IST,

IST,

Minutes of the Monetary Policy Committee Meeting October 1, 3 and 4, 2019

[Under Section 45 ZL of the Reserve Bank of India Act, 1934] The nineteenth meeting of the Monetary Policy Committee (MPC), constituted under section 45 ZB of the Reserve Bank of India Act, 1934, was held during October 1, 3 and 4, 2019 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members – Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, former Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45 ZB(2)(c) of the Reserve Bank of India Act, 1934); Shri Bibhu Prasad Kanungo, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45 ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (October 4, 2019) decided to:

Consequently, the reverse repo rate under the LAF stands reduced to 4.90 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 5.40 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Since the MPC’s last meeting in August 2019, global economic activity has weakened further. Heightened uncertainty emanating from trade and geo-political tensions continues to cloud the outlook. Among advanced economies (AEs), the slowdown in the US economy in Q2:2019 appears to have extended into Q3:2019, weighed down by softer industrial production. The Institute for Supply Management’s index for September indicates that manufacturing slipped further into contraction to touch its lowest reading in a decade; hiring by the private sector also slowed down. In the Euro area too, incoming data suggest that activity may have moderated further in Q3, with retail sales declining and manufacturing PMI remaining in contraction for the eighth consecutive month in September. The UK economy decelerated in Q2; the contraction in industrial production and soft retail sales in July suggest that the loss of speed has continued into Q3 as well. In Japan, the loss of momentum in Q2 spilled over into Q3, albeit cushioned by a fiscal stimulus and frontloaded consumer spending ahead of a planned sales tax hike. 7. The macroeconomic performance of major emerging market economies (EMEs) was weighed down by a deteriorating global environment in Q3. The Chinese economy appears to have slowed down in Q3 as well, with both retail sales and industrial production growth weakening in July-August and exports contracting in August; attention is now focussed on the efficacy of fiscal and monetary policy stimuli in averting a sharper deceleration. In Russia, economic activity ticked up in Q2, though still subdued consumer sentiment and weak industrial production may restrain momentum, going forward. Economic activity in both South Africa and Brazil rebounded in Q2, emerging out of contraction in the previous quarter; however, this nascent recovery faces both domestic and external headwinds. 8. Crude oil prices were pulled down by softer demand, amidst adequate supplies in early August. Prices remained range bound until mid-September when supply disruptions on account of an escalating geo-political conflict resulted in a spike which has abated faster than expected. Gold prices remained elevated on safe haven demand. Central banks became more accommodative with inflation remaining below targets across major AEs and EMEs. 9. Global financial markets have remained unsettled since the MPC’s early August meeting with bouts of volatility unleashed by protectionist policies and worsening global growth prospects. In the US, the equity market’s August losses were recouped by early September – investor sentiment was buoyed by signs of an easing in US-China trade tensions. Stock markets in EMEs fell, as the strong US dollar led to capital outflows, though they recovered partially in September. Bond yields in the US continued easing till August on growth worries, before a slight uptick was triggered in early September by better than expected US retail sales data and hopes of conciliatory trade negotiations between the US and China. In the Euro area, bond yields sank further into negative territory, propelled by the cut in the deposit rate by the European Central Bank (ECB) to (-) 0.5 per cent and the reintroduction of quantitative easing. In EMEs, bond yields exhibited mixed movements, driven by country-specific factors. In currency markets, the US dollar strengthened against currencies of other AEs. EME currencies, which were trading with a depreciating bias in August, appreciated in early September on country-specific factors and a revival of global risk-on sentiment. Domestic Economy 10. On the domestic front, growth in gross domestic product (GDP) slumped to 5.0 per cent in Q1:2019-20, extending a sequential deceleration to the fifth consecutive quarter. Of its constituents, private final consumption expenditure (PFCE) slowed down to an 18-quarter low. Gross fixed capital formation (GFCF) improved marginally on a sequential basis but remained muted as in the preceding quarter. Government final consumption expenditure (GFCE) cushioned the overall loss of momentum to some extent. 11. On the supply side, gross value added (GVA) growth decelerated to 4.9 per cent in Q1:2019-20, pulled down by manufacturing growth, moderating to 0.6 per cent. Agriculture and allied activities were lifted by higher production of wheat and oilseeds during the 2018-19 rabi season. Growth in the services sector was stalled by construction activity. 12. Turning to Q2:2019-20, the initial delay in the onset of the south-west monsoon rapidly caught up from July. By September 30, 2019, the cumulative all-India rainfall surpassed the long period average (LPA) by 10 per cent. The first advance estimates of major kharif crops for 2019-20 have placed production of foodgrains 0.8 per cent lower when compared with the last year’s fourth advance estimates. Looking ahead at the rabi season, the live storage of water in major reservoirs was 115 per cent of the live storage of the corresponding period of the previous year on September 26, 2019 and 121 per cent of average storage level over the last ten years. Abundant rains in August and September have led to improved soil moisture conditions in most parts of the country, particularly central India, compared to the corresponding period of the last year. Overall, the prospects of agriculture have brightened considerably, positioning it favourably for regenerating employment and income, and the revival of domestic demand. 13. Industrial activity, measured by the index of industrial production (IIP), weakened in July 2019 (y-o-y), weighed down mainly by moderation in manufacturing. In terms of uses, the production of capital goods and consumer durables contracted. Consumer non-durables, led by edible oils, and intermediate goods, mainly mild steel slabs, posted sustained expansion and have emerged as potential growth drivers. Infrastructure/construction sector activity turned around to register a growth of 2.1 per cent vis-à-vis (-)1.9 per cent in the previous month. The output of eight core industries contracted in August, pulled down by coal, electricity, crude oil and cement. Capacity utilisation (CU) in the manufacturing sector, measured by the OBICUS (order books, inventory and capacity utilisation survey) of the Reserve Bank, declined to 73.6 per cent in Q1:2019-20 from 76.1 per cent in the previous quarter. However, seasonally adjusted CU rose to 74.8 per cent in Q1:2019-20 from 74.5 per cent in Q4:2018-19. Manufacturing firms polled for the industrial outlook survey (IOS) expect capacity utilisation to moderate in Q2:2019-20. The Reserve Bank’s business assessment index (BAI) fell in Q2:2019-20 due to a decline in new orders, contraction in production, lower capacity utilisation and fall in profit margins of the surveyed firms. The manufacturing purchasing managers’ index (PMI) for September 2019 was unchanged at its previous month’s level; new orders and employment improved, albeit marginally, and new export orders declined. 14. High frequency indicators suggest that services sector activity weakened in July-August. Indicators of rural demand, viz., tractor and motorcycles sales, contracted. Of underlying indicators of urban demand, passenger vehicle sales contracted in July-August, while domestic air passenger traffic accelerated in August. The sales of commercial vehicles, a key indicator for the transportation sector, contracted by double digits in July-August. Of the two indicators of construction activity, finished steel consumption decelerated sharply in August and cement production contracted. The services PMI moved into contraction in September 2019, dragged down mainly by a decline in new business inflows. 15. Retail inflation, measured by y-o-y changes in the CPI, moved in a narrow range of 3.1- 3.2 per cent between June and August. While food inflation picked up, fuel prices moved into deflation. Inflation excluding food and fuel softened in August. 16. Food inflation in August was elevated by a spike in the rate of increase in vegetables prices, a pick-up in pulses inflation and persistently high meat and fish inflation. On the other hand, softer increases in prices of eggs, oils and fats, non-alcoholic beverages and prepared meals, and deflation in prices of fruits and sugar cushioned the rise in overall food inflation. 17. Deflation in the fuel group deepened in August largely due to the pass-through from a sharp decline in international prices of liquified petroleum gas (LPG). Subsidised kerosene prices, however, have been rising in a calibrated manner as oil marketing companies continued a gradual reduction in subsidies. 18. CPI inflation excluding food and fuel increased in July, but its roots were largely confined to prices of personal care and effects – mainly bullion prices, and transport and communication, reflecting rise in prices of petrol and diesel. By contrast, there was moderation in August, which was spread across most of the sub-groups; however, gold prices spiked further on global uncertainties. 19. The Reserve Bank’s September 2019 round of inflation expectations survey indicates that households expect inflation to rise by 40 basis points over a 3-month ahead horizon and 20 basis points over a one-year ahead horizon, possibly responding adaptively to the rise in food prices in recent months. The Reserve Bank’s consumer confidence survey shows weak consumer sentiment and tepid consumption demand, especially relating to non-essential items. Manufacturing firms see weakening of demand conditions in Q2:2019-20 and Q3 and expect their output prices to soften, going forward, as the cost of finance and salary outgoes remain muted. 20. Overall liquidity remained surplus in August and September 2019 despite expansion of currency in circulation and forex operations by the Reserve Bank draining liquidity from the system. Net daily average absorption under the LAF amounted to ₹1,40,497 crore in August, essentially on account of spending by the government, which resulted in availment of ways and means advances (WMA) and intermittent overdraft facilities from the beginning of the month (till August 25, 2019). In September, with a steady build-up of cash balances, particularly with advance tax inflows around September 15, surplus liquidity moderated, and the Reserve Bank undertook daily net absorption of ₹1,22,392 crore in September. Reflecting easy liquidity conditions, the weighted average call rate (WACR) traded below the policy repo rate (on an average) by 8 basis points (bps) in August and by 6 bps in September. 21. Monetary transmission has remained staggered and incomplete. As against the cumulative policy repo rate reduction of 110 bps during February-August 2019, the weighted average lending rate (WALR) on fresh rupee loans of commercial banks declined by 29 bps. However, the WALR on outstanding rupee loans increased by 7 bps during the same period. 22. Net exports had contributed to aggregate demand in Q1:2019-20 on account of a deeper contraction in imports relative to exports. In Q2, merchandise exports remained weak in July and August 2019, caused by lower shipments of engineering goods, petroleum products, gems and jewellery and cotton yarn. Imports contracted faster during the period mainly due to lower international crude oil prices downsizing the oil import bill and a large fall in the volume of gold imports. Non-oil non-gold imports were pulled down into contraction by coal, pearls and precious stones and transport equipment. These developments led to a narrowing of the trade deficit during July-August 2019. Higher net services receipts and private transfer receipts helped contain the current account deficit to 2.0 per cent of GDP in Q1:2019-20 from 2.3 per cent a year ago. On the financing side, net foreign direct investment rose to US$ 17.7 billion in April-July 2019 from US$ 11.4 billion a year ago. Net foreign portfolio investment (excluding the voluntary retention route) was of the order of US$ 3.3 billion during April-September 2019 as against net outflow of US$ 11.5 billion in the same period of last year. Net disbursals of external commercial borrowings rose to US$ 8.2 billion during April-August 2019 as against net repayments of US$ 0.2 billion during the same period a year ago. India’s foreign exchange reserves were at US$ 434.6 billion on October 1, 2019 – an increase of US$ 21.7 billion over end-March 2019. Outlook 23. In the third bi-monthly resolution of August 2019, CPI inflation was projected at 3.1 per cent for Q2:2019-20, 3.5-3.7 per cent for H2:2019-20 and 3.6 per cent for Q1: 2020-21 with risks evenly balanced. The actual inflation outcomes for Q2 so far (July-August) at 3.2 per cent have been broadly in line with these projections. 24. Going forward, several factors are likely to shape the inflation trajectory. First, the outlook for food inflation has improved considerably since the August bi-monthly policy. Kharif production is estimated at close to last year’s level, auguring well for the overall food supply situation. Vegetable prices may remain elevated in the immediate months but are likely to moderate as winter supplies enter the market. Prices of pulses are expected to remain contained by adequate buffer stocks. Secondly, forward looking surveys conducted by the Reserve Bank point to weak demand conditions persisting, with indications of softening of output prices in Q3:2019-20. Accordingly, price pressures in CPI excluding food and fuel are likely to be muted. Thirdly, crude oil prices may remain volatile in the near-term; while global demand is slowing down, the persisting geo-political uncertainties pose some upside risks to the inflation outlook. Fourthly, three-month and one-year ahead inflation expectations of households polled by the Reserve Bank have risen in the current round reflecting near-term price pressures. Finally, financial markets remain volatile with currencies of several emerging market economies trading with a depreciating bias in the recent period. Taking into consideration these factors and the impact of recent policy rate cuts, the CPI inflation projection is revised slightly upwards to 3.4 per cent for Q2:2019-20, while projections are retained at 3.5-3.7 per cent for H2:2019-20 and 3.6 per cent for Q1:2020-21, with risks evenly balanced (Chart 1). 25. Turning to the growth outlook, real GDP growth for 2019-20 in the August policy was projected at 6.9 per cent – in the range of 5.8-6.6 per cent for H1:2019-20 and 7.3-7.5 per cent for H2 – with risks somewhat tilted to the downside; GDP growth for Q1:2020-21 was projected at 7.4 per cent. GDP growth for Q1:2019-20 was significantly lower than projected. Various high frequency indicators suggest that domestic demand conditions have remained weak. The business expectations index of the Reserve Bank’s industrial outlook survey shows muted expansion in demand conditions in Q3. Export prospects have been impacted by slowing global growth and continuing trade tensions. On the positive side, however, the impact of monetary policy easing since February 2019 is gradually expected to feed into the real economy and boost demand. Several measures announced by the Government over the last two months are expected to revive sentiment and spur domestic demand, especially private consumption. Taking into consideration the above factors, real GDP growth for 2019-20 is revised downwards from 6.9 per cent in the August policy to 6.1 per cent – 5.3 per cent in Q2:2019-20 and in the range of 6.6-7.2 per cent for H2:2019-20 – with risks evenly balanced; GDP growth for Q1:2020-21 is also revised downwards to 7.2 per cent (Chart 2). 26. The MPC notes that the negative output gap has widened further. While the recent measures announced by the government are likely to help strengthen private consumption and spur private investment activity, the continuing slowdown warrants intensified efforts to restore the growth momentum. With inflation expected to remain below target in the remaining period of 2019-20 and Q1:2020-21, there is policy space to address these growth concerns by reinvigorating domestic demand within the flexible inflation targeting mandate. It is in this context that the MPC decided to continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target. 27. All members of the MPC voted to reduce the policy repo rate and to continue with the accommodative stance of monetary policy. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Michael Debabrata Patra, Shri Bibhu Prasad Kanungo and Shri Shaktikanta Das voted to reduce the repo rate by 25 basis points. Dr. Ravindra H. Dholakia voted to reduce the repo rate by 40 basis points. 28. The minutes of the MPC’s meeting will be published by October 18, 2019. 29. The next meeting of the MPC is scheduled during December 3-5, 2019.

Statement by Dr. Chetan Ghate 30. Since the last review, there has been a 40 bps increase in the three month ahead inflation expectations of households (now at 8%), and a 20 bps increase in the level of one year ahead inflationary expectations (to 8.1%). Households’ current perception of inflation also increased by 50 bps to 7.1%. The proportion of respondents (both in the three month and one year buckets) expecting inflation to be less than 6% has fallen. The uptick in inflationary expectations, while adaptively reflecting the uptick in food inflation, comes on the back of several rounds of declines, and therefore acquires salience. 31. The uptick in food inflation (3% in August) needs to be carefully watched. Vegetable prices have increased by 23.9% during April-August 2019 (compared to 15.7% in the same period last year), reflecting a stronger-than-usual summer uptick. The cumulative momentum in food prices during April-August was also higher (5.5%) compared to the same period last year (3.2%). Pulses inflation has turned positive for the first time since May 2019. The cumulative momentum on items like meat and fish has been higher than earlier occasions. The late exit of the monsoon will however be favorable for Rabi crop growing and should have a mitigating effect on the ongoing uptick in food inflation in the next couple of months. 32. Notwithstanding the uptick in food inflation, headline CPI inflation was almost flat at 3.2%. The August reading for inflation ex food and fuel was lower at 4.2% compared to 4.5% in July. The forward trajectory of inflation ex food and fuel will be influenced by several factors: the pace of growth, favorable base effects, lagged effects of the depreciation in the INR, the price of crude, and the pass-through of inflationary expectations into inflation ex food and fuel. These variables need to be carefully watched. 33. Since the last review, economic activity has continued to weaken. 34. This was manifest most poignantly in the weak Q1 FY19:20 growth numbers (5%) which slowed for a 5th consecutive quarter. Real GVA growth at 4.9% for Q1 FY 19:20 also continued to decline. Consumption demand grew at 3.1%, which is the slowest reading in 4 years. Investment grew at 4%, marginally higher than that in Q4 FY 18:19 which was 3.6%. Since the last review, the output gap has widened further. 35. External demand conditions have worsened. Geopolitical risks remain unresolved. There has been a resurgence of trade policy tensions, and global growth has continued to weaken. Exports contracted in Q1 FY19:20. 36. Domestically, sentiment remains weak. Consumer confidence fell for the 3rd consecutive round. Both the Current Situation Index (CSI) and Future Expectations Index (FEI) produced by the RBI have recorded lower readings compared to the previous round. Based on RBI’s survey of manufacturing activity, real sales growth across 1723 listed private manufacturing companies has become negative for the first time since Q1 FY 16:17. Capacity utilization has also fallen to 73.6% after growing consistently since Q1 FY 18:19. RBI’s Business Assessment Index (BAI) moved into a contraction zone. The Business Expectation Index (BEI) also dipped. However, sales growth remained steady for the non-IT services sector. I worry that weak sentiments may become self-fulfilling, which will complicate the job of monetary policy. 37. On the positive side, July IIP growth was higher at 4.3% compared to the June reading, largely driven by consumer non-durables and intermediate goods. The consumer non-durables segment, which typically proxies for fast moving consumer goods (FMCG), was strong at 8.3% (although influenced by a disproportionate jump in one-off items). However, capital goods contracted (-7.1%). Consumer durables also contracted (-2.7%). What mitigates this is the truncated IIP (i.e., taking out 2 per cent of most volatile components from both sides) which gives rise to a growth in the IIP of 2.4 per cent in July 2019. While there is a divergence in the year on year consumer durable growth number compared to its seasonally adjusted month on month momentum (7.5 % in July), this divergence has to be seen in the backdrop of high year on year growth of 14.1 per cent in July 2018. 38. FDI has picked up in April – July 2019 relative to 2018. 39. Compared to the last review, monetary transmission has become worse. The decline in the WALR on fresh rupee remained at 29 bps as in the last review. The WALR on outstanding rupee loans has however increased by 7 bps! This is despite the MPC cutting rates by 110 bps in the February-August window. The RBI should be commended for implementing a new set of norms on external benchmarking. This will help with monetary transmission. But as Milton Friedman said, monetary policy works with long and variable lags. In the Indian case, these lags are made worse by frictions in the banking system, complicating the MPC’s efforts to implement counter-cyclical policy. 40. I strongly feel that we need a more informed discussion of fiscal policy in India. While the government should be commended for implementing a new corporate tax rate regime, based on the discussion that I read, I find it premature, without a proper “dynamic scoring” analysis, to speculate on the impact of the tax cut on the fiscal deficit, what part of the economic effects will be on the demand side, and what part will be on the supply side. 41. In some of my own research with co-authors, we show that an impact of a corporate tax cut on GDP in an emerging market economy like India may not be very large. It leads to a rebalancing of the economy away from consumption and towards investment (which is why the GDP effects are muted). Overall, the tax cut leads to a decline in the fiscal deficit in the long run, although the size of this effect is negligible. The lowering impact on the fiscal deficit however depends on a very strong investment effect from the tax cut, which may not happen in the current economic climate. 42. Given the above, what is the appropriate path of monetary policy? 43. There is always a tension between pro-active risk management and being data dependent. Growth impulses however continue to be weak. Given this, the MPC has been pro-active in adjusting policy as reflected in the quantum of past rate cuts. Monetary policy however cannot be a permanent form of stimulus. As Lawrence Lindsey says in his book, The Growth Experiment Revisited (Basic Books, 2013) “Monetary policy should lean against the wind and help stabilize the business cycle. But it cannot become the wind itself, particularly one that blows at gale force.” 44. I vote to reduce the policy rate by 25 bps. I also vote to retain the stance as accommodative. I will remain data dependant, going forward; further monetary policy action will depend on the evolving growth-inflation dynamics. Statement by Dr. Pami Dua 45. Headline inflation, measured by CPI inflation, fell from 3.2% in June 2019 to 3.1% in July but rose back to 3.2% in August. Food inflation increased from 2.4% in June to 3% in August, mainly due to an increase in inflation in vegetables, pulses, and elevated inflation in meat and fish. Inflation excluding food and fuel rose from 4.1% in June to 4.5% in July, partly reflecting the increase in prices of petrol and diesel, but softened to 4.2% in August. 46. Looking forward, inflation expectations of households, as captured through RBI’s Inflation Expectations Survey of Households, increased in the September 2019 round, compared to the July round, by 40 basis points for the three-months-ahead horizon and by 20 basis points for the one-year-ahead horizon, possibly due to the recent increase in food prices. At the same time, the Industrial Outlook Survey (IOS) shows an expectation of selling prices of manufacturing being muted in Q3:2019-20. Further, according to Economic Cycle Research Institute’s (ECRI) Indian Future Inflation Gauge, which is a predictor of the direction of future inflation, inflation pressures remain contained. 47. Thus, while the actual inflation scenario and the outlook for inflation seem benign, some upside risks are prevalent, such as the possibility of supply disruptions in the global crude oil market. 48. On the output side, GDP growth fell for the fifth consecutive quarter to 5% in Q1:2019-20 from 5.8% in the previous quarter. Growth in private final consumption expenditure dropped to an 18-quarter low of 3.1% in the same period, while growth in gross capital formation remained muted at 3.7%. Growth in GVA also fell to 4.9% in Q1:2019-20 from 5.7% in Q4:2018-19, mainly due to a moderation in manufacturing growth and stalling of construction activity. 49. Industrial activity recorded moderate growth, with growth in IIP increasing from 1.2% in June to 4.3% in July, and with sub-indices for mining and quarrying, manufacturing and electricity registering positive growth, although growth in electricity slowed. Use based classification, however, indicates continuing deceleration in capital goods. Consumer non-durables accelerated for the fourth consecutive month, while for consumer durables, growth remained negative, although there was some improvement with growth rising from (-) 10.2% in June to (-) 2.7% in July. High frequency indicators of rural demand – tractor and motorcycle sales – and of urban demand – passenger vehicle sales – continued to contract. Growth in the index of eight core industries also fell in August. 50. Turning to survey data, RBI’s Order Books, Inventory and Capacity Utilisation Survey (OBICUS) suggests a drop in capacity utilisation in the manufacturing sector to 73.6% in Q1:2019-20 from 76.1% in the previous quarter, while seasonally adjusted capacity utilisation increased marginally to 74.8% in Q1 from 74.5% in Q4:2018-19. RBI’s Industrial Outlook Survey for the manufacturing sector shows a decline in the Business Assessment Index (a composite of demand indicators) for Q2:2019-20. The corresponding Business Expectations Index suggests that demand conditions are also expected to deteriorate in Q3:2019-20. According to RBI’s Consumer Confidence Survey, the Current Situation Index and the Future Expectations Index both dropped in the September round, implying lower current activity and a less optimistic outlook. Meanwhile, the manufacturing Purchasing Managers’ Index remained unchanged in September from the previous month, while the services PMI fell in September. 51. Thus, private consumption and investment activity are weak, and business and consumer sentiment are somewhat downbeat. 52. On the global front, the U.S. economic growth outlook is increasingly getting weaker, especially in manufacturing, and job growth prospects have dimmed. This boosts the probability of more Fed rate cuts this year. The overall global growth outlook also remains downcast, according to ECRI’s 20-Country Long Leading Index. In particular, Japan’s latest sales tax hike risks tipping the economy into its fifth recession since 2008. Meanwhile, Chinese economic growth is likely to languish. According to ECRI’s Chinese Leading Industrial Production Index, this is especially true in the industrial sector, hurting supplier countries like Germany, which is heavily reliant on exports to China. At the same time, industrial growth seems to have hit bottom in France and Italy earlier this year. 53. Nevertheless, in the context of largely gloomy international growth prospects, ECRI’s Indian Leading Exports Index growth rate remains in a cyclical downswing, suggesting that Indian export growth will stay weak. Thus, the global scenario is not likely to provide impetus to domestic growth. 54. With respect to transmission, between February and August 2019, the cumulative reduction in the policy repo rate has been 110 basis points, much of which is yet to be transmitted, although the financial markets have taken cognizance. While the importance of transmitting existing rate cuts before committing to fresh ones cannot be overstated, the recent linking of lending rates to external benchmarks is expected to expedite the process. 55. Of course, the policy heavy-lifting to reverse the growth slowdown has to be a multi-pronged approach. In this regard, there is a welcome delivery of a number of measures undertaken by the government since the last policy meeting with a focus on reviving growth. Among largely fiscal-neutral measures, the government has taken steps to relax norms for FDI, focus on seamless tax administration, improve ease of doing business, consolidate public sector banks, and encourage the flow of credit from the banking sector to the NBFCs and real economy sectors. The government has also undertaken fiscal stimulus in the form of a major overhaul in corporate income tax aimed at reducing the overall tax burden on corporates and in turn improving India's global competitiveness. 56. Given the measures undertaken by the government to address the growth slowdown, as well as the pending transmission of monetary policy, there is merit in a wait-and-watch approach to see how these measures pan out and impact real economy activity, going forward. At the same time, given the slowdown in growth on the domestic and global fronts, along with benign headline inflation and the expectation that it will remain below target, there is policy space to further cut the policy repo rate to boost domestic growth, within the flexible inflation targeting mandate. 57. Thus, on balance, the growth-inflation dynamics call for another 25 basis points cut, bringing the cumulative easing this year to 135 basis points. I therefore vote for a policy rate cut of 25 basis points. I also vote to keep the stance as accommodative. Statement by Dr. Ravindra H. Dholakia 58. Macroeconomic data coming in after the last meeting of MPC in August 2019 have further confirmed our serious concerns about the growth slow-down with continued benign inflation outlook. Compared to the expectation of 5.8% of real GDP growth during the first quarter of the current year 2019-20, the official estimate of the growth turned out to be far less at 5.0%. While we cannot rule out the possibility of the figure getting revised marginally upward by 10-20 bps, significant undershooting of the growth during Q1-2019-20 has to be recognized. In spite of late efforts by RBI and the Central Government to provide respectively the monetary and fiscal boost, it appears that growth recovery may take longer than expected. In fact, RBI has now revised its growth prediction for the current year 2019-20 substantially downward by 80 bps compared to the August meeting of MPC. Prediction about inflation rate, on the other hand, has been fairly stable and well below the target of 4%. As per the mandate given to the MPC by the Act under such circumstances, the growth concerns have to be addressed. In my opinion, we need to maintain accommodative stance with possible rate action till growth recovers provided the inflation remains within the target. At this juncture, I would like to act more aggressively by reducing the policy Repo Rate further by 40 bps so as to correct the real interest rates in the economy in due course. It would still leave some space for the rate action if required in future. More specific reasons for my vote are as follows –

59. External bench-marking of the lending rates by the banks would result in better transmission now. Corporate bond market reforms by allowing entry to corporates with lower rating than AAA; encouraging issuance of long term bonds and creating a proper yield curve for the government bond market to serve as a bench-mark can go a long way to deepen the market and improve the transmission. While such reforms are urgently required, they should not constrain the rate action by RBI. In my opinion, enough space exists as argued above for a 40 bps reduction in the policy repo rate now with space still existing for future till growth recovers. Hence, I vote for continuing with accommodative stance and cut the policy repo rate by 40 bps now. Statement by Dr. Michael Debabrata Patra60. The GDP print for the first quarter of 2019-20, high frequency indicators for the second quarter up to August, the indicators that have become available for September such as auto sales of industry majors, bank credit, the lowest GST collections in 19 months, and the wide swathe of downgrades of projections suggest that the downturn in the economy, and especially in spending, may be deeper and more pervasive than expected. This justifies the pre-emptive accommodative stance adopted by the MPC since February 2019. Headwinds from the global slowdown are also stronger than initially envisaged, and broader in their impact on domestic activity: transmitted through trade, they seem to be active in muting industrial activity and investment across borders. Sensing this, business expectations for the third quarter and consumer confidence over a year ahead have moderated from their earlier readings. This pronounced cyclical downswing suggests that the state of the economy will likely get worse before it gets better. 61. Meanwhile, inflation continues to trail below target and is projected to remain so over the 12 months ahead horizon. Its underlying dynamics excluding food and fuel seem to be mirroring the growing slack in the economy, given the succession of soft readings and the broad-based nature of its ebbing. If one-off factors like gold prices are excluded, inflation excluding food and fuel falls below target. Although inflation expectations of households a year ahead have ticked up, they are essentially adapting to the firming up of food prices in the summer. Businesses are anticipating modest input cost pressures but still lack pricing power, rendering the outlook on selling prices benign. 62. The conduct of monetary policy requires as accurate as feasible a sense of the economy’s potential output, given that is unobservable. This enables an assessment of the state of the output gap – the difference between actual and potential output – so as to gauge where the economy is positioned on the business cycle. Accordingly, monetary policy can perform its stabilisation or countercyclical role that is appropriate to the situation. The lament of the monetary policy wielder has been that potential output is notoriously difficult to estimate. But, amidst the evolving configuration of macro-fundamentals in India, actual output itself and its future path are overcast with high uncertainty. Consequently, the extent of the slack in the economy due to deficient demand is obscure, although that input is vital for setting the monetary policy stance. 63. In this challenging environment, my call would be for prudence rather than being data-dependent. In its counter-cyclical role, monetary policy has to be pre-emptive in addressing the negative gaps – inflation below target, and output below potential – that seem to be developing some persistence. Available space for policy action has to be calibrated to secure the closure of the gaps. 64. The outlook is fraught with downside risks, but the prospects for agriculture have brightened and along with industry’s inventory restocking requirements in the festival season, scope opens up for reviving spending. In this endeavour, interest rate smoothing is the preferred approach: reinforcing the policy intent with successive steps so as to obviate monetary policy surprises; nudging transmission to bank deposit and lending rates with repetitive but calibrated policy actions in the same direction that also offset the risk premium that appears to be building up in several sectors of the economy. 65. In my minutes at the time of the June 2019 meeting of the MPC, I had emphasised that while monetary policy is taking the lead as the first line of defence, a full throttle effort by all arms of macroeconomic management is the need of the hour. Over recent weeks, monetary and fiscal actions have been undertaken, and it is important to buttress this coordinated endeavour. 66. Accordingly, I vote for a 25 basis points reduction in the policy rate while maintaining an accommodative policy stance until economic activity in India is reinvigorated and firmly on the path of recovery. Statement by Shri Bibhu Prasad Kanungo 67. GDP growth at 5 per cent for Q1 of 2019-20 was a surprise as it significantly undershot the Reserve Bank’s projection of 5.8 per cent. This is particularly a cause of concern because it was caused by a sharp slowdown in private consumption expenditure. Investment activity remained weak, and exports contracted reflecting weak global demand. Growth continued to lose momentum in Q2 as reflected in high frequency indicators. Industrial production growth moderated in July relative to the corresponding month of last year mainly due to sluggish manufacturing activity. Capacity utilisation in the manufacturing sector declined in the last round of the RBI’s survey. The core sector contracted in August. PMI manufacturing remained unchanged in September. Information gleaned through the forward-looking surveys of the RBI indicate deterioration in the industrial outlook in Q2 with downbeat expectations for Q3, especially relating to production, new orders and employment. 68. Most services sector indicators relating to rural and urban demand, transport and construction activity declined/contracted in July-August. PMI services slipped into contraction zone in September 2019 due to a decline in fresh orders. 69. The silver lining in the evolving growth dynamics was provided by agriculture, supported by a sharp catch up in rainfall after a delayed start. The first advance estimates of kharif crops are broadly comparable with those of the last year (fourth advance estimates). The live storage of water in major reservoirs at 121 per cent of the average storage level over the last ten years bodes well for agriculture and rural incomes. 70. CPI inflation remained soft in July-August, though there was a pick-up in food inflation, as expected. Food prices are likely to moderate once new kharif crops arrive in the market. Fuel inflation moved deeper into deflation reflecting the decline in prices of liquified petroleum gas (LPG) in the international market. CPI inflation excluding food and fuel continued to soften reflecting possibly the slowdown of economic activity. Inflation expectations of households increased during the latest round of RBI’s survey, in response to the recent rise in food inflation. CPI inflation projection has been revised marginally upwards for Q2 of 2019-20 at 3.4 per cent (as against 3.1 per cent projected at the time of the August 2019 policy) but has been retained for other quarters as in the August policy – 3.5-3.7 per cent for the second half of 2019-20 and 3.6 per cent for the first quarter of 2020-21. 71. The cumulative repo rate reduction of 110 bps effected since February 2019 has resulted in 29 bps reduction in weighted average lending rate (WALR) on fresh rupee loans till August, which is much lower than expected. However, with the adoption of external benchmarking in pricing of loans by banks for lending to SME and personal loans effective October 1, 2019, monetary transmission is expected to improve. 72. To summarise, the slowdown of GDP growth in the recent period has been underpinned by deficient domestic demand. The recent measures initiated by the government should be helpful in supporting domestic demand, especially investment. While the impact of past policy rate cuts by the MPC is expected to transmit to the real sector gradually, there is a need to reinforce the past monetary policy measures and the recent steps taken by the government in supporting domestic demand. As inflation is projected to remain below the target of 4 per cent till the first quarter of 2020-21, policy space is available to support growth. I, therefore, vote for reducing the policy repo rate by 25 bps and continue with an accommodative monetary policy stance until the economy is on a revival path, within the mandate of flexible inflation targeting. Statement by Shri Shaktikanta Das 73. Economic activity has weakened further since the last MPC meeting in August 2019 with growth for Q1:2019-20 turning out to be 5 per cent. Various high frequency indicators show that economic activity remained weak in Q2. Inflation has evolved broadly along the projected lines and remains benign; while food inflation has edged up further in the last two months reflecting the sharper than expected increase in food prices, CPI inflation excluding food and fuel has moderated consistent with the slowing down of the economy. The global economy continued to lose traction with high frequency indicators in both the advanced and emerging market economies weakening further in Q3:2019, dragged down by escalating trade tensions and rising geo-political uncertainties. Central banks across the advanced and emerging market economies have adopted more accommodative stances of monetary policy to bolster their economies. 74. Headline CPI inflation edged up marginally in August, driven by an upward movement in food inflation reflecting the sharp summer uptick in prices of vegetables and a pick-up in pulses inflation. The increase in prices of vegetables this year was higher than that in last two years, but it was still in line with the long-term average. Fuel inflation moved further into deflation caused by a decline in prices of liquified petroleum gas (LPG). Inflation excluding food and fuel moderated in August, reversing the increase in the previous month; the moderation was broad-based, which more than offset the sharp increase in gold prices. CPI inflation excluding food and fuel moderated by around 90 bps between March and August 2019. Inflation expectations of households in the September round of the Reserve Bank’s survey increased by 40 basis points for a 3-month ahead horizon and 20 basis points for a 12-month ahead horizon. Overall, the near-term inflation scenario remains subdued; CPI inflation projections have been revised slightly upwards to 3.4 per cent for Q2:2019-20 but have been retained at 3.5-3.7 per cent for H2:2019-20 and 3.6 per cent for Q1:2020-21, with risks evenly balanced. 75. Moving on to economic activity, real GDP growth moderated to 5 per cent in the first quarter of 2019-20 as against the projection of 5.8 per cent made in the August policy. Private consumption declined even as investment demand remained weak. The slowdown in industrial activity that began in Q2:2018-19 accentuated further in Q1:2019-20 with manufacturing growth moderating to 0.6 per cent. High frequency indicators suggest that economic activity remained weak in Q2:2019-20. Industrial production growth decelerated in July 2019 in comparison with the same month of last year, while the output of eight core industries contracted in August. The slowing domestic demand was also reflected in shrinkage in non-oil non-gold imports in July-August. The manufacturing PMI for September 2019 was flat. High frequency indicators suggest that services sector activity also remained weak in July-August. Key indicators of both rural demand, viz., tractors and motor cycles sales, and urban demand such as passenger vehicles sales contracted in July-August. 76. On the positive side, the first advance estimates of major kharif crops for 2019-20 are broadly in line with the last year’s fourth advance estimates. More importantly, the prospects for the rabi 2019-20 season have brightened with the improved position of the live storage of water in major reservoirs. This portends well for the farm sector, and the revival of rural demand. Seasonally adjusted capacity utilisation in the manufacturing improved marginally from 74.5 per cent in Q4:2018-19 to 74.8 per cent in Q1:2019-20 in the last round of the Reserve Bank’s survey. This was close to the long-term average, reflecting intensive use of existing capacities. Real GDP growth for 2019-20 has now been revised downwards from 6.9 per cent in the August policy to 6.1 per cent – 5.3 per cent in Q2:2019-20 and in the range of 6.6-7.2 per cent for H2:2019-20 – with risks evenly balanced; GDP growth for Q1:2020-21 has also been revised downwards to 7.2 per cent. 77. Overall liquidity in the system remained in surplus in August and September. However, monetary transmission has remained weak. As against the cumulative policy repo rate reduction of 110 bps during February-August 2019, the weighted average lending rate (WALR) on fresh rupee loans of commercial banks declined by 29 bps. The WALR on outstanding rupee loans, in contrast, increased by 7 basis points. However, with the external benchmark framework coming into force from October 1, the transmission is expected to improve in the coming weeks and months. 78. Overall, domestic demand has moderated significantly. The weakening of private consumption, which for long has been the bedrock of aggregate demand, in particular, is a matter of concern. Private investment has also lost traction, with the corporate sector reluctant to make fresh investments even though capacity utilisation in the manufacturing sector has operated close to the long-term average in the recent period. The unsettled global environment in the face of rising trade tensions has impacted India’s exports, besides delaying the revival of private investment by creating uncertainty. In this environment, it is important to focus on strengthening domestic demand. The MPC has cumulatively reduced the policy repo rate by 110 basis points since the February 2019 policy and changed the stance from neutral to accommodative in the June policy. Systemic liquidity has been in surplus since June 2019. As stated earlier, the introduction of lending rates linked to an external benchmark should result in better monetary transmission. 79. The government has also initiated several measures in recent months which, together with monetary easing by the Reserve Bank, are gradually expected to work their way through the real economy. At the same time, continuing slowdown of the economy requires all out efforts to strengthen private consumption and investment. There is also a need to be watchful of the fiscal situation; however, the government has indicated that it would maintain the fiscal deficit. As the inflation scenario remains benign with headline inflation projected at below target in the remaining period of 2019-20 and Q1:2020-21, there is policy space to address growth concerns. Hence, I vote for reducing the policy repo rate by 25 basis points. With this, the policy repo rate would cumulatively stand reduced by 135 basis points in eight months. I also vote for persevering with the accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target. This enhanced forward guidance on the stance of monetary policy should strengthen monetary transmission and support the real economy. (Yogesh Dayal) Press Release: 2019-2020/987 | ||||||||||||||||||||||||

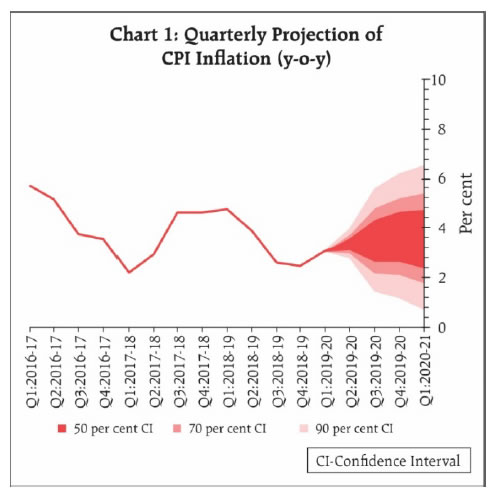

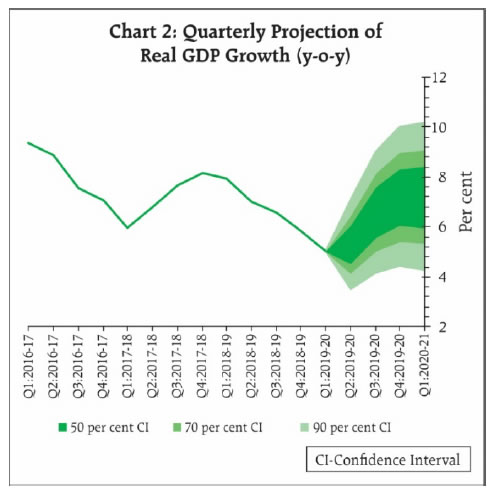

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: