IST,

IST,

III. Alternative Sources of Financing for Municipal Corporations

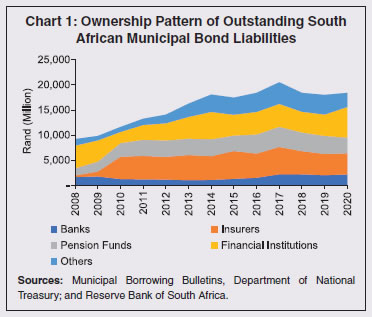

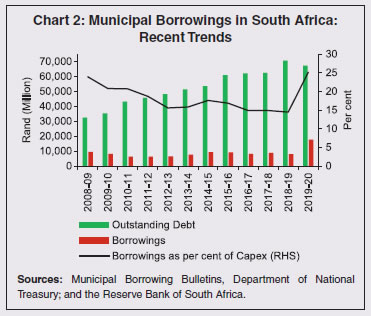

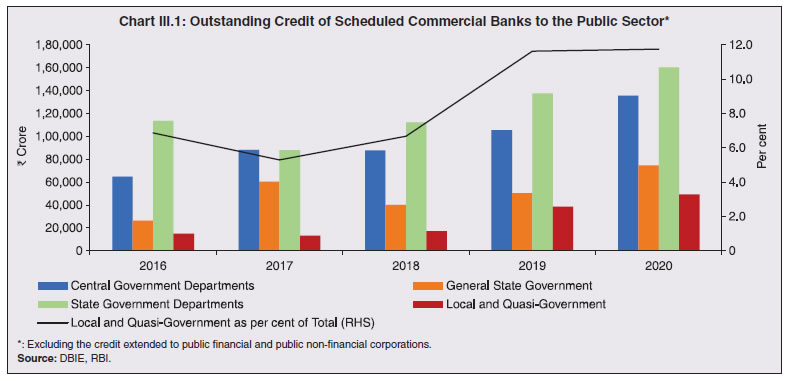

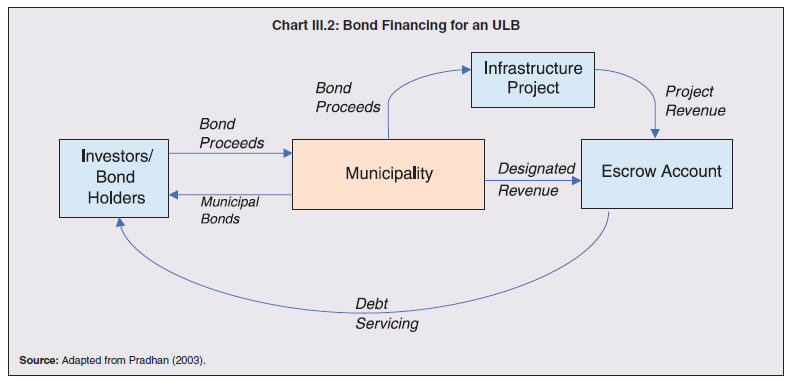

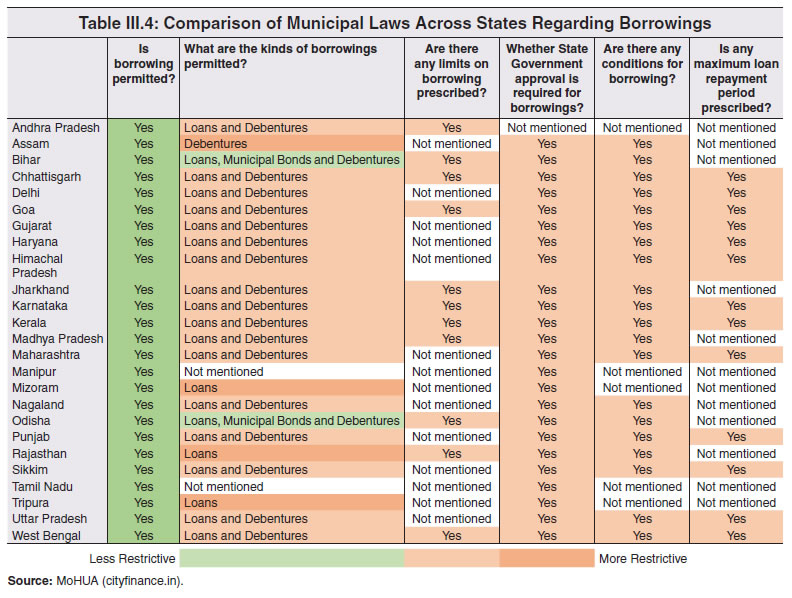

1. Introduction 3.1 Central and State governments in India finance their deficits primarily through market borrowings – States and UTs finance around 85 per cent, and the Central government finances around 61 per cent of their gross fiscal deficit through market borrowings. Municipal Corporations (MCs) in India are required by law to maintain a balanced/surplus budget and hence, they have not been able to tap capital markets sufficiently to supplement their revenues. They have remained dependent on State and Central government transfers. 3.2 This Chapter explores alternative sources of finance for the MCs in India. The Chapter is organised into seven sections. Section 2 examines the role of traditional bank credit in financing municipal borrowings. Section 3 discusses alternative sources of financing, especially bond financing and pooled financing. Section 4 analyses the uses of funds mobilised through bond financing. Section 5 highlights the need for credit ratings of urban local bodies (ULBs). Section 6 presents the issues and challenges relating to the development of a municipal bond market in India. Section 7 puts forth the concluding observations. 2. Bank Credit to Local Bodies 3.3 The banking sector plays a pivotal role in financing the borrowing requirements of different tiers of government. The Reserve Bank collects and publishes data on the deployment of bank credit, based on the type of receiver, in the annual Basic Statistical Returns (BSR1). Of the total outstanding bank credit extended to the public sector, local and quasi governments account for about 10 per cent1 (Chart III.1).   3. Financing of Municipal Corporations from Private Sources 3.4 Local governments can also tap the capital market by issuing municipal bonds. General obligation bonds issued by them are not secured by any asset but are backed by the issuer’s ‘full faith and credit’, with the power to tax residents to pay bondholders. On the other hand, Revenue bonds are backed by earnings/ accruals from a specific project such as highway tolls or lease fees. A hybrid mechanism is also feasible whereby the general revenue of the MC is used as a backup to service the bond in case user charges are insufficient. Whatever be the nature of the bond, an escrow account is generally created to serve as the primary source for servicing the bond, and funds raised from the project are used to replenish the escrow account (Chart III.2). In addition, MCs can choose to finance through special purpose vehicles (SPVs) and State-pooled finance entities. For example, China’s Local Government Financing Vehicle (LGFV) is an investment company that sells bonds in the bond markets for financing real estate development and other local infrastructure projects. Another variant is the practice followed by South Africa (Box III.1).

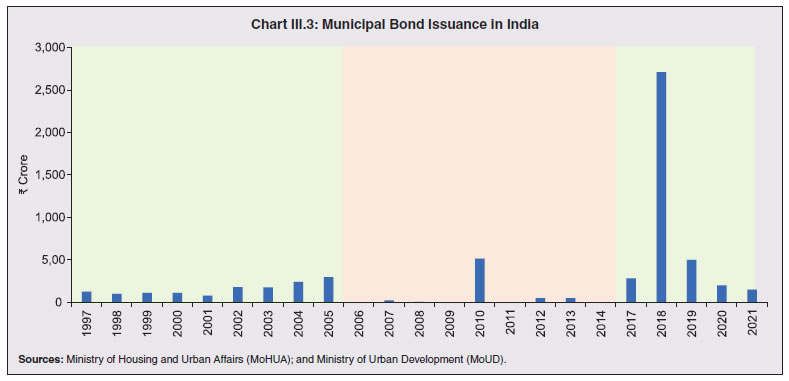

3.1 Bond Financing 3.5 Only a few prominent Indian MCs have used bonds as a source of finance. Bengaluru MC floated municipal bonds for the first time in India in 1997, followed by Ahmedabad MC in 1998. Since then, the Indian municipal bond market witnessed a healthy growth until the mid-2000s, with nine MCs raising around ₹1,200 crore (an average issue size of about ₹130 crore per corporation) (Chart III.3). Municipal bond issuances came to a sudden halt after 2005 with the launch of Jawaharlal Nehru National Urban Renewal Mission (JNNURM), envisaging total investment of about ₹1 lakh crore available to municipal corporations in the form of grants from the Centre.  3.6 In the recent period, there has been a resurgence of municipal bond issuances in India, with nine MCs raising around ₹3,840 crore during 2017-21 (Appendix Table A1). The Government of India has also provided financial incentives in the form of a lump-sum grant-in-aid for municipal bond issuances at the rate of ₹13 crore per ₹100 crore of bonds issued under the Atal Mission for Rejuvenation and Urban Transformation (AMRUT, 2015) Programme. 3.7 The Indore, Lucknow and Ghaziabad MCs raised ₹490 crore via municipal bonds on a private placement basis using the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) bond platforms. The Indore MC became the first municipal corporation to list on the NSE in 2018, while Ghaziabad MC became the first municipal corporation to issue green bonds in India in 2021. The coupon rates offered by the MCs are generally higher than the government bonds of similar maturity, even though they are rated as adequately safe with low credit risk (Table III.1 and III.2). 3.2 Pooled Financing 3.8 The experience of the past two decades shows that only large ULBs with good technical competencies can meet the necessary requirements of bond issuance. For India’s 200 plus municipal corporations and many smaller ULBs, the initial cost of bond issuance can be prohibitively high. Accordingly, the smaller ULBs’ access to the capital market can be enhanced through pooled financing, under which a common bond is issued by pooling the resources of several local bodies.

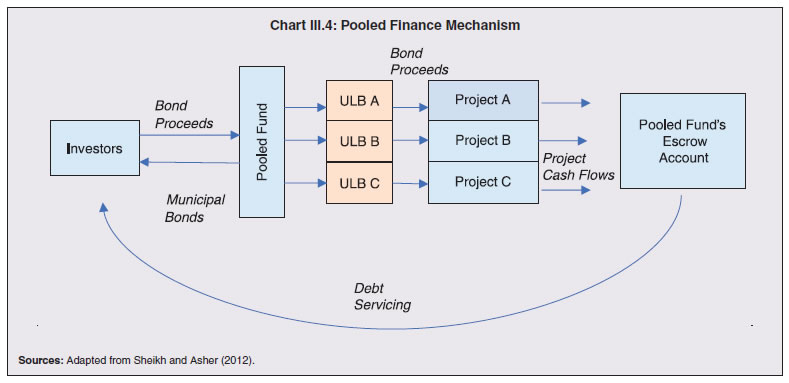

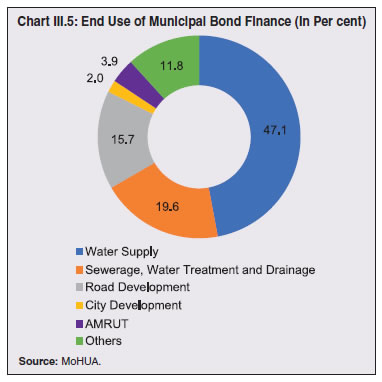

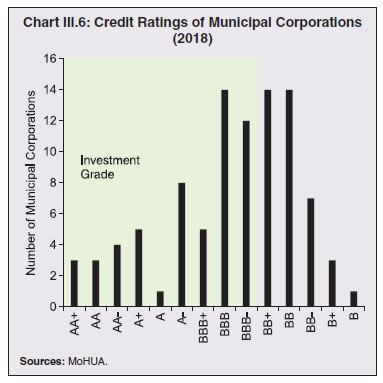

3.9 Pooled financing essentially involves creation of a State Pooled Finance Entity (SPFE), which can be registered either as a trust or a SPV. The SPFE issues bonds and debt servicing is financed through the pooled revenue stream of the participating municipal bodies. Creating a SPFE lowers the cost of bond issuance for individual local bodies and enhances the creditworthiness of the bond issued, as the risk gets hedged over all participating municipal bodies (Chart III.4). 3.10 The pooled financing mechanism has precedence in India, with Andhra Pradesh, Maharashtra, Karnataka and Tamil Nadu issuing bonds serviced from the pooled revenues of multiple ULBs/MCs (Table III.3). The Tamil Nadu Urban Development Fund (TNUDF) issued bonds on behalf of 14 municipalities through a Water and Sanitation Pooled Fund in 2003. Similarly, Karnataka created a debt fund – Karnataka Water and Sanitation Pooled Fund (KWSPF) - to raise money for the Greater Bangalore Water and Sanitation Project (GBWASP) in 2005. Both the funds were rated AA, reflecting their creditworthiness, which was achieved by pledging a tenth of the revenue from individual participating municipalities to service the bond. As a back up, State devolution was pledged for debt servicing in case of a shortfall in revenue.  3.11 The Central government also provided a thrust to pooled financing by launching the Pooled Finance Development Fund (PFDF) Scheme in 2006 to provide credit enhancement to ULBs through a State-level pooled finance mechanism.2 Additionally, income tax exemptions were granted in the past to bondholders to boost the demand for municipal/pooled bonds. 3.12 The proceeds from taxable bonds issued by Indian MCs have been used to finance the expansion of essential municipal services, viz., roads, water supply and sewerage, possibly because user charges in such infrastructure projects are easier to enforce and the amount and frequency of expected revenues can be predicted with some certainty. Of the bonds issued in India, 66 per cent has been used to finance water supply, sewerage, drainage and water treatment projects (Chart III.5). In the case of tax-free bonds, the government guidelines explicitly state the areas for which bond proceeds can be used include potable water supply, sanitation, drainage, solid waste management, roads and urban transport, out of which most corporations went for water supply, sewerage and sanitation projects. Thus, the overall experience indicates that the proceeds from municipal bonds in India have almost exclusively been used for capital expenditure and/or expansion of essential municipal services. Taking a cue from this, the bond financing route needs to be explored on a wider scale to meet the needed capex expansion plans of MCs in the years ahead.  3.13 Credit rating performs the critical function of providing an independent and credible assessment of the inherent risk of an instrument. In India, the municipal bond market is at a nascent stage and hence, credit rating can play an important role in attracting new investors. The Central government has included credit rating of MCs in the reform agenda of the Smart Cities and AMRUT programme. Of the 94 cities that have been assigned credit ratings in 2018, 59 per cent received a rating of investment grade or above, highlighting the underutilised potential for bond financing by Indian municipalities (Chart III.6). 3.14 Credit rating has incentivised municipal bodies to undergo reforms to achieve investment grade. All the municipal bond issuances in India were preceded by specific measures taken for credit enhancement of the issuing body, such as maintaining a proper account and using double entry accrual systems. All the major rating agencies in India have now developed a municipal-specific rating framework.  6. Municipal Bond Market Development in India 3.15 Municipal laws in India allow MCs to borrow, but with the permission of the respective State government. These borrowings are, however, constrained by several conditions imposed on the types of instruments, prescribed limits and maximum loan repayment period (Table III.4). Municipal laws of only two States explicitly allow borrowing through bond issuances. Additionally, the lack of a secondary market for municipal bonds has been a critical constraint in attracting a more extensive investor base for these securities.  3.16 In the last few years, a renewed thrust from the Centre, through schemes like AMRUT, has led to fresh issuances of municipal bonds by nine MCs3. Recent instances of bond issuances have demonstrated that bond financing can be a viable alternative for raising resources for MCs. With provisions relating to exchange listings in place4, involvement of major credit rating agencies in the municipal rating space and push from the Central government in the form of reform-linked financial incentives, the municipal bond market in India can witness significant growth in the coming years. 3.17 As the demand for infrastructure grows among Indian cities, MCs must further explore ways to reinvigorate and foster alternative and sustainable resource mobilisation through municipal bonds. Policies to improve the environment for financial investment through sound and efficient regulation, greater transparency, and better governance can help nurture a vibrant municipal bond market. Listing municipal bonds in the stock exchanges can pave the way for developing the much-needed secondary market for municipal bonds in India. 1 The BSR1 return does not explicitly capture the credit extended to the third tier of the government and it is clubbed with other quasigovernment institutions. 2 The scheme got a lukewarm response as only a single bond has been issued under the scheme by the TNUDF in 2008. 3 Pune, Hyderabad, Indore, Bhopal, Vishakhapatnam, Ahmedabad, Surat, Lucknow and Ghaziabad. 4 In 2015, the Security and Exchange Board of India (SEBI) issued guidelines relating to issuing and listing of municipal securities on domestic stock exchanges. Accordingly, municipal bonds issued since 2017, have been listed either on BSE or NSE. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: