IST,

IST,

Revisiting the Oil Price and Inflation Nexus in India

|

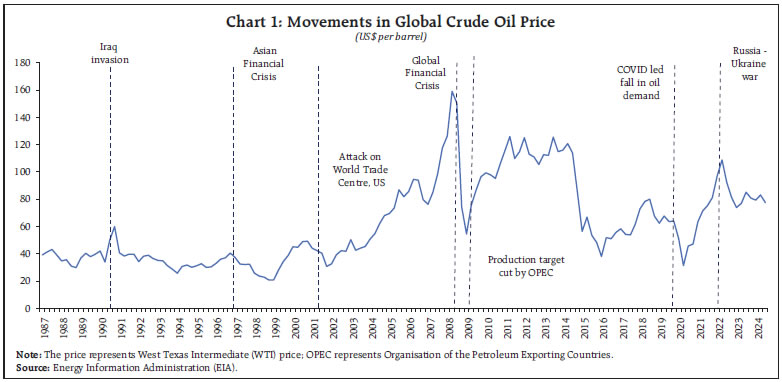

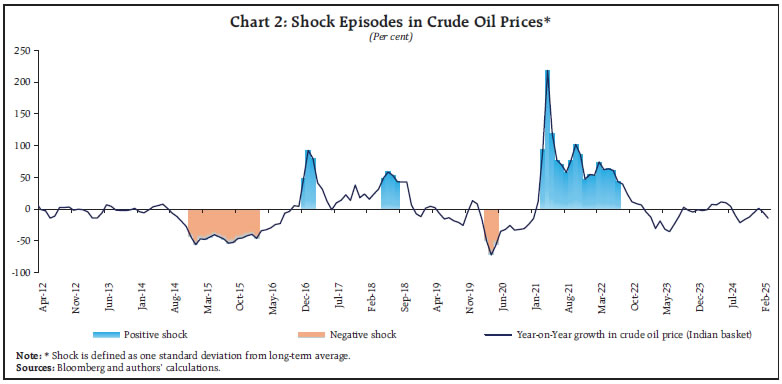

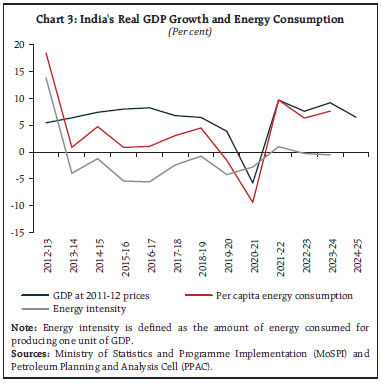

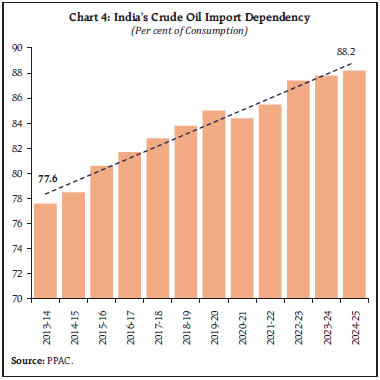

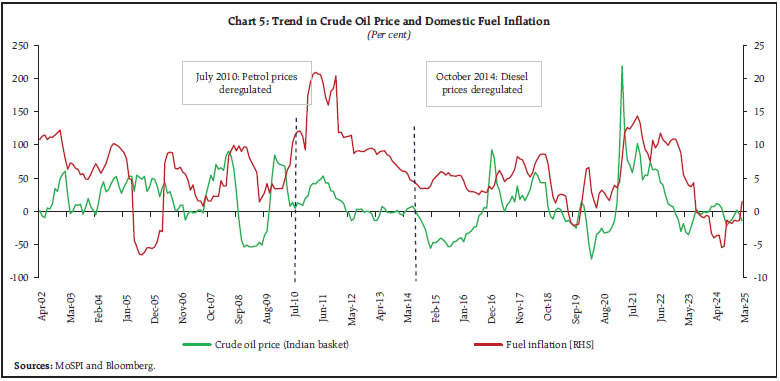

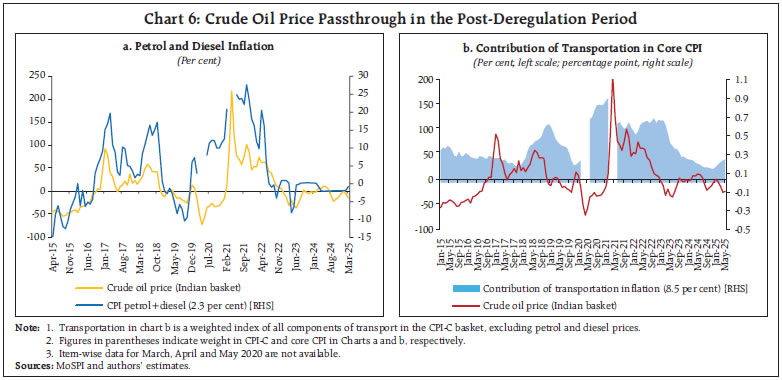

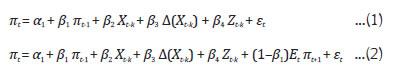

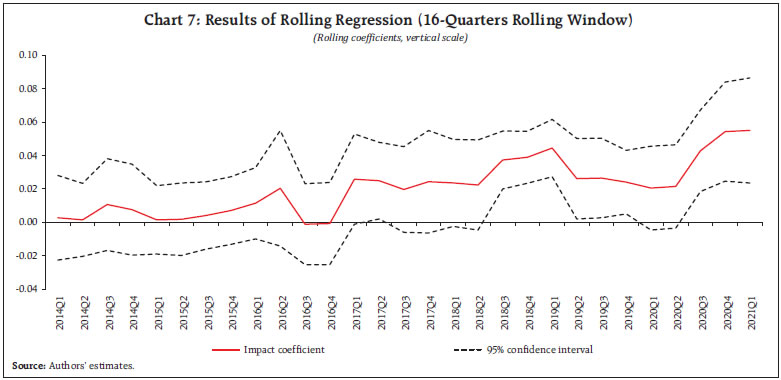

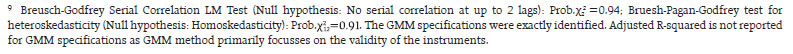

by Sujata Kundu, Soumasree Tewari and Indranil Bhattacharyya^ In recent years, India’s net import demand for crude oil has remained strong, fuelled by consumption growth and robust economic activity. In the backdrop of volatile global crude prices and a less regulated petrol and diesel prices regime, this paper reassesses the impact of international crude oil price movements on headline inflation. The results suggest that a 10 per cent rise in global crude oil prices could increase inflation by around 20 basis points. Although the passthrough to retail prices has remained contained with active government intervention, increasing dependence on crude oil imports may have inflationary consequences in the long run, warranting constant vigilance and careful monitoring of its potential impact. Introduction The oil price-inflation relationship has been a vexing issue for economists and central bankers for more than half a century. Since the twin oil price shocks of the 1970s, economists have endeavoured to delineate the impact of oil price shocks on aggregate economic activity. This is particularly important for oil importers as oil price surges have often been associated with a downturn in economic growth and worsening trade and current account balances. Generally, oil price fluctuations can be highly distortionary as adverse shocks (higher oil prices) can ratchet up inflation and unhinge inflation expectations. Therefore, monetary authorities – more so in inflation targeting (IT) economies – are keen observers of the evolving oil price dynamics. Since the pandemic, the global economy has experienced large gyrations in crude oil prices. From an average of US$ 59 per barrel in 2019-20, crude prices fell to US$ 44 per barrel in 2020-21 owing to the pandemic-induced global lockdown.1 Subsequently, with resumption of economic activity and recovery in demand, global oil prices increased by around 79 per cent to US$ 78 per barrel in 2021-22 and further to US$ 93 per barrel in 2022-23. The lingering impact of the pandemic, protracted geopolitical tensions since the Russia-Ukraine war along with sanctions imposed on Russian oil exports led to a significant surge in oil price volatility. From above US$ 90 per barrel during 2023-24, international crude oil prices fell below US$ 70 per barrel beginning 2025-26. India, being a net oil importer, has remained susceptible to the vagaries of global crude oil prices and has been actively intervening in the domestic fuel market to contain the adverse fallout of higher oil prices on domestic inflation and output. With imports constituting more than 85 per cent of India's crude oil requirements and the benchmarking of domestic pump prices to international prices, fuel (including petrol and diesel) prices in the consumer price index-combined (CPI-C) may impact headline inflation, both directly and indirectly, through higher cost of inputs and transportation across regions.2 In order to contain the spillover effect on domestic prices, government has revised excise duties from time to time. At the onset of the pandemic in 2020, fiscal measures in the form of higher taxes on domestic pump prices were announced to fund pandemic-related expenditure. In 2021, however, as international oil prices rose sharply, excise duties on petrol and diesel were reduced by 15 per cent and 32 per cent, respectively, in November 2021. The spike in energy prices since the Russia-Ukraine conflict in 2022 resulted in a direct as well as second-round price pressures on CPI inflation. To contain the spillover of the oil price shock, excise duties on petroleum products were further reduced by 28 per cent in May 2022, resulting in a cumulative reduction of 43 per cent and 60 per cent on petrol and diesel, respectively, since November 2021, which modulated the passthrough on domestic inflation. The existing literature suggests a positive but varied impact of oil price movements on inflation across economies. Moreover, the passthrough has weakened since the mid-eighties which has been attributed to effective anchoring of inflation expectations by central banks through the adoption of IT frameworks (Mishkin, 2007; Choi et al., 2018; López-Villavicencio and Pourroy, 2019). Following the surge in crude prices after the global financial crisis (GFC), prices dropped significantly from an average of US$ 102 per barrel during 2011-14 to an average of US$ 49 per barrel during 2015-17 – the latter period being coincidental with the adoption of IT by some emerging market economies (EMEs), including India. The current global economic scenario, characterised by increasing trade fragmentation, supply chain disruptions and intensifying tariff wars, can shrink global trade sharply and thereby derail global growth. The resultant oil price volatility can be debilitating for the Indian economy at this stage. Since India has largely deregulated domestic petrol and diesel prices with intervention from time to time aimed at stabilising inflation while supporting growth, it is pertinent to analyse the recent dynamics of oil prices and its impact on inflation. Against this backdrop, the paper attempts to re-assess the impact of global crude oil price movements on headline inflation, given that sudden oil price surges can impact the undergoing disinflation process and thwart policy normalisation. Specifically, the study seeks to answer the following questions: (i) what is the long run impact of oil price dynamics on India’s inflation?; and (ii) how large has been the impact of the post-pandemic oil price movements on inflation?. While previous studies on India are based on the wholesale price index (WPI) (Mandal et al., 2012), recent studies have analysed the passthrough of crude oil price to CPI-C3 inflation and the role of fuel taxes in limiting this passthrough (Benes et al., 2016; John et al., 2023). In this context, this paper revisits the crude oil-domestic price relationship using a sample spanning 2009-10 to 2023-24 and estimating the impact using a suite of models. The results indicate that a 10 per cent rise in global crude oil price could increase India’s headline inflation by around 20 basis points. Notably, government excise duties of petroleum products play a crucial role in determining the impact. Nevertheless, the impact of crude oil price may lead to inflationary pressures in the long run, particularly in the post-pandemic period with supply chains coming under increasing stress from geopolitical disturbances and conflicts. The remaining part of the paper is structured as follows. Section 2 provides a brief review of the related literature, while stylised facts on oil prices in the Indian context are set out in Section 3. The data, methodology and empirical findings are discussed in Section 4, while section 5 presents concluding observations while drawing some policy perspectives. Globally, oil price shocks have been a major driver of inflation, and the related literature is vast, analysing various potential channels of passthrough and its dynamics. For oil importing countries like India, oil price shocks are one of the major channels of global spillovers. According to the World Economic Outlook (WEO), the peak passthrough from a 1 percentage point increase in energy prices into CPI inflation at the country level historically was about 0.06 percentage point in advanced economies and 0.17 percentage point in emerging market and developing economies (IMF, 2024). However, the passthrough depends on several factors and varies across sectors and economies based on their macroeconomic structure, monetary policy credibility and extent of trade openness (Chen, 2009; Baba and Lee, 2022). The surge in global crude oil prices in the post-COVID period led to an increase in inflation of energy dependent sectors that resulted in generalisation of inflation across countries. However, the magnitude of the impact was observed to be limited in countries with higher fuel excise taxes. Oil price changes brought about by demand and supply shocks, however, have limited impact on actual and expected inflation; instead, the latter is found to be more influenced by shocks to economic activity (Aastveit et al., 2023). Nevertheless, well-anchored inflation expectations, credible monetary policy and lower energy imports are important in limiting the impact (Choi et al., 2018; Baba and Lee, 2022). While the short run effects of gasoline price shocks on headline inflation in the US are sizable, they have limited effects on long run inflation expectations (Kilian and Zhou, 2023). The passthrough in the US is more from direct channels in the short run but predominantly through the indirect channel in the long run (Yilmazkuday, 2021). However, the passthrough in the US and the Euro area is significant in the case of core inflation through the common effect of oil price shocks rather than through disaggregated commodity prices (Conflitti and Luciani, 2019). Furthermore, the pricing mechanism and exchange rates are the key factors impacting the degree of passthrough to retail fuel prices (Kpodar and Imam, 2021). The relevant literature in the Indian context is limited. When passthrough is incomplete, a 10 per cent rise in oil prices in the short run is found to increase inflation by 0.3 per cent, whereas it raises inflation by 0.6 per cent under complete passthrough. The impact, however, diminishes in the medium run (Bhanumurthy et al., 2012). Moreover, complete deregulation of oil prices may result in a significant surge in inflation as domestic prices adjust more frequently to international prices, particularly during an adverse oil price shock (Mandal et al., 2012). According to the RBI’s quarterly projection model (QPM 2.0), the direct effect of an increase in oil prices on petrol, diesel, LPG and kerosene prices could be further compounded by second round effects on inflation through depreciation of the INR. Consequently, an increase in oil prices by 10 per cent could result in an increase in inflation by 30 basis points at its peak (John et al., 2023). Moreover, fuel taxes in India also play an important role in thwarting complete passthrough of oil price changes to domestic inflation (Benes et al., 2016). As fuel taxes are exogenous and non-reverting in the absence of policy intervention, its impact on inflation remains entrenched. Oil prices are sensitive to geopolitical and large-scale macroeconomic events, driven by both demand and supply factors. The volatility of oil prices and its responsiveness to sudden events is inherent due to the inelastic nature of both supply and demand to price changes in the short run. III.1 Global oil price shocks and oil inflation Since the early 1990s, global crude oil price dynamics have been shaped by various episodes of geopolitical and geoeconomic significance (Chart 1).  While positive shocks, mainly originating from the geographical concentration of source and supply dynamics of oil exporting countries, are more frequent and sharper than negative shocks, the latter have also occurred due to demand contraction and entry of new entities such as the US shale in recent years (Chart 2). The fall in oil prices from mid-2014 to early 2015 was primarily driven by supply factors, including shale production and policy-shifts by the Organisation of the Petroleum Exporting Countries (OPEC). Slowdown in demand also played a role in keeping prices moderate, particularly from mid-2015 to early-2016. The unprecedented volatility in oil prices during the pandemic was driven by both demand and supply factors as the historic dip in 2020, driven by global lockdown of economic activity and logistics, was followed by a sharp upward correction with increased demand from resumption of normal activity. Consequently, price of crude oil (Indian basket) fell below US$ 20 per barrel during April 2020 before rising sharply in 2021, with global petrol demand surpassing its supply. The slow pace of supply recovery was primarily on account of OPEC plus production cuts that started in late 2020. Russia’s invasion of Ukraine in February 2022 led to a further disruption in the global oil market as Russia is a major exporter. Brent crude oil, the price benchmark for global crude, scaled historic peaks during that period (since June 2008). The supply shocks emanating from global conflicts and imposition of sanctions resulted in elevated oil prices. Intermittent dip in prices seen in the recent period is primarily on account of slowdown in demand amidst increasing supply, as also the increased supply of renewable energy.4 However, persistent geopolitical turmoil, growing geoeconomic fragmentation and heightened uncertainties have resulted in a significant volatility in global crude oil prices.  III.2 Oil price dynamics and India’s inflation Oil and gas, having strong forward linkages in India, is one of the core sectors. With a robust growth momentum, oil demand for production and transportation across sectors have increased consistently over the years, underscoring a strong relationship between growth and energy demand (Chart 3). Fuelled by strong consumption growth, robust economic activity and a stagnant domestic supply of oil, net import demand for crude oil has remained strong. To address the growing energy deficit, policies have been aimed at boosting domestic production, reducing crude oil import dependency through higher investment in natural gas, petroleum and refineries sector along with promotion of renewable sources of energy, such as wind, solar and nuclear energies, and alternate fuels like ethanol, biogas, biodiesel and natural gas that facilitate energy efficiency and conservation.5 While concerted efforts towards transition to renewable and non-fossil fuels have reduced energy intensity of output, faster increase in consumption demand relative to domestic supply has raised India’s import dependency for crude oil from 77.6 per cent in 2013-14 to 88.2 per cent in 2024-25 (compound annual growth rate (CAGR) of 1.1 per cent) [Chart 4].  According to the International Energy Agency (IEA), India will be the largest consumer of crude oil with its oil demand expected to increase by almost 1.2 million barrels per day (mb/d) over 2023-2030, accounting for more than one-third of the projected 3.2 mb/d global gains due to rapid increase in manufacturing, commerce, transport and agricultural sectors (IEA, 2024). A fall in domestic supply due to slowdown in new discoveries along with a rise in demand could further increase India’s oil demand-supply gap resulting in higher import dependency. Thus, continuing vulnerability to global crude oil price shocks has important ramifications for India’s growth and inflation.  Oil importing countries are generally price takers in the global market. In view of this, domestic policies have implications for the extent to which global crude oil price movements impact domestic inflation. In India, deregulation of petrol prices in 2010 and diesel prices in 2014 was implemented to reflect a greater passthrough of global crude oil price movements to domestic fuel prices. With a weight of around 9 per cent in CPI-C basket, fuel and light, including petrol and diesel, impacts headline inflation through both direct and indirect channels. A rise in fuel cost generally manifests in higher transportation and input costs resulting in cross-sectional spillovers and increase in core inflation (headline inflation excluding food and fuel components). The co-movement of domestic fuel inflation and oil prices is evident as the correlation has increased considerably post-2010, reflecting higher passthrough. However, government policies including excise duties and taxes have muted the impact even after deregulation, thus containing the spillover of global oil price shocks to domestic inflation (Chart 5). The incomplete passthrough of crude oil prices to petrol and diesel inflation and indirectly through costs of transportation, primarily on account of government intervention, is evident in the post-deregulation period (Charts 6a and b). In 2020, despite global crude oil price moderating to a historical low, fuel inflation remained high with higher duties of ₹13 per litre and ₹16 per litre announced on domestic pump prices for petrol and diesel, respectively, to finance pandemic-related expenditure. With sharp increase in global energy prices in 2021, however, excise duties on petrol and diesel were reduced by ₹5 per litre and ₹10 per litre, respectively. The spike in energy prices since the Russia-Ukraine conflict in February 2022 led to a persistent direct impact on domestic headline inflation as well as second-round pressures, which led to a further reduction in duties by ₹8 per litre and ₹6 per litre in petrol and diesel, respectively, in May 2022.   Unless retail fuel prices change, there is no direct impact of higher international oil prices on CPI. However, persistent increase in oil price can impact WPI and core (excluding food and fuel) in the form of higher transportation and input costs. It also has the potential to unhinge inflation expectations, thus changing the inflation path. Higher energy prices can raise inflation expectations of consumers and businesses, indirectly exerting pressure on food and core inflation. IV. Empirical Analysis and Results IV.1 Phillips curve estimates To examine the impact of global crude oil price changes on India’s headline inflation, a Phillips Curve (PC) estimation framework, widely used in modelling and forecasting inflation, is deployed. In this regard, the New Keynesian Phillips Curve (NKPC) is, generally, the standard tool of analyses (Nason and Smith, 2008; Dees et al., 2009). From this perspective, this exercise estimates (i) the backward-looking triangle model in reference to the three basic determinants of inflation in the model – inertia, demand and supply-side factors (Gordon and Stock, 1998); and (ii) a hybrid NKPC which incorporates both forward and backward-looking components, based on the related literature (Gali and Gertler, 1999; Patra, et al., 2014). More precisely, the following specifications are estimated:  where, πt is the measure of inflation at time period t, Xt is the measure of domestic economic activity represented by domestic output gap [((actual output - potential output)/potential output6)*100], Δ stands for first difference and Zt is a vector of supply-side factors such as global crude oil price, global non-fuel price, rainfall deviation from normal and exchange rate movements; Et πt+1 is the expected inflation and is proxied by one-year ahead median inflation expectations of the households; εt is the error term and k represents the time lags. All variables, except rainfall deviation from long period average (LPA), are de-seasonalised using the standard X-13 ARIMA procedure. The presence of unit roots in the variables is examined by employing the augmented Dickey-Fuller test and the test results are presented in Annex Table A1. Change in output gap – Δ(Xt) – is considered to capture the possibility of speed limit effects (Fisher et al., 1997; Malikane, 2014; Jose et al., 2021)7. The coefficients, β2 and β3, therefore, provide measures of the flexibility in price adjustment. All variables, barring inflation expectations (in percentage), were converted to their natural logarithms to stabilise their variances. The estimations are done on quarterly data for the sample period 2009-10 to 2023-24 with the quarter-on-quarter (q-o-q) change in headline CPI-C as the dependent variable, using a suite of econometric techniques such as the ordinary least squares (OLS) regression, constrained linear regression and generalised method of moments (GMM). The final form of the equations is derived by starting with a general form with several lags of the output gap and choosing an appropriate model, based on the significance of relevant coefficients and overall fit. Results indicate that the backward-looking terms are statistically significant with the expected positive sign across specifications (Table 1). The coefficients of the backward-looking terms (lags of price changes) are greater than the coefficient of the forward-looking term, i.e., inflation expectations, in hybrid PC estimations, thereby indicating the overbearing influence of lagged price changes, i.e., inflation inertia. The measure of economic activity – real output gap (3 quarters before) as well as the change in output gap – are found to be positive and significant across specifications suggesting the key role of demand. However, less than proportional impact of output gap on inflation (lower coefficient value) indicates lower degree of flexibility in price adjustment. Importantly, the impact coefficient of crude oil price change is 0.02 and statistically significant, indicating that a one per cent change in international crude oil price may lead to around 0.02 per cent increase in domestic CPI on a contemporaneous basis. In other words, the results indicate that a 10 per cent increase in international crude oil prices could increase India’s headline inflation by around 20 basis points contemporaneously.8 Exchange rate and global non-fuel prices are also found to have a bearing on headline inflation. IV.2 Time-varying nature of impact While the above models estimate the contemporaneous impact of oil price changes to domestic inflation, it is important to recognise that the impact would essentially be time-varying. As oil prices are highly volatile and are responsive to a host of factors and sudden events, including news items, straddling the global economic landscape, their impact on domestic consumer prices would be conditioned by the prevailing global and domestic macroeconomic conditions and policies. Therefore, to study the time-varying nature of the impact, rolling regression based on the hybrid-PC equation (without parameter constraints) has been estimated for the time period 2009-10 to 2023-24. The results indicate that the impact of global crude oil price changes on India’s headline inflation has increased to some extent since the deregulation of domestic petrol and diesel prices through the direct and indirect channels; nonetheless, the impact has remained largely rangebound due to active management of pump-prices, limiting spillover to domestic inflation from large fluctuations in global crude oil prices (also seen in Charts 6a and b). This primarily reflects the role of government measures in containing fuel inflation as domestic fuel prices are often conditional upon government policies on excise duties of petrol and diesel. In the post-pandemic period, the impact, although largely contained, is statistically significant with the surge in crude oil prices owing to the post-pandemic demand revival, which further intensified due to the supply chain disruptions caused by the outbreak of the Russia-Ukraine war in early 2022 (Chart 7). As current international prices are moderating consistently owing to increase in supply and fall in demand due to global economic slowdown, this augurs well for inflation as indicated by the limited passthrough to domestic prices. However, increasing oil demand and growing oil import dependency (indicated in Chart 4) may lead to higher susceptibility to global oil price shocks through the direct and indirect channels over a longer time horizon, warranting more intensive intervention to limit the impact of spillovers.

Oil prices and their inflationary impact is a key metric that sensitise monetary policy formulation in economies vulnerable to oil price shocks, particularly net oil importers, where rising oil prices can significantly dampen economic growth and stoke inflation pressures. The direct impact of international crude oil price changes to domestic petrol and diesel inflation, and indirectly through transportation and input costs, is evident in the post-deregulation period albeit at a subdued level as government intervention by taxes, cess and regulation of oil marketing companies has often muted the impact. The results of the empirical analysis suggest that a 10 per cent increase in international crude oil prices could raise India’s headline inflation by around 20 basis points on a contemporaneous basis. Thus, while active government intervention has contained spillover to domestic prices, policymakers need to be vigilant and cautious of the direct and indirect impact of the evolving global crude price dynamics through continuous assessment, given India’s increasing dependence on crude oil imports and a persistent demand-supply gap. In this regard, government policies would play a pivotal role in containing the impact. Specifically, reducing crude oil dependence by promoting alternate non-fossil energy usage and regional free trade agreements and bilateral treaties with major oil exporters could be explored for oil imports at favourable prices. References Aastveit, K.A., Bjørnland, H.C., and Cross, J.L. (2023). Inflation expectations and the pass-through of oil prices. Review of Economics and Statistics, 105(3), 733-743. Baba, C. and Lee, J. (2022). Second Round Effects of Oil price Shocks-Implications for Europe’s Inflation Outlook. IMF Working Paper WP/22/173, September. Benes, J., et al. (2016). Quarterly Projection Model for India: Key Elements and Properties. RBI Working Paper Series No. 08/2016. Bhanumurthy, N.R., Das, S., and Bose, S. (2012). Oil price shock, pass-through policy and its impact on India. National Institute of Public Finance and Policy Working Paper No. 2012-99. Chen, S.S. (2009). Oil price pass-through into inflation. Energy Economics, 31(1), 126-133. Choi, S., et al. (2018). Oil prices and inflation dynamics: Evidence from advanced and developing economies. Journal of International Money and Finance, 82, 71-96. Conflitti, C., and Luciani, M. (2019). Oil price pass-through into core inflation. The Energy Journal, 40(6), 221-248. Dees, S., et al. (2009). Identification of new Keynesian Phillips curves from a global perspective. Journal of Money, Credit and Banking, 41(7), 1481-1502. Fisher, P.G., Mahadeva, L., and Whitley., J.D. (1997). The output gap and inflation–Experience at the Bank of England. BIS Conference Papers, 4. Fuhrer, J.C. (1995). The Phillips curve is alive and well. New England Economic Review, 41-57. Gali, J., and Gertler, M. (1999). Inflation dynamics: A structural econometric analysis. Journal of Monetary Economics, 44(2), 195-222. Gordon, R.J. and Stock, J.H. (1998). Foundations of the Goldilocks economy: supply shocks and the time-varying NAIRU. Brookings Papers on Economic Activity, 1998(2), 297-346. IEA. (2024). Indian Oil Market Outlook 2030, February. IMF. (2024). World Economic Outlook, October. John, J., et al. (2023). A Recalibrated Quarterly Projection Model (QPM 2.0) for India. RBI Bulletin, February. Jose, J., et al. (2021). Alternative Inflation Forecasting Models for India-What Performs Better in Practice? Reserve Bank of India Occasional Papers, 42(1). Kilian, L., and Zhou, X. (2023). A broader perspective on the inflationary effects of energy price shocks. Energy Economics, 125, 106893. Kpodar, K., and Imam, P. A. (2021). To pass (or not to pass) through international fuel price changes to domestic fuel prices in developing countries: What are the drivers?. Energy Policy, 149, 111999. Lòpez-Villavicencio, A., and Pourroy, M. (2019). Inflation target and (a) symmetries in the oil price pass-through to inflation. Energy Economics, 80, 860-875. Malikane, C. (2014). A new Keynesian triangle Phillips curve. Economic Modelling, 43, 247-255. Mandal, K., Bhattacharyya, I., and Bhoi, B.B. (2012). Is the oil price pass-through in India any different?. Journal of Policy Modeling, 34(6), 832-848. Mishkin, F.S. (2007). Inflation dynamics. International Finance, 10(3), 317-334. Nason, J.M., and Smith, G.W. (2008). Identifying the new Keynesian Phillips curve. Journal of Applied Econometrics, 23(5), 525-551. Patra, M.D., Khundrakpam, J.K., and George, A.T. (2014). Post-Global crisis inflation dynamics in India: What has changed?. In S. Shah, B. Bosworth and A. Panagariya (Eds.), India Policy Forum, 10(1) (pp. 117-191). New Delhi: Sage Publications. RBI. (2018). Monetary Policy Report, October. Yilmazkuday, H. (2021). Oil price pass-through into consumer prices: Evidence from US weekly data. Journal of international Money and Finance, 119, 102494. Annex ^ The authors are from the Reserve Bank of India. The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. 1 In April 2020, average international crude prices stood at US$ 21 per barrel (US$ 32 per barrel in March 2020), which was the lowest since January 2016 (US$ 29.8 per barrel). 2 Petrol prices were de-regulated in India in July 2010, while diesel prices were de-regulated in October 2014. 3 India formally adopted the flexible IT framework in June 2016. Inflation, as measured by the CPI-C, is the nominal anchor under this framework with the inflation target set at 4 (+/- 2) per cent indicating upper and lower tolerance thresholds of 6 per cent and 2 per cent, respectively. 4 India also benefitted from the diversification of its import destinations of crude oil, with Russia gaining a major share. 5 Some of the policies include Production Sharing Contract (PSC) regime, Discovered Small Field Policy, Hydrocarbon Exploration and Licensing Policy and Setting up of National Data Repository. 6 Proxied by Hodrick-Prescott (HP) filtered trend series of actual real GDP. 7 The speed limit suggests that for a given level of economic activity, more rapid changes in the latter may cause larger changes in inflation (Fuhrer, 1995). 8 The results are consistent with the existing literature (RBI, 2018).  |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: