Composition and Ownership Pattern of Deposits with Scheduled Commercial Banks: March 2008* This article presents an analysis of composition and ownership pattern of outstanding deposits with Scheduled Commercial Banks (including Regional Rural Banks) as at the end of March 2008. The data on ownership of deposits are collected from a sample of branches of Scheduled Commercial Banks, under the reporting system of the annual Basic Statistical Return (BSR)-4. The BSR-4 return captures data on outstanding deposits as on March 31, according to type of deposits (viz., Current, Savings and Term deposits) classified by broad institutional sectors, (viz., 'Household', 'Government', 'Private Corporate (Non-Financial)', 'Financial' and 'Foreign' sectors) of the economy, which own the deposits. The ownership pattern of estimated deposits is analysed according to the Population groups, States/Union Territories and Bank groups. The article also provides comparative position of composition and ownership pattern of bank deposits in March 2007. The major highlights are:

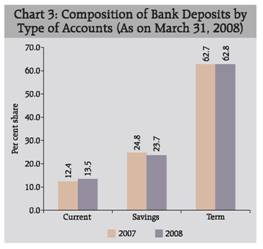

- The current, savings and term deposits accounted for 13.5 per cent, 23.7 per cent and 62.8 per cent, respectively in total deposits in March 2008. The share of current deposits in total deposits, as on March 31, 2008, registered 1.1 percentage points increase over the position a year ago, with corresponding decrease in the share of savings deposits. The share of term deposits remained almost same (at 62.7 per cent) in both the years.

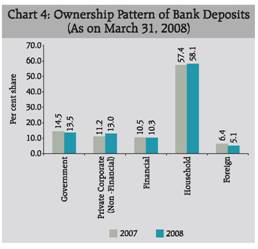

- ‘Household’ sector with 58.1 per cent share in total deposits was the largest holder of outstanding deposits as on March 31, 2008; its share was 57.4 per cent a year ago. As at end March 2008, the share of ‘Private Corporate (Non-Financial)’ sector in total deposits recorded a rise, while those of ‘Government’, ‘Financial’ and ‘Foreign’ sectors depicted a decline, compared to the position as at end March 2007.

- Term deposits contributed 63.1 per cent to incremental deposits during 2007-08 (72.1 per cent in 2006-07), while 18.3 per cent of incremental deposits were accounted for by current deposits (9.4 per cent in 2006-07).

- The share of current deposits in total deposits recorded an increase in case of ‘Private Corporate (Non-Financial)’ and ‘Financial’ sectors while it registered a decline in case of ‘Household’ sector. On the other hand, the relative share of term deposits in total deposits increased in the case of ‘Private Corporate (Non-Financial)’ and ‘Household’ sectors, and declined in the case of ‘Government’, ‘ Financial’ and ‘Foreign’ sectors.

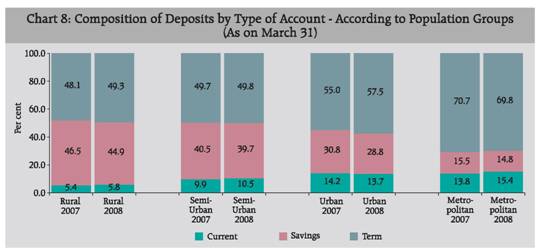

- The share of term deposits in total deposits of metropolitan areas stood at 69.8 per cent as on March 31, 2008 marginally lower compared to 70.7 per cent in the preceding year. Saving deposits accounted for 44.9 per cent and 39.7 per cent of the total deposits of rural and semi-urban areas, while their share was 14.8 per cent in metropolitan areas.

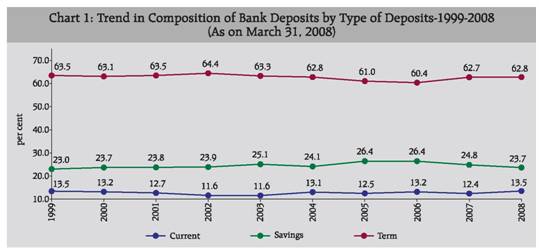

Introduction The sample survey on composition and ownership pattern of bank deposits with Scheduled Commercial Banks (SCBs), including Regional Rural Banks (RRBs), is conducted by the Reserve Bank of India under the system of Basic Statistical Returns (BSR) through the BSR-4 return on an annual basis and the results are published in the Reserve Bank of India Bulletin. The results of the survey as on March 31, 2008 are discussed in this article@. The survey schedule was designed to capture branch level data on ownership of deposits, classified according to broad institutional sectors and sub-sectors for each type of deposits, viz., current, savings and term, including inter-bank deposits. Out of 74,326 branches of SCBs as on March 31, 2008 a sample of 13,512 branches was selected as per the sampling design explained below. Of the 13,512 bank branches selected, valid filled-in schedules were received from 13,046 branches resulting in a response rate of 96.6 per cent. Stratified sampling design was used for selection of branches of banks for this survey. The branch-wise data on outstanding aggregate deposits as on March 31, 2008, based on quarterly BSR-7 return, formed the base for construction of the frame. All the branches of the SCBs in the country were first stratified into basic strata based on State/Union Territory, population group of the centre where bank branch was located, and bank group. The population groups are (i) rural, (ii) semi-urban, (iii) urban and (iv) metropolitan. Five bank groups, viz., (i) State Bank of India and its Associates; (ii) Nationalised Banks; (iii) Regional Rural Banks, (iv) Other Indian Scheduled Commercial Banks or Indian Private Sector Banks and (v) Foreign Banks, were considered for the purpose. Thereafter, each stratum was sub-stratified into 3 size classes of deposits (up to Rs. 25 crore, Rs. 25 crore to Rs. 100 crore and Rs. 100 crore and above). Thus, 1083 ultimate strata were formed. All branches having deposits of Rs. 100 crore and above were included in the sample. A sample of 15 per cent branches was selected from each of the ‘Rs. 25 crore to Rs. 100 crore’ strata, using Simple Random Sampling (SRS) technique. Similarly, 10 per cent of the branches were selected from ‘up to Rs. 25 crore’ strata. The minimum sample size for each stratum was fixed as 3 and if a stratum had fewer than 3 branches, then all the branches of such stratum were included in the sample. Accordingly, the selected sample consisted of 13,512 branches of 171 SCBs. The aggregate deposits of the branches selected amounted to Rs. 20,32,148 crore, forming 62.9 per cent of aggregate deposits of Scheduled Commercial Banks as on March 31, 2008. Results# The article presents the results of the survey encompassing various classificatory characteristics of deposits with Scheduled Commercial Banks. Section I presents a brief review of the trends and pattern of ownership of deposits over long period from March 1999 to March 2008. Detailed analysis of the results relating to the survey as on March 31, 2008 is provided in subsequent sections. Section II outlines, at the aggregate level, the composition by type of deposit account and ownership pattern of deposits by broad institutional sectors. Section III analyses ownership pattern of deposits by type of account and institutional sectors. Section IV discusses ownership pattern of deposits according to population groups and States/Union territories, as also for major metropolitan centres. Section V covers ownership pattern according to bank-groups, viz., State Bank of India (SBI) and its Associates, Nationalised Banks, Regional Rural Banks (RRBs), Foreign Banks and Other Scheduled Commercial Banks or Indian Private Sector Banks (OSCBs). Three categories of deposit accounts covered in the survey are current, savings and term deposits and are inclusive of inter-bank deposits. The broad sectors covered in the survey are ‘Household’, ‘Government’, ‘Private Corporate (Non-Financial)’, ‘Financial’ and ‘Foreign’ sectors. I Trends in Composition and Ownership Pattern of Deposits Chart 1 presents shares of different types of deposits, viz., current, savings and term deposits over the 10 year period 1999-2008. Term deposits accounted for over two-fifths of total deposits outstanding with SCBs, while the share of savings deposits was around one-fourth during the decade 1999-2008.

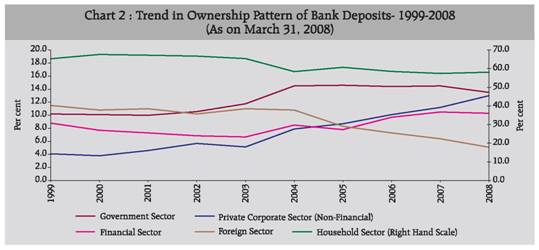

The trend in ownership pattern of deposits, according to major sectors is depicted in Chart 2. The household sector remained the largest holder of bank deposits, though its share showed a steady decline over the recent years; its share which averaged to 66.4 per cent during 1999-2003, declined to 58.6 per cent (average) during 2004-2008. During the same sub-periods of 1999-2008, the share (average) of ‘Private Corporate (Non-financial)’ sector more than doubled from 4.7 per cent to 10.2 per cent. The shares of ‘Government’ and ‘Financial’ sectors in total deposits also witnessed an increase during 2004-2008 compared to the position during 1999-2003. On the other hand, the share of ‘Foreign’ sector has recorded a decline. II. Ownership Pattern of Deposits: Aggregate Level II.1 Composition of Deposits by Type of Account The composition of aggregate deposits by type of account, viz., current, savings and term deposits during 2007-08, indicated an increase in the share of current deposits by 1.1 percentage points and a decline of equal magnitude in the share of savings deposits (Chart 3). The current deposits and savings deposits accounted for 13.5 per cent and 23.7 per cent of total deposits as on March 31, 2008. Term deposits accounted for 62.8 per cent of total deposits in March 2008 which was at the same level as a year ago (62.7 per cent).

The total outstanding deposits with SCBs, including inter-bank deposits, as on March 31,2008, at Rs 33,18,641 crore recorded 22.9 per cent increase over the outstanding deposits (Rs. 26,99,901 crore), as on March 31, 2007 (Statement 1); the growth rate for the previous year (March 31, 2007) was higher at 24.9 per cent. During the year 2007-08, growth in current deposits at 33.8 per cent was substantially higher than the previous year’s growth (17.8 per cent). On the other hand growth in term deposits decelerated to 23.0 per cent during 2007-08 from 29.8 per cent during 2006-07. savings deposits registered a little lower growth (17.1 per cent) than the previous year’s growth at 17.5 per cent (Table 1).

Table 1: Growth rates in Deposits according to type of account |

(Per cent) |

Account type |

2005-06 |

2006-07 |

2007-08 |

Current deposits |

27.5 |

17.8 |

33.8 |

Savings deposits |

20.9 |

17.5 |

17.1 |

Term deposits |

19.7 |

29.8 |

23.0 |

Total deposits |

21.0 |

24.9 |

22.9 |

II.2 Ownership Pattern By Institutional Sectors The classification of bank deposits by institutional sectors as on March 31, 2007 and 2008 is presented in Statement 1. During 2007-08, the ‘Private Corporate (Non-Financial)’ sector recorded an increase in its share in total deposits to 13.0 per cent from 11.2 per cent while the share of ‘Financial’ sector declined marginally from 10.5 per cent to 10.3 per cent. The ‘Government’ sector deposits constituted 13.5 per cent of total deposits with SCBs in March 2008, which was 1.0 percentage point lower than that in the previous year (14.5 per cent). The share of ‘Household’ sector, the largest shareholder of the deposits with the SCBs increased to 58.1 per cent as on March 31, 2008 from 57.4 per cent in 2007 (Chart 4).

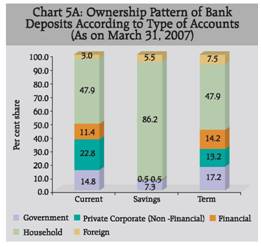

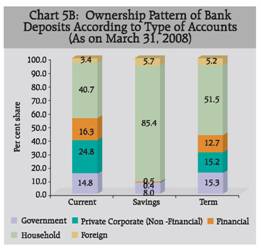

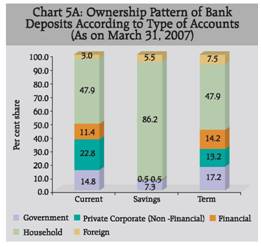

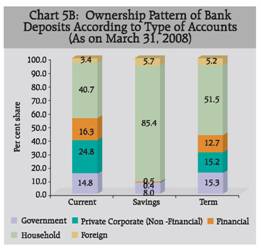

The share of deposits of ‘Foreign’ sector as at end March 2008 stood at 5.1 per cent, compared to 6.4 per cent a year ago. III. Ownership Pattern by Type of Deposit Accounts and Institutional Sectors The ownership pattern according to major sectors and type of deposits as on March 31, 2007 and 2008, is depicted in Charts 5A and 5B. The ‘Household’ sector, which was the largest holder of total deposits outstanding with SCBs, also held the largest share across the three types of deposits, viz., current, savings and term deposits. As regards current deposits, the share of ‘Household’ sector in total current deposits declined to 40.7 per cent in March 2008 from 47.9 per cent a year ago. The ‘Private Corporate(Non-Financial)’ and ‘Financial’ sectors, recorded 2.0 percentage points and 4.9 percentage points increase in their share of current deposits, during 2007-08, which stood at 24.8 per cent and 16.3 per cent as on March 31, 2008. The share of ‘Government’ sector deposits in outstanding current deposits was 14.8 per cent both as at end-March 2007 and 2008, while the share of ‘Foreign’ sector deposits in current deposits increased marginally to 3.4 per cent from 3.0 per cent.

|

|

‘Household’ sector accounted for the bulk of savings deposits in March 2008 with the largest share of 85.4 per cent, which was marginally lower than 86.2 per cent a year ago. The share of ‘Government’ sector in savings deposits improved marginally by 0.7 percentage points during 2007-08 and stood at 8.0 per cent as on March 31, 2008. The ‘Private Corporate (Non-financial)’ and ‘Financial’ sectors had negligible shares in savings deposits both in 2007 and 2008, while the ‘Foreign’ sector accounted for about 5.7 per cent share. As regards term deposits, share of the largest constituent, viz., the ‘Household’ sector increased by 3.6 percentage points during 2007-08 to 51.5 per cent. The share of ‘Private Corporate (Non-Financial)’ sector in term deposits improved by 2.0 percentage points during the year under review. The shares of ‘Government’ and ‘Foreign’ sectors registered a decline to 15.3 per cent from 17.2 per cent and to 5.2 per cent from 7.5 per cent, respectively. The ‘Financial’ sector held 12.7 per cent of term deposits in March 2008, as against a share of 14.2 per cent in March 2007. The percentage shares of the deposits in incremental deposits of the major sectors are presented in Table 2. During 2007-08 about two-thirds (63.1 per cent) of the incremental deposits were contributed by term deposits, as compared to 72.1 per cent in 2006-07. The share of current deposits in incremental deposits at 18.3 per cent in 2007-08 was almost double of 9.4 per cent share observed in 2006-07, while the share of savings deposits in incremental deposits was at about the same level (18.5 per cent) in both the years. The share of term deposits in incremental deposits in the case of ‘Government’ and ‘Financial’ sectors was 46.7 per cent and 41.7 per cent, respectively, while for the ‘Private Corporate (Non-Financial)’ and ‘Household’ sectors, 72.8 per cent and 69.6 per cent of the incremental deposits were in case of term deposits. As regards the ‘Foreign’ sector, term deposits witnessed a decline during 2007-08.The contribution of current deposits to incremental deposits was in the 27.0 per cent to 29.1 per cent range for ‘Government’ and ‘Private Corporate (Non-Financial)’ sectors. It was high (57.7 per cent) for the ‘Financial’ sector, but low (5.8 per cent) for the ‘Household’ sector. Savings deposits accounted for about one-fourth of the incremental deposits for the ‘Household’ sector.

Table 2: The contribution of the three types of deposits in incremental deposits of the selected sectors |

(Per cent) |

Sectors |

Contribution in incremental deposits |

2006-07 |

2007-08 |

Current |

Savings |

Term |

Total |

Current |

Savings |

Term |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Government |

11.9 |

15.5 |

72.6 |

100.0 |

29.1 |

24.2 |

46.7 |

100.0 |

Private corporate (Non-financial) |

15.1 |

0.4 |

84.6 |

100.0 |

27.0 |

0.2 |

72.8 |

100.0 |

Financial |

-4.1 |

-3.2 |

107.3 |

100.0 |

57.7 |

0.6 |

41.7 |

100.0 |

Household |

11.0 |

29.6 |

59.4 |

100.0 |

5.8 |

24.5 |

69.6 |

100.0 |

Foreign |

0.1 |

29.9 |

70.0 |

100.0 |

-88.8 |

-131.5 |

320.3 |

100.0 |

Total |

9.4 |

18.5 |

72.1 |

100.0 |

18.3 |

18.6 |

63.1 |

100.0 |

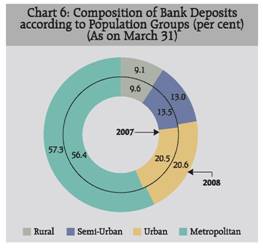

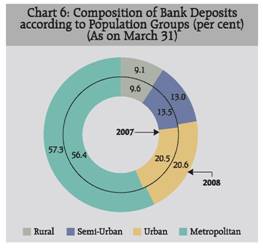

IV. Ownership Pattern of Deposits According to Population Groups/ States and Union Territories/ Metropolitan Centres IV.1 Population Groups1 The ownership of deposits classified by population groups is presented in Statement 2. The metropolitan areas accounted for the largest share (57.3 per cent) in total deposits as on March 31, 2008, compared to 56.4 per cent share as at end March 2007. The deposits of rural and semi-urban areas accounted for 9.1 per cent and 13.0 per cent, respectively as on March 31, 2008 and these shares were lower than those observed for March 2007. The share of deposits in March 2008 in urban areas remained almost at the same level as a year ago. Chart 6 provides information on distributional pattern of aggregate deposits according to population groups for 2007 and 2008. The ‘Household’ sector accounted for the largest share in total deposits in each of the population groups. The share of ‘Household sector’ was 86.4 per cent in rural areas, 77.9 per cent in semi-urban areas, 67.2 per cent in urban areas and 45.8 per cent in metropolitan areas as on March 31, 2008 (Statement 2). This sector’s shares have shown improvement over the position a year ago for semi-urban, urban and metropolitan population groups, while for the rural areas its share has declined by 0.8 percentage points. ‘Individuals (including Hindu Undivided Families-HUFs)’ were the major constituent of the ‘Household’ sector in all the population groups Individuals (including HUFs) held 74.6 per cent of the deposits in rural areas though their share declined by 3.9 per cent during 2007-08. Among the ‘Individuals (including HUFs)’, ‘Farmers’ held 27.6 per cent of total deposits in the rural areas and 11.4 per cent of total deposits in semi-urban areas. The corresponding shares were higher at 33.6 per cent and 13.2 per cent as on March 31,2007 and consequently the share of ‘Farmers’ in total deposits declined from 6.4 per cent to 5.3 per cent during 2007-08.

|

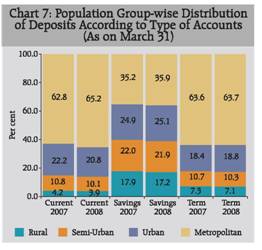

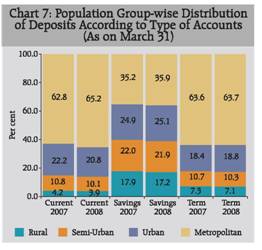

Shares of ‘Businessmen, Traders, Professionals and Self-employed Persons’ group in the rural, semi-urban and urban areas were in the range of 9.7 per cent to 11.4 per cent, while the same in the metropolitan areas was lower at 6.3 per cent. The share of ‘Wage and Salary Earners’ under the category of ‘Individuals (including HUFs)’ of the ‘Household’ sector was in the range of 8.0 per cent and 9.3 per cent in areas other than metropolitan areas, where it was lower at 5.1 per cent. Deposits from the ‘Government’ sector constituted 8.2 per cent and 8.4 per cent of the total deposits in rural and semi-urban areas, respectively as on March 31, 2008. The share of deposits held by the ‘Government’ sector in the urban and metropolitan areas stood higher at 16.0 per cent and 14.6 per cent of total deposits, respectively. Population group-wise shares of bank deposits of ‘Private Corporate (Non-Financial)’ and ‘Financial’ sectors exhibited a composition similar to that obtained for the deposits of ‘Government’ sector. The share of ‘Foreign’ sector deposits, comprising deposits of non-residents and foreign embassies, etc., in total deposits, across population groups, was the highest in semi-urban areas (8.2 per cent), followed by urban areas (5.3 per cent), metropolitan areas (4.6 per cent) and rural areas (2.1 per cent). Deposits from ‘Non Residents’ was the major constituent of ‘Foreign’ sector deposits and maintained same order among population groups as for the total ‘Foreign’ sector deposits. Distributional pattern of total deposits by their type and population groups, as on March 31, 2008 remained similar to that a year ago, with metropolitan centres accounting for the highest share and rural centres accounting for the lowest share in all types of deposits (Chart 7). In respect of current deposits, the metropolitan centres accounted for a share at 65.2 per cent, while the shares of urban and semi-urban centres were lower at 20.8 per cent and 10.1 per cent, respectively. Metropolitan centres held a share of 35.9 per cent in savings deposits in 2008. The shares in savings deposits of urban, semi-urban and rural centres were 25.1 per cent, 21.9 per cent and 17.2 per cent, respectively in March 2008. In the case of term deposits, metropolitan centres held the highest share of 63.7 per cent, followed distantly by urban (18.8 per cent), semi-urban (10.3 per cent) and rural (7.3 per cent) centres. The distribution of deposits according to type and population groups indicated that across all population groups, term deposits accounted for the largest share in total deposits in March 2008 with 69.8 per cent share in metropolitan centres, and between 49.3 per cent and 57.5 per cent in other centres (Chart 8). The share of current deposits as at end March 2008 increased across all population groups, except for the urban population group. The share of savings deposits in March 2008 was observed to be lower than that a year ago across all population groups. The share was the highest at 44.9 per cent in rural centres, followed by 39.7 per cent in semi-urban centres. In metropolitan centres, the share of term deposits declined to 69.8 per cent as at end March 2008 from 70.7 per cent a year ago while in urban centres it increased to 57.5 per cent from 55.0 per cent a year ago. In rural centres, the share of term deposits witnessed a 1.2 percentage increase and stood at 49.3 per cent in March 2008.

|

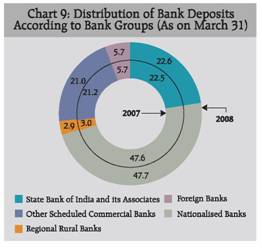

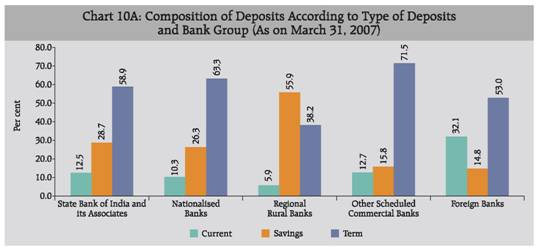

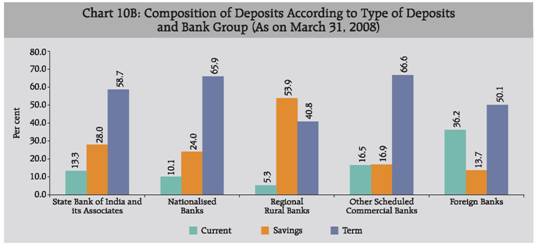

IV.2 States / Union Territories The ownership pattern of deposits for end March 2008 classified according to States/Union Territories is presented in Statement 3. In all the major States and Union Territories, except Maharashtra and Delhi, the bank deposits have been primarily mobilised from the ‘Household’ sector, which accounted for over one-half of the total deposits. This is brought out by the fact that in 29 States/UTs, share of ‘Household’ sector deposits in total deposits was higher than the all-India share of ‘Household’ sector deposits in total deposits (58.1 per cent). Further, in 8 of these States/ UTs, viz, Punjab, Rajasthan, Haryana, Jammu & Kashmir, Uttar Pradesh, Dadra & Nagar Haveli, Mizoram and Jharkhand the contribution of ‘Household’ sector deposits to total deposits in respective states was above 75 per cent. These states accounted for 16.2 of total deposits and 22.1 per cent of ‘Household’ sector deposits. 19 States/UTs had ‘Household’ sector deposits between 60.0 per cent and 75.0 per cent of their respective total deposits, and 5 States/UTs reported ‘Household’ sector deposits between 50.0 per cent and 60.0 per cent. At the other end of the spectrum, Maharashtra and Delhi had 37.8 per cent and 45.9 per cent of their total deposits from the ‘Household’ sector and they collectively accounted for 27.7 per cent of ‘Household’ sector deposits and 39.8 per cent total deposits in 2008. In 13 States/UTs, the share of the deposits of ‘Government’ sector in the total deposits as on March 31, 2008 was less than the all-India level share (13.5 per cent). The remaining 22 States/UTs, with combined share of 37.0 per cent of total deposits, accounted for 58.9 per cent of ‘Government’ sector’s deposits. Deposits of this sector had considerable contribution (more than 25 per cent) in the total deposits in 7 States/Union Territories viz., Andaman & Nicobar Islands, Delhi, Chhatisgarh, Chandigarh, Uttarakhand, Manipur and Lakshadweep. The share of ‘Foreign’ sector deposits in total deposits was below 5 per cent in respect of 25 States/UTs. The ‘Foreign’ sector deposits accounted for 28.5 per cent, 24.0 per cent and 21.7 per cent of deposits in respect of Kerala, Daman & Diu and Goa, respectively. However, the ‘Foreign’ sector deposits were concentrated in the States of Maharashtra, Kerala, Delhi, Gujarat, Tamil Nadu, Karnataka and Punjab, which collectively accounted for 83.6 per cent of total ‘Foreign’ sector deposits. The share of ‘Private Corporate (Non-Financial)’ sector in total deposits in Maharashtra, Delhi and Karnataka was higher than the all-India level (13.0 per cent). About three-fourths (75.9 per cent) of ‘Private Corporate (Non-Financial)’ sector deposits were concentrated in these three states. IV.3 Major Metropolitan Centres Deposits in Mumbai, Delhi, Kolkata and Chennai, the four major metropolitan centers, are analysed in this section. The ownership pattern of deposits of the four major metropolitan centers, viz., Mumbai, Delhi, Kolkata and Chennai, is presented in Statement 4. The ‘Household’ sector owned the highest share of deposits in each of the centre. The share was observed to be the highest in Chennai (58.9 per cent) and the lowest in Mumbai (30.4 per cent). The next highest shares of deposits were owned by ‘Private Corporate (Non-Financial)’ and ‘Government’ sectors in the four major metropolitan centers taken together. The highest share of ‘Government’ sector was recorded in Delhi (25.0 per cent), followed by Kolkata (21.2 per cent), Chennai (10.5 per cent) and Mumbai (8.4 per cent). The share of ‘Private Corporate (Non-Financial)’ sector was the highest in Mumbai (27.7 per cent), followed by Delhi and Chennai (about 19.0 per cent each) and Kolkata (11.7 per cent). The ‘Foreign’ sector accounted for 6.2 per cent and 5.3 per cent of total deposits in Chennai and Mumbai, respectively while its share was lower (3.1 per cent to 3.5 per cent) in other two major metropolitan centers and 4.7 per cent in the four major metropolitan centres taken together. V. Ownership Pattern of Deposits According to Bank Groups V.1 Composition of Deposits by Type of Account and Bank-groups The composition of deposits according to bank-groups is presented in Statement 5. At the aggregate level, the relative shares of different bank groups depicted very marginal changes as on March 31, 2008, as compared with the position a year ago (Chart 9). The Nationalised Banks accounted for the largest share at 47.7 per cent of total deposits as on March 31, 2008, followed by SBI and its Associates (22.6 per cent), OSCBs (21.0 per cent) and Foreign Banks (5.7 per cent) (Chart 9). The distribution of deposits according to type for SBI and its Associates and Nationalised Banks revealed more or less identical pattern, i.e., the share of term deposits at about 59.0 per cent to 66.0 per cent, share of savings deposits at about 24.0 per cent to 28.0 per cent and current deposits at about 10.0 per cent to 13.0 per cent. RRBs had 53.9 per cent of their deposits in savings deposits and 40.8 per cent of their deposits in term deposits. In respect of OSCBs, term deposits accounted for the largest share of 66.6 per cent of total deposits (Charts 10A and 10B), while in the case of Foreign Banks, they contributed 50.1 per cent to total deposits. Current deposits formed a substantial share (36.2 per cent) of total deposits with Foreign Banks and on the other hand, such deposits for RRBs constituted only 5.3 per cent of total deposits.

V.2 Ownership of Deposits by Institutional Sectors and Bank-groups The ownership pattern of deposits according to bank groups as on March 31, 2008 is presented in Statement 6. The ‘Household’ sector accounted for the highest share in total deposits in all bank groups, except Foreign Banks, in whose case ‘Private Corporate (Non-Financial)’ sector deposits had the largest share (48.9 per cent). The share of the ‘Household’ sector in total deposits was at 61.5 per cent for SBI and its Associates, 65.2 per cent for Nationalised Banks and 43.0 per cent for OSCBs while it was the highest at 85.9 per cent for RRBs. ‘Individuals (including HUFs)’ was the major constituent of the ‘Household’ sector, in all the bank groups, though its share ranged from 18.6 per cent in the case of Foreign Banks to as high as 80.7 per cent for RRBs, and about one-half each in the cases of SBI and its Associates and Nationalised banks. The share of the ‘Government’ sector deposits was the highest at about 17.3 in respect of deposits with both SBI and its Associates and Nationalised Banks. This sector’s share for RRBs was at 13.0 per cent and for OSCBs at 4.2 per cent. ‘Central and State Governments’ and ‘Public Sector Corporations and Companies’ contributed 12.7 per cent to deposits with SBI and its Associates, as against 9.4 per cent share at all SCB level. ‘Government’ sector deposits with RRBs were largely contributed by ‘State Governments’ (5.5 per cent) and ‘Local Authorities’ (5.4 per cent). ‘Government’ sector held 3.1 per cent of the total deposits with OSCBs and these were held with almost equal shares by ‘Central and State Governments’ and ‘Public Sector Corporations and Companies’. The share of ‘Private Corporate (Non-Financial)’ sector in the total deposits was the highest for Foreign Banks (48.9 per cent), followed by OSCBs (29.0 per cent). The corresponding shares in total deposits with SBI and its Associates and Nationalised Banks were relatively low at 6.5 per cent and 5.5 per cent, respectively as on March 31, 2008. The share of deposits from ‘Foreign’ sector was the highest in the case of Foreign banks (11.7 per cent of total deposits), followed by SBI and its Associates (6.7 per cent), OSCBs (4.7 per cent) and Nationalised Banks (3.9 per cent). This sector had a negligible share of 0.3 per cent for RRBs. All bank groups derived major part of ‘Foreign’ sector deposits from ‘Non-Residents’.

Statement 1 : Ownership of Deposits with Scheduled Commercial Banks by Type of Deposits and Sector - As on March 31, 2007 and 2008 |

(Rs. crore) |

Sector |

Current |

Savings |

Term |

Total |

Variations |

2007 |

2008 |

2007 |

2008 |

2007 |

2008 |

2007 |

2008 |

Current |

Savings |

Term |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

I. |

Government Sector |

49,663 |

66,281 |

49,049 |

62,861 |

2,91,961 |

3,18,663 |

3,90,673 |

4,47,805 |

16,618 |

13,811 |

26,702 |

57,131 |

|

(14.8) |

(14.8) |

(7.3) |

(8.0) |

(17.2) |

(15.3) |

(14.5) |

(13.5) |

(14.6) |

(12.0) |

(6.8) |

(9.2) |

|

1. |

Central & State |

20,918 |

30,529 |

25,966 |

34,138 |

83,206 |

1,13,888 |

1,30,091 |

1,78,555 |

9,611 |

8,172 |

30,682 |

48,464 |

|

|

Governments |

(6.2) |

(6.8) |

(3.9) |

(4.3) |

(4.9) |

(5.5) |

(4.8) |

(5.4) |

(8.5) |

(7.1) |

(7.9) |

(7.8) |

|

|

i)Central |

9,393 |

13,004 |

2,661 |

4,473 |

51,669 |

60,019 |

63,723 |

77,496 |

3,611 |

1,812 |

8,349 |

13,773 |

|

|

Government |

(2.8) |

(2.9) |

(0.4) |

(0.6) |

(3.1) |

(2.9) |

(2.4) |

(2.3) |

(3.2) |

(1.6) |

(2.1) |

(2.2) |

|

|

ii)State |

11,525 |

17,525 |

23,305 |

29,665 |

31,537 |

53,869 |

66,368 |

1,01,059 |

6,000 |

6,359 |

22,332 |

34,692 |

|

|

Governments |

(3.4) |

(3.9) |

(3.5) |

(3.8) |

(1.9) |

(2.6) |

(2.5) |

(3.0) |

(5.3) |

(5.5) |

(5.7) |

(5.6) |

|

2. |

Local Authorities |

6,051 |

7,967 |

13,616 |

16,908 |

48,711 |

44,971 |

68,377 |

69,846 |

1,916 |

3,292 |

-3,740 |

1,469 |

|

|

|

(1.8) |

(1.8) |

(2.0) |

(2.2) |

(2.9) |

(2.2) |

(2.5) |

(2.1) |

(1.7) |

(2.9) |

(-1.0) |

(0.2) |

|

3. |

Quasi Government |

10,750 |

9,800 |

3,979 |

4,890 |

53,701 |

53,287 |

68,431 |

67,977 |

-951 |

911 |

-414 |

-453 |

|

|

Bodies |

(3.2) |

(2.2) |

(0.6) |

(0.6) |

(3.2) |

(2.6) |

(2.5) |

(2.0) |

(-0.8) |

(0.8) |

(-0.1) |

(-0.1) |

|

|

Of which: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Electricity |

4,124 |

2,364 |

435 |

798 |

6,783 |

9,962 |

11,341 |

13,123 |

-1,760 |

363 |

3,179 |

1,782 |

|

|

Boards |

(1.2) |

(0.5) |

(0.1) |

(0.1) |

(0.4) |

(0.5) |

(0.4) |

(0.4) |

(-1.6) |

(0.3) |

(0.8) |

(0.3) |

|

4. |

Public Sector |

11,943 |

17,985 |

5,488 |

6,924 |

1,06,343 |

1,06,517 |

1,23,774 |

1,31,426 |

6,042 |

1,436 |

174 |

7,652 |

|

|

Corporations and Companies |

(3.6) |

(4.0) |

(0.8) |

(0.9) |

(6.3) |

(5.1) |

(4.6) |

(4.0) |

(5.3) |

(1.2) |

(-) |

(1.2) |

|

|

i) Non - Departmental |

3,681 |

5,801 |

751 |

699 |

59,246 |

40,261 |

63,677 |

46,761 |

2,120 |

-51 |

-18,985 |

-16,917 |

|

|

Commercial Undertakings |

(1.1) |

(1.3) |

(0.1) |

(0.1) |

(3.5) |

(1.9) |

(2.4) |

(1.4) |

(1.9) |

(-) |

(-4.9) |

(-2.7) |

|

|

ii) Others |

8,262 |

12,184 |

4,738 |

6,225 |

47,098 |

66,256 |

60,097 |

84,665 |

3,922 |

1,488 |

19,159 |

24,568 |

|

|

|

(2.5) |

(2.7) |

(0.7) |

(0.8) |

(2.8) |

(3.2) |

(2.2) |

(2.6) |

(3.5) |

(1.3) |

(4.9) |

(4.0) |

II. |

Private Corporate Sector |

76,647 |

1,11,357 |

3,245 |

3,487 |

2,23,591 |

3,17,365 |

3,03,482 |

4,32,209 |

34,710 |

242 |

93,774 |

1,28,727 |

|

(Non - Financial) |

(22.8) |

(24.8) |

(0.5) |

(0.4) |

(13.2) |

(15.2) |

(11.2) |

(13.0) |

(30.6) |

(0.2) |

(24.0) |

(20.8) |

|

1. |

Non- Financial |

61,242 |

77,295 |

917 |

886 |

1,85,668 |

2,51,110 |

2,47,826 |

3,29,291 |

16,053 |

-30 |

65,442 |

81,465 |

|

|

Companies |

(18.2) |

(17.2) |

(0.1) |

(0.1) |

(11.0) |

(12.1) |

(9.2) |

(9.9) |

(14.1) |

(-) |

(16.8) |

(13.2) |

|

2. |

Non-Credit |

842 |

375 |

607 |

411 |

2,623 |

2,101 |

4,071 |

2,887 |

-467 |

-195 |

-522 |

-1,184 |

|

|

Co -operative Institutions |

(0.3) |

(0.1) |

(0.1) |

(0.1) |

(0.2) |

(0.1) |

(0.2) |

(0.1) |

(-0.4) |

(-0.2) |

(-0.1) |

(-0.2) |

|

3. |

Others |

14,563 |

33,687 |

1,722 |

2,190 |

35,300 |

64,154 |

51,585 |

1,00,031 |

19,124 |

468 |

28,854 |

48,446 |

|

|

|

(4.3) |

(7.5) |

(0.3) |

(0.3) |

(2.1) |

(3.1) |

(1.9) |

(3.0) |

(16.8) |

(0.4) |

(7.4) |

(7.8) |

III. |

Financial Sector |

38,367 |

73,223 |

3,684 |

4,041 |

2,40,413 |

2,65,648 |

2,82,465 |

3,42,912 |

34,856 |

357 |

25,234 |

60,447 |

|

|

|

(11.4) |

(16.3) |

(0.5) |

(0.5) |

(14.2) |

(12.7) |

(10.5) |

(10.3) |

(30.7) |

(0.3) |

(6.5) |

(9.8) |

|

1. |

Banks |

18,732 |

19,889 |

1,693 |

2,042 |

91,849 |

97,178 |

1,12,274 |

1,19,110 |

1,157 |

348 |

5,329 |

6,835 |

|

|

|

(5.6) |

(4.4) |

(0.3) |

(0.3) |

(5.4) |

(4.7) |

(4.2) |

(3.6) |

(1.0) |

(0.3) |

(1.4) |

(1.1) |

|

|

i) Indian Commercial Banks |

13,822 |

12,383 |

1,389 |

1,572 |

59,838 |

65,158 |

75,048 |

79,114 |

-1,438 |

184 |

5,320 |

4,065 |

|

|

|

(4.1) |

(2.8) |

(0.2) |

(0.2) |

(3.5) |

(3.1) |

(2.8) |

(2.4) |

(-1.3) |

(0.2) |

(1.4) |

(0.7) |

|

|

ii) Foreign Resident |

1,614 |

1,359 |

5 |

2 |

8,779 |

4,081 |

10,398 |

5,441 |

-256 |

-3 |

-4,698 |

-4,956 |

|

|

Banks (Offices of Foreign Banks in India) |

(0.5) |

(0.3) |

(-) |

(-) |

(0.5) |

(0.2) |

(0.4) |

(0.2) |

(-0.2) |

(-) |

(-1.2) |

(-0.8) |

Statement 1 : Ownership of Deposits with Scheduled Commercial Banks byType of Deposits and Sector - As on March 31, 2007 and 2008 (Contd.) |

(Rs. crore) |

Sector |

Current |

Savings |

Term |

Total |

Variations |

2007 |

2008 |

2007 |

2008 |

2007 |

2008 |

2007 |

2008 |

Current |

Savings |

Term |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

|

iii) |

Co-operative Banks

& Credit societies |

3,296 |

6,147 |

300 |

467 |

23,232 |

27,940 |

26,828 |

34,555 |

2,851 |

168 |

4,708 |

7,726 |

(1.0) |

(1.4) |

(-) |

(0.1) |

(1.4) |

(1.3) |

(1.0) |

(1.0) |

(2.5) |

(0.1) |

(1.2) |

(1.2) |

|

|

a. Co-operative Banks |

3,043 |

5,679 |

99 |

141 |

22,539 |

26,639 |

25,682 |

32,459 |

2,636 |

42 |

4,099 |

6,777 |

|

|

|

(0.9) |

(1.3) |

(-) |

(-) |

(1.3) |

(1.3) |

(1.0) |

(1.0) |

(2.3) |

(-) |

(1.1) |

(1.1) |

|

|

b. Credit Societies |

253 |

468 |

201 |

326 |

693 |

1,301 |

1,147 |

2,096 |

215 |

126 |

608 |

949 |

|

|

|

(0.1) |

(0.1) |

(-) |

(-) |

(-) |

(0.1) |

(-) |

(0.1) |

(0.2) |

(0.1) |

(0.2) |

(0.2) |

2. |

Other Financial Institutions |

11,560 |

26,248 |

1,109 |

1,209 |

1,05,426 |

1,03,107 |

1,18,095 |

1,30,564 |

14,687 |

101 |

-2,319 |

12,469 |

(3.4) |

(5.8) |

(0.2) |

(0.2) |

(6.2) |

(4.9) |

(4.4) |

(3.9) |

(12.9) |

(0.1) |

(-0.6) |

(2.0) |

|

i) |

Financial Companies |

549 |

574 |

72 |

58 |

2,837 |

2,560 |

3,458 |

3,192 |

25 |

-14 |

-278 |

-267 |

|

|

|

(0.2) |

(0.1) |

(-) |

(-) |

(0.2) |

(0.1) |

(0.1) |

(0.1) |

(-) |

(-) |

(-0.1) |

(-) |

|

|

a. Housing Finance Companies |

387 |

293 |

62 |

46 |

1,093 |

1,045 |

1,541 |

1,385 |

-93 |

-16 |

-48 |

-157 |

(0.1) |

(0.1) |

(-) |

(-) |

(0.1) |

(0.1) |

(0.1) |

(-) |

(-0.1) |

(-) |

(-) |

(-) |

|

|

b. Auto Finance Companies |

163 |

281 |

10 |

12 |

1,744 |

1,515 |

1,917 |

1,807 |

118 |

2 |

-229 |

-110 |

(-) |

(0.1) |

(-) |

(-) |

(0.1) |

(0.1) |

(0.1) |

(0.1) |

(0.1) |

(-) |

(-0.1) |

(-) |

|

ii) |

Mutual Funds

(including Private Sector Mutual Funds) |

1,645 |

1,473 |

16 |

23 |

59,157 |

45,702 |

60,818 |

47,198 |

-173 |

7 |

-13,454 |

-13,620 |

(0.5) |

(0.3) |

(-) |

(-) |

(3.5) |

(2.2) |

(2.3) |

(1.4) |

(-0.2) |

(-) |

(-3.4) |

(-2.2) |

|

|

a. Mutual Funds in Private Sector |

640 |

332 |

- |

- |

19,399 |

21,760 |

20,040 |

22,092 |

-309 |

- |

2,361 |

2,052 |

(0.2) |

(0.1) |

|

|

(1.1) |

(1.0) |

(0.7) |

(0.7) |

(-0.3) |

|

(0.6) |

(0.3) |

|

|

b. Other Mutual Funds |

1,005 |

1,141 |

16 |

23 |

39,757 |

23,942 |

40,778 |

25,106 |

136 |

7 |

-15,815 |

-15,673 |

(0.3) |

(0.3) |

(-) |

(-) |

(2.3) |

(1.1) |

(1.5) |

(0.8) |

(0.1) |

(-) |

(-4.1) |

(-2.5) |

|

iii) |

Unit Trust of India |

2,009 |

18,637 |

16 |

85 |

4,028 |

3,414 |

6,054 |

22,136 |

16,628 |

68 |

-614 |

16,083 |

|

|

|

(0.6) |

(4.1) |

(-) |

(-) |

(0.2) |

(0.2) |

(0.2) |

(0.7) |

(14.6) |

(0.1) |

(-0.2) |

(2.6) |

|

iv) |

Insurance

Corporations and Companies (Life and General) |

5,739 |

4,269 |

29 |

22 |

16,853 |

18,671 |

22,621 |

22,962 |

-1,470 |

-7 |

1,818 |

341 |

(1.7) |

(1.0) |

(-) |

(-) |

(1.0) |

(0.9) |

(0.8) |

(0.7) |

(-1.3) |

(-) |

(0.5) |

(0.1) |

|

v) |

Term Lending Institutions |

249 |

176 |

21 |

51 |

2,918 |

3,409 |

3,189 |

3,636 |

-74 |

29 |

491 |

447 |

(0.1) |

(-) |

(-) |

(-) |

(0.2) |

(0.2) |

(0.1) |

(0.1) |

(-0.1) |

(-) |

(0.1) |

(0.1) |

|

vi) |

Provident Fund Institutions |

1,368 |

1,119 |

955 |

972 |

19,632 |

29,351 |

21,955 |

31,441 |

-249 |

17 |

9,718 |

9,486 |

(0.4) |

(0.2) |

(0.1) |

(0.1) |

(1.2) |

(1.4) |

(0.8) |

(0.9) |

(-0.2) |

(-) |

(2.5) |

(1.5) |

3. |

Other Financial Companies@ |

8,075 |

27,086 |

882 |

790 |

43,139 |

65,363 |

52,095 |

93,238 |

19,011 |

-92 |

22,224 |

41,143 |

(2.4) |

(6.0) |

(0.1) |

(0.1) |

(2.5) |

(3.1) |

(1.9) |

(2.8) |

(16.7) |

(-0.1) |

(5.7) |

(6.6) |

|

i) |

Financial Services

Companies |

2,137 |

14,400 |

52 |

33 |

11,356 |

13,114 |

13,545 |

27,547 |

12,262 |

-19 |

1,758 |

14,002 |

(0.6) |

(3.2) |

(-) |

(-) |

(0.7) |

(0.6) |

(0.5) |

(0.8) |

(10.8) |

(-) |

(0.5) |

(2.3) |

|

ii) |

Other Financial

Companies |

4,002 |

6,820 |

72 |

79 |

13,536 |

30,415 |

17,610 |

37,314 |

2,818 |

7 |

16,879 |

19,704 |

(1.2) |

(1.5) |

(-) |

(-) |

(0.8) |

(1.5) |

(0.7) |

(1.1) |

(2.5) |

(-) |

(4.3) |

(3.2) |

|

iii) |

Others |

1,936 |

5,866 |

759 |

679 |

18,247 |

21,833 |

20,941 |

28,378 |

3,930 |

-80 |

3,586 |

7,437 |

|

|

|

(0.6) |

(1.3) |

(0.1) |

(0.1) |

(1.1) |

(1.0) |

(0.8) |

(0.9) |

(3.5) |

(-0.1) |

(0.9) |

(1.2) |

Statement 1 : Ownership of Deposits with Scheduled Commercial Banks by Type of Deposits and Sector - As on March 31, 2007 and 2008 (Concld.) |

(Rs. crore) |

Sector |

Current |

Savings |

Term |

Total |

Variations |

2007 |

2008 |

2007 |

2008 |

2007 |

2008 |

2007 |

2008 |

Current |

Savings |

Term |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

I V. |

Household Sector |

1,60,883 |

1,83,013 |

5,78,107 |

6,70,895 |

8,10,726 |

10,74,109 |

15,49,716 |

19,28,017 |

22,130 |

92,789 |

2,63,383 |

3,78,301 |

|

(47.9) |

(40.7) |

(86.2) |

(85.4) |

(47.9) |

(51.5) |

(57.4) |

(58.1) |

(19.5) |

(80.7) |

(67.5) |

(61.1) |

|

1. |

Individuals (including

Hindu Undivided Families) |

73,220 |

82,796 |

5,15,938 |

5,98,620 |

6,12,681 |

8,13,963 |

12,01,839 |

14,95,379 |

9,576 |

82,682 |

2,01,282 |

2,93,540 |

(21.8) |

(18.4) |

(76.9) |

(76.2) |

(36.2) |

(39.1) |

(44.5) |

(45.1) |

(8.4) |

(72.0) |

(51.6) |

(47.4) |

|

|

i) Farmers |

2,716 |

3,569 |

85,316 |

82,609 |

84,410 |

91,012 |

1,72,442 |

1,77,189 |

853 |

-2,707 |

6,602 |

4,747 |

|

|

|

(0.8) |

(0.8) |

(12.7) |

(10.5) |

(5.0) |

(4.4) |

(6.4) |

(5.3) |

(0.8) |

(-2.4) |

(1.7) |

(0.8) |

|

|

ii) Businessmen,

Traders, Professionals and Self – Employed Persons |

38,796 |

39,971 |

69,206 |

87,928 |

1,01,167 |

1,35,647 |

2,09,170 |

2,63,546 |

1,174 |

18,722 |

34,480 |

54,376 |

(11.6) |

(8.9) |

(10.3) |

(11.2) |

(6.0) |

(6.5) |

(7.7) |

(7.9) |

(1.0) |

(16.3) |

(8.8) |

(8.8) |

|

|

iii) Wage and Salary

Earners |

4,240 |

3,886 |

95,582 |

1,07,263 |

78,211 |

1,07,046 |

1,78,033 |

2,18,196 |

-354 |

11,681 |

28,835 |

40,162 |

(1.3) |

(0.9) |

(14.2) |

(13.7) |

(4.6) |

(5.1) |

(6.6) |

(6.6) |

(-0.3) |

(10.2) |

(7.4) |

(6.5) |

|

|

iv) Shroffs, Money

Lenders, Stock Brokers, Dealers in Bullion etc. |

999 |

1,028 |

4,161 |

4,580 |

5,309 |

10,644 |

10,469 |

16,252 |

29 |

419 |

5,335 |

5,784 |

(0.3) |

(0.2) |

(0.6) |

(0.6) |

(0.3) |

(0.5) |

(0.4) |

(0.5) |

(-) |

(0.4) |

(1.4) |

(0.9) |

|

|

v) Other Individuals |

26,468 |

34,341 |

2,61,673 |

3,16,240 |

3,43,584 |

4,69,614 |

6,31,725 |

8,20,196 |

7,873 |

54,567 |

1,26,031 |

1,88,471 |

|

|

|

(7.9) |

(7.6) |

(39.0) |

(40.2) |

(20.3) |

(22.5) |

(23.4) |

(24.7) |

(6.9) |

(47.5) |

(32.3) |

(30.5) |

|

2 |

Trusts, Associations,

Clubs etc. |

10,229 |

12,904 |

11,717 |

12,056 |

49,718 |

56,017 |

71,663 |

80,977 |

2,676 |

339 |

6,299 |

9,314 |

(3.0) |

(2.9) |

(1.7) |

(1.5) |

(2.9) |

(2.7) |

(2.7) |

(2.4) |

(2.4) |

(0.3) |

(1.6) |

(1.5) |

|

3. |

Proprietary and

Partnership concerns etc. |

47,556 |

54,575 |

4,311 |

5,082 |

39,521 |

50,648 |

91,388 |

1,10,305 |

7,019 |

771 |

11,127 |

18,917 |

(14.2) |

(12.1) |

(0.6) |

(0.6) |

(2.3) |

(2.4) |

(3.4) |

(3.3) |

(6.2) |

(0.7) |

(2.9) |

(3.1) |

|

4. |

Educational

Institutions |

2,865 |

3,175 |

7,980 |

8,951 |

15,306 |

16,469 |

26112 |

28,595 |

310 |

971 |

1,163 |

2,444 |

(0.9) |

(0.7) |

(1.2) |

(1.1) |

(0.9) |

(0.8) |

(1.0) |

(0.9) |

(0.3) |

(0.8) |

(0.3) |

(0.4) |

|

5. |

Religious Institutions |

475 |

355 |

2,003 |

2,161 |

7,024 |

5,958 |

9,502 |

8,474 |

-119 |

158 |

-1,066 |

-1,028 |

|

|

|

(0.1) |

(0.1) |

(0.3) |

(0.3) |

(0.4) |

(0.3) |

(0.4) |

(0.3) |

(-0.1) |

(0.1) |

(-0.3) |

(-0.2) |

|

6 |

Others (not elsewhere classified) |

26,539 |

29,207 |

36,157 |

44,025 |

86,476 |

1,31,054 |

1,49,172 |

2,04,287 |

2,668 |

7,868 |

44,578 |

55,114 |

(7.9) |

(6.5) |

(5.4) |

(5.6) |

(5.1) |

(6.3) |

(5.5) |

(6.2) |

(2.4) |

(6.8) |

(11.4) |

(8.9) |

V. |

Foreign Sector |

10,147 |

15,355 |

36,765 |

44,479 |

1,26,653 |

1,07,865 |

1,73,565 |

1,67,699 |

5,208 |

7,714 |

-18,788 |

-5,866 |

|

|

|

(3.0) |

(3.4) |

(5.5) |

(5.7) |

(7.5) |

(5.2) |

(6.4) |

(5.1) |

(4.6) |

(6.7) |

(-4.8) |

(-0.9) |

|

1. |

Foreign Consulates,

Embassies, Trade Missions, Information Services etc. |

497 |

1,049 |

328 |

334 |

752 |

2,624 |

1,578 |

4,007 |

552 |

6 |

1,872 |

2,430 |

(0.1) |

(0.2) |

(-) |

(-) |

(-) |

(0.1) |

(0.1) |

(0.1) |

(0.5) |

(-) |

(0.5) |

(0.4) |

|

2. |

Non-Residents |

2,623 |

1,931 |

33,156 |

40,447 |

1,13,640 |

97,087 |

1,49,418 |

1,39,465 |

-692 |

7,291 |

-16,552 |

-9,953 |

|

|

|

(0.8) |

(0.4) |

(4.9) |

(5.1) |

(6.7) |

(4.7) |

(5.5) |

(4.2) |

(-0.6) |

(6.3) |

(-4.2) |

(-1.6) |

|

3. |

Others |

7,027 |

12,375 |

3,281 |

3,698 |

12,261 |

8,153 |

22,569 |

24,226 |

5,347 |

417 |

-4,107 |

1,657 |

|

|

(2.1) |

(2.8) |

(0.5) |

(0.5) |

(0.7) |

(0.4) |

(0.8) |

(0.7) |

(4.7) |

(0.4) |

(-1.1) |

(0.3) |

Total |

3,35,707 |

4,49,228 |

6,70,851 |

7,85,764 |

16,93,343 |

20,83,649 |

26,99,901 |

33,18,641 |

1,13,521 |

1,14,913 |

3,90,305 |

6,18,740 |

|

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

— : Nil or Negligible.

Note : Figures in brackets indicate percentages to total. |

Statement 2 : Population Group-wise Ownership of Deposits of Scheduled Commercial Banks – As on March 31, 2008 |

(Rs. crore) |

Sector |

Rural |

Semi-Urban |

Urban |

Metropolitan |

Total |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

I. |

Government Sector |

24,722 |

8.2 |

36,183 |

8.4 |

1,09,124 |

16.0 |

2,77,774 |

14.6 |

4,47,805 |

13.5 |

|

1. |

Central & State Governments |

9,427 |

3.1 |

17,407 |

4.0 |

43,256 |

6.3 |

1,08,466 |

5.7 |

1,78,555 |

5.4 |

|

|

i) Central Government |

1,458 |

0.5 |

4,605 |

1.1 |

11,219 |

1.6 |

60,214 |

3.2 |

77,496 |

2.3 |

|

|

ii) State Governments |

7,969 |

2.6 |

12,802 |

3.0 |

32,037 |

4.7 |

48,252 |

2.5 |

1,01,059 |

3.0 |

|

2. |

Local Authorities |

6,496 |

2.2 |

8,117 |

1.9 |

16,170 |

2.4 |

39,063 |

2.1 |

69,846 |

2.1 |

|

3. |

Quasi-Government Bodies |

3,837 |

1.3 |

2,882 |

0.7 |

19,936 |

2.9 |

41,323 |

2.2 |

67,977 |

2.0 |

|

|

of which: State |

|

|

|

|

|

|

|

|

|

|

|

|

Electricity Boards |

171 |

0.1 |

494 |

0.1 |

5,337 |

0.8 |

7,122 |

0.4 |

13,123 |

0.4 |

|

4. |

Public Sector Corporations and Companies |

4,963 |

1.6 |

7,777 |

1.8 |

29,763 |

4.4 |

88,923 |

4.7 |

1,31,426 |

4.0 |

|

|

i) Non-Departmental Commercial undertakings |

1,818 |

0.6 |

2,503 |

0.6 |

8,460 |

1.2 |

33,981 |

1.8 |

46,761 |

1.4 |

|

|

ii) Others |

3,145 |

1.0 |

5,274 |

1.2 |

21,303 |

3.1 |

54,942 |

2.9 |

84,665 |

2.6 |

II. |

Private Corporate Sector (Non-Financial) |

2,491 |

0.8 |

9,538 |

2.2 |

32,521 |

4.8 |

3,87,659 |

20.4 |

4,32,209 |

13.0 |

|

1. |

Non-Financial Companies |

1,343 |

0.4 |

5,000 |

1.2 |

21,122 |

3.1 |

3,01,826 |

15.9 |

3,29,291 |

9.9 |

|

2. |

Non-Credit Co-operative Institutions |

84 |

- |

150 |

- |

757 |

0.1 |

1,896 |

0.1 |

2,887 |

0.1 |

|

3. |

Others |

1,064 |

0.4 |

4,388 |

1.0 |

10,642 |

1.6 |

83,936 |

4.4 |

1,00,031 |

3.0 |

III. |

Financial Sector |

4,998 |

1.7 |

14,521 |

3.4 |

46,066 |

6.7 |

2,77,326 |

14.6 |

3,42,912 |

10.3 |

|

1. |

Banks |

3,704 |

1.2 |

9,330 |

2.2 |

30,432 |

4.5 |

75,644 |

4.0 |

1,19,110 |

3.6 |

|

|

i) Indian Commercial Banks |

2,274 |

0.8 |

5,343 |

1.2 |

16,862 |

2.5 |

54,635 |

2.9 |

79,114 |

2.4 |

|

|

ii) Foreign Resident Banks (Offices of foreign banks in India) |

|

|

6 |

|

197 |

|

5,238 |

0.3 |

5,441 |

0.2 |

|

|

iii) Co-operative Banks & Credit Societies |

1,430 |

0.5 |

3,982 |

0.9 |

13,372 |

2.0 |

15,770 |

0.8 |

34,555 |

1.0 |

|

|

a. Co-operative Banks |

1,238 |

0.4 |

3,575 |

0.8 |

12,759 |

1.9 |

14,887 |

0.8 |

32,459 |

1.0 |

|

|

b. Credit Societies |

192 |

0.1 |

407 |

0.1 |

614 |

0.1 |

884 |

- |

2,096 |

0.1 |

|

2. |

Other Financial Institutions |

464 |

0.2 |

2,963 |

0.7 |

10,838 |

1.6 |

1,16,299 |

6.1 |

1,30,564 |

3.9 |

|

|

i) Financial Companies |

149 |

- |

44 |

- |

330 |

- |

2,669 |

0.1 |

3,192 |

0.1 |

|

|

a. Housing Finance Companies |

109 |

- |

24 |

- |

294 |

- |

958 |

0.1 |

1,385 |

- |

|

|

b. Auto Finance Companies |

40 |

- |

20 |

- |

36 |

- |

1,712 |

0.1 |

1,807 |

0.1 |

|

|

ii) Total of Mutual Funds (including - Private sector Mutual Funds |

|

|

99 |

|

131 |

|

46,967 |

2.5 |

47,198 |

1.4 |

|

|

a. Mutual Funds in Private Sector |

- |

- |

1 |

- |

24 |

- |

22,067 |

1.2 |

22,092 |

0.7 |

|

|

b. Other Mutual Funds |

- |

- |

99 |

- |

107 |

- |

24,900 |

1.3 |

25,106 |

0.8 |

Statement 2 : Population Group-wise Ownership of Deposits of Scheduled Commercial Banks – As on March 31, 2008 (Concld.) |

(Rs. crore) |

Sector |

Rural |

Semi-urban |

Urban |

Metropolitan |

Total |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

|

|

iii) Unit Trust of India |

80 |

- |

1,378 |

0.3 |

5,007 |

0.7 |

15,671 |

0.8 |

22,136 |

0.7 |

|

|

iv) Insurance Corporations and Companies |

158 |

0.1 |

1,057 |

0.2 |

1,429 |

0.2 |

20,318 |

1.1 |

22,962 |

0.7 |

|

|

v) Term Lending Institutions |

9 |

- |

11 |

- |

177 |

- |

3,439 |

0.2 |

3,636 |

0.1 |

|

|

vi) Provident Fund Institutions |

68 |

- |

374 |

0.1 |

3,764 |

0.6 |

27,235 |

1.4 |

31,441 |

0.9 |

|

3. |

Other Financial Companies |

831 |

0.3 |

2,228 |

0.5 |

4,797 |

0.7 |

85,383 |

4.5 |

93,238 |

2.8 |

|

|

i) Financial Services Companies |

101 |

- |

194 |

- |

769 |

0.1 |

26,482 |

1.4 |

27,547 |

0.8 |

|

|

ii) Other Financial Companies |

50 |

- |

552 |

0.1 |

1,624 |

0.2 |

35,088 |

1.8 |

37,314 |

1.1 |

|

|

iii) Others |

679 |

0.2 |

1,482 |

0.3 |

2,404 |

0.4 |

23,812 |

1.3 |

28,378 |

0.9 |

IV. |

Household Sector |

2,59,952 |

86.4 |

3,36,983 |

77.9 |

4,59,104 |

67.2 |

8,71,978 |

45.8 |

19,28,017 |

58.1 |

|

1. |

Individuals (including Hindu Undivided Families) |

2,24,577 |

74.6 |

2,87,905 |

66.5 |

3,67,350 |

53.8 |

6,15,547 |

32.4 |

14,95,379 |

45.1 |

|

|

i) Farmers |

83,050 |

27.6 |

49,463 |

11.4 |

24,789 |

3.6 |

19,888 |

1.0 |

1,77,189 |

5.3 |

|

|

ii) Businessmen, Traders, Professionals and Self-Employed Persons |

34,420 |

11.4 |

42,935 |

9.9 |

66,439 |

9.7 |

1,19,752 |

6.3 |

2,63,546 |

7.9 |

|

|

iii) Wage and Salary Earners |

28,120 |

9.3 |

37,620 |

8.7 |

54,596 |

8.0 |

97,860 |

5.1 |

2,18,196 |

6.6 |

|

|

iv) Shroffs, Money

Lenders, Stock Brokers, Dealers in Bullion etc. |

942 |

0.3 |

2,356 |

0.5 |

3,559 |

0.5 |

9,395 |

0.5 |

16,252 |

0.5 |

|

|

v) Other Individuals |

78,045 |

25.9 |

1,55,531 |

35.9 |

2,17,967 |

31.9 |

3,68,652 |

19.4 |

8,20,196 |

24.7 |

|

2. |

Trusts, Associations, Clubs etc. |

3,147 |

1.0 |

8,489 |

2.0 |

16,092 |

2.4 |

53,249 |

2.8 |

80,977 |

2.4 |

|

3. |

Proprietary and Partnership Concerns |

4,629 |

1.5 |

11,424 |

2.6 |

25,018 |

3.7 |

69,234 |

3.6 |

1,10,305 |

3.3 |

|

4. |

Educational Institutions |

3,336 |

1.1 |

5,076 |

1.2 |

8,331 |

1.2 |

11,853 |

0.6 |

28,595 |

0.9 |

|

5. |

Religious Institutions |

792 |

0.3 |

2,391 |

0.6 |

3,196 |

0.5 |

2,094 |

0.1 |

8,474 |

0.3 |

|

6. |

Others (Not elsewhere Classified) |

23,471 |

7.8 |

21,698 |

5.0 |

39,117 |

5.7 |

1,20,000 |

6.3 |

2,04,287 |

6.2 |

V. |

Foreign Sector |

8,806 |

2.9 |

35,591 |

8.2 |

36,081 |

5.3 |

87,221 |

4.6 |

1,67,699 |

5.1 |

|

1. |

Foreign Consulates, Embassies, Trade |

360 |

0.1 |

158 |

- |

29 |

- |

3,460 |

0.2 |

4,007 |

0.1 |

|

2. |

Non-Residents |

7,383 |

2.5 |

32,652 |

7.5 |

31,388 |

4.6 |

68,042 |

3.6 |

1,39,465 |

4.2 |

|

3. |

Others |

1,063 |

0.4 |

2,781 |

0.6 |

4,664 |

0.7 |

15,719 |

0.8 |

24,226 |

0.7 |

Total |

3,00,969 |

100.0 |

4,32,816 |

100.0 |

6,82,897 |

100.0 |

19,01,958 |

100.0 |

33,18,641 |

100.0 |

@ : Includes (a) ‘Financial Service Companies’ which undertake issue management, portfolio management etc., (b) ‘Other Financial Companies’ which are engaged in leasing hire purchase, loan companies, etc., and (c) ‘Others’ indicating non-profit institutions serving business like FICCI, CII, ASSOCHAM, etc.

– : Nil or Negligible. |

Statement 3 : Ownership Pattern of Deposits of Scheduled Commercial Banks Classified by States & Union Territories - As on March 31, 2008 |

(Rs. crore) |

Region / State / Union Territory |

Government Sector |

Foreign Sector |

Private

Corporate

Sector

(Non -

Financial) |

Financial Sector |

Household Sector |

Total |

Banks |

Other

Financial

Institutions |

Other

Financial

Companies |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Northern Region |

1,36,848 |

32,929 |

92,866 |

9,732 |

10,053 |

19,716 |

4,45,980 |

7,48,123 |

(18.3) |

(4.4) |

(12.4) |

(1.3) |

(1.3) |

(2.6) |

(59.6) |

(100.0) |

Haryana |

6,809 |

1,348 |

5,312 |

1,155 |

719 |

209 |

58,710 |

74,262 |

|

(9.2) |

(1.8) |

(7.2) |

(1.6) |

(1.0) |

(0.3) |

(79.1) |

(100.0) |

Himachal Pradesh |

2,882 |

399 |

87 |

2,328 |

167 |

115 |

14,615 |

20,592 |

(14.0) |

(1.9) |

(0.4) |

(11.3) |

(0.8) |

(0.6) |

(71.0) |

(100.0) |

Jammu & Kashmir |

3,343 |

437 |

29 |

715 |

901 |

54 |

20,243 |

25,722 |

(13.0) |

(1.7) |

(0.1) |

(2.8) |

(3.5) |

(0.2) |

(78.7) |

(100.0) |

Punjab |

3,957 |

10,581 |

1,615 |

1,140 |

622 |

462 |

81,994 |

1,00,372 |

|

(3.9) |

(10.5) |

(1.6) |

(1.1) |

(0.6) |

(0.5) |

(81.7) |

(100.0) |

Rajasthan |

5,643 |

2,776 |

3,217 |

1,212 |

648 |

330 |

59,668 |

73,493 |

|

(7.7) |

(3.8) |

(4.4) |

(1.6) |

(0.9) |

(0.4) |

(81.2) |

(100.0) |

Chandigarh |

6,873 |

1,515 |

1,428 |

545 |

89 |

103 |

13,683 |

24,235 |

|

(28.4) |

(6.3) |

(5.9) |

(2.2) |

(0.4) |

(0.4) |

(56.5) |

(100.0) |

Delhi |

1,07,341 |

15,872 |

81,178 |

2,638 |

6,907 |

18,443 |

1,97,068 |

4,29,446 |

|

(25.0) |

(3.7) |

(18.9) |

(0.6) |

(1.6) |

(4.3) |

(45.9) |

(100.0) |

North- eastern Region |

11,329 |

137 |

1,343 |

2,301 |

1,434 |

379 |

34,950 |

51,872 |

(21.8) |

(0.3) |

(2.6) |

(4.4) |

(2.8) |

(0.7) |

(67.4) |

(100.0) |

Arunachal Pradesh |

440 |

20 |

105 |

140 |

30 |

61 |

2,150 |

2,947 |

(14.9) |

(0.7) |

(3.6) |

(4.7) |

(1.0) |

(2.1) |

(73.0) |

(100.0) |

Assam |

7,063 |

112 |

872 |

1,018 |

1,266 |

277 |

21,632 |

32,240 |

|

(21.9) |

(0.3) |

(2.7) |

(3.2) |

(3.9) |

(0.9) |

(67.1) |

(100.0) |

Manipur |

753 |

1 |

2 |

128 |

6 |

- |

1,068 |

1,958 |

|

(38.5) |

(0.1) |

(0.1) |

(6.5) |

(0.3) |

|

(54.5) |

(100.0) |

Meghalaya |

1,070 |

2 |

48 |

474 |

18 |

9 |

3,664 |

5,285 |

|

(20.3) |

(-) |

(0.9) |

(9.0) |

(0.3) |

(0.2) |

(69.3) |

(100.0) |

Mizoram |

308 |

1 |

5 |

35 |

18 |

4 |

1,162 |

1,534 |

|

(20.1) |

(0.1) |

(0.3) |

(2.3) |

(1.2) |

(0.3) |

(75.7) |

(100.0) |

Nagaland |

663 |

- |

85 |

120 |

44 |

10 |

1,809 |

2,731 |

|

(24.3) |

|

(3.1) |

(4.4) |

(1.6) |

(0.3) |

(66.3) |

(100.0) |

Tripura |

1,031 |

- |

225 |

386 |

52 |

18 |

3,465 |

5,178 |

|

(19.9) |

|

(4.4) |

(7.5) |

(1.0) |

(0.4) |

(66.9) |

(100.0) |

Eastern Region |

67,289 |

5,660 |

19,567 |

8,690 |

4,281 |

8,607 |

2,48,539 |

3,62,634 |

(18.6) |

(1.6) |

(5.4) |

(2.4) |

(1.2) |

(2.4) |

(68.5) |

(100.0) |

Bihar |

13,024 |

749 |

743 |

2,460 |

286 |

327 |

51,267 |

68,855 |

|

(18.9) |

(1.1) |

(1.1) |

(3.6) |

(0.4) |

(0.5) |

(74.5) |

(100.0) |

Jharkhand |

7,579 |

274 |

1,153 |

1,607 |

263 |

312 |

33,609 |

44,798 |

|

(16.9) |

(0.6) |

(2.6) |

(3.6) |

(0.6) |

(0.7) |

(75.0) |

(100.0) |

Orissa |

13,306 |

558 |

3,970 |

1,741 |

559 |

372 |

34,967 |

55,472 |

|

(24.0) |

(1.0) |

(7.2) |

(3.1) |

(1.0) |

(0.7) |

(63.0) |

(100.0) |

Sikkim |

463 |

5 |

70 |

90 |

53 |

29 |

1,454 |

2,164 |

|

(21.4) |

(0.2) |

(3.2) |

(4.2) |

(2.4) |

(1.3) |

(67.2) |

(100.0) |

West Bengal |

32,634 |

4,074 |

13,624 |

2,769 |

3,101 |

7,568 |

1,26,443 |

1,90,213 |

|

(17.2) |

(2.1) |

(7.2) |

(1.5) |

(1.6) |

(4.0) |

(66.5) |

(100.0) |

Statement 3 : Ownership Pattern of Deposits of Scheduled Commercial Banks Classified by States & Union Territories - As on March 31, 2008 (Concld.) |

(Rs. crore) |

Region / State / Union Territory |

Government Sector |

Foreign Sector |

Private

Corporate

Sector

(Non -

Financial) |

Financial Sector |

Household Sector |

Total |

Banks |

Other

Financial

Institutions |

Other

Financial

Companies |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Andaman & Nicobar |

283 |

1 |

8 |

23 |

20 |

- |

798 |

1,133 |

(25.0) |

(0.1) |

(0.7) |

(2.0) |

(1.8) |

|

(70.5) |

(100.0) |

Central Region |

61,532 |

4,932 |

14,608 |

17,772 |

2,324 |

2,274 |

2,69,221 |

3,72,663 |

(16.5) |

(1.3) |

(3.9) |

(4.8) |

(0.6) |

(0.6) |

(72.2) |

(100.0) |

Chhattisgarh |

8,996 |

74 |

1,109 |

2,471 |

615 |

47 |

19,644 |

32,956 |

|

(27.3) |

(0.2) |

(3.4) |

(7.5) |

(1.9) |

(0.1) |

(59.6) |

(100.0) |

Madhya Pradesh |

13,125 |

846 |

6,460 |

4,619 |

513 |

406 |

59,574 |

85,544 |

(15.3) |

(1.0) |

(7.6) |

(5.4) |

(0.6) |

(0.5) |

(69.6) |

(100.0) |

Uttar Pradesh |

25,954 |

3,594 |

6,568 |

8,311 |

1,125 |

1,676 |

1,70,304 |

2,17,532 |

(11.9) |

(1.7) |

(3.0) |

(3.8) |

(0.5) |

(0.8) |

(78.3) |

(100.0) |

Uttarakhand |

13,457 |

417 |

471 |

2,371 |

71 |

145 |

19,699 |

36,632 |

|

(36.7) |

(1.1) |

(1.3) |

(6.5) |

(0.2) |

(0.4) |

(53.8) |

(100.0) |

Western Region |

89,703 |

62,584 |

2,28,414 |

68,018 |

1,04,384 |

54,553 |

4,63,096 |

10,70,752 |

(8.4) |

(5.8) |

(21.3) |

(6.4) |

(9.7) |

(5.1) |

(43.2) |

(100.0) |

Goa |

1,335 |

4,116 |

1,455 |

85 |

307 |

48 |

11,664 |

19,010 |

|

(7.0) |

(21.7) |

(7.7) |

(0.4) |

(1.6) |

(0.3) |

(61.4) |

(100.0) |

Gujarat |

8,967 |

13,303 |

12,444 |

4,518 |

2,715 |

2,785 |

1,12,478 |

1,57,209 |

|

(5.7) |

(8.5) |

(7.9) |

(2.9) |

(1.7) |

(1.8) |

(71.5) |

(100.0) |

Maharashtra |

79,265 |

44,900 |

2,14,421 |

63,402 |

1,01,357 |

51,712 |

3,37,739 |

8,92,796 |

|

(8.9) |

(5.0) |

(24.0) |

(7.1) |

(11.4) |

(5.8) |

(37.8) |

(100.0) |

Dadra & Nagar Haveli |

81 |

2 |

48 |

9 |

- |

1 |

494 |

636 |

(12.7) |

(0.4) |

(7.6) |

(1.4) |

|

(0.2) |

(77.7) |

(100.0) |

Daman & Diu |

55 |

264 |

46 |

4 |

5 |

8 |

720 |

1,101 |

|

(5.0) |

(24.0) |

(4.2) |

(0.3) |

(0.4) |

(0.7) |

(65.4) |

(100.0) |

Southern Region |

81,104 |

61,457 |

75,411 |

12,597 |

8,088 |

7,708 |

4,66,231 |

7,12,596 |

(11.4) |

(8.6) |

(10.6) |

(1.8) |

(1.1) |

(1.1) |

(65.4) |

(100.0) |

Andhra Pradesh |

31,538 |

5,479 |

16,910 |

2,056 |

2,512 |

1,893 |

1,18,301 |

1,78,691 |

(17.6) |

(3.1) |

(9.5) |

(1.2) |

(1.4) |

(1.1) |

(66.2) |

(100.0) |

Karnataka |

23,955 |

11,138 |

32,236 |

4,514 |

1,673 |

2,158 |

1,39,058 |

2,14,732 |

|

(11.2) |

(5.2) |

(15.0) |

(2.1) |

(0.8) |

(1.0) |

(64.8) |

(100.0) |

Kerala |

6,867 |

31,805 |

2,588 |

2,825 |

1,328 |

515 |

65,560 |

1,11,488 |

|

(6.2) |

(28.5) |

(2.3) |

(2.5) |

(1.2) |

(0.5) |

(58.8) |

(100.0) |

Tamil Nadu |

17,654 |

12,562 |

23,454 |

3,131 |

2,511 |

3,119 |

1,40,135 |

2,02,566 |

|

(8.7) |

(6.2) |

(11.6) |

(1.5) |

(1.2) |

(1.5) |

(69.2) |

(100.0) |

Lakshadweep |

244 |

1 |

2 |

28 |

- |

- |

78 |

354 |

|

(69.1) |

(0.2) |

(0.7) |

(7.9) |

|

|

(22.1) |

(100.0) |

Puducherry |

845 |

472 |

219 |

43 |

65 |

23 |

3,098 |

4,765 |

|

(17.7) |

(9.9) |

(4.6) |

(0.9) |

(1.4) |

(0.5) |

(65.0) |

(100.0) |

Total |

4,47,805 |

1,67,699 |

4,32,209 |

1,19,110 |

1,30,564 |

93,238 |

19,28,017 |

33,18,641 |

|

(13.5) |

(5.1) |

(13.0) |

(3.6) |

(3.9) |

(2.8) |

(58.1) |

(100.0) |

– : Nil or Negligible.

Note : Figures in Brackets Indicate Percentage to Total. |

Statement 4: Pattern of Ownership of Deposits in Selected Metropolitan Areas - As on March 31, 2008 |

(Rs. crore) |

Centre |

Government Sector |

Foreign Sector |

Private

Corporate

Sector

(Non -

Financial) |

Financial Sector |

Household Sector |

Total |

Banks |

Other

Financial

Institutions |

Other

Financial

Companies |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Chennai |

10,100 |

5,991 |

18,371 |

1,480 |

1,677 |

2,056 |

56,788 |

96,463 |

|

(10.5) |

(6.2) |

(19.0) |

(1.5) |

(1.7) |

(2.1) |

(58.9) |

(100.0) |

Mumbai |

60,954 |

38,525 |

201,235 |

55,604 |

99,005 |

51,274 |

221,138 |

727,734 |

|

(8.4) |

(5.3) |

(27.7) |

(7.6) |

(13.6) |

(7.0) |

(30.4) |

(100.0) |

Delhi |

1,05,844 |

15,866 |

81,054 |

2,378 |

6,906 |

18,441 |

1,93,198 |

4,23,688 |

|

(25.0) |

(3.7) |

(19.1) |

(0.6) |

(1.6) |

(4.4) |

(45.6) |

(100.0) |

Kolkata |

22,479 |

3,312 |

12,374 |

958 |

1,502 |

7,166 |

58,397 |

1,06,188 |

|

(21.2) |

(3.1) |

(11.7) |

(0.9) |

(1.4) |

(6.7) |

(55.0) |

(100.0) |

Total |

1,99,377 |

63,694 |

3,13,033 |

60,420 |

1,09,090 |

78,937 |

5,29,521 |

13,54,072 |

|

(14.7) |

(4.7) |

(23.1) |

(4.5) |

(8.1) |

(5.8) |

(39.1) |

(100.0) |

Note : Figures in Brackets Indicate Percentages to Total. |

Statement 5: Composition of Deposits According to Bank Group and Type - of Deposits -

As on March 31, 2008 |

(Rs. crore) |

Bank group |

Current |

Savings |

Term |

Total |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

1 |