IST,

IST,

Chapter III: Structural Issues in Rejuvenating Growth

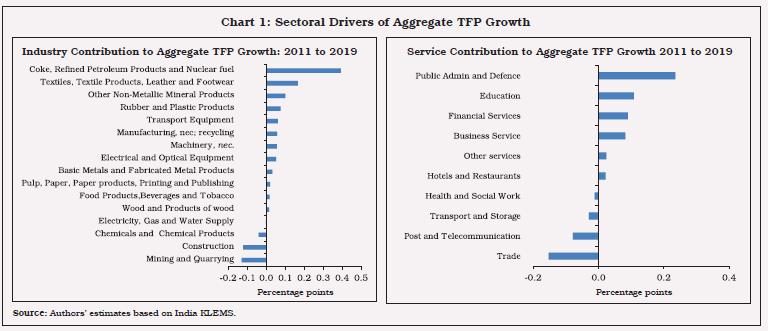

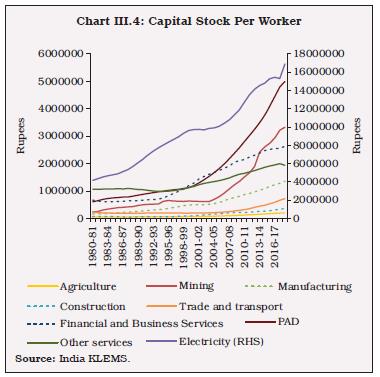

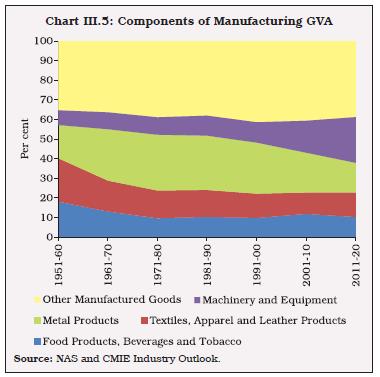

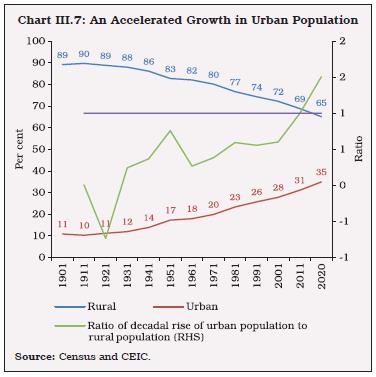

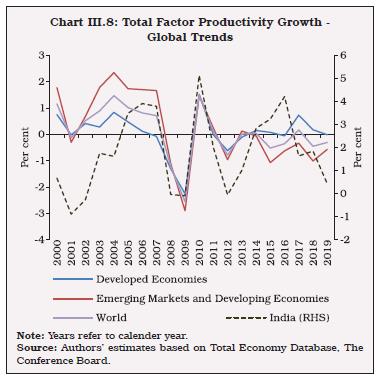

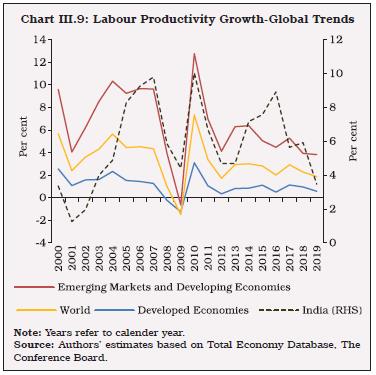

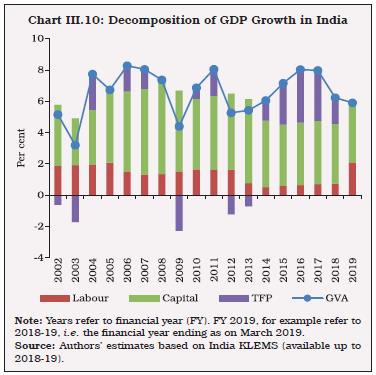

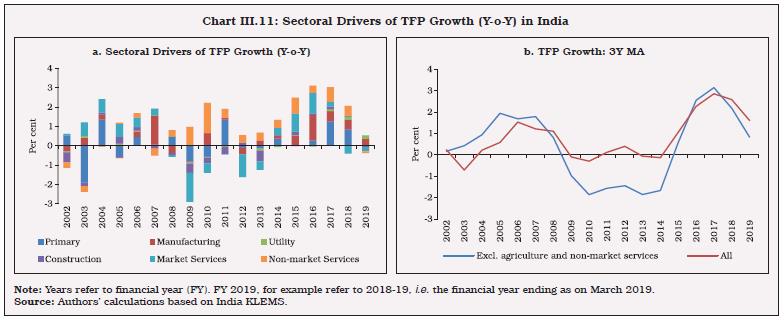

The Indian economy was baffled with several structural constraints to growth even before the outbreak of COVID. COVID induced disruptions, especially in the supply front, have posed additional challenges before the economy. The sub-optimal share of manufacturing in gross value added (GVA); deployment of the bulk of physical investment in a few capital-intensive sectors leading to low overall productivity; labour market rigidities hindering the creation of formal employment; the subsidy-heavy and low-investment imbalance in agriculture depressing yields; and weak growth dynamism in services reflect several infirmities in major sectors of the economy, which would require bold factor and product market reforms and effective implementation of several momentous reforms already announced to accelerate the growth momentum on a durable basis in the medium-term. 1. Introduction III.1 Even before the outbreak of the pandemic, a distinct deceleration in the growth momentum had set in from H2: 2016-17 in India, triggering a public debate on the state of India’s potential output in view of prolonged sluggishness in investment and productivity (Dieppe, 2021). With trend growth of 7.0 per cent (2003-20) at risk, structural reforms have been called for in order to regain and secure it as the trajectory over the medium-term (Economic Survey, 2020). In this context, this chapter addresses the structural reforms that are needed to invigorate post pandemic growth. Set against the backdrop of the transformation that is underway in the economy, the chapter examines key drivers and targeted policy interventions in the form of a range of sector specific reforms to remove bottlenecks and revive growth. The remaining part of this chapter is organised under six sections. Section 2 examines the pattern and nature of structural change in India. Drivers of productivity growth, the relative importance of factor productivity over factor endowment in India’s growth process; and resource reallocation to raise overall productivity growth is the focus of Section 3. Section 4 provides an assessment of structural impediments to growth in agriculture, industry and services, and their sub-sectors. Enabling conditions for growth at the economy level for the benefit of all sectors is the focus of Section 5. Section 6 covers issues relating to factor market, in particular land, where litigation free access at affordable cost remains a major impediment to growth.1 Section 7 concludes the chapter and presents a set of policy priorities that could raise India’s trend growth path in the medium-term. 2. Structural Transformation in India III.2 Transformative structural change requires moving production to sectors with increasing returns or higher productivity, where strategic policy interventions play a crucial role2. Innovation is the key driver of such structural shifts (Schumpeter, 1939) and diversification (away from traditional low productive sectors) along with sophistication of production processes could be an indication of such progresses (UNIDO, 2009). III.3 Accordingly, considerable attention has been devoted to defining and measuring structural change in the presence of productivity gaps across sectors, and even between firms in the same industry. While the two most commonly used indicators of economic progress in the literature are per capita GDP and some simple measures of productivity (such as labour productivity), the three most commonly tracked indicators of structural transformation are sectoral shares in value added, employment and consumption expenditure (Herrendorf et al., 2014). It is also important to track labour productivity (output per unit of labour), which could have two broad patterns – increase in productivity within a sector due to capital accumulation or change in technology, and at the level of the economy due to labour moving from low productive to high productive sectors (McMillan and Rodrik, 2011). The determinants of structural transformation could broadly include: (a) changes in income; (b) changes in relative (sectoral) prices; (c) changes in input–output linkages; and (d) changes in comparative advantage(s) through globalisation and trade. Differences in income elasticities across sectors could be a driver of structural change. Changes in sectoral relative prices can also induce reallocation of activity to the extent that they reflect differences in technology and total factor productivity (TFP) growth. The input-output matrix, a complex web of the underlying structure of an economy, has become a major driver of structural change due to rising importance of domestic and global supply chains where specialisation in each part of the production process by different players is more important than one player specialising in all parts of the value chain. In an open economy setting, comparative advantages open up new opportunities to drive sectoral reallocation of resources. III.4 In India, the sub-optimal share of manufacturing sector in gross value added (GVA) is an outcome of persistent structural constraints, resulting in the lowest share of manufacturing in GVA among a peer group of economies that are endowed with similar resources (Dieppe, 2021). Moreover, the bulk of physical investment in India is deployed in a few capital-intensive sectors, leading to low overall productivity in the economy. Together with labour market rigidities, this has hindered the creation of formal employment in the economy. As manufacturing productivity is considerably higher than other sectors, this incentivises the workforce to shift from low productive sectors, particularly agriculture, to manufacturing, as the global experience shows (Lewis, 1955; Kaldor, 1966; Chenery et al., 1986), giving rise to a virtuous cycle of growth and investment. Indian agriculture also suffers from structural impediments, resulting in low yields and sticky cropping pattern. To correct imbalances in agriculture, the policy thrust should not only change from subsidy-led to investment-led production but also from managing scarcity to managing surpluses (Gulati et al., 2020). In several services sectors such as telecommunication, transportation and logistics, retail and wholesale trade, real estate and tourism, the quality of service and growth dynamism remain less than desirable. Economic growth, in terms of simple accounting, is the sum of growth in factor inputs and productivity. Contrary to factor inputs, productivity growth provides an opportunity to increase output without increasing inputs and incurring related costs. After the Global Financial Crisis (GFC) 2008-09, however, the world economy faces a stagnation in productivity growth (Arnold and Grundke, 2021). A peculiar attribute of factor productivity is its very high correlation with GDP growth. Productivity deceleration/stagnation appears to be an emerging risk for India, given the post-GFC global experience, and requires targeted sector-specific policy interventions. III.5 Over the last 70 years, the Indian economy witnessed a remarkable transformation from a predominantly agriculture-based to a services dominated economy (Chart III.1). Industry’s share was increasing up to 1990s after which it has stagnated. III.6 Employment dependence on agriculture continues to remain high even after a decline in its share in total employment from around 70 per cent in 1980-81 to 41.3 per cent in 2018-19 (Chart III.2). During the same period, the employment share of industry remained unchanged at around 12 per cent, while the share of services increased from around 19 per to 47 per cent.   III.7 A dominant share of real gross capital formation (GCF) is allocated to the industrial sector (Chart III.3).   III.8 An analysis of the composition of aggregate GVA, aggregate employment and GCF shows that manufacturing has not generated commensurate employment and value addition, leading to adverse outcomes for sectoral productivity and system-wide efficiency (Chart III.4). III.9 The share of capital intensive ‘other manufactured goods’ and ‘machinery and equipment’ in manufacturing GVA increased to above 60 per cent in 2011-20 (Chart III.5). However, labour intensive sectors such as textile, readymade garments, leather products, food products and beverages have lost ground. Stringent labour regulations have contributed to a slow growth in employment in the organised sector (Panagariya et al., 2008). These regulations also result in labour market frictions which cause decreases in wages in the modern sector (Ghate et al., 2016), employment of inefficient labour (Gupta and Kumar, 2012) and constrain the growth of the modern sector by deterring entry of firms and skewing firm-size distribution (Alfaro and Chari, 2014). Other factors include low wage differentials between the non-agricultural informal sector and the agricultural sector for the unskilled work force, linguistic differences, lack of social protections such as mutual insurance provided to members of the same sub-caste networks (Munshi and Rosenzweig, 2009), and lack of cheap urban housing and poor planning in urban areas (Banerjee, 2006). More recent studies also show that policy interventions in the form of wage setting and providing unemployment benefits by the public sector may only increase the unemployment rate and increase the size of the informal sector (Ghate and Mazumder, 2019). This may also result in lowering the wage rate in the private sector.  III.10 The changing mix of GVA is also visible from the evolution of India’s exports composition. The share of services in gross exports increased from around 20 per cent in 1990-91 to above 40 per cent in 2020-21, driven by skill intensive information technology (IT) and business services. Among goods exports, engineering goods’ share almost doubled from around 10 per cent in 1990-91 to around 18 per cent in 2020-21 (Chart III.6). The decline in the share of labour intensive sectors in exports has adverse repercussions on employment generation and absorption of new workers migrating from agriculture sector.  III.11 In this backdrop, policy actions to alleviate labour market frictions can lift potential output, supported by re-skilling programmes. Higher subsidies towards agriculture are hardly a solution when a shift of resources from subsidies to capital investments in agriculture can yield higher output. A mix of tax and subsidy policies can, therefore, be used to modernise agriculture to reduce labour dependence on farm activities, besides boosting capital formation in more productive sectors. In this way, the problems of reverse migration of labour amidst the pandemic could be addressed and further absorption of labour in firms with higher productivity and wages can be encouraged.  2.1 Rising Role of Urban Agglomerations III.12 Seventeen of the 20 fastest-growing cities in the world between 2019 and 2035 will be from India (Economic Times, 2020). Indian cities are likely to contribute 70 per cent of India’s GDP by 20303. A comparison of decadal incremental rise in urban and rural population shows that for the first time, urban areas would add more new persons than rural areas (Chart III.7). A rapidly urbanising Indian economy poses several challenges for policymakers, ranging from generation of adequate quality employment to creating a robust and inclusive infrastructure. III.13 Globally, productivity growth has undergone a prolonged slowdown since 2010, after a brief recovery in the years immediately following the GFC (Chart III.8), with the deceleration in total factor productivity (TFP)4 being relatively sharper in emerging and developing economies. The slowdown in productivity growth has been attributed to a weakening investment climate, lower growth in employment in developed economies, reduced participation in global value chains, and fading gains from factor reallocation (Dieppe, 2021). The growing emergence of monopolistic forces across sectors and decline in dynamism of traditional firms also contributed to the loss of productivity (Parente and Edward, 1999; Herrendorf and Teixeira, 2004).  III.14 Labour productivity, measured by the value added per worker, has followed a similar trend. Despite showdown, India’s average labour productivity growth for 2010 to 2019 at 6.5 per cent was much higher than the emerging market average of 2.9 per cent (Chart III.9).  III.15 India suffered a moderate decline in TFP growth compared to the global experience with average TFP growth rate in India during 2010 to 2019 estimated at 2.25 per cent as against the emerging market average of -0.3 per cent for the same period. TFP growth accounted for about 30 per cent of India’s aggregate GDP growth during 2014 to 2018 (Chart III.10). In fact, the acceleration of GDP growth during this period can be attributed to increase in TFP growth, as contributions from both capital and labour declined. Since 2018-19, there has been a notable slowdown in TFP growth. III.16 TFP growth during 2014 to 2017 was mainly driven by non-market services such as public administration, defence, education, social works and related services (Chart III.11a). This raises doubts about the sustainability of aggregate TFP growth, given that TFP growth from market driven sectors (i.e., when non-market services and agriculture are excluded) has generally remained higher than aggregate TFP growth in years of high real GDP growth (Chart III.11.b).   3.1 Drivers of TFP Growth III.17 The factors that support sustained TFP growth over the long run can be broadly categorised into: (i) fostering innovation at the national level; (ii) facilitating diffusion of new technologies available at the global level among domestic firms; and (iii) reducing resource misallocation, particularly skill mismatches (OECD, 2015). III.18 In a market economy, the most innovative firms are expected to thrive. Innovation can be promoted through a pro-competition environment incentivising the entry of new innovative firms (OECD, 2015). India ranks significantly below the major developed and emerging countries in terms of innovation activities being carried out nationally (Chart III.12a)6. India also ranks far below other major economies in terms of aggregate research and development (R&D) expenditures, and also in the extent of participation by private business entities in R&D activities (Chart III.12b and Chart III.12c). In fact, the share of businesses in aggregate R&D expenditures in India is among the lowest across major countries, which implies that innovation activities in India are largely being carried out by the government and public sector enterprises (Chart III.12c). Consequently, aggregate productivity occupies the lower rung in a cross country comparison (Chart III.12d).  III.19 On the diffusion of technologies, the prominent factors are global connections via trade and FDI (Alvarez et al., 2013; Melitz and Trefler, 2012), participation in global value chains (GVCs) (Saia et al., 2015); synergic investments in R&D, skills and organizational know-how, particularly managerial capital, commonly known as knowledge based capital (KBC) (Griffith et al., 2004). Lower GVC participation across the globe since 2011 has possibly curtailed the scope for technology diffusion. III.20 Investment demand reflected by annual average growth of gross fixed capital formation (GFCF) has decelerated since 2008, both in India and other major emerging economies. This poses a challenge to sustaining TFP growth in the future, as stepping up private sector investment in R&D activities also requires a favourable overall investment outlook. Estimates suggest that capital deepening through higher investment in machinery and other fixed assets improve TFP growth in India (Box III.1). This process could, however, yield a desirable outcome only when supported by simultaneous improvement in the productivity of capital through innovations. Estimates also suggest that improvement in the education profile of the labour force improves TFP growth.

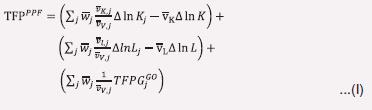

III.21 As regards reallocation of labour and capital from low productive to high productive sectors, reduction in skill mismatches within an economy is an important channel to improve aggregate TFP growth (OECD, 2015). Estimates suggest that a more efficient reallocation of labour and capital across firms can improve TFP growth by up to 60 per cent in the Indian manufacturing sector (Hsieh and Klenow, 2009). On the other hand, when this reallocation mechanism stalls, the aggregate TFP growth tends to be lower. The latest estimates for India on factor reallocation effects suggest that the contribution of resource reallocation to aggregate TFP growth declined from 82 per cent of aggregate TFP during 2001-2010 to 42 per cent of aggregate TFP during 2011-2019 (Box III.2). The productivity increase in India after 2010 was driven mainly by within industry TFP rise and less by resource reallocation effects across industries. From a policy perspective, therefore, the focus should be on addressing market distortions, reducing skill mismatches, ensuring greater product and labour market flexibilities.

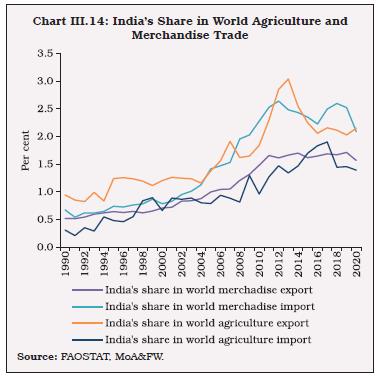

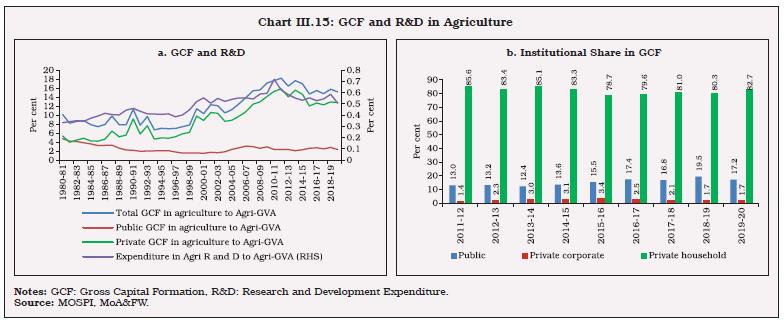

4. Structural Impediments in Key Sectors 4.1 Agriculture and Allied Activities III.22 The agriculture and allied (A&A) sector comprises crops (both agricultural and horticultural), livestock, fishing and aquaculture, and forestry and logging. The importance of the sector arises from the point of view of food and nutrition security, the supply of raw materials to the industrial sector and the generator of demand for industrial and services output. The sector is also the largest provider of livelihood and employment. III.23 From an initial condition of subsistence farming, food shortages and dependence on imports at the time of independence, India has transformed into a food surplus economy and an exporter of agricultural commodities. The country has emerged as a leading producer of cereals, pulses, vegetables, fruits, sugarcane, milk, fish, poultry and cotton in the world.  III.24 Horticulture crop production has increased 11.2 times since 1950-51 while production in the livestock sector has increased in similar large multiples (Charts III.13a and Charts III.13b) driven by rising per capita incomes and the consequent change in consumption patterns. III.25 India’s share in world agricultural exports has risen steadily from a little less than one per cent in the mid-1990s to 2.2 per cent in 2020 and in world agricultural imports from less than 0.5 per cent to 1.4 per cent (Chart III.14). The export shares of rice, marine products, meat products, groundnut, spices, fruits, vegetables, milk products, processed vegetables and fruit juices have increased. III.26 The agriculture export policy of 2018 aimed at doubling India’s agricultural exports from US$30 billion to US$60 billion by 2022; by 2020-21 these exports reached US$41.7 billion. Low Capital Formation III.27 Over the last decade, there has been a trend deceleration in the growth of gross capital formation (GCF) (Chart III.15a). III.28 Public sector GCF in agriculture has stagnated during the 2010s. Growth in private GCF has also moderated, reflecting the behaviour of the household sector which accounts for the majority share (Chart III.15b).   III.29 As early as 2000, the Pradhan Mantri Gram Sadak Yojana (PMGSY) (Prime Minister’s Village Road Scheme) was launched as a centrally sponsored scheme. The connectivity it provided to villages that had no access to the rest of the economy, except by way of foot, brought about sweeping changes in the lifestyles of many villagers in hilly terrains and boosted income levels, altered production and consumption cycles and integrated these villages with the broader Indian economy. This nationwide plan is crying out for replication across the country. Investments in rural roads have strong multiplier effects, working through improved access to better agricultural inputs, extension services and alternative rural occupations. Public investment in roads, agricultural research and development (R&D) and rural infrastructure can crowd in private investment and generate sustained impulses of growth in agriculture (Akber and Paltasingh, 2019; Bathla, 2014). Research and Development Expenditure III.30 Agriculture R&D expenditure has been less than 1 per cent of agriculture GVA, which is substantially lower than some of the peer groups such as that of 1.82 per cent for Brazil in 2013 (latest available data, (ASTI, 2016)) and exhibits a declining trend. At the regional level, the excessive input use practices driven by Minimum Support Price (MSP), procurement and buffer stock policy have led to soil degradation, overexploitation of groundwater resources and declining yields. Technology adoption in terms of climate-smart agriculture techniques has also been low and skewed. III.31 Total factor productivity (TFP)10 growth in agriculture plays a central role in sustaining higher agriculture growth (Evenson et al., 1999; Chand et al., 2012). The key propellers of TFP growth are technological innovations driven by R&D and physical and human capital accumulation (Fan et al., 2007).  III.32 In India, growth in agriculture GVA is primarily driven by TFP growth, reflecting the lower contribution of factor inputs (Gulati et al., 2020). Average TFP growth in Indian agriculture has, however, been lower than in several other emerging and Asian economies over the last two decades (Chart III.16a). India’s crop yields also lag behind levels achieved by other countries (Chart III.16b). An empirical assessment of the determinants of TFP growth in Indian agriculture for the period from 1981-82 to 2018-19 (latest available data), shows that area under irrigation, rural roads, growth in GCF and cumulative expenditure on R&D are the most significant influences (Box III.3).

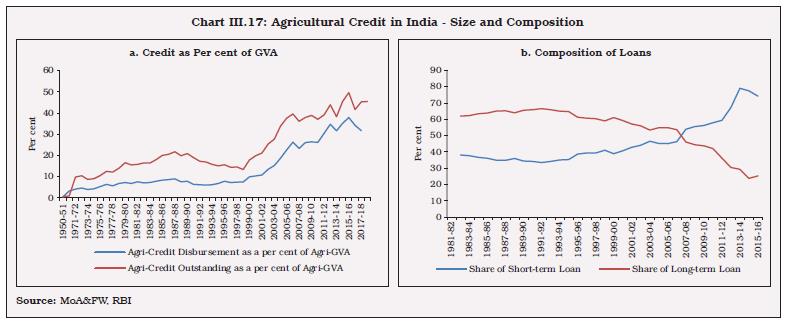

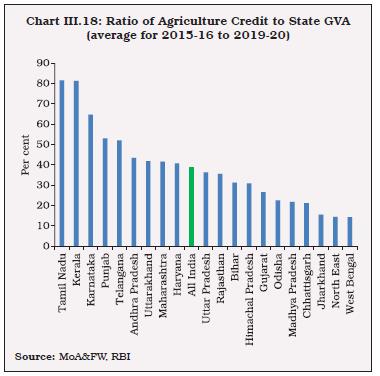

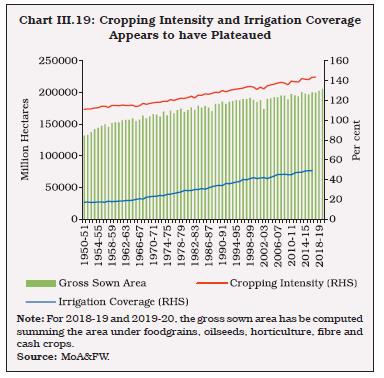

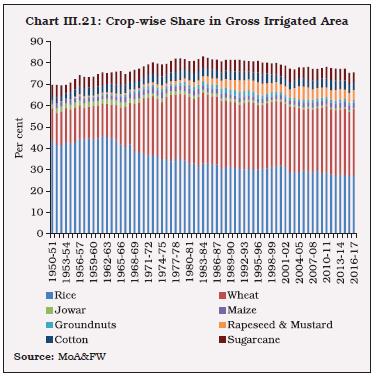

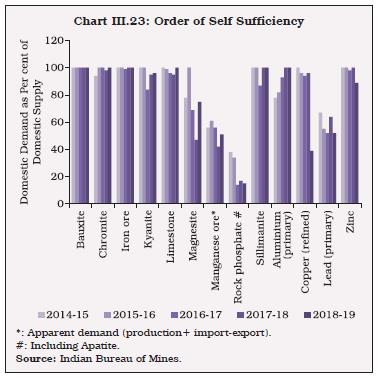

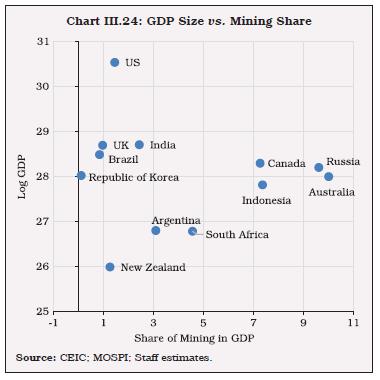

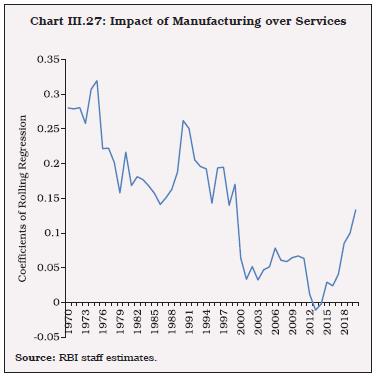

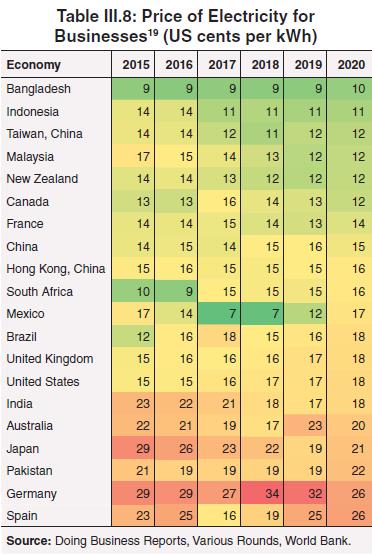

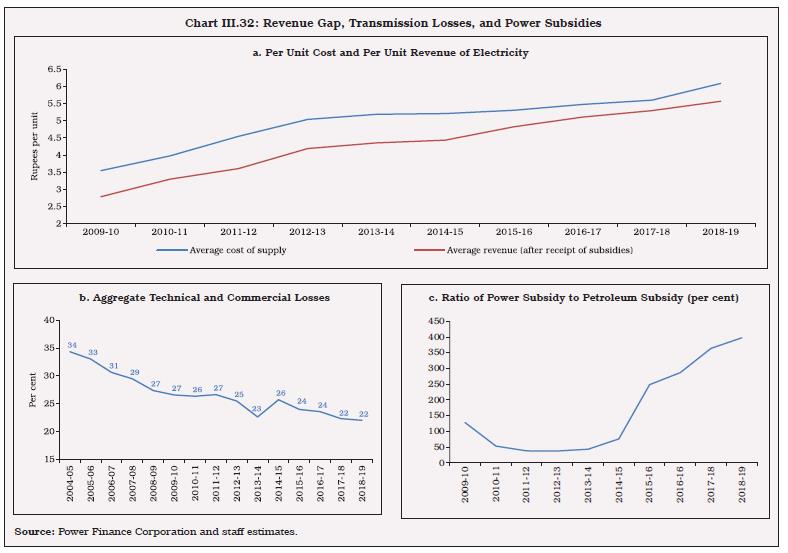

Credit to Agriculture III.33 Credit flows to the A&A sector has stagnated in recent years (Chart III.17). In addition, the inter-state imbalance in usage of agriculture credit is also stark (Chart III.18). Cropping Intensity III.34 There are two broad options to raise production: (1) increasing the Net Sown Area (NSA) under crops, which may be difficult due to the rising demand for land from the non-agriculture sector, and (2) increasing the Gross Sown Area (GSA) by increasing the cropping intensity, which is possible if farmers adopt short-duration crops and investment in irrigation infrastructure is raised by the public and private investors. Another option is to enhance investment in R&D in agriculture to develop newer high-yielding varieties (HYV) in both agriculture and horticulture crops. III.35 As regards NSA, it has declined to 139 million hectares in 2017-18 (latest available data). On the other hand, GSA increased during the period primarily due to higher irrigation facilities and short-duration crops, consequently, the cropping intensity13 has shown a gradual increase.   III.36 Irrigation coverage14 has increased from 17 per cent in 1950-51 to nearly 49 per cent in 2017-18 (latest available data). However, despite this positive development, nearly half of the GSA continues to depend on rainfall (Chart III.19). III.37 There has also been a skewed development in the sources of irrigation. In the recent period, the share of tubewells has been increasing significantly, which has posed the challenge of groundwater depletion - a risk to sustainability of growth in the sector (Chart III.20). III.38 Paddy and wheat continue to garner the highest share in the gross irrigated area in the country. The various input subsidies and price incentives through MSP, backed by procurement, allow paddy and wheat this dominating position. (Chart III.21).  Farm Input Subsidies III.39 The policy approach to support the farm sector in India has been to subsidise farm inputs such as fertiliser, power, credit, irrigation and insurance in order to increase farm production rapidly by promoting technology adoption (Ellis, 1992; Gulati and Sharma, 1995; Fan et al., 2007; Chand and Kumar, 2004; Gulati and Narayanan, 2003).   III.40 The significant share of input subsidies to agriculture has squeezed space for public GCF in agriculture. Though input subsidy as a per cent of agriculture GVA declined from a peak of 15 per cent in 2008-09, public GCF as a per cent of agriculture GVA continues to hover between 2 per cent to 3 per cent in the last two decades (Chart III.22). III.41 Protecting the farmer through crop insurance led to the implementation of the Pradhan Mantri Fasal Bima Yojana (PMFBY) in 2016. Operational across all States and Union Territories, this scheme provided financial insurance to farmers suffering crop loss due to uncertain events. The program assumed significance in a country where rainfed agriculture is predominant and where farmer’s income fluctuated due to other natural calamities such as cyclones and floods. The program functions on a self-selection basis and is voluntary for participation15. The scheme, apart from smoothening farmer’s income over the years has indirectly helped financial institutions by ensuring loan repayment capacity of farmers by insulating them from production risks. The percentage of beneficiaries in the total insurers stands at 31 per cent from 2016-17 to 2019-20 so far, with the highest number of beneficiary farmers being from Maharashtra. 4.2 Industry III.42 As discussed in Section 2, the contribution of the industrial sector to India’s growth has not been adequate relative to its potential. Almost all constituent sectors under industry face challenges that limit their contribution to growth. Mining III.43 India possesses one of the largest reserves of metallic, non-metallic, fuel and minor minerals. It produces as many as 95 minerals, including four fuels, ten metallic, 23 non-metallic, three atomic, and 55 minor minerals (including building and other materials) (GoI, 2021). Accounting for around 2.4 per cent of the real gross value added (GVA)16, mining and quarrying contributes more than 10 per cent of total industry output. III.44 India has the largest coal reserves in the world and is the third largest producer of coal in the world. Indian coal is, however, of low calorific value with high ash content. India is the fourth largest producer of iron ore. The reserve stock of iron (Magnetite) has more than doubled since 2010. Chromite reserves increased by almost 70 per cent and the reserves of Laterite increased by 50.1 per cent. III.45 India is self-reliant in bauxite, chromite and limestone. For magnesite, manganese ore, rock phosphate and lead, India still largely depends on imports for blending with locally available mineral raw materials and/or for manufacturing special quality mineral-based products (Chart III.23).  III.46 Starting from 2004-05, however, the share of mining and quarrying in total GVA has reduced almost by half, which appears to be a puzzle in view of natural endowments and high dependence on annual imports (Table III.1) including in a cross-country perspective (Chart III.24). III.47 The output of three fuel minerals, viz. coal, crude oil and natural gas in the eight core industries index is of particular relevance from the viewpoint of the country’s energy security (Chart III.25). Crude oil production is almost stagnant at the levels achieved in the early 1990s and, in fact, has declined over the last 10-years. Natural gas has been witnessing a secular contraction. Crude oil and natural gas production performance largely reflects the ageing of existing fields, sand ingress, and technological limitations of domestic producers. Import dependence in these three critical minerals (for meeting domestic demand) pose significant spillover risks to India from volatility in international prices as well as from global supply chain constraints, as experienced during 2021-22. As new fields become operational by the end of 2022, some ramp up in gas production can be expected. ONGC or major private Indian players can partner with international majors for offshore and ultra-deep sea exploration for oil and gas fields. India has already launched a Deep Ocean Mission 2021-24 with a plan to extract minerals from oceans. Price deregulation or more remunerative returns through better price realisations need to be examined afresh to create an enabling environment for investments to flow in.   Major Challenges and Policy Options III.48 A large number of small mines (including quarries for extracting minor minerals) and rampant illegal mining complex challenges for sustainable development. The government has taken various steps in recent years, especially in 2021-22, to address these challenges (Annex Table 2). Nevertheless, a comprehensive energy planning strategy is needed so that the country’s commitments to move towards net zero emission and related targets and the changing energy mix are dovetailed into energy security. India has set a target of achieving 40 per cent of electric power installed capacity from non-fossil fuel sources by 2030 in its Nationally Determined Contribution (NDC) under the Paris Agreement. At the ‘Climate Change Conference’ in Glasgow, India committed itself to one of the fastest transitions towards renewable sources that any country has ever undertaken. It will require to raise the country’s non-fossil energy capacity to 500GW by 2030. While complete coal phase out is impractical in the context of India’s energy security, it is clear that incrementally new private investments will flow into renewables to tap more solar energy and to develop grid-level storage for EV batteries network. Manufacturing III.49 Nations seek to raise economic growth through manufacturing because of at least four reasons. First, shifting labour from traditional, low-productivity sectors to higher-productivity manufacturing sector can lift labour productivity (Lewis, 1955; Kaldor, 1966; Chenery et al.,1986). As productivity is higher in manufacturing than in agriculture, transferring resources from agriculture generates a ‘structural bonus.’ Second, manufacturing has the potential for productivity catch-up with the rest of the world that is often unmatched by most services. Arithmetically, this effect could be more significant when employment-intensive manufacturing expands. Third, to the extent that manufactured goods have high income elasticities of demand (higher than those of agricultural products), and are also more likely to be produced under increasing returns to scale, industrialisation sets in motion a virtuous growth cycle (Rosenstein-Rodan, 1943, Murphy et al., 1989). Fourth, as income per capita increases, so does per capita demand for manufactured products. If a developing country does not have a strong manufacturing sector, it may face the risk of perpetual trade deficits (Thirlwall 1979). To cover this deficit, the economy may have to borrow or secure an equally large surplus through trade in non-manufactured goods (e.g., services, minerals, food, etc.). Either of these is challenging for a typical developing country (Felipe, 2018). III.50 In India, GDP and manufacturing display a high degree of co-movement, during the 40-year period from 1980-81 to 2020-21 (Chart III.26). The correlation coefficient between them for this period was found to be high at 0.8. Rolling regressions of manufacturing growth on services growth and vice versa (for a time window of 20-year period) suggest that manufacturing has a positive spillover effect on services growth17 (Chart III.27). In contrast, services coefficients are found to be statistically insignificant, indicating lower backward and forward inter-sectoral linkages of services with manufacturing. Therefore, targeted policy attention to manufacturing is necessary.  III.51 A decomposition of manufacturing growth between corporate and household sectors reveals that the slowdown is more pronounced in the household sector’s output as also visible in electricity consumption (Chart III.28). An analysis of investment in fixed assets and employment trends from the annual survey of industries (ASI) reveals that the share of the top four sectors, viz., basic metals, coal and refined petroleum, chemical and chemical products and other manufacturing in overall fixed investment is 56 per cent. Many other industries which are either important from an employment generation perspective or for meeting domestic and global demand of industrial goods account for a small share in fixed capital. This highlights the importance of correcting the imbalance with a focus on employment-intensive and export-intensive manufacturing.  III.52 Food products, textiles and wearing apparel provide around one-third of total employment in the manufacturing sector. Yet, their share in fixed investment has exhibited a sustained decline. Despite a manifold increase in domestic and global demand for computers, electronic and optical products, their share in industrial fixed investment remains low. In fact, in the last two decades, the fixed investment share of this crucial sector in overall industrial investment has shrunk drastically.  III.53 India’s manufacturing investment base is also narrow. A handful of capital intensive industries, metal and petrochemicals, have garnered the lion’s share of physical investment. Since metals and petroleum are highly procyclical and linked to global demand conditions, India is often affected by adverse price movements worldwide. The narrow investment base of manufacturing also reflect the low employment elasticity of the sector and lower labour productivity, leading to loss of competitiveness. III.54 The price of electricity charged to the Indian industry is considerably higher vis-à-vis other countries, which is the result of a policy of cross-subsidization (of agriculture and household consumption), leading to higher input costs in the economy. Electricity tariffs paid by the industry and commercial establishments are almost twice the rate at which it is sold by the electricity generating companies to the distribution companies. These factors act adversely on the overall competitiveness of the industry sector. III.55 Thus, in a nutshell, the industrial sector has witnessed a secular trend of stunted capital formation in not only traditional employment intensive sectors but even in the fast growing sectors, viz., computers and electronics. Importantly, all these sectors faced high demand in both domestic and global markets. Thus, it may be appropriate to conclude that the industrial slowdown in India has not occurred due to downturn in the business cycle, and hence, countercyclical policies alone may not be enough to address the slowdown. Rather it shows a more generalised structural problem, requiring targeted policy interventions.  4.3 Services III.56 Services represent a complex universe of heterogeneous activities. Since 2015-16 services sector growth has been showing a distinct deceleration (Chart III.29). III.57 A sector-wise breakdown reveals that growth slowdown in services is primarily led by construction, financial services, and transport and communication services (Table III.2). The slowdown is stark in transport and communication sub-sectors (Annex Table 3). 4.4 Construction III.58 Construction contributes around eight per cent of real GVA. It is critical to the economy for employment generation and creation of a lasting asset base. Around 5.7 crore workers are estimated to be employed directly in construction activity, which has high inter-sectoral backward and forward linkages. Importantly, expenditure on construction related activities contributes almost half of total real gross fixed capital formation (GFCF)18.  III.59 A bifurcation of construction output reveals that the share of residential construction declined to 20.1 per cent in 2019-20 from 34.3 per cent in 2011-12 (Table III.3). The count of new launches and sales of the residential units (apartments and villas) as surveyed in 10 major cities by Prop Tiger for the past few years has slackened (Chart III.30). III.60 At the same time, the share of non-residential buildings, roads and bridges expanded from 38.9 per cent to 49 per cent. This decomposition reveals that growth retardation in construction primarily emanates from the slowdown in residential construction. The policy-induced push to construction of roads and bridges has not been adequate to compensate for the drag in the residential sector. 5.1 Infrastructure III.61 Availability of high-class infrastructure enhances the comptetiveness of an economy (Chart III.31). India witnessed impressive growth in several infrastructure sectors such as national highways, seaport capacity, and installed electricity generation capacity. However, expansion of railway tracks has remained relatively subdued (Table III.4).  III. 62 By their nature, infrastructure industries are capital intensive (Table III.5). Their share in aggregate capital formation increased from 17.7 per cent in 2011-12 to above 20 per cent in 2019- 20. During the same period, their contribution to the aggregate GVA remained stagnant at around 9 per cent. This asymmetry indicates that many of these sectors may struggle to generate an operating surplus in a cyclical slowdown. 5.2 Energy III.63 India has a high degree of reliance on imported energy. With renewable energy emerging as an economical alternative to conventional energy resources and the evolution of newer technologies in the transport sector, India’s imported energy dependence could shift to domestic sources in the long run. This could be promoted by rationalising investment in the energy infrastructure. Historically, the emphasis has been more towards generation capacity vis-a-vis transmission and distribution (Table III.6). The focus however needs to gradually shift towards transmission and distribution, with higher participation by the private entities. III.64 A peculiarity of renewable energy is dependence on location and geographical suitability. Hence, renewable energy sources are concentrated in a few states, with adequate sun-lit waste, fallow land and windy areas together accounting for 81 per cent of potential renewable energy capacity (Table III.7). III.65 With rising electricity demand, keeping the cost of power reasonable becomes paramount for long-term growth. Electricity tariffs for businesses are higher in India than in export competitors such as Bangladesh, ASEAN economies, and China (Table III.8). In this context, renewable energy can play a vital role and depress overall tariffs.  III.66 For lowering the cost of power it is also essential to reform the electricity distribution companies - closing the gap between the average cost of supply (ACS) and average revenue realised (ARR) by DISCOMs (Chart III.32). The aggregate technical and commercial (AT&C) loss or the deadweight loss - the percentage of power procured by a distribution company for which it did not receive any payment remains high. This contrasts with the experience of advanced economies, viz. the UK and the US, where AT&C losses are about 6-7 per cent. III.67 The electricity sector has a complex cross-subsidisation scheme under which high energy-consuming customers from industry and commercial sectors subsidise consumption in agriculture and domestic sectors. Based on the experience gained so far from rationalization of petroleum product subsidies, electricity pricing may also be completely deregulated. Levy of additional taxes/cess after deregulation must be eschewed as it could dilute the intended benefits of reforms. 5.3 Telecommunication III.68 Decrease in number of private telecom players, beside the one operating in the public sector, has led to an oligopolistic market structutre. Further, the industry suffers the burden of high debt. The declining average revenue per user in this segment is noteworthy in this context. 5G and IoT are sources of future economic growth for which a viable and strong telecom industry is a necessity. Limited spectrum availability and low broadband penetration in the country are two other concerns. III.69 There is a need to make India attractive for start-ups like Singapore or UAE by simplifying rules and regulations. According to the Department for Promotion of Industry and Internal Trade (DPIIT), start-ups in India are also employment-intensive. The potential of the start-ups could be harnessed by ensuring sufficient access to funds to the sector, both at the early stage of risk taking and when they scale up, and reducing red-tapes. Delayed enforcement of formal contracts or business agreements impede new investment and may also dampen foreign direct investment. India lags in contract enforcement relative to other emerging countries, affecting ease of doing business (Box III.4).

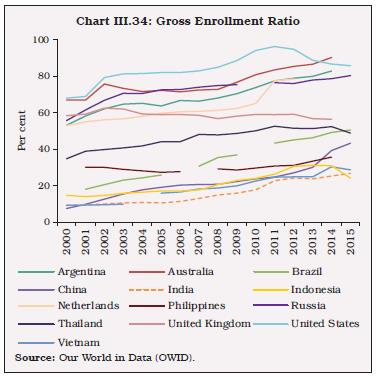

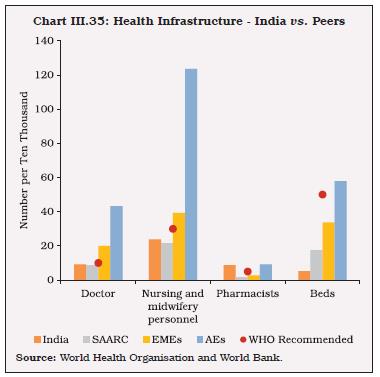

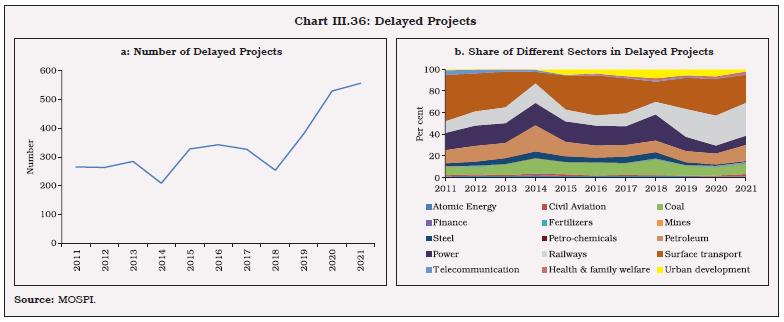

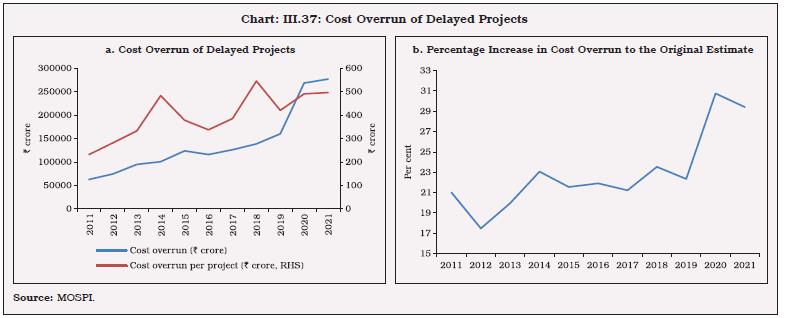

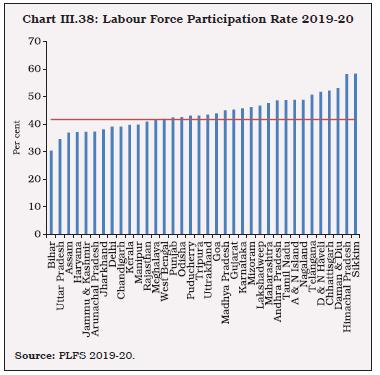

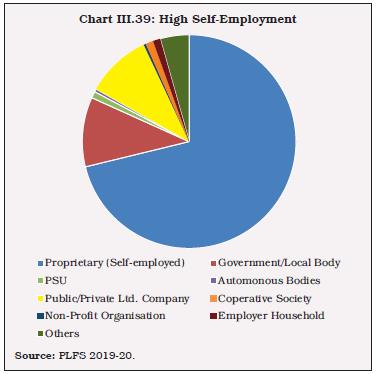

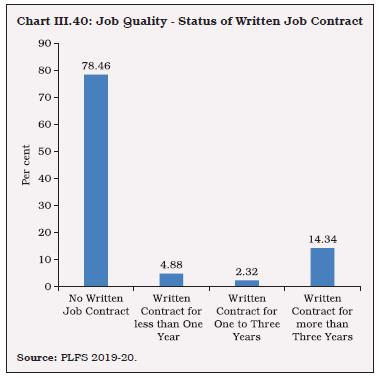

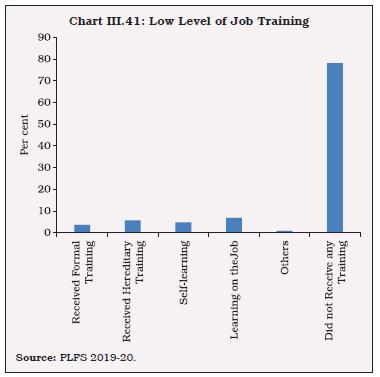

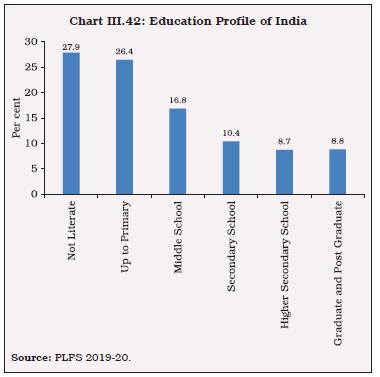

5.5 Education III.70 Globally, efforts towards educating children suffered a major setback during the pandemic by making more than 100 million additional children fall below minimum reading proficiency levels in 202020. In India, concerted efforts are required to make further progress, with a focus on skill augmentation/upgradation (Chart III.33). III.71 It is important to recognise that rising literacy rates alone may not ensure the desired learning outcomes. Survey based results (ASER 2018) show deficiencies in quality of learning in elementary schools. The gap is also visible from the level of India’s gross enrollment ratio in higher education relative to the developed and developing nations (Chart III.34).   5.6 Health III.72 The pandemic has brought to the fore the defiencies in the Indian healthcare system, particularly the poor state of the healthcare infrastructure, falling short on most of the WHO standards (Chart III.35). This has been the result of meagre public expenditure (1.26 per cent of GDP) incurred on health in India over successive decades. III.73 Close to 75 per cent of outpatient care and 65 per cent of in-hospital care in India is provided in the private sector. India also has one of the highest levels of out of pocket expenditure (OOPE) incurred by patients among countries – highlighting the limited support from public expenditure and insurance. The private sector may have little incentives to invest in rural/semi urban areas where the gaps in healthcare infrastructure is more alarming. III.74 Recognising glaring gaps in India’s healthcare infrastructure, the government put in place a policy framework with targeted measures for implementation over the medium-term. This is set out in the national infrastructure pipeline (NIP) policy for the healthcare sector (Table III.9).  6.1 Land III.75 Agriculture has a disproportionately high share in land available for use in economic activity, despite being the least productive (Table III.10). Access to land is intimately tied to protecting property rights, and by extension, expropriation procedures (OECD, 2015). Domestic legal frameworks must provide clarity on compensation to land owners in the event of expropriation and also set out the public benefit purposes for which an expropriation can lawfully occur for attracting long-term investment, including in infrastructure and industrial zones. III.76 Since independence, India has enacted more than a hundred land acquisition laws (Yoshino et al., 2018), including central and state laws which contain provisions for land acquisition, viz., the Forest Act 1927, the Railways Act 1989, Electricity Act 2003, and the Special Economic Zones Act, 2005 etc. Post-1991, land acquisition by the government for industrial use by the private sector increased significantly, leading to episodes of discontent among the public. Therefore, the Land Acquisition Act (LAA) 1894 was replaced by the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013. The usefulness of the present Act, however, has been questioned by several stakeholders, stating that it may stall land acquisition by making the cost of land prohibitive for industry and the procedures more cumbersome (Yoshino et.al., 2018). An effort to change this law in 2015 was not successful, and the state governments were advised to frame their own land acquisition laws. Gujarat, Rajasthan, Maharashtra, Jharkhand, and Telangana have enacted new laws. Gujarat and Telangana have exempted a long list of projects from social impact assessment (SIA) and mandatory consent of landowners. They include projects of national security, defence, rural infrastructure, affordable housing, industrial corridors, and other infrastructural projects, including projects under public-private partnerships (PPPs). In Maharashtra, PPP projects have been fully exempted from the SIA and consent clauses. Telangana, Uttar Pradesh and Andhra Pradesh have reduced the notice period for public hearings under SIA from three weeks to one week. In Jharkhand, for instance, the quorum for seeking consent from the gram sabha has been reduced from half to one-third. For parity and distributional justice, however, India needs to explore laws for land pooling (Yoshino, Paul, Sarma, and Lakhia, 2018). III.77 According to the Ministry of Statistics and Programme Implementation data, the number of stalled projects has increased sharply since 2018 for projects above ₹150 crore of investment (Chart III.36). III.78 Since 2018, the share of stalled projects in the railway sector has increased significantly (from 11 per cent in 2018 to around 25 per cent in 2019). The average cost overrun per project shows an increasing trend, touching a high of 31 per cent of the original cost in 2020 (Chart III.37).  6.2 Labour III.79 Favourable demographies and the large pool of excess labour absorbed into agriculture require industry friendly labour reforms to harness their potential as growth drivers of the future. Over the years, recommendations of various Committees on labour such as the First National Commission on Labour (1969), National Commission on Rural Labour (1991), National Commission on Labour (2002) and National Commission for Enterprises in the Unorganised sector (2009) have shaped existing labour laws. As a concurrent list subject, both the Central and State Governments have powers to make labour legislations. In 2019, the Ministry of Labour introduced four labour bills to consolidate the existing 29 labour laws. These bills relate to (1) industrial relations; (2) minimum wages; (3) social security; and (4) occupational safety, health and working conditions. All labour codes have been passed by the Parliament and will be implemented from the fiscal year 2022-23.  III.80 The code on minimum wages ensure that the employers pay minimum wages to their employees. The industrial relations code provides that if a firm employed more than 100 employees at any point of time in the past 12 months, it must constitute a works committee comprising members from both the employer and employees with the responsibility of nurturing amicable relationship between the employer and employees. Firms employing more than 20 workers need to have more than one grievance redressal committees to resolve issues of individual employees. III.81 The labour code on social security envisages strengthening social security for labour through employees’ provident fund, state insurance corporations, medical benefit committee, and the national social security board that will recommend schemes to unorganised workers. The code on occupational safety, health and working conditions requires every employer to ensure that the occupational place is free of hazards. III.82 Apart from benefiting the workers, these labor codes may also be beneficial for industry. The inclusion of fixed term employment will provide flexibility to firms to hire workers according to the changing economic environment. At the same time, these codes may streamline the process of settlement of labor disputes; envisage a time bound and hassle free resolution of labor disputes; create enabling conditions for collective bargaining between the firm and workers; and simplify the process of labor administration (filling of one return, one license and one registration). Collectively these reforms, when implemented, will improve flexibility in India’s labor markets.  6.2.1 Labour Participation III.83 As per the Periodic Labour Force Survey (PLFS), around 42 per cent of the population forms the labour force. India has one of the lowest Labour Force Participation Rate (LFPR) among the major economies, partly due to very low female LFPR (22 per cent) (WDI, World Bank), especially among poorer states (Chart III.38). III.84 The prevalence of high informal employment is a major challenge with 71 per cent of the total employed labour force being ‘self-employed’ (Chart III.39). Seventy seven per cent of the self employed enterprises are small enterprises with less than six workers.  III.85 Seventy nine per cent of the working population do not have a written job contract in their usual principal activity (Chart III.40). III.86 Seventy eight per cent of the working population in India have not received any type of job training (PLFS, 2019-20) (Chart III.41).   III.87 Twenty eight per cent of the population is illiterate and another 26 per cent have received only primary school education (PLFS, 2019-20). Only nine per cent of the population possesses a graduate/post graduate degree in India (Chart III.42).  III.88 The Indian economy was riddled with several structural impediments to growth even before the outbreak of COVID-19 which had dampened the investment outlook. COVID induced supply disruptions and potential hyteresis effects have imposed testing challenges. Addressing these structural constraints has become central to reviving and reconstructing the Indian economy from the ravages of the pandemic. III.89 The agriculture sector suffers from low capital formation, declining R&D, low crop yields, inadequate crop diversity and intensity, with excessive dependence on subsidies and price support schemes. India’s dependence on imports of minerals, depleted natural endowment is another drag. In manufacturing, a few capital-intensive industries have garnered the lion’s share of physical investment, whereas the investment share of employment generating industries and high-demand electronics and computer industries has either stagnated or contracted over the years. In the service sector, growth slowdown was primarily led by construction, financial services, and transport and communication services, due to prevalence of many sector-specific problems as discussed in this chapter. III.90 Recognising the need for urgent and bold structural reforms, the Government has announced privatisation and asset monetisation; tax reforms (GST and corporate tax rationalisation); targeted sector-specific incentives to raise production and exports under the production linked incentive (PLI) scheme; insolvency and bankruptcy code (IBC) to improve the credit culture and resource allocation mechanism; labour reforms (four codes); and a fiscal policy focus on capex and infrastructure. III.91 These reforms need to be augmented by other measures to reverse the sustained decline in private investment and low productivity in the economy. What is needed include access to litigation free low cost land; raising the quality of labour through large scale expansion of public expenditure on education and health and the skill India mission; reducing the cost of capital for industry and improve resource allocation in the economy by promoting competition; encouraging industries and corporates to scale up R&D activities with an emphasis on innovation and technology; creating an enabling environment for startups and unicorns; encouraging corporate investment in agriculture; addressing the challenges faced by the debt-ridden telecom industry and DISCOMs; rationalisation of subsidies that promote inefficiencies; encouraging urban agglomerations by improving the housing and physical infrastructure. III.92 While aiming to boost India’s participation in global value chains (GVCs) and raise export competitiveness, greater adoption of technology assumes critical importance. The reform package of the future hinges around (i) an ecosystem that increases the adaptability of domestic firms to state-of-the-art technology; (ii) ensuring policy certainty on royalty payments for technology transfer by foreign companies; (iii) improving domestic R&D infrastructure for innovations. The industrial revolution 4.0 and committed transition to net zero emission target will create new investment opportunities requiring greater policy emphasis on technology and green financing. The next wave of global structural transformation is likely to be powered by both technology and environmentally sustainable production processes. III.93 A comprehensive plan is necessary to revive the rural economy of the country alongside the existing several other policy measures (Annex - I). Organising farmers’ clubs or agricultural cooperatives is a possible solution to correct the pricing imbalances by reducing gaps between farm gate prices and retail prices. In this regard, the development of a modern supply chain infrastructure needs priority attention. III.94 Farmers are still dependent on money lenders. There is a need to adopt a viable ‘whole of business’ approach covering all aspects of farming. Developing numerous small-scale irrigation projects as well as using wind energy to lift water from bore wells as implemented in many western African countries can be replicated in India’s drought prone areas. India is one of the most vulnerable countries to extreme weather events in the world21. According to the India Meteorological Department, the occurrence of extreme weather events like floods, cyclones, heat waves and droughts has increased in both frequency and intensity. Furthermore, the average temperature has increased by 1.8 degrees Celsius between 1997 and 2019 as against an increase of 0.5 degrees Celsius between 1901 and 2000. Similarly, the fall in groundwater level in Punjab, Haryana and Madhya Pradesh has exceeded the annual recharging levels. III.95 Apart from measures already taken (Annex Table 3), the production linked incentives (PLI) scheme recognises growth opportunities in 14 key manufacturing sectors of the economy. The incentives, however, effectively compensate industries for domestic structural impediments (ranging from access to litigation free land, high cost of electricity tariff, inefficient domestic supply chain, high cost of logistics and settlement disputes). Unless the structural impediments are addressed, these reforms may become unsustainable. Building on “Start-up India, Stand-up India”, the policy ecosystem for the startups needs a dynamic framework with provision for adequate access to risk capital and globally competitive environment for doing business. The textile industry has a special place in the Indian industrial landscape owing to its labour intensive nature, particularly employment of women in the sector. For enhancing female labour participation and the associated scope to raise output, greater support to the textile sector is necessary. III.96 The National Infrastructure Pipeline (NIP) through public-private partnerships would require a strategy for meeting the financing requirement, given limited domestic financial savings and sustainable levels of capital flows. III.97 Labour reform with flexibility to hire and fire workers can allow firms to adjust their workforce according to economic cycles, thereby enabling them to use their resources more efficiently. This, however, could come only at the cost of lower welfare/social security of the workers. One option here could be to build an unemployment insurance fund during periods of economic boom at the firm level, which can be utilized to financially support workers up to a limited period after retrenchment. Further, many of the social security measures apply to firms having a certain minimum number of workers, which creates incentives for firms to not scale up. To address this issue, a policy option could be universal access to social security irrespective of firm size, with each firm required to earmark a certain percentage of their profit for the social security schemes for the workers. References Akber, N. and K. R. Paltasingh (2019), “Investment, Subsidy and Productivity in Indian Agriculture: An Empirical Analysis”, Agricultural Economics Research Review, Vol. 32, No. 3, pp. 13-25. Alfaro, L. and A. Chari (2014), “Deregulation, Misallocation, and Size: Evidence from India”, The Journal of Law and Economics, Vol. 57, No. 4, pp. 897-936. Alvarez, F., F. Buera and R. Lucas, Jr. (2013), “Idea Flows, Economic Growth and Trade”, NBER Working Paper Series, No. 19667. Arnold, J.M. and Grundke, R. (2021), “Raising productivity through structural reform in Brazil”, OECD Library. Annual Status of Education Report (ASER), 2018. Banerjee, A. V. (2006), “The Paradox of Indian growth: A Comment on Kochhar et al.”, Journal of Monetary Economics, Vol. 53, No. 5, pp. 1021- 1026. Bathla, S. (2014), “Public and Private Capital Formation and Agricultural Growth in India: State level Analysis of Inter-linkages During Pre- and Post-reform Periods”, Agricultural Economics Research Review, Vol. 27, No. 1, pp. 19-36. Chand, R., P. Kumar, and S. Kumar (2012), “Total Factor Productivity and Returns to Public Investment on Agricultural Research in India”, Agricultural Economics Research Review, Vol. 25, No. 2, pp. 181-194. Chand, R. and P. Kumar (2004), “Determinants of Capital Formation and Agriculture Growth: Some New Explorations”, Economic and Political Weekly, Vo. 39, No. 52, pp. 5611-5616. Chenery, H.B., S. Robinson, M. Syrquin and S. Feder (1986), Industrialization and growth, New York: Oxford University Press, pp. 175. Dieppe, A (2021), “Global Productivity: Trends, Drivers, and Policies’, Washington, DC: World Bank. Ellis, F. (1992), “Agricultural Policies in Developing Countries”, Cambridge University Press. Evenson, R., E. Pray, E. Carl and M. W. Rosegrant (1999), “Agricultural Research and Productivity Growth in India”, Vol. 109, International Food Policy Research Institute, Washington, DC, USA. Fan, S., A. Gulati and S. Thorat (2007), “Investment, Subsidies and Pro-poor Growth in Rural India”, IFPRI Discussion Paper, International Food Policy Research Institute, Vol. 716. Felipe, J. (2018), “Asia’s Industrial Transformation: the Role of Manufacturing and Global Value Chains (Part 1)”, Asian Development Bank Economics Working Paper Series, Vol. 549. Ghate, C., G. Glomm and J. L. Streeter (2016), “Sectoral Infrastructure Investments in an Unbalanced Growing Economy: The Case of Potential Growth in India”, Asian Development Review, Vol. 33, No. 2, pp. 144-166. Ghate, C. and D. Mazumder (2019), “Employment Targeting in a Frictional Labor Market”, Indian Growth and Development Review. Government of India (2020), Economic Survey. Gupta, P. and U. Kumar (2012), “Performance of Indian Manufacturing in the Post-Reform Period”, Chapter 8. In C. Ghate, ed. The Oxford Handbook of the Indian Economy, pp. 276–310, New York: Oxford University Press. Griffith, R., S. Redding and J. V. Reenen (2004), “Mapping the Two Faces of RandD: Productivity Growth in a Panel of OECD Industries”, The Review of Economics and Statistics, Vol. 86, No. 4, pp. 883-895. Gulati, A. and S. Narayanan (2003), “The Subsidy Syndrome in Indian Agriculture”, Oxford University Press, Oxford. Gulati, A. and A. Sharma (1995), “Subsidy Syndrome in Indian Agriculture”, Economic and Political Weekly, Vol. 30, No. 39, pp. A93-A102. Gulati, S, U. Saksena, A. K. Shukla, V. Dhanya, and T. Sonna (2020), “Trends and Dynamics of Productivity in India: Sectoral Analysis”, Reserve Bank of India Occasional Papers, Vol. 41, No. 1, pp. 77-108. Herrendorf, B. and R. Rogerson (2014), “Growth and Structural Transformation” Chapter 6, Handbook of Economic Growth, Vol. 2. Hsieh, C. T. and P. J. Klenow (2009), “Misallocation and Manufacturing TFP in China and India”, The Quarterly journal of economics, Vol. 124, No. 4, pp.1403-1448. Kaldor, N. (1966), “Marginal productivity and the macro-economic theories of distribution: Comment on Samuelson and Modigliani”, The Review of Economic Studies, Vol. 33, No. 4, pp. 309-319. Lewis, W.A. (1955), “The Theory of Economic Growth”, London: George Allen and Unwin Ltd. McMillan, M. and D. Rodrik (2011), “Globalization, Structural Shange and Productivity Growth”, Ch.2, Making Globlisation Socially Sustainable, ILO. Melitz, M., and D. Trefler (2012), “Gains from Trade When Firms Matter”, Journal of Economic Perspectives, Vol. 26(2), pp. 91-118. Munshi, K., and M. Rosenzweig (2009), “Why is Mobility in India so Low? Social Insurance, Inequality. and Growth”, Working papers, Brown University, Department of Economics. Murphy, K.M., A. Shleifer and R.W., Vishny (1989), “Industrialization and The Big Push”, Journal of Political Economy, Vol. 97, No. 5, pp.1003-1026. OECD (2015), “The Future of Productivity”, OECD, Paris. Parente, S.L. and Edward.C. Prescott (1999), “Monopoly Rights: A Barrier to Riches”, American Economic Review, Vol. 89, No.5, pp.1216-1233. Herrendorf, B and A. Teixeira (2004), “Monopoly Rights and Cross-Country TFP”, 2004 Meeting Papers, No. 17, Society for Economic Dynamics. Panagariya, A. (2008), “India: The Emerging Giant”, Oxford University Press. Rosenstein-Rodan, P.N. (1943), “Problems of Industrialisation of Eastern and South-Eastern Europe”, The Economic Journal, Vol. 53, pp. 202- 211. Saia, A., D. Andrews and S. Albrizio (2015), “Public Policy and Spillovers From the Global Productivity Frontier: Industry Level Evidence”, OECD Economics Department Working Papers, No. 1238. Schumpeter, J.A. (1939), “Business Cycles”, Vol. 1, pp. 161-174 New York: Mcgraw-hill. Subramanian, A. and J. Felman (2019), “India’s Great Slowdown: What Happened? What’s the Way Out?”, CID Working Paper Series. Thirlwall, A.P. (1979), “The Balance of Payments Constraint as an Explanation of International Growth Rate Differences”, BNL Quarterly Review, Vol. 32, No. 128, pp.45-53. United Nations Industrial Development Organization (UNIDO), (2009), “Breaking In and Moving Up: New Industrial Challenges for the Bottom Billion and the Middle-Income Countries”. United Nations Industrial Development Organization, (2017), Annual Report. Yoshino, N., P. Saumik, V. Sarma, and S. Lakhia (2018), “Land Acquisition and Infrastructure Development through Land Trust Laws: A Policy Framework for Asia”, ADBI Working Paper No. 854, Asian Development Bank Institute, Japan. Annex – I: List of Measures for Agriculture • The Ministry of Agriculture and Farmers Welfare, Government of India and the Indian Council of Agricultural Research (ICAR), launched a network project 'National Innovations in Climate Resilient Agriculture' (NICRA) in 2011. The project aims at strategic research on adaptation and mitigation; demonstration of technologies on farmers' fields; and creating awareness among farmers and other stakeholders to minimise the climatic change impacts on agriculture. The main thrust areas covered for strategic research are (i) identifying the most vulnerable districts/regions; (ii) evolving crop varieties and management practices for adaptation and mitigation; and (iii) assessing climate change impact on livestock, fisheries and poultry and identifying adaptation strategies. So far, seven climate resilient varieties and 650 district agricultural contingency plans have been developed besides assessing the risk and vulnerability of Indian agriculture to climate change. Location specific technologies have been demonstrated in 151 climatically vulnerable districts. State-of-the-art infrastructure facilities have been established by ICAR in the National Agricultural Research and Education System (NARES) across the country to facilitate climate change research. Unique infrastructure facilities viz. High Throughput Plant Phenomics, Free Air Temperature Enrichment Facility (FATE), Free Air CO2 Enrichment Facility (FACE), CO2 Temperature Gradient Chambers (CTGC), Gas Chromatography, Atomic Absorption Spectrophotometers, Environmental Growth Chamber, UV-VIS Spectrophotometer, Thermal imaging system, Psychrometric chambers etc. have been established at various ICAR institutes to facilitate the climate change research. The construction and operation of psychometric chambers have been undertaken for studying the effect of different environmental conditions viz., temperature, humidity, and air movement on livestock, with special reference to cattle and buffaloes, environmental growth chambers with CO2 and temperature controls and a special calorimetric system to study livestock response to heat stress. Custom hiring centres (CHCs) have been established in 121 NICRA villages to ensure the availability of farm implements for timely operations. • The National Agricultural Research System (NARS) under the aegis of Indian Council of Agricultural Research (ICAR) comprising of ICAR Institutes and State/Central Agricultural Universities are involved in the development of new high yielding and biotic/abiotic stress tolerant crop varieties of field and horticultural crops. During the last 3 years (2018-2020) and in the current year, 1,017 new varieties of 69 field crops and 206 varieties of 58 horticultural crops have been developed. • The Government of India has been promoting organic farming through dedicated schemes of Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development in the North East Region (MOVCDNER). Farmers are provided financial assistance (₹31000/ ha / 3 years in PKVY and ₹32500/ ha/ 3years under MOVCDNER) for organic inputs including seeds, bio-fertilisers, bio-pesticides, organic manure, compost/vermicompost and botanical extracts. In addition, support is also provided for group/ Farmers Producers Organization (FPO) formation, training, certification, value addition and marketing of their organic produce. Organic cultivation on either side of the River Ganga, natural farming, large area certification and support for individual farmers have also been introduced under PKVY to increase organic production. • Burning of Crop residue leading to higher air pollution and health hazards has been a contentious issue within/between the States. The 'Pusa Decomposer Technology' is a new low-cost capsule technology developed by the ICAR - Indian Agriculture Research Institute (IARI), New Delhi for crop residue management. In coordination with the State Governments, the Government of India has made multiple efforts to demonstrate this technology for crop residue management across the country. During 2020-21, the Pusa Decomposer was provided for 5730 ha area comprising of Uttar Pradesh (3700 ha), Punjab (200 ha), Delhi (800 ha), West Bengal (510 ha), Telangana (100 ha); Confederation of Indian Industry (100 ha) and NGO and Farmers (320 ha). In-situ application of Pusa decomposer on paddy residue was demonstrated at farmers' fields in several villages of Punjab and Haryana. A slogan of "jalana nahi, galana hai" was publicised among the farmers. In addition, regular interactive sessions with farmers through online meetings, Webinars, and messaging Apps have been conducted to make them aware of this technology and to wean them away from burning. The IARI has licensed this technology to 12 companies for mass multiplication and marketing of the Pusa Decomposer. In addition, ICAR – IARI has produced about 20000 packets of Pusa decomposer at its facility for use by the farmers. • The Government of India has made a provision for the opening of one Krishi Vigyan Kendra (KVK) in each of the rural districts across the country. A total of 725 KVKs have been established across the country to date. The KVKs are mandated for frontline extension which act as a bridge between research organisations and the main extension system operated by different development departments of the State Governments. Considering the role and resources of a KVK, it caters to the requirement of the selected farmers of the district and provides capacity development support to State Development Departments. • The Government of India has launched the Agriculture Infrastructure Fund (AIF) scheme to mobilise a medium - long term debt financing facility for investment in viable projects for post-harvest management (PHM) Infrastructure and community farming assets (CFAs) through incentives and financial support to improve agriculture infrastructure in the country. This financing facility will also help APMCs to upgrade their Infrastructure, which will ultimately benefit the farmers. The scheme provides financial assistance in interest subvention and credit guarantee for setting PHM projects, which will help better post-harvest management and reduce wastage. Further, the following CFA projects are eligible under the scheme: (1) Organic inputs production, (2) Biostimulant production units, (3) Infrastructure for smart and precision agriculture, (4) Projects identified for providing supply chain infrastructure for clusters of crops including export clusters, (5) Projects promoted by Central/State/Local Governments or their agencies under Public- Private Partnerships (PPP) for building CFAs or PHM projects. Greenhouse gas emissions and the associated climate change risks pose new concerns for the sector which include lower yields, weed and pest proliferation and large crop losses, the frequency of which could even endanger national food security. This chapter has been prepared by Mridul Kumar Saggar, Sadhan Kumar Chattopadhyay, Avdhesh Kumar Shukla, Arun Vishnu Kumar, Rakhe Balachandran, Siddhartha Nath, Sreerupa Sengupta, Silu Muduli, D. Suganthi and Ishu Thakur. The authors sincerely acknowledge the guidance and insightful suggestions by Dr. Michael Debabrata Patra. 1 Capital, as the third critical factor, is covered in Chapter IV in the context of contribution of finance to growth. 2 The neoclassical school of thought, however, would suggest that structural changes could be the outcome of market forces. Even on state intervention, the strategy could differ depending on the preference for welfare economics versus neoliberalism. 3 The Economic Times, November 27, 2020. 4 Total Factor Productivity (TFP) is estimated as a residual growth in an economy’s aggregate output after deducting the contributions from labour, capital and intermediate inputs from growth in gross output. In other words, TFP growth accounts for that part of growth in aggregate output which is not explained by growth in labour, capital, and intermediate inputs. TFP growth essentially measures the impact of technological progress and efficiencies in production processes, collectively called as the productivity growth in an economy. 5 TFP being a residual of growth accounting, it is more appropriate to refer to period averages rather than TFP estimate of any single year. 6 Innovation is measured by the number of patent applications by a country’s residents relative to its total population. 7 Education categories are: i) below primary, ii) primary, iii) middle, iv) secondary & higher secondary and v) above higher secondary. 8 A two-step least-square instrumental variable (2SLS IV) approach is used to address the issue of inconsistency in the estimates for the coefficients of capital deepening, capital composition and labour quality due to their correlations with the error terms of the regression. This is also known as the endogeniety problem. This occurs when the explanatory variables are not completely exogenous. We use the contemporaneous growth in intermediate input as instrument for growth in capital stock following Levinsohn and Petrin (2003). For the capital composition and labour quality, we used the fourth lag of capital stock growth, and the second lag of change in labour-capital ratio, respectively, as instruments.  10 Total factor productivity (TFP) is the quantum of change in output not accounted for by changes in the conventional inputs such as land, labour and capital. 11 The real values were obtained by using GDP deflators. 12 To elevate crop yields by enhancing seed replacement rate, mostly the certified/quality seeds are made available to the farmers. The contribution of private sector to the commercial seed requirement of the country stood at 58.8 per cent in 2016 (Chauhan et al., 2016). Since private sector R&D expenditure data is unavailable, it has been proxied by the distribution of certified quality seeds. 13 Cropping Intensity = GSA/NSA * 100 14 Irrigation Coverage = Net Irrigated Area / Net Cropped Area *100 15 PMFBY 1.0 was not voluntary; the farmers availaing loan were covered by default under the crop insurance scheme; however, the awareness among the farmers was poor. Currently, PMFBY 2.0 has been made voluntary. 16 Mining and Quarrying accounted for 2.4 per cent share in real GVA during 2021-22 as per the second advance estimates of National Accounts released on February 28, 2022. 17 The coefficient is greater than zero and statistically significant. 18 Its share declined from 58 per cent in 2011-12 to around 48 per cent in 2019-20. 19 The price of electricity is measured in U.S. cents per kWh. A monthly electricity consumption is assumed, for which a bill is then computed for a warehouse based in the largest business city of the economy for the month of March. The bill is then expressed back as a unit of kWh. The index is computed based on the methodology in the Doing Business 16-20 Studies. 20 As per United Nations progress report on SDG Goal 4, it is estimated that 101 million additional children and young people (from grades 1 to 8) fell below the minimum reading proficiency level in 2020 owing to the consequences of the pandemic, which wiped out the education gains achieved over the past 20 years. |

Page Last Updated on: