Banking sector

in India is currently passing through an exciting and challenging phase. The reform

measures have brought about sweeping changes in this vital sector of the country's

economy. This paper is an attempt to study the trends in important banking indicators

for the 25-year period from 1980 to 2005. Analysing the data from balance sheets

of banks, the paper draws some important conclusions for the banking sector as

a whole as well as for different bank groups.

JEL Classification

: G 21

Keywords : Commercial Banks, Annual Accounts,

Income and Expenditure, Assets and Liabilities

Introduction The

banking system is central to a nation’s economy. Banks are special as they

not only accept and deploy large amounts of uncollateralised public funds in a

fiduciary capacity, but also leverage such funds through credit creation. In India,

prior to nationalisation, banking was restricted mainly to the urban areas and

neglected in the rural and semi-urban areas. Large industries and big business

houses enjoyed major portion of the credit facilities. Agriculture, small-scale

industries and exports did not receive the deserved attention. Therefore, inspired

by a larger social purpose, 14 major banks were nationalised in 1969 and six more

in 1980. Since then the banking system in India has played a pivotal role in the

Indian economy, acting as an instrument of social and economic change. The rationale

behind bank nationalisation has been succinctly put forth by eminent bankers:

“Many bank failures and crises over two centuries, and the damage they

did under laissez faire conditions; the needs of planned

growth and equitable distribution of credit, which in

privately owned banks was concentrated mainly on the controlling industrial houses

and influential borrowers; the needs of growing small scale industry and farming

regarding finance, equipment and inputs; from all these there emerged an inexorable

demand for banking legislation, some government control and a central banking

authority, adding up, in the final analysis, to social control and nationalisation”

(Tandon, 1989).

Post nationalisation, the Indian banking system registered

tremendous growth in volume. Despite the undeniable and multifold gains of bank

nationalization, it may be noted that the important financial institutions were

all state owned and were subject to central direction and control. Banks enjoyed

little autonomy as both lending and deposit rates were controlled until the end

of the 1980s. Although nationalisation of banks helped in the spread of banking

to the rural and hitherto uncovered areas, the monopoly granted to the public

sector and lack of competition led to overall inefficiency and low productivity.

By 1991, the country’s financial system was saddled with an inefficient

and financially unsound banking sector. Some of the reasons for this were (i)

high reserve requirements, (ii) administered interest rates, (iii) directed credit

and (iv) lack of competition (v) political interference and corruption. As recommended

by the Narasimham Committee Report (1991) several reform measures were introduced

which included reduction of reserve requirements, de-regulation of interest rates,

introduction of prudential norms, strengthening of bank supervision and improving

the competitiveness of the system, particularly by allowing entry of private sector

banks. With a view to adopting the Basel Committee (1988) framework on capital

adequacy norms, the Reserve Bank introduced a risk-weighted asset ratio system

for banks in India as a capital adequacy measure in 1992. Banks were asked to

maintain risk-weighted capital adequacy ratio initially at the lower level of

4 per cent, which was gradually increased to 9 per cent. Banks were also directed

to identify problem loans on their balance sheets and make provisions for bad

loans and bring down the burgeoning problem f non- performing assets. The period

1992-97 laid the foundations for reform in the banking system (Rangarajan, 1998).

The second Narasimham Committee Report (1998) focussed on issues like strengthening

of the banking system, upgrading of technology and human resource development.

The report laid emphasis on two aspects of banking regulation, viz.,

capital adequacy and asset classification and resolution of NPA-related problems.

Commercial banks in India are expected to start implementing Basel II norms

with effect from March 31, 2007. They are expected to adopt the standardised approach

for credit risk and the basic indicator approach for operational risk initially.

After adequate skills are developed, both at the banks and at the supervisory

levels, some banks may be allowed to migrate to the internal rating based (IRB)

approach (Reddy 2005).

At present, banks in India are venturing into

non-traditional areas and generating income through diversified activities other

than the core banking activities. Strategic mergers and acquisitions are being

explored and implemented. With this, the banking sector is currently on the threshold

of an exciting phase.

Against this backdrop, this paper endeavours to

study the important banking indicators for the last 25-year period from 1981 to

2005. These indicators have been broadly grouped into different categories, viz.,

(i) number of banks and offices (ii) deposits and credit (iii) investments (iv)

capital to risk-weighted assets ratio (CRAR) (v) non performing assets (NPAs)

(vi) Income composition (vii) Expenditure composition (viii) return on assets

(ROAs) and (ix) some select ratios. Accordingly, the paper discusses these banking

indicators in nine sections in the same order as listed above. The paper concludes

in section X by drawing important inferences from the trends of these different

banking parameters.

Section I

Number of Banks and Offices The number of offices of all

scheduled commercial banks almost doubled from 29,677 in 1980 to 55,537 in 2005.

This rapid increase

Table

1: Number of Scheduled Commercial

Banks- Bank Group-wise

| Year

| SBI

& its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector Banks | All

Scheduled

Commercial Banks |

Number

of

Banks | Number

of

Offices | Number

of

Banks | Number

of

Offices | Number

of

Banks | Number

of

Offices | Number

of

Banks | Number

of

Offices | Number

of

Banks | Number

of

Offices |

1980 | | 8 | 7745 | 20 | 18083 | 13 | NA | 34 | 3849 | 75 | 29677 |

1985 | | 8 | 10568 | 20 | 25061 | 20 | NA | 32 | 4833 | 80 | 40462 |

1990 | | 8 | 12074 | 20 | 29800 | 22 | 148 | 25 | 3961 | 75 | 45983 |

1995 | | 8 | 12947 | 19 | 31817 | 27 | 157 | 32 | 4213 | 86 | 49134 |

2000 | | 8 | 13589 | 19 | 33905 | 42 | 237 | 33 | 5437 | 101 | 53168 |

2005 | | 8 | 13896 | 20 | 35075 | 31 | 245 | 29 | 6321 | 88 | 55537 |

Note :

Number

of banks and branches of the Nationalised bank group for the year 2005 includes

IDBI Ltd.

Source :

Data on number of

bank offices are taken from Banking Statistics, 1972 to 1996, Basic Statistical

Returns, 1998 and various issues of Statistical Tables Relating to Banks

in India for the years from 1996 to 2005. | in

the number of bank offices is observed in the case of all the bank groups. However,

the number of banks in the case of foreign bank group and domestic private sector

bank group decreased from 42 in 2000 to 31 in 2005 and from 33 in 2000 to 29 in

2005, respectively. This fall in the number of banks is reflective of the consolidation

process and, in particular, the mergers and acquisitions that are the order of

the banking system at present (Table 1).

Section

II

Deposits and Credit

II.1

Credit Deposit Ratio

The credit-deposit ratio (C-D ratio)

provides an indication of the extent of credit deployment for every unit of resource

raised in the form of deposits. The C-D ratios of all scheduled commercial banks

decreased gradually from 63.3 per cent in 1980 to 49.3 per cent in 2000. This

declining trend has been reversed in the recent years, with the ratio increasing

to 62.7 per cent in 2005. The foreign bank group recorded the highest C-D ratio

(87.1 per cent) and State Bank Group the lowest (56.3 per cent) in 2005. The C-D

ratios of all the bank groups had fallen drastically in 2000, except for foreign

banks. With respect to domestic private sector banks group, this ratio

Table

2: Credit Deposit Ratios of Scheduled Commercial Banks |

(Per

cent) | Year

| SBI &

its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector Banks | All

Scheduled

Commercial

Banks |

C-D

Ratio | C-D

Ratio | C-D

Ratio | C-D

Ratio | C-D

Ratio | 1980 | | 74.4 | 58.9 | 73.5 | 54.3 | 63.3 |

1985 | | 64.6 | 58.9 | 74.1 | 55.5 | 60.8 |

1990 | | 74.0 | 56.6 | 62.3 | 54.1 | 61.6 |

1995 | | 57.1 | 48.0 | 54.3 | 54.3 | 51.4 |

2000 | | 50.3 | 46.4 | 72.2 | 49.0 | 49.3 |

2005 | | 56.3 | 61.3 | 87.1 | 70.5 | 62.7 |

Note :

Ratio includes the impact of the conversion of two non-banking entities into banking

entities.

Source :

Base data are taken from Annual Accounts

of Scheduled Commercial Banks 1979 to 2004 and Statistical Tables Relating to

Banks in India 2004-05. | was high at 70.5 per cent in

2005. With respect to State Bank Group and nationalised bank group, the C-D ratios

were lower at 56.3 per cent and 61.3 per cent, respectively, which were less than

the C-D ratio of all scheduled commercial banks at 62.7 per cent in 2005. There

has been a significant increase in the C-D ratios in 2005 across all the bank

groups. (Table 2 and Chart 1).

II.2 Per Office

Deposits and Credit

The overall business of foreign banks per

office is higher than the per office business of other bank groups. Across the

board, the

per

office deposits are more than the per office credit as expected. With respect

to all scheduled commercial banks, deposits per office increased from Rs.1.4 crore

in 1980 to Rs. 33 crore in 2005 and credit per office also increased from Rs.

0.9 crore to Rs. 20.7 crore during the same period (Table 3). II.3

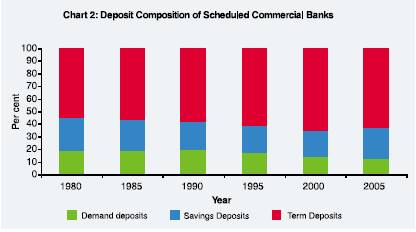

Type-wise Deposits

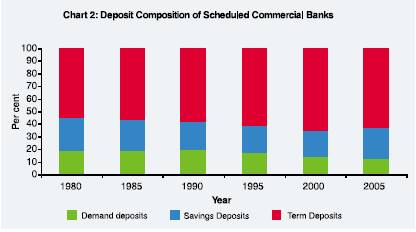

Over the years, there has been a shift in

the composition of deposits. While the savings bank deposits of all scheduled

commercial banks remained more or less constant at around one fourth of the total

deposits, term deposits increased from 55.1 per cent in 1980 to 63.0

per cent in 2005. On the other hand, demand deposits fell from 19.7 per cent in

1980 to 12.8 per cent in 2005. More or less similar trend is observed for both

State Bank Group and also for the nationalised bank group. In the case of

foreign banks and domestic private sector bank groups, the pattern in the composition

of deposits differs from that of the public sector banks. In the case of foreign

banks, demand deposits, which formed 25.7 per cent in 1980, increased to 30.1

per cent in 2005. The share of savings bank deposits in total deposits of foreign

banks, decreased from 21.5 per cent in 1980 to 9.9 per cent in 2000. This share

was 17.9 per cent in 2005. The analysis shows that more funds of short-term nature

are parked with the foreign banks group. This may be an indication that the business

class is attracted towards better

Table

3: Per Office deposits and credit of Scheduled Commercial Banks |

(Rs.

crore) | Year

| SBI

& its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector Banks | All

Scheduled

Commercial Banks |

| Deposits | Credit | Deposits | Credit | Deposits | Credit | Deposits | Credit | Deposits | Credit |

1980 | 1.5 | 1.1 | 1.5 | 0.9 | - | - | 0.6 | 0.3 | 1.4 | 0.9 |

1985 | 2.8 | 1.8 | 2.5 | 1.5 | - | - | 1.0 | 0.5 | 2.5 | 1.5 |

1990 | 4.7 | 3.5 | 4.3 | 2.4 | 60.3 | 37.6 | 2.0 | 1.1 | 4.4 | 2.7 |

1995 | 8.7 | 5.0 | 7.4 | 3.6 | 178.5 | 97.0 | 6.9 | 3.8 | 8.3 | 4.2 |

2000 | 18.9 | 9.5 | 14.2 | 6.6 | 208.1 | 150.3 | 20.9 | 10.3 | 16.9 | 8.3 |

2005 | 36.4 | 20.5 | 26.5 | 16.2 | 353.1 | 307.4 | 49.5 | 34.9 | 33.0 | 20.7 |

Source

:

Base data are taken from Annual Accounts of Scheduled Commercial

Banks 1979 to 2004 and Statistical Tables Relating to Banks in India 2004-05. |

service offered by foreign banks. In the case of domestic

private sector bank group, while the composition of demand deposits did not vary

much over the 25-year period, the share of savings deposits fell from 26.8 per

cent in 1980 to 16.0 percent in 2005, whereas term deposits increased from 56.7

per cent to 69.5 per cent over the same period. Even though bank deposit

rates are low, people prefer to park major portion of their funds in the form

of term deposits because of the risk free returns and assured returns it provides.

We can infer that the interest rate structure has definitely influenced the maturity

structure of bank deposits. For example, since the year 2000, the share of term

deposits to total deposits declined across bank groups except for State Bank group.

The deposit rates of 1 to 3 yrs maturity show that there is a clear fall in the

rates since 2000. This could be the major reason for decline in term deposits

after 2000 (Table 4 and Chart 2).

Table

4: Bank Group-wise Deposits of Scheduled

Commercial Banks:

Type-wise | (Per

cent) | Year

| SBI

& its Associates | Nationalised

Banks | Foreign

Banks | Demand

Deposits | Savings

Bank Deposits | Term

Deposits | Demand

Deposits | Savings

Bank Deposits | Term

Deposits | Demand

Deposits | Savings

Bank Deposits | Term

Deposits | 1980 | | 24.6 | 23.3 | 52.1 | 17.6 | 26.1 | 56.3 | 25.7 | 21.5 | 52.8 |

1985 | | 24.7 | 23.4 | 52.0 | 16.5 | 24.9 | 58.6 | 33.7 | 16.9 | 49.4 |

1990 | | 26.7 | 22.9 | 50.4 | 16.7 | 22.2 | 61.1 | 26.9 | 9.3 | 63.8 |

1995 | | 22.5 | 22.5 | 55.0 | 15.8 | 23.5 | 60.7 | 15.5 | 8.3 | 76.2 |

2000 | | 17.7 | 21.5 | 60.7 | 11.9 | 24.1 | 64.0 | 21.6 | 9.9 | 68.5 |

2005 | | 14.1 | 25.0 | 60.9 | 9.9 | 27.2 | 63.0 | 30.1 | 17.9 | 51.9 |

Year

| Domestic

Private

Sector Banks | All

Scheduled

Commercial Banks | |

Demand

Deposits | Savings

Bank

Deposits | Term

Deposits | Demand

Deposits | Savings

Bank

Deposits | Term

Deposits | 1980 | | 16.5 | 26.8 | 56.7 | 19.7 | 25.2 | 55.1 |

1985 | | 16.9 | 27.3 | 55.8 | 19.4 | 24.3 | 56.2 |

1990 | | 16.9 | 25.1 | 58.0 | 19.9 | 22.0 | 58.1 |

1995 | | 16.0 | 15.0 | 69.0 | 17.6 | 21.6 | 60.8 |

2000 | | 14.3 | 11.0 | 74.7 | 14.4 | 20.9 | 64.7 |

2005 | | 14.4 | 16.0 | 69.5 | 12.8 | 24.2 | 63.0 |

Source

: Base data are taken from Annual Accounts of Scheduled

Commercial Banks 1979 to 2004 and Statistical Tables Relating

to Banks in India 2004-05. |

II.4 Bank Group-wise Share in Deposits

The bank group-wise

share in deposits of scheduled commercial banks depicts that nationalised bank

group contributed more than 50 per cent in the total deposits mobilised by all

scheduled commercial banks in the year 2005. This share dropped from 64.4 per

cent in 1980 to 50.7 per cent in 2005. The share of deposits of State Bank group

remained more or less constant during the 25-year period constituting a little

more than one fourth of the total deposits by all scheduled commercial banks.

State Bank group is successful in holding on to its percentage share of deposits

in total deposits of all scheduled commercial banks. However, nationalised bank

group is seen to be slipping in this area. The share of foreign bank group in

total deposits is showing increasing trend. The share of foreign banks increased

from 2.9 per cent to 4.7 per cent and in the case of domestic private sector banks,

it increased from 5.3 per cent in 1980 to 17.0 per cent in 2005. This shows that

banks in the private sector have taken a head start in the deposit mobilisation

after the liberalisation measures adopted with regard to entry of new private

sector banks in 1995 (Table 5).

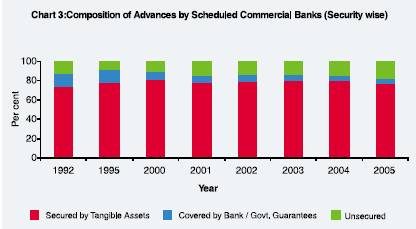

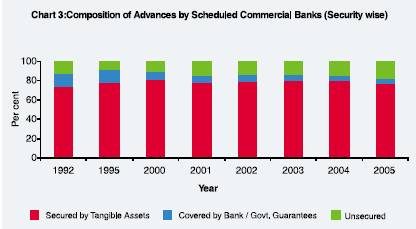

II.5 Security-wise Advances

The advances secured by tangible assets in the case of all scheduled commercial

banks increased from 73.2 per cent in 1992 to

Table

5: Bank Group-wise Share of Deposits of

Scheduled Commercial

Banks to Total | (Per

cent) | Year | SBI

& its | Nationalised | Foreign | Domestic

Private | | Associates | Banks | Banks | Sector

Banks | 1980 | 27.4 | 64.4 | 2.9 | 5.3 |

1985 | 29.3 | 63.2 | 2.9 | 4.6 |

1990 | 28.1 | 63.6 | 4.4 | 3.9 |

1995 | 27.8 | 58.2 | 6.9 | 7.2 |

2000 | 28.5 | 53.4 | 5.5 | 12.6 |

2005 | 27.6 | 50.7 | 4.7 | 17.0 |

Source

: Base data are taken from Annual Accounts of Scheduled Commercial Banks

1979 to 2004 and Statistical Tables Relating to Banks in India

2004-05. | 76.4 percent in 2005. For all

the bank groups, with the exception of foreign bank group, advances secured by

tangible assets were more than 70 per cent for the period 1992 to 2005.

In the case of foreign banks, such secured loans increased from 54 per cent in

1992 to 57.9 per cent in 2005. Advances covered by government / bank guarantees

with respect to all scheduled commercial banks decreased from 15.1 per cent to

5.9 per cent during the same period. Such type of advances declined for each of

the bank groups. It is interesting to note here that unsecured loans granted by

foreign banks group was more than a third of the total advances for all the years

from 1992 to 2005. For all other bank groups, unsecured loans were less than 21

per cent. It is also noteworthy that unsecured advances granted by State Bank

of India and its Associates increased sharply from 15.4 per cent in 2004 to 20.9

percent in 2005 (Table 6 and Chart 3). II.6 Bank Group-wise Share

in Advances

The bank group-wise share of advances of scheduled

commercial banks depicts that nationalised bank group contributed

about 50 per cent of the total credit advanced by all scheduled commercial banks

followed by State Bank Group with a share of about 25 per cent, domestic private

sector banks with a share of 19 per cent and foreign banks about 7 per cent

in the year 2005. This indicates that banks in the public sector even after the

implementation of reforms since 1991, contribute about 75 per cent of the total

credit advanced by all scheduled commercial banks.

Table

6: Security-wise Advances of Scheduled Commercial Banks |

(Per

cent) | | | SBI

& its Associates | Nationalised

Banks | Foreign

Banks | Year | | Secured

by

tangible

assets | Covered

by Bank/

Govt.

Guara-

ntees | Un-

secured | Secured

by

tangible

assets | Covered

by Bank/

Govt.

Guara-

ntees | Un-

secured | Secured

by

tangible

assets | Covered

by Bank/

Govt.

Guara-

ntees | Un-

secured | | |

| |

| |

| |

1992 | | 70.8 | 24.7 | 4.5 | 76.4 | 10.0 | 13.6 | 54.0 | 13.9 | 32.1 |

1995 | | 78.3 | 18.0 | 3.7 | 76.0 | 14.3 | 9.7 | 67.2 | 5.9 | 26.8 |

2000 | | 86.0 | 8.3 | 5.8 | 81.6 | 8.7 | 9.7 | 56.1 | 8.1 | 35.9 |

2001 | | 81.0 | 7.6 | 11.4 | 80.0 | 8.5 | 11.5 | 51.9 | 9.3 | 38.8 |

2002 | | 81.4 | 6.3 | 12.3 | 77.2 | 9.9 | 12.9 | 53.1 | 12.0 | 34.9 |

2003 | | 80.4 | 7.2 | 12.4 | 79.9 | 7.2 | 12.9 | 56.2 | 11.3 | 32.6 |

2004 | | 77.3 | 7.4 | 15.4 | 80.1 | 6.5 | 13.3 | 58.7 | 7.3 | 34.0 |

2005 | | 74.7 | 4.4 | 20.9 | 77.6 | 7.2 | 15.1 | 57.9 | 5.6 | 36.4 |

| | Domestic

Private

Sector Banks | All

Scheduled

Commercial Banks | |

| |

Year

| Secured

by

tangible

assets | Covered

by Bank/

Govt.

Guara-

ntees | Un-

secured | Secured

by

tangible

assets | Covered

by Bank/

Govt.

Guara-

ntees | Un-

secured | 1992 | | 76.2 | 8.7 | 15.1 | 73.2 | 15.1 | 11.7 |

1995 | | 87.0 | 6.4 | 6.6 | 77.2 | 14.0 | 8.8 |

2000 | | 76.7 | 11.9 | 11.4 | 80.2 | 8.9 | 10.9 |

2001 | | 77.6 | 8.3 | 14.1 | 77.7 | 8.3 | 14.1 |

2002 | | 85.9 | 5.8 | 8.3 | 78.0 | 8.4 | 13.6 |

2003 | | 85.5 | 6.4 | 8.1 | 79.4 | 7.4 | 13.3 |

2004 | | 85.1 | 5.1 | 9.7 | 78.9 | 6.5 | 14.6 |

2005 | | 81.7 | 4.4 | 14.0 | 76.4 | 5.9 | 17.7 |

Source

: Base data are taken from Annual Accounts of Scheduled Commercial Banks

1979 to 2004 and Statistical Tables Relating to Banks in India

2004-05. | This trend may not continue

in future as the data reveals that the share of the public sector banks declined

from 92.1 per cent in 1980 to 74.3 per cent in 2005. On the other hand,

the advances made by foreign banks increased from 3.3 per cent in 1980 to 6.5

per cent in 2005 and that made by private banks in the domestic sector increased

from 4.5 per cent in 1980 to 19.2 per cent in 2005. Data supports that in the

post reform period, public sector banks

are facing increasing competition from the private sector

banks-both foreign and domestic (Table 7).

II.7 Priority

Sector Advances

Priority sector advances of scheduled commercial

banks showed some marginal decline from 35 per cent in 1992 to 34 per cent in

2005. This declining trend is observed in the case of all bank groups except for

foreign banks. In the case of foreign banks, priority sector advances increased

over the years since the banking sector reforms started. Of the total advances,

nationalised banks advanced loans to priority sectors to the extent of 37.4 per

cent and State Bank group to the extent of 35.3 per cent in 2005. Such loans

were low

Table

7: Bank Group-wise Share of Advances of Scheduled

Commercial

Banks to Total | (Per

cent) | Year | SBI

& its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector Banks |

1980 | 32.2 | 59.9 | 3.3 | 4.5 |

1985 | 31.1 | 61.2 | 3.5 | 4.2 |

1990 | 33.7 | 58.4 | 4.5 | 3.4 |

1995 | 30.8 | 54.3 | 7.3 | 7.6 |

2000 | 29.1 | 50.3 | 8.0 | 12.6 |

2005 | 24.8 | 49.5 | 6.5 | 19.2 |

Source:

Base data are taken from Annual Accounts of Scheduled Commercial Banks

1979 to 2004 and Statistical Tables Relating to Banks in India 2004-05. |

Table

8: Percentage of Priority Sector Advances to Total Advances:

Bank

Group-wise | (Per

cent) | Year

| SBI &

its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector Banks | All

Scheduled

Commercial

Banks |

1992 | 36.0 | 38.4 | 7.9 | 28.9 | 35.0 |

1995 | 31.1 | 33.6 | 20.7 | 27.0 | 31.3 |

2000 | 32.3 | 34.1 | 21.4 | 26.6 | 31.5 |

2001 | 32.2 | 333.9 | 21.1 | 24.5 | 31.0 |

2002 | 31.4 | 34.1 | 21.6 | 16.9 | 29.2 |

2003 | 31.2 | 36.2 | 21.9 | 22.2 | 31.1 |

2004 | 33.2 | 38.6 | 23.2 | 26.9 | 33.7 |

2005 | 35.3 | 37.4 | 25.8 | 26.5 | 34.0 |

Source

: Base data are taken from Annual Accounts of Scheduled Commercial Banks

1979 to 2004 and Statistical Tables Relating to Banks in India

2004-05. | with respect to domestic

private sector banks group at 26.5 per cent and foreign banks at 25.8 per cent.

A target of 40 per cent of net bank credit has been stipulated for lending to

the priority sector by domestic scheduled commercial banks both in the public

and private sectors and a target of 32 per cent has been stipulated for lending

to the priority sector by foreign bank groups at present. However, the data presented

in this section are percentages of priority sector lending to gross bank credit

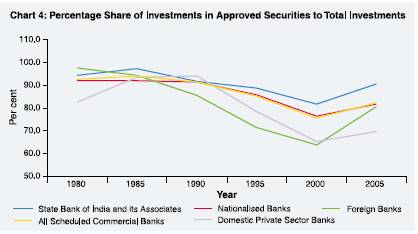

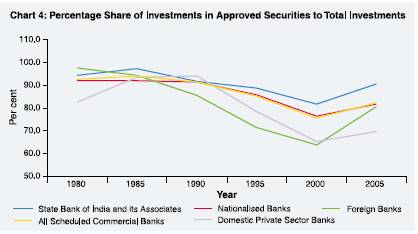

(Table 8). Section III Investments

Bank group-wise

investments show that all scheduled commercial banks invested 92.6 per cent of

their total investments in government and other approved securities in the year

1980, which declined to 82.4 per cent in 2005; whereas other investments increased

from 7.4 per cent to 17.6 per cent during the same period. This could be due to

the reduction in SLR requirements. Even though the SLR requirements have been

reduced from a high of 38.5 per cent in 1992 to the statutory minimum of 25 per

cent, banks still prefer to invest large portion of their investments in approved

securities, because of the risk-free and assured returns they get through such

investments. In the case of public sector banks and foreign banks, there was a

reduction in investment in government securities and a preference for other investments

like shares, bonds and debentures, which are not counted for SLR requirements.

However, in 2005, a major reduction was noticed with respect to investments in

other securities and a clear preference for government and other approved securities.

As against this, in the case of domestic private sector banks, there is a clear

preference for investments in other securities after the year 1995 and a reduction

of investments in government and other approved securities. Since the year 2000,

with the entry of more private sector banks, this group invested more than one

third of their total investments in non-SLR securities, which indicates that the

private banks of late are currently venturing into more riskier, nonetheless challenging

business (Table 9 and Chart 4).

Table

9: Bank Group-wise Distribution of Investments

of Scheduled

Commercial Banks | (Per

cent) | Year

| SBI

& its Associates | Nationalised

Banks | Foreign

Banks | Govt.

&

Other

Appr.

Securities | Other

Invest-

ments | Govt.

&

Other

Appr.

Securities | Other

Invest-

ments | Govt.

&

Other

Appr.

Securities | Other

Invest-

ments |

1980 | 94.5 | 5.5 | 92.2 | 7.8 | 97.7 | 2.0 |

1985 | 97.3 | 2.7 | 92.2 | 7.8 | 94.5 | 5.5 |

1990 | 91.9 | 8.1 | 91.6 | 8.4 | 85.5 | 14.5 |

1995 | 88.7 | 11.3 | 85.8 | 14.2 | 71.4 | 28.6 |

2000 | 81.8 | 18.2 | 76.4 | 23.6 | 63.8 | 36.2 |

2005 | 90.5 | 9.5 | 81.7 | 18.3 | 80.5 | 19.5 |

Year

| Domestic

Private

Sector Banks | All

Scheduled

Commercial Banks | |

Govt.

&Other

Appr. Securities | Other

Investments | Govt. &Other

Appr.Securities | Other

Investments | 1980 | 82.6 | 17.2 | 92.6 | 7.4 |

1985 | 93.6 | 6.3 | 94.0 | 6.0 |

1990 | 94.1 | 5.9 | 91.5 | 8.5 |

1995 | 78.5 | 21.5 | 85.2 | 14.8 |

2000 | 65.2 | 34.8 | 75.7 | 24.3 |

2005 | 69.8 | 30.2 | 82.4 | 17.6 |

Source

: Base data are taken from Annual Accounts of Scheduled Commercial Banks

1979 to 2004 and Statistical Tables Relating to Banks in India

2004-05. |

Section IV

Capital

To Risk-weighted Assets Ratio (CRAR)

The capital

to risk weighted assets ratio (CRAR) is an indicator for assessing soundness and

solvency of banks. Out of 92 scheduled commercial banks, 75 banks could maintain

the CRAR of more than 8 per cent during the year 1995-96, when the prescribed

CRAR was 8 per cent. During 1999-2000, 96 banks maintained CRAR of 9 to 10 per

cent and above when the prescribed rate was 9 per cent. In 2004-05, out of 88

scheduled commercial banks, 78 banks could maintain CRAR of above 10 per cent

and 8 banks between 9 and 10 per cent. All banks in the State Bank group maintained

capital to risk weighted assets ratio of more than 10 per cent in 2004-05. In

the nationalised bank group, 17 banks reached more than 10 per cent CRAR level

except two banks whose CRAR during 2004-05 was between 9-10 per cent. During 2004-05,

there were 2 banks in the old private sector categorywhose CRAR was less than

9 per cent (Table 10). Section V

Non-performing Assets (NPAs) The measure of non-performing

assets helps us to assess the efficiency in allocation of resources made by banks

to productive

Table

10: Distribution of Scheduled Commercial Banks by CRAR |

Year | Bank

Group | State

Bank

Group | Nation-

alised

Bank

Sector

Banks | Old

Private

Sector

Banks | New

Private | Foreign

Banks

in

India

| Scheduled

Commer-

cial

Banks |

1995-1996 | Below

4 per cent | - | 5 | 3 | - | - | 8 |

| Between

4-8 per cent | - | 3 | 3 | - | 3 | 9 |

| Between

8-10 per cent | 6 | 7 | 7 | 1 | 12 | 33 |

| Above

10 per cent | 2 | 4 | 12 | 8 | 16 | 42 |

1999-2000 | Below

4 per cent | - | 1 | 2 | - | - | 3 |

| Between

4-9 per cent | - | - | 2 | - | - | 2 |

| Between

9-10 per cent | - | 4 | 2 | 1 | 5 | 12 |

| Above

10 per cent | 8 | 14 | 18 | 7 | 37 | 84 |

2003-2004 | Below

4 per cent | - | - | - | 1 | - | 1 |

| Between

4-9 per cent | - | - | - | 1 | - | 1 |

| Between

9-10 per cent | - | 1 | - | - | - | 1 |

| Above

10 per cent | 8 | 18 | 20 | 8 | 33 | 87 |

2004-05 | Below

4 per cent | - | - | 1 | - | - | 1 |

| Between

4-9 per cent | - | - | 1 | - | - | 1 |

| Between

9-10 per cent | - | 2 | 3 | 2 | 1 | 8 |

| Above

10 per cent | 8 | 17 | 15 | 7 | 30 | 78 |

Source:

Handbook of Statistics on the Indian Economy, 2004-05 & Report on

Trend and Progress of Banking in India 2004-05. | sectors.

The problem of NPAs arise either due to bad management by banks or due to external

factors like unanticipated shocks, business cycle and natural calamities (Caprio

and Klingebiel, 1996). Several studies have underscored the role of banks’

lending policy and terms of credit, which include cost, maturity and collateral

in influencing the movement of non-performing assets of banks (Reddy, 2004, Mohan

2003, 2004).

The ratio of gross non-performing assets (NPAs) to gross

advances of all scheduled commercial banks decreased from 14.4 per cent in 1998

to 5.1 per cent in 2005. Bank group-wise analysis shows that across the bank groups

there has been a significant reduction in the gross non-performing assets. With

respect to public sector banks (State Bank group and nationalised bank group together),

NPAs have decreased from 16.0 per cent in 1998 to 5.4 per cent in 2005.

In the case of foreign banks group, gross NPAs as a percentage to gross advances,

which was the lowest among all the groups at 6.4 per cent in 1998, decreased to

2.9 per cent in 2005. With regard to domestic private sector banks group,

gross NPAs decreased from 8.7 per cent to 3.9 per cent during the same period.

The ratio of net NPAs to net advances of different bank groups also exhibited

similar declining trends during the period from 1998 to 2005. The net NPAs of

all scheduled commercial banks declined from 7.3 per cent in 1998 to 2.0 per cent

in 2005 (Table 11). The decline in NPAs is more evidenced across bank groups

especially since 2003. This reflects on the positive impact of the measures taken

by the Reserve Bank towards NPA reduction and specifically due to the enactment

of the Securitisation and Reconstruction of Financial Assets and Enforcement of

Security Interest (SARFAESI) Act, ensuring speedier recovery without intervention

of courts or tribunal.

The composition of NPAs of public sector banks

brings to light certain interesting aspects. It is observed that in 1995 for State

Bank group, the share of NPAs was 52.5 per cent for the priority sector, 41.4

per cent for the non-priority sector, and 6.1 per cent for the public sector.

These percentages were 47.4 per cent, 51.5 per cent and 1.1 per cent, respectively

in 2005. Similarly in the case of nationalised banks also, the NPA composition

for non-priority sector

Table

11: NPAs of Scheduled Commercial Banks (Bank Group-wise) |

(Per

cent) | Year | Public

| Foreign

| Domestic

Private | All

SCBs | | Sector

Banks | Banks | | Sector

Banks | | Gross | Net | Gross | Net | Gross | Net | Gross | Net |

| NPA | NPA | NPA | NPA | NPA | NPA | NPA | NPA |

1998 | 16.0 | 8.2 | 6.4 | 2.2 | 8.7 | 5.3 | 14.4 | 7.3 |

2000 | 14.0 | 7.4 | 7.0 | 2.4 | 8.2 | 5.4 | 12.7 | 6.8 |

2001 | 12.4 | 6.7 | 6.8 | 1.8 | 8.4 | 5.4 | 11.4 | 6.2 |

2002 | 11.1 | 5.8 | 5.4 | 1.9 | 9.6 | 5.7 | 10.4 | 5.5 |

2003 | 9.4 | 4.5 | 5.3 | 1.8 | 8.1 | 5.0 | 8.8 | 4.4 |

2004 | 7.8 | 3.0 | 4.6 | 1.5 | 5.8 | 2.8 | 7.2 | 2.9 |

2005 | 5.4 | 2.1 | 2.9 | 0.9 | 3.9 | 2.2 | 5.1 | 2.0 |

Source

:Handbook of Statistics on Indian Economy 2004-05 and Report on Trend

and Progress of Banking in India 2004-05. |

Table

11A: Composition of NPAs of Public Sector Banks |

(Per cent) |

Year | SBI

& its Associates | Nationalised

Banks | Priority | Non-priority | Public | Priority | Non-priority | Public |

Sector | Sector | Sector | Sector | Sector | Sector |

1995 | 52.5 | 41.4 | 6.1 | 48.7 | 49.2 | 2.0 |

2000 | 45.2 | 51.9 | 2.8 | 44.1 | 54.5 | 1.5 |

2001 | 44.2 | 49.8 | 6.0 | 46.2 | 52.3 | 1.5 |

2002 | 47.0 | 50.4 | 2.6 | 45.7 | 53.1 | 1.2 |

2003 | 47.5 | 49.4 | 3.1 | 47.1 | 51.3 | 1.6 |

2004 | 47.1 | 51.5 | 1.5 | 47.7 | 51.1 | 1.1 |

2005 | 47.4 | 51.5 | 1.1 | 48.4 | 50.7 | 0.9 |

Source:

Statistical Tables Relating to Banks in India, Various issues. | has

increased, whereas, that for priority sector and public sector, there is a marginal

reduction. This shows that not only advances to the priority sector are going

non-performing, but more than that, non-priority sector lending is the area where

the bankers need to cautiously examine the possibilities of loans becoming non-performing.

Here the question of moral hazard, adverse selection and credit rationing comes

to the fore. These issues are to be addressed face on. This also goes to explode

the commonly held myth that the problem of NPAs is caused mainly due to the credit

allocation to priority sectors. (Table 11 A).

Section

VI Income Composition Income

composition of scheduled commercial banks shows that across the different bank

groups, interest income viz., income from advances and investments are falling

and the percentage of other income is increasing. Other income inter alia

includes income earned in the form of commission, exchange and brokerage and income

from profit on sale of investments. In 1980, the share of interest income of all

scheduled commercial banks was 89.0 per cent, which decreased to 82.0 per cent

in 2005. Other income on the other hand, increased from 11.0 per cent to 18.0

per cent during the same period. This reflects upon the increasing reliance on

non-interest income vis-à-vis interest income of commercial banks.

This is a welcome trend as it may reduce the risks arising out of the sole dependency

on interest as the source of income (Ramasastri, Samuel & Gangadaran, 2004)

Bank group-wise interest and non-interest income shows that in the case of SBI

and its Associates, interest income declined from 84.5 per cent in 1980 to 82.3

percent in 2005 and in the case of nationalised banks group, the same declined

from 91.4 per cent to 84.0 per cent. In the case of domestic private sector banks

also, interest income declined from 90.3 per cent in 1990 to 80.5 per cent in

2005. It is evident from these figures that more than 80 per cent of the income

still comes from interest income in the case of public sector banks and domestic

private sector banks, which indicates that these banks are seen to be dependent

mainly on the traditional way of earning income even though there is a reduction

in such dependence. In contrast, foreign banks are seen to be increasingly dependent

upon non-interest sources of income. Non-interest income of foreign banks formed

about 29.6 per cent of their total income, followed by domestic private sector

banks 19.5 per cent, State Bank of India and its Associates 17.7 percent and nationalised

banks 16.0 per cent (Table 12 and Chart 5). A comparison

of the break-up of interest income viz., interest on advances and interest on

investments shows that with respect to all scheduled commercial banks, interest

income on advances has fallen

| Table

12: Income Composition of Scheduled Commercial Banks | |

(Per cent) | |

Year |

SBI & its |

Nationalised |

Foreign |

Domestic Private |

All Scheduled |

| Associates |

Banks |

Banks |

Sector Banks |

Commercial Banks |

| Interest |

Other |

Interest |

Other |

Interest |

Other |

Interest |

Other |

Interest |

Other | |

Income |

Income |

Income |

Income |

Income |

Income |

Income |

Income |

Income |

Income | |

1980 |

84.5 |

15.5 |

91.4 |

8.6 |

- |

- |

- |

- |

89.0 |

11.0 | |

1985 |

88.2 |

11.8 |

93.6 |

6.4 |

- |

- |

- |

- |

91.8 |

8.2 | |

1990 |

89.1 |

10.9 |

91.9 |

8.1 |

82.8 |

17.2 |

90.3 |

9.7 |

90.3 |

9.7 | |

1995 |

86.9 |

13.1 |

88.8 |

11.2 |

80.1 |

19.9 |

86.0 |

14.0 |

87.2 |

12.8 | |

2000 |

85.8 |

14.2 |

88.4 |

11.6 |

79.2 |

20.8 |

83.9 |

16.1 |

86.2 |

13.8 | |

2005 |

82.3 |

17.7 |

84.0 |

16.0 |

70.4 |

29.6 |

80.5 |

19.5 |

82.0 |

18.0 | |

‘_’ : Not Available.

Source :

Base

data are taken from Annual Accounts of Scheduled Commercial Banks 1979 to 2004

and

Statistical Tables Relating to Banks in India 2004-05. |

from 60.7 per cent in

1992 to 52.3 per cent in 2005. Whereas, interest income on investments increased

from 25.6 per cent in 1992 to 42.2 per cent in 2005. This is true for all the

bank groups (Table 12 A) .

| Table

12A: Composition of Interest Income of Scheduled Commercial Banks |

| (Per

cent) | | |

SBI & its Associates |

Nationalised Banks |

Foreign Banks | |

| Year |

Interest |

Interest |

Others |

Interest |

Interest Others |

Interest |

Interest Others |

| | on |

on | |

on |

on | |

on |

on | |

| | Advances |

Investments | |

Advances |

Investments | |

Advances |

Investments | |

| 1992 |

60.8 |

22.5 |

16.7 |

60.9 |

28.0 |

11.1 |

61.1 |

21.5 |

17.4 | |

1995 | 47.4 |

44.1 |

8.5 |

49.6 |

42.1 |

8.3 |

52.8 |

41.5 |

5.7 | |

2000 | 44.3 |

43.4 |

12.3 |

48.3 |

45.9 |

5.7 |

52.1 |

40.3 |

7.5 | |

2001 | 44.2 |

43.7 |

12.2 |

49.1 |

45.0 |

5.9 |

54.4 |

38.1 |

7.5 | |

2002 | 39.5 |

47.7 |

12.8 |

49.4 |

44.9 |

5.7 |

55.0 |

37.8 |

7.2 | |

2003 | 39.1 |

48.7 |

12.1 |

50.1 |

45.4 |

4.6 |

60.1 |

35.0 |

4.9 | |

2004 | 39.7 |

51.0 |

9.3 |

49.1 |

47.1 |

3.8 |

56.1 |

37.9 |

6.0 | |

2005 | 43.0 |

48.4 |

8.6 |

52.8 |

43.3 |

3.9 |

60.4 |

32.1 |

7.5 | | |

Domestic Private |

All Scheduled | |

| |

Sector Banks |

Commercial Banks |

| Year |

Interest |

Interest |

Others |

Interest |

Interest |

Others | | |

on |

on | |

on |

on | |

| | Advances |

Investments | |

Advances |

Investments | |

| 1992 |

56.7 |

27.6 |

15.6 |

60.7 |

25.6 |

13.7 | |

1995 | 56.9 |

36.0 |

7.2 |

49.7 |

42.3 |

8.1 | |

2000 | 50.8 |

42.1 |

7.1 |

47.8 |

44.3 |

8.0 | |

2001 | 49.9 |

43.5 |

6.6 |

48.2 |

43.9 |

8.0 | |

2002 | 48.8 |

44.6 |

6.6 |

46.7 |

45.2 |

8.1 | |

2003 | 57.0 |

37.8 |

5.3 |

48.7 |

44.4 |

6.9 | |

2004 | 59.0 |

36.1 |

4.9 |

48.6 |

45.7 |

5.7 | |

2005 | 63.5 |

32.1 |

4.5 |

52.3 |

42.2 |

5.5 | |

Note:

‘Others’

include interest on balances with RBI and other inter-bank funds and others.

Source: Base data are taken from Annual Accounts of Scheduled Commercial

Banks 1979 to 2004 and Statistical Tables Relating to Banks in India 2004-05. |

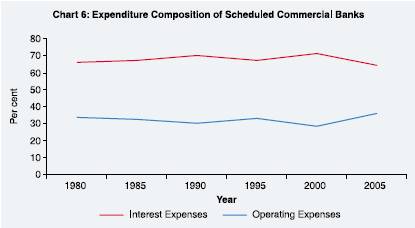

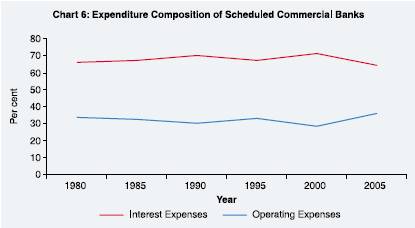

Section VII Expenditure

Composition The expenditure composition of scheduled

commercial banks indicates that the percentage of interest expenses to total expenses

of all scheduled commercial banks declined by 2.1 per cent from 66.3 per cent

in 1980 to 64.2 per cent in 2005. Percentage of operating expenses to total expenses

has increased from 33.7 per cent in 1980 to 35.8 per cent in 2005. In the case

of all bank groups, similar trend is noticed except for foreign banks where the

interest expenses has decreased from 64.6 per cent in 1990 to 47.9 per cent in

2005. Whereas, percentage of operating expenses to the total expenses of foreign

banks increased from 35.4 per cent to 52.1 per cent (Table 13 & Chart 6). A

further break-up of operating expenses reveals that wages, as percentage of operating

expenses of public sector banks is more than 60 per cent. These are symptoms of

under employment. This situation calls for more apt and pragmatic human resource

policies and proper man power planning for the future. The wages of foreign banks

increased from 25.9 per cent in 1990 to 30.6 per cent of their

| Table

13: Expenditure Composition of Scheduled Commercial Banks |

| (Per

cent) | | |

SBI & its |

Nationalised |

Foreign |

Domestic Private |

All Scheduled |

| Year |

Associates |

Banks |

Banks |

Sector Banks |

Commercial Banks |

| | Interest |

Operating |

Interest |

Operating |

Interest |

Operating |

Interest |

Operating |

Interest |

Operating |

| | expenses |

expenses |

expenses |

expenses |

expenses |

expenses |

expenses |

expenses |

expenses |

expenses | | |

to total |

to total |

to total |

to total |

to total |

to total |

to total |

to total |

to total |

to total | |

1980 | 64.3 |

35.7 |

67.4 |

32.6 |

- |

- |

- |

- |

66.3 |

33.7 | |

1985 | 64.8 |

35.1 |

68.6 |

31.4 |

- |

- |

- |

- |

67.3 |

32.6 | |

1990 | 69.0 |

31.0 |

71.4 |

28.6 |

64.6 |

35.4 |

62.8 |

37.2 |

69.9 |

30.1 | |

1995 | 65.5 |

34.5 |

67.6 |

32.4 |

67.4 |

32.6 |

70.9 |

29.1 |

67.1 |

32.9 | |

2000 | 70.6 |

29.4 |

71.4 |

28.6 |

65.8 |

34.2 |

78.0 |

22.0 |

71.5 |

28.5 | |

2005 | 64.9 |

35.1 |

65.5 |

34.5 |

47.9 |

52.1 |

65.3 |

34.7 |

64.2 |

35.8 | |

- = Not Available.

Source : Base data

are taken from Annual Accounts of Scheduled Commercial Banks 1979 to 2004 and

Statistical Tables Relating to Banks in India 2004-05. |

operating expenses in 2005. In the case of domestic private sector banks group,

wages as percentage of operating expenses was 73.5 per cent in 1990 and the same

decreased drastically to 33.7 per cent. This goes to indicate that banks in the

private sector both foreign and domestic are spending for other business boosting

measures like image building, software development etc. (Table 13 A and Chart

6 A).

Table

13A:Wages as Percentage of Operating Expenses*

of Scheduled

Commercial Banks | (Per

cent) | Year

| SBI &

its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector Banks | All

Scheduled

Commercial Banks |

1980 | 74.1 | 72.1 | - | - | 72.9 |

1985 | 72.5 | 71.3 | - | - | 71.7 |

1990 | 67.8 | 68.9 | 25.9 | 73.5 | 65.7 |

1995 | 72.4 | 67.1 | 32.8 | 62.9 | 66.1 |

2000 | 71.6 | 73.6 | 33.3 | 49.1 | 67.0 |

2005 | 67.4 | 67.4 | 30.6 | 33.7 | 58.3 |

- = Not Available.

* Wages are calculated as percentage of payments to and provisions for employees

to total expenses.

Source : Base data are taken from Annual

Accounts of Scheduled Commercial Banks 1979 to 2004 and Statistical Tables Relating

to Banks in India 2004-05. |

Section

VIII Return on Assets Return

on assets (ROA) is an important performance indicator of banks. Return on assets

has been worked out by taking the ratio of net profit or loss to average advances

and investments. For all scheduled commercial banks, the ROA increased from 0.1

per cent in 1980 to 1.1 per cent in 2005. Amongst the bank groups, the ROA of

foreign banks group is the highest at 1.8 per cent in 2005. All other bank groups

recorded a return on assets of 1.1 per cent showing that all banks are making

profits and their performances are good. Foreign banks group is on a higher plane

with respect to its performance in comparison with other bank groups. Compared

to the pre-reform period, the ROA of public sector banks improved significantly

after the initiation of reforms. In the case of foreign banks and domestic private

sector banks, data are available only from 1995 (Table 14).

The distribution

of scheduled commercial banks by ROA reveals that in 1995, with respect to State

Bank group, all 8 banks were in the ROA range of up to 1 per cent. This position

improved slightly as one bank was in the ROA category of more than 1.5 per cent

in 2000 and 2005. This goes to indicate that State Bank group has much potential

to enhance their performance. Similarly, majority of the banks in the nationalised

group were in the ROA range of less than 1 per cent in

Table

14: Return on Assets (ROAs)* of Scheduled Commercial Banks |

(Per

cent) | Year

| SBI & its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector Banks | All

Scheduled

Commercial Banks |

| 1980 | 0.1 | 0.1 | - | - | 0.1 |

| 1985 | 0.1 | 0.1 | - | - | 0.1 |

| 1990 | 0.2 | 0.2 | - | - | 0.3 |

| 1995 | 0.8 | 0.1 | 2.6 | 1.9 | 0.6 |

| 2000 | 1.2 | 0.6 | 1.7 | 1.3 | 0.9 |

| 2005 | 1.1 | 1.1 | 1.8 | 1.1 | 1.1 |

‘-’ = Not Available.

*

ROAs are calculated as percentage of net profit / loss to average advances

and investments.

Source:

Base data are taken from Annual

Accounts of Scheduled Commercial Banks 1979 to 2004 and Statistical Tables Relating

to Banks in India 2004-05. 1995, which exhibited some improvement since 2000.

In the case of domestic private sector banks also, there seems to be more scope

for improvement as many banks reported negative ROA in 2005. In contrast to all

other bank groups, majority of the foreign banks were placed in the category of

high ROA of more than 1.5 per cent (Table 14 A). |

Table

14 A: Distribution of Scheduled Commercial Banks by ROA |

Year | Range | SBI

& its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Private

Sector

Banks | All

Scheduled

Commercial

Banks |

1995 | Negative | - | 8 | - | 2 | 10 |

| 0

to 0.1 | 1 | 2 | 4 | 11 | 18 |

| 0.1

to 0.5 | 3 | 2 | 2 | 3 | 10 |

| 0.5

to 1.0 | 4 | 4 | 1 | 3 | 12 |

| 1

to 1.5 | - | 1 | 2 | 4 | 7 |

| >1.5 | - | 2 | 18 | 9 | 29 |

2000 | Negative | - | 1 | 9 | 1 | 11 |

| 0

to 0.1 | - | - | 6 | 2 | 8 |

| 0.1

to 0.5 | - | 8 | 1 | 3 | 12 |

| 0.5

to 1.0 | 3 | 5 | 2 | 7 | 17 |

| 1

to 1.5 | 4 | 3 | 6 | 8 | 21 |

| >1.5 | 1 | 2 | 18 | 11 | 32 |

2005 | Negative | - | 1 | 8 | 10 | 19 |

| 0

to 0.1 | - | - | 1 | 3 | 4 |

| 0.1

to 0.5 | 1 | 2 | - | 2 | 5 |

| 0.5

to 1.0 | 3 | 6 | 2 | 4 | 15 |

| 1

to 1.5 | 3 | 8 | 4 | 4 | 19 |

| >1.5 | 1 | 3 | 16 | 6 | 26 |

Source

:

Base data are taken from Annual Accounts of Scheduled Commercial

Banks 1979 to 2004 and Statistical Tables Relating to Banks in India 2004-05. |

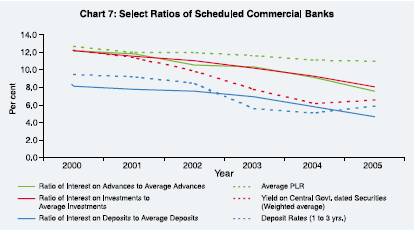

Section IX

Some

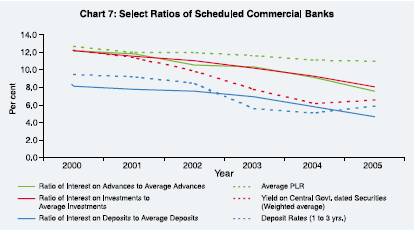

Select Ratios The data reveals that the ratio of interest on advances

to average advances of all scheduled commercial banks, which is reflective of

the lending rates, decreased from 14.0 per cent in 1992 to 7.1 percent in 2005.

The prime lending rate was 19.0 per cent in 1992 and in the range of 10.25 to

10.75 per cent in 2005. From this, it is evidenced that banks are lending at the

sub prime lending rates. The gap between the PLR and lending rates of all scheduled

commercial banks was very less for the years 2000 to 2002. However, this gap widened

since 2003. This is true for all the bank groups, which is indicative of the fact

that during the recent years, banks are lending at sub PLR rates with wider gaps

between PLR and lending rates.

The ratio of interest on investments to average

investments, which is reflective of the return on investments, shows that for

all scheduled commercial banks, the rates have declined from 10.1 per cent in

1992 to 7.6 percent in 2005. In comparison, the interest rates on central government

dated securities (weighted average) declined from 11.8 per cent in 1992 to 6.1

per cent in 2005. Overall trends indicate that the return on investments made

by the public sector banks is higher than that of all scheduled commercial banks.

An interesting point to note here is that even though private sector banks invested

more of their funds in non-SLR securities, still their interest on investments

as a percentage to average investments is lower than that obtained by the public

sector banks. Between State Bank group and nationalised bank group, the former

was successful in getting higher yields on their investments than the latter group.

The ratio of interest on deposits to average deposits of scheduled commercial

banks, which is reflective of the deposit rate, declined from 7.5 per cent in

1992 to 4.2 per cent in 2005. These rates are lower than the rates of deposits

with 1 to 3 year maturity for all the bank groups. This indicates that banks are

able to mobilise deposits at a lower rate than that of the rates for deposits

of 1 to 3 years maturity (Table 15 and Chart 7).

Table

15: Some Select Ratios of Scheduled Commercial Banks

(Bank

Group-wise) | Year | Ratio

of Interest on Advances to Average advances | PLR* |

SBI &

its | Nationalised | Foreign | Domestic | All

Sch. | Associates | Banks | Banks | Pvt.

Sector Banks | Comm

Banks. | 1992 | 13.9 | 13.4 | 21.8 | 13.8 | 14.0 | 19.00 |

1995 | 11.1 | 11.5 | 14.7 | 13.0 | 11.7 | 15.00 |

2000 | 10.9 | 11.8 | 13.1 | 12.3 | 11.7 | 12.00-12.50 |

2001 | 10.7 | 11.5 | 13.1 | 11.7 | 11.4 | 11.00-12.00 |

2002 | 9.7 | 10.6 | 11.6 | 8.8 | 10.1 | 11.00-12.00 |

2003 | 9.0 | 9.8 | 10.7 | 10.9 | 9.9 | 10.75-11.50 |

2004 | 7.9 | 8.7 | 9.0 | 9.8 | 8.7 | 10.25-11.00 |

2005 | 6.6 | 7.1 | 7.3 | 7.5 | 7.1 | 10.25-10.75 |

Year | Ratio

of interest on Investments to average Investments | Interest

Rate on Central Govt. | SBI

& its Associates | Nationalised

Banks | Foreign

Banks | Domestic

Pvt. Sector Banks | All

Sch.Comm. Banks | Dated

Securities average) (Weighted | 1992 | 10.1 | 10.1 | 10.1 | 10.6 | 10.1 | 11.78 |

1995 | 12.3 | 11.0 | 11.0 | 12.0 | 11.5 | 11.90 |

2000 | 11.7 | 11.7 | 11.7 | 11.5 | 11.7 | 11.77 |

2001 | 10.7 | 11.4 | 11.4 | 11.2 | 11.1 | 10.95 |

2002 | 10.8 | 11.0 | 11.0 | 9.2 | 10.6 | 9.44 |

2003 | 9.7 | 10.2 | 10.2 | 9.0 | 9.7 | 7.34 |

2004 | 8.9 | 9.2 | 9.2 | 7.6 | 8.8 | 5.71 |

2005 | 8.2 | 7.8 | 6.9 | 6.0 | 7.6 | 6.11 |

Year | Ratio

of interest on deposits to average deposits | Deposit

Rates**(1 to 3 Yrs.) | SBI

& its

Associates | Nationalised

Banks | Foreign

Banks | Domestic

Pvt.

Sector

Banks | All

Sch.

Comm.

Banks |

1992 | 7.9 | 7.5 | 6.9 | 6.8 | 7.5 | 12.00 |

1995 | 7.1 | 6.8 | 5.9 | 6.9 | 6.8 | 11.00 |

2000 | 7.9 | 7.5 | 7.2 | 8.1 | 7.7 | 8.50

- 9.50 | 2001 | 7.6 | 7.2 | 6.7 | 7.8 | 7.3 | 8.50

- 9.00 | 2002 | 7.6 | 6.9 | 6.1 | 7.3 | 7.1 | 7.50

- 8.50 | 2003 | 7.0 | 6.2 | 5.3 | 6.6 | 6.5 | 4.25

- 6.00 | 2004 | 5.8 | 5.2 | 3.9 | 5.3 | 5.3 | 4.00

- 5.25 | 2005 | 4.6 | 4.2 | 3.0 | 3.8 | 4.2 | 5.25

- 5.50 | *

Relates to the prime lending rates of 5 major public sector banks.

** Relates

to the deposit rates of 5 major public sector banks.

Source :

(i) Base data are taken from Annual Accounts of Scheduled Commercial Banks 1979

to 2004 and Statistical Tables Relating to Banks in India 2004-05.

(ii) Handbook

of Statistics on the Indian Economy, 2004-05. |

The

spread between the lending and deposit rates have reduced over the years from

1992 to 2005. The general fall in interest rates in the recent period is in consonance

with the monetary policy stance of a soft and flexible interest rate regime.

Section X

Concluding Observations There

has been a spurt in the number of banks during the late 1990s, which decreased

during the early period of the new millennium. This could be reflective of the

consolidation process, and in particular, the mergers and acquisitions that are

the order of the banking system at present. The number of bank offices increased

significantly during the early 1980s. After a consolidation phase during the late

1980s and early 1990s, there has been a moderate increase in the number of offices

mainly due to the entry of new generation private sector banks since late nineties.

The public sector banks continued to play a very prominent role in both deposit

mobilisation and credit disbursal even after the implementation of reforms since

1991. They contribute about 75 per cent of the total deposits mobilised and total

credit advanced by all scheduled commercial banks. The entry of domestic private

sector banks has been altering this trend to some extent since the late nineties. There

has been a significant change in the composition of deposits, with a clear shift

in favour of term deposits, whereas demand deposits witnessed a decline. The share

of savings bank deposits remained more or less constant. It is observed that more

funds of short-term nature in the form of demand deposits are parked with the

foreign banks group. This may be an indication that the business class is attracted

towards better service offered by foreign banks.

Even though the SLR

requirements have been reduced to the statutory minimum of 25 per cent, banks

still prefer to invest large portion of their investments in approved securities,

due to the risk-free and assured returns they get through such investments. However,

in the case of private sector banks in the domestic sector, there is a clear preference

for investments in other securities and a reduction of investments in government

and other approved securities. Since the year 2000, with the entry of more private

sector banks, this group invested more than one third of their total investments

in non-SLR securities, which indicates that the private banks, of late, are currently

venturing into more riskier, nonetheless challenging business.

Across

the bank groups, there has been a significant reduction in the non-performing

assets (NPAs). The composition of NPAs of public sector banks interestingly reveals

that NPAs connected to non-priority sector has increased, whereas, NPAs relating

to priority sector advances exhibited a decline. This goes to explode the commonly

held myth that the problem of NPAs is caused mainly due to the credit allocation

made to priority sectors.

The share of non-interest income in the total

income has been increasing across the different bank groups. This is a welcome

trend as it may reduce the risks arising out of the sole dependency on interest

as the source of income. Wages as a percentage of operating expenses of

public sector banks is more than 60 per cent. This situation possibly calls

for more apt and pragmatic human resource policies and proper manpower planning

for the future of these banks. Banks in the private sector both foreign and domestic,

however, have reduced their wage component in the operating expenses and are spending

more for other business boosting measures like image building, software development

etc. Compared to the pre-reform period, the ROA of public sector banks improved

significantly after the initiation of reforms, although it is still lower as compared

to foreign banks.

The objective of the analysis was to study the trends in

banking during a span of 25 years, covering both pre- and post- reforms period.

The study has clearly brought out the positive effects of the reform measures

on the banking industry in general. A comparative analysis of various bank

groups with respect to different variables has also identified certain specific

problem areas of the respective groups. The pace of the reform process is sometimes

a cause for concern and criticism. But, there seems to be a great wisdom in this

gradualism.

The Indian approach to financial sector reforms is based on

pancha sutra or five principles- cautious and proper sequencing; mutually

re-inforcing measures, complementarity between reforms in the banking sector and

changes in fiscal, external and monetary policies, developing financial infrastructure

and developing financial markets (Reddy, 2000). The progress of the banking sector

reforms this far, albeit slow, vindicates this stand.

References

1. Banerjee Abhijit V., Cole Shawn and Duflo Esther (2004):

“Banking Reform in India”, Bureau for Research in Economic Analysis

of Development, Policy Paper, No. 006, September, Harvard.

2.

Caprio G. Jr. and Klingebiel D. (1996) “ Bank Insolvency: Bad Luck, Bad

Policy, or Bad Banking ?” Annual World Bank Conference on Development

Economics 1996, Policy Research Working Paper, 1620, World Bank.

3.

Fama E (1985): “ What’s Different about Banks” Journal

of Monetary Economics, 15, pp. 29- 39.

4. Government of India

(1998) Report of the Committee on Banking Sector Reforms (Chairman: M

Narasimham).

5. Mohan Rakesh (2003): “ Transforming Indian

Banking: In Search of a Better Tomorrow”, Reserve Bank of India Bulletin,

January.

6. Mohan Rakesh (2004): “Finance for Industrial

Growth”, Reserve Bank of India Bulletin, March. 7.

Ramanathan A & Samuel Achamma (1997-98): “Financial Liberalization and

Economic Development: The Theory and Experience”, The Indian Economic

Journal, Vol. 46, July.

8. Ramasastri A S, Samuel Achamma

& Gangadaran S (2004): “Emerging Structure of Indian Banking”,

Seminar on Basel-II & Risk Management, Member Education Series, Indian

Institute of Banking and Finance,

Mumbai.

9. Ramasastri

A S, Samuel Achamma & Gangadaran S (2004): “Income Stability of Scheduled

Commercial Banks Interest vis-à-vis Non-Interest Income”, Economic

and Political Weekly, Vol. XXXIX No.12, March 20-26.

10. Rangarajan C

(1998): Indian Economy: Essays in Money and Finance, UBSPD, New Delhi.

11. Reddy Y.V. (2000): Monetary and Financial Sector Reforms in India: A Central

Bankers’s Perspective, UBSPD.

12. Reddy Y.V. (2004): “Credit

Policy, Systems and Culture”, Reserve Bank of India Bulletin, March.

13. Reddy Y.V. (2005): “Banking Sector Reforms in India: An Overview”

Reserve Bank of India Bulletin, June.

14. Reserve Bank of India:

Report on Trend and Progress of Banking in India, Various issues.

15. Reserve Bank of India (1991): Report of the Committee on the Financial

System (Narasimham Committee Report).

16. Tandon Prakash (1989) Banking

Century: A Short History of Banking in India, Viking, New Delhi.

*

The authors are Director and Assistant Adviser, respectively, in the Department

of Statistical Analysis and Computer Services. The views expressed in the paper

are those of the authors’ and not of the institution to which they belong. |

IST,

IST,