The Inflation Expectations Survey of Households for the July-September 2012 quarter (29th round) captures the inflation expectations of 4,000 urban households across 12 cities, for the next three-month and for the next one-year period. These expectations are based on their individual consumption baskets and hence, these rates should not be considered as predictors of any official measure of inflation. The households’ inflation expectations provide useful directional information on near-term inflationary pressures and also supplement other economic indicators to get a better indication of future inflation. The survey results are those of the respondents and are not necessarily shared by the Reserve Bank of India.

The proportion of respondents expecting increase in general prices by ‘more than current rate’ has decreased noticeably for three-month ahead period but has gone up for one-year ahead expectations as compared with the previous quarter. The perceived current inflation and three-month ahead inflation expectations based on median as well as mean inflation rate have also moved down as compared with the previous round. However, one-year ahead median inflation expectation has moved up and mean inflation expectation has moved down as compared with the previous round. Households expect inflation to rise further by 90 and 210 basis points during next three-month and next one-year respectively from their perceived current rate of 10.6 per cent. As in the past rounds, daily workers and housewives expect higher inflation rates compared with other categories.

I. Introduction

The Reserve Bank has been conducting Inflation Expectations Survey of Households (IESH) on a quarterly basis, since September 2005. The survey elicits qualitative and quantitative responses for three-month ahead and one-year ahead period on expected price changes and inflation. Inflation expectations of households (HHs) are subjective assessments and are based on their individual consumption baskets and therefore, may be different from the official inflation numbers released periodically by the government. These inflation expectations should not be treated as forecast of any official measure of inflation, though they provide useful inputs on directional movements of future inflation.

II. Sample Coverage and Information Sought

The survey is conducted simultaneously in 12 cities that cover adult respondents of 18 years and above. The major metropolitan cities, viz., Delhi, Kolkata, Mumbai and Chennai are represented by 500 households each, while another eight cities, viz., Jaipur, Lucknow, Bhopal, Ahmedabad, Patna, Guwahati, Bengaluru and Hyderabad are represented by 250 households each. The respondents having a view on perceived current inflation are well spread across the cities to provide a good geographical coverage. The male and female respondents in the group are approximately in the ratio of 3:2. The sample coverage in terms of occupational category-wise representation is nearly as per the target (Table 1).

The survey schedule is organised into seven blocks covering the respondent profile (block 1), general and product-wise price expectations (block 2 and 3), feedback on RBI's action to control inflation (block 4), current and expected inflation rate (block 5), amount paid for the purchase of major food items during last one month (block 6) and the expectations on changes in income/wages (block 7).

The response options for price changes are (i) price increase more than current rate, (ii) price increase similar to current rate, (iii) price increase less than current rate, (iv) no change in prices and (v) decline in prices. The inflation rates are collected in intervals - the lowest being ‘less than 1 per cent’ and the highest being ‘16 per cent and above’ with 100 basis points size for all intermediate classes.

III. Survey Results

III.1 General Price Expectations

- Almost all the respondents expect prices to go up three-month ahead and one-year ahead..

- However, the percentage of respondents expecting increase in general prices by ‘more than current rate’ for three-month ahead period has decreased noticeably to 78.9 from 83.6 per cent and that for one-year ahead has gone up to 86.8 from 84.4 per cent in the previous round. (Table 2)

III. 2 Product Group-wise Price Expectations

-

The percentages of respondents expecting price increase in three-month ahead have decreased for household durables, housing and cost of services whereas it has gone up for non-food products. However, the percentages of respondents expecting price increase in one-year ahead period have moved down for all the product groups. (Table 2)

-

The proportions of households expecting price increase three-month ahead by ‘more than current rate’ have decreased for all product groups except housing, whereas such proportions have risen in case of one-year ahead expectations for all product groups except household durables. (Table 2)

III.3 Coherence between General and Product Group-wise Price Expectations

-

As in the past rounds, the general price expectations are more consistently aligned with food price expectations than with other product groups. More than 90 per cent of the respondents appeared to have been influenced by expected changes in food prices for arriving at general price expectations (Table 3).

-

Further, sharp increase in coherence between general price expectations and housing price expectations are observed for one-year ahead period in the current survey round as compared with the previous round. (Table 3).

III.4 Inflation Expectations

-

The perceived current inflation and three-month ahead inflation expectations based on median as well as mean inflation rate have moved down as compared with the previous round. However, in case of one-year ahead period, median inflation expectation has moved up and mean inflation expectation has moved down as compared with the previous round (Table 4).

-

Households expect inflation to rise further by 90 and 210 basis points during next three-month and next one-year respectively from their perceived current rate of 10.6 per cent (Table 4).

-

Daily workers and housewives tend to have marginally higher level of inflation expectations based on mean inflation rate. City-wise, inflation expectations based on mean inflation rate were found to be the highest in Jaipur and Mumbai and the lowest in Kolkata (Table 5).

-

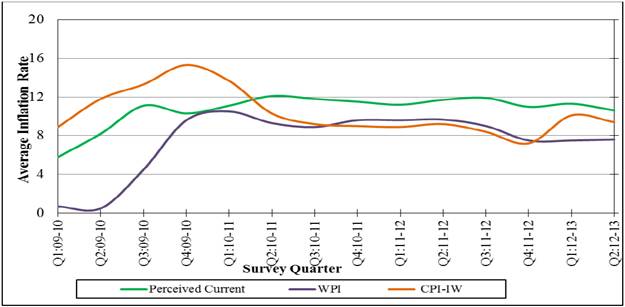

For a large part of survey history, the households’ perceived current inflation rate remained between the WPI and CPI-IW inflation rates. However, from quarter ended September 2010 round onwards, it is higher than those inflation rates (Chart-1)

Chart 1: Households Inflation Expectations - vis-à-vis Official Inflation Numbers

III.5 Cross-classification of Current Inflation and Future Expectations

- The proportion of respondents perceiving current inflation, three-month ahead and one-year ahead inflation to be at double digit have declined as compared with those in the last round.

- In particular, 47.1 per cent (51.8 per cent in previous round) of respondents perceive double digit current inflation. Similarly, 59.3 per cent (65.0 per cent in previous round) and 73.1 per cent (76.5 per cent) of the respondents expect double digit inflation rates for three-month ahead and one-year ahead periods (Table 6 and Table 7).

III.6 Awareness on RBI Action to Control Inflation

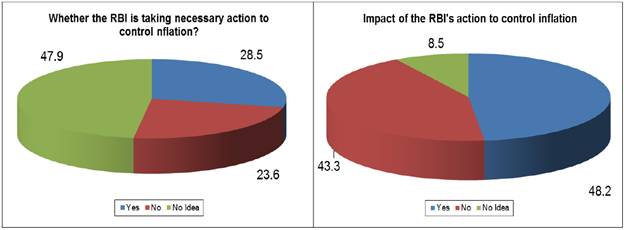

- On the feedback of the RBI action to control inflation and its impact, 52 per cent of the respondents are aware of the role of RBI in controlling inflation, of which 29 per cent felt that Reserve Bank is taking necessary action. Among these 29 per cent, 48 per cent think that RBI’s action has an impact on controlling inflation (Chart 2).

- While financial sector employees are mostly aware of Reserve Bank’s role in controlling inflation, daily workers are largely unaware (Table 8).

Chart 2 : Respondents’ view on RBI's Action to Control Inflation

III.7 Expectations in Change of Income/Wages

-

Out of 2,244 respondents in the wage earners/self-employed/daily workers categories, 54 per cent reported increase in wages/income in the past one year and 80 per cent expected that their income/wages would increase in next one-year. About 72 per cent of respondents did not see any change in their incomes in next three-month period (Table 9).

-

The share of respondents, reporting wage increase in past one year and/or expecting so during one year ahead, is highest in case of financial sector employees and lowest in case of Daily Workers (Table 9).

Table 1: Respondents’ Profile (Category): Share in Total Sample |

Category of Respondents |

Share in Total (%) |

Target Share (%) |

Financial Sector Employees |

9.4 |

10.0 |

Other Employees |

16.3 |

15.0 |

Self-employed |

21.5 |

20.0 |

Housewives |

29.3 |

30.0 |

Retired Persons |

9.0 |

10.0 |

Daily Workers |

9.0 |

10.0 |

Others |

5.6 |

5.0 |

Note: The above sample proportion is for the quarter ended September 2012 survey |

Table 2: Product-wise Expectations of Prices for Three-month ahead and One-year ahead |

(percentage of respondents) |

Round No./survey period

(quarter ended) → |

25 |

26 |

27 |

28 |

29 |

25 |

26 |

27 |

28 |

29 |

Sep-11 |

Dec-11 |

Mar-12 |

Jun-12 |

Sep-12 |

Sep-11 |

Dec-11 |

Mar-12 |

Jun-12 |

Sep-12 |

| Options: For General |

Three-month ahead |

One-year ahead |

Prices will increase |

97.3 |

96.1 |

98.2 |

99.0 |

98.9 |

96.0 |

97.1 |

98.3 |

99.5 |

99.1 |

Price increase more than current rate |

75.8 |

73.4 |

75.6 |

83.6 |

78.9 |

73.5 |

76.9 |

78.8 |

84.4 |

86.8 |

Price increase similar to current rate |

15.4 |

13.2 |

15.9 |

11.2 |

14.5 |

16.7 |

12.6 |

14.0 |

10.5 |

7.6 |

Price increase less than current rate |

6.0 |

9.6 |

6.7 |

4.2 |

5.5 |

5.9 |

7.6 |

5.5 |

4.6 |

4.8 |

No change in prices |

2.2 |

3.0 |

1.6 |

1.0 |

1.1 |

3.3 |

2.5 |

1.6 |

0.4 |

0.8 |

Decline in price |

0.6 |

0.9 |

0.2 |

0.1 |

0.1 |

0.7 |

0.4 |

0.1 |

0.1 |

0.1 |

Options: For Food Products |

Three-month ahead |

One-year ahead |

Prices will increase |

97.3 |

95.3 |

98.2 |

98.8 |

98.8 |

95.8 |

96.8 |

98.2 |

99.4 |

99.1 |

Price increase more than current rate |

74.2 |

70.4 |

69.8 |

80.8 |

78.6 |

72.0 |

73.7 |

74.4 |

82.5 |

85.7 |

Price increase similar to current rate |

17.2 |

16.7 |

21.2 |

14.3 |

15.5 |

19.0 |

15.8 |

18.6 |

12.6 |

9.9 |

Price increase less than current rate |

5.9 |

8.2 |

7.2 |

3.7 |

4.7 |

4.8 |

7.4 |

5.2 |

4.3 |

3.5 |

No change in prices |

1.9 |

3.4 |

1.6 |

1.1 |

1.1 |

3.3 |

2.7 |

1.7 |

0.5 |

0.9 |

Decline in price |

0.9 |

1.3 |

0.3 |

0.1 |

0.2 |

0.9 |

0.5 |

0.2 |

0.1 |

0.1 |

Options: For Non Food Products |

Three-month ahead |

One-year ahead |

Prices will increase |

95.6 |

94.3 |

97.5 |

97.8 |

98.1 |

95.2 |

96.2 |

98.1 |

99.3 |

99.0 |

Price increase more than current rate |

67.1 |

66.1 |

63.7 |

72.6 |

70.0 |

66.4 |

67.5 |

68.5 |

79.9 |

80.3 |

Price increase similar to current rate |

21.5 |

18.3 |

24.3 |

20.3 |

20.5 |

22.7 |

20.8 |

22.6 |

15.2 |

13.8 |

Price increase less than current rate |

7.0 |

9.9 |

9.5 |

4.9 |

7.6 |

6.1 |

8.0 |

7.0 |

4.2 |

4.9 |

No change in prices |

3.8 |

4.9 |

2.4 |

2.2 |

1.9 |

4.1 |

3.3 |

1.9 |

0.6 |

1.0 |

Decline in price |

0.7 |

0.9 |

0.2 |

0.2 |

0.1 |

0.8 |

0.5 |

0.1 |

0.1 |

0.1 |

Options: For Household Durables |

Three-month ahead |

One-year ahead |

Prices will increase |

91 |

86.9 |

90.0 |

94.3 |

86.9 |

91.5 |

90.6 |

91.9 |

96.3 |

94.9 |

Price increase more than current rate |

50.5 |

53.6 |

50.7 |

63.5 |

49.9 |

52.2 |

54.6 |

52.4 |

66.9 |

60.9 |

Price increase similar to current rate |

26.4 |

19.5 |

25.7 |

22.4 |

21.9 |

26.0 |

22.6 |

25.7 |

18.8 |

21.6 |

Price increase less than current rate |

14.1 |

13.8 |

13.6 |

8.4 |

15.1 |

13.3 |

13.4 |

13.8 |

10.6 |

12.4 |

No change in prices |

5.8 |

10.8 |

8.5 |

5.1 |

11.7 |

6.2 |

7.8 |

7.0 |

3.4 |

4.7 |

Decline in price |

3.3 |

2.3 |

1.5 |

0.6 |

1.4 |

2.3 |

1.7 |

1.2 |

0.4 |

0.4 |

Options: For Housing Prices |

Three-month ahead |

One-year ahead |

Prices will increase |

97 |

95.5 |

96.3 |

96.4 |

94.9 |

95.8 |

96.1 |

97.7 |

98.9 |

98.4 |

Price increase more than current rate |

73.5 |

67.4 |

70.4 |

73.0 |

75.1 |

70.2 |

67.3 |

73.4 |

76.9 |

83.5 |

Price increase similar to current rate |

18.2 |

18.2 |

19.5 |

18.3 |

14.8 |

20.0 |

20.6 |

19.3 |

16.8 |

10.7 |

Price increase less than current rate |

5.4 |

10.0 |

6.4 |

5.1 |

5.0 |

5.6 |

8.2 |

5.0 |

5.2 |

4.2 |

No change in prices |

2.2 |

3.8 |

3.3 |

3.2 |

3.5 |

3.3 |

3.5 |

2.1 |

0.9 |

1.5 |

Decline in price |

0.8 |

0.7 |

0.4 |

0.5 |

1.7 |

0.9 |

0.5 |

0.3 |

0.2 |

0.1 |

Options: For Cost of Services |

Three-month ahead |

One-year ahead |

Prices will increase |

95.3 |

91.9 |

95.8 |

96.4 |

93.6 |

95.2 |

93.6 |

97.1 |

98.1 |

97.4 |

Price increase more than current rate |

68.1 |

58.7 |

67.3 |

73.0 |

69.1 |

66.3 |

65.3 |

69.6 |

74.0 |

76.5 |

Price increase similar to current rate |

20.3 |

21.2 |

20.3 |

18.3 |

17.8 |

23.4 |

18.6 |

19.8 |

18.5 |

14.5 |

Price increase less than current rate |

6.8 |

12.1 |

8.2 |

5.1 |

6.7 |

5.4 |

9.8 |

7.7 |

5.6 |

6.5 |

No change in prices |

4.0 |

7.4 |

4.0 |

3.2 |

5.9 |

4.2 |

5.9 |

2.8 |

2.0 |

2.5 |

Decline in price |

0.8 |

0.7 |

0.3 |

0.5 |

0.5 |

0.7 |

0.5 |

0.2 |

0.1 |

0.1 |

Table 3: Expecting General Price Movements in Coherence with Movements in Price Expectations of Various Product Groups: Three-month ahead and One-year ahead |

Survey Round |

Survey Quarter ended |

Food |

Non-Food |

Household durables |

Housing |

Cost of services |

Three-month Ahead period |

percentage of respondents |

25 |

Sep-11 |

88.8 |

86.2 |

68.0 |

84.4 |

85.2 |

26 |

Dec-11 |

87.9 |

82.4 |

67.6 |

74.4 |

74.7 |

27 |

Mar-12 |

87.7 |

82.7 |

65.4 |

84.1 |

83.7 |

28 |

Jun-12 |

90.5 |

84.5 |

73.2 |

82.8 |

82.6 |

29 |

Sep-12 |

90.9 |

86.0 |

60.5 |

83.3 |

81.1 |

One-year Ahead period |

percentage of respondents |

25 |

Sep-11 |

92.4 |

87.2 |

71.1 |

85.7 |

86.3 |

26 |

Dec-11 |

92.3 |

84.5 |

68.0 |

78.1 |

81.2 |

27 |

Mar-12 |

91.8 |

84.0 |

65.7 |

83.9 |

85.9 |

28 |

Jun-12 |

92.5 |

88.0 |

77.1 |

85.1 |

87.1 |

29 |

Sep-12 |

95.9 |

90.3 |

69.5 |

91.0 |

87.2 |

Table 4: Household Inflation Expectations - Current, Three-month Ahead and One-year Ahead |

Survey Round |

Survey Quarter ended |

Inflation rate in Per cent |

Current |

Three-month ahead |

One-year ahead |

Mean |

Median |

Std. Dev. |

Mean |

Median |

Std. Dev. |

Mean |

Median |

Std.Dev. |

25 |

Sep-11 |

11.7 |

10.5 |

3.1 |

12.2 |

11.5 |

3.4 |

12.9 |

13.5 |

3.7 |

26 |

Dec-11 |

11.9 |

11.5 |

3.5 |

12.4 |

12.5 |

3.4 |

13.3 |

13.5 |

3.4 |

27 |

Mar-12 |

11.0 |

10.5 |

4.1 |

11.7 |

11.5 |

3.9 |

12.5 |

12.5 |

3.8 |

28 |

Jun-12 |

11.3 |

10.5 |

3.9 |

12.0 |

11.5 |

3.7 |

12.8 |

12.5 |

3.4 |

29 |

Sep-12 |

10.6 |

9.5 |

3.8 |

11.5 |

10.5 |

3.6 |

12.7 |

13.5 |

3.5 |

Table 5: Various Group-wise Inflation Expectations for September 2012 Survey Round |

| |

Current |

Three-month Ahead |

One-year Ahead |

Mean |

Median |

Std. Dev. |

Mean |

Median |

Std. Dev. |

Mean |

Median |

Std. Dev. |

Gender-wise |

Male |

10.4 |

9.5 |

3.8 |

11.3 |

10.5 |

3.7 |

12.6 |

13.5 |

3.5 |

Female |

10.9 |

10.5 |

3.8 |

11.8 |

11.5 |

3.7 |

12.9 |

13.5 |

3.6 |

Category-wise |

|

|

|

|

|

|

Financial Sector Employees |

9.7 |

8.5 |

3.7 |

10.6 |

9.5 |

3.5 |

11.9 |

11.5 |

3.3 |

Other Employees |

10.6 |

9.5 |

3.7 |

11.3 |

10.5 |

3.7 |

12.6 |

13.5 |

3.5 |

Self-Employed |

10.7 |

10.5 |

3.8 |

11.5 |

11.5 |

3.9 |

12.9 |

13.5 |

3.5 |

Housewives |

10.9 |

10.5 |

3.8 |

11.7 |

11.5 |

3.6 |

12.9 |

13.5 |

3.6 |

Retired Persons |

10.1 |

9.5 |

3.9 |

11.2 |

10.5 |

3.7 |

12.4 |

12.5 |

3.6 |

Daily Workers |

11.1 |

9.5 |

3.9 |

12.0 |

11.5 |

3.7 |

13.1 |

14.5 |

3.5 |

Other category |

10.5 |

9.5 |

3.9 |

11.3 |

10.5 |

3.6 |

12.8 |

13.5 |

3.5 |

Age-wise |

|

|

|

|

|

|

Up to 25 years |

10.8 |

10.5 |

3.8 |

11.6 |

11.5 |

3.7 |

13.0 |

13.5 |

3.5 |

25 to 30 years |

10.6 |

9.5 |

3.8 |

11.5 |

10.5 |

3.6 |

12.6 |

13.5 |

3.7 |

30 to 35 years |

10.8 |

9.5 |

3.9 |

11.7 |

11.5 |

3.7 |

12.9 |

13.5 |

3.5 |

35 to 40 years |

10.4 |

9.5 |

3.8 |

11.3 |

10.5 |

3.7 |

12.7 |

13.5 |

3.4 |

40 to 45 years |

10.5 |

9.5 |

3.9 |

11.3 |

10.5 |

3.7 |

12.6 |

12.5 |

3.6 |

45 to 50 years |

10.7 |

9.5 |

3.9 |

11.7 |

11.5 |

3.8 |

12.9 |

13.5 |

3.6 |

50 to 55 years |

10.4 |

9.5 |

3.7 |

11.2 |

10.5 |

3.8 |

12.3 |

12.5 |

3.8 |

55 to 60 years |

10.7 |

9.5 |

3.9 |

11.4 |

10.5 |

4.1 |

12.8 |

13.5 |

3.7 |

60 years and above |

10.4 |

9.5 |

3.9 |

11.4 |

10.5 |

3.6 |

12.7 |

13.5 |

3.4 |

City-wise |

|

|

|

|

|

|

Mumbai |

14.7 |

15.5 |

2.5 |

15.2 |

16.5 |

2.5 |

16.2 |

16.5 |

1.1 |

Delhi |

10.6 |

9.5 |

3.4 |

11.3 |

10.5 |

3.5 |

12.3 |

11.5 |

3.2 |

Chennai |

9.0 |

8.5 |

2.4 |

10.0 |

9.5 |

2.4 |

9.9 |

9.5 |

3.4 |

Kolkata |

7.0 |

6.5 |

1.1 |

7.7 |

7.5 |

1.9 |

9.1 |

9.5 |

2.2 |

Bangalore |

13.4 |

14.5 |

3.4 |

14.0 |

15.5 |

3.1 |

14.5 |

16.5 |

2.7 |

Hyderabad |

11.1 |

11.5 |

4.2 |

11.5 |

12.5 |

4.2 |

12.5 |

13.5 |

3.6 |

Ahmedabad |

8.6 |

8.5 |

1.1 |

10.3 |

9.5 |

1.6 |

15.0 |

15.5 |

1.7 |

Lucknow |

11.3 |

11.5 |

3.6 |

12.6 |

13.5 |

3.2 |

14.2 |

15.5 |

2.7 |

Jaipur |

15.5 |

16.5 |

3.2 |

15.6 |

16.5 |

2.9 |

15.8 |

16.5 |

2.3 |

Bhopal |

8.8 |

8.5 |

2.9 |

10.1 |

9.5 |

3.0 |

11.9 |

11.5 |

2.8 |

Patna |

10.6 |

10.5 |

3.1 |

11.8 |

11.5 |

2.9 |

13.8 |

14.5 |

2.5 |

Guwahati |

8.1 |

8.5 |

1.7 |

9.2 |

9.5 |

2.6 |

11.1 |

10.5 |

2.3 |

All |

10.6 |

9.5 |

3.8 |

11.5 |

10.5 |

3.6 |

12.7 |

13.5 |

3.5 |

Table 6: Cross-tabulation of Current and Three-month Ahead Inflation Expectations |

(Number of respondents) |

| |

Three-month ahead inflation rate (per cent) |

Current inflation rate (per cent) |

|

<1 |

1-2 |

2-3 |

3-4 |

4-5 |

5-6 |

6-7 |

7-8 |

8-9 |

9-10 |

10-11 |

11-12 |

12-13 |

13-14 |

14-15 |

15-16 |

>=16 |

No idea |

Total |

<1 |

2 |

|

|

|

2 |

|

2 |

|

|

|

1 |

|

|

|

|

|

1 |

|

8 |

1-2 |

|

|

1 |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

2-3 |

|

|

|

4 |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

3-4 |

|

|

1 |

2 |

6 |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

12 |

4-5 |

|

|

|

|

2 |

30 |

13 |

3 |

1 |

2 |

|

|

|

|

|

1 |

|

|

52 |

5-6 |

1 |

|

|

|

1 |

29 |

98 |

12 |

7 |

1 |

1 |

|

|

|

|

|

1 |

|

151 |

6-7 |

|

|

|

|

1 |

30 |

87 |

325 |

75 |

52 |

10 |

3 |

2 |

|

|

|

|

|

585 |

7-8 |

1 |

|

|

|

|

|

7 |

69 |

282 |

113 |

25 |

4 |

|

|

|

|

3 |

5 |

509 |

8-9 |

2 |

|

|

|

|

1 |

0 |

6 |

60 |

177 |

116 |

14 |

6 |

2 |

1 |

1 |

1 |

|

387 |

9-10 |

|

|

|

|

|

|

1 |

|

6 |

79 |

214 |

68 |

14 |

8 |

5 |

6 |

1 |

|

402 |

10-11 |

|

|

|

|

|

|

|

|

|

2 |

32 |

174 |

79 |

11 |

8 |

8 |

4 |

|

318 |

11-12 |

2 |

|

|

|

|

|

|

|

|

1 |

2 |

12 |

156 |

23 |

10 |

1 |

3 |

|

210 |

12-13 |

|

|

|

|

|

|

|

|

|

|

|

|

8 |

131 |

37 |

7 |

1 |

|

184 |

13-14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

76 |

22 |

2 |

|

106 |

14-15 |

2 |

|

|

|

|

|

|

|

|

1 |

1 |

|

2 |

2 |

13 |

146 |

20 |

|

187 |

15-16 |

2 |

|

|

|

|

|

|

|

|

|

|

|

2 |

1 |

|

13 |

115 |

1 |

134 |

>=16 |

7 |

|

|

|

|

|

|

|

1 |

1 |

6 |

1 |

|

1 |

6 |

5 |

715 |

3 |

746 |

Total |

19 |

|

2 |

8 |

14 |

93 |

208 |

415 |

432 |

429 |

408 |

276 |

269 |

185 |

156 |

210 |

867 |

9 |

4000 |

Note: The shaded cells represent the number of respondents who expressed double digit current and three-month ahead inflations. |

Table 7: Cross-tabulation of Current and One-year Ahead Inflation Expectations |

(Number of respondents) |

|

One-year ahead inflation rate (per cent) |

Current inflation rate (per cent) |

|

<1 |

1-2 |

2-3 |

3-4 |

4-5 |

5-6 |

6-7 |

7-8 |

8-9 |

9-10 |

10-11 |

11-12 |

12-13 |

13-14 |

14-15 |

15-16 |

>=16 |

No idea |

Total |

<1 |

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

7 |

|

8 |

1-2 |

|

|

|

|

1 |

1 |

1 |

|

|

|

|

|

|

|

|

|

|

|

3 |

2-3 |

|

|

|

|

2 |

1 |

2 |

|

|

1 |

|

|

|

|

|

|

|

|

6 |

3-4 |

|

|

1 |

|

|

4 |

2 |

0 |

1 |

2 |

|

|

|

1 |

1 |

|

|

|

12 |

4-5 |

|

|

|

3 |

2 |

0 |

22 |

8 |

8 |

4 |

1 |

|

1 |

|

|

1 |

1 |

1 |

52 |

5-6 |

3 |

|

|

|

1 |

20 |

8 |

68 |

23 |

10 |

6 |

2 |

3 |

|

2 |

1 |

4 |

|

151 |

6-7 |

3 |

|

|

|

2 |

15 |

64 |

62 |

202 |

86 |

76 |

42 |

16 |

4 |

5 |

7 |

0 |

1 |

585 |

7-8 |

7 |

|

|

|

|

|

11 |

55 |

22 |

182 |

83 |

52 |

17 |

15 |

14 |

35 |

10 |

6 |

509 |

8-9 |

4 |

|

|

|

|

|

|

6 |

26 |

37 |

119 |

44 |

62 |

12 |

17 |

34 |

26 |

|

387 |

9-10 |

2 |

|

|

|

|

|

|

|

7 |

24 |

35 |

120 |

36 |

43 |

46 |

28 |

59 |

2 |

402 |

10-11 |

3 |

|

|

|

|

|

|

|

|

4 |

14 |

29 |

86 |

36 |

60 |

55 |

30 |

1 |

318 |

11-12 |

1 |

|

|

|

|

|

|

|

|

|

|

8 |

10 |

123 |

11 |

42 |

13 |

2 |

210 |

12-13 |

4 |

|

|

|

|

|

|

|

|

|

|

2 |

4 |

1 |

76 |

67 |

28 |

2 |

184 |

13-14 |

1 |

|

|

|

|

|

|

|

|

|

|

1 |

|

4 |

2 |

54 |

44 |

|

106 |

14-15 |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

1 |

8 |

26 |

147 |

1 |

187 |

15-16 |

|

|

|

|

|

|

|

|

|

|

1 |

|

|

1 |

|

|

126 |

6 |

134 |

>=16 |

1 |

|

|

1 |

|

|

2 |

4 |

4 |

|

2 |

1 |

4 |

|

|

9 |

703 |

15 |

746 |

Total |

29 |

|

1 |

4 |

8 |

41 |

112 |

203 |

293 |

350 |

338 |

301 |

243 |

241 |

242 |

359 |

1198 |

37 |

4000 |

Note: The shaded cells represent the number of respondents who expressed double digit current and one-year ahead inflations. |

Table 8:- Awareness of RBI’s Action on controlling Inflation and their Impact |

(Percentage of respondents) |

Category |

Whether RBI is taking action to control inflation |

Yes |

No |

No Idea |

Impact of RBI’s action to control inflation |

Yes |

No |

No Idea |

Total |

Financial Sector Employees |

27.5 |

22.9 |

6.4 |

56.8 |

12.8 |

30.4 |

Other Employees |

18.3 |

14.9 |

2.2 |

35.4 |

18.9 |

45.7 |

Self-Employed |

12.6 |

14.2 |

3.4 |

30.2 |

24.4 |

45.5 |

Housewives |

8.8 |

7.2 |

0.7 |

16.6 |

27.8 |

55.5 |

Retired Persons |

16.4 |

15.6 |

3.1 |

35.0 |

23.6 |

41.4 |

Daily Workers |

6.9 |

5.0 |

1.9 |

13.9 |

32.1 |

54.0 |

Other Categories |

14.7 |

13.8 |

1.8 |

30.4 |

17.0 |

52.7 |

All |

13.8 |

12.4 |

2.4 |

28.5 |

23.6 |

47.9 |

Table 9: Respondent's Expectation on Change in Wage/Income level |

(Percentage of respondents) |

Category of Respondents |

Change in income since last year |

Change in income in three-month ahead period |

Change in income in one-year ahead period |

Increase |

Same |

Decrease |

Increase |

Same |

Decrease |

Increase |

Same |

Decrease |

Financial Sector Employees |

70.4 |

27.7 |

1.9 |

30.1 |

69.1 |

0.8 |

92.3 |

6.9 |

0.8 |

Other Employees |

59.5 |

39.1 |

0.8 |

22.6 |

75.8 |

0.9 |

83.5 |

15.1 |

0.6 |

Total Employees |

63.5 |

34.9 |

1.2 |

25.4 |

73.4 |

0.9 |

86.7 |

12.1 |

0.7 |

Self- Employed |

48.0 |

42.2 |

9.1 |

29.0 |

67.6 |

2.8 |

77.0 |

19.1 |

3.3 |

Daily Workers |

39.9 |

54.3 |

5.8 |

17.5 |

80.1 |

2.5 |

70.6 |

27.4 |

1.9 |

Total |

53.8 |

40.8 |

4.9 |

25.5 |

72.2 |

1.9 |

80.4 |

17.2 |

1.9 |

|

IST,

IST,