IST,

IST,

Sixth Bi-monthly Monetary Policy Statement, 2016-17 Resolution of the Monetary Policy Committee (MPC), Reserve Bank of India

On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

Consequently, the reverse repo rate under the LAF remains unchanged at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving consumer price index (CPI) inflation at 5 per cent by Q4 of 2016-17 and the medium-term target of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 2. Global growth is projected to pick up modestly in 2017, after slowing down in the year gone by. Advanced economies (AEs) are expected to build upon the slow gathering of momentum that started in the second half of 2016, led by the US and Japan. However, uncertainty surrounds the direction of US macroeconomic policies with potential global spillovers. Growth prospects for emerging market economies (EMEs) are also expected to improve moderately, with recessionary conditions ebbing in Russia and Brazil, and China stabilising on policy stimulus. Inflation is edging up on the back of rising energy prices and a mild firming up of demand. However, global trade remains subdued due to an increasing tendency towards protectionist policies and heightened political tensions. Furthermore, financial conditions are likely to tighten as central banks in AEs normalise exceptional accommodation in monetary policy. 3. International financial markets turned volatile from mid-January on concerns regarding the ‘Brexit’ roadmap and materialisation of expectations about economic policies of the new US administration. Within the rising profile of international commodity prices, crude oil prices firmed up with the OPEC’s agreement to curtail production. Prices of base metals have also increased on expectations of fiscal stimulus in the US, strong infrastructure spending in China, and supply reductions. Geopolitical concerns have also hardened commodity prices. More recently, the appetite for risk has returned in AEs, buoying equity markets and hardening bond yields as a response to the growing likelihood of further increases in the Federal Funds rate during the year. Coupled with expectations of fiscal expansion in the US, this has propelled the US dollar to a multi-year high. 4. The Central Statistics Office (CSO) released its advance estimates for 2016-17 on January 6, placing India’s real GVA growth at 7.0 per cent for the year, down from 7.8 per cent (first revised estimates released on January 31) a year ago. Agriculture and allied activities posted a strong pick-up, benefiting from the normal south-west monsoon, robust expansion in rabi acreage (higher by 5.7 per cent over the preceding year) and favourable base effects as well as the continuing resilience of allied activities. In contrast, the industrial sector experienced a sharp deceleration, mainly due to a slowdown in manufacturing and in mining and quarrying. Service sector activity also lost pace, concentrated in trade, hotels, transport and communication services, and construction, cushioned to some extent by public administration and defence. 5. Industrial output measured by the index of industrial production (IIP) finally shrugged off the debilitating drag from insulated rubber cables from November and was also pushed up by a favourable base effect. In December, the output of core industries accelerated on a year-on-year as well as on a sequentially seasonally adjusted basis. The drivers of the upturn were steel production and petroleum refinery throughput, the former, inter alia, supported by import tariff safeguards and the latter buoyed by external demand. The acceleration in coal production and thermal electricity generation since November after three consecutive months of contraction augur well for the outlook for power. Reflecting these developments, the manufacturing purchasing managers’ index (PMI) returned to expansion mode in January on the back of growth of new orders and output, and the future output index has risen strongly. On the other hand, the 76th round of the Reserve Bank’s industrial outlook survey suggests that financing conditions facing the manufacturing sector have worsened in Q3 of 2016-17 and are expected to remain tight in Q4. This is corroborated by the sharp slowdown in bank credit to industry and continuing sluggishness in the investment climate in some sectors. 6. High frequency indicators point to subdued activity in the services sector, particularly automobile sales across all segments, domestic air cargo, railway freight traffic, and cement production. Nevertheless, some areas stand out as bright spots, having weathered the transient effects of demonetisation – steel consumption; port traffic; international air freight; foreign tourist arrivals; tractor sales; and, cellular telephone subscribers. The services PMI for January 2017 remained in retrenchment, but the fall in output was the least in the current phase of three consecutive months of contraction. 7. Marking the fifth consecutive month of softening, retail inflation measured by the headline consumer price index (CPI) turned down sharper than expected in December and reached its lowest reading since November 2014. This outcome was driven by deflation in the prices of vegetables and pulses. Some moderation in the rate of increase in prices of protein-rich items – eggs, meat and fish – also aided the downturn in food inflation. 8. Excluding food and fuel, inflation has been unyielding at 4.9 per cent since September. While some part of this inertial behaviour is attributable to the turnaround in international crude prices since October – which fed into prices of petrol and diesel embedded in transport and communication – a broad-based stickiness is discernible in inflation, particularly in housing, health, education, personal care and effects (excluding gold and silver) as well as miscellaneous goods and services consumed by households. 9. The large overhang of liquidity consequent upon demonetisation weighed on money markets in December, but from mid-January rebalancing has been underway with expansion of currency in circulation and new bank notes being injected into the system at an accelerated pace. Throughout this period, the Reserve Bank’s market operations have been in liquidity absorption mode. With the abolition of the incremental cash reserve ratio from December 10, liquidity management operations have consisted of variable rate reverse repos under the LAF of tenors ranging from overnight to 91 days and auctions of cash management bills under the market stabilisation scheme (MSS) of tenors ranging from 14 to 63 days. The average daily net absorption under the LAF was ₹ 1.6 trillion in December, ₹ 2.0 trillion in January and ₹ 3.7 trillion in February (up to February 7) while under the MSS, it was ₹ 3.8 trillion, ₹ 5.0 trillion and ₹ 2.9 trillion, respectively. Money market rates remained aligned with the policy repo rate albeit with a soft bias, with the weighted average call money rate (WACR) averaging 18 basis points below the policy rate during December and January. 10. Turning to the external sector, export growth remained in the positive zone for the fourth month in succession in December. Imports other than petroleum oil and lubricants (POL) came out of the spike in November and moderated in December. In contrast, there was an increase of over 10 per cent in POL imports, in part reflecting the rise in international crude oil prices. Overall, the trade deficit shrank both sequentially and on a year-on-year basis, being lower for the period April-December by US$ 23.5 billion than its level a year ago. On the whole, the current account deficit is likely to remain muted and below 1 per cent of GDP in 2016-17. While the buoyancy in net foreign direct investment was sustained, there have been portfolio outflows beginning October on uncertainty relating to the direction of US macroeconomic policies and expectations of faster normalisation of US monetary policy in the year ahead. Foreign exchange reserves were at US$ 363.1 billion on February 3, 2017. Outlook 11. In the fifth bi-monthly statement of December, headline inflation was projected at 5 per cent in Q4 of 2016-17 with risks lower than before but still tilted to the upside. The decline in headline CPI inflation in November and December has been larger than expected, but almost exclusively on the back of deflation in vegetables and pulses. While the seasonal ebb in the prices of vegetables that usually occurs with the onset of winter as well as some demand compression may have contributed to this outcome, anecdotal evidence points to some distress sales of perishables having accentuated the decline in vegetable prices, with spillovers into January as well. Looking beyond, prices of pulses are likely to remain soft with comfortable supply conditions, while vegetable prices may potentially rebound as the effects of demonetisation wear off. 12. The Committee is of the view that the persistence of inflation excluding food and fuel could set a floor on further downward movements in headline inflation and trigger second-order effects. Nevertheless, headline CPI inflation in Q4 of 2016-17 is likely to be below 5 per cent. Favourable base effects and lagged effects of demand compression may mute headline inflation in Q1 of 2017-18. Thereafter, it is expected to pick up momentum, especially as growth picks up and the output gap narrows. Moreover, base effects will reverse and turn adverse during Q3 and Q4 of 2017-18. Accordingly, inflation is projected in the range of 4.0 to 4.5 per cent in the first half of the financial year and in the range of 4.5 to 5.0 per cent in the second half with risks evenly balanced around this projected path (Chart 1). In this context, it is important to note three significant upside risks that impart some uncertainty to the baseline inflation path – the hardening profile of international crude prices; volatility in the exchange rate on account of global financial market developments, which could impart upside pressures to domestic inflation; and the fuller effects of the house rent allowances under the 7th Central Pay Commission (CPC) award which have not been factored in the baseline inflation path. The focus of the Union budget on growth revival without compromising on fiscal prudence should bode well for limiting upside risks to inflation. 13. GVA growth for 2016-17 is projected at 6.9 per cent with risks evenly balanced around it. Growth is expected to recover sharply in 2017-18 on account of several factors. First, discretionary consumer demand held back by demonetisation is expected to bounce back beginning in the closing months of 2016-17. Second, economic activity in cash-intensive sectors such as retail trade, hotels and restaurants, and transportation, as well as in the unorganised sector, is expected to be rapidly restored. Third, demonetisation-induced ease in bank funding conditions has led to a sharp improvement in transmission of past policy rate reductions into marginal cost-based lending rates (MCLRs), and in turn, to lending rates for healthy borrowers, which should spur a pick-up in both consumption and investment demand. Fourth, the emphasis in the Union Budget for 2017-18 on stepping up capital expenditure, and boosting the rural economy and affordable housing should contribute to growth. Accordingly, GVA growth for 2017-18 is projected at 7.4 per cent, with risks evenly balanced (Chart 2). 14. The Committee remains committed to bringing headline inflation closer to 4.0 per cent on a durable basis and in a calibrated manner. This requires further significant decline in inflation expectations, especially since the services component of inflation that is sensitive to wage movements has been sticky. The committee decided to change the stance from accommodative to neutral while keeping the policy rate on hold to assess how the transitory effects of demonetisation on inflation and the output gap play out. 15. The Reserve Bank has conducted market liquidity operations consistent with the liquidity management framework put in place in April 2016, progressively moving the system level ex ante liquidity conditions to close to neutrality. This stance will continue. Surplus liquidity should decline with progressive remonetisation. Nonetheless, the currently abundant liquidity with banks is likely to persist into the early months of 2017-18. The Reserve Bank is committed to ensuring efficient and appropriate liquidity management with all the instruments at its command to ensure close alignment of the WACR with the policy rate, improved transmission of policy impulses to lending rates, and adequate flow of credit to productive sectors of the economy. 16. The Committee believes that the environment for timely transmission of policy rates to banks lending rates will be considerably improved if (i) the banking sector’s non-performing assets (NPAs) are resolved more quickly and efficiently; (ii) recapitalisation of the banking sector is hastened; and, (iii) the formula for adjustments in the interest rates on small savings schemes to changes in yields on government securities of corresponding maturity is fully implemented.1 17. Six members voted in favour of the monetary policy decision. The minutes of the MPC’s meeting will be published by February 22, 2017. 18. The next meeting of the MPC is scheduled on April 5 and 6, 2017. Jose J. Kattoor Press Release: 2016-2017/2126 Mumbai 1 Since the introduction of the formula in April 2016, interest rates on small savings are about 65-100 basis points higher, depending on tenor, compared to what they should be if the formula is followed. If the spread between small savings rates and bond yields remains wide, the diversion of deposits to small savings would impede a full transmission to bank lending rates. |

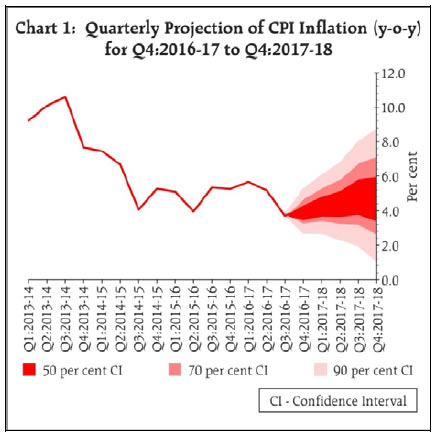

Page Last Updated on: