IST,

IST,

Currency Swaps of the Reserve Bank of India: Role in the GFSN and Fostering International Financial Cooperation

|

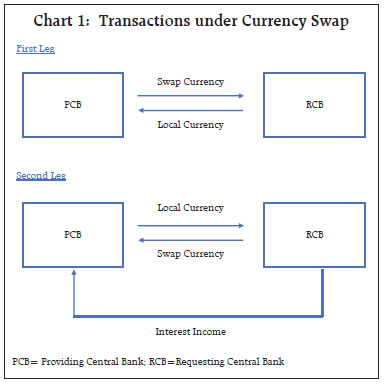

by Ajesh Palayi^ The central bank currency swaps have played a crucial role in the global financial system since the Global Financial Crisis, particularly through bilateral and regional financing arrangements. Through the SAARC Currency Swap Framework and the BRICS Contingent Reserve Arrangement, the RBI plays a key role in the GFSN. During the COVID-19 pandemic, the Reserve Bank’s swap support under the SAARC Currency Swap Framework rose significantly. Considering the healthy forex reserve position of India, central bank currency swaps have the potential to foster India’s external financial cooperation further. I. Introduction Financial and economic cooperation has been an integral part of the relations among the countries. The economic relations among countries have over time expanded from trading activities to a wide spectrum of financial activities such as investment, developmental assistance like aid and grants, credit and remittances. The globalisation in the later part of the 20th century has further reshaped economic engagements among countries. Various financial crisis episodes, viz., Asian Financial crisis 1997-98 and Global Financial Crisis 2008 and the need to mitigate their adverse consequences and spillovers have deepened financial and economic cooperation amongst countries, particularly at the regional level (Henning, 2011). In the realm of financial and economic cooperation, the Global Financial Safety Net (GFSN) holds a key position. The GFSN is an umbrella term for a set of institutional arrangements and mechanisms that provide precautionary support against a crisis and extend liquidity support during a crisis while encouraging adoption of robust macroeconomic policies. The GFSN has mainly four layers: countries’ own reserves at the national level, swap arrangements among central banks at the bilateral level, pooling of financial resources among the countries at the regional level, which are referred as Regional Financing Arrangements (RFAs) and the International Monetary Fund (IMF) at its core, providing a global financial backstop. Central bank currency swap arrangements are one of the key elements of the GFSN, acting mainly through bilateral swaps and RFAs1. Of the total US$ 18 trillion resource of the GFSN, currency swap arrangements account for approximately US$ 2,817 billion. The swap arrangements include the SAARC2 Currency Swap Framework and the BRICS3 Contingent Reserve Arrangement (CRA) with contributions of US$ 2.0 billion and US$ 100 billion, respectively (Table 1). Central bank swap lines help to address foreign currency funding issues particularly during the time of liquidity stress and BoP crisis. While central banks could provide local currency to the domestic financial institutions to address any stress emanating from local currency liquidity, central bank’s ability to extend support by providing foreign currency is constrained by the forex reserves they hold. In this context, it is important for central banks to have access to forex swap lines with other central banks, who are willing to offer swap lines. The Global Financial Crisis (GFC) provided an impetus to financial cooperation through central bank swap lines. The US Federal Reserve extended US dollar swap lines to select central banks during the GFC to address enhanced pressures in short term dollar funding markets. These swap lines were instrumental for managing liquidity disruptions (Goldberg et al., 2010). During the COVID-19 pandemic, the US Federal Reserve provided liquidity to nine central banks4 through central bank swap lines. Six central banks including the US Federal Reserve5 announced a coordinated action to further enhance the provision of US dollar liquidity. Post the GFC, China has entered into bilateral swap arrangements with 32 counter parties with a view to promoting trade and fostering internationalisation of Chinese Yuan (CNY) (Central Bank Currency Swap Tracker). The ASEAN+3 countries established Chiang Mai Initiative Multilateralisation (CMIM) in 2010 as a multilateral currency swap mechanism to provide a backstop line of funding for member countries6. Similarly, the BRICS countries established the CRA in 2015 as a multilateral currency swap mechanism to support BRICS countries during a crisis7. Post the GFC, India launched the SAARC Currency Swap Framework in 2012 to support macroeconomic and financial stability in the SAARC region and promote economic cooperation among SAARC countries. Many central bank swap arrangements have evolved into permanent institutionalised swap mechanisms today (Mingqi Xu, 2016). Some of these swap arrangements are also a part of countries’ larger goal of achieving internationalisation of their currencies. Against the above backdrop, this article makes an attempt to cover various currency swap arrangements of the Reserve Bank of India (RBI) with other central banks and the supportive role played by these swap arrangements. Accordingly, the rest of the article has been divided into five sections. Section II presents the concept and objectives of currency swap arrangements. Sections III and IV cover the SAARC Currency Swap Framework and the BRICS CRA, respectively. Section V discusses the role of swap lines to foster international financial relations, with concluding remarks in Section VI. II. Currency Swap Facility: Concept and Objectives Currency swap transaction shall mean a transaction between the requesting central bank and a providing central bank by which the requesting central bank purchases US dollars or any other foreign currency (swap currency) from the providing central bank in exchange for the requesting central bank’s currency (local currency) and repurchases on a later date the local currency in exchange for swap currency. The exchange rate of the spot leg transaction shall also be applied to the forward leg transaction. The swap recipient central bank can lend the swapped currency to its domestic banks and financial institutions, on its own terms, conditions and risks (Chart 1).  The swap mechanism would help to maintain financial stability during a crisis by providing a backstop line of funding for forex liquidity requirements or to address short-term balance of payments stress. The swap lines of US Fed Reserve to select countries during the GFC and the COVID-19 pandemic played a crucial role in ensuring adequate US dollar liquidity and reducing financial instability risks (Perks et al., 2021). Swaps are usually extended for an initial period of three or six months or one year followed by rollovers (renewals) as per agreed terms. After a full round of drawal including the rollover period, providing countries generally stipulate a standard waiting period before the next drawal with a view to avoiding repeated recourse to the facility. One noteworthy feature of currency swap is that the exchange rate between swap currency and local currency is fixed at the value date of drawal and would remain same for both the spot and forward transaction. Pricing of swap mechanism is an important aspect. Usually, interest of swap drawal is benchmarked to a financial benchmark like London Inter-Bank Offered Rate (LIBOR)8. Secured Overnight Financing Rate (SOFR), Euro short-term rate (ESTR) etc., depending on the currency of the swap drawal. A spread is added to this benchmark to cover multiple risks involved including the default risk. Quantum and duration of the swap, sovereign credit rating of the recipient country, past records of repayments of swap and other external obligations, probability of default, operating charges and geopolitical considerations are the major factors considered while the providing party decides on the spread. The benchmark is usually reset at the time of rollover of the swap. Swap mechanisms normally have provisions of penal interest rate if there is an occurrence of default. Swap mechanism has some risks associated with it. Credit risk is inherently high with the currency swap as most of the times, swap support is extended to countries to tide over a crisis/difficult situation. If the recipient central bank defaults, the providing party is left with collateral in the form of the currency of the recipient country. In the circumstance of a default, the currency of recipient country is likely to lose its value relative to the exchange rate at which the swap was executed. It would result in losses for the providing party. On account of this, providing party central banks, whenever they enter into swap with countries who have highly volatile currencies, include the provision of a periodic revaluation of the local currency during the swap transaction period. Another concern is how the providing party would utilise the collateral in the form of the currency of the recipient country, when default occurs. Generally, procedures set out below are followed for resolving such a default situation:

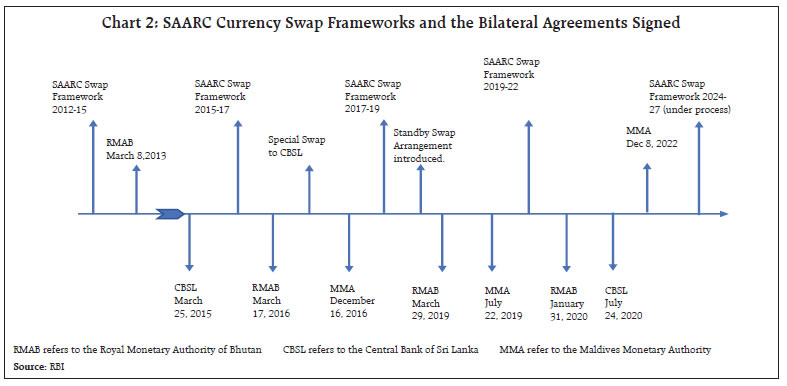

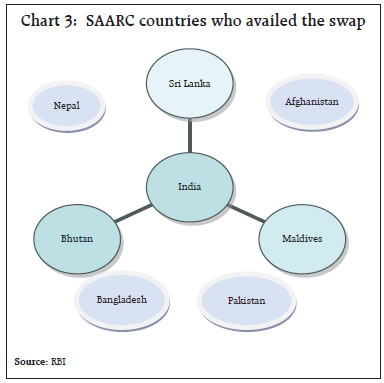

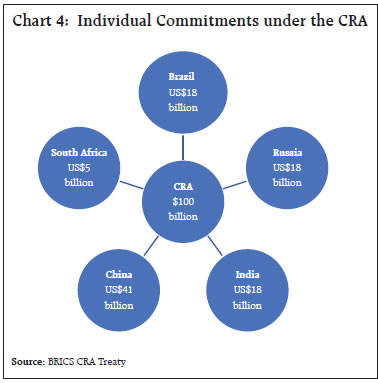

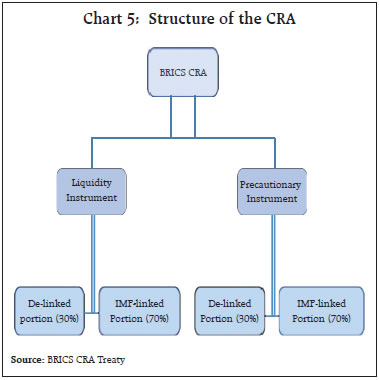

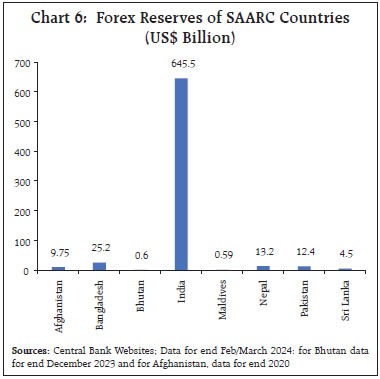

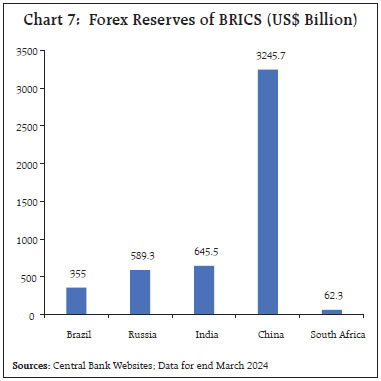

III. SAARC Currency Swap Framework The SAARC countries decided to set up a currency swap mechanism to meet the short-term forex liquidity requirement of SAARC countries and accordingly, the Framework on Currency Swap Arrangement for SAARC countries came into effect in November 2012. The SAARC Currency Swap Arrangement helps to provide a back-stop line of funding to address short-term forex liquidity needs or balance of payment needs. Under the Framework, the RBI would offer swaps of varying sizes to each SAARC member countries, within the overall corpus of US$ two billion. The Framework allows the countries to draw swaps in US Dollar, Euro or INR. The Framework is updated in regular intervals. Currently, the Framework on Currency Swap Arrangement for SAARC countries 2019-22 is in place9. The RBI has initiated work on finalising the SAARC Currency Swap Framework 2024-27. The evolution of the Framework and various agreements signed under the Framework are given in Chart 2. SAARC Currency Swap Framework has a provision of ‘Standby Swap Arrangement’ which was added to the Framework through an amendment in 2018. The Standby Swap Arrangement empowers the Finance Minister, Government of India, to approve additional swap requests from member countries (beyond their eligible limits) aggregating up to US$ 400 million. The Framework stipulates a waiting period between two consecutive drawals, requirement of an IMF staff level agreement for availing second rollover and information sharing as means of cooperation between bilateral/multilateral swap arrangements and the IMF.   Since the inception of the Framework, Bhutan, Sri Lanka and Maldives availed the swap facility multiple times. Afghanistan, Bangladesh, Nepal and Pakistan, however, never availed the facility (Chart 3). The Reserve Bank provided an aggregate swap support of US$ 6.1 billion under the SAARC Currency Swap Framework since its establishment in 2012. Out of these, the share of Sri Lanka is 62 per cent (US$ 3.8 billion), Bhutan is 26 per cent (US$ 1.6 billion) and Maldives is 12 per cent (US$ 0.7 billion) (Table 2). During the COVID-19 pandemic (2020-22), the Reserve Bank provided swap support aggregating US$ 2.0 billion to Bhutan, Maldives and Sri Lanka in comparison to the swap support of US$ 1.1 billion during the preceding three years 2017-19, providing a significant help to these member countries to manage their external sector pressures (Table 3). IV. BRICS Contingent Reserve Arrangement (CRA) The BRICS CRA is a major flagship initiative under the economic and financial cooperation track of the BRICS. The CRA is a mechanism wherein the BRICS countries have established a self-managed contingent reserve pool to help to address short term balance of payments crises by providing mutual swap support. The BRICS countries have committed to a total resource of US$ 100 billion under the CRA with individual commitments as given in Chart 4.  The CRA has mainly two instruments, liquidity and precautionary. A liquidity instrument would provide immediate liquidity support in response to balance of payments pressures. A precautionary instrument is a commitment to provide support in view of potential balance of payments stress. Both these instruments have De-linked and IMF-linked portion. Under the De-linked portion, countries have access equal to 30 per cent of the maximum access for each Party. Under the IMF-linked portion, countries have access to remaining 70 per cent of the maximum access (Chart 5).  The multiplier values for determining access amount from commitment amount vary with highest multiplier value for South Africa (2) and lowest for China (0.5). Brazil, Russia and India have multiplier value of one (1). The country wise access amount is presented in Table 4. The maturity, number of renewals and total support period under the CRA vary depending on the type of instrument. It also varies between De-linked and IMF-linked portion, with a minimum duration of the swap support of six months and maximum of three years (Table 5). Other major features of the CRA are briefly mentioned in Table 6. The CRA SC decided in December 2017 to conduct test runs in order to maintain operational readiness and credibility of the CRA. Accordingly, BRICS central banks, so far, successfully conducted the six test runs, involving various complications and scenarios (Table 7). As a swap mechanism, BRICS CRA has a lot of commonalities with the CMIM and the SAARC Currency Swap Framework. There are also some key differences among them in their design, structure and operations (Table 8). In addition to the SAARC Swap Framework and the CRA, the Reserve Bank signed a currency swap arrangement, for an amount of up to US$ 75 billion, with the Bank of Japan. V. Fostering International Financial Cooperation The central bank swap lines help to deepen the financial cooperation between/among countries. Central bank swaps are agreements between sovereign nations executed through their central banks with the consent and approval of the respective Governments. A Guarantee from the Sovereign Government of the requesting party, covering the entire swap amount is generally a prerequisite for signing the swap agreement. The Government of the requesting country also need to certify that they would not impose any payment restrictions which would adversely affect central banks’ repayment of outstanding obligation of the swap. By extending a direct financial support to a country during a crisis time, the swap mechanism provides for a robust channel of financial cooperation. There are many occasions that India provided swap support to SAARC countries beyond their eligible limits and duration under the SAARC Currency Swap Framework, to meet additional requirements of these countries to manage contingent situations. The Reserve Bank extended two special currency swap facilities to the CBSL, which were outside the SAARC Currency Swap Framework, with a support of US$ 1100 Million and US$ 700 Million in July 2015 and March 2016, respectively. These special swap supports are provided for short-term liquidity management in the context of India’s strong bilateral relations and economic ties with Sri Lanka. The provision of Standby Swap Arrangement has been invoked multiple times to support the request for additional swap support by countries. The comfort of healthy forex reserves helped India to extend these swap supports (Chart 6).  BRICS countries’ contribution to the CRA is reflective of their forex reserve position (Chart 7). Even though swap has never been availed under the CRA so far, various engagements under the CRA helped to intensify the cooperation among BRICS central banks. As part of BRICS CRA, BRICS Central Banks developed a System of Exchange of Macro-Economic Information (SEMI) during India’s BRICS Chair in 2016 which is a template of sixty macroeconomic indicators covering real, fiscal and external sectors, capital market and financial soundness. In 2020, under the Russian Chair, BRICS central banks produced an annual edition of the BRICS Economic Bulletin as part of the CRA, with the theme ‘COVID-19 pandemic’. The Bulletin provided an overview of the situation in the BRICS economies, accumulated risks, policy measures undertaken to mitigate the impact of the COVID-19 crisis, future outlook and new areas of co-operation. The BRICS Economic Bulletin 2021 focussed on the theme ‘navigating the ongoing pandemic: the BRICS experience of resilience and recovery’. In 2022, under China’s BRICS Chair, BRICS central banks continued with the annual exercise of BRICS Economic Bulletin. The first BRICS Collaborative Study conducted in 2021 on the topic ‘COVID-19: headwinds and tailwinds for balance of payments of BRICS’ examined the impact of the pandemic on current account balance as well as capital flows in the BRICS economies.  The conduct of multiple CRA test runs by simulating crisis situations has deepened engagements among BRICS central banks. The CRA Technical Group examines various technical issues involved in the CRA and takes measures to address these issues. More importantly, CRA GC, a body of the Finance Ministers and the Central Bank Governors of the BRICS countries, meets at least once in a year and make strategic decisions regarding the CRA. Similarly, the CRA SC, at the level of Deputy Governors of BRICS central banks, makes decisions on any operational issues regarding the CRA. These multiple levels of exchanges through the CRA have intensified the relation among BRICS central banks. The India-Japan Swap Arrangement reflects long-standing relation between India and Japan which has helped to deepen the financial engagements between these two countries. India’s forex reserves have increased significantly in recent years. When India constituted the SAARC Swap Framework in 2012, India’s forex reserves were around $300 billion, whereas it is more than twice today. This has provided India comfort and leverage to extend more swap support to the countries. Currently, the Reserve Bank provides various concessions to INR swap drawals under the SAARC Swap Framework, with a view to incentivising the drawal of swaps in INR, in terms of shorter waiting period between two consecutive drawals and waiver of conditionalities for availing second swap rollover. Central bank currency swaps are an integral part of the GFSN architecture. The swap lines at bilateral and regional level have provided more options to the countries to meet their contingent forex liquidity requirements. The swap arrangements played a vital role during the pandemic to support countries to manage their external sector pressures. Going forward, collaboration among various pillars of the GFSN including the IMF and the RFAs needs to be encouraged to make the GFSN system more robust and dynamic. Supported by healthy level of forex reserves, central bank currency swaps have higher potential to strengthen and deepen India’s external financial cooperation. References Ball, M., Clarke, A., and Noone, C. (2020). The Global Financial Safety Net and Australia. Reserve Bank of Australia Bulletin, September. Central Bank Currency Swaps Tracker, https://www.cfr.org/article/central-bank-currency-swaps-tracker Goldberg, L ., Kennedy, C., and Miu, J. (2010). Central Bank Dollar Swap Lines And Overseas Dollar Funding Costs. NBER Working Paper 15763. Henning, C.R. (2011). Economic Crises and Institutions for Regional Economic Cooperation. Asian Development Bank. International Monetary Fund. (2017). Discussion Paper on ‘The Treatment of Currency Swaps Between Central Banks’. Mingqi, Xu. (2016). Central Bank Currency Swaps and Their Implications to the International Financial Reform. China Quarterly of International Strategic Studies, Vol. 2, No. 1, 135–152. Perks, M., Rao, Y., Shin J., and Tokuoka, K. (2021). Evolution of Bilateral Swap Lines. International Monetary Fund Working Paper 21/210. ^ The author is from International Department, Reserve Bank of India. Author would like to thank Mr. Rajan Goyal for the encouragement and valuable guidance in preparing this article. The author expresses gratitude to Mrs. Gunjeet Kaur and Mrs. Smita Sharma for their valuable inputs and gratefully acknowledges contributions of Sreejith S. and comments from the Department of External Investments and Operations (DEIO). The views expressed in the article are those of the author and do not represent the views of the Reserve Bank of India. 1 Even though the IMF loans are also technically in the nature of currency swaps, the IMF treats these as one directional. 2 The South Asian Association of Regional Cooperation (SAARC) is an organization among Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan and Sri Lanka with the larger aim of promoting the development and progress of all countries in the region. 3 Grouping of Brazil, Russia, India, China and South Africa 4 Central banks of Australia, Brazil, Korea, Mexico, Singapore, Sweden, Denmark, Norway and New Zealand. 5 The Bank of England, the Swiss National Bank, the European Central Bank, the Bank of Canada and the Bank of Japan 6 Chiang Mai Initiative (CMI) started after the Asian Financial Crisis in 1997-1998 was a bilateral swap mechanism. 7 CRA treaty was signed in July 2014 |

Page Last Updated on: