IV. Credit Delivery and Financial Inclusion - RBI - Reserve Bank of India

IV. Credit Delivery and Financial Inclusion

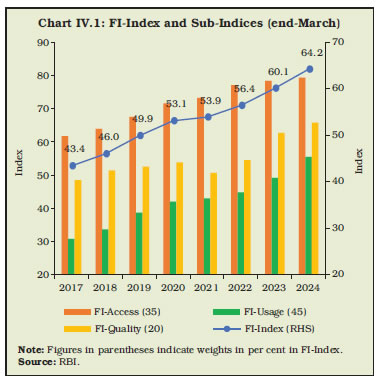

| The Reserve Bank continued with its endeavour to deepen financial inclusion in the country as envisaged under the National Strategy for Financial Inclusion (NSFI). Steps were undertaken for the formulation of the next iteration of the NSFI for the period 2025-30. RBI90Quiz was conducted for enhancing financial literacy among youth. The Centre for Financial Literacy (CFL) project was scaled up in a phased manner to cover the entire country in 2024. IV.1 The Reserve Bank continued with its focus on ensuring availability of banking services to all sections of society across the country, including strengthening the credit delivery system to cater to the needs of productive sectors of the economy, particularly agriculture, and micro and small enterprises (MSEs). During 2024-25, a number of initiatives were taken such as initiation of process for formulation of the next iteration of the NSFI for the period 2025-30, review of priority sector lending (PSL) guidelines, extension of expanding and deepening of digital payments ecosystem (EDDPE) programme in all districts [except two districts of Union Territory (UT) of Andaman and Nicobar Islands and one district of Manipur] and bolstering the credit availability for micro, small and medium enterprises (MSMEs). Moreover, the composite financial inclusion index (FI-Index) registered a year-on-year (y-o-y) growth of 6.8 per cent to 64.2 in March 2024, with expansion across all sub-indices. The CFL project was scaled up to 2,421 CFLs across the country to provide greater stimulus to the financial literacy programme. A nationwide general knowledge-based quiz competition, RBI90Quiz, for undergraduate students across the country was conducted during the year. IV.2 Against this backdrop, the rest of the chapter is structured into three sections. The implementation status of the agenda for 2024-25 along with the performance of credit flow to priority sectors and developments with respect to financial inclusion and financial literacy are presented in section 2. The agenda for 2025-26 is provided in section 3 with concluding observations in section 4. IV.3 The Department had set the following goals for 2024-25:

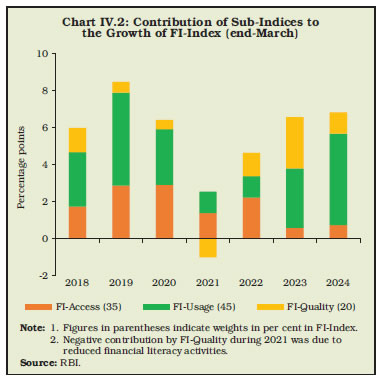

Implementation Status IV.4 The work relating to formulation of the next iteration of NSFI for the period 2025-30 is in progress. IV.5 The PSL guidelines were comprehensively reviewed and revised Master Directions on PSL were issued on March 24, 2025 which became effective from April 1, 2025. The revised directions include, inter alia, enhancement of several loan limits under PSL categories, broadening of the purposes based on which loans may be classified under ‘Renewable Energy’, revision of overall PSL target for urban co-operative banks (UCBs) from 75 per cent to 60 per cent, fixation of target for non-corporate farmers, etc. The enhanced coverage of the revised guidelines is expected to facilitate better targeting of bank credit to the priority sectors of the economy. IV.6 The EDDPE programme was extended to all districts (except two districts of UT of Andaman & Nicobar Islands and one district of Manipur) in August 2023. As on March 31, 2025, 100 per cent coverage has been achieved in more than 60 per cent districts (514 districts) across the country. This includes all districts in 15 states, viz., Kerala, Telangana, Andhra Pradesh, Tripura, Tamil Nadu, Madhya Pradesh, Rajasthan, Bihar, Himachal Pradesh, Karnataka, Jharkhand, Gujarat, Goa, Uttar Pradesh, Odisha and six UTs, viz., Delhi, Chandigarh, Lakshadweep, Dadra and Nagar Haveli and Daman and Diu, Ladakh and Puducherry. IV.7 A comprehensive review of the LBS is underway with a view to enhancing the effectiveness of the scheme in deepening financial inclusion through improved access, usage, and quality of financial services for all sections of the population. IV.8 Access to credit is critical for the growth and sustainability of MSMEs. Some of the common challenges faced by MSMEs in accessing formal credit include information asymmetry, excess documentation and lack of transparency. To address these challenges, the following instructions were issued to banks on June 11, 2024: a) Scheduled commercial banks (SCBs) have been advised to have a uniform turnaround time (TAT) of 14 days for loans up to ₹25 lakh for micro and small enterprises (MSE) borrowers to ensure faster disposal of such loan applications, and clearly display all credit related information under a separate tab on their websites. b) It was reiterated to banks to implement a credit proposal tracking system (CPTS) and inform the MSME borrowers in writing, the main reason/s of rejection of loan applications, furnish them with an indicative checklist of documents required at the time of loan application, and display the pendency position of loan applications on their websites. c) The guidelines on cluster financing were reviewed to provide a clear definition of clusters and address their credit needs. MSE clusters have now been defined as those identified by the Ministry of MSME, Government of India and state governments. Lead banks are required to promote credit linkage in all clusters in their districts directly/with other banks, to create awareness among the MSE units and incorporate the credit needs of clusters in the branch/block level credit plans. Major Developments Credit Delivery Priority Sector IV.9 SCBs’ priority sector lending as on March 31, 2025 stood at 43.1 per cent2 of adjusted net bank credit (ANBC)/credit equivalent of off-balance sheet exposure (CEOBSE), whichever is higher. Each of the bank groups achieved the prescribed 40 per cent overall PSL target during 2024-25 (Table IV.1). Flow of Credit to Agriculture IV.10 The Kisan Credit Card (KCC) is a single window facility for providing working capital as well as investment credit to farmers for cultivation, animal husbandry and fisheries. The number of operative KCCs declined by 2.7 per cent during 2024-25 over the previous year, while the outstanding amount increased by 4.5 per cent (Table IV.2). Enhancement of Collateral-free Agriculture Loan Limit IV.11 Keeping in view the rise in agricultural input costs and overall inflation, the limit for collateral-free agriculture loans was raised from ₹1.6 lakh to ₹2 lakh per borrower in December 2024 to further enhance credit availability for small and marginal farmers. Bank Credit to the MSME Sector IV.12 Increasing the flow of credit to the MSMEs has been a policy priority of the Reserve Bank and the Government of India. SCBs’ outstanding credit to the MSMEs increased by 14.8 per cent (y-o-y) during 2024-25 (Table IV.3). Financial Inclusion Assignment of Lead Bank Responsibility IV.13 The assignment of lead bank responsibility to a designated bank in every district is undertaken by the Reserve Bank. At present, 12 public sector banks and two private sector banks (Jammu & Kashmir Bank and ICICI Bank) have been assigned lead bank responsibility, covering 782 districts across the country. Universal Access to Financial Services in Every Village IV.14 Providing banking access to every village within a 5 km radius/hamlet of 500 households in hilly areas is one of the milestones of the NSFI: 2019-24, which has been fully achieved in 27 states and eight UTs as on March 31, 2025. 99.99 per cent of the identified villages/hamlets across the country have been covered. Efforts are underway to achieve the target for the remaining few villages/hamlets. Financial Inclusion Plan (FIP) IV.15 The progress made by the banks in the financial inclusion sphere as captured through various indicators under the FIP as at end-December 2024 is set out in Table IV.4. The aggregate balance in Basic Savings Bank Deposit Accounts (BSBDA) increased by 11.9 per cent (y-o-y) in December 2024. Financial Inclusion Index (FI-Index) IV.16 The Reserve Bank has constructed a composite FI-Index to measure and evaluate the extent of financial inclusion across the country. It has three sub-indices, viz., FI-access, FI-usage and FI-quality. The index incorporates granular data on banking, investments, insurance, postal as well as the pension sector collated from the government and sectoral regulators. The FI-Index for March 2024 increased to 64.2 from 60.1 in March 2023, with growth witnessed across all sub-indices, mainly contributed by FIusage (Charts IV.1 and IV.2).

National Strategy for Financial Inclusion (NSFI): 2019-24 IV.17 NSFI: 2019-24, released in January 2020, has facilitated the deepening of financial inclusion in the country. The strategy envisaged providing access to formal financial services in an affordable manner, broadening and deepening financial inclusion, promoting financial literacy and consumer protection.

IV.18 Five of the 18 milestones under NSFI were envisaged to be achieved during 2024. These include: (a) leveraging developments in FinTech space for strengthening outreach through virtual modes; (b) moving towards an increasingly digital and consent-based architecture for customer on-boarding; (c) focusing on process literacy along with concept literacy; (d) expanding the reach of CFLs at every block in the country; and (e) articulating the responsibilities of respective stakeholders to ensure convergence of action. These milestones have been achieved in 2024. Financial Literacy Observing Financial Literacy Week 2025 IV.19 The Financial Literacy Week (FLW) is an initiative of the Reserve Bank to spread awareness among the masses/various sections of the population on key topics through a focused campaign every year. FLW 2025 was observed between February 24 – 28, 2025 on the theme of ‘Financial Literacy – Women’s Prosperity’, with a focus on creating financial awareness among women. During the week, the Reserve Bank undertook a centralised mass media campaign to disseminate essential financial awareness messages on the theme among the general public. The financial awareness messages were also made available in Indian Sign Language (ISL). The Regional Offices of the Reserve Bank also carried out localised campaigns. Banks were also advised to disseminate information and create awareness amongst their customers and the general public. Centre for Financial Literacy (CFL) IV.20 The CFL pilot project on financial literacy was initiated by the Reserve Bank in 2017 in nine states across 80 blocks in collaboration with eight sponsor banks and six non-governmental organisations (NGOs) for a three-year period, with funding support from Financial Inclusion Fund (FIF) of the National Bank for Agriculture and Rural Development (NABARD) and the respective sponsor banks. The CFL project was scaled up in a phased manner to cover the entire country by 2024 with each CFL covering about three blocks. As on March 31, 2025, a total of 2,421 CFLs3 have been operationalised across the country. The financial literacy camps conducted by these CFLs aim to achieve certain end-outcomes such as opening/reactivation of bank accounts, pension and insurance linkages, etc. RBI90Quiz IV.21 As part of the series of events to mark the 90th year of the Reserve Bank, a nation-wide general knowledge-based quiz competition, RBI90Quiz, was organised for undergraduate students. The quiz was held in multiple stages starting with online mode and culminating in a national final. The quiz attracted participation of 79,103 teams (1,58,206 students) from 13,961 colleges across the country. Activities Conducted by Financial Literacy Centres (FLCs) IV.22 As on December 31, 2024, there were 1,508 FLCs in the country, which conducted a total of 1,31,220 financial literacy camps during April-December 2024. IV.23 The Department has set the following goals for 2025-26:

IV.24 The Reserve Bank endeavoured to achieve the agenda set for the year by undertaking various measures to improve financial inclusiveness and enhance the flow of credit to priority sectors. The implementation of the strategy adopted under the NSFI:2019-24 document led to significant improvement in financial inclusion. Further, Master Directions on priority sector lending were updated to harmonise the various instructions. Going forward, sustained efforts will continue towards further deepening financial inclusion. 1 Providing every eligible individual in the identified districts at least one mode of digital payment, viz., debit/RuPay cards, net banking, mobile banking, UPI, unstructured supplementary service data (USSD), Aadhaar enabled payment system (AePS), etc. 2 Pertains to public sector banks, private sector banks and foreign banks. 3 https://www.rbi.org.in/FinancialEducation/FLCs_CFLs_Details.aspx |