Private Corporate Investment: Performance and Near-term Outlook - RBI - Reserve Bank of India

Private Corporate Investment: Performance and Near-term Outlook

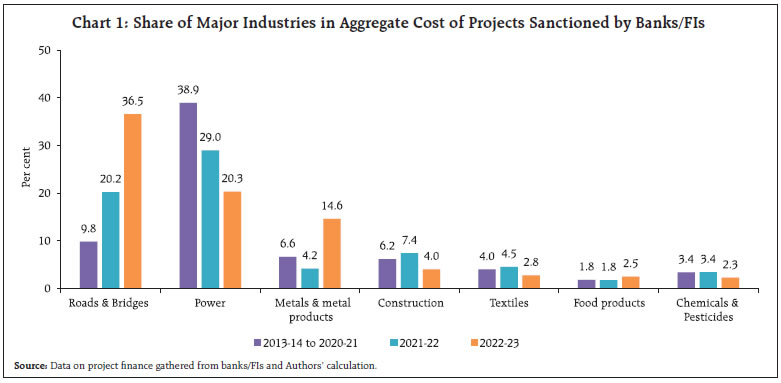

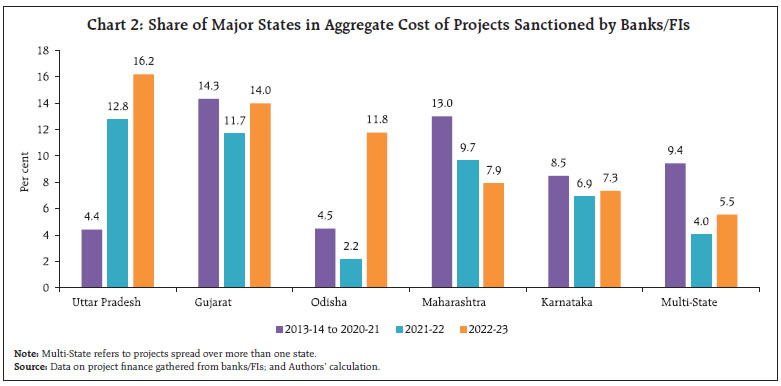

by Shreya Bhan^, Rajendra N Chavhan^ and Rajesh B Kavediya^ The near-term outlook for private investment activity in India is gauged from project investment proposals of the private corporate sector. A sustained pick-up in bank credit in recent period, rising capacity utilisation, improved business outlook and demand conditions and various government policy initiatives to support investment activities provided a conducive environment for the private corporates to undertake fresh capital all-India investment. The envisaged total cost of the projects financed by banks/financial institutions reached a new peak during 2022-23 since 2014-15. Of the total capital investment during 2022-23, about 40 per cent is expected to be spent in 2023-24. A long-term analysis points to the usefulness of investment intentions of private corporates as an early indicator of the assessment of private capex. Introduction Generally, investment and consumption remained the major drivers of India’s growth story. After experiencing a slowdown in investment since 2013-14, early signs of revival in the capex cycle, particularly of the private corporate sector, was seen since 2021-22, supported by the capital expenditure push by the Government. The improvement in capacity utilisation of the manufacturing sector, pick-up in credit demand, improving demand conditions and consumer sentiment bode well for the capex cycle. Cleaning up of balance sheets by both corporates and banks provides scope to increase lending activities. Capital expenditure (capex) of the private corporate sector serves as a leading indicator that reflects the investment climate within the economy. This underscores the importance to evaluate the potential for economic expansion by conducting a thorough analysis of the private investment outlook. Given the time lag in releasing the yearly financial statements by corporations, relying solely on a balance sheet-based investment assessment may not be an effective approach for setting up a forward-looking investment outlook for prospective planning. In many economies, survey-based approach is commonly employed as an alternative source to gather data on intended corporate investment plans and investment sentiment. These surveys provide valuable insights into the current investment climate and the anticipated investment intentions that are expected to materialise in the near to medium-term. India too, since the late 1980s, regularly collects the information on project finance data of private corporates from the select banks/financial institutions (FIs)1 for the assessment and forecasting/nowcasting of private investment. The Reserve Bank has been tracking capex plans of the private corporate sector through the projects that are funded by banks/FIs for providing an outlook on investment2. The article is structured into six sections. Section II sets out the methodology and its limitations. Important features of projects sanctioned or contracted during the period of review (i.e., 2022-23), funding thereof, and distributional aspects in terms of regions and industries are presented in Section III. Section IV deals with the phasing profile of the sanctioned/contracted loans/financing and estimates growth of corporate investment. Analysis of envisaged capital expenditure and gross fixed capital formation of private corporates is presented in section V, while section VI concludes the study. II. Methodology and Limitations For the assessment of the near-term outlook of investment activity of private corporates, the methodology proposed by Rangarajan (1970)3 has been adopted. For this purpose, data on investment intentions were gathered through three different sources, viz., (i) banks and FIs which are involved in the business of project finance to private corporates, (ii) finances raised for capex purpose through the external commercial borrowings (ECBs) [including issuance of foreign currency convertible bonds (FCCBs)), rupee denominated bonds (RDBs)], and (iii) initial public offerings (IPOs), follow-on public offerings (FPOs) and rights issues during a year by the private corporates for capex purpose. To avoid double counting and consequent overestimation of capital investment, meticulous efforts have been made to ensure that each project is included in the dataset only once. This is achieved by utilising internal databases of the Reserve Bank and incorporating information supplied by the Securities and Exchange Board of India (SEBI), even when a project is funded through multiple sources. This study focuses exclusively on projects that receive funding from the aforementioned sources, having a project cost exceeding ₹10 crore, and majority ownership stake of project with private corporates. Projects having majority stakeholding with the Central and/or State governments, and projects initiated by trusts and educational institutions are excluded from the scope of this study. The estimates are derived under the assumption that companies adhere to their ex-ante capital expenditure plans. However, it is important to note that these estimates differ from the actual private corporates fixed investment figures reported in the National Accounts Statistics (NAS), as some planned intentions may not materialise into realised investments in terms of their amount and timing, and that certain projects may be funded through internal resources as well as through the fund raised from capital market/ bond financing and foreign direct investment (FDI), which are not being captured in the project finance data collected by the RBI. III. Characteristics of Projects Sanctioned/Contracted The investment outlook of private corporates, as reflected in terms of the total number of projects as well as the total project cost, which got sanctioned by banks/FIs, continued to show improvement during 2022-23. About 547 projects got assistance from banks/FIs during 2022-23 with a record high total project cost of ₹2,66,547 crore, compared to 401 projects having a total project cost of ₹1,41,976 crore during 2021-22 (Annex Table A1). During 2022-23, 393 companies, which did not avail of any financing from banks/FIs for capex projects, raised ₹82,448 crore through ECBs, while 42 other companies raised ₹3,629 crore through domestic equity issues under the IPO route for funding their capex needs. Overall, investment plans of 982 projects were made during 2022-23, with record capital outlay of ₹3,52,624 crore – higher than the level seen since 2014-15, as against 791 projects in 2021-22 with investment intentions of ₹1,96,445 crore (Annex Table A1-A4). i) Size-wise The size-wise distribution of projects showed a noticeable increase in the number of projects across various sizes. There were eight mega projects (with project cost ₹5,000 crore & above) and 68 large projects (₹1000 crore-₹5000 crore), sanctioned by banks/FIs during 2022-23, having share of 27.1 per cent and 41.3 per cent of total project costs, respectively. The phasing plan of mega/large projects may have a bearing on the capex in the longer-term (Annex Table A5). ii) Purpose-wise Purpose-wise pattern of projects indicates that investment in green field (new) projects accounted for the largest share of 93.1 per cent in the total cost of projects financed by banks/FIs during 2022-23, in line with the trend seen in the past. A marginal share of 6.1 per cent of total project cost was directed towards expansion and modernisation (Annex Table A6). iii) Industry-wise The infrastructure sector, comprising (a) power, (b) telecom, (c) ports and airports, (d) storage and water management, (e) special economic zone (SEZ), industrial, biotech and IT park, and (f) roads & bridges, remained the major sector accounting for 60 per cent share in the total cost of projects during 2022-23 (Annex Table A7). Within the infrastructure sector, roads & bridges held a significant share in the total project cost, supported by government’s push towards infrastructure projects through “Bharatmala4” initiative. Besides the infrastructure sector, major industries like metal & metal products, construction, textile, and food products accounted for the sizable share in the total cost of projects envisaged during 2022-23, with a notable increase in its share by metal & metal products as compared with the previous year (Chart 1). iv) State-wise The location of projects depends upon a range of factors, including the accessibility to raw materials, the nature of the project, the availability of skilled labour, the presence of adequate infrastructure, the size of the market, the growth potential, the availability of suppliers, and the demand for the products. For the analysis purpose, in this article, the projects which are spread across multiple states have been classified as “multi-state” projects. The state-wise distribution revealed that the top five states viz., Uttar Pradesh, Gujarat, Odisha, Maharashtra and Karnataka, together account for 57.2 per cent share in total project cost during 2022-23, higher than 43.2 per cent share during 2021-22 (Chart 2 and Annex Table A8). In 2022-23, Uttar Pradesh accounted for the highest share (16.2 per cent) in the total cost of projects sanctioned by banks/FIs, followed by Gujarat, Odisha, Maharashtra and Karnataka. The share of Uttar Pradesh and Odisha in the total cost of projects improved significantly from the previous year as well as the average share recorded during the period 2013-14 to 2020-21.

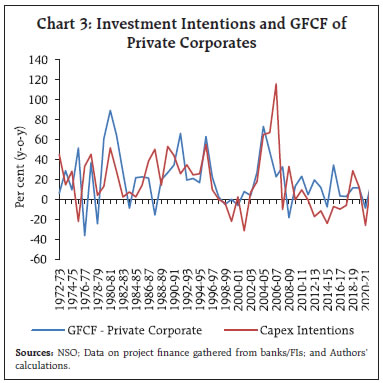

IV. Phasing Profile of Investment Intentions Phasing profile of capital expenditure of projects sanctioned by banks/FIs during the current year and the previous years provides near-term (one year ahead) investment outlook of private corporates. The phasing from the cohort of projects in 2022-23 indicates that about 33.0 per cent (₹87,997 crore) of the total proposed capital expenditure was expected to be spent in the same year, while 34.7 per cent (₹92,539 crore) is likely to be spent in 2023-24 and another 24.8 per cent (₹66,071 crore) in the subsequent period. Of the total cost of projects sanctioned in 2022-23, 7.5 per cent of the amount was already spent prior to 2022-23. From the planned capital expenditure based on the projects sanctioned by banks/FIs till 2022-23, the capex envisaged in 2022-23 recorded an increase of 9.8 per cent to ₹1,58,903 crore during 2022-23 over the previous year (Annex Table A1). Resources raised through the ECB and IPO route by private corporates supplement the financing of their investment activities. From the fund raised through ECB route for capex purpose, capital expenditure planned to be incurred during 2022-23 declined by 3.0 per cent over the previous year to ₹58,186 crore. The capital market (equity route) enabled the financing of envisaged capex of ₹2,560 crore in 2022-23, higher than the previous year (Annex Tables A2 and A3), though its share in total envisaged capital expenditure remained miniscule. Overall, a total capital investment of ₹2,19,649 crore through the various channels of funding, as alluded to earlier, was expected to be made by the private corporate sector in 2022-23, recording an increase of 6.7 per cent from the planned phasing of the previous year, primarily led by a rise in capex projects financed by banks/FIs more than offsetting the decline in capital investment through ECB. The phasing profile of the envisaged capex, based on the pipeline projects5 sanctioned by the banks/ FIs in the previous years prior to the reference year, increased from ₹70,906 crore in 2022-23 to ₹1,17,182 crore in 2023-24; while based on all channels of financing together, it stood at ₹1,71,568 crore in 2023-24 as against ₹94,876 crore in 2022-23 (Annex Tables A1 and A4). V. Investment Intentions and GFCF of Private Corporates Envisaged capital investment, based on the project finance data through all sources, tracks the growth of gross fixed capital formation (GFCF) at current prices by private corporates well, barring episodic occasions of divergence in direction (Chart 3). However, over the period, the ratio of envisaged capex to GFCF of private corporates (as per NAS data) declined significantly - the average share declined from 40.5 per cent during 1971-72 to 2010-11 to 15.5 per cent during 2011-12 to 2021-22. Deleveraging of corporate balance sheet, rising use of internal sources of funds and funds raised through other sources such as FDI, resulted in lower dependence of private corporates on banks/FIs for funding their capital investment, which has been mirrored in the decline in the ratio of envisaged capex to GFCF of private corporates. Despite a decline in the ratio, envisaged capital investment still remains useful as an early indicator for assessing private capital investment cycle (Box 1).

The Government’s thrust on capex, besides various policy initiatives to revive the investment cycle, and improved economic outlook provided a conducive environment for the private corporates to undertake fresh capital investment. The envisaged capital investments of private corporates, based on the projects sanctioned by banks/FIs, increased for the second consecutive year after remaining subdued during 2019-20 and 2020-21. The total cost of projects sanctioned by banks/FIs during 2022-23 increased to a record high of ₹2,66,547 crore. The infrastructure sector continued to attract maximum capex projects, led by ‘Road & Bridges’ and ‘Power’ sectors, reflecting the Government’s push towards infrastructure development. Of the total cost of projects, around 35 per cent is likely to be spent during 2023-24 and about 25 per cent in the subsequent period. The phasing profile of the envisaged capex, based on the pipeline projects finance through all three channels, suggests that the envisaged capex increased significantly to ₹1,71,568 crore in 2023-24 as against ₹94,876 crore in 2022-23. Further, empirical analysis underscored the usefulness of envisaged capital investment (ex-ante phasing plan) as an early indicator for assessing the near-term private corporate investment outlook. Improved capacity utilisation, pick-up in credit demand, and improved business expectations, as reflected in forward-looking enterprise surveys conducted by the RBI and also by other agencies, are pointing towards reinvigoration of investment activity in the Indian economy in the period ahead. On the downside, the higher cost of capital owing to tightening of monetary policy by various central banks including India, global uncertainty led by geo-political tensions, and risk of slowdown in major advanced economies could hamper investment activities. Overall, the investment cycle appears to be poised to gain momentum going ahead, but, its sustainability needs to be watched closely. ^ The authors are from the Department of Statistics and Information Management. The views expressed in the article are those of the authors and do not represent the views of the Reserve Bank of India. The previous article in the series “ Private Corporate Investment: Growth in 2021-22 and Outlook for 2022-23” was published in the August 2022 issue of the Reserve Bank of India Bulletin. 1 Includes all public sector banks, major private sector and foreign banks, and financial institutions which are actively involved in project financing namely, Industrial Financial Corporation of India (IFCI), Life Insurance Corporation (LIC), Power Finance Corporation (PFC), Rural Electrification Corporation of India (REC) and Export-Import Bank of India (EXIM). 2 Analysis of investment outlook of private corporates are regularly released in the form of articles, initially in the Economic and Political Weekly and, since 1989, in the RBI Bulletin. 3 The methodology was published on 19th December, 1970 in the article “Forecasting Capital Expenditure in the Corporate Sector” authored by Dr. C Rangarajan in the Economic and Political Weekly (EPW), Volume No. 5, Issue No. 51, Page 2049-2051. 4 Bharatmala, under Ministry of Road Transport and Highways, Government of India, is an umbrella programme for the highways sector in India that focuses on optimising efficiency of freight & passenger movement across the country by bridging critical infrastructure gaps. 5 Pipeline projects are those projects which are already undertaken for implementation. Capex from pipeline projects are envisaged amounts for a given year, which got sanctioned prior to that given year. 6 M.H. Pesaran, Y. Shin (1998), “An autoregressive distributed lag Modelling approach to cointegration analysis”, S. Strøm (Ed.), Econometrics and Economic Theory in The Twentieth Century: The Ragnar Frisch Centennial Symposium, Cambridge University Press, Cambridge, UK (1998), pp. 371-413. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||