IST,

IST,

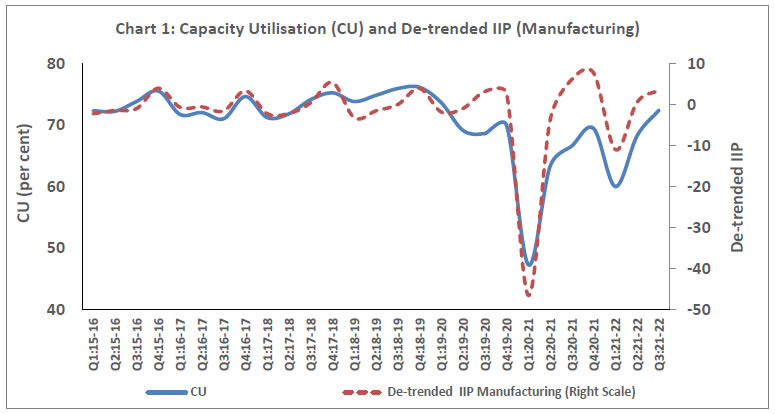

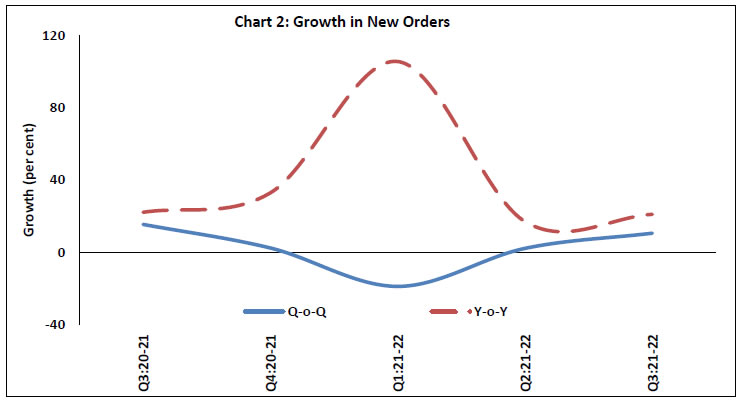

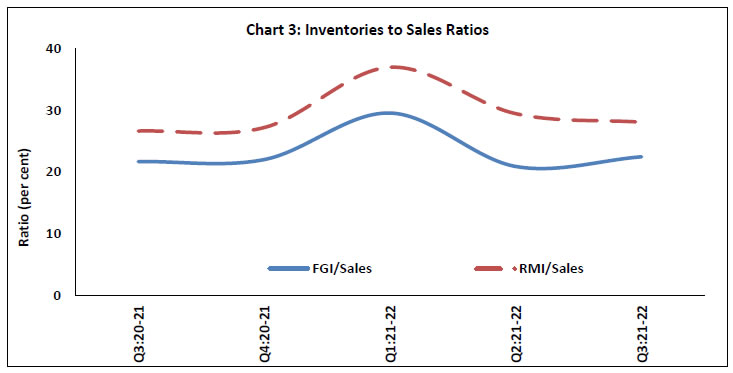

OBICUS Survey on the Manufacturing sector for Q3:2021-22

Today, the Reserve Bank released the results of the 56th round of the quarterly Order Books, Inventories and Capacity Utilisation Survey (OBICUS), which provides a snapshot of demand conditions in India’s manufacturing sector1 during October-December 2021. The survey covered 800 manufacturing companies. Highlights:

Note- Please see the excel file for time series data. ANNEX 1: Data Tables

Note: The computations of order book growths and inventory to sales ratios are based on methodology given in the RBI press release dated October 8, 2021 (link: /en/web/rbi/-/publications/obicus-survey-on-the-manufacturing-sector-for-q1-2021-22-20650) and not on the basis of averages given in the above tables. 1 The survey responses are voluntary. Results of the previous survey round were released on the Bank’s website on February 10, 2022. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: