Combined Government Finances: 2007-08

Combined Government finances were budgeted to improve in 2007-08, with key deficit ratios placed 0.7-0.9 percentage points of GDP lower than in 2006-07, reflecting the improvement in the finances of both the Central and State Governments. The improvement was envisaged to be achieved through a reduction in expenditure (as percentage of GDP), particularly in the revenue account. The combined debt-GDP ratio was budgeted to decline from 77.1 per cent at end-March 2007 to 73.8 per cent at end-March 2008 (Table 17).

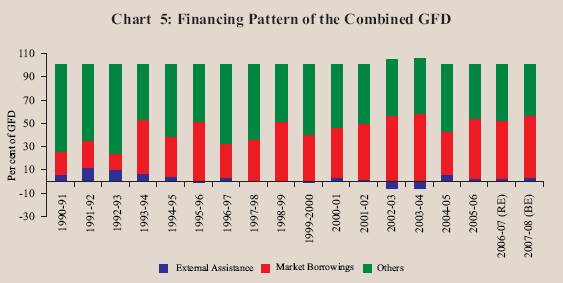

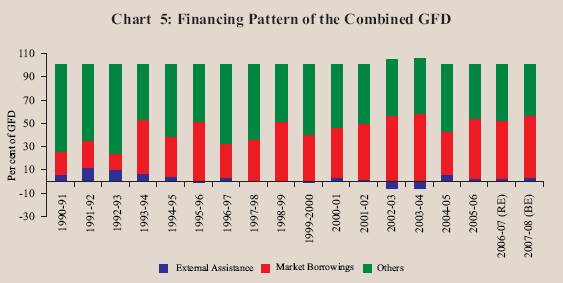

The combined fiscal deficit during 2007-08 was budgeted to be financed primarily from domestic resources. Market borrowings were budgeted to finance 53.5 per cent of the gross fiscal deficit (GFD) during 2007-08 (49.1 per cent a year ago), while other liabilities (small savings, provident funds, reserve funds and deposits and advances) were budgeted to finance 42.9 per cent (47.9 per cent in 2006-07). External assistance was budgeted to finance 3.6 per cent of the combined fiscal deficit during 2007-08 as compared with 3.0 per cent in 2006-07 (Chart 5).

Table 17: Key Fiscal Indicators |

(Per cent to GDP) |

Year |

Primary

Deficit |

Revenue

Deficit |

Gross Fiscal

Deficit |

Outstanding

Liabilities* |

1 |

2 |

3 |

4 |

5 |

Centre |

2002-03 |

1.1 |

4.4 |

5.9 |

63.5 |

2003-04 |

-0.03 |

3.6 |

4.5 |

63.0 |

2004-05 |

-0.04 |

2.5 |

4.0 |

63.3 |

2005-06 |

0.4 |

2.6 |

4.1 |

63.1 |

2006-07 |

-0.2 |

1.9 |

3.5 |

61.2 |

2007-08 BE |

-0.2 |

1.5 |

3.3 |

58.5 |

2007-08 RE |

-0.6 |

1.4 |

3.1 |

61.7 |

2008-09 BE |

-1.1 |

1.0 |

2.5 |

57.7 |

States |

2002-03 |

1.3 |

2.3 |

4.1 |

32.0 |

2003-04 |

1.5 |

2.3 |

4.4 |

33.2 |

2004-05 |

0.7 |

1.2 |

3.4 |

32.7 |

2005-06 |

0.2 |

0.2 |

2.5 |

32.6 |

2006-07 RE |

0.4 |

0.1 |

2.7 |

30.6 |

2007-08 BE |

0.1 |

-0.3 |

2.3 |

29.4 |

Combined |

2002-03 |

3.1 |

6.7 |

9.5 |

80.3 |

2003-04 |

2.0 |

5.9 |

8.4 |

81.4 |

2004-05 |

1.4 |

3.7 |

7.4 |

81.3 |

2005-06 |

1.0 |

2.8 |

6.7 |

80.4 |

2006-07 RE |

0.8 |

2.1 |

6.4 |

77.1 |

2007-08 BE |

0.1 |

1.3 |

5.5 |

73.8 |

RE: Revised Estimates.

BE: Budget Estimates.

* : Includes external liabilities at historical exchange rates.

Note: The fiscal ratios are based on CSO’s estimates of GDP, except for the Centre for the years 2007-08 and 2008-09 which are as per the Union Budget, 2008-09. |

Centre’s Fiscal Situation: 2007-08

The process of fiscal correction and consolidation under the Fiscal Responsibility and Budget Management (FRBM) framework continued during 2007-08; the revised estimates for the year placed the revenue deficit and fiscal deficit lower than budget estimates, both in absolute terms and relative to GDP. Revenue deficit at Rs.63,488 crore in 2007-08 was lower by Rs. 7,990 crore than the budget estimates. This reflected the significant increase in the tax and non-tax revenue which more than offset the increase in the revenue expenditure on account of higher provision for interest payments and subsidies. The GFD at Rs.1,43,653 crore in 2007-08 was lower by Rs.7,295 crore than the budget estimates on account of the lower revenue deficit coupled with a decline in capital expenditure. As a result, gross primary surplus in the revised estimates at Rs.28,318 crore was significantly higher than the budget estimates by Rs.20,271 crore.

The reduction in GFD and revenue deficit by 0.4 per cent and 0.5 per cent of GDP, respectively, during 2007-08 (RE) over 2006-07 met the stipulated minimum threshold levels of 0.3 per cent and 0.5 per cent of GDP for GFD and revenue deficit, respectively, under the FRBM Rules, 2004.

Table 18: Receipts of the Centre |

(Amount in Rupees crore) |

Item |

2006-07 |

2007-08 |

2007-08 |

Variation |

|

(Accounts) |

(BE) |

(RE) |

(4 over 3) |

|

|

|

|

Amount |

Per cent |

1 |

2 |

3 |

4 |

5 |

6 |

1. |

Total Receipts (2+3) |

5,83,387 |

6,80,521 |

7,09,373 |

28,852 |

4.2 |

|

|

(14.1) |

(14.5) |

(15.1) |

|

|

2. |

Revenue Receipts (i+ii) |

4,34,387 |

4,86,422 |

5,25,098 |

38,676 |

8.0 |

|

|

(10.5) |

(10.4) |

(11.2) |

|

|

|

i) Tax Revenue (Net) |

3,51,182 |

4,03,872 |

4,31,773 |

27,901 |

6.9 |

|

|

(8.5) |

(8.6) |

(9.2) |

|

|

|

ii) Non-Tax Revenue |

83,205 |

82,550 |

93,325 |

10,775 |

13.1 |

|

|

(2.0) |

(1.8) |

(2.0) |

|

|

3. |

Capital Receipts |

1,49,000 |

1,94,099 |

1,84,275 |

-9,824 |

-5.1 |

|

|

(3.6) |

(4.1) |

(3.9) |

|

|

of which: |

|

|

|

|

|

|

Market Borrowings |

1,14,801 |

1,10,827 |

1,10,727 |

-100 |

-0.1 |

|

Recoveries of Loans |

5,893 |

1,500 |

4,497 |

2,997 |

199.8 |

|

Disinvestment proceeds |

534 |

41,651 |

36,125 |

-5,526 |

-13.3 |

Memo Items: Net of transactions relating to transfer of Reserve Bank’s stake in SBI |

Total receipts |

5,83,387 |

6,40,521 * |

6,75,065 # |

34,544 |

5.4 |

|

|

(14.1) |

(13.6) |

(14.4) |

|

|

Disinvestment proceeds |

5,893 |

1,651 * |

1,817 # |

166 |

10.1 |

RE: Revised Estimates.

BE: Budget Estimates.

* : Adjusted for an amount of Rs.40,000 crore on account of transactions relating to transfer of Reserve Bank’s stake in State Bank of India (SBI) to the Central Government.

# : Net of transfer of profit from the Reserve Bank to the Central Government on account of sale of Reserve Bank’s stake in SBI amounting to Rs.34,308 crore.

Note : Figures in parentheses are percentages to GDP. |

Revenue receipts in the revised estimates increased by 8.0 per cent over the budgeted level and were placed at 11.2 per cent of GDP (Table 18). This was mainly on account of higher than budgeted net tax revenue, particularly under personal income tax, corporation tax, customs duties, service tax and securities transaction tax. However, collections under excise duties in the revised estimates were lower than the budget estimates (Chart 6).

The collections under non-tax revenues were also higher than the budget estimates on account of dividends and profits which were higher by 6.4 per cent than the budget estimates. Among the capital receipts, recoveries of loans and advances were higher than budgeted.

The aggregate expenditure (adjusted for acquisition cost of Reserve Bank’s stake in SBI) in the revised estimates for 2007-08 was 5.2 per cent higher than the budget estimates on account of higher revenue expenditure, particularly in interest payments and subsidies (Table 19). Increase in interest payments was mainly due to higher interest outgo in market loans, securities issued under market stabilisation scheme (MSS) and compensation and other bonds.

The expenditure on subsidies at Rs.69,742 crore (1.5 per cent of GDP) in the revised estimates for 2007-08 was 28.4 per cent higher than the budgeted amount mainly on account of food and fertiliser subsidies exceeding the budget estimates by Rs.5,850 crore (22.8 per cent) and Rs.8,050 crore (35.9 per cent), respectively (Chart 7). Food subsidies increased to Rs.31,546 crore in the revised estimates mainly due to higher minimum support price and carrying cost. Fertiliser subsidies increased to Rs.30,501 crore mainly on account of increases in input cost of indigenous fertilisers and the cost of imported fertilisers.

Table 19: Aggregate Expenditure of the Centre |

(Amount in Rupees crore) |

Item |

2006-07

(Accounts) |

2007-08

(BE) |

2007-08

(RE) |

Variation

(4 over 3) |

|

|

|

|

Amount |

Per cent |

1 |

2 |

3 |

4 |

5 |

6 |

1. |

Total Expenditure (2+3= 4+5) |

5,83,387 |

6,80,521 |

7,09,373 |

28,852 |

4.2 |

|

|

(14.1) |

(14.5) |

(15.1) |

|

|

2. |

Non-Plan Expenditure |

4,13,527 |

4,75,421 |

5,01,849 |

26,428 |

5.6 |

|

|

(10.0) |

(10.1) |

(10.7) |

|

|

|

of which: |

|

|

|

|

|

|

Interest Payments |

1,50,272 |

1,58,995 |

1,71,971 |

12,976 |

8.2 |

|

|

(3.6) |

(3.4) |

(3.7) |

|

|

|

Defence Expenditure |

85,510 |

96,000 |

92,500 |

-3,500 |

-3.6 |

|

|

(2.1) |

(2.0) |

(2.0) |

|

|

|

Subsidies |

57,125 |

54,330 |

69,742 |

15,412 |

28.4 |

|

|

(1.4) |

(1.2) |

(1.5) |

|

|

3. |

Plan Expenditure |

1,69,860 |

2,05,100 |

2,07,524 |

2,424 |

1.2 |

|

|

(4.1) |

(4.4) |

(4.4) |

|

|

4. |

Revenue Expenditure |

5,14,609 |

5,57,900 |

5,88,586 |

30,686 |

5.5 |

|

|

(12.4) |

(11.9) |

(12.5) |

|

|

5. Capital Expenditure |

68,778 |

1,22,621 |

1,20,787 |

-1,834 |

-1.5 |

|

|

(1.7) |

(2.6) |

(2.6) |

|

|

Memo Items: Net of transactions relating to Reserve Bank’s stake in SBI |

Total Expenditure |

5,83,387 |

6,40,521 * |

6,73,842 # |

33,321 |

5.2 |

|

|

(14.1) |

(13.6) |

(14.4) |

|

|

Non-Plan Expenditure |

4,13,527 |

4,35,421 * |

4,66,318 # |

30,897 |

7.1 |

|

|

(10.0) |

(9.3) |

(9.9) |

|

|

Capital Expenditure |

68,778 |

82,621 * |

85,256 # |

2,635 |

3.2 |

|

|

(1.7) |

(1.8) |

(1.8) |

|

|

RE: Revised Estimates.

BE: Budget Estimates.

* : Excludes an amount of Rs.40,000 crore on account of transactions relating to transfer of Reserve Bank’s stake in SBI to the Government.

# : Excludes acquisition cost of Reserve Bank’s stake in SBI at Rs.35,531 crore.

Note: Figures in parentheses are percentages to GDP. |

Under capital expenditure, while defence capital expenditure declined, non-defence capital outlay adjusted for transactions relating to transfer of Reserve Bank’s stake in State Bank of India increased by Rs.3,358 crore or 10.1 per cent. Plan expenditure did not show much variation from the budget estimates, although Central assistance for State and Union Territories (UT) plans increased markedly in the revised estimates.

Financing of the Union Budget

Gross and net market borrowings (dated securities and 364-day Treasury Bills excluding allocations under the Market Stabilisation Scheme) of the Centre for 2007-08 were budgeted at Rs.1,87,769 crore and Rs.1,10,827 crore, respectively. In the revised estimates, net market borrowings were placed marginally lower at Rs.1,10,727 crore, financing 77.1 per cent of GFD. Apart from market borrowings, short-term borrowings (14-day, 91-day and 182-day Treasury Bills) financed 17.7 per cent of GFD in the revised estimates as compared with 0.3 per cent of GFD in the budget estimates. In the public account, deposits and advances, state provident funds and reserve funds financed 5.4 per cent, 3.3 per cent and 2.4 per cent, respectively, of GFD.

According to the Reserve Bank records, gross and net market borrowings (including 364-day Treasury Bills) during 2007-08 amounted to Rs.1,88,205 crore and Rs.1,09,504 crore, respectively, accounting for 99.7 per cent and 99.9 per cent of the estimated borrowings for the year. Gross market borrowings through dated securities by the Central Government during 2007-08 amounted to Rs.1,56,000 crore as against Rs.1,51,000 crore scheduled in the issuance calendar for the year (Table 20). All auctions were re-issuances of existing securities, barring one new issue (10-year security) for Rs.6,000 crore on July 9, 2007. During 2007-08, an amount of Rs.957 crore devolved on primary dealers (PDs). The weighted average maturity of dated securities issued during 2007-08 at 14.90 years was higher than that of 14.72 years during the previous year. The weighted average yield of dated securities issued during 2007-08 was 8.12 per cent as compared with 7.89 per cent during 2006-07.

Cash Management: Central Government

Higher than anticipated spending and a decline in investments in Treasury Bills by the States on account of lower collections under the National Small Saving Fund (NSSF) resulted in the recourse to Ways and Means Advance (WMA) during the greater part of the first quarter of 2007-08 by the Central Government, even as the year commenced with a surplus cash balance of Rs.50,092 crore. The Central Government also resorted to overdraft during this period. A surplus was, however, built up in June 2007, ahead of acquisition of Reserve Bank’s stake in SBI, which was used up by the month-end to meet this expenditure and the Central Government reverted to WMA. With the transfer of surplus from the Reserve Bank on August 9, 2007, the Centre’s cash balance returned to a surplus mode and remained so thereafter. The cash surplus surpassed Rs.1,00,000 crore on March 19, 2008 on the strength of buoyant advance tax collections. As on March 31, 2008, the surplus cash balance was placed at Rs.76,686 crore. During 2007-08, the Centre took recourse to WMA for 91 days as compared with 39 days during 2006-07. The average utilisation of WMA/OD during 2007-08 was Rs.4,255 crore as compared with Rs.402 crore in the previous year.

Extra-Budgetary Items

The Union Government has recognised that revenue deficit and GFD are understated to the extent the Government incurs liabilities on account of oil, food and fertiliser bonds which are recorded below the line. Therefore, as a step towards bringing about greater transparency in fiscal accounting, the Budget has reported in its revised estimates for 2007-08 the issuance of special securities aggregating Rs.18,757 crore to oil marketing companies (Rs.11,257 crore) and fertiliser companies (Rs.7,500 crore) in lieu of subsidies. During 2007-08, the actual issuance of special bonds to oil companies as compensation for under-recoveries and for settlement of contingent liabilities amounted to Rs.20,333 crore and Rs.221 crore, respectively. Special bonds issued to fertiliser companies as compensation for fertiliser subsidy amounted to Rs.7,500 crore. The Central Government also issued special bonds worth Rs.9,996 crore to State Bank of India as subscription towards State Bank of India’s rights issue of equity shares.

Table 20: Central Government Securities Issued during 2007-08 |

(Amount in Rupees crore/Maturity in years/Yield in per cent) |

|

Borrowings as per Issuance

Auction Calendar |

Actual Borrowings |

Sr. |

Period of Auction |

Amount |

Residual |

Date of Auction |

Amount |

Residual |

Yield |

No. |

|

|

Maturity |

|

|

Maturity |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1. |

April 5-12, 2007 |

6,000 |

5-9 |

April 12, 2007 |

6,000 |

8.39 |

8.16 |

|

|

4,000 |

20 and above |

April 12, 2007 |

4,000 |

29.15 |

8.58 |

2. |

April 20-27, 2007 |

6,000 |

10-14 |

April 27, 2007 |

6,000 |

9.71 |

8.16 |

3. |

May

4-11, 2007 |

6,000 |

10-14 |

May 11, 2007 |

6,000 |

9.92 |

8.31 |

|

|

4,000 |

20 and above |

May 11, 2007 |

4,000 |

29.06 |

8.64 |

4. |

May 18-25, 2007 |

5,000 |

5-9 |

May 25, 2007 |

5,000 |

8.26 |

8.24 |

|

|

3,000 |

15-19 |

May 25, 2007 |

3,000 |

14.96 |

8.40 |

5. |

June 1-8, 2007 |

6,000 |

10-14 |

June 5, 2007 |

6,000 |

9.86 |

8.18 |

|

|

3,000 |

20 and above |

June 5, 2007 |

3,000 |

29.00 |

8.52 |

|

|

|

|

June 12, 2007* |

5,000 |

9.84 |

8.44 |

6. |

June 15-22, 2007 |

6,000 |

10-14 |

June 15, 2007 |

6,000 |

9.83 |

8.35 |

7. |

July 6-13, 2007 |

6,000 |

10-14 |

July 6, 2007 |

6,000 |

10.00 |

7.99 |

|

|

4,000 |

20 and above |

July 7,2007 |

4,000 |

28.91 |

8.45 |

8. |

July 20-27,2007 |

6,000 |

5-9 |

July 20,2007 |

6,000 |

6.10 |

7.59 |

|

|

3,000 |

20 and above |

July 20,2007 |

3,000 |

25.10 |

8.34 |

9. |

August 3-10, 2007 |

6,000 |

10-14 |

August 3, 2007 |

6,000 |

9.93 |

7.93 |

|

|

4,000 |

20 and above |

August 3, 2007 |

4,000 |

24.87 |

8.45 |

10. |

August 17-24,2007 |

5,000 |

5-9 |

August 24, 2007 |

5,000 |

6.02 |

7.87 |

|

|

2,000 |

10-14 |

August 24, 2007 |

2,000 |

9.89 |

7.91 |

11. |

September 7-14, 2007 |

4,000 |

10-14 |

September 7, 2007 |

4,000 |

14.43 |

8.16 |

|

|

3,000 |

20 and above |

September 7, 2007 |

3,000 |

28.74 |

8.41 |

12. |

October 5-12, 2007 |

6,000 |

10-14 |

October 12, 2007 |

6,000 |

9.73 |

7.91 |

|

|

4,000 |

20 and above |

October 12, 2007 |

4,000 |

25.20 |

8.45 |

13. |

October 19-26, 2007 |

4000 |

5-9 |

October 26, 2007 |

4000 |

5.84 |

7.74 |

|

|

4000 |

15-19 |

October 26, 2007 |

4000 |

14.54 |

8.13 |

14. |

November 2-8, 2007 |

5000 |

10-14 |

November 8, 2007 |

5000 |

14.26 |

8.26 |

|

|

3000 |

20 and above |

November 8, 2007 |

3000 |

28.57 |

8.39 |

15. |

November 16-23, 2007 |

3000 |

10-14 |

November 23, 2007 |

3000 |

9.62 |

7.90 |

|

|

4000 |

15-19 |

November 23, 2007 |

4000 |

14.47 |

8.20 |

16. |

December 7-14, 2007 |

5000 |

10-14 |

December 14, 2007 |

5,000 |

9.56 |

7.92 |

|

|

2000 |

20 and above |

December 14, 2007 |

2,000 |

28.47 |

8.26 |

17. |

January 4-11, 2008 |

6000 |

10-14 |

January 11, 2008 |

6000 |

9.49 |

7.55 |

|

|

4000 |

20 and above |

January 11, 2008 |

4000 |

28.40 |

7.89 |

18. |

February

1-8, 2008 |

4000 |

20 and above |

February 8, 2008 |

4000 |

28.32 |

7.77 |

|

5000 |

15-19 |

February 8, 2008 |

5000 |

14.01 |

7.62 |

Total |

1,51,000 |

|

1,56,000 |

|

Memo: |

Year |

Weighted Average Maturity |

Weighted Average Yield |

2003-04 |

14.94 |

5.71 |

2004-05 |

14.13 |

6.11 |

2005-06 |

16.90 |

7.34 |

2006-07 |

14.72 |

7.89 |

2007-08 |

14.90 |

8.12 |

* : Not scheduled.

Source : Reserve Bank of India. |

State Finances : 2007-08

The State Governments budgeted a revenue surplus of 0.3 per cent of GDP in 2007-08 as against a revenue deficit (RD) of 0.1 per cent in 2006-07 (RE). The gross fiscal deficit (GFD) was budgeted at 2.3 per cent of GDP in 2007-08, lower by 0.4 percentage points over the previous year (see Table 17). The progressive enactment of Fiscal Responsibility Legislation (FRL) by 26 States has enabled them to usher in a rule-based fiscal regime. The efforts of the State Governments towards reducing fiscal imbalances were aided by larger devolution and transfers from the Centre based on the recommendations of the Twelfth Finance Commission (TFC) along with the improvement in tax buoyancy on the strength of macroeconomic fundamentals. Furthermore, all States have implemented Value Added Tax (VAT) in lieu of sales tax, which has been an unqualified success in raising the tax revenue for the States. The State Governments while presenting their budgets for 2007-08 took into account the priorities as laid down in the Eleventh Five-Year Plan (2007-12). In order to ensure the quality of human resource development, social sector expenditure was proposed to be raised by higher allocations in 2007-08. In view of the priority given to infrastructure development in the Eleventh Five-Year Plan, the State Governments have envisaged implementation of various projects, especially power and roads. Several State Governments have proposed to implement the infrastructure projects through the framework of public-private partnership (PPP). The State Governments have also undertaken development of urban infrastructure under the Jawaharlal Nehru National Urban Renewal Mission (JNNURM).

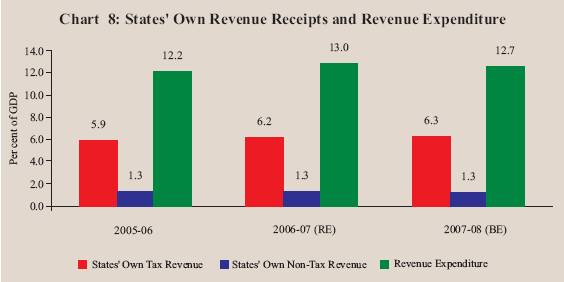

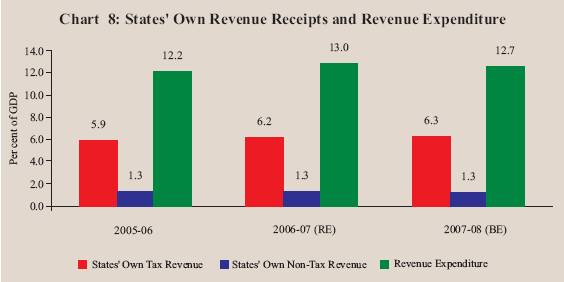

The correction in the revenue account during 2007-08 has been envisaged to be achieved primarily through enhancement in revenue receipts by 14.2 per cent on top of 23.3 per cent growth recorded in the previous year. Revenue receipts as a per cent of GDP have been estimated to increase by 0.1 percentage point to 12.9 per cent in 2007-08, mainly on account of own tax revenue and devolution and transfers from the Centre. The improvement in revenue account would also be facilitated by deceleration in revenue expenditure to 10.8 per cent during 2007-08 from 22.6 per cent growth in the previous year. As a per cent of GDP, the revenue expenditure was placed at 12.7 per cent in 2007-08 (BE) as compared with 13.0 per cent in 2006-07 (RE) (Chart 8).

The decomposition of consolidated GFD of all State Governments based on their budget documents reveals that the surplus in the revenue account would partly finance capital expenditure in 2007-08, in contrast to the previous year when RD constituted 4.9 per cent of GFD. Accordingly, the share of capital outlay in GFD was budgeted to increase from 92.1 per cent to 109.7 per cent in 2007-08. Securities issued to NSSF would continue to be the major financing item of GFD, though its share was budgeted to decline due to expected shortfall in net collections in keeping with the recent trends and the policy decision to reduce the minimum obligation of the States to borrow from the NSSF to 80 per cent of net collections from 100 per cent. Market borrowings would correspondingly finance a higher proportion of GFD during 2007-08 at 24.3 per cent as compared with 16.8 per cent during the previous year (Table 21).

Cash Management and State Governments’ Market Borrowings

The net allocation (provisional) for the market borrowings of the State Governments during 2007-08 was placed at Rs.28,781 crore. Taking into account repayment of Rs.11,555 crore during the year, and additional allocation of Rs.40,234 crore (of which Rs. 35,780 crore was on account of allocation made by the Central Government in view of expected shortfall in NSSF collection), the gross allocation of market borrowings was placed at Rs.80,570 crore for the year 2007-08. During 2007-08, the States (including the Union Territory of Puducherry) raised market loans amounting to Rs. 67,779 crore (84.1 per cent of gross allocation) through auctions, as compared with Rs.20,825 crore (78.3 per cent of gross allocation) during the previous year. The cut-off yield ranged between 7.84-8.90 per cent. The weighted average yield on market loans firmed up to 8.25 per cent during 2007-08 from 8.10 per cent in the previous year (Table 22).

Table 21: Decomposition and Financing Pattern of GFD of States |

(Per cent) |

Item |

1990-95 |

1995-2000 |

2000-05 |

2005-06 |

2006-07 |

2007-08 |

|

(Average) |

(Average) |

(Average) |

(Accounts) |

(RE) |

(BE) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Decomposition (1+2+3-4) |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

1. |

Revenue Deficit |

25.2 |

47.1 |

54.6 |

7.8 |

4.9 |

-11.1 |

2. |

Capital Outlay |

55.4 |

43.1 |

40.5 |

86.1 |

92.1 |

109.7 |

3. |

Net Lending |

19.4 |

10.0 |

4.9 |

6.1 |

5.7 |

10.7 |

4. |

Non-debt Capital Receipts |

- |

0.2 |

- |

- |

2.7 |

9.3 |

Financing (1 to 11) |

|

|

|

|

|

|

1. |

Market Borrowings |

16.1 |

16.4 |

26.4 |

17.0 |

16.8 |

24.3 |

2. |

Loans from Centre |

48.8 |

39.7 |

4.3 |

0.0 |

1.8 |

6.0 |

3. |

Special Securities issued to |

|

|

|

|

|

|

|

NSSF/Small Savings |

- |

28.9 * |

40.2 |

81.9 |

51.5 |

49.6 |

4. |

Loans from LIC, NABARD, |

|

|

|

|

|

|

|

NCDC, SBI & Other Banks |

1.8 |

2.9 |

4.0 |

4.5 |

5.6 |

6.8 |

5. |

Small Savings, P.F., etc. |

17.6 |

16.2 |

10.1 |

11.6 |

9.6 |

11.4 |

6. |

Reserve Funds |

6.8 |

5.6 |

5.0 |

5.8 |

4.2 |

3.9 |

7. |

Deposits & Advances |

9.9 |

9.9 |

4.2 |

8.1 |

1.6 |

1.4 |

8. |

Suspense & Miscellaneous |

4.3 |

2.8 |

-0.8 |

8.8 |

0.0 |

-1.3 |

9. |

Remittances |

-1.4 |

-3.7 |

0.7 |

0.1 |

0.3 |

0.0 |

10. |

Others |

0.7 |

1.4 |

4.7 |

0.0 |

-2.8 |

-0.9 |

11. |

Overall Surplus (-)/Deficit (+) |

-4.5 |

3.0 |

1.2 |

-37.7 |

11.6 |

-1.1 |

RE : Revised Estimates. BE: Budget Estimates.

-: Nil/Negligible/Not applicable.

NSSF : National Small Savings Fund.

* : Pertains to 1999-2000 as it was introduced from that year only.

The sum of items for 1995-2000 (Average) will, therefore, not add up to 100.

Note :

1. Owing to the change in the accounting procedure from 1999-2000, loans from the Centre excludes States’ share in small saving collections which is shown under securities issued to the NSSF under internal debt. Accordingly, repayments of small saving collections included under repayments of loans to Centre is shown under discharge of Internal Debt in order to have consistent accounting for receipts and expenditure.

2. ‘Others’ include Compensation and Other Bonds, Loans from Other Institutions, Appropriation to Contingency Fund, Inter-state Settlement and Contingency Fund.

3. Figures in respect of Jammu and Kashmir and Jharkhand relate to revised estimates.

4. All financing items are on a net basis.

Source : Budget Documents of the State Governments. |

The average daily utilisation of WMA and overdraft by the States during 2007-08 was Rs. 648 crore, as against Rs.248 crore during 2006-07. The average daily utilisation of WMA since December 2007 has been lower than the corresponding months of the preceding year (Chart 9). During 2007-08, eight States availed of WMA for a period of 1-184 days, of which three States resorted to overdraft for a period ranging between 3-65 days.

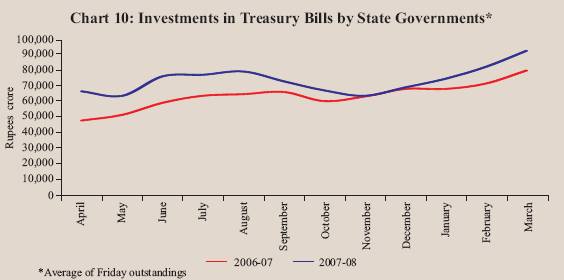

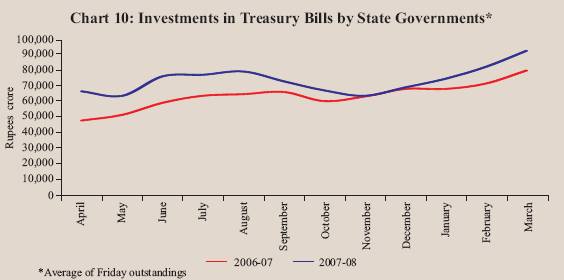

The cash surplus position of the States, as reflected in their investments in Treasury Bills (14-day and auction Treasury Bills), remained sizeable, increasing from Rs.73,403 crore at end-March 2007 to Rs.97,615 crore at end-March 2008. The average investment by the States in Treasury Bills during 2007-08 amounted to Rs.73,680 crore as against Rs.63,718 crore during the previous year (Chart 10).

Table 22: Market Borrowings of State Governments - 2007-08 |

Item |

Date |

Cut-off Rate |

Tenor |

Amount Raised |

|

|

(Per cent) |

(Years) |

(Rupees Crore) |

1 |

2 |

3 |

4 |

5 |

Auctions |

|

|

|

|

First |

April 19, 2007 |

8.30 |

10 |

1,837 |

Second |

May 10, 2007 |

8.34 |

10 |

350 |

Third |

May 17, 2007 |

8.40 |

10 |

1,400 |

Fourth |

June 19, 2007 |

8.45-8.57 |

10 |

3,566 |

Fifth |

July 26, 2007 |

8.00-8.25 |

10 |

1,389 |

Sixth |

August 16, 2007 |

8.30-8.90 |

10 |

3,485 |

Seventh |

September 20, 2007 |

8.14-8.50 |

10 |

3,074 |

Eighth |

October 4, 2007 |

8.20 |

10 |

590 |

Ninth |

October 8, 2007 |

8.31-8.40 |

10 |

4,672 |

Tenth |

November 13, 2007 |

8.39-8.69 |

10 |

5,300 |

Eleventh |

November 30, 2007 |

8.45-8.50 |

10 |

5,212 |

Twelfth |

December 18 ,2007 |

8.39-8.58 |

10 |

2,963 |

Thirteenth |

January 7, 2008 |

8.03-8.12 |

10 |

5,833 |

Fourteenth |

January 24, 2008 |

7.84-7.98 |

10 |

7,778 |

Fifteenth |

February 15, 2008 |

7.93-8.02 |

10 |

7,776 |

Sixteenth |

February 22, 2008 |

8.12-8.48 |

10 |

4,975 |

Seventeenth |

March 7, 2008 |

8.28-8.45 |

10 |

4,349 |

Eighteenth |

March 26,2008 |

8.35-8.70 |

10 |

3,229 |

Grand Total |

|

|

|

67,779 |

Memo: |

Year |

|

|

Weighted Average Yield

(per cent) |

2003-04 |

|

|

|

6.13 |

2004-05 |

|

|

|

6.45 |

2005-06 |

|

|

|

7.63 |

2006-07 |

|

|

|

8.10 |

2007-08 |

|

|

|

8.25 |

Source : Reserve Bank of India. |

Fiscal Outlook: 2008-09

The Union Budget for 2008-09 proposed to continue the fiscal consolidation process, with the key deficit indicators, viz., revenue deficit and GFD, budgeted to be lower by 0.4-0.6 percentage points and primary surplus higher by 0.5 percentage points of GDP in 2008-09 than in the previous year (Table 23). While the FRBM targets relating to GFD are set to be achieved in accordance with the mandate, the Budget proposed to reschedule the stipulated target of zero revenue deficit by 2008-09 under FRBM Rules, 2004, primarily on account of a shift in plan priorities in favour of revenue expenditure-intensive programmes and schemes. The Budget envisaged a revenue-led fiscal consolidation along with reprioritisation of expenditure to augment allocations for improvement in social and physical infrastructure, particularly in rural areas so as to achieve a ‘faster and more inclusive’ growth.

The procedural reforms aimed at expanding the tax base, improving efficiency in tax collections and providing certain concessions for investment, which have led to the remarkable improvement in tax collections in recent years, are expected to continue in 2008-09. As a result, the gross tax-GDP ratio, which has been rising since 2002-03, is budgeted to improve from 12.5 per cent in 2007-08 (RE) to 13.0 per cent in 2008-09 (BE) (Table 24).

Aggregate expenditure (adjusted for acquisition cost of Reserve Bank’s stake in SBI in 2007-08) is budgeted to increase by 11.4 per cent in 2008-09 as compared with 15.5 per cent in the preceding year. Revenue expenditure in 2008-09 is budgeted to increase by 11.8 per cent as compared with 14.4 percent in 2007-08 on account of containment of subsidies and deceleration in the growth of interest payments. The growth in grants to States and Union Territories is, however, budgeted to be higher at 16.3 per cent than 15.7 per cent a year ago. The capital expenditure comprising capital outlay and loans and advances is budgeted to decline by 23.2 per cent. Adjusting for the impact of expenditure incurred on acquisition of the Reserve Bank’s stake in the SBI in 2007-08, the capital expenditure is budgeted to increase by 8.8 per cent in 2008-09. This order of increase would still be significantly lower than the increase of 24.0 per cent in 2007-08. While the defence capital outlay is budgeted to increase by Rs. 10,302 crore (by 27.3 per cent) to Rs.48,007 crore, non-defence capital outlay adjusted for SBI transactions is budgeted to be broadly around the level of 2007-08 (RE).

Table 23 : Union Budget 2008-09 at a Glance |

(Amount in Rupees crore) |

Item |

2007-08 |

2008-09 |

Growth rate

(per cent) |

|

(RE) |

(BE) |

2007-08 |

2008-09 |

1 |

2 |

3 |

4 |

5 |

1. |

Revenue Receipts (i+ii) |

5,25,098 |

6,02,935 |

20.9 |

14.8 |

|

|

|

(11.2) |

(11.4) |

|

|

|

i) |

Tax Revenue (Net) |

4,31,773 |

5,07,150 |

22.9 |

17.5 |

|

|

|

(9.2) |

(9.6) |

|

|

|

ii) |

Non-Tax Revenue |

93,325 |

95,785 |

12.2 |

2.6 |

|

|

|

(2.0) |

(1.8) |

|

|

2. |

Non-Plan Expenditure |

4,66,318 * |

5,07,498 |

12.8 |

8.8 |

|

of which: |

(9.9) |

(9.6) |

|

|

|

i) |

Interest Payments |

1,71,971 |

1,90,807 |

14.4 |

11.0 |

|

|

|

(3.7) |

(3.6) |

|

|

|

ii) |

Defence Expenditure |

92,500 |

105,600 |

8.2 |

14.2 |

|

|

|

(2.0) |

(2.0) |

|

|

|

iii) |

Subsidies |

69,742 |

71,431 |

22.1 |

2.4 |

|

|

|

(1.5) |

(1.3) |

|

|

3. |

Plan Expenditure |

2,07,524 |

2,43,386 |

22.2 |

17.3 |

|

|

|

(4.4) |

(4.6) |

|

|

4. |

Revenue Expenditure |

5,88,586 |

6,58,119 |

14.4 |

11.8 |

|

|

|

(12.5) |

(12.4) |

|

|

5. |

Capital Expenditure |

85,256 * |

92,765 |

24.0 |

8.8 |

|

|

|

(1.8) |

(1.7) |

|

|

6. |

Total Expenditure |

6,73,842 * |

7,50,884 |

15.5 |

11.4 |

|

|

|

(14.4) |

(14.2) |

|

|

7. |

Revenue Deficit |

63,488 |

55,184 |

-20.9 |

-13.1 |

|

|

|

(1.4) |

(1.0) |

|

|

8. |

Gross Fiscal Deficit |

1,43,653 |

1,33,287 |

0.8 |

-7.2 |

|

|

|

(3.1) |

(2.5) |

|

|

9. |

Gross Primary Deficit |

-28,318 |

-57,520 |

267.8 |

103.1 |

|

|

|

(-0.6) |

(-1.1) |

|

|

*: Net of acquisition cost of Reserve Bank’s stake in SBI at Rs.35,531 crore.

Note : Figures in parentheses are percentages to GDP. |

Table 24 : Gross Tax Revenues of the Centre |

( Per cent to GDP ) |

Year |

Direct |

Indirect |

Total |

1 |

2 |

3 |

4 |

1990-91 |

1.9 |

8.2 |

10.1 |

1991-92 |

2.3 |

8.0 |

10.3 |

1992-93 |

2.4 |

7.5 |

10.0 |

1993-94 |

2.4 |

6.4 |

8.8 |

1994-95 |

2.7 |

6.5 |

9.1 |

1995-96 |

2.8 |

6.5 |

9.3 |

1996-97 |

2.8 |

6.6 |

9.4 |

1997-98 |

3.2 |

6.0 |

9.1 |

1998-99 |

2.7 |

5.5 |

8.2 |

1999-00 |

3.0 |

5.8 |

8.8 |

2000-01 |

3.2 |

5.7 |

9.0 |

2001-02 |

3.0 |

5.2 |

8.2 |

2002-03 |

3.4 |

5.4 |

8.8 |

2003-04 |

3.8 |

5.4 |

9.2 |

2004-05 |

4.2 |

5.5 |

9.7 |

2005-06 |

4.6 |

5.8 |

10.4 |

2006-07 |

5.3 |

6.1 |

11.4 |

2007-08RE |

6.5 |

6.0 |

12.5 |

2008-09BE |

6.9 |

6.1 |

13.0 |

During 2008-09, net market borrowings (net of MSS) are budgeted to decline from Rs.1,10,727 crore in 2007-08 (RE) to Rs.99,000 crore. Inclusive of repayments of Rs.79,575 crore, gross market borrowings (net of MSS), are placed at Rs.1,78,575 crore in 2008-09. The financing pattern of GFD reveals that the share of net market borrowings (excluding allocations under MSS) declined to 74.3 per cent of the GFD in 2008-09 from 77.1 per cent in 2007-08. On the other hand, the share of external assistance is budgeted to increase to 8.2 per cent from 6.9 per cent in 2007-08. Investments by the National Small Savings Fund (NSSF) in the special Central Government securities are budgeted to finance 7.4 per cent of GFD, as against a negative contribution of 1.3 per cent last year. During 2008-09, the Budget expects draw drown of cash balances to finance 5.4 per cent of GFD, as against build up of cash balances amounting to 12.7 per cent of GFD in 2007-08.

|

IST,

IST,