IST,

IST,

VII. Macroeconomic Outlook

The slowdown in the Indian economy persisted, with growth hobbled by structural bottlenecks and adverse global conditions. While demand-side inflation pressures reduced, high consumer price inflation along with the current account deficit (CAD) well above sustainable levels limits the space for monetary policy to support growth. Surveys show that business confidence remains subdued despite reforms and policy initiatives since September 2012. Against this backdrop, a recovery in 2013-14 is likely to be slow-paced. It would require further all-round efforts that includes initiatives to remove structural impediments and improve governance. Resolving outstanding issues that constrain infrastructure investment and a public investment stimulus rebalanced by revenue spending cuts holds the key to the economy’s revival. Growth slowdown, macroeconomic risks come to fore in 2012-13 VII.1 Growth slowdown, persistent inflation and the twin deficit risks came to the fore during 2012-13 and enervated the Indian economy endangering the reversal of its declining growth path. Amidst trade-offs, monetary policy factored in increased growth risks and shifted its stance to calibrated easing to address the growth slow down as headline inflation gradually moderated. The government also launched concerted policy action and reforms during H2 of 2012-13. These reforms, with fuller implementation, are expected to arrest the downward spiral and kick in a modest recovery in 2013-14. VII.2 In the interim, growth impulses turned weaker in H2 of 2012-13 as mining and manufacturing activity remained subdued and slowdown spilled over to certain segments of the services sector, most notably ‘trade, hotels, transport and communication’. Growth in Q3 of 2012-13 dropped to a 15-quarter low of 4.5 per cent, taking the growth during the first three quarters to 5.0 per cent . It looks probable that growth for 2012-13 may be at a 10-year low at about the CSO’s Advance Estimates of 5.0 per cent. VII.3 Part of the slowdown has been due to global factors with weak external demand impacting activity levels, especially that of the manufacturing sector. Growth in most emerging market and developing economies (EMDEs) slowed during 2012 and their growth is expected to stay low in 2013. On the domestic front, the services sector activity decelerated. The sector has been the mainstay of India’s recent growth story. Industrial growth is now virtually facing stagnation resulting from a combination of factors, most notably the investment cycle downturn, supply-side bottlenecks, governance problems and weak external demand. Slowing private consumption demand is also dragging down growth, especially in the recent quarters. VII.4 Macro-financial conditions worsened with slowing growth, widening current account deficit (CAD) and persistence of high consumer price inflation. The CAD/GDP ratio rose to a record 6.7 per cent in Q3 of 2012-13. Notwithstanding likely improvement in Q4, the CAD/GDP ratio is expected to be at a new high of around 5.0 per cent for the year 2012-13, which is about twice the sustainable level. Other indicators also suggest increased external sector vulnerabilities. Short-term debt on a residual maturity basis increased to 44.1 per cent of the total debt and 56.2 per cent of the foreign exchange reserves by end-December 2012. The economy has become vulnerable to any event shocks that might precipitate a sudden stop or a reversal of capital inflows. The recent fall in global commodity prices, especially of crude oil and gold, provide some much needed relief, but being complacent based on price movements that may not necessarily be enduring could be myopic since the CAD/GDP ratio could exceed sustainable levels for the third successive year in 2013-14. Macro-financial risks start getting addressed, may pave the way for recovery VII.5 The widening CAD was accompanied by an increasing fiscal deficit in H1 of 2012-13. With the emerging macroeconomic imbalance from the fiscal side that had accentuated the twin deficit risks, the government embraced a plan for fiscal consolidation following the recommendations of the Kelkar Committee. The Committee had projected the GFD/GDP ratio to touch 6.1 per cent for 2012-13 in the absence of corrective measures. However, binding itself to a credible commitment to lower fiscal deficits, the GFD/GDP ratio was lowered to 5.2 per cent in 2012-13. This correction has effectively lowered the twin deficit risks at a critical juncture. If the government stays on its fiscal plans in 2013-14 and rebalances spending from non-plan to planned expenditure, it would lay the foundation for a sustainable recovery. VII.6 Monetary space in 2012-13 was constrained by twin deficits and elevated inflation. Headline inflation hovered in the 7-8 per cent band for most of the year before moderating to about 6.0 per cent by the end of 2012-13. However, a more perceptible fall in non-food manufactured product inflation along with marked progress in addressing fiscal risks provided headroom for monetary policy to start easing. Using the available space, it lowered policy rates cumulatively by 100 bps, CRR by 75 bps (on top of a 125 bps reduction in Q4 of 2011-12) and SLR by 100 bps. VII.7 Recovery at the current juncture will critically depend on supply-side action to remove a host of micro-constraints and structural bottlenecks that impede production and investment, especially in growth-driving sectors such as road and power. The government has initiated action in this direction, but progress has been slow, making it imperative for decisive action to be taken quickly on the outstanding issues. Failure to do so could lead to multiple problems and cause further deterioration in the asset quality of bank finance, choke off flow of debt as well as equity finance to stressed firms and stall recovery in its tracks. In addition, a significant dose of public investment stimulus could crowd-in private investment, but such a stimulus needs to be financed within the budgetary constraints by downsizing its current spending. Business expectations surveys show little improvement in sentiments VII.8 The current growth slowdown has been amplified by the loss of business confidence. confidence has been dented by macroeconomic deterioration, global macroeconomic and financial uncertainties and the perception of adverse and biased information, driven in part by recent experience during the global financial crisis. In this environment, expectations are being anchored around recent bad news. VII.9 Various surveys on business expectations indicate that business confidence remains subdued despite policy action and reforms during H2 of 2012-13 (Table VII.1).

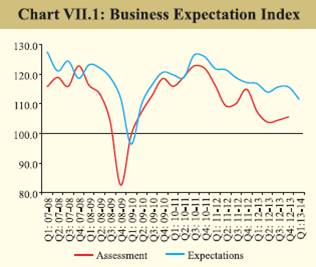

Although the seasonally adjusted HSBC Markit Purchasing Managers’ Indices (PMI) for manufacturing and services (March 2013) Industrial Outlook Survey reflects further weakening of business expectations in Q1 of 2013-14. VII.10 The Reserve Bank’s 61st Round of the Industrial Outlook Survey (/en/web/rbi/-/publications/industrial-outlook-survey-q4-2012-13-round-61-14973) conducted during Q4 of 2012-13 showed that the Business Expectation Index (BEI), a composite indicator based on several business parameters recorded marginal improvement for Q4 of 2012-13. However, index capturing expectations for Q1 of 2013-14 dropped significantly (Chart VII.1). These indices have persisted in the growth terrain (i.e. above 100, which is the threshold that separates contraction from expansion). VII.11 An analysis of the net responses among various components of demand conditions showed improved optimism on order books, capacity utilisation and exports during Q4 of 2012-13. However, their outlook for Q1 of 2013-14 showed significant moderation. The sentiments on the overall financial situation reflected lower optimism (Table VII.2).

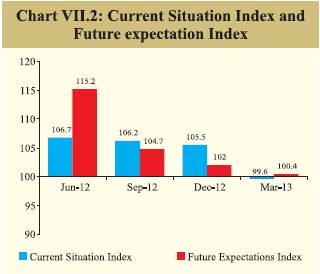

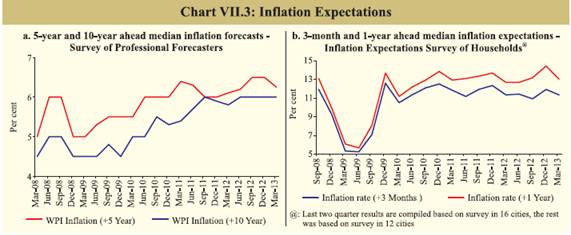

Further fall in consumer confidence VII.12 The Reserve Bank’s 12th Round of the Consumer confidence Survey (/en/web/rbi/-/publications/consumer-confidence-survey-march-2013-round-12-14974), conducted in March 2013 indicates a declining trend in consumer confidence for the past one year (Chart VII.2). External agencies expect revival in the economy VII.13 Forecasts by various external agencies indicate a moderate recovery in the Indian economy during 2013-14. The projections for GDP growth range from 5.8 per cent to 6.7 per cent (Table VII.3). Current projections by these agencies are slightly lower than their earlier projections, indicating that they anticipate a weaker recovery. Survey of Professional Forecasters anticipates modest recovery in growth1 VII.14 The Reserve Bank’s 23rd Round of the Survey of Professional Forecasters outside the Reserve Bank (/en/web/rbi/-/publications/results-of-the-survey-of-professional-forecasters-on-macroeconomic-indicators-23rd-round-q4-2012-13-14971) shows anticipation of modest recovery in 2013-14 to 6.0 per cent from 5.0 per cent in the preceding year. Average WPI inflation is expected to moderate to 6.5 per cent from 7.3 per cent. 5-year ahead inflation expectations moderated slightly (Chart VII.3a) Both these latest growth and inflation projections are half a percentage downward revision from the earlier round. Forecasters expect the CAD to come down to 4.5 per cent of GDP in 2013-14 from a projected 5.1 per cent for 2012-13 (Table VII.4).

Modest decline observed in the households’ inflation expectations VII.15 The latest round of Inflation Expectations Survey of Households (IESH Round 31) (/en/web/rbi/-/publications/inflation-expectations-survey-of-households-march-2013-round-31-14975) indicates that the perception of current inflation as well as the mean and median expectations on future inflation, both at 3-month and 1-year ahead, has decreased in this quarter (i.e., January-March 2013) as compared with the previous quarter (Chart VII.3b). Moreover, the percentage of respondents expecting price rise ‘more than the current rate’ in next quarter as well as next year has decreased as compared with the last round of the survey. Slow-paced recovery likely in 2013-14 but negative output gap may persist VII.16 Given the current state of the economy, the policy action taken so far and the expectations of various economic agents and factoring in a reasonable policy response ahead, the Reserve Bank’s baseline assessment is that a recovery in 2013-14 is likely but would be contingent on further policy action to unwind the bottlenecks to productive activity. The output gap would still remain negative during 2013-14. VII.17 India’s sub-par economic activity over the past two years is not completely surprising given that growth has slowed down in most EMDEs. With the exception of China, India and Indonesia, growth in most EMDEs slipped to below 4 per cent in 2012. Deceleration in world trade played a major role in slowing down the growth of EMDEs. According to the IMF’s WEO, the volume of world trade in goods and services expanded 2.5 per cent in 2012, which is a considerably slower pace than the average annual growth of 6.3 per cent during 1995-2011. If global trade in goods and services picks up on improved external demand, it would have a positive effect on domestic manufacturing activity that has high export intensity. Invisibles earnings could also improve with an acceleration in software exports. This would help in narrowing the CAD and reducing external sector risks to macroeconomic stability. However, the baseline projections in the WEO of April 2013 suggest that the volume of global trade in goods and services is likely expand at a slow pace of 3.6 per cent in 2013. VII.18 Dependence on improved external demand to shape recovery in India could, therefore, be problematic. External uncertainties remain significant from euro area problems in Italy, Cyprus and Slovenia, the sequestration impact in the US and unconventional policies in Japan. How they ultimately shape global capital flows would have an impact on the rupee. VII.19 As such, recovery crucially hinges on domestic action. Interest rates can play only a limited role in revival. Activity in the mining sector has been severely affected by legal enforcements on illegal mining, cancellation of inappropriate coal block auctions and law and order problems. Vexed issues have also cropped up on natural gas pricing and coal supply, which threaten the viability of the new power project investments. The telecom sector, which was a major driver of the investment boom in the past, is facing issues of regulation, besides penetration ratios plateauing out. Execution of road projects slowed down in 2012-13 despite record tendering in 2011-12, mainly on account of failures to meet environmental requirements and land acquisition issues, as also the rising leverage of the project executing firms (see Chapter 2 for more details). While appropriate regulatory and legal frameworks are necessary to ensure sustainable growth, transparency and the speedy redressal of issues would go a long way towards improving the business climate. VII.20 Corporate investment has slowed down due to structural and cyclical factors after a capital expenditure boom during 2003-11, in which planned fixed investments of the corporates in large projects increased over 8.6 times in eight years. However, if structural issues of the kind mentioned above are quickly resolved, a turnaround in investment activity should be possible. VII.21 The forecast by Indian Meteorological Department of a normal monsoon estimated at 98 + 5 per cent of the Long Period Average (LPA) raises hope that consumption may improve. Some further moderation in headline inflation in H1 of 2013-14 from the current levels can also be expected to have a favourable impact on real private consumption. Therefore, the growth recovery process in the economy should kick-in later during 2013-14 but the pace of recovery is likely to remain slow. Inflation likely to stay above comfort levels in 2013-14 and remain range-bound around current levels VII.22 Average headline inflation declined from 9.6 per cent in 2010-11 to 8.9 per cent in 2011-12 and further to 7.3 per cent in 2012-13, with a low of 6.0 per cent in March 2013. As a baseline case, it is expected to see some further moderation in H1 of 2013-14 on the back of subdued pricing power of domestic producers and falling global commodity prices before it increases somewhat in H2 due to base effects and a reduction in the output gap. On the whole, inflation during 2013-14 is likely to remain range-bound around current levels, but stay above the Reserve Bank’s comfort level. significant suppressed inflation lingers in the system, despite the considerable pass-through that occurred during 2012-13. The proposed diesel price pass-through and the likely increase in electricity tariffs and coal prices, would exert some upward pressure on prices. VII.23 An increase in coal prices would be necessitated, factoring in coal imports that would be needed to bridge the demand-supply gap. An increase in power tariffs is expected along the lines envisaged as part of the restructuring package for the distribution companies. Sticking to the envisaged path of diesel price hikes is necessary to create fiscal space for increasing public investments and for lowering the fiscal risks to macro-financial stability. VII.24 As a baseline case, the outlook on global energy prices is benign. Supplies are expected to improve, in part by the exploitation of shale gas reserves in the US. Along with soft metal prices, it could contribute significantly to keeping the imported inflation component low during 2013-14, though its ultimate transmission would depend on the extent of correction in the CAD and the consequent rupee exchange rate movements. Macro-financial risks require cautious monetary policy response ahead VII.25 Even while macro-financial stability risks have started getting addressed, they stay significant at the current juncture. This necessitates careful calibration of monetary policy during 2013-14. While several risk factors impinge upon the likely growth and inflation outcomes for 2013-14, six factors may be highlighted in this context. First, if consumption decelerates markedly from here and impacts staples and not just discretionary items, it could delay the recovery process. However, given that CAD risks are still large, monetary stimulus from a consumption viewpoint needs to be restrained for some time to allow the trade account to adjust. Second, the risk of a sub-normal monsoon to growth and inflation cannot be ignored altogether for 2013-14 despite forecast of a normal monsoon. Third, the biggest risk to recovery comes from failure to effectively complete policy action to remove supply-side constraints that impede investments. This could bring to the fore both the growth and financial stability risks. With rising corporate leverage, especially in the infrastructure space, it is necessary to resolve the vexed structural issues that the sector faces. Fourth, while fiscal risks have been lowered, they have not waned. If growth slows down further it could result in revenue shortfalls that could lead to the resurgence of fiscal risks. Fifth, global risks still remain significant which could have an adverse impact in the form of sudden stop and reversal of capital inflows. Sixth, while global inflation is expected to stay muted in the near term, given the large doses of QE, liquidity could feed into long-term inflation expectations at some stage. VII.26 In view of the above risks and the fact that headline inflation remains above the threshold over which it becomes inimical to growth sustainability, and consumer price inflation remains high, the monetary space for 2013-14 remains very limited. If some of the risks enumerated above come to the fore, policy-recalibration could become necessary in either direction as may be considered appropriate. 1 The forecasts reflect the views of professional forecasters and not of the Reserve Bank. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

صفحے پر آخری اپ ڈیٹ: