IST,

IST,

Annual Report on Banking Ombudsman Scheme, 2014-15

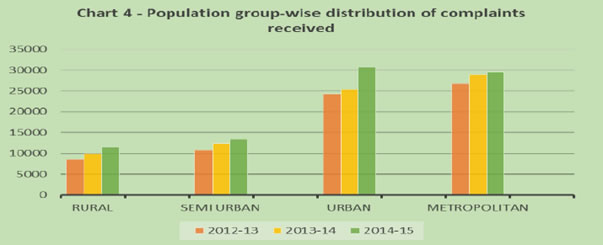

A substantial increase in the bank customers coupled with a sudden surge in first time users of banking services and the use of various financial services by them has brought into focus the need for strengthened financial regulation and customer education to safeguard, empower and protect the customers. The banks form the pivot of the entire financial system of our country. They are primarily engaged in the business of financial intermediation and the process is embedded with various risks. The trust, the people repose in the banking system is unfathomable, which is one of the primary reasons for the active regulatory initiatives on customer protection by RBI that has gained significance over the years. On the one hand, a well-functioning customer protection regime provides effective safeguards for retail financial services customers, while on the other hand it empowers customers to exercise their rights and fulfill their obligations. RBI has always strived hard to put in place robust customer protection framework. Banking Ombudsman Scheme is one component of this framework, which provides a simple, cost free apex level grievance redress mechanism for bank customers. The customer base of banks in the country is dominated by low income and middle class customers, who have diverse financial needs for savings/credit/ investments/retirement planning etc. The service providers of these products and services are in possession of huge repository of information and have the capability to apply more analytics. On the contrary, the consumers, the recipients of these services, are largely financially illiterate and have limited awareness. They do not have access to the level of information that the service providers have, which has led to a wide gap i.e. asymmetry in information and resources between the service provider and service receiver. These are ‘information deprived illiterates’, not in the sense of education, albeit in respect of the financial information they possess. The level of awareness on simple aspects like need for timely payment of the bills, credit card dues and loans etc. is absolutely low among this group of bank customers. They aren’t really aware about the unforeseen penalties that they might end up paying for their failures to make timely payment of bills/ credit card dues. Not only the penalty could be severe, even more importantly, the bad credit behavior can feed into their credit history with credit companies, which can act as an impediment for their future credit requirements. This asymmetry of information leads to grievances, which are typical and pose difficulties in resolution. Unresolved complaints of this group of bank customers ultimately reach Banking Ombudsmen. For an effective and efficient grievance redress system in any jurisdiction, the redress action should be as closely associated as possible to the initial point where the grievance arises. In effect, the banks themselves should make efforts to redress the complaints of their customers through their internal mechanism. The RBI has recently advised all Public Sector banks and select Private Sector and Foreign banks to appoint Chief Customer Service Officer (CCSO - Internal Ombudsman). The CCSO will be the topmost grievance redress authority within the bank. The complaints will be examined by the bank’s internal grievance redress mechanism and in case the bank decides to reject a complaint and/or to provide only partial relief to the complainant, such complaints will be escalated to the CCSO (Internal Ombudsman) for further examination. This will not only improve the banks’ customer grievance redress machinery but also enable banks to play more important role in resolution of customer complaints. During the year under review, there was 11% increase in number of complaints received in the offices of Banking Ombudsmen. This is a sign that the awareness about the Scheme is increasing. The high-point of this report is that the proportion of complaints from rural and semi urban population has increased by 15.6% and 8.5% respectively over the last year. These areas have remained low penetration areas for the Scheme. The situation is changing, though slowly, but surely. The RBI has directed the Banking Ombudsmen to increase awareness of the Scheme in smaller towns and rural areas. The introduction of Prime Minister Jan Dhan Yojana (PMJDY) by the Government of India and the supplemented financial inclusion efforts of RBI have resulted in massive increase in customer base of banks. This will result in increasing number of complaints. I am confident, the Offices of Banking Ombudsmen will meet the growing challenges.

Vision and Goals of the Banking Ombudsmen Offices Vision

Goals

Banking Ombudsman Scheme, 1995 was notified by the Reserve Bank of India on June 14, 1995 under section 35A of the Banking Regulation Act, 1949. The aim and objective of the Scheme is to provide a quick and cost free resolution mechanism for complaints relating to deficiency of banking services of common bank customers, who otherwise find it difficult or cost prohibitive to approach any other redressal fora such as courts. The Scheme is applicable to Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks and the Regional Rural Banks. The Scheme has undergone several revisions during the years 2002, 2006, 2007 and 2009. Presently, the Banking Ombudsman Scheme 2006, (BOS) as amended up to February 3, 2009, is in operation. There are 15 Banking Ombudsmen with specific State-wise jurisdiction covering all the 29 States and 7 Union Territories. Brief review of operations of the BO Scheme in 2014-15

1. The Banking Ombudsman Scheme 2006 1.1 The word 'ombudsman' originated from Sweden which, in 1809, established the position of Justlieombudsman to oversee government administration. It denotes loosely as 'citizen's defender' or 'representative of the people'. Since 1809, it has been adopted in many parts of the world, in both government and private industry (eg. banking and insurance) settings. The word ombudsman is not gender specific. 1.2 New Zealand became the first English speaking country to appoint an ombudsman in 1962. The office of the United Kingdom Ombudsman was established in 1967. The first Ombudsman in Australia was appointed in Western Australia in 1971, and was followed by the appointment of an ombudsman in Victoria in 1972, and in Queensland and New South Wales in 1974. The United Kingdom's Financial Ombudsman Service is an ombudsman established in 2001 as a result of the Financial Services and Markets Act 2000 to help settle disputes between consumers and UK-based businesses providing financial services, such as banks, building societies, insurance companies, investment firms, financial advisers and finance companies. The Financial Ombudsman Service is funded by the UK's financial services sector through a combination of statutory levies and case fees. These are paid by financial businesses that are regulated by the Financial Conduct Authority or licensed by the Office of Fair Trading and are automatically covered by law by the ombudsman service. The payment of these statutory levies and fees are not optional and are payable whether or not a complaint is upheld by the Financial Ombudsman Service. The service is free to consumers. 1.3 The ‘Narasimhan’ Committee on “Banking and Financial Sector Reforms” recommended introduction of the “Banking Ombudsman Scheme 1995” as a part of Financial Sector Policy and Systems Reforms 1991-92 to 1995-96. The RBI accepted the recommendation and as a part of banking policy, Dr. C. Rangarajan; Governor, announced the “The Banking Ombudsman Scheme” on June 14, 1995. The scheme was notified under Section 35 of the Banking Regulation Act, 1949. It covers all Scheduled Commercial Banks, Regional Rural Banks and the Scheduled Primary Co-operative Banks having business in India. RBI has set up 15 offices of Banking Ombudsmen which cover 29 states and 7 Union Territories of India. The aim and objective of the Scheme is to provide a quick and cost free resolution mechanism for complaints on deficiency of banking services for common bank customers, who otherwise find it difficult or cost prohibitive to approach any other redressal for a such as courts. 1.4 The Scheme is reviewed periodically by the RBI to expand its scope to all newly introduced banking services and products. As on date the Scheme specifies 27 grounds of complaints which customer complaints relating to ATM/debit/credit cards, recovery agents, failure of banks to provide promised services, levying service charges without prior notice to the customer, non-adherence to the fair practices code/BCSBI Codes, internet banking etc. 1.5 The objective of the Scheme is mainly settlement of dispute through conciliation and mutual agreement between customers and banks with the Banking Ombudsman acting as the mediator. The underlying advantage of the Scheme being administered by the RBI is that, it gives insights to many systemic issues which act as inputs while framing appropriate regulatory guidelines. 1.6 Over the years the Banking Ombudsman Scheme has done a great deal to ensure the public's faith in the banking system and its processes. The acceptability of the Scheme among bank customers is evidenced in the number of complaints received by the offices of Banking Ombudsman which is steadily increasing every year and now exceeds 85000. The Ombudsman scheme is a very important channel for redressal of grievances by the general public against banking services. The Scheme does not oust the jurisdiction of other courts, and hence, aggrieved people do not hesitate in using the mechanism of Banking Ombudsman as a primary forum for resolution of disputes regarding banks. The Banking Ombudsman is in a position to do justice in an individual case, as he is not bound by the precedents and the proceedings adopted by him/her are summary in nature, while resolving disputes between aggrieved customer and the bank. 1.7 During the year 2014-15 the 15 offices of Banking Ombudsmen received 85131 complaints. A detailed analysis of the complaints handled by the offices of Banking Ombudsmen during the year is given in the ensuing chapters. Profile of customer complaints handled by OBOs

2.1 During the year 2014-15, 15 OBOs covering 29 States and 7 Union Territories, received 85131 complaints. Comparative position of complaints received during the last three years in given in Table 1.

Compared to previous year the number of complaints received in the year 2014-15 has increased by 11.2%. This is an indication that the awareness about the BOS is increasing and the outreach activities and other awareness initiatives undertaken by OBOs and Regional Offices of RBI are showing results.  OBO-wise receipt of complaints 2.2 OBO-wise position of complaints received during the last three years is given in Table 2 and Chart 2. The trend in receipt of complaints received in the OBOs continued this year also, with OBO New Delhi receiving highest number of complaints (14712). Four metro centres OBOs viz. New Delhi, Chennai, Kolkata, Mumbai and two non-metro centres viz. OBO Kanpur and Bhopal put together, accounted for 62% of the total complaints received.

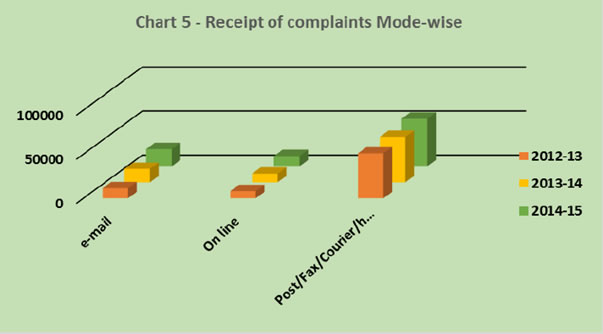

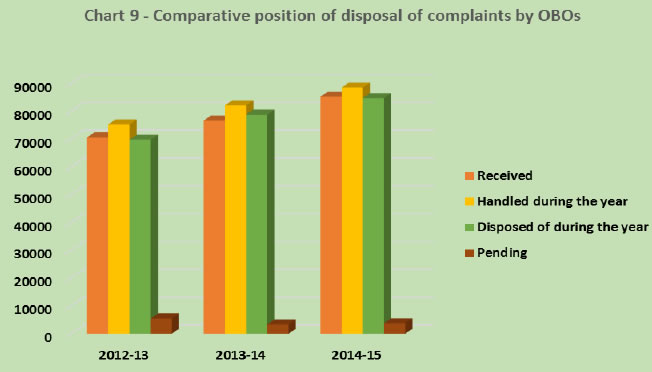

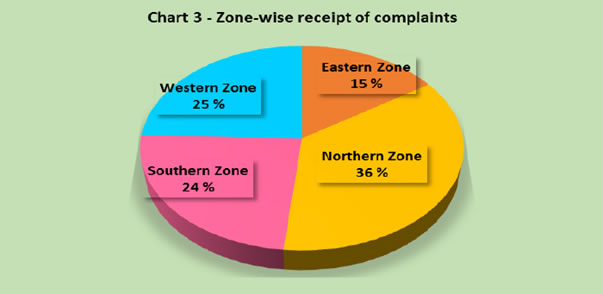

Northern Zone accounted for 36% of total complaints received, followed by Western Zone 25%, Southern Zone 24% and Eastern Zone 15%. Eastern Zone witnessed 29.5% increase in number of complaints received, over the last year. In Northern Zone complaints increased by 15.2% whereas in Western and Southern Zones the rate of increase was 7.2% and 0.5% respectively. Population group-wise distribution of complaints received 2.3 Comparative position of last three years’ Population group-wise distribution of complaints is given in Table 4 and Chart 4. Over the years Urban and Metropolitan population have remained major group of complainants under the BOS. During the current year also 71% of the complaints were received from this group. Year-on-year basis, the complaints from Rural population and Semi-urban population increased by 15.6% and 8.5% respectively, whereas in Urban and Metropolitan population groups, the increase was 17% and 2% respectively. OBOs have placed more trust on the awareness campaigns and outreach activities in smaller towns and rural areas. Increase in receipt of complaints from these areas are indicative of success of focused attention provided by OBOs in their outreach activities and awareness programmes. Brief details of these activities by OBOs are given in Chapter No. 9 - “Other Developments”. Receipt of complaints Mode-wise 2.4 Complainant can lodge the complaint with the OBO in any mode viz., by hand delivery, by post, courier, by fax or e-mails or the complaint can be lodged by online complaint form placed on the website of RBI. Comparative position of complaints lodged through various modes during the last three years is indicated in Table 5 and Chart 5. Physical mode of lodging complaint (Post/Fax/Courier/hand delivery) continued to predominant mode among bank customers. But the trend reveals that, slowly customers are moving to electronic mode for lodging complaints. This is evident from the data of the last three years. The percentage of usage of electronic mode has increased from 28% in 2012-13 to 37% in 2014-15. Year-on-year basis, there was an increase of 29% in complaints lodged by e-mail and 19% in complaints lodged online respectively during the year. However, the growth rate in physical mode is comparatively less at the level of 5%. Complainant group-wise classification 2.5 BOS primarily caters to grievance resolution of individual customers of banks. During the year individuals and senior citizens taken together accounted for 93.6% of the complaints. Break-up of complaints received from various segments of society is given in Table 6 and Chart 6. Bank group-wise classification 2.6 Classification of complaints received by OBOs based on bank group is indicated in Table 7 and Chart 7.

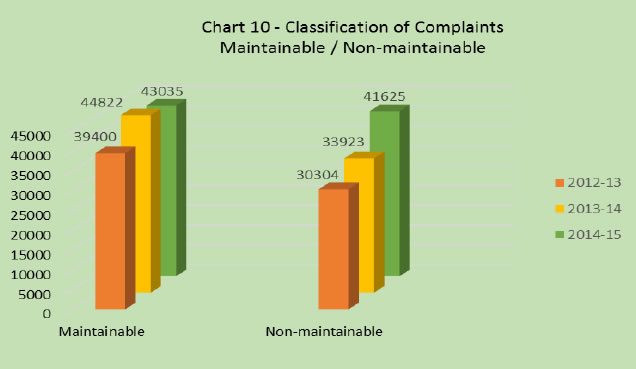

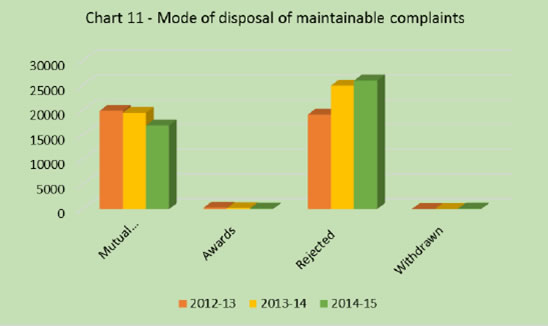

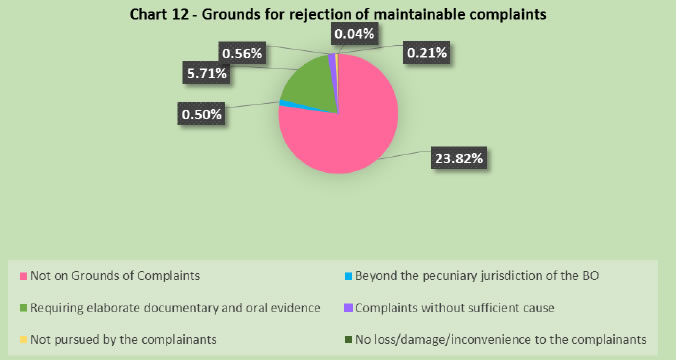

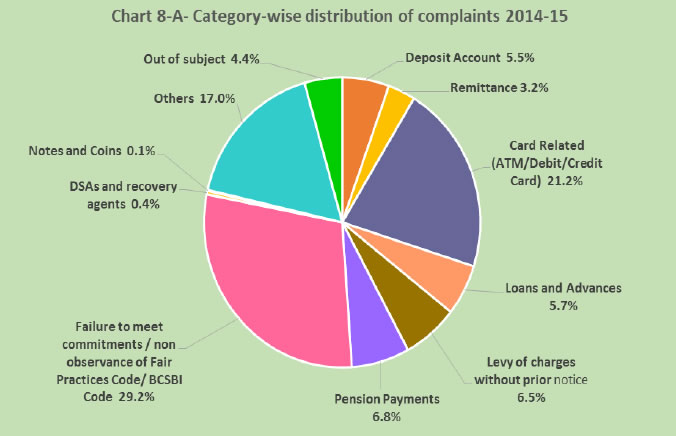

Public Sector Banks accounted for 65% of the total complaints out of which 31% complaints were against SBI & Associates group. Private Sector Banks accounted for 23% whereas Foreign Banks accounted for 4% of total complaints received. Regional Rural Banks and Scheduled Urban Co-operative Banks accounted for 2% of the complaints received. 6% of the complaints were received against other non-bank entities not covered under the BOS. Year-on-year basis, compared to last year, complaints received against Public Sector banks increased by 27% and against Private Sector banks by 16%. On the contrary, there was a 32% decline in complaints against Foreign banks. The detailed bank-wise (Scheduled Commercial Banks) and complaint category-wise break-up of complaints received during the year 2014-15 is given at Annex VI. 3. Nature of Complaints Handled 3.1 Grounds of complaints on which the complaints can be lodged with the BO are laid down in the BOS. There are 27 grounds of complaints regarding deficiency in banking services covering almost entire gamut of banking services. Periodically these grounds are reviewed to cater to various new products and services in the banking sector. Complaints received under these grounds are broadly categorized into major heads indicated in Table 8 and Chart 8.  3.2 The complaints pertaining to failure to meet commitments, non-observance of fair practices code, BCSBI Codes constituted the major category of complaints received with 29.2% of complaints received. Lack of awareness about the Codes amongst bank staff as also the customers and lack of bank’s commitment to adhere to agreed terms & conditions are major reasons for these complaints. The banks need to pay more attention to this aspect through sensitization and training of their staff. 3.3 Card related complaints comprised 21.2% of the total complaints and was the second largest category of complaints. On a year-on-year basis compared to last year there was a small decrease of 2% in card related complaints during the year. Out of a total of 18123 card related complaints, 10651 complaints were pertaining to ATM/Debit Cards (12.51% of complaints received). Of these, 6990 complaints were about failure of ATM cash withdrawal transactions involving short payment/non-payment of cash. With expansion of customer base and the ATM network, proportion of such complaints is on the rise. These complaints also involve alleged fraudulent withdrawals from ATMs. In all such complaints BOs mainly rely on the documentary evidence such as JP Log, electronic journal, switch report etc. The CCTV footage is an important evidence in deciding the nature of the transaction, whether authorized or fraudulent and the veracity of the complainant’s contention. CCTV footage has also thrown light on some dubious practices employed by fraudsters. In card related complaints, 7472 (8.8% of complaints received) complaints pertained to credit card operations of banks. These complaints were mainly about issue of unsolicited cards, sale of unsolicited insurance policies and recovery of premium along with card charges, charging of annual fees in spite of being offered as 'free' card, authorization of loans over phone, wrong billing, settlement offers conveyed telephonically, non-settlement of insurance claims after the demise of the card holder, exorbitant charges, high-handed practices by recovery agents, wrong reporting of credit information by banks to Credit Information Companies etc. 3.4 Complaints on ‘loans and advances’ accounted for 5.7% of the complaints received. These complaints mainly pertained to non-sanction/delay in sanction of loans, charging of excessive rate of interest, non-return of title deeds, non-issuance of no due certificate, education loans, wrong/delayed reporting to CIBIL etc. 3.5 Pension related complaints at 6.8% of the complaints received, declined by 13% compared to last year. Major reasons for pension related complaints were delayed payments, errors in calculations, difficulties in converting the pension to family pension on demise of pensioner etc. 3.6 Complaints under the category ‘levy of charges without prior notice’ constituted 6.5% of the complaints received. These were mainly regarding charges for non-maintenance of minimum balance, processing fees, pre-payment penalties in loan accounts, cheque collection charges, etc. 3.7 Complaints in the category of ‘Deposit Accounts’ constituted 5.5% of complaints received. Delays in credit, non-credit of proceeds to parties accounts, non-payment of deposit or non-observance of the RBI directives, if any, applicable to rate of interest on deposits in savings, current or other account maintained with a bank, etc., were the major reasons for complaints in this category. 3.8 Non-payment or delay in payment of inward remittances, Non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc were some of the reasons for 3.2% complaints received under the category of ‘Remittances’ 3.9 17% complaints were in the category of ‘Others’ which comprised of complaints on grounds other than those mentioned in the foregoing paragraphs. These were non-adherence to prescribed working hours, delay in providing banking facilities, refusal or delay in accepting payment towards taxes as required by RBI/Government, refusal or delay in issuing/servicing or redemption of government securities, non-adherence to RBI directives, etc. 3.10 Complaints under the category ‘Out of Subject’ are those complaints which are not relating to the grounds of complaints specified under the BOS. During the year 4.4% of the complaints received were in this category. Lack of awareness among the public about applicability of the BOS is the primary reason for receipt of such complaints. 4.1 Table 9 and Chart 9 below indicate a comparative position of disposal of complaints by OBOs. OBOs handled 88438 during the year including 3307 complaints pending at the beginning of the year. OBOs maintained a disposal rate of 96% during the year. BO office wise position of complaints disposed during the year 2014-15 is indicated in Table 10 below: Disposal of complaints - Maintainable / Non-Maintainable 4.2 The complaints which do not pertain to grounds of complaint specified in Clause 8 of the BOS and those complaints, where procedure for filing the complaint laid down in Clause 9 of the BOS is not followed, are classified as ‘non-maintainable’. All other complaints are classified as ‘maintainable’ and are dealt in accordance with the provisions of the BOS 2006. Table 11 and Chart 10 indicate classification of maintainable and non-maintainable complaints disposed by all the OBOs during the last three years. Of the 84660 complaints disposed during the year, 51% complaints were maintainable. Compared to previous year, there was 4% decline in maintainable complaints. 49% of the complaints handled by the OBOs during the year were non-maintainable. Mode of disposal of maintainable complaints 4.3 In terms of Clause 7(2) of the BOS, the BO shall facilitate resolution of complaints by settlement, by agreement or through conciliation and mediation between the bank and the aggrieved parties or by passing an Award in accordance with the Scheme. The aim is to arrive at amicable settlement by mutual agreement by mediation and conciliation. When mediation and conciliation fails to ensure amicable resolution, the BO gives a decision or passes an Award. Over the last three years the percentage of disposal by mutual agreement is witnessing a decline. Also there is a decline in the percentage of disposal by issue of Awards which is less than 1%. There is a very steady increase in the percentage of disposal by rejection under various clauses of the BOS. Table 12 and Chart 11 below indicate the mode of disposal of Maintainable complaints. 39.3% of the maintainable complaints received during the year were resolved by mutual settlement. Awards were passed in less than 1% of the cases, whereas 60.5% complaints were rejected / withdrawn. Grounds for rejection of complaints – Maintainable 4.4 The grounds for rejection of maintainable complaints and their proportion to complaints received during the year are indicated in the Table 13 and Chart 12. Non-Maintainable complaints 4.5 Non-maintainable complaints are those complaints which do not fall within the ambit of the BOS. These complaints are rejected under various clauses of the BOS. Reasons for treating the complaint as non-maintainable and their proportion to total complaints received during the year are given in Table 14. 4.6. First resort complaints: The BOS under Clause 9 (3) (a) specifies that the complainant should first approach the respective bank for redress of his grievance. If the bank does not reply within a month or the complainant is not satisfied with bank's reply, then he/she can approach the BO. When the complainant directly approaches the BO with the complaint without approaching the bank, the complaint is treated as First Resort Complaint (FRC) and rejected by the BO. Such complaints are invariably sent by the OBO to concerned bank for suitable resolution. During the year, 14% of the complaints received were FRCs. FRCs are also received through online complaint form placed on the website of RBI. These complaints are forwarded online directly to the bank concerned without registering them under the BOS as these are prima-facie non-maintainable complaints under the BOS. During the year, 10317 FRCs received through online complaint form were forwarded directly to the banks concerned. OBOs also have this option of forwarding the FRCs received physically in their offices to concerned banks online. During the year OBOs forwarded 2706 FRCs to concerned banks using this facility. 4.7. High rate of rejection of complaints under the BOS is due to lack of awareness about the applicability of the BOS amongst the bank customers. Though OBOs are making efforts to educate the customers about the BOS through their awareness campaigns, outreach activities, Town Hall events etc., these efforts need be supplemented by the banks. Awards Issued 4.8 During the year BOs issued 87 Awards. Out of these, 4 Awards remained unimplemented as on June 30, 2015, in 2 cases the banks have filed appeal before the Appellate Authority, 8 Awards lapsed for non-submission of acceptance letter by the complainants. For one Award, the appeal preferred was examined and the case was remanded back to BO by the Appellate Authority for review. OBO-wise position of Awards issued during the year 2014-15 is indicated in Table 15 below: Age –wise classification of pending complaints 4.9 Table 16 and Chart 13 below indicate age-wise classification of pending complaints. OBOs maintained the disposal rate of 96% during the year 2014-15. At the end of the year, 3778 (4%) complaints were pending at all OBOs. Out of these, 2.69% complaints were pending for less than one month, 1.36% complaints were pending for one to two months, 0.12% complaints were pending for two to three months and only 0.1% complaints were pending beyond three months. Reasons for pendency beyond two months are mainly attributed to delays in getting complete information/documents from banks/complainants. Complaints per officer 4.10 During the year 2014-15 there were 149 desk officers handling the complaints received in all OBOs. On an average, proportion of complaints per officer worked out to 571 complaints. Table 17 and Chart 14 below indicate complaints 'per officer' in respective OBOs. 5.1 From year 2006 onwards, the expenditure incurred for running the BOS is fully borne by the RBI. The expenditure includes the revenue expenditure and capital expenditure incurred on administration of the BOS. The revenue expenditure includes establishment items like salary and allowances of the staff attached to OBOs and non-establishment items such as rent, taxes, insurance, law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include furniture, electrical installations, computers/related equipment, telecommunication equipment and motor vehicle. Average cost incurred for handling a complaint under the BOS 2006 is indicated in Table 18 and Chart 15.

Aggregate cost of running the BOS has increased from ₹ 315 million in 2012-13 to ₹ 387 million in 2014-15. Average cost of handling a complaint has risen from ₹ 4468/- to ₹ 4541/- during this period. Compared to year 2013-14 there was a decline in average cost from ₹. 4824/- to ₹. 4541/-. BO Office wise 'Per-Complaint Cost’ for the year 2014-15 is given in Table 19: 6. Appeals against the Decisions of the BOs 6.1 In terms of Clause 14 of the BOS 2006, any person aggrieved by an Award issued by the BO under clause 12 or rejection of a complaint for the reasons referred to in sub clauses (d) to (f) of clause 13, can prefer an appeal before the Appellate Authority designated under the Scheme within 30 days of the date of receipt of communication of Award or rejection of complaint. The Deputy Governor in charge of the department of RBI administering the Scheme (Consumer Education and Protection Department) is the designated Appellate Authority under the BOS 2006. The secretarial assistance to the Appellate Authority is provided by the Consumer Education and Protection Department. Position of appeal handled by the Appellate Authority during the year 2014-15 is given in Table 20 below. 6.2 During the year 73 appeals were received against the decisions of BOs. Including 30 appeals pending at the beginning of the year, the AA handled 103 appeal during the year. Out of these 88 appeals were disposed. In 32 cases the Appellate Authority’s decision was in favour of customers whereas in 47 cases it was in favour of banks. The OBO wise position of appeals received during the year 2014-15 is given in Table 21. Representations to review the complaints closed under non-appealable clauses of the BOS 2006 6.3 In terms of Clause 14 (1) of BOS 2006 complaints rejected by the BO under Clause 13 (a), (b) & (c) of the Scheme are non-appealable. Still, representations from the complainants to reopen complaints rejected under these non-appealable Clauses of the Scheme are being received in the Consumer Education and Protection Department, the Secretariat of the Appellate Authority. During the year 810 such representations were received and disposed. 7. Complaints received through Centralised Public Grievance Redress and Monitoring System (CPGRAMS) CPGRAMS is a web based application developed by the Department of Administrative Reforms and Public Grievances of Government of India empowering the citizens to lodge their complaints online and also enabling redress action within a prescribed time limit. Government Departments, banks are sub-ordinate offices under this system to receive and redress complaints forwarded through this portal. The Consumer Education and Protection Department, RBI is the Nodal Office for RBI. Fifteen OBOs are sub-ordinate offices. Position of complaints handled by OBOs through this portal during the year 2014-15 is given in Table 22 below. 8. Applications received under Right to Information Act, 2005 The Banking Ombudsmen have been designated as the Central Public Information Officers under the Right to Information Act 2005 to receive applications and furnish information relating to complaints handled by the OBOs. During the year 15 OBOs received 454 applications under RTI Act. The OBO wise position is indicated in the Table 23. 9. Other Important Developments Annual Conference of Banking Ombudsmen 2015 9.1 The Annual Conference of Banking Ombudsmen was held at Chandigarh on April 24 and 25, 2015. The Conference was inaugurated by Dr Raghuram G. Rajan, Governor, Reserve Bank of India. CEOs/EDs of major public/ private sector banks, representatives of major foreign banks, Chairman of Indian Banks’ Association, Chairman of BCSBI, MD & CEO of NPCI, Banking Ombudsmen, CGMs/senior officers from Central Office Departments of RBI attended the Conference. In his keynote address the Governor stated that the Banking Ombudsman Scheme had come a long way since 1995. The aspect to be considered now is whether and how to expand the Scheme to new institutions and also to make the benefits of the Scheme to seamlessly reach smaller towns and rural areas. He expressed the need to increase awareness about the Scheme and making the Scheme really simple to use with an in-built evaluation process. Shri S. S. Mundra, Deputy Governor, RBI urged the banks to build a system which can capture all complaints for undertaking a root-cause analysis, which obviates the need for a regulatory intervention by ensuring internal system level correction at the banks. He also urged the banks to consciously build in a culture within to expeditiously settle the customer grievances involving small amounts which would provide credibility to the other customer service initiatives taken by the banks. Shri U S Paliwal, Executive Director in his opening remarks urged the banks to put in place an appropriate mechanism to ensure quick turn-around time for resolving complaints received under BO Scheme. He moderated the panel discussions on various issues related to the Banking Ombudsman Scheme. The Guest Speaker, Shri Deep Kalra, Founder & CEO, MakeMyTrip shared his experience about their grievance redressal mechanism and initiatives taken towards consumer protection in this organisation. Principal Nodal Officers Conference 9.2 A meeting with PNOs of Scheduled Commercial Banks was held in three phases on January 13, 14 and 19, 2015 at RBI Mumbai. Shri U S Paliwal, Executive Director, RBI, in his keynote address appreciated the role played by the Banking Ombudsmen in the grievance redress mechanism and emphasized that the role of Banking Ombudsman was to protect the interest of the customers where deficiency in service was observed in relation to policy/norms of the bank, in a transparent way. Major issues that emanated from root cause analysis of complaints received in BO Offices and RBI were discussed during the meeting. Heads of regulatory departments of the RBI, select BOs and CEO of BCSBI present in the meeting had interaction on various issues with PNOs. Annual Conference of International Network of Financial Services Ombudsman Schemes (INFO) 2014 : 9.3 The Banking Ombudsman Scheme is a member of International Network of Financial Services Ombudsman Schemes. Every year INFO organises Annual Conference of its member schemes which is designed to help members to develop their expertise in dispute resolution, by sharing experiences and exchanging information. The INFO conference 2014 was held at Trinidad and Tobago between September 28 and October 2, 2014. The topics of discussion included an introspection of the schemes followed across the world covering aspects such as accountability, clarity of scope, fairness, transparency, independent governance, effectiveness, accessibility, staffing, funding etc. Unlike in India, the Financial Services Ombudsman Scheme in various parts of the world are not covered under the ambit of Regulators but purely a voluntary mechanism. The pros and cons of such systems were widely discussed. Regional Conferences of Banking Ombudsmen 9.4. Regional Conferences of Banking Ombudsmen of respective zones were organized by nodal OBOs during the year. Important systemic issues were discussed in these conferences. Meetings with the Zonal Heads of major banks of the region were also organized on this occasion where various customer service related issues of topical interest were discussed and regulatory concerns were flagged for action by banks. Meeting with Consumer Professionals/Activists 9.5 The Governor, RBI met select certain consumer professionals/activists on May 25, 2015 to ascertain the developments taking place in the sphere of Consumer Education and Protection and convey what the RBI’s endeavour to do further in these areas. The core discussion was primarily with regard to cross-selling of third party products and mis-selling of financial products by the banks. The participants suggested measures to arrest mis-selling of financial products by banks. Meeting with Credit Information Companies 9.6 In view of increasing number of complaints about wrong/delayed reporting of credit information by banks to Credit Information Companies (CICs), it was decided to ascertain a feedback from CICs on systems and procedures followed by CICs for reporting, updation and modification of records. A meeting with the four CICs was convened on June 25, 2015, which was chaired by Shri U S Paliwal, Executive Director, RBI. The important aspects emerged from the discussions were that there is a need to educate customers about the factors affecting their credit score and its implications on credit rating of the customer and the need for inter cycle updation of data by all CICs for the changes effected by the banks. ED suggested that the industry can come up with a pilot project on consumer education and awareness and urged CICs to explore the possibility of setting up of a credit helpline for this purpose. Awareness and Consumer Education 9.7 OBOs adopted multi-pronged outreach strategy to spread awareness about the BOS and education of consumers. This included outreach programmes, Town Hall events, advertisement campaigns in print and electronic media, participation in exhibitions, trade fairs, display of posters etc. The focus of these outreach initiatives remained vulnerable class of bank customers and people in smaller towns and rural centres. Following are some of the initiatives by each OBO during the year to spread awareness and consumer education:

Press Meetings 9.8 The OBOs arranged meetings with local media and shared the information on the number and nature of complaints handled / resolved and a few significant / exemplary cases handled during the year. This initiative has proved helpful in spreading awareness about the BO Scheme. Meetings with Nodal Officers of Banks 9.9 During the year the OBOs held periodical meetings with Nodal Officers of the banks under their jurisdiction. During these meetings the systemic issues were analysed and steps to be taken were discussed to reduce complaints in this regard. Importance of quick response by banks to ensure quick resolution of complaints was also stressed upon the banks. Participants are also apprised with changes/new developments taking place in the areas of customer services/consumer protections including the latest circulars issued by RBI on these aspects. Skill building 9.10 With proliferation of technology in banking and introduction of various IT based banking services and products, nature of complaints received in OBOs has undergone a major shift. This has highlighted a need to equip OBO staff with requisite skills and knowledge to handle such complaints. The Zonal Training Centre, New Delhi and Reserve Bank Staff College, Chennai organised training programmes for officers and staff of the OBOs. Number of programmes being conducted has been increased during the year. Also the officers and staff of the OBOs were deputed to IDRBT, Hyderabad for specialized courses on electronic payments, internet banking, payment systems etc. OBOs also organised various trainings, in-house, as well as with external agencies like NPCI, IDRBT for their staff. The knowledge gained from such trainings helps the staff in understanding the ways to understand various reports pertaining to internet banking and ATM transactions (such as Audit log, transaction log, IP addresses, EJ log, Switch Report, etc.) as well as appreciate issues relating to internet banking. This insight has proved to be very helpful in effective and efficient resolution of fraudulent complaints on internet/ATM complaints. 10. Customer Service Initiatives by Reserve Bank of India 10.1 For development of transparent and efficient financial market, empowerment of consumers is a pre-requisite. Transparency and disclosures are two basic parameters which empower the consumers with requisite information and knowledge to take informed decision while availing any financial service or products. Technological innovation and increased competition for financial services have created a wide array of financial services and products available to consumers coupled with new risks and rewards. This has made it difficult for the consumer to take an informed decision suitable to his/her requirements. In the Indian scenario, asymmetry in information and awareness about financial products and services between customers and financial institutions acts as a barrier to an effective system of protection of customer rights. A large number of financial consumers end up in making wrong choices while availing of financial services and/or accepting what is thrust upon by the service providers. Under such conditions, the regulator by per force has to step in to take up the mantle of protecting the consumers. As a regulator of the Banking Sector, RBI assigns a lot of importance to consumer education and protection. During the year 2014-15 the RBI initiated several consumer centric measures aimed at protecting the interests of vulnerable class of bank customers. Some of such initiatives are given below. Charter of Customer Rights 10.2 Reserve Bank, in the Monetary Policy Statement 2014-15 had announced its intention to frame comprehensive consumer protection regulations based on domestic experience and global best practices. As a further structured measure towards protection of bank customers and setting standards of customer service, it was decided to formulate a “Charter of Customer Rights” as a broad, overarching principles for protection of bank customers. The “Charter of Customer Rights” was released on December 3, 2014. It primarily covers five Basic Rights of a bank customer, viz., Right to Fair Treatment; Right to Transparency Fair and Honest Dealing; Right to Suitability; Right to Privacy and Right to Grievance Redress and Compensation. A model Customer Rights Policy/Code has been formulated jointly by IBA and BCSBI based on the Charter of Customer Rights and circulated to the banks. Banks have been advised to formulate a Board approved Customer Rights Policy or dovetail the existing Customer Service Policies with the approval of the Board by July 31, 2015 incorporating the “Charter of Customer Rights” enunciated by RBI. Appointment of Chief Customer Service Officer (Internal Ombudsman) 10.3 Consequent to the recommendations made by the “Committee on Customer Service in Banks” (Damodaran Committee) regarding the need for an Ombudsman within the banks’ internal grievance redressal set up and with a view to strengthen the grievance redressal mechanism available for banks customers, to ensure minimum number of complaints get escalated to the existing Banking Ombudsman, the Reserve Bank of India has advised all the public sector banks, select private sector banks and foreign banks to appoint Chief Customer Service Officers ( Internal Ombudsman) at the earliest. (For details see Box No. I) Box – I: Internal Ombudsman for banks – Chief Customer Service Officer While examining the Banking Ombudsman Scheme 2006, the Committee on Customer Service in Banks (Damodaran Committee) in its report had observed that “There is a need for the banks in developing their Internal Grievance Redressal Mechanism to ensure only the minimum number of cases gets escalated to the Banking Ombudsman and the Scheme is strictly utilised only as an appellate mechanism. This can be made possible by having an official within the bank in the form of an internal Ombudsman which is in vogue in some countries like Canada and France”. RBI accepted this recommendation and advised all the Public Sector Banks, select Private Banks and Foreign Banks in May 2015 to appoint Chief Customer Service Officers (CCSO – Internal Ombudsman). The prerequisites laid down by the RBI for appointment of CCSO are that the CCSO shall be a retired banker of not less than the rank of a retired General Manager / Deputy General Manager of a Scheduled Commercial bank. He / She should not have worked in the bank in which he/she is appointed as CCSO and should possess necessary skills and have exposure in working of more than three areas of operations in banking such as general banking, credit, forex operations, treasury, government business, merchant banking, credit card operations etc. This will ensure that a senior level officer with required expertise is appointed as CCSO who will not have any bias towards the bank in which he/she has been appointed as CCSO. To ensure the independence in decision making process the RBI has further stipulated that the Audit Committee of the Board shall exercise oversight over the working of CCSO and he/she would report directly either to the Chairman, MD & CEO or ED of the bank and not to any other executive. The CCSO shall examine the grievances which are on the grounds listed in the BOS under Clause 8 and which were not resolved by the bank’s internal grievance redressal mechanism. The complaints outside the purview of Clause 8 of the BOS shall also be dealt with by the CCSO provided, these have been examined by the bank’s internal grievance redressal mechanism and left unresolved/unredressed to the satisfaction of the complainant. The bank shall forward all such complaints to CCSO, which, after the examination by its internal grievance redressal mechanism has been decided to reject and/or to provide only partial relief to the complainant. In all the final communication being sent to the complainants by CCSO, where the complaints are unresolved / unredressed to the satisfaction of the complainant after examination by CCSO, the clause relating to the availability of option to approach the BO should invariably be indicated. The appointment of CCSO as Internal Ombudsman in the long run will ensure that only a minimum number of complaints are escalated to Banking Ombudsman and the role of Banking Ombudsman would be extended to provide valuable inputs for policy formulation. Advertisement campaign on fictitious mails in Print Media 10.4 In view of increase in number of instances of people receiving emails/SMS/Telephone calls about fictitious offers of money by camouflaging the communication to appear as sent by the Governor, the Top Management or officials of RBI, a joint countrywide awareness campaign with Department of Consumer’s Affairs, Government of India on fictitious offers of money was conducted through print media. Advertisements cautioning members of public about such fictitious offers of money were released in 290 newspapers across the country. Charges for non-maintenance of minimum balance 10.5 From April 1, 2015 banks will have to notify the customer by SMS/email/letter before applying penal charges for non-maintenance of minimum balance in the savings account. Furthermore, penal charges are required to be directly proportional to the extent of shortfall observed and will be levied after one month from the date of notice to a customer. KYC norms simplified further 10.6 To give wide publicity to KYC’s simplification, the Reserve Bank of India issued a press release and a poster and a booklet and advised banks to promote public awareness about KYC at their branches. Following an amendment to the Prevention of Money Laundering (Maintenance of Records) Rules, 2013, KYC requirements were simplified and streamlined. The list of ‘officially valid documents’ (OVDs) for KYC was clearly enumerated to minimise banks’ discretion in the process. OVDs include passport, driving license, permanent account number (PAN) card, voter’s identity card, job card issued under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) duly signed by an officer of the state government and the letter issued by the Unique Identification Authority of India containing details of name, address and Aadhaar number or any document as notified by the central government in consultation with the regulator. Banks were also advised to apply simplified measures for low-risk customers. Banks can now rely on third party due diligence at the time of account opening, provided the third party is regulated, supervised and monitored and has adequate measures in place for compliance with client due diligence. Partial freezing of accounts in case of KYC non-compliance 10.7 In case of non-compliance of KYC requirements by customers despite repeated reminders by banks, banks should impose ‘partial freezing’ of such accounts in a phased manner. The main objective is to prevent money laundering and financing of terrorism. However, the account can be revived by submitting KYC documents as per the instructions in force. In case of such KYC non-compliant accounts, banks are advised to give an initial notice of three months to a customer to comply with KYC requirements, and follow this with a reminder for a further period of three months. Thereafter, banks may impose ‘partial freezing’ of the account by allowing all credits and disallowing debits with the freedom to close the account. If the account is still KYC non-compliant after six months of imposing ‘partial freezing’ the banks may disallow all debits and credits from/to the account, rendering it inoperative. However, the customer can always close the account. Digital life certificates for pensioners 10.8 The government has launched “Jeevan Pramaan”, a digital life certificate based on the Aadhaar biometric authentication, which is aimed at further simplifying the process of submission of life certificates and facilitating accuracy and timeliness in pension disbursals. Agency bank branches will be able to obtain digital information about their pensioner customers through the “Jeevan Pramaan” website and their own CBS framework, or through communication from pensioner customers. Banks have been advised to create adequate awareness about this facility among their pensioner customers and also suitably amend the Frequently Asked Questions (FAQs) on pension payments posted on their websites, and provide a link to the “Jeevan Pramaan” website. Online Display of Interest Rate Range 10.9 In order to further enhance transparency in pricing of credit, banks have been advised to display on their websites the interest rate range of contracted loans for the past quarter for different categories of advances granted to individual borrowers, including the mean interest rates, total fees and other applicable charges. Banks will also have to provide a clear, concise, one page key fact statement to all individual borrowers at every stage of the loan processing, and in case of any change in any terms and conditions. Acknowledgement of receipt of life certificates 10.10 In order to alleviate the hardships faced by pensioners on account of misplacement of life certificates at the bank branches, RBI has advised all agency banks handling Government pension payments to issue a duly signed acknowledgement to the pensioners on receipt of the life certificate submitted in physical form. Banks are also advised to consider entering the same in their CBS immediately on receipt and issue a system based receipt to the pensioner as this would ensure both acknowledgement as well as real-time updation of records. Relaxation in requirement of Additional Factor of Authentication (AFA) for small value card present transactions 10.11 RBI relaxed the need for Additional Factor Authentication for small value card present transactions using contact-less cards, upto a maximum limit of Rs. 2000/- per transaction. Banks have also been advised to create awareness on the features of the product to its customers including the maximum liability devolving on the customer in case of loss of cards reported to the bank. Dispensing with ‘No Due Certificate’ for lending by banks 10.12 In order to ensure hassle free credit to all borrowers, especially in rural and semi-urban areas and keeping in view the technological developments and the different ways available with banks to avoid multiple financing, the RBI advised banks to dispense with obtaining ‘No Due Certificate’ from the individual borrowers in rural and semi-urban areas for all types of loans including loans under Government Sponsored Schemes, irrespective of the amount involved unless the Government Sponsored Scheme itself provides for obtention of ‘No Dues Certificate’. Annex - I

Annex - II