FAQ Page 1 - ربی - Reserve Bank of India

Indian Currency

D) Soiled, Mutilated and Imperfect Banknotes

Reserve Bank of India has been continuously making efforts to make good quality banknotes available to the members of public. To help RBI and the banking system towards this objective, the members of public are requested to ensure the following:

-

Not to staple the banknotes;

-

Not to write/put rubber stamp or any other mark on the banknotes;

-

Not to use banknotes for making garlands/toys, decorating pandals and places of worship or for showering on personalities in social events, etc.

The Reserve Bank of India has issued a press release on March 12, 2008, appealing members of public not to use banknotes for making garlands, decorating pandals and places of worship or for showering on personalities in social events, etc. Press Release issued in this regard is available at the following link:

https://rbi.org.in/web/rbi/-/press-releases/respect-your-banknotes-rbi-appeals-to-public-18026.

FAQs on Non-Banking Financial Companies

Credit Rating

All you wanted to know about NBFCs

C. Residuary Non-Banking Companies (RNBCs)

Retail Direct Scheme

Investment and Account holdings related queries

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: Any domestic liabilities or assets (even if it is in foreign currency) should not be reported in the FLA return.

Domestic Deposits

III. Advances

Government Securities Market in India – A Primer

32.1. RBI financial market watch - /en/web/rbi/financial-markets/other-links/financial-market-watch

This site provides links to information on prices of G-Secs on NDS-OM, money market and other information on G-Secs like outstanding stock etc.

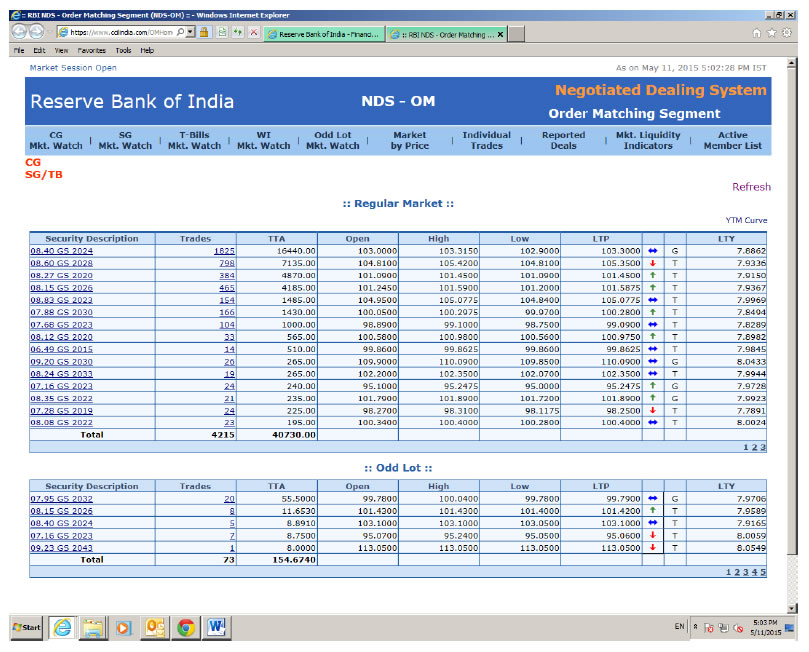

32.2. NDS-OM market watch https://www.ccilindia.com/OMHome.aspx

This site provides real-time information on traded as well as quoted prices of G-Secs, both in Order matching and Reporting segment. In addition, prices of When Issued (WI) (whenever trading takes place) segment are also provided.

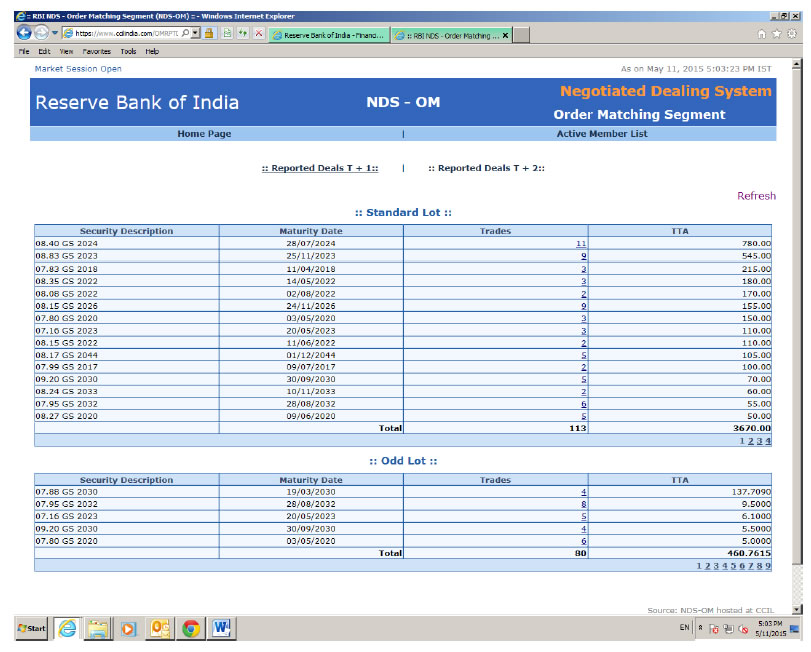

32.3. Reported deals on NDS-OM: https://www.ccilindia.com/OMRPTDeals.aspx

This site provides information on prices of G-Secs in OTC market as reported. One can see chronological traded price levels and quantity in various securities.

32.4 FBIL – www.fbil.org.in

Financial Benchmark India Private Ltd (FBIL) was jointly promoted by Fixed Income Money Market & Derivative Association of India (FIMMDA), Foreign Exchange Dealers’ Association of India (FEDAI) and Indian Banks’ ‘Association (IBA). It was incorporated on 9th December 2014 under the Companies Act 2013. It was recognised by Reserve bank of India as an independent Benchmark administrator on 2nd July 2015.

The company is run by a Board of Directors, assisted by an oversight committee. The main object of the company is to act as the administrators of the Indian interest rate and foreign exchange benchmarks and to introduce and implement policies and procedures to handle the benchmarks. It also will make policies for possible cessation of any benchmark and to follow steps for ensuring orderly transition to the new benchmarks. FBIL will review each benchmark to ensure that the benchmarks accurately represent the economic realities of the interest that it intends to measure. It will take up/consider such other benchmarks as may be required from time to time by periodically assessing the emerging needs of the end -users.

32.5 FIMMDA - http://www.fimmda.org/

This site provides a host of information on market practices for all the fixed income securities including G-Secs. Accessing information from this site requires a valid login and password which are provided by FIMMDA to the eligible entities.