IST,

IST,

III. Monetary Policy Framework: An Analytical Overview (Part 1 of 2)

3.1 The framework of monetary policy has undergone far-reaching changes all over the world in the 1990s, mainly in response to the challenges and opportunities of financial liberalisation. There is, first of all, a clearer focus on price stability as a principal - though not necessarily the sole - objective of monetary policy. Besides, with the deregulation of financial markets and globalisation, the process of monetary policy formulation has acquired a much greater market orientation than ever before, inducing a shift from direct to indirect instruments of monetary control. This has been accompanied by several institutional changes in the monetary-fiscal interface to ensure that central banks possess the autonomy to anchor inflation expectations.

3.2 Monetary management is now further complicated by the increasing trade and financial openness. The opening up of the capital account, while necessary for efficiency of capital, exposes the economy to sudden switches in capital flows. This, in turn, can lead to large changes in exchange rates over short periods of time, not necessarily related to fundamentals. Volatility in capital flows and exchange rate impacts not only domestic demand and inflation, but also has implications for the maintenance of financial stability. Central banks are thus concerned not only about price stability but also financial stability. With exogenous shocks hitting the economy at different points of time, the stabilisation of the real economy as well as financial markets requires a multi-pronged response from central banks. In a way, central banks have, therefore, emerged as the primary shock absorbers in the system.

3.3 The process of globalisation and liberalisation has thus necessitated a widening of the mandate of central banks. At the same time, for their policies to be effective, monetary authorities have been required to modify the way in which they conduct monetary policy. Central banks in emerging markets also face a similar set of issues. A special challenge in their case has been the need to calibrate the changes in the operating procedures of monetary policy with the pace of transition from an administered regime of interest rates to a market-based process of price discovery. Accordingly, intermediate targets, instruments and operating procedures of central banks have been evolving in the recent decades.

3.4 In consonance with international experience and the liberalisation process initiated by structural reforms of the early 1990s, the monetary policy framework in the Indian economy has also witnessed a major transformation. The Reserve Bank adopted a three-pronged strategy of financial liberalisation. Improvement in the allocative efficiency of the financial system entailed deregulation of financial prices, including the institution of a market-determined exchange rate regime in March 1993. This was supported by the development of financial markets - spot and futures - of varying tenors and degrees of risk. Finally, the withdrawal of balance sheet restrictions on financial intermediaries through rationalisation of directed credit programmes as well as investment limits facilitated development of the inter-linkages between markets, essential for the process of price discovery. In tune with the process of financial liberalisation, the Reserve Bank, like other central banks in most emerging market economies (EMEs), has shifted from direct to indirect instruments of monetary policy. The Reserve Bank has been able to develop an array of monetary levers that are designed to manage market liquidity in order to achieve the overall objectives of price stability and credit availability for growth and to ensure orderly conditions in the financial markets. These developments have been facilitated by initiatives to limit the fiscal dominance of monetary policy through measures such as reducing statutory pre-emptions, raising Government debt at market-related rates and phasing out of the automatic monetisation through ad hoc Treasury Bills. As a result, monetary policy emerged as a key instrument of stabilisation in the face of macroeconomic shocks, especially as fiscal policy continues to be handicapped by the persistence of large deficits.

3.5 A key development that shaped the conduct of monetary management during the 1990s was the progressive opening up of the Indian economy to capital flows. Accordingly, monetary policy had to contend not only with the usual supply shocks emanating from the vagaries of the monsoon but had to increasingly manage external shocks emanating from surges and ebbs in capital flows, volatility in the exchange rate and global business cycles. Concomitantly, maintaining financial stability hasemerged as an additional key objective of monetary policy, apart from price stability and credit availability. In view of all these developments, the Reserve Bank had to make necessary modifications in its conduct of monetary policy. Intermediate targets, instruments and operating procedures have, therefore, evolved over time and these issues form the subject of this Chapter.

3.6 The first Section surveys the cross-country experience in the evolution of the monetary policy framework in terms of objectives, intermediate targets and instruments. The role of institutional developments - central bank independence and fiscal rules - in contributing to monetary stability is also addressed. Section II traces the process of monetary policy evolution in India. It analyses the shifting perspectives on intermediate targets in the switch from monetary targeting to a multiple indicator approach. It also discusses the changes in the operating procedures that became necessary to conduct monetary policy in an effective manner. Section III presents concluding observations.

I. MONETARY POLICY FRAMEWORK : INTERNATIONAL EXPERIENCE

3.7 The intellectual discourse in monetary policy has been strongly influenced by the classic Tinbergen (1952)-Theil (1961) policy framework in which each policy instrument is geared to meet a defined objective. Assuming there are no spillovers between different policies, monetary policy is best suited to achieve price stability. While price stability and output stabilisation are final objectives of monetary policy, they are not directly under the control of the central bank. Monetary authorities typically set intermediate targets in terms of macroeconomic variables, which bear a stable relationship with the overall objectives of monetary policy. This Section surveys the issues involved in each of the three elements of the monetary policy framework in terms of objectives, intermediate targets and instruments. The Section reviews briefly the debate regarding objectives of monetary policy. This is followed by a discussion on intermediate targets and even the very necessity of intermediate targets in the emerging inflation targeting framework. Finally, this Section evaluates the choices involved in adopting particular operating procedures of monetary policy.

Objectives of Monetary Policy

3.8 Price stability - defined as low and stable inflation - is considered a key objective of monetarypolicy. It is now widely believed that monetary policy can contribute to sustainable economic growth through price stability. At the same time, the focus and the weight attached to the price stability objective evolved over time. During the 1960s and 1970s, the Phillips curve paradigm came to dominate monetary economics. It was believed that there exists not only a short-run but even a long-run trade-off between inflation and output. This led to a viewpoint that central banks could achieve higher growth on a sustainable basis, if they permit inflation to be a little higher. The pitfalls of this reasoning were brought out by the stagflation of the 1970s. These developments justified the stance taken by Phelps (1967) and Friedman (1968) who had argued that, once inflation expectations are taken into account, there existed no long-run trade off. The lessons learned from the spike in inflation in the 1970s brought about a renewed focus on price stability as a key objective of monetary policy. In the subsequent decades, inflation has been brought under control not only in advanced economies but also in developing and emerging market economies. In the latter group, the fall in inflation has been quite dramatic (Table 3.1). Empirical evidence suggests that disinflations are associated with transitory output and employment losses. Typically, measured through sacrifice ratios, these losses are high even for independent central banks (Ball, 1994; Anderson and Wascher, 1999). Over longer periods of time, the decline in inflation, as the decadal analysis in Table 3.1 indicates, need not be associated with any significant adverse impact on growth, consistent with a long-run vertical Phillips curve. In fact, Table 3.1 suggests that high inflation in the 1970s did not buy any additional growth either in developed countries or in EMEs. Issues related to the Phillips curve, the build-up of inflation, the subsequent moderation and the reasons for this rise and fall are explored further in Chapter V.

