Order Books, Inventories and Capacity Utilisation Survey on the Manufacturing sector for Q3:2023-24 - RBI - Reserve Bank of India

Order Books, Inventories and Capacity Utilisation Survey on the Manufacturing sector for Q3:2023-24

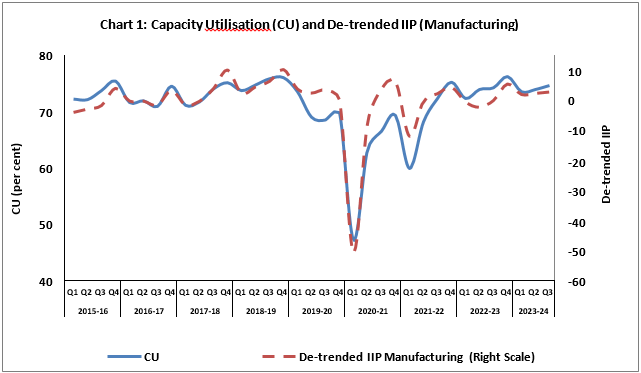

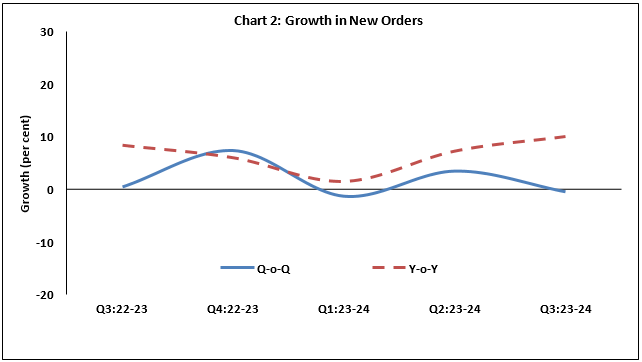

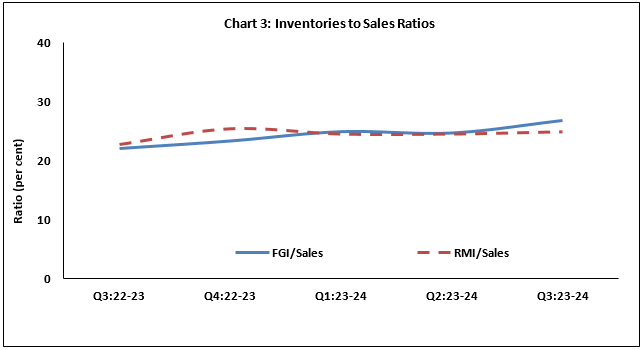

| Today, the Reserve Bank released the results of its 64th round of the quarterly order books, inventories and capacity utilisation survey (OBICUS), which was conducted during Q4:2023-24 and covered 813 manufacturing companies. The survey1 provides a snapshot of demand conditions in India’s manufacturing sector during October-December 2023. Highlights:

Note-Please see the excel file for time series data. ANNEX 1: Data Tables

*: Index of Industrial Production (Base: 2011-12)

#: Growth rates are calculated using three rounds common set of companies, namely, companies responded in the current quarter, one quarter ago and the same quarter a year ago.

##: Weighted average of industry level ratios using GVA as weights

Note: The computations of order book growths and inventory to sales ratios are based on methodology given in the RBI press release dated October 8, 2021 (link: https://website.rbi.org.in/en/web/rbi/-/publications/obicus-survey-on-the-manufacturing-sector-for-q1-2021-22-20650) and not on the basis of averages given in the above tables. Please also see footnote 2 on direct estimation of RMI since 53rd round of the survey. [1] The survey responses are voluntary, and the results reflect the views of the respondents, which are not necessarily shared by the Reserve Bank. Results of the previous survey round were released on the Bank’s website on February 08, 2024. [2] So far, the survey estimates of raw materials inventory (including stores and spares, loose tools, stock-in- trade and other inventories) were arrived at by netting out finished goods inventory and work-in-progress inventory from total inventory. Since the 53rd round of the survey (i.e., Q4:2020−21), however, direct data on raw material inventory (excluding stores and spares, loose tools, stock-in-trade and other inventories) are also being collected from survey respondents, in parallel. Estimates of raw materials inventory based on the additional reporting are presented here.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||