternoon Governor. Our forex reserves have overtaken Russia’s reserves to become the world’s fourth largest. Now, if we look at the traditional and often talked about parameters like import cover, which is one of the highest in the recent decade, almost 18 to 19 months’ of cover; similarly, the debt based indicators, like reserves as a part of external debt, the forex stock looks to be adequate. I just want to know what are other parameters that RBI is studying or looking at to assess the adequacy of reserves and is there a cost attached to it? Shaktikanta Das: First thing that I would like to say is that there are several ways of looking at the adequacy of our reserves. The conventional method has been to look at the import cover- how many months of import bills your reserves are covering. Second approach is to look at the ratio between the total reserves and the total foreign debt. Within the foreign debt, the size of reserves vis-à-vis the short-term debt and long-term debt. So, there are various ways of looking at the adequacy of reserves. So far as the Reserve Bank is concerned, we use all possible methods of assessing the adequacy of our reserves but we are not in the market only to buy or sell, it is not that whatever be the exchange rate RBI will go on buying or go on selling. Because, we also have a parallel responsibility and a parallel objective of preventing excess volatility. Our primary objective is to prevent the excessive volatility of the exchange rate between the rupee and the dollar. So, interventions are to prevent volatility and to ensure that there is stability in the exchange rate. And, there is a steady evolution in the rate and not a sudden strengthening or sudden depreciation. That is our first approach. And the second approach is, as I had said earlier that we have to build up our buffers and as it was mentioned by the Deputy Governor little while ago, you have problems coming out of spill-overs. It can be two-way flow of forex. When it comes in, you have one situation and when forex flows out, there is another situation. So, we keep all these aspects in mind and to deal with both these situations, we need to have adequate reserves, we need to have adequate buffers. So, our main objective is to have adequate reserves to deal with two way flows, any situation may arise. And, a parallel objective, as I said, is to prevent excessive volatility of the rupee exchange rate vis-à-vis the dollar and to maintain overall exchange rate stability. Yogesh Dayal: Thank you Sir. Before I close, Mr. Mrigank Dhaniwala has been waiting for quite some time. So, I will take this last question and we can then wind up. Mrigank Dhaniwala, Newsrise: Good afternoon Governor. While the MPC gives more importance to growth over inflation, core inflation you have said is near 6%, with headline prints of above 6% last year. Does it mean that liquidity injection will remain the primary move and the Repo Rate is likely to stay at this level, what the market sees as the term loan Repo Rate level? Shaktikanta Das: Deputy Governor Dr. Patra can take this question. Dr. Michael D. Patra: We are extremely conscious of core inflation pressures. We watch it very carefully to see if there is a generalisation of pressures. Our current judgement is that core inflation is largely driven by pandemic related disruptions rather than demand pull. Accordingly, the MPC has chosen to look through these pressures for the current time and focus on growth, which is the need of the hour. On the Repo Rate, as Governor keeps mentioning, everything is on the table. Nothing is withdrawn, nothing is said no to. All options are open to the RBI. And, we remain flexible on all fronts. Yogesh Dayal: Thank you Sir. With this, we come to the close of the press conference. I would like to take this opportunity to thank the Governor, Deputy Governor Shri M. K. Jain, Dr. M. D. Patra, Shri M. Rajeshwar Rao, Executive Director, Shri T. Rabi Sankar and all our media participants who have been a part of this process today. I would urge everyone to stay safe till we meet again after two months. All the very best. Stay safe. Thank you all. Shaktikanta Das: Thank you everyone. |

صفحے پر آخری اپ ڈیٹ: