Introduction The Railway Budget (Vote-on-Account) for 2009-10 was presented to the Parliament on February 13, 2009. The Budget reviewed the performance during 2007-08, provided revised estimates for 2008-09 and presented the budget estimates for 2009-10. As the Railway Budget for 2009-10 is a Vote-on-Account, it has only sought for expenditure for the first four months of the fiscal 2009-10 although the estimates for the whole year have been provided. However, some measures in respect of passenger fares and initiatives for development of infrastructure have been announced in the Budget.

This article analyses the financial position of the Railways as presented in the Railway Budget for 2009-10. Section I sets out the major policy initiatives. Important developments in revised estimates for 2008-09 are presented in Section II. Section III provides analysis of the budget estimates for the year 2009-10. Section IV contains the concluding observations.

I. Major Policy Initiatives

The Vote on Account Railway Budget 2009-10 proposes to carry forward the process of improving the quality of passenger services and competitiveness of the Railways. The major policy initiatives are set out below: The work on construction of the double line Eastern Dedicated Freight Corridor has commenced, while that of the Western Dedicated Freight Corridor will commence in March 2009. Surveys have been proposed for establishing 14 new lines, gauge conversion in three routes and doubling of tracks in eight routes. * Prepared in the Division of Central Finances of the Department of Economic Analysis and Policy. This article is based on the Vote-on-Account Railway Budget: 2009-10 presented to the Parliament on February 13, 2009.

-

Pre-feasibility studies for bullet trains in various regions of the country would be undertaken.

-

Two new railway divisions at Bhagalpur and Thawe will be set up to facilitate improved train operations.

-

The Budget proposes introduction of new trains in 42 routes, extension of train services in 15 routes and increase in frequency in 14 train services.

-

Fares for non sub-urban mail/express and ordinary passenger trains have been reduced by one rupee for fares costing up to Rs.50 per passenger. This reduction will not be applicable for second class rail journey up to 10 km. Fares of second class and sleeper class of all mail/express and ordinary passenger trains for the ticket costing more than Rs.50 per passenger have been reduced by 2 per cent. Fares of AC first class, AC 2 tier, AC 3 tier and AC Chair car have been reduced by 2 per cent.

II. Revised Estimates: 2008-091 The passenger earnings for 2008-09 in the Revised Estimates (RE) at Rs.22,330 crore and freight earnings at Rs.54,293 crore have been higher than the Budget Estimates (BE) by 3.0 per cent each. Earnings from other coaching (including parcel and luggage) were estimated to be same between BE and RE (Rs.2,420 crore). Thus, the gross traffic receipts in 2008-09 RE were estimated at Rs. 82,393 crore (0.6 per cent higher than the budgeted level). The total working expenses are expected to increase by Rs.5,900 crore to Rs.72,490 crore, leading to considerable dent in the internal generation of resources during 2008-09. Consequently, the operations of the Railways showed a lower surplus of Rs.6,355 crore in the RE of 2008-09 as against Rs.11,787 crore projected in the BE. Appropriation to capital fund declined by Rs.5,875 crore from Rs.10,840 crore in the BE. As a result, there was deterioration in the operating ratio to 88.3 per cent in the RE from 81.4 per cent in the BE. The net return on capital investment went down to 10.6 per cent in the RE from 15.8 per cent in the BE (Statement 1). It may be indicated that the deceleration in the financial ratios was on account of provision made for implementing Sixth Pay Commission award, which in the RE turn out to be much larger than the BE. 1 In this section, all comparisons are with respect to the budget estimates for 2008-09 unless stated otherwise.

Table 1: Major Financial Ratios |

(Per cent) |

Year |

Operating Ratio |

Net Railway Revenue as percentage of Capital-at-Charge |

1 |

2 |

3 |

2000-01 |

98.3 |

2.5 |

2001-02 |

96.0 |

5.0 |

2002-03 |

92.3 |

7.5 |

2003-04 |

92.1 |

8.0 |

2004-05 |

91.0 |

8.9 |

2005-06 |

83.2 |

15.4 |

2006-07 |

78.7 |

19.6 |

2007-08 |

75.9 |

20.7 |

2008-09 RE |

88.3 |

10.6 |

2009-10 BE |

89.9 |

9.1 |

Note:Due to changed accounting of lease charges, from 2005-06 onwards only the interest portion has been charged to Ordinary Working Expenses and the principal portion to Plan Expenditure. |

Plan Outlay

The Annual Plan outlay was placed at Rs. 37,905 crore for 2009-10, 1.0 per cent higher than the previous year. Of the total outlay, 72 per cent (Rs.27,292 crore) would be financed through internal generation of resources and the extra-budgetary resources. The budgetary support from the general revenue would finance 25.3 per cent (Rs.9,600 crore).

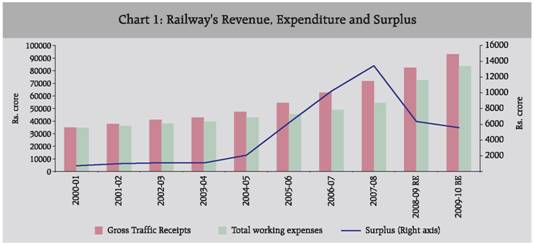

III. Budget Estimates: 2009-102 The gross traffic receipts for 2009-10, budgeted at Rs. 93,159 crore, would increase by 13.1 per cent over the RE for 2008-09 (14.9 per cent a year ago). All the components, except ‘Sundry Other Earnings’, would record a lower growth than the previous year. Freight earnings at Rs.59,059 crore would grow by 8.8 per cent (14.5 per cent in the previous year). Passenger earnings at Rs.25,000 crore, are budgeted to show an increase of 12.0 per cent over the RE (12.5 per cent in the previous year). However, ‘Sundry Other Earnings’ are budgeted to show an increase of 84.6 per cent to Rs.6,000 crore in 2009-10 (26.7 per cent a year ago) (Statement 1). Total working expenses for 2009-10 budgeted at Rs.83,590 crore would increase by 15.3 per cent, much lower than 33.1 per cent in 2008-09. Net ordinary working expenses at Rs.62,900 crore would show a growth of 14.4 per cent, while appropriation to pension fund at Rs.13,690 crore would increase by 30.5 per cent over the RE of 2008-09 (Chart 1 and Statement 1). The allocation for repairs and maintenance is estimated to be 34.0 per cent of the total net ordinary working expenses for 2009-10 (Statement 2). The net revenue (total receipt minus total expenditure) of the railways is budgeted to decline by 1.7 per cent (Rs.190 crore) as against a much higher decline of 39.6 per cent (Rs.7,269 crore) in 2008-09. The operating ratio is also budgeted to be higher at 89.9 per cent in 2009-10 as compared with 88.3 per cent in 2008-09. The total dividend

2 In this Section, all references to the fiscal 2009-10 relate to budget estimates and all comparisons are with respect to the revised estimates for 2008-09, unless stated otherwise. payment is budgeted to increase by 12.6 per cent in 2009-10 to Rs.5,304 crore as against a decline of 3.9 per cent to 4,711 crore in the previous year. The net surplus (net revenue less total dividend payable) for 2009-10 is budgeted at Rs.5,572 crore, 12.3 per cent lower than that of 2008-09. The return on capital (i.e., ratio of net revenue to Capital-at-Charge and Investment from Capital Fund) is budgeted at 9.1 per cent, lower than 10.6 per cent in 2008-09 (Table 1).

The major thrust of the Annual Plan for 2009-10 is modernisation, infrastructure improvement and enhancement of freight capacity. The work on Western Dedicated Freight Corridor is also underway. The momentum of investment is maintained by allocating significant amount for the Annual Plan.

IV. Concluding Observations The financial performance of the Railways in terms of 2008-09 RE showed some deterioration in view of impact of global slowdown on freight earnings. The budget estimates for 2009-10 indicate further deterioration in financial performance. The operating ratio is expected to rise moderately while the return on capital is expected to decline. This is on account of rise in the working expenses and pension provision. Although a Vote-on-Account Budget, it emphasises the quality of improving the services to the passengers while enhancing the competitiveness of the Railways. The annual plan outlay for 2009-10 has been budgeted marginally more than last year with internal and extra-budgetary resources contributing around 72 per cent. The Budget proposes to introduce new passenger trains along with expansion of rail network. The Budget has proposed reduction for different category of passenger fares. The Budget estimates are conservative and have factored in expected moderation in economic activity as a fall out of global financial turmoil.

Statement 1: Financial Results of Railways |

(Rs. crore) |

Items |

2007-08 (Actuals) |

2008-09 (Budget Estimates) |

2008-09 (Revised Estimates) |

2009-10 (Budget Estimates) |

1 |

2 |

3 |

4 |

5 |

1. |

Gross Traffic Receipts (a to e) |

71,720 |

81,901 |

82,393 |

93,159 |

| |

(a) |

Passenger Earnings |

19,844 |

21,681 |

22,330 |

25,000 |

| |

(b) |

Freight (Goods) Earnings |

47,435 |

52,700 |

54,293 |

59,059 |

| |

(c) |

Sundry Other Earnings |

2,565 |

5,000 |

3,250 |

6,000 |

| |

(d) |

Other Coaching |

1,800 |

2,420 |

2,420 |

3,000 |

| |

(e) |

Suspense |

75 |

100 |

100 |

100 |

2. |

Total Miscellaneous Receipts (a to d) |

1,557 |

1,796 |

1,840 |

2,147 |

| |

a) |

Interest on Fund Balances |

0 |

0 |

0 |

0 |

| |

b) |

Receipts from Safety Surcharge on Passengers Fares |

0 |

0 |

0 |

0 |

| |

c) |

Subsidy from General Revenues towards dividend relief & other concessions |

1,468 |

1,708 |

1,735 |

2,026 |

| |

d) |

Other Miscellaneous Receipts |

89 |

88 |

105 |

121 |

3. |

Total Receipts (1+2) |

73,277 |

83,697 |

84,233 |

95,306 |

4. |

Net Ordinary Working Expenses |

41,033 |

50,000 |

55,000 |

62,900 |

5. |

Appropriation to Pension Fund |

7,979 |

9,590 |

10,490 |

13,690 |

6. |

Appropriation to Depreciation Reserve Fund |

5,450 |

7,000 |

7,000 |

7,000 |

7. |

Total Working Expenses {4+5+6} |

54,462 |

66,590 |

72,490 |

83,590 |

8. |

Total Miscellaneous Expenditure |

480 |

684 |

677 |

840 |

| |

a) |

Appropriation to Special Railway Fund |

0 |

0 |

0 |

0 |

| |

b) |

O.L.W.R. |

47 |

60 |

58 |

60 |

| |

c) |

Other Miscellaneous Expenditure |

434 |

624 |

619 |

780 |

9. |

Total Expenditure (7+8) |

54,942 |

67,274 |

73,167 |

84,430 |

10. |

Net Revenue (3-9) |

18,335 |

16,423 |

11,066 |

10,876 |

11. |

a) |

Dividend Payable to General Revenue |

4,239 |

4,636 |

4,711 |

5,304 |

| |

b) |

Payment of Deferred Dividend |

664 |

0 |

0 |

0 |

| |

c) |

Total Dividend Payment (a+b) |

4,903 |

4,636 |

4,711 |

5,304 |

12. |

Surplus [10-11(c)] |

13,432 |

11,787 |

6,355 |

5,572 |

13. |

Appropriation to Development Fund |

2,359 |

947 |

1,391 |

0 |

14. |

Appropriation to Capital Fund |

11,072 |

10,840 |

4,965 |

5,572 |

15. |

Appropriation to Railway Safety Fund |

0 |

0 |

0 |

0 |

16. |

Appropriation to Special Railway Safety Fund |

813 |

53 |

0 |

53 |

17. |

Operating Ratio |

75.9 |

81.4 |

88.3 |

89.9 |

18. |

Ratio of Net Revenue to Capital-at-Charge and Investment from Capital Fund |

20.7 |

15.8 |

10.6 |

9.1 |

Source : Explanatory Memorandum on the Railway Budget, 2009-10. |

Statement 1: Financial Results of Railways (Concld.) |

(Rs. crore) |

Items |

Variations |

Col.4 over Col. 3 |

Col.4 over Col. 2 |

Col.5 over Col. 4 |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

1 |

6 |

7 |

8 |

9 |

10 |

11 |

1. |

Gross Traffic Receipts (a to e) |

492 |

0.6 |

10,673 |

14.9 |

10,766 |

13.1 |

| |

(a) |

Passenger Earnings |

649 |

3.0 |

2,486 |

12.5 |

2,670 |

12.0 |

| |

(b) |

Freight (Goods) Earnings |

1,593 |

3.0 |

6,858 |

14.5 |

4,766 |

8.8 |

| |

(c) |

Sundry Other Earnings |

-1,750 |

-35.0 |

685 |

26.7 |

2,750 |

84.6 |

| |

(d) |

Other Coaching |

0 |

0.0 |

620 |

34.4 |

580 |

24.0 |

| |

(e) |

Suspense |

0 |

0.0 |

25 |

33.3 |

0 |

0.0 |

2. |

Total Miscellaneous Receipts (a to d) |

44 |

2.4 |

283 |

18.2 |

307 |

16.7 |

| |

a) |

Interest on Fund Balances |

0 |

— |

0 |

— |

0 |

— |

| |

b) |

Receipts from Safety Surcharge |

|

|

|

|

|

|

| |

|

on Passengers Fares |

0 |

— |

0 |

— |

0 |

— |

| |

c) |

Subsidy from General Revenues towards dividend relief & other concessions |

27 |

1.6 |

267 |

18.2 |

291 |

16.8 |

| |

d) |

Other Miscellaneous Receipts |

17 |

19.3 |

16 |

18.0 |

16 |

15.2 |

3. |

Total Receipts (1+2) |

536 |

0.6 |

10,956 |

15.0 |

11,073 |

13.1 |

4. |

Net Ordinary Working Expenses |

5,000 |

10.0 |

13,967 |

34.0 |

7,900 |

14.4 |

5. |

Appropriation to Pension Fund |

900 |

9.4 |

2,511 |

31.5 |

3,200 |

30.5 |

6. |

Appropriation to Depreciation Reserve Fund |

0 |

0.0 |

1,550 |

28.4 |

0 |

0.0 |

7. |

Total Working Expenses {4+5+6} |

5,900 |

8.9 |

18,028 |

33.1 |

11,100 |

15.3 |

8. |

Total Miscellaneous Expenditure |

-7 |

-1.0 |

197 |

41.0 |

163 |

24.1 |

| |

a) |

Appropriation to Special Railway Fund |

0 |

— |

0 |

— |

0 |

— |

| |

b) |

O.L.W.R. |

-2 |

-3.3 |

11 |

23.4 |

2 |

3.4 |

| |

c) |

Other Miscellaneous Expenditure |

-5 |

-0.8 |

185 |

42.6 |

161 |

26.0 |

9. |

Total Expenditure (7+8) |

5,893 |

8.8 |

18,225 |

33.2 |

11,263 |

15.4 |

10. |

Net Revenue (3-9) |

-5,357 |

-32.6 |

-7,269 |

-39.6 |

-190 |

-1.7 |

11. |

a) |

Dividend Payable to General Revenue |

75 |

1.6 |

472 |

11.1 |

593 |

12.6 |

| |

b) |

Payment of Deferred Dividend |

0 |

— |

-664 |

-100.0 |

0 |

— |

| |

c) |

Total Dividend Payment (a+b) |

75 |

1.6 |

-192 |

-3.9 |

593 |

12.6 |

12. |

Surplus [10-11(c)] |

-5,432 |

-46.1 |

-7,077 |

-52.7 |

-783 |

-12.3 |

13. |

Appropriation to Development Fund |

444 |

46.9 |

-968 |

-41.0 |

-1,391 |

-100.0 |

14. |

Appropriation to Capital Fund |

-5,875 |

-54.2 |

-6,107 |

-55.2 |

607 |

12.2 |

15. |

Appropriation to Railway Safety Fund |

0 |

— |

0 |

— |

0 |

— |

16. |

Appropriation to Special Railway Safety Fund |

-53 |

-100.0 |

-813 |

-100.0 |

53 |

— |

17. |

Operating Ratio |

7 |

8.5 |

12 |

16.3 |

2 |

1.8 |

18. |

Ratio of Net Revenue to Capital-at-Charge and Investment from Capital Fund |

-5 |

-32.9 |

-10 |

-48.8 |

-2 |

-14.2 |

Statement 2: Ordinary Working Expenses of Indian Railways |

(Rs. crore) |

Items |

2007-08 (Actuals) |

2008-09 (Budget Estimates) |

2008-09 (Revised Estimates) |

2009-10 (Budget Estimates) |

Variations |

col.4 over col.3 |

col.4 over col.2 |

col.5 over col.4 |

Amount |

Per cent |

Amount |

Per cent |

Amount |

Per cent |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

Net Ordinary Working Expenses |

41,033 |

50,000 |

55,000 |

62,900 |

5,000 |

10.0 |

13,967 |

34.0 |

7,900 |

14.4 |

(a to h) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

|

|

|

|

|

|

a) General Superintendence and Services |

2,291 |

3,141 |

3,562 |

4,372 |

421 |

13.4 |

1,271 |

55.5 |

810 |

22.7 |

|

(5.6) |

(6.3) |

(6.5) |

(7.0) |

|

|

|

|

|

|

b) Repairs and Maintenance |

12,982 |

16,173 |

18,033 |

21,401 |

1,860 |

11.5 |

5,051 |

38.9 |

3,368 |

18.7 |

| |

(31.6) |

(32.3) |

(32.8) |

(34.0) |

|

|

|

|

|

|

c) Operating Expenses (Traffic) |

6,602 |

8,509 |

9,539 |

10,924 |

1,030 |

12.1 |

2,937 |

44.5 |

1,385 |

14.5 |

| |

(16.1) |

(17.0) |

(17.3) |

(17.4) |

|

|

|

|

|

|

d) Operating Expenses (Fuel) |

12,150 |

13,618 |

14,218 |

14,856 |

600 |

4.4 |

2,068 |

17.0 |

638 |

4.5 |

| |

(29.6) |

(27.2) |

(25.9) |

(23.6) |

|

|

|

|

|

|

e) Operating Expenses |

3,249 |

3,914 |

4,458 |

5,108 |

544 |

13.9 |

1,209 |

37.2 |

650 |

14.6 |

(Rolling Stock and Equipment) |

(7.9) |

(7.8) |

(8.1) |

(8.1) |

|

|

|

|

|

|

f) Staff Welfare and Amenities |

1,845 |

2,313 |

2,597 |

3,100 |

284 |

12.3 |

752 |

40.8 |

503 |

19.4 |

| |

(4.5) |

(4.6) |

(4.7) |

(4.9) |

|

|

|

|

|

|

g) Suspense |

56.0 |

-35.0 |

-146.0 |

-93.0 |

-111 |

317.1 |

-202 |

-360.7 |

53 |

-36.3 |

| |

(0.1) |

-(0.1) |

-(0.3) |

-(0.1) |

|

|

|

|

|

|

h) Others* |

1,858 |

2,367 |

2,739 |

3,232 |

372 |

15.7 |

881 |

47.4 |

493 |

18.0 |

| |

(4.5) |

(4.7) |

(5.0) |

(5.1) |

|

|

|

|

|

|

* : Includes miscellaneous working expenses, Provident Fund, Pension and Other Retirement Benefits.

Note : Figures in brackets represent percentage to total.

Source: Explanatory Memorandum on the Railway Budget, 2009-10. |

|