IST,

IST,

Minutes of the Monetary Policy Committee Meeting, June 6 to 8, 2023

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The forty third meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during June 6 to 8, 2023. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (June 8, 2023) decided to:

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

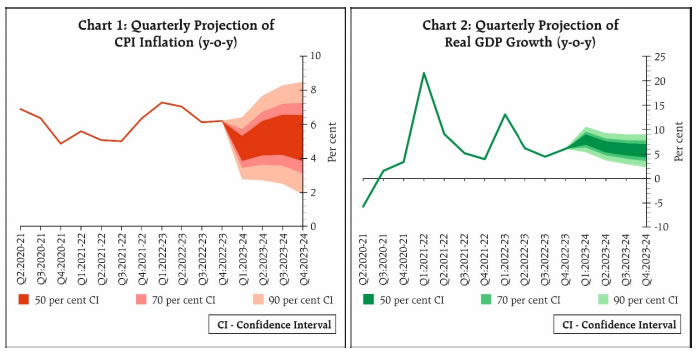

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. In the second quarter of 2023, the global economy is sustaining the momentum gained in the preceding quarter in spite of still elevated though moderating inflation, tighter financial conditions, banking sector stress, and lingering geopolitical conflicts. Sovereign bond yields are trading sideways on expectations of the imminent peaking of the tightening cycle of monetary policy while the US dollar has appreciated. Equity markets have remained range bound since the last MPC meeting. For several emerging market economies (EMEs), weak external demand, elevated debt levels and geoeconomic disintegration amidst tighter external financial conditions pose risks to growth prospects, although capital flows are cautiously returning to them on renewed risk appetite. Domestic Economy 7. According to the provisional estimates released by the National Statistical Office (NSO) on May 31, 2023, India’s real gross domestic product (GDP) growth accelerated from 4.5 per cent (year-on-year, y-o-y) in Q3:2022-23 to 6.1 per cent in Q4, supported by fixed investment and higher net exports. Real GDP growth for 2022-23 was placed at 7.2 per cent, higher than the second advance estimate of 7.0 per cent. 8. Domestic economic activity remains resilient in Q1:2023-24 as reflected in high frequency indicators. Purchasing managers’ indices (PMI) for manufacturing and services indicated sustained expansion, with the manufacturing PMI at a 31-month high in May and services PMI at a 13-year high in April-May. In the services sector, domestic air passenger traffic, e-way bills, toll collections and diesel consumption exhibited buoyancy in April-May, while railway freight and port traffic registered modest growth. 9. On the demand side, urban spending remains robust as reflected in indicators such as passenger vehicle sales and domestic air passenger traffic which recorded double digit growth in April. Rural demand is gradually improving though unevenly – motorcycle sales expanded in April, while tractor sales contracted partly owing to unseasonal rains. Investment activity is picking up as reflected in the healthy expansion in steel consumption and cement output in April. Merchandise exports and non-oil non-gold imports remained in contraction mode in April while services exports sustained a robust expansion. 10. CPI inflation fell sharply to 4.7 per cent in April 2023 from 6.4 per cent in February on the back of large favourable base effects, with softening observed across all the three major groups. Food group inflation eased, with moderation in cereals, eggs, milk, fruits, meat and fish, spices and prepared meals inflation and deepening of deflation in edible oils. In the fuel group, inflation in LPG and firewood and chips prices fell and kerosene prices slipped into deflation. Core inflation (i.e., CPI inflation excluding food and fuel) dipped, driven down by clothing and footwear, household goods and services, health, transport and communication, personal care and effects and recreation and amusement sub-groups. 11. The average daily absorption under the LAF increased to ₹1.7 lakh crore during April-May from ₹1.4 lakh crore in February-March. Money supply (M3) expanded by 10.1 per cent y-o-y and non-food bank credit by 15.6 per cent as on May 19, 2023. India’s foreign exchange reserves were placed at US$ 595.1 billion as on June 2, 2023. Outlook 12. Going forward, the headline inflation trajectory is likely to be shaped by food price dynamics. Wheat prices could see some correction on robust mandi arrivals and procurement. Milk prices, on the other hand, are likely to remain under pressure due to supply shortfalls and high fodder costs. The forecast of a normal south-west monsoon by the India Meteorological Department (IMD) augurs well for kharif crops; however, the spatial and temporal distribution of the monsoon would need to be closely monitored to assess the prospects for agricultural production. Crude oil prices have eased but the outlook remains uncertain. According to the early results from the Reserve Bank’s surveys, manufacturing, services and infrastructure firms polled expect input costs and output prices to harden. A clearer picture will emerge when the final survey results are available. Taking into account these factors and assuming a normal monsoon, CPI inflation is projected at 5.1 per cent for 2023-24, with Q1 at 4.6 per cent, Q2 at 5.2 per cent, Q3 at 5.4 per cent and Q4 at 5.2 per cent. The risks are evenly balanced (Chart 1). 13. The higher rabi crop production in 2022-23, the expected normal monsoon, and the sustained buoyancy in services should support private consumption and overall economic activity in the current year. The government’s thrust on capital expenditure, moderation in commodity prices and robust credit growth are expected to nurture investment activity. Weak external demand, geoeconomic fragmentation, and protracted geopolitical tensions, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent with Q1 at 8.0 per cent, Q2 at 6.5 per cent, Q3 at 6.0 per cent, and Q4 at 5.7 per cent, with risks evenly balanced (Chart 2).  14. The MPC took note of the moderation in CPI headline inflation in March-April into the tolerance band, in line with projections, reflecting the combined impact of monetary tightening and supply augmenting measures. Headline inflation is projected to decline in 2023-24 from its level in 2022-23 but would still be above the target, warranting continuous vigil. The progress of the south west monsoon is critical in this regard. Domestic economic activity is holding up well. Consumer confidence is improving and businesses remain optimistic about the future. The cumulative rate hike of 250 basis points undertaken by the MPC is transmitting through the economy and its fuller impact should keep inflationary pressures contained in the coming months. Monetary policy would need to be carefully calibrated for alignment of inflation with the target. Against this backdrop, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent. The MPC resolved to continue keeping a close vigil on the evolving inflation and growth outlook. It will take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and to bring down inflation to the target. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. 15. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent. 16. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 17. The minutes of the MPC’s meeting will be published on June 22, 2023. 18. The next meeting of the MPC is scheduled during August 8-10, 2023. Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent

Statement by Dr. Shashanka Bhide 19. Since the April meeting of the MPC, the GDP growth numbers for FY 2022-23 have been updated and we also have the headline inflation numbers for April 2023. The official provisional estimates (PE) for GDP at constant prices place the GDP growth higher at 7.2 per cent for FY 2022-23 from 7 per cent in the Second Advance Estimates. The headline YOY inflation rate in April dropped to 4.7 per cent, well below the rate in March, 5.7 per cent. A significant part of the improvement in GDP in FY 2022-23 was due to the growth in Q4 FY 2022-23 at 6.1 per cent in comparison to the expectations of growth of 5.1 per cent implied by the overall growth rate of 7 per cent in SAE. The better than anticipated growth in Q4 combined with the lower inflation reading for March-April reflect different sets of factors influencing growth and inflation. 20. The global macroeconomic conditions have continued to be adverse, reflecting slow growth momentum and moderating but elevated inflation pressures across economies. In addition, global trading opportunities have been limited by policies restricting supply chains. The recent events have also pointed to the vulnerability of the banking and financial sectors to monetary and fiscal policy stances. The energy markets experienced uncertainty in the face of global economic slowdown and the protracted Ukraine war. The monetary policy measures aimed at curbing inflationary pressures in the major advanced and emerging market economies appear to be successful in moderating inflation rate, although the rates remain well above the policy targets. 21. This provides an overall context for an assessment of the likely course of growth and inflation in the short to medium term. One important feature of GDP growth in 2022-23 and also 2021-22 was the dominance of Q1 compared to the other quarters. As the pandemic induced sharp decline in GDP in Q1 of 2020-21 is offset by the subsequent growth, growth in Q1:2023-24 is likely to be closer to the growth across quarters. A second feature of growth performance in 2022-23 is the uneven performance across sectors. Manufacturing growth reflected in the growth of Gross Value Added (GVA) is placed at 1.3 per cent compared to the growth in construction (10.0 per cent) or the services sector (9.5 per cent). While the input cost pressures in 2022-23 appear to have had greater impact in the case of manufacturing than in the other sectors, slower growth of consumption spending and investment would also have affected demand for manufacturing more than the others. Finally, the deceleration in export demand would affect manufacturing output. Going forward, reduction in cost pressures and overall inflation, and revival of exports would be important in accelerating manufacturing growth. The indicators compiled by RBI for listed manufacturing companies in Q4: 2022-23 indicate significant improvement in profit margins with increased GVA growth and sustained improvement in capacity utilisation during the year are positive for the revival of manufacturing growth in 2023-24. However, there are segments within manufacturing sector where weak export environment would be a concern. 22. The services sector was the growth driver for the economy in 2022-23. Revival of demand in the service sectors badly hit during the pandemic has sustained the growth of the overall sector. GVA growth in the sub-sector Trade, Hotels, Transportation and Broadcasting in 2022-23 is still only 4.1 per cent over its pre-pandemic level in 2019-20 with considerable upside potential of the sub-sector for growth. The export of services is expected to be adversely affected by the global economic slowdown in 2023-24. 23. In the case of agriculture and allied sectors, GVA growth in 2022-23 turned out to be higher than 2021-22 although there were adverse weather effects during the year. The normal monsoon forecast by the Indian Meteorological Department, despite the emergence of the El Nino phenomenon, would be supportive of agricultural growth. 24. On the demand side of the economy, RBI’s recent sample surveys of households and enterprises indicate improving consumer sentiments and business outlook for 2023-24. The improvement is, however, in comparison to a period of weak sentiments through 2022-23. Early results of the enterprise surveys indicate greater optimism on the part of services and infrastructure firms on demand conditions than in the case of manufacturing. The Consumer Confidence Survey of urban households conducted in May reflects steady improvement in confidence for the current period and strengthening optimism on ‘one-year ahead’ situation. Expenditure expectations remain broadly stable with indications of increasing non-essential expenditure by the households. While cost pressures are expected to moderate in Q1, the expectation of rising costs – inputs, financing and staff – is still widely shared especially in Q2. Higher selling prices are seen to improve profit margin. In the sectors where demand is buoyant, transmission of higher costs to selling prices would be greater. Overall, perceptions on cost pressures and selling prices vary across sectors. 25. The high frequency indicators for the recent period of April-May provide a mixed picture. The urban and demand conditions show improvement, PMIs for manufacturing and services reflect rising output. However, there are also mixed signs of transport activity. Railway freight and port traffic, and motor spirit sale show YOY growth rates of less than five per cent but E-way bills and toll collections continue to register double digit growth. External trade has weakened in April. Non-food credit, a broader measure of economic activity, has increased by about 16 per cent during April-May 2023. 26. The overall growth momentum for 2023-24 is expected to be more moderate than in 2022-23. The projections provided in the April meeting of the MPC hold over the improved official estimates for 2022-23. The GDP growth for 2023-24 is retained at 6.5 per cent YOY basis. The quarterly YOY growth projections are Q1: 8.0 per cent, Q2: 6.5 per cent, Q3: 6.0 per cent and Q4: 5.7 per cent, respectively. The significant downside risks to growth are the unfavourable rainfall conditions during the monsoon season, steeper than expected decline in global demand conditions and supply chain disruptions due to spillovers from the geo-political conflicts. As compared to the April forecast, the quarterly growth rates in Q1 and Q2 are revised upward and Q3 and Q4 downward in the present set of projections. RBI’s Survey of Professional Forecasters provides a median forecast of 6.0 per cent for 2023-24, the same as in the previous round. 27. The headline inflation rate, YOY, dropped further to below 5 per cent mark in April, following the decline to below 6 per cent in March. The rate of price rise fell in all three main categories of consumption basket: food, fuel and the ‘core’. The decline was steeper in fuel and food than the ‘core’. This broad-based decline in the inflation rate was also seen in March. A number of factors have contributed to the significant decline in inflation rate in March and April: deceleration in the commodity prices in the international markets; decline in the inflation rates in the major economies, although they remain well above the targets; favourable base effects; and the impact of monetary and policy measures on inflation directly and through their impact on inflation expectations. RBI’s recent Inflation Expectations Survey of Urban Households finds that along with the perceived current inflation rates, the median expected inflation rate on a 3-months ahead and one-year ahead horizons is declining as compared to their levels in the previous round. 28. Taking into account the current trends and assessment of factors influencing price trends, RBI’s projected average headline inflation rate for FY 2023-24 is 5.1 per cent, with quarterly projections of 4.6 per cent in Q1, 5.2 per cent in Q2, 5.4 per cent in Q3 and 5.2 per cent in Q4. The projected inflation rate for FY 2023-24 is well below the rate of 6.7 per cent experienced in the previous year and close to the median forecast of 5.0 per cent for FY 2023-24 in the RBI’s Survey of Professional Forecasters. 29. However, a few concerns remain on the question of sustainability of the trends seen in March and April headline inflation rate. Several sub-categories of consumption basket still register price rise of well-above 6 per cent. Price rise, YOY basis, in the case of cereals and products is in double digits, and in milk and products above 8 per cent in March and April. Clothing and footwear and Household goods and services also are at or above 6 per cent rate of price rise in March and April. Among the broad groupings of items in the consumption basket excluding (1) Food and beverages, (2) Pan, tobacco and intoxicants and (3) Fuel and light, items with YOY price rise of 6 per cent or more account for 45 per cent of the weight of this broad group. The month over month change is higher in April as compared to March for several commodity groups although significant ‘base effects’ have lowered the YOY headline inflation rate. These issues require consideration in assessing the sustainability of moderating trend in headline inflation rate to the target of 4 per cent. 30. The decline in the overall headline inflation in the recent two months combined with the strong growth performance in Q4: FY 2022-23 suggest a trajectory of lower YOY inflation of 5 per cent and GDP growth of above 6 per cent in FY 2023-24. The projected inflation rate is below the upper tolerance limit of 6 per cent but well above the target of 4 per cent. There are also upside risks to inflation both on account of the evolution of sectoral price trends and developments at the global level. The impact of increase in policy rate between May 2022 and April 2023 by 250 basis points and other economic policy measures have been crucial in anchoring price expectations. As transmission of the policy changes through the economy to reach the inflation target is subject to unpredictable developments, it is necessary to ensure that the policy framework is focused on achieving the inflation target while supporting growth. 31. Accordingly, I vote:

Statement by Dr. Ashima Goyal 32. Global uncertainty continues although its economic impact has been less severe than expected. Major advanced economy (AE) central banks have slowed their tightening. Inflation is softening although it continues to be above target. They have shifted to a more data-based approach and are more willing to wait for the lagged effects of past tightening. Inflation has not been high for as long as it was in the seventies so there is less reason to fear persistence without higher for longer policy rates. Labour markets remain tight, but this may partly reflect labour hoarding by employers following the post Covid-19 labour shortages so that tightness may be overestimated. AE fiscal tightening has less global spillovers compared to monetary tightening so more AE fiscal consolidation may reduce pressures on monetary policy. 33. Indian growth outperformed market expectations but did fall from 9.1% in FY22 to 7.2% in FY23. Some turnaround in manufacturing and continued growth in fixed investment in Q4FY23 augurs well for the future, however. Construction also remains robust, but consumption and exports have areas of softness, pent up demand for services may moderate, and unemployment remains high. 34. Inflation has moderated into the tolerance band but is not yet firmly on the path to target, particularly in view of monsoon related uncertainties. Even so, it is clear that core inflation is neither persistent nor broad-based. Core inflation fell from 6.2% in January to 5.1% in April this year. Softening is to be expected in the absence of true second round effects from excess demand or from tight labour markets. Inflation was higher for so long because of multiple supply shocks. 35. Going ahead firms’ input output price gap is almost closed, profit margins rose sharply in Q4FY23, input costs have fallen, wage pressures are not there, and since demand is slack they are unlikely to raise prices. WPI inflation, that has a larger weight of manufacturing prices, is negative. The IIM Ahmedabad business expectation survey shows a moderation in firms’ one year ahead price and cost inflation as well as sales expectations. Preliminary results from the RBI enterprise surveys, however, show firms expecting price and cost inflation to rise, despite actual costs and inflation softening. This may be due to fears about the monsoon and bears watching over the next few months. 36. The quick succession of repo rate raises has brought the real rate to near equilibrium levels, which has prevented over-heating as well as over-tightening of demand and helped to anchor inflation expectations. The slowdown and pause was also well-timed. 37. It is necessary to build on the learning of the past few years where allowing sufficient nominal variation in repo and exchange rates to keep real rates near equilibrium has helped smooth shocks and sustain Indian growth resilience. The experience has shown that independence from AE monetary cycles is feasible and foreign inflows are not tightly linked to the interest rate differential with AE rates. Flexibility in inflation targeting, intervention in FX markets to reduce excess volatility, economic diversity, supply-side action and good monetary-fiscal coordination under supply shocks have all contributed to better outcomes. 38. As expected inflation falls, however, it is important that real repo rate does not rise too high. This is what happened in 2015 as international oil prices fell, damaging the economic cycle. Research suggests that the inflation targeting regime has contributed to reducing inflation expectations. Commitment to such a regime only involves aligning the nominal repo rate with expected inflation. Such action, together with the greater impact of official communication in emerging markets, is adequate to bring inflation to target as the effect of shocks dies down. It does not require the nominal repo to be kept higher for longer. 39. But in this meeting, it is appropriate for the MPC to pause. I also vote for the present stance to continue since at present it is not possible to give a signal about future action. The latter will be conditional on the data coming in. The pause is only for the current meeting. Moreover, transient events have created a liquidity surplus, so that withdrawal of liquidity itself is also required. Statement by Prof. Jayanth R. Varma 40. The outlook on inflation and growth has changed only marginally between the April meeting and this meeting. The two inflationary risks that I spoke about in April (crude prices and the monsoon) have become a little less worrisome. On the crude oil front, it is now clear that OPEC+ is struggling to reduce supply adequately to counter sluggish demand, and the risk of a substantial spike in crude price in the near term is not very high. As regards the monsoon, the official forecast of a normal monsoon provides some comfort, but it is tempered by the fact that the forecast includes an almost even chance of monsoon being below normal or worse. Fortunately, the forecast likelihood of a deficient monsoon is only marginally higher than the climatological probability, and the chance of a drought appears to be rather remote. This augurs well because the Indian economy is quite resilient to a monsoon which is somewhat below normal if its spatial and temporal distribution is satisfactory. Another indication of a slight reduction in inflationary risks is the slight decline in the RBI projections of inflation for 2023-24 between the April and June meetings. Similarly, the outlook for growth remains more or less the same as in April with several high frequency indicators suggesting that growth is not as robust as we would like. 41. Considering the balance of risks, I vote for keeping the repo rate unchanged in this meeting. I am of the view that the current level of the repo rate is high enough to keep inflation below the upper tolerance band on a sustained basis and also glide it towards the middle of the band. However, there are significant risks to both inflation and growth, and the process of bringing inflation under control is still very much work in progress. It would be premature to declare victory at this point of time based on the inflation prints of just a couple of months. In this context, I am not at all comfortable with the self-congratulatory tone of the statement in the MPC Monetary Policy Statement that “The MPC took note of the moderation in CPI headline inflation in March-April into the tolerance band, in line with projections, reflecting the combined impact of monetary tightening and supply augmenting measures.” 42. Turning to the stance, I find that with every successive meeting, this stance is becoming more and more disconnected from reality. Based on the forecast inflation for 5.1% for 2023-24, the real repo rate is now almost 1½%. (The real short term rate could well be above that level since in recent weeks, many money market rates have often drifted towards the MSF rate of 6.75%). In other words, monetary policy is now dangerously close to levels at which it can inflict significant damage to the economy. Despite this, the majority of the MPC wishes to remain focused on withdrawal of accommodation whatever that phrase might mean. I have therefore seriously considered dissenting on this part of the resolution, but after careful thought I have decided to confine myself to expressing reservations on it. The main reason for not dissenting is that, after two successive meetings at which the repo rate has been left unchanged, this stance now appears more vestigial than a serious statement of intent. Statement by Dr. Rajiv Ranjan 43. The reasons outlined for a pause in rate action in my previous statement of April 2023 broadly hold for this meeting as well. Moreover, as the latest prints of growth and inflation indicate a Goldilocks scenario, with growth higher and inflation marginally lower than anticipated, this is telling us that our cumulative actions taken so far are working in the right direction. It needs to be acknowledged, however, that knowing when to stop is hard. The effects of tight policy will continue to percolate through the system months after the pause. If policy makers continue tightening until inflation falls as much as they want, they are likely to go farther than they need to (Romer and Romer, 2023)1. Notwithstanding this, it is important that we do not drop our guard against inflation, especially when we are still away from our primary goal of aligning inflation to the 4.0 per cent target. 44. On the domestic growth front, the optimism spelt out in my earlier minutes has materialised, with the acceleration in real GDP growth for Q4:2022-23 to 6.1 per cent from 4.5 per cent in the preceding quarter. The quarter-on-quarter (qoq) seasonally adjusted momentum in Q4 at 2.9 per cent, well above the pre-pandemic average of 1.7 per cent (2012-13 to 2019-20), bodes well for growth going forward. Furthermore, there are clear signs of economic activity holding up well in Q1:2023-242 as indicated by various high frequency indicators and this optimism is expected to follow through in the remaining quarters of 2023-24. This stems from three factors: (i) revival in rural consumption; (ii) private corporate investment gaining steam; and (iii) moderating drag from net external demand. Let me elaborate. Rural demand is supported by the robust rabi foodgrains production and expected normal monsoon.3 Given the low share of agriculture in aggregate GVA (around 15 per cent in 2022-23) and its contribution to GDP growth, even if monsoon turns out be lower than normal, its impact on growth may not be significant. On the other hand, deficient monsoon could have a more tangible impact on inflation due to the higher share of food items in the CPI consumption basket. 45. There is an increasing revival in corporate investment due to slackening of input cost pressures and rising capacity utilisation. Credit growth to industry has improved driven by large industries, particularly, roads, steel, cement, construction, petroleum and chemicals. On the supply side, manufacturing sector performance, which turned positive in Q4:2022-23, is likely to improve further with softening commodity prices, normalisation of supply chains and production linked incentive (PLI) scheme gaining traction. Manufacturing companies in several key sectors have expanded their fixed assets. Services sector constituted about 63 per cent share in aggregate gross value added (GVA) and contributed around 83 per cent to growth in GVA during 2022-23 and is expected to remain the mainstay of growth in 2023-24. Higher contraction in merchandise imports coupled with buoyant services exports are improving net external demand. 46. Headline CPI inflation fell sharply by 1.7 percentage points between February and April 2023, supported by favourable base effects and soft price momentum. The softening in core inflation was seen across various exclusion based as well as trimmed mean measures. CPI diffusion indices indicate that a majority of the CPI items saw price increases less than a seasonally adjusted annualised rate (SAAR) of 6 per cent during March-April 2023, a significant reversal from February. All these suggest some waning of price pressures in CPI in recent months, as the impact of monetary policy actions, supply side measures and easing of global commodity prices played through. Inflation, however, is likely to remain well above the target rate of 4 per cent throughout the year. 47. We have been prudent in our approach using the flexibility imbedded in the framework to operate within the tolerance band in balancing macroeconomic priorities depending upon the need of the hour. With greater clarity on macro fronts, prudence requires that we now focus on aligning inflation to the target of 4 per cent. Time is opportune to emphasise the distinction between the inflation target and tolerance of deviations from the target. The tolerance band can be conceptually broken down into an uncertainty range4 owing to imperfect knowledge of the (present and future) state of the economy; the indifference range over which monetary policy is not expected to react; and finally, the operational range that allows for intentional deviations to exercise short-run trade-offs between inflation and growth (Chung et al, 2020).5 Sustained deviations of inflation from the target may lead to a steady drift of inflation expectations. The risk of ceding part of the operational range to the indifference range makes it imperative to emphasise the primacy of the 4 per cent inflation target. This is crucial to support the ongoing process of anchoring inflation expectations around the target. Moreover, real policy rate continues to be positive which will further anchor inflation expectations. 48. The rate pause in April seems to have had a sobering impact on domestic financial conditions. For instance, the average spread of the 10-year G-sec yield over the 1-year G-sec, 91-day Treasury bills, and the policy repo rate moderated to 20 bps, 29 bps and 58 bps, respectively, during April 6-June 7, 2023. In the credit market, the weighted average lending rate (WALR) on fresh rupee loans and the weighted average domestic term deposit rate (WADTDR) on fresh deposits of scheduled commercial banks fell by 23 bps and 12 bps, respectively, in April 2023. Such an easing of financial conditions occurred, even as the MPC had unequivocally argued that the pause was specific to the April policy and not a policy pivot. Accordingly, continuity in the stance with a clear-cut objective of aligning inflation to the 4 per cent target is important. Any premature change in stance may be hasty and could undo the hard work done so far. It may also tamper with the transmission process that is currently underway. Recent actions of some advanced economies reverting back to rate hikes after a pause need to be kept in mind. Thus, I vote for a pause in rate action and continuity of stance. Monetary policy actions would need to be calibrated carefully by assessing the impact of past actions, meticulously scrutinising the incoming data, and responding appropriately to the evolving macroeconomic conditions. Statement by Dr. Michael Debabrata Patra 49. Macroeconomic outcomes have broadly evolved along projected paths, vindicating the April 2023 monetary policy decision and stance. This provides elbow room to re-assess the evolving outlook with information gleaned from current rounds of forward-looking surveys and updated forecasts of goal variables, while keeping in mind the cumulative actions already taken and the lags of monetary policy’s effects on the economy. 50. Overall, the outlook for real GDP growth in India is brighter than in April. Global risks appear contained for now, but idiosyncratic monsoon-related risks have risen and need to be seen off over the ensuing months. Financial conditions have eased considerably, and domestic financial markets are reflecting a stable growth outlook along with re-anchoring of inflation expectations. 51. The near-term outlook for inflation is also relatively benign vis-a-vis the 2022-23 experience. Beyond the first quarter, however, pressure points emanating from specific supply-demand mismatches could impart upward pressure to the momentum of prices and offset favourable base effects, especially in the second half of 2023-24. Hence, monetary policy needs to remain in ‘brace’ mode, ensuring that the effects of these shocks dissipate without leaving scars on the economy. 52. Accordingly, my vote for maintaining status quo on the policy rate should be seen as taking middle stump guard to prepare for a bouncier pitch. Holding the rate unchanged should not be interpreted as the interest rate cycle having peaked, but as a period of careful evaluation of a decision on the extent of additional policy tightening, if needed. This is a part of continuous learning about the underlying structure of the economy with new information until the next meeting of the MPC, and not a prolonged pause. Headline inflation is edging down towards the target, but it is still well above it and the balance of risks suggests that it will go up in coming months before it comes down. Therefore, continuing with the stance of withdrawal of accommodation is appropriate as it adequately conveys the future course of interest rates in the economy. Statement by Shri Shaktikanta Das 53. The global economy has sustained the growth momentum and the overall uncertainty is somewhat receding. Nevertheless, headwinds to global growth outlook persist. The geopolitical conflict continues unabated. Headline inflation across countries is on a downward trajectory, but is still high and above their respective targets. Central banks remain on high alert and watchful of the evolving conditions. 54. India’s macroeconomic fundamentals are strengthening and growth prospects are steadily improving and becoming broad-based. Inflation has eased and the external sector outlook has improved. Balance sheets of banks and corporates look resilient and healthy, thereby engendering twin balance sheet advantage for growth. Demand conditions remain supportive of growth on the back of improving rural demand and investment activity. Urban demand remains strong. Consumer and business outlook surveys display continued optimism. Overall, the Indian economy presents a story of resilience and sustainability, with an expected real GDP growth of 6.5 per cent in 2023-24. Macroeconomic and financial stability is now well entrenched and needs to be nurtured and preserved with well calibrated and timely actions. 55. The inflation trajectory has seen significant softening during March-April 2023, as anticipated, with the near-term outlook turning out to be more favourable than envisaged earlier. Inflation is now projected to average 5.1 per cent in 2023-24 compared to 6.7 per cent in 2022-23, but this would still be above the target. The disinflation towards the target rate of 4 per cent is likely to be gradual and protracted. Compared to April, uncertainties on the inflation outlook for H2:2023-24 have not abated. The spatial and temporal distribution of the south-west monsoon in the backdrop of a likely El Nino weather pattern needs to be watched carefully, especially for its impact on food prices. International prices for key food items like rice and sugar are at elevated levels. Adverse climate events have the potential to quickly change the direction of the inflation trajectory. Geo-political tensions, uncertainty on crude price trajectory and volatile financial markets pose further upside risks to prices. These considerations warrant close monitoring of the evolving price dynamics. 56. The pause in April MPC was based on the need to assess the cumulative impact of 250 bps rate hike over the past one year. Our surveys indicate that anchoring of expectations is underway and our monetary policy actions are yielding the desired results. Given the baseline inflation projections for 2023-24, positive real policy rates will aid the ongoing disinflation process. The full impact of past actions is still unfolding. In this situation, a pause in the rate hike cycle and closely assessing the evolving situation looks the most appropriate option for this meeting of the MPC. Accordingly, I vote for keeping the policy rate unchanged in this meeting of the MPC. 57. Our job is only half done, having brought inflation within the target band. Our fight against inflation is not yet over. We need to undertake forward-looking assessment of the evolving inflation-growth outlook and stand ready to act, if situation so warrants. Beyond this and given the prevailing uncertainties, it is difficult to give any definitive forward guidance about our future course of action in a rate tightening cycle. 58. I also vote to continue with the stance of withdrawal of accommodation, given that liquidity in the banking system is still in surplus and we have a way to go to align headline inflation with 4.0 per cent target on a durable basis and ensure that the overall financial conditions are in sync with the monetary policy stance. We will continue to remain agile and flexible in managing liquidity through two-way operations. We do recognise that durable price and financial stability are mutually reinforcing and necessitate greater policy focus at the current juncture. Our future actions will be shaped accordingly. (Yogesh Dayal) Press Release: 2023-2024/449 1 Romer C.D. and David H. Romer (2023), “Does Monetary Policy Matter? The Narrative Approach after 35 Years”, American Economic Review, Vol. 113, Issue 6, June. 2 Real GDP in Q1:2023-24 will also benefit from base effect which is yet to normalise. 3 Around 55 per cent of rabi production is accounted for in Q1:2023-24. 4 This comprises forecast errors, Knightian uncertainty, among others. 5 https://www.federalreserve.gov/econres/feds/files/2020075pap.pdf |

Page Last Updated on: