IST,

IST,

Minutes of the Monetary Policy Committee Meeting October 3-5, 2018

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The thirteenth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held from October 3-5, 2018 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, former Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

Consequently, the reverse repo rate under the LAF remains at 6.25 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. 6. The decision of the MPC is consistent with the stance of calibrated tightening of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 7. Since the last MPC meeting in August 2018, global economic activity has remained resilient in spite of ongoing trade tensions, but is becoming uneven and the outlook is clouded by several uncertainties. Among advanced economies (AEs), the United States (US) economy appeared to have sustained pace in Q3:2018 as reflected in strong retail sales and robust industrial activity. In the Euro area, economic activity remained subdued due to overall weak economic sentiment, weighed down mainly by political uncertainty. The Japanese economy has so far maintained the momentum of the previous quarter, buoyed by recovering industrial production and strong business optimism. 8. Economic activity in major emerging market economies (EMEs) has been facing headwinds from both global and country-specific factors. In China, industrial production growth has moderated with slowing exports and the ongoing deleveraging of the financial system weighing on growth prospects. The Russian economy has been gathering steam with the manufacturing sector turning around, and the employment scenario remaining upbeat on rising oil prices. In Brazil, economic activity is recovering from the setback in Q2, supported by improving business and consumer sentiment, though weak domestic demand and the sluggish pace of recovery in manufacturing activity point to a slow revival. The South African economy slipped into recession in Q2:2018, pulled down by the negative contribution from agriculture on account of a strong unfavourable base effect. 9. Growth in global trade is weakening as reflected in export orders and automobile production and sales. Crude oil prices eased during the first half of August on concerns of reduced demand from EMEs due mainly to the spillover from country-specific turmoil, and accentuated by rising supplies. However, prices rebounded on expectation of reduced supplies due to sanctions on Iran and falling US stockpiles. Base metal prices witnessed selling pressure in anticipation of weak demand from major economies. Gold prices continued to slide lower on a strong US dollar, though they recovered somewhat on safe-haven demand from the mid-August lows. Inflation remained firm in the US, reflecting tightening labour market and elevated energy prices, while it persisted much below the central bank’s target in Japan. In the Euro area, inflation pressures have been sustained by elevated crude prices. Inflation in many key EMEs has risen on surging crude prices and currency depreciations, caused by a firm dollar and domestic factors. 10. Global financial markets continued to be affected by monetary policy stances in major AEs, the spreading of contagion risks from specific EMEs, and geopolitical developments. Among AEs, equity markets in the US touched a new high, driven by technology stocks, while in Japan, they were boosted by the weak yen. In contrast, stock markets in the Euro area suffered losses on signs of a slowdown and budget concerns in some member states. Sharp sell-offs have occurred on waning appetite of foreign portfolio investors for EME equities. The 10-year sovereign yield in the US has traded sideways, falling on dovish Fed guidance only to recover by end-September on robust economic data. Among other AEs, bond yields in the Euro area hardened in September on risk aversion following the sharp rise in financial market volatility in August. In contrast, bond yields in Japan moved in a narrow range, driven by the central bank’s yield curve management policy. In most EMEs, yields rose due to domestic factors and/or contagion effects from the stress in other EMEs. In currency markets, the US dollar witnessed selling pressures since August on reduced investor expectations of rate hikes by the US Fed. However, it recovered in the last week of September on a rate hike by the Fed and strong economic data. The euro remained in bearish territory due to fiscal risks in some member countries and expectations of weak growth. EME currencies continued to depreciate against the US dollar. 11. On the domestic front, real gross domestic product (GDP) growth surged to a nine-quarter high of 8.2 per cent in Q1:2018-19, extending the sequential acceleration to four successive quarters. Of the constituents, gross fixed capital formation (GFCF) expanded by double digits for the second consecutive quarter, driven by the government’s focus on the road sector and affordable housing. Growth in private final consumption expenditure (PFCE) accelerated to 8.6 per cent, reflecting rising rural and urban spending, supported by retail credit growth. However, government final consumption expenditure (GFCE) decelerated, largely due to a high base. The growth of exports of goods and services jumped to 12.7 per cent, powered by non-oil exports on the back of strong global demand. In spite of import growth continuing to surge, high exports growth helped reduce the drag from net exports on aggregate demand. 12. On the supply side, growth of gross value added (GVA) at basic prices accelerated in Q1, underpinned by double-digit expansion in manufacturing activity which was robust and generalised across firm sizes. Agricultural growth also picked up, supported by robust growth in production of rice, pulses and coarse cereals alongside a sustained expansion in livestock products, forestry and fisheries. In contrast, services sector growth moderated somewhat, largely on account of a high base. Construction activity, however, maintained strong pace for the second consecutive quarter. 13. The fourth advance estimates of agricultural production for 2017-18 released in August placed foodgrains production at a high of 284.8 million tonnes, 1.9 per cent higher than the third advance estimates (released in May 2018) and 3.5 per cent higher than the final estimates for the previous year. The progress of the south-west monsoon has been marked by uneven spatial and temporal distribution, with an overall deficit of 9 per cent in precipitation. However, the first advance estimates of production of major kharif crops for 2018-19 have placed foodgrains production at 141.6 million tonnes, 0.6 per cent higher than last year’s level. The live storage in major reservoirs (as on September 27) rose to 76 per cent of the full capacity, which was 17 per cent higher than last year and 5 per cent higher than the average of the last 10 years. This bodes well for the rabi sowing season. 14. Industrial growth, measured by the index of industrial production (IIP), accelerated in June-July 2018 on a year-on-year (y-o-y) basis, underpinned mainly by high growth in consumer durables, notably two-wheelers, readymade garments, stainless steel utensils, auto components and spares, and accessories. Growth in consumer non-durables also accelerated in July. The infrastructure and construction sector continued to show solid growth. Primary goods growth accelerated, driven by mining, electricity and petroleum refinery products. Growth in capital goods production spiked in June, but decelerated sharply in July. The output of eight core industries growth remained strong in July, driven by coal, petroleum refinery products, steel and cement, but moderated in August. Capacity utilisation (CU) declined from 75.2 per cent in Q4:2017-18 to 73.8 per cent in Q1:2018-19, while seasonally adjusted CU increased by 1.8 percentage points to the long-term average of 74.9 per cent. Based on the Reserve Bank’s business expectations index (BEI), the assessment for Q2:2018-19 improved, led by enhanced production, order books, exports and capacity utilisation. The August and September manufacturing purchasing managers’ index (PMI) remained in expansion zone; the September print rebounded close to the July level confirming robustness of manufacturing activity. 15. High-frequency indicators of services in July and August present a mixed picture. Indicators of rural demand, viz., growth in tractor and two-wheeler sales, slowed down. Passenger vehicle sales, an indicator of urban demand, declined possibly due to rising fuel prices. However, growth in air passenger traffic – another indicator of urban demand – remained robust. Transportation sector indicators, viz., commercial vehicle sales and port cargo, expanded at an accelerated pace. Steel consumption and cement production, indicators of construction activity, showed strong growth. The services PMI remained in expansion zone in August and September, though it decelerated from July, with slower expansion in new business and employment. 16. Retail inflation, measured by the y-o-y change in the CPI, fell from 4.9 per cent in June to 3.7 per cent in August, dragged down by a decline in food inflation. Some softening of inflation in items other than food and fuel also contributed to the decline. Adjusting for the estimated impact of an increase in house rent allowance (HRA) for central government employees, headline inflation was at 3.4 per cent. 17. Inflation in the food and beverages group declined sharply in the absence of seasonal uptick in prices of fruits and vegetables. Of the three key vegetables, the prices of tomatoes declined due to strong mandi arrivals, while those of onions and potatoes remained muted. Continued deflation in prices of pulses and sugar accentuated the decline in food inflation. Inflation in other items of food – cereals, meat and fish, milk, spices and non-alcoholic beverages – remained benign. 18. Inflation in the fuel and light group continued to rise on the back of a significant increase in liquefied petroleum gas prices, tracking international product prices. Kerosene prices rose as oil marketing companies reduced subsidies in a calibrated manner. While remaining elevated, CPI inflation excluding food and fuel moderated due to softening in inflation in housing; pan, tobacco and intoxicants; personal care; and transportation. 19. While the September round of the Reserve Bank’s survey of households reported a sharp uptick of 50 basis points in three-month ahead inflation expectations over the last round, one-year ahead expectations moderated by 30 basis points. Inflation expectations for both input prices and selling prices of manufacturing firms, polled by the Reserve Bank’s industrial outlook survey, firmed up in Q2:2018-19. The manufacturing and services PMIs also reported an increase in input costs and selling prices in Q2, reflecting a pass-through of higher costs to clients. On the other hand, growth in wages in the rural and organised manufacturing sectors remained contained. 20. Systemic liquidity alternated between surplus and deficit during August-September 2018, reflecting the combined impact of expansion of currency in circulation, Reserve Bank’s forex operations and movements in government cash balances. From a daily net average surplus of ₹201 billion during August 1-19, 2018, liquidity moved into deficit during August 20-30. After turning into surplus during August 31-September 10 due to increased government spending, the system again moved into deficit during September 11-29 on the back of an increase in government cash balances and Reserve Bank’s forex interventions. Based on an assessment of the evolving liquidity conditions, the Reserve Bank conducted two open market purchase operations in the second half of September to inject ₹200 billion of durable liquidity. LAF operations absorbed, on a daily net average basis, ₹30 billion in August, but injected ₹406 billion in September. The weighted average call rate (WACR), on an average, traded below the repo rate by 15 basis points (bps) in August and by 4 bps in September. 21. Exports maintained double digit growth in July and August 2018, driven mainly by petroleum products (which benefitted from elevated crude oil prices), engineering goods, gems and jewellery, drugs and pharmaceuticals, and chemicals. However, imports grew faster than exports, reflecting not only a higher oil import bill, but also higher imports of gold, coal, electronic goods and machinery. This led to a widening of the trade deficit to US$ 35.3 billion in July-August 2018 from US$ 24.6 billion a year ago over and above the expansion in Q1:2018-19. However, higher net services receipts and private transfer receipts helped contain the current account deficit to 2.4 per cent of GDP in Q1:2018-19 from 2.5 per cent a year ago. On the financing side, net foreign direct investment (FDI) flows improved in April-July 2018. By contrast, foreign portfolio investors have been net sellers in both the equity and debt segments so far on a cumulative basis in 2018-19 due to higher US interest rates, risk-off sentiment in EMEs and escalation of trade wars. India’s foreign exchange reserves were at US$ 400.5 billion on September 28, 2018. Outlook 22. In the third bi-monthly resolution of August 2018, CPI inflation was projected at 4.6 per cent in Q2:2018-19, 4.8 per cent in H2 and 5.0 per cent in Q1:2019-20, with risks evenly balanced. Excluding the HRA impact, CPI inflation was projected at 4.4 per cent in Q2:2018-19, 4.7-4.8 per cent in H2 and 5.0 per cent in Q1:2019-20. Actual inflation outcomes, especially in August, were below projections as the expected seasonal increase in food prices did not materialise and inflation excluding food and fuel moderated. 23. Going forward, the inflation outlook is expected to be influenced by several factors. First, food inflation has remained unusually benign, which imparts a downward bias to its trajectory in the second half of the year. Inflation in key food items such as pulses, edible oils, sugar, fruits and vegetables remains exceptionally soft at this juncture. The risk to food inflation from spatially and temporally uneven rainfall is also mitigated, as confirmed by the first advance estimates that have placed production of major kharif crops for 2018-19 higher than last year’s record. An estimate of the impact of an increase in minimum support prices (MSPs) announced in July has been factored in the baseline projections. Secondly, the price of the Indian basket of crude oil has increased sharply, by US$ 13 a barrel, since the last resolution. Thirdly, international financial markets remained volatile with EME currencies depreciating significantly. Finally, the HRA effect came off its peak in June and is dissipating gradually on expected lines. Taking all these factors into consideration, inflation is projected at 4.0 per cent in Q2:2018-19, 3.9-4.5 per cent in H2 and 4.8 per cent in Q1:2019-20, with risks somewhat to the upside (Chart 1). Excluding the HRA impact, CPI inflation is projected at 3.7 per cent in Q2:2018-19, 3.8 - 4.5 per cent in H2 and 4.8 per cent in Q1:2019-20. 24. Turning to the growth outlook, the GDP print of Q1:2018-19 was significantly higher than that projected in the August resolution. Private consumption has remained robust and is likely to be sustained even as the recent rise in oil prices may have a bearing on disposable incomes. Improving capacity utilisation, larger FDI inflows and increased financial resources to the corporate sector augur well for investment activity. However, both global and domestic financial conditions have tightened, which may dampen investment activity. Rising crude oil prices and other input costs may also drag down investment activity by denting profit margins of corporates. This adverse impact will be alleviated to the extent corporates are able to pass on increases in their input costs. Uncertainty surrounds the outlook for exports. Tailwinds from the recent depreciation of the rupee could be muted by the slowing down of global trade and the escalating tariff war. Based on an overall assessment, GDP growth projection for 2018-19 is retained at 7.4 per cent as in the August resolution (7.4 per cent in Q2 and 7.1-7.3 per cent in H2), with risks broadly balanced; the path in the August resolution was 7.5 per cent in Q2:2018-19 and 7.3-7.4 per cent in H2. GDP growth for Q1:2019-20 is now projected marginally lower at 7.4 per cent as against 7.5 per cent in the August resolution, mainly due to the strong base effect (Chart 2). 25. While the projections of inflation for 2018-19 and Q1:2019-20 have been revised downwards from the August resolution, its trajectory is projected to rise above the August 2018 print. The outlook is clouded with several uncertainties. First, the government announced in September measures aimed at ensuring remunerative prices to farmers for their produce, although uncertainty continues about their exact impact on food prices. Secondly, oil prices remain vulnerable to further upside pressures, especially if the response of oil-producing nations to supply disruptions from geopolitical tensions is not adequate. The recent excise duty cuts on petrol and diesel will moderate retail inflation. Thirdly, volatility in global financial markets continues to impart uncertainty to the inflation outlook. Fourthly, a sharp rise in input costs, combined with rising pricing power, poses the risk of higher pass-through to retail prices for both goods and services. Firms covered under the Reserve Bank’s industrial outlook survey report firming of input costs in Q2:2018-19 and Q3. However, global commodity prices other than oil have moderated, which should mitigate the adverse influence on input costs. Fifthly, should there be fiscal slippage at the centre and/or state levels, it will have a bearing on the inflation outlook, besides heightening market volatility and crowding out private sector investment. Finally, the staggered impact of HRA revision by the state governments may push up headline inflation. While the MPC will look through the statistical impact of HRA revisions, there is need to be watchful for any second-round effects on inflation. The inflation outlook calls for a close vigil over the next few months, especially because the output gap has virtually closed and several upside risks persist. 26. Against this backdrop, the MPC decided to keep the policy repo rate unchanged. The MPC reiterates its commitment to achieving the medium-term target for headline inflation of 4 per cent on a durable basis. 27. The MPC notes that global headwinds in the form of escalating trade tensions, volatile and rising oil prices, and tightening of global financial conditions pose substantial risks to the growth and inflation outlook. It is, therefore, imperative to further strengthen domestic macroeconomic fundamentals. 28. Regarding the policy repo rate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of keeping the policy repo rate unchanged. Dr. Chetan Ghate voted for an increase in the policy rate by 25 bps. 29. Regarding the stance, Dr. Pami Dua, Dr. Chetan Ghate, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of changing the stance to calibrated tightening. Dr. Ravindra H. Dholakia voted to keep the neutral stance unchanged. The minutes of the MPC’s meeting will be published by October 19, 2018. 30. The next meeting of the MPC is scheduled from December 3 to 5, 2018. Voting on the Resolution to keep the policy repo rate unchanged at 6.5 per cent

Statement by Dr. Chetan Ghate 31. Anchoring inflationary expectations, which are shaped by the target, is extremely important in an inflation targeting regime. If there is substantial deviation of inflationary expectations in relation to the target, by failing to react with the policy interest rate, we will lose credibility and reduce our capacity to influence expectations. 32. While I am comforted by the decline in median inflationary expectations of households for the 1-year ahead horizon by 30 bps in the last RBI’s survey, the median 1-year ahead expectations are now higher by 180 basis points over the September 2017 round. Meanwhile, the three-month median inflationary expectations increased by 50 bps compared to the previous round, with a cumulative increase of about 220 basis points over the September 2017 round. 33. What makes these cumulative increases in inflationary expectations salient, is that they risk being unanchored by both the 7% nominal depreciation in the INR and the USD 13 a barrel increase in the price of oil, since the August 2018 policy. Another factor is the nature and scope of MSP implementation, details of which are still not clear. My own projections with the above variables suggest that these factors will push inflation beyond the Q1 FY19-20 projection of 4.8% made by the RBI. Doing so risks the possibility of the un-anchoring of inflationary expectations which will impair our ability to keep headline inflation durably at 4%. 34. There has been a slight moderation in CPI inflation, excluding food and fuel to 6.0% in August, from 6.2% in July, which is comforting. The elevated value of ex food and fuel inflation is consistent with a nearly-closed output gap which should be carefully watched. 35. On the growth front, the Q1 of 18-19 GDP growth at 8.2% was strong. GVA growth was also strong at 8% (compared to 7.6% in Q4 17-18). Sectoral growth patterns in agriculture, manufacturing, and services in Q1 of 18-19 numbers were robust. Capex good production remains resilient, and the growth in consumer non-durables, which was lack-luster before, has picked up. 36. These numbers are confirmed by RBI’s own surveys. Demand conditions in the manufacturing sector continued to improve with the latest round of the RBI industrial outlook survey (of 1095 manufacturing companies) showing strong sentiments on production and order books. The RBI’s enterprise survey, OBICUS, based on a survey of 994 companies, showed a seasonally adjusted increase in capacity utilization at a 20-quarter high. Firms expect demand conditions to improve in Q3 FY 18-19 on the back of improved business expectations. Higher inventories indicate that producers are stocking up in anticipation of higher demand in coming quarters. Upward pressure on input and staff costs continue to push up selling prices, posing a risk to headline inflation. The most recent PMI manufacturing corroborates this, showing an uptick in input prices and output prices, although the pass through is lower. 37. What worries me on the pick up in growth is the dismal consumer confidence numbers, with consumer confidence in Q2 FY 18-19 worsening. Ideally, in a growing economy, the durability of growth is better sustained if it is supported by growing consumer confidence. Notwithstanding this, I continue to remain sanguine about current and medium term growth prospects as in the last policy. 38. Despite the two hikes in the policy rate in the last two policies, the data since August risks impairing our ability to keep headline inflation durably at 4%. I say this fully cognizant of the trade-off facing the MPC: moving too quickly and needlessly shortening the growth turnaround or, calibrating the rate hikes too slowly, and risking an over-heating in an economy with a nearly closed output gap. Given the strong possibility of the un-anchoring of inflationary expectations for the reasons given above, the appropriate “risk-management approach” would be to act now. We should not allow the commitment to the 4% target to be flexible. 39. I vote for an increase in the policy repo rate by 25 basis points at today’s meeting of the Monetary Policy Committee. I also vote for a change in the stance from “neutral” to “calibrated tightening”. Statement by Dr. Pami Dua 40. Headline inflation softened to 3.7 per cent in August from 4.2 per cent in July and 4.9 per cent in June, mainly due to the drop in food inflation from 3.1 per cent in June to 1.7 per cent in July and 0.9 per cent in August. Headline inflation adjusted for the estimated impact of an increase in house rent allowance (HRA) of central government employees (as per RBI’s calculations) also moderated from 4.6 per cent in June to 3.4 per cent in August, while CPI excluding food and fuel and adjusted for the impact of an increase in HRA fell from 5.7 per cent in June to 5.4 per cent in August. At the same time, various surveys provide mixed signals regarding inflation expectations. The September round of the Reserve Bank’s Survey of Households points towards an increase of 50 basis points in three-month-ahead inflation expectations but a moderation of 30 basis points in one-year-ahead expectations. The July-September round of the Reserve Bank’s Industrial Outlook Survey indicates that manufacturing firms expect higher cost of raw materials, input prices and selling prices. The manufacturing and services PMIs also signal a similar trend. 41. Looking forward, the downside risks to the inflation outlook include benign food inflation. The recent cuts in excise duty on petrol and diesel are expected to moderate retail inflation. However, crude oil prices have escalated and the rupee has weakened considerably, with potential pass-through effects on inflation. Moreover, with EME currencies depreciating against the US dollar, volatility in global financial markets continues to impart uncertainty to the inflation outlook. Additionally, fiscal slippages by the government may have adverse implications for market volatility, and may crowd out private investment and impact the outlook for inflation. The upside risks associated with an increase in minimum support prices (MSPs) and the HRA still persist, although the latter has somewhat moderated. Risks due to an increase in state level HRAs and input prices also prevail. Thus, there is considerable uncertainty with respect to the inflation outlook. 42. On the output side, GDP growth in the first quarter of 2018-19 was strong, with robust growth in private consumption. However, downside risks to investment activity include an increase in input prices and crude oil prices and tightening of global and domestic financial conditions, including the recent developments in the non-banking sector. Despite a depreciating rupee, growth in exports may also be hampered due to geopolitical risks, trade war and slowing global economy. 43. Indeed, growth in the Indian Leading Export Index, a predictor of the direction of exports growth maintained by the Economic Cycle Research Institute (ECRI), New York, remains in the doldrums, indicating an unfavourable Indian export growth outlook. This is consistent with weakening growth in ECRI’s 20-country composite Long Leading Index, which still points to a global growth slowdown. However, growth in ECRI’s Indian Leading Index, a harbinger of future economic activity, has firmed lately, pointing to somewhat improved economic growth prospects. 44. In sum, while inflation has softened, upside risks to inflation remain, along with some downside risks to output growth. The policy repo rate has already been increased in the past two consecutive meetings of the MPC (June and August), each time by 25 basis points. Due to the transmission lags, the effects of these may take time to play out. It is therefore best to pause and wait and watch while maintaining a vigil on inflation. I therefore vote for keeping the policy repo rate unchanged. At the same time, given the upside risks to inflation, I also vote for a change in the stance from neutral to calibrated tightening. Statement by Dr. Ravindra H. Dholakia 45. In the last meeting of the MPC in August 2018, I had clearly mentioned that, if the RBI’s inflation forecast for July and August substantially exceeded the actual reading, its medium term forecast would also have to be revised downward substantially. As expected, this has happened. The RBI forecast for the headline CPI inflation in July and August 2018 turned out to be significantly higher than the actual readings. Similar deviations had occurred even for the RBI’s May and June 2018 headline inflation forecasts. RBI has, therefore, revised its short to medium term forecast of headline inflation significantly downward even after considering revisions in its baseline scenario of higher oil prices and exchange rate. As I had argued in the last meeting, moreover, the household inflationary expectations 12 months ahead have come down (by 30 bps) as per the latest RBI survey. The growth forecast for the Indian economy considering both the latest upside and downside risks has remained the same (7.4 percent) as during the previous meeting of MPC in August 2018 when the MPC decided by a 5-1 majority vote to hike the policy rate pre-emptively by 25 bps. Therefore, now there is no case for any hike in the policy rate this time. This is the time for a pause to allow the consecutive rate hikes to sink in the system and settle down. I, therefore, vote for status quo on both the policy rate and the neutral stance. More specific reasons for my vote are:

46. Considering all these points, status quo in both the neutral stance and policy rate at this point is the best option. Statement by Dr. Michael Debabrata Patra 47. In its third bi-monthly resolution of August, the MPC had expected inflation to ease in the second quarter of 2018-19 and had brought down its forecast for that quarter by 30 basis points relative to the projection in June. In my minutes in August, I anticipated the soft inflation readings that came in for July and August: “The forecast – the intermediate target that provides a proximate view of how the goal variables are forming – suggests that inflation is likely to encounter a soft patch in the second quarter, but it will resume an upward trajectory in the second half of the year.” I also warned that “the softer inflation prints expected in Q2 could likely lull inflation expectations, but abundant precaution and decisiveness in quelling risks to the target is warranted if the hard-earned gains in terms of macroeconomic stability and credibility have to be preserved.” 48. Thus, the projections turned out to be directionally correct, although they overestimated the levels of inflation in these months. 49. In view of the reasonable reliability of the forecasts in terms of direction, inflation appears to have troughed and is projected to rise from September, exceeding the target from the fourth quarter of 2018-19 and the first quarter of 2019-20 in an environment suffused with upside risks. Disconcertingly, global risks to inflation from crude prices and financial market turbulence are materialising on an ongoing basis. Corporate finances suggest that it is only a matter of time before firms pass through heightened input costs more aggressively into selling prices. Food inflation is imparting a downside under the influence of a deep cyclical downswing in the prices of some constituents and irregular downturns in others. 50. Meanwhile, aggregate domestic demand, as measured by GDP growth, appears to have quickened on to a higher trajectory (8 per cent) during January-June 2018. Slack has been pulled in and capacity utilisation is getting stretched. Rural and urban spend is strengthening to a point where aggregate demand, especially private consumption, is likely running ahead of the supply response, even as the outlook for agriculture, manufacturing and construction is brightening and a gradual upturn is taking hold in various services sectors. 51. The evolving macroeconomic configuration warrants an appropriate policy response. With the downward level shift in the projections relative to the August resolution, especially during January-June 2019, it is reasonable to keep the policy rate on hold in this meeting and to monitor the cumulative 50 basis points increase in June and August as it works its way through the economy. Stakeholders are anticipating this transmission – households have lowered their expectations of one year ahead inflation, while professional forecasters have revised downwards their outer forecasts of headline inflation. Yet, inflation is set to rise over the period ahead in an environment in which the balance of risks is shifting to the upside. Monetary policy needs to move to high alert, and this needs to be reflected in a pro-active policy stance. Overarchingly, monetary policy needs to stay focused on its mandate – the target of 4 per cent inflation, while keeping in mind the objective of growth – within the RBI’s overall policy framework that assigns appropriate instruments to goals in order to secure efficient policy outcomes. 52. I vote for status quo on the policy rate and a change in stance to “calibrated tightening”. Statement by Dr. Viral V. Acharya 53. Since the August policy, food inflation has surprised dramatically on the downside. Seasonal pickup in prices of vegetables and fruits in summer months was simply missing due to a combination of increased mandi arrivals, export policies and other supply management measures. This, coupled with a normal monsoon, has shifted RBI's food inflation projections significantly downward. 54. Elsewhere, fuel inflation continues its rapid upward march. While inflation excluding food and fuel has eased marginally due to lower momentum in certain goods and services, it remains at elevated levels. International crude oil prices keep surging as Iran sanctions approach, creating a difficult choice between pass-through to the pump prices and fiscal or quasi-fiscal absorption through excise cuts. The rising oil prices also coincide with the misfortune of weaker current account balance, inducing financial market volatility which raises imported inflation, though the direct impact of oil price on inflation via the consequent fare price impact is much larger. The worry is that this could generalise quickly through transportation and freight costs – input costs – that could get passed on to selling prices as capacity utilisation is improving and pricing power is returning to firms. 55. While there was mild softening in the 12-month ahead inflation expectations of households between the June 2018 and September 2018 rounds of RBI’s surveys, the 3-month expectations showed a sharp uptick. I am particularly concerned about the near 200 basis points increase in the 3-month and 12-month inflation expectations of households, based on the surveys of September 2017 to September 2018. Households are telling us that their inflation outlook has moved palpably upwards. Business expectations of headline inflation as well as input costs are showing similar trends, rising steadily in RBI's and other surveys. 56. As a result, headline inflation for Q1:2019-20 is projected at 4.8% vis-à-vis the mandated target of 4%, in spite of the benign food inflation outlook. Between the time the projections were finalised for the Monetary Policy Report (specifically, October 1) and today (October 5), oil prices have risen steeply, without any signs of durable supply adjustment amidst strong global demand. 57. Growth has been reasonably buoyant as evidenced by the real economic activity indicators for both the rural economy and the urban counterpart. Our estimates of the output gap suggest it has virtually closed as per the traditional measures; my preferred finance-neutral output gap measure has in fact turned positive due to asset price growth and especially non-food credit growth that is now in excess of the nominal GDP growth rate. 58. In such a milieu, the likelihood of oil prices remaining elevated rules out a rate cut anytime soon. Second round effects of the steep oil price rise can generalise causing inflation expectations to unhinge. Even if pass-through to pump prices is made less than one for one, inflation risk would generalise through fiscal slippage. 59. Given these factors, and given the flexible inflation-targeting mandate of the Monetary Policy Committee (MPC), it seems important to signal commitment to keeping to the mandate and move forward carefully at an appropriate time, allowing the economy to adjust to the past two back-to-back rate hikes while being vigilant of any emerging inflationary pressures. 60. Hence, I vote for not to raise the policy rate but change the stance of monetary policy to one of “calibrated tightening”. Statement by Dr. Urjit R. Patel 61. Headline inflation adjusted for the estimated impact of HRA for central government employees moderated significantly from 4.6 per cent in June 2018 to 3.8 per cent in July and further to 3.4 per cent in August, reversing the trend of previous three months. Food inflation continued to surprise on the downside, declining sharply from 3.1 per cent in June to 0.9 per cent by August in the absence of a seasonal pick up in prices of key vegetables and fruits in summer months. Inflation in items other than food and fuel also moderated due mainly to softening in housing, clothing and transportation. However, inflation in the fuel group increased reflecting higher international petroleum product prices. Overall, actual inflation turnouts in July and August were lower than the projections set out in the August resolution of the MPC. 62. Going forward, excluding the HRA impact, CPI inflation is projected at 3.7 per cent in Q2:2018-19, 3.8-4.5 per cent in H2 and 4.8 per cent in Q1:2019-20. The outlook for inflation continues to face several upside pressures, which include: (i) uncertainty surrounding the impact of the increase in minimum support prices of kharif crops on food inflation; (ii) surge in crude oil prices; (iii) heightened volatility in financial markets of emerging economies; (iv) a further increase in inflation expectations of households at three-month horizon, which when combined with rising input costs, may impact price and wage setting behaviour, though it is comforting that one-year ahead inflation expectations have moderated; (v) the risk of fiscal slippage at the centre and/or state level; and (vi) second round effects on inflation on account of the staggered HRA revisions by various state governments, though the direct statistical impact of HRA revisions will be looked through. 63. The GDP growth print for Q1 of 2018-19 touched a high of 8.2 per cent, driven by robust private consumption and investment activity, suggesting that growth impulses, thus far, continue to be buoyant. The first advance estimates of production of major kharif crops are reassuring, considering spatially and temporally uneven monsoon. Going forward, consumption is expected to be sustained. Though rising oil prices and tightening of financial conditions may have a bearing on investment demand, overall economic activity is expected to be resilient with GDP growth for 2018-19 projected at 7.4 per cent (as in the August resolution). GDP growth for Q1:2019-20 is projected marginally lower at 7.4 per cent vis-à-vis 7.5 per cent in the August resolution. 64. The policy repo rate was raised by 25 basis points each in the last two consecutive meetings of the MPC in June and August. Moderation in inflation in the last two months has lowered the projected inflation trajectory. I vote for keeping the policy repo rate unchanged. Recognising that inflation risks have been persistent, and to reaffirm the commitment to securing the mandated 4 per cent inflation target on a durable basis, it is apposite to change the stance of monetary policy from “neutral” to “calibrated tightening”. “Calibrated tightening” means that in the current rate cycle, a cut in the policy repo rate is off the table, and we are not obliged to increase the rate at every policy meeting. Jose J. Kattoor Press Release : 2018-2019/924 |

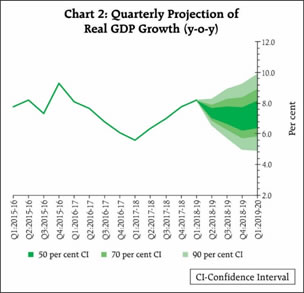

Page Last Updated on: