IST,

IST,

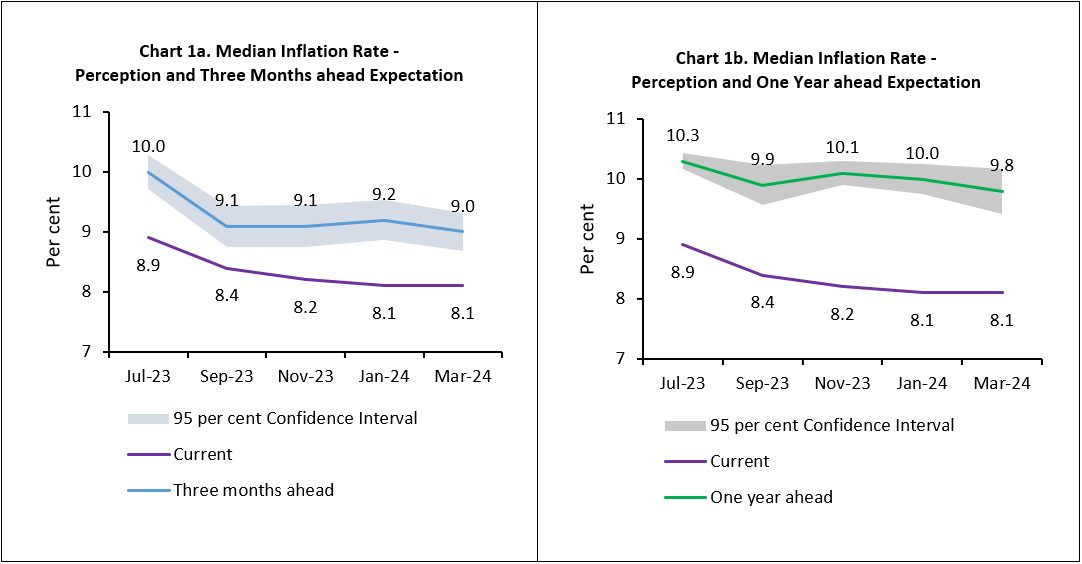

Households’ Inflation Expectations Survey

|

Today, the Reserve Bank released the results of March 2024 round of its bi-monthly inflation expectations survey of households (IESH)1 2. The survey was conducted during March 2-11, 2024 in 19 major cities, with responses from 6,083 urban households. Female respondents accounted for 50.8 per cent of this sample. Highlights:

Note: Please see the excel file for time series data.3 1 The survey is conducted at bi-monthly intervals by the Reserve Bank; it provides directional information on near-term inflationary pressures as expected by respondents and may reflect their own consumption patterns. Hence, survey results reflect respondents’ views, which are not necessarily shared by the Reserve Bank. 2 All estimates of inflation expectations are given in terms of median, unless stated otherwise. 3 Results of the previous survey round were released on the Bank’s website on February 08, 2024. Unit-level data for previous rounds of the survey are available on the Bank’s ‘Database on Indian Economy’ (DBIE) portal (weblink: https://dbie.rbi.org.in/#/dbie/home) under the head ‘Unit-level Data’. |

Page Last Updated on: