IST,

IST,

Annual Report of the Banking Ombudsman Scheme and Ombudsman Scheme for Non-Banking Financial Companies for the year 2018-19

This Annual Report of the Ombudsman Schemes, issued in the silver jubilee year of Banking Ombudsman Scheme (BOS) has special relevance, since it is being released at the confluence of 150th birth anniversary of Mahatma Gandhi, the champion of customer rights. Over the years, the BOS has gained popularity and played an important part in aligning the alternate grievance redressal structure of RBI with the G-20 OECD High-Level Principles (HLPs) on Financial Consumer Protection (FCP) as the Scheme provides cost-free and expeditious grievance redressal mechanism. A third-party survey has shown overall satisfaction level of 73% among complainants under BOS, which RBI will strive to improve further. Another important aspect of the HLPs on FCP pertains to ‘financial awareness and education’. RBI strengthened this area by initiating campaigns through electronic media while continuing with print, SMS and Interactive Voice Response System (IVRS) messages to create financial awareness apart from Townhall / outreach programmes by Ombudsmen. In 2018-19, RBI extended the Ombudsman Scheme for Non-Banking Financial Companies (NBFCs) to non-deposit taking NBFCs, launched the Ombudsman Scheme for Digital Transactions, rolled out Complaint Management System, a ‘one-stop’ portal for lodgment of grievances and launched the Internal Ombudsman Scheme which mandated banks with more than ten branches to appoint an Internal Ombudsman to serve as an objective review mechanism to support their internal customer grievance redressal structure. The Annual Report carries analysis of receipt and resolution of complaints and the initiatives of RBI for strengthening consumer protection. It also lays down the plan of action for future while identifying areas for further action by Financial Service Providers as well as RBI. I hope this Report would be informative and useful for all stakeholders. (M K Jain) Vision and Goals of the Vision

Goals

Banking Ombudsman Scheme The Banking Ombudsman Scheme (BOS) was notified by the Reserve Bank of India (RBI) in 1995 under Section 35A of the Banking Regulation Act, 1949. As on date, Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks, Regional Rural Banks (RRBs), Small Finance Banks and Payment Banks are covered under the Scheme. It is administered by RBI through 211 Offices of Banking Ombudsman (OBOs) covering all states and union territories. 2. A brief analysis of complaints handled by BOs during the year is as under:

Ombudsman Scheme for Non-Banking Financial Companies 3. The Ombudsman Scheme for Non-Banking Financial Companies (NBFC-O Scheme) was notified by RBI under Section 45L of the RBI Act, 1934 on February 23, 2018. The Scheme is applicable to Non-Banking Financial Companies (NBFCs) which (a) are authorized to accept deposits; or (b) have customer interface, with assets size of ₹100 crore or above, as on the date of the audited balance sheet of the previous financial year and is administered from the offices of the NBFC-Os in four metro centers viz. Chennai, Kolkata, Mumbai and New Delhi for handling complaints from the respective zones, so as to cover the entire country. 4. Brief analysis of complaints handled by NBFC-Os during the year is as under: i. The number of complaints received at NBFC-Os rose from 675 in four months operation during 2017-18 to 3,991 in 2018-19; ii. Non-adherence to fair practices code constituted 40.44% of complaints received, followed by non-observance of RBI directions (17.21%), levy of charges without notice (12.63%) and lack of transparency in contract / loan agreement (9.17%); iii. The disposal rate of NBFC-Os stood at 95.41% in 2017-18 and 99.10% in 2018-19; iv. One appeal has been received against the decision of NBFC-O during 2018-19, as compared to nil in the previous year. Developments during the Year 5. During the year, Consumer Education and Protection Department (CEPD) took a few initiatives for improving the accessibility of grievance redressal mechanism to the members of public. i. Ombudsman Scheme for Digital Transactions (OSDT) was introduced to provide grievance redressal forum for the consumers of the Payment System Participants (popularly known as Prepaid Payment Instrument providers); ii. The NBFC-O Scheme was extended to cover the regulated non-deposit taking NBFCs having asset size of ₹100.00 crore and above; iii. Internal Ombudsman (IO) Scheme was reviewed and extended to all Scheduled Commercial Banks having more than 10 outlets (excluding RRBs); iv. A third office of the Ombudsman at RBI, New Delhi was set up with effect from July 1, 2019 with a view to meet the growing demand for resolution of complaints; v. A state-of-art and user-friendly web-based online Application named Complaint Management System (CMS) was launched for filing complaints, which also allows the customers to track their complaints; vi. Education and awareness campaigns were undertaken through print and electronic media for the benefit of customers / members of public at large; vii. Annual conference of Banking Ombudsmen was held at Mumbai on June 21, 2019 on the theme of ‘Consumer Protection beyond Boundaries’. It witnessed wide-ranging discussions on issues related to emerging areas of complaints, safety in digital financial transactions and experience of other jurisdictions in redressal of customer grievances. Way Forward 6. In an endeavor to further strengthen the redressal mechanism and the preventive aspects of consumer protection framework, so that the confidence of the consumers of financial services is maintained, commitments in the form of Strategic Action Plans (SAPs) in the medium-term strategy framework for RBI, namely ‘UTKARSH – 2022’, have been delineated. For the year 2019-20, five SAPs will be taken up for implementation, viz.,

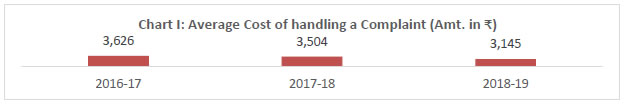

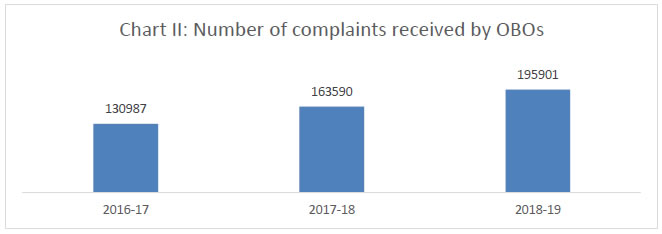

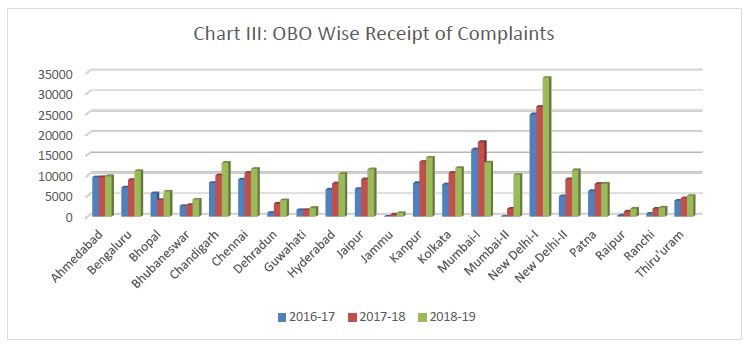

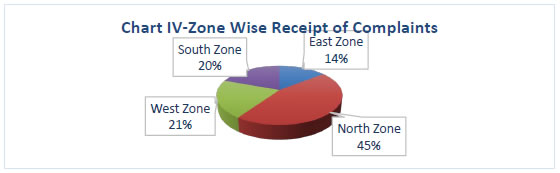

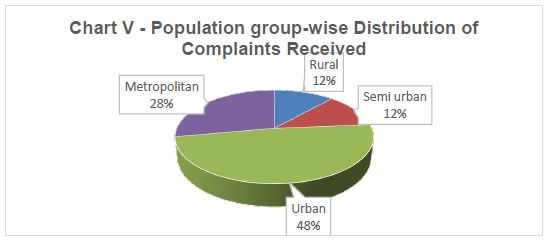

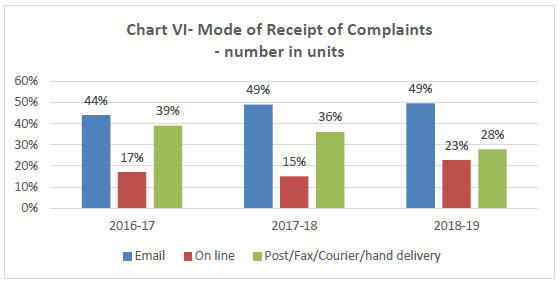

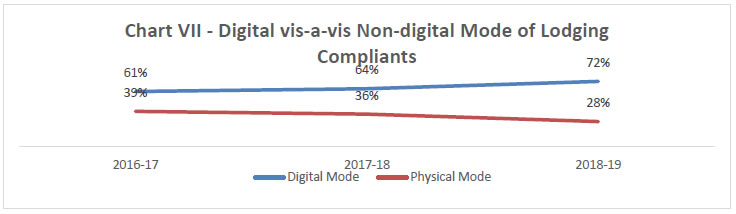

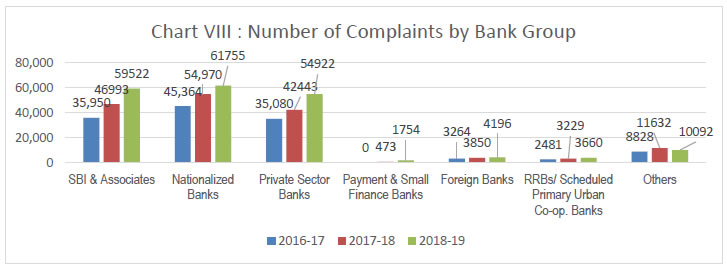

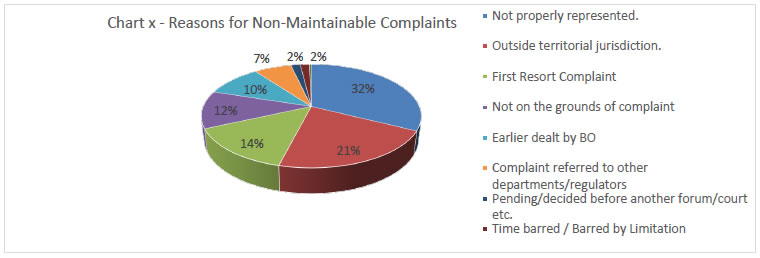

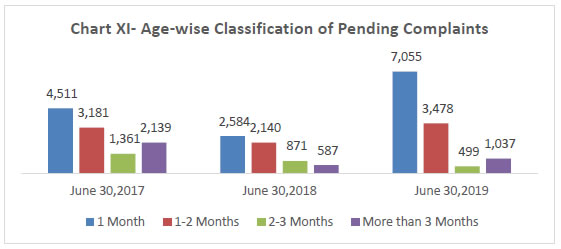

7. The education and awareness initiative of CEPD has been two-pronged, i.e. physical and digital. Offices of Ombudsman will continue with the existing Town Hall, outreach / awareness and other innovative methods to sensitize the customers in their respective jurisdiction. CEPD will delve into the digital method in close association with Department of Communications. In the year 2019-20, the CEPD will generate awareness about the grievance redressal mechanisms of RBI and the Ombudsman Schemes as also undertake campaigns on safe digital banking and the regulatory stipulations on customer protection. Chapter 1 Overview 1.1 The Banking Ombudsman Scheme was notified by the Reserve Bank of India (RBI) in 1995 under Section 35 A of the Banking Regulation Act, 1949. Over the years, it has undergone five2 revisions, the last being in July 2017. As on date, Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs) and Payment Banks (PBs) are covered under the Scheme. It is administered by the RBI through 213 OBOs covering all states and union territories of India. The cost of running the Scheme, which includes revenue and capital expenditures4, is borne by the RBI. 1.2 Over the years, the Scheme has gained wider acceptance and popularity as reflected by the Y-o-Y increase of 19.75% in the number of complaints received at the OBOs. The year-wise number of complaints received at OBOs in last three years is given at Appendix – I. 1.3 During the year, in line with the declining trend observed in the last three years, average cost of handling a complaint came down from ₹3,504/- to ₹3,145/-, evident from Chart I below. The decline is largely due to increase in volume of complaints while the human resources for handling these complaints remained the same.  1.4 A comparative position of cost of running the Scheme as well as the average cost per complaint during the last three years is given at Appendix II. 1.5 The BO-wise per complaint cost for the year 2018-19 is given at Appendix III. Considering the fixed costs involved, the offices having lesser inflow of complaints show higher cost per complaint. 1.6 A record 2,02,0835 complaints were handled by OBOs in 2018-19 as against 1,74,805 complaints in the previous year. While 6,182 complaints comprising 3.53% were pending at the end of the year 2017-18, the pendency for this year has gone up to 12,069 complaints, which worked out to 5.97% of the complaints handled. This is largely due to 19.75% increase in inflow of complaints attended to by the same available resources at the disposal of OBOs. The position of customer complaints handled by OBOs is given at Appendix IV. 1.7 The average Turn Around Time (TAT) for disposal of complaints of Offices of BOs has come down from 53 days in 2017-18 to 47 days in 2018-19, despite considerable increase in the complaints pertaining to digital transactions which require more time for investigation / and analysis documents for redressal. However, improvement in TAT is largely due to continuous follow up with the OBOs and banks and efficient handling by the BOs. 1.8 In addition to handling complaints, the BOs were also committed to the RBI’s agenda of spreading awareness about the grievance redressal system put in place by RBI at the level of banks as well as at the RBI. The BOs organised Town Hall events, awareness programmes / outreach activities besides participating in trade fairs, cultural events like Rath Yatra, etc. The awareness initiatives were targeted particularly in rural and semi-urban areas. In addition, awareness campaigns were also launched by CEPD for popularizing the Scheme. Receipt of Complaints 1.9 A comparison of the number complaints received by the OBOs during the last three years is given in Chart II.  1.10 In 2018-19, the number of complaints received by the BOs increased by 19.75% over 2017-18 (Appendix V). The upward trend could, inter alia, be attributed to the increase in the number of bank customers, increased usage of digital modes of transactions and the impact of initiatives for financial inclusion and spreading of awareness exercises undertaken by RBI, including through TV channels, FM Radio, SMS handle viz., “RBISay” as well as the outreach efforts made by OBOs at the regional levels. 1.11 Of the 1,95,901 complaints received by the OBOs, (Appendix I), in line with the last year’s trend, OBO New Delhi I received the maximum number of complaints (33,690), which accounted for 17.20% of the total complaints received by the OBOs. Together with OBO, New Delhi II, the total number of complaints handled by the OBOs at New Delhi stood at 44,932 representing 22.94% of total complaints received during the year. 1.12 With the launch of two new Schemes viz the NBFC-O Scheme and the OSDT, the same BOs handled complaints emanating from system participants and NBFCs require greater resources in terms of time and efort. Considering the need to improve the rate of disposal and the volume of complaints being received by offices at New Delhi, it was decided to open a third office of BO at New Delhi (OBO, New Delhi III) from July 1, 2019 by dividing the territorial jurisdiction of OBO, New Delhi I. 1.13 Complaints received at OBO Mumbai II, set up in February, 2018 by bifurcating the jurisdiction of OBO Mumbai I, rose to more than five times the previous year to 10,162 complaints (an increase of 439.38%) in 2018-19 from 1,884 complaints in 2017-18. Consequently, complaints received at OBO, Mumbai I witnessed a decline of 27.53% (from 18,085 complaints in 2017-18 to 13,106 complaints in the year 2018-19) during the year. A comparative position of complaints received by OBOs during the last three years is given in Chart III.  Zone-wise Distribution of Complaints 1.14 Continuing the trend, and owing to huge volume of complaints received at offices at New Delhi, the North zone accounted for the maximum share of complaints (45.24%) in 2018-19. The East zone accounted the least i.e., 14.38% of total complaints received, highlighting the need for increased awareness initiatives in the zone. The zone-wise distribution of complaints received is depicted in Chart IV below.  1.15 Zone-wise receipt of complaints is given at Appendix VI. It may be observed therefrom that the maximum Y-o-Y growth in the number of complaints was also highest in North zone (23.41%), followed by South zone (18.65%), West zone (17.91%) and East zone (13.19%) respectively. Population Group-wise Distribution of Complaints 1.16 During the year, 48.36% of complaints were lodged by bank customers residing in urban areas. Complaints from metropolitan areas accounted for 27.90%, while semi-urban and rural areas accounted for 12.06% and 11.67% respectively. Recognizing that relatively lower share of complaints received from rural and semi-urban areas highlights the need to scale up the awareness campaigns in these areas in addition to taking initiatives to undertake such programmes in local languages, uniform guidelines have been issued to OBOs for selection of venue, conduct of programmes and evaluation of their impact so as to maximize their impact. Population group-wise distribution of complaints during the last year is given in Chart V below and at Appendix VII.  1.17 The percentages of complaints on each of the grounds follow similar pattern with the maximum being from metropolitan centers and least from rural centers as given at Appendix VIII. The complaints rise proportionately with the size of population, bank branches and awareness among the public. Modes of Receipt of Complaints 1.18 Complaints were received in the OBOs through various modes, including hand delivery, post, courier, fax, e-mails and online portal i.e. the RBI’s Complaint Tracking System, and with effect from June 24, 2019, through the CMS. A comparison of the various modes through which complaints were received during the last three years is given at Appendix IX and shown in Chart VI below:  1.19 The trend in the last three years indicates that complaints are increasingly being lodged through digital modes (email and online portal) than through physical modes (post/fax/courier/hand delivery). During the year, 72.19% of the complaints were filed using the digital mode of which 49.48% were through e-mails and 22.71% using the online portal. The share of complaints received using online portal stood at 14.98% in 2017-18 and rose to 22.71% in 2018-19 on the back of surge in receipt of complaints on CMS after its launch on June 24, 2019. By end June 2019, 5,813 complaints were received on CMS. The trend during the last three years is given in Chart VII below:  1.20 CMS provides a single platform for customers of regulated entities for lodging of complaints. With features like tracking of complaint and option of furnishing feedback, the percentage of complaints received through online mode is expected to increase markedly in the next year. Complainants: Group-wise Classification 1.21 Out of the total number of complaints lodged in the year 2018-19, 92.44% were by individuals. Of these, 0.68% complaints were lodged by senior citizens. The second category of complainants was ‘Individuals – Business’ with a share of 2.81% as shown at Appendix X. Bank Group-wise Classification 1.22 The bank-group wise classification of complaints received by OBOs during the last three years is indicated in Chart VIII.  1.23 Of the total number of complaints received in OBOs, nationalized banks and SBI taken together accounted for 61.91% during the last three years as detailed at Appendix XI. The share of Private Sector banks went up from 25.94% of total complaints received in last year to 28.04% during this year. The RRBs and Scheduled Primary Urban Cooperative banks together accounted for 1.87% of total number of complaints. The complaints against the new entities viz., PBs and SFBs went up from 0.30% during the last year to 0.90% during the current year, witnessing an Y-o-Y growth of 270.82%. Share of complaints against entities that are not covered under the Scheme went down from 7.11% in 2017-18 to 5.15% during the year under review. Nature of Complaints Handled 1.24 As specified under Clause 8 of the Scheme, there are 30 grounds for lodging complaints with the BO. Table 1 below broadly indicates the proportion of complaints received under the various grounds of complaints listed in the Scheme. 1.25 While non-observance of fair practices code at 19.17% continued to remain major ground for complaints during the year, its percentage came down from 22.10% in the previous year. Complaints received on grounds relating to pension, levy of charges without notice, credit cards and remittance have declined this year vis-a-vis previous year. However, number of complaints pertaining to ‘mis-selling’ have gone up from 579 complaints in 2017-18 to 1,115 complaints during this year, showing an increase of 92.57%. 1.26 Complaints relating to ATM / Debit Cards comprised 18.65% of total complaints, up from 15.08% in the previous year. Of the total number of ATM / Debit Cards complaints, a major sub-category was ‘Account debited but cash not dispensed by ATMs’ which accounted for almost 53.00% of the ATM related complaints (Table 2). 1.27 The complaints on the ground relating to digital transactions (mobile, internet, ATM and credit cards) rose by 18,801 to 64,607 complaints and accounted for 32.984.98% of total complaints, a 6.48% increase in share of complaints over the previous year. This, however, did not include the digital related complaints falling under other grounds under the Scheme. The rise in complaints reflects rising popularity of digital modes of transactions. 1.28 The rising complaints relating to digital transactions led to the launch of OSDT (please refer para 4.2), extension of limited liability circular to the PPIs in January 2019 and introduction of tokenization of card transactions for facilitating transactions without disclosing the 16 digit Primary Account Numbers. 1.29 During the year, 3.61% of the complaints related to ‘Pension Payments’ as compared to 4.79% in the previous year. The number of complaints in this category has come down both in absolute and in percentage terms, inter alia, due to the continued efforts of RBI to improve the services received by this class of customers. However, the number at 7,000 plus is still high. The Department will continue to strive to bring this number further down by closely working and following up with the banks. 1.30 Complaints on ‘deposit accounts’ constituted 5.54% of the total complaints received, witnessing an increase of 61.39% on Y-o-Y basis. The complaints were mainly on grounds of delay in credit, non-credit of proceeds to party’s account, non-payment of deposit or non-observance of the RBI directives and wrong application of rate of interest on deposits in savings or other accounts, etc. 1.31 Complaints relating to ‘Loans and Advances’ constituted 3.88% of the total complaints received and generally pertained to delay in sanction, disbursement, non-observance of prescribed time schedule for disposal of loan applications, non-acceptance of application without valid reason, etc. 1.32 In 2018-19, 1.76% of the complaints received related to ‘Remittances’ such as non-payment/ inordinate delay in the payment or in the collections of cheques, drafts, bills etc. 1.33 OBOs also received 3.32% of the complaints which were ‘Out of Purview’ of the Scheme and were closed as non-maintainable, which were marginally less than those in the previous year (3.47%). 1.34 Complaints under ‘Others’ category at 14.46% related to complaints on ‘Non-adherence to Prescribed Working Hours’, delay in providing banking facilities, etc. as detailed in Table 3. Complaints on Grounds added in 2017-18 1.35 Two grounds namely (i) ‘Non-adherence to RBI instructions on Mobile / Electronic Banking’ and ‘Non-adherence to Reserve Bank guidelines on para-banking activities like sale of insurance / mutual fund / other third-party investment products by banks’ (misselling) were included in the BO Scheme with effect from July 2017. The new grounds together accounted for 9,066 (5.54% of total complaints) and 15,909 (8.12%) complaints during the last two years as shown in Chart IX.  1.36 Table 4 below indicates a comparative position of disposal of complaints by OBOs. 1.37 The table above indicates that the OBOs have disposed of 21,391 more complaints during this year with the same resources available with them. The OBO-wise position of complaints disposed during the year 2018-19 is given at Appendix XII. 1.38 The share of Non-Maintainable6 complaints received during 2018-19 stood at 52.90% as compared to 48.94% during 2017-18 and 52.26% in 2016-17. The details of the grounds under which the complaints have been disposed of as non-maintainable are given in the Chart X below. It could be observed therefrom that the complaints have been disposed of as non-maintainable largely due to i) incomplete information given in the complaint, ii) complaints falling outside the territorial jurisdiction of the BOs, iii) First Resort complaints (FRCs) and iv) not falling under the grounds listed under Clause 8 of BOS. The satisfaction survey conducted by M/s Karvy Data Management Ltd. revealed that some respondents admitted to having lodged complaints with the Ombudsmen even when they knew that it fell outside the purview of BOS and also having approached BOs as a first resort because, in their experience, the banks normally resolve the complaints expeditiously once the same had been forwarded to them by the BOs. Going forward, while CMS will filter FRCs and the non-maintainable complaints arising out of jurisdictional reasons, there is a need for creating greater awareness on the BOS and for improving the grievance redressal mechanisms in the banks.  1.39 OBO and bank- wise distribution of maintainable complaints is given at Appendix XIII and XIV respectively. Mode of Disposal of Maintainable Complaints 1.40 The Scheme promotes settlement of complaints by agreement through conciliation and/or mediation by BOs. If the parties fail to arrive at an acceptable agreement, the BO gives a decision or passes an Award. There has been a marked increase in the number of complaints resolved by agreement in the last two years. As detailed in Table 5 below 69.88% of the maintainable complaints were resolved through agreement as compared to 65.82% during 2017-18 and 42.43% during 2016-17, indicating mediation is being used as an effective tool in complaint resolution. Turn Around Time for Disposal of Complaints 1.41 The time taken by BOs to dispose a complaint stood at 47 days during the year 2018-19 as compared to 53 days a year ago. The most remarkable improvement was marked with regard to complaints against recovery agents, which witnessed a reduction by 18 days, i.e., from 61 days to 43 days. The ground-wise Turn Around Time is given at Appendix XV. Grounds for Rejection of Maintainable complaints 1.42 The grounds for rejection of maintainable complaints and their proportion to total complaints received during the year are indicated in Table 6. 1.43 As may be seen from the Table 6 above, the number of maintainable complaints rejected has come down in absolute number from 28,259 in 2017-18 to 26,905 in 2018-19. The maximum number of rejections were on the ground that the complaint was ‘not on grounds of complaint (Clause 8) or not filed in accordance with required provisions of Clause 9 (3). More rejections on this ground calls for creating greater awareness among complainants about BOS. The launch of CMS for lodgement of complaints is expected to address this issue. 1.44 The BO Scheme envisages summary disposal of complaints. As such, complaints requiring elaborate documentary and oral evidence are rejected by the BOs. Such rejections were made appealable with effect from July 1, 2017 with an objective to review these decisions at Appellate Authority level. Consequently, the number of such disposal declined from 3,883 in 2016-17 to 2,337 in 2017 –18 and 193 in 2018-19. 1.45 ‘First Resort Complaints7 (FRCs) are returned to the complainants advising them to follow the laid down procedure with a copy to the concerned bank for suitable redressal. During the year, 5.13% of the non-maintainable complaints were FRCs. Age–wise Classification of Pending Complaints 1.46 Although the Scheme specifies no time limit for resolution of complaints by OBOs, efforts are made to resolve the same within two months. However, due to reasons such as non-submission and / or delay in submission of complete information by complainants/banks, the time taken for resolution may get extended in some cases. Of the total complaints do not remain pending as on June 30, 2019, around 12.73% were over two months old. The BOs and the PNOs of banks have been continuously advised/sensitized to ensure that complaints are not pending for more than two months. The age-wise classification of number of pending complaints is detailed at Appendix XVI. Chart XI below indicates age-wise classification of pending complaints.  Awards Issued 1.47 During the year, 98 Awards were issued by BOs. The OBO-wise position of Awards issued and implemented is indicated in Table 7.

Satisfaction Survey of Complainants 1.48 On the direction of the Central Board, the Department undertook an All India Survey through a vendor M/s Karvy Data Management Limited to gauge the level of satisfaction of complainants who approached the Banking Ombudsman for redressal of their grievance. The Survey was based on five parameters to measure the level of customer satisfaction on a scale of five, viz., (i) ease of lodging a complaint, (ii) resolving complaint in reasonable time, (iii) promoting settlement of the complaint by mediation and conciliation, (iv) escalating complaint to the Ombudsman drives the service provider to redress the complaint immediately (v) overall satisfaction with redressal. As per the findings of the survey, more than 70% of complainants were satisfied with the redressal provided by the BO. The findings of the Survey are placed at Appendix XVII. Appeals against the Decisions of the BOs 1.49 The Deputy Governor-in-Charge of the CEPD, RBI is the designated as the Appellate Authority9 (AA) as per the provisions of the BO Scheme. CEPD provides the Secretariat to the AA. During the year, 78 appeals were received as compared to 125 appeals during the last year. Of these, 57 appeals were received from complainants who were aggrieved by the decision of the respective BOs whereas 21 were filed by the banks. With 95 appeals pending from the previous year, the AA handled 173 appeals during the year. The number of appeals disposed during the year went up substantially by 173% to 101 from 37 during 2017-18. 1.50 The position of appeals handled by the AA during the last three years and the OBO-wise position of appeals received during the year 2018-19 is given in Tables 8 and 9 respectively. Chapter 2 2.1 RBI, in exercise of the powers under Section 45L of the RBI Act, 1934, introduced the Ombudsman Scheme for Non-Banking Financial Companies (NBFC-O Scheme) on February 23, 2018. The objective of the Scheme is to provide a system of Ombudsman for redressal of complaints of customers of Non-Banking Financial Companies (NBFC) pertaining to deficiency in service by the NBFCs. The Scheme is applicable to NBFCs10 which (a) are authorized to accept deposits; or (b) have customer interface, with assets size of ₹100 crore or above, as on the date of the audited balance sheet of the previous financial year, or with any such asset size as the RBI may prescribe. 2.2 The Scheme was initially operationalized for all deposit taking NBFCs in the country. Upon review, it was decided to extend its coverage to Non-Deposit Taking NBFCs having customer interface, with assets size of ₹100 crore or above with effect from April 26, 2019. 2.3 The Non-Banking Financial Company - Infrastructure Finance Company (NBFC-IFC), Core Investment Company (CIC), Infrastructure Debt Fund-Non-Banking Financial Company (IDF-NBFC) and NBFCs under liquidation, are excluded from the ambit of the Scheme. The Scheme is being administered from the offices of the NBFC-Os in four metro centers viz. Chennai, Kolkata, Mumbai and New Delhi for handling complaints from the respective zones, so as to cover the entire country. Number of NBFCs and complaints received by NBFC-Os 2.4 The position of complaints received by four offices of NBFC-Os is given in Table 10 below. Annualizing the 675 complaints received in the four months of 2017-18, it could be observed that the complaints against NBFCs have nearly doubled this year vis-à-vis last year. 2.5 NBFC-O New Delhi accounted for 34.05% of the complaints received followed by Chennai (28.16%), Mumbai (24.93%) and Kolkata (12.85%). Ground-wise distribution of complaints 2.6 Complaints are classified into broad categories based on the grounds of complaints specified under Clause 8 of the Scheme. The ground-wise distribution of complaints received by NBFC-Os is given in the Table 11 below: 2.7 With 40.44% of the total complaints received, non-adherence to the fair practices code was the major category of complaints received in the offices of NBFC-Os followed by non-Observance RBI directions to NBFCs at 17.21%, levying of charges without notice (12.63%), lack of transparency in contract/loan (9.17%). Disposal of Complaints 2.8 NBFC-Os handled 4,022 complaints during the year disposing 99.10% of the complaints by the end of June 2019. The detailed position of complaints disposed is given below at Table 12. Mode of Disposal of Maintainable Complaints 2.9 The complaints which pertain to any of the grounds of complaints specified under Clause 8 of the Scheme or categorized as maintainable complaints and their mode of disposal is indicated in Table 13 below: 2.10 Conforming to the inherent objective laid down in Clause 11 of the Scheme, 79.02% of the Maintainable complaints were resolved by conciliation and mediation. No Award was passed by the NBFC Ombudsman during the year. NBFC-O wise position of complaints disposed (2018-19) 2.11 The status of complaints received in the offices of NBFC-O is given in Table 14 below: NBFC- wise list of complaints received is given in the Annex V. Appeals 2.12 The Scheme provides the appellate mechanism under which both, the complainant as well as the NBFC, can appeal against the decision or Award of the BO to the Appellate Authority designated under the Scheme, provided the complaint is closed under the appealable clauses of the Scheme, i.e. against Award under Clause 12 allowing the complaint or rejecting the complaint for the reasons referred to in Sub Clauses (c) to (f) of Clause 13. The Deputy Governor-in-Charge of the CEPD is the designated Appellate Authority. The secretarial assistance to the Appellate Authority is provided by CEPD. Only one appeal against the decision of the Ombudsman has been received which is being processed. Chapter 3 Centralised Public Grievance Redress and Monitoring System 3.1 Centralised Public Grievance Redress and Monitoring System (CPGRAMS) is an initiative of Government of India which provides an alternate channel to public to lodge their complaints with regulators. The CPGRAMS portal has been developed by the Department of Administrative Reforms and Public Grievances of Government of India. Government Departments and banks are subordinate offices in this portal, to receive and redress complaints. CEPD is the Nodal Office for RBI and OBOs are subordinate offices. 3.2 A comparative position of the complaints received through this portal and handled by OBOs during the last three years is given at Appendix XVIII. During 2018-19, the complaints received through this portal went up by 115.44% from 149 in the previous year to 321. Applications Received under Right to Information Act, 2005 3.3 The BOs are the Central Public Information Officers under the Right to Information Act, 2005 (RTI Act) to receive applications and furnish information relating to complaints handled by the OBOs. During the year, 829 RTI applications were received by all OBOs. The OBO-wise position of such applications received during the last three years is detailed at Appendix XIX. Chapter 4 4.1 During the year under review, in order to provide platform of grievance redressal to the customers of Payment System Participants, the RBI launched a new Scheme christened as Ombudsman Scheme for Digital Transactions (OSDT). Further, the existing NBFC Ombudsman Scheme was reviewed and its coverage was extended to include those Non-Deposit Taking NBFCs who have an asset size of Rs.100.00 crore or more. The ease of filing complaints was enhanced significantly by the launch of CMS. The thrust on awareness was also enhanced. The Annual Conference of Ombudsman was organized on the theme of ‘Consumer Protection beyond Boundaries’. Launch of the Ombudsman Scheme for Digital Transactions (OSDT) 4.2 The OSDT, announced in the Monetary Policy Statement of December 5, 2018, was launched on January 31, 2019. The Scheme has been launched in exercise of the powers conferred under Section 18 of the Payment and Settlement Systems Act, 2007. It provides a cost-free and expeditious complaint redressal mechanism for redressal of complaints pertaining to deficiency in service related to digital transactions provided by the System Participants defined under the Scheme. Complaints relating to digital transactions undertaken through banks continue to be handled under the Banking Ombudsman Scheme. The offices of Ombudsman for Digital Transactions (ODT) are functioning from all the existing OBOs. The Scheme also provides for an Appellate mechanism under which the complainant / System Participant has the option to appeal against the decision of the ODT before the Appellate Authority, which is vested with the Deputy Governor in charge of CEPD. Extension of the NBFC-O Scheme to Non-Deposit Taking NBFCs 4.3 RBI had launched the NBFC-O Scheme on February 23, 2018 for deposit-taking NBFCs registered with RBI. The Scheme was to be extended to remaining identified categories of NBFCs based on experience gained. Upon review, it was decided to extend the coverage of NBFC-O Scheme to Non-Deposit Taking NBFCs having customer interface, with assets size of ₹100 crore or above with effect from April 26, 2019.The Non-Banking Financial Company - Infrastructure Finance Company (NBFC-IFC), Core Investment Company (CIC), Infrastructure Debt Fund-Non-Banking Financial Company (IDF-NBFC) and NBFCs under liquidation, are excluded from the ambit of the Scheme. The Scheme is being administered from the offices of the NBFC-Os in four metro centers viz. Chennai, Kolkata, Mumbai and New Delhi for handling complaints from the respective zones, so as to cover the entire country. Launch of Complaint Management System (CMS) 4.4 CMS, which is a web-based software for consumers, RBI users at Ombudsman offices, CEPCs, CEPD and regulated entity users for enabling end-to-end complaints management was launched by Governor, RBI on June 24, 2019. This system provides a single platform available on web and mobile for lodging and monitoring complaints against entities regulated by RBI. It has replaced the Complaint Tracking System which was launched in the year 2006 and was limited only to BOS as the other Schemes were launched recently. CMS application features workflow and integration amongst Ombudsman verticals, CEPCs, CEPD and regulated entities, as well as communication channels (e-mail and SMS) to digitize end-to-end complaint management process. It provides real time status of complaints at pan-India level and has advance management information dashboards which will improve the operational efficiency of offices by enabling online handling and monitoring of complaints, thereby reducing the turnaround time. It also has a comprehensive e-learning based consumer education material to enhance awareness related to financial services and consumer rights. Awareness Initiatives 4.5 During 2018-19, the Reserve Bank conducted country-wide awareness campaigns through print and electronic media on various topics such as fictitious offers, BSBD Accounts, banking facilities for senior citizens and differently-abled persons and safe digital banking. The Reserve Bank’s SMS handle ‘RBISAY’ was also extensively used for sending text messages on such topics across India. An IVRS was made available to the public for obtaining information on these and other awareness initiatives of the Reserve Bank. During the year, the offices of BO also conducted 259 Town Hall/ awareness/ outreach programs, mainly in Tier II cities. Opening of third Ombudsman Office at New Delhi 4.6 The Reserve Bank has set up a third office of the BO and ODT at RBI, New Delhi (New Delhi-III) with a view to meet the growing demand for resolution under the BOS and the OSDT. This office became operational with effect from July 1, 2019. With addition of this Office, the RBI has now 22 Ombudsman Offices in the country. Annual Conference of Banking Ombudsmen (BOs) 4.7 Annual conference of RBI Ombudsmen was held at Mumbai on June 21, 2019. The theme of the Conference was ‘Consumer Protection beyond Boundaries’. It was inaugurated by Shri M.K. Jain, Deputy Governor (DG), RBI. Smt. Surekha Marandi, the then Executive Director (ED), RBI, Smt. Malavika Sinha, ED, RBI, MDs / CEOs of major public, private and foreign banks, heads of regulatory and supervisory departments, Legal Department of RBI attended the Conference. 4.8 Smt. Surekha Marandi, ED in her address complemented the Ombudsmen on achieving a high rate of disposal of 96.46% during 2017-18. She counselled all stakeholders to be prepared to meet the challenges of rising consumer expectation in the era of technology driven faceless banking. 4.9 In his inaugural address, DG, while highlighting the achievements in grievance redressal and consumer protection spelled out his expectations from the Ombudsmen and impressed upon the need for creating greater awareness. He also exhorted the banks to ensure that their internal grievance redressal mechanisms were strengthened. 4.10 Shri D Sethy, Chief General Manager (CGM), CEPD read out the keynote address of Shri Shaktikanta Das, Governor, RBI. The message outlined five areas of priority for further strengthening consumer protection viz. (i) Approach to grievance redressal to be simple, accessible, through dynamic channels, with periodic updation (ii) Consumer protection to be discussed in international fora of ombudsmen and Central Banks (iii) higher investment on financial education (iv) periodic review of system and procedures in ombudsman offices with training and capacity building of staff and (v) near real time fraud mitigation and complaint resolution to enhance customers’ trust in digital transactions. Governor, through the message, reiterated that consumer must find a place in the business policies of banks and FSPs and urged them to own their customers. 4.11 The conference deliberated on (i) best practices in consumer protection with perspectives across geographies and (ii) digital innovation in a financial space - need for a robust consumer protection framework. Dignitaries from overseas ombudsman offices like United Kingdom and South Africa and Head, Consumer Protection, Organization for Economic Protection and Development also participated and shared their perspective. The action points of the Conference have been taken up for implementation. Review of Internal Ombudsman Mechanism in Banks 4.12 The RBI had, in May 2015, advised all public-sector and select private and foreign banks to appoint Internal Ombudsman (IO) as an independent authority to review complaints that were partially or wholly rejected by the banks. RBI revisited this arrangement and in September 2018, issued revised directions under Section 35 A of the Banking Regulation Act, 1949 in the form of an ‘Internal Ombudsman Scheme, 2018’. The Scheme covers, inter-alia, appointment / tenure, roles and responsibilities, procedural guidelines and oversight mechanism for the IOs. All Scheduled Commercial Banks in India having more than ten banking outlets (excluding Regional Rural Banks), are required to appoint one or more IO. The IO is required to examine all customer complaints, which are in the nature of deficiency in customer service and are partly or wholly rejected by the bank. As the banks are required to internally escalate all complaints which are not fully redressed to their IOs before conveying the final decision to the complainant, the customers of banks need not approach the IO directly. The implementation of IO Scheme is to be monitored through the bank’s internal audit mechanism apart from supervisory oversight by RBI. Way Forward 4.13 The way forward for CEPD is delineated in RBI’s medium-term strategy framework – ‘Utkarsh 2022’ – announced by the Governor, RBI on July 23, 2019. 4.14 Formulate policy to strengthen the system based on Root Cause Analysis (RCA) of major areas of complaint: Offices of Ombudsman and CEPC had undertaken RCA of the major areas of complaint. The study revealed that the major reasons for complaints arise from lack of customer awareness regarding RBI instructions and safe banking practices, lack of sensitization regarding customer protection among front desk staff of banks, instances of non-implementation of RBI instructions and variation in practices adopted by banks in areas where detailed guidance is not listed in the extant regulations. The findings of the RCA are being examined for necessary regulatory and supervisory action with an objective of strengthening consumer protection among the entities regulated by RBI. 4.15 Conduct review of CEPCs for empowering them on the lines of Banking Ombudsman: The CEPCs redress complaints that do not fall under the ambit of Ombudsman Schemes of RBI. However, unlike the case of Ombudsmen, there is no explicit ground, pecuniary jurisdiction or power to issue Award by CEPCs. The feasibility of empowering the CEPCs is being examined. 4.16 Review Internal Ombudsman Scheme for extension to NBFCs: It is proposed to strengthen the internal grievance redressal mechanism of the NBFCs on the basis of experience gained in implementing the Ombudsman Scheme for NBFCs. The review for extending the IO Scheme to NBFCs will be undertaken in due course. 4.17 Review of the Ombudsman Scheme for effective implementation, including through convergence: With the launch of the Ombudsman Scheme for Digital Transactions, RBI is administering three different Ombudsman Schemes. Since there is a need to converge the three schemes into one, the CEPD will undertake a review during the coming year. 4.18 Operationalizing IVRS: The IVRS will be integrated to CMS to provide online voice support to the customers. The work will be completed during 2019-20. 4.19 Creating consumer awareness through multi-pronged strategy: The education initiative of CEPD will be two-pronged, i.e. physical and digital. With the CEPCs and OBOs continuing with the existing Town Hall, Outreach / awareness and other innovative methods to sensitize the customers in their respective jurisdiction, CEPD will undertake multimedia publicity campaign during the year 2019-20. Important Notifications Relating to Customer Service issued by the RBI in 2018-19

ANNEX II-STATEMENT OF COMPLAINTS RECEIVED BY THE OFFICES OF THE BANKING OMBUDSMAN (2018-19)

Annex III - NBFC- wise list of complaints received during 2018-19

Appendix I - Number of complaints received by OBOs

Appendix II - Cost of handling a complaint

Appendix III - OBO wise 'Per-Complaint Cost’ for the year 2018-19

Appendix IV - Position of customer complaints handled by OBOs

Appendix V - OBO-wise receipt of complaints

Appendix VI - Zone-wise distribution of complaints

Appendix VII - Population group-wise distribution of complaints received

Appendix VIII - Nature of Complaints across population group

Appendix IX – Mode of Receipt of complaints

Appendix X – Complainant group-wise classification

Appendix XI - Bank group-wise classification

Appendix XII - OBO wise position of complaints disposed during 2018-19

Appendix XIII – OBO wise Break-up of Maintainable Complaints during 2018-19

Appendix XIV Bank-Wise List of Maintainable Complaints Disposed during 2018-19

Appendix XV – Complainant category wise Break-up Turn Around Time (TAT) in Days during 2017-18 and 2018-19

Appendix XVI - Age-wise classification of pending complaints

Appendix XVII - Findings of Consumer Satisfaction Survey of Complaints Lodged in OBOs RBI conducted a feedback collection exercise of those who have registered a complaint with the Banking Ombudsman through Karvy Data Management Limited. The sample design and sample size achieved: The Survey was conducted in 18 locations throughout the country - five cities in the North zone, four in the South zone, three in the West zone and six in East zone. 3,010 respondents who have faced financial fraud / financial loss and had registered complaints were interviewed face-to-face. 2,285 respondents were interviewed from urban centers and remaining 725 interviews were conducted in the semi-urban/rural locations. Questionnaire: Apart from consumer name, address, contact number, complaint number of the office of Banking Ombudsman, the questionnaire consisted of source through which the consumer got to know about the Ombudsman Scheme (print media, friends / family, electronic media, internet and others), rating on a scale of five (1-strongly disagree and 5 – strongly agree) on the following:

Suggestion of the respondent was also solicited at the end of the questionnaire. Findings: Source of information: Friends/Family and internet are the most prominent source of information for the complainants. Word of mouth is the most important source of information regarding Ombudsman. Internet followed by print and electronic media also acts as a source of information regarding the Scheme.

Note: The total % does not add to 100% as respondents cited more than one source. At an overall level, respondents are satisfied with the Banking Ombudsman Scheme. Respondents perceive the process of lodging the complaints with BO as easy and simple, although the time frame for resolution of complaints needed to improve. Promoting settlements and effectiveness of escalation is perceived to be satisfactory by respondents.

Appendix XVIII - Position of Complaints received through CPGRAMS

Appendix XIX - Applications received by OBOs under RTI Act, 2005

1 22nd Office of Banking Ombudsman has since been opened at New Delhi on July 1, 2019. 2 The revisions were carried out in the years 2002, 2006, 2007, 2009 and 2017. 3 A new office of Banking Ombudsman has been set up at New Delhi with effect from July 1, 2019, taking the total number of Banking Ombudsmen at New Delhi to three and at All India to 22. 4 The revenue expenditure includes establishment items like salary and allowances of the staff attached to OBOs and non-establishment items such as rent, taxes, insurance, law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include furniture, electrical installations, computers / related equipment, telecommunication equipment and motor vehicles. 5 Complaints handled comprise of 1,95,901 received during the year 2018-19 and 6,182 carried over from the previous year 6 The cases which do not fall under the grounds of complaint specified under Clause 8 of the Scheme and those wherein the procedure for filing the complaint is not adhered to as laid down in Clause 9 of the BOS, are classified as ‘Non-maintainable’ complaints. OBOs return such complaints to the complainants stating the reason and send a copy to bank for suitable action. 7 Clause 9 (3) of the Scheme stipulates that, "No complaint to the Banking Ombudsman shall lie unless:- (a) the complainant had, before making a complaint to the Banking Ombudsman, made a written representation to the bank and the bank had rejected the complaint or the complainant had not received any reply within a period of one month after the bank received his representation or the complainant is not satisfied with the reply given to him by the bank". If complainants directly approach the OBO without filing a complaint with their bank, such a complaint is referred to as First Resort Complaint. 8 Includes awards which were passed in 2017-18 and implemented in 2018-19. 9 Clause 14 of the Scheme provides that “any party aggrieved by an Award issued by the BO under Clause 12 or by rejection of a complaint for the reasons referred to in Sub-Clauses (d) to (g) of Clause 13 of the Scheme, can appeal to the Appellate Authority (AA) designated under the Scheme.” 10 As defined in Section 45-I(f) of the Reserve Bank of India Act, 1934 and registered with the RBI under Section 45-IA of the Reserve Bank of India Act, 1934. The Non-Banking Financial Company - Infrastructure Finance Company (NBFC-IFC), Core Investment Company (CIC), Infrastructure Debt Fund - Non-Banking Financial Company (IDF-NBFC) and an NBFC under liquidation, are excluded from the ambit of the Scheme. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: