IST,

IST,

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

No, the definition of “companies in the group” is only for the purpose of determining the applicability of prudential norms on multiple NBFCs in a group.

Coordinated Portfolio Investment Survey – India

Updated: دسمبر 01, 2023

Special instructions for banks

Ans: No, investments made by branches of your bank located outside India should not be included in CPIS.

Core Investment Companies

D. Miscellaneous:

Ans: The period of 10 years was specified as a prudential measure not necessarily in alignment with a provision of the Companies Act. Moreover, the issue here is not public deposits but Outside Liabilities.

FAQs on Non-Banking Financial Companies

Classification of NBFCs into sub-groups

Retail Direct Scheme

Investment and Account holdings related queries

While the primary auctions are conducted generally on specified days of the week as given in the table below, these days may differ due to holidays or other considerations. Half yearly indicative calendars are published on RBI website for Government of India’s dated securities and Sovereign Gold Bonds whereas quarterly indicative calendars are published for Treasury Bills and State Development loans. For details visit /en/web/rbi

| S. No. | Government security | Primary auction usually held on |

| 1 | Government of India Treasury Bills (T-Bills) | Wednesdays |

| 2 | Government of India dated securities (dated G-Sec) | Fridays |

| 3 | State Development Loans (SDLs) | Tuesdays |

| 4 | Sovereign Gold Bonds (SGB) | Weekly windows announced by RBI in its press release |

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans:

Foreign Subsidiary: An Indian entity is called as a Foreign Subsidiary if a non-resident investor owns more than 50% of the voting power/equity capital OR where a non-resident investor and its subsidiary(s) combined own more than 50% of the voting power/equity capital of an Indian enterprise.

Foreign Associate: An Indian entity is called as Foreign Associate if non-resident investor owns at least 10% and no more than 50% of the voting power/equity capital OR where non-resident investor and its subsidiary(s) combined own at least 10% but no more than 50% of the voting power/equity capital of an Indian enterprise.

Special Purpose Vehicle: A special purpose Vehicle (SPV) is a legal entity (usually a limited company of some type or, sometimes, a limited partnership) created to fulfil narrow, specific or temporary objectives. SPV have little or no employment, or operations, or physical presence in the jurisdiction in which they are created by their parent enterprises, which are typically located in other jurisdictions (economies). They are often used as devices to raise capital or to hold assets and liabilities and usually do not undertake significant production.

Domestic Deposits

III. Advances

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Money Transfer through UPI/ IMPS

Government Securities Market in India – A Primer

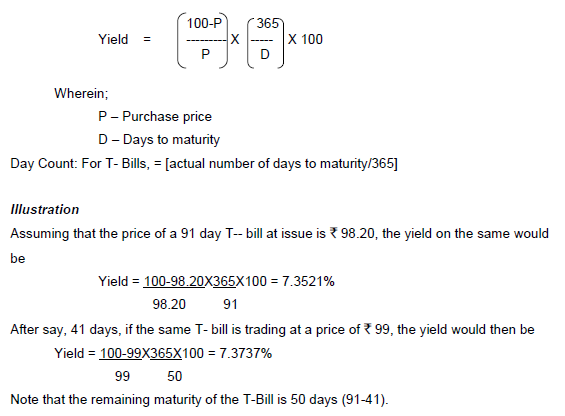

It is calculated as per the following formula

External Commercial Borrowings (ECB) and Trade Credits

G. END-USES

صفحے پر آخری اپ ڈیٹ: