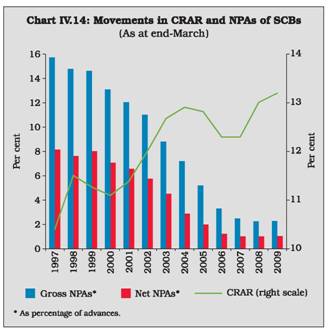

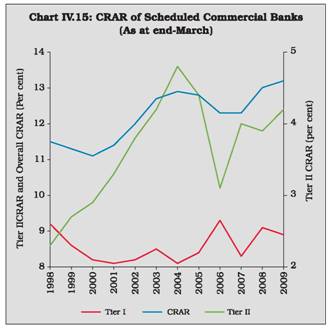

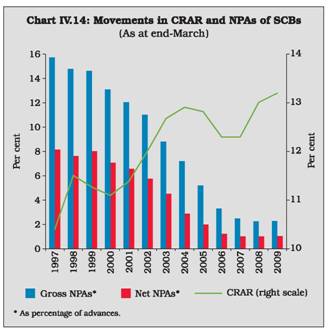

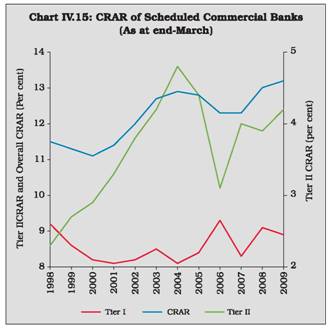

In the backdrop of global financial crisis and its repercussions on the Indian economy, the year 2008-09 has been a testing year for the Indian banking sector. The Indian banking sector, however, withstood this test and the resilience of this sector was more than evident. The Indian banks were largely immune from the crisis, as their exposure to toxic assets was minimal. More importantly, the Reserve Bank’s initiatives regarding adoption of counter-cyclical prudential regulations framework, both during credit boom period as well as during the slowdown, proved to be successful. The capital to risk-weighted assets ratio (CRAR) of SCBs improved to 13.2 per cent as at end-March 2009 from 13.0 per cent as at end-March 2008. Furthermore, the gross non-performing assets (NPA) to gross advances ratio of SCBs as at end March 2009 remained at last year’s level of 2.3 per cent. The Return on Assets (ROA) also remained at last year’s level of 1.0 per cent. Significantly, the Return on Equity (ROE) increased to 13.3 per cent during 2008-09 from 12.5 per cent during 2007-08, indicating increased efficiency with which capital is used by the banks. Thus, though the expansion of the balance sheet moderated, the asset quality was maintained. Going forward, the challenge for the banking sector would be to support credit growth, as the Indian economy moves closer to the higher growth trajectory, while ensuring the efficiency and soundness of the sector.

1. Introduction

4.1 The balance sheets of Scheduled Commercial banks (SCBs)1 in India remained robust against the backdrop of global financial crisis. It is noteworthy that contrary to the trend in some advanced countries, the leverage ratio (Tier I capital to total assets ratio) in India has remained high reflecting the strength of the Indian banking system. However, the Indian banking sector was not completely insulated from the effects of the slowdown of the India economy.

4.2

The consolidated balance sheets of SCBs, expanded by 21.2 per cent as at end-March 2009 as compared with 25.0 per cent in the previous year. While the balance sheet of public sector banks maintained their growth momentum, the private sector banks and foreign banks registered a deceleration in growth rate.

4.3 During 2008-09, the growth rate of banks’ lending to industries, personal loans and services sector witnessed a deceleration, while growth rate of banks’ lending to agriculture and allied activities increased substantially. Overall, the incremental Credit–Deposit (C-D) ratio declined sharply reflecting the slowdown in credit growth, as corporates deferred their investments against the backdrop of widespread uncertainty. Growth rate of investments by banks decelerated marginally but the proportion of Statutory Liquidity Ratio (SLR) investment in Net Demand and Time Liabilities (NDTL) increased, reflecting a large Government market borrowing programme. Consequently, the incremental Investment Deposit (I-D) ratio rose.

4.4 In a reversal of trend, the Off-Balance Sheet (OBS) exposures of SCBs, which had witnessed exponential growth in recent years,

declined by 26.4 per cent on a year on year (y-o-y) basis. This was partly due to the appropriate prudential regulation implemented by the Reserve Bank in case of OBS exposures. The growth rate of income as well as that of expenditure of SCBs decelerated, leading to deceleration in growth rate of net profits. The Capital to Risk-Weighted Assets Ratio (CRAR) of SCBs improved to 13.2 per cent at end-March 2009 from 13.0 per cent a year ago, thus, remaining significantly above the stipulated minimum of 9.0 per cent.

4.5

SCBs did not raise any resources from the primary market during 2008-09 mainly reflecting the lacklustre performance of the stock market. However, banks preferred to raise resources through debt issues in the private placement market.

4.6

The growth rate of the balance sheets of Local Area Banks (LABs) and their financial performance also witnessed a deceleration. The Regional Rural Banks (RRBs) however, withstood the adversities and their balance sheets continued to grow with almost the same pace.

4.7

This chapter profiles the operations and financial performance of SCBs at the aggregate as well as bank group levels. It is organised into thirteen sections. Section 2 analyses the balance sheet operations of SCBs on an aggregate basis, while Section 3 delineates their off-balance sheet operations. Financial performance of SCBs is analysed in Section 4. Section 5 delineates the trends in soundness indicators. Operations of SCBs in the capital market are detailed in Section 6, while technological developments in banking during the year are covered in Section 7. Regional spread of banking is set out in Section 8. Section 9 presents an update on customer service and financial inclusion. The progress in regard to micro finance initiatives is captured in Section 10. Apart from the SCBs, 86 regional rural banks (RRBs)2 and four local area banks (LABs) were also operating in the country. While the performance of SCBs forms the core of this chapter, the performance of RRBs and LABs is detailed separately in Section 11 and Section 12, respectively. Section 13 draws broad conclusions based on the discussion in the earlier sections.

2. Liabilities and Assets of Scheduled Commercial Banks

4.8

At end-March 2009, there were 80 Scheduled Commercial Banks (SCBs) in India3. The growth rate of consolidated balance sheet of SCBs decelerated to 21.2 per cent in 2008-09 from 25.0 per cent in 2007-08. The assets of SCBs, however, continued to grow at a higher rate than the nominal gross domestic product (GDP) (at current market prices) resulting in a higher ratio of assets of SCBs to GDP. This ratio increased to 98.5 per cent at end-March 2009 from 91.6 per cent at end-March 2008.

4.9

It is noteworthy that contrary to the trend in some advanced countries, the leverage ratio4 in India has remained high reflecting the strength of the Indian banking system. For instance, as observed by the World Bank (2009)5, the leverage ratio of banks in the UK witnessed a decline throughout 1990s, which was accentuated after

2000 to reach a level of about 3 per cent by 2008 from around 5 per cent in the 1990s. On the other hand, the leverage ratio for Indian banks has risen from about 4.1 per cent in March 2001 to reach a level of 6.3 per cent by March 2009.

4.10 The composition of liabilities of SCBs broadly remained same during 2008-09 as compared to 2007-08. The growth rate of term deposits accelerated to 27.3 per cent as at end March 2009, from 24.8 per cent last year. The growth rate of demand deposits decelerated to 6.9 per cent from 24.9 per cent during the same period reflecting slowdown in economic

activity. The slowdown in growth of assets side of the balance sheet was reflected in corresponding deceleration in the growth of loans and advances component. As at end-March 2009, the cash and balances of SCBs with the Reserve Bank declined mainly on account of softening of CRR. However, the balances of SCBs with banks and money at call and short notice registered an increase, thus reversing the pattern witnessed as at end-March 2008 [Table IV.1 and Table IV.2].

4.11 While the balance sheets of public sector banks maintained their growth momentum, the

private sector banks and foreign banks registered a deceleration in growth rate. Furthermore, the old private sector banks, which had been registering a significantly lower growth rate than their newer counterparts in the recent past, managed a better performance this year [Appendix Table IV.1 (A) to (C)].

Table IV.1: Consolidated Balance Sheet of Scheduled Commercial Banks |

(Amount in Rs. crore) |

Item

|

As at end-March |

2008 |

2009 |

Amount |

Per cent to total |

Amount |

Per cent to total |

1 |

2 |

3 |

4 |

5 |

1. |

Capital |

39,963 |

0.9 |

44,037 |

0.8 |

2. |

Reserve and Surplus |

2,75,524 |

6.4 |

3,24,218 |

6.2 |

3. |

Deposits |

33,20,061 |

76.7 |

40,63,203 |

77.5 |

| |

3.1. |

Demand Deposits |

4,42,056 |

10.2 |

4,72,578 |

9.0 |

| |

3.2. |

Savings Bank Deposits |

7,44,051 |

17.2 |

8,74,539 |

16.7 |

| |

3.3. |

Term Deposits |

21,33,953 |

49.3 |

27,16,084 |

51.8 |

4. |

Borrowings |

3,02,629 |

7.0 |

3,23,184 |

6.2 |

5. |

Other Liabilities and Provisions |

3,87,987 |

9.0 |

4,86,685 |

9.3 |

Total Liabilities/Assets |

43,26,166 |

100 |

52,41,330 |

100 |

1. |

Cash and Balances with RBI |

3,22,971 |

7.5 |

2,97,263 |

5.7 |

2. |

Balances with Banks and Money at Call and Short Notice |

1,09,109 |

2.5 |

1,98,581 |

3.8 |

3. |

Investments |

11,77,329 |

27.2 |

14,49,474 |

27.7 |

| |

3.1 |

Government Securities (a+b) |

9,25,723 |

21.4 |

11,64,444 |

22.2 |

| |

|

a) In India |

9,20,165 |

21.3 |

11,58,714 |

22.1 |

| |

|

b) Outside India |

5,558 |

0.1 |

5,730 |

0.1 |

| |

3.2 |

Other Approved Securities |

10,587 |

0.2 |

8,153 |

0.2 |

| |

3.3 |

Non-Approved Securities |

2,41,017 |

5.6 |

2,76,876 |

5.3 |

4. |

Loans and Advances |

24,76,936 |

57.3 |

30,00,906 |

57.3 |

| |

4.1 |

Bills purchased and Discounted |

1,50,988 |

3.5 |

1,73,910 |

3.3 |

| |

4.2 |

Cash Credits, Overdrafts, etc. |

8,88,882 |

20.5 |

11,13,556 |

21.2 |

| |

4.3 |

Term Loans |

14,37,065 |

33.2 |

17,13,439 |

32.7 |

5. |

Fixed Assets |

42,394 |

1.0 |

48,361 |

0.9 |

6. |

Other Assets |

1,97,425 |

4.6 |

2,46,743 |

4.7 |

Note : Data for 2007-08 are as reported in the balance sheets of banks for 2008-09 and hence may not match with those reported in the Report on Trend and Progress of Banking in India, 2007-08, as the figures for 2007-08 were revised by some banks.

Source: Balance Sheets of respective Banks.

|

Table IV.2: Growth of Balance Sheet of Scheduled Commercial Banks - Bank Group-wise |

(Per cent) |

Item

|

As at end-March |

2008 |

2009 |

Public Sector Banks |

Old Private Sector Banks |

New Private Sector Banks |

Foreign Banks |

All SCBs |

Public Sector Banks |

Old Private Sector Banks |

New Private Sector Banks |

Foreign Banks |

All SCBs |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

1. |

Capital |

5.2 |

1.8 |

14.6 |

71.4 |

35.2 |

3.6 |

8.2 |

-3.1 |

16.3 |

10.2 |

2. |

Reserve and Surplus |

31.3 |

47.1 |

97.9 |

34.7 |

45.3 |

20.4 |

14.6 |

9.1 |

25.8 |

17.7 |

3. |

Deposits |

23.1 |

19.8 |

23.1 |

26.8 |

23.1 |

26.9 |

20.3 |

5.4 |

12.0 |

22.4 |

| |

3.1. |

Demand Deposits |

20.4 |

23.4 |

38.6 |

28.3 |

24.6 |

9.9 |

1.8 |

1.1 |

2.3 |

6.9 |

| |

3.2. |

Saving Bank Deposits |

14.9 |

16.2 |

40.5 |

20.2 |

17.8 |

18.4 |

15.6 |

14.7 |

9.7 |

17.4 |

| |

3.3. |

Term Deposits |

27.0 |

20.2 |

16.0 |

27.7 |

24.8 |

33.1 |

24.2 |

3.9 |

18.0 |

27.3 |

4. |

Borrowings |

28.4 |

8.0 |

26.3 |

14.1 |

24.5 |

1.2 |

22.6 |

7.1 |

20.3 |

6.8 |

5. |

Other Liabilities and Provisions |

25.6 |

21.6 |

17.3 |

65.5 |

29.0 |

21.3 |

8.1 |

12.8 |

57.8 |

25.4 |

Total Liabilities/Assets |

23.8 |

21.2 |

27.5 |

32.7 |

25.0 |

24.6 |

19.3 |

6.7 |

22.8 |

21.2 |

1. |

Cash and Balances with RBI |

61.5 |

74.4 |

74.2 |

81.2 |

65.4 |

-2.4 |

-14.6 |

-20.7 |

-28.9 |

-8.0 |

2. |

Balances with Banks and Money at Call and Short Notice |

-32.6 |

-24.2 |

-33.7 |

-25.1 |

-31.1 |

106.5 |

47.1 |

27.8 |

66.8 |

82.0 |

3. |

Investments |

20.3 |

23.9 |

31.3 |

38.4 |

23.8 |

26.6 |

33.7 |

4.3 |

31.8 |

23.1 |

| |

3.1 |

Government Securities (a+b) |

20.5 |

20.0 |

21.8 |

47.4 |

22.7 |

30.6 |

27.3 |

7.7 |

20.7 |

25.8 |

| |

|

a. In India |

20.3 |

20.0 |

21.9 |

47.4 |

22.6 |

30.8 |

27.3 |

7.7 |

20.7 |

25.9 |

| |

|

b. Outside India |

58.3 |

0 |

-53.6 |

0 |

49.3 |

4.0 |

0 |

-32.0 |

0 |

3.1 |

| |

3.2 |

Other Approved Securities |

-16.7 |

-20.7 |

12.0 |

-60.9 |

-17.0 |

-22.8 |

-24.3 |

-12.0 |

-80.7 |

-23.0 |

| |

3.3 |

Non-Approved Securities |

23.3 |

42.1 |

57.0 |

5.7 |

31.2 |

11.9 |

58.2 |

-2.8 |

89.4 |

14.9 |

4. |

Loans and Advances |

24.8 |

20.2 |

26.4 |

27.5 |

25.0 |

25.7 |

15.1 |

9.9 |

2.7 |

21.2 |

| |

4.1 |

Bills Purchased and Discounted |

16.3 |

36.9 |

36.8 |

36.6 |

21.5 |

18.3 |

7.0 |

16.1 |

-3.8 |

15.2 |

| |

4.2 |

Cash Credits, Overdrafts, etc. |

24.3 |

18.5 |

31.0 |

33.8 |

25.2 |

29.4 |

15.1 |

9.4 |

9.2 |

25.3 |

| |

4.3 |

Term Loans |

26.1 |

19.9 |

24.6 |

21.2 |

25.3 |

24.0 |

16.1 |

9.6 |

-1.6 |

19.2 |

5. |

Fixed Assets |

42.6 |

26.1 |

15.9 |

32.3 |

35.2 |

17.2 |

8.0 |

1.2 |

19.4 |

14.1 |

6. |

Other Assets |

31.0 |

-1.7 |

28.3 |

67.0 |

38.2 |

2.0 |

28.2 |

19.8 |

68.1 |

25.0 |

Source: Balance Sheets of respective banks. |

4.12 The public sector banks’ share in aggregate assets, deposits, advances and investments increased as at end-March 2009 vis-a-vis last year, while the shares of private sector banks registered a decline. This was mainly on account of the strong balance sheet growth registered in case of public sector banks, against the backdrop of deceleration in growth rate of other bank groups (Table IV.3).

Deposits

4.13 The growth rate of aggregate deposits of SCBs decelerated to 22.4 per cent as at end March 2009 from 23.1 per cent as at end March 2008 and that of 24.6 per cent in the previous year. The importance of Certificates of Deposit (CDs) as means of raising resources continued during 2008-09, albeit with some deceleration in growth rate. CDs outstanding as percentage of aggregate deposits stood at 4.7 per cent (Appendix Table IV.2).

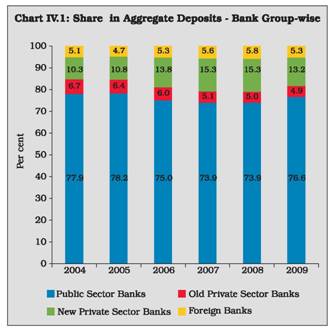

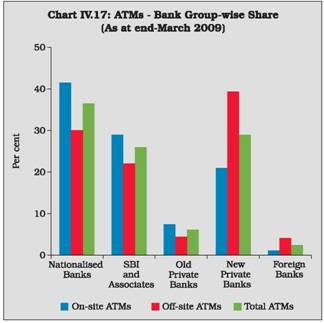

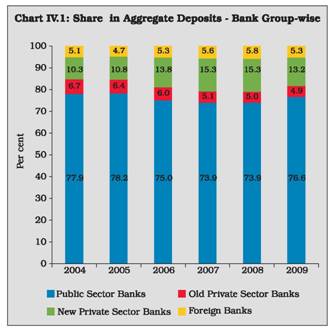

4.14 In terms of bank group wise share in deposits, the public sector banks not only continued to be the leaders, their share also increased, while that of other bank groups witnessed a decline (Chart IV.1).

Table IV.3: Major Components of Balance Sheets of Scheduled Commercial Banks - Bank Group-wise

(As at end-March) |

(Per cent) |

Bank Group

|

Assets |

Deposits |

Advances |

Investments |

2008 |

2009 |

2008 |

2009 |

2008 |

2009 |

2008 |

2009 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Public Sector Banks |

69.9 |

71.9 |

73.9 |

76.6 |

72.6 |

75.3 |

67.9 |

69.9 |

Nationalised Banks |

43.5 |

44.2 |

48.4 |

49.1 |

45.3 |

47.2 |

42.7 |

41.7 |

State Bank Group |

23.4 |

24.4 |

23.3 |

24.8 |

24.0 |

24.6 |

22.4 |

24.7 |

Other Public Sector Bank |

3.0 |

3.3 |

2.2 |

2.8 |

3.3 |

3.4 |

2.8 |

3.5 |

Private Sector Banks |

21.7 |

19.6 |

20.3 |

18.1 |

20.9 |

19.2 |

23.7 |

21.1 |

Old Private Sector Banks |

4.5 |

4.4 |

5.0 |

4.9 |

4.5 |

4.3 |

4.6 |

5.0 |

New Private Sector Banks |

17.2 |

15.2 |

15.3 |

13.2 |

16.4 |

14.9 |

19.1 |

16.2 |

Foreign Banks |

8.4 |

8.5 |

5.8 |

5.3 |

6.5 |

5.5 |

8.4 |

9.0 |

Scheduled Commercial Banks |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

Source: Balance sheets of respective banks. |

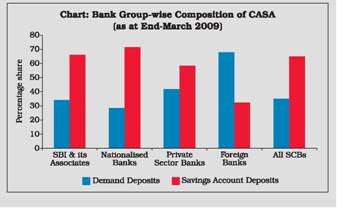

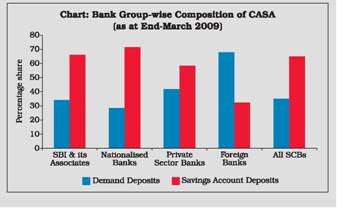

4.15 The current account and saving account

(CASA) deposits are an important source of

raising resources at a lower rate for the banks.

Recently however, the growth rate of CASA

deposits has decelerated and their share in total

deposits has also declined, posing a challenge

for the banking sector (Box IV.1).

Non-Deposit Resources

4.16 Among the non-deposit resources,

growth in borrowings by banks decelerated to 6.8 per cent as at end March 2009 from 24.5 per cent in the previous year (refer Table IV.2). While during 2007-08, Rs.30,455 crore were raised by banks through public issues in the capital market, this source of raising resources virtually dried up in 2008-09, mainly due to subdued conditions in the primary as well secondary capital markets. Banks, however, raised substantially higher resources from the private placement market (refer to section 6 for details).

International Liabilities of Banks

4.17 The international liabilities of Indian banks (in Rs.terms) declined by 1.1 per cent as at end March 2009 as against an increase of 8.4 per cent during 2007-08. The decline of international liabilities was mainly due to decline in ‘other liabilities’ like ADRs/GDRs reflecting the drying up of overseas lines of credit for banks and corporates. On the other hand, in a reversal of trend, the share of foreign currency deposits in total international liabilities, which had witnessed a continuous fall during the period 2005-08, registered a sharp rise during 2008-09. This was mainly on account of the encouraging policy initiatives by Reserve Bank like upward adjustment of the interest rate ceiling on the foreign currency deposits by non-resident Indians, as also continuing confidence of depositors in Indian economy against the backdrop of international uncertainty (Table IV.4).

Box IV.1: Trends in Current Account and Saving Accounts Deposits (CASA) of SCBs

The share of current and saving accounts (CASA) deposits significantly influence the cost structure of commercial banks. Current accounts are primarily meant for companies, public enterprises and entrepreneurs having numerous banking transactions daily. On the other hand, savings accounts are the most common operating account for individuals and others for non-commercial transactions. Banks pay no interest on current accounts and an interest rate of 3.5 per cent on savings accounts. Thus, as compared to other modes of deposits, say fixed deposits, CASA deposits represent the cheapest mode of raising money. Consequently, the higher the CASA component in total deposits of a bank, the cheaper is its cost of deposits.

In the Indian context, the CASA deposits constitute more than a third of the total deposits (Table 1).

The foreign banks have the highest share of CASA deposits in total deposits, followed by SBI and its associates, nationalised banks, and private sector banks. This pecking order almost remained robust till March 2008, though a slight change was observed subsequently. Furthermore, there was a consistent decline in the share of CASA deposits at the consolidated level for the SCBs from the March 2006 to March 2009. Share of CASA deposit component in total deposits of all bank groups declined from March 2006 to March 2009, except for private sector banks which witnessed an increase in its CASA deposits share.

Table 1: Bank Group-wise Share of CASA Deposits in Total Deposits |

(per cent) |

Bank Groups |

End-March |

| |

2006 |

2007 |

2008 |

2009 |

1 |

2 |

3 |

4 |

5 |

State Bank of India & its associates |

43.4 |

42.9 |

42.0 |

38.6 |

Nationalised Banks |

38.2 |

35.4 |

33.0 |

29.9 |

Private Banks |

30.4 |

29.8 |

32.8 |

32.9 |

Foreign Banks |

50.5 |

45.1 |

44.7 |

41.7 |

All Scheduled Commercial Banks |

38.6 |

36.6 |

35.7 |

33.2 |

The CASA deposits of SCBs recorded a growth rate of 13.4 per cent as at end March 2009 as compared to that of 20.2 per cent in the preceding year, registering a deceleration. Growth of CASA deposits recorded marginal decline in nationalised banks, steep fall in case of private sector banks and foreign banks. For SBI and its associates, growth of CASA deposits in 2008-09 remained at the same level as in the previous year.

A disaggregated analysis suggests that as at end-March 2009, the share of current deposits was higher than saving bank deposits for foreign banks, while for other bank groups, the share of saving bank deposits is higher (Chart). Further, the share of demand deposits in CASA deposits declined as at end-March 2009, compared to the preceding year for all the bank groups. In growth terms, current deposits and saving bank deposits grew by 6.7 per cent and 17.4 per cent in March 2009 as compared to 24.6 per cent and 17.8 per cent in March 2008.

The declining share of CASA deposit in total deposits and the deceleration in their growth may pose a challenge for the banking sector. This is because as mentioned above, the CASA deposits constitute the cheapest source of funds for the banking sector. In case of drying up of this source, alternate sources may be not only difficult but also prove expensive. In the context of impending revival of economic growth, with commensurate increase in the credit needs of the economy, the banking industry may require to take initiatives to attract more CASA deposits.

4.18 In line with the trend witnessed for last few years, the share of international liabilities of scheduled commercial banks in their total liabilities, continued to decline during 2008-09, mainly reflecting higher dependence of SCBs on domestic funds.

Bank Credit

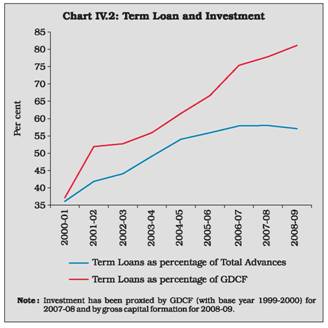

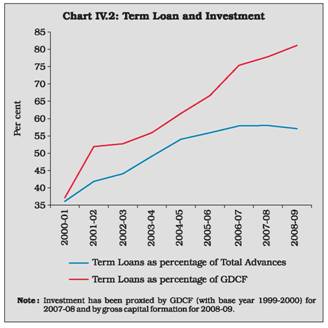

4.19 The growth rate of loans and advances of SCBs, which was as high as 33.2 per cent as at end-March 2005 has been witnessing a slowdown since then. In continuation of the trend, the growth rate of aggregate loans and advances of SCBs decelerated to 21.2 per cent as at end-March 2009 from 25.0 per cent in the previous year. Apart from cyclical factors which lead to slowdown in growth after a period of high credit growth, the deceleration was accentuated this year due to the overall slowdown in the economy in the aftermath of global financial turmoil. Notwithstanding the deceleration in growth of the term loans, their share in investment in the economy increased to 81.0 per cent in 2008-09 from 77.8 per cent in the previous year (Chart IV.2).

Table IV.4: International Liabilities of Banks - By Type

(as at end-March) |

(Amount in Rs. crore) |

Item |

2007 |

2008 |

2009 |

1 |

2 |

3 |

4 |

1. |

Deposits and Loans |

2,71,403 |

2,89,362 |

3,23,205 |

| |

|

(75.2) |

(74.0) |

(83.6) |

| |

of which: |

|

|

|

| |

a) Foreign Currency Non-Resident Bank [FCNR(B)] |

68,086 |

60,340 |

72,783 |

| |

(18.9) |

(15.4) |

(18.8) |

| |

b) Foreign currency Borrowings * |

61,470 |

77,257 |

75,398 |

| |

(17.0) |

(19.8) |

(19.5) |

| |

c) Non-resident External Rupee (NRE) A/C |

1,12,907 |

1,11,301 |

1,24,488 |

| |

(31.3) |

(28.5) |

(32.2) |

| |

d) Non-Resident Ordinary |

6,855 |

11,387 |

20,686 |

| |

(NRO) Rupee Deposits |

(1.9) |

(2.9) |

(5.4) |

2. |

Own Issues of Securities/Bonds (including IMD/RIBs) |

10,036 |

9,166 |

6,864 |

| |

|

(2.8) |

(2.3) |

(1.8) |

3. |

Other Liabilities |

79,258 |

92,329 |

56,540 |

| |

|

(22.0) |

(23.6) |

(14.6) |

| |

of which: |

|

|

|

| |

a) ADRs/GDRs |

23,515 |

25,111 |

10,357 |

| |

(6.5) |

(6.4) |

(2.7) |

| |

b) Equity of banks held by non-residents |

40,328 |

45,603 |

18,932 |

| |

(11.2) |

(11.7) |

(4.9) |

| |

c) Capital/remittable profits of foreign banks in India and other unclassified international liabilities |

15,415 |

21,615 |

27,251 |

| |

(4.3) |

(5.5) |

(7.0) |

Total International Liabilities |

3,60,698 |

3,90,857 |

3,86,608 |

* : Inter-bank borrowings in India and from abroad and external commercial borrowings of banks.

Note: Figures in parentheses are percentages to total.

Source: Locational Banking Statistics (LBS). |

Sectoral Deployment of Bank Credit

4.20 The deceleration in bank credit growth witnessed during 2007-08 continued in 2008-09 as well mainly reflective of the slowdown in real economy as also cautious approach adopted by banks against the backdrop of growing uncertainties. The data suggests that growth rate of bank’s lending to industries, personal loans and services sector witnessed a deceleration, while bank’s lending to agriculture and allied activities increased substantially during 2008-09 (Table IV.5 and Appendix Table IV.3).

Table IV.5: Sectoral Deployment of Gross Bank Credit: Flows

(Variations over the year) |

(Amount in Rs. crore) |

Sector |

2007-08 |

2008-09 |

| |

Absolute |

Per cent |

Absolute |

Per cent |

1 |

2 |

3 |

4 |

5 |

1. |

Agriculture & Allied Activities |

44,966 |

19.5 |

63,313 |

23.0 |

2. |

Industry |

1,69,536 |

24.3 |

1,87,515 |

21.6 |

3. |

Personal Loans |

54,730 |

12.1 |

54,991 |

10.8 |

| |

of which: Housing |

26,802 |

11.6 |

19,165 |

7.4 |

4. |

Services |

1,32,419 |

31.5 |

93,580 |

16.9 |

| |

Of which: |

|

|

|

|

| |

(i) |

Wholesale Trade (other than food procurement) |

5,559 |

11.1 |

11,723 |

21.0 |

| |

(ii) |

Real Estate Loans |

19,235 |

43.6 |

28,261 |

44.6 |

| |

(iii) |

Non-Banking Financial Companies |

30,094 |

61.5 |

19,835 |

25.1 |

Total Non-Food Gross Bank Credit (1 to 4) |

4,01,650 |

22.3 |

3,99,400 |

18.1 |

Of which: |

|

|

|

|

Priority Sector |

1,11,414 |

17.5 |

1,68,506 |

22.5 |

Notes: 1. Data are provisional and relate to select banks. Data also include the effects of mergers of Bharat Overseas Bank with Indian Overseas Bank, American Express Bank with Standard Chartered Bank and State Bank of Saurashtra with State Bank of India.

2. Gross bank credit data include bills rediscounted with the Reserve Bank, Exim Bank, other financial institutions and inter-bank participations.

Source: Sectoral and Industrial Deployment of Bank Credit Return (Monthly). |

4.21 Provisional data on sectoral deployment of credit available till July 17, 2009 indicate that on year-on-year basis bank credit growth to industry, services and personal loans decelerated to 20.8 per cent, 13.8 per cent and 3.4 per cent, respectively, from 30.7 per cent, 36.9 per cent and 17.0 per cent. Growth of credit to agriculture accelerated to 29.1 per cent from 14.9 per cent in the same period of the previous year. Credit to real estate and non-banking financial companies (NBFCs) remained high at 46.7 per cent (43.9 per cent in July 2008) and 31.4 per cent (53.9 per cent in July 2008).

Priority Sector Advances

4.22

The outstanding priority sector advances of public sector banks increased by 18.0 per cent during 2008-09 as compared to 17.1 per cent during 2007-08 and formed 42.5 per cent of Adjusted Net Bank Credit (ANBC)6. Similarly, in the case of private sector banks, the priority sector advances increased by 15.9 per cent during 2008-09 as compared to 13.5 per cent during the last year and formed 46.8 per cent of ANBC (Table IV.6). It is noteworthy that this increase in priority sector lending at an accelerated pace has come against the backdrop of general slowdown in the economy and a decelerating in total bank credit (Appendix Tables IV.4 to IV.7).

4.23

In contrast to the trend witnessed in the case of public sector banks and private sector banks, growth rate of lending to the priority sector by foreign banks decelerated to 10.4 per cent as at end-March 2009, as compared to 32.8 per cent last year. Even in terms of percentage to ANBC/CEOBSE, their disbursements constituted 34.3 per cent, down from 39.5 per cent last year (Table IV.7 and Appendix Table IV.8).

Table IV.6: Priority Sector Lending by Public and Private Sector Banks

(As on the last reporting Friday of March) |

(Amount in Rs. crore) |

Item |

Public Sector Banks |

Private Sector Banks |

1 |

2008 |

2009P |

2008 |

2009P |

| |

2 |

3 |

4 |

5 |

Priority Sector Advances# |

6,10,450 |

7,20,083 |

1,64,068 |

1,90,207 |

| |

(44.7) |

(42.5) |

(42.5) |

(46.8) |

of which: |

|

|

|

|

Agriculture^ |

2,49,397 |

2,98,211 |

58,566 |

76,062 |

| |

(18.3) |

(17.2) |

(17.1) |

(15.9) |

Micro and Small Enterprises |

1,51,137 |

1,91,307 |

46,912 |

47,916 |

| |

(11.1) |

(11.3) |

(13.7) |

(12.0) |

P : Provisional.

# : In terms of revised guidelines on lending to priority sector, broad categories include agriculture, small enterprises sector, retail trade, microcredit, education and housing.

^ : Indirect agriculture is reckoned up to 4.5 per cent of ANBC for

calculation of percentage.

Note: Figures in parentheses represent percentages to net bank credit/ adjusted net bank credit (ANBC)/ credit equivalent amount of off-balance sheet exposures (CEOBSE) whichever is higher. |

Table IV.7: Priority Sector Lending by Foreign Banks

(As on the last reporting Friday of March) |

(Amount in Rs. crore) |

Sector

|

2007 |

2008 |

2009P |

Amount |

Percentage to ANBC/ CEOBSE |

Amount |

Percentage to ANBC/ CEOBSE |

Amount |

Percentage to ANBC/ CEOBSE |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Priority Sector Advances # |

37,831 |

33.4 |

50,254 |

39.5 |

55,483 |

34.3 |

of which: |

|

|

|

|

|

|

Export credit |

20,711 |

18.3 |

28,954 |

22.7 |

31,511 |

19.4 |

Micro and Small Enterprises* |

11,637 |

10.3 |

15,489 |

12.2 |

18,138 |

11.2 |

P : Provisional.

# : In terms of revised guidelines on lending to priority sector, broad categories include agriculture, small enterprises sector, retail

trade, micro credit, education and housing.

* : The new guidelines on priority sector advances take into account the revised definition of small and micro enterprises as per the

Micro, Small and Medium Enterprises Development Act, 2006. |

Special Agricultural Credit Plans (SACP)7

4.24

During the year 2008-09, the public sector banks moved closer to their target under SACP as compared to the last year. The private sector banks continued to overshoot their target during 2008-09, though the growth rate of disbursements witnessed a deceleration (Table IV.8).

4.25

Public sector banks were advised to earmark 5 per cent of their ANBC to women. At the end of March 2009, the aggregate credit to women by public sector banks stood at 6.3 per cent of their net bank credit with 25 banks reaching the target. Eight public sector banks have opened 23 specialised women branches.

Table IV.8: Targets and Disbursements under Special Agricultural Credit Plans |

(Amount in Rs. crore) |

Bank Group |

2007-08 |

2008-09 P |

Target |

Disbursement |

Target |

Disbursement |

1 |

2 |

3 |

4 |

5 |

Public Sector Banks |

1,52,133 |

1,33,226 |

1,59,470 |

1,65,198 |

| |

|

(87.6) |

|

(103.6) |

Private Sector Banks |

41,427 |

47,862 |

57,353 |

63,753 |

| |

|

(115.3) |

|

(111.2) |

Note: Figures in parentheses indicate the achievement of target (per cent). |

Credit to Industry

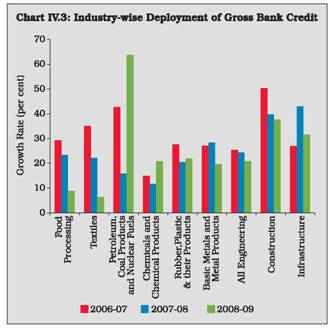

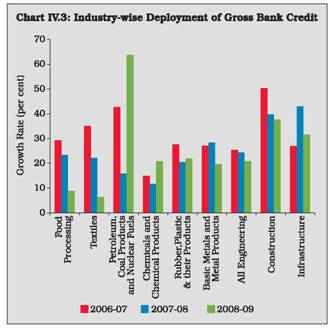

4.26 As at end-March 2009, growth rate of credit to industry (small, medium and large) decelerated for the second consecutive year to 21.6 per cent from 24.3 per cent as at end-March 2008 and 27.0 per cent as at end-March 2007. In line with last year, the industrial credit growth rate was higher than the overall credit growth rate. Therefore, the share of outstanding credit to industry in non-food gross bank credit increased to 40.5 per cent at end-March 2009 from 39.4 per cent at end-March 2008. Infrastructure, which has the largest share in credit outstanding, also accounted for the largest share of incremental bank credit to industry in absolute terms, followed by basic metals and metal products, and textiles. In terms of growth rates, credit to petroleum, coal products and nuclear fuels registered the sharpest rise in growth rate (63.8 per cent), followed by construction (37.8 per cent) and infrastructure (31.6 per cent) (Chart IV.3 and Appendix Table IV.9). It is noteworthy that notwithstanding the slowdown, credit to select sectors especially petroleum and coal products registered a sharp rise.

Credit to Micro and Small Enterprises (MSE) Sector

4.27 The total credit provided by public sector banks to MSE sector as on the last reporting Friday of March 2009 was Rs.1,91,307 crore which formed 11.3 per cent of ANBC/CEOBSE and 26.5 per cent of the total priority sector advances of these banks. Advances to manufacturing enterprises and service enterprises by public sector banks amounted to Rs.1,31,177 crore and Rs.54,449 crore respectively, constituting 68.6 per cent and 28.5 per cent respectively of the total advances to MSE sector. The total credit provided by private sector banks to MSE sector as on the last reporting Friday of March 2009 was Rs.47,916 crore, which formed 11.8 per cent of ANBC/ CEOBSE and 25.2 per cent of the total priority sector advances of these banks. Advances to manufacturing enterprises and service enterprises by private sector banks amounted to Rs.17,625 crore and Rs.26,363 crore, respectively, constituting 36.8 per cent and 55.0 per cent respectively of the total advances to MSE sector. The total credit to MSE sector by SCBs as on the last reporting Friday of March 2009 was Rs. 2,57,361 crore which formed 11.4 per cent of ANBC/CEOBSE and 26.7 per cent of the total priority sector advances.

4.28 The total credit provided by foreign banks

to MSE sector as on the last reporting Friday of

March 2009 was Rs.18,138 crore, which formed

11.2 per cent of ANBC/CEOBSE, and 32.7 per cent

of total priority sector advances of these banks.

Credit to Khadi and Village Industries Commission

4.29 A consortium of select public sector

banks was formed with the State Bank of India

as the leader to provide credit to the Khadi and

Village Industries Commission (KVIC). These

loans are provided at 1.5 per cent below the

average prime lending rates of five major banks

in the consortium. At the end of August 31,

2009, an amount of Rs.300 crore was

outstanding out of Rs.738 crore disbursed by

the consortium of banks under the scheme.

Retail Credit

4.30 The retail credit growth rate, which was

higher than 40.0 per cent in 2004-05 and 2005-

06 has witnessed a deceleration since then.

Continuing this trend, the growth rate in retail

credit by banks decelerated further to 4.0 per

cent as at end March 2009 from 17.1 per cent

last year and 29.9 per cent as at end March

2007. It also remained lower than the growth

in loans and advances of SCBs (21.2 per cent).

As a result, the share of retail credit in total

loans and advances declined to 21.3 per cent at

end-March 2009 from 24.5 per cent at end-

March 2008. Deceleration in the growth of retail

portfolio of banks was mainly on account slow down in credit for housing loans, auto loans, credit card receivables and other personal loans, though loans to consumer durables witnessed a turnaround (Table IV.9).

Table IV.9: Retail Portfolio of Banks |

(Amount in Rs. crore) |

Item

|

Outstanding as at end-March |

Percentage variation |

2008 |

2009 |

2007-08 |

2008-09 |

1 |

2 |

3 |

4 |

5 |

1. |

Housing Loans |

2,52,932 |

2,63,235 |

12.7 |

4.1 |

2. |

Consumer Durables |

4,802 |

5,431 |

-34.2 |

13.1 |

3. |

Credit Card Receivables |

27,437 |

29,941 |

49.8 |

9.1 |

4. |

Auto Loans |

87,998 |

83,915 |

6.6 |

-4.6 |

5. |

Other Personal Loans |

1,97,607 |

2,11,294 |

27.5 |

6.9 |

Total Retail Loans (1 to 5) |

5,70,776 |

5,93,815 |

17.1 |

4.0 |

| |

(24.5) |

(21.3) |

|

|

Total Loans and Advances of SCBs |

23,32,032 |

27,93,572 |

23.2 |

19.8 |

Note: Figures in parentheses represent percentage share in total loans and advances. Source: Off-site Returns (domestic, unaudited and provisional). |

Lending to Sensitive Sectors

4.31

On a y-o-y basis SCBs’ lending to sensitive sectors (capital market, real estate and commodities) showed a marginal increase as at end March 2009. However, the SCBs exposure to capital market reduced substantially during 2008-09 mainly reflecting the subdued conditions in the capital market and perception of high risk in the market. While credit to commodities declined, that to real estate market continued to increase notwithstanding the subdued real estate market (Table IV.10). This partly reflected the normalisation of risk weight to claims sought by commercial real estate to 100 per cent as also the extension of the special regulatory treatment to housing loans and commercial real estate loans under the restructuring of advances scheme. Overall exposure of SCBs to sensitive sectors as percentage of aggregate bank loans declined to 19.3 per cent from 21.0 per cent last year (Appendix Table IV.11).

4.32

Among all the bank groups, the foreign banks had the largest exposure to sensitive sectors as at end-March 2009, mainly on account of higher lending to the real estate sector. The share of sensitive sector lending in total loans and advances in case of public sector banks and new private sector banks, however, declined (Table IV.11 and Appendix Table IV.11).

Table IV.10: Lending to the Sensitive Sectors by

Scheduled Commercial Banks (As at end-March) |

(Amount in Rs. crore) |

Sector

|

2008 |

2009 |

Amount |

Per cent to Total |

Amount |

Per cent to Total |

1 |

2 |

3 |

4 |

5 |

1. |

Capital Market |

61,638 |

11.9 |

55,282 |

9.5 |

| |

|

(75.6) |

|

(-10.3) |

|

2. |

Real Estate Market |

4,56,858 |

87.8 |

5,24,227 |

90.3 |

| |

|

(22.5) |

|

(14.8) |

|

3. |

Commodities |

1,643 |

0.3 |

897 |

0.2 |

| |

|

(90.6) |

|

(-45.4) |

|

Total (1+2+3) |

5,20,140 |

100.0 |

5,80,407 |

100.0 |

| |

|

(27.2) |

|

(11.6) |

|

- : negligible.

Note: Figures in parentheses are percentage variations over the

previous year.

Source: Balance sheets of respective banks. |

Investments

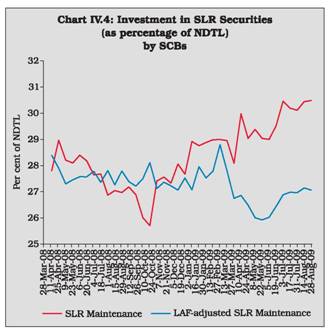

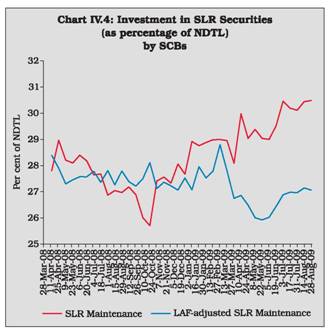

4.33 Growth rate of investments by banks decelerated to 23.1 per cent as at end March 2009. However SLR securities as percentage of NDTL increased during the year due to banks preference to park their funds in low risk and low return instruments against the backdrop of prevailing uncertainties (Table IV.12).

Table IV.11: Lending to the Sensitive Sectors - Bank Group-wise*

(As at end-March) |

(Per cent) |

Sector/Bank Group |

Public Sector Banks |

New Private Sector Banks |

Old Private Sector Banks |

Foreign Banks |

| |

2008 |

2009 |

2008 |

2009 |

2008 |

2009 |

2008 |

2009 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Capital Market# |

1.7 |

1.5 |

5.6 |

3.1 |

2.3 |

1.8 |

3.3 |

3.6 |

Real Estate @ |

15.8 |

14.8 |

28.9 |

27.6 |

16.7 |

17.3 |

23.2 |

26.8 |

Commodities |

0.0 |

0.0 |

0.0 |

0.0 |

0.7 |

0.7 |

0.1 |

0.0 |

Total Advances to Sensitive Sectors |

17.5 |

16.3 |

34.5 |

30.7 |

19.7 |

19.8 |

26.6 |

30.5 |

* : Advances to the sensitive sector as percentage to total loans and advances of the concerned bank group.

# : Exposure to the capital market is inclusive of both investments and advances.

@ : Exposure to real estate sector is inclusive of both direct and indirect lending. |

4.34 Although the banking sector held excess SLR investment at Rs.1,69,846 crore (above the prescribed minimum requirement of 24.0 per cent) at end-March 2009, several banks were operating their statutory liquidity ratio portfolio very close to the prescribed minimum level. Excess SLR investments of SCBs increased to Rs.2,88,754 crore on September 25, 2009. As a result, SLR investments in relation to NDTL increased to 30.4 per cent. The LAF adjusted SLR holding was Rs.1,82,639 crore which was 28.0 per cent of NDTL (Chart IV.4).

Table IV.12: Growth in Investment and Deposits of SCBs |

(per cent) |

Year |

SLR Investment |

SLR Investment as per cent of NDTL (end-March) |

Total Investment |

Deposits |

Loans

and advances |

1 |

2 |

3 |

4 |

5 |

6 |

2005-06 |

-2.9 |

31.3 |

-0.4 |

17.8 |

31.8 |

2006-07 |

10.3 |

27.9 |

9.7 |

24.6 |

30.6 |

2007-08 |

22.8 |

27.8 |

23.8 |

23.1 |

25.0 |

2008-09 |

20.0 |

28.1 |

23.1 |

22.4 |

21.2 |

Source: Section 42(2) returns submitted by SCBs for column no. 2 and 3; balance sheets of respective banks for column no. 4-6. |

Non-SLR investments

4.35 Growth of banks’ investments in non-SLR securities (i.e., bonds/debentures/ shares and commercial papers) decelerated to 10.5 per cent during 2008-09 as compared with an increase of 14.3 per cent during the previous year (Table IV.13). The total flow of funds from SCBs to the commercial sector comprising credit and non-SLR investments, increased by 17.5 per cent (Rs.4,21,091 crore) in 2008-09 as compared with 22.6 per cent (Rs.4,44,807 crore) in the previous year.

Table IV.13: Non-SLR Investments of Scheduled Commercial Banks |

(Amount in Rs. crore) |

Instrument |

As on

March 28,

2008 |

Per cent

to

Total |

As on

March 27,

2009 |

Per cent

to Total |

As on

Sept. 12,

2008 |

Per cent

to Total |

As on

Sept. 11,

2009 |

Per cent

to Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1. |

Commercial Paper |

13,270 |

11.5 |

20,001 |

13.9 |

12,538 |

10.8 |

12,875 |

5.1 |

2. |

Investment in shares |

26,414 |

22.9 |

27,829 |

19.4 |

27,716 |

23.9 |

27,105 |

10.7 |

| |

of which: |

|

|

|

|

|

|

|

|

| |

a) |

Public sector undertakings |

3,025 |

2.6 |

2,769 |

1.9 |

3,497 |

3.0 |

2,345 |

0.9 |

| |

b) |

Private corporate sector |

23,389 |

20.3 |

25,060 |

17.5 |

24,219 |

20.9 |

24,761 |

9.7 |

3. |

Investments in bonds/debentures |

56,635 |

49.2 |

58,587 |

40.8 |

53,437 |

46.2 |

57,545 |

22.6 |

| |

of which: |

|

|

|

|

|

|

|

|

| |

a) |

Public sector undertakings |

27,935 |

24.3 |

25,456 |

17.7 |

25,548 |

22.1 |

22,312 |

8.8 |

| |

b) |

Private corporate sector |

28,700 |

24.9 |

33,131 |

23.1 |

27,889 |

24.1 |

35,233 |

13.8 |

4. |

Units of MFs |

18,824 |

16.3 |

37,035 |

25.8 |

22,042 |

19.0 |

1,56,963 |

61.7 |

Total Non-SLR Investment (1+2+3+4) |

1,15,143 |

100.0 |

1,43,452 |

100.0 |

1,15,733 |

100.0 |

2,54,488 |

100.0 |

Source: Section 42(2) returns submitted by SCBs. |

4.36 The composition of non-SLR investments

of banks has undergone a change in recent

years, notably since 2004-05. The share of

banks’ investment in shares, commercial papers

and units of mutual funds has witnessed a

growth, while the share of investment in bonds/

debentures has been declining, partly reflecting

the changing risk appetite of the commercial

banks in India. This trend also continued in

2008-09, except for banks’ investment in

shares, mainly due to the subdued conditions

in the Indian stock markets (Table IV.14).

International Assets of Banks

4.37 The growth rate of international assets of

SCBs in India decelerated to 3.0 per cent as at end-March 2009, from 9.7 per cent last year. In a reversal of trend, the ‘Nostro balances’ which had registered a sharp decline last year, revived this year. While holdings of debt securities continued to decline, the foreign currency loans to residents also declined in contrast to the sharp rise witnessed last year (Table IV.15).

Table IV.14: Composition of Non-SLR Investments |

(Per cent) |

Instrument |

2002-03 |

2003-04 |

2004-05 |

2005-06 |

2006-07 |

2007-08 |

2008-09 |

As on Sept. 12,

2008 |

As on Sept. 11,

2009 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Commercial Paper |

3.1 |

2.7 |

2.7 |

5.4 |

9.4 |

11.5 |

13.9 |

10.8 |

5.1 |

Bonds/Debentures |

84.2 |

81.5 |

79.2 |

68.9 |

59.0 |

49.2 |

40.8 |

46.2 |

22.6 |

Shares |

7.9 |

7.3 |

9.4 |

14.2 |

19.3 |

22.9 |

19.4 |

23.9 |

10.7 |

Units of Mutual Funds |

4.9 |

8.5 |

8.7 |

11.5 |

12.3 |

16.3 |

25.8 |

19.0 |

61.7 |

Source: Section 42(2) returns submitted by SCBs. |

4.38 The consolidated international claims of banks, based on immediate country risk, showed a higher growth of 32.6 per cent as at end March 2009 as compared to 13.5 per cent during last year. The share of short-term claims (with residual maturity less than one year) in the consolidated international claims declined as at end March 2009, with corresponding increase in long-term claims. Sector-wise disaggregation of consolidated international claims of banks indicated revival in the share of banks (45.5 per cent as compared with 36.8 per cent last year) and a corresponding decline in the share of non-bank private sector (Table IV.16).

Table IV.15: International Assets of Banks -By Type |

Asset

|

End-March |

2008 |

2009 |

1 |

2 |

3 |

International Assets (1+2+3) |

2,22,711 |

2,29,356 |

1. |

Loans and Deposits |

2,12,126 |

2,19,547 |

| |

|

(95.2) |

(95.7) |

| |

of which : |

|

|

| |

a) |

Loans to Non-Residents* |

8,565 |

8,341 |

| |

|

|

(3.8) |

(3.6) |

| |

b) |

Foreign Currency Loans to |

108,440 |

99,973 |

| |

|

Residents** |

(48.7) |

(43.6) |

| |

c) |

Outstanding Export Bills |

49,011 |

44,564 |

| |

|

drawn on Non-Residents by Residents |

(22.0) |

(19.4) |

| |

d) |

Nostro Balances@ |

45,752 |

66,496 |

| |

|

|

(20.5) |

(29.0) |

2. |

Holdings of Debt Securities |

334 |

76 |

| |

|

(0.1) |

(0.0) |

3. |

Other Assets @@ |

10,250 |

9,733 |

| |

|

(4.6) |

(4.2) |

* : Includes rupee loans and foreign currency (FC) loans out of

non-residents (NR) deposits.

** : Includes loans out of FCNR (B) deposits, PCFC's, FC lending

to and FC deposits with banks in India etc.

@ : Includes placements made abroad and balances in term

deposits with non-resident banks.

@@ : Capital supplied to and receivable profits from foreign

branches/subsidiaries of Indian banks and other unclassified

international assets.

Note: Figures in parentheses are percentages to total.

Source: Locational Banking Statistics. |

4.39 The country-wise consolidated international claims of banks, based on immediate country risk, showed a mixed trend. As at end March 2009, while the shares of claims on the US, the UK, Hong Kong and United Arab Emirates increased, that of Germany declined. The claims on the US, the UK, Singapore and Hong Kong collectively accounted for over 50 per cent of total international claims (Table IV.17).

Table IV.16: Classification of Consolidated International Claims of Banks -

By Maturity and Sector (As at end-March) |

(Amount in Rs. crore) |

Residual Maturity/Sector |

2008 |

2009 |

1 |

2 |

3 |

Total Consolidated International Claims |

1,69,481 |

2,24,665 |

a) |

Maturity-wise |

|

|

| |

1) |

Short-term (residual maturity |

1,17,279 |

1,40,289 |

| |

|

less than one year) |

(69.2) |

(62.4) |

| |

2) |

Long-term (residual maturity |

50,232 |

79,828 |

| |

|

of one year and above) |

(29.6) |

(35.5) |

| |

3) |

Unallocated |

1,970 |

4,548 |

| |

|

|

(1.2) |

(2.0) |

b) |

Sector-wise |

|

|

| |

1) |

Bank |

62,394 |

1,02,223 |

| |

|

|

(36.8) |

(45.5) |

| |

2) |

Non-Bank Public |

748 |

656 |

| |

|

|

(0.4) |

(0.3) |

| |

3) |

Non-Bank Private |

1,06,339 |

1,21,786 |

| |

|

|

(62.7) |

(54.2) |

Note: 1. Figures in brackets are percentages to total.

2. Unallocated residual maturity comprises maturity not

applicable (e.g., for equities) and maturity information

not available from reporting bank branches.

3. Bank sector includes official monetary institutions (e.g.,

IFC, ECB, etc.) and central banks

4. Prior to the quarter ended March 2005, non-bank public

sector comprised of companies/ institutions other than

banks in which shareholding of state/central governments

was at least 51 per cent, including State/Central

Government and its departments. From March 2005

quarter, 'Non-bank public' sector comprises only State/

Central Government and its departments and,

accordingly, all other entities excluding banks are

classified under 'Non-bank private’ sector.

Source: Based on Consolidated Banking Statistics (CBS) Statements - Immediate country risk basis. |

Quarterly Trends – Commercial Banking Survey8

4.40 A quarterly analysis of developments in scheduled commercial banks revealed several interesting features (Table IV.18, Appendix Table IV.12). On a y-o-y basis, mobilisation of deposits by banks was lower during the first two quarters of 2008-09, but the mobilisation picked up during the next two quarters and was higher than the earlier year. On the other hand, credit expansion exhibited a mixed pattern. On a y-o-y basis bank credit to commercial sector increased during the first two quarters of 2008-09 and reached a peak in October 2008. Sustained moderation in bank credit was witnessed in the subsequent quarters of 2008-09. This gave banks space to increase their investment in Government securities.

Table IV.17: Consolidated International Claims

of Banks on Countries other than India (As at end-March) |

(Amount in Rs. crore) |

Itmes |

2008 |

2009 |

1 |

2 |

3 |

Total Consolidated International Claims |

1,69,481 |

2,24,665 |

of which: |

|

|

a) |

United States of America |

35,374 |

55,734 |

| |

|

(20.9) |

(24.8) |

b) |

United Kingdom |

21,899 |

29,753 |

| |

|

(12.9) |

(13.2) |

c) |

Singapore |

11,918 |

15,762 |

| |

|

(7.0) |

(7.0) |

d) |

Germany |

10,607 |

9,869 |

| |

|

(6.3) |

(4.4) |

e) |

Hong Kong |

9,792 |

19,031 |

| |

|

(5.8) |

(8.5) |

f) |

United Arab Emirates |

7,990 |

11,309 |

| |

|

(4.7) |

(5.0) |

Note: Figures in the parentheses are percentage shares in total

international claims.

Source: Consolidated Banking Statistics - Immediate Country Risk Basis. |

Developments during 2009-10

4.41 During 2009-10 so far (up to September

25, 2009), the moderation in the flow of credit

from SCBs continued, reflecting the slowdown

in economic activity. This moderation was

particularly evident in the case of private and

foreign banks.

Credit-Deposit Ratio

4.42 The incremental credit-deposit (C-D)

ratio and investment-deposit (I-D) ratio of SCBs

mirrored the banks’ behaviour in respect of investments and credit. During the high credit growth phase (2002-03 to 2006-07) the two series drifted away from each other as C-D ratio rose sharply and as a consequence the I-D ratio declined, reflecting banks preference for lending over investment. In fact, banks liquidated some investments in 2005-06 leading to a sharp decline in incremental I-D ratio. Subsequently, however, as the cyclical factors lead to cooling off of the credit growth rate, the trend in incremental C-D ratio and I-D ratio reversed. During the post-September 2008 period, the incremental C-D ratio declined sharply reflecting the slowdown in credit growth. The slowdown in credit growth is reflective of companies deferring their investments against the backdrop of widespread uncertainty. As a consequence, the incremental I-D ratio rose, notwithstanding the softening of interest rates (Chart IV.5).

Table IV.18: Operations of Scheduled Commercial Banks |

(Amount in Rs. crore) |

Item |

Outsta

nding

as on

March

27, 2009 |

Variation |

2007-08 |

2008-09 |

2009-10 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

Components |

|

|

|

|

|

|

|

|

|

|

|

1. |

Aggregate Deposits of Residents (a+b) |

37,66,842 |

58,993 |

2,08,191 |

67,544 |

2,60,803 |

53,155 |

1,83,287 |

1,11,471 |

2,78,925 |

1,30,600 |

1,54,127 |

| |

a) |

Demand Deposits |

5,23,085 |

-41,898 |

57,771 |

-7,894 |

86,600 |

-77,630 |

52,219 |

-60,449 |

84,635 |

-32,922 |

61,410 |

| |

b) |

Time Deposits of Residents |

32,43,757 |

1,00,890 |

1,50,420 |

75,439 |

1,74,204 |

1,30,785 |

1,31,068 |

1,71,920 |

1,94,290 |

1,63,522 |

92,717 |

2. |

Call/Term Funding from Financial Institutions |

1,13,936 |

-2,984 |

5,756 |

7,441 |

10,455 |

-1,116 |

7,015 |

-685 |

2,217 |

-15,786 |

-3,561 |

Sources |

|

|

|

|

|

|

|

|

|

|

|

1. |

Credit to the Government |

11,55,786 |

50,067 |

68,965 |

27,436 |

36,136 |

33,245 |

-19,641 |

99,566 |

83,955 |

1,26,014 |

75,338 |

2. |

Credit to the Commercial Sector (a to d) |

29,95,361 |

-13,527 |

1,34,775 |

94,969 |

2,42,980 |

40,471 |

1,30,938 |

1,25,746 |

1,49,109 |

62,935 |

60,661 |

| |

a. |

Bank Credit |

27,75,549 |

-36,348 |

1,42,638 |

87,012 |

2,37,422 |

31,325 |

1,57,787 |

92,708 |

1,31,815 |

-7,563 |

1,05,169 |

| |

|

i. Food Credit |

46,211 |

-2,564 |

-6,948 |

3,259 |

4,131 |

5,748 |

-4,971 |

6,934 |

-5,899 |

14,450 |

-18,244 |

| |

|

ii. Non-food Credit |

27,29,338 |

-33,784 |

1,49,586 |

83,752 |

2,33,291 |

25,577 |

1,62,758 |

85,774 |

1,37,714 |

-22,014 |

1,23,413 |

| |

b. |

Net Credit to Primary Dealers |

1,671 |

-282 |

780 |

1,370 |

-1,146 |

-797 |

-1,174 |

1,520 |

-1,400 |

-508 |

3,753 |

| |

c. |

Investments in Other Approved Securities |

10,624 |

-384 |

-1,010 |

-654 |

-357 |

-194 |

-567 |

-1,360 |

-309 |

-96 |

6,221 |

| |

d. |

Other Investments (in non-SLR Securities) |

2,07,517 |

23,487 |

-7,634 |

7,241 |

7,061 |

10,136 |

-25,109 |

32,877 |

19,003 |

71,967 |

-54,482 |

3. |

Net Foreign Currency Assets |

|

|

|

|

|

|

|

|

|

|

|

| |

Of commercial Banks (a-b-c) |

-53,359 |

2,817 |

-16,584 |

974 |

-16,793 |

-19,924 |

-5,564 |

33,708 |

8,618 |

27,733 |

-26,244 |

| |

a. |

Foreign Currency Assets |

55,312 |

-8,312 |

-9,934 |

-781 |

-8,537 |

-8,383 |

2,934 |

24,151 |

5,421 |

18,428 |

-29,440 |

| |

b. |

Non-resident Foreign Currency |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Repatriable Fixed Deposits |

67,268 |

-4,202 |

-1,181 |

-3,490 |

-1,653 |

2,048 |

3,898 |

-2,323 |

6,710 |

755 |

416 |

| |

c. |

Overseas Foreign Currency Borrowings |

41,404 |

-6,928 |

7,830 |

1,734 |

9,909 |

9,494 |

4,600 |

-7,234 |

-9,907 |

-10,060 |

-3,611 |

4. |

Net Bank Reserves |

2,46,748 |

6,468 |

76,009 |

-22,695 |

21,268 |

28,526 |

35,997 |

-1,16,193 |

27,252 |

-17,189 |

20,787 |

5. |

Capital Account |

3,32,444 |

26,813 |

24,184 |

6,887 |

11,937 |

47,618 |

4,932 |

3,043 |

4,230 |

41,256 |

2,584 |

Note: 1. Data are provisional.

2. Data relate to last reporting Friday of each quarter. |

4.43 The C-D ratio and I-D ratio, based on the outstanding amount, have remained more or less stable for the last three years. Thus the C-D ratio, which was 74.6 per cent as at end March 2008 declined marginally to 73.9 per cent as at end March 2009, while the I-D ratio increased marginally from 35.5 per cent to 35.7 per cent in the same period.

4.44

Among bank-groups, the C-D ratio (in terms of outstanding amount) of new private sector banks was the highest at end-March 2009, followed by foreign banks and public sector banks (Chart IV.6). Old private sector banks continued to have the lowest C-D ratio.

4.45

The C-D ratio of public sector banks, barring IDBI Bank Ltd., remained range bound, in line with the pattern witnessed last year. This range was between 64.9 per cent (United Bank of India) and 77.8 per cent (State Bank of Travancore and State Bank of Mysore). The C-D ratio of IDBI Bank Ltd., however, was much higher at 92.0 per cent. In the case of old private sector banks, the C-D ratio ranged between 51.2 per cent (Bank of Rajasthan) and 71.3 per cent (Lakshmi Vilas Bank). The C-D ratio of new private sector banks ranged between 69.2 per cent (HDFC Bank) and 106.3 per cent (Kotak Mahindra Bank). In the case of top five foreign banks, the C-D ratio ranged between 55.2 per cent (Hongkong and Shanghai Banking Corporation) to 104.4 (ABN Amro Bank). Of the 30 foreign banks, the C-D ratio of as many as 9 banks was over 100 per cent. This suggests that the foreign banks have been much more aggressive in their lending, followed by the new private sector banks, while the public sector banks have been maintaining a mediocre path (Appendix Table IV.13).

Maturity Profile of Assets and Liabilities of Banks

4.46 The broad pattern of the maturity structure of private sector banks suggests a shift from short term maturity (up to one year maturity) to medium term maturity (1-3 years and 3-5 years). This is indicative of the hardening of term interest rates in the first half of 2008-09 and augurs well from the point of view of financing long term projects. This pattern is also evident in case of borrowings where preference has shifted from the short term maturity to long- term maturity bucket for private sector and foreign banks. In contrast the investment pattern suggests a shift from medium term (1-3 years) to up to 1 year maturity buckets for public sector, old private sector and foreign banks, suggesting banks’ perception that the interest rates may harden in the near future. As at end-March 2009, the foreign banks had majority share of their deposits, borrowings, loans and advances as well as investments, in short term maturity buckets. In contrast however, the public sector banks had short term deposits, borrowings and loans and advances but long term investments (Table IV.19).

3. Off-Balance Sheet Operations

4.47

The off-balance sheet operations of the SCBs, which include forward exchange contracts, guarantees, acceptances, endorsements etc., had increased manifold in the recent years. The year 2008-09 however, marked an exception to this trend with the SCBs reducing their OBS exposures by 26.4 per cent as compared to last year (Chart IV.7). This partly reflected the strengthening of prudential regulations effected by the Reserve Bank on OBS exposures.

Table IV.19: Bank Group-wise Maturity Profile of Select Liabilities /Assets

(As at end-March) |

(Per cent to Total) |

Assets/Liabilities

|

Public Sector Banks |

Old Private Sector Banks |

New Private Sector Banks |

Foreign Banks |

2008 |

2009 |

2008 |

2009 |

2008 |

2009 |

2008 |

2009 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

I. |

Deposits |

|

|

|

|

|

|

|

|

| |

a) |

Up to 1 year |

44.1 |

45.7 |

50.9 |

48.3 |

57.1 |

53.1 |

64.7 |

63.8 |

| |

b) |

Over 1 year and up to 3 years |

26.5 |

27.3 |

35.5 |

38.4 |

34.3 |

35.6 |

33.3 |

23.1 |

| |

c) |

Over 3 years and up to 5 years |

10.3 |

8.4 |

7.7 |

8.4 |

2.5 |

3.7 |

0.4 |

9.6 |

| |

d) |

Over 5 years |

19.1 |

18.7 |

6.0 |

4.9 |

6.0 |

7.6 |

1.6 |

3.5 |

II. |

Borrowings |

|

|

|

|

|

|

|

|

| |

a) |

Up to 1 year |

69.6 |

70.8 |

79.1 |

76.7 |

49.2 |

44.3 |

90.9 |

84.8 |

| |

b) |

Over 1 year and up to 3 years |

16.5 |

23.9 |

5.4 |

7.8 |

25.4 |

30.8 |

8.4 |

13.9 |

| |

c) |

Over 3 years and up to 5 years |

6.0 |

3.6 |

3.0 |

5.7 |

21.9 |

19.3 |

0.3 |

1.3 |

| |

d) |

Over 5 years |

7.9 |

1.7 |

12.5 |

9.8 |

3.5 |

5.5 |

0.3 |

0.0 |

III. |

Loans and Advances |

|

|

|

|

|

|

|

|

| |

a) |

Up to 1 year |

38.0 |

39.1 |

40.4 |

40.8 |

33.6 |

32.4 |

49.6 |

55.8 |

| |

b) |

Over 1 year and up to 3 years |

33.3 |

33.5 |

36.1 |

35.5 |

34.2 |

35.5 |

34.4 |

24.1 |

| |

c) |

Over 3 years and up to 5 years |

11.2 |

9.9 |

11.5 |

12.3 |

12.2 |

14.0 |

6.6 |

10.1 |

| |

d) |

Over 5 years |

17.6 |

17.5 |

12.0 |

11.4 |

19.9 |

18.1 |

9.4 |

10.0 |

IV. |

Investments |

|

|

|

|

|

|

|

|

| |

a) |

Up to 1 year |

19.0 |

22.8 |

21.3 |

37.2 |

55.8 |

46.3 |

62.2 |

69.0 |

| |

b) |

Over 1 year and up to 3 years |

19.0 |

14.9 |

16.5 |

7.1 |

21.1 |

25.0 |

25.9 |

18.8 |

| |

c) |

Over 3 years and up to 5 years |

13.8 |

15.5 |

12.2 |

11.1 |

5.4 |

5.5 |

4.1 |

6.0 |

| |

d) |

Over 5 years |

48.2 |

46.8 |

50.0 |

44.7 |

17.6 |

23.2 |

7.8 |

6.2 |

4.48 The decline in OBS was especially evident in the case of foreign banks, whose contingent liabilities continue to be highest both in absolute terms as well as in terms of

percentage to total liabilities. Apart from the foreign banks, the State Bank Group and the new private sector banks also witnessed a decline in their OBS (Appendix Table IV.14).

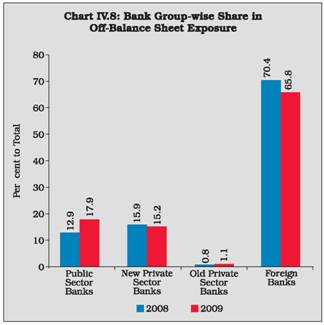

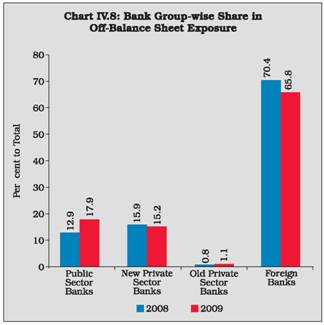

4.49 The foreign banks continued to have largest share of off-balance sheet exposures of the SCBs (65.8 per cent), followed by public sector banks (share of 17.9 per cent) and new private sector banks (15.2 per cent) (Chart IV.8).

4. Financial Performance of Scheduled Commercial Banks

4.50 The balance sheets of SCBs in India

remained robust against the backdrop of global

financial crisis and its effects on India economy

through various transmission channels. However,

the Indian banking sector was not completely

insulated from the effects of the slowdown of

the Indian economy as evident from the financial

performance of SCBs. The growth rates of

income as well as the expenditure of SCBs

decelerated, leading to deceleration in growth

of net profits. This deceleration in growth of profit

was due to the rising cost of deposits and

borrowing but declining return on investments.

The efficiency parameters like RoA and RoE,

however, increased during the year. In a nutshell,

as highlighted by the Report on Financial Sector

Assessment (2009), ‘The Indian economy has

withstood the shocks of the global meltdown well

and none of the key financial parameters point

to any discernable vulnerability’.

Interest Rate Scenario

4.51 Deposit and lending rates of SCBs across

various bank groups showed a generally

upward movement during the first half of the year

2008-09. Taking a cue from the Reserve Bank

monetary policy announcements, the SCBs

reduced their deposit and lending rates in the

second half of 2008-09. In the first half of

2009-10, (upto September 11, 2009), the

deposit and lending rates of SCBs have declined

further (Table IV.20 and Chart IV.9).

Cost of Deposits and Return on Advances

4.52 Notwithstanding the softening of the

deposit rates, especially in the second half of

2008-09, the cost of deposits, cost of borrowings

and cost of funds of SCBs increased as

compared with that during the previous year.

At the same time the return on investment

decreased. This was mainly on account of

several structural rigidities in the interest rates as spelt out in the Annual Monetary Policy Document, 2009-10. These trends in cost and return affected the spread of banks adversely. This trend was evident in case of almost all the bank groups (Table IV.21).

Table IV.20: Movements in Deposit and Lending Interest Rates |

(Per cent) |

Interest Rates |

March 2007 |

March 2008 |

October 2008 |

March 2009 |

June 2009 |

Sept. 2009** |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Term Deposit Rates

|

|

|

|

|

|

|

Public Sector Banks |

|

|

|

|

|

|

a) |

Up to 1 year |

2.75-8.75 |

2.75-8.50 |

2.75-10.25 |

2.75-8.25 |

1.00-7.00 |

1.00-6.75 |

b) |

1 year up to 3 years |

7.25-9.50 |

8.25-9.25 |

9.50-10.75 |

8.00-9.25 |

6.50-8.00 |

6.50-7.50 |

c) |

Over 3 years |

7.50-9.50 |

8.00-9.00 |

8.50-9.75 |

7.50-9.00 |

6.75-8.50 |

6.50-8.00 |

Private Sector Banks |

|

|

|

|

|

|

a) |

Up to 1 year |

3.00-9.00 |

2.50-9.25 |

3.00-10.50 |

3.00-8.75 |

2.00-7.50 |

2.00-7.00 |

b) |

1 year up to 3 years |

6.75-9.75 |

7.25-9.25 |

9.00-11.00 |

7.50-10.25 |

6.00-8.75 |

5.25-8.00 |

c) |

Over 3 years |

7.75-9.60 |

7.25-9.75 |

8.25-11.00 |

7.50-9.75 |

6.00-9.00 |

5.75-8.25 |

Foreign Banks |

|

|

|

|

|

|

a) |

Up to 1 year |

3.00-9.50 |

2.25-9.25 |

3.50-10.75 |

2.50-8.50 |

1.80-8.00 |

1.25-8.00 |

b) |

1 year up to 3 years |

3.50-9.50 |

3.50-9.75 |

3.50-11.25 |

2.50-9.50 |

2.25-8.50 |

2.25-8.50 |

c) |

Over 3 years |

4.05-9.50 |

3.60-9.50 |

3.60-11.00 |

2.50-10.00 |

2.25-9.50 |

2.25-8.50 |

BPLR |

|

|

|

|

|

|

Public Sector Banks |

12.25-12.75 |

12.25-13.50 |

13.75-14.75 |

11.50-14.00 |

11.00-13.50 |

11.00-13.50 |

Private Sector Banks |

12.00-16.50 |

13.00-16.50 |

13.75-17.75 |

12.75-16.75 |

12.50-16.75 |

12.50-16.70 |

Foreign Banks |

10.00-15.50 |

10.00-15.50 |

10.00-17.00 |

10.00-17.00 |

10.50-16.00 |

10.50-16.00 |

Actual Lending Rates* |

|

|

|

|

|

|

Public Sector Banks |

4.00-17.00 |

4.00-17.75 |

- |

3.50-18.00 |

3.50-17.50 |

- |

Private Sector Banks |

3.15-25.50 |

4.00-24.00 |

- |

4.75-26.00 |

4.10-26.00 |

- |

Foreign Banks |

5.00-26.50 |

5.00-28.00 |

- |

5.00-25.50 |

2.76-25.50 |

- |

– : Not Available.

* : Interest rate on non-export demand and term loans above Rs.2 lakh excluding lending rates at the extreme five per cent on both

sides.

** : As on September 11, 2009

Source: Special Fortnightly (VI-B, VI-AB) / Quarterly (VI-AC) Returns received from banks. |

Income

4.53 Growth of income of SCBs during 2008-09 decelerated to 25.7 per cent from 34.3 per cent in the previous year, but was higher than the growth rate of 24.4 per cent in 2006-07. The income to assets ratio improved marginally to 8.8 per cent from 8.5 per cent last year. Reflecting the lower lending rates, growth of interest income of SCBs as at end March 2009 decelerated to 26.0 per cent as compared with 33.2 per cent in the previous year (Table IV.22).

Table IV.21: Cost of Funds and Returns on Funds - Bank Group-wise |

(Per cent) |

Indicator |

Public Sector Banks |

Old Private Sector Banks |

New Private Sector Banks |

Foreign Banks |

Scheduled Commercial Banks |

| |

2007-08 |

2008-09 |

2007-08 |

2008-09 |

2007-08 |

2008-09 |

2007-08 |

2008-09 |

2007-08 |

2008-09 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

1. |

Cost of Deposits |

5.4 |

5.6 |

5.7 |

6.2 |

5.9 |

6.4 |

3.8 |

4.3 |

5.4 |

5.7 |

2. |

Cost of Borrowings |

3.5 |

4.0 |

4.6 |

5.0 |

3.1 |

3.7 |

4.5 |

3.9 |

3.6 |

3.9 |

3. |

Cost of Funds |

5.3 |

5.5 |

5.7 |

6.1 |

5.5 |

6.0 |

3.9 |

4.2 |

5.3 |

5.5 |

4. |

Return on Advances |

8.6 |

9.1 |

9.6 |

11.0 |

10.0 |

10.8 |

9.8 |