IST,

IST,

Minutes of the Monetary Policy Committee Meeting August 1-2, 2017

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The sixth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held on August 1 and 2, 2017 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:–

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The Committee reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

Consequently, the reverse repo rate under the LAF stands adjusted to 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.25 per cent. The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 6. Since the June 2017 meeting of the MPC, impulses of growth have spread across the global economy albeit still lacking the strength of a self-sustaining recovery. Among the advanced economies (AEs), the US has expanded at a faster pace in Q2 after a weak Q1, supported by steadily improving labour market conditions, increasing consumer spending, upbeat consumer confidence helped by softer than expected inflation, and improving industrial production. Policy and political risks, however, continue to cloud the outlook. In the Euro area, the recovery has broadened across constituent economies on the back of falling unemployment and a pickup in private consumption; political uncertainty has receded substantially. In Japan, a modest but steady expansion has been taking hold, underpinned by strengthening exports, accelerating industrial production and wage reflation. 7. Among emerging market economies (EMEs), growth has regained some lost ground in China in Q2, with retail sales and industrial production rising at a steady pace. Nonetheless, tightening financial conditions on account of deleveraging financial institutions and slowdown in real estate could weigh negatively. The Russian economy has emerged out of two years of recession, aided by falling unemployment, rising retail sales and strong industrial production. In Brazil, a fragile recovery remains vulnerable to political uncertainty and a still depressed labour market. Economic activity in South Africa continues to be beset by structural and institutional bottlenecks and is in a technical recession. 8. The modest firming up of global demand and stable commodity prices have supported global trade volumes, reflected in rising exports and imports in key economies. In the second half of July, crude prices have risen modestly out of bearish territory on account of inventory drawdown in the US, but the supply overhang persists. Chinese demand has fuelled a recent rally in metal prices, particularly copper. Bullion prices fell to multi-month lows on improved risk appetite but remain vulnerable to shifts in the geopolitical environment. Notwithstanding these developments, inflation is well below target in most AEs and is subdued across most EMEs. 9. International financial markets have been resilient to political uncertainties and volatility has declined, except for sporadic reactions to hints of balance sheet adjustments by systemic central banks. Equity markets in most AEs have registered gains, with indices crossing previous highs in the US, but European markets were weighed down by Brexit talks and the strengthening euro. In EMEs, equities have gained on surging global risk appetite underpinned by improving macroeconomic fundamentals that have been pulling in capital inflows. Bond yields in major AEs have hardened on expectations of monetary policy normalisation, with German bunds reaching an intra-year high. In EMEs, the situation has remained diverse, driven by domestic factors, and fixed-income markets have been generally insulated from the bond sell-off in AEs. In the currency markets, the US dollar weakened further and fell to a multi-month low in July on weak inflation and uncertainty around the policies of the US administration. The euro, which has remained bullish, rallied further on upbeat economic data. The Japanese yen has generally eased, interspersed by bouts of appreciation on safe haven demand. EME currencies largely remained stable and have traded with an appreciating bias. 10. On the domestic front, a normal and well-distributed south-west monsoon for the second consecutive year has brightened the prospects of agricultural and allied activities and rural demand. By August 1, rainfall was 1 per cent above the long period average (LPA) and 84 per cent of the country’s geographical area received excess to normal precipitation. Kharif sowing has progressed at a pace higher than last year’s, with full-season sowing nearly complete for sugarcane, jute and soybean. The initial uncertainty surrounding sowing of pulses barring tur and rice in some regions has also largely dissipated. Sowing of cotton and coarse cereals has exceeded last year’s levels but for oilseeds, it is lagging. Overall, these developments should help achieve the crop production targets for 2017-18 set by the Ministry of Agriculture at a higher level than the peak attained in the previous year. Meanwhile, procurement operations in respect of rice and wheat during the rabi marketing season have been stepped up to record levels – 36.1 million tonnes in April-June 2017 – and stocks have risen to 1.5 times the buffer norm for the quarter ending September. 11. Industrial performance has weakened in April-May 2017. This mainly reflected a broad-based loss of speed in manufacturing. Excess inventories of coal and near stagnant output of crude oil and refinery products combined to slow down mining activity. For electricity generation, deficiency of demand seems to remain a binding constraint. In terms of uses, the output of consumer non-durables accelerated and underlined the resilience of rural demand. It was overwhelmed, however, by contraction in consumer durables – indicative of still sluggish urban demand – and in capital goods, which points to continuing retrenchment of capital formation in the economy. The weakness in the capex cycle was also evident in the number of new investment announcements falling to a 12-year low in Q1, the lack of traction in the implementation of stalled projects, deceleration in the output of infrastructure goods, and the ongoing deleveraging in the corporate sector. The output of core industries was also dragged down by contraction in electricity, coal and fertiliser production in June, owing to excess inventory and tepid demand. On the positive side, natural gas recorded an uptick in production after a prolonged decline and steel output remained strong. The 78th round of the Reserve Bank’s industrial outlook survey (IOS) revealed a waning of optimism in Q2 about demand conditions across parameters, and especially on capacity utilisation, profit margins and employment. The manufacturing purchasing managers’ index (PMI) moderated sequentially to a four-month low in June and the future output index also eased marginally. In July, the PMI declined into the contraction zone with a decrease in new orders and a deterioration in business conditions, reflecting inter alia the roll out of the GST; however, both new export orders and the future output index rose, reflecting optimism in the outlook. 12. In contrast to manufacturing, high frequency real indicators of services sector activity point to a mixed picture in Q1. In the transportation sub-sector, freight carriage by air registered a strong performance sequentially and on an annual basis. Commercial vehicle sales rose after two successive months of contraction in response to the Bharat Standard (BS)-IV emission compliance switchover. Sales of passenger cars and two-wheelers suffered temporary dislocation in June even as motorcycle sales continued to grow for the third consecutive month, reflecting the firmness of rural demand. Activity in the communication sub-sector accelerated in May on strong and sustained growth in the subscriber base of voice and data services. The hospitality sub-sector was supported by vigorous growth of foreign tourist arrivals and air passenger traffic. The acceleration in steel consumption in April-May may be a precursor to a pickup in construction activity in Q1, but cement production remains in contraction mode. The PMI for the services sector continued to remain in expansion mode in May-June on expectations of improvement in market conditions. 13. In June, retail inflation measured by year-on-year changes in the CPI plunged to its lowest reading in the series based to 2011-12. This was mainly the outcome of large favourable base effects which are slated to dissipate and reverse from August. Although month-on-month increases in the price level have been picking up since April, they were weak in relation to the typical food-price driven summer uptick. The delay in indirect tax revisions and anecdotal evidence of clearance sales across commodities could have dampened the momentum. 14. Prices of food and beverages, which went into deflation in May 2017 for the first time in the new CPI series, sank further in June as prices of pulses, vegetables, spices and eggs recorded year-on-year declines and inflation moderated across most other sub-groups. There are now visible signs, however, of the usual seasonal price spikes, even if with a delay and especially in respect of tomatoes, onions and milk. 15. Fuel inflation declined for the second month in succession as international prices of liquefied petroleum gas (LPG) fell and price increases moderated in the case of coke, and firewood and chips. Administered prices of LPG and kerosene are set to rise with the calibrated reduction in subsidy. Households appear to have discounted the recent low inflation prints; their three month ahead and one year ahead inflation expectations polled in the June 2017 round of the Reserve Bank’s survey have somewhat hardened. 16. Excluding food and fuel, CPI inflation moderated for the third month in succession in June, falling to 4 per cent as price momentum moderated inter alia in respect of education due to delay in fee revision cycles, and also in respect of health, clothing and footwear. Inflation in transport and communication services was depressed by the pricing war in the telecommunication space. Input costs relating to both industry and farms remain benign tracking international prices. Pricing power polled in the Reserve Bank’s industrial outlook survey and in manufacturing and services PMIs is still subdued. 17. Surplus liquidity conditions persisted in the system, exacerbated by front-loading of budgetary spending by the Government. There was also some moderation in the pace of increase in currency in circulation (CiC) which is typical at this time of the year – as against the increase of ₹ 1.5 trillion in CiC during the first two months of 2017-18, it was ₹ 436 billion and ₹ 95 billon during June and July, respectively. Normally, currency returns to the banking system in these months and is reflected in a decline in CiC; consequently, the increase in CiC recorded this year reflects the sustained pace of remonetisation and the associated absorption of liquidity from the system. Surplus liquidity of ₹ 1 trillion was absorbed through issuance of treasury bills (TBs) under the market stabilisation scheme (MSS) and ₹ 1.3 trillion through cash management bills (CMBs) on a cumulative basis so far this financial year. Enduring surplus conditions warranted outright open market sales of ₹ 100 billion each on two occasions in June and July. Another auction of an equivalent amount has been announced and will be conducted on August 10, 2017. Apart from these operations, net average absorption of liquidity under the LAF was at ₹ 3.1 trillion in June and ₹ 3.0 trillion in July. Reflecting this active liquidity management, the weighted average call rate (WACR) firmed up and traded about 17 bps below the repo rate on average during June and July – down from 29-32 basis points (bps) in March-April and 21 bps in May – within the LAF corridor. 18. Turning to the external sector, merchandise export growth weakened in May and June from the April peak as the value of shipments across commodity groups either slowed or declined. By contrast, import growth remained in double digits, primarily due to a surge in oil imports and stockpiling of gold imports ahead of the implementation of the GST. Imports of coal, electronic goods, pearls and precious stones, vegetable oils and machinery also accelerated. As import growth continued to outpace export growth, the trade deficit at US$ 40.1 billion in Q1 was more than double its level a year ago. Net foreign direct investment doubled in April-May 2017 over its level a year ago, flowing mainly into manufacturing, retail and wholesale trade and business services. Foreign portfolio investors made net purchases of US$ 15.2 billion in domestic debt and equity markets so far (up to July 31), remaining bullish on the outlook for the Indian economy. The level of foreign exchange reserves was US$ 392.9 billion as on July 28, 2017. Outlook 19. The second bi-monthly statement projected quarterly average headline inflation in the range of 2.0-3.5 per cent in the first half of the year and 3.5-4.5 per cent in the second half. The actual outcome for Q1 has tracked projections. Looking ahead, as base effects fade, the evolving momentum of inflation would be determined by (a) the impact on the CPI of the implementation of house rent allowances (HRA) under the 7th central pay commission (CPC); (b) the impact of the price revisions withheld ahead of the GST; and (c) the disentangling of the structural and transitory factors shaping food inflation. The inflation trajectory has been updated taking into account all these factors and incorporates the first round impact of the implementation of the HRA award by the Centre (Chart 1). 20. There are several factors contributing to uncertainty around this baseline inflation trajectory. Implementation of farm loan waivers by States may result in possible fiscal slippages and undermine the quality of public spending, entailing inflationary spillovers. Moreover, the timing of the States’ implementation of the salary and allowances award is critical – it is not factored into the baseline projection in view of lack of information on their plans. If States choose to implement salary and allowance increases similar to the Centre in the current financial year, headline inflation could rise by an additional estimated 100 basis points above the baseline over 18-24 months. Also, high frequency indicators suggest that price pressures are building up in vegetables and animal proteins in the near months. There are, however, some moderating forces at work. First, the second successive normal monsoon coupled with effective supply management measures may keep food inflation under check. Second, if the general moderation of price increases in CPI excluding food and fuel continues, it will contain upside pressures on headline inflation. Third, the international commodity price outlook is fairly stable at the current juncture. 21. Business sentiment polled in the manufacturing sector reflects expectations of moderation of activity in Q2 of 2017-18 from the preceding quarter. Moreover, high levels of stress in twin balance sheets – banks and corporations – are likely to deter new investment. With the real estate sector coming under the regulatory umbrella, new project launches may involve extended gestations and, along with the anticipated consolidation in the sector, may restrain growth, with spillovers to construction and ancillary activities. Also, given the limits on raising market borrowings and taxes by States, farm loan waivers are likely to compel a cutback on capital expenditure, with adverse implications for the already damped capex cycle. At the same time, upsides to the baseline projections emanate from the rising probability of another good kharif harvest, the boost to rural demand from the higher budgetary allocation to housing in rural areas, the significant step-up in the budgetary allocation for roads and bridges, and the growth-enhancing effects of the GST, viz., the shifting of trade from unorganised to organised segments; the reduction of tax cascades; cost, efficiency and competitiveness gains; and synergies in domestic supply chains. In turn, these virtuous forces may spur investment. External demand conditions are gradually improving and should support the domestic economy, although global political risks remain significant. Keeping in view these factors, the projection of real GVA growth for 2017-18 has been retained at the June 2017 projection of 7.3 per cent, with risks evenly balanced (Chart 2).   22. The MPC observed that while inflation has fallen to a historic low, a conclusive segregation of transitory and structural factors driving the disinflation is still elusive. In respect of inflation-sensitive vegetables, prices are recording spikes. Excess supply conditions continue to push down prices of pulses and keep those of cereals in check. The MPC will continue monitoring movements in inflation to ascertain if recent soft readings are transient or if a more durable disinflation is underway. In its assessment of real activity, the MPC noted that while the outlook for agriculture appears robust, underlying growth impulses in industry and services are weakening, given corporate deleveraging and the retrenchment of investment demand. 23. The MPC noted that some of the upside risks to inflation have either reduced or not materialised - (i) the baseline path of headline inflation excluding the HRA impact has fallen below the projection made in June to a little above 4 per cent by Q4; (ii) inflation excluding food and fuel has fallen significantly over the past three months; and, (iii) the roll-out of the GST has been smooth and the monsoon normal. Consequently, some space has opened up for monetary policy accommodation, given the dynamics of the output gap. Accordingly, the MPC decided to reduce the policy repo rate by 25 basis points. Noting, however, that the trajectory of inflation in the baseline projection is expected to rise from current lows, the MPC decided to keep the policy stance neutral and to watch incoming data. The MPC remains focused on its commitment to keeping headline inflation close to 4 per cent on a durable basis. 24. On the state of the economy, the MPC is of the view that there is an urgent need to reinvigorate private investment, remove infrastructure bottlenecks and provide a major thrust to the Pradhan Mantri Awas Yojana for housing needs of all. This hinges on speedier clearance of projects by the States. On their part, the Government and the Reserve Bank are working in close coordination to resolve large stressed corporate borrowers and recapitalise public sector banks within the fiscal deficit target. These efforts should help restart credit flows to the productive sectors as demand revives. 25. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Viral V. Acharya and Dr. Urjit R. Patel were in favour of the monetary policy decision, while Dr. Ravindra H. Dholakia voted for a policy rate reduction of 50 basis points and Dr. Michael Debabrata Patra voted for status quo. The minutes of the MPC’s meeting will be published by August 16, 2017. 26. The next meeting of the MPC is scheduled on October 3 and 4, 2017. Voting on the Resolution to reduce the policy repo rate by 25 basis points to 6.0 per cent

Statement by Dr. Chetan Ghate 27. While a significant decline in both headline inflation and inflation excluding food and fuel provides reason for cautious optimism, it remains unclear at this juncture whether these outcomes will sustain durably in the future. In fact, it is highly likely that inflation excluding food and fuel bottomed out in June. Momentum in June headline index has also picked up (because of the seasonal rebounds of some vegetables) with a reversal in the headline inflation trajectory expected from July. However, what is encouraging is that both the 3-month and 1-year median inflation expectations are stable, despite marginal upticks. The survey of professional forecasters (SPF) also conveys optimism on prices. The government’s push through on key structural reforms, i.e., the GST, will be akin to a positive supply shock in the long run, and will assist in the disinflationary process. 28. New data and information also provide more clarity on the magnitude of upside risks to headline inflation highlighted in my comments in the June review. First, there is more evidence that the current monsoon will be normal. Second, the rise in the housing price index because of HRA is likely to be more gradual than earlier envisaged. While upside risks in the form of second round effects will kick in as private rentals try to “keep up with the Jones’s”, these effects are likely to be muted because of depressed demand conditions in the real estate sector. Having said this, both farm loan waivers and proximity to the 2019 election year suggest that fiscal impulses could contribute to inflationary pressures. These need to be carefully watched. Given the above, at this juncture, I expect headline inflation to evolve in line with the medium-term inflation target of 4 per cent within a band of +/- 2 per cent. 29. A lexicographic flexible inflation-targeting mandate requires monetary policy to now accommodate the objective of growth. While re-monetisation, front loaded government expenditures and a good monsoon will sustain a positive momentum on growth, my biggest concern at the moment is the slowing rate of capital accumulation. Indebted manufacturing companies continue to de-leverage, and envisaged capex continues to decline. A prolonged period of weak investment growth will impact potential growth. Weak investment growth is also associated with slower growth in total factor productivity (TFP) in the long run which is the key driver of long-term real wage growth (after inflation). Both the industrial outlook survey and the consumer confidence survey conducted by the RBI suggest that negative output gaps will remain in Q2 also. 30. With the US Fed announcing a somewhat gradual tapering of its balance sheet to begin in the near term, some volatility from this “quantitative tightening” is likely to be imparted on EME exchange rates and financial markets, and needs to be carefully watched. 31. Taking into account these considerations, I vote for a 25 basis points (bps) cut in the policy repo rate from 6.25 per cent to 6.0 per cent at today’s meeting of the Monetary Policy Committee. Statement by Dr. Pami Dua 32. Retail inflation has softened, touching a new low of 1.5 per cent in June 2017, slowing mainly due to a favourable base effect, falling food prices, and decline in international prices of fuel, as well as contraction in inflation excluding food and fuel. Going forward, as base effects fade, some upside risks to inflation remain, including rising pressures on the price of food (especially vegetables and animal proteins), inflationary effects from implementation of farm loan waivers, and the possible rise in inflation due to implementation of house rent allowances under the 7th Central Pay Commission. At the same time, some upside risks to inflation have either decreased or not materialised, counterbalancing the inflationary pressures. These include a normal monsoon, along with effective supply management, smooth roll-out of the GST, continuation of moderation in inflation excluding food and fuel, and expectation of stable international commodity prices. However, continuous monitoring of incoming data is required to ascertain the extent to which the recent softening is durable. 33. On the growth front, the agricultural sector is expected to perform strongly on account of a normal monsoon for the second successive year and well-timed sowing for the kharif season. This is expected to further boost rural consumption, as evidenced by the growth in consumer non-durables. At the same time, industrial growth remains subdued on the back of sluggish demand and a consequent build-up of inventories reflected in contraction in consumer durables and capital goods. The twin problems of weak capex cycle and debt overhang have constrained the private sector from undertaking new investment. Infrastructure bottlenecks are also a major constraint, while the government’s plan for housing to all may provide an impetus to growth. 34. Moving on to forward looking indices that predict future economic activity, growth in the Indian Leading Index (constructed by the Economic Cycle Research Institute (ECRI), New York, with which the author is affiliated) is falling, as is Indian Leading Exports Index growth. These are indicative of a fading economic growth outlook, as well as a pessimistic outlook with respect to exports growth. The latter is reinforced by movements in ECRI’s leading indices for the global economy that suggest that international economic growth is about as good as it gets, and could start easing in the months ahead. Furthermore, consistent with the cyclical downturns in ECRI’s international future inflation gauges (predictors of inflation), there are already concerted inflation cycle downturns starting in most major economies. 35. There is thus room for a policy repo rate cut by 25 basis points. Statement by Dr. Ravindra H. Dholakia 36. In the MPC meeting of 7th June 2017, I pleaded for a rate cut of 50 basis points from 6.25 per cent to 5.75 per cent providing several reasons to do so. Most of the developments and additional data points since then have only vindicated my stand and forecasts. In my opinion, MPC should effect a major cut of 50 basis points in the policy rate without losing any more time. My reasons for this recommendation in addition to the ones I mentioned in my statement in the Minutes of the June 7, 2017 meeting of MPC are the following: 37. Subsequent to the meeting of 7th June 2017, the two readings of inflation for the months of May and June 2017 that came in were closer to my forecast than the RBI’s. The RBI has also further revised its base forecast of inflation downward. It now expects the base inflation to be a little above 4 per cent by March 2018 without the statistical impact of the revision of HRA from the 7th Pay Commission. My estimates based on our independent exercise suggest that the base CPI inflation is likely to be about 50 basis points lower than the RBI forecast. 38. Our research now provides an empirical support from the data over the last five years to the hypothesis that the headline CPI inflation in India shows a tendency to drift towards the core inflation (excluding food and fuel) in the long run and not vice versa. I had indicated a possibility of such a result in my statement in the Minutes of the April 6, 2017 meeting of MPC, where I had also clearly stated that the core inflation according to our calculations is likely to show a declining trend over the coming year. The RBI has also acknowledged that the core inflation has shown a declining trend for the last three months (April, May and June). Our exercise suggests that the core inflation is on a declining path with minor spikes ultimately reaching around 3.1-3.5 per cent by March-April 2018. I expect the headline inflation also to show a converging trend over long term. 39. The Indian Institute of Management Ahmedabad (IIMA) monthly Business Inflation Expectations Survey (BIES) started in May 2017 has provided two monthly readings by now – May and June 2017. Both these readings show that businesses in India expect their cost inflation a year ahead to be around 3 per cent. This measure of inflation closely traces the CPI core inflation. It provides further support to our empirical exercise and estimates derived independently. As it is very well recognised, the fears of upside risks to inflation considered so far either have not materialised or are considerably subdued except the statistical impact of the implementation of revised HRA for the government employees. The HRA impact in any case is a transient influence and not a permanent factor for inflation. However, this influence is likely to persist for 18-24 months because of sequential implementation of the HRA hikes by different states. 40. Monsoon for the second consecutive year is likely to be normal and progressing well. Procurement during the last year, some reforms in the agricultural sector and improvements in the logistics enabled by the introduction of GST may help keep the food inflation under control. 41. As I had argued in the June 7, 2017 meeting of MPC, the farm loan waiver by some states has not resulted in the “expected” fiscal slippage so far. In fact, the budget announced subsequently by the UP state government has absorbed the expenditure to manage the fiscal deficit at 2.97 per cent of the state income – just below the fiscal responsibility legislation (FRL) target of 3 per cent. Some of the states have staggered the implementation and others are yet to work out implementation details. The argument that state fiscal deficits are usually understated by unrealistic assumptions on their revenues may not apply when we have evidence to expect high revenue buoyancy for both the direct and indirect taxes in the country. Thus, the developments on this front so far do not suggest a serious threat to inflation on account of fiscal slippage. 42. On the other hand, capacity utilisation has been consistently below 75 per cent now for a long time. The industrial outlook survey and household expectations survey by the RBI do not paint a rosy picture of the economy. The manufacturing purchasing managers’ index (PMI) has declined to a contraction zone in July 2017. Rupee has continually appreciated and exports are not doing well. Investment demand is not picking up. Simultaneously, several major reforms including GST have started enhancing the efficiency of the system and raising revenue buoyancy enabling the governments to spend more on capacity creating projects and schemes. This is likely to result in raising potential output and its growth. All these observations point not only to the existence but expansion of negative output gap in the economy. It is important to note that output gap in this context is the difference between the level of realised output and the level of potential output, which would have a direct bearing on the inflation rate. Difference between actual growth and potential growth rates to measure the output gap in this context is a misconception and can be misleading for the policy purposes because higher actual growth than the potential growth need not necessarily result in a positive output gap or even in narrowing the negative output gap. With this clarity and all above observations on the output front, expanding negative output gap in India cannot be wished away, but needs immediate aggressive policy action to correct it. Persistence of negative output gap imposes severe social costs on the economy that is largely borne by the poor and the unemployed. 43. The basic purpose of Flexible Inflation Targeting framework according to me is to move away consciously from the Activist Discretion-based policy to Rule-based policy. As I had argued in the June 7, 2017 meeting of MPC, with a year ahead inflation forecast now brought down to 4 per cent by the RBI and existence of expanding negative output gap, any rule-based policy would suggest a cut in the policy rate by at least 50 basis points. My forecasts and arguments above suggest space for even higher cut. However, exercising caution and waiting for further vindication of my stand and forecasts by data and facts, I vote for a cut of 50 basis points in the policy rate at this stage. In my opinion, the neutral policy stance needs to be seriously reconsidered in favour of the accommodative stance given the above arguments. Statement by Dr. Michael Debabrata Patra 44. I have consistently maintained that an inflation targeting framework has to be forward-looking. Setting monetary policy by looking over the shoulder at inflation prints of the recent past runs the risk of time inconsistency with respect to the target. A good example of forward-looking time-consistent monetary policy is the monetary policy committee’s (MPC) first decision in October 2016. In its resolution, the MPC presciently gave forward guidance: “It (the MPC) notes that the sharp drop in inflation reflects a downward shift in the momentum of food inflation – which holds the key to future inflation outcomes…”. Correctly anticipating recent inflation developments back in October 2016, the MPC took monetary policy action that was consistent. To reduce the policy rate now – when inflation is set to rise in a couple of months – will be inconsistent and will undermine credibility. 45. Households’ inflation expectations three months ahead and a year ahead have gone up! More than 70 percent of respondents expect prices to increase, with the sharpest rise expected in prices of household durable goods, followed by prices of services. It seems to me that households have completely discounted CPI inflation’s historic low. Professional forecasters, who are regarded as forward-looking, also see inflation rising over the rest of the year. In this context, I have also consistently held that in reading forecasts, it is the direction rather than the level that matters. 46. There are many moving parts in inflation’s near term path that need to settle. First, the increase of 106 per cent in house rent allowance for central government employees will feed into the CPI cumulatively – starting from July, it will likely reach its maximum effect in December. Given this incremental pattern of build-up, it could potentially stir up second order effects even as the first order impact is getting complete. Second, there is uncertainty around the inflationary impact of the roll-out of the GST – the release of pending price revisions; restocking after clearance sales; unwinding of arrangements that were made to prepare for initial difficulties in pass through of tax credits. My sense is that one-off inflation effects could emerge in the near months. Third, base effects will reverse and turn unfavourable from August – this should go to the top of the hierarchy of moving parts. Fourth, seasonal spikes in inflation-sensitive food prices are already in evidence. The question is: will there be spillovers that induce generalisation of the inflation momentum? 47. All these factors could come together in CPI readings from August. If that turns out to be the case, why not stay on hold now, watch the shape and slope of the upturn and if it is benign, deliver credible monetary policy that supports the economy? In the context of the latter, it is paradoxical that weak aspects of economic activity are widely cited, but every projection of growth – official; multilateral; independent – shows that it is expected to accelerate in 2017-18! 48. The financial environment is bubbly and frothy. The combination of high valuations in equity and fixed income markets, an appreciating currency and the persistence of a liquidity overhang in the money market is a perfect recipe for a financial imbalance. A rate cut can amplify it if the central bank is seen as encouraging risk-taking. 49. In the run-up to the formal institution of the new monetary policy framework, inflation targets adopted by the RBI – 8 per cent; 6 per cent; 5 per cent – were achieved with a considerable amount of good luck (collapse of international crude prices; new CPI index; demonetisation; favourable supply shocks). Now that we are in a formal inflation targeting framework, why not strive to achieve the mandated target with good policy? 50. I vote for status quo. Statement by Dr. Viral V. Acharya 51. Inflation prints since the last policy have turned out even lower, though there are emerging signs that certain deflating food items are on a price rebound. Excluding the HRA impact, headline inflation is now projected to be lower in Q4 of 2017-18 as compared with the projection made in the last policy statement. More significantly, inflation excluding food and fuel has eased markedly, falling to around 4 per cent and suggesting a broad-based weakening of underlying demand. Our 12-month ahead headline inflation projection, without the statistical HRA effects, is now just above 4 per cent, even as the inflation path is projected to be on an upward trajectory. Households’ inflation expectations have, however, slightly moved up even in the face of recent low inflation prints. 52. Our output gap estimates turned somewhat negative after the last quarter's growth numbers and associated revisions. Together with easing of underlying inflation and given that our 12-month ahead inflation forecast (excluding the HRA impact) is in line with the mandated target, there seems some room for monetary policy accommodation. Hence, I vote for a policy repo rate cut by 25 basis points while retaining the neutral stance. 53. Why the neutral stance? I wish to reiterate that growth slowdown since Q1 2016-17 is rooted in the stressed balance-sheets of our banks and corporates in several sectors. Our output gap estimates that account for financing conditions using recent modelling advances do pick up this protracted slowdown. To address this, our efforts on stressed asset resolution are firmly underway. This very stress has also resulted in poor transmission of monetary policy (except after demonetisation, and only for fresh rupee loans, as bank deposits surged). 54. In my assessment, therefore, our focus at the present juncture should be on improving the conditions for sound transmission such as healthy bank and corporate balance sheets, market-based benchmarking of bank lending rates and a thriving corporate bond market. Higher real rates are justified in the meantime as absent efficient transmission, attempts to address symptoms of balance-sheet problems with aggressive monetary easing get wasted and can even backfire by misallocating investments, fuelling asset price inflation, creating false hopes of a growth boost, and relaxing the pedal on deeper structural reforms. 55. I remain concerned about the impact of farm loan waivers on inflation and growth, due to induced departure from fiscal discipline, shift in the nature of state spending and the crowding out of private credit by further state borrowings from the market. Given the additional uncertainty around how much of the real-time economic indicator surprises are due to the likely temporary impact of the GST rollout on business activity, careful scrutiny of upcoming data seems necessary. Hence, I prefer to keep the monetary stance neutral. Statement by Dr. Urjit R. Patel 56. Excluding the house rent allowance (HRA) impact under the 7th central pay commission (CPC), the current assessment is that inflation during Q4 of 2017-18 would be lower than what it was projected in the last monetary policy review. CPI inflation excluding food and fuel has also softened over the last three months. Seasonally adjusted momentum moderated during this period. Available forward looking information on demand conditions for Q2 of 2017-18, particularly the RBI’s industrial outlook survey and the consumer confidence survey do not suggest much risk of immediate demand pressures. While the growth outlook in terms of projected GVA growth for 2017-18 is retained unchanged at 7.3 per cent, there are some signs of downside risks on the underlying growth momentum in industry and services. A normal monsoon for the second year in succession should help sustain some of the disinflationary impulses in food items that generally accompany improved supply conditions. The moderation in pulses prices is likely to continue in the medium-term on account of favourable supply conditions. I vote in favour of a cut in the policy repo rate by 25 basis points. 57. While using the space available for monetary accommodation to support growth, we retain the monetary policy stance as neutral for the following reasons. First, disentangling recent disinflation in terms of relative roles of structural and transitory drivers remains a challenge. Second, HRA will push up the inflation trajectory. Even if one excludes the direct HRA impact, one has to be vigilant about the second order effects, especially on inflation expectations as States would also start implementing revision in salary and allowances. Third, inflation expectations of households edged up even in an atmosphere of significant disinflation. Fourth, specific food items such as tomato exhibited sharp price pressures in recent weeks, which were not reflected in the low June 2017 inflation print. The present low level of food prices is unusual and is vulnerable to upward pressures. An assessment of whether the recent deflation in food items is sustainable, despite a normal monsoon, would require more hard data going forward. Fifth, while the frontloaded expenditure by the Central Government so far during the year has provided a boost to the economy, the implementation of farm debt waivers by the State Governments has significantly increased the fiscal risks and poses an upside risk to the inflation outlook. 58. Effective transmission of a policy rate cut is the key to achieving the goal of supporting the non-inflationary growth. By the Central Government’s own formula effective April 1, 2016, there is scope for administered interest rates to be reduced. While the transmission has improved, there is still some space for banks to cut their lending rates, especially on the existing loan portfolios. Credit growth has also been low partly because of risk aversion among banks on account of their stressed assets position. Resolution of stressed balance sheets of banks, therefore, will remain important for reviving credit demand and the investment cycle. Jose J. Kattoor Press Release : 2017-2018/460 |

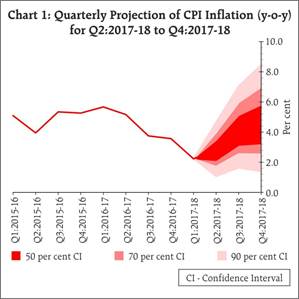

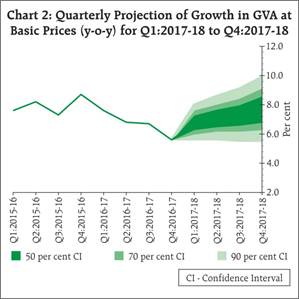

Page Last Updated on: