|

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (December 8, 2023) decided to:

- Keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent.

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

Assessment and Outlook

- Global growth is slowing at a divergent pace across economies. Inflation continues to ebb though it remains above target with underlying inflationary pressures staying relatively stubborn. Market sentiments have improved since the last MPC meeting – sovereign bond yields have declined, the US dollar has depreciated, and global equity markets have strengthened. Emerging market economies (EMEs) continue to face volatile capital flows.

- Domestic economic activity is exhibiting resilience. Real gross domestic product (GDP) grew year-on-year (y-o-y) by 7.6 per cent in Q2:2023-24, underpinned by robust investment and government consumption, which cushioned the drag from net external demand. On the supply side, gross value added (GVA) rose by 7.4 per cent in Q2, driven by buoyant manufacturing and construction activities.

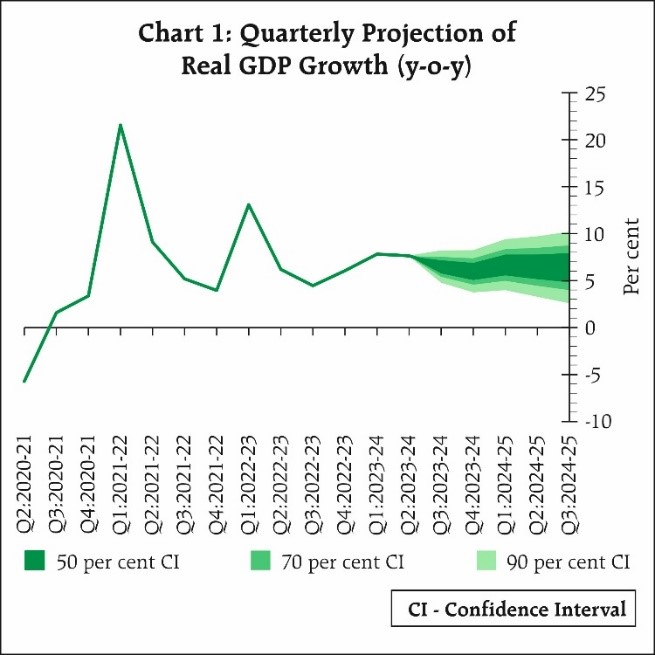

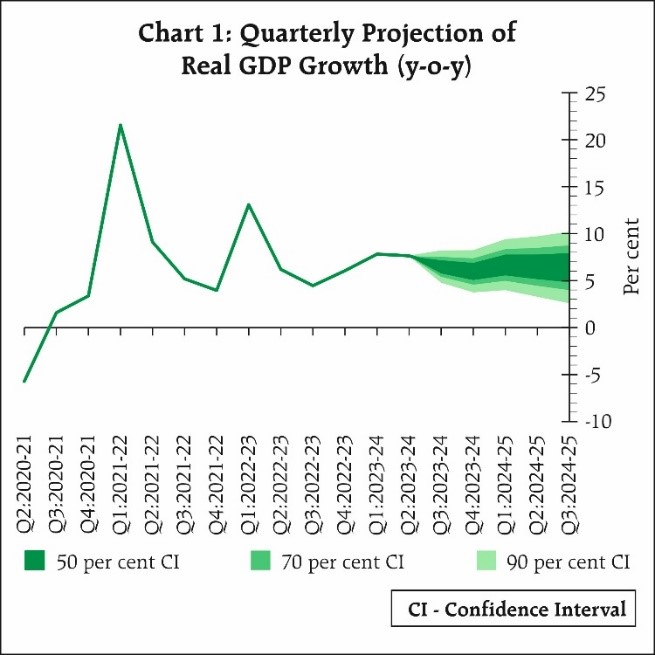

- Continued strengthening of manufacturing activity, buoyancy in construction, and gradual recovery in the rural sector are expected to brighten the prospects of household consumption. Healthy balance sheets of banks and corporates, supply chain normalisation, improving business optimism, and rise in public and private capex should bolster investment going forward. With improvement in exports, the drag from external demand is expected to moderate. Headwinds from the geopolitical turmoil, volatility in international financial markets and geoeconomic fragmentation pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 7.0 per cent with Q3 at 6.5 per cent; and Q4 at 6.0 per cent. Real GDP growth for Q1:2024-25 is projected at 6.7 per cent; Q2 at 6.5 per cent; and Q3 at 6.4 per cent (Chart 1). The risks are evenly balanced.

- CPI headline inflation fell by about 2 percentage points since the last meeting of the MPC to 4.9 per cent in October 2023 on sharp correction in prices of certain vegetables, deflation in fuel and a broad-based moderation in core inflation (CPI inflation excluding food and fuel).

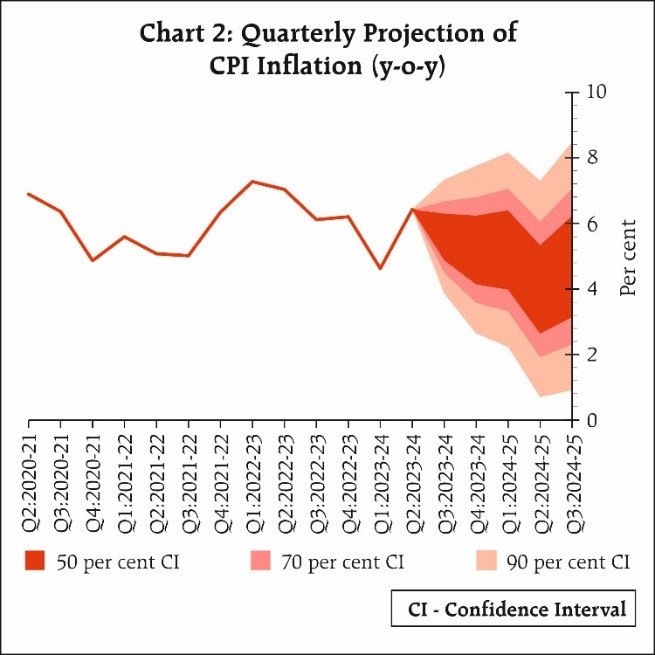

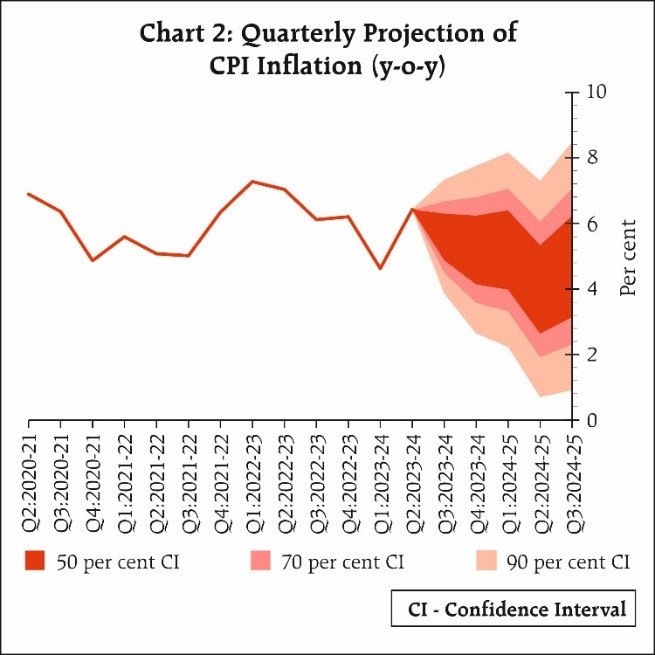

- Uncertainties in food prices along with unfavourable base effects are likely to lead to a pick-up in headline inflation in November-December. Kharif harvest arrivals and progress in rabi sowing together with El Niño weather conditions need to be monitored. Adequate buffer stocks for cereals and a sharp moderation in international food prices, along with pro-active supply side interventions by the Government may keep these food price pressures under check. Crude oil prices may remain volatile. Early results from the firms polled in the Reserve Bank’s enterprise surveys indicate softer growth in input costs and selling prices for the manufacturing firms in Q4 relative to the previous quarter, while price pressures persist for services and infrastructure firms. Taking into account these factors, CPI inflation is projected at 5.4 per cent for 2023-24, with Q3 at 5.6 per cent; and Q4 at 5.2 per cent. Assuming a normal monsoon next year, CPI inflation for Q1:2024-25 is projected at 5.2 per cent; Q2 at 4.0 per cent; and Q3 at 4.7 per cent (Chart 2). The risks are evenly balanced.

- The MPC observed that recurring food price shocks are impeding the ongoing disinflation process. Core disinflation has been steady, indicative of the impact of past monetary policy actions. Headline inflation, however, remains volatile, with possible implications for the anchoring of expectations. Domestic food inflation unpredictability, and volatility in crude oil prices and financial markets in an uncertain international environment pose risks to the inflation outlook. The path of disinflation needs to be sustained. The MPC will carefully monitor any signs of generalisation of food price pressures which can fritter away the gains in easing of core inflation. On the growth front, improved momentum in investment demand along with business and consumer optimism, would support domestic economic activity and ease supply constraints. As the cumulative policy repo rate hike is still working its way through the economy, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting, but with preparedness to undertake appropriate and timely policy actions, should the situation so warrant. Monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission. The MPC will remain resolute in its commitment to aligning inflation to the target. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

- All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent.

- Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution.

- The minutes of the MPC’s meeting will be published on December 22, 2023.

- The next meeting of the MPC is scheduled during February 6-8, 2024.

(Yogesh Dayal)

Chief General Manager

Press Release: 2023-2024/1438

|

IST,

IST,