3.9 Although low and stable inflation is the final objective, it is not inconsistent with stabilisation of output - around its potential - by monetary authorities. In fact, monetary policy affects inflation not directly but via its impact on aggregate demand in the economy. Thus, even if price stability is the objective of monetary policy, monetary authorities have a key role to play in the stabilisation of output and employment in the economy. This is reflected in the charters of central banks. Amongst advanced economies, some central banks such as the US Federal Reserve have multiple objectives of price stability, maximum employment and moderate long-

|

Table 3.1: Inflation and Growth in Select Economies |

||||||||

|

(Per cent) |

||||||||

|

Growth |

Inflation |

|||||||

|

Region/Country |

1970s |

1980s |

1990s |

2000-03 |

1970s |

1980s |

1990s |

2000-03 |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

Developed Countries |

2.9 |

2.8 |

3.2 |

3.1 |

8.4 |

5.9 |

2.6 |

2.0 |

|

Australia |

3.0 |

3.4 |

3.3 |

3.1 |

10.5 |

8.4 |

2.5 |

3.7 |

|

Canada |

4.3 |

3.0 |

2.4 |

3.0 |

7.8 |

6.5 |

2.2 |

2.6 |

|

Japan |

4.7 |

3.8 |

1.7 |

1.3 |

9.3 |

2.5 |

1.2 |

-0.6 |

|

New Zealand |

2.5 |

2.7 |

2.6 |

3.1 |

12.0 |

12.0 |

2.0 |

2.4 |

|

United Kingdom |

2.4 |

2.4 |

2.1 |

2.4 |

13.3 |

7.4 |

3.7 |

2.3 |

|

United States |

3.6 |

3.1 |

3.1 |

2.3 |

7.2 |

5.6 |

3.0 |

2.5 |

|

Developing Countries |

4.9 |

4.2 |

5.0 |

4.3 |

16.3 |

37.1 |

36.6 |

6.2 |

|

Mexico |

6.4 |

2.3 |

3.4 |

2.1 |

10.3 |

68.8 |

20.4 |

6.4 |

|

South Africa |

3.0 |

2.2 |

1.4 |

2.9 |

10.3 |

14.6 |

9.9 |

6.5 |

|

India |

2.7 |

5.9 |

5.7 |

5.4 |

7.8 |

9.1 |

9.5 |

4.0 |

|

Indonesia |

7.8 |

5.8 |

4.3 |

n.a. |

17.4 |

9.6 |

14.5 |

8.6 |

|

Thailand |

7.0 |

7.3 |

5.3 |

4.8 |

8.9 |

5.8 |

5.0 |

1.4 |

|

Korea |

8.6 |

7.6 |

6.1 |

5.6 |

15.1 |

8.4 |

5.7 |

3.1 |

|

Malaysia |

8.4 |

5.9 |

7.2 |

4.6 |

6.5 |

3.7 |

3.7 |

1.5 |

|

Source : International Financial Statistics, IMF. |

||||||||

term interest rates but many like the United Kingdom and the European Central Bank have hierarchical objectives. In the latter case, price stability is the primary objective, and subject to that, these central banks are concerned about growth and employment. However, the distinction between the two categories is now much less pronounced. Both groups of central banks are as much concerned about price stability as they are about deviations of output from its potential. In the words of Mervyn King, neither group is a 'inflation nutter' and they are better described as flexible inflation targeters. While many central banks may in practice continue to attempt to stabilise output, they find it useful for their public mandate to be restricted to price stability alone, since this reduces their vulnerability to political pressure for expansionary policy (Kamin et al, 1998).

3.10 While price stability remains a key objective of monetary policy, central banks in EMEs have generally tended to follow multiple objectives, especially as they are usually assigned a key role in promoting economic development. Besides, in EMEs that are relatively more open, exchange rates often emerge as a key policy issue. Empirical evidence suggests that in EMEs central bank interest rates often react more strongly to the changes in the exchange rate rather than changes in the inflation rate or the output gap (Mohanty and Klau, 2004). At the same time, a number of EMEs are gradually veering to a sole price stability objective (Table 3.2).

This switch to single/ hierarchical mandates has occurred as these economies have adopted inflation targeting frameworks during the 1990s. The usefulness of inflation targeting frameworks in both advanced and emerging economies continues to be a matter of debate. While it is true that many inflation targeting economies reduced inflation during the 1990s, so has been the case with countries that have not adopted inflation targeting (see Chapter V for a detailed discussion).

3.11 Paradoxically, the 1990s - a decade of price stability - witnessed a number of episodes of financial instability suggesting that price stability by itself is not sufficient. As stated earlier, globalisation and integration of economies with the rest of the world have thrown up new challenges for monetary policy. Large movements in capital flows and exchange rates affect the conduct of monetary policy on a daily basis. These impact not only demand and inflation but also balance sheets of residents. Large and sudden changes in exchange rates have, therefore, implications for financial stability. Beyond the traditional trade-off between inflation and growth, there is now thus the challenge of financial stability. This has led to an intense debate as to how monetary policy can contribute to financial stability. While it is true that price stability is necessary for financial stability, it is increasingly clear that price stability, per se, is not sufficient to guarantee financial stability

|

Table 3.2: Objectives of Monetary Policy |

|

|

Central Bank |

Objective |

|

1 |

2 |

|

Developed Economies |

|

|

Australia |

Stability of the currency, maintenance of full employment and economic prosperity and welfare. |

|

Canada |

Low and stable inflation. |

|

ECB |

Price stability primary objective. Without prejudice to the objective of price stability, also support the general |

|

economic policies with a view to contributing to a high level of employment and sustainable and non- |

|

|

inflationary growth. |

|

|

Japan |

Price stability and to ensure the stability of the financial system. |

|

New Zealand |

Maintaining a stable general level of prices. |

|

UK |

Monetary stability – meaning stable prices and confidence in the currency – and financial stability. |

|

USA |

Maximum employment, stable prices and moderate long-term interest rates. |

|

Emerging Market Economies |

|

|

China |

Stability of the currency and thereby promote economic growth. |

|

India |

Price stability and credit availability. |

|

Indonesia |

Achieve and maintain currency stability by maintaining monetary stability and by promoting financial system |

|

stability. |

|

|

Malaysia |

Safeguard the value of the currency, promote monetary stability and a sound financial structure and influence the |

|

credit situation to the advantage of the country. |

|

|

Mexico |

Price stability. |

|

Russia |

Stability of currency, development of banking system and efficient settlement system. |

|

South Africa |

Financial stability. |

|

Thailand |

Maintain monetary stability. |

|

Source : Central bank websites. |

|

(Schwartz, 1995; Cukierman, 1992; Mishkin, 1996; Padoa-Schioppa, 2002; Issing, 2003). One line of argument suggests that central banks should continue to focus on achieving the macroeconomic goal of low and stable inflation as it is difficult to identify potential sources of financial instability. In this view, asset price misalignments are not easy to identify ex ante. And, even if it was possible to do so, it is debatable as to whether monetary policy can prick these bubbles (Bernanke and Gertler, 2001; Bernanke, 2003; Bean, 2003; Filardo, 2004). An alternative view is that central banks should pro-actively tighten monetary policy and monitor various indicators such as credit and monetary aggregates to identify incipient financial imbalances (Cecchetti et al, 2000; Crockett, 2001; Borio and Lowe, 2002). Accordingly, central banks need to extend their policy horizon beyond the usual two-year period as financial imbalances need not necessarily show up in overtinflation in such a short period. Furthermore, given the limitations of monetary policy, effective regulation and supervision of financial institutions have assumed importance (see Chapter VIII for a further discussion).

3.12 To sum up, the debate over the objectives that monetary policy can pursue is far from settled. While price stability remains the key objective of monetary policy, global integration is increasingly requiring central banks to focus on financial stability as well. Although the possible multiple goals of price stability, economic growth and financial stability are mutually reinforcing in the long run, the critical issue in the design of monetary policy is to meet the challenges of the trade-offs in the short run, which involve conscious policy choices. While there is very little disagreement over the fact that price stability should remain a key objective of monetary policy, reservations persist about adopting it as the sole objective of monetary policy.

Price Stability and Institutional Arrangements

3.13 It is increasingly realised that inflation expectations play a key role in determining actual inflation. Most of the reforms in the institutional design of monetary policy - central bank independence, transparency, communications and accountability -have been aimed at increasing the credibility of the central banks so that they can stabilise inflation expectations of the public at low levels. As Walsh (2003) stresses, the three most important ingredients of a successful monetary policy are credibility, credibility and credibility. The contemporary literature has, therefore, underscored the need for an official commitment to price stability - either in the form of a conservative central banker or in the form of an institutional/legislative commitment to price stability - to avoid political cycles which could entice governments to finance populist programmes by printing money during the elections (Table 3.3) (Nordhaus, 1975; Rogoff, 1985; Alesina, 1988; Persson and Tabellini, 1990; Walsh, 1995). During the 1990s, the commitment to price stability has been reinforced by a legislative mandate in favour of price stability as the principal - if not the only - objective of monetary policy in a number of economies to stabilise inflation expectations. Central bank independence thus connotes the autonomy of instrument choice and not independence in regard to objectives. Governments reserve the right to determine the overall objectives of economic policy, including monetary policy. Studies suggest that central bank independence does help to lower inflation (Alesina and Summers, 1993; Blinder, 1998). The role of monetary policy in reducing output volatility, however, is a matter of debate. Apart from an improved monetary policy, a number of factors such as the increasing share of services in GDP, better inventory management and improved consumption-smoothing on account of financial innovations and deregulation are believed to have played a role. Good luck -absence of major supply disruptions and other such macroeconomic shocks in the recent decades - is also considered as one of the contributory factors (Stock and Watson, 2002) (see Chapter V).

3.14 Notwithstanding the institutional reforms granting independence to central banks, price stability and inflation expectations are ultimately dependent upon the fiscal regime in the economy. Expansionary fiscal policies and their accommodation by monetary policies are the major causes of inflation in many developing economies. Even in the context of the advanced economies, the steep increase in inflation during the 1970s is attributed, inter alia, to expansionary fiscal policy. The conduct of monetary policy is, thus, inextricably linked with the fiscal regime. As the unpleasant monetary arithmetic (UMA) proposition of Sargent and Wallace (1981) shows, if fiscal policy is imprudent and if the central bank does not finance the

|

Table 3.3: Government-Central Bank Relationships |

||||

|

Central |

Counter-party Relations |

Purchase of |

||

|

Bank |

Overdraft |

Loans |

Subscriptions in |

Government |

|

Primary Market |

Bonds in |

|||

|

Secondary |

||||

|

Market |

||||

|

1 |

2 |

3 |

4 |

5 |

|

Euro area |

Prohibited |

Prohibited |

Prohibited |

Allowed |

|

India |

Limited, at Bank Rate |

Short-term |

Prohibited after |

Allowed |

|

plus 200 basis points |

March 2006. |

|||

|

Japan |

Prohibited |

Limited amount |

Allowed |

Allowed |

|

Mexico |

Mandatory, limited |

Prohibited |

Prohibited |

Allowed |

|

at market rate |

||||

|

U.K. |

Limited |

Prohibited |

Prohibited |

Allowed |

|

U.S.A. |

Prohibited |

Prohibited |

Prohibited |

Allowed |

|

Source : Hawkins (2003). |

||||

fisc initially, the end-result could still be inflationary as the public debt-GDP ratio would turn unsustainable over time (see Chapter V). If economic agents have rational expectations, a tight monetary policy today may lead almost immediately to a step-up in inflation. Thus, a combination of tight monetary policy with an expansionary fiscal policy will be ineffective. In other words, central bank independence, per se, is not a panacea for fiscal irresponsibility. In the alternative scenario whereby high fiscal deficits are financed by recourse to external borrowings denominated in foreign currency, this will result in a build-up of external debt leading eventually to a balance of payments crisis. This outcome is more likely for EMEs since they do not have the benefit of borrowing in their own currencies. Thus, external borrowings are a substitute neither for a well-developed domestic government securities market nor for fiscal discipline. As a result, in consonance with the increasing emphasis on price stability as an objective of monetary policy, most countries have put in place fiscal rules. These rules, inter alia, place limits on the deficit and debt of the government and prohibit primary subscriptions by the central banks to the governments' borrowing programmes.

3.15 Fiscal deficits are not only inflationary, but also put pressure on real interest rates and crowd out private investment (Engen and Hubbard, 2004). There is a vicious circle between inflation and budget deficits: higher deficits cause higher inflation through excessive money financing and then, the higher inflation feeds back into higher deficits by reducing the real value of tax collections. An attempt by Latin American governments to fund themselves through an inflation tax in the 1980s, for instance, sent inflation soaring to three-digit levels in many cases (Selowsky, 1989). Budget deficits turn out to be especially inflationary when the central bank is not independent and the financial markets are not developed enough to contain inflationary expectations (Neyapti, 2003). The very existence of large fiscal deficits puts continuous pressure on inflationary expectations (Drazen and Helpman, 1991). While the conventional view is that fiscal deficits lead to excessive monetary expansion and hence inflation, a more recent view -the fiscal theory of the price level - argues that fiscal imbalances lead to an increase in inflation and it is the money supply which adjusts subsequently to higher prices (see Chapter V).

3.16 The inflationary consequences of the fiscal dominance of monetary policy brought into sharp focus the need to reduce fiscal imbalances, per se, as well as the draft of resources by the fisc on the central bank.

This need for monetary and fiscal coordination naturally raises the issue of its nature. A key issue in this context is whether this coordination should be rule-based or discretionary. Frameworks based on clear mandates and rules are usually considered preferable to ad hoc discretionary coordination, which could be clouded by problems of implementation and incentive distortions caused by electoral cycles. Furthermore, uncertainty and imperfect information about the current state of the economy as well as future outlook make it difficult to agree and implement a case-by-case discretionary approach to coordination. On all these grounds, there is a explicit preference for frameworks based on clear mandates/rules. In most countries, these take two forms: central bank independence and fiscal responsibility legislation.

3.17 An ideal fiscal rule should be well-defined, transparent, simple, flexible, adequate relative to the final goal, enforceable, consistent and supported by structural reforms if needed (Kopits and Symansky, 1998). Cross-country evidence shows that the form of fiscal responsibility legislation has varied from country to country, depending upon factors such as the historical background, social set-up, nature of financial market evolution and objectives of macro-economic policies. Some countries have set transparency requirements for their governments while others follow expenditure rules and deficit and debt rules (Table 3.4).

3.18 The efficacy of the fiscal rules remains a matter of debate. First, the frameworks may be circumvented by creative accounting (for example, modifying

|

Table 3.4: Fiscal Responsibility Legislation in OECD Economies : Summary Characteristics |

|

|

Type of Rule |

Countries |

|

1 |

2 |

|

Balanced/surplus |

Canada, EU countries, Japan, |

|

budget policy |

New Zealand. |

|

Limits on budget/ |

Japan, Norway, Poland, Switzerland, U.K. |

|

fiscal deficit |

|

|

Limits on expenditure |

U.S., Japan, Switzerland. |

|

Limits on borrowing / |

U.K., EU countries, New Zealand, |

|

debt |

Switzerland. |

|

Enforcement |

|

|

sanctions |

EU countries, Poland, U.S. |

|

No explicit sanctions |

Australia, Canada, Japan, New Zealand, |

|

Switzerland, U.K. |

|

|

Transparency |

Australia, EU countries, New Zealand, |

|

U.K. |

|

|

Escape clause |

Canada, EU countries, Japan, |

|

Switzerland, U.S. |

|

|

Source : OECD (2002). |

|

accounting practices and changing the nominal timing or other classification of taxes and expenditure). A second issue of contention is that fiscal rules might increase business cycle fluctuations. Two opposing factors are at work here. On the one hand, fiscal rules restrict unbridled government spending and this checks the excessive build-up of deficits and public debt which imparts stability to the economy. On the other hand, fiscal rules may restrict the government's ability to take countercyclical policy measures and hence, contribute to increased business cycle volatility. Ultimately, it is, therefore, an empirical exercise as to which of these two effects dominates. Levinson (1998), Poterba (1994) and Alt and Lowry (1994) find that fiscal rules are inflexible and inhibit counter-cyclical fiscal policy and thus lead to more volatile business cycles. In contrast, Alesina and Bayoumi (1996) find that such rules do not have any affect on output volatility as fiscal rules may limit destabilising politically motivated and biased policies. Fatas and Mihov (2004) find that the first factor dominates the second and, fiscal rules are, therefore, stabilising. Overall, fiscal policy rules are likely to be effective if they are accompanied by strong commitments and increased transparency (Bayoumi and Eichengreen, 1995).

3.19 To conclude, the inflationary consequences of the monetisation of fiscal deficits are now well-recognised. Alternatives such as recourse to external borrowings in foreign currency to finance high fiscal deficits are more likely to engender unsustainable current account deficits, high external debt and an eventual balance of payments crisis. In this context, well-developed domestic debt markets can help governments to raise their borrowing requirements locally. This will avoid automatic monetisation and the pitfalls associated with external borrowings. However, if the government borrowing requirements are high, this could exert upward pressure on domestic interest rates. Thus, the development of domestic government securities markets needs to be supported by fiscal discipline so as to provide a more enduring solution. As a result, there is a widespread consensus in favour of central bank independence, backed by some form of fiscal discipline. Such clear-cut rules are an essential pre-requisite to contain inflation and stabilise inflation expectations.

Intermediate Targets

3.20 While price stability and output stabilisation are final objectives of monetary policy, they are not directly under the control of central banks. Monetary authorities, therefore, typically set 'intermediate targets' in terms of macroeconomic variables, which bear a stable relationship with the overall objectives of monetary policy (Friedman, 1990). The choice of the intermediate target is critical. A macro variable, if too narrow, such as base money, may be fully within the central bank purview but could be incapable of providing an effective conduit to the overall objectives. At the same time, a macro variable, if too broad, such as nominal income, may not be amenable to central bank control. Besides, the selection of intermediate targets is also conditional on the channels of transmission of monetary policy. With the growing complexities of macroeconomic relationships, a number of central banks have, however, chosen to abandon single intermediate targets and directly target inflation. In the following paragraphs, a brief discussion is undertaken of the various intermediate targets of monetary policy.

3.21 Although central banks such as the US Federal Reserve did traditionally set credit targets, the concept of a formal intermediate target really came into its own with the monetarist emphasis on money targeting in the 1960s (Friedman, 1968). In the 1970s, evidence of a stable relationship between money, output and prices, coming as it did in a climate of worsening inflation, prompted central banks to give more weight to money in their policy deliberations (Volcker, 1978). A commitment to rules was thought to anchor inflation expectations (Kydland and Prescott, 1977; Barro and Gordon, 1983). A number of central banks, starting with Switzerland and including Germany, Japan, the UK and the USA, adopted money targets in the mid-1970s.

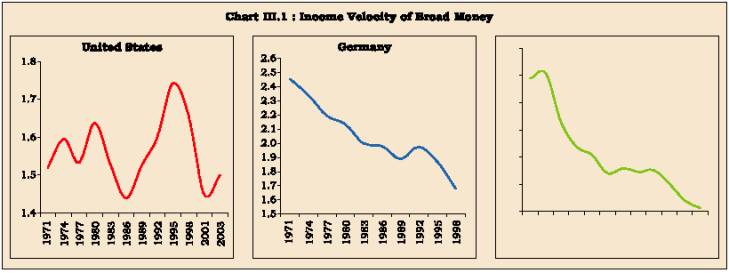

3.22 At the heart of the monetary targeting framework is the assumption that money demand is stable. This, in turn, requires that income velocity of money is reasonably stable and predictable. Velocity of money is essentially the number of times the stock of money changes hands to finance transactions. In the long-run, the velocity of money generally follows a U-curve pattern, determined by a range of institutional factors (Bordo and Jonung, 1987). Velocity declines in the initial stages of economic development reflecting monetisation of the economy as a result of the spread of the banking network. It subsequently rises in the advanced stages, as the parallel sophistication in financial markets reduces the need for financial intermediation by the banking system. The 1970s and 1980s witnessed a spate of financial innovations such as money market mutual funds. The concomitant process of disintermediation began to impar t volatility to the behaviour of monetary aggregates and the velocity of money, especially in market-based economies, such as the USA (Chart III.1 and Table 3.5). The volatility in

velocity of money undermined the efficacy of monetary targeting. Their central banks, therefore, gradually started de-emphasising the role of monetary aggregates in the conduct of monetary policy.

3.23 In contrast, bank-based economies, especially in continental Europe such as France, Germany and Switzerland were able to persevere with some version of monetary targeting as money demand continued to be relatively stable. This was due to the fact that financial innovations in these economies led to substitution towards instruments that could be considered as part of money and, therefore, could be taken care of by simply redefining monetary

aggregates (Calza and Sousa, 2003; Brand, Gerdesmeier and Roffia, 2002). Real money gaps (the gap between current real balances and long-run equilibrium real balances) appear to have substantial predictive power for future inflation in the euro area (Gerlach and Svensson, 2003). Econometric results suggest that money demand continues to be stable in the euro area even after the adoption of the euro although the impact of wealth may have become more pronounced (ECB, 2004). In view of this, central banks in some advanced economies continue to lay stress on monetary aggregates in the process of monetary policy formulation (Box III.1).

|

Table 3.5: Velocity of Narrow Money – Cross Country Experience |

||||||

|

1970s |

1980s |

1990-2002 |

||||

|

Economy |

Mean |

Volatility |

Mean |

Volatility |

Mean |

Volatility |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

Developed Economies |

||||||

|

Australia |

7.5 |

9.9 |

9.1 |

9.8 |

5.9 |

21.6 |

|

Canada |

6.9 |

15.4 |

7.9 |

19.1 |

5.6 |

15.4 |

|

Japan |

3.0 |

6.4 |

3.5 |

2.7 |

2.7 |

25.8 |

|

United States |

4.9 |

10.3 |

6.0 |

5.7 |

6.2 |

6.2 |

|

New Zealand |

7.0 |

8.8 |

10.0 |

13.7 |

8.1 |

13.2 |

|

Emerging Market Economies |

||||||

|

Mexico |

9.0 |

3.9 |

13.8 |

38.2 |

11.1 |

15.9 |

|

South Africa |

6.5 |

12 |

6.0 |

11.1 |

4.2 |

23.6 |

|

India |

6.2 |

6.6 |

6.5 |

3.9 |

6.2 |

5.4 |

|

Indonesia |

10.5 |

13.2 |

9.6 |

6.2 |

8.5 |

0.3 |

|

Thailand |

8.1 |

9.2 |

10.7 |

9.6 |

9.6 |

18.8 |

|

Korea |

8.6 |

7.5 |

10.5 |

8.5 |

11.3 |

11.6 |

|

Malaysia |

5.4 |

5.6 |

5.2 |

6.2 |

4.0 |

12.5 |

|

Note :Volatility is measured by co-efficient of variation in per cent. Source :International Financial Statistics, IMF. |

||||||

Box III.1

Does Money Matter?

With perceived instability of money demand during the 1980s, many central banks started de-emphasising monetary targets and shifted towards using short-term interest rates as operating instruments/targets of monetary policy. Concomitantly, models without any explicit role for monetary aggregates have become a norm. These 'monetary models without money' typically contain three equations - an aggregate demand equation (IS-type curve), an aggregate supply equation (Phillips curve) and a monetary policy reaction function (Taylor-type rule) (McCallum, 2001, 2003). This raises the issue as to whether money has any useful role to play in the conduct of monetary policy.

First, models without monetary aggregates do not imply that inflation is a non-monetary phenomenon and are not necessarily non-monetary models. This is because the central bank's control over the nominal interest rate ultimately stems from its ability to control the quantity of base money. Using an interest rate rule does not eliminate the concept of money demand and money supply; it simply makes money endogenous. Money stock and interest rates jointly transmit monetary policy in many cases (Leeper and Roush, 2003).

Second, although money demand may be unstable in the short-run because of financial innovations, it is found to be reasonably stable over the long run (Lucas, 1988; Poole, 1988; Stock and Watson, 1993; Ball, 1998). Alternative measures of the opportunity cost or adjustment for structural breaks or a proxy for economic uncertainty often reinforces a long-run relationship between money, output and prices. Some studies find that even short-run money demand is stable, if it is properly specified - in particular, if the rate of interest on near monies is also included as an explanatory variable (Ball, 2002).

Third, reflecting the financial innovations, the definition of money supply cannot be static and needs to evolve over time (Sriram, 2001). Fourth, empirical evidence confirms that the neutrality proposition does hold over long periods of time (Serletis and Krause, 1996).

In brief, monetary aggregates continue to be an important indicator variable. Illustratively, the European Central Bank’s (ECB) monetary policy strategy rests on the twin pillars of general economic analysis and monetary analysis. The first pillar comprises a broad based assessment of the risks to price stability, using a wide range of economic and financial indicator variables, including long-term interest rates and the yield curve, indicators of consumer and business confidence, measures of output growth, wages and unit labor costs, import prices for commodities, and the external value of the euro. The second pillar - monetary analysis - is based on the premise that inflation is ultimately a monetary phenomenon. At the same time, it is recognised that, in the short-run, movements in inflation need not be correlated with money supply. Accordingly, the quantitative reference value of broad money growth of 4.5 per cent (three-month moving average) is not regarded as an intermediate monetary target, to avoid an automatic monetary policy reaction to monetary fluctuations.

Amongst other major central banks, while the Swiss National Bank abandoned monetary targeting in the beginning of 2000 in favour of an inflation forecast (but, not inflation target), it continues to lay stress on the role of money. It believes that money remains the most important determinant of inflation in the long-run (period of 18 months and above) and the forecasting abilities of the models improve substantially if broad money is taken into account. At the same time, the Swiss National Bank did not follow the 2-pillar approach of the ECB as it felt that the public would have been confused as to which pillar determined monetary policy in practice. For this reason, while the inflation forecast acts as its main policy compass, money serves as an important input into that forecast.

3.24 Following the adoption of monetary targets in advanced economies, developing countries began to adopt money targeting in the 1980s. A money target was deemed particularly appropriate in their case because of the dominance of the quantum-based credit channel of monetary policy transmission, especially as the absence of developed financial markets alongside administered interest rates virtually ruled out the interest rate channel of monetary policy transmission (van't Dack, 1999). Given the under-developed financial markets, price signals were considered to be less reliable in these economies. Rapidly shifting levels of interest rates in an unstable inflation environment were believed to produce a noisy and distorted echo of the stance of monetary policy.

Money targets were also seen as the most effective way to discipline Government finances. They continue to be in vogue even now as money demand continues to remain stable in many developing countries, which are yet to witness large-scale financial liberalisation. Several studies on large EMEs, which have adopted bank-based systems and which have also seen a fair degree of financial innovations, also testify to a stable relationship between money demand, inflation and real economic activity. At the same time, in cases of relatively sophisticated market-based systems, such as the ASEAN economies, money demand tended to turn unstable very quickly under the impact of financial market development and liberalisation (Dekle and Pradhan, 1997).

3.25 The breakdown of the money-targeting framework naturally set off a search for alternate intermediate targets. Following Poole (1970), it is believed that central banks can modulate aggregate demand by targeting interest rates in case of instability of money demand. An increasing number of central banks in advanced economies as well as EMEs emphasise the role of short-term interest rates as operating targets of monetary policy or as an instrument variable or as a key information variable1 (Friedman, 2000). The reaction function of central banks that have adopted interest rates as instruments of monetary policy can be encapsulated in the Taylor rule (Taylor, 1993). A Taylor-rule relates short-term policy interest rates to deviations of inflation and output from their target and potential, respectively. In particular, the Taylor principle requires that nominal interest rates should increase more than one-to-one with an increase in the inflation rate so that real interest rates also rise in order to dampen aggregate demand and bring inflation back to target (Clarida, Gali and Gertler, 1998). The use of interest rates as operating targets has revived interest in the natural rate of interest (Woodford, 2000; Laubach and Williams, 2003). While useful in theory, the concept of a natural/neutral/equilibrium rate of interest is difficult to implement in practice (see Chapter VII for a detailed discussion).

3.26 EMEs have witnessed significant structural changes and financial innovations during the 1990s. With financial liberalisation, central banks in these economies are progressively moving away from quantitative targets towards using interest rates as instruments in the conduct of monetary policy. However, in the absence of fully developed and integrated financial markets, central banks in these economies still need to rely upon quantitative targets in their conduct of monetary policy. In particular, due to high information and transaction costs, credit markets continue to be regulated in order to direct the flow of credit to productive sectors of the economy. Thus, even as central banks in developing economies make use of short-term interest rates, monetary policy continues to aim at influencing aggregate demand by altering the quantity of availability of credit along with changes in the price of credit. Thus, quantitative targets, although diminishing in importance, still play an important role in the transmission mechanism.

3.27 Finally, a number of central banks have switched away from any sort of intermediate targets. These inflation targeting (IT) central banks - at present, more than 20 - directly target inflation, attracted by the primary advantage of the transparency of an explicit commitment to an inflation rate target. As noted earlier, both IT and non-IT central banks were able to reduce inflation. The jury is still out on the extent to which inflation targeting policies have actually contributed to the reduction in inflation that has occurred (Ball and Sheridan, 2003; Gramlich, 2003; Mohan, 2004). The adoption of IT in emerging market economies is, in particular, complicated by the lack of strong fiscal, financial and monetary institutions (Mishkin, 2004).

3.28 In sum, although there is widespread acceptance of price stability as a key monetary policy objective, the underlying monetary frameworks vary a great deal (Table 3.6) (Stone and Bhundia, 2004). At one end of the spectrum, the overwhelming

|

Table 3.6: Taxonomy of Monetary Regimes |

||

|

Central Bank |

Monetary Regime |

|

|

1 |

2 |

|

|

Developed Countries |

||

|

Australia |

Inflation targeting |

|

|

Canada |

Inflation targeting |

|

|

Japan |

Multiple indicators |

|

|

United Kingdom |

Inflation targeting |

|

|

United States |

Multiple indicators |

|

|

Euro area |

Multiple indicators |

|

|

New Zealand |

Inflation targeting |

|

|

Emerging Market Economies |

||

|

Mexico |

Inflation targeting |

|

|

South Africa |

Inflation targeting |

|

|

China,P.R. |

Money targeting and |

|

|

exchange rate anchor |

||

|

Russia |

Multiple indicators |

|

|

India |

Multiple indicators |

|

|

Indonesia |

Money targeting |

|

|

Thailand |

Inflation targeting |

|

|

Korea |

Inflation targeting |

|

|

Malaysia |

Exchange rate anchor |

|

|

Singapore |

Multiple indicators |

|

|

Source :Annual Report on Exchange Arrangements and Exchange Restrictions, IMF (2004). |

||

1 In the mid-1990s, some central banks, especially in relatively open economies, led by the Bank of Canada (and for some time, the Reserve Bank of New Zealand) briefly experimented with so-called monetary conditions indices (MCI) - essentially a linear weighted combination of nominal or real interest rate and exchange rate deviations with respect to a base period - as ‘operating’ targets (Freedman, 1994).

majority of central banks, which follow a broad price stability objective and even put out inflation forecasts, have not formally adopted inflation targeting. At the centre, stand the inflation targeters, with a formal inflation anchor. At the other extreme, are a few central banks, especially in developed countries, such as the European Central Bank, which follow implicit price stability but do not formally declare themselves as inflation targeting. Ultimately, it is the existence of explicit quantitative targets - exchange rates, money growth rates or inflation targets - and their achievement rather than any particular target which is associated with a better inflation performance (Fatas, Mihov and Rose, 2004).

3.29 There is now an emerging consensus that the growing complexities of monetary management require that the process of monetary policy formulation be guided by the information content available from a number of macroeconomic indicators rather than the reliance on a single intermediate anchor. Central bankers operate in an environment of high uncertainty regarding the functioning of the economy as well as its prevailing state and the future course of developments. These uncertainties have increased further since the 1990s due to ongoing structural changes and financial globalisation. In such a complex environment, a single model or a limited set of indicators is not a sufficient guide for monetary policy. Instead, an encompassing and integrated set of data is required (Trichet, 2004). Thus, most central banks now monitor a number of macroeconomic indicators which have a bearing on the ultimate objective of price stability.

Operating Procedures of Monetary Policy

3.30 With short-term interest rates emerging as instruments of monetary policy, central banks need to modulate liquidity in order to stabilise the money markets. In fact, the power of monetary policy stems from the central bank's monopoly over primary money in the economy (Friedman, 2000). The key issue in monetary policy design is to determine the form and pricing of primary liquidity with a view to impacting the overall objectives through the available channels of monetary policy transmission. The operating procedures of monetary policy are, therefore, changing as central banks cope with the opportunities and challenges of financial liberalisation. There are several choices to make in terms of the appropriate regime, the deployment of par ticular sets of instruments and their impact on the central bank balance sheet and finally, the linkages with the parallel framework of financial stability.

3.31 Alongside advanced economies, the operating procedures of monetary policy in EMEs have also undergone changes in the context of an overall shift in the paradigm of the financing framework. Changes in the operating procedure in most EMEs (especially, transition economies), however, had to be calibrated with the development of a market mechanism for resource allocation by the financial system, in terms of building markets, deregulating interest rates and allowing financial intermediaries freedom of portfolio allocation.

3.32 The search for an alternate operating procedure of monetary policy is now coalescing into a strategy of liquidity management which broadly follows a two-step procedure of estimating market liquidity, autonomous of policy action, to initiate liquidity operations to steer monetary conditions (Borio, 1997; Schaechter et al, 2000). A key advantage of this framework is that it is possible to switch between quantitative targets and interest rate targets in response to the macroeconomic circumstances of the economy. In consonance with the growing market orientation of the economy, most central banks try to build in automatic stabilisers in the liquidity management framework itself. First, reserve requirements, set on an average basis, allow the financial system the leverage to adjust to temporary/seasonal liquidity shocks on its own account without central bank action. A second automatic stabiliser results from the central banks' preference for encasing short-term interest rates in a corridor around some optimal rate rather than at a point target rate. For instance, Australia, Canada, Malaysia and New Zealand currently operate a 50 basis point spread corridor while the European Central Bank has a wider 100 basis point band. The precise position of the short-term interest rate in the corridor depends on the liquidity position of the market, especially in case reserve requirements are set on an average basis, and the countervailing liquidity operations of the central bank. A sine qua non of the liquidity management framework, therefore, is the ability of the central bank to define and defend an interest rate corridor around the policy rate. The ceiling (and the floor) of the corridor is set by the prices of the standing lending (and deposit) facilities. At the hear t of the efficacy of the liquidity management framework is the ability of the central bank to forecast market liquidity (Box III.2 and Table 3.7). A number of central banks such as the Bank of England, the European Central Bank and the Bank of Japan publish forecasts of ‘autonomous’ factors that impact upon bank liquidity to provide the market a guide to monetary policy action. Beyond the design of the liquidity management strategy, the relative efficacy of alternate instruments of monetary policy also poses challenges for monetary management (Box III.3).

Box III.2

Forecasting Market Liquidity

Most central banks are putting in place a strategy of liquidity management in which market liquidity is modulated by open market operations to steer monetary conditions to the desired trajectory. At the core of this exercise is an estimate of liquidity conditions prior to policy action. For this purpose, the bifurcation of the central bank balance sheet into autonomous liquidity and policy position is useful (Borio, 1997). Autonomous liquidity comprises balance sheet flows arising out of regular central banking functions such as issue of currency, banker to government and banker to banks. If the demand for market liquidity, proxied by the demand for bank reserves, is in excess of autonomous liquidity, the central bank could absorb primary liquidity (through changes in the policy position) to balance the market. Alternately, interest rates change to clear the market for bank reserves through the liquidity effect.

Central banks, therefore, typically begin by estimating the demand for bank reserves. This is usually a function of reserve requirements (which determines required reserves), the volume of transactions (which determines settlement balances) and the opportunity cost of holding bank reserves (which determines excess reserves). This is supplemented by a forecast of autonomous liquidity. This, in turn, depends on a variety of factors such as the fiscal deficit (which determines the Government's recourse to the central bank), the balance of payments position (which determines central bank's foreign assets) and transactions demand (which determines cash demand). These two sets of projections provide an estimate of the ex ante market liquidity conditions.

The estimation of the market liquidity is often difficult in view of its complex dynamics. First, if banks are allowed to maintain their reserve requirements on an average basis, the central bank has to take day-to-day bank portfolio reallocations between bank reserves and the money and government securities markets. Second, the demand for settlement balances often fluctuates with trading volumes rather than administrative requirements. Third, in case of gross settlement systems, there is also the demand for intra-day liquidity depending on the sequence of settlement of debits and credits. Fourth, the estimation of the fiscal gap, especially on a day-to-day basis, is difficult because the presentation of cheques issued could be guided by the liquidity position of a variety of entities, including employees, government contractors and tax payers receiving refunds. Fifth, the estimation of capital flows is also challenging given their intrinsic volatility. Finally, it is difficult to get a fix on the seasonality of cash demand, especially in economies where festivals are not calendar date-specific.

|

Table 3.7: Liquidity Forecasting in Central Banks |

|||

|

Central |

Operating |

Most |

Forecast |

|

Bank |

Target |

Unpredictable |

Horizon |

|

item |

|||

|

1 |

2 |

3 |

4 |

|

Brazil |

Overnight inter |

Net foreign |

1 month |

|

-bank rate |

assets |

||

|

European |

1 month |

||

|

Central Bank |

|||

|

India |

Net RBI credit |

1 day |

|

|

to Government |

|||

|

Indonesia |

Monetary |

Net foreign |

1 week |

|

base |

assets |

||

|

Japan |

Bank reserves |

1 day |

|

|

Malyasia |

Over |

Government |

1 day |

|

night inter- |

and |

||

|

bank rates |

currency |

||

|

Mexico |

- |

1 day |

|

|

South |

Government |

1-6 |

|

|

Africa |

months |

||

|

UK |

1 day |

||

|

– 13 weeks |

|||

|

USA |

Federal Funds |

||

|

rate |

2 weeks |

||

|

Source : Van’t dack, 1999; Schaechter, 2001; RBI, 2002. |

|||

3.33 The ability of a central bank to carry its market operations effectively depends on the strength of its balance sheet. This implies that the central bank must weigh the relative costs of market stabilisation and the implications of the fragility of its own balance sheet in deploying the instruments of monetary control. Accordingly, central bank balance sheets and accounting practices have attracted a great deal of attention in recent years (Box III.4 and Table 3.8).

3.34 To conclude this Section, it is evident that the transformation of monetary policy in the wake of financial sector reforms is far from complete. While price stability has emerged as a key policy objective, the growing integration and globalisation of the economies have thrown new challenges to monetary policy. In the context of sharp swings in capital flows and exchange rates, ensuring orderly conditions in the financial markets has emerged as a key policy concern. More generally, monetary policy is expected to maintain financial stability although the instruments for this purpose and their efficacy remain a matter of debate. On the issue of achieving price stability on a sustainable basis and to stabilise inflation expectations, there is a reasonably clear consensus about the need to ensure central bank autonomy from the budgetary requirements of the fisc. This is necessary in order to accord monetary management the necessary flexibility to attain its objectives.

Box III.3

Instruments of Monetary Policy

During the 1990s, there has been an increasing shift from direct to indirect instruments of monetary policy. This is in consonance with the consistent preference for market-based instruments of monetary policy. The process has been reinforced by a switch, within the group of indirect instruments, from relatively less market-oriented instruments such as reserve requirements to relatively more market-oriented instruments such as open market operations (Alexander, Balino and Enoch, 1995).

The cash reserve ratio (CRR) remains a powerful instrument of monetary policy in developing economies. It not only impounds liquidity at the first instance but also directly impacts banks' cost of raising funds since a portion of deposit mobilisation is continuously impounded by the central bank. Reserve requirements are especially effective in developing countries as their financial markets are not mature enough for open market operations. The principal drawback of reserve requirements is that they impose an indirect tax on the banking system as an across-the-board levy, which does not take into consideration the relative liquidity position of the players in the credit markets.

Most central banks have, therefore, gradually de-emphasised the use of reserve requirements, and as noted earlier, prefer open market operations as a tool of monetary policy. This allows them to adjust market liquidity and impact on the interest rate structure at varying tenors through an auction mechanism in which market players are able to bid their preferences. For such market operations to be effective, the secondary markets need to be deep and liquid. At the same time, the central bank must have a sufficient stock of eligible securities to undertake market operations.

Box III.4

Central Bank Balance Sheets

It is sometimes argued that central banks may not require reserves at all, since the owner in cases, is the government itself. Notwithstanding this initial thinking regarding the uniqueness of central banking, most central banks now usually follow conservative accounting norms of income recognition such as periodic revaluation of assets and ignoring unrealised gains (Kurtzig and Mander, 2003). A number of central banks are now adopting the International Accounting Standards (IAS), while the European Central Bank (ECB) System of Central Banks prefer the ECB Generally Accepted Accounting Principles (ECB GAAP). The International Monetary Fund has introduced a comprehensive safeguard assessments standard, ELRIC, based on five areas: External audit mechanism, Legal structure and independence, financial Reporting (based on the IAS), Internal audit mechanism and system of internal Controls. It is, however, recognised that the net worth of a central bank is difficult to establish, especially as the 'franchise' value of currency issuance is almost impossible to measure (Fry, 1993). While explicit contingent liabilities could be valued, the lender-of-last-resort function is difficult to provide for (Blejer and Schmacher, 2003).

With the increasing market orientation of monetary policy, there is now an emerging consensus that well-capitalised central banks are relatively more credible because they can bear larger quasi-fiscal costs of market stabilisation (Stella, 1997; Zhu, 2003). Most central banks, therefore, prefer to maintain sufficient reserves to ensure that monetary policy is not limited by balance sheet considerations. In particular, central banks in EMEs tend to maintain larger reserves, especially as the fiscal position is often not strong enough to protect central bank balance sheets.

Central bank legislations often link the size of reserves to the size of the balance sheet, paid-up capital, annual surplus, or some macroeconomic variable, such as GDP or money supply. A related issue is to determine the share of the central bank (i.e., in the form of reserves), the Government and non-Government owners in central bank income. In most cases, central banks have the first charge on annual income. Although governments typically appropriate the dominant share (often up to 90 per cent), especially given the right of seignorage for having farmed out the right of issue, this is counterbalanced by parallel restrictions on the monetisation of the fiscal deficit.

In brief, the health of the central bank balance sheet is increasingly viewed as an essential element in the credibility of monetary policy. Most central banks are now strengthening their balance sheets by building adequate reserves to ensure that balance sheet considerations do not hamper their ability to undertake policy actions.

|

Table 3.8: Apportionment of Central Bank Profits |

||||||

|

Per cent of profits |

||||||

|

Central |

Appropriation of Central Bank Surplus |

Deciding Authority |

First |

Charge |

||

|

Bank |

Central Bank |

Government |

Others |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

|

|

India |

Contingency |

Balance |

Central bank, |

Central bank |

||

|

reserves of 12 per |

after reaching |

in consultation |

||||

|

cent of balance sheet |

June 2005. |

with Government. |

||||

|

by June 2005. |

||||||

|

Japan |

At least 5 per cent to |

Balance surplus |

Up to 5 per cent |

Government |

Central bank |

|

|

reserve fund. |

||||||

|

Mexico |

Provisions to reserves |

Balance |

Government and |

Central bank |

||

|

aimed at maintaining real |

central bank |

|||||

|

value in line with GDP. |

||||||

|

Poland |

At least 2 per cent of net |

Balance |

Central bank |

Central bank |

||

|

profit to reserve capital. |

||||||

|

South Africa |

10 per cent to the |

Balance |

Statutory |

Central bank |

||

|

central bank reserve |

after appropriations |

|||||

|

fund. |

||||||

|

U.K. |

Allocations from |

Agreed share plus |

Government and |

|||

|

banking department, |

income of issue |

central bank |

||||

|

if any. |

department. |

|||||

|

U.S.A. |

Remainder to surplus fund. |

6 per cent of capital |

Central bank |

Shareholders |

||

|

Source : Pringle and Courtis (1999) and Hawkins (2003). |

||||||

3.35 In view of the growing complexities of monetary management, most central banks now track multiple indicators although the evidence suggests that a clear commitment - be it an inflation forecast or a traditional intermediate target - is useful in anchoring the path of inflation expectations. The operating procedures of monetary policy have acquired a greater market orientation than ever before. In view of the need to ensure central bank credibility, there is an increasing focus on strengthening the central banks’ balance sheet.

II. MONETARY POLICY FRAMEWORK IN INDIA

3.36 In India, the transition of economic policies in general, and financial sector policies in particular, from a control oriented regime to a liberalised but regulated regime has been reflected in changes in the nature of monetary management (Mohan, 2004a). While the basic objectives of monetary policy, namely price stability and ensuring credit flow to support growth, have remained unchanged, the underlying operating environment for monetary policy has undergone a significant transformation. An increasing concern is the maintenance of financial stability. The basic emphasis of monetary policy since the initiation of reforms has been to reduce segmentation through better linkages between various segments of the financial markets including money, Government securities and forex markets. The key development that has enabled a more independent monetary policy environment was the discontinuation of automatic monetisation of the Government's fiscal deficit through an agreement between the Government and the Reserve Bank in 1997. The enactment of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 has strengthened this further. Development of the monetary policy framework has also involved a great deal of institutional initiatives to enable efficient functioning of the money market: development of appropriate trading, payments and settlement systems along with technological infrastructure.

3.37 Against this brief overview, this Section focuses on the key changes in the monetary policy framework that became necessary in the liberalised economic regime. As in Section I, the discussion is organised under three broad heads: objectives, intermediate targets and operating procedures.

Objectives

3.38 The preamble of the Reserve Bank of India Act, 1934 enjoins the central bank '…to regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage…'. Within this broad mandate, the Reserve Bank's monetary policy pursues the twin objectives of price stability and ensuring the availability of credit to the productive sectors in the Indian economy. The emphasis between the twin objectives of price stability and growth has,

Page Last Updated on: