IST,

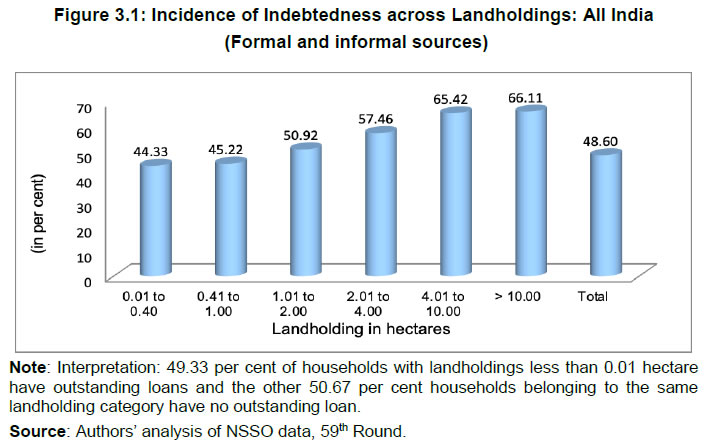

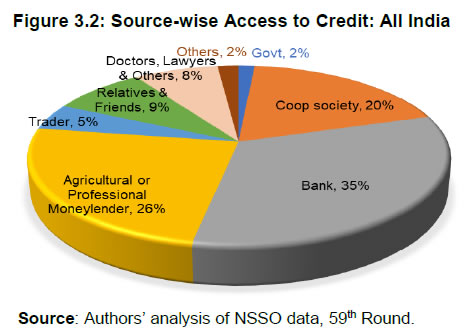

IST,

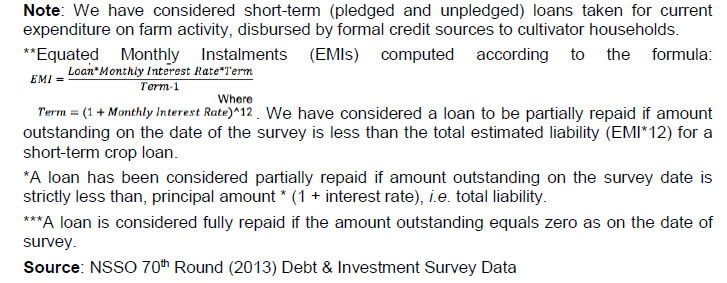

Interest Subvention for Short-term Crop Loans in Karnataka

This project was made possible because of funding from the Reserve Bank of India, Mumbai, and we greatly appreciate the support received from the Reserve Bank. We also thank both the Bank officials and farmers covered in the study for their valuable time during our field visits. We are especially grateful to the Director, Institute for Social and Economic Change (ISEC), the Registrar and the Accounts Officer, ISEC, for their support. We are also thankful to Ms Suma from the accounts section of ISEC for handling the accounts of the project. We are also most grateful to Mr Devaraju and Mr Jaisimha at ISEC for their assistance in this project, without whose sincere efforts it would not have been completed. Mr Pranav Nagendran at ISEC helped revise and finalise the report and we are most grateful to him too. We also express our gratitude to the two anonymous referees and several RBI officials for their valuable comments. We thank the RBI and the Indian Council of Social Science Research for their support to ISEC. None of the organisations and people mentioned here, however, shares any responsibility for the views expressed or errors that remain. 1. Indian agricultural activity is predominantly carried out on small and marginal land holdings. Farmers in India, at large, have inadequate incomes and, consequently, low to no savings. However, in order to commence cropping, investments are required in the form of seeds, fertilisers, tools and other inputs, while returns on these investments are realised much later at the harvest stage. Insufficient savings lead to a shortage of funds to make these crucial investments; thereby forcing farmers to rely on credit. Previously, funds were predominantly borrowed from village-level moneylenders and other informal agents who charged hefty interest rates. This led to a multitude of travails for the farm sector, since high interest rates left little income for farmers and during periods of crop failure, farmers often found themselves unable to repay their dues. 2. In order to ameliorate the problem of farmer distress, the Government of India has made strides in expanding the formal banking network into rural areas following bank nationalisation (Rajeev and Mahesh, 2014). Additionally, in order to further attract farmers seeking short-term funds for cropping to the formal sector, the government introduced an Interest Subvention Scheme for short term crop loans in 2005 which was fine tuned in subsequent year. Under the scheme, short term credit is made available to farmers by commercial banks at an interest rate of 7 per cent at the ground level, thereby providing a subsidy of 2 percentage points out of the 9 per cent interest rate charged by banks on such loans. As a further incentive aimed at inculcating a habit of prompt repayment, banks have been directed to provide an additional interest subvention of 3 per cent per annum to farmers who have fully repaid their loans within the due date set by the banks, subject to a maximum period of one year. Thus, farmers repaying on time effectively bear only 4 per cent interest rate on credit. 3. The Interest Subvention Scheme for Short Term Crop Loans, which is aimed primarily at alleviating farmer distress and making affordable credit available to poor and vulnerable farmers, requires an assessment of its performance and an examination of its shortcomings, if any. In this respect, this study focuses on the state of Karnataka, which is a drought-prone region with low irrigation; more susceptible to farmer distress; and therefore, is in need of greater support in the form of credit and other inputs. 4. Utilising National Sample Survey Office (NSSO) data from the 70th Round (NSSO, 2013), the study found that more than 50 per cent credit comes from the informal sector in India. Small and marginal farmers face a high modal interest rate of 36 per cent, and most loans are taken for income-generating activities, thus indicating that there is a shortage of formal loans even for productive purposes. Landholding size was found to be directly related to the accessibility of credit from commercial banks such that while 83 per cent of large farmers’ loans came from institutional agencies, this figure was around 60 per cent for small and marginal farmers. Judging by the 70th Round data, 12 per cent of Scheduled Caste (SC) farmers had access to commercial bank credit in Karnataka, and 77 per cent of this was cornered by the top two quintiles of farmers classified by their assets. These observations point to an urgent need to improve access to formal financial services for marginalised and poorer farm communities. 5. Looking at the performance of the Interest Subvention Scheme for Short-term Crop Loans, we find that only 27 per cent of loanee farmers in Karnataka availed institutional loans at 7 per cent rate of interest or less, as opposed to 38 per cent at the all-India level, both of which appear to be low figures (NSSO, 2013). 6. For loans under interest subvention, as the rate of interest is subsidised, the possibility of an arbitrage opportunity arises by way of re-lending. While we cannot directly obtain information on arbitrage from NSSO data, the possibility of interest rate arbitrage can be indirectly estimated by the percentage of farmers who borrowed from both institutional sources as well as act as informal moneylenders. From our analysis of NSSO 70th Round Debt and Investment Survey data, it was found that such cases were negligible, at less than 1 per cent of cultivator households in the sample (NSSO, 2013). Insights from our field survey indirectly indicate that less than 2–3 per cent of households were possibly engaged in re-lending. 7. Using econometric analysis with a sample selection model to study repayment habits of farmer households, it was found that banks tend to lend to relatively better-off farmers with more assets and land, and those from majority social groups, however, these groups are relatively less likely to make prompt repayments. 8. To obtain a more contemporary understanding of agricultural credit in Karnataka, a field survey was conducted in four districts. The findings largely re-inforce what was indicated by the NSSO data. Only around 30 per cent of marginal and small farmers were found to have received subsidised credit, while this figure was around 70 per cent for large farmers. However, almost all farmer households were found to be financially included and 66 per cent were reported as regularly visiting banks. In 43 per cent of households, women members were reported as belonging to a self-help group (SHG) through which they obtained access to a commercial bank. 9. Financial literacy is a key element in improving the situation of agricultural credit. However, only 40 per cent of marginal and small farmers in Karnataka reported being even moderately aware of the Interest Subvention Scheme, and most farmers were unaware of the incentive for prompt repayment. 10. An emerging issue in agricultural credit, the rising prominence of jewel-based loans under the Interest Subvention Scheme, was revealed through a survey of banks in select districts in Karnataka. Due to mutations not occurring automatically, many farmers lacked the requisite land records. Even among farmers possessing adequate land records, hurdles were faced in obtaining a ‘no due certificate’ from all bank branches in the locality, certifying that the farmer does not have an outstanding short-term crop loan. The process also involves significant time (from lost working hours) and money (from transport and charges for certificates) costs. These bottlenecks have worked towards driving farmers to opt for jewel loans. 11. However, jewel loans were of smaller amounts (for a given land size) than the alternative loans (i.e. loans taken by providing a record of Rights, Tenancy, and Cropping or RTC). The size of a jewel loan is often insufficient to cover the full cost of cultivation. This has possibly led to an increased reliance on informal credit to cover the shortfall, especially for small and marginal farmers. Furthermore, in richer districts, where jewel loans are seen to be more prevalent, such loans appear to crowd out RTC-based loans. 12. Policy intervention is required to reduce reliance on gold/jewels for short-term crop loans. Observing the scenario on the ground, we propose that a fixed portion of loans (say 40–45 per cent) should be necessarily provided through the RTC route by any branch to ensure that small and marginal farmers (who lack gold) have access to formal finance for cultivation. 13. A different portal may be created so that information about outstanding loan of a loanee farmer in one bank branch can become readily available/ to other bank branches of the region through certain identification number (may be through his/her Kisan Credit Card (KCC) account). Additionally, alongside ‘no due certificates’, farmers are often asked to bring other documents such as an encumbrance certificate (EC) from the taluka office, and/or a legal opinion, all of which add to the cost and time to obtain a short-term crop loan. As farm activities are seasonal and timebound, it is necessary to set a definite timeline for processing crop loan applications. 14. Land records should be digitised and mutations should take place automatically so as to better enable formal financial access, and allowances should be made for landless/tenant farmers for accessing bank credit. 15. It is observed that tenant farmers’ access to credit is constrained by lack of land records or tenancy contracts (RTC). The study suggests that tenant farmers should be given short-term crop loans up to ₹1 lakh on a declaration basis. Banks can verify the credentials of randomly selected subset of applicants for authenticity. In Andhra Pradesh, revenue authorities issue credit eligibility certificates to tenant farmers who do not hold land records. Such a system can be adopted in other states as well. Further, tenant farmers often lack records of tenancy owing to stringencies in tenancy laws. Relaxation and amendments of these laws can help relieve some of the credit access woes among this group. 16. During our interactions, bank officials expressed their viewpoint that subsidised credit should also be extended to horticulture and dairy farmers especially to the poorest section. 17. Bank officials also indicated that several small farmers were unable to avail short-term crop loans owing to prior unpaid dues. Loan waiver drives often lead to bad repayment habits as farmers default on repayments in anticipation of such announcements. When asked about their outlook on loan waivers, farmers were favourable, but almost always expressed a preference for enhanced irrigation or similar productivity augmenting facilities over loan waivers. Thus, there is a strong policy suggestion to minimise loan waivers and instead concentrate on improving agricultural infrastructure and extension services (training programmes, marketing services, etc.). Direct cash benefits to compensate for crop losses during times of drought or proper implementation in terms of timely compensation and coverage of the existing crop insurance scheme will also help to alleviate agricultural distress. 18. There is a need to accelerate the formation of farmers’ Joint Liability Groups (JLGs) to improve credit access. Studies have found that SHGs among rural women in Karnataka have been successful in improving their access to formal financial services for establishing businesses and running business operations. By forming JLGs, farmers, too, can potentially have greater credit access. Such groups can be powerful catalysts for improving access to formal finance among marginalised groups such as SCs/STs and tenant farmers constrained by the absence of land or tenancy records. 19. In certain cases, farmers’ incomes are more dependent on the buyers of their crops, as is the case of sugarcane farmers. Here, the ability to repay loans depends on timely payments by sugar mills/factories, and hence, outside the control of farmers. Such loans should be rescheduled and also be made eligible, on a case-to-case basis, to receive the benefits of prompt repayment. 20. Low financial literacy is an important factor in determining the utilisation of the benefits of the Interest Subvention Scheme. Financial literacy may be improved through the printing of information brochures in local languages. Financial literacy may also lead to an improvement in payment habits when the advantages of prompt repayment become clear to a farmer. Announcing the names of farmers who repay loans in a timely manner in the gram sabha (with a token reward, if possible) can also help foster better repayment habits. 21. Farmers were also found to be withdrawing the entire eligible amount under the KCC scheme at once, which is not an optimal practice as credit is required at different stages of cultivation. The amount that can be withdrawn under KCC can be split into four instalments, as follows: 35 per cent at the time of sowing, 25 per cent during the weeding and irrigation phase, 20 per cent at the pest-fertiliser phase, and 20 per cent during harvest. 22. Overall, the Interest Subvention Scheme has functioned well in the state but requires attention in the aforementioned areas in order to ensure realisation of its true welfare generating potential among farmers in Karnataka. 23. Contextually, the Union Budget (Interim) presented on February 1, 2019 has announced to provide the benefits of interest subvention as well as prompt repayment to all farmers pursuing activities of animal husbandry. The Budget has also announced to extend the benefits of interest subvention and prompt payment for the rescheduled period of loans to farmers affected by natural calamities, where assistance is provided from National Disaster Relief Fund (NDRF). While these announcements will help the needy farmers, such benefits may also be extended to horticulture and to farmers whose payments get delayed due to non-receipt of proceeds from buyers of their produce. The structural composition of India’s gross domestic product (GDP) has changed significantly, tilting away from the primary sector, even though more than half of its population still depends on agriculture. Among cultivator households, around 80 per cent belong to the small and marginal farmer group whose income levels are substantially low and do not allow for sufficient savings required for investments. In addition, the agricultural sector in the country is at the crossroads, often with conflicting forces working simultaneously. The vagaries of the weather create uncertainty, and the resultant high instability in production and productivity drags the development in the agricultural sector. In this context, it is to be noted that Karnataka is among the driest states in India. It has a low share of area under irrigation and, therefore, protective irrigation does not play a significant role here. Dominated by low-value and low-density crops, farmers’ income here is perennially low, and with the increase in prices of inputs (specifically of cash inputs), farmers’ net income is further reduced. As a result, farmers are unable to manage the probable risk or even working capital needs of the sector. One of the unpleasant outcomes of this scenario is the high indebtedness arising from institutional as well as non-institutional sources in the farm sector. Most of the recent studies on the farm sector have highlighted this as the dominant cause of farmer distress. Keeping the need for funds in mind, the Indian banking sector has been mandated to provide 18 per cent of their total credit to the agricultural sector at a reasonable rate of interest. The interest rate charged to the farmers is kept at a comparatively low rate of 7 per cent through government interest subvention, and to encourage prompt repayment, an additional 3 per cent subvention is provided for borrowers who repay on time. However, like numerous other welfare schemes of the government, the success of this scheme too depends on its proper implementation. As the Interest Subvention Scheme involves fiscal resources and is intended to benefit poor farmers, it is essential to examine how far the scheme has been successful in benefitting the neediest. It is also necessary to identify shortcomings, if any, in such initiatives by examining field-level operations, and look for remedies so that such initiatives can serve the objective. The state of Karnataka is an appropriate case study covering these aspects, given that this is a drought prone region with low irrigation facilities and, hence, in need of adequate support in terms of credit and other inputs than the states which are endowed with better land quality and weather conditions. 1.1 Subvention Schemes1 Given our focus on the subvention scheme and to place the discussion in perspective, it is worthwhile to discuss certain aspects of the scheme. • As directed by the Government of India (GoI) and in pursuance of the budget announcement made by the finance minister on February 28, 2006 relating to the Interest Subvention Scheme, an interest subvention of 2 per cent per annum is made available to the Public Sector Banks (PSBs) and the Private Sector Scheduled Commercial Banks with respect to loans given by their rural and semi-urban branches. The scheme is applicable to loans from banks’ own funds for short-term crop loans up to ₹3,00,000 per farmer, provided the banks make available short-term credit at the ground level at the rate of 7 per cent per annum to farmers. • An additional interest subvention of 3 per cent is made available to the farmers who repay the loan within one year from the date of disbursement of the crop loan or by the due date fixed by the bank for repayment, whichever is earlier, subject to a maximum period of one year from the date of disbursement. This also implies that the farmers who pay promptly would get short-term crop loans at 4 per cent per annum. This benefit would not accrue to those farmers who repay after one year of availing such loans. • Further, with regard to the Kisan Credit Card (KCC) scheme, the GoI has clarified that loans granted only for categories (i) and (ii) (given below), out of the following six categories, are covered under the Interest Subvention Scheme, which should be computed and segregated accordingly for claiming reimbursement of the interest subvention:

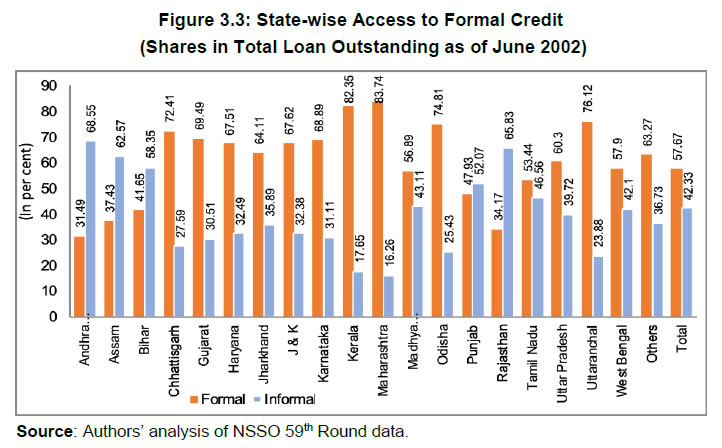

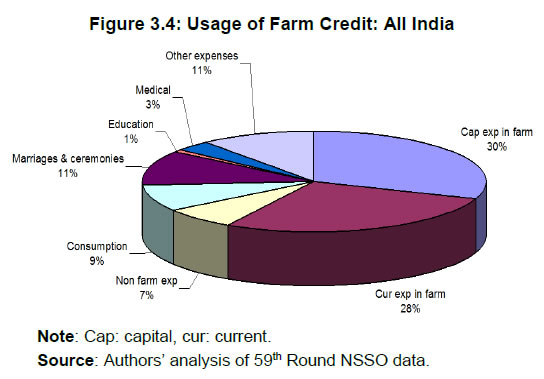

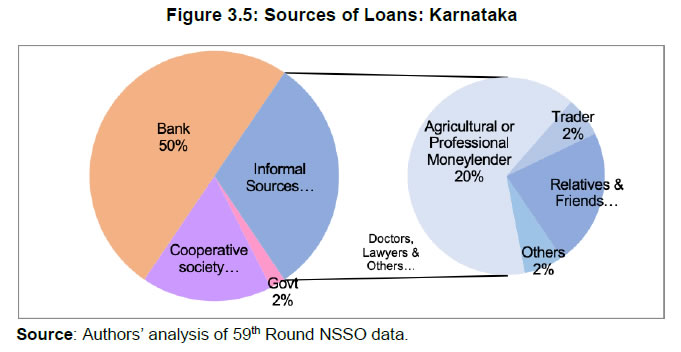

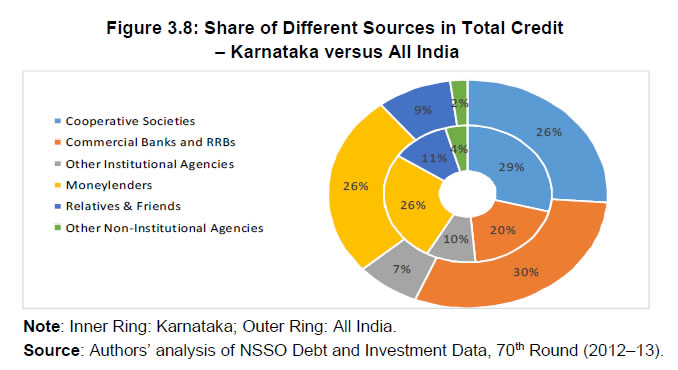

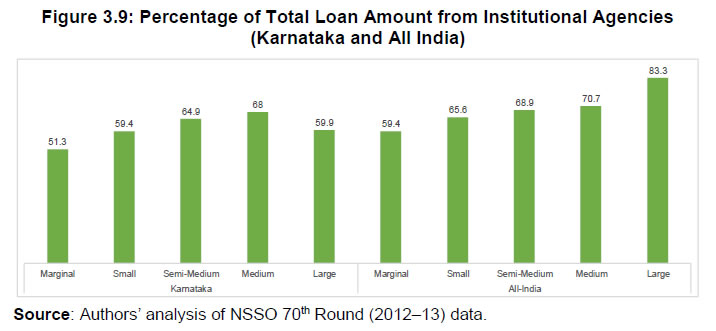

• The benefits of interest subvention are available to small and marginal farmers holding KCCs for an additional period of up to six months, post-harvest, against negotiable warehouse receipt for having kept their produce in warehouses. Before moving on to the findings with regard to the Interest Subvention Scheme, it is useful to look at the existing literature on the subject. 1.2 A Brief Review of the Literature and Research Gaps The literature on interest rate subvention schemes for crop loans, especially pertaining to India, is rather limited. Several studies, however, concentrate on the agrarian credit market in developing countries in general and the Indian agricultural credit market in particular (see Bardhan, 1989; Bell and Srinivasan, 1989). Although there has been a decline in the share of rural population in the total over time, 60 per cent of the population still lives in rural areas and depends mainly on agriculture, majority of which are small or marginal farmers. For this group of farmers, facing land and liquidity constraints in the risky and fluctuating production environment of Indian agriculture, credit remains a crucial input (Srinivasan, 1989). Amongst a few studies in the Indian context, Mitra et al. (1986) look at the causes of rural indebtedness in the state of Assam. As the nature of rural indebtedness largely depends on the state of the formal banking sector in rural areas, Ramachandran and Swaminathan (2001) examine the role of the rural banking sector in India. Historically, after the nationalisation of 14 major Indian banks on July 19, 1969, commercial banks were entrusted with the task of meeting the credit needs of the hitherto neglected rural masses (Rajeev and Mahesh, 2014). These banks were to provide credit to the neediest and reduce the role of informal lenders in the market. Formal banking institutions, thus, became an important source of credit to the agricultural sector, though it coexisted with the informal sector where interest rates were much higher (Stiglitz and Hoff, 1990). There are however a number of problems with the formal sector as noted by scholars. It is frequently observed that formal credit is not available at the beginning of a crop cycle when it is needed more (Gupta and Chauduri, 1997). Another serious problem in the formal credit market mentioned by some authors is that the officials of the formal credit institutions, who are in charge of disbursement of credit, often deliberately undertake dilatory tactics to seek bribes from farmers (ibid.; Benjamin, 1981; Lele, 1981). Because of these problems, in spite of the considerable expansion of the rural formal credit network, informal lenders still thrive in the agricultural credit market (NSSO, 2003). This is true not only in India but also in other developing nations including Pakistan (Aleem, 1990), Thailand (Siamwalla et al., 1990) and the African nations (Udry, 1990). The informal credit market has also undergone certain changes in the recent past. In the changing credit scenario, traditional landlords and moneylenders (Bhaduri, 1977 and Gangopadhyay and Sengupta, 1987) are fading away and a new class of lenders, who are the dealers of working capital have emerged (Rajeev and Deb, 2006). Due to their market power, they can charge a higher interest rate and their loan contracts are adverse towards comparatively smaller borrowers (ibid.). Exploitation by village moneylenders has been discussed by Basu (1989), who theoretically establishes that the rate of interest charged by an informal lender is lower if the loan size is greater, which in turn puts small borrowers are at a disadvantageous position. Unequal access to capital and hierarchies in an agrarian system are illustrated in the study by Eswaran and Katowal (1990) as well. Thus, one can see that while there are studies on Indian agricultural credit market, not many studies have dealt directly with the issue of effectiveness of the subvention scheme, and most of these studies are also dated. Additionally, while the incentives for prompt repayment are included to inculcate a habit of timely repayment, it would be of interest to study whether the formation of such a habit is negatively impacted by loan waiver schemes initiated by various state governments from time to time. Loan waivers create the problem of moral hazard among farmers for repayment, as it rewards those who have not repaid loans, providing incentives to farmers to avoid repayment until another loan waiver is initiated. A field-based survey is required to look at the ground level scenario concerning some of these pertinent issues. 1.3 Researchable Issues and Objectives Researchable issues on the subject at hand can be classified under three major headings. First, it is important to note that in order to benefit from this facility, farmers need to access the formal banking sector, especially for obtaining credit. Secondly, she/he needs to repay the loan on time, failing which higher interest rates will be charged for the entire period (i.e. they will not be able to take benefit of the prompt repayment scheme). Given that such facilities are intended to benefit the poor, it is necessary to examine whether small and marginal farmers are able to access credit facilities from the formal sector and benefit from the subvention scheme. One of our earlier studies in Karnataka has revealed that financial accessibility in terms of credit is limited for small and marginal farmers primarily due to lack of land records (Rajeev et al., 2011). Thus, whether the intended beneficiaries have benefited from the programme or not needs to be ascertained. In any scheme for rural areas, ensuring proper flow of information to the ultimate beneficiary is a major challenge. This is seen in the case of the KCC scheme as well, where the intended beneficiaries of the scheme were unaware of its benefits (Rajeev and Vani, 2012). The success of the subvention scheme, thus, to a great extent, depends on information dissemination among the small and marginal farmers. As mentioned earlier, the subvention facility is further extended to prompt re-payers whereby those farmers can subsequently get the loan at 4 per cent interest rate. Given the fact that Indian farmers are used to loan waivers from time to time, the important question that arises is whether the scheme has been successful in conveying this information to the farmers and inculcating the habit of timely repayment in them. Given that the farmers are often cash starved, it is necessary to examine whether the credit under this scheme has been utilised for the stated purpose or diverted to other uses. Diversions can be for different purposes, including:

Thus, the major issues, in a nutshell, are: Is the credit with subsidised interest rate really being used for the stated purposes, i.e., for agricultural (short-term loan) activities? If not, what other activities are the credit being channelled to? Access to Credit

Credit Sources and their Problems and Prospects

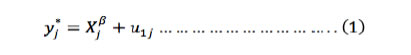

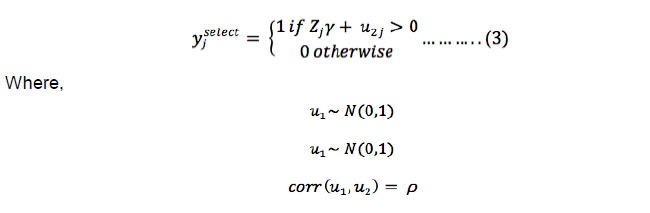

Financial Literacy

Financial Integrity

Policy Suggestion

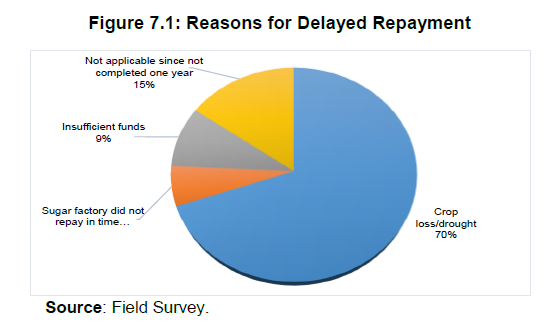

The study utilises the 59th and 70th Rounds of NSSO debt and investment survey data to understand the macro-level scenario pertaining to access to credit and its utilisation. The sample size of NSSO being large, state-level parameters can be estimated by analysing the unit record data. However, NSSO data do not highlight the problems faced by the farmers and the possible remedial measures, for which a primary survey of limited size has been undertaken. For the primary survey, respondents include individuals from the following groups: